Internal Audit Performance

Overview

Internal audit is an independent, objective assurance and consulting activity designed to add value and improve an agency’s operations. It is an important part of the internal control framework and helps an agency accomplish its objectives by bringing a systematic, disciplined approach to evaluating and improving the effectiveness of risk management, internal controls and governance processes.

In Victorian Government departments, the internal audit function provides the head of the department—the Secretary—and the audit committee and senior executives with assurance that key risks to the achievement of the department’s objectives are being appropriately addressed.

In this audit, we examined the internal audit functions of all seven portfolio departments and assessed how well they use their internal audit resources. We evaluated the role and positioning of the internal audit function within departments, its independence and objectivity, the alignment of internal audit plans with departmental goals and risks, quality assurance and resourcing, performance against stakeholder expectations, and the communication of internal audit outcomes and insights.

We made 10 recommendations to portfolio departments.

Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER August 2017

PP No 257, Session 2014–17

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Internal Audit Performance.

Yours faithfully

Dave Barry

Deputy Auditor-General

9 August 2017

Acronyms

| ANAO | Australian National Audit Office |

| CAE | Chief audit executive |

| CFO | Chief financial officer |

| DEDJTR | Department of Economic Development, Jobs, Transport and Resources |

| DELWP | Department of Environment, Land, Water and Planning |

| DET | Department of Education and Training |

| DHHS | Department of Health and Human Services |

| DJR | Department of Justice and Regulation |

| DPC | Department of Premier and Cabinet |

| DTF | Department of Treasury and Finance |

| GAIN | Global Audit Information Network |

| IBAC | Independent Broad-based Anti-corruption Commission |

| IIA | Institute of Internal Auditors |

| IPPF | International Professional Practices Framework |

| VAGO | Victorian Auditor-General's Office |

Audit overview

Internal audit is intended to be an independent, objective assurance and consulting activity designed to add value and improve an agency's operations. It can be an important part of the internal control framework and help an agency accomplish its objectives by bringing a systematic, disciplined approach to evaluating and improving the effectiveness of risk management, internal controls and governance processes.

In Victorian Government departments, the internal audit function provides the head of the department —the Secretary —and the audit committee and senior executives with assurance that key risks to the achievement of a department's objectives are being appropriately addressed.

Although internal audit is part of a department, its reporting structures should be operationally independent from line management. To achieve this, internal audit typically has a dual reporting structure —it reports on its plans and activities to the audit committee, and reports administratively to the Secretary of the department. The chief audit executive (CAE) is the most senior officer responsible for the internal audit function. An internal audit charter defines the roles and responsibilities of internal audit.

We examined the internal audit functions of all seven portfolio departments and assessed how well they use their resources. We evaluated the role and positioning of the internal audit function within departments, its independence and objectivity, the alignment of internal audit plans with departmental goals and risks, quality assurance and resourcing, performance against stakeholder expectations, and the communication of internal audit outcomes and insights.

Past performance audits have questioned the effectiveness of agencies' use of internal audit. Recurring issues relate to the adequacy of internal audit resources—their capacity and capability—and whether the way they are used in the risk and control environments of each agency maximises their value and impact.

Conclusion

Departments use internal audit resources effectively to provide a reasonable level of assurance on the effectiveness of risk management, controls and governance processes.

Internal audit generally performs the core aspects of its role well across all departments. Some departments, particularly the Department of Education and Training (DET) and the Department of Justice and Regulation (DJR), go much further than complying with the minimum legislative requirements and adopt many aspects of better practice.

Internal audit largely meets the current expectations of both departmental management and the respective audit committees. However, it could add greater value by enhancing communication and sharing insights, identifying trends and systemic issues, and providing a more comprehensive view of department-wide assurance activities. This would provide greater assurance on risk management, controls and governance processes.

Findings

Establishing effective internal audit functions

Charters

Charters define the purpose of internal audit and its authority and responsibility. Internal audit charters of all departments comply with mandatory legislative requirements, except that three departments' internal audit functions have not communicated the charter to their departments.

Each department's charter, except for that of the Department of Treasury and Finance (DTF), reflects most of the better practice elements and provides robust foundations for an effective internal audit function.

Chief audit executive

To achieve true organisational independence and align with better practice guidance, internal audit should ideally report functionally to the audit committee and administratively to the Secretary.

All departments have established dual functional and administrative reporting lines for internal audit. Strong working relationships between all CAEs and audit committee chairs are evident. Administrative reporting lines, however, do not reflect better practice, with all CAEs reporting to a management delegate instead of reporting directly to the Secretary of the department.

The current positioning of the CAE in some departments, at three to five levels from the Secretary, diminishes the importance of the internal audit function. In two departments, the CAEs are at manager level and are not involved in executive forums —this is a missed opportunity for these CAEs to engage in strategic discussions, raise risk or control issues, and to be fully informed of operational developments, changes and emerging risks.

Direct reporting lines facilitate access. Only the DTF CAE meets regularly with the Secretary. All departments advised that there is no restriction on CAEs meeting with the Secretary, and meetings do occur when required, although in practice they are infrequent. To address this issue, DET and the Department of Health and Human Services (DHHS) recently established quarterly meetings.

The Department of Environment, Land, Water and Planning (DELWP), the Department of Premier and Cabinet (DPC) and DTF —three departments that outsource the internal audit function —each have an internal staff member responsible for actively monitoring the performance of the provider, although these positions are not formally designated as CAE roles.

The CAEs of five departments have relevant tertiary degrees, professional accounting qualifications and internal audit experience, which is consistent with better practice.

Managing objectivity and potential conflicts of interest

All departments actively manage the objectivity of internal audit and conflicts of interest. They do this through an established process for audit committee review and approval of proposed consulting work by outsourced internal audit providers.

Using transparent processes to manage consulting work enables the audit committee to monitor and manage any financial interest the external provider may have in the department. The presence of a financial interest has the potential to impair internal audit independence and objectivity.

Planning

Strategic alignment

Internal audit adds the greatest value when its activities support the department to achieve its goals. Aligning the audit plan with the department's goals and risks ensures that audit efforts focus on providing assurance that the risks to the achievement of the department's goals are effectively controlled.

All departments conduct extensive engagement to inform the development of the internal audit plan. All internal audit plans clearly demonstrate alignment with departmental objectives and risks, and include assurance maps. Audit committees approve all changes to audit plans and detailed audit scopes.

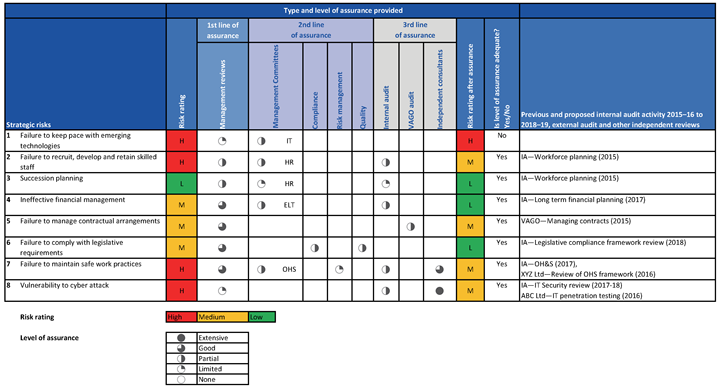

Assurance mapping visually represents assurance activities against risks. This provides an overview of risks and highlights areas of inadequate or duplicated coverage.

All departments conduct assurance mapping, but only the Department of Economic Development, Jobs, Transport and Resources (DEDJTR), DJR and DPC assurance maps provide a comprehensive view of agency-wide assurance and include assessments of risk appetite and the adequacy of assurance coverage. The other departments have an incomplete view of their assurance coverage, which may affect their audit committees' ability to assess the adequacy of coverage of departmental risks.

Horizons

Each department, except DTF and DEDJTR, has an approved three- to four-year rolling internal audit plan that includes the detailed annual work program required by the Standing Directions of the Minister for Finance 2016 (the Standing Directions). Guidance supporting the Standing Directions indicates the purpose of the three- to four-year rolling plan is to link with the department's business plan period.

DTF had an annual plan and has recently developed the 2017 –18 internal audit plan, which includes a three-year strategic internal audit plan.

DEDJTR developed a four-year rolling plan, which was discussed in a workshop with the audit committee. However, the audit committee did not formally approve the rolling plan, as it required changes, and approved only the annual plan. Plans must be approved by the audit committee to demonstrate endorsement of the intended coverage.

Program quality and execution

Delivery against plan

All internal audit functions monitor and regularly report progress against the plan at each audit committee meeting. Five departments delivered their 2015–6 internal audit plans with approved exceptions.

The two departments that did not deliver their audit plan in 2015 –16—DET and DEDJTR—were affected by resourcing challenges, departmental restructuring and a high volume of planned audits. Delivery of the DET internal audit plan was affected by unplanned activities, including ad-hoc audits, Integrity Reform Program projects in response to Independent Broad-based Anti-corruption Commission (IBAC) hearings, and an increased number of audit committee meetings due to IBAC commitments. The audit committee approved all changes and deferred audits to be considered in the following year's internal audit planning process.

Reporting results of audits

All internal audit reports include overall ratings and risk-rated findings. This supports departments in prioritising efforts to address areas of greatest risk. We did not observe any significant delays in communicating internal audit findings to the audit committee. Timely conduct and reporting ensures internal audit findings are relevant and have impact.

Audit committee chairs of each department brief the Secretary following each audit committee meeting, or at regular intervals during the year, and discuss any issues relating to internal performance, report findings or the implementation of recommendations.

Internal audit in most departments identifies and reports the root cause of findings in internal audit reports. This enables the department to address the reason the issue occurred rather than just the result. DELWP, DET, DHHS, DJR and DPC identify root causes and categorise them into themed groups for cumulative reporting to the audit committee. This has been recently implemented at DHHS and DELWP. Organisational themes are summarised annually and reported to the audit committee with limited analysis in all departments except DET.

All departments have processes to monitor and report on the status of audit recommendations to the audit committee.

