Grants to Non-Government Schools

Overview

This audit examined whether the Department of Education & Training (DET), non‑government schools and their system administrators are effectively and efficiently managing and using state government grants.

There is limited assurance that grants to non-government schools are used for their intended purpose or are achieving intended outcomes. This is primarily due to weaknesses in funding agreements and DET’s ineffective grants management, including limited oversight of grant recipients and their use of grants, as well as inadequate monitoring and reporting.

It is encouraging that DET has recently developed interim memorandums of understanding, funding agreements and guidelines for the major state recurrent grant funding, which have strengthened reporting and accountability requirements. It is important that DET continues to work with the non-government school sector to further improve accountability and transparency for the use of state government grants as it develops arrangements for 2017 and beyond. DET must also improve its oversight, monitoring and reporting of grant recipients.

Grants to Non-Government Schools: Message

Ordered to be published

VICTORIAN GOVERNMENT PRINTER March 2016

PP No 145, Session 2014-16

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on the audit Grants to Non-Government Schools.

Yours faithfully

Dr Peter Frost

Acting Auditor-General

March 2016

Auditor-General's comments

|

Dr Peter Frost Acting Auditor-General |

Audit team Chris Sheard—Engagement Leader Andrew Evans—Team Leader Karen Ellingford, Teri Lim, Jason Cullen, Anna Cooshna—Team members Engagement Quality Control Reviewer Ray Winn |

In 2016, the Victorian Government will provide an estimated $676 million in financial assistance to non-government schools which provide education to more than a third of Victorian school children. This audit assessed the use of state government grants in 2014—the most recent year which could be completely examined—when the state provided over $640 million in grants to the non‑government school sector.

State recurrent grants make up the bulk of state government grants to non-government schools, at over $624 million in 2014, and the vast majority of these funds are 'untagged'. Schools must use grants to meet the general recurrent costs of providing education programs and must not use funds for capital expenditure, but they determine how the funds are spent. While funding agreements outline that the state respects the independence of non-government schools and systems who determine their own priorities, taxpayers, parents of students at non-government schools and the broader community are entitled to expect that funds are used transparently and that the Department of Education & Training (DET), non-government schools and their system administrators are effectively and efficiently managing the use of grants.

The Catholic Education Commission Victoria (CECV) reallocates over $400 million in recurrent grants to Catholic schools using its own methodology. This results in a significantly different allocation to individual schools when compared to DET's allocation—some schools receive substantially more and some substantially less. All other non-government schools receive recurrent grants as allocated by DET. The department has very limited visibility of CECV's methodology and the revised allocations provided to Catholic schools, and I have recommended it clarify any conditions and reporting associated with reallocating recurrent grants.

My audit found that there is limited assurance that grants are used for their intended purpose or are achieving intended outcomes. There are significant weaknesses in DET's funding agreements with system authorities and non-government schools, and its management of grants has been poor. There has been limited oversight of the non-government school sector by DET, and this has resulted in a lack of transparency and accountability for the use of state government grants.

DET acknowledges and accepts the need to improve arrangements and accountability for the use of state government grants. The department has begun to address some of the identified issues through the development of interim arrangements with the non-government sector for the 2016 year, including having clearer objectives and expected outcomes from state recurrent grants and a greater focus on strengthened reporting and accountability requirements. It is critical that DET continues to work with the non-government school sector to further improve transparency and accountability as it develops arrangements for 2017 and beyond.

I have made a number of recommendations to DET focused on improving funding agreements, clarifying record keeping and reporting requirements, and strengthening its oversight and monitoring of the non-government school sector, to provide greater assurance that grants are used as intended. I am pleased that DET accepts all of my recommendations and that it has identified actions to address them.

I have made a further audit comment in relation to a number of matters raised by the CECV. Its response includes a series of assertions and inferences which comprehensively misrepresent the content of my report. The tenor of the CECV's response is also particularly troubling. In a section of the executive director's response to our proposed report, he had this to say:

'At the outset of this audit – before any substantive work had commenced – the former Auditor-General stated in the media, in relation to grants to non-government schools, that there is quite limited accountability coming back the other way as to what the money was used for, how it was used, and whether it was effective. VAGO has now produced a report to endorse these comments. It is hard not to conclude that the scope was intentionally designed to serve this purpose, given that a broader scope would have challenged many of VAGO's findings'.

The burden of the executive director's comments is clear enough—effectively, VAGO has conducted this audit in bad faith, that the scope of the audit has been rigged to align with comments made by the former Auditor-General, and that consequently, it seems, the evidence, the findings, the conclusions and recommendations were pre-ordained. These inferences are utterly without foundation or measure and as a commentary, it is quite unworthy of the administrative head of an important system of education.

Aside from citing a comment made by the former Auditor-General, the executive director has proffered no evidence to support his conclusions about this audit's apparently confected purpose. In this regard, rather than raise this fundamental issue at any point during the audit, he has chosen the very conclusion of the audit to impugn the integrity of this office. All Auditors-General are bound by the Audit Act 1994, and the Australian Auditing and Assurance Standards, which require audit findings and conclusions to be based on sufficient and appropriate evidence. Regrettably, there is nothing sufficient or appropriate about these intemperate observations of the executive director.

While this audit may not have been the one the CECV wanted, at its core are issues of accountability and transparency. Every citizen is entitled to transparency around the use of state government funds. The response from Independent Schools Victoria notably makes that very point, stating 'government and the public have the right to know how all government funding is being used'. DET itself acknowledges it has not adequately overseen the non-government school sector, but is now working to improve transparency.

CECV's suggestion that my report will be of little use to schooling in Victoria has already been belied by DET's agreement to implement my recommendations. These should provide significant improvements in accountability and transparency, and give all Victorians confidence that government funds provided to non-government schools are used efficiently and effectively. I will be monitoring DET's progress and revisit the issues identified in this report.

Finally, I would like to thank the staff from DET, system bodies and the selection of non-government schools who participated in this audit.

Dr Peter Frost

Acting Auditor-General

March 2015

Audit Summary

Non-government schools provide education to around 334 000 Victorian school children, which represents around 37 per cent of all Victorian students. These schools operate in two ways—through system authorities, that manage multiple schools, and as independent, non-systemic schools. They are diverse in nature, serving a range of different communities. They may provide religious or values-based education, or be based on educational philosophies or different interpretations of mainstream education.

There are four system authorities in Victoria. The largest of these is the Catholic Education Commission Victoria (CECV), which acts for 493 Catholic schools in the state. The other system authorities are the Lutheran system (overseeing 15 schools), the Ecumenical system (overseeing 15 schools, although this increased to 16 schools from January 2016) and the Seventh-day Adventist system (overseeing five schools). There are currently also 171 non-government schools that do not operate within one of the 'systems'. Other relevant bodies in the non-government school sector are Independent Schools Victoria, a membership-based organisation that receives and then distributes specific-purpose funding for targeted initiatives to non-government schools outside the Catholic system, and the Victorian Independent Schools Block Grants Authority which administers some grant programs.

Non-government schools receive funds from a range of sources, including the Australian and Victorian governments and student fees. The Victorian Government funds non-government schools through a range of non-competitive grants. In 2014, the state provided over $640 million in grants to the non-government school sector. Grants are provided for both general and specific purposes. The bulk of state government grants (over $624 million in 2014) are provided as state recurrent grants (SRG). This is a relatively minor share of government funding for non-government schools, since recurrent Australian Government grants are more than three times greater than state government grants.

