Effectiveness of Rail Freight Support Programs

Audit snapshot

Have programs to encourage more freight on rail been effective?

Why this audit is important

The 2018 Delivering the Goods – Victorian Freight Plan confirmed the government’s intention to increase the share of freight moved by rail rather than road.

Despite this, the share of rail freight going in and out of the Port of Melbourne (the port) by rail is now less than half its 2013–14 peak.

The volume of freight carried by train has stayed static over this time. This means that trucks have carried most of the 30 per cent growth in the port’s container freight trade.

Who we examined

- The Department of Transport and Planning (the department).

- V/Line.

What we examined

- The Mode Shift Incentive Scheme (the scheme), a rebate available to freight handlers at 4 regional road-to-rail terminals.

- The Port Rail Shuttle Network (the shuttle network), an infrastructure project that aims to reduce trucks on Melbourne’s roads and give freight operators more direct port access.

What we concluded

The department’s 2 programs have not yet fully realised the government’s intention to move more freight by rail.

Although the scheme has kept some containers on trains that would have likely gone to trucks, it has not increased rail’s share of container freight in regional areas.

Delays in delivering the shuttle network facilities and services mean the social, economic and environmental benefits from diverting metropolitan containers from road to rail are also delayed.

Video presentation

Key facts

Source: VAGO

What we found and recommend

We consulted with the audited agencies and considered their views when reaching our conclusions. The agencies’ full responses are in Appendix A.

The programs have not increased rail’s freight share

The objective of this reasonable assurance engagement was to determine whether programs to encourage more freight on rail have been effective.

The 2 programs we examined – the Mode Shift Incentive Scheme (the scheme) and the Port Rail Shuttle Network (the shuttle network) – have not yet been effective in implementing the government’s intention to move more freight by rail.

Overall freight volume and activity has increased in Victoria but rail’s share of freight has not scaled with this growth.

This is largely because:

- the scheme has only partly achieved the objectives that government set for it. It has, however, kept container freight on rail that would likely have otherwise gone to road

- most of the container cargo growth in the port is occurring at Webb Dock, which has no rail connection. A concept rail route is shown in the Fishermans Bend Framework, but there is no funded project to deliver a Webb Dock rail link, even though strategic infrastructure planning documents call for it to be delivered by 2030. The government stated in its 2022 Victorian Commercial Ports Strategy that it will consider a proposal from the Port of Melbourne (the port) for a new rail connection

- progress on delivering the shuttle network has been slow since the government first funded it in its current form 8 years ago. This is delaying any shift of metropolitan container freight from road to rail and also delaying any potential social, economic and environmental benefits that would come from this.

The scheme kept freight on rail but did not increase it

The scheme has partly achieved its objectives and generated value for the state. Specifically:

- the scheme has kept container freight traffic on rail but has not significantly shifted freight from road to rail

- the scheme has promoted supply chains that include trains by supporting intermodal freight terminals on 4 rail lines across the state

- the department has not allocated the scheme’s funding through an open competitive process since 2014–15

- the scheme has not demonstrated improvements to the financial sustainability of the 4 freight operators it funds. Three of these 4 companies have said that without the rebate their rail freight services would not be viable

- the scheme has funded the same 4 freight operators for 9 financial years, giving them a potential competitive advantage over others.

An intermodal terminal is a place where freight can be transferred from one mode of transport to another; for example, between road and rail.

Rail freight volume under the scheme has declined since 2018

The department’s publicly reported data on freight containers moved by rail under the scheme shows a decline against targets, with 13 per cent fewer container movements achieved than the target for the 2018–22 period.

The department’s assurance processes for publicly reported data on the scheme and related expenditure are mostly accurate but can be improved. We found its public reporting on containers moved by rail under the scheme since 2018–19 is overstated by around 5.6 per cent in its annual reports and Budget Paper No 3: Service Delivery.

The scheme has delivered some economic value for Victoria

The scheme has delivered economic value for the state. However, estimating this value and assessing whether it exceeds the cost of the scheme relies on a range of assumptions.

Between 2021 and 2023 the government sought advice from the department on a wind-down strategy for the scheme. The 2023–24 state Budget has confirmed a further single year of funding for the scheme worth $3.5 million.

Recommendations about the scheme

| We recommend that: | Response | |

|---|---|---|

| Department of Transport and Planning | 1. Report accurately on containers funded and transported under the Mode Shift Incentive Scheme when reporting actual performance in its annual report and the 2023–24 Budget Paper No. 3: Service Delivery, to provide integrity and transparency against the performance measure for the scheme (see Section 2.1). | Accepted by: Department of Transport and Planning |

| 2. Enhance its assurance approach over payments it makes under the Mode Shift Incentive Scheme, based on an assessment of the significance of the funding provided, and risk (see Section 2.1). | Accepted by: Department of Transport and Planning |

Achieving 30 per cent of Melbourne’s metropolitan containers on rail by 2050 is unlikely

Thirty per cent of Melbourne’s metropolitan containers on rail by 2050 has been stated by the government as an expectation of the shuttle network. Reaching this would require at least 215 return train trips per week, or 31 return trips each day, between shuttle network sites and the port.

In the future, there will be more competition for train paths, particularly on the Dandenong line which has limited space for freight services during daylight hours. The number and frequency of passenger services on this corridor is expected to increase by 2050.

At present, the port’s new on-dock terminal will only unload trains during daylight hours until volumes increase, which could worsen the rail network capacity challenge. This means that overnight or off-peak freight train paths are not currently an efficient or viable solution, as the trains will be idle at the port for extended periods.

By 2050, Webb Dock is projected to handle half of the port’s containers. However, there is no rail connection to Webb Dock, nor an agreed plan or funding set aside for one. These containers, which account for nearly all growth in the port’s trade volumes, cannot be efficiently or economically transported by rail from the dockside.

Recommendations about achieving more freight on rail

| We recommend that: | Response | |

|---|---|---|

| Department of Transport and Planning | 3. Review the feasibility of the ‘30 per cent of metropolitan containers will go by rail by 2050’ expectation expressed in various public statements by the government, considering the current rail network constraints and other known commercial viability challenges that the Port Rail Shuttle Network is facing, and advise government accordingly (see Section 3.1). | Accepted by: Department of Transport and Planning |

4. Work with the Port of Melbourne operator and other freight stakeholders to give focus to re-establishing a rail connection to the Webb Dock precinct and assist as required with:

|

Accepted by: Department of Transport and Planning |

Slow progress is delaying the shuttle network’s benefits

The shuttle network program has not achieved the original contract milestones and the department has amended and extended contract dates for Altona 6 times and Somerton 14 times.

There is an average delay of 17.6 months when compared against the original expected service commencement contract dates.

While there have been delays, key contracted works are progressing:

- The Altona site’s intermodal terminal works, such as drainage culverts and new rail infrastructure, are nearly complete.

- The government delivered the Dandenong South rail spur line in August 2022, with the final rail signalling infrastructure due to be installed by June 2024. The freight terminal is now due for completion by mid-September 2025.

- Construction has not started at Somerton because the developer needs to meet precursor conditions for the contract. These were due in early June 2023, which was after we finalised this audit report. After the developer satisfies the precursor contract conditions, the department will be able to confirm the construction and service commencement milestone dates.

Despite the many time extensions and delays at all sites, the department is actively managing the shuttle network contracts. It does this by regularly liaising with the developers and seeking reports on their progress. It assesses and responds to developer requests for time extensions or other matters in a timely manner.

Beyond these delays, all parties are meeting required contract conditions, and the developers are co-investing in the project as expected.

The department has limited contractual ‘levers’ it can use to rectify the private sector developers’ time delays. Under the contracts, the department only pays out money when the developer has achieved certain milestones. This approach protects public funds and is aimed at incentivising developers to achieve their milestones so that they can get their agreed funds.

Delays in starting rail shuttle services is, however, deferring expected benefits from this project. This means that the current number of trucks carrying containers will stay the same or, more likely, grow. Any social, environmental and traffic congestion disbenefits from truck trips will therefore continue to impact the state and increase in severity.

A rail spur line is a railway track that diverges from the main railway line to allow access to industrial or commercial areas.

Recommendation about the shuttle network’s progress

| We recommend that: | Response | |

|---|---|---|

| Department of Transport and Planning | 5. Actively manage the Port Rail Shuttle Network contracts and work with the private sector developers so that freight rail services can start as soon as possible by keeping a focus on:

|

Accepted by: Department of Transport and Planning |

Shuttle network commercial viability challenges

Not long after signing their contracts in 2020, all the private sector parties raised concerns around the project’s commercial viability.

Based on this, the government agreed in early 2022 that the department should commission research and advice on the commercial viability challenges before operations start.

Consultancy report on the viability of the shuttle network

The requested consultancy report confirms that the commercial viability of the shuttle network is not certain. It identified a number of challenges to resolve.

- Trucks are estimated to have a significant competitive advantage in pricing per metropolitan container compared to freight trains, based on current pricing models and operating procedures.

- Pricing, access and operating arrangements at the port’s new on-dock rail terminal are not yet finalised.

- Upon opening, the port’s on-dock terminal will not operate on weekends and only during daylight hours unless there is a commercial driver and enough volume to extend service hours. This may not align with available freight rail paths to the port, particularly from Dandenong South.

- Freight train paths for Somerton and Dandenong South cannot be allocated until rail operators are appointed for these sites.

The viability report also confirms that Webb Dock’s lack of a rail connection is a critical challenge to the success of the shuttle network.

