Delivering Local Government Services

Overview

Victoria's 79 local councils deliver wide-ranging services, such as health, social welfare, waste, recreation, infrastructure, planning and emergency management. Services vary across councils, depending on the demographics, size, location and priorities of each community. Councils also have corporate services—such as finance, payroll, human resources and IT—to support their frontline service delivery.

Since the introduction of rate capping in 2015, it is vital that councils have robust service planning and review processes to ensure the services they provide are both cost effective and meeting community needs.

In this audit, we assessed whether selected councils effectively plan for and deliver cost efficient frontline services that meet community needs. We also benchmarked corporate services expenditure and examined how councils look for and achieve efficiencies in their corporate services.

We audited Bayside City Council, City of Wodonga, Indigo Shire Council, Moira Shire Council, and Wyndham City Council. We also examined the role of Local Government Victoria (LGV)—part of the Department of Environment, Land, Water and Planning (DELWP)—in providing support and guidance to councils on efficient service delivery.

We made nine recommendations in total—four for all Victorian councils and five for DELWP.

Transmittal Letter

Ordered to be published

VICTORIAN GOVERNMENT PRINTER September 2018

PP No 443, Session 2014–18

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Delivering Local Government Services.

Yours faithfully

Andrew Greaves

Auditor-General

19 September 2018

Acronyms and abbreviations

|

ABC |

activity-based costing |

|

ABEF |

Australian Business Excellence Framework |

|

ABS |

Australian Bureau of Statistics |

|

ACELG |

Australian Centre of Excellence for Local Government |

|

Bayside |

Bayside City Council |

|

DELWP |

Department of Environment, Land, Water and Planning |

|

ESC |

Essential Services Commission |

|

ERP |

enterprise resource planning |

|

FAST |

Finance and Accounting Support Team |

|

FGRS |

Fair Go Rates System |

|

FinPro |

Local Government Finance Professionals |

|

FTE |

full-time equivalent |

|

Indigo |

Indigo Shire Council |

|

IT |

information technology |

|

LGPRF |

Local Government Performance Reporting Framework |

|

LGPro |

Local Government Professionals |

|

LGV |

Local Government Victoria |

|

MAV |

Municipal Association of Victoria |

|

Moira |

Moira Shire Council |

|

VAGO |

Victorian Auditor-General's Office |

|

VGC |

Victoria Grants Commission |

|

Wodonga |

City of Wodonga |

|

Wyndham |

Wyndham City Council |

Audit overview

Victoria's 79 local councils deliver wide-ranging services, such as health, social welfare, waste, recreation, infrastructure, planning and emergency management. Services vary across councils, depending on the demographics, size, location and priorities of each community. Councils are required to provide some services by law, and there are others they choose to provide.

Councils' frontline service delivery is supported by corporate services functions, such as revenue, finance, payroll, human resources, information technology (IT), legal, governance, communications, records management and customer service.

Section 3C(2)(b) of Victoria's Local Government Act 1989 (the Act) requires that councils use their resources efficiently and effectively, and that they ensure their services meet community needs. Section 208B of the Act sets out the Best Value Principles that councils must apply to the services they provide.

The introduction of the Fair Go Rates System (FGRS) in 2015, in which annual rate caps constrain revenue growth, added to councils' statutory obligation to ensure their services are cost effective. Councils need to be able to demonstrate that they have the right balance between the standard of service they aim for—volume, quality, access, timeliness—and the cost to ratepayers and residents of achieving these standards.

Delivering cost-efficient services requires councils to plan effectively. Councils need to understand the current and future needs of their communities; identify the resources needed to achieve desired levels and quality of service; compare these to the resources available; and make informed, rational decisions about how to best allocate their scarce resources.

It also requires that councils design and operate their services to be as economic and efficient as possible by minimising input costs—such as labour and materials—while maximising service outputs.

In this audit, we assessed whether selected councils effectively plan for and deliver cost-efficient services that meet community needs. We also benchmarked councils' expenditure on corporate services and examined how councils look for and achieve efficiencies in corporate services.

We audited Bayside City Council (Bayside), City of Wodonga (Wodonga), Indigo Shire Council (Indigo), Moira Shire Council (Moira), and Wyndham City Council (Wyndham).

We also examined the role of Local Government Victoria (LGV)—part of the Department of Environment, Land, Water and Planning (DELWP)—in providing support and guidance to councils on efficient service delivery.

Conclusion

Each council we audited has some good elements of service planning, review and evaluation. But none are sufficiently comprehensive or systematic to be assured that their service mix and costs meet the needs of their community.

More needs to be done to better understand and attribute full costs to frontline services—in particular, the indirect costs or overheads necessarily incurred in supporting service delivery. These are often invisible in internal and external reporting, so councils do not adequately consider them when deciding on their service mix.

The lack of a comprehensive approach to service planning and review is evident in how councils manage their corporate services. Although all the audited councils can provide some examples of projects that have resulted in efficiencies, none has holistically sought to improve its corporate services' efficiency. As a result, councils miss opportunities to achieve cost savings that could be redirected to improving or expanding frontline service delivery, or to constraining rate increases.

Benchmarking is an essential part of planning and reviewing corporate services and driving efficiencies. DELWP—which holds a detailed dataset about councils—has missed an opportunity to assist councils to do this effectively by not ensuring the reliability of its data. Better benchmarking would increase transparency about council costs and allow councils, and the wider community, to compare efficiency over time.

Findings

Planning and reviewing council services

A comprehensive approach combines both the planning and review of services. Although we found some good examples of both planning and service reviews, no council has an approach that fully addresses both elements. Bayside is closest to achieving this—it has a structured service review process and is about to implement a four-year costed service planning method.

Service planning

Bayside and Indigo have centralised service planning processes that use a common template to define services and outline performance objectives. Wyndham also demonstrates good practice by using a service catalogue to list key information for each council service, including service levels, target customers and performance indicators. In contrast, the approach to service planning at two of the audited councils—Wodonga and Moira—is not consistent or conducted with the same rigour across all parts of the council. Wodonga has recognised this issue and is in the process of developing a standardised service planning approach.

Clearly and consistently defining services is challenging, and each council has a different understanding of what constitutes a distinct 'service'. For example, Moira outlined 52 different services within its building and planning department, including 'registering and filing permits' and 'staff performance review'. These are activities, not services. In contrast, Bayside considers 'building surveying and asset protection' as one service. The lack of a common understanding or definition of what constitutes a service makes it hard in practice for councils to compare performance and difficult to share resources about service planning.

Another important element of service planning is its link to asset management. Councils need to ensure they have the right facilities to deliver services. Bayside and Indigo link service planning to asset management through their service plan templates. Wyndham is currently implementing a service planning and asset strategy that aims to ensure that infrastructure projects support service delivery. Wodonga's planned approach to service planning intends to link to asset management plans. Moira does not currently link service and asset planning in a structured way.

Service reviews

|

A service review is a formal process that considers the cost, quality and efficiency of a council service, and assesses whether the current mode of delivery is appropriate. |

Councils need to review services regularly to ensure they continue to achieve their objectives.

According to the Australian Centre of Excellence for Local Government (ACELG), local councils should review services as part of business-as-usual strategic planning, and they should do this frequently enough to consider relevant financial, environmental and community changes.

Only two councils—Wodonga and Bayside—have robust approaches to service reviews, ensuring that all of their services are reviewed on a rolling basis. Wodonga has a five-year program for conducting reviews of all service areas. Bayside also has a structured service review program and has a performance target in its council plan to complete four service reviews per year.

Although Indigo and Moira have completed service reviews, both lack a structured approach that ensures they regularly assess all services. Without a structured approach, these councils may miss opportunities to find efficiencies across all their services.

Until 2017, Wyndham had a structured service review program but decided to pause the program after an internal review found that not all service reviews resulted in recommended change. Wyndham advised that it has shifted its focus to refining its service catalogue, to ensure that its future decisions about service provision are based on robust evidence. Although the catalogue is a useful planning tool, Wyndham needs to ensure it does not miss opportunities to improve service performance and cost. Without structured reviews, it may be difficult for Wyndham to assess the value of alternative service delivery models, such as shared services or outsourcing.

Balancing the need for objective analysis with the cost of engaging external consultants is a key challenge for councils when conducting service reviews. An internal review team, particularly one that is currently delivering the service under review, may not be in the best position to consider alternative modes of service delivery, such as outsourcing, or to examine whether to discontinue a service.

At Moira, service area managers were responsible for conducting most reviews and making recommendations. Wodonga also relied on internal staff to conduct many of its service reviews, though it attempted to improve the objectivity of reviews in some cases by including staff from other service areas. Although this builds capability and takes advantage of internal knowledge, these councils cannot assure themselves that reviews are objective and complete. Bayside is best able to balance these competing considerations because it has established cross-organisational review teams led by managers outside the areas under review.

Understanding the cost of service delivery

All audited councils could make better use of cost information. Understanding the full cost of service delivery—including direct costs and overheads—assists councils to find efficiencies in service provision. Budgeting and service planning processes, as well as service reviews, should reflect these costs to ensure more accurate long-term financial planning, decision-making and continuous improvement.