Other Victorian Government grants to non-government schools—amounting to over $15 million in 2014—have specific purposes and limitations on how they may be used. These include grants to support students with disabilities, targeted or other special purpose grants, and facilitation and reward funding.

This audit examined whether the Department of Education & Training (DET), non-government schools and their system administrators are effectively and efficiently managing and using grants.

We examined DET's administration of state recurrent and other grants and examined compliance with funding agreements and the use of funds by grant recipients, including the four system authorities, and a selection of non-government schools. We did not examine other activities not related to state government grants, such as the use of Australian government grants to non-government schools or the activities of the Victorian Registration and Qualifications Authority.

Conclusions

There is limited assurance that grants to non-government schools are used for their intended purpose or are achieving intended outcomes. This is primarily due to weaknesses in funding agreements and DET's ineffective grants management, including limited oversight of grant recipients and their use of grants, and inadequate monitoring and reporting. While the funding agreements and associated guidelines set out the goals of the grants and conditions on the use of grant funds, there are no performance measures or targets, and limited reporting requirements for the non-government sector, beyond financial reporting.

It is encouraging that DET has recently developed interim memorandums of understanding, funding agreements and guidelines for the major state recurrent grant funding, which have strengthened reporting and accountability requirements. It is important that DET continues to work with the non-government sector to further improve accountability and transparency for the use of state government grants as it develops arrangements for 2017 and beyond. DET must also improve its oversight, monitoring and reporting of grant recipients.

There is significant variation in the management practices of the selection of non‑government schools tested as part of this audit—overall, they lacked policies and procedures to demonstrate the effective use of state government grants. With some exceptions, they cannot adequately track and demonstrate how grant funds have been spent.

We were able to reconcile state recurrent grant funds received by a sample of independent schools against DET's allocation. The recurrent grant funds to Catholic schools are reallocated to individual schools by the CECV using its own methodology. This results in a significantly different allocation to Catholic schools, compared to DET's allocation. However, we were able to reconcile SRG funds received by Catholic schools in the audit against allocation data provided by CECV.

Most schools that received targeted funding for students with disabilities (SWD) or grants under the support services program could not demonstrate that funds were used for their intended purpose.

There is a need to strengthen guidelines and funding agreements, and the associated accountability for the use of all grants to non-government schools. Both school-level accountability and controls, and DET's oversight and monitoring need strengthening.

Findings

Departmental oversight of grants

The absence of clear, appropriate governance by DET has led to poor grant administration, including inadequate monitoring and oversight of whether grants are used as intended.

The purpose and goals of the state recurrent grants are set out in the funding agreements between DET and grant recipients. The funding agreements have specific goals—however, there are no performance measures or monitoring and reporting requirements associated with these goals. Therefore DET is unable to determine if the grants are contributing to the achievement of its goals.

There are limited conditions within the funding agreements to adequately monitor the use of grants, and reporting requirements relate to financial information and some output data. Other controls that do exist are not actively used by DET to test or validate how grants are used by non-government schools. The limited reporting that does occur is not sufficiently used by DET to determine whether grants are being used as intended.

DET does not oversee or monitor the use of state recurrent grants beyond receiving financial acquittals, nor does it utilise other sources of performance information, to assure itself that the intended goals are being achieved. As monitoring and reporting are limited to financial acquittals, there has been a lack of accountability for achieving the government's goals through the use of state recurrent grant funding. The interim 2016 funding agreement includes some improved reporting requirements and performance measures, which will partially address these issues, provided DET improves its monitoring and oversight activities.

In some cases, DET relies on system authorities to administer and oversee grants made to schools. In effect, this means that the system authorities oversee themselves, because they receive the grant funding from DET, manage the allocation of grants to schools, and provide acquittals to DET on expenditure. DET has only assessed these acquittals from system authorities to ensure that expenditure matched the payments provided. DET does not oversee or monitor system authorities to assure itself that grants are used for their intended purpose or achieving the intended outcomes.

DET has acknowledged there is a need for improvement in this area and has advised that it is introducing performance measures and other improvements. In addition to commissioning the recent review of reporting and accountability arrangements, DET has developed interim funding agreements, memorandums of understanding and guidelines for 2016, which strengthen performance outcome measures and reporting requirements.

Allocation of grants to non-government schools

State recurrent grants

The Lutheran, Ecumenical and Seventh-day Adventist system authorities pass on in full the SRGs to schools allocated by DET, and independent, non-systemic schools receive their SRGs directly from DET. We verified SRG funding received by each school in our sample against their allocations from information provided by either system authorities or DET and the amounts received for all schools were fully reconciled.

CECV reallocates the SRG to Catholic schools using its own methodology. The overall effect of the CECV distribution methodology is that some Catholic schools receive substantially more than they would receive under DET's allocation and some substantially less. While student-family background is only one of a number of elements in the model DET use to determine grant allocations, the overall effect of the CECV methodology is to reduce the importance of that element in providing funds to individual schools. CECV's position is that its reallocation of SRGs is required because DET's Financial Assistance Model—used by the department to determine grant allocations—does not accurately estimate the need for government grants in Catholic schools, with a disproportionate share of funding being allocated on an equity/needs basis.

As part of this audit, we tested the SRG amounts received by six Catholic schools against allocations from CECV, and were able to reconcile these amounts.

Students with disabilities grants

We tested the financial records for SWD grants received in 2014, and were able to reconcile all allocations for all the schools we tested.

Use of grants by non-government schools

Non-government schools do not have adequate procedures and systems in place to ensure that Victorian Government grants are used for their intended purpose. A sample of 22 non-government schools were generally unable to provide evidence that grants had been used as allowed under the funding agreements.

Policies and procedures

None of the sampled schools had adequately documented policies and procedures in place to support the sound administration of SRGs. Five schools had appropriate documentation of staff responsibilities, but no schools had clearly documented business rules for grants administration. Six schools relied on what they described as 'verbal' policies.

Systems and processes

None of the sampled schools provided evidence that adequate systems and processes were in place to ensure that grants were used for their intended purpose. One school had a series of controls for the approval of expenditure. Four schools relied on 'verbal' processes.

Ability to demonstrate use of grant funds

State recurrent grants

Nearly all of the sampled schools (21 of 22) had budgets in place to ensure grants were spent or committed in the relevant year. While the majority of sampled schools were able to demonstrate that grant money was spent or committed in the financial year for which they were received, they were unable to provide sufficient supporting evidence, through detailed general ledgers and invoices, that grant money had been spent as budgeted. While all individual schools we tested had an auditor's report stating SRG funds were expended for the purposes for which they were provided, no school was able to demonstrate to VAGO that SRG funds were spent in full accordance with the agreement

DET's 2016 funding agreement includes reporting requirements that specify how funding is to be spent, with a requirement for a strengthened acquittal certificate to be issued by the school head and an independent auditor. This includes assurance that funds have not been used for capital purposes. However, without schools separately identifying expenditure of SRG funding it is not clear how a school, and consequently DET, can be assured that grant recipients and non-government schools are using funds as intended.

Students with disabilities grants

Of the 20 schools in the sample that received SWD funding, only four schools (20 per cent) were able to provide sufficient evidence that SWD funds were used for their intended purpose. A further three schools were able to provide some evidence of expenditure, but were unable to either link the expenditure to the source of funds or substantiate the expenditure shown in the general ledger. Thirteen schools could not demonstrate that their SWD grants were used for the intended purpose.