Quality

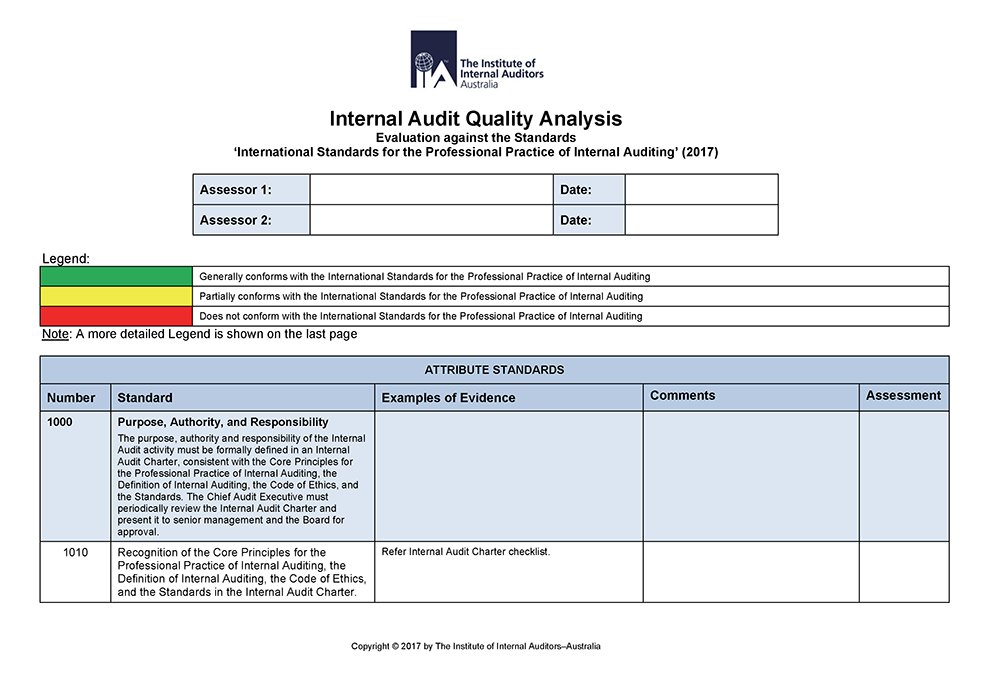

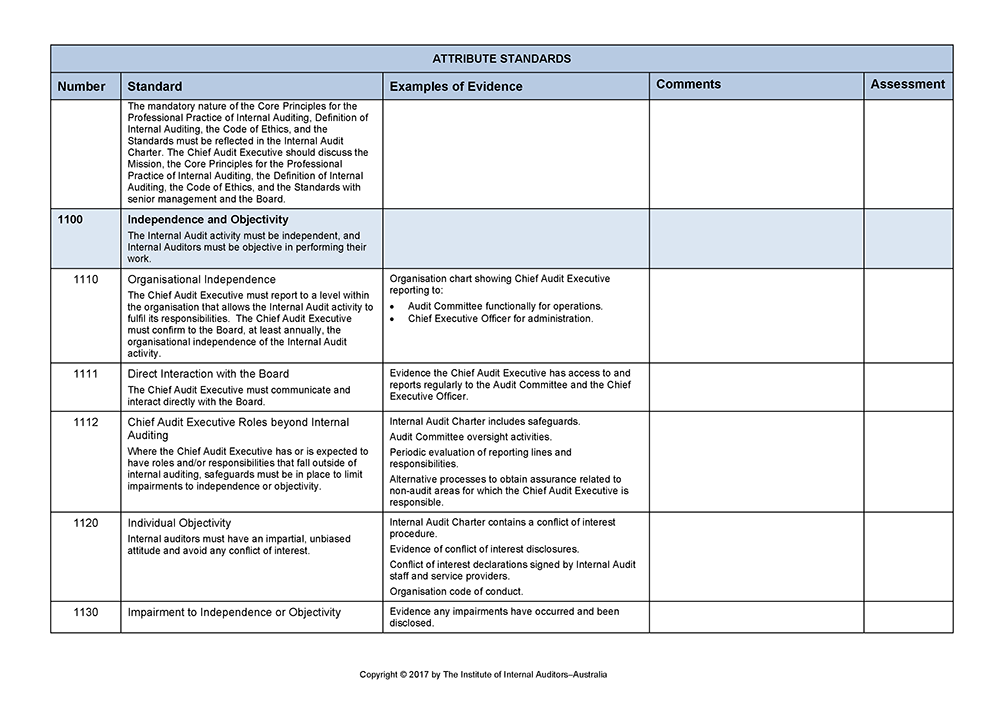

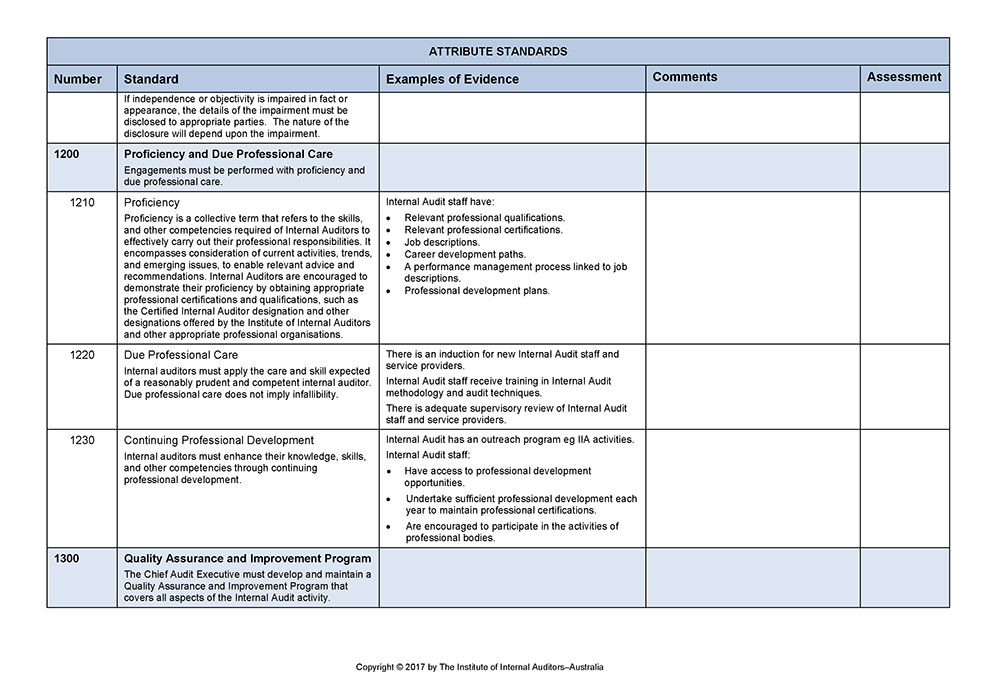

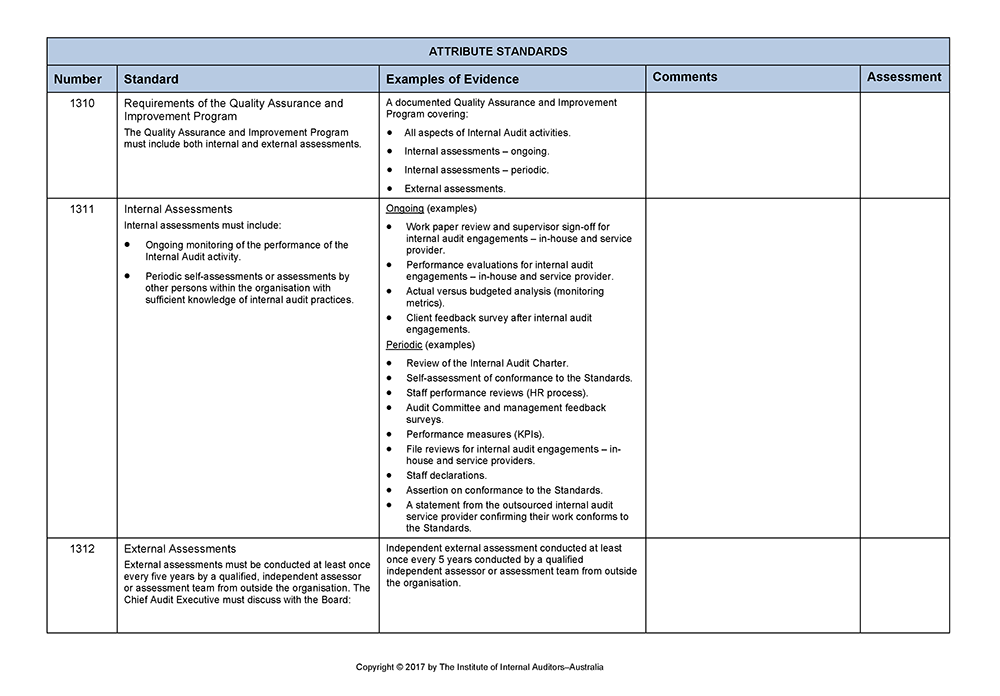

All departments demonstrate a commitment to quality and continuous improvement, and all audit charters adopt the internationally recognised professional standards issued by the Institute of Internal Auditors (IIA —the International Standards for the Professional Practice of Internal Auditing (the IIA Standards).

However, only DHHS, DET and DEDJTR—departments with co‑sourced internal audit functions provided by a combination of internal staff and external service providers and managed within the department—met the IIA Standards requirement of conducting an external quality assessment at least every five years. Departments that do not conduct external assessments are not measuring the quality of their internal audit work against professional standards.

Measuring and monitoring performance

Internal audit perspectives

Performance reporting can support a department's investment in internal audit and reflects a commitment to continuous improvement. Measuring and reporting against agreed measures demonstrates internal audit's level of performance to the audit committee.

All departments have developed a range of quantitative and qualitative performance measures to evaluate the efficiency and effectiveness of their internal audit functions. The frequency of measurement, analysis and reporting against performance measures varies between departments.

The most common measures relate to the timeliness of the delivery of the internal audit program and audit engagement customer satisfaction surveys. The results of these measures are also the focus of routine reporting of internal audit performance to audit committee meetings. These performance indicators are useful, but they do not assess the full range of internal audit activities.

The range of measures in place to evaluate internal audit performance should reflect the key activities of the function and be agreed with the audit committee. Comprehensive reporting to the audit committee should occur at least annually.

DEDJTR, DET, DPC, DJR and DTF each provide an annual performance assessment to their audit committees, as required by the Standing Directions. DET and DJR provide their audit committees with comprehensive annual internal audit performance reports that include analysis of results and identify trends in performance and areas for improvement. The DET annual report of internal audit includes achievements, opportunities for improvement, performance trends, self‑assessment against the IIA Standards, and progress against the most recent external quality assessment. DET's report is a good example of better practice.

Departmental perspectives

DET also demonstrates better practice in reporting on the departmental internal control environment. DET's internal audit provides an annual report that summarises themes and trends from its work, management engagement, departmental surveys and feedback from other integrity agencies. The report highlights departmental achievements and areas of concern. It discusses systemic themes, indicates the trend for each area and evaluates the impacts on the audit plan. This enables the audit committee and management to address agency-wide issues that may have broader organisational benefits.

Recommendations

Our recommendations are directed to specific departments. Figure A provides an overview of relevant recommendations, by department.

