Auditor-General’s Report on the Annual Financial Report of the State of Victoria, 2010–11

Overview

Each year the Treasurer prepares the Annual Financial Report of the State of Victoria which is audited by the Auditor-General. Parliament can have confidence in the Annual Financial Report of the State prepared for 2010–11 as a clear audit opinion was issued on 10 October 2011.

In that report, the state recorded a net surplus of $1 646.8 million for 2010–11. This is an improved result on the prior two financial years and reflects improved economic conditions. However, there is upward pressure on expenditure from salaries and wages, interest and depreciation, which is a risk when coupled with decreasing Commonwealth revenue across the forward estimates period. At the same time, the state's debt grew by 8.7 per cent to total $55 634.4 million at 30 June 2011. The state's ability to service this debt is decreasing because debt is growing faster than Gross State Product.

Underpinning the growth in state assets is a rolling $35.9 billion investment program. This report makes comment on the progress in terms of time and cost for projects which exceed $1 000 million. Comments are provided for Building the Education Revolution, Victorian Schools Plan, Victorian Comprehensive Cancer Centre, social housing, the desalination plant, Foodbowl Modernisation, Northern Sewerage Project, myki, new trains and trams, Regional Rail Link, Peninsula Link and major road upgrades.

Auditor-General’s Report on the Annual Financial Report of the State of Victoria, 2010–11: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER November 2011

PP No 82, Session 2010–11

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit the Auditor-General’s Report on the Annual Financial Report of the State of Victoria, 2010–11.

Yours faithfully

![]()

D D R PEARSON

Auditor-General

9 November 2011

Audit summary

Background

Each year the Treasurer prepares a set of financial statements for the State of Victoria that combine the results and balances of the 286 state-controlled entities in terms of Australian Accounting Standards. The financial statements are tabled in Parliament as part of the Annual Financial Report of the State of Victoria (known as the AFR).

The AFR is an important accountability document as it provides Parliament and the public with a report on the state’s revenue, expenditure, and financial position as at 30 June each year. The Auditor-General conducts a financial audit of the AFR and issues an opinion as to the reliability of the financial statements.

The Auditor-General’s Report on the Annual Financial Report of the State of Victoria, 2010–11 analyses the state’s reported result and financial position for 2010–11 by looking at short-term and long-term indicators of financial sustainability.

The state collected $53.3 billion in revenue in 2010–11 and incurred expenditure of $53.8 billion over the same period.

Underpinning the growth in state assets is a rolling $35.9 billion investment program, with 10 large projects accounting for $18 billion of this amount. Given their financial impact, this report also comments on the progress of the major projects and initiatives in each sector including in terms of timeliness and cost.

Conclusion

Parliament can have confidence in the AFR and the reported financial position of the state as at 30 June 2011.

A clear audit opinion was issued on the AFR on 10 October 2011. The independent audit opinion adds credibility to the financial report by providing assurance that the information is reliable.

The state had a positive financial outcome for the 2010–11 financial year, reporting a net surplus of $1 646.8 million. However, the ability of the state to produce surpluses in future years will be challenged if expenditure continues to grow faster than revenue.

Major projects reviewed were largely on time and tracking against revised budgets. Opportunities exist for the public sector to enhance reporting and disclosures to provide more transparency on project costs.

Findings

Results of audit

The AFR was tabled on 13 October 2011, one month later than in 2009–10 and one month later than planned. The Department of Treasury and Finance prepared 10 drafts of the AFR with material changes in each version. As a result, the audit was disrupted and protracted.

Timely preparation of the AFR relies on the 46 material entities finalising their financial statements in accordance with AFR milestones. In 2010–11, only 17 per cent of material entities finalised their financial reports by the AFR milestone date. This compressed the time available for the Department of Treasury and Finance to prepare the AFR and increased the risk of material error.

The state’s financial result

The state reported a net surplus of $1 646.8 million for 2010–11: an improvement from the deficits reported in the past two financial years. The net surplus takes into account movements in financial assets and liabilities and, is therefore, vulnerable to economic conditions. The net surplus for 2010–11 reflects improved economic conditions that delivered smaller actuarial losses on unfunded superannuation, and gains on financial assets in excess of financial liabilities. Prior year deficits also included asset write‑downs. None were required in 2010–11.

The net result from transactions was a deficit of $512.5 million for 2010–11. There were negative trends underlying this figure that present risks that the state must manage. Specifically, expenditure continued to grow faster than revenue. There was upward pressure on expenditure from salaries and wages, interest and depreciation, and this is expected to continue. Conversely, revenue received from the Commonwealth is expected to decrease in 2011–12 and across the forward estimates period.

Infrastructure renewal

The state’s infrastructure assets totalled $66 109.4 million at 30 June 2011, increasing by 5.3 per cent in the year. These infrastructure assets have ongoing maintenance requirements which are a funding pressure on the state.

The infrastructure renewal gap measures the rate of spending on assets compared to the rate of asset consumption, represented by depreciation. The renewal gap for the state moved to 3.65:1 in 2010–11 (2.73:1 in 2009–10), remaining above the threshold of 1:1 which is the point at which investment in assets equals depreciation. The result indicates that the state’s spending on assets is at a level where assets are being maintained.

Debt

State debt grew by 8.7 per cent during the year, totalling $55 634.4 million at 30 June 2011. The additional debt was used to fund infrastructure programs in schools, transport and water.

We looked at the state’s ability to service this debt by calculating a debt sustainability ratio that divides borrowings and the unfunded superannuation liability, by Gross State Product (GSP). The analysis showed that the state’s ability to service its debt decreased because debt grew at a faster rate than GSP. Specifically, in 2010–11 debt grew by 8.7 per cent and GSP increased by 3.5 per cent.

Significant projects and developments

This report comments on current state projects with individual budgets exceeding $1 000 million. A snapshot of the projects, actual costs and progress at 30 June 2011 is provided in Figure A.