Support Services Program

Of the 13 schools that received support services program grants, only two schools (15.4 per cent) provided sufficient evidence that grant funds were spent on their intended purpose. Four schools were able to provide a sufficiently detailed general ledger, but were not able to provide documentation to verify the expenditure.

Recommendations

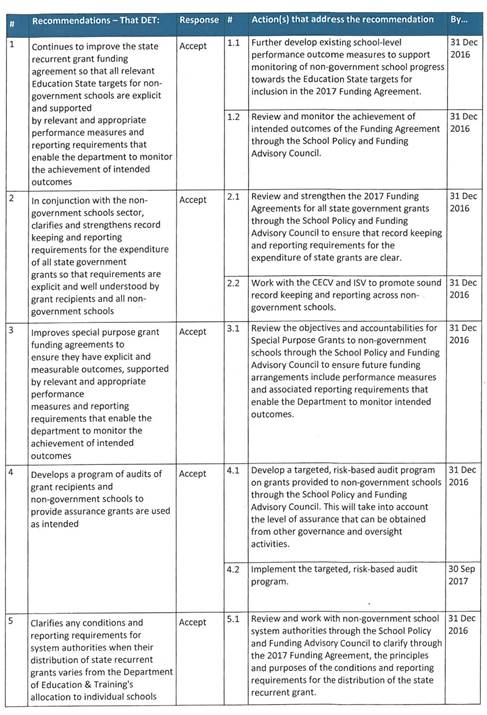

That the Department of Education & Training:

- continues to improve the state recurrent grant funding agreement so that all relevant Education State targets for non-government schools are explicit and supported by relevant and appropriate performance measures and reporting requirements that enable the department to monitor the achievement of intended outcomes

- in conjunction with the non-government schools sector, clarifies and strengthens record keeping and reporting requirements for the expenditure of all state government grants so that requirements are explicit and well understood by grant recipients and all non-government schools

- improves special purpose grant funding agreements to ensure they have explicit and measurable outcomes, supported by relevant and appropriate performance measures and reporting requirements, that enable the department to monitor the achievement of intended outcomes

- develops a program of audits of grant recipients and non-government schools to provide assurance grants are used as intended

- clarifies any conditions and reporting requirements for system authorities when their distribution of state recurrent grants varies from the department's allocation to individual schools.

Submissions and comments received

Throughout the course of the audit, we have professionally engaged with:

- the Department of Education & Training

- Adventist Schools Victoria

- Catholic Education Commission of Victoria Ltd

- Independent Schools Victoria

- Lutheran Education Vic, NSW & Tas

- Victorian Ecumenical System of Schools.

In accordance with section 16(3) of the Audit Act 1994 we provided a copy of this report to those agencies and requested their submissions or comments. We have considered those views in reaching our audit conclusions and have represented them to the extent relevant and warranted. Their full section 16(3) submissions and comments are included in Appendix B.

1 Background

1.1 Introduction

Non-government schools are diverse in nature, serving a range of different communities. They may provide religious or values-based education, or be based on educational philosophies or different interpretations of mainstream education.

They provide education to around 334 000 Victorian children, which represents around 37 per cent of all Victorian students. Non-government schools operate in two ways—through system authorities that manage multiple schools, and as independent, non-systemic schools.

There are four system authorities in Victoria. The largest of these is the Catholic Education Commission Victoria (CECV), which acts for 493 Catholic schools in the state. The other system authorities are Lutheran Education Vic, NSW & Tas (LEVNT, overseeing 15 schools), Victorian Ecumenical System of Schools (VESS, overseeing 15 schools, although this increased to 16 schools from January 2016) and Adventist Schools Victoria (ASV, overseeing five schools). There are also currently 171 non-government schools that do not operate within one of the 'systems'. In the non-government school sector, and throughout this report, the schools are often described as being in one of two categories—'Catholic' and 'independent', where Lutheran, Ecumenical and Adventist schools are included in the 'independent' category along with independent, non-systemic schools.

There are two further organisations involved in distributing funding to schools. Independent Schools Victoria (ISV) is a membership-based organisation that receives and then distributes specific-purpose funding for targeted initiatives. The Victorian Independent Schools Block Grant Authority (VIS BGA) also receives and reallocates funding to schools for specific initiatives.

Non-government schools receive funds from a range of sources including the Australian and Victorian governments and student fees. The Victorian Government funds non-government schools through a range of non-competitive grants. In 2014, the state provided over $640 million in grants to the non-government school sector. This is a relatively minor share of government funding for non-government schools, with recurrent Australian Government grants over three times greater than state government grants.

1.2 Victorian non-government schools

In 2015, there were 700 non-government schools in Victoria (31.4 per cent of all schools in Victoria). Figure 1A shows the number of schools by type and sector as at February 2015.

Figure 1A

Size and structure of the Victorian school system, February 2015

|

School type |

Government |

Catholic |

Independent |

Total number of schools |

|||

|---|---|---|---|---|---|---|---|

|

Number of schools |

Per cent |

Number of schools |

Per cent |

Number of schools |

Per cent |

||

|

Primary |

1 128 |

72.7 |

387 |

25.0 |

36 |

2.3 |

1 551 |

|

Primary and secondary |

78 |

33.2 |

13 |

5.5 |

144 |

61.2 |

235 |

|

Secondary |

238 |

70.0 |

86 |

25.3 |

15 |

4.7 |

340 |

|

Special |

80 |

80.8 |

7 |

7.1 |

12 |

12.1 |

99 |

|

Language |

4 |

100.0 |

0 |

0.0 |

0 |

0.0 |

4 |

|

Total |

1 528 |

68.6 |

493 |

22.1 |

207 |

9.3 |

2 229 |

Source: Victorian Auditor-General's Office from the Department of Education & Training's February 2015 School Census.

In February 2015, there were 339 152 students enrolled at non‑government schools (37.1 per cent of all Victorian school students)—207 186 at Catholic schools and 131 966 at independent schools.

Figure 1B

Number of Victorian students by enrolment type, February 2015

|

School type |

Government |

Catholic |

Independent |

Total number of schools |

|||

|---|---|---|---|---|---|---|---|

|

Number of students |

Per cent |

Number of students |

Per cent |

Number of students |

Per cent |

||

|

Primary |

340 844 |

67.3 |

111 233 |

22.0 |

54 661 |

10.8 |

506 738 |

|

Secondary |

221 458 |

56.3 |

95 394 |

24.2 |

76 738 |

19.5 |

393 591 |

|

Special |

12 076 |

91.5 |

559 |

4.2 |

566 |

4.3 |

13 201 |

|

Language |

1 629 |

100.0 |

0 |

0.0 |

0 |

0.0 |

1 629 |

|

Total |

576 007 |

62.9 |

207 186 |

22.6 |

131 965 |

14.4 |

915 159 |

Note: Total figures do not add due to rounding.

Source: Victorian Auditor-General's Office from the Department of Education & Training's February 2015 School Census.

1.3 Grants to non-government schools

1.3.1 State government funding for non-government schools

Figure 1C shows government recurrent funding to Victorian schools in 2012–13, by sector and funding source, from the most recent Productivity Commission report. The Victorian Government accounted for 86.7 per cent of total government funding to Victorian government schools, and 23.3 per cent of government funding to non‑government schools.

Figure 1C

Government recurrent funding to Victorian schools 2012–13 ($'000)

|

Australian Government |

Victorian Government |

Total |

|

|---|---|---|---|

|

Government schools |

1 011 |

6 580 |

7 590 |

|

Non-government schools |

2 073 |

631 |

2 704 |

Source: Victorian Auditor-General's Office from the Productivity Commission's, Report on Government Services 2015.