The Department of Treasury and Finance's 2013 Cost Recovery Guidelines recommend using an activity-based costing (ABC) method to allocate overheads. The ABC method allocates overheads by identifying relevant cost drivers for each corporate activity.

Although all the audited councils consider the full cost of services when conducting service reviews, only Wodonga and Wyndham currently allocate overheads and consistently use an ABC method. Moira and Indigo do not consistently apply overheads as part of the budgeting process, while Bayside is in the process of adapting the costing model it uses in service reviews—which attributes overheads to service costs—for use in future budgets.

Without accurately and consistently allocating corporate overheads, councils do not understand the full cost of each of their services. This reduces their capacity to meaningfully compare the costs of their services with comparable organisations, including other local councils and the private sector. It also means councils risk not making fully informed decisions when considering alternative options such as increasing, decreasing or withdrawing services or outsourcing certain work.

Guidance and support for councils

LGV does not offer guidance to councils on how to plan or review services, or use the Best Value Principles to support service delivery. Previously, councils received guidance through LGV's Best Value Commission, but the commission was abolished in 2007 after a review found councils had a robust approach to service planning and review. A decade later, this is no longer the case—councils would benefit from clear guidance on how to plan and review services, and how to implement the Best Value Principles.

Although reporting on the Best Value Principles to the community is mandatory under the Act, the audited councils do not report in a meaningful way. Four of the audited councils reported on the principles in 2016–17 but provided a very limited description of how they met them. One council—Wodonga—provided no information about the principles.

LGV does not monitor or advise the Minister for Local Government on whether councils comply with the Best Value Principles. Without proper monitoring and guidance, there is a risk that the principles will not have a meaningful impact on how councils plan and deliver services. The Local Government Bill 2018 proposes to replace the Best Value Principles with Service Performance Principles. These strongly resemble the current principles, and councils' obligations would not change significantly.

Although LGV does not provide guidance on service planning and reviews, it does provide support to improve councils' financial management. In 2016–17, LGV established the Finance and Accounting Support Team (FAST) program. The program includes grants for regional and rural councils to gain access to expert financial support and support for shared services, procurement and service improvements.

Two of the program streams provide direct and tailored support to individual councils. Although this may improve the capability of the recipient councils, LGV needs to ensure that any insights generated are shared across the sector.

Council corporate services

VAGO benchmarking survey

During this audit, we conducted a survey to benchmark corporate service costs across Victorian councils. The 58 councils that responded reported that they collectively spent more than $1 billion on corporate services during 2016–17.

On average, these councils spent approximately 15 per cent of their total expenditure on corporate services. This is in line with a 2013–14 consultant's report that surveyed Australian federal and state public sector entities and found that small- and medium-sized entities spend on average 14 per cent of total expenditure on corporate services.

However, our survey indicated that expenditure varies widely, with councils spending between 9 and 26 per cent of their total expenditure on corporate services. The variance did not relate to either council location or population size. This is significant because it suggests that councils, regardless of size, can achieve efficiencies.

Our survey also found that the average corporate services area within a council had 75.8 full-time equivalent (FTE) staff members, or approximately 18 per cent of total staff. Finance and rates was the corporate services area with the most employees, followed by customer service and support—which includes councillor and executive support—and IT. The area with the largest expenditure was IT.

Benchmarking corporate services

All audited councils have benchmarked their corporate services costs and processes against neighbouring or similar-sized councils on an ad hoc basis. This usually occurs when a specific corporate services function is the focus of a service review by external consultants. However, we found that infrequent benchmarking is insufficient because it does not enable councils to monitor and compare their costs over time.

Over the past 10 years, the Victoria Grants Commission (VGC) has collected detailed expenditure and revenue data from all councils, including information about corporate services. Councils input data on corporate services inconsistently, and VGC does not monitor or address this issue. VGC collects this data on behalf of other organisations such as the Australian Bureau of Statistics (ABS) and uses it to allocate financial assistance grants, but it has missed an opportunity to maximise the benefit of this rich dataset. An improved VGC dataset would enable councils to benchmark effectively, providing better insights for councils and their stakeholders, including residents.

Corporate services efficiency

All audited councils provided some examples where a specific project or initiative has improved the efficiency of corporate services. However, none have systematically examined all their corporate services to determine whether they are operating efficiently and effectively to support staff to deliver frontline services.

Bayside and Wyndham demonstrate the strongest commitment to continuous improvement and successfully used process-mapping methodologies to achieve efficiencies. Wodonga's service review program aims to review all services within five years, which also provides an opportunity to identify efficiencies within all corporate services areas.

Wyndham also has the most robust framework for monitoring the impact of improvements. The other audited councils do not have a consistent approach to quantifying the benefits of their actions, which is usually done on a project‑by‑project basis, rather than systematically whenever an improvement is implemented.

Shared corporate services

All audited councils have considered using shared services or outsourcing to improve the cost efficiency and quality of corporate services functions. However, only Indigo and Moira have established some shared corporate services.

The audited councils advised that there are barriers to successful shared services, such as different service expectations and priorities, incompatible technology, different software expiration dates, and different risk profiles.

The limited use of shared services by audited councils reflects sector-wide practices. Our corporate services survey found that 60 per cent of the councils that responded did not use any outsourcing or shared service arrangements. The most common functions that councils outsourced or shared were rates collection, debt collection and valuations. Across council categories, large shires reported the lowest rate of shared services or outsourcing, with only three out of 15 large shires using this approach to service delivery.

Recommendations

We recommend that each Victorian council:

