Realising the Benefits of Smart Meters

Overview

In 2006, the Victorian Government mandated the rollout of electricity smart meters to all households and small businesses across Victoria under the Advanced Metering Infrastructure (AMI) program.

The audit examined whether the deficiencies identified in our 2009 audit have been addressed and whether the Department of Economic Development, Jobs, Transport & Resources (DEDJTR) can demonstrate that the AMI program is delivering expected consumer benefits and is set up to maximise longer-term benefits.

The recommendations from VAGO's 2009 audit have been substantially addressed, however, many of the costs and benefits cannot be directly controlled by the state.

By the end of 2015, Victoria's electricity consumers will have paid an estimated $2.239 billion for metering services, including the rollout and connection of smart meters. In contrast, while a few benefits have accrued to consumers, benefits realisation is behind schedule and most benefits are yet to be realised. Current estimates suggest that approximately 80 per cent of the expected benefits could be achieved. There are significant uncertainties and risks associated with achieving these benefits, and consumers may experience a higher net cost than the most recent $319 million estimate.

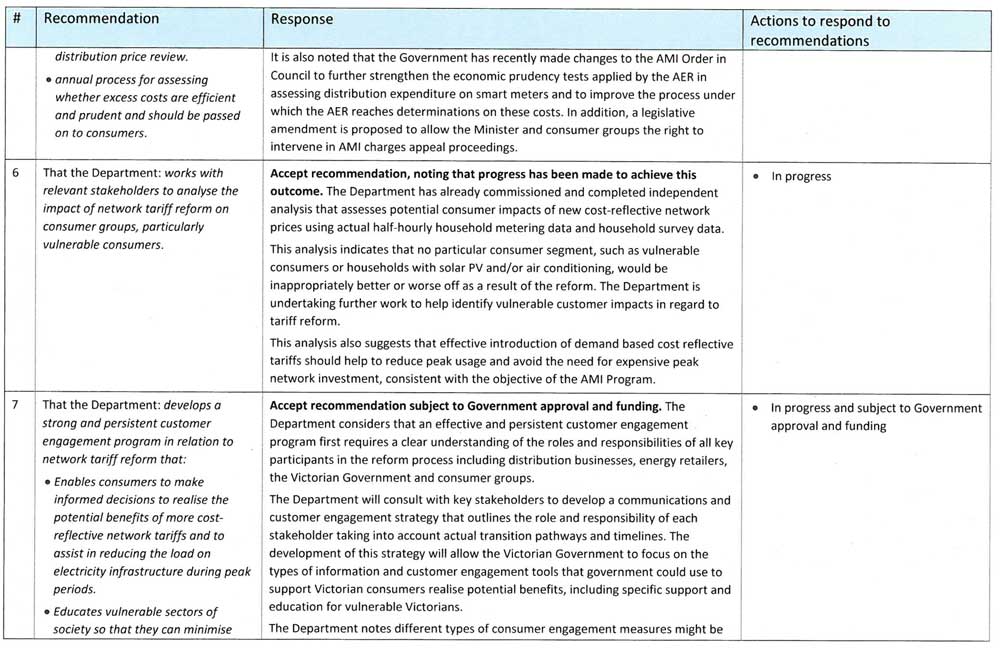

Given that consumers have been progressively paying for the program since 2009 and ultimately pay the full costs, DEDJTR must focus now on actions that will accelerate the achievement of any benefits to consumers and avoid any further increase in the net costs of the program.

Realising the Benefits of Smart Meters: Message

Ordered to be published

VICTORIAN GOVERNMENT PRINTER September 2015

PP No 42, Session 2014–15

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on the audit Realising the Benefits of Smart Meters.

The audit examined whether the Department of Economic Development, Jobs, Transport & Resources (DEDJTR) can demonstrate that the Advanced Metering Infrastructure (AMI) program is delivering expected consumer benefits and is set up to maximise longer-term benefits.

I concluded that, while VAGO's 2009 recommendations have been substantially addressed, these changes have not been sufficient to overcome manifest problems with the program's design―that the control of costs to consumers and their realisation of benefits cannot be directly controlled by the state. Approximately only 80 per cent of original benefits are forecast to be realised, and consumers may experience a higher net cost than the most recent $319 million estimate.

However, significant opportunities to maximise benefits exist and it is the responsibility of DEDJTR to ensure that the maximum value of benefits will be passed on to consumers from the AMI program, who have paid for it.

Yours faithfully

John Doyle MBA FCPA

Auditor-General

16 September 2015

Auditor-General's comments

John Doyle Auditor-General |

Audit team Andrew Evans—Engagement Leader Verena Juebner—Team Leader Jennifer Chan—Graduate Analyst Engagement Quality Control Reviewer Kristopher Waring |

In 2006, the Victorian Government mandated the rollout of smart meters to all households and small businesses across Victoria. Consumers have been paying for this since 2009, not through tax dollars, but through additional charges applied to their electricity bills. When the rollout was announced, the benefits were promoted widely. However, when the government reviewed the program in 2011 it was clear there would be no overall benefit to consumers, but instead a likely cost of $319 million. When the continuation of the rollout was announced at this time it was said to be the 'better option' for Victoria, but it was not made clear that this was based on excluding the costs that consumers had already incurred.

By the end of this year, Victorians will have paid an estimated $2.239 billion in metering charges, which includes the cost of the rollout and connection of smart meters. Worryingly, the Department of Economic Development, Jobs, Transport & Resources does not have a good understanding of the cost of the program, which it does not track. I do not agree with the department's views that it should not report publicly on costs and its assertion that it would have to take on the role of the regulator or replicate its work. Nor do I accept the department's assertion that the costs incurred to date do not warrant monitoring and reporting as these are 'sunk', noting instead that only benefits tracking is what is important.

Of course benefits tracking is crucial, but the success or otherwise of the smart meters program cannot be properly scrutinised without an understanding of the costs of achieving the benefits. Further, none of the arguments raised by the department absolve it from providing full transparency to consumers and government. After all, consumers had no choice in paying for the rollout, but they are surely entitled to clear and transparent reporting of all aspects of the program.

I also found a real risk that the expected benefits will not be achieved. Current forecasts predict consumers will only receive approximately 80 per cent of the benefits identified in the most recent 2011 cost-benefit analysis—provided that all issues and risks are effectively mitigated—and as costs increase over the life of the program, the final net cost to consumers is likely to rise above $319 million.

Further, the single largest benefit achieved to date—which accounts for around 40 per cent, or $1.4 billion of the total expected $3.2 billion benefits from smart meters over the life of the program—relates to the avoided costs of accumulation meters for things such as their installation and manual meter reading. These costs are saved as smart meters replace the old accumulation meters, but they do not represent any additional value generated by the program. Furthermore, the overall costs of the smart meters program significantly outweigh these savings.

The reality of the smart meter rollout is that the state approved a program, many of the costs of which it could not directly control, nor drive many of the benefits ascribed to it. Nevertheless, the rollout is now complete and Victoria has infrastructure in place that might lead to future innovation and benefits to consumers. Government's role must now be to help consumers to get the most out of what they have paid for.

Achieving these benefits relies heavily on the majority of consumers changing behaviour, including by finding a better electricity deal and changing consumption patterns. In this respect, a key role for government is in providing consumers with a better understanding of the benefits that smart meters can provide and encouraging the required behaviour change. Yet despite improvements to consumer education since our 2009 audit, market research conducted in early 2014 found that two-thirds of Victorians do not understand what the benefits provided through smart meters are, and many are still unaware of their ability to help minimise energy bills.

Consumers who do take action will not only benefit directly, but changes in behaviour will also achieve cost savings for electricity distributors and retailers and. Over the longer term, these cost savings are expected to flow through to all customers in the form of smaller increases in bills. However, this relies on factors such as retail competition and the regulator passing these savings on. Again, these processes are beyond the direct control of the state and may take many years. Nevertheless, the department must do all it can to ensure that all benefits are passed on to consumers.

I have made a series of recommendations, including to track and report on costs, improve consumer education and facilitate benefits pass-through, which if addressed will maximise the benefits to consumers. Disappointingly, the department has failed to satisfactorily respond to the issues raised by my report. I strongly urge the department to review its position in the interests of all consumers, and to fully address my recommendations. I intend to closely monitor the department's progress in this regard.

Lastly, I note the department has misleadingly suggested that my report exhibits 'systematic pessimism' that is not justified by the evidence. This assertion fails to recognise that my audits must be conducted in accordance with the Australian Auditing and Assurance Standards which require auditors to exercise professional judgement and scepticism in assessing the sufficiency and appropriateness of audit evidence supplied by agencies. The conclusions I have reached in this report reflect such an assessment, on the quality of the evidence supplied by the department.

John Doyle MBA FCPA

Auditor-General

September 2015

Audit Summary

Introduction

In 2006, the Victorian Government committed to the Advanced Metering Infrastructure (AMI) program which involved replacing existing electrical metering infrastructure in all Victorian residential and small business premises with digital smart meters by December 2012. At that time, this was expected to involve the rollout of 2.6 million meters to 2.4 million sites. Before the rollout commenced in 2009, the deadline for completion was changed to December 2013.

The 2005 business case anticipated a net incremental benefit of $79 million[1] relative to a 2004 cost-benefit analysis for the rollout of interval meters. Key expected benefits of smart meters were to:

- improve consumers' ability to monitor and control their electricity use, potentially allowing for cheaper and more efficient energy use

- reduce the cost to industry of planning and managing power supply, potentially leading to lower retail prices for consumers

- increase retail competition through new services, potentially resulting in a greater choice of retail offerings to consumers.