Figure A

Overview of recommendations, by department

|

Department |

Relevant recommendations |

|---|---|

|

Department of Economic Development, Jobs, Transport and Resources (DEDJTR) |

2, 4, 9, 10 |

|

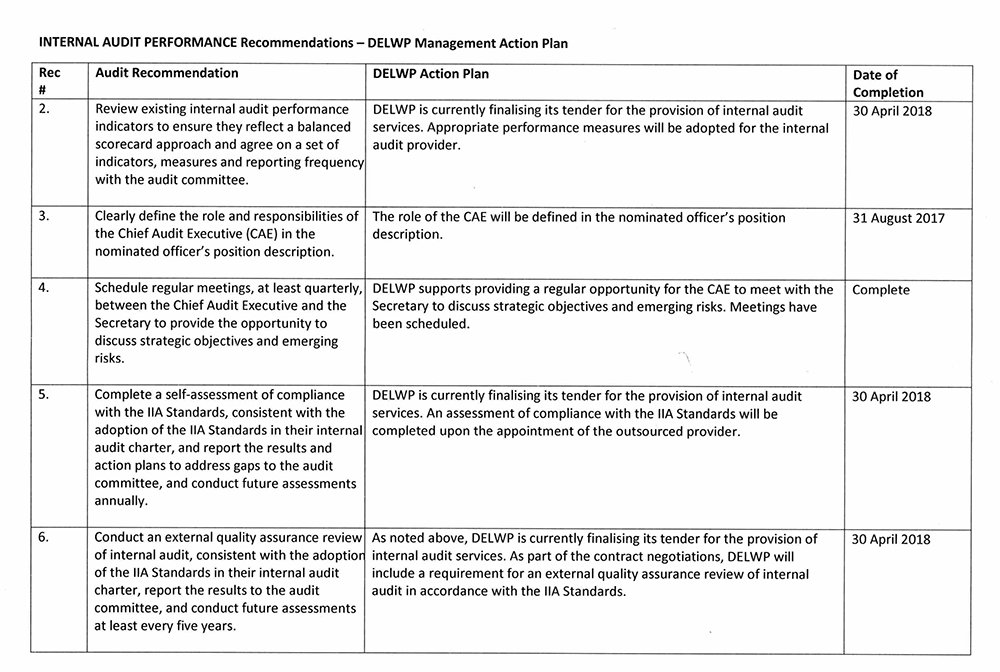

Department of Environment, Land, Water and Planning (DELWP) |

2, 3, 4, 5, 6, 8, 9, 10 |

|

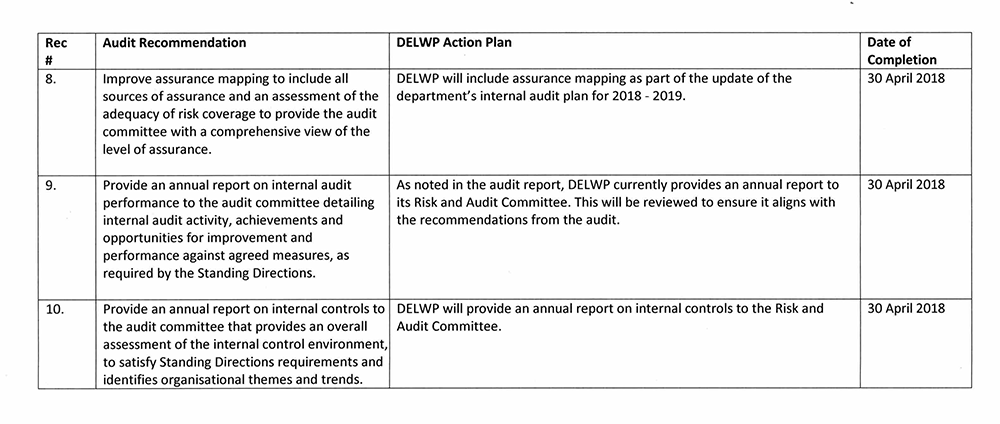

Department of Education and Training (DET) |

2, 8 |

|

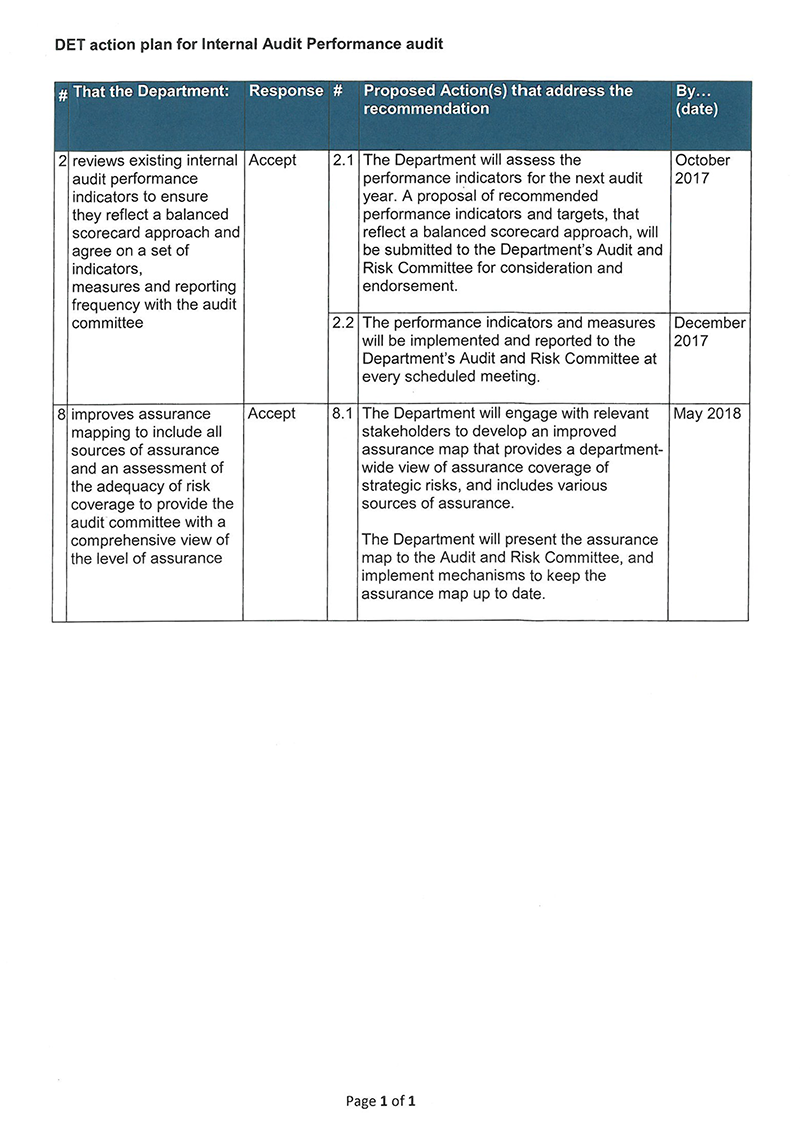

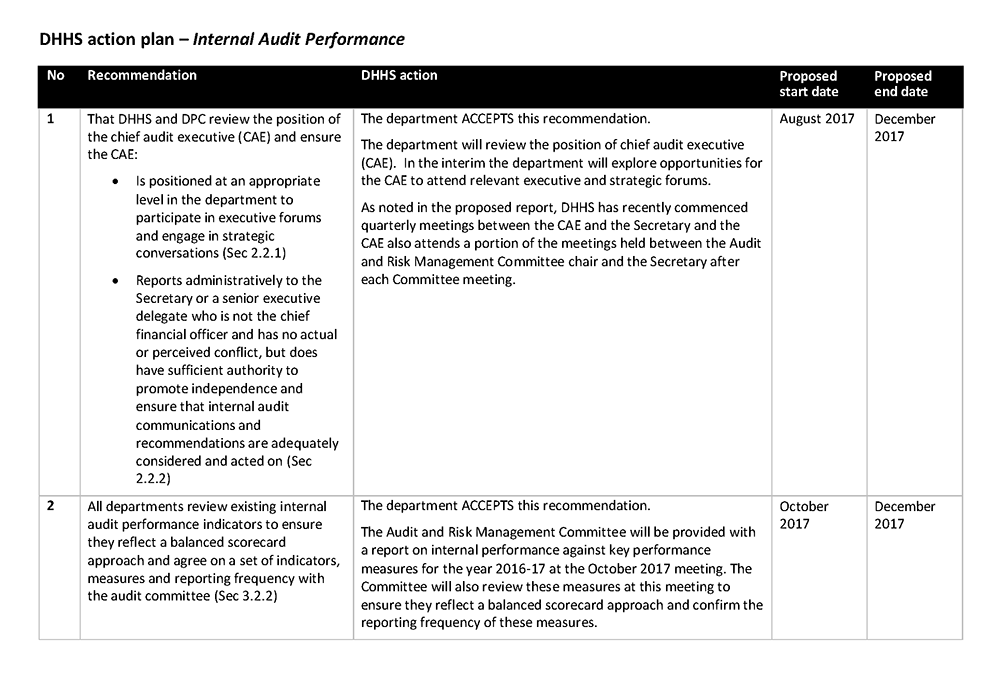

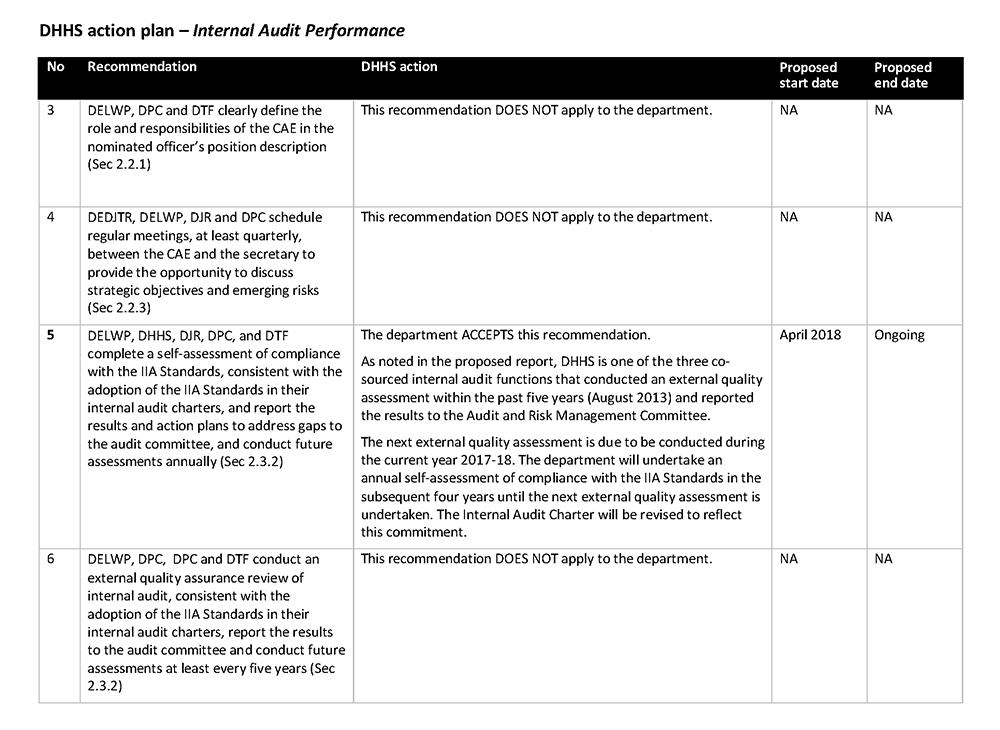

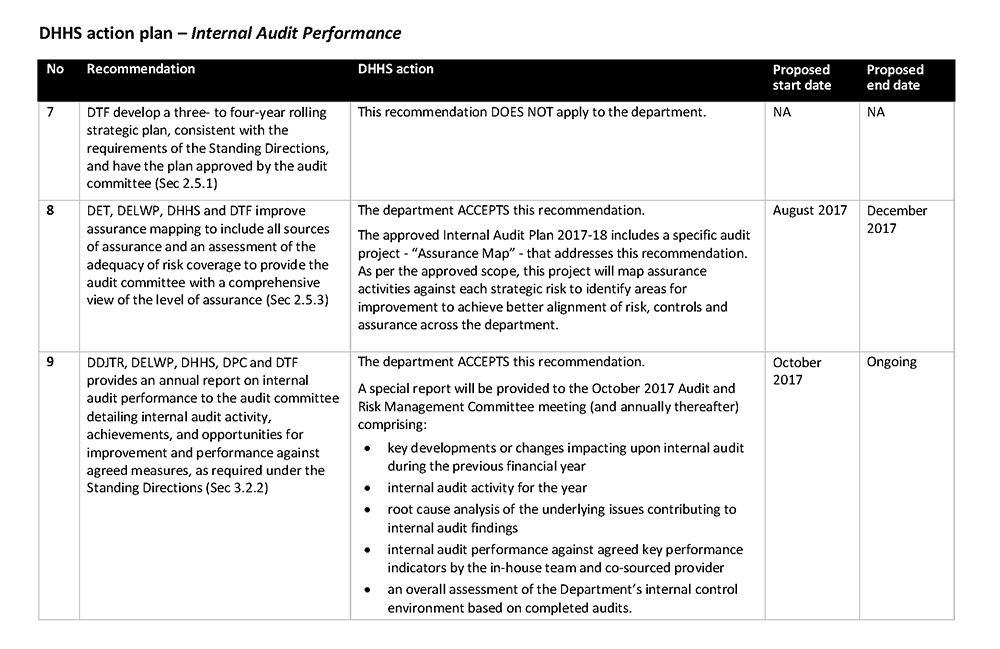

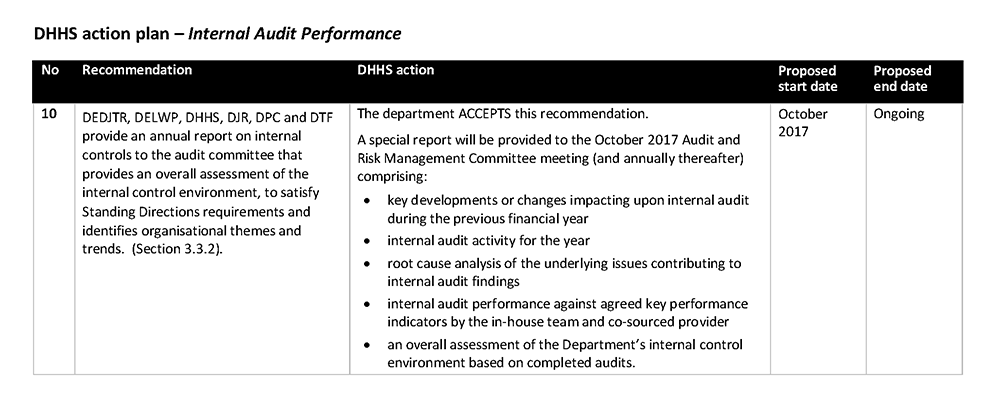

Department of Health and Human Services (DHHS) |

1, 2, 5, 8, 9, 10 |

|

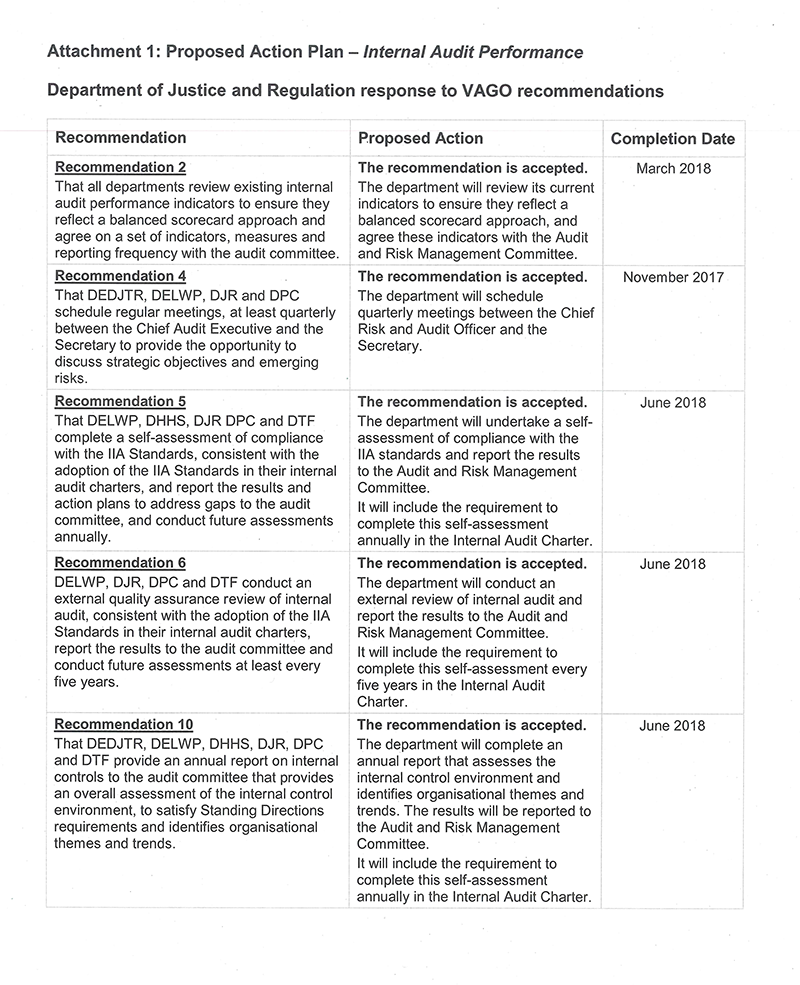

Department of Justice and Regulation (DJR) |

2, 4, 5, 6, 10 |

|

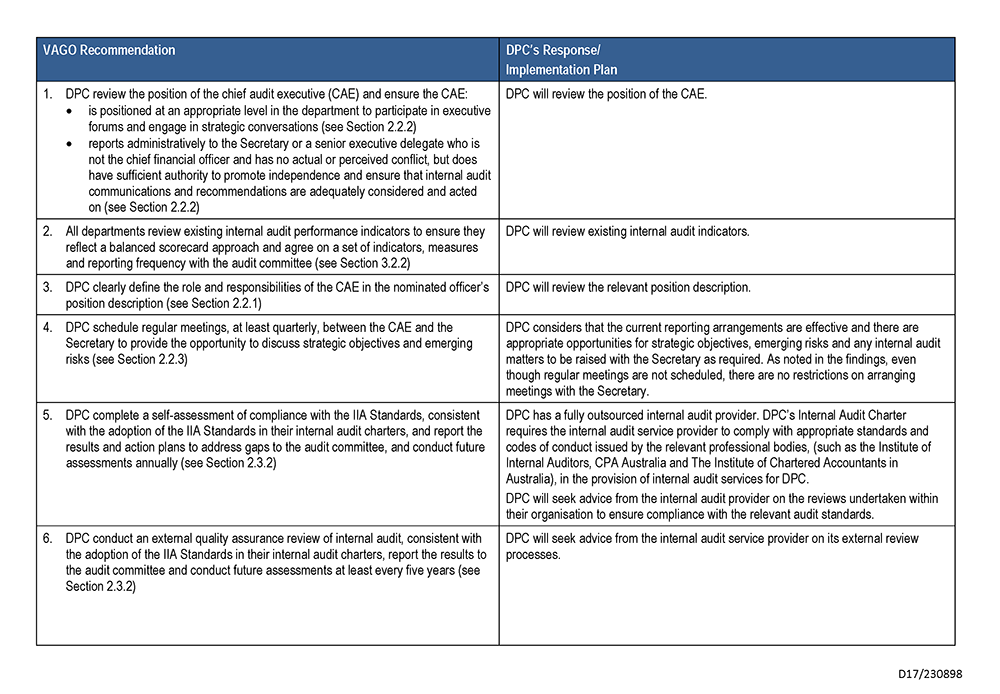

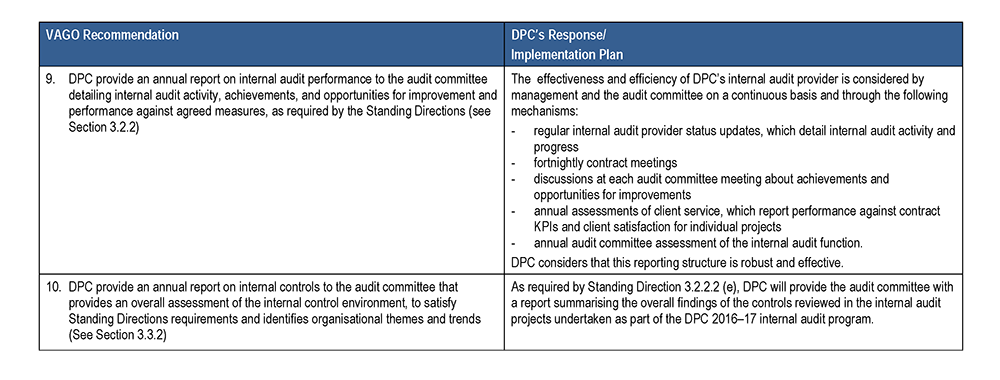

Department of Premier and Cabinet (DPC) |

1, 2, 3, 4, 5, 6, 9, 10 |

|