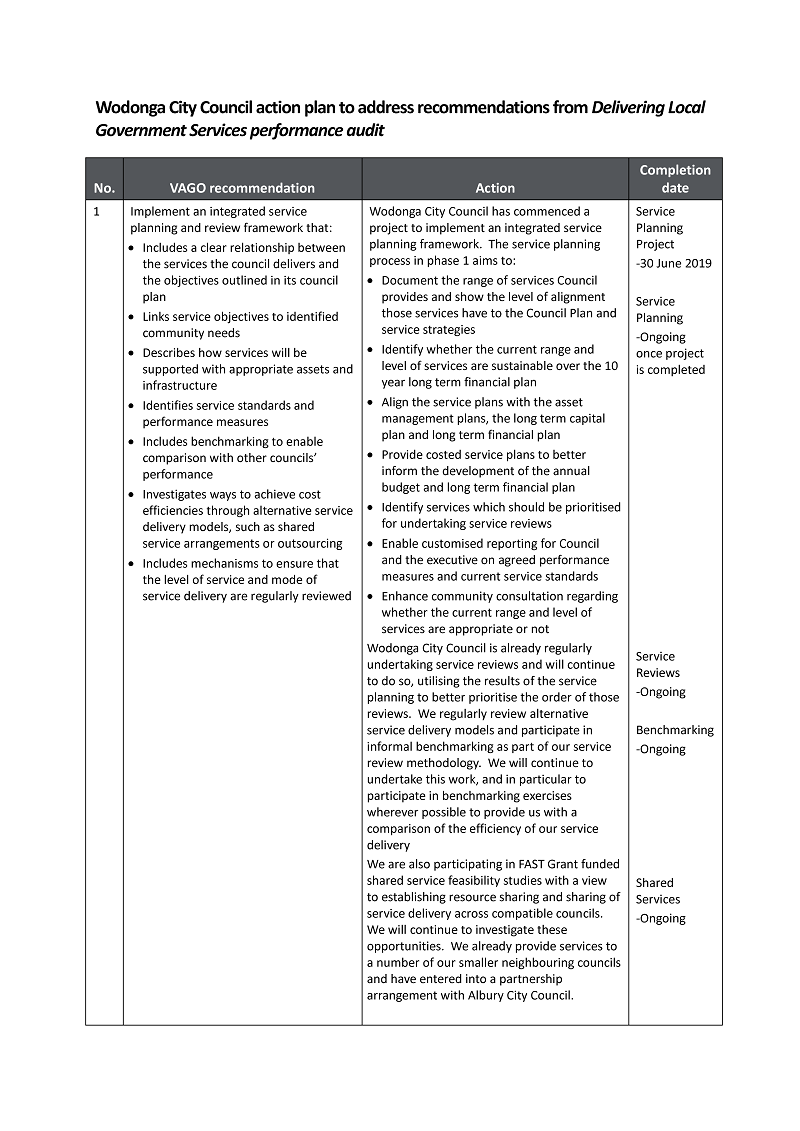

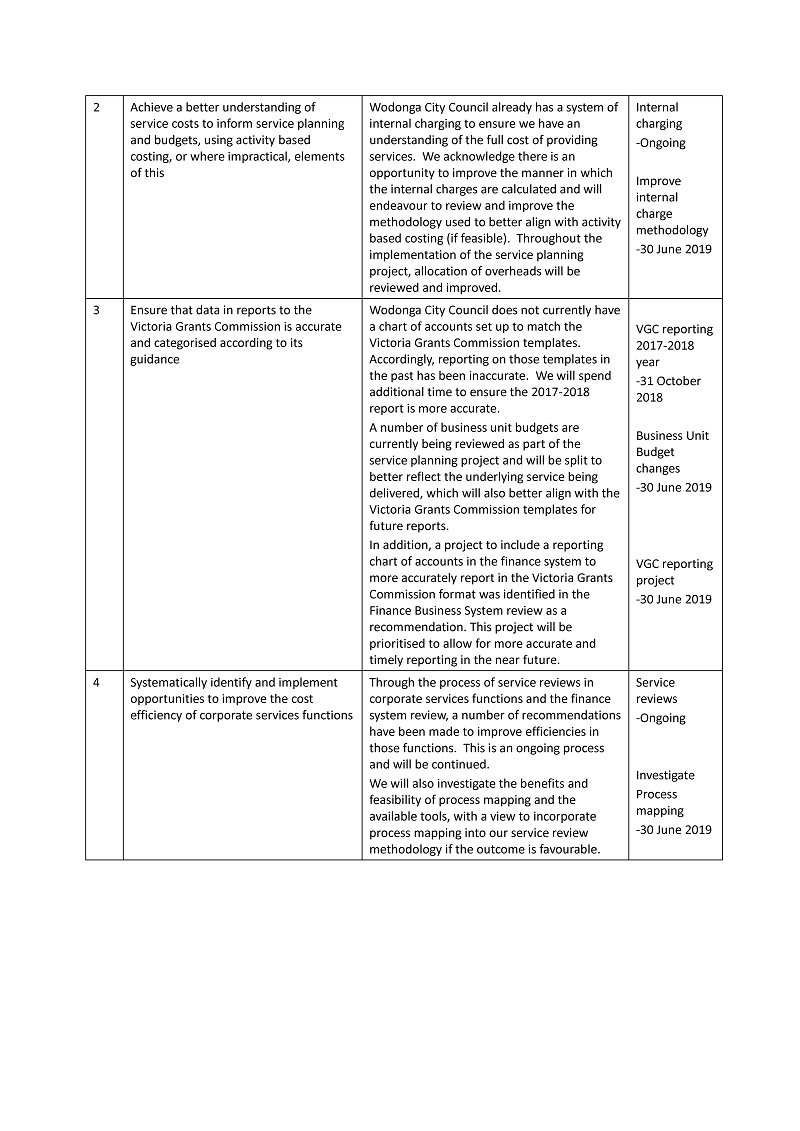

1. implement an integrated service planning and review framework that:

- includes a clear relationship between the services the council delivers and the objectives outlined in its council plan

- links service objectives to identified community needs

- describes how services will be supported with appropriate assets and infrastructure

- identifies service standards and performance measures

- includes benchmarking to enable comparison with other councils' performance

- investigates ways to achieve cost efficiencies through alternative service delivery models, such as shared service arrangements or outsourcing

- includes mechanisms to ensure that the level of service and mode of service delivery are regularly reviewed (see Sections 2.2, 2.3, 2.4, 3.3 and 3.5)

2. achieve a better understanding of service costs to inform service planning and budgets using activity-based costing or, where impractical, elements of this (see Section 2.5)

3. ensure that data it reports to the Victoria Grants Commission is accurate and categorised according to its guidance (see Section 3.3)

4. systematically identify and implement opportunities to improve the cost efficiency of corporate services functions (see Section 3.4).

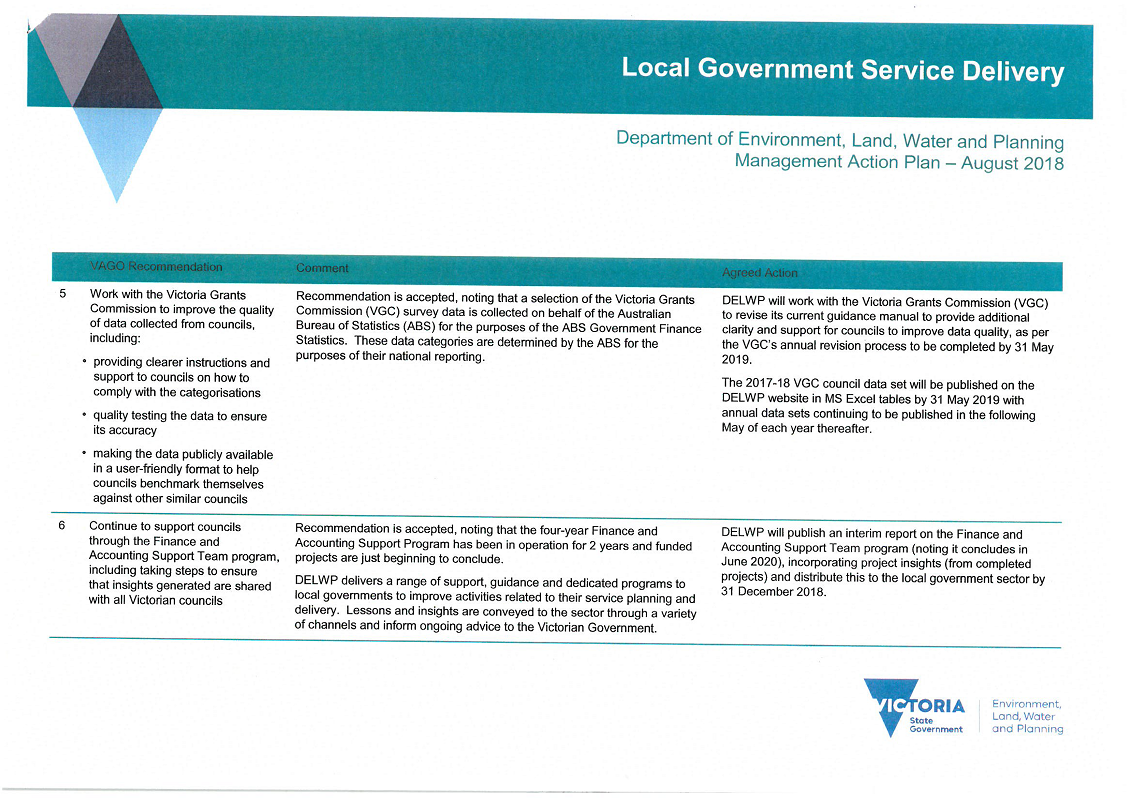

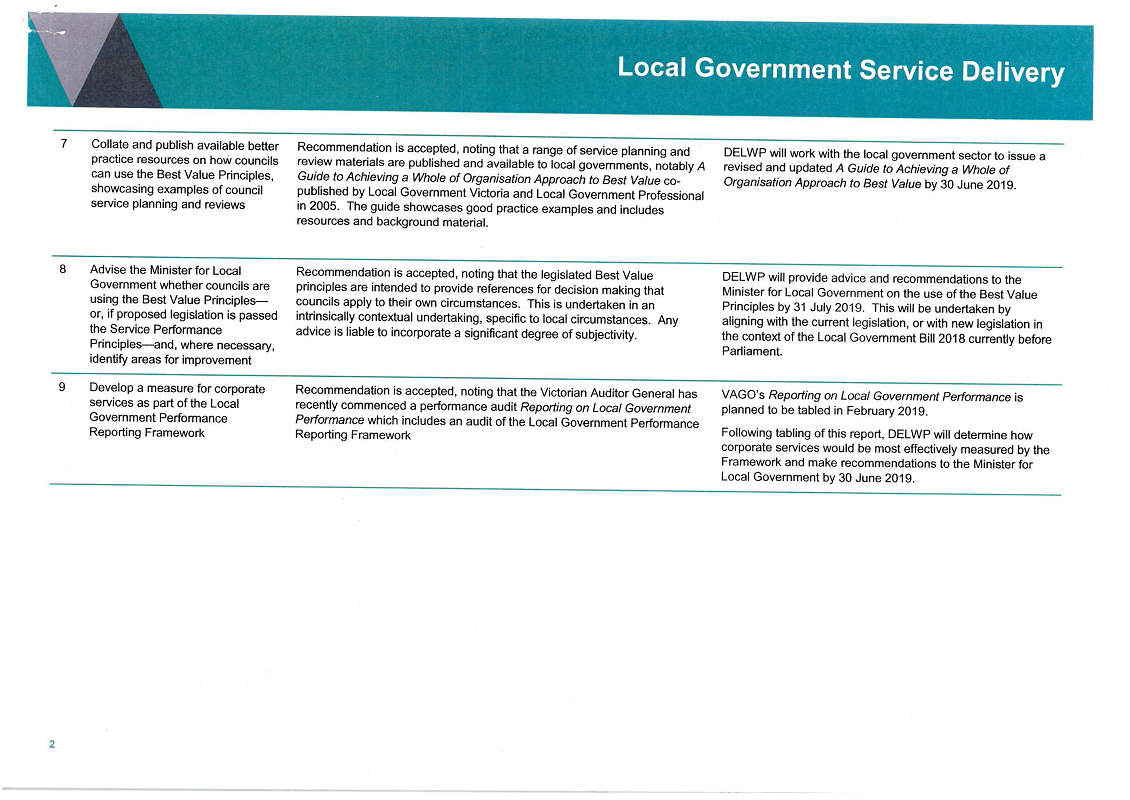

We recommend that the Department of Environment, Land, Water and Planning:

5. work with the Victoria Grants Commission to improve the quality of data collected from councils, including:

- providing clearer instructions and support to councils on how to comply with the categorisations

- quality testing the data to ensure its accuracy

- making the data publicly available in a user-friendly format to help councils benchmark themselves against other similar councils (see Section 3.3)

6. continue to support councils through the Finance and Accounting Support Team program, including taking steps to ensure that insights generated are shared with all Victorian councils (see Section 2.6)

7. collate and publish available better practice resources on how councils can use the Best Value Principles, showcasing examples of council service planning and reviews (see Section 2.6)

8. advise the Minister for Local Government whether councils are using the Best Value Principles—or, if proposed legislation is passed, the Service Performance Principles—and, where necessary, identify areas for improvement (see Section 2.6)

9. develop a measure for corporate services as part of the Local Government Performance Reporting Framework (see Section 3.3).