Specifically, the report notes that without a rail connection at Webb Dock, this expected container growth could reduce the pool of ‘contestable’ containers that could be shifted from truck to train. The report estimates that this reduction could range from 33 to 40 per cent.

The department aims to advise the government in the second half of 2023 on potential interventions related to freight and port policy, regulation, pricing and operational procedures.

Availability of sufficient freight rail paths

Under the shuttle network contracts, the department is not responsible for procuring or supplying freight rail paths. Developers need to seek paths from rail network managers based on their own commercial requirements.

The shuttle network needs sufficient and suitable train paths to be successful. Leaving this to the private sector to resolve could lead to suboptimal commercial outcomes unless the department exercises sufficient influence and support.

Metro Trains Melbourne (Metro) manages the metropolitan rail network. Metro is responsible for allocating paths and granting access to rail operators wanting to run freight services that use metropolitan tracks.

Metro has analysed the current and future freight challenges for the metropolitan network. It has developed its own network plan, which examines the challenges that more rail freight paths will bring to the metropolitan rail network.

Specifically, Metro has noted the particular challenge of the Dandenong rail line, which has many competing demands and limited paths for freight trains.

The department has a role to lead and coordinate stakeholders to help deliver the government’s rail freight policy intent. It has not fully analysed potential freight train path conflicts with the publicly stated expectations by the government about the shuttle network’s capacity to divert more freight from trucks to trains.

The department’s actions to date have not resolved issues around freight train path certainty and availability. Nor have they resolved other potentially conflicting government commitments, such as the announcement that airport rail services will run every 10 minutes. This proposed passenger train frequency could reduce available freight rail paths on the Cranbourne line and make the Dandenong South shuttle network site less viable.

Recommendations about the shuttle network’s viability

| We recommend that: | Response | |

|---|---|---|

| Department of Transport and Planning | 6. Assess the Port Rail Shuttle Network’s wider commercial viability challenges identified by its commissioned research and advice, and work with its experts and advisory committee to provide an action plan to the government before the end of 2023 (see Section 3.4). | Accepted by: Department of Transport and Planning |

7. Use its leadership and coordination role in the transport and freight sector to deliver the government’s rail freight policy intent and the Port Rail Shuttle Network’s public commitments by:

|

Accepted by: Department of Transport and Planning |

1. Audit context

In 2014, transport networks in Victoria carried 360 million tonnes of freight. The government expects this volume to more than double by 2051 to 900 million tonnes each year.

To help address this long-term challenge, in 2018 the government developed a plan for the freight and logistics system called Delivering the Goods – Victorian Freight Plan.

One key objective of the plan is to move freight more efficiently while minimising adverse impacts. The objectives in the plan have priority areas, such as reducing the impact of congestion on supply chain costs and communities, and better use of rail freight assets.

The department and V/Line play important roles in delivering these commitments by practically supporting rail freight users and operators, as well as working with other key rail entities.

This section provides essential background information about:

1.1 Freight in Victoria

Victoria’s freight network carries a wide range of goods, from fruit, to grain, to meat and cheese. It supports diverse industries and producers across the state and southern New South Wales, as Figure 1A shows.

Figure 1A: Victoria’s freight flows

Source: The department.

By 2051, the government’s freight plan estimates that Victorian transport will carry nearly 900 million tonnes of freight each year, more than double the 360 million tonnes carried in 2014.

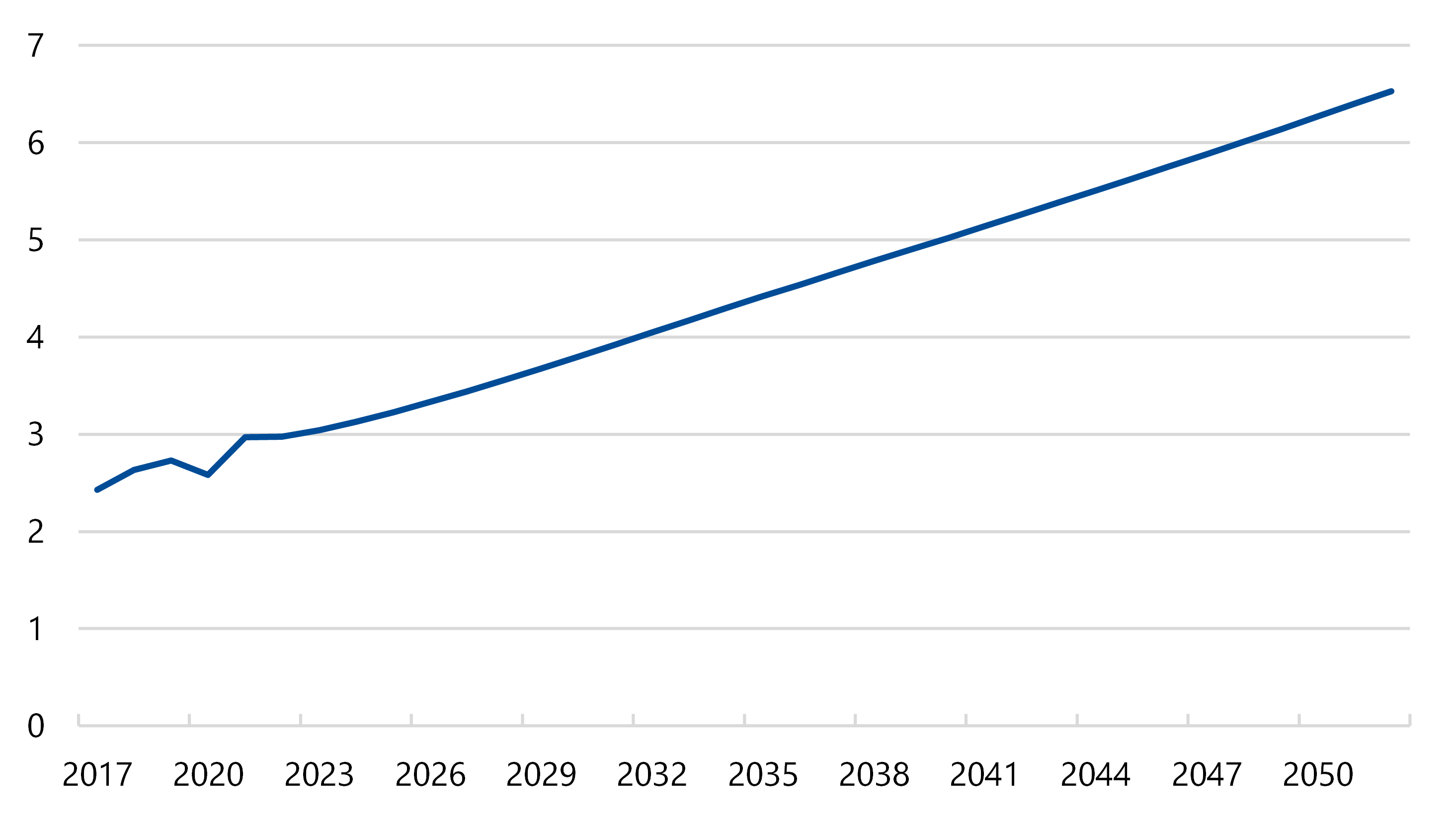

The port forecasts that its containerised freight will grow 169 per cent, from 2.4 million 20 foot container equivalent units (containers) in 2017 to 6.5 million containers in 2052, as Figure 1B shows.

Measuring container freight

The freight industry measures cargo volume in ‘20-foot container equivalent units’ (widely known as a TEU). This refers to a standard shipping container with internal dimensions of 20 feet by 8 feet by 8 feet.

Freight and shipping companies use this base unit to calculate available capacity and transport cost, even though actual container sizes may vary.

When we refer to ‘containers’ throughout this report, we are referring to 20 foot container equivalent units.

Figure 1B: Forecast growth in containerised freight through the Port of Melbourne (millions of containers)

Source: VAGO, based on Port of Melbourne data.

The transport sector is the second largest contributor to Victoria’s greenhouse gas emissions. It made up 25 per cent of the state’s total emissions in 2020, according to the Department of Energy, Environment and Climate Action.

In 2020, 89.5 per cent of transport emissions were from road transport, compared to 1.5 per cent from railways.

1.2 Policy intentions for rail freight

The 2018 Delivering the Goods – Victorian Freight Plan confirmed the government’s policy intention to increase the share of freight moved by rail rather than road.

