Management of Spending in Response to COVID-19

Snapshot

Have agencies used spending in response to coronavirus (COVID-19) for its stated purpose and complied with relevant laws and policies?

Why this audit is important

During a crisis, government departments need to respond rapidly to unexpected events. However, they still need to be transparent and accountable for how they spend public money.

This audit examines how departments managed their spending in response to COVID-19. It is a chance to reflect on how they can improve their preparedness for future crises.

Who we examined

We examined all eight departments and HealthShare Victoria, including the former Department of Health and Human Services (DHHS).

What we examined

For their COVID-19 response, we examined:

- if departments minimised the risk of waste, corruption and fraud in procurement

- how departments managed grants

- how the Victorian Government's COVID-19 spending is monitored and reported on.

What we concluded

Departments made extraordinary efforts to respond to COVID-19. However, not all departments effectively managed their spending leading to waste in some instances.

Most departments had gaps in how they used their critical incident process for COVID-19 procurement, such as poor documentation and inadequate consideration of conflicts of interest. Without strong processes, departments cannot be certain that material fraud or corruption did not occur.

Four audited departments managed their COVID-19 grants programs effectively. However, DHHS and the Department of Jobs, Precincts and Regions (DJPR) did not put in place effective fraud controls at inception because they needed to set their programs up quickly. Although they later tried to improve controls, an internal review found DJPR still had gaps that risked fraud and waste.

The central finance system that government agencies use is not designed to track specific funding initiatives, including those announced in response to the pandemic. This made it difficult for the Department of Treasury and Finance (DTF) to gain an accurate picture of whole-of-government COVID-19 spending. DTF has since developed a new manual reporting approach, which aims to publicly report on total spend in response to COVID-19.

What we recommended

We made a total of 16 recommendations to all departments, the Victorian Government Purchasing Board and the Victorian Public Sector Commission. These focused on improving critical incident procurement processes, reviewing risks in grant programs and financial reporting.

Six of nine departments accepted all recommendations we made to them.

Video presentation

Key facts

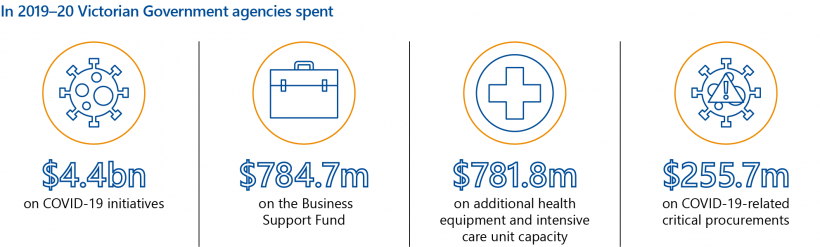

Source: VAGO, based on information from DTF’s COVID-19 actual expenditure 2019–20 and the Victorian Government Purchasing Board’s Annual Report 2019–20.

What we found and recommend

We consulted with the audited agencies and considered their views when reaching our conclusions. The agencies’ full responses are in Appendix A.

Critical incident procurement in response to COVID-19

Making critical procurements during coronavirus (COVID-19)

Seven of eight departments used their critical incident procurement (CIP) policy to make purchases related to COVID-19. Although this gave staff the flexibility to respond quickly to the pandemic, it also meant that in some cases, speed, rather than value for money, was the main consideration. The Department of Treasury and Finance (DTF) did not activate its CIP policy, and managed its procurement using normal processes.

VGPB advises government organisations on how to buy goods and services. Its 2018 Market approach: goods and services policy (the VGPB policy) sets out the mandatory requirements for procurement, including during critical incidents.

During a critical incident, departments can choose to use a flexible and streamlined CIP process. However, the Victorian Government Purchasing Board (VGPB) policy notes that staff should still consider value for money to the extent that they can, given the severity and urgency of a critical incident. The policy does not provide any guidance on how departments should do this.

Staff making decisions in a crisis need clear communication and guidance. Of the departments that chose to use their CIP policies to make purchases related to COVID 19, only the Department of Justice and Community Safety (DJCS), the Department of Education and Training (DET), and the Department of Premier and Cabinet (DPC) made formal announcements invoking and closing their policies. These announcements support staff to make good decisions by clearly outlining expectations and responsibilities. This was particularly important because only the Department of Environment, Land, Water and Planning (DELWP) and DJCS had significant experience using their CIP policies. This meant that staff in other departments were largely unfamiliar with the requirements of the CIP process.

Gaps in departments' procurement processes

Except DJCS, all departments had gaps in their CIP processes, including:

- using CIP policies for non-urgent purchases

- missing and incomplete documentation

- inaccurate reporting of total procurement expenditure.

These gaps reduce transparency around departments’ decision-making for procurement related to COVID-19. They also make it difficult for departments to assure themselves that staff made purchases with proper consideration of value for money and probity.

Despite these gaps there were also some examples of better practice. For example:

- DET, DJCS and the Department of Transport (DoT) had active central procurement teams that monitored the most high-value CIPs related to COVID-19.

- DET minimised the risk of waste when procuring additional cleaning for schools by varying and extending existing contracts rather than engaging new suppliers.

- In November 2020, DJCS reviewed prison cleaning contracts it had entered into early in the pandemic and went out to market to improve value for money.

Conflicts of interest

From 1 February 2021, DHHS split into two departments: the Department of Health (DH) and the Department of Families, Fairness and Housing (DFFH). The government transferred some of DPC’s functions to DFFH, including multicultural affairs and equality. Throughout the report we refer to DHHS when discussing events that took place prior to 1 February 2021.

Only staff at DJCS and DELWP consistently completed conflict of interest declarations for procurements related to COVID-19. At the Department of Health and Human Services (DHHS) and DJPR, staff did not always complete declaration forms until after a procurement had taken place. DJPR staff did not complete declaration forms for some procurements until over six months after they occurred.

Managing conflicts of interest is particularly important during critical incidents when staff do not use a competitive process to select suppliers. This can leave departments exposed to fraud or, at least, perceptions of favouritism. For example, at DHHS, an executive-level staff member did not disclose that they had previously worked with a consultant the department hired.

DHHS’s poor management of conflicts of interest during COVID-19 mirrors known issues. A 2016 internal audit on declarations of private interests also found gaps in how the department managed conflict of interest requirements. DHHS addressed all but one of the recommendations by January 2020. DH and DFFH are due to complete the final recommendation, an online system for declarations of private interests and conflicts of interest, by the end of 2021.

Using professional services and state purchase contracts

All departments engaged professional services firms to prepare advice, deliver projects or provide surge staffing related to COVID-19. However, departments were often uncertain about their obligation to use state purchase contracts (SPCs) when hiring professional services and did not always make full use of the panel available.

An SPC is a whole-of-government contract that aims to achieve value for money by harnessing the collective purchasing power of government. The contracts cover commonly used goods and services, such as utilities, professional services, office supplies, ICT equipment and travel services.

DHHS used professional services firms extensively to respond to COVID-19. However, it used several different processes to engage staff from these firms, including engaging some staff as ‘secondees’ rather than consultants. As departments do not need to disclose spending on secondees, it is difficult for the public to get an overall view of the full cost of using professional services to respond to COVID-19.

At DJPR, the Hotel Quarantine Board of Inquiry also found that staff lacked awareness of SPCs and hired a security firm that was not on the security services SPC.

Using single quotes for non-urgent purchases

By treating all procurement related to COVID-19 with the same level of urgency, departments missed opportunities to achieve better value for money by taking the time to go to market. Although the VGPB policy does not require departments to seek quotes from more than one supplier during a critical incident, they must still consider value for money.

DJPR and DPC used a single quote for some purchases that, while related to COVID 19, were not so time sensitive to justify avoiding a standard, competitive process. Examples included:

- engaging a professional services firm to provide executive team coaching (DJPR)

- commissioning a professional services firm to review the department’s corporate structure (DJPR)

- creating a website to advertise government initiatives (DJPR)

- engaging creative services firms to develop entertainment to promote community wellbeing (DPC)

- buying online platforms to host live performance events online (DJPR).

In addition, in August 2020, DJPR engaged a professional services firm to supply a call centre for $4.5 million. The post-incident brief states that DJPR considered value for money because the firm gave a discount on normal SPC rates. However, the brief does not state why DJPR contacted this particular firm over other firms and does not consider that other providers also may have offered a discount.