In 2009, VAGO released its report, Towards a 'smart grid'—the roll-out of the Advanced Metering Infrastructure, which was highly critical of the original business case. It also made a number of recommendations including to improve governance and stakeholder engagement, reassess the economic viability of the smart meter program by updating the cost-benefit analysis (CBA) to reflect existing and emerging risks, and to assess the impact of changes to scope and underlying assumptions.

In 2011, the government reviewed the AMI program and decided to continue to roll out smart meters to all Victorian residential and small business customers by 31 December 2013.

This audit assessed whether the Department of Economic Development, Jobs, Transport & Resources (DEDJTR) has effectively addressed recommendations from VAGO's 2009 audit, and can demonstrate that the AMI program is delivering expected consumer benefits and is set up to maximise longer-term benefits.

1in present value terms at 2005 in 2005 dollars.

Conclusions

By the end of 2015, Victoria's electricity consumers will have paid an estimated $2.239 billion[2] for metering services, including the rollout and connection of smart meters. The net position of the program has changed significantly since its inception, and there is now expected to be a substantially increased net cost to consumers over the life of the program.

In contrast, while a few benefits have accrued to consumers, benefits realisation is behind schedule and most benefits are yet to be realised. Current estimates suggest that approximately 80 per cent of the expected benefits could be achieved. However, there are significant uncertainties and risks associated with achieving these benefits, which are not within the control of the state.

There is a risk that the AMI program's most recent 2011 estimate of a net cost of $319 million[3] to consumers may worsen as costs are projected to increase and benefits remain decidedly uncertain. Other factors increase this risk even further, such as the move to national competitive retail metering from 2017, which could further diminish the benefits of the AMI program and expose those consumers who choose to have the smart meters installed under the AMI program replaced by other, competitively provided meters to additional costs.

The 2011 CBA is the fourth time that the costs and benefits of the AMI program have been analysed in just 10 years. In each analysis since our 2009 audit the estimated costs have increased and the benefits have diminished. This continual change highlights the serious flaws in the program's original business case which we identified in our 2009 audit, as well as the unrealistic assumptions around the achievability of the costs and benefits which were beyond the control of the state. DEDJTR has advised that it is now reassessing the expected benefits of the program for a fifth time, as many of the 2011 assumptions have materially changed.

The three departments which have administered the AMI program have taken action to address most of the recommendations from VAGO's 2009 audit. They have strengthened program governance structures, the oversight and management of risks, improved communications with consumers and regulators, and increased the scrutiny of costs to inform regulatory decisions. However, these changes have not been sufficient to overcome the manifest problems with the estimation and control of costs and benefits, and to ensure the realisation of the projected benefits for consumers.

By the end of the 31 December 2013 deadline, 92.79 per cent of the installation of smart meters was completed. By June 2014, the installation was 98.62 per cent complete, however, approximately 13.5 per cent of households and small businesses did not have a smart meter that could be remotely read.

Given that consumers have been progressively paying for the program since 2009 and ultimately pay the full costs, DEDJTR must focus now on actions that will accelerate the achievement of any benefits to consumers and avoid any further increase in the net costs of the program.

2nominal dollars, undiscounted.

3in present value terms at 2008 in 2011 dollars.

Findings

Costs will increase

The average residential household has paid around $760[4] since 2009 in metering services, which included the costs associated with installing and maintaining smart meters and related infrastructure and systems. These fees are applied to electricity bills but are not itemised.

Despite departmental action to influence the Australian Energy Regulator's (AER) scrutiny of metering costs, total metering charges imposed on consumers over the period 2009 to 2015 have been approximately $285.7 million[5], or 11.4 per cent, over the distributors' original forecasts. The costs for 2014 and 2015 are forecast to be 88 per cent and 28 per cent over budget respectively due to a delay in the installation of meters.

Costs are forecast to reduce from 2013 to 2023 but increase again sharply from 2024, if the meters are replaced from that time as anticipated by the 2011 CBA. Consequently, there is a risk that the expected net cost to consumers over the life of the program may increase above the most recent estimate of $319 million[6].

Benefits realisation is falling behind schedule

In 2011, the government commissioned a CBA which has become the benchmark against which DEDJTR measures benefits realisation.

Benefits realisation as at 2014 had already fallen behind the 2011 CBA forecast and current projections are that consumers can only expect to achieve approximately 80 per cent of the full benefits to 2028. However, achieving these benefits is subject to many assumptions that have not materialised, and is dependent on the actions of many stakeholders.

The single largest benefits category of the AMI program relates to the avoided cost of replacing and manually reading the old accumulation meters. However, accumulation meter costs have been replaced with smart meter costs that are much higher. While the program has reported $591.99 million[7] in these avoided costs to 2014, which is in line with the 2011 forecast schedule, this does not represent any additional value generated by the AMI Program.

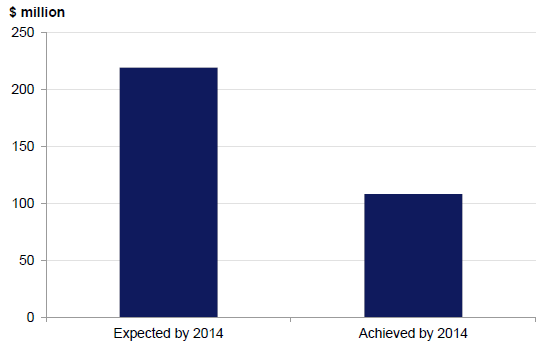

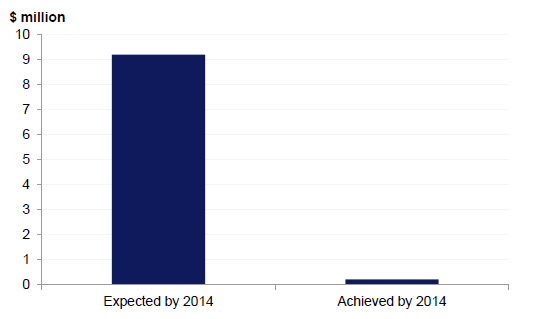

Meanwhile, the other benefits categories, which represent actual added value from the AMI program, are falling well behind schedule. This is due, in part, to the delay in the finalisation of the smart meter rollout, the fact that initial flexible tariffs did not necessarily compare favourably with flat tariffs and a perceived waning interest in flexible pricing. These are:

- benefits associated with the uptake of innovative tariffs and demand management—which has achieved only 2.5 per cent of expected benefits to be realised by 2014

- benefits that come from network operational efficiencies—which have achieved 49.32 per cent of expected benefits to be realised by 2014.

Benefits realisation by consumers is uncertain

Few of the benefits accrue directly to consumers, and they clearly rely on consumer action to take advantage of these services. For instance, consumers can take up flexible pricing offers that may result in savings on their electricity bills. Similarly, consumers may benefit directly if they move house and take advantage of the cost reduction in de-energising and re-energising power supply, arising from the ability of power companies to now do this remotely using smart meters.

The majority of expected benefits for consumers from the AMI program are cost savings that accrue first to distributors and to retailers that must be passed on to consumers through a chain of action, including regulatory decisions and competitive action. However, the state cannot directly control these processes.

As an example, consumers' reaction to flexible pricing—which provides higher electricity prices at peak times—is assumed to reduce overall peak electricity consumption. This is expected to reduce or defer distributors' need to upgrade electricity networks to meet demand, which results in cost savings for distributors. However, these cost-savings can only be realised by consumers if they are passed on to retailers through regulatory pricing decisions made by the AER. Retailers must then pass these savings on to consumers through competitive pressures. As such, the actual transfer of these types of benefits to consumers is unclear as these actions cannot be fully determined in advance.

Most of the cost savings achieved by distributors from smart meters are yet to flow through to retailers and on to customers. The AER is currently preparing for its next Victorian distribution pricing decision which will take effect from 1 January 2016. This provides an opportunity for cost savings achieved by distributors to be passed on to retailers and then to customers. DEDJTR should be vigorously prosecuting this process with its own rigorous analysis of the distributors' ongoing costs to determine the benefits that should be flowing to retailers and to consumers.

The amount of expected benefits may no longer be valid

The amount of overall benefits from the AMI program as calculated in the 2011 CBA relied on many assumptions being met. For instance, the 2011 CBA estimated that $778 million of benefits associated with the uptake of flexible tariffs and demand management would be realised by consumers over the life of the program to 2028. However, this figure is based on complex assumptions around the rate at which households will take up new pricing offers.

These assumptions are not currently being met. By 2014, the 2011 CBA expected 4 per cent of consumers to have taken up flexible electricity price offers, however, only 0.27 per cent have done so. This is due to a slower than expected smart meter rollout, the moratorium on the introduction of flexible pricing, the fact that initial flexible tariffs did not necessarily compare favourably with flat tariffs and perceived waning interest in flexible pricing. At this rate, it is unclear whether the expected uptake of 15 per cent by 2017 will be achieved. Accelerating the uptake and benefits from flexible price offers relies on retailers providing better value-for-money options compared to the existing flat tariffs, and increasing consumer awareness of the availability and benefits of such offers.

The department is re-evaluating the expected benefits

DEDJTR now acknowledges that some key assumptions underpinning the expected benefits realisation as defined in the 2011 CBA may no longer be valid. It proposes to review these assumptions but remains committed to achieving the targets outlined in the 2011 CBA. This review is again likely to change the value of anticipated benefits through to the end of the program.