Figure A

Project costs and progress to 30 June 2011

Project |

Actual expenditure ($mil) |

Comment on progress |

|---|---|---|

Building the Education Revolution |

2 311 |

85 per cent of projects completed. Program time lines extended, 290 projects rephased to 2011–12. |

Victorian Schools Plan |

1 657 |

Upgrades to continue. A further $187 million provided for in the 2011–12 Budget. |

Victorian Comprehensive Cancer Centre |

10.5 |

Public private partnership agreement not yet signed. $10.5 million spent on early site works. |

Social housing |

1 096.2 |

Construction of new social housing 75 per cent complete. Repairs and maintenance works completed on 9 363 dwellings, exceeding the original target of 7 000 dwellings. |

Desalination plant |

218.9 |

No contract payments made. The state may recover $14 million if certain conditions are met, as commercial acceptance and project completion delayed. |

Food Bowl Modernisation Stage 1 |

558.9 |

Completion revised from December 2012 due to floods and the need to seek alternative channel remediation solutions. |

Northern Sewerage Project |

482.0 |

Melbourne Water works to be commissioned by October 2011. Yarra Valley Water Limited works to be commissioned by February 2012. |

myki |

771.6 |

Cost of modifications announced by the government not yet determined. Assets of $27.6 million written off due to the modifications. Farebox guarantee extended due to delays in rollout. $76.1 million paid under the guarantee in 2010–11. |

New trains |

486 |

23 of 38 new trains received, 15 on order. Contracted for seven more trains at total cost of $210.4 million. |

New trams |

34.6 |

$272 million contract for design and construction of 50 trams. $537.6 million to be spent on project costs and infrastructure. |

Regional Rail Link |

251 |

Budget under review. Upward pressure from land acquisitions, signalling costs and construction complexities. |

M1 upgrade |

1 299 |

Project completed. $41 million in future costs means project completed on budget. |

M80 upgrade |

358 |

Expected completion 2018–19. |

Peninsula Link |

50.4 |

Total estimated nominal cost $2 802 million over 25-year contract period. |

Western Highway upgrades |

188 |

Stages 1A and 1B commenced. Budget increased to $311 million. |

Source: Victorian Auditor-General's Office.

Presentation of the cost of public private partnerships

Public private partnerships (PPP) are contractual arrangements entered into by the state with the private sector typically designing, constructing, financing and operating a public asset in exchange for periodic payments. At the end of the contract period, ownership of the asset reverts to the state.

At 30 June 2011 the state had 19 PPP contracts, with state commitments totalling $9 496.9 million (net present value).

Under the requirements of Australian Accounting Standards, PPP contracts are accounted for as finance leases. Reporting by departments, agencies and at the AFR level satisfies the standards’ requirement to report and disclose these contractual liabilities in general purpose financial statements.

However, the full cost to the state of PPP projects is difficult for a reader of general purpose financial statements to ascertain. This is because the related costs incurred directly by the state are not drawn out and reported beside the contractual obligations. Direct costs paid by the state are typically for land acquisition, site preparatory works, environmental assessments and project management.

For the two PPP projects discussed in this report, the Desalination Plant and Peninsula Link, direct costs added 14 per cent and 3 per cent, respectively, to the contractual costs.

There needs to be enhanced disclosure of PPP costs to provide transparency to the public of the full cost implications to the state. This would remove the ambiguity that surrounds the total cost of these projects and their reporting in the public arena.

Opportunity cost of delayed repayments

Within the Business and Innovation portfolio, loans provided to two portfolio agencies have not been repaid in accordance with signed loan agreements. This is an opportunity cost to the state as the money not repaid, is not available to fund other planned activities.

A loan of $31.5 million was provided to Central City Studios Holdings Pty Ltd (now Docklands Studios Melbourne) in 2002. No principal or interest payments had been received by the state when the loan was converted to equity in August 2010. The conversion increased the state’s investment in the company, in effect, outside the normal equity investment decision‑making process of government.

The Melbourne Convention and Exhibition Trust (MCET) is required to meet 50 per cent of the cost to the state of the new Melbourne Convention and Exhibition Centre. To do this, MCET was lent $227.7 million on 1 April 2009, against which principal and interest repayments were to be made from the time the facility commenced operating.

However, financial modelling by the Department of Business and Innovation in 2009 predicted that the additional revenue generated by the centre would enable MCET to service a loan of $173 million only.

The centre opened on 5 June 2009. MECT has reported larger operating deficits than predicted, principally due to higher interest on the loan. As a consequence, MCET has been unable to make interest or principal repayments against the loan and will be unable to meet the continuing terms of the loan unless financial results improve.

Recommendations

- That the Department of Treasury and Finance review its AFR processes to improve quality assurance over the material produced and to introduce a realistic timetable for delivery of quality drafts to audit in order to reduce delays and inefficiencies in financial reporting.

- That the Department of Treasury and Finance require material entities to align their reporting time frames to meet AFR milestones.

- That the Department of Treasury and Finance prepare and seek approval of the Appropriation Certification earlier so that all material entities can achieve the AFR milestones.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16A and 16(3) of the Audit Act 1994 a copy of this report, or relevant extracts from the report, was provided to the Treasurer and all relevant agencies with a request for submissions or comments.

The Treasurer’s and agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16A and 16(3) submissions and comments, however, are included in Appendix E.

1 Background

1.1 Introduction

The Financial Management Act 1994 (FMA) governs the financial administration, accountability and reporting of the Victorian public sector. It requires the annual preparation of a consolidated financial report of the state, known as the Annual Financial Report of the State of Victoria (AFR).

The AFR acquits the government's stewardship of the state's finances to Parliament. It is incorporated into a narrative report, the Financial Report for the State of Victoria, which analyses the government's costs, revenue, assets and liabilities.

The Treasurer is responsible for the AFR. The Department of Treasury and Finance (DTF) prepares the AFR in accordance with section 24 of the FMA and applicable Australian accounting standards and interpretations.

1.2 Scope of the Annual Financial Report

1.2.1 Entities included

The AFR provides the combined financial results of all state-controlled entities. The state controls entities where it has the power to govern their financial and operating policies to obtain benefits from its activities. Controlled entities include portfolio departments and state-owned enterprises.