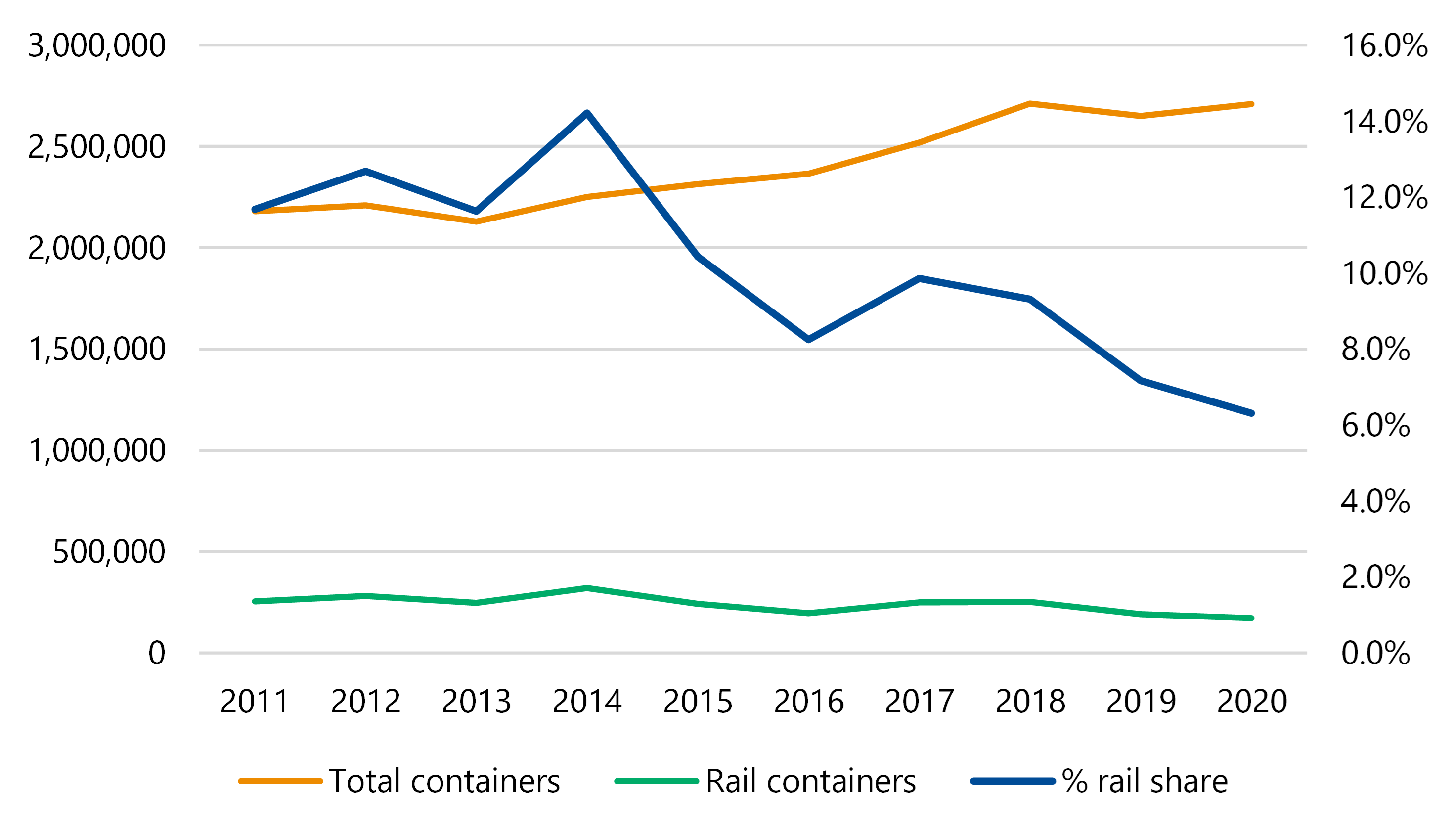

Despite this, in 2020–21 the share of freight going in and out of the port by rail dropped to less than half of its 2013–14 peak, as Figure 1C shows.

Figure 1C: Port of Melbourne containers

Source: VAGO, data sourced from Waterline reports, Bureau of Infrastructure and Transport Economics.

The share of rail freight has dropped because most container trade growth is at the new international container terminal at Webb Dock, which has no rail connection.

Economic impact of rail’s freight decline in share

Rail has carried a mostly stable volume of freight since 2013–14. This means trucks have carried almost all the increased freight traffic. This has negative economic impacts on the state, including by:

- reducing road safety

- increasing road maintenance costs

- reducing amenity for regional and metropolitan communities due to truck noise and vibration

- increasing traffic congestion

- increasing vehicle emissions.

Advantages of carrying more freight on rail

Carrying more freight on rail would reduce the number of trucks on Victoria’s roads. This would:

- decrease traffic congestion on freight routes

- lower truck-related emissions

- help the transport sector meet the state’s legislated commitment of net-zero emissions by 2050

- reduce traffic accidents and support Victoria’s road safety vision of zero road deaths by 2050.

1.3 Government investments to support rail freight

To achieve its policy intention, the government has invested in several rail freight support programs, including:

- the Mode Shift Incentive Scheme, a rebate to incentivise certain regional export freight handlers to use trains instead of trucks.

- an urban Port Rail Shuttle Network, a short-haul urban rail system that will give freight operators more direct dock access at the port.

Figure 1D shows the sites for these programs.

Figure 1D: Mode Shift Incentive Scheme and Port Rail Shuttle Network sites

Source: VAGO, using department information.

The scheme

The scheme aims to encourage road freight to move to rail by making rail freight more cost-effective.

Under the scheme, the government pays private operators of 4 regional intermodal terminals a rebate for each container they move by rail instead of road.

The scheme has operated since July 2012, when the government first allocated $10 million over 2 years.

The 2014–15 Budget included funding for the scheme over 4 years to 2017–18.

From 2018 to 2019, the government extended the scheme on a yearly basis. No other rail freight operators, beyond the current 4, have accessed the scheme since 2015.

According to the department’s Annual Report 2021–2022:

|

The intermodal terminal at… |

Is serviced by … |

|---|---|

|

Dooen (near Horsham) |

SCT Logistics (trading as Wimmera Container Line) |

|

Merbein (near Mildura) |

Seaway Intermodal |

|

Tocumwal |

Linx Portlink |

|

Warrnambool |

Seaway Intermodal |

In 2020–21, operators moved 36,478 containers by rail.

In 2022–23 the government allocated $3.5 million to the scheme. This translates to a target of 42,508 containers to move by rail.

The shuttle network

The shuttle network is a system of urban freight depots connected by rail that aims to reduce the number of trucks carrying containers on Melbourne’s roads.

It is designed to move freight between the port and 3 intermodal freight terminals at Altona, Dandenong South and Somerton.

Early attempts to develop a port rail shuttle

The concept of a port rail shuttle has existed since at least 2003, when the Victorian Government funded a $20 million project to reconnect Swanson Dock West to the rail network and build an intermodal terminal.

In 2009 the Australian Government allocated $70 million towards a $100 million investment in intermodal terminals. The Victorian Government funded the other $30 million. This included funding for intermodal sites at Altona/Laverton, Dandenong and Somerton.

According to the department’s advice to the Victorian Government in 2018, approximately $42 million of this funding was used for technical investigations and to build connecting rail infrastructure at Altona.

Funding of the current shuttle network

The current shuttle network was first announced in the 2014–15 state Budget. This $58 million capital investment consolidated the remaining $38 million the Australian Government had funded in 2009.

This money was previously allocated as separate grants for intermodal facilities at Somerton ($20 million) and Dandenong ($18 million). The remaining $20 million is the balance of the $30 million the Victorian Government previously committed.

Procurement steps for the project

The government decided to tender out a long-term lease for the port in September 2015. This meant the shuttle network project was paused while this large and complex transaction concluded.

In September 2016, the government sold a 50-year port lease to a private sector consortium for $9.7 billion. Among other things, the lease agreement required the new port operator to develop a rail access strategy.

After this, the shuttle network project recommenced in September 2017 with a procurement process to seek terminal operators.

The department issued an expression of interest to the open market that set out the government’s aims. It described the risks the government would take on and expectations about what the private sector would take responsibility for (such as requesting freight train paths and accepting market risk).

In early 2018 the government agreed to progress a number of expressions of interest it had received into a more detailed negotiation of proposals and contracts.

Current shuttle network contracts

In 2020, after these various procurement processes concluded, the department signed agreements with 3 private sector intermodal terminal operators and developers:

- Austrak at Somerton

- Salta Properties at Dandenong South

- SCT Logistics at Altona.

These contracts leverage private sector capital investments at each of the 3 terminals. The $58 million in public funding is allocated to:

- building a connecting rail track spur at Dandenong South

- modifying existing rail infrastructure and connections to the rail network at Altona and Somerton

- making operational improvements to the layout of existing intermodal terminals at Altona and Somerton.

Milestones are important events in the development of a project or delivery of a service.

Payments usually depend on whether contracted milestones are achieved.

The government has said publicly that it expects the shuttle network to move 30 per cent of Melbourne’s container freight by rail by 2050. Department and government announcements say this will ‘save millions of truck trips each year’.

Originally, the department planned to have the shuttles running from late 2022. However, unexpected challenges like the COVID-19 pandemic, plus flooding and storms in late 2022, caused business uncertainty for the 3 operators and impacted their ability to meet contractual milestones.

Other important rail freight investments

There are other programs that support rail freight that we did not include in the scope of this audit. These include the Port Rail Transformation Project and the Melbourne Intermodal Terminal Package.

Port Rail Transformation Project

The port is investing $125 million to build a new on-dock rail terminal that will ‘anchor’ the 3 shuttle network sites. The Port Rail Transformation Project is under construction and due to open in mid-2023.

To fund the Port Rail Transformation Project, in June 2020 the government supported the port to increase revenue from full import containers by $9.75 per 20-foot container equivalent unit. This project will provide new and upgraded on-dock and near-dock rail infrastructure to receive freight shuttle trains, as Figure 1E shows.

Figure 1E: Port Rail Transformation Project new rail connections and terminal

Source: VAGO, from Port of Melbourne.

Note: The orange track sections show the new on-dock rail terminal location plus new track layout.

Melbourne Intermodal Terminal Package

In the 2022–23 Budget handed down in May 2022, the Australian Government committed up to $3.1 billion towards the $3.6 billion Melbourne Intermodal Terminal Package.

This package will build intermodal terminals at:

- Truganina (the Western Intermodal Freight Terminal)

- the north of Melbourne (the Beveridge Intermodal Freight Terminal).