Maintaining complete procurement records

All departments that used CIPs, except DJCS, had gaps in their record keeping for CIP transactions. Accurate documentation is especially important in a crisis, as staff often act under pressure and because of the extensive use of non-competitive procurement processes.

Although it is understandable that staff may not always have the time to update their records when making an urgent procurement, they need to ensure that they complete records soon thereafter. We found that some departments’ CIP registers were missing transactions from up to six months prior.

Better-practice procurement approaches

Despite the enormous pressures facing staff, there were examples of better-practice approaches to procurement at DoT, DJCS, DET and DPC. These included:

- strong oversight from central procurement teams to ensure purchases were critical

- seeking quotes from multiple suppliers to test value for money

- researching and conducting due diligence on new suppliers

- using SPCs where possible to buy ICT equipment and office supplies, including masks

- renegotiating contracts as the pandemic progressed to strengthen value for money.

Procuring personal protective equipment

PPE is equipment that aims to minimise the spread of infections. It includes disposable gloves, face masks, face shields and eye protection.

HSV was established on 1 January 2021. It is an independent public sector organisation responsible for statewide procurement and supply of medical consumables. HSV absorbed the responsibilities of the former Health Purchasing Victoria.

Victoria did not have a personal protective equipment (PPE) stockpile prior to the pandemic. As a result, departments needed to act quickly, rely on unfamiliar suppliers and often paid high prices.

PPE for the health sector

Although the former DHHS and HealthShare Victoria (HSV) tried to mitigate the risk of using unfamiliar overseas suppliers, they still experienced stock delays. They also received stock that was not fit for purpose, worth more than $172 million. This mostly comprised:

- 33 million N95 respirators costing $110 million

- 14 million surgical face masks costing $9.5 million.

DHHS 'quarantined' this stock from use because over time, the Therapeutic Goods Administration updated its advice on PPE standards. HSV and DH advised us that they are now looking at ways to minimise waste by repurposing PPE items that do not meet the relevant standards.

PPE for the non-health sector

Staff in other departments typically had no familiarity with the PPE products they sourced and did not have access to pre-vetted suppliers or established supply chains. Despite this, there were examples of better practice as departments shared information with each other about suppliers and tried to consider value for money.

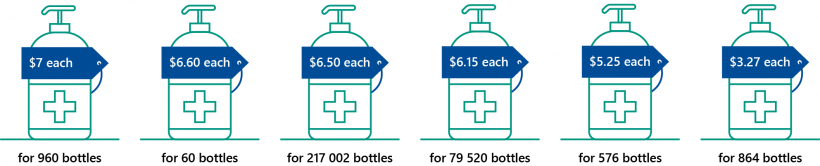

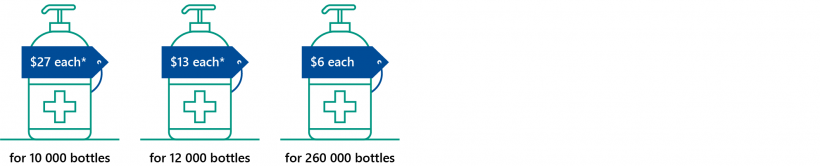

Victoria has a single-vendor SPC for stationery and office supplies, which covers masks, sanitiser, wipes and gloves. Several departments used this SPC, but it quickly became overwhelmed with demand and departments needed to find other suppliers. As a result, departments ended up paying widely varying prices for PPE. For example, at different times throughout the pandemic DJCS paid between $6 and $27 per bottle of hand sanitiser.

EMV is the statutory authority responsible for Victoria’s emergency management. It is part of DJCS.

Despite DJPR coordinating sourcing and distribution of non-health PPE since April 2020, DET, DJPR and Emergency Management Victoria (EMV) separately hold surplus stock. In November 2020, DPC received the report of its external Whole of Victorian Government Personal Protective Equipment Review. The review recommended that EMV and DJPR set up a working party to resolve the surplus stock issue within three months. This has yet to occur. There is a risk of waste because departments are paying to store PPE separately and if they do not coordinate distribution some PPE stock may expire.

DTF and DJPR are working to establish an SPC for PPE.

Recommendations about CIP

| We recommend that: | Response | |

|---|---|---|

|

All departments |

1. review and amend their procurement policies to ensure they:

|

Accepted by: DELWP, DET, DFFH, DH, DJCS, DoT, DPC and DTF Partially accepted by: DJPR |

2. review their critical incident procurement forms to ensure they clearly document:

|

Accepted by: DELWP, DET, DFFH, DH, DJCS, DJPR, DoT, DPC and DTF | |

| 3. regularly review and update their centralised procurement registers to ensure they are as accurate and as up-to-date as possible (see Section 2.3) | Accepted by: DELWP, DET, DFFH, DH, DJCS, DJPR, DoT, DPC and DTF | |

| Victorian Government Purchasing Board | 4. revises its Market approach: goods and services policy to include further guidance on:

|

Accepted by: DTF |

| Department of Premier and Cabinet works with the Victorian Public Sector Commission | 5. to revise its whole-of-government guidelines on using professional services to include guidance on how the policy should be applied when a critical incident is declared under the Victorian Government Purchasing Board's Market approach: goods and services policy (see Section 2.1) | Accepted by: DPC |

| Department of Premier and Cabinet | 6. works with all departments to implement recommendations from the Whole of Victorian Government Personal Protective Equipment Review to define the roles and responsibilities of each agency in relation to purchasing and distributing personal protective equipment for future needs (see Section 2.5) | Accepted by: DPC |

| Department of Treasury and Finance | 7. sets up a state purchase contract for personal protective equipment to implement the recommendation from the Whole of Victorian Government Personal Protective Equipment Review (see Section 2.5) | Accepted by: DTF |

|

Department of Premier and Cabinet works with Emergency Management Victoria and the Department of Jobs, Precincts and Regions |

8. to set up a working party to address surplus stock of personal protective equipment to implement the recommendation from the Whole of Victorian Government Personal Protective Equipment Review (see Section 2.5) |

Accepted by: DJCS Accepted in principle by: DJPR and DPC |

| Department of Health and Department of Families, Fairness and Housing | 9. clarify the way they define consultants, contractors and secondees, including those hired as part of strategic alliance agreements, to ensure transparent reporting around the total expenditure on professional services (see Section 2.1). | Accepted by: DFFH and DH |

Managing COVID-19 grant programs

Departments managed grant programs in response to COVID-19. We audited grant programs run by six departments, including:

- DoT, DPC, DJPR and DHHS’s grant programs for individuals, businesses and community organisations affected by COVID-19

- DELWP, DET and DoT’s business continuity grants for organisations within their sectors, including TAFEs, public transport operators and public entities, such as the Melbourne Zoo.

Managing risks and identifying fraud

Only DoT advised government of the risks associated with its COVID-19 grants program for the commercial passenger vehicle industry. This included the risk that poor data could make it difficult for DoT to quickly check if applicants were eligible.

In contrast, despite setting up large-scale grant programs in two weeks, DHHS and DJPR did not formally advise government of their risks. DJPR advised us that it had informal discussions with the minister about risk management. DPC also did not advise government of the risks associated with its grant programs for multicultural community organisations, but the programs were lower risk because they involved organisations that it had worked with previously.

Due to the pressure to pay grants quickly, neither DHHS nor DJPR had time to establish sufficient fraud controls at inception. Although both departments have since strengthened their fraud controls, gaps remain at DJPR, increasing the risk of paying ineligible applicants.

DoT and DPC effectively managed the risk of fraud, corruption and waste of resources for their grants related to COVID-19. They did this by building preventative fraud controls into their grant application process, setting up a consistent assessment process, and requiring grant recipients to report on how they used their grants.

Managing conflicts of interest in grants administration

DoT, DPC and DHHS did not have processes to ensure that staff considered conflicts of interest when assessing grants. This means that departments cannot be as certain as they should be that staff did not pay some grants inappropriately.

Working for Victoria grant program

DJPR used grant funding from the Working for Victoria program to purchase goods and services that should otherwise have been purchased using a procurement process. This included using a grant to procure the ICT platform for the program and paying DoT a grant to purchase cleaning services. By using a grant and not following a formal procurement process, DJPR cannot be confident that these purchases minimised probity risks or achieved value for money.