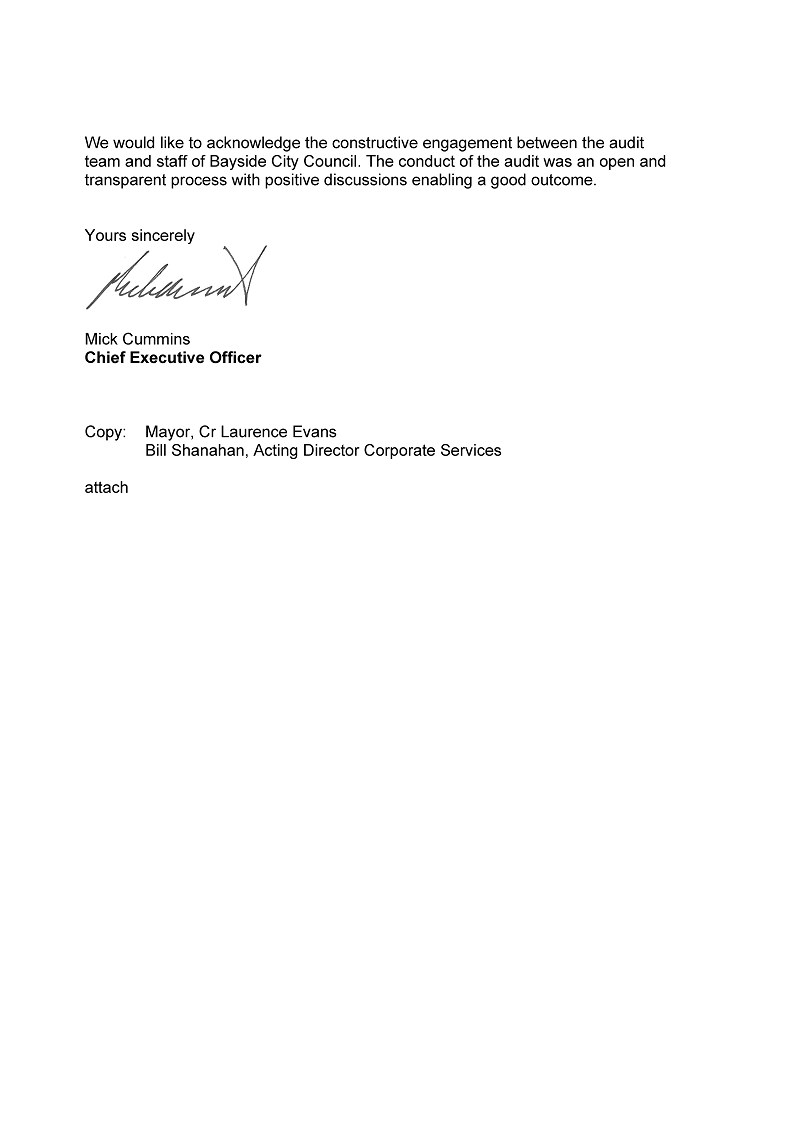

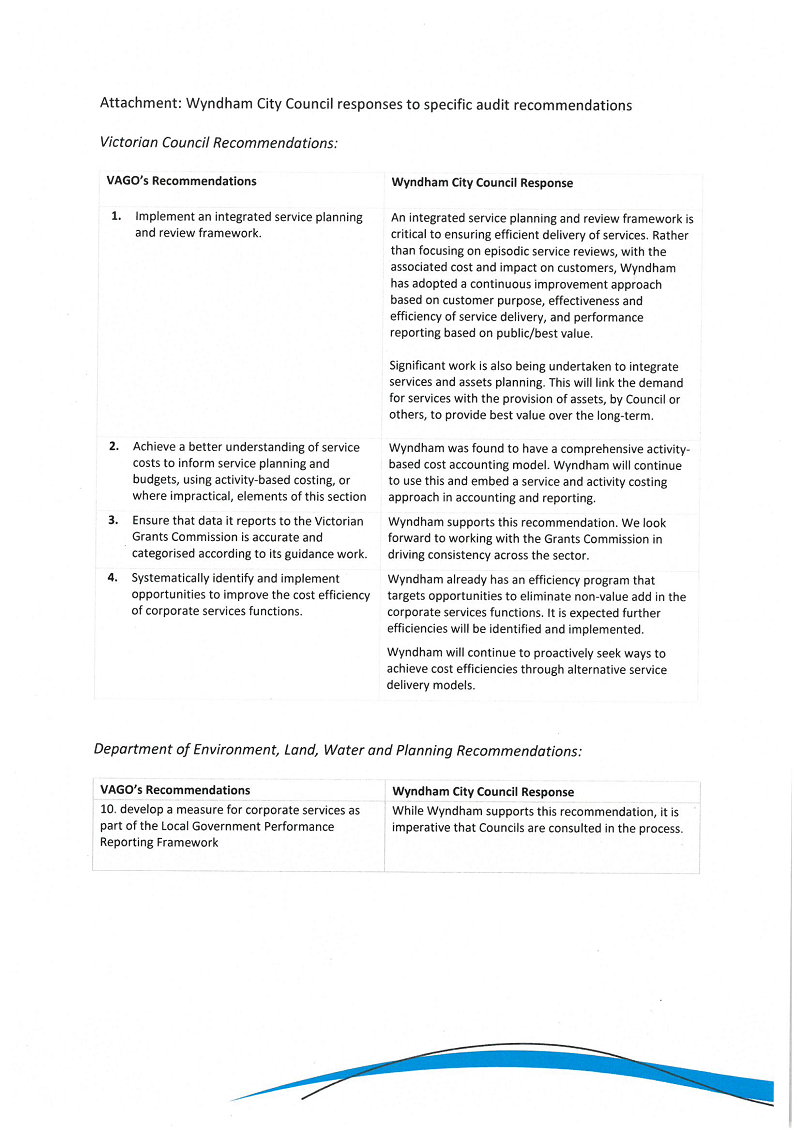

Responses to recommendations

We have consulted with DELWP, Bayside, Indigo, Moira, Wodonga and Wyndham, and we considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet.

The following is a summary of those responses. The full responses are included in Appendix A. following is a summary of those

Bayside, DELWP, Indigo, Moira and Wodonga have accepted the recommendations and outlined how they will address the issues we identified. While Wyndham has accepted the recommendations and developed an action plan, its response notes its preference for a continuous improvement approach to achieving efficiencies, rather than service reviews.

1 Audit context

Victoria's 79 local councils provide a wide range of services including health, social welfare, waste, recreation, infrastructure, planning and emergency management. Services vary significantly across councils, depending on the demographics, size, location, and priorities of each community.

Section 3C(2)(b) of the Act requires councils to use their resources efficiently and effectively and ensure that services meet the needs of the community. Councils determine the range and cost of the services they provide through formal council decisions, service planning by council staff, consultation with the local community and relevant legislation.

1.1 Strategic and financial planning

The Act requires councils to develop strategic and financial plans, including:

- a four-year council plan that outlines the council's strategic objectives and strategies for achieving these

- a four-year strategic resource plan, which details the resources required to achieve the council's strategic objectives

- an annual budget that outlines how the council will deliver specific services and initiatives.

Figure 1A outlines the council strategic and financial planning framework. Although not legally mandated, councils also develop plans, strategies and policies to provide detailed information on how they will deliver services.

Figure 1A

Council strategic and financial planning framework

Key: ▲ activities required under the Act.

Source: VAGO.

The Local Government Bill 2018 was introduced to Parliament in May 2018. The proposed legislation replaces the strategic resource plan with a 10-year financial plan, 10-year asset management plan and a four-year budget in addition to the annual budget. The changes aim to encourage councils to consider short-, medium- and longer-term approaches to resource planning.

1.2 Service planning and reviews

Over time, the needs and expectations of communities can change. Councils need to have robust processes for service planning and review to ensure all services continue to provide value for money and are in line with community expectations. In doing so, councils should engage with communities to determine how to prioritise resources and balance service provision against other responsibilities such as asset maintenance and capital works.

