Accessing Emergency Funding to Meet Urgent Claims

Snapshot

Have government departments met their legislative obligations when accessing emergency funding?

Why this audit is important

The Treasurer's Advance gives parliamentary and legal authority to the government to access funds to meet urgent expenditure claims.

By its nature, it is not aligned to any agency or output. Consequently, it is not subject to the parliamentary scrutiny that applies to the rest of the budget before it is spent.

Instead, Parliament can only authorise its use after any funds are spent. Due to this, there should be strong processes and controls over access to this funding and clear accountability to Parliament and the community on its use.

What we examined

We performed a limited assurance review engagement under section 20 of the Audit Act 1994.

We reviewed Treasurer's Advance payments to departments, which were disclosed in the state's

2019–20 Annual Financial Report.

Our review examined:

- the adequacy of the processes that departments used to request and gain access to the Treasurer's Advance for 2019–20

- evidence that those processes operated for selected advances, which represent over 59 per cent of the value of the 2019–20 approvals.

What we concluded

Nothing has come to our attention that causes us to believe that, in all material respects, there were any advances made for the period 1 July 2019 to 30 June 2020 that:

- were not approved by the Treasurer

- did not meet the criteria established in the Appropriation Acts that they were urgent claims that arose before Parliamentary sanction was obtained.

What we recommended

We recommend process improvements and also greater transparency in disclosing Treasurer's Advance spending.

Video presentation

What we found and recommend

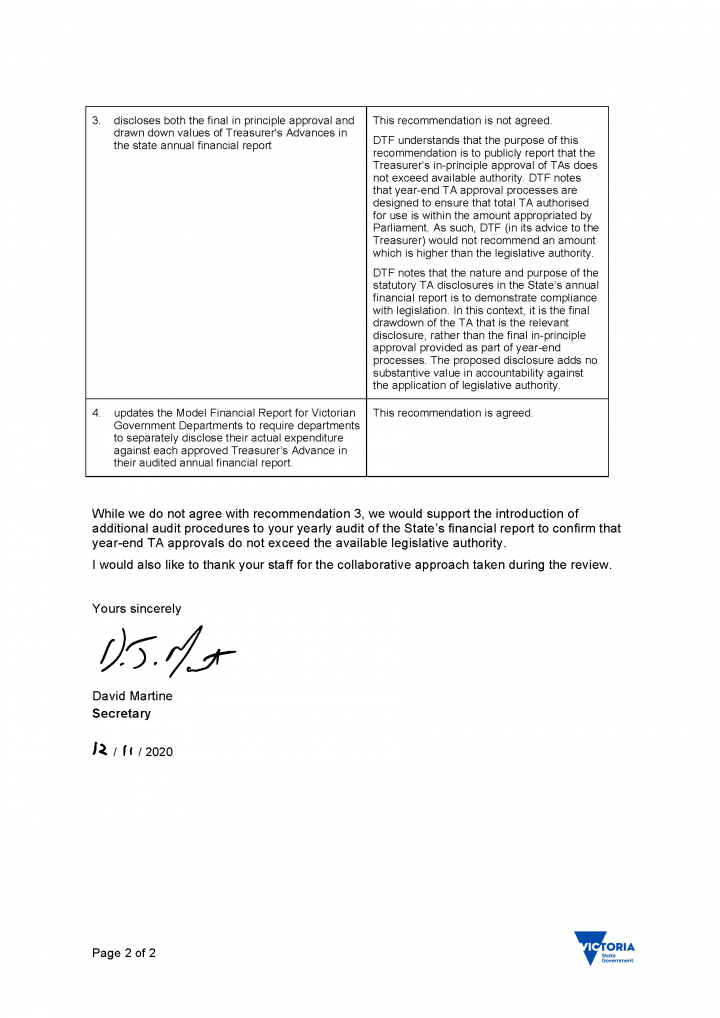

We consulted with the relevant agencies subject to this review and considered their views when reaching our conclusions. Their full responses are in Appendix A.

Following documented processes and controls

Most Treasurer’s Advance approvals for 2019–20 did not result from requests specifically seeking Treasurer’s Advance funding

Typically, most Treasurer’s Advance approvals resulted from funding requests that were considered and approved by the government where the Treasurer’s Advance was identified as the source of funding after the event.

The RMF process applies where a minister or department submits a request to the Treasurer specifically seeking access to Treasurer’s Advance funding. The RMF sets out the mandatory requirements for such requests, including the need to address if the funding requests relate to urgent and unforeseen matters.

In this review we examined 33 funding requests out of around 300 and found that:

- the Department of Treasury and Finance (DTF) provided evidence to support all funding requests and its assessments of these requests

- 12 of these requests followed the process outlined in the Resource Management Framework (RMF) for Treasurer’s Advance requests. We noted some exceptions where not all the mandatory information requirements were explicitly addressed

- the other 21 requests were initiated as general funding requests where the Treasurer’s Advance was subsequently identified as the appropriate funding source after the event.

The RMF does not explicitly require all requests or approvals to be processed under its requirements and the Appropriation Acts and the Financial Management Act 1994 (FMA) do not specify any process or requirements for accessing the Treasurer’s Advance.

Because most requests funded by Treasurer’s Advances did not follow the RMF process, and therefore the key requirements specified in the RMF did not apply, there was less clarity about matters like urgency in these requests and in DTF’s advice and recommendations to the Treasurer.

All Treasurer’s Advances disclosed in the state’s Annual Financial Report 2019–20 (AFR) were approved by the Treasurer as Treasurer’s Advances. While most requests were not initiated to seek access to the Treasurer’s Advance, they ended as such and were approved accordingly.

DTF has accepted that funding requests are ‛urgent’ when there is no alternative appropriation funding

DTF advised us that it is a long-standing practice to accept funding requests as urgent when recommending the use of Treasurer's Advance.

This is because after the annual Appropriation Act is passed:

- any additional funding approved by the government that is over and above the amounts appropriated for departments is deemed ‘urgent’

- any additional in-year funding that the government approves for a department, is funded from the Treasurer’s Advance, unless there is an obvious alternative funding source available.

DTF’s practice of referring to the annual Appropriation Act’s purpose ‛to meet urgent claims that may arise before parliamentary sanction is obtained’ instead of applying a literal definition of ‘urgent’ when assessing funding requests is appropriate.

Consistent with DTF’s advice to the Treasurer, this is because not supporting the recommended Treasurer’s Advance allocations would result in departments breaching the Constitution Act 1975 and the annual Appropriation Act by drawing funds from the Consolidated Fund without authority.

For the funding requests we examined, DTF’s assessments did not always explicitly address the urgency of the funding request at its initial approval, even where it was an RMF request. However, DTF did address urgency as part of its advice to the Treasurer on the final funding requirements and requests for the Treasurer’s Advance in June 2020.

Some requests did not address the RMF requirement of being ‘unforeseen’

DTF advised that in the context of assessing requests for the Treasurer's Advance, ‘unforeseen’ should be interpreted to mean that an item was not included in an appropriation bill in that year, irrespective of the reason for exclusion. ‘Unforeseen’ is not defined by what government should have known about an issue at the time of making a decision, or when the Treasurer approves a Treasurer's Advance.

Some funding requests did not meet the RMF requirement of being ‘unforeseen’ because they provided ongoing budget supplementation rather than one-off funding for unforeseen events.

From the selection of requests we reviewed, the Treasurer’s Advance of $121.3 million provided to support Victoria Police operations in 2019–20 continued a pattern established in recent years where Treasurer’s Advance funding is used for this purpose. It would be beneficial for DTF to undertake an annual review of the nature of expenditure that the Treasurer’s Advance supports to identify opportunities to minimise its use for reasonably foreseeable spending. An annual review could also monitor and advise on any underlying budgeting, financial management or cost pressures that may contribute to the need for such requests.

Approval and authorisation

Treasurer’s Advance payments disclosed in the AFR were within parliamentary authority and approved by the Treasurer.

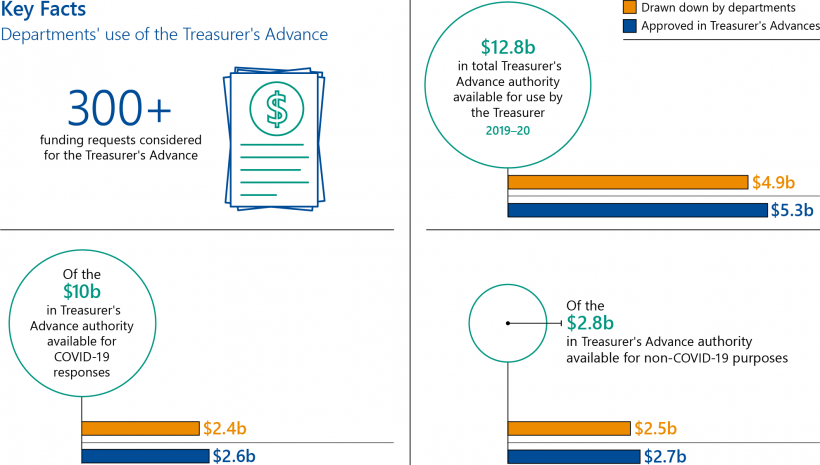

Before COVID-19 was declared a pandemic in early 2020, the government had $2.8 billion in Treasurer's Advance funding available under the Appropriation (2019–2020) Act 2019 to meet departments’ urgent claims in 2019–20.

Parliament responded to the pandemic by approving an additional $24.5 billion in Treasurer’s Advance funding—$10 billion for 2019–20 and $14.5 billion for

2020–21—under the Appropriation (Interim Act) 2020, largely intended to support the government’s public health, social and economic responses.

Of the $5.3 billion in Treasurer's Advances approved by the Treasurer for 2019–20, $4.9 billion was used. Of this, only $2.4 billion was used for the government’s COVID 19 response.

We saw no evidence that payments from the Treasurer’s Advance were more than the relevant approvals.