Combined Victorian and Australian government funding for non‑government schools has increased by around $732 million (37.1 per cent) in real terms between 2003–04 and 2012–13. Victorian Government funding increased by 53.4 per cent while Australian Government funding increased by 32.8 per cent.

Types of Victorian Government grants to non-government schools are summarised in Figure 1D.

Figure 1D

Victorian Government grants to non-government schools

|

Type of grant |

Description |

|---|---|

|

State recurrent grants (SRG) |

The main form of grant that the Victorian Government provides non-government schools is the SRG. It is intended to provide funding for schools to meet the recurrent costs of providing education programs consistent with Victoria's education policies and goals. With the exception of money provided to support students with disabilities, the money is 'untagged' and schools must use it to meet the general recurrent costs of providing education programs, and not use it for capital expenditure. Payment of SRGs is based on annual enrolment data that schools provide to the Australian Government Department of Education & Training. It makes up the vast majority of state funding to non-government schools. |

|

Students with disabilities grants |

Students with disabilities grants are paid to non-government schools based on the proportion of students with disabilities. While this funding must be used to support students with disabilities, it does not need to be linked or allocated to individual students. |

|

Special purpose or targeted grants |

Special purpose or targeted grants are provided to schools to meet the additional costs of assisting groups of students with particular needs or to implement specific initiatives—for example, support services (visiting teachers, psychology or speech pathology services), suicide prevention, or interest subsidies. CECV distributes these grants to Catholic schools, and ISV and VIS BGA distribute them to all other non-government schools. Schools usually have to apply to receive special purpose grants. Some support programs are also delivered by CECV and ISV. |

|

Facilitation and reward funding |

The Facilitation and Reward Program for School Improvement was introduced in 2010 as part of the 2010–13 funding arrangements. The program was designed to widen and deepen the implementation of three National Partnership programs: Smarter Schools National Partnerships on Literacy and Numeracy, Improving Teacher Quality, and Low Socioeconomic School Communities. While Australian Government funding under the Facilitation and Reward Program was not recurrent, the Victorian Government has committed these funds for ongoing non-government school expenditure. |

|

Capital funding |

The Victorian Government has not provided capital funding for non-government schools in recent years. However, in the 2015–16 State Budget, the government allocated $120 million over four years for capital projects at non-government schools. This has not been assessed as part of this audit. |

Source: Victorian Auditor-General's Office based on information from the Department of Education & Training.

1.3.2 Grant allocations to non-government schools

The total amount of SRGs paid by the Victorian Government to non-government schools between 2009 and 2014 is shown in Figure 1E. The Department of Education & Training (DET) determines these allocations using its Financial Assistance Model (FAM), which comprises core funding and equity funding. See Appendix A for further detail on FAM.

Nearly 60 per cent of SRG funding is equity funding. FAM recognises that SRG funding is not the major contributor of funds to non-government schools, and is therefore intended to target particular needs, based on the students at each school.

Figure 1E

State recurrent grants paid to each system authority and independent schools, 2009 to 2014

|

2009 ($) |

2010 ($) |

2011 ($) |

2012 ($) |

2013 ($) |

2014 ($) |

|

|---|---|---|---|---|---|---|

|

CECV |

287 522 003 |

308 198 282 |

399 113 914 |

412 676 650 |

419 050 026 |

430 813 271 |

|

Ecumenical |

14 973 134 |

15 899 747 |

16 960 219 |

16 975 535 |

17 503 404 |

17 750 893 |

|

Lutheran |

5 172 148 |

5 689 299 |

7 061 934 |

7 620 999 |

8 062 409 |

8 556 171 |

|

Seventh-day Adventist |

3 045 300 |

3 336 680 |

4 285 894 |

4 310 258 |

4 468 999 |

5 531 374 |

|

Independent schools |

109 421 096 |

120 235 223 |

148 023 076 |

151 214 039 |

153 593 096 |

161 764 717 |

|

Total |

420 133 682 |

453 359 234 |

575 445 039 |

592 797 482 |

602 677 936 |

624 416 428 |

Note: CECV and independent schools figures include students with disabilities funding paid in addition to SRGs. Total figures do not add due to rounding.

Source: Victorian Auditor-General's Office based on information from the Department of Education & Training.

Figure 1F shows the allocation of special purpose and other specific grants for 2009 to 2014. Note that in 2014, some categories of grants were combined.

Figure 1F

Special purpose grants, 2009 to 2014

|

2009 ($) |

2010 ($) |

2011 ($) |

2012 ($) |

2013 ($) |

2014 ($) |

|

|---|---|---|---|---|---|---|

|

Independent Schools Victoria |

||||||

|

Suicide prevention |

308 333 |

308 333 |

308 333 |

308 333 |

308 333 |

|

|

Support services |

965 070 |

984 372 |

1 006 520 |

1 034 199 |

1 060 055 |

|

|

Suicide prevention and support services |

1 390 829 |

|||||

|

Facilitation program |

960 000 |

960 000 |

960 000 |

960 000 |

960 000 |

|

|

Reward program |

1 280 000 |

1 280 000 |

1 280 000 |

1 280 000 |

||

|

Victorian Independent Schools Block Grant Authority |

||||||

|

Interest subsidy scheme |

217 778 |

217 778 |

217 778 |

217 778 |

217 778 |

221 351 |

|

Catholic Education Commission of Victoria |

||||||

|

Suicide prevention |

891 667 |

891 667 |

891 667 |

891 667 |

891 667 |

|

|

Support services |

4 887 227 |

4 984 972 |

5 097 134 |

5 237 305 |

5 368 238 |

|

|

Suicide prevention, support services and interest subsidy |

7 055 977 |

|||||

|

Interest subsidy scheme |

682 221 |

682 221 |

682 221 |

682 221 |

682 221 |

|

|

Facilitation program |

2 040 000 |

2 040 000 |

2 040 000 |

2 040 000 |

2 040 000 |

|

|

Reward program |

2 720 000 |

2 720 000 |

2 720 000 |

2 720 000 |

||

|

Total |

7 952 298 |

11 069 344 |

15 203 654 |

15 371 505 |

15 528 293 |

15 668 157 |

Note: Total figures do not add up due to rounding.

Source: Victorian Auditor-General's Office based on information from the Department of Education & Training.

1.3.3 Funding instruments

There are several key documents that govern the purpose and use of grants to non-government schools. These need to be read together, particularly the Victorian Government Financial Assistance for Non-Government Schools 2010–2013 Guidelines and the Victorian Non-Government Schools Funding Agreement 2010–2013. The funding agreement was extended for one year in 2014 and again in 2015. A new 2016 memorandum of understanding (MoU), funding agreement and guidelines have recently been developed. These are discussed in Section 2.6. However, the 2010–13 MOI, funding agreement and guidelines were in place for all activities examined during this audit.

Memorandums of understanding covering 2010 to 2013

The broad terms of the funding agreement and the wider partnership between the Victorian Government and non-government schools are set out in two MoUs, signed in 2009 by the then Premier of Victoria and the heads of two of the Victorian non-government school bodies (ISV and CECV).

Victorian Government Financial Assistance for Non-Government Schools 2010–2013 Guidelines

The Victorian Government Financial Assistance for Non-Government Schools 2010–13 Guidelines outlines the policies, procedures and accountabilities associated with funding provided by the Victorian Government to non-government schools.