In addition, DJPR did not effectively manage the perceived conflict of interest of using a non competitive process to hire staff from an organisation which, at the time, was chaired by a former minister who had been responsible for DJPR. DJPR engaged the organisation to administer the then $500 million Working for Victoria program. DJPR paid the organisation $770 000 for 10 staff and associated working costs.

Business continuity grants

DELWP, DET and DoT administered business continuity grants to support entities within their sectors that had lost income due to COVID-19 to meet urgent costs and retain their staff. All three departments effectively managed the risks of fraud, corruption and waste involved in providing financial viability funding to portfolio entities and associated organisations.

Departments’ financial viability payments were supported by clear advice to government that identified the risk of not supporting recipients to manage the financial impact of COVID-19. Departments also had strong oversight over how recipients used the funding. This meant that departments could assure themselves that recipients used the funding as intended and, in the case of payments to non government entities, did not profit from public funding.

Recommendations about managing COVID-19 grant programs

| We recommend that: | Response | |

|---|---|---|

| All departments | 10. review, and as necessary revise, their internal guidance material on grants to ensure it aligns with the requirements in Better Grants by Design: a guide to best practice grant program investment, design, management and administration for the Victorian public sector (Better Grants by Design) for:

|

Accepted by: DELWP, DET, DFFH, DH, DJCS, DJPR, DoT, DPC and DTF |

| 11. conduct reviews of their COVID-19 grants programs to identify any gaps in their controls or administrative processes that lead to risks of fraud, corruption or waste (see sections 3.2, 3.3 and 3.4) | Accepted by: DELWP, DET, DFFH, DH, DJCS, DJPR, DoT, DPC and DTF | |

| Department of Jobs, Precincts and Regions | 12. develops a governance framework for administering large-scale grant programs, including guidance on how to implement effective fraud controls (see sections 3.1, 3.2, 3.4 and 3.5). | Accepted by: DJPR |

Collecting COVID-19-related spend data

Whole-of-government spend

DTF is not using the COVID-19 spend data it has collected from departments to monitor whole-of-government spending. Although DTF is a central agency, it does not consider this its responsibility because the Financial Management Act 1994 requires departments to monitor their own spending. However, this means that there has been no central oversight of cross-departmental COVID-19 initiatives. Without this, the government cannot fully understand how well it is managing its COVID-19 spend at a state level.

DTF experienced difficulties in collating all of the departments' spend related to COVID-19 for 2019–20. This was because the central finance system used by government agencies does not allow departments to report sufficiently granular data for DTF to identify COVID-19 spend. As a result, DTF had to set up a manual reporting process for departments to consistently report COVID-19 spend. However, competing priorities during the pandemic led to a long development process and delayed reporting.

DTF did not issue the first guideline for departments on reporting COVID-19-related spend until August 2020. This was a month after the 2019–20 financial year ended and five months after the government announced the state of emergency. DTF had to revise its reporting approach in December 2020 after finding data quality issues. For example, departments used different names for the same COVID-19 initiative involving multiple departments.

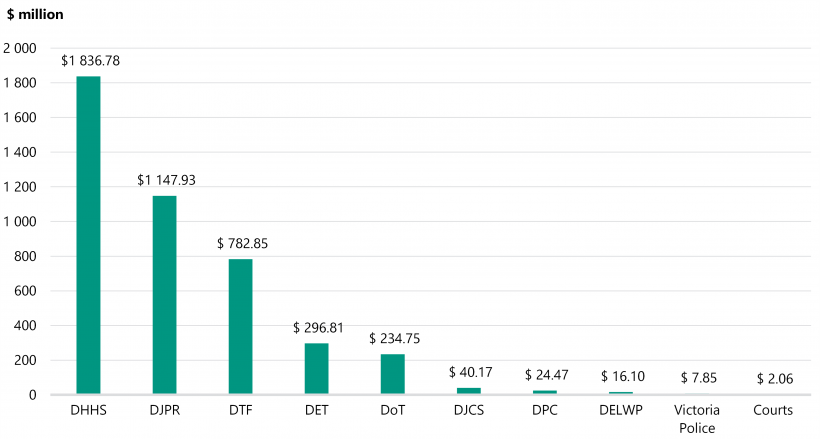

In July 2021, DTF published departments' 2019–20 expenditure for COVID-19 initiatives. This data shows that departments spent $3.6 billion in COVID-19 initiatives, with most spending in the Business Support Fund ($784.7 million) and in additional equipment and intensive care unit capacity ($781.8 million). DTF’s subsequent review of its published data identified three initiatives that it did not report. DTF did not republish the corrected 2019–20 expenditure until October 2021, which reported a total spend of $4.4 billion.

DTF collected 2020–21 data on a monthly or quarterly basis depending on the value of each COVID-19 initiative. This should enable DTF to detect data quality issues earlier and to proactively monitor whole-of-government spending on a regular basis.

Departmental spend

All departments record and track their spend related to COVID-19 in their finance system. However, limitations in their finance systems mean that departments need to manually consolidate their expenditure across different initiatives. DJCS and DHHS are the only departments that have addressed this issue by creating a filter in its budgeting tool that automatically identifies all expenditure for COVID-19 initiatives. Although it is separate to their financial systems, DH and DFFH maintain a dashboard that reports on COVID-19 spend.

Although all departments monitor their overall financial position, only three departments have a specific focus on COVID-19 spend. DHHS produces a monthly finance report covering only COVID-19 initiatives, while DJPR and DJCS generate dashboards to distinguish spending related to COVID-19.

Recommendations about financial reporting

| We recommend that: | Response | |

|---|---|---|

| Department of Treasury and Finance | 13. publicly reports on the costs directly attributable to the COVID-19 pandemic for 2021–22 and for any future years that may apply (see Section 4.1) | Accepted by: DTF |

| 14. reviews its process for collecting data on whole-of-government COVID-19 costs and identify ways to ensure that spending for any future significant events is accurately reported to the public in a timely way (Section 4.1) | Accepted by: DTF | |

|

All departments |

15. review ways to align financial systems, policies and business practices that improve consistency, accessibility and accuracy of whole-of-government data, such as the Department of Premier and Cabinet's common corporate platforms project (see Section 4.1) |

Accepted by: DELWP, DET, DFFH, DH, DJCS, DJPR, DoT, DPC and DTF Accepted in principle by: DET |

| 16. regularly report and monitor their budgets and expenditure for COVID-19 initiatives (see Section 4.2). |

Accepted by: DELWP, DET, DFFH, DH, DJCS, DJPR, DoT, DPC and DTF |

1. Audit context

Departments needed to act quickly to respond to COVID-19, such as by buying essential medical supplies and setting up support programs. To fund these unexpected costs, the Victorian Government announced a range of new funding initiatives. These included extra funding for the health system and grants for businesses affected by public health restrictions.

This chapter provides essential background information about:

1.1 Spending in response to COVID-19

The Victorian Government reported spending $4.4 billion on COVID-19 responses in 2019–20. The highest expenditure was:

- $784.7 million in the first round of the Business Support Fund to support businesses and reduce unemployment

- $781.8 million in additional health equipment and capacity for intensive care units

- $673 million in payroll tax relief for small and medium businesses.

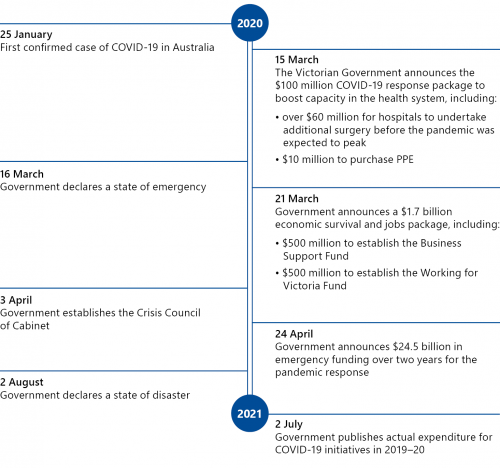

Figure 1A outlines key COVID-19 events and funding announcements in Victoria.

Figure 1A: Timeline of key COVID-19 events and funding announcements

Note: On 15 October 2021, DTF republished actual expenditure for COVID-19 initiatives in 2019–20.