Department of Treasury and Finance (DTF) |

2, 3, 5, 6, 7, 8, 9, 10 |

Source: VAGO.

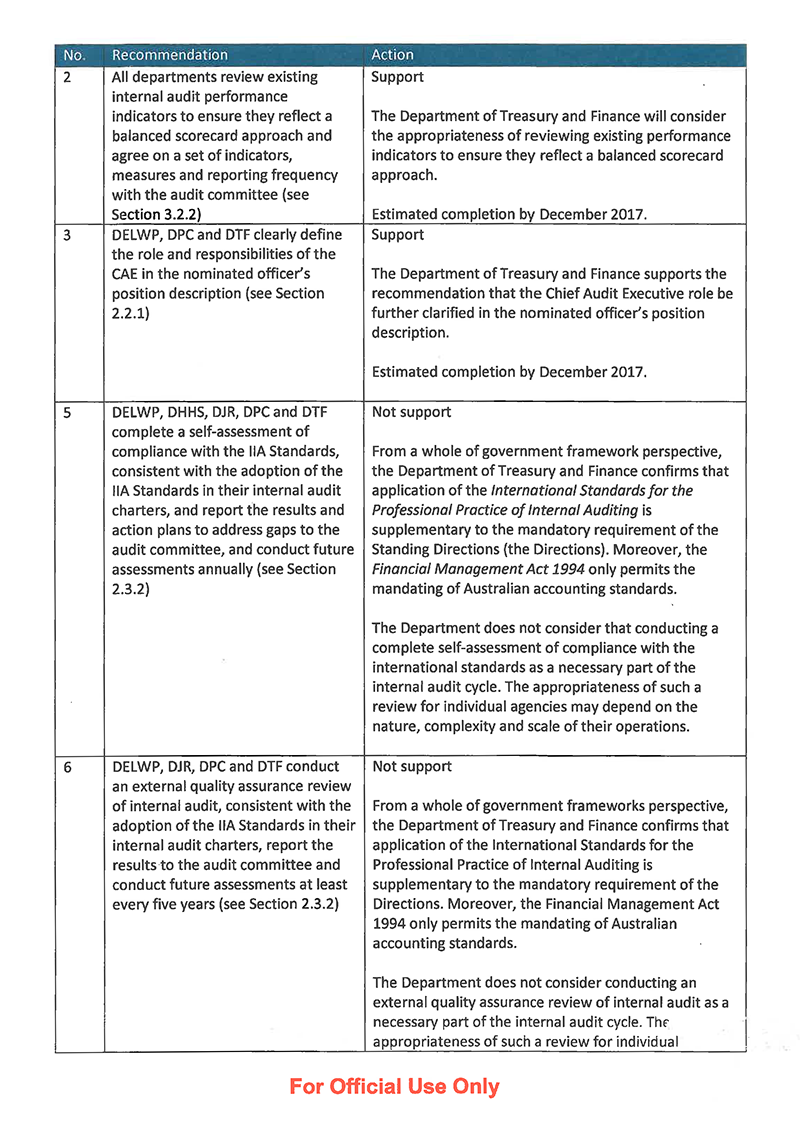

We recommend that:

1. DHHS and DPC review the position of the chief audit executive (CAE) and ensure the CAE:

- is positioned at an appropriate level in the department to participate in executive forums and engage in strategic conversations (see Section 2.2)

- reports administratively to the Secretary or a senior executive delegate who is not the chief financial officer and has no actual or perceived conflict, but does have sufficient authority to promote independence and ensure that internal audit communications and recommendations are adequately considered and acted on (see Section 2.2)

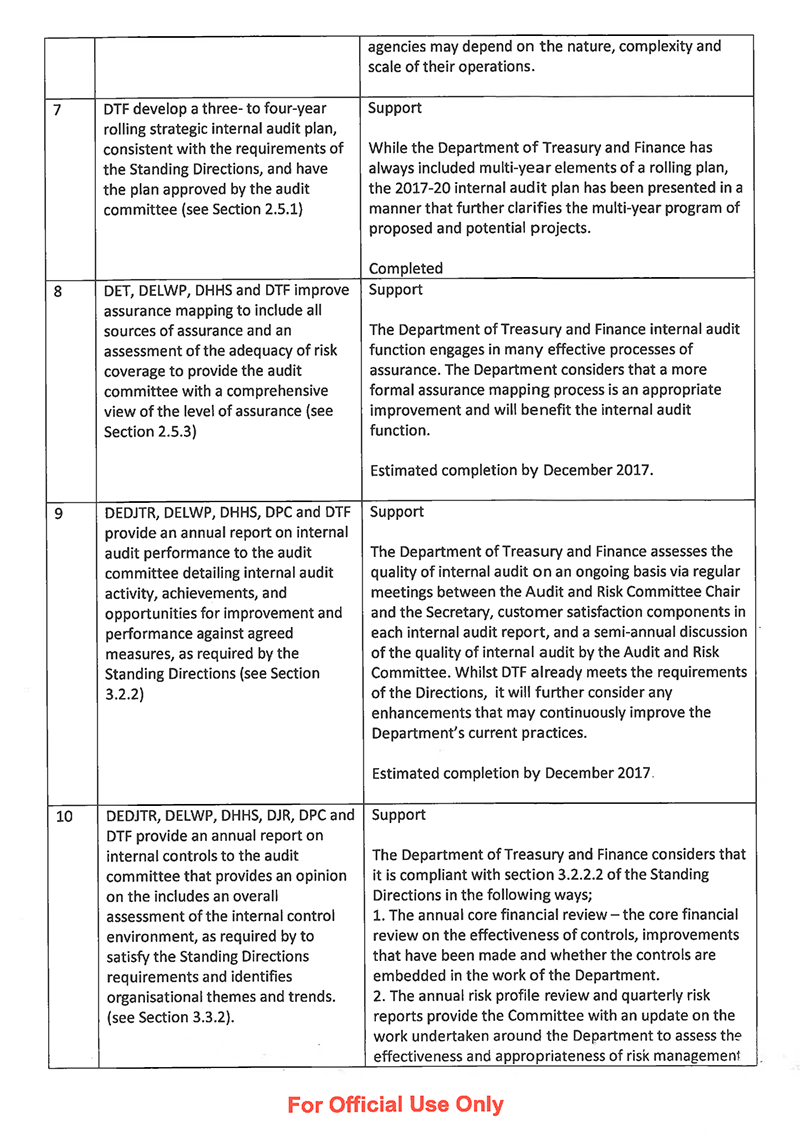

2. all departments review existing internal audit performance indicators to ensure they reflect a balanced scorecard approach and agree on a set of indicators, measures and reporting frequency with the audit committee (see Section 3.2)

