Improving Public Sector Financial Reporting: Power of streamlining

Neha Juneja, Manager, Financial Reporting Advisory

Siva Sivanantham, Director, Financial Reporting Advisory

April, 2021

In a nutshell

- Streamlining financial statements helps an entity tell its story in a simple and concise manner while complying with relevant laws, regulations and accounting standards.

- Mindset change and buy-in from relevant stakeholders are key to effective streamlining.

-

Proper project planning, mastering materiality, transparent communication, attention to detail and a focus on telling the entity’s story succinctly and effectively are fundamental to the success of a streamlining project.

Background

Over the years, financial statements in both public and private sectors have become increasingly complex and lengthy, often with little regard for the needs of the end user. As a result, readers often struggle to navigate to relevant information in these large documents.

There are a number of reasons for these developments, including:

- the increasingly complex nature of business transactions and accounting requirements

- challenges in applying the concept of materiality

- limited staff resources, particularly in smaller organisations

- a reluctance to deviate from established practices

- a lack of focus on telling the story with users’ perspectives in mind.

Some public sector entities already recognise this issue and are undertaking projects to streamline their financial statements with support and encouragement from relevant regulators.

The Victorian Department of Treasury and Finance (DTF), for example, has included a useful guide to streamlining financial statements in its May 2019 publication 2018–19 Model Report for Victorian Government Departments (pages 230–243). However, there is still a long way to go in getting entities to fully embrace streamlining and simplify public sector financial statement disclosures to focus on users’ needs and material information.

With that in mind, this article aims to provide:

- information on streamlining

- insights on how public sector entities can begin streamlining their financial statements

- practical ways to make financial statements less complex and tell the story more effectively.

What is streamlining and why is it important?

Streamlining financial statements enables entities to tell their story in a simple and easy-to-understand manner. It focuses on understanding users’ needs and providing material information while also ensuring compliance with applicable laws, regulations and accounting standards.

Streamlining is particularly important in the public sector due to the broad range of primary users of the sector’s financial statements. These key users include lenders, creditors, members of parliament, taxpayers, donors and recipients of public goods and services. Some of these users will not have the technical knowledge of typical investors and lenders, so it is essential that financial statements are presented in a simple and comprehensible format, with a specific focus on material information.

How to approach streamlining

The appropriate approach to streamlining will vary from entity to entity and depends on a number of factors, including:

- the size of the entity

- the nature and complexity of its operations

- the availability of resources.

We provide some steps and insights below to guide you in developing the best possible approach to streamlining your entity’s financial statements.

Changing the mindsets of those involved in financial reporting is vital; and stakeholder engagement is a key step in the process. It is therefore crucial that you engage relevant stakeholders and secure their buy-in when you first approach streamlining. Your stakeholders may include those charged with your entity’s governance, audit committees, the DTF, relevant regulators and auditors.

It is also important to keep any model financial statements released by relevant public sector bodies (such as the DTF and Local Government Victoria) in mind and clearly understand the level of flexibility for deviating from the model. Working this out may require discussions with the relevant bodies.

In recent years, many of these models have themselves gone through a process of streamlining. Bodies that release them encourage entities to tailor the model to reflect their specific circumstances.

While models promote consistency, they are, by their nature, generic and cannot practically cater for every single transaction. The onus, then, is on entities to tailor their financial statements, focusing on material information and telling their unique story in an effective manner.

Once your entity has decided to initiate a streamlining project and stakeholders are on board, you must decide on a suitable approach and agree to project milestones and timelines. Like any new process, an entity’s first attempt at streamlining will take time and require proper project planning.

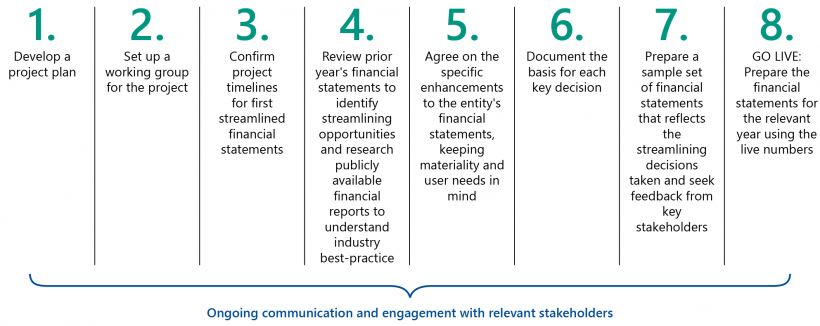

Approaches to streamlining will vary depending on the entity and Figure A illustrates one way to proceed.

Figure A: How to approach streamlining

Source: VAGO.

Tips on streamlining

Identifying material information:

One of the difficulties many entities face is deciding what information is material to financial statements and therefore must be disclosed in financial statements, and what information is not material and therefore can and should be omitted.