Source: VAGO, based on information from the premier’s media releases, reports from the Public Accounts and Estimates Committee (PAEC) and information from DTF.

Sources of funding to respond to COVID-19

As part of the annual state Budget process, the government outlines the goods and services it plans to deliver. Parliament then endorses this plan by passing the annual Appropriation Bill, which allows government to use public money.

As COVID-19 was an unexpected event, the government needed to source additional funding outside the annual budget process to fund its response. Government departments also re-prioritised some of their existing funding to manage their internal costs related to COVID-19, such as extra cleaning and equipment to support staff to work from home.

Treasurer’s Advance

The Treasurer has the discretion to provide agencies with more funding to meet any urgent or unforeseen claims. This is known as the Treasurer’s Advance. The Treasurer approved $2.4 billion from this funding source for COVID-19 initiatives for 2019–20.

Crisis Council of Cabinet

On 3 April 2020, the Victorian Government set up the Crisis Council of Cabinet to oversee its COVID-19 response. The council ran until 10 November 2020. Its responsibilities included considering departments’ requests for additional funding above $20 million. The Treasurer considered requests for less than $20 million in consultation with the premier.

To receive funding via the Crisis Council of Cabinet, departments needed to demonstrate that they had:

- taken steps to minimise their expenditure

- deferred discretionary projects

- managed cost pressures within their portfolio.

Reporting COVID-19 spend

General government sector refers to departments and other government-controlled entities that deliver public services.

In its 2019–20 Financial Report, the Victorian Government reported a net operating deficit of $6.5 billion for the general government sector. It explained this deficit as largely related to COVID-19 and the government's pandemic response.

Our November 2020 Auditor-General's Report on the Annual Financial Report of the State of Victoria: 2019–20 attributed $4 billion of this net operating deficit to COVID 19. This is a combination of increased expenses and a drop in revenue. To clarify the financial impact of COVID-19, we recommended that DTF publicly report all costs related to COVID-19 for 2019–20 and 2020–21.

DTF published the 2019–20 data, which as Figure 1B shows, reported that the Victorian Government spent $4.4 billion on COVID-19 initiatives.

Figure 1B: 2019–20 actual expenditure for COVID-19 initiatives that were centrally endorsed

Source: VAGO, based on DTF's COVID-19 actual expenditure 2019–20.

1.2 Procurement related to COVID-19

All departments have had unexpected procurement costs related to COVID-19, including PPE and cleaning supplies. Many departments also procured services to support their response to COVID-19, such as advice and surge staffing from professional services firms, call centre staff, website design and advertising. Some departments procured goods and services to support the hotel quarantine program, such as hotel accommodation, transport and security services. In addition, departments purchased ICT equipment to support staff to work from home.

Government procurement policies

Departments must follow several policies when purchasing goods and services. These policies include specific measures designed to streamline purchasing in response to a critical incident, such as COVID-19.

VGPB advises government organisations on how to buy goods and services. The VGPB policy sets out the mandatory requirements for agencies' procurement, including during critical incidents. The policy applies to all departments and some other government agencies.

Procurement during critical incidents

Under the VGPB policy, departments can use a streamlined procurement process when the relevant minister, responsible officer or chief procurement officer declares that there is a critical incident.

The VGPB policy states that during a critical incident, normal procurement processes do not apply to the extent that the critical incident makes it impractical to apply them. However, departments must still:

- take into account value for money, accountability, information security and probity to the extent that they can be applied given the severity and urgency of the incident

- adopt minimum record keeping processes

- meet contract disclosure requirements.

To be accountable for decision-making during critical incidents, for each procurement the VGPB policy requires departments to record:

- the good/service being procured

- the purpose of the procurement activity

- the total value of the procurement (including GST)

- the name and contact details of the supplier

- a short summary of the procurement process followed

- contact details of the party managing the procurement.

Each year, departments need to report to VGPB the total value of goods and services purchased, and the nature of the critical incident to which the procurement values relate.

State purchase contracts

An SPC is a whole-of-government contract that aims to achieve value for money by harnessing the collective purchasing power of government. The contracts cover commonly used goods and services, such as utilities, professional services, office supplies, ICT equipment and travel services.

In addition to following the VGPB policy, departments must use an SPC to buy goods and services if it is mandated. When a critical incident is declared under the VGPB policy, departments can choose not to use a mandated SPC if it is impractical. In March 2020, VGPB released guidance to departments advising that they can and should continue to use SPCs during a state of emergency.

Hiring professional services

Professional services are individuals or organisations that government agencies can hire to provide advice or perform a specialist or technical service.

They are sometimes known as consultants.

In October 2019, DPC issued the Administrative Guidelines on Engaging Professional Services in the Victorian Public Service (the DPC guidelines).

The DPC guidelines state that one of the ‘legitimate circumstances’ in which departments can engage professional services is for ‘work requiring capacity due to unpredictable demands that require immediate or time critical action’. This specifically includes ‘surge capacity required due to emergency management, or similarly critical events'. In these situations, staff do not need to seek their secretary’s approval.

The DPC guidelines apply to all departments. They state that agencies should not engage professional services to undertake 'universal and enduring public service functions’. If a department wants to engage professional services for these functions, staff must get approval from their secretary.

In July 2021, responsibility for maintaining the DPC guidelines moved to the Victorian Public Sector Commission.

Conflicts of interest

A conflict of interest occurs when an employee has private interests that could influence, or be seen to influence, their decisions or actions in the performance of their public duties. A conflict of interest can be actual, potential or perceived.

The Victorian Secretaries Board has endorsed the Victorian Public Sector Commission's model conflicts of interest policy. The policy states that staff need to ‘regularly consider the relationship between their private interests and public duties in order to identify any conflict of interest’. It states that any staff involved in procurement should sign a conflict of interest declaration regardless of whether they actually have a conflict.

1.3 Purchasing PPE to support the response to COVID-19

In response to COVID-19, the Victorian Government set up separate processes to coordinate the purchasing of PPE for health and non-health sectors.

PPE for the health sector

In early March 2020, the government set up a supply chain to coordinate the sourcing, purchasing and distribution of PPE for the health sector. The supply chain involved DHHS, HSV and Monash Health. Figure 1C shows the supply chain arrangements.

Figure 1C: Agencies' roles in procuring PPE for the health sector

Source: VAGO, based on information from DHHS.

On 4 March 2020, HSV negotiated the first bulk order for PPE on behalf of the state. HSV is not bound by the VGPB policy. It has its own policy that allows for streamlined and flexible procurement for critical incidents.

On 10 March 2020, DHHS released the COVID-19 Pandemic Plan for the Victorian Health Sector, which refers to plans to set up a centralised procurement process for health PPE. In April 2020, DHHS set up a task force to oversee and manage PPE supply and usage. This task force includes DHHS, HSV, DJPR, and EMV.

PPE for non-health government agencies

Victoria did not have a plan for PPE needs outside the health sector before the pandemic.

EMV's 2015 Victorian action plan for influenza pandemic outlines that its responsibilities for pandemics are coordinating emergency management personnel and recovery efforts. The plan does not mention PPE.

On 17 March 2020, the government tasked EMV with coordinating PPE procurement for non-health agencies that could not source their own or where their stock was unexpectedly delayed. EMV required agencies to firstly rely on their own processes.

On 20 April 2020, the Crisis Council of Cabinet transferred responsibility for sourcing non-health PPE to DJPR. DJPR then set up separate task forces for medical equipment and supplies, and for PPE.

1.4 Grants programs related to COVID-19

Departments managed several grants programs in response to COVID-19. They gave grants to a range of individuals and organisations affected by COVID-19, such as local councils, community groups, individuals and businesses.

Figure 1D outlines the grant programs related to COVID-19 we selected to examine in this audit. All these programs were announced prior to June 2020.