When the $14.5 billion Inland Rail opens it will be designed to run double-stacked container trains up to 1.8 kilometres long.

The Australian Rail Track Corporation (ARTC) is currently building this railway. When complete, Inland Rail will stretch between Brisbane and Melbourne through southern Queensland and across inland New South Wales into Victoria.

The National Intermodal Corporation (fully owned by the Australian Government) will invest in Melbourne’s new interstate rail freight terminals. The corporation has bought an option to buy 1,100 hectares of land at Beveridge for one of the terminals proposed in the package.

1.4 Rail freight stakeholders, agencies and legislation

Stakeholders

The Victorian rail freight network has a wide mix of stakeholders, including federal, state and private sector entities.

Those who wish to transport goods on the rail freight network have to use a private sector freight operator with access to an intermodal terminal with sidings or spur lines that connect to the public rail network. Private sector entities also own the trains that carry rail freight.

Freight operators have to negotiate access to the rail network with the rail network managers. These could be V/Line, the ARTC or Metro, or a mixture of all 3, based on what route the freight train will take to its destination.

All trains that enter the port must traverse part of the ARTC network. The port has also appointed the ARTC to operate the rail network within port precincts.

Public sector agency roles

Figure 1F shows the roles and responsibilities of relevant entities.

Figure 1F: Entity roles and responsibilities

| Entity | Role |

|---|---|

| Australian Rail Track Corporation | An Australian Government-owned government business enterprise that builds, maintains and operates an 8,500 km rail network across Australia. ARTC was established in 1998 after an intergovernmental agreement between the Commonwealth of Australia and the governments of New South Wales, Victoria, Queensland, Western Australia and South Australia. |

| Department of Transport and Planning | Victoria’s lead transport agency, tasked with delivering an integrated transport network. The department works closely with the ports, freight and logistics sectors to ensure Victoria has access to essential goods and export markets. |

| Freight Victoria (a division of the department) | The central point of contact for industry, local government and other stakeholders on freight and logistics matters. Freight Victoria develops freight policy and reports on implementation of the key actions in the 2018 Delivering the Goods – Victoria’s Freight Plan. As part of the department, it also administers freight-related support programs. |

| Major Transport Infrastructure Authority | This public sector authority delivers and oversees major transport projects in Victoria. |

| Metro Trains Melbourne | The private railway operator that runs Melbourne’s train network on behalf of the government, under a long-term contract. The government confirmed in March 2023 that it will extend this contract by 18 months from November 2024. Metro is responsible for operating and maintaining the rail track and supporting infrastructure, the trains and their power systems, as well as signalling and other critical transport systems. Metro is also the safety and access body for accredited rail operators that want to use the network. |

| Port of Melbourne | A private sector entity operates the port under a lease until 2066. It is responsible for master planning of port precincts, as well as operating and maintaining port land and shipping berths. |

| VicTrack | A state-owned enterprise which owns Victoria’s transport land, assets and infrastructure. VicTrack provides property, telecommunications and project delivery services to the transport sector. |

| V/Line | The regional public transport operator of trains and road coaches, and the regional rail network manager. V/Line maintains 3,540 km of rail track used by passengers and freight rail operators across regional Victoria. |

Source: VAGO, using public information sources.

Relevant legislation

The Transport Integration Act 2010 is the key legislation for Victoria’s transport system. It covers the planning and management of the state’s many transport modes, networks and services, including rail and road freight services.

The Rail Management Act 1996 covers rail network access arrangements and also balances the relative priority of passenger rail transport services against other users, including freight.

The Rail Safety National Law Application Act 2013 applies the Rail Safety National Law (Victoria) which implements the national rail safety system in Victoria. The Office of the National Rail Safety Regulator has regulatory oversight of rail safety in every Australian state and territory. This regulatory responsibility also includes accreditation of rail transport operators.

2. The scheme

Conclusion

The scheme has partly achieved its objectives and generated economic value for the state. It has kept container freight traffic on rail but has not achieved any significant shift of freight from road to rail.

The department’s publicly reported data on freight containers moved by rail under the scheme shows a decline against targets in recent years.

The department’s assurance processes over publicly reported data on the scheme and related expenditure need improvement.

In this section

2.1 Achievement of scheme objectives

The scheme has achieved some of the objectives the government set for it since 2012.

|

The scheme …. |

Its objective to … |

Because … |

|---|---|---|

|

partly achieved |

encourage mode shift by moving more freight containers from regional Victoria on rail |

while the scheme has kept container freight on rail, it has not grown rail’s mode share. Performance against freight volume targets has declined in recent years. |

|

achieved |

promote intermodal supply chains consistent with broader government policy |

the scheme has supported intermodal freight terminals and supply chains on 4 rail corridors across the state. |

|

partly achieved |

allocate scheme funding using an open competitive process to achieve best returns |

funding was allocated through an open competitive process in 2012 and 2014, but not since the scheme closed to new entrants in 2015. |

|

did not achieve |

make the funded companies more sustainable so they do not become financially dependent on the scheme |

3 of the 4 freight companies receiving support have said that their rail freight services would likely become unviable if the government ended the rebate. |

|

did not achieve |

not distort rail freight competition on targeted freight corridors |

closing the scheme to new entrants since 2014–15 means it has funded the same 4 operators in the targeted rail corridors for 9 financial years. This has potentially given them a competitive advantage over other freight operators. |

Between 2021 and 2023 the government sought advice from the department on a strategy to wind down the scheme.

The 2023–24 state Budget has confirmed a further single year of funding for the scheme in 2023–24.

Achievement against targets for rail freight movements

Transferring freight from road to rail and promoting intermodal supply chains are key objectives of the scheme.

To measure this, the department sets annual targets for the number of containers moved by rail under the scheme. It reports on this performance measure in its annual report and in Budget Paper No. 3: Service Delivery.

This performance measure is deficient, because these volume targets do not show whether the proportion of freight moved by rail is growing. This means the measure gives no insight about the extent to which the scheme is meeting the government’s goal to shift freight from road to rail.