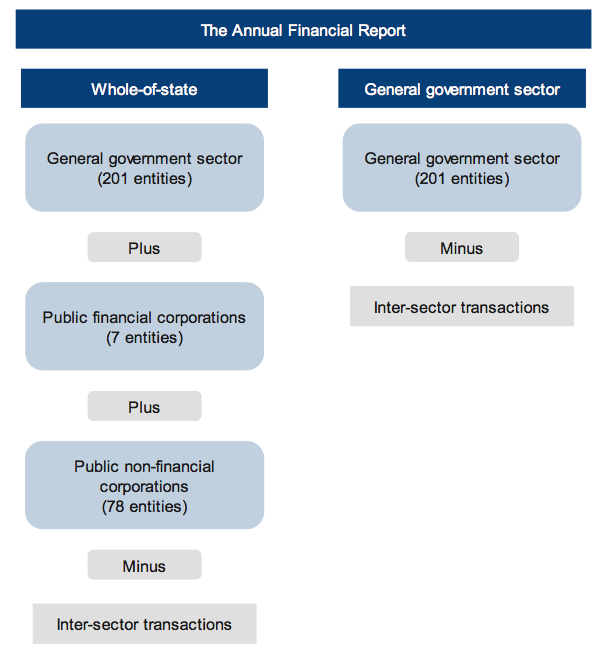

Entities controlled by the state are classified into three sectors of government. Figure 1A describes each sector. A list of all entities consolidated is contained in Note 40 of the AFR.

Figure 1A

Sectors of government and explanation of their controlled entities

Sector |

Explanation |

|---|---|

General government sector (GGS) |

201 entities whose primary purpose is to provide public services. Examples include government departments, public hospitals and technical and further education institutes (TAFEs). |

Public financial corporations |

Seven entities that borrow centrally accept deposits and acquire financial assets. Examples include the Treasury Corporation of Victoria and the Rural Finance Corporation. |

Public non-financial corporations |

78 entities whose primary purpose is to provide goods and/or services in a competitive market and are non-regulatory and non‑financial in nature. Entities include water authorities, alpine resort management boards and the Victorian Rail Track Corporation. |

Source: Victorian Auditor-General's Office.

Of the controlled public sector entities, 46 were deemed 'material' entities for 2010–11 (47 in 2009–10). A public sector entity is classified as 'material' when its individual financial operations are significant in the reporting of the consolidated finances of the state. Collectively, material entities account for more than 90 per cent of the state's assets, liabilities, revenue and expenditure. Material entities are listed in Appendix B.

DTF produces the AFR by consolidating the financial results of 286 public sector entities controlled by the state.

The controlled entities transmit their financial data to DTF, and transactions between them are netted out to avoid double counting.

1.2.2 Entities excluded

Local government entities, universities, denominational hospitals and superannuation funds are not controlled entities and therefore are not included in the AFR. Figure 1B details the rationale for excluding these entities, consistent with Australian accounting standards.

Figure 1B

Entities not controlled by the state and the related rationale

Entity |

Rationale |

|---|---|

Local government |

Local government is a separate tier of government with councils elected by, and accountable to, their ratepayers. |

Universities |

Universities are primarily funded by the Commonwealth and the state directly appoints only a minority of University council members. |

Denominational hospitals |

Denominational hospitals are private providers of public health services and have their own governance arrangements. |

State superannuation funds |

The net assets of state superannuation funds are the property of the members. However, any shortfall in the net assets related to defined benefit scheme entitlements of the state's superannuation funds are an obligation of the state and reported as a liability in the AFR. |

Source: Victorian Auditor-General's Office.

1.3 Structure of the Annual Financial Report

1.3.1 Levels of reporting

The AFR presents information on two aspects of the state's finances:

- whole-of-state level—consolidates all three sectors of government set out in Figure 1A

- GGS level—provides consolidated information on the 201 entities whose primary purpose is to provide public services.

Figure 1C shows the entities covered for each of these aspects and the items netted out to eliminate double counting.

Figure 1C

Coverage of the Annual Financial Report

Source: Victorian Auditor-General's Office.

1.3.2 Financial performance

The consolidated comprehensive operating statement in the AFR contains information about the amount and type of state revenue and expenses, and other economic flows. It includes two key measures of financial performance and sustainability: the 'net result from transactions' and the 'net result'.

The net result from transactions is revenue less expenditure that can be directly attributed to government policy.

The net result, however, includes other economic flows that represent changes in the value of assets and liabilities due to market re-measurements. It includes actuarial gains and losses that primarily reflect the valuation movement in the state's superannuation liability.

1.3.3 Financial position

The consolidated balance sheet in the AFR reports the value and composition of the state's assets and liabilities. The notes to the AFR contain further information about other financial commitments, and contingent assets and liabilities that are not in the consolidated balance sheet. Combined, the balance sheet and notes provide the state's financial position.

1.4 Audit requirements

Section 9A of the Audit Act 1994 requires the Auditor-General to provide an audit opinion on the AFR. A financial audit is conducted in accordance with the Australian auditing standards to form that opinion.

Section 16A of the Audit Act 1994 requires the Auditor-General to report to Parliament on each AFR. This report comments on the:

- results of the audit

- financial performance and position of the state

- major capital projects of the state.

The Auditor-General's Report on the Annual Financial Report of the State of Victoria, 2010–11 is the first of six reports to be presented to Parliament during 2011–12 covering the results of financial audits. Appendix A outlines the intended reports and time frames.

1.5 Method and cost

The audit was conducted in accordance with Australian Auditing and Assurance Standards.

The cost was $155 000.

1.6 Structure of this report

The report is structured as follows:

- Part 2 reports on the results of the audit

- Part 3 provides commentary and analysis of the state's result

- Part 4 examines the financial status and progress of significant projects and developments.

2 Annual Financial Report audit result

At a glance

Background

The Annual Financial Report of the State of Victoria (AFR) is audited in compliance with the law and the Australian Auditing Standards, and Interpretations. This Part reports on the results of the audit.

Audit result

A clear audit opinion was issued on the AFR on 10 October 2011 and was tabled in Parliament on 13 October 2011.

The clear audit opinion means that the public and government can be reasonably assured that the state's financial reporting is reliable and accurate.

Findings

- The Department of Treasury and Finance (DTF) was challenged by the preparation of the AFR. The audit was disrupted and protracted because DTF initiated 10 drafts of the AFR, each with material changes.

- DTF has yet to manage most material entities to meet its AFR deadlines.

- Thirteen material entities were unable to achieve the AFR financial report finalisation milestone because the Appropriation Certification was not provided to audit until the milestone date, meaning audit opinions could not be provided on that date.