Transparency and accountability

The Treasurer’s Advance disclosures in the AFR are complete, accurate and fairly represent performance

Accountability for use of the Treasurer’s Advances is achieved by disclosing details of payments to departments against these advances in the state’s AFR for the year, and also in the subsequent Annual Appropriation Act.

DTF provided transparency in the AFR by separately disclosing if individual Treasurer’s Advance items for 2019–20 were attributable to the government's COVID-19 response.

According to the RMF, SRIMS supports DTF in its ‘head office’ role to provide the government with financial and performance information from departments and agencies. This information supports whole of government decision making and accountability obligations.

The payments shown in the AFR against individual Treasurer’s Advances reflects advice from departments to DTF on the amounts that they actually drew down. DTF compares aggregate information relating to departments' drawdowns to relevant aggregate information entered by departments in the State Resource Information Management System (SRIMS), which is the state’s central ledger system, to check if they match in aggregate.

Departments' chief finance officers provide a separate attestation to DTF to confirm that all amounts included in SRIMS are consistent with their audited accounts. However, departments' accounts do not typically include separate disclosures that show the actual amounts spent against Treasurer’s Advances.

In terms of actual expenditure:

- DTF does not seek confirmation from departments on their actual spending or commitments against individual Treasurer’s Advance approvals

- departments disclose the total amount approved for all Treasurer’s Advances as part of a note on compliance with annual parliamentary and special appropriations in their audited financial reports. However, they do not separately disclose their actual expenditure against Treasurer’s Advances either individually or in aggregate.

Our limited assurance review did not extend to verifying that the funds reported as drawn down by departments were actually expended.

Departments could enhance transparency around Treasurer's Advance expenditure if their financial reports included separate disclosures on the amounts they spent against Treasurer’s Advance initiatives.

This would also provide greater assurance that the amounts reported as drawn down were actually expended in the financial year. This is important because the Treasurer’s Advance authority lapses at the end of each year and unused amounts cannot be carried forward.

Recommendations

| We recommend that: | Response | |

|---|---|---|

| Department of Treasury and Finance | 1. updates the Resource Management Framework to:

|

Accepted |

| 2. assesses whether all funding requests to be met with the Treasurer’s Advance meet the mandatory requirements in the Resource Management Framework | Accepted | |

| 3. discloses both the final in principle approval and drawn down values of Treasurer’s Advances in the state’s annual financial report | Not accepted | |

| 4. updates the Model Financial Report for Victorian Government Departments to require departments to separately disclose their actual expenditure against each approved Treasurer’s Advance in their audited annual financial report. | Accepted |

1. Context for this review

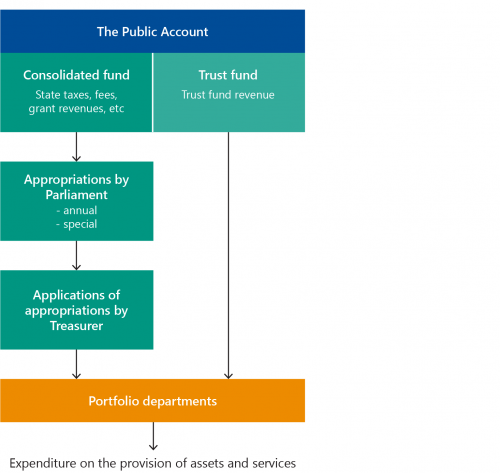

Appropriation Acts give the Treasurer the legal authority to make payments from the state's Consolidated Fund.

An amount for the Treasurer's Advance is authorised in each annual Appropriation Act. This advance gives the government the necessary flexibility to meet funding needs that were not (or not fully) provided for when departments’ annual appropriation authorities were set.

The unused balance of the advances approved for departments lapses at year end.

This chapter provides essential background information about:

1.1 The legal framework that governs public finances

The Constitution Act 1975, annual Appropriation Acts and FMA provide the legislative framework for administering public finances, including the government’s financial management and accountability obligations.

Figure 1A summarises the public finance and appropriations framework established by these Acts in Victoria.

FIGURE 1A: Public finance and appropriations framework in Victoria

Source: VAGO.

Constitution Act 1975

The Constitution Act 1975 outlines the framework that Parliament must operate within. It also includes important financial provisions that establish Parliament’s role in controlling public finances. In particular, that:

‛… all taxes, imposts, rates and duties and all territorial casual and other revenues of the Crown in right of the State of Victoria (including royalties) which the Parliament has power to appropriate shall form one Consolidated Revenue …’.

The Act also states that:

-

this revenue can only be appropriated for specific purposes that Parliament directs through legislation

The Consolidated Fund is the account that all consolidated revenue is paid into.

- the government cannot issue money from the consolidated fund unless authorised by warrants approved by the Governor.

With the FMA’s complementary requirement, these provisions establish further constitutional control over the government’s expenditure of consolidated revenue.

The Treasurer must prepare warrants, which are examined by the Auditor-General, to access money from the Consolidated Fund. These warrants determine if the requested funds are legally available. The Governor reviews and approves endorsed warrants.

Annual Appropriation Acts

The annual Appropriation Acts enable Parliament to exercise control over state finances by allocating public money to departments and the Treasurer.

The Appropriation Acts give the Treasurer the authority to issue funds from the Consolidated Fund for departments to:

- provide outputs, which involves producing or acquiring goods and services

-

add to the net asset base, which involves acquiring or constructing assets or injecting capital funding

Transfer payments are payments, such as grants or subsidies, to third parties outside of government for which no goods or services are provided in return.

- make payments on behalf of the state, including transfer payments, central financing costs and other expenditure that is not directly related to the state’s purchase of goods and services.

Appropriations are provided on an accrual basis and cover all costs incurred in providing services.

Appropriation amounts must be within the upper limits of authority specified for each department’s appropriation. The Treasurer cannot exceed these limits without Parliament’s authority.

Contingencies

Appropriation amounts may include contingency provisions. DTF manages central contingency funding for future expenditure to support:

- service growth

- new initiatives in future budgets

- cost pressures on capital projects

- urgent and unforeseen expenditure.

The Appropriation Acts also give the Treasurer the authority to issue:

- additional money out of the Consolidated Fund to meet increased salary and related costs that arise from legislation or determinations if departments’ annual appropriations are insufficient to meet these costs

- funds from the Treasurer’s Advance to meet departments’ urgent claims for funding in excess of what the annual Appropriation Act authorises.

The Treasurer’s Advance

The appropriations schedule in the Annual Appropriation Acts includes a specific appropriation called the Treasurer’s Advance, which is made available to the Treasurer as part of DTF’s appropriation. The Treasurer’s Advance enables the Treasurer 'to meet urgent claims that may arise before Parliamentary sanction is obtained, which will afterwards be submitted for Parliamentary authority'.

Parliamentary sanction, or approval, for Treasurer’s Advance expenditure is obtained through tabling the subsequent financial year’s annual Appropriation Bill. This bill includes a schedule with all payments made against the Treasurer’s Advance in the previous financial year. Payments made against the Treasurer’s Advance are also disclosed in the state’s AFR.

The Treasurer's Advance gives the government the necessary flexibility to meet funding needs that were not (or not fully) provided for when the annual appropriation authorities for departments were set.

The number and value of Treasurer’s Advances approved each year varies depending on the extent of urgent and unplanned for spending by departments.

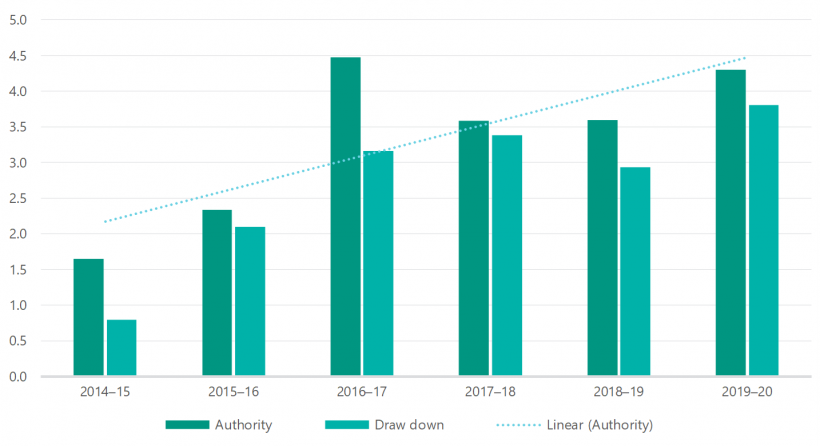

Figure 1B shows the amounts advanced to the Treasurer under the annual Appropriation Acts since 2014–15. It also shows the aggregate of Treasurer’s Advance payments to departments as disclosed in the state’s AFR.

FIGURE 1B: Treasurer's Advance authority and payments 2014–15 to 2019–20

| Financial year | Authority for Treasurer's Advance ($ million) | Authority as proportion of total appropriations (per cent) | Payments to departments ($ million) | Payments as proportion of total appropriations (per cent) |

|---|---|---|---|---|

| 2014–15 | 681.1 | 1.65 | 325.5 | 0.79 |

| 2015–16 | 991.2 | 2.34 | 892.8 | 2.10 |

| 2016–17 | 2 219.4 | 4.47 | 1 571.2 | 3.16 |

| 2017–18 | 1 966.9 | 3.58 | 1 861.3 | 3.38 |

| 2018–19 | 2 148.5 | 3.59 | 1 753.7 | 2.93 |

| 2019–20: | ||||

| Appropriation (2019–2020) Act 2019—non-COVID-19 Treasurer’s Advances | 2 806.4 | 4.30 | 2 475.2 | 3.80 |

| Appropriation (Interim Act) 2020)—COVID-19 Treasurer’s Advances | 10 000.0 | 27.73 | 2 423.7 | 6.72 |

Source: VAGO, based on relevant annual Appropriation Acts and the State of Victoria’s AFRs.