3. DELWP, DPC and DTF clearly define the role and responsibilities of the CAE in the nominated officer's position description (see Section 2.2)

4. DEDJTR, DELWP, DJR and DPC schedule regular meetings, at least quarterly, between the CAE and the Secretary to provide the opportunity to discuss strategic objectives and emerging risks (see Section 2.2)

5. DELWP, DHHS, DJR, DPC and DTF complete a self-assessment of compliance with the International Standards for the Professional Practice of Internal Auditing (the IIA Standards), consistent with the adoption of the IIA Standards in their internal audit charters, and report the results and action plans to address gaps to the audit committee, and conduct future assessments annually (see Section 2.3).

6. DELWP, DJR, DPC and DTF conduct an external quality assurance review of internal audit, consistent with the adoption of the IIA Standards in their internal audit charters, report the results to the audit committee and conduct future assessments at least every five years (see Section 2.3)

7. DTF develop a three- to four-year rolling strategic internal audit plan, consistent with the requirements of the Standing Directions of the Minister for Finance 2016 (the Standing Directions), and have the plan approved by the audit committee (see Section 2.5)

8. DELWP, DET, DHHS and DTF improve assurance mapping to include all sources of assurance and an assessment of the adequacy of risk coverage to provide the audit committee with a comprehensive view of the level of assurance (see Section 2.5)

9. DEDJTR, DELWP, DHHS, DPC and DTF provide an annual report on internal audit performance to the audit committee detailing internal audit activity, achievements, and opportunities for improvement and performance against agreed measures, as required by the Standing Directions (see Section 3.2)

10. DEDJTR, DELWP, DHHS, DJR, DPC and DTF provide an annual report on internal controls to the audit committee that provides an overall assessment of the internal control environment, to satisfy Standing Directions requirements, and identifies organisational themes and trends (see Section 3.3).

Responses to recommendations

We have consulted with DEDJTR, DELWP, DET, DHHS, DJR, DPC and DTF, and we considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions and comments.

The following is a summary of those responses. The full responses are included in Appendix A.

DEDJTR, DET, DELWP, DHHS and DJR accept our recommendations and have developed action plans to address them.

DPC accepts most of our recommendations. DPC will seek advice from its external internal audit service provider regarding the need for self-assessment and external quality assessments against the IIA Standards. In regard to scheduling regular meetings between the CAE and the Secretary, DPC considers that the current reporting arrangements are effective.

DTF accepts most of our recommendations and has developed an action plan to address them. DTF does not support two recommendations relating to the conduct of self-assessment and external quality assessment against the IIA Standards. DTF advised that application of the IIA Standards is supplementary to the mandatory requirements of the Standing Directions and that the Financial Management Act 1994 only permits the mandating of Australian Accounting Standards. DTF does not consider conducting a self-assessment or external assessment against the standards a necessary part of internal audit practice.

1 Audit context

Internal audit is a key pillar of good governance. It provides the audit committee, the Secretary of a department, senior executives and stakeholders with an independent view on whether the department has an appropriate risk and control environment. It also helps promote a strong risk management and compliance culture within a department.

According to the IIA, internal audit helps a department accomplish its objectives by bringing a systematic, disciplined approach to evaluating and improving the effectiveness of risk management, internal controls and governance processes.

An internal audit function can be delivered in various ways:

- in-house—provided by internal departmental staff

- co-sourced—provided by a combination of internal staff and an external service provider or providers, and managed within the department

- outsourced—provided by an external service provider contracted to deliver a range of internal audit services.

1.1 Role of internal audit

Internal audit is an important part of a department's internal control framework. It provides an independent and objective assessment of the efficiency and effectiveness of controls, and makes recommendations for their improvement.

Internal audit provides the audit committee and departmental Secretary with assurance that key risks to the achievement of the department's objectives are addressed.

To foster independence, the internal audit function should report on its plans and activities to the audit committee, while being administratively accountable to the Secretary. The internal audit charter provides the framework for the conduct of the internal audit function.

The CAE is the most senior officer responsible for the internal audit function, consistent with the internal audit charter and professional standards.

The assurance environment

Agencies use a range of activities to provide assurance that they are effectively governed.

Figure 1A shows the three lines of defence model, a better practice model of an assurance environment. This approach involves integrating and aligning assurance processes from multiple sources.

Figure 1A

Three lines of defence model

Source: VAGO, based on IIA Australia.

In this model:

- the first line of defence manages the risks and establishes mechanisms to demonstrate that controls are working effectively

- the second line of defence monitors, reviews and tests the effectiveness of first‑line control and management of risks

- the third line of defence independently evaluates and gives an opinion on the adequacy and effectiveness of both first-line and second-line risk management approaches.

1.2 Legislation, standards and better practice

Appendix B outlines legislation, guidance and better practice for internal audit and cross-references information to sections of this report.

Legislation and guidance

Internal audit in Victorian public sector agencies is governed by legislation and supporting guidelines. The Financial Management Act 1994 (the Act) sets the financial management accountability, reporting and financial administration obligations of the Victorian public sector.

The obligations in the Act are supported by the Standing Directions. The Standing Directions specify standards for governance, including oversight and assurance responsibilities for audit committees and internal audit. DTF provides non-mandatory guidance to help departments follow the Standing Directions.

Professional standards and better practice guidelines

Internal auditors should apply professional standards to ensure quality and consistency in their work. The Standing Directions require internal audit to apply relevant professional standards for internal audit activities. The most widely recognised professional standards are contained in the IIA's International Professional Practices Framework (IPPF), which consists of core principles, a code of ethics, the definition of internal audit and the IIA Standards. Standing Directions guidance refers to the IIA Standards for better practice. Internal auditors who are members of the IIA must comply with the IIA Standards and code of ethics.

The IIA issues practice guides on various topics to help internal auditors. The Australian National Audit Office (ANAO) Public Sector Internal Audit Better Practice Guide is a reference document for chief executives, boards, members of audit committees, managers with responsibility for internal audit activities, and internal audit staff.

Figure 1B shows the mandatory, recommended and better practice internal audit standards and guidelines that apply to the Victorian public sector.

Figure 1B

Internal audit standards and guidelines

Source: VAGO.

1.3 Public sector internal audit functions

Standing Directions requirements

Standing Direction 3.2.2 states that public sector agencies must establish and maintain, and may dismiss, the internal audit function. Internal audit may be sourced internally or externally. Agencies must ensure the internal audit function:

- is independent of management

- has suitably experienced and qualified internal auditors

- has access to the Secretary, the audit committee and chief financial officer (CFO), and has sufficient information to enable it to perform its function

- is subject to a protocol to manage conflicts of interest for internal auditors.

The Standing Directions also set out the responsibilities of the internal audit function, which are to:

- prepare and maintain an internal audit charter, for approval by the audit committee, which is clearly understandable and made available to all agency management and staff

- each year, prepare, maintain and implement a strategic internal audit plan based on the governance, risks and controls of the agency, with a rolling period of three or four years

- each year, prepare, maintain and implement an audit work program, based on the governance, risks and controls of the agency, that sets out the key areas of internal audit work for the year

- in its strategic audit plan and audit work program, include audits of business processes or units likely to be vulnerable to fraud, corruption and other losses

- each year, provide to the audit committee an independent and objective assessment of the effectiveness and efficiency of the agency's financial and internal control systems, reporting processes and activities in accordance with its work program

- assist the Secretary to identify deficiencies in financial risk management

- develop and implement systems to ensure the internal audit function operates effectively and efficiently and is appropriate for the agency's needs

- apply relevant professional standards relating to internal audit

- report to the audit committee on the effectiveness of the internal audit function.

Department service-delivery models

All departments have established an internal audit function, as required by the Standing Directions. The seven Victorian departments vary in size, operations and complexity and use different internal audit delivery models. Three are co-sourced—DEDJTR, DET and DHHS—and the remainder are outsourced.

Audit committees

Under the Standing Directions, agencies must establish an audit committee. Audit committees play a key accountability role in the governance framework of Victorian public sector agencies. While the department retains ultimate accountability for operations, the audit committee enhances governance practices by independently reviewing and assessing the effectiveness of key aspects of an agency's operations, including:

- risk management

- financial statements

- internal controls

- compliance requirements

- internal audit

- implementation of management actions in response to internal and external audit recommendations.

The audit committee's responsibilities for internal audit are to:

- review and approve the internal audit charter, the strategic internal audit plan and the annual audit work program

- review the effectiveness and efficiency of the internal audit function

- advise the agency on the appointment and performance of internal auditors

- meet privately with internal auditors if necessary.

Our 2016 report Audit Committee Governance provides further information on the role and performance of audit committees.

1.4 Why this audit is important

Internal audit is a cornerstone of good governance and can play an important role in an agency's financial and non-financial management and accountability, and in continuous improvement. In the public sector, internal audit is a critical element in the assurance environment and is a valuable tool for managing risk more effectively.

IBAC's examination of specific activities at DET—Operation Ord—highlighted the importance of the role of internal audit in providing risk assurance. An internal audit report had alerted the department to the high risk of fraud associated with the coordinator school program.

We conducted our audit in accordance with section 15 of the Audit Act 1994 and the Australian Auditing and Assurance Standards. The cost of this audit was $560 000.

1.5 What this audit examined and how

Our objective was to establish how well departments are using their internal audit resources and to assess whether:

- internal audit is sufficiently independent and objective to provide effective assurance

- the internal audit plans are aligned with the departments' organisational goals and risks

- internal audit is delivering high-quality services

- internal audit is performing to stakeholder expectations and adding value.

We looked at all Victorian portfolio departments—DEDJTR, DELWP, DET, DHHS, DJR, DPC and DTF.

We examined the systems and processes that departments use to plan, conduct and evaluate internal audit activities.

We looked at a sample of internal audit working paper files to assess their completeness and whether they provide enough evidence of the planning, execution and reporting of internal audit activities and appropriate quality controls.

We also analysed quantitative data on key internal audit operational metrics. The key metrics on internal audit staffing we looked at included staff and cost ratios, strategies for sourcing staff, and their competencies, capabilities, and skills coverage. We also looked at departments' acceptance of internal audit recommendations and the timeliness of implementing them. We used better practice guidance and benchmarking data from both the public and private sectors to inform our assessments.

1.6 Report structure

The remainder of this report is structured as follows:

- Part 2 examines the role, position and influence of the CAE, assesses the resourcing and quality of internal audit services in the seven portfolio departments in the Victorian public sector, evaluates internal audit charters, and assesses the alignment of internal audit plans with departmental objectives and risks

- Part 3 examines how internal audit measures performance and communicates insights.