Figure 1D: Grants programs related to COVID-19 we examined

| Responsible department | Grant | Purpose | Initial funding amount |

|---|---|---|---|

| DJPR | Business Support Fund | Businesses impacted by COVID-19 restrictions could apply for grants between $5 000 to $20 000. The fund had three rounds | $500 million(a) |

| DJPR | Working for Victoria | Creating jobs for unemployed people, including those who lost employment due to COVID-19 | $500 million |

| DHHS | Rent Relief Grants Program | Supporting renters facing hardship | $80 million |

| DoT | Commercial passenger vehicle industry grant | Supporting drivers, funding cleaning costs and ensuring service availability for vulnerable passengers | $10.8 million |

| DPC | Priority Response to Multicultural Communities | Supporting organisations to deliver support services to multicultural and faith organisations, such as outreach and emergency food relief | $4.36 million |

| DPC | Local Partnership Model Pilot | Supporting selected local council areas to achieve higher COVID-19 testing rates through community engagement | $2.1 million |

(a)This funding amount is only for the first round of the Business Support Fund. The second and third rounds were $534 million and $822 million, respectively.

Source: VAGO, based on information from departments.

Government policies and guidance for grants

The Standing Directions 2018 under the Financial Management Act 1994, outline departments’ mandatory requirements in relation to discretionary financial benefits, which include grants. It states that departments must:

- maximise value for money

- establish effective and efficient administrative controls

- apply DTF’s 2016 Investment principles for discretionary grants.

DTF's Investment principles for discretionary grants include nine principles for departments to consider when designing and implementing grants. One of these is to follow Better Grants by Design.

Better Grants by Design

Better Grants by Design states that departments managing grants need to:

- have a clear policy objective

- assess the risks associated with the program

- include an evaluation mechanism

- not create an ongoing need for funding

- minimise administration costs

- have accountability requirements for recipients that are proportionate to risk.

Business continuity grants and financial viability initiatives

Some departments administered business continuity grants or financial viability payments to entities within their sector. These payments aimed to support organisations that had lost income due to COVID-19 to meet urgent costs and retain their staff.

We examined the following business continuity grants and financial viability initiatives in this audit:

- DELWP’s financial support for portfolio entities

- DET’s funding for TAFE and adult and community education providers

- DoT’s financial support for public transport operators.

Figure C1 in the appendix outlines these in further detail.

1.5 Other spending related to COVID-19

In addition to awarding grants and procuring goods and services, departments’ other expenditure related to COVID-19 included:

- working from home allowances for staff

- tax relief payments

- refunding liquor licences

- revenue loss payments to service providers.

The State Revenue Office, which we did not audit, managed payroll tax relief and liquor licensing waivers.

1.6 Other reviews and inquiries about Victoria's COVID-19 response

There have been several reviews and inquiries into aspects of the government's response to COVID-19. These include:

- Victorian Parliament's Legal and Social Issue Committee's Inquiry into the Victorian Government's COVID-19 contact tracing system and testing regime (December 2020)

- COVID-19 Hotel Quarantine Inquiry Final Report and Recommendations (December 2020)

- Victorian Parliament's PAEC's Inquiry into the Victorian Government's response to the COVID-19 pandemic (February 2021)

- Victorian Ombudsman's Investigation into the Department of Jobs, Precincts and Regions' administration of the Business Support Fund (April 2021).

Key themes across these reviews included:

- departments working under extraordinary pressure to respond to COVID-19

- a lack of probity and transparency in procurement

- poor coordination across departments

- the challenges of implementing support programs quickly.

2. Critical procurements in response to COVID-19

Conclusion

Most departments had weaknesses in their COVID-19 procurements, such as incomplete and missing documentation, frequent use of quotes from single suppliers and inadequate consideration of conflicts of interest. This means these departments cannot be sure that material fraud, corruption and waste did not occur.

The lack of a PPE stockpile meant that departments often paid high prices to secure essential items. Despite this, staff did consider value for money and conducted due diligence on new PPE suppliers. However, the risk of waste remains, as government has yet to centralise the storage and distribution of PPE for non health sectors.

This chapter discusses:

2.1 Using CIP processes

DTF was the only department that chose not to use its CIP policy for procurement related to COVID-19. Although DTF only spent $1.8 million, by continuing to use normal processes it was able to reduce the risk of waste, fraud and corruption. All other departments used their CIP policies. While this allowed them to speed up purchasing to respond to urgent needs, it also exposed them to increased risks such as:

- not achieving value for money by relying on single quotes

- perceptions of favouritism or conflicts of interest when using single quotes

- focusing on speed over documenting decision-making and approvals

- lack of transparency and poor oversight from central procurement units.

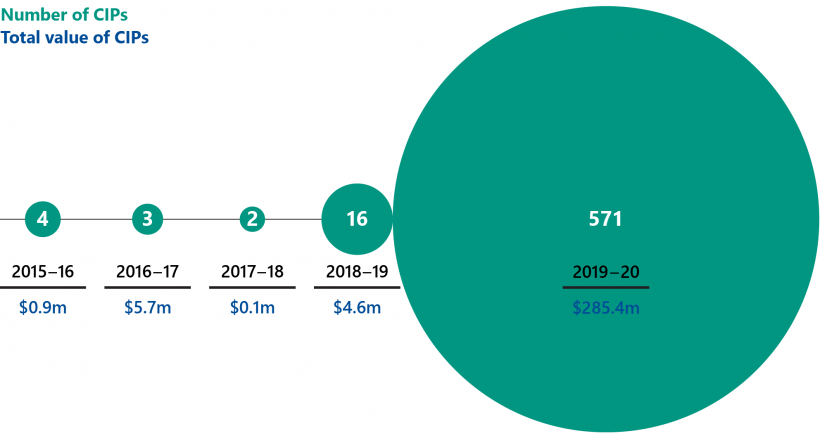

As shown in Figure 2A, departments significantly increased their use of CIP policies in 2019–20.

Figure 2A: Number and value of CIPs from 2015–16 to 2019–20

Source: VAGO, based on VGPB annual reports from 2015–16 to 2019–20.

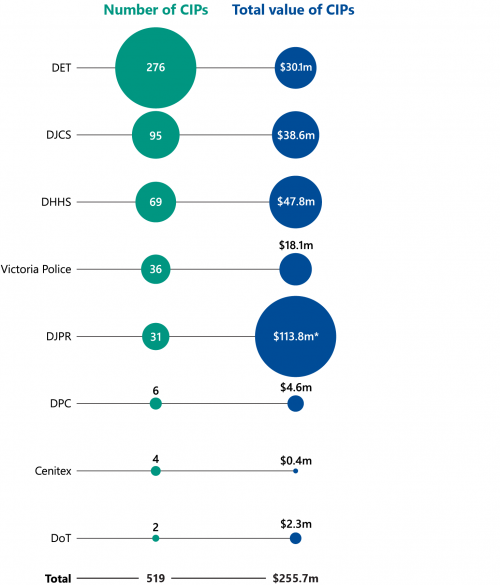

VGPB's data shows that 91 per cent (519) of all CIPs in 2019–20 were related to COVID-19. The remaining transactions related to the early 2020 bushfires. As shown in Figure 2B, departments reported to VGPB $255.7 million in CIPs related to COVID 19 for 2019–20.

Figure 2B: CIPs related to COVID-19 reported to VGPB in 2019–20

Note: *This value excludes contracts where values have not been finalised. DTF and DELWP did not report any COVID-19-related CIPs for 2019–20.

Source: VGPB's Annual Report 2019–20.

DELWP did not report any CIPs related to COVID-19 to VGPB for 2019–20 even though its records show it had one. We discuss this further in Figure 2I.

Activating the CIP process

The VGPB policy requires departments to formally activate and close off their CIP policies. These announcements support staff to make good decisions during times of crisis by clearly outlining their responsibilities.

CIP policies allow staff to use a more flexible, less-competitive process, so it is vital that departments set clear boundaries around their use. In addition, only DELWP, DJCS and DoT had used their CIP policies between 2015–16 to 2018–19, which means that other departments’ staff were mostly unfamiliar with the CIP process. DPC did, however, have some recent experience using CIPs to respond to the bushfires in early 2020. Despite this, of the departments that chose to use their CIP policies, only DET, DJCS and DPC made formal announcements to start and close them.

Staff at DJPR and DHHS advised us that they did not believe it was necessary to formally activate their CIP policies because the government had declared a state of emergency. Although this is a trigger for activating a CIP process under the VGPB policy, departments still need to clearly activate their own policy. This is because a state of emergency does not always affect all departments’ procurement activities. For example, the government often declares states of emergency in relation to bushfires. However, this does not mean that all departments need to change their approach to procurement.