Public reporting on the freight moved by rail under the scheme

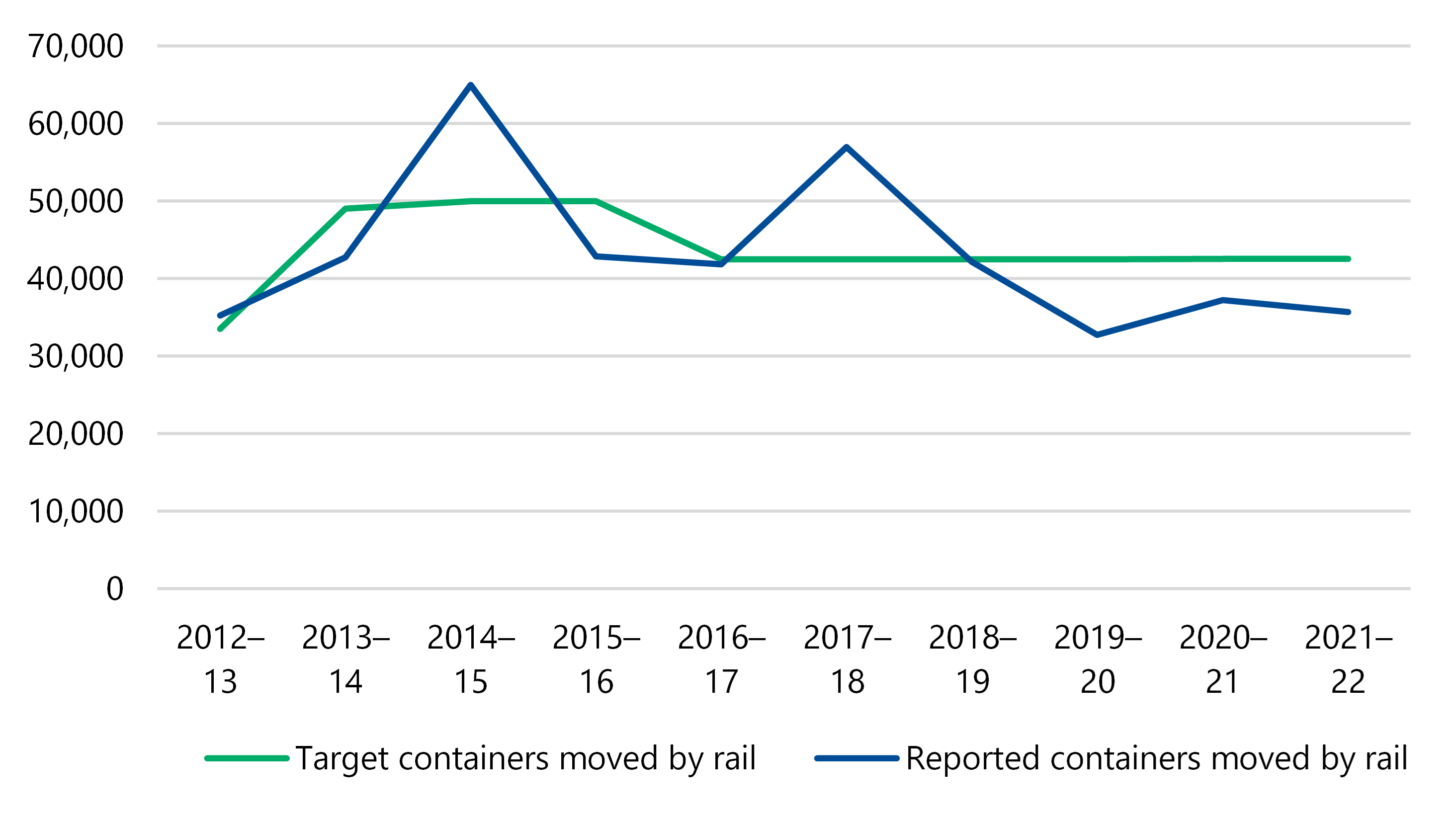

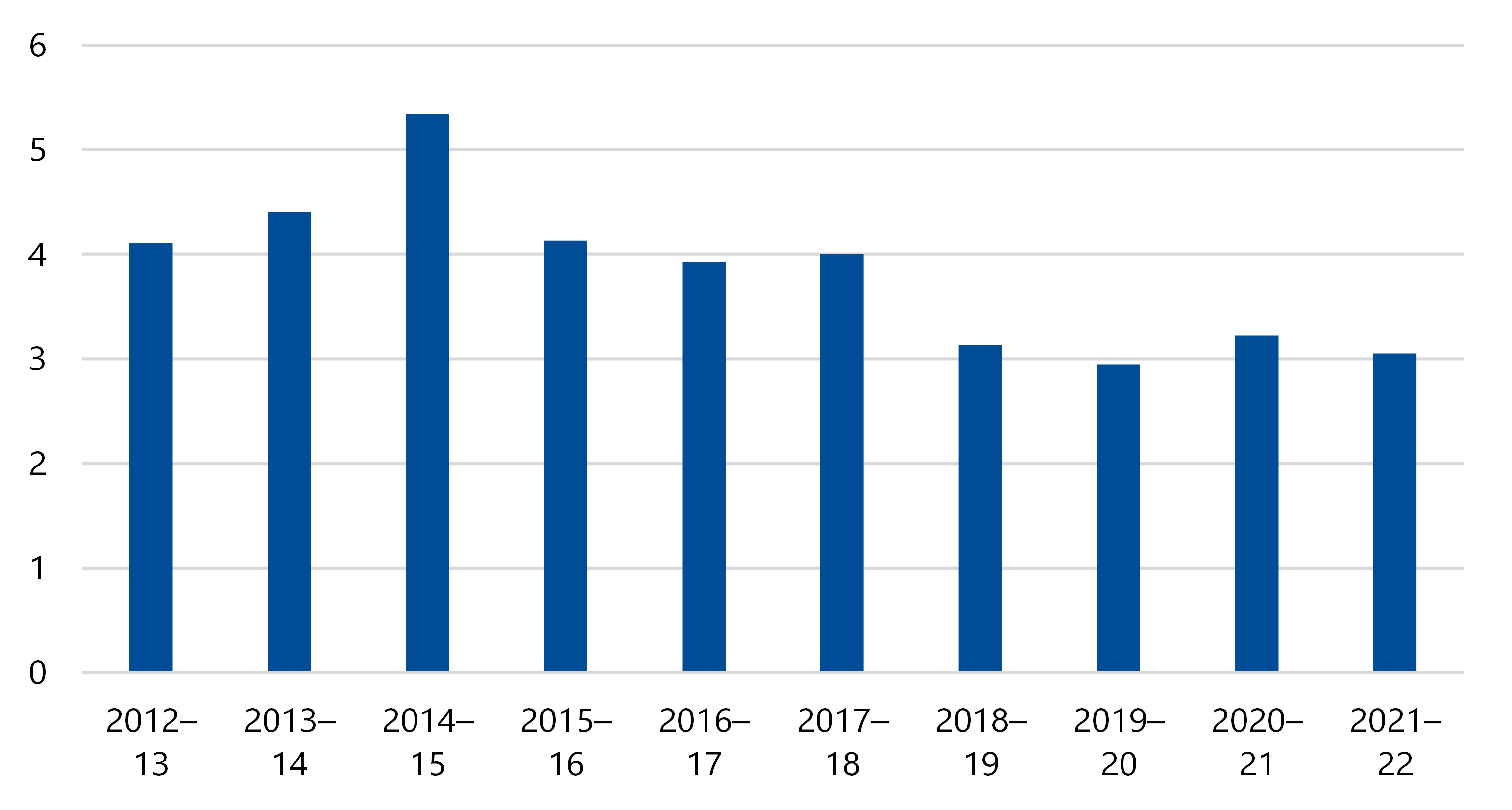

According to the department’s public reporting, the scheme has only met or exceeded the ‘freight container on rail’ volume targets in 3 of the 10 years from

2012–13 to 2021–22, as Figure 2A shows.

Figure 2A: Target and reported containers moved by rail, 2012–13 to 2021–22

Source: VAGO, based on department and Budget Paper No. 3: Service Delivery data.

Overall, from the start of the 2012–13 financial year to March 2023, the department’s public reporting shows the scheme supporting the movement of 452,875 containers, or 2.8 per cent below the target of 465,854 containers.

This shows that while the scheme kept container freight traffic on rail, it has not successfully achieved a significant shift of freight from road to rail, or increased rail container movements.

The reporting also shows that performance against container targets has declined in recent years. This data says that, from 2018–19 to 2021–22 ,13 per cent fewer containers were moved by rail than the target.

As we explain below, variances we found in the department’s data suggest the actual containers moved by rail under the scheme were even further below target than the department has reported.

Reasons for rail freight’s decline from 2018–19 to 2021–22

Underperformance was largely outside the control of the freight operators that the scheme supports. The department told us the reasons include:

- climatic conditions, such as drought in 2018–19 and 2019–20 and wetter than normal weather conditions in 2022–23, which disrupted or delayed agricultural seasons and reduced freight volumes

- the COVID-19 pandemic, which disrupted container supply chains. This meant some operators could not source enough empty containers and reduced the rail freight carried

- rail freight operators not being certain whether the Port Rail Transformation Project would significantly improve the efficiency of regional rail trains at the port to make them more cost competitive with road transport

- regulatory changes that have made road freight more efficient, increasing its cost advantage over rail. These include allowing high-productivity road freight vehicles and A-double trucks with bigger load limits on major highways

- rail infrastructure works that disrupted some operators’ rail access.

Accuracy of the department’s public freight movement data

The department’s publicly reported performance data about freight containers moved by rail under the scheme from 2018–19 to 2021–22 is largely accurate.

We examined invoices and other primary evidence from scheme recipients between July 2018 and June 2022 to verify this.

However, we also found inaccuracies of varying significance in each year of the public reporting, as Figure 2B shows.

Figure 2B: Accuracy of public reporting on containers moved by rail under the scheme 2018–19 to 2021–22

| 2018–19 | 2019–20 | 2020–21 | 2021–22 | Total | |

|---|---|---|---|---|---|

| The department’s publicly reported containers moved by rail under the scheme | 42,165 | 32,734 | 37,235 | 35,680 | 147,814 |

| Actual containers moved by rail under the scheme | 35,831 | 32,666 | 36,478 | 34,530 | 139,505 |

| Variance | 6,334 | 68 | 757 | 1,150 | 8,309 |

Source: VAGO, based on department data.

Notes:

2018–19 – the department incorrectly included 6,334 containers in the public reporting that may have been moved by operators involved in the scheme but were not paid for under the scheme.

2019–20 – public reporting overstated the number of containers due to errors in recording container numbers when an operator submitted revised invoices.

2020–21 – the department included 759 containers that were moved under the scheme, but by road rather than rail.

2021-22 – the department incorrectly included 1,147 containers that were moved by road, not rail under the scheme.

Differences between the explanations provided in these notes and variance reported in Figure 2B relate to minor administrative errors by the department.

Overstatement of rail container movements under the scheme

These variances mean the department has publicly overstated container movements by rail under the scheme since 2018–19 by around 5.6 per cent.

This also means container movements by rail over the 4 full financial years from 2018–2019 to 2021–22 are nearly 18 per cent below target, not the 13 per cent below target that the public reporting suggests.

As Figure 2B outlines, the department’s public reporting did not include any explanatory notes to disclose the inclusion of freight movements that do not meet the definition of the performance measure for the scheme.

This is a significant deficiency. It adds weight to the series of assurance engagement reports we have made that aim to support more meaningful and accurate data from the wider public sector that is reported in Budget Paper No. 3: Service Delivery.

The most significant variance we found was for 2018–19. The department’s reporting overstated the actual containers transported by rail under the scheme by around 15 per cent.

The overstatement was due to the department including 6,334 containers in the total that were not financially supported under the scheme.

The performance target is based on the overall ‘container cap’ agreed with operators for container movements under the scheme, not an estimate of all containers they may move in any particular year.

Adding container movements that were not supported by the scheme makes it impossible for Parliament and other users of public reporting to assess actual performance against the target.

Inclusion of some road freight in rail freight data

The reported data on actual container movements by rail under the scheme for 2020–21 and 2021–22 is inaccurate because the department included some containers that were moved by road under the scheme.

The scheme’s current funding agreement allows the government to pay operators to move containers by road where the government’s actions have directly led to a temporary and unscheduled loss of access to the relevant rail network.

One of the operators legitimately used this provision. It moved over 2,000 containers by road under the scheme between 2020–21 and 2022–23.

However, the definition of the scheme’s performance measure in the department’s annual report and the relevant Budget paper clearly only refers to containers moved by rail.

Containers moved by road should not be included in public reporting for this performance measure. The department should have excluded these containers and transparently disclosed the number of road-moved containers in a note under the reported performance.