We acknowledge that the nature and amount of benefits may change—especially as the technology is rolled out and market participants, policy makers and customers experience and better understand the potential of AMI over time. In this context, it is encouraging that DEDJTR will actively review the expected benefits. However, it is concerning that the fundamental assumptions underpinning the 2011 CBA, which were used to justify the continued rollout of smart meters, have become so uncertain as to require, yet again, a review of future targets for benefits realisation.

Program governance and risk management

DEDJTR has recognised its leadership role with respect to the AMI program and has put in place governance structures to strengthen its oversight and management of program risks.

It has established clear accountabilities and responsibilities to enable it to better identify and manage risks, including establishing the AMI Program Steering Committee, Ministerial Advisory Council, and Program Management Office. DEDJTR has also developed a risk management plan to identify, evaluate and mitigate future risks, which is reviewed regularly by its Program Steering Committee.

DEDJTR has taken action to address program issues. For example, it has provided distributors with an incentive to complete the rollout by requiring them to pay a rebate of $125 to customers at premises where:

- the distributor had failed to attempt to install a smart meter by 30 June 2014—this rebate was payable by 31 October 2014

- the smart meter installed was not functioning as required by 31 March 2015—this rebate was payable by 30 June 2015.

Six hundred and eighty households have received the first rebate as they do not yet have a smart meter installed, and approximately 90 per cent of eligible account holders received the tranche two rebates. DEDJTR has also been effective in influencing the AER in its scrutiny of distributors' metering costs that are recovered from customers through charges.

Consumer engagement and education

DEDJTR has demonstrated a strong focus on improving communications with consumers, including addressing consumer issues arising from the AMI program. Various evaluations of DEDJTR's communications campaigns have found that they have increased consumer awareness, and consumer use of My Power Planner as a tool to find a better electricity plan and save money.

However, despite the work to date, market research conducted in early 2014 found that two-thirds of Victorians did not understand what the benefits of smart meters were and many were still unaware of the link between their smart meter and saving money on their electricity bills. A very small number of Victorians still had a negative perception of smart meters due to misinformation and a lack of understanding.

DEDJTR needs to improve its communications to further promote the active use of smart meters to inform household energy consumption, and to encourage the uptake of flexible pricing. Consumer action is a key determinant of any future benefits realisation.

Future developments impacting on smart meter benefits

The amount of benefits that are expected to be achieved by the AMI program may be impacted by the introduction of competitive metering and network tariff reform.

National reforms to metering that are expected to be introduced from mid-2017 could mean that smart meters installed under the AMI program may be replaced by other, competitively provided meters, under nationally agreed arrangements. DEDJTR has acknowledged that the removal of distributor exclusivity in Victoria is a risk to the realisation of the benefits of the AMI program. It may also expose consumers to increased costs.

Network tariff reform, enabled by smart meters, is intended to create a fairer cost structure for consumers by removing cross-subsidies that exist in the current cost structure. However, the impact that network tariff reforms will have on different community groups is not yet well understood, and for some consumers network costs could increase.

DEDJTR should focus on developing a customer engagement program to explain the reasons behind these reforms, but also to protect vulnerable consumers from potential adverse impacts. It should also engage with the AER to introduce metering competition in a way that maintains AMI benefits for Victorian consumers.

Future actions to enhance benefits realisation

Despite expecting significant consumer and other benefits when the AMI program commenced in February 2006, the state has few options to influence—and no ability to directly control—costs to consumers and drive many of the benefits.

Nevertheless, DEDJTR has a responsibility to take an active role in implementing the AMI program to contain any further costs and adverse impacts and to maximise and accelerate the available benefits for consumers, who have paid for the rollout and connection of smart meters to date. The recommendations in this report highlight the key areas on which DEDJTR must focus its efforts so as to protect consumers and maximise their benefits realisation.

Public reporting

Reporting on the AMI program has been inadequate. While consumers pay for the costs of the smart meter rollout on the promise of future benefits, there is limited public reporting on the program in DEDJTR's annual report and in the Budget Papers. In particular, there is little clear and transparent knowledge of costs to consumers to date and no public reporting of either the costs or benefits of the program.

What exists does not provide sufficient information for consumers to assess the program's performance in terms of the costs incurred to date and whether benefits have been realised. This reduces transparency and accountability for this program.

4nominal dollars, undiscounted.

5nominal dollars, undiscounted.

6in present value terms at 2008 in 2011 dollars.

7All benefits values are expressed in net present value at 2014 in 2011 dollars, unless stated otherwise.

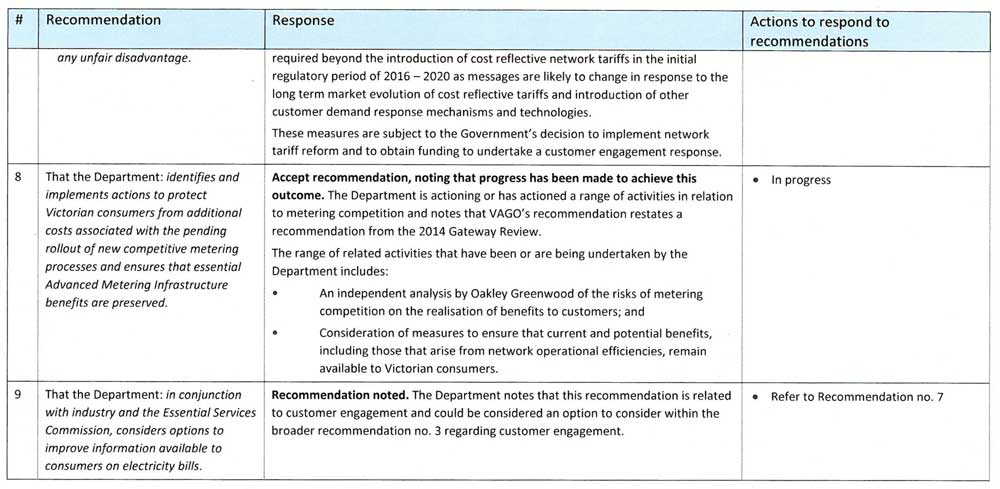

Recommendations

That the Department of Economic Development, Jobs, Transport & Resources:

- develops Budget Paper measures that report performance against the objectives of the Advanced Metering Infrastructure program, and publicly reports annually on costs incurred and benefits achieved

- improves its consumer education to focus on the opportunities to use smart meters to reduce energy consumption, and to take up flexible retail pricing offers, and use other tools, to reduce bills

- works with distributors and retailers to identify and implement clear systems and processes for monitoring the changes in energy consumption and peak demand

- works with distributors and retailers to develop and implement systems and processes to more effectively measure and track network benefits to enable these to be passed on to consumers

- effectively influences the Australian Energy Regulator's:

- decisions related to the passing on of network efficiency benefits to consumers in the 2016–2020 distribution price review

- annual process for assessing whether excess costs are efficient and prudent and should be passed on to consumers

- works with relevant stakeholders to analyse the impact of network tariff reform on consumer groups, particularly vulnerable consumers

- develops a strong and persistent customer engagement program in relation to network tariff reform that:

- enables consumers to make informed decisions to realise the potential benefits of more cost-reflective network tariffs and to assist in reducing the load on electricity infrastructure during peak periods

- educates vulnerable sectors of society so that they can minimise any unfair disadvantage

- identifies and implements actions to protect Victorian consumers from additional costs associated with the pending rollout of new competitive metering processes, and ensures that essential Advanced Metering Infrastructure program benefits are preserved

- in conjunction with industry and the Essential Services Commission, considers options to improve the information available to consumers on electricity bills.

Submissions and comments received

We have professionally engaged with the Department of Economic Development, Jobs, Transport & Resources, and the Department of Treasury and Finance throughout the course of the audit. In accordance with section 16(3) of the Audit Act 1994 we provided a copy of this report, or relevant extracts to those agencies and requested their submissions or comments.

We have considered those views in reaching our audit conclusions and have represented them to the extent relevant and warranted. Their full section 16(3) submissions and comments are included in Appendix B.

1 Background

1.1 Introduction

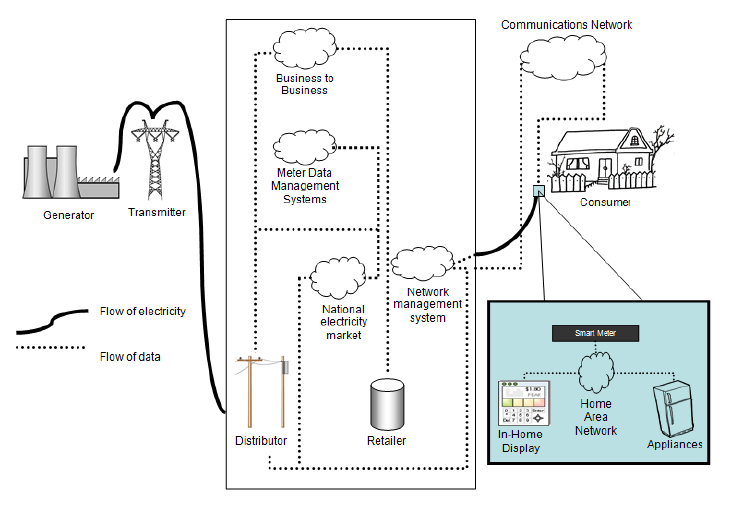

When an electrical appliance is switched on, power is instantly transmitted from a power station to the appliance. Although this occurs instantaneously, a specific sequence of events takes place to ensure the required electricity is delivered.

Key players involved in the supply of electricity are:

- generators who produce the electricity in power stations, using either fossil fuels, such as coal or gas, or renewable energy sources, such as wind, water or the sun

- one transmission company that owns and operates the high voltage electricity transmission network that transfers electricity from generators to distributors

- distributors who own and manage the network of poles and wires that takes electricity to the consumer

- retailers who buy electricity from generators through wholesale markets, pay transmission and distribution businesses for the use of their networks to transfer the electricity and then sell the electricity to their customers at different rates.