Victorian Government and Non-Government Schools Funding Agreement 2010–2013

The Victorian Government and Non-Government Schools Funding Agreement 2010–2013 was signed by the former Department of Education and Early Childhood Development (DEECD) and the heads of the four Victorian non-government school system authorities and individual independent, non-systemic schools. It implements the funding arrangement between the state and non-government schools and sets out the conditions that apply. This funding agreement applies to SRGs and Facilitation and Rewards Program payments only.

For special purpose grants there is, as of 2014:

- a separate funding agreement between the former DEECD and CECV, for all three special purpose grant programs

- separate funding agreement between the former DEECD and ISV for the support services and suicide prevention programs, and a separate funding agreement with the VIS BGA for the interest subsidy scheme.

1.3.4 Grant allocation mechanisms

For Catholic, Lutheran, Ecumenical and Seventh-day Adventist schools, DET provides SRG funding through the respective system authorities. For independent, non-systemic schools, DET provides SRG funding directly. The flow of SRG funding from DET to non-government schools is shown in Figure 1G.

Figure 1G

Funding flow for state recurrent grants to non-government schools

Source: Victorian Auditor-General's Office.

As shown in Figure 1H, for special purpose grants, funding for Catholic schools is provided through CECV, while funding for all other non-government schools is provided through ISV.

Figure 1H

Funding flow for special purpose grants to non-government schools

Source: Victorian Auditor-General's Office.

1.3.5 Education and Training Reform Amendment (Funding of Non-Government Schools) Act 2015

The Education and Training Reform Amendment (Funding of Non-Government Schools) Act 2015 (the Act) specifies the minimum amount of funding to be provided to non-government schools. It amounts to 25 per cent of the cost of educating a government school student.

The Act aims to ensure that growth in per-student state funding for government schools will also flow through to growth in state funding for non-government schools. The cost of educating a government school student is calculated based on a 'basket of goods' that specifies the particular recurrent lines on which the 25 per cent is applied. The basket is designed to capture the funding that is directly related to the cost of instruction of students in government schools.

The Act also sets up new mechanisms for accountability and reporting, such as:

- imposing reasonable funding conditions on non-government schools

- requiring non-government schools and system authorities to report on the application of funding.

It is too early to assess whether these new accountability mechanisms will be effective, as they came into operation on 1 July 2015.

The Act also provides for the establishment of a new School Policy and Funding Advisory Council. The function of the council is to advise the Minister for Education about regulatory, policy and funding issues that affect government and non-government schools. The council was established in August 2015 and consists of the following members appointed by the minister:

- the Secretary of DET who is the chair of the council

- a representative of CECV nominated by CECV

- a representative of ISV nominated by ISV

- Representative of government schools who is employed by DET.

1.4 Key entities involved in grants to non-government schools

1.4.1 Department of Education & Training

DET leads the delivery of education and development services to children, young people and adults, both directly through government schools and indirectly through the regulation and funding of early childhood services, non-government schools and training programs. It also implements Victorian Government policy on early childhood services, school education and training and higher education services. DET manages Victorian government schools and drives improvement in primary and secondary government education.

Grants to non-government schools are administered by DET, which represents the government in the funding agreements and determines grant amounts. It is responsible for all aspects of managing grants to non-government schools.

1.4.2 Non-government school sector bodies

Catholic Education Commission of Victoria

The largest of the non-government school sector bodies is the CECV. Catholic education in Victoria is administered in two tiers—at the diocesan level, and at the state level. There are four dioceses of the Catholic Church in Victoria—Melbourne, Ballarat, Sale and Sandhurst. Catholic Education Offices in each diocese, acting on behalf of the bishops, have primary responsibility for overseeing schooling activities. However, the key body for school funding purposes is the CECV. The CECV is a public company limited by guarantee whose members comprise the four bishops of Victoria. Its roles include receiving government grants provided to Catholic systemic schools, and allocating, distributing, expending or appropriating grants to schools in accordance with government conditions.

Adventist Schools Victoria

ASV oversees the operation of five schools across eight campuses. All ASV schools are low fee, non-selective, coeducational day schools.

Lutheran Education Vic, NSW & Tas

LEVNT oversees 15 schools in Victoria and works with and for schools to:

- encourage spiritual and professional growth of all within the school community

- provide quality teaching and learning programs

- provide support in governance and management

- develop and support financial structures

- facilitate communication between schools and the wider professional community.

Victorian Ecumenical System of Schools

VESS is a registered public company limited by guarantee. The board of directors, through its executive and executive officer, work together with all member schools to establish goals, define policy and establish working protocols.

Independent Schools Victoria

ISV is not a system authority managing schools, but a not-for-profit member association providing professional services and working to raise quality standards. ISV represents the interests of member schools to governments and the community on a wide range of issues.

ISV represents, promotes the interests of, and provides services to 210 member schools, educating more than 129 000 students.

Victorian Independent Schools Block Grant Authority

VIS BGA administers Australian and Victorian Government programs to improve educational outcomes for independent school students by providing funding to assist with developing school infrastructure. Established in 1989, VIS BGA's primary objective is to carry out the functions of a block grant authority, as described in theAustralian Education Act 2013 (Cth). The VIS BGA administers the Victorian Government's Interest Subsidy Schem for Non-Government Schools, which provides grants to assist in the repayment of borrowings undertaken to finance capital expenditure on buildings and curriculum related equipment.

1.4.3 Other agencies

Victorian Registration and Qualifications Authority

The Victorian Registration and Qualifications Authority (VRQA) is responsible for the registration and regulation of all Victorian schools. All schools must comply with the minimum standards and other requirements specified in the Education and Training Reform Act 2006 and the Education and Training Reform Regulations 2007.

The minimum standards for registration cover:

- school governance—democratic principles, structure, probity, philosophy and not‑for-profit status

- enrolment—student enrolment numbers, enrolment policy, register of enrolments

- curriculum and student learning—curriculum framework,student learning outcomes,monitoring and reporting on students' performance

- student welfare—care, safety and welfare of students, discipline,attendance monitoring,attendance register

- staff employment—teacher registration requirements, compliance with the Working with Children Act 2005

- school infrastructure—buildings, facilities and grounds and educational facilities.

Non-government schools are assessed against the standards and other requirements for school registration by VRQA. All schools are reviewed at least once every five years, and may be reviewed at any time.

School review bodies manage the registration and the monitoring and compliance of certain schools against the minimum standards and other requirements for registration. The VRQA has approved DET, CECV and ASV as review bodies for government schools, Catholic schools and Seventh-day Adventist schools, respectively. It has developed a self-assessment tool that allows independent schools to assess their own compliance with the standards and other requirements for school registration.

1.5 Audit objective and scope

The objective of the audit was to determine whether DET, non-government schools and their system administrators are effectively and efficiently managing and using grants.

The audit examined DET's administration of state recurrent and other grants to non-government schools. It also examined compliance with funding agreements and the use of funds by the four system authorities, other bodies and a selection of non-government schools.

The audit included:

- Department of Education & Training

- Adventist Schools Victoria

- Catholic Education Commission of Victoria Ltd

- Independent Schools Victoria

- ISV Block Grant Authority

- Lutheran Education Vic, NSW & Tas

- Victorian System of Ecumenical Schools

- as election of 22 non-government schools.

1.6 Audit method and cost

DET, non-government school system bodies and a sample of 22 non-government schools were key sources of information for this audit. The audit team gathered evidence by:

- conducting interviews with and reviewing documents provided by DET and non-government system bodies

- reviewing system authority systems and financial records related to state government grants

- reviewing systems and process, and documentation for a sample of 22non‑government schools including financial and other records related to the use of state government grants.