Figure 1C shows that the value of Treasurer’s Advances has increased as a proportion of total appropriations since 2014–15.

FIGURE 1C: The Treasurer’s Advance as a percentage of annual appropriations

Note: The data for 2019–20 does not include the Treasurer’s Advance authority for COVID-19-related purposes authorised in the Appropriation (Interim Act) 2020 because this was a response to unusual circumstances.

Source: VAGO, using data extracted from the annual Appropriation Acts and the State of Victoria’s AFRs.

Financial Management Act 1994

The FMA requires the government, departments and public bodies to soundly manage and be accountable for public sector financial resources. The FMA establishes:

- a framework for the government to budget, collect, spend and manage public money and other public resources

- a requirement for the government to table Budget Papers in Parliament as supplementary information to support the annual Appropriation Acts

- financial accountability responsibilities for the government and individual public sector agencies relating to administering and managing public resources.

The FMA’s budget-management provisions do not deal with the Treasurer’s Advance. However, they do include provisions that enable the government to make temporary advances to meet urgent claims.

Temporary advances

Section 35 of the FMA permits the Treasurer to make temporary advances—distinct from Treasurer's Advances under the Appropriation Acts—to meet urgent funding claims before obtaining parliamentary sanction. Total advances approved by the Treasurer under section 35 cannot exceed 0.5 per cent of the total amount appropriated by the annual Appropriation Act for each financial year.

These temporary advances are loans. In this respect they differ from Treasurer’s Advances because all money advanced under section 35 must be paid back into the Public Account immediately once parliamentary sanction is obtained. In 2019–20, $325.3 million was available under this provision.

The state’s AFR for the year and the annual Appropriation Act for the subsequent year, which disclose the details of temporary advances, provide accountability for advances made by the Treasurer under section 35.

The Resource Management Framework

DTF issues the RMF to help departments understand and apply the legal and policy framework that underpins public sector resource management, budgeting and reporting processes.

The RMF is mandated for departments by the Assistant Treasurer’s Standing Directions 2018 under the Financial Management Act 1994. These directions include mandatory requirements and guidance for departments on matters relating to the department funding model, objectives and outputs, appropriation funding, trust accounts, carryovers, reporting and other matters, including requests for the Treasurer’s Advance.

As defined in section 42 of the FMA, accountable officers are public sector bodies’ department heads and chief executive officers.

Departments’ accountable officers must attest to their compliance with the RMF’s mandatory requirements as part of their annual compliance attestation against Victoria’s financial management compliance obligations.

1.2 Treasurer’s Advance application and approval process and related roles and responsibilities

Neither the Appropriation Acts nor the FMA specify any processes or requirements for accessing the Treasurer’s Advance.

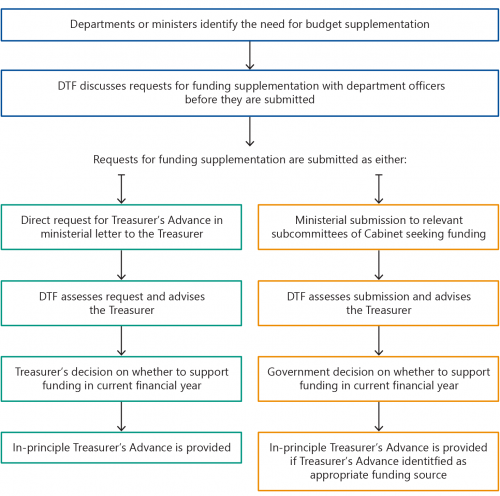

The RMF outlines the mandatory requirements for requesting a Treasurer’s Advance when a minister is requesting budget supplementation directly from the Treasurer. It also describes DTF’s role in assessing these requests and the Treasurer’s role in approving them.

DTF advised that the RMF requirements do not apply to ministerial submissions to Cabinet and its committees. While there are prescribed templates and guides for ministerial submissions issued by the Cabinet Secretariat and DTF, these submissions can take many forms and can be based on what ministers consider appropriate for decision making. Many of these decisions would ultimately involve the use of the Treasurer’s Advance.

The RMF’s application pathway and requirements

The RMF states that:

- a minister may submit a letter of request to the Treasurer to apply for budget supplementation from the Treasurer’s Advance

- DTF assesses each request and provides advice to the Treasurer

- the Treasurer determines whether to fund the request or not

- the Treasurer’s Advance may be applied to output or asset funding requests. This is determined by the Treasurer, who is informed by advice from DTF

- additional warrant authority, beyond that included in the warrant for the relevant budget, is not required to access the Treasurer’s Advance.

The RMF also states that the Treasurer’s Advance capacity is limited to the amount specified in the Appropriation Act. Due to this, the Treasurer only initially provides ‘in principle’ approval for successful funding requests. DTF then reviews the final source of funding and confirms it with the Treasurer towards the end of the financial year. DTF considers the total capacity of the Treasurer’s Advance and other available sources of departmental appropriation authority during this review.

As Figure 1D shows, the RMF requires Treasurer’s Advance applicants to submit a documented request that contains specified minimum information, including the reasons for the request and if it is urgent and unforeseen.

FIGURE 1D: RMF mandatory information requirements

Managing requests for the Treasurer’s Advance

- the reasons for the funding request, including whether the request is urgent and unforeseen

- the amount of the funding sought

- confirmation that there are no other sources available to fund the request

- how the funding request aligns with the government’s objectives

- adjustments to output and financial performance targets arising from the request

- funding variations previously approved by the Treasurer or the relevant Cabinet committee for the program or output seeking the advance.

Reporting on Treasurer’s Advance expenditure

Restrictions on the Treasurer’s Advance

Source: The RMF effective from 1 July 2019.

The RMF also includes non-mandatory requirements for DTF and the Treasurer on assessing, determining and advising departments on Treasurer’s Advance requests.

Application and approval process

The RMF outlines a clear process for submitting, assessing and determining ministerial Treasurer’s Advance requests.

The requests that specifically seek access to the Treasurer’s Advance in the first instance are typically for funding responses to unforeseen events. This could include natural disasters and public health or other emergencies that require government interventions, and other urgent funding needs that were not foreseen when setting departmental budgets.

However, not all requests that the Treasurer’s Advance funds follow the processes described in the RMF. This is because ministers also submit requests for funding without first identifying an appropriation source. Such requests may be for:

- supplementary funding for existing activities

- new funding for new initiatives

- accessing funds held by DTF in contingency, which typically represent amounts that the government has approved but not released in previous funding decisions. Departments need to apply to justify releasing these funds.

The government considers and approves these funding requests with supporting advice from DTF as part of its usual decision-making processes. The Treasurer’s Advance is identified as the source of funding after the event.

Initial in-principle approval

Because Treasurer’s Advance capacity is limited to the amount specified in the annual Appropriation Act, the Treasurer only initially approves successful funding requests in principle.

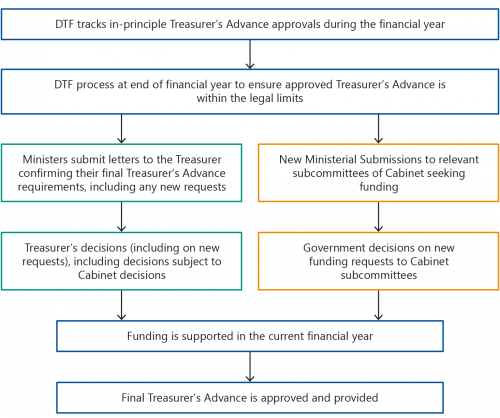

Figure 1E shows the initial ‘in principle’ approval stage of the Treasurer’s Advance application and approval process as it is applied in practice. This stage applies to:

- funding requests that are designated as requests for the Treasurer’s Advance from the outset and follow the process set out in the RMF

- general funding requests that are met from the Treasurer’s Advance but do not follow the process set out in the RMF.

FIGURE 1E: Initial in-principle approval stage

Source: VAGO, based on information provided by DTF.

DTF records decisions on the Treasurer's in-principle approvals of Treasurer’s Advance requests and the government’s funding decisions. The Treasurer writes to the relevant Minister on the in-principle outcome of direct requests for Treasurer’s Advances.

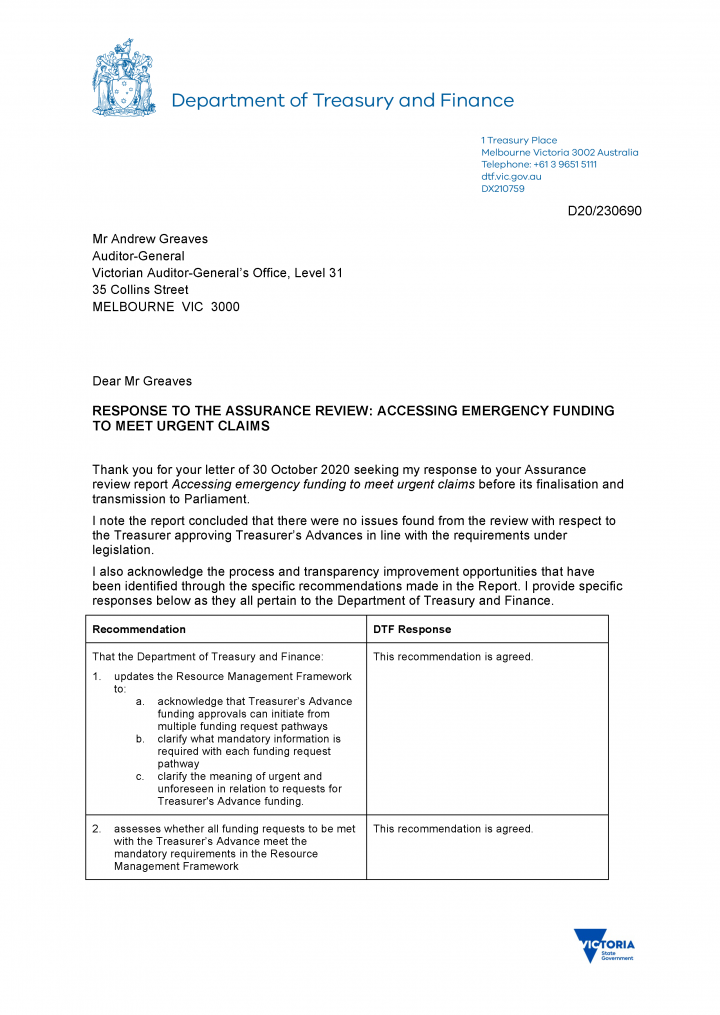

Final in-principle approval

As Figure 1F shows, DTF reviews the final funding source and the Treasurer confirms it after the end of the financial year. DTF and the Treasurer consider the total Treasurer’s Advance capacity and other available funding sources through departmental appropriation authority during this stage.