Although councils have a legal obligation to provide some services—such as animal management, local roads, food safety and statutory planning—most council services are not legally mandated, including some services closely associated with councils, such as libraries, building permits and sporting facilities.

Although no agreed approach exists to categorise council services, Figure 1B summarises some of the services councils provide and the rationale for providing them.

Figure 1B

Rationale for providing council services, with examples

|

Rationale for service |

Explanation |

Example of service |

|---|---|---|

|

Statutory obligation |

Council is legally required to provide the service |

Rates, roads, sanitation, animal management |

|

Statutory discretion |

Legislation gives council the option to deliver a service, but it is not mandatory for council to do so |

Household recycling collection, economic development, community grants |

|

Community expectation |

Due to market failure or community demand, council is expected to provide the service and it would be extremely difficult for council to exit the service |

Sport and recreation services, libraries, citizenship ceremonies |

|

Council discretion |

Although it is not legally required to do so, council provides the service to meet an identified community need that other organisations may be able to provide |

Markets and saleyards, sister-city relationships |

Source: VAGO.

Councils may deliver a discretionary service on a commercial basis. For example, Indigo provides gas to the Mount Buller ski resort through its commercial entity Buller Gas.

1.3 Best Value Principles

Section 208B of the Act sets out the Best Value Principles that councils must apply to the services they provide. All services delivered by councils must:

- meet quality and cost standards

- respond to community need

- demonstrate continuous improvement

- be accessible to relevant members of the community.

When applying the Best Value Principles, section 208C of the Act directs councils to consider a range of factors, including:

- the need to review services against the best services delivered by the public and private sectors

- value for money

- community expectations and values

- the balance between affordability and accessibility

- the value of potential partnerships with other councils.

The Best Value Principles were added to the Act in 1999 to replace the requirement for compulsory competitive tendering for local government services. The Act required councils to review all services by 31 December 2005 to demonstrate that the principles were being met, and to report annually on compliance with the principles. The amendment to the Act was supported by the establishment of LGV's Best Value Commission, which advised the minister on the implementation of the principles and any shortfalls or assistance required by councils.

Following an external review in 2007, the Best Value Commission was abolished, and councils were no longer required to formally review their services. However, the Act continues to mandate that councils report annually on how they use the principles in service provision.

The proposed Local Government Bill replaces the Best Value Principles with Service Performance Principles. Figure 1C shows that the new principles reflect similar concepts of quality, responsiveness, accessibility and value for money, and that they introduce a new obligation for a complaints policy.

Figure 1C

Best Value Principles compared to Service Performance Principles

|

Best Value Principles— Local Government Act 1989 |

Service Performance Principle— Local Government Bill 2018 |

|---|---|

|

|

Source: VAGO.

Under the proposed Bill, councils would be required to plan and deliver their services in accordance with the Service Performance Principles. The proposed Bill does not include a requirement for councils to report on how they use the Service Performance Principles.

1.4 Fair Go Rates System

In 2015, the Victorian Government introduced FGRS, which enables the minister to establish a yearly rate cap that limits councils' ability to increase their rates and municipal charges each year. This acts as a constraint on how councils have previously raised revenue—to increase rates beyond the cap, councils must apply to the Essential Services Commission (ESC).

Under section 185E of the Act, councils applying for a higher cap must demonstrate a range of factors, including:

- how the views of ratepayers and the community have been considered in proposing the higher cap

- how the higher cap is an efficient use of council resources and represents value for money

- whether the council has considered reprioritising proposed expenditure and alternative funding options and why those options are not adequate.

In the first three years of FGRS, few councils applied for adjustments to their rate cap. In 2016–17, nine councils applied for a variation and six succeeded. In 2017–18, five councils applied to ESC and four were approved. In 2018–19, only the City of Monash applied and was granted a variation to the rate cap, although at a lower level than requested.

ESC has advised that councils seeking a higher rate cap must establish a long‑term funding need. The council needs to demonstrate this through a rigorous approach to long-term financial planning, which can include:

- service reviews (service planning and service prioritisation) leading to affordable services and service levels, informed by community engagement

- asset management planning that identifies cost-effective outlays and is based on properly considered and documented risk management practices

- rigorous and well-documented financial strategies and practices.

Under FGRS, a key challenge for councils is to become more efficient while continuing to deliver services, maintain infrastructure, and renew assets that meet the needs of their communities.

Rate cap calculation

ESC advises the minister on the appropriate rate cap. Figure 1D outlines the ESC rate cap calculation for the current financial year.

Figure 1D

ESC rate cap calculation, 2018–19

|

For 2018–19, ESC advised the minister that the following calculation was appropriate to set the rate cap: (0.6 x Consumer Price Index) + (0.4 x Wage Price Index) − efficiency factor The Consumer Price Index measures changes in the retail price of a fixed basket of goods. The Wage Price Index measures changes in the price of Australian labour and was included to reflect councils' limited capacity to adjust their wage costs in the short to medium term due to existing employment agreements. An efficiency factor is a common way to encourage service providers to pursue ongoing efficiencies in their operations and pass them on to customers—in this case, ratepayers. For 2018–19, ESC applied an efficiency factor of 0.10 per cent. Using this calculation, the ESC recommended a rate cap of 2.25 per cent. The minister set this as the rate cap in December 2017. |

Source: VAGO based on information from ESC and ABS.

In March 2018, ESC announced it would no longer use an efficiency factor. Instead, it will gradually increase the weighting that it places on the Consumer Price Index and decrease the weighting on the Wage Price Index in its calculation.

1.5 Service efficiency

The need to maximise profits motivates businesses to produce efficiencies. Although councils do not have this driver, becoming more efficient enables them to meet changing community needs without extra resources.

To become more efficient and to ensure decisions about service delivery are based on evidence, councils must have a detailed understanding of all the services they provide and the full cost of delivering these services. The full cost of services includes:

- direct costs, which relate clearly and exclusively to a specific service

- indirect costs, which can be more difficult to identify and allocate because they include overheads that are not specific to an individual service.

For example, the costs of employing lifeguards and buying pool chemicals are direct costs of operating an aquatic centre. One of the indirect costs of delivering this service is the work performed by a council's human resources and payroll staff. Human resources and payroll staff do not exclusively support the aquatic centre, but council can identify the portion of staff time and resources related to the service and allocate this as an indirect cost to the aquatic centre's operations.

The most challenging aspect of determining a service's full cost is effective identification and allocation of indirect costs. These are usually 'hidden costs' and require councils to take a more sophisticated approach to quantifying them.

Councils also need to identify other opportunities to make their service delivery more efficient. These may include:

- streamlining work practices to remove unnecessary steps in an internal process

- working with other councils to deliver joint services to achieve economies of scale and share operating costs

- outsourcing services

- using technology to improve processes.

Measuring efficiency

As part of its research into whether to introduce an efficiency factor, ESC engaged a consultant to review councils' productivity. The consultant found that productivity in the Victorian local government sector had declined over the period 2010–11 to 2015–16, falling behind productivity trends in the broader economy.

|

An output is the product or service that an organisation produces. In the case of councils, outputs could include rubbish bins collected or library books borrowed. |

The consultant also analysed how many councils were achieving 'full technical efficiency', which is where a council delivers the highest possible number of outputs using available resources or uses the lowest amount of possible resources to deliver required outputs. To determine this, ESC used the most efficient council within each council category. It found that a greater proportion of small rural councils had achieved full technical efficiency relative to their peers, indicating that some small rural councils had adopted practices to address the disadvantage of low and declining populations. However, ESC stressed that the comparative nature of this measure means these councils could still become more efficient.

ESC acknowledges that although these quantitative measures of efficiency are useful, they do not provide an understanding of councils' management decisions and the process improvements councils made to achieve efficiencies. For this reason, our report uses the audited councils as case studies to highlight better practices and some common areas for improvement.

1.6 Corporate services

Corporate services, or 'back office' functions, are services that support frontline service delivery. Corporate services vary between councils, but usually include human resources, IT, legal, governance, communications, records management, customer service, and finance, revenue and payroll functions. Efficient corporate services support councils' overall financial sustainability and lower the overheads associated with frontline services.

VAGO benchmarking survey

We conducted a survey to benchmark the costs of corporate services across Victorian councils. We asked councils to provide information about their expenditure and employee numbers for a range of corporate services functions for 2016–17. Appendix B provides more detail on the survey methodology.

1.7 Council population and expenditure

As part of its work allocating financial assistance grants to councils on behalf of the Australian Government, VGC collects and publishes annual data on expenditure and revenue for all 79 councils. This data provides useful context about councils' financial performance and the challenges faced across the sector.

Throughout the audit, we have used LGV's council categories to compare councils. The categories are:

- metropolitan

- interface—one of the nine councils that form a ring around metropolitan Melbourne

- regional city

- large shire

- small shire—a rural council with a population of less than 15 000.

LGV's categorisations are based on councils self-identifying as members of existing groups—Interface Group of Councils, Regional Cities Victoria and Rural Councils Victoria.