The audit was conducted in accordance with section 15 of the Audit Act 1994 and the Australian Auditing and Assurance Standards. Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated any persons named in this report are not the subject of adverse comment or opinion.

The total cost of the audit was $440 000.

1.7 Structure of the report

The report is structured as follows:

- Part 2 examines the grants governance arrangements and oversight by DET

- Part 3 examines the use of grants by system authorities and non-government schools.

2 Grants governance and oversight

At a glance

Background

The Department of Education & Training's (DET) responsibility for administering grants to non-government schools is laid out in a series of memorandums of understanding, guidelines and funding agreements. These agreements set out the government's objectives for the grants, conditions on their use and the related reporting requirements.

Conclusion

There is limited assurance that grant funds are being used for their intended purpose or are achieving the government's intended outcomes. This is primarily due to weaknesses in funding agreements, and DET's inadequate grants management including limited oversight of grant recipients and poor monitoring and reporting. DET has recently developed improved interim arrangements for 2016 which address some deficiencies.

Findings

- Beyond basic financial reporting there are no performance measures or monitoring or reporting associated with grants to non-government schools.

- The reporting that does occur is not sufficiently tested or used by DET to determine whether grants are being used as intended.

- DET undertakes limited oversight and monitoring of non-government schools receiving state government grants.

Recommendations

That DET:

- continues to improve the state recurrent grant funding agreement goals and performance measures

- clarifies record keeping and reporting requirements for grants

- improves special purpose grant funding agreements

- develops program of audits of grant recipients and non-government schools.

2.1 Introduction

The purpose and use of grants provided to non-government schools is governed by a number of documents, particularly the Victorian Non-Government Schools Funding Agreement 2010–2013, which incorporates the Victorian Government Financial Assistance for Non‑Government Schools 2010–2013 Guidelines.

The Department of Education & Training (DET) negotiates the terms of the funding agreements, issues the guidelines, determines the amount of the grants, allocates funding under the agreements and is responsible for enforcing the terms of the agreements on behalf of the state. It is responsible for ensuring the grants to non-government schools are meeting the government's policy objectives.

This Part examines the governance arrangements for grants to non-government schools and DET's oversight of the non-government school sector.

2.2 Conclusion

There is limited assurance that funds are being used for their intended purpose or are achieving the government's intended outcomes. This is primarily due to weaknesses in funding agreements, and DET's ineffective grants management. This includes insufficient oversight of grant recipients and their use of grants, and inadequate monitoring and reporting.

While the funding agreements and associated guidelines set out the goals of the grants and conditions on their use, there are no performance measures or targets, and limited reporting requirements. Controls that do exist are not used by DET to test or validate how grants are used by non-government schools.

The absence of clear, appropriate governance has led to poor grant administration and a lack of monitoring or oversight to ensure grants are being used as intended. It is encouraging that DET has recently developed interim memorandums of understanding (MoU), funding agreements and guidelines for the major state recurrent grant funding which have strengthened reporting and accountability requirements. It is important that DET continues to work with the non-government sector to further improve accountability and transparency for the use of state government grants when developing arrangements for 2017 and beyond. DET must also improve its oversight, monitoring and reporting of grant recipients.

2.3 State recurrent grants

2.3.1 Purpose of the state recurrent grants

The purpose and goals of the state recurrent grants (SRG) are set out in the 2010–13 funding agreements between DET and the non-government system authorities and with independent, non-systemic schools.

The funding agreement has the following goals, which were agreed by DET and non-government school sector representatives and independent, non-systemic schools:

- improving student outcomes

- providing funding certainty for schools and school systems

- improving the equity of funding by targeting need

- supporting choice and assisting parents to make informed choices

- supporting best practice approaches in schools

- achieving effective partnerships

- achieving the effective and efficient use of public funds.

There are no performance measures or monitoring and reporting requirements associated with these goals, therefore DET has no ability to assure itself that they are being achieved. DET agrees that there is limited assurance that funds are used for intended purposes, although it believes that reporting for the Australian Curriculum, Assessment and Reporting Authority (ACARA), for the Australian Government's Financial Questionnaire, and system authority and school acquittals provide evidence of reporting. We also note that the Australian Government undertakes a Financial Questionnaire verification exercise—a routine quality assurance process in which the relevant Australian Government department checks whether Financial Questionnaire data submitted by non-government schools and school systems has been correctly drawn from their audited statements.

ACARA is responsible for collecting data from schools for the purpose of accountability and reporting, research and analysis, and resource allocation. Information on individual schools is also published on the My School website including information about performance on National Assessment Program – Literacy and Numeracy (NAPLAN) tests as well as information about school finances and school communities. While we accept there is a range of reporting, data and information relating to non-government schools that DET has access to, it does not use this information to monitor the performance of non-government schools or the achievement of the goals of the funding agreement.

DET has acknowledged that there are opportunities for improving the monitoring and assurance around grant funds. A recent review commissioned by DET also found that there are significant weaknesses with performance measures and related monitoring by DET. It found that:

- DET has yet to define the objectives of the recurrent funding program and determine how to best utilise the 'reasonable conditions' clause within the amended Education and Training Reform Act 2006 (discussed in Section 1.3.5)

- no significant performance measures have been developed or utilised in relation to state recurrent funding provided to non-government schools

- DET may lack the systems, technology and resources required to implement a non-government school performance monitoring framework.

The review also found that current funding arrangements have been limited in their scope and have lacked sufficient rigour around performance measures and reporting on outcomes. It found that while annual financial acquittals have been provided by individual independent schools and system authorities, these acquittals provide limited detail about the expenditure of the funds received. In addition, it found that reporting to DET around educational outcomes for the non-government school sector has been limited and largely informed by data collected at a national level.

As discussed in Section 2.6, interim funding agreements have been developed for 2016 and these include improved performance measures that will use data to be sourced from a range of sources external to DET.

2.3.2 Reporting required by the funding agreements

Funding agreement clause 21 requirements

Under clause 21 of the funding agreements with all non-government school bodies except the Catholic Education Commission Victoria (CECV), the recipient must keep full and accurate records to enable:

- the identification of all income and expenditure of funds provided under this agreement

- the audit of those records in accordance with current Australian professional accounting standards

- the recipient to perform and report on any obligations under this agreement.

DET advised that the intent of this clause was that all school systems and schools keep full and accurate records to enable the identification of all income provided under the agreement and the expenditure of school funds. It advised that this does not extend to schools and systems being required to separately identify expenditure of SRG funds as opposed to expenditure from other sources of funding.

CECV's funding agreement with DET has a different clause 21 compared to all other funding agreements, with the second and third points the same. It reads as follows:

The recipient must keep, and must ensure that the systemic schools keep, full and accurate records, including financial records, to enable:

- the identification of all income provided under this agreement and expenditure of school funds

- the audit of those records in accordance with current Australian professional accounting standards

- the recipient to perform and report on any obligations under this agreement.

It is not clear why CECV had a different clause in its funding agreement which could be interpreted as meaning there were different requirements for CECV and Catholic schools, compared to all other non-government schools, despite them all receiving the same SRG funds. DET advised that while there was a difference in the clause relating to record keeping in past agreements for CECV and the other school systems and schools, the intent of this clause was the same. However it did not provide any evidence to support this assertion. CECV's view is that the requirements of clause 21 in its funding agreement with DET mean that Catholic schools do not have to separately track SRG expenditure, which is consistent with DET's advice.