FIGURE 1F: Final in-principle approval stage

Source: VAGO, based on information provided by DTF.

DTF advised that this final approval stage remains in-principle and represents the upper limit of funding available until departments confirm their final drawdowns against each Treasurer's Advance. It is these final drawn down, or payment, amounts against each Treasurer’s Advance that are disclosed in the state’s AFR and are approved by the Treasurer. The final amount drawn down is the final amount approved for each Treasurer's Advance.

Special circumstances that impacted the Treasurer’s Advance process during the 2020 COVID-19 pandemic

Special circumstances applied during 2019–20 because the Treasurer’s Advance was available through two different Appropriation Acts:

- the Appropriation (2019–2020) Act 2019, which allocated $2.8 billion in Treasurer's Advances to meet urgent funding requests from departments and agencies in 2019–20 before the COVID-19 pandemic emerged in early 2020

- the Appropriation (Interim) Act 2020, which authorised a further $10 billion in Treasurer’s Advances in 2019–20, largely intended to respond to the COVID-19 pandemic.

In addition, several government decisions were still to be made in late June 2020 when DTF was preparing the year-end brief to the Treasurer on Treasurer’s Advance funding. This meant that DTF needed to ensure that its recommendations to the Treasurer included the amounts subject to further government decisions and that total amounts remained within the available Treasurer’s Advance capacity under each authority.

Figure 1G shows the Treasurer's Advance and other amounts authorised and allocated for 2019–20. In this review we focused on the Treasurer’s Advance.

FIGURE 1G: Treasurer’s Advance and other funding: 2019–20

| Authority available ($ million) | Amounts allocated ($ million) | Purpose | |

|---|---|---|---|

| Treasurer’s Advance in place pre-COVID-19 (per Appropriation (2019–2020) Act 2019) | 2 806.4 | 2 475.2 | Non-COVID 19 related |

| Additional Treasurer’s Advance for COVID-19 responses (per Appropriation (Interim) Act 2020) | 10 000.0 | 2 423.7 | COVID 19 related |

| Funding available under section 35 of the FMA | 325.3 | 287.3 | Various |

| Total | 13 131.7 | 5 186.2 |

Source: VAGO, based on information provided by DTF.

We provide more detailed information on Treasurer’s Advance funding applied for, approved and used in 2019–20 in Appendix D.

1.3 Review objective and approach

We undertook a limited assurance review engagement under section 20 of the Audit Act 1994 to determine whether government departments met their legislative obligations when accessing emergency funding in 2019–20.

A review engagement provides meaningful assurance, but less assurance than an audit. Our review examined:

- the adequacy of the processes that departments used to request and gain access to the Treasurer's Advance for 2019–20

- evidence that those processes operated for selected advances, which represent over 59 per cent of the value of the 2019–20 approvals.

We provide more detail on our review in Appendix C.

2. Application, assessment and approval

Conclusion

We found no evidence that the processes for accessing and allocating the Treasurer’s Advance in 2019–20 were inconsistent with legislation.

Most Treasurer’s Advances did not result from requests that specifically sought funding from the Treasurer’s Advance.

While this is consistent with legislation, it means that the RMF's mandatory documentation requirements for Treasurer’s Advance requests, including that they address if they are urgent and unforeseen, are not always made explicit. This does not mean that there is non-compliance with the RMF, but there would be benefits if all funding requests that are intended to be met from Treasurer's Advance are assessed against the RMF requirements.

This chapter discusses:

2.1 Background

As discussed in Chapter 1, the FMA and Appropriation Acts do not specify any processes or requirements for accessing the Treasurer’s Advance.

The RMF includes mandatory requirements for funding requests that specifically seek access to the Treasurer’s Advance. It also describes DTF’s and the Treasurer's role in assessing and approving these requests.

In this review we examined 33 funding requests that represented $2.8 billion, or 58 per cent, of Treasurer’s Advance payments in 2019–20.

For these advances, we sought evidence of:

- the initial funding requests, including funding requests that both specifically sought access to the Treasurer’s Advance and funding requests that initially did not

- DTF's assessments and advice that supported the initial, or primary, funding decisions

- DTF's advice and the Treasurer's decisions on:

2.2 Funding request applications

The RMF’s mandatory information requirements, which we outline in Figure 1D, only apply when a funding request specifically seeks access to the Treasurer’s Advance from the Treasurer.

DTF advised us that in practice, Treasurer’s Advance approvals arise from:

- budget decisions on general funding requests as part of Cabinet subcommittees' decision-making processes

- releasing centrally held contingencies that the government and/or the Treasurer can approve

- requests for Treasurer’s Advances, which the Treasurer determines under the RMF process.

Budget decisions on general funding requests as part of Cabinet subcommittees' decision making processes

DTF told us that general funding requests, or budget bids, are not required to identify an appropriation source and are assessed on their own policy merits. DTF scrutinises the costing and proposed phasing of expenditure, including whether requested funding is likely to be spent in the current year.

General funding requests that are met with the Treasurer’s Advance but do not follow the RMF process can arise where departments require funding:

- for purposes that were anticipated but require funding over and above the appropriated amounts, which the government approved without specifying a funding source

- to implement new government-approved services or asset initiatives that were not provided for in the Appropriation Act but have financial implications in the current year

- to access contingency amounts provided for in previous funding decisions by the government., which is common for major capital projects. DTF controls a central pool of contingency funding

- to respond to unforeseen events, such as natural disasters and public health or other emergencies that require government interventions.

Once the government agrees to provide additional funding to a department in the current year, it is assumed that this will be funded from the Treasurer’s Advance unless a more appropriate funding source is identified.

Releasing centrally held contingencies

To request funds held in central contingency, ministers or departments must seek access to contingency funding that has been approved in a previous government decision.

While contingency funding requests still require approval by the Treasurer, they follow a simpler approval process. This process usually requires departments to demonstrate that they have met certain criteria before the funding is released.

DTF and/or the Treasurer may designate such funding releases as Treasurer’s Advances.

Requests for Treasurer’s Advances

DTF advised us that the RMF requirements for Treasurer’s Advance requests are:

- intended to address requests for urgent and unforeseen funding needs that do not go through a government decision-making body, such as a Cabinet subcommittee, and are not related to centrally held contingencies

- not applicable for assessing budget bids that come through central government or requests to access funds held in central contingency.

Funding requests we examined

Twelve of the 33 Treasurer’s Advance requests we examined followed the RMF process for Treasurer’s Advance requests. The other 21 were general funding requests.

DTF was able to provide documentation and information to support all funding requests. This evidence clearly demonstrated that DTF assessed and advised on all requests and that general funding requests were considered by the government, with the Treasurer deciding on requests that specifically sought access to the Treasurer's Advance.

For the requests we examined that followed the RMF process, we noted exceptions where some requests did not explicitly address all of the mandatory information requirements set out in the RMF.

DTF advised that the minister's request was consistent with the established process for funding fire and emergency response activities. Bushfire-related funding requests have been dealt with using Treasurer’s Advance due to the underlying uncertainty over the duration and severity of bushfire seasons. The process involves DELWP tracking and reporting actual and estimated spend to DTF throughout a fire season and seeking a final Treasurer’s Advance capturing these unanticipated costs, after fire suppression activities are complete. This process is intended to avoid delays in funding authorisation for the fire-fighting services.

For example, the Minister for Energy, Environment and Climate Change’s request for $390 million in Treasurer’s Advance funding to cover the Department of Environment, Land, Water and Planning (DELWP), Department of Jobs, Precincts and Regions (DJPR), Department of Health and Human Services (DHHS), Department of Justice and Community Safety's (DJCS) and portfolio entities expenditure incurred during the emergency response to the 2019–20 bushfire season did not meet all of the mandatory requirements for Treasurer’s Advance applications. Specifically:

- the request letter did not include an explicit reason why the spending was urgent and unforeseen

- the letter did not directly reference or confirm that DELWP or the other departments and agencies had reviewed and exhausted other funding sources for the request

- the letter did not address any adjustments to output and financial performance targets arising from the request.

However, we accept that, in substance, DELWP established the urgency of the spending, which was the subject of this request. The request clearly referenced the challenging and unprecedented bushfire season and DELWP's role in responding to the state of disaster declared between 3 January and 11 January 2020.

DELWP asserted that the spending had already occurred as part of its immediate and direct responses to the bushfires. We also accept that the 'unforeseen' element was satisfied due to the significance of the bushfire events and related expenditure.

DTF advised us that DELWP discussed the lack of alternative funding sources with it before formally submitting the request.

COVID-19 funding requests that did not follow the RMF process

A number of the 21 general funding requests we examined that did not follow the RMF process were for government responses to COVID-19. These significant requests, which included the Business Support Fund and funding for the hotel quarantine program, were initially considered and approved by the government and subsequently met by Treasurer’s Advance approvals.

Our review confirmed that DTF assessed and made recommendations to the Treasurer on both the initial funding requests and subsequent Treasurer's Advance approvals. Appendix E contains our analysis of a selection of funding requests relating to the:

- Business Support Fund

- bushfire response and recovery

- COVID-19 emergency accommodation program that included hotel quarantine.