We collated the past five years of available data from VGC, from 2012–13 to 2016–17. We used five-year averages in our analysis to account for fluctuations in yearly expenditure.

Population growth

Population growth has occurred unevenly across Victorian council categories, as Figure 1E shows. This growth impacts expenditure and service delivery. The challenges of population growth for councils include funding infrastructure and managing current community needs while planning to meet the expectations of future residents.

Figure 1E

Population growth across council categories, 2006 to 2017

|

Population growth |

||

|---|---|---|

|

Council category |

Total (%) |

Average annual (%) |

|

Metropolitan |

20 |

1.7 |

|

Interface |

49 |

3.7 |

|

Regional city |

16 |

1.4 |

|

Large shire |

16 |

1.3 |

|

Small shire |

2 |

0.1 |

|

All councils |

25 |

2.0 |

Source: VAGO based on ABS data.

Figure 1F shows that Wyndham is experiencing significant growth—more than doubling its population since 2006—compared with the other audited councils.

Figure 1F

Population growth of audited councils, 2006 to 2017

|

Population growth |

||

|---|---|---|

|

Council category |

Total (%) |

Average annual (%) |

|

Bayside |

15 |

1.2 |

|

Indigo |

8 |

0.7 |

|

Moira |

7 |

0.6 |

|

Wodonga |

21 |

1.7 |

|

Wyndham |

110 |

7.0 |

Source: VAGO based on ABS data.

|

Correlation is the statistical measure of the relationship between two or more things. It is often measured by an R score, with a score of 1 representing positive perfect correlation. |

Expenditure and population

The data we collected confirms that across councils a strong relationship exists between council population, expenditure and revenue. Figure 1G shows there is a strong correlation between average council operating expenditure and population.

Figure 1G

Average total expenditure and population of Victoria councils, 2012–13 to 2016–17

Note: Does not include capital expenditure. Excludes Melbourne City Council because, as a capital city, its total expenditure is not comparable to other councils.

Source: VAGO based on VGC and ABS data.

For metropolitan councils and small shire councils, the relationship between average council operating expenditure and population is not as strong. This highlights the different cost pressures that councils face, even those within the same category. Figure 1H shows the strength of correlation between expenditure and population across the council categories.

Figure 1H

Correlation between average total expenditure and population for council categories, 2012–13 to 2016–17

Note: Excludes Melbourne City Council because, as a capital city, its total expenditure is not comparable to other councils.

Source: VAGO based on VGC data.

The LGV Local Government Performance Reporting Framework (LGPRF)—which collates 83 measures about council performance, financial management and sustainability—also measures the relationship between expenditure and population. It uses a measure of total council expenditure per capita. The most populous councils—metropolitan and interface—generally perform the best on this measure. In contrast, there is wider discrepancy in how small shires perform. Figure 1I shows the distribution of performance in this measure across the council categories.

Figure 1I

Expenditure per capita across council categories, 2016–17

Note: See Appendix C for each council's result.

Source: VAGO based on LGPRF data.

Council employees

From 2008–09 to 2016–17, the number of FTE employees across the local government sector grew by 22 per cent, as Figure 1J shows. This is in line with councils' overall population growth of 25 per cent.

Figure 1J

FTE employee growth by council category, 2008–09 to 2016–17

|

Council category |

Total FTE growth (%) |

|---|---|

|

Metropolitan |

24 |

|

Interface |

34 |

|

Regional city |

15 |

|

Large shire |

17 |

|

Small shire |

2 |

|

All councils |

22 |

Source: VAGO based on VGC data.

Figure 1K shows that between 2012–13 and 2016–17, employee costs represented a significant part of council expenditure, particularly for metropolitan councils.

Figure 1K

Average employee expenditure as percentage of total expenditure across council categories, 2012–13 to 2016–17

|

Employee expenditure as a percentage of total expenditure |

||

|---|---|---|

|

Council category |

Category average (%) |

Category range (%) |

|

Metropolitan |

45 |

39–53 |

|

Interface |

38 |

32–45 |

|

Regional city |

40 |

32–44 |

|

Large shire |

38 |

30–45 |

|

Small shire |

38 |

25–46 |

Note: Does not include capital expenditure.

Source: VAGO based on VGC data.

In terms of actual expenditure across the sector, employee costs have grown by 19 per cent from 2012–13 to 2016–17, with an average annual increase of 4.5 per cent.

In the past 10 years, employee expenditure per employee in Victorian councils has grown by 51 per cent, compared with 36 per cent in the Victorian Public Service. Figure 1L shows the annual growth in average employee expenditure per employee across the two sectors since 2008–09.

Figure 1L

Growth in average employee cash wages and salaries in the local government sector and the Victorian Public Service, 2008–09 to 2016–17

Note: Average employee cash wages and salaries were calculated by dividing total cash wages and salary expenditure by number of employees in the sector.

Source: VAGO based on ABS data.

1.8 Agency roles and responsibilities

Local councils

Councils are responsible for planning and delivering services that meet the needs of their communities, including preparing a council plan and strategic resource plan. Councils have their own financial management and cost accounting processes for setting the price of services and determining the direct and indirect costs of services.

Local Government Victoria

LGV—part of DELWP—provides policy advice to the Minister for Local Government and oversees relevant legislation, including the Act. LGV also works with councils to improve their business and governance practices. This includes grant programs to support councils' finance capability and better practice guides on preparing council plans, budgets, financial reports, and revenue and rating strategies. LGV also administers LGPRF and presents the results of councils' performance on the Know Your Council website.

Victoria Grants Commission

VGC, which is supported by DELWP, allocates financial assistance grants from the federal government to Victorian councils.

1.9 Why this audit is important

As FGRS is heading into its third year, councils face the challenge of delivering effective services without relying on increased rates revenue. This audit examined how councils meet the needs of their communities while responding to cost pressures. The audit provides councils with information on dealing with emerging challenges, potential opportunities and better practices across the sector.

This audit builds on previous VAGO audits that have identified risks to the financial sustainability of councils, and weaknesses in service planning, delivery, and cost accounting:

- Our financial audit report Results of 2016–17 Audits: Local Government found that councils were forecasting a 1 per cent decrease in revenue over the next three years, while expenditure is set to increase by 2 per cent over the same period. We found that councils were planning to reduce spending to address this shortfall.

- Our 2014 audit report Shared Services in Local Government found that while most Victorian councils undertake some form of shared services, their use was relatively immature. We projected that shared services activity in relation to 'back office' functions would increase significantly.

- Our 2011 audit report Business Planning for Major Capital Works and Recurrent Services in Local Government found little evidence that councils appropriately review their service delivery to inform their spending decisions.

1.10 What we examined and how

We focused on whether councils effectively plan for and deliver cost efficient services that meet community needs.

We considered the quality of councils' overall service planning and cost management processes. The audit also examined the efficiency of council corporate services as an example of a type of service that all councils provide.

We did not focus on the effectiveness of councils' community consultation practices, as this was part of our 2017 audit Public Participation and Community Engagement: Local Government Sector. However, we did consider how councils use community consultation to identify and plan services.

We selected which councils to audit by analysing VGC and LGPRF expenditure data and performance reporting measures. This data indicated that the cost efficiency of council services varied significantly according to location, size and community demographics. We selected one council from each LGV council category, as Figure 1M shows.

Figure 1M

Audited councils

|

Council category |

Audited council |

|---|---|

|

Metropolitan |

Bayside |

|

Interface |

Wyndham |

|

Regional city |

Wodonga |

|

Large shire |

Moira |

|

Small shire |

Indigo |

Source: VAGO.

The methods for this audit included:

- analysis and linking of data on council performance and expenditure from councils, VGC, ESC and LGPRF

- a survey of council corporate services and cost accounting processes—58 of the 79 Victorian councils responded to our survey, which is a response rate of 73 per cent

- case studies of service planning practices and the efficiency of corporate services at audited councils

- discussions and formal interviews with staff at audited agencies

- consultation with broader stakeholders such as peak bodies and professional organisations.

We conducted our audit in accordance with section 15 of the Audit Act 1994 and ASAE 3500 Performance Engagements. We complied with the independence and other relevant ethical requirements related to assurance engagements. The cost of this audit was $375 000.

1.11 Report structure

The remainder of this report is structured as follows:

- Part 2 examines councils' planning and review of their services

- Part 3 examines councils' corporate services.

2 Planning and reviewing council services

Councils must both plan for and review services to ensure they are financially sustainable and designed to meet community needs. Although service planning and review is not explicitly required by the Act, councils must adhere to the Best Value Principles, which specify that services must:

- meet quality and cost standards

- respond to community need

- demonstrate continuous improvement

- be accessible to relevant members of a community.

Effective service planning requires councils to understand the current and future needs of their communities and to identify the resources required to achieve the desired level and quality of service. Councils also need to review the services they provide to ensure they are meeting their intended objectives, and to consider improvements in service delivery.

2.1 Conclusion

Although all the audited councils can demonstrate some elements of good practice, none have a comprehensive approach to both planning and reviewing services. Without planning and reviewing their services in a systematic way, councils risk not delivering best value and may fail to align their services with community expectations.