To give more integrity and transparency around performance measures for the scheme, the department should only include containers funded and transported by rail under the scheme when reporting actual performance in its annual report and the 2023–24 Budget Paper No. 3: Service Delivery.

Basis of the department’s publicly reported scheme data

The department’s publicly reported data on containers moved by rail under the scheme is based on invoices and supporting declarations from funding recipients.

The department asserts confidence in the accuracy of this publicly reported data based on limited verification activity. This includes checking invoices and statutory declarations provided by operators against the agreed container number caps and regular interactions with the funding recipients, rail operators and the port operator.

Transparency requirements in the scheme’s funding agreement

The current funding agreement for the scheme:

- requires funding recipients to provide monthly tax invoices that specify both the number of containers moved for the month and the dates of these movements

- requires recipients to provide a statutory declaration confirming that the container numbers and movement dates on invoices are true and correct

- gives the department a right to appoint an independent auditor to audit operators’ records to substantiate invoice information at any time during the term of the agreement.

The department introduced the requirement for a statutory declaration in the funding agreement implemented for 2018–19. This was a good initiative that has improved the department’s assurance about the accuracy of the invoices funding recipients submit to it.

Opportunities for the department to gain more assurance

Despite these provisions, the department has not:

- used its right under the funding agreement to audit funding recipients to verify the accuracy of claimed container movements

- sought to verify the accuracy of container movements that scheme recipients reported against the rail or port operators’ information on actual container movements, except for the relatively infrequent and limited container movements where recipients are seeking funding under the scheme for containers moved by road

- enforced funding recipients’ requirement under the scheme to include details on the specific dates of container movements on invoices. Only one of the 4 funding recipients consistently complies with this requirement.

The department could have done more to gain assurance about the validity of around $39 million in scheme funding paid out to recipients from July 2012 to December 2022.

Activities such as audits and cross-checking of invoices against data sourced from third-party rail or port operators would give the department more assurance about the scheme’s expenditure.

The department told us that its ongoing contact with the funding recipients, rail operators and the port operator would alert it to any issues of falsely reported or ‘phantom’ container movements.

The department has given us evidence to support its assertions about the occurrence of regular meetings with the port operator during 2021–22. However, this evidence does not demonstrate how these interactions enable it to verify the specific containers the 4 operators have moved under the scheme.

The department should base any enhanced assurance approach it adopts on an assessment of:

- the significance of the funding it provides under the scheme

- the risk that recipients would seek payment for containers they have not moved by rail.

Open competitive funding, operator sustainability and equity

The other key objectives set for the scheme since 2012 relate to:

- allocating its funding using an open and competitive process

- improving the sustainability of the freight operators it supports

- not distorting competition on the freight corridors it targets.

Allocating funding using an open process, equity and competition

The government wanted to allocate funding available under the scheme based on a competitive process aimed at achieving positive and best returns.

The department implemented this approach for the 2012–13 and 2014–15 funding rounds for the scheme. It did this by:

- seeking applications for funding through an open process

- assessing applications with a model developed to calculate the economic, environmental and social costs and benefits for each application.

In early 2015 the government decided to reduce the funding available for the scheme by $3.2 million over 4 years. This was followed by ongoing uncertainty around future funding from 2018–19 to 2022–23.

These factors reduced the department’s capacity to open the scheme to new entrants. There has not been a competitive application and funding allocation process since 2014–15.

The effective closure of the scheme to new entrants since 2014–15 means the same 4 operators have received government funding in the targeted rail corridors over the last 9 financial years. These operators have a potential competitive advantage over other freight operators in the same markets.

This means the department has not met the government’s intention to allocate scheme funding through a competitive process to optimise returns and not distort the market.

Sustainability of scheme-supported rail freight operators

The department has not achieved the government’s goal to support rail freight operators without them becoming financially dependent on the scheme.

The department’s advice to applicants for funding under the scheme in 2012 and 2014 clearly indicate that the government:

- did not wish for supported companies to become reliant on scheme funding

- intended the scheme to promote growth in freight on rail for the supported freight operators so that they would require less support over time.

The department told freight operators seeking funding that they should not rely on an ongoing funding stream from the scheme.

Evaluating the sustainability of scheme-supported operators

Department evaluations of the scheme in 2018 and 2021 suggest that the sustainability of the rail freight operators supported by the scheme is deteriorating.

A 2018 evaluation found the operators were heavily reliant on the scheme. At least 2 of the operators said they could not operate viable rail freight services without it.

A 2021 evaluation found that the net jobs supported by the scheme has fallen by around 21 per cent. It also found that 3 of the 4 operators receiving support were unlikely to be able to operate a commercially viable rail freight service if scheme funding stopped.

In 2021–22, 3 of the 4 operators failed to meet their agreed container movement caps under the scheme. This suggests that these operators had no unsubsidised rail freight movements in that year.

The department does not routinely track ‘total’ rail freight movements by the operators supported by the scheme to understand the extent of unsubsidised rail freight activity. This is a missed opportunity to gain insights about the extent the scheme is supporting sustainable rail freight operations and mode shift.

2.2 Economic value of the scheme

Externalities are costs or side effects that market pricing does not fully reflect. They impact society as a whole.

The scheme has delivered economic value for Victoria.

However, estimating this value and assessing whether it exceeds the scheme’s costs depends on a range of economic and other assumptions. These include assumptions about weight and load capacities of road and rail transport modes, and on the value of various ‘externalities’ associated with the environmental, congestion, collision and maintenance impacts of these freight modes.

Another key assumption relates to the extent to which freight currently supported by the scheme would stay on rail without a subsidy, as this influences assessments of whether benefits arising from the scheme exceed its cost.

Costs of the scheme between 2012–13 and 2021–22

Between 2012–13 and 2021–22 the scheme paid $38.3 million to freight operators, as Figure 2C shows.

Figure 2C: Amounts paid to operators under the scheme ($ million)

Source: VAGO based on information provided by the department.

Note: This Figure shows total payments amounting to $38.3 million to freight operators for the movement of containers under the scheme between 2012–13 and 2021–22. Of this total, $38.1 million was for containers moved by rail. The remaining payments were for containers moved by road under the scheme, where rail movements were not possible due to state-initiated projects or actions.

Funding spent on activities other than moving freight

Between 2018–19 and 2021–22 around $3.2 million, or just over 20 per cent, of the funding available under the scheme was not spent on directly supporting rail freight.

Instead, the government approved the department’s requests to spend this money on other related activities. These included evaluations and business cases for the scheme.

Economic benefits delivered by the scheme

The scheme has helped avoid negative economic externalities that would have arisen if trucks moved this freight instead.

The department commissioned evaluations of the scheme in 2018 and 2021. These evaluations of the effectiveness, impact and value the scheme delivers focused on calculating economic externality-related benefits attributable to the scheme.

They respectively estimated the benefits of avoiding these externalities at up to $5.8 million and $4.9 million each year. This exceeds the annual cost of the scheme – historically $3.5 million to $4 million over the last 7 years.

However, these benefit estimates are an upper band. They assume that none of the freight movements the scheme currently supports would still go by rail if the scheme ended. There is no definitive evidence that this assumption is reliable.

The evaluations’ ‘lower bound’ estimate of externality benefits attributable to the scheme would be zero dollars if all freight were retained on rail.

There is evidence suggesting that not all freight movements the scheme currently supports would move from trains to trucks if the scheme ends:

- A report to the department in early 2022 advised that around 25 per cent of existing freight would be retained on rail if the scheme were discontinued, based on discussions with relevant stakeholders.

- In early 2022, the department advised the government that up to 30 per cent of the freight supported by the scheme would stay on rail if the scheme were terminated.

Specific economic externality benefits

The department’s 2021 evaluation found that up to $4.9 million in savings on negative externalities could be attributed to the scheme, as Figure 2D shows.

Figure 2D: Avoided externality costs and benefits from the scheme

|

|

Environmental costs. These include:

Rail freight is estimated to produce 16 times less carbon emissions than road freight per tonne-kilometre travelled. |

|

|

Crash costs. These are a function of the number of vehicle kilometres travelled by each transport mode. Rail transport has much lower crash rates and related costs than road transport. This results in potential benefits when freight shifts from road to rail. |

|

|

Maintenance. Freight transported by trucks and trains creates wear and tear on roads and railway lines respectively. The cost of maintenance to rail lines is generally passed on to rail operators through rail access charges. Meanwhile, truck registration fees do not usually cover the full cost of damage that trucks do to roads. |

|

|

Congestion. Freight transported on roads adds to the number of vehicles on the road network. This increases congestion in both regional and metropolitan areas. |

Source: VAGO, based on information from the department.

3. The shuttle network

Conclusion

The shuttle network is not proceeding according to its original timetable. Service start dates across the 3 sites are delayed by 17.6 months on average, although construction at Altona is nearly complete.

The department is using the 3 contracts to attempt to manage private sector developer delays and other issues. The department is also trying to manage freight train path restrictions on the rail systems it controls and is working with the port to plan the re establishment of a Webb Dock rail connection. These activities are critical for the shuttle network’s future success.

The department’s recent advice to government confirms that the shuttle network is unlikely to deliver the expected volume of metropolitan container freight by rail unless the government approves further interventions and investments.

In this section

3.1 Meeting government expectation that 30 per cent of Melbourne’s containers will travel by rail by 2050

The government has publicly stated over recent years that it expects the shuttle network to move 30 per cent of Melbourne’s forecast container trade (or 1.8 million containers) by rail by 2050. The department’s website also states this.