Improvement opportunities

The alternate funding request pathways for most Treasurer's Advances mean that key information requirements and criteria set out in the RMF are not always transparently established in funding applications or explicitly addressed in DTF's assessments and recommendations to the Treasurer.

It is reasonable to conclude that DTF designed and specified the RMF's mandatory requirements for direct ministerial requests to the Treasurer for the Treasurer’s Advance to elicit information it considers important when assessing such requests and making recommendations to the Treasurer.

We found that most requests do not proceed through the RMF process, but are submitted to government and assessed by DTF and determined under the Cabinet decision-making process. The RMF requirements do not apply to these funding requests even if they are ultimately met from Treasurer's Advance.

In some cases, even requests that do follow the RMF process do not address mandatory information requirements. There are therefore opportunities for DTF to improve the process by:

- requiring departments to submit a formal request under the RMF process for all funding claims that are intended to be met by the Treasurer’s Advance

- ensuring that it assesses the extent to which all funding requests that are expected to be met by the Treasurer’s Advance explicitly address the RMF's mandatory requirements.

Initial in-principle Treasurer’s Advance decisions and approvals were made throughout 2019-20 and finalised in June and July 2020 based on DTF's review of the available appropriation authority. The final in-principle approvals for all Treasurer's Advance requests were made in early September. There is therefore enough time available for these steps to occur in future. DTF advised us that departments already provide updates on all new and supplementary funding requests in June each year to inform DTF’s advice on Treasurer’s Advances.

DTF could implement these improvements by updating the RMF to:

- acknowledge that the Treasurer's Advance is used to meet funding requests that occur through multiple pathways

- clarify the RMF requirements and when they apply

- require DTF to assess if all funding requests that are proposed to be funded by the Treasurer’s Advance meet the RMF's mandatory requirements and seek additional information from departments when necessary.

2.3 DTF's assessments and advice to the Treasurer

For the requests we examined, DTF provided evidence to support its assessments and advice to the Treasurer for the initial, or primary, funding decisions, including:

- its briefs to the Treasurer on requests that specifically sought Treasurer’s Advance funding under the RMF process

- general funding requests that did not specifically seek access to the Treasurer's Advance and were determined by relevant government decision-making processes, such as Cabinet subcommittee deliberations.

DTF also provided evidence for its advice to the Treasurer for the initial and final in principle approval stages for 2019–20 Treasurer’s Advances.

For the requests we examined in this review that followed the RMF process, we noted some exceptions where DTF’s assessments and advice to the Treasurer did not explicitly address all of the mandatory information requirements set out in the RMF.

Initial in-principle approvals

The funding available under the Treasurer’s Advance is limited to the amount specified in the annual Appropriation Act. Given this, the Treasurer only initially provides in-principle approval for successful funding requests to retain flexibility to meet urgent claims that arise late in the financial year and ensure that the approved authority for the Treasurer’s Advance is not exceeded.

There is clear evidence that DTF manages the Treasurer’s Advance and requests for budget supplementation with knowledge of the budget situation, including the availability of appropriation funding, centrally controlled contingency allocations and the Treasurer’s Advance.

DTF provided clear evidence of its advice to the Treasurer on the initial in-principle Treasurer’s Advance funding approvals in June and July 2020. DTF’s initial brief in late June 2020 indicated that the Treasurer had $13 131.7 million in supplementary funding available consisting of:

- $10 000 million in Treasurer’s Advance authority under the Appropriation (Interim) Act 2020 for the government’s COVID-19 response

- $2 806.4 million in Treasurer’s Advance authority in the Appropriation (2019–20) Act 2019

- $325.3 million in temporary advances allowed under section 35 of the FMA.

DTF also identified $6 062.6 million of departments’ budget supplementation requests in 2019–20, which included $1 422.8 million of urgent new Treasurer’s Advance requests.

DTF noted that its advice to the Treasurer was based on draft, rather than final, requests from several departments. It also stated that its recommendations to support funding for several requests were subject to future Crisis Council of Cabinet decisions or Treasurer’s approvals based on separate briefs or the outcomes of Commonwealth funding requests.

DTF’s initial brief in June 2020 recommended that the Treasurer approve $6 027.3 million of total budget supplementation funding, including contingency releases, for 2019–20 sourced from:

- the Treasurer’s Advance ($5 332.1 million, including $2 691.9 million for non COVID 19 related responses and $2 640.2 million for COVID-19 responses)

- unapplied appropriation funding ($374.1 million)

- temporary advances under section 35 of the FMA ($321.0 million).

The Treasurer approved DTF’s recommendations on 30 June 2020.

DTF provided a further brief to the Treasurer in early July. This brief:

- recommended approving a further $129.6 million in Treasurer’s Advances for departments, including $92.6 million for COVID-19 responses and $36.9 million for other funding needs

- included a recommendation to confirm $25 million of funding sought as part of the earlier June brief for additional operating and maintenance costs claimed by Metro Trains Melbourne, resulting from new metropolitan rail assets forming part of the rail network.

The Treasurer approved these recommendations from DTF on 13 July 2020.

In total, the Treasurer approved initial in principle Treasurer's Advances of $5 436.7 million for 2019–20.

Final assessments and approvals

Departments provided updated advice on their final requirements and expected drawdowns of Treasurer’s Advance funding for 2019–20 following DTF’s final advice on initial in-principle approvals for Treasurer’s Advances in July 2020. The Crisis Council of Cabinet and the Treasurer went on to make further funding decisions. Overall, these changes decreased the amount of funding required from the Treasurer’s Advance.

In early September 2020, DTF briefed the Treasurer on the final position of the Treasurer's Advance for 2019–20 . As part of this advice, DTF:

- recommended approving an additional $2.7 million in final Treasurer’s Advance funding

- recommended approving some reclassifications of Treasurer’s Advances as COVID-19 responses and non-COVID-19 responses

- recommended that the Treasurer sign letters to ministers on the final outcomes of Treasurer’s Advance funding requests, which approved a total of $5 328.9 million of Treasurer’s Advances in aggregate for 2019–20

- indicated that departments were expected to draw down a total of $4 898.9 million in Treasurer’s Advance in 2019–20, with $2 423.7 million relating to the state’s COVID-19 response and $2 475.2 million for non COVID-19 initiatives.

The Treasurer approved the final in principle Treasurer’s Advance amounts that DTF recommended and provided letters to ministers on 3 September 2020, which confirmed the amounts for all funding requests met by the Treasurer’s Advance in 2019–20.

2.4 Urgent and unforeseen claims

While the Appropriation Acts indicate that the Treasurer's Advance should be used to meet urgent claims, they make no reference to ‘unforeseen’ claims. The RMF introduces the concept of ‘unforeseen’ in relation to the Treasurer’s Advance.

We found that few funding requests that are met by the Treasurer’s Advance and few DTF briefs on these requests explicitly address the criteria of urgent and unforeseen because:

- most funding requests that end up being met by Treasurer’s Advance are submitted as general funding requests and not as direct requests for Treasurer’s Advances. The RMF requirements do not apply to general funding requests

- DTF interprets the urgency criteria as satisfied if there is no alternative appropriation funding available.

Urgency criteria

DTF advised us that its interpretation of urgency is consistent with longstanding practice for Treasurer’s Advance use. This is because after the Annual Appropriations Act is passed:

- irrespective of the literal meaning of ‘urgent’, urgency in practice relates to any additional funding the government approves that is over and above the amounts appropriated for departments

- once the government approves additional funding for a department in the current financial year, it is funded from the Treasurer’s Advance because that is the relevant provision in the annual Appropriation Act for such decisions, unless there is an obvious alternative funding source identified by departments or DTF, such as special appropriations, unused appropriations, or prior year surpluses.

DTF’s practice of referring to the purpose of the Treasurer’s Advance that the Annual Appropriation Acts describe, which is ‛… to meet urgent claims that may arise before Parliamentary sanction is obtained’, instead of applying a literal definition of urgent when assessing requests is appropriate.

DTF advised us that in this context, parliamentary sanction refers to a future appropriation bill, which means that the funding pressure cannot wait until then and must be dealt with in the current financial year.

This means that only funding requests that specifically seek access to the Treasurer’s Advance under the RMF process need to explicitly establish their urgency.

For the funding requests we examined, DTF’s advice did not typically explicitly address the urgency of the funding request at the initial approval stage, even where it was an RMF request.

However, DTF did address urgency in its advice to the Treasurer on the final requirements and requests for Treasurer’s Advances in June 2020. Specifically, DTF advised that not supporting the recommended Treasurer’s Advance allocations would result in departments having spent appropriated funds without authority, which breaches section 90 of the Constitution Act 1975 and section 3 of the Appropriation Act. These sections stipulate that funds cannot be drawn from the Consolidated Fund without the appropriate authority.

We also saw examples where DTF did not support providing Treasurer’s Advance for funding requests on the grounds that the planned expenditure was not regarded as urgent or unforeseen.

Unforeseen criteria

DTF advised us that in the context of assessing requests for Treasurer's Advance, ‘unforeseen’ is interpreted to mean that an item was not included in an appropriation bill in that year, irrespective of the reason for exclusion. ‘Unforeseen’ is not defined by what government should have known about an issue at the time of making a decision, or when the Treasurer approves a Treasurer's Advance.

In our review, we identified instances where the Treasurer’s Advance has been used to fund expenditure that recurs year after year. For example, to provide additional funding for Victoria Police to address budget shortfalls.

Figure 2A provides more detail on this issue in relation to the Treasurer’s Advance provided to Victoria Police in 2019–20 to support its operations.

FIGURE 2A: Victoria Police case study

Section 30 of the FMA allows transfers between items of departments’ appropriation where the amount to be transferred is not required for the purposes of that item and can be assigned for another purpose where access to funds is insufficient.