2 Establishing effective internal audit functions

For the internal audit function to be effective, it must be able to carry out its responsibilities independently and objectively, without interference. Operational independence ensures that internal audit operates free from conflicts of interest, bias and management influence.

In this part of the report, we discuss the role, position and influence of the CAE, and the resourcing and quality assurance of the internal audit function in the seven portfolio departments in the Victorian public sector. We also evaluate internal audit charters and the alignment of internal audit plans with the departments' objectives and risks.

2.1 Conclusion

The internal audit functions in the seven portfolio departments are sufficiently independent from management to perform effectively. The departments have established organisational independence for internal audit by establishing dual reporting lines, with functional reporting to the audit committee and administrative reporting to a management representative.

The positioning of the CAE within some departments is three to five levels from the Secretary, which serves to diminish the importance of the internal audit function and the key role of the CAE. It also limits the CAE's ability to fully engage with the executive, have appropriate influence, raise risk or control issues, and be fully informed of operational developments, changes and emerging risks.

All internal audit plans are risk based and align with departmental objectives. Internal audit plans should include assurance maps that show the extent of coverage of departmental risks by all assurance providers. Some departments need to improve their assurance maps so they provide a complete view of the coverage of organisational risks and enable the audit committee to assess how well departmental risks are covered.

Overall, internal audit uses its resources effectively, but could provide further value by focusing on better practice, continuous improvement and compliance with professional standards. This would enable departments to demonstrate a commitment to quality assurance and continuous improvement. It would also improve internal audit communication and increase the confidence of the audit committee and management in the standard of assurance that the internal audit function provides.

2.2 Chief audit executive

The CAE is the most senior officer responsible for the internal audit function, consistent with the internal audit charter and professional standards. The CAE should have a strong understanding of internal audit to be able to effectively manage the function.

All departments should have a CAE, even if the internal audit function is outsourced. Although CAEs of departments with outsourced internal audit functions partly perform a contract management role, they still have key responsibilities as the CAE. These include ensuring internal audit's performance is consistent with its charter requirements, and that it applies professional standards, effectively uses resources to deliver the internal audit plan, adds value and contributes to improving the department's performance.

Managing and overseeing internal audit includes assessing the service provider's competence, independence, objectivity and performance. CAEs who manage the contract of an external provider need a strong understanding of internal audit principles and techniques to perform this role effectively.

Role and qualifications of the CAE

Four departments clearly define the role and responsibilities of the CAE in the position description for the role —DEDJTR, DET, DHHS and DJR.

Three of the departments with outsourced audit functions —DELWP, DPC and DTF —have an officer responsible for internal audit who monitors the performance of the provider, although they do not formally nominate these roles as the CAE in their position descriptions or clearly articulate their responsibilities.

Qualifications of the CAE and internal audit team

There are no mandated qualifications for internal auditors. Guidance that supports the Standing Directions recommends that CAEs have relevant tertiary qualifications and suggests that professional designation, such as membership of the IIA, is helpful to support professional knowledge and continuing education. 'Relevant tertiary qualification' is not defined. Traditionally a relevant qualification for internal audit was an accounting background, although this has broadened to include other disciplines such as information technology, law and engineering.

The IIA Standards require the CAE and others reporting to the CAE to have appropriate professional certifications and qualifications. In Global Public Sector Insight: Policy Setting for Public Sector Auditing in the Absence of Government Legislation, the IIA recommends that the minimum qualifications for the CAE should include a combination of years of auditing, leadership experience, audit-specific certifications and relevant tertiary qualifications. Internal audit-specific qualifications are globally recognised professional certifications issued by the IIA and include professional membership of the IIA. The most common certification is Certified Internal Auditor.

CAEs of all departments meet leadership requirements and have tertiary qualifications, although only some have membership or certifications of professional accounting or internal audit bodies or have internal audit-specific qualifications.

All co-sourced internal audit departments have personnel with a suitable mix of qualifications and experience to provide high-quality internal services. All DHHS internal audit staff are professional members of the IIA or Information Systems Audit and Control Association —the global association for information systems professionals. All DEDJTR and DET internal audit staff have tertiary qualifications, and most have professional accounting qualifications and are associate or professional members of the IIA. All senior staff members of external providers have tertiary qualifications, professional accounting qualifications, or internal audit qualifications and experience.

Position and influence in the organisation

All CAEs report functionally to the audit committee and none has a direct administrative reporting line to the Secretary.

All CAEs have strong working relationships with audit committee chairs and meet with them regularly. Internal auditors at DET, DHHS, DPC and DTF meet with the audit committee chairs before each audit committee meeting to discuss internal audit matters.

All audit committees should meet with the internal auditors, in the absence of management, at least once every 12 months. The absence of management ensures frank discussions without management influence. A meeting between the audit committee and internal auditors, without management present, is formally scheduled on the annual audit committee work plan of all departments except DELWP and DJR. DJR has addressed this in its 2017 –18 audit committee work program, which was approved on 30 June 2017.

In practice, these meetings have occurred in all departments in the past 12 months, except at DELWP and DHHS. In these two departments, internal audit or the audit committee can request a meeting if they deem it necessary, but neither party did so in the past year.

All CAEs report administratively to a senior management representative. Better practice recommends that this senior executive should have no actual or perceived conflict. The senior executive should also have sufficient authority to promote independence and to ensure broad audit coverage and adequate consideration and action on internal audit communications and recommendations.

The role of the CAE is positioned at various levels in the seven departments. Figure 2A shows the administrative reporting line of the CAE position in each department.

Figure 2A

Organisational position of the CAE

Note: Restructuring within DHHS, effective July 2017, added a Deputy Secretary to the reporting line.

Source: VAGO.

The CAEs at DHHS and DPC are not involved in executive forums, which is a missed opportunity for them to engage in strategic discussions and increase their awareness and understanding of departmental issues, risks and objectives. The CAE role at DHHS is relatively junior, given the complexity and breadth of the internal audit activity and operations. The CAE at DPC is at manager level and reports to the CFO, which creates an actual or potential conflict of interest as the CFO is responsible for many areas of the department that are subject to audit.

Deputy Secretaries in the administrative reporting line of internal audit are members of the audit committee in four departments (DET, DHHS, DJR and DTF). This creates a risk that internal audit independence could be compromised. DPC is the only department with a fully independent audit committee. The Standing Directions require audit committees to have a majority of independent members and an independent chair, but allow management membership, except for the Secretary and CFO. DJR's audit committee charter states that internal members of the audit committee cannot vote on issues related to their functional area of responsibility due to a conflict of interest.

We interviewed all CAEs and audit committee chairs, and did not identify any specific issues that would suggest interference with the independence of internal audit due to management presence on the audit committee. Audit committee chairs generally see the presence of management staff as a great benefit, due to the knowledge of the business they bring to discussions. This could also be achieved by audit committees issuing a standing invitation to relevant management representatives to attend audit committee meetings.

Access to the audit committee, Secretary, personnel and records

To be effective, internal audit must engage in executive forums and be aware of strategic issues and emerging risks. Where reporting lines or operational arrangements do not require internal audit to be regularly involved in executive-level discussions, there is a greater need for internal audit to have direct access to the Secretary. Without regular access, it may be difficult for the CAE and the Secretary to establish a strong relationship, and the CAE will have limited opportunities to share organisational insights, communicate concerns, and increase awareness of strategic issues and emerging risks.

Only the DTF CAE advised that regular independent meetings are scheduled with the Secretary. We interviewed the CAEs of each department and a selection of internal audit stakeholders, including the audit committee chairs, some Secretaries, Deputy Secretaries and executive directors, about the effectiveness of the positioning and degree of access of the CAE to the Secretary. All departments' internal audit charters, with the exception of DTF, state that the CAE has direct access to the Secretary. DTF advised that there is no restriction on the CAE meeting with the Secretary and meetings occur when required. DET and DHHS have recently scheduled quarterly meetings between the CAE and the Secretary to address this issue. This is a positive initiative.

In all departments, the audit committee chair meets with the Secretary following each audit committee meeting or at regular intervals during the year. The CAE at DHHS attends the beginning of the audit committee chair's post-committee meeting with the Secretary.

All internal audit staff members have access to records, systems and other personnel to enable them to fulfil their responsibilities. We interviewed in-house and outsourced internal audit teams to confirm that they had free and unrestricted access to records, systems and personnel.

Managing objectivity and potential conflicts of interest

Objectivity allows internal audit to evaluate issues based on evidence without personal influence. Objectivity may be impaired if an auditor has had operational responsibility for areas subject to audit or has personal or financial relationships with individuals under review.

All departments actively manage internal audit objectivity and conflicts of interest. DET has established an annual declaration process for members of the internal audit team to declare their independence, conflicts of interest, objectivity, and compliance with the code of ethics and training obligations.

Operational responsibilities

None of the in-house internal audit staff has a current operational role or has had one in the past. However, the CAE at DEDJTR —which has a co-sourced internal audit function —has operational responsibility for risk management and integrity. DEDJTR revised its charter in June 2017 to include particular protocols for audits of risk and integrity to minimise potential impairment to objectivity.

In all departments with fully outsourced functions, processes are in place to ensure internal audit does not involve departmental staff with operational responsibilities for the area audited.

Consulting work by internal audit providers

Internal audit activity includes assurance and consulting services. Internal audit consulting activity involves providing advice or review of systems and processes, and does not include policy or program implementation or design.

Internal audit service providers may deliver other professional services to the department, including design and development of systems and processes, and tax or strategic advice. This may create a financial interest, which has the potential to impair objectivity and affect internal audit service providers' ability to conduct internal audit work in areas where they have provided other consulting services.

All departments have processes to review and approve proposed consulting work of outsourced internal audit providers to identify and manage any potential conflicts of interest. Audit committee chairs are also involved in this process. However, the formality and timing of this process varies across departments. In some cases, this process occurs before a consultant bids for work, whereas in other departments it is discussed with the audit committee chair only when a bid has been successful. In DPC, the approval of consulting work is not formally documented.

Audit committees closely monitor the level of consulting work allocated to outsourced internal audit providers. Payments to outsourced providers for consulting services exceeded internal audit fees in DEDJTR, DELWP, DHHS, DJR and DPC in 2015 –16, and this poses a challenge for managing perceived conflicts of interest and financial independence.

Our consultation with all audit committee chairs indicates that this issue is being actively managed. DEDJTR advised us that the high level of consulting fees is a legacy of machinery-of-government changes that took effect in January 2015. One of the two departments that combined to form DEDJTR had used the other department's internal audit provider for consulting services. Existing internal audit contracts remained in place until the new internal audit contract for DEDJTR commenced on 1 July 2016.

Figure 2B shows consulting services fees paid to internal audit service providers as a percentage of total internal audit fees for the years 2015–16 and 2016–17 (until February 2017).

Figure 2B

Consulting services as a percentage of internal audit fees

Note: DELWP expenditure includes a multi-year contract for consulting services that was signed before the internal audit services contract.

Source: VAGO, based on departmental data.

DELWP, DHHS and DJR have increased the transparency and reporting of consulting activity by including a summary of consulting work performed in the internal audit status report to the audit committee. DJR includes a list of the external provider's consulting work as part of the internal audit planning processes.

Management of potential conflicts of interest

Departments manage potential conflicts by having non-exclusive contractual arrangements with their internal audit provider. This allows them to engage other auditors if the external provider has previously been engaged in consulting work related to the particular audit area.

DELWP can access providers from an assurance panel, and the other departments can use the whole‑of‑government consulting panel. DELWP has redirected work to other assurance providers to manage possible conflicts in the current year. The DJR audit committee has expressed concern about the volume of consulting work its provider performs, and has requested a review of audits to consider a future transfer to another provider.