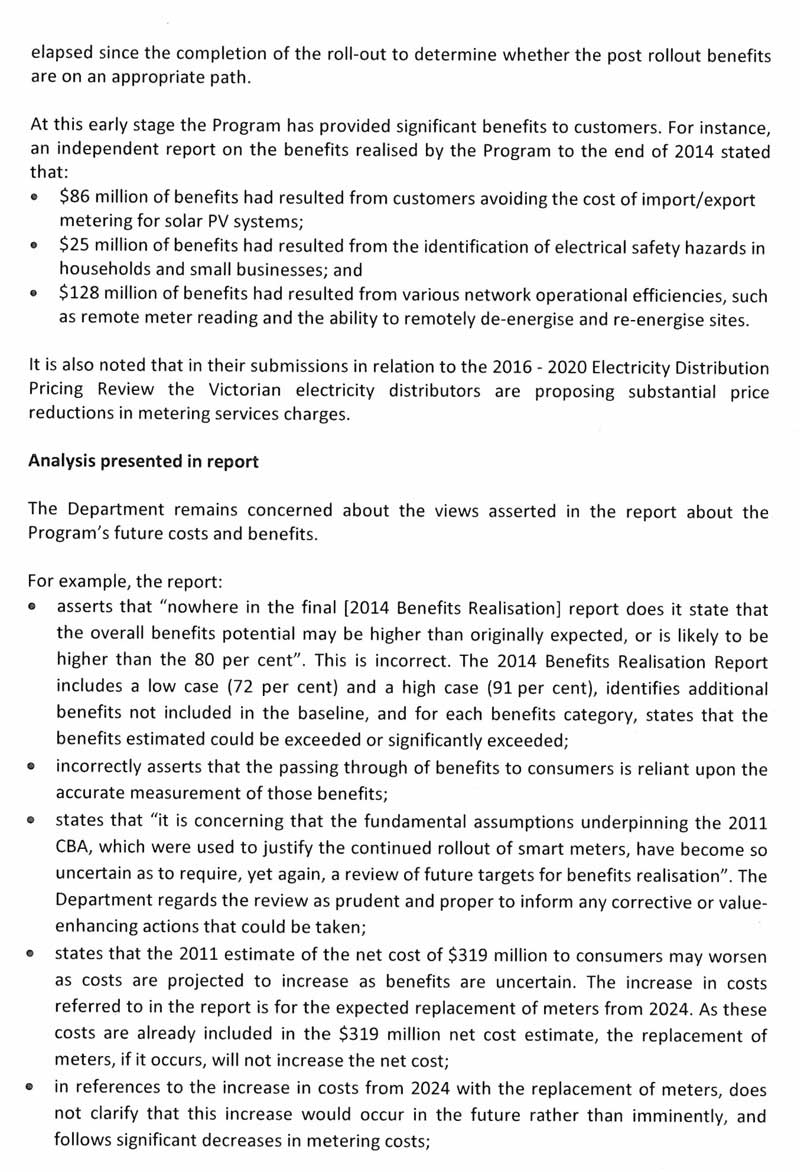

Figure 1A

How smart meters work

Source: Victorian Auditor-General's Office.

1.1.1 What is an electricity meter?

Electricity meters are used by retailers, distributors and transmission companies to monitor and manage the performance of the network and to identify the amount of electricity used by customers, including small businesses and households for the purposes of billing. They are also used by the Australian Energy Market Operator (AEMO) for the purposes of settling the wholesale electricity market. Figure 1B summarises the differences between common types of electricity meters.

Figure 1B

Types of electricity meters

|

Accumulation meters—are manually read and measure the accumulated electricity used between meter reads. A small number of accumulation meters are still in use in Victoria. Interval meters—are manually read and measure electricity use over short intervals, typically every half hour and differentiate consumption at different times of day. This allows electricity companies to offer more innovative tariffs such as where electricity use is charged differently at different times of day. This also allows the wholesale electricity market to be settled based on actual rather than estimated half hourly data. Smart meters—are also interval meters with the key difference of remote communications. They allow for remote meter reading (and eliminate the need for estimated meter reads), remote re-energisation and de-energisation (connection and disconnection) and remote outage and supply quality detection. They also allow for the automated control of appliances, such as a temporary adjustment to the thermostat setting of a connected air conditioner. Information from smart meters provides consumers with better consumption information, giving them more control over how they manage usage, and the ability to compare retail pricing offers and services. |

Source: Victorian Auditor-General's Office.

1.1.2 Origins and development of the Advanced Metering Infrastructure program

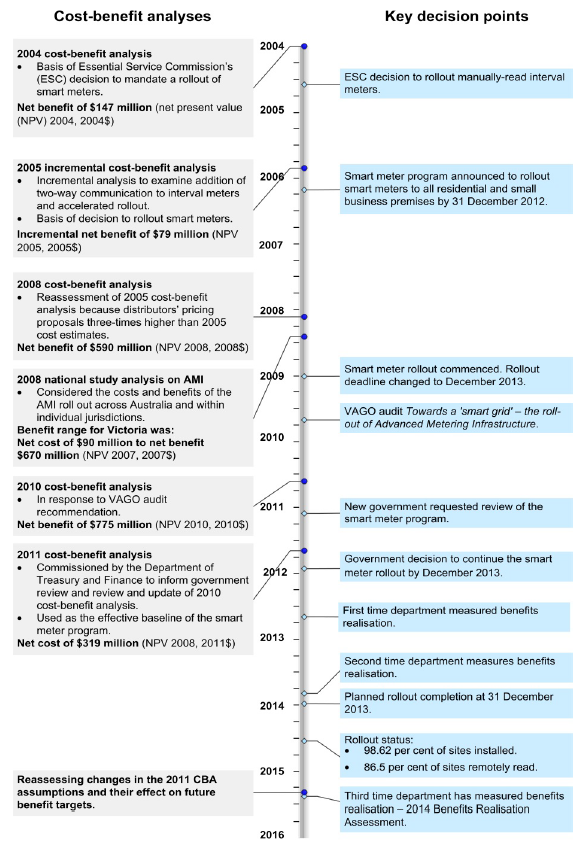

Figure 1C shows significant decisions and milestones associated with the Advanced Metering Infrastructure (AMI) program and key cost-benefit analyses (CBA) which have informed decision-making.

Figure 1C

Time line of key events of the AMI program

Note: The net benefits from each of these studies cannot be directly compared as assumptions in each CBA are different, in particular the reference year, dollar values, length of time over which the analysis has been undertaken, the discount rate and the number of customers assumed.

Source: Victorian Auditor-General's Office.

2004 decision to mandate the rollout of interval meters

In 2004, prior to the government decision to roll out smart meters under the AMI program, the Essential Services Commission (ESC) mandated the replacement of traditional accumulation meters throughout Victoria with manually-read interval meters. The ESC's decision was based on assessments that:

- market forces alone would fail to deliver a timely rollout of interval meters on a scale sufficient to make meter manufacture, installation and reading economical

- a net economic benefit would arise from the timely, mandatory rollout of interval meters.

In light of developments in metering technology, the then Department of Infrastructure (DPI) commissioned a CBA in 2005 that examined the incremental effect of adding two-way communications to the manually read interval meters and accelerated the rollout compared to the schedule that the ESC mandated for rollout in 2004. The study reviewed various assumptions used in the 2004 CBA but did not re-examine the basis for estimated costs and benefits in the 2004 study. Rather the 2005 CBA took the ESC's rollout decision as the base case.

However, as noted in our 2009 report, Towards a 'smart grid'—the roll-out of Advanced Metering Infrastructure, the incremental analysis approach used in the 2005 CBA introduced a number of uncertainties because:

- there was no visibility of the total costs and benefits of the AMI rollout on a consolidated basis—the characteristics of the AMI project were sufficiently different from the 2004 project to warrant a complete, separate review, and not

- an incremental analysis

- the reliance on the 2004 CBA meant that the validity of the assumptions used in that study were not confirmed against contemporary data.

2006 decision to roll out smart meters under the AMI program

The 2005 CBA underpinned the government's decision to suspend the rollout of interval meters and announce the AMI program, which mandated the rollout of smart meters to all of the 2.4 million residential and small business premises in Victoria at the time. The rollout was to occur over an accelerated period commencing in 2009 and ending in December 2012, later changed to December 2013. Victoria's five electricity distributors were responsible for the rollout and could recover their costs from consumers through a cost-recovery framework. Victoria was the only Australian jurisdiction to mandate a distributor-led rollout of smart meters.

Prior to the installation of smart meters, Victoria's residential and small business electricity consumers were paying ongoing metering service charges for their meters through their electricity bills. From 1 January 2009, these consumers started paying for smart meters through these charges. However, the Department of Economic Development, Jobs, Transport & Resources (DEDJTR) advised that it was only from 1 January 2010 that these metering services charges increased noticeably. This is because charges for 2009 were set on the same basis as the charges set by the ESC from 2006 to 2008 and the number of smart meters rolled out increased significantly from 2010.

The 2005 CBA expected the benefits of the AMI program to include:

- lower electricity costs because consumers would have both the information and the opportunity to better manage their energy use

- greater retail competition through the introduction of new services, such as prices tailored to suit consumers' needs

- more efficient electricity suppliers as a result of the ability to read meters and turn the electricity supply on or off without visiting the premises

- improved service quality through better network management, such as detecting and fixing faults remotely.