- a Treasurer’s Advance of $175 million

- a transfer of $50 million under section 30 of the FMA

- access to prior year surpluses of $10 million under section 33 of the FMA.

- $38.9 million for its involvement in and response to the Royal Commission into the Management of Police Informants

- $10.8 million for COVID-19 response costs

- $10.4 million for its involvement in responding to the 2019–20 bushfire season.

- accommodation and leasing costs

- utility costs

- costs arising from recruiting more personnel than its funded staffing profile.

Source: VAGO, based on information from DTF.

We also identified Treasurer’s Advances that were approved for spending described as 'scheduled asset replacement' or depreciation funding that would seem foreseeable given the clear and long-standing requirements for asset management in the Victorian public sector.

It is acknowledged that there may be good and valid reasons for holding funding back from an agency until such time that its required. It would be beneficial for DTF to undertake an annual review of the nature of expenditure that the Treasurer’s Advance supports to identify opportunities to minimise the use of Treasurer’s Advances for reasonably foreseeable spending, and to monitor and advise on underlying budgeting, financial management or cost pressures that may contribute to such requests.

3. Transparency and accountability

Conclusion

The Treasurer’s Advance disclosures in the state’s Annual Financial Report for 2019–20 are complete, accurate and fairly presented.

DTF enhanced transparency and accountability by disclosing if individual Treasurer’s Advance items for 2019–20 were attributable to government COVID-19 responses.

Agencies could further enhance transparency by disclosing the amounts they spend against each approval in their financial reports.

This chapter discusses:

3.1 2019–20 Treasurer’s Advances

The State of Victoria's AFR discloses payments made against the Treasurer’s Advance during that financial year. The Annual Appropriation Act for the following financial year also discloses these payments.

Figures 3A and 3B summarise the outcomes of departments' COVID-19-related and non-COVID-19 requests to access the Treasurer's Advance during 2019–20.

FIGURE 3A: Summary of COVID-19-related Treasurer’s Advance requests in 2019–20

| Department | Requested ($ 000) | Alternate funds ($ 000) | Treasurer's approval ($ 000) | Drawn down ($ 000) | Unused ($ 000) |

|---|---|---|---|---|---|

| Courts | 4 311 | 0 | 4 311 | 1 504 | 2 807 |

| Education and Training | 95 240 | 5 000 | 90 240 | 88 975 | 1 265 |

| Environment, Land, Water and Planning | 17 904 | 0 | 16 404 | 16 104 | 300 |

| Health and Human Services | 1 005 622 | 0 | 1 005 622 | 886 672 | 118 950 |

| Jobs, Precincts and Regions | 1 186 343 | 500 | 1 167 091 | 1 134 302 | 32 789 |

| Justice and Community Safety | 22 160 | 0 | 20 880 | 15 650 | 5 230 |

| Premier and Cabinet | 20 783 | 0 | 20 783 | 20 110 | 673 |

| Transport | 243 301 | 0 | 242 390 | 234 720 | 7 670 |

| Treasury and Finance | 43 300 | 0 | 43 300 | 25 690 | 17 610 |

| Total | 2 638 964 | 5 500 | 2 611 021 | 2 423 727 | 187 294 |

Note: Some figure totals may not add up due to rounding.

Note: Unused departmental Treasurer’s Advance funding lapses and cannot be carried over into the subsequent financial year.

Note: The amounts shown for 'requested' are sourced from DTF's briefings to the Treasurer on Treasurer's Advance at the end of the financial year and so may differ from the initial requests made earlier in the financial year. The approval amounts are sourced from the Treasurer's final in-principle approvals in September 2020.

Source: VAGO, using data supplied by DTF.

FIGURE 3B: Summary of non-COVID-19 Treasurer’s Advance requests in 2019–20

| Department | Requested ($ 000) | Alternate funds ($ 000) | Treasurer's approval ($ 000) | Drawn down ($ 000) | Unused ($ 000) |

|---|---|---|---|---|---|

| Courts | 9 671 | 0 | 9 671 | 9 439 | 232 |

| Education and Training | 478 172 | 225 769 | 252 403 | 250 978 | 1 425 |

| Environment, Land, Water and Planning | 461 719 | 0 | 461 719 | 423 791 | 37 928 |

| Health and Human Services | 672 410 | 0 | 672 410 | 516 199 | 156 211 |

| Jobs, Precincts and Regions | 139 335 | 0 | 139 333 | 135 073 | 4 260 |

| Justice and Community Safety | 817 689 | 215 398 | 592 010 | 580 017 | 11 993 |

| Parliament | 5 263 | 0 | 5 263 | 4 909 | 354 |

| Premier and Cabinet | 97 381 | 0 | 97 381 | 85 793 | 11 588 |

| Transport | 631 658 | 158 246 | 469 609 | 451 516 | 18 093 |

| Treasury and Finance | 18 409 | 250 | 18 159 | 17 507 | 652 |

| Total | 3 331 707 | 599 663 | 2 717 959 | 2 475 224 | 242 735 |

Note: Some figure totals may not add up due to rounding.

Note: Unused departmental Treasurer’s Advance funding lapses and cannot be carried over into the subsequent financial year.

Note: The amounts shown for 'requested' are sourced from DTF's briefings to the Treasurer on Treasurer's Advance at the end of the financial year and so may differ from the initial requests made earlier in the financial year. The approval amounts are sourced from the Treasurer's final in-principle approvals in September 2020.

Source: VAGO, using data supplied by DTF.

Figures 3A and 3B show that DTF initially explores if alternative funding sources are available when considering these requests. As a result, around 10 per cent of requests were funded from alternate sources.

These figures also demonstrate that the actual amounts reported as drawn down by departments in total were less than or equal to the Treasurer’s final in principle approval.

3.2 Reporting on departments' use of Treasurer's Advances

In 2019–20, the 196 individual line items disclosed the AFR in notes 8.2.13 Payments from advance to the Treasurer exclusive of those attributable to COVID-19 for the financial year ended 30 June and 8.2.14 Payments from advance to the Treasurer attributable to COVID-19 for the financial year ended 30 June (pages 163–167) represent over 300 individual Treasurer’s Advance decisions.

DTF merges or amalgamates related Treasurer’s Advance requests for disclosure purposes. We reconciled evidence on individual Treasurer’s Advance approvals for 2019–20 to relevant disclosures in the AFR and found no material issues.

Verifying the amounts drawn down and spent

The disclosure of payments against individual Treasurer’s Advances in the state’s AFR and Annual Appropriation Acts reflects advice from departments to DTF on the amounts that they actually drew down against approved Treasurer’s Advances to the end of the relevant financial year.

DTF compares aggregate information relating to departments' drawdowns to relevant aggregate information entered by departments in the state’s central ledger system SRIMS to check if they match in aggregate.

Departments' chief finance officers provide a separate attestation to DTF to confirm that all amounts included in SRIMS are consistent with their audited accounts.

However, DTF does not seek confirmation from departments on their actual spending against each advance.

Additionally, departments only disclose the total approval authority they receive for Treasurer’s Advances as part of a note on compliance with annual parliamentary and special appropriations in their audited financial reports. They do not separately disclose their actual expenditure against Treasurer’s Advances either individually or in aggregate.

Departments could further enhance transparency by including separate disclosures of the amounts they have spent against Treasurer's Advances in their financial reports.

Appendix A. Submissions and comments

We have consulted with DTF, Department of Education and Training (DET), DELWP, DHHS, DJCS, DJPR, Department of Transport (DoT), Department of Premier and Cabinet (DPC) and Victoria Police, and we considered their views when reaching our conclusions. As required by the Audit Act 1994, we gave a draft copy of this report, or relevant extracts, to those agencies and asked for their submissions and comments.

Responsibility for the accuracy, fairness and balance of those comments rests solely with the agency head.

Response provided by the Secretary, DTF

Response provided by the Associate Secretary, DET

Response provided by the Secretary, DELWP

Response provided by the Secretary, DHHS

Response provided by the Secretary, DJCS

Response provided by the Associate Secretary, DJPR

Response provided by the Secretary, DoT

Response provided by the Secretary, DPC

Response provided by the Chief Commissioner, Victoria Police

Appendix B. Acronyms

| Acronyms | |

|---|---|

| AFR | Annual Financial Report (of the State of Victoria) |

| DET | Department of Education and Training |

| DELWP | Department of Environment, Land, Water and Planning |

| DHHS | Department of Health and Human Services |

| DJCS | Department of Justice and Community Safety |

| DJPR | Department of Jobs, Precincts and Regions |

| DoT | Department of Transport |

| DPC | Department of Premier and Cabinet |

| DTF | Department of Treasury and Finance |

| FMA | Financial Management Act 1994 |

| RMF | Resource Management Framework |

| SRIMS | State Resource Information Management System |

| VAGO | Victorian Auditor-General’s Office |

Appendix C. About this assurance review

Review objectives, scope and approach

| Who we reviewed | What we assessed | What the review cost |

|---|---|---|

| DET, DELWP, DHHS, DJCS, DJPR, DoT, DPC, DTF | We assessed whether applications by accountable officers to use the Treasurer’s Advance and approvals to use the Treasurer’s Advance (regardless of the source of the request) complied with the prescribed processes and were lawfully drawn down. | The review cost $175 000, which includes preparation of this report. |

We conducted this limited assurance review in accordance with the Audit Act 1994 and Australian Standard on Assurance Engagements ASAE 3000 Assurance Engagements Other than Audits or Reviews of Historical Financial Information.

A review is a limited assurance engagement that is less in scope than an audit conducted in accordance with Australian Auditing Standards. Consequently, it does not enable us to obtain reasonable assurance that we would become aware of all significant matters that might be identified in a reasonable assurance engagement.