DET advised that while there was a difference in the clause relating to record keeping in past agreements for the CECV and the other school systems and non-systemic schools, this anomaly was addressed in the 2016 agreement. DET reiterated that this requires all school systems and non-systemic schools to keep full and accurate records to enable the identification of all income provided under the agreement and the expenditure of school funds, but it does not extend to schools and systems being required to separately identify expenditure of SRG funds as opposed to expenditure from other sources of funding.

In new 2016 interim funding agreements, the relevant clause is the same for all grant recipients, including CECV. DET should make the intent of this clause and the explicit record keeping and reporting requirements clear and should communicate this to the non-government school sector. This is important as this clause establishes fundamental record keeping and accountability requirements for non-government schools. This is also relevant to the school level activities discussed in Part 3 including schools' general inability to demonstrate how grant funds were spent.

Specific reporting requirements

Reporting requirements are set out in the funding agreements and the guidelines. The main requirement is the provision of a certificate by a qualified person (a registered company auditor and/or a member of the Institute of Chartered Accountants or Certified Practising Accountants) stating whether an amount equal to the funds paid under the agreement has been spent or committed to be spent for each calendar year, and for the purposes for which the funds were provided.

Audited financial statements and financial reports must be provided if requested by DET. However, DET has never exercised these requirements and this represents a gap in its accountability framework.

Other reporting requirements, which grant recipients must comply with, include the provision of:

- student family occupation data for each school

- the number of students with a disability (SWD) enrolled at each school, specifying the number of students at each Disability Severity Level

- are port, in the format specified in the guidelines, on SWDs enrolled and programs provided by each school for SWDs.

2.3.3 Monitoring performance against the funding agreements

DET oversight

DET does not oversee or monitor the use of SRGs beyond receiving financial acquittals. Nor does it use other sources of performance information to assure itself that the intended goals are being achieved. As discussed in Section 2.6, new interim arrangements partially address these issues, provided DET improves its monitoring and oversight activities.

As monitoring and reporting are limited to financial acquittals, there has been a lack of accountability for achieving the government's goals for the use and outcomes of SRGs. Identified weaknesses in DET's oversight are supported by the findings of its 2015 review of the accountability and reporting framework for non-government schools in relation to financial management and stewardship:

- The current acquittals provide limited value or assurance to DET. There is no formal mechanism to validate or confirm the information provided. The funding agreements provide DET with powers to request additional financial information,however, this has never been used.

- DET does not currently use the Australian Financial Questionnaire to analyse the financial position of non-government schools.

2.4 Other grants

Conditions and requirements for other grants are set out in the relevant funding agreements and associated guidelines. DET does not oversee how schools use these grants, which means that it cannot provide assurance that the grants are being used for their intended purposes or achieving their intended objectives.

2.4.1 Students with disabilities grants

For SWD grants, CECV reports to DET for Catholic schools, while Independent Schools Victoria (ISV) reports for all independent schools, including Lutheran, Ecumenical and Seventh Day Adventist schools. These acquittals show the allocation of SWD funding to individual schools. The guidelines state that schools or system authorities must complete and provide to DET by 1 April 2011, 2012, 2013 and 2014, a report on programs provided for SWDs in the previous calendar year.

System authorities were to provide a completed system-level report. The report was to contain information on the number of SWDs at each severity level enrolled in the current calendar year, details of the programs provided to support these students, details of the demand for specific programs and an acquittal of expenditure against these programs.

Schools were only required to provide a report once its format was developed. This never occurred, and consequently this requirement was never enforced and DET only received acquittals of the allocation of grant funds to each school.

2.4.2 Special purpose grants

Reporting to DET on special purpose grants by CECV, ISV and the Victorian Independent Schools Block Grant Authority (VIS BGA) consists of one-page financial acquittals and metrics such as the number of students receiving support services, and/or the number of teachers receiving professional development relating to suicide prevention and/or the number of schools receiving interest subsidy funding. These are output metrics; there is no other accountability relating to the delivery or outcomes of these grants.

In the 2013 funding agreements with CECV and ISV, DET requested metrics on different grant programs, such as:

- the number of students receiving support services

- the schools involved in the support services program

- the type of support services delivered

- the number of teachers receiving professional development relating to suicide prevention

- the outcomes of the consultancy services funded under the suicide program

- the number of schools receiving interest subsidy funding

- the number of schools funded in comparison to the number of eligible applicants.

However, to reduce the administrative burden, funding agreements were combined in 2014. For CECV the support services, suicide prevention and interest subsidy funding agreements were rolled into one, while for ISV the support services and suicide prevention funding agreements were combined. For independent schools the interest subsidy funding agreement is signed with VIS BGA. The 2014 agreements do not include the above metrics and simply request the provision of details of payments made under the three programs. This diminishes oversight, accountability and transparency.

DET oversight of special purpose grants

DET advised that CECV and ISV have the responsibility for administering and overseeing grants made to schools for all special purpose programs, and that CECV and ISV monitor and evaluate the programs according to guidelines provided by DET. In effect, this means that CECV and ISV oversee themselves, as they receive the grant funding from DET, manage the allocation of grants to schools, and provide acquittals to DET on expenditure. DET also advised that it has only assessed acquittals from system authorities to ensure that expenditure matched the payments provided. DET does not oversee or monitor ISV or CECV to assure itself that grants are used for their intended purpose or are achieving the intended outcomes.

2.4.3 Facilitation and reward payments

Facilitation and reward payments are designed to 'widen and deepen the implementation of the Smarter Schools National Partnerships on Literacy and Numeracy, Improving Teacher Quality and Low Socioeconomic School Communities'. Conditions relating to the payments were designed to be consistent with those applying to National Partnerships.

These partnerships have now lapsed. However, DET has continued funding facilitation and reward payments. The reward payments were allocated to reward reform, based on the 'achievement of predetermined milestones and benchmarks'. DET cannot be assured that milestones and benchmarks are being achieved because it does not have a monitoring and evaluation framework in place for facilitation and reward payments.

2.5 DET responsibility for non-government schools

Clear governance arrangements are essential for effective oversight and accountability for the expenditure of government funds.

Over many years DET has lacked clear, appropriate governance around grants to non-government schools. This has led to poor grant administration, including a small number of acquittals not being submitted by grant recipients. Significantly there has been very limited monitoring or oversight of grant recipients that would provide DET with the necessary assurance that grants are being used as intended or achieving the intended outcomes.

Figure 2A shows the various divisions and branches of DET and the former Department of Education and Early Childhood Development with various responsibilities related to non-government schools.

Figure 2A

Departmental responsibilities for non-government schools 2009 – present

|

Division or branch |

Functions |

|---|---|

|

2009 |

|

|

System Policy Division Office for Policy, Research and Innovation |

|

|

Financial Services Division |

|

|

2012 |

|

|

Education Partnerships Division School Education Group |

|

|

Financial Services Division |

|

|

Infrastructure and Sustainability Division |

|

|

Intergovernmental Relations Division |

|

|

2013 |

|

|

As for 2012 with amendment: School Education Group |

|

|

2014 |

|

|

Financial Services Division |

|

|

School Education Group |

|

|

2015 |

|

|

Group Strategy and Coordination Division (Early Childhood and School Education Group) |

|

|

Infrastructure and Sustainability Division |

|

Source: Victorian Auditor-Generals Office based on information from the Department of Education & Training.

DET's Financial Services Division allocates grant funds and receives acquittals. However, it does not undertake any testing or verification associated with the allocation or use of the funds, and no monitoring, reporting or oversight of grants recipients or the use of grants by non-government schools.