Since the 2006 decision, the AMI program has undergone a number of reviews and CBAs that have influenced critical program decisions. A full discussion of the historical detail is covered in our 2009 report.

Towards a 'smart grid'—the roll-out of Advanced Metering Infrastructure

In 2009, VAGO tabled its report Towards a 'smart grid'—the roll-out of Advanced Metering Infrastructure. The audit examined the advice and recommendations provided to government on the AMI program.

The report concluded that there were significant inadequacies in the advice and recommendations provided to government and that the CBA around the AMI decision was flawed and failed to offer a comprehensive view of the economic case for the program.

In particular, it questioned the 2005 CBA used to support the AMI program, as this CBA was based on the previously planned interval meter rollout. The characteristics of the AMI program were sufficiently different to warrant a complete, separate review and the consumer impact—including the benefits and costs—and the program risks were not clear.

The report also concluded that DPI needed to provide stronger governance and oversight of the program. DPI had failed to adequately communicate to consumers the purpose of smart meters and there was a need for a greater focus on the associated consumer issues.

The report made eight recommendations including to improve governance and stakeholder engagement, and to reassess the economic viability of the AMI program by updating the CBA to reflect existing and emerging risks, as well as the impact of changes to the scope and underlying assumptions.

In response to our 2009 audit, DPI commissioned reports in 2009 and 2010 to separately assess the costs and the benefits of the program. These reports became the basis of the 2010 CBA. All CBAs up to and including this one showed net benefits from the AMI program.

2011 government review and decision to continue the mandated rollout

After the change in government in late 2010, the new Minister for Energy requested that a full review of the program, including its costs and benefits, be undertaken by the Department of Treasury and Finance (DTF). The review was to:

- determine whether the mandated and accelerated rollout of smart meters by December 2013 to all residential and small business premises was the best option going forward

- respond to concerns about the program raised in the Auditor-General's report

- consider options to maximise and bring forward net benefits to consumers

- identify risks to the program and strategies to address these risks.

At this point in time approximately 700 000 smart meters had been installed. In 2011, DTF commissioned a full CBA that modelled three scenarios, with the following results:

- total AMI program over 2008 to 28—expected to result in net costs to customers of $319 million[1]

- continuing the mandated rollout of smart meters from 2012—expected to result in net benefits to customers of $713 million[2]—this was on the basis of not including the significant amount of costs already incurred between 2008 and the end of 2011

- removing the AMI mandate from 2012, where distributors are most likely to roll out smart meters only for new customers and to replace accumulation meters—expected to result in $343 million[3]net benefits.

This 2011 CBA was the first analysis that predicted a net cost to consumers over the life of the AMI program from 2008 to 28. This significant change was driven by the assessment that AMI costs had increased, and even though some additional benefits had been identified, the total expected benefits had reduced and would be delayed.

The 2011 CBA was the key external report informing the 2011 DTF review and government decision to continue with the AMI program.

DTF's advice to government recommended that it remove the mandate to complete the rollout on an accelerated time frame to the end of 2013. Instead, it recommended that government allow the electricity distributors to determine the rate at which smart meters are rolled out. Overall, this preferred option was thought to enable similar benefits to be realised as those estimated under a mandated rollout, but for lower total cost. DTF's advice suggested that this option would:

- provide an incentive to distributors to roll out smart meters to those remaining areas where they could provide the greatest value, rather than mandating the rollout to all relevant customers by 31 December 2013

- shift some responsibility and risk for the rollout back to the industry, and increase the acceptance of smart meters

- allow consumers to self-select and request a meter if they did not already have one installed.

However, the Department of Premier and Cabinet (DPC) did not support DTF's preferred option on the grounds that this particular option was not modelled in the 2011 CBA and the rollout would be contingent on the commercial decisions of the distributors. It also thought that:

- this option was inherently uncertain and may involve unidentified and unquantifiable risks

- charges for consumers could not be estimated at the time

- it would be difficult to communicate this option to consumers.

On the basis of the 2011 DTF review and advice from DTF and DPC, government decided to continue with the mandated rollout, scheduled for completion by the end of 2013, but with several changes aimed at bringing forward the benefits and reducing the risk of further cost increases. These changes included reforming program governance, discussed in Section 2.5.1, amending the cost-recovery framework for distributors, discussed in Section 2.4 and implementing initiatives such as subsidising in-home displays, discussed in Section 2.5.2.

Government announcements around continuing the rollout

The 2011 decision to continue with the rollout of smart meters by 31 December 2013 was based on not including the costs that consumers had already incurred to that date. When including all the costs associated with the program from 2008, the 2011 CBA found a net cost to consumers over the life of the program.

The government announced its decision to continue with the mandated rollout from 2012 as the 'better option' for Victoria, stating that 'at this stage of the program's life, the maximum benefit is delivered by continuing the rollout'. The government announcement did not make it clear that this was based on excluding the costs that consumers had already incurred. It also did not mention that continuing the mandated rollout would result in a net cost of $319 million to consumers over the life of the program.

Moratorium on flexible pricing

In its review, DTF also recommended removing the moratorium on flexible pricing that had been in place since March 2010. This moratorium was designed to ensure that retailers did not mass-market tariffs until a price comparator was in place for consumers, and until retail tariffs were aligned with distribution tariffs.

DTF recommended its removal because:

- it contributed to retailers not offering time-of-use tariffs to consumers on a mass scale

- time-of-use tariffs are essential to realising the full benefits associated with smart meters

- it contributed to the negative public perception surrounding time-of-use tariffs and other innovative tariff structures.

However the government agreed to extend the moratorium on time-of-use tariffs to the end of 2012. This was to ensure that any future flexible tariffs be voluntary and that flat tariffs continue to be available, and that any future introduction of flexible tariffs be supported by appropriate consumer protections. Effectively, this policy decision delayed the benefits to consumers associated with more innovative and cost effective tariff structures.

2014 Public Accounts and Estimates Committee Review

A 2014 Review of the Auditor‑General's Reports 2009–2011 by the Public Accounts and Estimates Committee (PAEC) found that, in the main, the then Department of State Development, Business and Innovation (DSDBI) had implemented the recommendations from VAGO's 2009 audit report. PAEC noted 'fundamental changes in how the department has approached' the program, noting that it 'appears that these changes have been lasting, with the department continuing to take an active leadership role in the AMI project and placing a focus on realising the consumer benefits'. PAEC urged 'DSDBI to remain vigilant about these issues to ensure consumer interests continue to be served'.

1in present value terms at 2008 in 2011 dollars

2in present value terms at 2012 in 2011 dollars

3in present value terms at 2012 in 2011 dollars

1.2 Expected costs and benefits

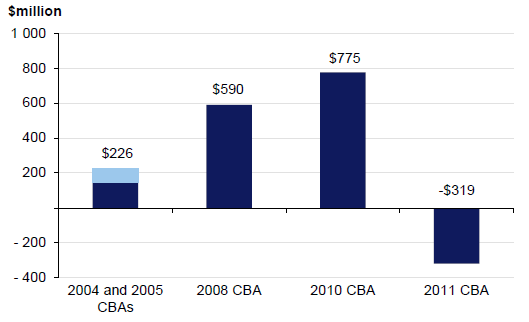

A high degree of uncertainty existed around the economic case for the program. As shown in Figure 1D, the net position of the program has changed significantly since its inception, and the fact that there is now expected to be a substantial net cost to consumers over the life of the program substantiates the flaws identified in our 2009 report.

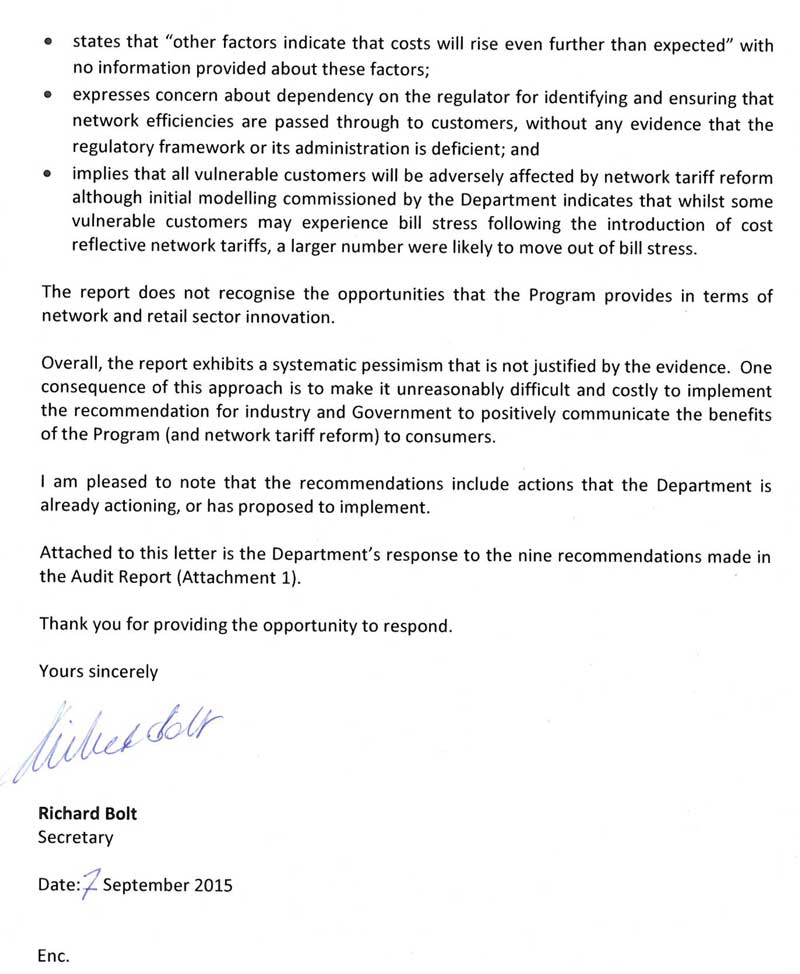

Figure 1D

Results of cost-benefit analyses showing the net benefits and costs of the AMI program 2008 to 28

Note: Light blue shows the 2005 net result, which is $79 million and incremental to the 2004 net benefit, which is $147 million. The net benefits from each of these studies cannot be directly compared as the assumptions in each CBA are different, in particular the reference year, dollar values, length of time over which the analysis has been undertaken, the discount rate and the number of customers assumed.