Our specific procedures included reviewing:

- whether DTF had comprehensive information to support its advice and recommendations on the initial and final in-principle approvals of all Treasurer’s Advances in 2019–20

- all approved Treasurer’s Advances over $100 million for 2019–20. DTF was able to quickly provide evidence to support these Treasurer’s Advances’ applications, assessments and approvals and we examined this evidence for a sample of them

- a further sample of Treasurer’s Advances below $100 million to ensure coverage of all departments and different types of Treasurer’s Advance purposes and funding decision pathways.

We also sought advice and explanations from DTF on the Treasurer’s Advance process and controls and how it implements these for specific Treasurer’s Advances.

Appendix D. Treasurer’s Advance Approvals for 2019–20

Figure D1 itemises departments’ use of Treasurers Advances in their response to the COVID-19 pandemic. The most significant items in this list include:

- $784.7 million for the Business Support Fund (DJPR)

- $715.8 million (multiple items) for additional resources for health services and the health system for COVID-19 responses (DHHS)

- $145.8 million to support the metropolitan public transport network and services (DoT)

- $142.2 million to quarantine returning international travellers (DJPR)

- $108.9 million for the Working for Victoria Fund (DJPR).

FIGURE D1: Itemised requests for COVID-19-related Treasurer’s Advances by entity

| Entity | Requested ($) | Alternate funds ($) | Treasurer’s approval ($) | Drawn down ($) | Unused ($) |

|---|---|---|---|---|---|

| Courts | 4 311 000 | 0 | 4 311 000 | 1 504 419 | 2 806 581 |

| Victorian Civil and Administrative Tribunal remote hearing services | 4 311 000 | 0 | 4 311 000 | 1 504 419 | 2 806 581 |

| Education and Training | 95 240 000 | 5 000 000 | 90 240 000 | 88 975 354 | 1 264 646 |

| COVID-safe training for hospitality businesses and local government | 1 000 000 | 0 | 1 000 000 | 1 000 000 | 0 |

| Kindergarten Viability during COVID-19 | 25 340 000 | 5 000 000 | 20 340 000 | 19 075 354 | 1 264 646 |

| TAFE and Training sector COVID-19 Response and Viability | 68 900 000 | 0 | 68 900 000 | 68 900 000 | 0 |

| Environment, Land, Water and Planning | 17 904 000 | 0 | 16 404 000 | 16 104 000 | 300 000 |

| Delivery of Development Facilitation Initiatives to Support COVID-19 Recovery (VPA development facilitation) | 8 600 000 | 0 | 8 600 000 | 8 600 000 | 0 |

| Financial support—Alpine Resort Management Board | 3 600 000 | 0 | 2 100 000 | 1 800 000 | 300 000 |

| Financial support for Committees of Management | 1 230 000 | 0 | 1 230 000 | 1 230 000 | 0 |

| Financial support for portfolio entities | 4 400 000 | 0 | 4 400 000 | 4 400 000 | 0 |

| Targeted support for Victorians struggling with energy bills | 74 000 | 0 | 74 000 | 74 000 | 0 |

| Health and Human Services | 1 005 621 649 | 0 | 1 005 621 649 | 886 671 507 | 118 950 141 |

| Additional support for Victoria’s mental health system | 7 080 500 | 0 | 7 080 50 | 7 080 500 | 0 |

| COVID-19 Response Extra funding boost for Victoria’s health system* | 296 059 000 | 0 | 296 059 000 | 282 643 556 | 13 415 444 |

| COVID-19 support for people with disability | 6 010 000 | 0 | 6 010 000 | 4 250 000 | 1 760 000 |

| COVID-19 support for the children and families system | 20 600 000 | 0 | 20 600 000 | 17 474 402 | 3 125 598 |

| Elective surgery blitz | 50 000 000 | 0 | 50 000 000 | 50 000 000 | 0 |

| Emergency accommodation program | 17 080 000 | 0 | 17 080 000 | 17 080 000 | 0 |

| Food relief program | 2 700 000 | 0 | 2 700 000 | 1 840 000 | 860 000 |

| Health procurement and supply chain | 3 400 000 | 0 | 3 400 000 | 3 400 000 | 0 |

| Increase testing, tracing and response capacity* | 33 595 914 | 0 | 33 595 914 | 33 195 914 | 400 000 |

| Treasurer's Advances approved but not used | 19 182 000 | 0 | 19 182 000 | 0 | 19 182 000 |

| Peter Doherty Institute COVID-19 Research | 6 000 000 | 0 | 6 000 000 | 6 000 000 | 0 |

| Rent relief scheme | 30 527 000 | 0 | 30 527 000 | 30 527 000 | 0 |

| COVID-19 Response Additional support for the health system with additional equipment and ICU capacity* | 513 387 235 | 0 | 513 387 235 | 433 180 135 | 80 207 099 |

| Jobs, Precincts and Regions | 1 186 343 000 | 500 000 | 1 167 091 000 | 1 134 301 544 | 32 789 456 |

| Economic Survival Package—Business Support Fund* | 787 100 000 | 0 | 787 100 000 | 784 671 123 | 2 428 877 |

| Economic Survival Package—Working for Victoria Fund | 115 000 000 | 0 | 115 000 000 | 108 954 679 | 6 045 321 |

| Emergency Accommodation Framework—additional funding for accommodation for family violence victim survivors and perpetrators | 20 000 000 | 0 | 20 000 000 | 20 000 000 | 0 |

| Emergency Support For Victoria’s International Students | 24 300 000 | 0 | 24 300 000 | 20 830 672 | 3 469 328 |

| Experience Economy Survival Package | 60 675 000 | 0 | 59 005 000 | 45 960 457 | 13 044 543 |

| International Quarantine of Travellers* | 167 118 000 | 0 | 150 036 000 | 142 234 614 | 7 801 386 |

| Melbourne Convention and Exhibition Trust | 11 650 000 | 0 | 11 650 000 | 11 650 000 | 0 |

| Treasurer's Advance requests that did not proceed | 500 000 | 500 000 | 0 | 0 | 0 |

| Justice and Community Safety | 22 160 000 | 0 | 20 880 000 | 15 650 060 | 5 229 940 |

| Additional legal assistance services and ICT upgrades | 9 180 000 | 0 | 9 180 000 | 9 179 996 | 4 |

| Supporting people with disability in Victoria | 900 000 | 0 | 900 000 | 614 878 | 285 122 |

| Treasurer's Advance request that DTF did not support | 1 280 000 | 0 | 0 | 0 | 0 |

| Victoria Police COVID-19 Response* | 10 800 000 | 0 | 10 800 000 | 5 855 186 | 4 944 814 |

| Premier and Cabinet | 20 783 367 | 0 | 20 783 367 | 20 110 474 | 672 893 |

| Anzac Appeal, Legacy and Victorian Veterans Council | 1 550 000 | 0 | 1 550 000 | 1 550 000 | 0 |

| COVID-19 response—Multicultural and faith communities | 2 516 000 | 0 | 2 516 000 | 2 240 087 | 275 913 |

| COVID-19 response—Public Health Communications campaign | 6 500 000 | 0 | 6 500 000 | 6 500 000 | 0 |

| COVID-19 response—Victoria Together | 850 000 | 0 | 850 000 | 453 457 | 396 453 |

| COVID-19 response—Victoria Together (music component)* | 721 000 | 0 | 721 000 | 721 000 | 0 |

| Good Friday Appeal | 8 560 000 | 0 | 8 560 000 | 8 559 563 | 437 |

| Support for South Sudanese disadvantaged youth during COVID 19 | 86 367 | 0 | 86 367 | 86 367 | 0 |

| Transport | 243 301 000 | 0 | 242 390 000 | 234 719 865 | 7 670 135 |

| Additional metropolitan and regional public transport cleaning costs | 17 162 000 | 0 | 16 200 000 | 16 173 000 | 27 000 |

| Treasurer's Advances approved but not used | 1 230 000 | 0 | 1 230 000 | 0 | 1 230 000 |

| Registration and licensing services resourcing | 12 900 000 | 0 | 12 900 000 | 12 768 865 | 131 135 |

| Rent relief supplementation | 12 700 000 | 0 | 12 700 000 | 7 768 000 | 4 932 000 |

| Support for the metropolitan public transport network and services | 145 809 000 | 0 | 145 860 000 | 145 810 000 | 50 000 |

| Support for public transport rail partnerships | 26 500 000 | 0 | 26 500 000 | 25 200 000 | 1 300 000 |

| Support for the regional public transport network and services | 27 000 000 | 0 | 27 000 000 | 27 000 000 | 0 |

| Treasury and Finance | 43 300 000 | 0 | 43 300 000 | 25 690 206 | 17 609 794 |

| Economic Survival Package—Implementation | 300 000 | 0 | 300 000 | 300 000 | 0 |

| Economic Survival Package—Refund of Liquor Licenses* | 30 000 000 | 0 | 30 000 000 | 22 590 206 | 7 409 794 |

| Cenitex to support remote working* | 13 000 000 | 0 | 13 000 000 | 2 800 000 | 10 200 000 |

| Grand Total | 2 638 964 016 | 5 500 000 | 2 611 021 016 | 2 423 727 431 | 187 293 585 |

Note: *Indicates the requests we examined.

Note: Some totals may not add up due to rounding.

Note: The amounts shown for 'requested' are sourced from DTF's briefings to the Treasurer on Treasurer's Advance at the end of the financial year and so may differ from the initial requests made earlier in the financial year. The approval amounts are sourced from the Treasurer's final in-principle approvals in September 2020.

Note: Unused Treasurer’s Advance funding lapses and cannot be carried over into the subsequent financial year.

Source: VAGO using data supplied by DTF.

Figure D2 itemises the non-COVID-19 purposes that the Treasurer’s Advance was used for in 2019–20. The most significant items in this list include:

- $660.897 million for bushfire responses (various agencies)

- $336.831 million for the Level Crossing Removal Authority (DoT)

- $121.284 million to support Victoria Police (DJCS)

- $118.150 million for additional resources for health services (DHHS)

- $112.638 million for essential maintenance and compliance in schools (DET).