These public statements also say that meeting this expectation would avoid millions of truck trips on metropolitan roads each year.

Number of return freight train trips needed

To transport 1.8 million metropolitan containers in 2050, there would need to be at least 215 return rail trips per week between shuttle network sites and the port. This is approximately 31 return freight train trips per day.

Uncertainty around access to freight rail paths makes it unclear whether the shuttle network can run 31 return trips each day. At present, there are no regular rail freight services moving metropolitan containers to and from the port.

Shuttle network developers will also face challenges to attract freight to rail and keep it there. They will face competition from entrenched road operators and an expanding, high-productivity freight vehicle network that allows individual trucks to carry larger volumes of freight on selected routes.

Rail’s share of containers has been steadily decreasing since 2009, when 283,000 (or 13.4 per cent) of all containers handled by the port were transported by rail.

By 2019 this had decreased to 223,000 containers, 7.5 per cent of the total. Meanwhile, total containers handled by the port increased by 39.8 per cent to 2.9 million.

To meet the government’s expectation of 30 per cent of Melbourne’s containers being transported by rail by 2050, rail’s share of containers needs to increase by 4.6 per cent each year.

According to the port's Container Logistics Chain Study, updated in 2020, 84 per cent of the 1.3 million metropolitan containers are within the catchment zones for the 3 shuttle network locations.

Challenges in achieving ‘30 per cent by 2050’

Increasing rail’s share of metropolitan container freight to 30 per cent by 2050 will be challenging for a range of reasons.

|

Underlying issue |

Why it is a challenge |

|---|---|

|

Rail freight’s share of containers has been dropping since 2009. |

Increasing rail’s share of containers becomes more difficult each year. |

|

Webb Dock East, which the port forecasts to handle 50 per cent of all international containers by 2050, has no rail connection. |

Rail cannot service this terminal. This reduces the containers that could be transported by rail from the port. |

|

Total containers have been steadily increasing since 2009, except for a downturn in 2021 probably due to the COVID-19 pandemic. |

Containers are forecast to continue to increase, making it harder for rail to gain a bigger share year on year. |

|

There are widespread delays in starting services on the shuttle network. |

Developers have less time to recruit or convert the same number of containers from road to rail that they were contracted to achieve. |

3.2 Progress against originally expected timelines

Current progress at each shuttle network site

The shuttle network project is delayed overall. However, development works are progressing at 2 of the 3 sites.

The Altona intermodal terminal

The Altona developer has nearly completed key components of the contracted works, including drainage culverts and new rail infrastructure.

Services are expected to be ready to start by July 2023.

The Dandenong South intermodal terminal

The government built the contracted rail track access spur at Dandenong South as part of a nearby level crossing removal. It commissioned the spur in August 2022 and will install the final rail signalling infrastructure by the end of June 2024.

The developer is due to complete its terminal by mid-September 2025.

The Somerton intermodal terminal

Construction has not started at Somerton because the developer still needs to meet precursor conditions contained in the contract.

This means that construction milestone dates are not yet confirmed because the contract calculates milestone dates from a point after the precursor contract conditions are met.

The contract’s precursor conditions were due to be satisfied in early June 2023, which was after we finalised this audit report. After this occurs, the construction and service commencement milestone dates can be calculated and set.

Due to a new investor and operator being announced in January 2023, the Somerton terminal’s design will materially change compared to what was first agreed in the current contract. The department will need to consider any new terminal layout when the private sector party lodges amended designs and formally seeks a contract amendment.

Performance against milestones

The 3 developers have not achieved the original expected contract milestones the government set.

On average, the sites are 17.6 months behind the original publicly announced dates, as Figure 3A shows.

Figure 3A: Original expected and revised construction completion and service commencement dates

| Site | Original expected construction completion date* | Latest expected construction completion date | Delay | Original expected service commencement date* | Latest expected service commencement date | Delay |

|---|---|---|---|---|---|---|

| Altona | June 2022 | June 2023 | 12 months | June 2022 | June 2023 | 12 months |

| Dandenong South | November 2023 | September 2025 | 22 months | March 2024 | January 2026 | 22 months |

| Somerton | May 2022 | Date not yet set** | 19 months^ | May 2022 | Date not yet set** | 19 months^ |

| Average delay | 17.6 months | 17.6 months |

Source: VAGO, based on department documents.

Notes:

*Date calculated from initial contract, based on the developer satisfying all precursor conditions.

**Date not yet set because precursor contract conditions have not yet been satisfied.

^After agreed amendments to the original contract requirements, construction completion and service commencement are now expected in December 2023, which is 14 months after a land condition was satisfied in October 2022. We have used December 2023 to calculate delay from the original contracted date of May 2022, noting that due to a proposed change in the terminal's design, these dates will likely need amendment.

Consequence of delays starting the freight shuttle services

Delays in starting rail freight shuttle services defer any expected benefits from the initiative.

Without the shuttle network operating, truck trips will continue at current or increased rates for longer. Trucks’ contribution to congestion and environmental pollution will therefore also grow.

These delays may make it harder for the department to achieve the government’s expectation that the shuttle network will move 30 per cent of metropolitan container freight by rail by 2050. This is because it would be more challenging to attract freight customers to trains, away from entrenched and dominant truck operators.

3.3 Shuttle network contract requirements

Compliance with the contract requirements

In addition to meeting the milestones discussed above, the contracts may require the developers to:

- acquire land

- give project documentation and approvals to the department

- provide performance securities (such as bank guarantees)

- commit funding to the project.

There are 17 of these additional requirements across the 3 contracts. The developers had achieved 13 of them by April 2023, as Figure 3B shows.

Figure 3B: Developer contract requirements achieved by April 2023

| Site | Number of ‘other’ contract requirements | Requirements concluded (as of April 2023) |

|---|---|---|

| Altona | 7 | 6; 1 waived |

| Dandenong South | 6 | 3; 1 not required* |

| Somerton | 4 | 2 |

| Total | 17 | 13** |

Source: VAGO, based on department documents.

Notes:

*Not required because the developer met the milestone by the due date.

**Includes the requirements that the department waived or were not required.

Co-investment by private sector developers

A performance security is an amount of money (or certificate such as a security) that a private operator must lodge to show it is committed to meeting a certain performance target.

Private sector developers will financially benefit from these projects, and the shuttle network contracts require them to contribute their own funds.

The Altona and Somerton contracts both require developers to commit funding to their projects. Altona has satisfied this requirement. Somerton was required to satisfy it by early June 2023, which was after we finalised this audit report.

Dandenong South has a different co-investment arrangement than the other 2 contracts. The developer must provide performance securities to the department.

|

The Dandenong South developer must give the department … |

Of which … |

|---|---|

|

3 mandatory performance securities |

it has provided all 3. |

|

3 performance-dependent securities if it does not achieve specific milestones by their due date |

|

The department’s management of the 3 contracts

In the Altona and Somerton contracts, the developers have the same due date to complete construction and commence services.

The Dandenong South contract separates construction completion and service commencement as different milestones with extra time between them.

More realistic ‘construction end’ and ‘service start’ dates could have been set

The Altona and Somerton ‘construction end’ and ‘service start’ contract dates seem optimistic from a practical perspective. Capital projects usually allow time between the end of construction and start of services, typically to resolve any infrastructure defects and commissioning matters.

They may also allow a several-month ‘ramping-up’ phase for operators to:

- design and trial proposed procedures

- integrate technologies

- train workers

- test new cargo handling and rail equipment.

The department has amended and extended the due dates in the contracts for Altona 6 times and Somerton 14 times.

In our view, the department could have expressed a more realistic and practical time gap between the construction completion and service commencement milestones.

The department is actively managing the contracts

Despite the many time extensions and delays at all the sites, the department is actively managing the shuttle network contracts. It does this by regularly liaising with the developers, reviewing progress reports and assessing and responding to developer requests for time extensions or other matters.

The department is limited by the contractual ‘levers’ it can use to rectify time delays.

Under the contracts, the government only pays out money when the developer has achieved certain milestones. This protects the state’s interests and is meant to incentivise developers to meet their milestones on time.

3.4 Optimising the network’s commercial viability

The contracts require the department to do or facilitate specific things to support the establishment of the shuttle network, such as building connecting rail infrastructure. The department is delivering on this requirement.

The department is not responsible for freight paths or planning permissions under the contracts. However, the shuttle network needs sufficient and suitable freight paths to be successful.

Transferring this activity to the private sector to resolve alone could lead to suboptimal commercial outcomes unless the department provides sufficient influence and support.

The department’s contractual requirements for each site

For Altona and Somerton, the department has no contractual requirements that it must meet. The private sector must deliver required works, such as enhancements to rail infrastructure, before the department pays agreed capital costs.

For Dandenong South, the government has delivered the physical rail infrastructure the contract requires. The final rail signalling for the connecting spur line is not yet in place but according to the department, it will be before a terminal is built. The government has agreed in contract amendment letters to install this by no later than June 2024.

This later date should not affect the developer's service commencement timeline, as it also requested an extension to design and construction milestones. The department agreed to this request.

Understanding the network’s wider viability challenges

Not long after signing their contracts in 2020, all private sector parties raised concerns around the project’s commercial viability with the minister and the department.

The developers’ concerns related to a need for certainty around pricing and rail access, as a lack of information was making it difficult to market their future shuttle network services as well as secure customers and business partners.

The department met with the developers and then briefed the government in November 2021.

The department’s advice to the government noted the business impacts of the COVID-19 pandemic. The department recommended that more focused work needed to be done to understand any challenges to the proposed shuttle network’s viability.