Source: Victorian Auditor-General's Office.

1.3 National move to competitive metering

In Victoria, electricity distributors are currently solely responsible for providing metering and related services to residential customers. However, the Australian Energy Market Commission (AEMC) is currently considering a rule change proposal to introduce competition in smart meter services to small customers.

This would mean that any person, including distributors, retailers or third parties, could install and maintain smart meters and could collect and process metering data, provided that person is registered and accredited with the AEMO.

Under the new arrangements, which are unlikely to commence before July 2017:

- smart meters installed under the AMI program could be replaced by other, competitively provided meters

- a national smart meter functionality specification and a shared market protocol will be developed by the AEMO, however, jurisdictions may choose to adopt only part of this specification—Victoria's policy position is currently being considered.

DEDJTR has acknowledged that the removal of distributor exclusivity in Victoria is a risk to the realisation of the benefits of the AMI program. It may also expose consumers to increased costs, in particular those who choose to have the smart meters installed under the AMI program replaced by other, competitively provided meters. This is further discussed in Part 4.

1.4 Electricity prices in Victoria

Victoria is part of the National Electricity Market and associated regulatory system, and prices for the transmission and distribution of electricity are approved by a national regulator—the Australian Energy Regulator (AER).

Customers' electricity bills are comprised of a number of different costs, including:

- a consumption cost—which includes:

- the variable component of the network tariff—which is made up of distributors' charges for the use of their poles and wires and transmission lines to get electricity to household and commercial customers in their distribution zone as approved by the AER

- the retailer's energy cost purchased from the wholesale market

- a supply charge—which includes:

- the fixed component of the network tariff

- a metering fee—the cost of installing, operating and maintaining electricity meters—since 2009, this fee has covered the metering costs associated with the rollout and connection of smart meters under the AMI program.

The amounts charged to customers for the network tariff and metering fee are not individually shown on electricity bills.

Consumption costs

Since 2002, Victorian small businesses and households can choose their electricity supplier from 20 retailers currently selling electricity in Victoria.

Victoria removed the regulation of retail electricity prices in 2009. This means that retail businesses can charge whatever prices they choose, subject to competitive pressure. Retailers supply energy under:

- standing contracts—where customers can arrange for electricity connection on the retailer's standard terms, in which prices for are set by retailers

- market contracts—where customers choose from a number of market retail contracts with different prices, incentives and other terms and conditions—customers can shop around for the contract that suits their needs and must give explicit informed consent before taking up an offer.

Electricity retailers offer three common types of tariffs:

- Flat rate—this is the most common type for residential consumers. The same rate is charged for electricity consumed at any time of the day or night.

- Time-of-use—this is where a different price is charged according to when the electricity is used and usually involves peak and off‑peak pricing, which means users are charged less for electricity during 'off-peak' or low demand periods and a higher rate for electricity used during high demand or 'peak' hours.

- Flexible tariffs—this is an extended time-of-use tariff, with peak, shoulder and off-peak rates.

The AER reported that approximately 15 per cent of Victorian households are on standing contracts, the price of which rose by 5 to 12 per cent in 2013 across the state's five distribution network areas, following increases of 20 to 25 per cent in 2012. As retail prices are unregulated, limited information is available on the reasons for these increases. However, market contracts in Victoria discount bills on average by between 16 and 19 per cent. DEDJTR asserted that this information does not reflect the price decreases that have occurred since the removal of the carbon tax and that some market offers can discount bills by approximately 30 per cent if prompt payment is made.

The ESC reported that retailer margins on standing contract tariffs Victoria have increased by 15 per cent since the removal of retail price regulation. This means increased profits for retailers, and increased bills for customers.

Network tariffs

According to the AER, network tariffs represent around 40 per cent of the total cost of supplying electricity to residential customers in Victoria, since it approved increases in network tariffs in 2015.

The AER estimates that this led to increases in electricity bills of about 4 per cent on average in 2015, however, the exact amount charged also depends on where a customer lives. All else being equal, the AER estimates that for a household with an average annual bill of around $2 100, using a single flat rate, the new network tariffs would mean an annual increase of around $53 for people living in the south east region and around $144 for those living in the outer north east region. This includes the recent impact of smart meter charges. DEDJTR asserted that network tariffs now represent a smaller proportion of the total cost, however, it did not provide any evidence to support its claim.

Metering fees

Metering fees are applied to consumers' electricity bills and have surpassed the original cost estimates for the rollout and installation of smart meters. This issue is discussed in Part 3.

1.5 Roles and responsibilities

1.5.1 Department of Economic Development, Jobs, Transport & Resources

Since the 2015 machinery-of-government changes, DEDJTR is responsible for managing and overseeing the AMI program. Its governance arrangements and key activities are discussed in Part 2. Previously, the AMI program was administered by the former DSDBI.

The AMI program was provided funding of $25 million from 2012–13 to 2015–16 to implement the government's decision to continue the accelerated rollout of smart meters, and to make significant changes to the AMI program to reduce the risk of further cost increases and bring forward benefits for consumers. The specific goals of the program team are to:

- inform and clarify the government's policy position on a range of critical energy reforms, such arrangements for a flexible pricing environment and any consumer protections that may be required around flexible pricing

- implement a robust governance structure that provides the leadership, direction and accountability essential to the timely achievement of AMI program benefits

- engage with and deliver reliable information to consumers about the nature, impacts and benefits of the changes being enabled by smart metering.

1.5.2 Department of Treasury and Finance

DTF provides economic, financial and resource management advice to help the government deliver its policies. It oversaw the 2011 review of the AMI program, and commissioned the 2011 CBA. It also manages the Gateway Review Process, which provides independent scrutiny to projects and programs at key decision points and is aimed at providing assurance that projects can proceed successfully to the next stage.

The AMI program has been subject to three Gateway Reviews.

1.5.3 Essential Services Commission

The ESC is the independent regulator of the retail energy industry in Victoria. It licenses the distribution and sale of energy in Victoria and ensures that licensees comply with its codes and guidelines. However, its role does not extend to regulating retail electricity prices given there is a competitive market for the sale of electricity in Victoria.

Prior to 1 January 2009, the ESC was also responsible for the economic regulation of Victorian electricity distribution networks, including metering services. However, responsibility for this transferred to the AER under the National Electricity Rules.

1.5.4 Australian Energy Market Commission

Victorian is part of the National Electricity Market which is underpinned by the National Electricity Rules. These rules are made and amended by the AEMC and:

- govern the operation of the National Electricity Market—the competitive wholesale electricity market and associated national electricity system

- govern the economic regulation of the services provided by monopoly transmission and distribution networks

- facilitate the provision of services to retail customers.

The AEMC conducts independent reviews and provides advice to governments on the development of electricity markets. In both of these functions, it is required by law to have regard to the National Electricity Objective, which is to promote efficient investment in, and the efficient operation and use of, electricity services for the long-term interests of electricity consumers. It considers the price, quality, safety, reliability, and security of supply of electricity, as well as the reliability, safety and security of the national electricity system.

1.5.5 Australian Energy Regulator

In Victoria there are five electricity distributors that are for-profit businesses, each responsible for one geographic zone. As this creates a 'natural monopoly', there is a need for regulation to determine the charges that distributors can charge retailers, who are not restricted by geographic zones.

The AER is responsible for the economic regulation of electricity transmission and distribution networks across the National Electricity Market, as well as monitoring and enforcing compliance with the National Electricity Rules. Its functions, which mostly relate to energy markets in eastern and southern Australia, include:

- determining the revenues to be earned by network providers and approving the prices charged for using energy networks—electricity poles and wires and gas pipelines—to transport energy to customers

- monitoring wholesale electricity and gas markets to ensure suppliers comply with the legislation and rules, and taking enforcement action where necessary

- publishing information on energy markets, including the annual State of the energy market report as well as more detailed market and compliance reporting, to assist participants and the wider community

- assisting the Australian Competition and Consumer Commission with energy-related issues arising under the Competition and Consumer Act 2010, including enforcement, mergers and authorisations.

1.5.6 Australian Energy Market Operator

The AEMO is responsible for settling the wholesale electricity market on a half hourly basis. That is, it determines how much each electricity retailer pays for energy and how much each generator receives for energy supplied. The market is settled based on half hourly meter reads, where these are available (interval or smart meters are installed), and estimates of the half hourly meter reads, where these are not available (accumulated meters are installed).

1.6 Audit objective and scope

This audit examined the extent to which deficiencies in the AMI program have been addressed and whether benefits for consumers are being realised. It assessed whether DEDJTR:

- has effectively addressed recommendations from VAGO's Towards a 'smart grid'—the roll-out of Advanced Metering Infrastructure report

- can demonstrate that the AMI program is delivering expected consumer benefits and is set up to maximise longer-term benefits.

DEDJTR was the primary focus of the audit as it has responsibility for delivery of the AMI program. The audit also included DTF as it commissioned the 2011 review of the program and has undertaken several Gateway Reviews.