Considering value for money

Although departments' approaches to considering value for money when using their CIP policies varied widely, we did find examples of better practice.

|

Better-practice approaches to value for money involved … |

This allowed departments to … |

|

seeking quotes from multiple suppliers. |

be confident that they were securing the best price. |

|

using SPCs to buy ICT equipment and office supplies, including masks. |

save time by not needing to go to market and taking advantage of prices and contract terms agreed prior to the pandemic. |

|

researching and conducting due diligence on new suppliers. |

check whether a supplier offering a below market price was a legitimate business. |

As we discuss in Section 2.4, DoT, DJCS and DET all had central procurement teams that monitored whether staff continued to consider value for money when using CIP policies. The following are other examples of good practice at these departments:

- More than 91 per cent of DET's purchases from March to October 2020 were from existing suppliers, including suppliers that are part of SPCs.

- DET minimised the risk of waste when procuring additional cleaning for schools by varying and extending existing contracts. It also negotiated tiered pricing so it would pay different amounts depending on whether a school had a confirmed COVID-19 case or not.

- In November 2020, DJCS reviewed prison cleaning contracts it had entered into early in the pandemic and went out to market to improve value for money.

- DoT required all staff who used its CIP process to work with the central procurement team to approach the market.

In contrast, some departments prioritised speed over value for money. DHHS and DJPR relied heavily on new suppliers or single quotes, even where an SPC panel existed.

Examples where DHHS did not make use of available SPCs and registers included not using:

- a $100 000 procurement to engage a firm to develop a communications and issues management strategy that did not use the marketing services register

- a $9 500 placement fee for a customer relationship manager for workforce planning that did not use the staffing services SPC.

In addition, DJPR used its CIP process to procure a consulting firm to provide executive coaching and wellbeing support to staff affected by the COVID-19 response, at a total cost of up to $100 000. DJPR did not approach any other providers for quotes and did not finalise a contract with the firm until several months after it started providing services.

Although using only one quote is acceptable under the VGPB policy, gaps in DHHS and DJPR's procurement records mean it is not always clear how they considered value for money or chose a particular supplier.

Figure 2C shows an example of a DHHS procurement that used a CIP process to contract a senior executive staff member using a single quote rather than a traditional recruitment process. This contractor received a higher payment than the job description and relevant pay band.

Figure 2C: Contracting a senior executive through a single quote

In June 2020, DHHS used its CIP policy to contract a senior executive using a single quote.

The procurement documents argue that DHHS needed to use a CIP process because the position related to a pending government announcement.

DHHS's documentation states that the executive officer was directly engaged as a contractor for one year for $594 595 (including GST), via a single quote from an ‘identified candidate’.

An internal memorandum states that DHHS considered value for money by comparing the role ‘to other like-roles and similar procurements’. However, DHHS's records do not explain:

- how it identified the candidate

- how the procurement compares to similar roles and procurements

- how and why the agreed remuneration exceeded the job description by more than $250 000 and the relevant pay band by $230 000.

Source: VAGO, based on information from DHHS.

Figure 2D shows an example at DJPR where it was unclear why a supplier was approached to provide a service.

Figure 2D: Engaging a call centre using a single quote

In August 2020, DJPR engaged a professional services firm to supply a call centre for $4.5 million.'

The post-incident brief states that DJPR considered value for money because the firm gave a discount on normal SPC rates. However, the brief does not state why DJPR contacted this particular firm over other firms and does not consider that other providers may have also offered a discount.

Source: VAGO, based on information from DJPR.

Using CIP processes for non-urgent purchases

The VGPB policy does not provide guidance on whether departments should use CIP policies for procurements that are part of an economic or recovery response to a critical incident, rather than an immediate health or safety response. This means that departments may use a CIP process even when a procurement does not respond directly to an immediate crisis situation.

By treating all procurement related to COVID-19 with the same level of urgency, some departments missed opportunities to achieve better value for money by taking the time to go to market. DJPR, DHHS and DPC all used a single quote for some purchases that, while related to COVID-19, were not so time sensitive to justify avoiding a standard, competitive process. Examples included:

- engaging a professional services firm to provide executive team coaching (DJPR)

- commissioning a professional services firm to review the department’s corporate structure (DJPR)

- creating a website to advertise government initiatives (DJPR)

- engaging creative services firms to develop entertainment to promote community wellbeing (DPC)

- buying online platforms to host live performance events online (DJPR).

The VGPB policy notes that staff should still consider value for money to the extent that they can, given the severity and urgency of a critical incident. However, it does not provide any guidance on how departments should do this.

In an example of better practice, the Queensland Government's Office of the Chief Advisor—Procurement issued specific advice to departments in March 2021 on how to procure during the COVID-19 emergency. This included guidance on how staff should differentiate between levels of urgency or stages in the pandemic and tailor their procurement processes accordingly.

Where there is a risk to life, the guidance states that is appropriate to rely on single quotes and, if necessary, verbal or email approvals. If there is no risk to life but the procurement is still time sensitive, staff should use pre-vetted suppliers and supplier panels, simplified contracts and confirm all purchases and approval in writing. The guidance also notes that procurement that is related to ongoing recovery efforts should use standard competitive processes.

On 1 December 2020, the government established COVID-19 Quarantine Victoria as an administrative office within DJCS responsible for managing hotel quarantine.

COVID-19 Quarantine Victoria advised us that it is considering the need to develop a 'staged' approach to procurement during critical incidents to maximise value for money. This approach could have different requirements for procurements depending on level of urgency and risk to life. This would ensure that the agency only uses a non-competitive procurement process when necessary.

Using professional services firms

All departments engaged professional services firms to prepare advice, deliver projects or provide surge staffing related to COVID-19. However, departments were often uncertain about their obligations when hiring professional services and did not always make full use of the SPC panel for professional services.

The DPC guidelines consider a critical incident as a valid exemption from the need to have secretary approval to engage professional services. However, they do not state whether departments still need to complete an exemption form in these circumstances. There is no guidance from VGPB or DPC that clarifies the relationship between the DPC guidelines and the VGPB policy.

Only two departments (DJPR and DET) have used an approval form to record exemptions to the DPC guidelines for hiring professional services. However, even these departments did not use the form for all professional services engagements related to COVID-19.

Although departments can hire professional services using single quotes under the VGPB policy, there are several examples of firms receiving an ‘incumbency advantage’ from departments after they were engaged this way.

DHHS and DJPR both have examples where staff explained their decision to engage a firm based on a single quote with reference to the fact that the firm offered a ‘voluntary discount’ due to COVID-19. When extending the engagements, the departments then justified the new contract on the basis that the firm already had essential knowledge of the project.

Although it is positive that departments were able to secure discounts, there is no evidence that other similar firms on the SPC would not also have offered a discount. There is also no evidence that staff tried to mitigate the incumbency advantage when they extended the engagements.

As discussed in Figure 2E, DHHS used professional services firms extensively to respond to COVID-19. However, because it has engaged staff using several different processes, which each have different reporting requirements, the public will not be able to know the full costs incurred by using professional services to respond to COVID-19.

Figure 2E: DHHS’s use of professional services to respond to COVID-19

DHHS used several different processes to engage staff from professional services firms to support its COVID-19 response.

DHHS engaged professional services firms to support its COVID-19 response as:

- consultants using its CIP policy

- consultants or contractors using its pre-existing strategic alliance agreements with several firms, where alliances aim to improve strategic advice and build staff capability

- 'secondees'.

DHHS’s CIP register includes approximately $22.6 million worth of professional services firm engagements. However, this figure does not include staff hired under its strategic alliance arrangements or as ‘secondees’.

DHHS hired 'secondees' from a professional services firm for $4.9 million using its CIP policy. Although DHHS repeatedly referred to these secondees as consultants in its internal documentation, it advised us that under DHHS’s internal definition of ‘secondee’, secondees are not consultants. This meant that DHHS did not publicly report this amount as part of its consultancy expenditure.

Although professional services can provide important support to departments in times of crisis, it is essential that departments are transparent about their use. There is no agreed definition across the public service or sector of what constitutes a 'secondee' from a professional services firm (as opposed to a secondee from another government department)

Source: VAGO, based on information from DHHS.

2.2 Identifying and managing conflicts of interest

DJCS and DELWP were the only departments where staff consistently completed conflict of interest declarations for CIPs related to COVID-19.