Not all councils know the full cost of their services because they do not accurately and consistently allocate their overheads. This diminishes the ability of councils to make robust decisions about service levels and limits the effectiveness of how they plan to provide effective and efficient services to their communities. It also reduces their capacity to meaningfully compare the costs of their services with other councils.

Although it is the responsibility of councils to ensure that the services they provide are effective and efficient, there is scope for LGV to play a greater role in assisting councils to use the Best Value Principles, such as by sharing better practice examples of service planning and reviews.

Although LGV does not provide guidance on the Best Value Principles, it does provide support to improve aspects of councils' financial management—including service planning, budgeting and long-term financial planning—through the FAST program. It is too early to determine the success of the program, but there is potential for LGV to use the insights generated by the program to support whole-of-sector improvement.

2.2 Service planning

To deliver effective services, councils need a robust approach to service planning that sets clear objectives and outlines the resources required to achieve them. Councils typically document their service planning in a service plan or service catalogue.

Two of our audited councils—Wodonga and Moira—do not have a consistent, council-wide approach to service planning. Bayside, Indigo and Wyndham have service planning processes that reflect elements of good practice. Overall, we found that the audited councils could improve the effectiveness of their service planning by taking a longer-term approach and making better use of information about the full cost of delivering services.

Approaches to service planning

Service planning can take different forms, but a common model is for councils to develop focused service plans that:

- define the type and level of service to be delivered

- set out the resources and infrastructure required to deliver a service

- set clear objectives to assess performance.

It is important that service planning aligns with a council's other strategic planning processes, including the council plan and asset management plan, to ensure that the council can coordinate its efforts to achieve agreed priorities.

Although each council has a different approach to service delivery, we identified some common elements of effective service planning through research and consultation with the sector. Figure 2A shows key elements in effective service planning.

Figure 2A

Elements of service planning

Source: VAGO.

Service plans

Two of the audited councils, Bayside and Indigo, have developed internal service plan documents. Using an agreed service plan template across council prompts each service area to consider the same issues when planning services, which encourages a consistent approach across council. Figure 2B describes Indigo's consistent, council-wide approach to service planning.

Figure 2B

Case study: Indigo service plans

|

Indigo has developed a uniform approach to service planning. Each year, managers enter key information into a service plan template, including target customers, performance measures and the activities the service will deliver. It also outlines the risks facing the service and the actions that council will take to address these. Managers must also identify which council assets each service uses. The council then uses the completed service plans to support the annual budget process. By gathering detailed information at a service level, the council can ensure its decisions are based on a full understanding of the service and related community needs. The use of a template ensures a consistent approach and makes it easier for the council to form a holistic view of service delivery. Managers at Indigo advised us that the template was easy to use and that the process was beneficial for their services. This approach demonstrates that service planning does not need to be a complex and resource-intensive exercise. Smaller councils can develop simple yet useful tools to enable them to plan for better service delivery. |

Source: VAGO based on information provided by Indigo.

Although Indigo's service plans are useful, they could benefit from a more long‑term view. Indigo has recognised this and recently secured support through LGV's FAST program to fund improvements to its service planning and develop a 10-year financial plan. Bayside has also recognised the need to take a longer‑term view and is in the process of transitioning from annual department plans to four-year service plans.

These changes should allow greater scope for the councils to oversee how their services respond to changing community need. They also align with the potential upcoming requirement under the Local Government Bill 2018 for councils to produce 10-year financial and asset management plans.

Although service areas at Moira and Wodonga undertake service planning, the councils do not use a service plan template or common approach across all council services. Instead, each business unit conducts its own service planning process. This means the councils cannot be assured that service planning is consistent and conducted with the same rigour, and there is a risk that the services delivered will not align with the priorities in the council plan. Wodonga is addressing this risk by developing a council-wide approach to service planning, due to be implemented by February 2019.

Service catalogues

As discussed, councils usually conduct service planning by requiring each department or business unit to outline how it will deliver services. Another approach to service planning is to develop a service catalogue. When preparing a service catalogue, councils start by defining the services that are required to address community need. They then plan their operations to support service delivery. A catalogue ensures councils plan to address community needs first, rather than the operational requirements of their internal departments.

Only one council in our audit, Wyndham, used a service catalogue approach to service planning, as outlined in Figure 2C.

Figure 2C

Case study: Wyndham service catalogue

|

Wyndham's service catalogue lists all 66 services that the council provides and outlines key information about each one, including its current service level, target customers and performance indicators. It also identifies the rationale for service delivery—for example, if a service is mandated by legislation. It also includes information about the cost of delivering each service. The catalogue also groups services into categories based on a customer view of the council. For example, although Maternal and Child Health and Animal Management are in different departments within the council, the catalogue groups them both under a category called 'My Family'. This focuses council's service planning activities on community need, rather than the operational requirements of departments. |

Source: VAGO based on information provided by Wyndham.

Service plans are usually static documents that are reviewed yearly, but Wyndham's service catalogue is hosted on an online platform, which means that managers can add to it as circumstances change. Wyndham has advised that it is in the process of adding other information to the online platform—such as risk and audit committee actions, council plan initiatives and other strategic documents—with the aim that a service manager can access all relevant information about a service at once, ensuring that decisions are based on comprehensive and up-to-date evidence.

Understanding the needs of the community

Councils need to conduct regular and meaningful consultation with communities to ensure that service levels and quality meet community needs and expectations. To understand the needs of their communities, councils use a combination of demographic data, research and community consultation.

Under the Best Value Principles, councils must consult regularly with the community about the services they provide. As part of this, councils engage with the community when developing the council plan, which provides long‑term direction for council activities.

Although the council plan and budget are the primary vehicles for community engagement, councils often undertake more focused consultation around specific service areas. However, the audited councils advised that it can be difficult to engage the community in meaningful discussions around service levels, such as changes to service quality, trade-offs and willingness to pay. For example, Wodonga advised that only one resident attended an evening consultation on the current budget. Similarly, Indigo reported that only 15 people attended its recent series of budget workshops.

Indigo has attempted to address this by engaging 'community champions'—members of the community who host conversations with other residents and run surveys focused on the council plan and on other issues—for some projects. This model enables community members to increase their understanding of the challenges facing councils when prioritising resources. Indigo has advised that it is also considering a new participatory budget process, where residents are asked how they would allocate council resources.

Wodonga reported that it used a participatory budget process when planning a new playground and asked participants to select playground equipment within a specific budget limit. Although Wodonga advised that it is considering whether a similar process could be used for the budget, it has found that the community is more interested in focused conversations about specific services than about finance or budget trade-offs. In 2017, Wodonga developed the Make Wodonga Yours website, which hosts all its community consultation activities separate from the main council website. Wodonga advised that the new website has increased community engagement.

Wyndham's process for engaging the community in ongoing conversations about council priorities involves District Advisory Committees. These committees include diverse community representatives who provide feedback about council actions and facilitate communication between the council and the broader community.

Councils also draw on population and demographic data to determine long-term community need and assess whether to redirect resources. This information is important both for councils planning to meet the challenges of growth, as well as for those with declining or ageing populations. For example, Indigo used demographic data in its 2016 review of community services. The data revealed a disconnect between council services—primarily aimed at children and youth—and the needs of its ageing community. Indigo restructured its community services to better meet these needs.

LGV facilitates an annual community satisfaction survey on behalf of councils. Although it provides feedback on key areas of council performance, it is not designed to collect detailed information on community expectations about service levels or quality. Wyndham and Bayside have conducted their own community satisfaction surveys with detailed questions about services to aid service planning.

2.3 Challenges to service planning

Defining council services

All councils advised that defining services was a key challenge for service planning, with each council having a different understanding of what constitutes a service. For example, one council may consider 'recreation' as a service, with several programs or activities sitting under it, such as 'swimming pools' or 'sporting facilities'. However, another council may consider each activity as a service. This is reflected in the discrepancy in the number of services that councils report they deliver. Bayside reports delivering 40 services, while Moira—despite having less than one-third of the population of Bayside—reports delivering over 250 services. This suggests that Moira delivers more services to its community than Bayside, but it is the result of councils defining services differently.

Many of the 250 services Moira delivers could be described as activities or processes. For example, Moira outlined 52 different services within its building and planning department, including 'registering and filing permits' and 'staff performance review'. In contrast, Bayside considers 'building surveying and asset protection' as one service.

As part of a project to improve its service catalogue, Wyndham refined its service definitions and reports that it currently delivers 66 services, down from 113. This does not indicate that Wyndham now provides less services—rather, Wyndham has a clearer understanding that each service it delivers can include several linked activities and functions, which need to be planned and delivered together as one service.

In 2015–16, ESC asked councils to provide data on each service they provided to assess council compliance with the rate cap. Our analysis of a selection of 15 of these councils—across all council categories—demonstrated significant similarities in councils' service mix. Despite this, the number of services these councils listed ranged from 10 to 100. Although councils need to define services in a way that makes sense for their organisations and communities, it is difficult to compare service delivery across councils without a common understanding of what constitutes a 'service'.