1.7 Audit method and cost

The method for the audit included:

- desktop research and interviews with relevant departmental and agency staff

- examination of relevant policy and procedure documents

- review of key studies, reports and analyses that have informed the AMI program, including PAEC hearings, testimony and reports, and DTF Gateway Reviews

- document and file examination of other relevant evidence held by departments.

All benefits' values are expressed in net present value at 2014 in 2011 dollars, unless stated otherwise.

The audit was performed in accordance with the Australian Auditing and Assurance Standards. Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated any persons named in this report are not the subject of adverse comment or opinion.

The cost of the audit was $465 000.

1.8 Structure of the report

The report is structured as follows:

- Part 2 examines the current status of the AMI program, including the implementation of VAGO's 2009 audit recommendations

- Part 3 examines the benefits realised by the AMI program to date

- Part 4 examines opportunities to maximise the benefits of the AMI program.

2 Status of the rollout and AMI program improvements

At a glance

Background

The Advanced Metering Infrastructure (AMI) program mandated distributors to roll out smart meters to all small business and residential customers by the end of December 2013. It also set up a framework for distributors to recover their costs from consumers through electricity bills. VAGO's 2009 audit found significant deficiencies in the AMI program in relation to governance, risk management, consumer education and engagement with the relevant regulator for the purpose of monitoring and overseeing the transfer of expected benefits to consumers.

Conclusion

Despite the installation being 92.79 per cent complete at the end of December 2013, even now not all installed smart meters are fully functioning. The Department of Economic Development, Jobs, Transport & Resources (DEDJTR) can demonstrate that it has undertaken actions that address most of VAGO's 2009 recommendations, however, the state has few policy levers or any ability to directly control costs and drive any of the consumer benefits. Consumers are yet to see the benefits from smart meters flow through from electricity distribution businesses.

Findings

- By 31 December 2013, 92.79 per cent of smart meters had been installed but only 85.9 per cent were being remotely read. By June 2014, this increased to 98.62 per cent of smart meters installed, but still 13.5 per cent of sites are not being remotely read.

- DEDJTR has improved governance arrangements to better manage risks, and has required distributors to pay a rebate to customers who did not have fully functioning smart meters installed by 30 March 2015.

- Communications with consumers and regulators have improved, but the uptake of flexible tariffs is low.

- DEDJTR cannot directly control the rollout costs that are passed on to consumers, although it has taken action to increase the scrutiny of these costs.

- DEDJTR needs to strongly engage the regulator to ensure that network efficiency benefits are passed on to consumers.

2.1 Introduction

In 2006, the Advanced Metering Infrastructure (AMI) program was approved. It aimed to replace accumulation meters in Victorian homes and small businesses with smart meters between 2009 and 2013.

In 2009, VAGO tabled the report Towards a 'smart grid'—the roll-out of Advanced Metering Infrastructure. The report concluded that there were significant inadequacies in the advice and recommendations provided to government on the rollout of the AMI program. The report made eight recommendations that focused on updating the program's costs and benefits and improving governance, risk management and stakeholder engagement. This report is discussed in more detail in Section 1.1.2.

2.2 Conclusion

The Department of Economic Development, Jobs, Transport & Resources (DEDJTR) has taken action to address most of the recommendations from VAGO's 2009 audit, with the exception of Recommendation 3—engaging with regulators to monitor and oversee the transfer of expected benefits to consumers—which has been partially addressed.

Since the program reset in 2011, DEDJTR has taken on a greater leadership role and has put in place governance structures to strengthen its oversight and management of program risks. It has also improved communications and has taken action to address delays to the smart meter rollout and increase the scrutiny of costs.

However, despite considerable improvement in the relevant program areas, significant challenges to consumers' understanding of the benefit of smart meters remain. Similarly, while DEDJTR has had preliminary discussions with the Australian Energy Regulator (AER) and is preparing to engage further with respect to passing on network benefits to consumers, it is not clear whether this will be successful. DEDJTR needs to strongly influence this process with its own rigorous analysis of the distributors' ongoing costs and determine the benefits that should be flowing to retailers and ultimately to consumers.

2.3 Status of the rollout

The objective of the rollout was to have a smart meter installed at all residential and small business premises by 31 December 2013. This equated to approximately 2.4 million homes and small businesses at the time of the 2006 decision, however, due primarily to population increases and development, that number has increased and now stands at approximately 2.67 million sites. As some sites may have two meters, the number of total meters installed by March 2015 is reported to be 2.79 million.

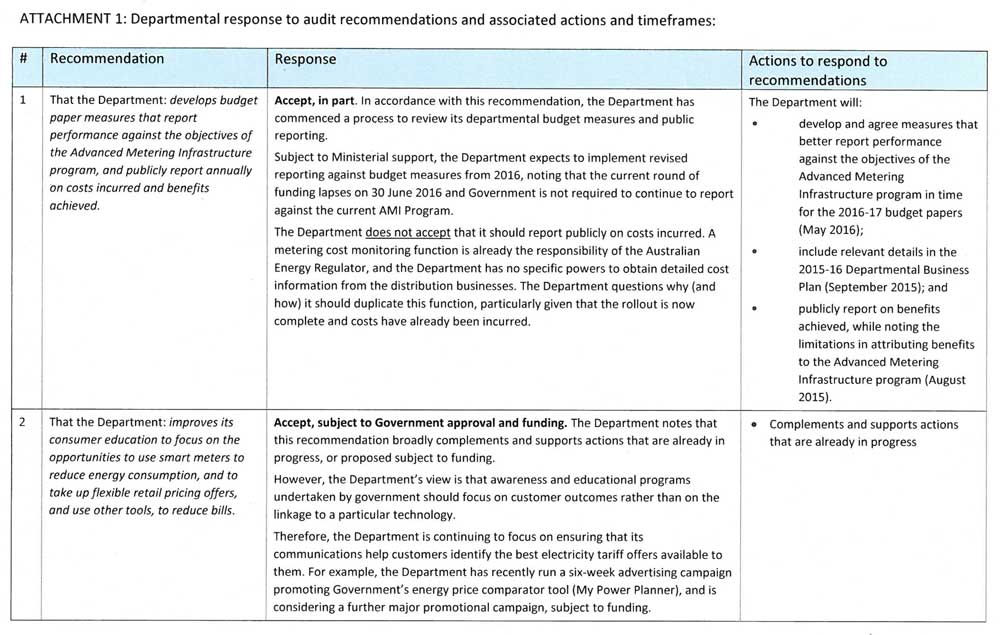

The full status of the smart meter rollout is outlined in Figure 2A.

Figure 2A

Status of smart meter rollout

|

Category |

As at 31 December 2013 |

As at 30 June 2014 |

||

|---|---|---|---|---|

|

Number |

Percentage of target |

Number |

Percentage of target |

|

|

Total number of target sites visited |

2 552 132 |

95.75% |

2 831 255 |

99.98% |

|

Total number of target sites with installed smart meter |

2 473 441 |

92.79% |

2 792 660 |

98.62% |

|

2 124 685 |

85.90 % |

2 415 650 |

86.50% |

|

Total number of target sites with issues |

78 691 |

2.95% |

38 595 |

1.36 % |

|

13 829 |

0.52% |

12 238 |

0.43% |

|

35 440 |

1.33% |

26 213 |

0.93% |

|

29 422 |

1.10% |

144 |

0.01% |

|

Total sites not yet visited |

113 381 |

4.25% |

425 |

0.02% |

|

Total number of sites (target) |

2 665 513 |

2 831 680 |

||

Source: Victorian Auditor-General's Office using DEDJTR's analysis.

By the end of the 31 December 2013 deadline, 92.79 per cent of the rollout target was completed, with 2.47 million households and small businesses having had smart meters installed. However, only 2.12 million, or 85.9 per cent of those sites, were being remotely read. By 30 June 2014, the number of households and small businesses with installed meters increased to 2.79 million, however, still only 86.5 per cent of those sites were being remotely read.

The lower than expected percentage of remote meter reading is mainly attributable to one distributor that has experienced technology and communications failures which prevents 270 000 meters from being remotely read. These failures relate to its choice of technology and have affected rollout timing and benefits realisation, as well as creating the risk that its customers pay for these failures. DEDJTR continues to investigate and closely monitor developments, as described in Section 2.5.3.

The outstanding installations of smart meter infrastructure across Victoria are a combination of:

- sites where the distributor had failed to attempt to install a smart meter

- sites where the smart meter installed was not functioning as required

- sites where the customer refused the smart meter

- non-economic sites where access to remote communications is not available at economic cost, such in remote locations or in concrete basements.

2.3.1 Actions to address delays to the rollout

Approximately 7 per cent of sites did not have a smart meter installed by 31 December 2013. The key reasons for this were:

- the distributor had not yet attempted to install a smart meter

- the customer at the premises had actively refused the installation of a smart meter for health, privacy or other concerns

- access issues, such as a locked gate or an aggressive dog prevented installation

- other issues, such as defects or technical issues.

DEDJTR acknowledges that delays in smart meter installations, and in ensuring that installed meters are able to remotely read, defers the realisation of benefits. These delays also mean that distributors have had to operate dual meter reading services for smart meters and accumulation meters in some areas, resulting in lost benefits.

However, the government took action in 2014 to address delays in the rollout by implementing changes to the regulatory regime which creates financial incentives for distributors and customers to install remaining meters.