Recommendations

- That the Department of Treasury and Finance review its AFR processes to improve quality assurance over the material produced and to introduce a realistic timetable for delivery of quality drafts to VAGO audit in order to reduce delays and inefficiencies in financial reporting.

- That the Department of Treasury and Finance require material entities to better align their reporting time frames to meet AFR milestones.

- That the Department of Treasury and Finance prepare and seek approval of the Appropriation Certification earlier so that all material entities can achieve the AFR milestones.

2.1 Audit opinion

The Auditor-General issued a clear audit opinion on the Annual Financial Report of the State of Victoria, 2010–11 (AFR) on 10 October 2011, providing reasonable assurance that the information in the financial report is reliable and accurate, and prepared in accordance with the requirements of the Financial Management Act 1994 (FMA) and Australian Accounting Standards and Interpretations.

The opinion is included in Chapter 4 of the Financial Report for the State of Victoria 2010–11 (the Financial Report) tabled in Parliament on 13 October 2011.

2.2 Quality of reporting

The timeliness and accuracy of the preparation and finalisation of the financial report can serve as indicators of the quality of financial reporting.

2.2.1 Accuracy

Achieving accuracy was a challenge for the Department of Treasury and Finance (DTF) in preparing the AFR financial statements for 2010–11.

While the number of material adjustments requested by audit was small (four in 2010–11), the audit team received 10 drafts of the AFR, each initiated by DTF and containing material changes. The continual changes to figures disrupted and protracted the audit, and the finalisation of the AFR was delayed by one month.

The accuracy of the draft AFR financial statements is measured by the frequency and size of adjustments arising from the audit, and the number of drafts prepared by DTF. Ideally there should be no material adjustments required once a complete draft is provided to VAGO. This was not achieved in 2010–11 and the number of drafts provided indicates that the AFR preparation process requires review.

In particular, DTF should apply more robust quality assurance that would enable material adjustments to be identified and corrected prior to the audit commencing.

2.2.2 Timeliness

DTF tabled the 2010–11 AFR in Parliament on 13 October 2011 (15 September in 2010). This met the statutory requirement to table by 15 October but was one month later than last year.

A complete AFR draft was provided to VAGO on 26 August 2011. This was an improvement on the previous year when the draft was provided on 3 September 2010. However, material changes were made to successive drafts up until 10 October 2011, when the final draft was provided to VAGO. Despite this, we provided our audit opinion on 10 October 2011.

The timeliness of delivery of the draft AFR was impacted because 15 of the 46 material entities did not finalise their draft financial statements by the 26 July 2011 milestone set by DTF.

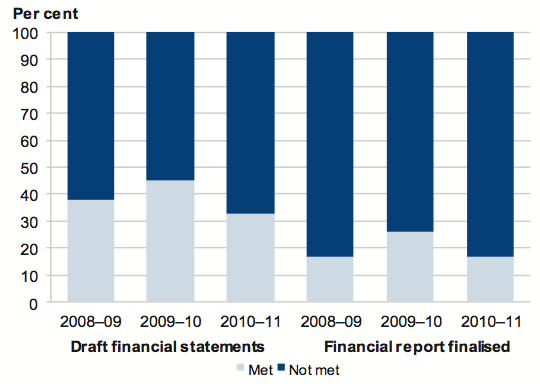

Figure 2A shows performance of material entities in providing draft financial statements and finalisation of financial reports against the AFR milestones over the past three years.

Figure 2A

Timeliness of preparation and finalisation of statements by material entities against AFR milestones

Source: Victorian Auditor-General's Office.

The data shows that DTF has yet to influence most material entities to meet the milestones. After some improvement in 2010, performance in 2011 slipped back, particularly for preparing the draft statements. There has been no substantive or sustained improvement in the timeliness of draft financial statements preparation and financial report finalisation over the past three years.

Thirteen material entities were unable to achieve the AFR financial report finalisation milestone for 2011 because the Minister for Finance and Treasurer's Appropriation Certification was not provided to VAGO until 11 August 2011. This was the same day that material entities were scheduled to finalise their financial reports.

An audit opinion cannot be issued, and consequently the financial statements finalised, until the signed Certification has been received and tied into the financial statements by VAGO. The timing of the receipt of the certification meant that the audit opinions could not be provided on 11 August 2011.

When material entities do not meet the AFR milestones, the time frames for DTF to prepare the AFR and for the audit to occur are compressed. This increases the risk of error both in the preparation and audit of the AFR.

DTF needs to refresh the AFR preparation time line to set a more realistic time frame of when to engage with VAGO. The time line needs to provide DTF with enough time to carry out adequate quality assurance over the material before it is provided for audit.

Recommendations

- That the Department of Treasury and Finance review its AFR processes to improve quality assurance over the material produced and to introduce a realistic timetable for delivery of quality drafts to audit in order to reduce delays and inefficiencies in financial reporting.

- That the Department of Treasury and Finance require material entities to align their reporting time frames to meet AFR milestones.

- That the Department of Treasury and Finance prepare and seek approval of the Appropriation Certification earlier so that all material entities can achieve the AFR milestones.

3 The state's financial result

At a glance

Background

Financial indicators, when monitored over time, enable trends and potential risks to be identified and managed. We have adopted four key financial indicators to interpret the state's results and measure performance. They are the state's net result, net result from transactions, the infrastructure renewal ratio and the debt sustainability ratio.

Overall conclusion

The state reported a positive overall financial position at 30 June 2011. However, there are negative trends in some indicators that need to be managed over the longer term or the state's finances will deteriorate.

Findings

- The state reported a net surplus of $1 646.8 million for 2010–11, which is an improvement on the deficits reported in the past two financial years.

- A net deficit from transactions of $512.5 million was achieved in 2010–11. The ability to generate net surpluses will be at risk if expenditure continues to grow faster than revenue, as it has for the past five years.

- The state's infrastructure assets totalled $66 109.4 million at 30 June 2011, increasing by 5.3 per cent in the financial year.

- The infrastructure renewal ratio for the state increased to 3.65:1 in 2010–11 (2.73:1 in 2009–10), and remains above the threshold of 1:1. This indicates that the state's spending on assets is at a level where assets are being maintained.

- State debt has grown by 8.7 per cent, totalling $55 634.4 million at 30 June 2011.

- The state's ability to service its debt has decreased because debt is growing at a faster rate than the Gross State Product is increasing.