Managing conflicts of interest is key to ensuring that government decisions are free from bias. This is particularly important during critical incidents as staff may not be using a competitive process to select suppliers. Typically, staff complete a conflict of interest declaration form to state whether or not they have a conflict in relation to a particular procurement. This is a quick yet critical process and would not delay an urgent procurement.

The Victorian Public Sector Commission model policy advises that staff on a procurement panel or involved in a complex procurement should complete a declaration form regardless of whether a conflict is identified.

DET advised us that it did not believe its staff needed to complete a conflict of interest declaration unless there was a conflict to declare. Conversely, DoT advised us that it does require staff undertaking a CIP process to complete declarations. However, this did not occur for three of four procurements that we reviewed. DPC requires its staff to complete a declaration as part of CIPs, but this did not occur for five transactions until after we reviewed them.

At DHHS and DJPR, staff regularly did not complete declaration forms until after a procurement had taken place. At DJPR, staff did not complete declaration forms for some procurements until over six months after they occurred. This means there is no documented evidence to show that staff considered conflicts of interest specific to each procurement at the time it was undertaken. Figure 2F outlines an example from DHHS of a poorly managed conflict of interest.

Figure 2F: Example of poorly managed conflict of interest

Source: VAGO, based on information from DHHS.

DHHS’s management of conflicts of interest during COVID-19 mirrors known issues. A 2016 internal audit on declarations of private interests found gaps in how the department managed conflict of interest requirements. DHHS addressed all but one of the recommendations by January 2020. DH and DFFH are due to complete the final recommendation, an online system for declarations of private interests and conflicts of interest, by the end of 2021.

In an example of better practice, a staff member at DJCS correctly identified that they had a perceived conflict of interest in relation to a hotel quarantine accommodation site as they lived in an apartment in the same building. The staff member alerted their manager, and they developed a suitable management plan so the staff member would not have contract management responsibilities for the hotel.

Record keeping and accountability

Departments need to keep good records to be transparent about their decisions. Without comprehensive documentation that outlines how and why staff chose a particular supplier, departments cannot be fully accountable for their spending.

The VGPB policy requires departments to develop a ‘suitable form’ for recording the required minimum information about each procurement. Although all departments except DET have a specific CIP form to record details about each procurement, only DJCS did not have gaps in record keeping.

|

Common weaknesses in departments' records included … |

This means that … |

|

incomplete or unapproved forms (including missing conflict of interest declarations). |

the forms do not provide a reliable and specific account of how a procurement actually took place. |

|

using similar 'pro forma' wording for multiple procurements. |

|

|

not clearly explaining why a procurement was critical. |

in some cases, it is not clear why departments could not have used a competitive, business-as-usual approach. |

|

long gaps between the procurement date and when staff competed the form. |

staff did not document their procurement process in a timely way, which is a key step in managing the risk of waste and fraud. |

Figure 2G outlines two examples of departments’ poor record keeping practices for CIPs.

Figure 2G: Examples of poor record keeping for CIPs

Delayed post-incident briefs

Given that DJPR had the highest CIP expenditure of any department, it is understandable that there were delays completing paperwork. However, there are significant gaps in DJPR's procurement records. DJPR’s CIP policy requires staff to complete a post-incident brief for each CIP transaction that clearly documents the procurement approach used. Across all DJPR's CIPs for 2019–20, it took an average of 24 weeks from the estimated date of the contract to complete a procurement post-incident brief. For the 12 briefs we reviewed in detail, DJPR completed them more than six months after the date of the original contract. This includes 10 which DJPR only completed after we requested them in February 2021.

Not updating centralised registers

DHHS also processed a high volume of CIPs and had gaps in internal record keeping. For example, in February 2021, DHHS provided us with a copy of its 2020–21 CIP register that only included 39 transactions. In May 2021, DHHS provided an updated register with 208 transactions. DHHS’s register does not include the date each transaction occurred.

However, we know that several transactions that it added to the May 2021 version had been completed in 2020. An April 2021 internal audit report on rapid procurement also found gaps in DHHS’s CIP record keeping.

Source: VAGO, based on information from DJPR and DHHS.

Aside from their annual reporting obligations to VGPB, there is no mandated timeframe within which departments need to update their internal CIP registers. However, without up-to-date, accurate data it is difficult for departments to progressively monitor whether staff are complying with CIP policies.

It is particularly important that departments keep up-to-date records, as it can be difficult for staff to remember why they made decisions after the fact. For example, DHHS has an incomplete critical incident report for one $875 000 transaction because it was not completed at the time and the responsible staff member has since left.

Departments’ reporting to VGPB

In addition to records about individual transactions, departments need to report all CIP transactions to VGPB. Departments did not consistently capture all CIPs related to COVID-19 in their reports to VGPB.

As shown in Figure 2H, all departments except DTF and DPC reported different values of CIPs to VGPB compared to the values they reported to us or recorded in their own procurement registers.

Figure 2H: Values of departments’ CIPs related to COVID-19 for 2019–20

| Department | Total value reported to VGPB | Total value reported to VAGO |

|---|---|---|

| DET | $30.1 million | $34.8 million |

| DELWP | $0 | $85 500 |

| DHHS | $47.8 million | $42.8 million |

| DJCS | $38.6 million | $33.7 million |

| DJPR | $113.8 million(a) | $177.8 million |

| DPC | $4.6 million | $4.6 million |

| DoT | $2.3 million | $2.9 million |

| DTF | $0 | $0 |

| Total | $237.2 million | $295.8 million |

(a)This figure excludes contracts where the total value has not yet been finalised.

Source: VAGO, based on the VGPB Annual Report 2019–20 and information from departments.

Although DJPR reported its CIPs to VGPB, it was the only department that qualified its figures by noting that they did not include any contracts where the final cost has yet to be finalised.

As mentioned in Section 2.1, DELWP did not report any CIPs related to COVID-19 for 2019–20 to VGPB. Figure 2I discusses weaknesses in DELWP's reporting to VGPB.

Figure 2I: DELWP’s reporting to VGPB

DELWP advised VGPB that it did not make any purchases using its CIP policy for 2019–20. However, a December 2020 whole-of-government review on PPE purchasing noted that DELWP had made two CIP purchases in the year to date. DELWP subsequently gave us information about the two CIPs. It later advised us that it had in fact made one CIP transaction related to COVID-19 in 2019–20 and three in 2020–21.

DELWP advised us that it has since disclosed the CIP not reported for 2019–20 to VGPB. The conflicting information about the number of CIPs completed suggests that DELWP did not have sufficient oversight over how staff used its CIP policy. This means that it cannot be confident that it has an accurate record of all procurements related to COVID-19.

Source: VAGO, based on information from DELWP.

2.3 Monitoring how staff used procurement policies

DoT, DJCS, DET and DPC took a better-practice approach to monitoring how staff used their CIP policies for higher-value procurements. This was important because, as noted in Section 2.1, most staff had never used CIP policies before.

The following are examples of strong oversight:

- DoT required staff to seek the approval of the central procurement team for all CIP procurements.

- DET, DPC and DJCS procurement staff were involved in transactions that they considered high value.

- DET and DJCS procurement staff conducted 'spot checks' to ensure staff were using CIP processes for legitimate reasons.

- DPC set up a procurement governance committee to oversee all procurements related to COVID-19 valued at more than $350 000.

In contrast, DHHS and DJPR, which made the highest value procurements related to COVID-19, had limited central oversight over how staff used CIP policies. This means they cannot assure themselves that staff only used CIP processes when appropriate and continued to consider probity and value for money.

DHHS advised us that staff in business units had to engage its central procurement team for all procurements that would result in a contract, regardless of value. However, there were instances of staff ignoring this practice and other examples of staff disregarding the central team's advice.

In one example, a business unit sought advice from DHHS's central team about a procurement to support clients with mental health and alcohol and other drug issues during COVID-19. Despite the central unit advising against an up-front payment, the business unit paid approximately $600 000 up-front. It then decided it no longer wanted to engage the supplier and had to negotiate repayment. DHHS has since updated its CIP policy to strengthen the central procurement team’s oversight role.

Figure 2J discusses issues relating to lack of central oversight of the procurement of DHHS's digital contact tracing platform.