Developer concerns and department-commissioned viability review

In early 2022 the government agreed that the department should commission a consultancy company to research and advise on the commercial viability challenges before operations start.

An advisory committee with ports, logistics and supply chain expertise oversaw this work.

The consultancy firm gave its report to the department in July 2022. The department briefed the government on the report’s key findings and identified some areas it would seek to better understand.

Findings of the review of the shuttle network’s viability

The consultancy report confirmed that the commercial viability of the shuttle network was not certain. It identified a number of challenges to resolve:

- Pricing, access and operating arrangements at the new on-dock rail terminal at the port are uncertain because the future operator has not yet published its rates.

- Trucks are estimated to have a significant competitive advantage over rail per metropolitan container, based on current pricing and port-precinct operating models.

- The new on-dock terminal, in its initial operating phase, will not operate on weekends and only during the daylight hours of 6 am to 6 pm. This is unlikely to align with available rail paths to the port, especially from Dandenong South, as well as the shuttle network operators' operational needs.

- No freight train paths for Somerton or Dandenong South can be allocated until a rail operator is appointed for these sites. This will need to happen closer to when they are ready to start services.

Webb Dock’s container trade growth impacts the shuttle network’s viability

Webb Dock East became the port’s third major international container terminal after a new stevedore started operations in 2017. The new container terminal is highly automated and can berth larger, new-generation ships, known as ‘post-Panamax’ vessels.

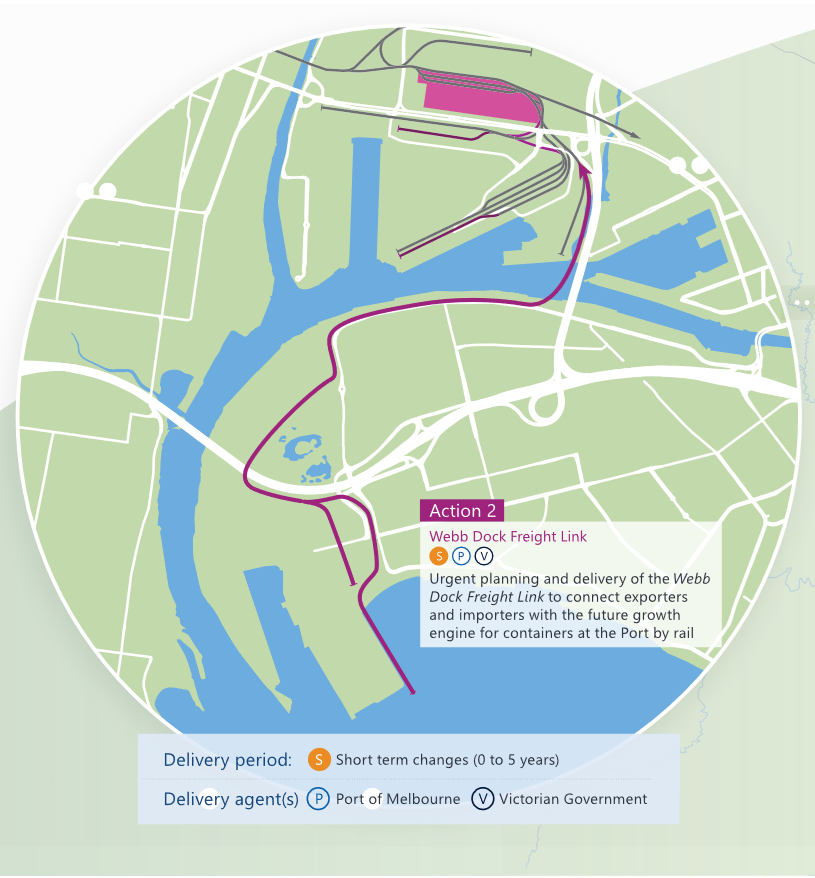

This dock previously had a rail connection. However, the government severed this in the 1990s to develop the Docklands urban regeneration precinct.

The new container terminal at Webb Dock now accounts for just over a third of all international container trade through the port. This growth is a challenge for the government’s policy intent to move more freight by rail because the lack of a direct rail connection means all freight from Webb Dock must travel by road.

The department’s shuttle network viability study states that the lack of a rail connection at Webb Dock is a critical challenge to the success of the shuttle network. Specifically, it notes that:

- Webb Dock’s current 30 per cent share of container trade is forecast to increase to 50 per cent of all the port’s container throughput within a decade

- without a rail connection, this growth could reduce the pool of ‘contestable’ containers (those containers that could shift from truck to train) by 33 to 40 per cent

- if a fourth stevedore sets up in the Webb Dock precinct within a decade, and no rail connection is built, this would further exacerbate the dilution of rail contestable containers and increase the number of road trips

- the port has developed a concept for a new rail connection, but it is not yet committed to by the government.

Other advice on a Webb Dock rail connection

This consultancy report is not the first advice to the department, port and government saying that they need to work together to re-establish a Webb Dock rail connection.

In 2016, Infrastructure Victoria issued its first 30-year infrastructure strategy. It recommended a rail link should be built within 10 years. Its refreshed 2021 strategy said that decisions around this connection need to be resolved.

In its 2017 response to the 2016 infrastructure strategy, the government agreed in principle that a connection was needed. However, in its 2022 response to the refreshed 2021 strategy, it made no further specific commitment.

In 2020, the port developed a rail-focused plan, Our Plan for Rail, and a future-looking strategy document, 2050 Port Development Strategy. Both documents confirmed the port’s strong commitment to plan and implement a Webb Dock rail link, in conjunction with the government, by 2030. (See Figure 3C below.)

Figure 3C: Our Plan for Rail shows a proposed Webb Dock rail link

Source: VAGO-amended extract from Port of Melbourne (2020) Our Plan for Rail.

In February 2021 Infrastructure Australia added a Webb Dock rail link as an early stage proposal to its Infrastructure Priority List. On its website, it noted that the options include building new rail connections or reinstating the previously decommissioned rail corridor.

The Victorian Commercial Ports Strategy released in July 2022 commits the government to:

‘… consider the [port’s] proposal for a potential new rail connection to Webb Dock via a new bridge over the Yarra River and rail staging sidings in the vicinity of the Old Melbourne Market site. These plans will be considered as part of the usual [port development] process and the planning requirement under the Port of Melbourne Lease.’

Any new rail link is likely to be an expensive and technically difficult project to implement, due to:

- the constrained geography near the Bolte Bridge where a new rail link would need to cross the Yarra River

- the engineering complexity of a heavy rail ‘swing bridge’ that would be required so that larger recreational vessels could continue to travel upriver into Victoria Harbour

- potential conflicting land use challenges from urban regeneration occurring in Fishermans Bend along the likely route of a freight link.

To date, the government has not committed to a project to build a Webb Dock rail link. Nor has it agreed on any timeline to make a decision about this.

According to the department, the port has not yet formally proposed delivery of a project to build a link. It advised us that the government will respond to the port when any proposal is brought forward and expects that a decision on a rail connection will be needed in the next 3 to 5 years.

Work plan arising from the shuttle network viability review

In light of the challenges identified in the viability review, the department’s advice to the government proposed a focus on:

- coordinating the shuttle network as one network, to ensure entities from different jurisdictions convert their general support for the concept into practical and focused assistance

- increasing pricing certainty for containers to be carried on the shuttle network

- increasing certainty and reducing costs of rail network access, as the government can regulate some fees and charges by V/Line and Metro

- helping to reduce costs across the port for containers carried by rail.

The department is currently developing and assessing options and initiatives from the viability review recommendations. It aims to provide advice to the government on potential interventions to support the commencement and viability of the shuttle network’s operations by July 2023.

3.5 Rail network challenges for freight traffic growth

The department can demonstrate that it has analysed and assessed potential conflicts in the capacity and scheduling of passenger versus freight rail traffic in the urban and regional networks it oversees.

The department also understands the future freight pathing constraints on the regional and metropolitan rail network. There is evidence that it is giving the needs of freight operators specific focus in future rail plans.

The department is also considering rail freight path conflicts in the metropolitan train franchise review. Metro’s internal network development plan has specifically examined and articulated these issues.

Understanding current and future rail freight needs

The government approved Victoria’s Rail Plan in March 2020. However, the department considers this to be a draft internal document and has not released it to the public.

The current document updated a previous draft rail plan produced in 2019. Among other things, it analyses and describes the current freight services that use the regional and metro network.

The department also leads an integrated modelling group, which includes V/Line, Metro and the Major Transport Infrastructure Authority. This group produces detailed rail system modelling that identifies current and future freight paths beyond the more general analysis in Victoria’s Rail Plan.

This modelling is directly linked to the current and future physical layouts of the rail network, known as ‘configuration states’. The configuration states reflect announced and funded rail infrastructure projects the government is building in the short and medium term, as well as some longer-term unfunded projects.

The department told us that it identifies available paths in future timetables and works with the rail network managers to make sure those paths are built into a master timetable, even if they are not used.

When those freight paths become fully used, the department advised us that it has some contingency options within the timetable to implement specific strategies, such as increasing the gap between some non-peak passenger services and using limited express running for passenger trains to clear a path for a following freight service.

Identifying the rail network’s capacity and scheduling conflicts

It is Metro’s responsibility to deliver the metropolitan rail network’s master timetable based on specifications from the department. This timetable is informed by:

- any capacity constraints shown by rail system modelling

- the status and sequencing of the government’s intended rail configuration states.