3.1 Introduction

This chapter provides analysis and commentary on the state's financial position and performance for 2010–11. Key financial indicators are used to interpret the state's results and measure performance. When monitored over time, financial indicators enable trends and potential risks to be identified and managed.

3.2 Overall conclusion

The state reported a positive overall financial position at 30 June 2011. However, there are negative trends in some indicators that need to be managed over the longer term. Expenditure has grown faster than revenue and debt has grown faster than Gross State Product (GSP) which, if not addressed, will cause the state's finances to deteriorate.

3.3 Key financial indicators

The key financial indicators discussed in this chapter are the state's net result, net result from transactions, the infrastructure renewal ratio and debt sustainability ratio. These indicators show a generally positive financial outcome for the state for 2010–11.

3.3.1 Net result

The 2010–11 net result for the state was a surplus of $1 646.8 million (deficit of $5 677.7 million in 2009–10).

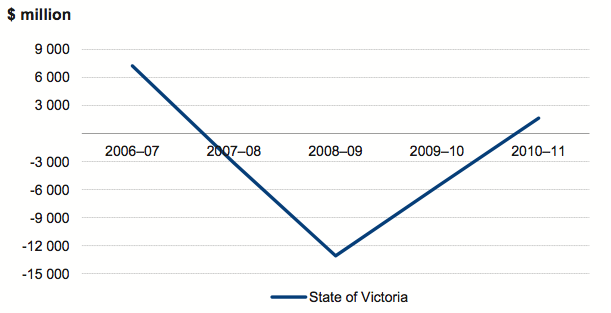

Figure 3A shows the trend in the state's net result for the past five financial years.

Figure 3A

Net result

Source: Victorian Auditor-General's Office.

The 2010–11 net result continued the improvement from the large deficit reported in 2008–09. The improved net result reflects an improvement in economic conditions since 2008–09. In particular, the return to a positive net result in 2010–11 was due to:

- actuarial gains of $303 million in 2010–11 on the state's unfunded superannuation plans, compared to actuarial losses of $1 435.8 million in 2009–10

- financial assets increasing in value at a faster rate than financial liabilities. The value of net financial assets increased by $1 257.5 million in 2010–11 compared to $187.2 million in 2009–10

- no material other economic flows in 2010–11. In 2009–10, other economic flows included a $4 000 million revaluation loss resulting from a change in the method for valuing land under roads.

Risks to the net result

As the economic climate and markets can change very quickly, it is important that financial risks are identified and managed. To be financially sustainable, the state should be able to absorb the impact of foreseeable changes and risks materialising, without significantly changing its policies and strategies.

The fluctuating net result as displayed in Figure 3A shows that material financial risks are not always foreseen. However, the net deficits reported in 2008–09 and 2009–10 have had no obvious impact on the state's operations with no known significant changes to policies and strategies as a result.

3.3.2 Net result from transactions

The net result from transactions for the state for 2010–11 was a deficit of $512.5 million ($155.2 million surplus in 2009–10).

Figure 3B shows the state's net result from transactions for the past five financial years.

Figure

3B

Net result from transactions

Source: Victorian Auditor-General's Office.

The deterioration between 2009–10 and 2010–11 is primarily due to expenditure growing faster than revenue. Over the past five years expenditure from transactions has increased by 38.4 per cent, and revenue has increased by 36.7 per cent.

In 2010–11, expenditure increased by $2 758.1 million compared with an increase of $2 090.4 million in revenue.

The increase in expenditure was due to:

- higher wages resulting from enterprise bargaining agreement increases and staff increases. Employee expenses increased by 6.4 per cent ($1 038.4 million) primarily driven by an additional $440 million incurred at public hospitals, $151million at the Department of Education and Early Childhood Development, $70 million at the Department of Justice, $61 million at Victoria Police, $42millionat TAFEs, and $32 million at the Department of Health

- greater depreciation due to recent infrastructure programs in schools, transport and water that increased the state's asset base, and revaluations in the transport portfolio. The result was a 6.3 per cent ($213.8 million) increase in depreciation.

The increase in revenue was due to:

- increased revenue from water and sewerage charges—the revenue earned by the state's 19 water entities increased by $294.0 million

- additional taxation revenue of $1 112.5 million was earned in 2010–11.

A summary of the increases in significant taxation revenue classes is in Figure 3C.

Figure

3C

Taxation revenue increases from 2009–10 to 2010–11

State of Victoria

Taxation revenue |

Increase (%) |

Additional revenue ($ million) |

|---|---|---|

Growth areas infrastructure contribution(a) |

– |

70.2 |

Land tax |

20.0 |

230.2 |

Land transfer duties |

8.5 |

306.1 |

Payroll tax |

7.3 |

293.8 |

Vehicle registration fees |

6.9 |

59.8 |

(a) New tax in 2010–11.

Source: 2010–11 Financial Report for the State of Victoria.

Risks to the net result from transactions

The pressure on the net result from transactions will increase going forward with the state's share of GST revenue declining coupled with growing employee expenses.

The state is heavily reliant on Commonwealth Government funding, which accounted for 41.9 per cent of total revenue in 2010–11. In February 2011, a review of revenue sharing relativities by the Commonwealth Grants Commission resulted in Victoria's GST funding being decreased by $500 million for 2011–12, and by a predicted aggregate of $2.5 billion over the forward estimates. The decrease in Commonwealth revenue may, however, be offset by increasing state-generated revenues. In 2010–11, state-generated revenues increased by $2 398.4 million compared to a decrease in Commonwealth revenue of $308.0 million.

To deliver a positive net result from transactions the state will need to closely monitor and tightly control expenditure.

Employee expenses accounted for 32.1 per cent of total expenses from transactions for 2010–11 and were one of the key drivers of the increase in expenses. The renegotiation of expiring major enterprise bargaining agreements, will likely further increase employee expenses. The state is due to renegotiate enterprise bargaining agreements with teachers and nurses in 2011–12. This will impose additional cost pressure on the net result as employee expenses have historically grown at a rate above CPI.

Figure 3D demonstrates the percentage growth in employee expenses year on year for the past five financial years compared to CPI for the same period.