DET has a conflict of interest procedure to manage real or perceived conflicts of interest for in-house internal audit staff. DET in-house staff members each provide an annual audit declaration, which includes a conflict of interest declaration. The CAE assesses these declarations and takes any necessary action.

DEDJTR and DHHS have no conflict of interest procedures to manage conflicts of in‑house internal audit staff.

Figure 2C shows the results of our assessment of each department's overall performance for the role of the CAE.

Figure 2C

CAE role and managing conflicts of interest

|

Aspect |

DEDJTR |

DELWP |

DET |

DHHS |

DJR |

DPC |

DTF |

|---|---|---|---|---|---|---|---|

|

CAE role and managing conflicts of interest |

◕ |

◕ |

◕ |

◑ |

◕ |

◔ |

◕ |

|

Legend |

|

|

● |

Meets mandatory requirements and demonstrates most aspects of better practice |

|

◕ |

Meets mandatory requirements and demonstrates some aspects of better practice |

|

◑ |

Meets mandatory requirements and demonstrates few aspects of better practice |

|

◔ |

Meets mandatory requirements |

|

○ |

Does not meet mandatory requirements |

2.3 Internal audit resourcing and quality assurance

Resourcing

Internal audit costs

Internal audit cost as a percentage of the total operating expenditure is one measure of the adequacy of internal audit resourcing. The average internal audit cost as a percentage of the total controlled operating expenditure for the seven Victorian departments was 0.024 per cent in 2015 –16.

We looked at internal audit cost and total operating expenditure for 2015 –16 for all departments. The internal audit cost includes outsourced providers' fees and in-house costs for audit work, contract management and follow-up of audit recommendations, and excludes audit committee secretariat work that internal auditors performed.

The optimal value for internal audit cost as a percentage of total operating expenditure varies depending on the size and nature of an agency.

The Queensland Audit Office's Results of Audits: Internal Control Systems 2013–14 reported the average internal audit budget for the Queensland Government as a percentage of total operating expenditure for 2012–13 as 0.128 per cent. The New South Wales Department of Premier and Cabinet's Internal Audit Capacity in the NSW Public Sector noted the average New South Wales Government internal audit budget for 2007–08 was 0.1 per cent. New South Wales and Queensland have a large number of small departments. Most Victorian departments are large and have achieved economies of scale that are not available for the smaller departments in New South Wales and Queensland, so their figures are not directly comparable with the lower Victorian average.

The diverse nature of business and the complexity of department operations affect the level of resources required to provide adequate assurance over risks, and this may not be reflected in the operating expenditure of the department. Internal audit cost as a percentage of the total operating expenditure is just one of a number of indicators that can be used to assess the adequacy of departments' internal audit budgets.

Benchmarking

We developed a model to benchmark the adequacy of internal audit resourcing based on the premise that departments with higher total expenditure should have a lower benchmark to account for the economies of scale available to larger agencies. Regardless of the size of the agency, establishment costs for the internal audit function include the costs of developing and reviewing an internal audit charter, preparing the internal audit plan, reporting to the audit committee and tracking audit recommendations. Smaller agencies have to meet these costs without the benefits of reductions through economies of scale.

We developed the benchmark based on the most recent available Australian public sector data. In 2013–14, the Queensland Audit Office benchmarked departments' internal audit costs based on the results of the Global Audit Information Network (GAIN) benchmarking performed on Queensland Government departments. GAIN benchmarking is a tool the IIA uses to compare internal audit departments on different metrics such as departmental costs and staffing, organisational statistics and performance measures. Queensland benchmarking results are included in the report Results of Audits: Internal Control Systems 2013–14.

Our benchmark starts at 0.74 per cent for small departments and reduces to 0.02 per cent for larger departments, with a slowing rate of decrease as the total expenditure increases.

Figure 2D shows the internal audit costs as a percentage of the benchmark for the year 2015 –16. Five departments lie within the range of 50–150 per cent of the benchmark. DJR and DPC are below 50 per cent of the benchmark. DJR's current internal audit services contract is in its fifth year and has recently been re-tendered. Current costs may not reflect the future cost of internal audit services.

Figure 2D

Internal audit cost as a percentage of the benchmark, 2015–16

Source: VAGO, based on departmental data.

Trends in internal audit costs

Internal audit expenditure has been relatively consistent in 2014–15 and 2015–16 and compared with the current year's budget. We considered actual costs incurred for 2014–15 and 2015–16, and we used the budgeted cost for 2016–17 because the full‑year actual expense data was not available at the time of the audit.

Some departments have provided extra funding to internal audit to address new and emerging risks, and to conduct additional unplanned audits. DPC had extra funding approved for audits relating to family violence when the government allocated significant new funding to this area in 2016–17. DET's internal audit costs include coverage of Victorian government schools and statutory authorities and the work undertaken to support the IBAC public hearings and subsequent Integrity Reform Program activities within the department.

Figure 2E shows the change in internal audit costs for the years 2014–15 to 2015–16 and from 2015–16 to 2016–17. The overall change from 2014–15 to 2015–16 is a decrease of 9 per cent, and for 2015–16 to 2016–17 it is an increase of 20 per cent.

Figure 2E

Trends in internal audit costs

Note: DJR budgeted cost for 2016–17 includes some budget funding carried forward from 2015–16. The cost for internal audit at DEDJTR in 2014–15 was not available due to machinery-of-government changes effective 1 January 2015. Internal audit costs for DEDJTR before this have been difficult to determine, due to the nature of the restructure and available financial data.

Source: VAGO, based on departmental data.

Quality assurance and continuous improvement

Adoption of the IIA Standards

Internal auditors should apply professional standards to ensure quality and consistency in their work. The Standing Directions state the 'internal audit function must apply relevant professional standards relating to internal audit'.

All departments' internal audit charters, except DELWP and DHHS, state that they follow the IIA Standards, which are the only applicable standards relevant to internal audit in Australia. The DELWP and DHHS charters state that they will apply relevant professional standards, and the CAEs of these departments confirmed this means the IIA Standards.

All departments, including those with outsourced internal audit functions, should be following the IIA Standards.

Internal and external quality assessments

All departments demonstrate a commitment to quality assurance and continuous improvement. While all departments practise elements of quality assurance, only DET has a documented quality assurance and improvement program in place.

All departments demonstrate aspects of ongoing internal assessment of internal audit. Only departments with co-sourced internal audit functions—DEDJTR, DET and DHHS—have conducted an external quality assessment within the past five years and reported the results to the audit committee.

Departments with outsourced internal audit functions have not conducted an external quality assessment. An external quality assessment can help build stakeholder confidence in the internal audit function as it demonstrates a commitment to quality assurance, continuous improvement and a professional approach to internal audit.

An external assessment provides an independent objective evaluation of the internal audit function's compliance with the IIA mandatory requirements (the IIA Standards and code of ethics), the legislation and the internal audit charter. It also includes expectations of management and the audit committee, a review of audit techniques and staff capability, and an assessment of internal audit's ability to add value and improve operations.

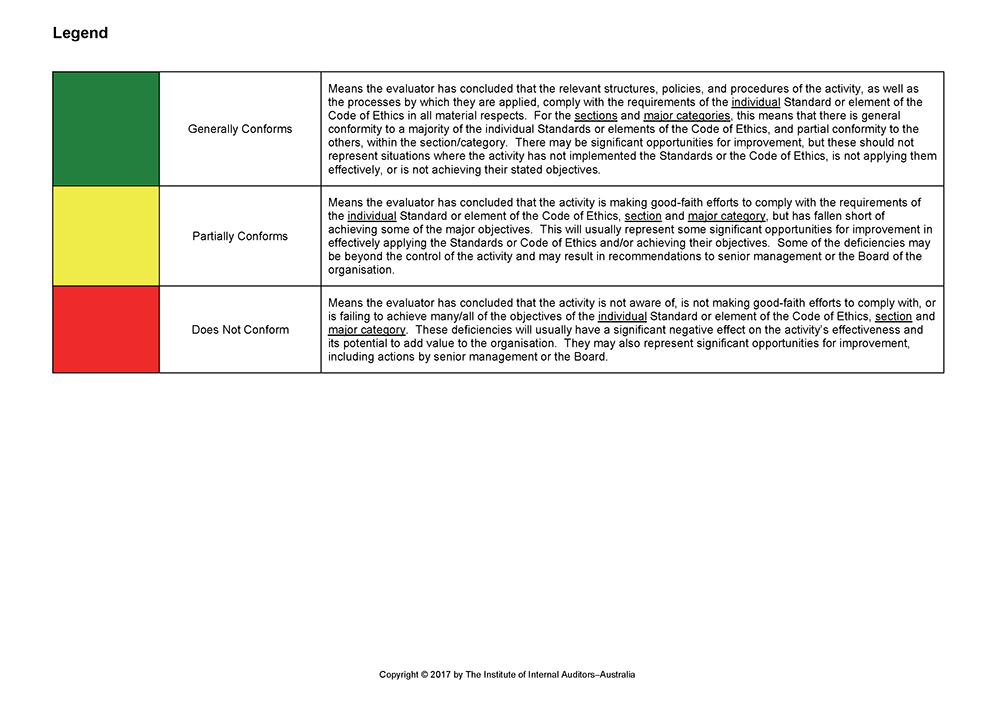

An audit opinion of 'generally conforms' means that the internal audit function's activities are conducted in accordance with the IIA Standards. An external quality assessment must be performed at least once every five years for all internal audit functions, regardless of the type of service delivery. An external self-assessment can take the form of a full external assessment or a self-assessment with external independent validation. Appendix F includes the template for self-assessment against the IIA Standards.

DET demonstrates better practice in quality assurance and continuous improvement. DET is the only department to conduct an annual self-assessment against the IIA Standards and provide an annual report to the audit committee on internal audit achievements and performance. Its internal audit has an extensive quality assurance program.

DEDJTR began its current internal audit service delivery model in July 2016, and has planned internal audit quality assurance activities for the end of the 2016–17 financial year. DEDJTR will not conduct a self-assessment this year, as an external assessment is underway.

Figure 2F shows the elements of quality assurance in place in the seven departments.

Figure 2F

Quality assurance assessments

|

Key performance indicator |

DEDJTR |

DELWP |

DET |

DHHS |

DJR |

DPC |

DTF |

|---|---|---|---|---|---|---|---|

|

Internal quality assessment —ongoing |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

✘ |

✘ |

✘ |

✘ |

✘ |

✘ |

✘ |

|

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Internal quality assessment —periodic |

✘ |

✘ |

✔ |

✘ |

✔ |

✔ |

✘ |

|

✘ |

✔ |

✔ |

✔ |

✔ |

✔ |

✘ |

|

✘ |

✘ |

✔ |

✘ |

✘ |

✘ |

✘ |

|

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

✘ |

✘ |

✘ |

✘ |

✔ |

✔ |

✘ |

|

✘ |

✘ |

✔ |

✘ |

✘ |

✘ |

✘ |

|

✘ |

✘ |

✔ |

✘ |

✘ |

✘ |

✘ |

|

✔ |

✘ |

✔ |

✔ |

✘ |

✘ |

✘ |

(a) Although formal performance evaluations are not in place for each engagement, all departments provide feedback to auditors on performance as part of the draft report finalisation process and through contract management meetings.

(b) The DEDJTR internal audit charter was first approved in September 2015. The audit committee revised and approved it in June 2017.

(c) DEDJTR will not conduct a self-assessment this year, as an external assessment is underway.

(d) DEDJTR intends to issue the 2016 –17 survey shortly and report the results to its October 2017 audit committee meeting.

(e) DEDJTR's internal audit charter was updated in June 2017 to include the requirement for in-house staff and external providers to complete conflict of interest declarations. In-house staff declarations were scheduled to be completed in July 2017. Scope documents for outsourced audits now incorporate a conflict of interest statement.

(f) In the past 12 months, DEDJTR has been subject to three external evaluations that included a review of working papers. DEDJTR has advised that in future it will undertake reviews of internal audit files either as part of ongoing quality assessment or annually as part of the performance assessment of the service provider.