Figure 2J: Procuring DHHS's Test, Trace and Isolate contact tracing system

In the second half of 2020, DHHS procured a new digital platform for contact tracing known, as the Test, Trace and Isolate system, for approximately $11.5 million.

In August 2020, DHHS engaged a professional services firm to provide ‘vendor validation and selection’ services to assist with procuring a new digital contact tracing system. DHHS's ICT division did not seek the advice of the central procurement team and did not approach more than one professional services firm for advice. DHHS approached only two suppliers to provide quotes for delivering the contact tracing platform. DHHS advised us that it notified its central procurement team of the engagement on the same day it appointed the supplier.

The supplier started work on the project in August 2020, but DHHS did not finalise a contract until 24 October 2020. Prior to finalising the contract, DHHS negotiated with the supplier to exit the project due to delivery difficulties. This was even though DHHS had no clearly agreed performance measures against which to assess supplier performance. DHHS paid a total of $4.48 million to this supplier.

On 26 October 2020, the supplier ceased working on the project. DHHS then engaged a professional services firm that DHHS had initially engaged to undertake vendor selection for the project to continue implementing the platform. This second contract was valued at $11.5 million. It is not clear when DHHS approached the professional services firm about taking over the project.

Although the professional services firm completed conflict of interest declarations in relation to its initial role in the project, it did not update these when DHHS later selected it to implement the project. There is no evidence that DHHS actively considered the possible conflict of interest of hiring the firm that was involved in identifying the original supplier, and thus had greater knowledge of the project than any other bidder, to implement the same project.

DHHS advised the Minister for Health that it engaged the professional services firm to complete the project through a rapid competitive evaluation process. DHHS advised the minister that there were three competitive proposals, including an internal proposal from the department’s own ICT team. However, DHHS advised us it does not have an evaluation report for this procurement. While it may be necessary for departments to part ways with suppliers, DHHS could have avoided wasting time and money, and ensured it documented its decision-making appropriately, by using its central procurement team to ensure that:

- a contract was in place before services commenced

- the supplier agreed to all fees, including any exit fees up-front

- staff prepared complete evaluation reports and kept appropriate records.

Note: DHHS entered into a second contract with a consortium led by the professional services firm.

Source: VAGO, based on information from DHHS.

DJPR advised us that its central procurement team provided advice to business units on request, but it did not document this advice or follow up to confirm that staff followed it. In September 2021, our Managing Conflicts of Interest in Procurement report found that DJPR staff responsible for procuring hotel security services engaged a provider that was not on the security services SPC. Although they subsequently received advice from the central procurement team and central agencies to use SPC providers or apply for an exemption from the SPC, DJPR staff continued to use a company not on the SPC without an exemption.

Our September 2021 report explored this issue further. The DJPR staff who engaged the non-SPC provider did not have training in procurement or previous experience in procuring security services. Not going through the central procurement team meant that staff were not aware of the SPC for security services until after they had engaged the provider.

In April 2021, DJPR moved to a more centralised procurement model, with staff now required to gain approval from the central procurement unit for any procurement above $100 000. DJPR advised us that this change was not in response to COVID-19 procurement issues. Instead, it was part of broader efforts to create a more cohesive sense of DJPR as ‘one department’ rather than siloed business units. However, our findings and those of the Hotel Quarantine Board of Inquiry demonstrate the need for tighter central control over procurement.

2.4 Challenges relating to PPE procurement

Victoria did not have a PPE stockpile prior to the pandemic. This meant that departments needed to rely on unfamiliar suppliers and often paid high prices to meet the urgent need for supplies. Despite this, departments responded quickly to the crisis and considered value for money as best they could under the circumstances.

PPE procurement for the health sector

The Victorian health management plan for pandemic influenza 2014 states that in the event of a pandemic, the former DHHS would manage and distribute PPE from the National Medical Stockpile and the Victorian Medical Stockpile.

However, in December 2020, the Australian National Audit Office’s report Planning and Governance of COVID-19 Procurements to Increase the National Medical Stockpile found that prior to the pandemic, Victoria did not have a PPE stockpile. This is because Victoria’s public health system has a devolved governance model, where individual health services manage their own PPE supplies. Only Victoria and the Northern Territory did not have a PPE stockpile for any type of PPE.

As discussed in Section 1.3, in March 2020 the government set up a state supply chain involving DHHS, HSV and Monash Health to source, purchase and distribute PPE for the health sector.

|

Agencies that were part of the state supply chain identified risks to buying PPE during the pandemic, including that they … |

They tried to address this by … |

|

might not be able to procure PPE that met required quality standards and sizes. |

researching PPE models and brands that met relevant standards and health services’ requirements. |

|

would not be able to source sufficient stock volumes or fail to meet delivery timeframes. |

placing orders with multiple suppliers. |

|

might not receive stock from other countries that may block deliveries due to diplomatic tensions. |

sourcing stock from various locations, including local suppliers where possible. |

In May 2021, HSV noted that 48 per cent of its PPE suppliers were new and it was able to order only about 11 per cent of PPE from Australian manufacturers. Although DHHS and HSV tried to mitigate the risk of using unfamiliar overseas suppliers, they still experienced stock delays.

Also, DHHS could not use more than $172 million worth of stock that was not fit for purpose. Most of this comprised:

- 33 million N95 respirators at a cost of $110 million

- 14 million surgical face masks at a cost of $9.5 million.

Reasons for ‘quarantining’ this stock included:

-

health services discovering that some respirators did not meet the relevant standards so they could not be used by health workers

The Therapeutic Goods Administration is the Australian Government body that regulates medical goods and devices.

- the Therapeutic Goods Administration updated its advice on PPE standards as the pandemic evolved. This meant that some masks purchased early in the pandemic could not be used for their intended purpose.

HSV and DH have advised us that they are now looking at ways to minimise waste by repurposing PPE items that do not meet the relevant standards.

In June 2020, DHHS cancelled PPE orders worth $68 million. Reasons for cancellations included delivery delays, stock quality issues and no longer requiring stock. DH advised us that it is considering cancelling a further $53 million in orders. As it has paid $7 million of this up-front, unless it can negotiate with suppliers to agree to the cancellations, it will not be able to recoup the initial payment.

In addition, there were some gaps in how DHHS and HSV managed the risk of items not being delivered. In September 2020, our review of DHHS and HSV’s financial records identified that neither could supply evidence that they had insured PPE in transit from overseas.

PPE pricing

Due to the lack of a stockpile and high demand, DHHS paid higher than usual prices for PPE. Early in the pandemic, DHHS’s Equipment and consumables team considered value for money when assessing offers from suppliers. HSV supplied DHHS with price estimates to guide this work. For example, HSV advised that N95 masks typically cost between $1.02 and $2.23. However, demand for PPE was high and countries were competing for limited stock. As a result, HSV often had to pay considerably more than normal prices. For example, HSV paid 16 times the pre-pandemic price for gloves, paying up to $0.14 per unit.

However, HSV did negotiate on prices with suppliers where possible. For example, in April 2021, HSV managed to secure a price reduction of $1.84 million with a supplier of N95 respirators.

As shown in Figure 2K, DHHS also paid varying prices for hand sanitiser, which fluctuated from between $3.27 and $7 per 500 ml bottle during 2020.

Figure 2K: Prices paid by DHHS for hand sanitiser throughout 2020

Note: All values are based on 500 ml bottles purchased during 2020.

Source: VAGO, based on information from DHHS.

PPE procurement for non-health agencies

The lack of a PPE stockpile was a particular issue for non-health services, as staff typically had no familiarity with the PPE products they were sourcing and did not have access to pre-vetted suppliers or established supply chains. However, non-health agencies did use the office supplies SPC where possible and conducted appropriate due diligence over new suppliers.

Victoria has a single-vendor SPC for stationery and office supplies, which covers masks, sanitiser, wipes and gloves. Throughout 2020, DJCS and DET made approximately $2.4 million and $245 000 worth of purchases respectively from this SPC.

However, departments advised us that the SPC quickly became overwhelmed with demand and they needed to find other suppliers.

When using new suppliers, departments made efforts to consider value for money and probity, including:

- approaching multiple suppliers

- benchmarking prices

- sharing information among agencies about legitimate suppliers

- checking the Australian Securities and Investments Commission register to confirm that suppliers were legitimate businesses