Figure

3D

Comparison of increases in employee expenses and CPI,

2006–07 to 2010–11

Financial year |

Employee expenses increase (%) |

CPI (%) |

|---|---|---|

2006–07 |

6.0 |

2.0 |

2007–08 |

7.3 |

4.4 |

2008–09 |

8.0 |

1.2 |

2009–10 |

7.9 |

3.1 |

2010–11 |

6.4 |

4.6 |

Source: Victorian Auditor-General's Office and Australian Bureau of Statistics.

3.3.3 Infrastructure renewal

A significant challenge for the state is to maintain existing infrastructure and provide new infrastructure to achieve the state's social, economic and environmental objectives. In the long-term, the state must be able to generate sufficient funds from operations to fund infrastructure acquisition and maintenance.

The state's infrastructure assets include roads, transport networks, ports and water infrastructure assets. In 2010–11, the value of the state's infrastructure assets increased by 5.3 per cent, from $62 788.8 million at 30 June 2010 to $66 109.4 million at 30 June 2011.

An indicator of the state's financial performance in relation to infrastructure renewal is the comparison of the rate at which existing infrastructure is being used up, to the rate at which it is being replaced. This can be measured by comparing expenditure on assets with the annual depreciation charge on assets. A renewal ratio higher than 1:1 indicates that infrastructure expenditure exceeds depreciation and therefore overall the state's infrastructure assets are increasing.

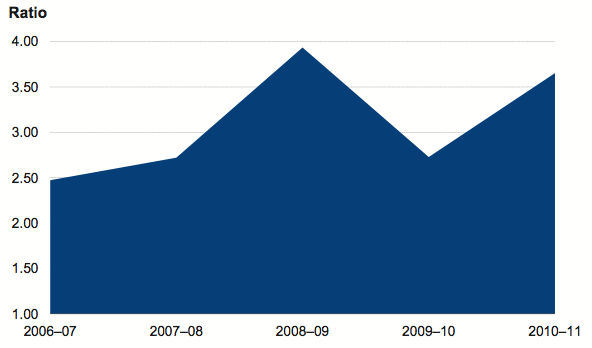

Figure 3E shows the infrastructure renewal ratios from 2006–07 to 2010–11.

Figure

3E

Infrastructure renewal ratio for plant, equipment, vehicles

and infrastructure systems, 2006–07 to 2010–11

Source: Victorian Auditor-General's Office.

The infrastructure renewal ratio for the state has improved from 2.73:1 in 2009–10 to 3.65:1 in 2010–11, indicating that the state's rate of spending on infrastructure, when compared to depreciation, is increasing significantly. The ratio is greater than 1:1 indicating no immediate concern with infrastructure renewal.

Caution is required when interpreting these results, however, as annual expenditure on infrastructure includes both the upgrade of existing assets and the acquisition of new assets. From the information reported in the AFR it is not possible to conclude to what extent upgrades of existing assets are keeping pace with consumption (depreciation expense) of those assets.

Risks to infrastructure renewal

The state currently has new programs for schools, transport and water infrastructure. These programs will progressively increase the state's asset base, thus increasing future maintenance requirements. Spending on maintenance will need to increase in line with the increase in infrastructure to avoid a maintenance backlog, the consequential shortening of asset life, and greater overall life cycle costs.

This is partially managed by the state by the inclusion of an unallocated capital provision into the forward estimates, providing capacity for changes in future asset investment requirements.

3.3.4 Debt sustainability

Sustainable debt is the level of debt that can be paid back while dealing with factors such as economic growth, interest rates and the state's capacity to generate surpluses in the future. Measuring debt sustainability is difficult as debt is typically repaid over a significant period where such factors are not able to be reliably forecast.

An indicator of debt sustainability is the ratio of borrowings and unfunded superannuation liabilities to GSP. A lower ratio indicates that the state is better able to service its debt obligations.

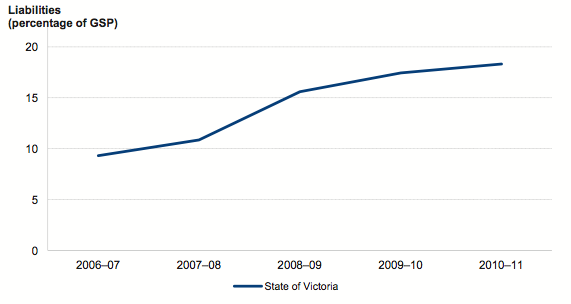

Figure 3F shows the state's debt sustainability ratio for the past five financial years.

Figure

3F

Debt sustainability, 2006–07 to 2010–11

Source: Victorian Auditor-General's Office.

Debt sustainability has declined between 2006–07 and 2010–11 because debt has grown faster than GSP. In 2010–11, the state's debt increased by 8.7 per cent to $55 634.4 million at 30 June 2011. In the same period GSP increased by 3.5 per cent.

The state's debt includes public sector borrowings of $27 825.4 million, unfunded superannuation liabilities of $22 843.2 million, finance leases entered into by public sector entities of $2 723.1 million, and derivative financial instruments of $2 242.7 million.

Risks to debt sustainability

As the state's debt increases so too does the interest expense incurred to service the debt. For 2010–11, interest expenditure was $1 797.9 million or 3.3 per cent of total expenditure. As discussed in section 3.3.1, growing interest expenses will add to the pressures on the state's net result. The state's ability to repay debt would also be impacted by reduced surpluses and movements in GSP.

4 Significant projects and developments

At a glance

Background

This Part sets out the status and financial implications of a range of significant projects and developments underway during 2010–11.

Findings

- Interest or principal repayments have not been paid to the Department of Business and Innovation on loans to two agencies within that portfolio. Unpaid interest totalled $38.3 million at 30 June 2011. This is an opportunity cost to the state.

- The transparency of reporting by the public sector is limited because accounting standards for the preparation of general purpose financial statements do not require the full cost of public private partnership projects to be drawn together and disclosed in the AFR.

- The budgeted cost of preparation works, stages 1A and 1B of the M80 ring road upgrade increased from $863 million to $980 million, principally due to scope changes for Stage 1A: the Calder Freeway to Sydney Road section, offset by savings in Stage 1B: the Western Highway to Sunshine Avenue section.

- The myki ticketing system is to be retained with modifications to its scope. The cost implication of the modifications is yet to be determined. The Transport Ticketing Authority has written off assets of $27.6million no longer required because of these modifications.