Information is considered material if omitting or misstating it could influence users' decisions. Determining whether the information is material or not often requires a significant level of professional judgement and involves both quantitative and qualitative considerations.

Entities can refer to the Australian Accounting Standards Board’s guidance in Practice Statement 2 Making Materiality Judgements, which provides a useful step-by-step approach to making materiality assessments, for help.

Organising information in financial statements

When an entity has identified what information is material, it must organise that information in its financial statement in a logical and user-friendly manner. Figure B includes a number of techniques that entities can use to help streamline their financial statements.

Figure B: Streamlining techniques

| Techniques | Description |

|---|---|

|

Cross-referencing |

Where information relating to a specific area is disclosed across multiple notes (for example, financial instruments), effective cross-referencing can help to reduce duplication and improve navigation. In digital financial reports, hyperlinks to relevant notes can significantly enhance user experience. However, be mindful that excessive use of cross-references can distract readers. |

|

Disclosing important information early |

Disclose or flag any information that is critical to users’ understanding of an entity’s performance early in the notes. This will help reduce the risk of users missing important pieces of information. For example, include a concise summary of the most significant transactions or events for the year in the first few notes and include cross-references to additional information disclosed in the remaining notes. |

|

Grouping related information |

Bring together all related information for a particular item in one place. |

|

Indexing |

Provide an index at the beginning of the notes section to help users navigate and find information easily. For example, organise information into categories, such as those related to balance sheet, operating statement, risks and contingencies. |

|

Infographics |

Where possible, replace quantitative tables and lengthy qualitative disclosures with simple infographics. For example, different streams of revenue may best be illustrated with an infographic rather than by being listed in a table. |

|

'In tandem' with the rest of the annual report |

Ensure consistency between different sections of the annual report. For example, information presented in the management commentary section and the relevant financial statement note disclosures should reflect each other so the annual report as a whole tells a consistent story. |

|

Using plain language |

Where possible, explain the specific application of accounting policies and judgements exercised using plain language rather than adopting wording from accounting standards (boilerplating) or model financial statements. Technical terms or accounting jargon should be kept to a minimum and only used where necessary. |

Source: VAGO.

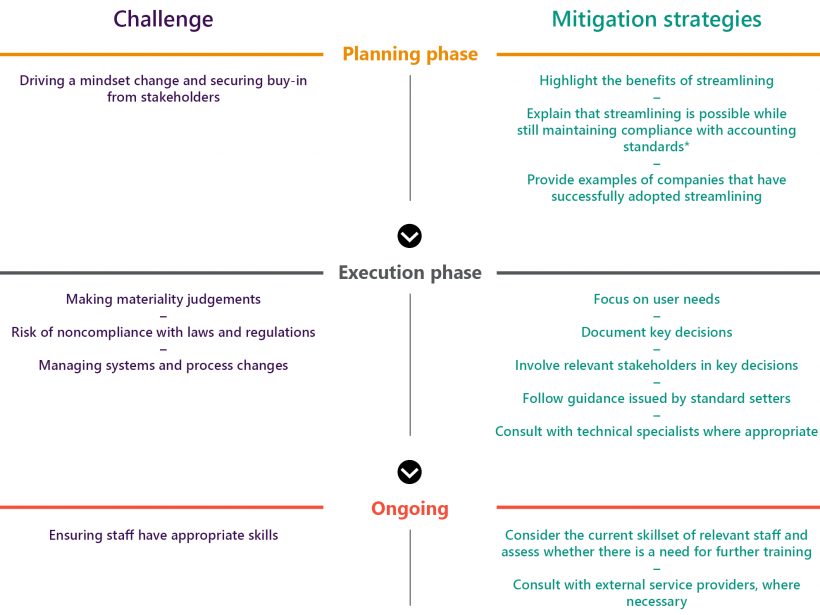

Addressing key challenges

Each entity embarking on a streamlining project will face unique challenges. These challenges will depend on the phase of streamlining an entity is in and the complexity of its operations. Figure C highlights some challenges entities may face and includes suggestions on how they might be overcome.

Figure C: Challenges to streamlining and possible mitigation strategies

*For example, refer to IFRS Foundation's Better Communication in Financial Reporting (page 4).

Source: VAGO

Conclusion

Streamlining can help entities overcome the challenges of information overload, clutter, the use of standardised technical (boilerplate) language and duplication in financial statements. It is important that entities take a fresh look at their financial statements and ensure they are still relevant and meeting the needs of users. Be bold, embrace the journey of streamlining and tell your organisation’s story in a more effective manner that puts users at the heart of financial reporting.

VAGO Financial Audit contacts

|

Charlotte Jeffries |

Simone Bohan |

|

Janaka Kumara |

Tim Maxfield |

|

Paul Martin |

Travis Derricott |

|

Sanchu Chummar |