DET has advised that the Group Strategy and Coordination Division of the Early Childhood and School Education Group are now responsible for non-government school policy. It has developed a formal work program to put the legislative amendments into operation and has developed the interim 2016 MoU and funding agreements. The Group Strategy and Coordination Division's role includes the development and oversight of funding agreements for non-government schools (with the Infrastructure and Financial Services Division) and establishing and overseeing the ongoing operations of the School Policy and Funding Advisory Council (SPFAC).

DET advised that the establishment of SPFAC, which has an agreed 2016 work program, provides a strong governance framework for DET and the non-government school sector. The implementation of improved arrangements in 2016 and the further development of strengthened accountability and transparency arrangements requires DET to have a far more active role in overseeing and monitoring the agreements, non-government schools use of grants and the achievement of intended outcomes.

2.6 Recent developments

DET advised it is strongly committed to ensuring that the funding provided by the state government to the non-government school sector is provided for the benefit of improved educational outcomes in Victoria and is spent in accordance with Victorian legislation, the funding agreements and government policy.

DET recognises the need to improve its ability to demonstrate whether grant funds are being used to deliver the outcomes for which they are provided. It advised that assurance over grant funding can be improved, with key areas for improvement being the funding agreement and DET's grant management process. This includes improving DET's oversight of grant recipients for the use of grants and in the monitoring and reporting by recipients that grant funds have been spent in accordance with the purpose for which they were intended.

DET advised it has commenced a program to enhance and improve the arrangements for grant funding to non-government schools through a combination of legislative, funding and regulatory means. The introduction of the Education and Training Reform Amendment (Funding of Non-Government Schools) Act 2015 established the following:

- funding is paid directly to non-government schools or to an organisation (such as CECV or ISV) for the benefit of the non-government schools

- the Minister of Education may impose any 'reasonable conditions' on the provision of funding and may require a non-government school or organisation to enter into an agreement

- anon-government school is to provide a report (to the minister) if required, outlining the application of recurrent funding.

- formalizes establishment of the SPFAC.

DET has developed a new MoU, funding agreement and guidelines for 2016 to improve to its grant administration and governance. These are interim measures with new arrangements to be developed for commencement in 2017. The interim measures for 2016 were developed in consultation with CECV and ISV through SPFAC. DET advised it has also established its own Non-Government Schools Funding and Accountability Working Group to drive the work required by DET to improve processes and provide support to the work of SPFAC.

2.6.1 2016 memorandum of understanding

The 2016 MoU between DET and CECV, and DET and ISV set out a commitment by the parties to work together through SPFAC to achieve high quality educational outcomes across all schools, and to support the Victorian Non-Government Schools Funding Agreement 2016.

The MoU sets out a range of contextual information and commitments, including:

- the parties' commitment to work together to address the findings and recommendations from this audit of grants to non-government schools

- the parties' commitment to participate in the Education State vision and directions, and recognise targets apply to all students in all school sectors

- the investigation and development of school-level measures to support monitoring and progress towards the Education State targets

- a comprehensive review of the allocation methodology of the Financial Assistance Model (FAM)

- commitment to an efficient and effective reporting and monitoring framework that strengthens accountability and efficient administration for non-government schools

- commitment to the development of a new funding agreement and MoU from 2017, including responding to any changes arising from Education State priorities, this audit of grants to non-government schools, and other relevant state and Australian reforms

- improved financial acquittal processes and school-level performance outcome measures, outlined in the funding agreement.

2.6.2 Guidelines for Victorian Government financial assistance for non-government schools 2016

The Guidelines for Victorian Government financial assistance for non-government schools 2016 have been updated to reflect a range of changes including the current policy environment, establishment of SPFAC and the new 2016 MoU and funding agreements. The guidelines outline the state's financial assistance to non-government schools and the type and purpose of grants, performance measures, reporting requirements and so on consistent with the new MoU and funding agreement. The guidelines also outline the FAM used to allocate the state recurrent grant to non-government schools, although DET has committed to reviewing FAM during 2016.

2.6.3 Victorian Non-Government Schools Funding Agreement 2016

The 2016 funding agreement includes some notable changes compared to the 2010–13 agreement, including the goals and improved performance measures and reporting requirements. It includes some background information on the purpose of the recurrent grants, stating that DET provides recurrent financial assistance grants to non-government schools in Victoria to support the state's education policies and goals. The agreement outlines that financial assistance contributes to meeting the operational costs of schools for the purpose of supporting the teaching, learning and welfare of school students.

Goals

Unlike the previous agreement, there are no specific goals. However, the 2016 MoU includes a commitment to participate in the Education State vision and directions, and recognises that targets apply to all students in all school sectors. The Education State targets cover a range of areas relating to student learning, resilience, physical activity, school completion and the impact of disadvantage.

Reporting requirements

The 2016 agreement includes some strengthened reporting requirements including specifying how funding is spent, and a more robust acquittal process at the school level with a certificate issued by the school head and an independent auditor. It also strengthens financial oversight by requiring evidence that funding has been spent in specified categories. It also specifies areas that funding must not be used for.

The agreement includes provisions similar to the past arrangements allowing DET to undertake monitoring and audits. This provides an opportunity for DET to undertake a regular and robust program of audits of non-government schools to provide the requisite assurance that government grants are being used for their intended purposes. Under legislative changes from 2015, the Minister for Education may also require a non-government school to provide a report outlining the use of recurrent funding.

The 2016 MoU specifically commits the non-government school sector to work with DET in the development of school-level measures to monitor progress towards the Education State targets. The agreement also includes new performance outcomes and associated measures which will use information from other agencies. The outcomes and measures are shown in Figure 2B.

Figure 2B

Performance outcome data, 2016 funding agreement

|

Outcome |

Measure |

Data source |

|---|---|---|

|

Achievement |

Reading (per cent of Year 5 and Year 9 students with a score in the top 2 bands) |

NAPLAN |

|

Numeracy (per cent of Year 5 and Year 9 students with a score in the top 2 bands) |

NAPLAN |

|

|

Engagement and wellbeing |

Certificate completion (per cent of Year 11 students who attain a certificate) |

Certificate completion |

|

Attendance (aggregate school attendance rate Years 1–10, the proportion of students attending 90 per cent or more of the time) |

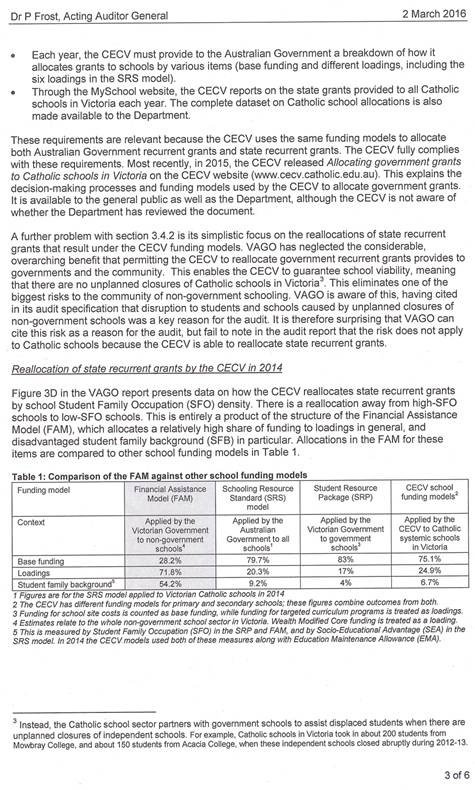

National collection student attendance data |