- Delays in the rollout of myki mean that the period for which the state must guarantee fare box revenue to the train and tram operators has been extended to December 2013. The operators were paid $76.1 million under the guarantee in 2010–11 because actual fare box revenue collected was less than the amount of the guarantee.

- In 2010–11, the consortium constructing the desalination plant advised the state that commercial acceptance and project completion would be delayed. As a result, the state may recover $14 million from the consortium under the terms of the contract, subject to conditions of the agreement.

4.1 Introduction

The status and financial implications of significant projects and developments undertaken in 2010–11 are set out in this Part. The projects and developments we comment on are those where Parliament or the public would have a reasonable expectation of timely, independent disclosure of the related financial implications, but which accounting standards for the preparation of general purpose financial statements do not require coverage in the Annual Financial Report of the State (AFR) or the relevant entities annual financial statements.

Each project commented on in this Part is listed as a key project in the state's Budget Information Paper No.1 and has an estimated cost exceeding $1 000 million. The total value of all projects reviewed is $18 030.2 million, representing 75.1 per cent of the total value of projects identified in Budget Information Paper No.1.

The projects are presented in the Part under their relevant departmental portfolio.

4.2 Common themes

4.2.1 Presentation of the cost of public private partnerships

The state currently has 19 public private partnership (PPP) agreements. Thirteen facilities under such agreements had been commissioned and were operating at 30 June 2011. Note 33 of the AFR discloses the total contract commitment for each of the PPPs as at 30 June 2011. In aggregate the present value of these contractual commitments was $9 496.9 million at 30 June 2011.

For PPPs the total cost to the state is generally more than the contract cost disclosed by the portfolio agencies and in the AFR. This is because the state can incur additional direct costs relating to these projects, such as land acquisition, environmental works, planning and preparation works. These direct costs can be significant. For example for the Desalination Plant and Peninsula Link, the costs incurred directly by the state have added 14 per cent and 3 per cent respectively on top of the contract cost.

While the financial statements of agencies and the AFR are prepared in accordance with Australian Accounting Standards, the standards do not require all costs associated with a project or its development to be drawn together. Consequently, a reader of the financial statements may have difficulty in identifying and isolating the total costs associated with individual capital projects.

Australian Accounting Standards set the minimum requirements for accounting and disclosures, however, in the interests of better informing stakeholders, this should not preclude entities from making additional disclosures. For the public sector, a higher level of disclosure around PPP projects should be adopted to increase transparency and to minimise the opportunity for ambiguity and misunderstanding.

Further analysis and comment on the total cost to the state of two PPPs under construction, Peninsula Link and the Desalination Plant, appear later in this Part.

4.2.2 Opportunity cost of delayed repayments

The Department of Business and Innovation (DBI) had entered into the following loans with two portfolio agencies:

- $31.5 million to Central City Studios Holdings Pty Ltd (now operating as Docklands Studios Melbourne), provided in 2002

- $227.7 million to the Melbourne Convention and Exhibition Trust (MCET), provided in 2009.

At 30 June 2011, no interest or principal repayments had been received by DBI from either agency since the loans were provided, despite the signed agreements requiring repayments to be made. Unpaid interest totalled $38.3 million at 30 June 2011.

The loan to Docklands Studios Melbourne was converted to equity on 10 August 2010, following DBI's assessment that the agency did not have the capacity to service its loan. Transparency around investment decisions is lost when loans are converted to equity, effectively increasing the state's investment in portfolio agencies outside of the normal budget and investment decision-making processes.

MCET has continued to report net losses from transactions since the new convention centre opened and therefore has not had the financial capacity to service its loan. Interest costs on the loan have been higher than projected as the final loan struck was greater than that included in the modelling.

There is an opportunity cost to the state when interest and loans are not repaid because activities that might be funded if the monies had been repaid to the state cannot now be funded, and any resultant benefits arising from those activities cannot be realised.

Further detail on these transactions is provided in section 4.3.1 and 4.3.2.

4.3 Business and Innovation portfolio

4.3.1 Docklands Studios Melbourne

In 2002, the state and Central City Studios Holdings Pty Ltd (now operating as Docklands Studios Melbourne) entered into a loan agreement under which the state agreed to provide a cash advance to fund the design, construction and operation of a film and television complex. Repayment of the $31.5 million loan plus interest was to begin once the studios were fully operational. The studios commenced operations in 2004.

A summary of the time lines and transactions to 30 June 2010 is provided in Figure 4A.

Figure 4A

Summary of time lines and transactions between the state and

Docklands Studios Melbourne to 30 June 2010

Year ended |

Event |

Progressive amount owing to the state ($mil) |

|---|---|---|

30 June 2003 |

Loan from the state Central City Studios Holdings Pty Ltd and the state entered into loan agreement. The state agreed to provide $31.5 million for the design, construction and operation of a film and television complex (Docklands Studios Melbourne). Loan payable over 20 years from 2004 to 2024. |

31.50 |

30 June 2005 |

Studios commence operation Repayment of loan to begin, however, no repayment made. |

|

Rental agreement commenced 22 November 2004 at $300 000 per annum, subject to biennial CPI increases. No rent paid from November 2004. |

||

30 June 2006 to 30 June 2008 |

Interest accrued and payable from 1 January 2006 No loan repayments made or rent paid |

|

30 June 2009 |

State purchase of Docklands Studios Melbourne The state acquired all shares in the company in November 2008 and took full control of the facility. No principal or interest payments had been made. Interest of $3.18 million capitalised into the loan. |

34.68 |

Rent deferred Rent unpaid since November 2004 totalling $1.5 million deferred. |

1.50 |

|

30 June 2010 |

No loan repayments made or rent paid No repayments made against the loan. Interest of $967 000 capitalised into the loan bringing total interest capitalised to $4.15 million. | 35.65 |

|

Rent deferred Rent of $342 025 deferred, bringing total rent deferred to $1.8 million. |

1.80 |

Source: Victorian Auditor-General's Office.

During 2010–11, DBI waived all obligations under the loan agreement. The state received 35 648 077 ordinary shares fully paid to the value of $1 each, in consideration for waiving the $35.65 million debt.

In waiving the loan, DBI determined that rent incurred after 1 July 2010 would no longer be deferred and would be payable monthly from July 2010. Rent for 2010–11 was paid by the company to the state during the year.