Penalties for not completing the rollout

Government introduced regulations to require distributors to pay a rebate of $125 to customers at premises where:

- the distributor had failed to attempt to install a smart meter by 30 June 2014—this rebate was payable by 31 October 2014

- the smart meter installed was not functioning as required by 31 March 2015—this rebate was payable by 30 June 2015.

The rebate is an incentive to distributors to complete the rollout, so that all premises have a smart meter in place by 30 June 2014, with the exception of those premises where a distributor has been unable to install a smart meter for reasons beyond its control. It also seeks to compensate those customers who do not have a smart meter, or have a smart meter that is not functioning as required, but who have paid the metering fee through their electricity bill. Customers who refused the installation of a smart meter are not entitled to this rebate. Distributors are prevented from recovering the costs of this rebate through general metering or network charges.

Distributors must report to the Minister for Energy and Resources and the Essential Services Commission (ESC) on the number of eligible households and amount of rebate paid. On 30 November 2014, distributors reported that 680 households were eligible for the first tranche of rebates and received payments by 31 October 2014. As at 30 June 2015, approximately 90 per cent of eligible account holders received the tranche two rebates.

Addressing community concerns and encouraging smart meter acceptance

The delay in completing the smart meter rollout was also impacted by the active refusal of customers, based on concerns relating to health or for other reasons.

DEDJTR has sought to address the specific community concerns that were contributing to refusals. It commissioned several reports, including a study into the health impacts of electromagnetic emissions from smart meters, and found that their emissions are well below the established exposure limits.

Introducing manual meter reading fees

Since April 2015, the government has also allowed distributors to charge customers who refuse a smart meter a manual meter reading fee, which is approved by the AER.

This has the dual purpose of discouraging smart meter refusal and ensuring that at least a portion of the costs associated with maintaining separate systems for manual meter reads are borne by these customers.

2.4 Increasing scrutiny of distributors' costs

The smart meter rollout began in 2009 and metering costs associated with the rollout and connection of smart meters have been paid upfront by consumers since 2009. These costs have been applied annually to Victorian electricity bills since that time. However, as costs are managed by distributors and approved or rejected by the AER, DEDJTR has no direct influence over costs.

Under the framework, budgets for the AMI rollout are established by the distributors and agreed with the AER at the beginning of the budget period. Annual charges are then determined based on a combination of forecast and actual expenditure verified with the AER.

This process requires distributors to provide an initial budget to the regulator, which the regulator must approve, unless it can establish that the expenditure is for activities that are out of scope or are not prudent. Our 2009 audit noted two important issues arising from this process:

- Distributors were allowed to claim up to 20 per cent of costs above budgeted expenditure for the 2009–2011 period and 10 per cent for the next budget period, 2012–2015, without the need to justify the overspend. This reduced the incentive for distributors to minimise costs.

- The AER faced a substantial challenge in effectively examining the prudence of expenditure, even when the actual costs exceeded the budgeted cost by 20 per cent, due to the inherent technical complexity and risks involved in the implementation of the AMI program.

A key finding of the 2009 audit was that there had been little analysis to understand the potential risks of following this approach—such as the risk that consumers will incur higher than expected costs, arising from cost overruns of 20 per cent, before the AER is able to investigate the prudence of any expenditure above the approved budget.

Since our 2009 audit, DEDJTR has amended the cost–recovery framework to introduce more cost scrutiny and has engaged directly with the AER. This action has been effective to:

- grant the AER greater guidance in assessing the prudence and efficiency of excess expenditure

- give the AER more time to assess the distributor overspends

- remove distributors' 'as of right' ability to recover expenditure up to 10 per cent above budget without the need to justify the overspend—this means that, for the period 2012–15, distributors have been required to justify any expenditure incurred in excess of budget as prudent and efficient, however, it is noted that the excess expenditure for the 2009–2011 period was 6 per cent, significantly below the 20 per cent threshold that applied for that period

In addition, DEDJTR also actively seeks to influence the outcome of the AER's annual metering cost reviews, in which the AER decides whether distributors can recover costs above their budgeted expenditure.

Despite departmental action, consumers have already paid an estimated $2.239 billion[1] in metering charges, including the rollout and connection of smart meters, and this is likely to increase further. This is discussed in Section 3.3.

1nominal dollars, undiscounted.

2.5 Addressing the 2009 recommendations

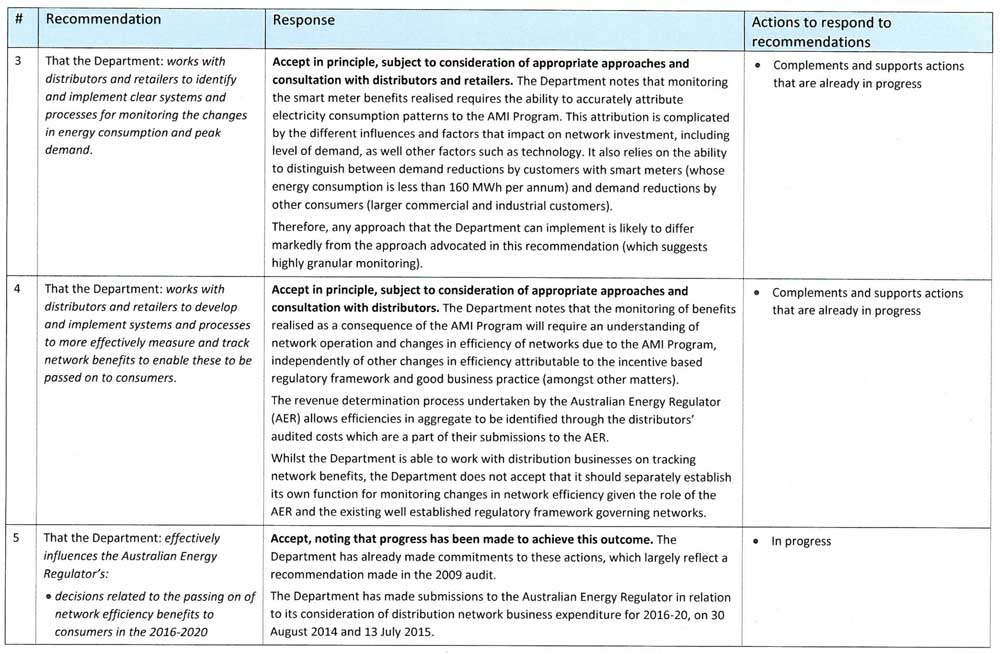

Our 2009 VAGO audit made a number of recommendations aimed at addressing the key deficiencies identified in the AMI program. Figure 2B summarises our assessment of the effectiveness of DEDJTR's actions in response to these recommendations.

Figure 2B

DEDJTR response to VAGO's 2009 recommendations

|

No. |

Recommendation |

Addressed |

|---|---|---|

|

1 |

Re-examine the existing governance structure of the AMI project to proactively identify, assess, own and manage the project's strategic risks. |

✔ |

|

2 |

Develop, appropriately resource and implement a stakeholder engagement plan with a particular focus on addressing consumer issues arising from the AMI project. |

✔ |

|

3 |

Actively engage with the relevant regulator to monitor and oversee the transfer of expected benefits to consumers. |

Partly |

|

4 |

Commission a program review by the Gateway Unit of the Department of Treasury and Finance on governance and implementation of the AMI project to date |

✔ |

|

5 |

Re-assess the economic viability of the AMI project by updating the cost-benefit analysis to reflect existing and emerging risks as well as the impact of changes to scope and underlying assumptions. |

✔ |

|

6 |

Use the Department of Treasury and Finance's business case development guidelines and other advice to produce an updated cost‑benefit analysis. |

✔ |

|

7 |

Obtain assurance from Victoria's electricity distributors that their candidate technologies for AMI are capable of achieving the expected functionality and service specification prior to the further installation of these technologies in customer premises. |

✔ |

|

8 |

Adopt the Department of Treasury and Finance's risk management guidelines as a basis for monitoring and managing the risks that threaten the economic viability of the AMI project. |

✔ |

Source: Victorian Auditor-General's Office.

Actions against these recommendations are discussed further in the following sections.

2.5.1 Governance and risk management

VAGO's 2009 audit found that the then Department of Primary Industries' (DPI) program governance was not appropriate for the nature and scale of the market intervention the program posed. In particular, it found that:

- DPI engaged with the program in only a limited way as an 'observer' during its implementation phase

- it had not been able to adequately engage with such a large scale and complex program

- there was a gap in DPI's understanding of its governance and accountability role in a non-budget-funded program.

It also identified inadequate management of program risks by DPI, which were linked directly to the governance model and risk transfer approach.

Recommendations 1 and 8 required DPI to review the existing governance structure of the AMI program to identify, assess, own and manage the program's strategic risks.

In 2011, following the Department of Treasury and Finance's (DTF) review of the AMI program, the government agreed to continue the mandated rollout of AMI but with significant changes. These aimed to 'reduce the risk of further cost increases and to bring forward tangible benefits for customers', including by immediately reforming the governance of the AMI program in accordance with our recommendations.

Since the 2009 audit, the former DPI and subsequently the former Department of State Development, Business and Innovation (DSDBI) made significant changes to the overall governance structure with clear accountabilities and responsibilities for particular aspects of the program. In particular, the following elements were established:

- AMI Program Steering Committee—responsible for leading the effective development and implementation of the AMI program. In particular, it is responsible for overseeing program risks, providing strategic policy advice to the Minister for Energy and Resources and ensuring that benefits and outcomes are realised.

- Ministerial Advisory Council—responsible for providing advice on the implementation of smart meters and the realisation of their benefits.

- Program Management Office—responsible for reporting on progress and issues related to the program, including undertaking annual assessment of the benefits realised and identifying risks to the realisation of future benefits.