Integrating service and asset planning

Our 2011 audit report Business Planning for Major Capital Works and Recurrent Services in Local Government found a lack of integration between council strategic planning, service planning and asset management. Linking service planning to asset management is vital because the use and value of council assets depends on the services councils provide.

Indigo's service plans have explicit links to the asset priorities identified in the council plan. Bayside's annual budget process involves each service area creating a service summary that details the assets and infrastructure required to meet defined council objectives. Wyndham is developing an organisation-wide approach to link strategic service and asset planning, with the aim of ensuring that council facilities are built and maintained to optimise service delivery. Wodonga advises that it intends its new approach to service planning to link to asset management plans. Moira is not currently linking service and asset planning in a structured way.

All audited councils reported that they participate in the Municipal Association of Victoria's (MAV) STEP Asset Management and Financial Sustainability Program, which provides some assistance for councils considering the role of assets in their service provision.

2.4 Service reviews

Although all councils have conducted recent service reviews, only Bayside and Wodonga have a structured council-wide approach that ensures all services are reviewed regularly to assess whether they are meeting community needs.

Approaches to service reviews

Councils need to review services to determine whether they are effective, efficient and meeting community needs. A robust annual service planning process includes an element of review as councils consider how best to deliver a service in the coming year. Councils can also review aspects of service delivery by evaluating the impact of a specific program or activity according to defined criteria. In addition, councils can conduct formal, structured service reviews that examine the cost, quality and efficiency of a council service and, where necessary, recommend improvements.

A service review can consider whether:

- a service is meeting community expectations

- the current mode of service delivery is appropriate

- outsourcing or a shared service model would achieve greater value for money.

When a service review involves external consultants or staff from outside the relevant service area, it can also provide an independent assessment of service quality.

ESC regards service reviews as an essential part of a rigorous approach to long‑term financial planning, and it has considered councils' service reviews when assessing applications for rate cap variations.

As for service planning, councils do not have an agreed approach to conducting service reviews. However, better practice tools are available to assist councils to conduct robust reviews. The former ACELG developed better practice resources for local government, which are still available from the University of Technology Sydney. Figure 2D outlines the key steps in ACELG's 2015 Service Delivery Review: A how to manual for local government.

Figure 2D

ACELG's key steps for service review

|

Step |

Description |

|---|---|

|

Establish the building blocks |

Councils need to understand the foundations required for an effective service review project, including commitment to stakeholder engagement and continuous improvement. |

|

Set the project up |

Councils should agree on the objectives, scope and resources for review and establish a review team. |

|

Gather existing information |

Review teams should gather and record information about the services under review. |

|

Analyse services |

Review teams should examine existing service levels, review service delivery models and conduct relevant financial and risk assessments. |

|

Engage stakeholders |

Councils need to share their findings with stakeholders, including the community. |

|

Implement change |

Councils should develop meaningful recommendations, implement them and monitor the outcomes of any changes. |

|

Evaluate and drive continuous improvement |

To ensure continuous improvements, councils should evaluate the review process and share learnings across the organisation. |

Source: VAGO based on ACELG, Service Delivery Review: A how to manual for local government, 2015.

Of our audited councils, only Wodonga uses the ACELG manual as a template for its service reviews. However, all other audited councils were aware of ACELG's resources, and Bayside and Wyndham advised that they referred to the service review manual when developing their own approaches to reviews.

Although the ACELG template provides a useful starting point, it does not provide criteria for councils to assess whether a service is effective. Given that councils' services vary according to the needs of their unique communities, an important part of any service review or evaluation is determining how to assess service quality.

Frequency of reviews

According to ACELG, councils should review services as part of business-as-usual strategic planning and frequently enough to consider relevant financial, environmental and community changes. ACELG guidance notes that councils commonly adopt a time line of two to five years to review all services. If a service is delivered externally, one method is to align the timing of service reviews to the length of the contract.

Only two councils, Wodonga and Bayside, have structured approaches to service reviews that ensure all services are reviewed on a rolling basis.

Wodonga has a five-year program for conducting reviews of all service areas. The program prioritises services for review based on various factors including:

- likelihood of savings

- potential to adjust service levels

- availability of alternative service models such as outsourcing.

This strategy means that the council focuses on reviewing services with the most capacity for efficiencies while still ensuring all services are reviewed.

Bayside also has a structured program for service reviews and has a performance target in its council plan to complete four service reviews per year. However, Bayside does not have a current policy to guide how it selects services to review each year. As a result, it risks not prioritising services that would most benefit from reviews. Bayside is aware of this issue, and an internal 2017 evaluation recommended that the council target future reviews towards discretionary services. Councils are not obliged to provide these types of services, so there is greater scope for them to make changes to service levels or withdraw the service if it no longer meets community need.

Indigo and Moira do not have structured service review programs. Indigo conducts ad hoc reviews and has completed eight formal reviews in the past three years. Moira reviewed all its services for the first time in 2016 but does not have a formal plan to conduct any further reviews. Without a structured program, these councils may miss opportunities to find efficiencies across all their services.

Wyndham previously had a structured service review program but decided to pause the program after a 2015 internal evaluation found issues with the objectives and methods of its services reviews. The evaluation found that although Wyndham engaged consultants for most reviews—costing an average of $30 000 each—not all service reviews resulted in the recommended changes being implemented.

In early 2017, Wyndham decided to further refine its service catalogue, to ensure that decisions about service provision were based on robust evidence that could be used in future review activities. Although the catalogue is a useful planning tool, Wyndham needs to ensure it does not miss opportunities to improve service performance and cost.

Challenges to service reviews

Central responsibility and accountability

Councils must ensure central responsibility and accountability for service reviews. Without this, they may fail to implement and monitor improvements.

Four of the five councils address this risk. Bayside and Wyndham ensure central responsibility of service reviews and evaluations through a separate business unit tasked with continuous improvement and strategy. Indigo and Wodonga maintain central responsibility of their reviews without a separate business unit, instead allocating responsibility for review processes and outcomes to existing leadership roles or groups.

Moira has not demonstrated ongoing central responsibility or accountability for service reviews. In 2016, the council conducted a review of all services. Managers were required to review five key services within their service area and recommend improvements to the executive group. However, there was not a systematic and centralised approach to monitoring the implementation of the recommendations.

In addition, the review process created a significant amount of data about the performance and cost of council services. Moira has not updated this data since the 2016 review, and the two managers who initially developed the service review tool have since changed roles. Staff could not identify who currently has responsibility for the review process. This indicates that Moira has not clearly established central and ongoing responsibility for its service reviews. Moira risks failing to capitalise on the work it completed in 2016 and is missing an opportunity to use the data to develop evidence-based service planning and review programs.

Independence and capability

A key question for councils is whether to engage external consultants or to conduct reviews in house. According to ACELG, conducting a review internally may lack objective analysis and miss opportunities to improve business-as-usual practice. An internal review team, particularly one that is currently delivering that service, may not be best positioned to identify its own inefficiencies, consider alternative modes of service delivery or examine whether to discontinue a service.

Conducting a review internally does, however, have advantages—the council can benefit from the skills and knowledge that its staff develop during the process, and staff can take greater ownership of the outcome of the review.

Bayside was best able to balance these competing considerations by designing and conducting service reviews in house, as described in Figure 2E.

Figure 2E

Case study: Bayside service review teams

|

Bayside has developed an innovative approach to service reviews that enables the council to build internal capacity while mitigating the risk of subjective analysis. At the outset of each review, Bayside establishes a cross-organisational team led by a manager outside the area under review. The team also includes a finance representative to ensure that financial analysis is accurate. This approach mitigates the risk that service managers will not consider outsourcing or withdrawing services. For example, Bayside's 2015 review of Family and Children's Services recommended that the council cease delivery of its vacation care service, baby capsule hire service and home cleaning service because they were no longer relevant to community needs. In the case of vacation care, the review identified that the service was not financially sustainable due to declining participation rates and because external providers were increasingly meeting the community's need for the service. By conducting the reviews in house, Bayside could build skills and strengthen employee ownership of the review. One internal survey revealed that nearly all service review participants across council reported an improvement in individual skills and knowledge. A different survey, the Employee Engagement Survey, found that service areas that had undertaken a review in the previous 12 months had higher levels of engagement. |

Source: VAGO based on information provided by Bayside.

In contrast, Indigo uses a mix of internal and external resources to deliver its reviews and has outsourced two major reviews since 2014. Figure 2F outlines an example of a service review conducted by Indigo.

Figure 2F

Case study: Indigo review of aged and disability services

|

In 2017, Indigo conducted a review of its aged and disability services following significant Australian Government reforms in the sector, including the introduction of the National Disability Insurance Scheme. Due to the complexity of the service area and high community sensitivity, Indigo chose to engage an external consultant for the review. The consultant made a series of recommendations about Indigo's role in the sector and concluded that it was likely that Indigo would need to transition out of its current service arrangements. In December 2017, supported by the consultant's findings, the council resolved to stop delivering services under the Commonwealth Home Support Program and Home and Community Care Program for Younger People from June 2018. |

Source: VAGO based on information provided by Indigo.