Source: VAGO, based on departmental data and IIA Standard 1311-1 and Implementation Guide Standard 1312 External Assessments.

Figure 2G shows the results of our assessment of departmental performance for internal audit resourcing and quality.

Figure 2G

Internal audit resourcing and quality in portfolio departments

|

Aspect |

DEDJTR |

DELWP |

DET |

DHHS |

DJR |

DPC |

DTF |

|---|---|---|---|---|---|---|---|

|

Internal audit resourcing and quality |

◕ |

◕ |

◕ |

◑ |

◕ |

◔ |

◕ |

|

Legend |

|

|

● |

Meets mandatory requirements and demonstrates most aspects of better practice |

|

◕ |

Meets mandatory requirements and demonstrates some aspects of better practice |

|

◑ |

Meets mandatory requirements and demonstrates few aspects of better practice |

|

◔ |

Meets mandatory requirements |

|

○ |

Does not meet mandatory requirements |

2.4 Internal audit governance

Internal audit charter

The internal audit charter defines the purpose, roles, responsibilities, authority and accountability of the internal audit function.

Standing Directions compliance

All departments except DTF fulfil the mandatory requirements of the Standing Directions by having an internal audit charter approved by the audit committee.

DTF's charter was undated and had been reviewed by the audit committee chair, although there was no evidence that the charter had been submitted to the audit committee for approval in the past three years. DTF's audit committee reviewed and approved the internal audit charter in April 2017.

At the time of our audit, the internal audit charters of three departments did not include the following elements of Standing Directions guidance:

- annual review of the charter by the audit committee (DEDJTR and DPC)

- review of the independence and objectivity of the internal audit function (DEDJTR)

- details of outsourcing and co-sourcing arrangements (DTF).

The DEDJTR audit committee approved a revised internal audit charter in June 2017, which includes requirements for annual review of the charter and addresses internal audit independence and objectivity.

DPC reviews its charter annually, even though annual revision is not specified in the charter.

Better practice

Six of the seven departments' charters include the majority (between 10 and 15) of the 17 better practice elements we assessed. Of the seven departments, the DHHS charter is the best aligned with better practice guidance.

DTF's charter includes six better practice elements. DTF has not reviewed its charter on an annual basis as required by its charter. Our detailed assessment of the departments' internal audit charters is included in Appendix C.

Communicating the role of internal audit

The DET, DHHS, DJR and DPC charters are available on their intranet sites. DELWP has a brief summary on its intranet about the role of internal audit and a guide to engaging with internal audit. DEDJTR, DELWP and DTF have not adequately communicated with their management and staff about the role of internal audit and the charter, as required by the Standing Directions. DTF has recently added a link on its intranet to address this. DEDJTR removed its internal audit charter from the department's intranet in late 2016 while it was being updated. The update will include information on the role of internal audit and a copy of the internal audit charter.

Better practice internal audit functions communicate information about the assurance role to all stakeholders and provide details in the governance section of an agency's annual report.

Departmental annual reports provide limited information about the role of internal audit within departments. The annual reports of four of the seven departments —DELWP, DET, DJR and DPC —provide no information about the role of internal audit, its composition, work program or resourcing. The annual reports of the remaining three departments —DHHS, DJR and DPC —contain limited information.

Figure 2H shows the results of our assessment of department performance for internal audit governance.

Figure 2H

Internal audit governance in the portfolio departments

|

Aspect |

DEDJTR |

DELWP |

DET |

DHHS |

DJR |

DPC |

DTF |

|---|---|---|---|---|---|---|---|

|

Internal audit governance |

◕ |

◑ |

◕ |

● |

◕ |

◕ |

◑ |

|

Legend |

|

|

● |

Meets mandatory requirements and demonstrates most aspects of better practice |

|

◕ |

Meets mandatory requirements and demonstrates some aspects of better practice |

|

◑ |

Meets mandatory requirements and demonstrates few aspects of better practice |

|

◔ |

Meets mandatory requirements |

|

○ |

Does not meet mandatory requirements |

Source: VAGO.

2.5 Internal audit planning

The purpose of internal audit planning is to direct audit resources to areas of greatest risk. Internal audit does this effectively when its activities are fully aligned with the agency's objectives and identified risks.

Internal audit in all departments engages extensively within the department and with the audit committee to inform the development of the annual internal audit plan.

Compliance with the Standing Directions

Five departments have an approved three- to four-year rolling internal audit plan that includes an annual work program, as required by the Standing Directions.

DTF has an annual plan but has not developed a three- to four-year rolling internal audit plan. DTF stated that the current plan contains the elements of a multi-year plan as it identifies recurring audits and operations not recently audited. All other departments consider these elements and include a detailed forward plan, listing audits to be conducted over the next three to four years.

In July 2017, DTF provided us with its draft 2017 –18 internal audit plan, which includes a three-year strategic plan for 2017 –2020, consistent with the Standing Directions. DTF expects its audit committee will approve the plan in August 2017.

DEDJTR has developed a four-year rolling plan, but only the annual plan has been approved by its audit committee. The audit committee discussed the four-year internal audit plan in its annual planning workshop in July 2016 but did not formally approve it.

Developing the internal audit plan

Consultation and engagement

Internal audit engages extensively in each department to inform the development of the internal audit plan. This involves meetings with the Secretary and Deputy Secretary, risk management and key business areas. Internal audit socialises and tests draft internal audit plans with the department's executive and audit committee.

We interviewed several department Secretaries and all audit committee chairs to seek their views about the extent of planning engagement, and all of them were satisfied with the level of engagement. DHHS uses sector specialists and advisers from the external provider to test the rigour of its internal audit plan.

Alignment with risk and business objectives

All departments demonstrated effective internal audit planning practices. Internal audit invests significant effort in developing the internal audit plan. All internal audit plans we reviewed clearly demonstrated alignment with departmental objectives and risks, and the relevant audit assurance requirements (compliance, financial or operational), and listed resources and time lines.

The internal audit budget does not limit development of the plan but is considered when determining priorities. Our discussions with the Secretaries of DET and DHHS and all audit committee chairs indicate they are comfortable that internal audit plans address business objectives and key risks, and this is consistent with our assessment.

Types of audits

The internal audit plans of each department consider compliance requirements, the work of the external auditors, and strategic goals and risks. Departments focus on operational audits that link to strategic risks and business objectives to provide value. This is consistent with the role of internal audit.

We analysed internal audit plans for 2015 –16 and classified audits by key audit types —operational audits, compliance audits and financial audits. The blend of work included in the plans is risk based, and audits are directed towards key organisational outcomes.

All plans incorporate legislative requirements from the Standing Directions and rotational audits of key financial activities. The plans also link operational audits to departmental strategy and risk.

Figure 2I shows the mix of audit types for all departments.

Figure 2I

Key audit types in the annual internal audit plans across departments

Source: VAGO, based on departmental data.

Figure 2J shows the mix of audit types for each department.

Figure 2J

Key audit types in departments' annual internal audit plans

Note: DET's 'follow-up audits' are compliance and operational audits with a component of follow up. These are explicitly identified in the 'follow-up audits' section of the internal audit plan to enable acquittal of DET's Integrity Reform Program actions.

Source: VAGO, based on departmental data.

Approval and changes to the internal audit plan

The DHHS and DEDJTR internal audit plans were not approved by their audit committees until two months after the beginning of the plan year.

DHHS delayed the internal audit planning process to finalise its contract with a new external service provider and to involve it in the planning process. DHHS advised that the Secretary gave verbal approval to begin audits before the plan was formally approved.

At DEDJTR, only approved 2015 –16 audits that were rolled forward into the 2016 –17 internal audit program began before the 2016 –17 program was formally approved. The delay in approval did not affect the delivery of DEDJTR's internal audit program.

The audit committees in all departments approve changes to the internal audit plan. Internal audit reviews its plan annually and also completes the planning cycle annually, based on the forward schedule of the previous year's plan. Internal audit considers management requests for additional audit activity in consultation with the audit committee, and also presents audit scopes and reports for all additional unplanned audits to the audit committee.

Mapping assurance coverage

Internal audit is one of a number of activities that provide assurance on how well each department is managing risks. Other sources of assurance include management, risk and quality assessments, and external audits and reviews by integrity agencies and independent contractors. It is important that the work of internal audit complements the work of other providers rather than duplicating it. Better practice internal audit departments use assurance maps to provide an agency-wide view of assurance coverage of strategic risks.

An assurance map can help an audit committee to be well-informed about the department's governance, risk and control environments. It is also a valuable tool for developing the internal audit plan. Using a collaborative approach to mapping assurance coverage helps to identify gaps and duplication of effort. It enables internal audit to direct resources to areas of greatest value to the department, and to minimise the cost of assurance activities.

All departments' internal audit plans include assurance maps. The maps of four departments—DET, DELWP, DHHS and DTF—include internal audit and external audit activity but do not provide a complete view of assurance across the department.

DEDJTR, DJR and DPC demonstrate better practice in assurance mapping. DJR conducted an extensive assurance mapping exercise across the whole department in 2014 and 2016 as part of its risk attestation process. This work forms the basis of DJR's internal audit planning, although the internal audit plan contains more detail. DPC's assurance map provides an indication of the risk appetite against each strategic risk and an assessment of the adequacy of the coverage provided. DEDJTR's assurance map includes management committees, and internal audit and external audit coverage, and assesses the adequacy of the coverage provided.

Appendix D contains an example of an assurance map.

External audit reliance on the work of internal audit

The type and mix of internal audit activity depends on the department's desired approach to providing assurance over departmental risks. The objectives of internal audit and external audits generally differ, as do the evidentiary requirements.

As part of annual audit planning, our financial auditors evaluate each department's inherent risk and internal control environment. Our performance auditors look at internal audit plans in the development of the VAGO annual plan. As an independent assurance function, internal audit is considered an important element of departments' internal control environments, which are subject to annual review.

Our financial auditors also review each department's internal audit plan to identify audits with a financial focus that could be relied on for the purposes of forming an opinion on the financial statements. Our financial auditors reflect this in their financial audit strategy for each department, which is presented to the audit committee.

Our departmental financial audit strategies for 2017 indicate some reliance on the work of internal audit in the departments we reviewed. Factors that can affect the extent of external financial audit reliance on the work of internal audit include:

- the quality and independence of the internal audit work performed

- the relevance of the completed internal audits to the formation of an opinion on the annual financial statements

- the extent of the internal audits with a financial focus

- the adequacy of the internal audit sample methodology or sample size for external audit purposes

- whether internal audit working papers meet the evidentiary requirements of external audit

- whether internal audit time frames coincide with the financial year, as the timing of audits may not meet external audit time lines.

If the internal audit testing period is for only part of the financial year, it may be more cost-effective or efficient for external financial audit to re-test the full period rather than re-perform internal audit work for part of the year and separately test the balance.

All internal audit charters, with the exception of DEDJTR's and DET's charters, refer to internal audit engaging with external audit. Although some engagement occurs across all departments, an opportunity exists to enhance engagement between internal and external audit to minimise factors that can affect external audit's ability to rely on the work of the internal audit function.

Figure 2K shows the results of our assessment of departmental performance for internal audit planning.

Figure 2K

Internal audit planning in the portfolio departments

|

Aspect |

DEDJTR |

DELWP |

DET |

DHHS |

DJR |

DPC |

DTF |

|---|---|---|---|---|---|---|---|

|

Internal audit planning |

◕ |

● |

● |

◕ |

● |

● |

◔ |

|

Legend |

|

|

● |

Meets mandatory requirements and demonstrates most aspects of better practice |

|

◕ |

Meets mandatory requirements and demonstrates some aspects of better practice |

|

◑ |

Meets mandatory requirements and demonstrates few aspects of better practice |

|

◔ |

Meets mandatory requirements |

|

○ |

Does not meet mandatory requirements |

Source: VAGO.

3 Measuring performance and communicating insights