FIGURE D2: Itemised requests for non-COVID-19-related Treasurer’s Advances by entity

| Entity | Requested ($) | Alternate funds ($) | Treasurer's approval ($) | Drawn down ($) | Unused ($) |

|---|---|---|---|---|---|

| Courts | 9 671 000 | 0 | 9 671 000 | 9 439 100 | 231 900 |

| Aboriginal Justice Agreement Phase Four | 1 508 000 | 0 | 1 508 000 | 1 385 620 | 122 380 |

| Bourke Street Coronial Inquest | 2 030 000 | 0 | 2 030 000 | 1 990 210 | 39 790 |

| Judicial Commission of Victoria resourcing | 1 700 000 | 0 | 1 700 000 | 1 635 205 | 64 795 |

| Royal Commission into the Management of Police Informants | 830 000 | 0 | 830 000 | 828 065 | 1 935 |

| Additional depreciation equivalent funding following an asset revaluation* | 3 603 000 | 0 | 3 603 000 | 3 600 000 | 3 000 |

| Education and Training | 478 171 792 | 225 768 866 | 252 402 926 | 250 977 92 | 1 425 000 |

| Camps, Sports and Excursions Fund | 37 583 000 | 1 000 000 | 36 583 000 | 36 183 000 | 400 000 |

| English as an Additional Language | 25 737 000 | 0 | 25 737 000 | 25 737 000 | 0 |

| Kindergarten Enrolment Based Funding | 3 404 000 | 0 | 3 404 000 | 2 379 000 | 1 025 000 |

| Treasurer's Advance requests that did not proceed | 193 639 792 | 193 639 792 | 0 | 0 | 0 |

| School Enrolment Based Funding | 74 041 000 | 0 | 74 041 000 | 74 041 000 | 0 |

| Essential Maintenance and Compliance in schools* | 143 767 000 | 31 129 074 | 112 637 926 | 112 637 926 | 0 |

| Environment, Land, Water and Planning | 461 718 529 | 0 | 461 718 529 | 423 790 984 | 37 927 545 |

| Additional aviation resources for firefighting | 14 133 000 | 0 | 14 133 000 | 14 133 000 | 0 |

| Alpine Resorts—Southern Alpine Resort Management Board* | 7 070 000 | 0 | 7 070 000 | 7 070 000 | 0 |

| Bushfire response and recovery* | 340 909 529 | 0 | 340 909 529 | 318 681 571 | 22 227 958 |

| Cladding rectification program | 37 915 000 | 0 | 37 915 000 | 37 915 000 | 0 |

| Drought response | 5 875 000 | 0 | 5 875 000 | 5 875 000 | 0 |

| Early works for transport infrastructure projects* | 660 000 | 0 | 660 000 | 660 000 | 0 |

| Enhanced preparedness for the 2019–20 fire season | 8 900 000 | 0 | 8 900 000 | 8 900 000 | 0 |

| Fencing upgrades to help landholders recover from fire | 3 200 000 | 0 | 3 200 000 | 3 200 000 | 0 |

| Immediate support for Victoria’s Wildlife and Biodiversity | 7 000 000 | 0 | 7 000 000 | 7 000 000 | 0 |

| Improve access to emergency water supply points | 500 000 | 0 | 500 000 | 500 000 | 0 |

| Local Government service support payment | 5 240 000 | 0 | 5 240 000 | 5 240 000 | 0 |

| Treasurer's Advances approved but not used | 14 986 000 | 0 | 14 986 000 | 0 | 14 986 000 |

| Power saving bonus extension | 13 000 000 | 0 | 13 000 000 | 12 286 413 | 713 587 |

| Recycling industry support | 2 330 000 | 0 | 2 330 000 | 2 330 000 | 0 |

| Health and Human Services | 672 410 196 | 0 | 672 410 196 | 516 198 950 | 156 211 246 |

| Additional resources for health services* | 118 150 000 | 0 | 118 150 000 | 118 150 000 | 0 |

| Bushfire response* | 7 582 622 | 0 | 7 582 622 | 7 307 786 | 274 836 |

| Civil claims for historical institutional child abuse | 19 152 000 | 0 | 19 152 000 | 19 152 000 | 0 |

| Elective surgery Blitz | 40 000 000 | 0 | 40 000 000 | 40 000 000 | 0 |

| Family violence Central Information Point | 19 394 833 | 0 | 19 394 833 | 16 988 984 | 2 405 849 |

| Implementation of recommendations from the Royal Commission into Victoria’s Mental Health System | 7 001 000 | 0 | 7 001 000 | 4 887 388 | 2 113 612 |

| Increased support for children with complex disabilities | 10 196 000 | 0 | 10 196 000 | 10 196 000 | 0 |

| Joan Kirner Women’s and Children’s Hospital | 21 800 000 | 0 | 21 800 000 | 21 800 000 | 0 |

| National Disability Insurance Scheme—Home and Community Care | 661 000 | 0 | 661 000 | 661 000 | 0 |

| National Disability Insurance Scheme—Transfer of disability accommodation and respite services | 70 550 000 | 0 | 70 550 000 | 70 550 000 | 0 |

| Treasurer's Advances approved but not used | 4 879 000 | 0 | 4 879 000 | 0 | 4 879 000 |

| Responses to drought and dry seasonal conditions | 1 650 000 | 0 | 1 650 000 | 1 650 000 | 0 |

| Supplementation for the hospital and charities fund* | 239 370 741 | 0 | 239 370 741 | 92 832 792 | 146 537 949 |

| Walter and Eliza Hall Institute for medical research | 18 000 000 | 0 | 18 000 000 | 18 000 000 | 0 |

| Scheduled asset replacement in the health sector | 94 023 000 | 0 | 94 023 000 | 94 023 000 | 0 |

| Jobs, Precincts and Regions | 139 335 013 | 0 | 139 333 279 | 135 073 319 | 4 259 960 |

| Beckley Park racing precinct | 1 997 000 | 0 | 1 997 000 | 1 997 000 | 0 |

| AgriBio Centre for AgriBioscience | 673 597 | 0 | 673 597 | 673 597 | 0 |

| Building the visitor economy: tourism marketing campaign* | 14 635 000 | 0 | 14 635 000 | 14 635 000 | 0 |

| Bushfire Response* | 4 802 611 | 0 | 4 800 877 | 4 800 877 | 0 |

| Community Cricket Program | 500 000 | 0 | 500 000 | 500 000 | 0 |

| Community Sports Infrastructure Loans | 342 279 | 0 | 342 279 | 292 780 | 49 499 |

| Drought response | 24 873 516 | 0 | 24 873 516 | 24 710 182 | 163 334 |

| Eureka Sport Precinct | 3 880 000 | 0 | 3 880 000 | 3 880 000 | 0 |

| Globally Connected Investment and Trade | 48 000 | 0 | 48 000 | 48 000 | 0 |

| Ikon Park upgrades | 3 800 000 | 0 | 3 800 000 | 3 800 000 | 0 |

| Job fairs in Melbourne’s north and west | 93 673 | 0 | 93 673 | 93 673 | 0 |

| Legal costs associated with litigation | 570 000 | 0 | 570 000 | 417 691 | 152 309 |

| Melbourne Markets | 482 000 | 0 | 482 000 | 482 000 | 0 |

| National Biosecurity Control Agreements | 1 881 857 | 0 | 1 881 857 | 1 881 857 | 0 |

| Treasurer's Advances approved but not used | 410 000 | 0 | 410 000 | 0 | 410 000 |

| Regent Theatre | 468 000 | 0 | 468 000 | 468 000 | 0 |

| Reid Oval | 1 750 000 | 0 | 1 750 000 | 1 750 000 | 0 |

| Repowering and cash advance facility | 47 470 647 | 0 | 47 470 647 | 47 470 647 | 0 |

| Royal Melbourne Showgrounds | 161 833 | 0 | 161 833 | 161 833 | 0 |

| Ryan’s Reserve upgrades | 750 000 | 0 | 750 000 | 750 000 | 0 |

| Victoria: The Basketball Capital of Australia—Melbourne Arena upgrades | 6 500 000 | 0 | 6 500 000 | 6 500 000 | 0 |

| Victorian Forestry Plan | 15 930 000 | 0 | 15 930 000 | 14 451 181 | 1 478 819 |

| Victorian Home of Golf and National High Performance Centre* | 2 297 000 | 0 | 2 297 000 | 2 297 000 | 0 |

| Whitten Oval preliminary design | 1 000 000 | 0 | 1 000 000 | 1 000 000 | 0 |

| Worker Transfer Scheme | 3 173 000 | 0 | 3 173 000 | 1 742 000 | 1 431 000 |

| Young Farmers Scholarship Program | 125 000 | 0 | 125 000 | 125 000 | 0 |

| Shareholding management and advisory costs related to Carbon Revolution | 720 000 | 0 | 720 000 | 145 000 | 575 000 |

| Justice and Community Safety | 817 689 078 | 215 397 965 | 592 010 295 | 580 017 334 | 11 992 961 |

| Best practice integrity oversight | 25 000 | 0 | 25 000 | 22 273 | 2 727 |

| Bushfire Case Support Program for the Department of Health and Human Services—Natural Disaster Financial Assistance | 7 900 000 | 0 | 7 900 000 | 7 900 000 | 0 |

| Bushfire Community Recovery Package and Clean-up Program | 161 000 000 | 0 | 161 000 000 | 161 000 000 | 0 |

| Bushfire Financial Assistance Grant Programs | 59 247 113 | 0 | 59 247 113 | 59 247 113 | 0 |

| Bushfire suppression* | 38 000 000 | 0 | 38 023 182 | 37 249 604 | 773 578 |

| Crime Prevention Initiatives | 5 000 000 | 0 | 5 000 000 | 4 903 193 | 96 807 |