The deferred rent of $1.8 million is to be repaid once the company's cash-flows exceed $1 million (subject to CPI increase) after Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) in any given year. In 2010–11, Docklands Studios Melbourne made EBITDA of $107 093. However, the studio recorded a loss after depreciation. Docklands Studios Melbourne has not made payments against the deferred rent.

4.3.2 Melbourne Convention and Exhibition Centre

On 5 June 2009, the new Melbourne Convention and Exhibition Centre opened. The centre, valued at $455.4 million, was delivered under a PPP. The private sector designed, constructed and financed the facility and will maintain it for 25 years. The Melbourne Convention and Exhibition Trust (MCET) operates and markets the centre.

MCET is required to pay DBI $227.7 million, 50 per cent of the asset's value, over the same 25-year period as the PPP contract. The agreement between the state and MCET is structured as a loan and commenced on 1 April 2009. The agreement requires principal and interest payments of $18.1 million per annum.

Before establishing the loan, DBI conducted modelling that predicted that additional revenue from the centre would enable MCET to fund the $173 million (in 2009 dollars) ongoing facility management costs set out in the PPP contract. Despite this, the loan was set at $227.7 million, that is, more than $54 million or 31 per cent over the amount modelled.

MCET has operated the centre for two full financial years. The additional revenue generated by the centre has been in line with initial modelling. However, expenditure has been higher because of increased interest charges on the loan. As a result, MCET has reported greater than expected deficits in its net result from transactions for both 2009–10 and 2010–11. This has limited its ability to service the loan.

Figure 4B shows the difference between the projected and actual financial results for MCET.

Figure 4B

Projected and actual financial results for the Melbourne Convention

and Exhibition Trust 2009–10 and 2010–11

2009–10 |

2010–11 |

|||

|---|---|---|---|---|

Projected ($mil) |

Actual ($mil) |

Projected ($mil) |

Actual ($mil) |

|

Earnings before interest, tax, depreciation and amortisation |

13.0 |

10.7 |

15.3 |

15.6 |

Interest expense |

14.1 |

14.8 |

13.9 |

15.8 |

Net result from transactions |

(12.8) |

(27.1) |

(10.3) |

(23.4) |

Source: Victorian Auditor-General's Office.

At the time the loan agreement was signed, DBI agreed to defer all repayments for 2008–09 and 2009–10. As a result, scheduled repayments totalling $22.6 million for those years were not made.

At 30 June 2011 the arrears of the principal and interest was $43.4 million.

In September 2011, MCET repaid $9.7 million towards the outstanding liability of $261.9 million. Unless the financial results of MCET improve, MCET will not be able to meet the continuing terms of the loan.

4.4 Education portfolio

4.4.1 Building the Education Revolution

Under the Building the Education Revolution (BER), the Commonwealth Government committed funding of $3 772 million over a three-year period from 2008 to 2011 to provide new facilities and refurbishments in Victorian schools. The initiative was to provide school facilities that meet the needs of 21st century students and teachers. The BER contains three separate programs. Figure 4C shows the allocation of Victoria's BER funding by program and type of education provider.

Figure 4C

Building the Education Revolution funding by program and education provider

Funding program |

Government ($mil) |

Catholic ($mil) |

Independent ($mil) |

Total ($mil) |

|---|---|---|---|---|

Primary Schools for the 21st Century |

2 203 |

750 |

321 |

3 274 |

Science and Language Centres for the 21st Century |

137 |

30 |

29 |

196 |

National School Pride |

205 |

67 |

30 |

302 |

Total |

2 545 |

847 |

380 |

3 772 |

Source: Victorian Auditor-General's Office.

The Department of Education and Early Childhood Development (DEECD) is responsible for achieving the outcomes and outputs of the Victorian government school component of the BER.

Current status of the Building the Education Revolution program

Figure 4D shows the BER funding and expenditure to 30 June 2011 for Victorian government schools.

Figure 4D

Building the Education Revolution project funding and expenditure for the three

years to 30 June 2011

Funding program |

Total funding ($mil) |

Funding received ($mil) |

Budgeted expenditure ($mil) |

Actual expenditure ($mil) |

Actual to budget (per cent) |

|---|---|---|---|---|---|

Primary Schools for the 21st Century |

2 203 |

2 110 |

2 110 |

1 978 |

94 |

Science and Language Centres for the 21st Century |

137 |

137 |

137 |

128 |

93 |

National School Pride |

205 |

205 |

205 |

205 |

100 |

Total |

2 545 |

2 452 |

2 452 |

2 311 |

94 |

Source: Victorian Auditor-General's Office.

When the BER was announced, projects were to commence by June 2009 and be completed by 30 June 2011. However, recognising the need for flexibility, the BER guidelines provided for the Commonwealth to consider extensions to project completion time lines where necessary. The Commonwealth has extended the BER program into 2011–12.

For Victoria, $93 million of the Primary Schools for the 21st Century program funding for 290 projects, has been rephased from 2010–11 to 2011–12.

At 30 June 2011:

- $2 311 million or 94 per cent of the total $2 452 million funding received and expenditure budgeted had been spent

- The National School Pride program had been completed and fully acquitted.

Figure 4E provides a summary of the status of projects for each BER program as at 30 June 2011.

Figure 4E

Building the Education Revolution project status as at 30 June 2011

Program |

Planned projects (no.) |

Construction commenced (no.) |

Construction completed (no.) |

Completed projects (no.) |

Completed projects (%) |

|---|---|---|---|---|---|

Primary Schools for the 21st Century |

1 253 |

1 205 |

969 |

853 |

68 |

Science and Language Centres for the 21st Century |

70 |

70 |

44 |

30 |

43 |

National School Pride |

1 581 |

1 581 |

1 581 |

1 581 |

100 |

Total |

2 904 |

2 856 |

2 594 |

2 464 |

85 |

Source: Victorian Auditor-General's Office.

Both the Primary Schools for the 21st Century and the Science and Language Centres for the 21st Century are expected to be completed during 2011–12.

Subsequent to 30 June 2011, additional funding of $47 million was received from the Commonwealth with a final payment of $46 million due on 7 November 2011.

Administration costs

The cost to administer the BER funding was budgeted at 1.5 per cent of project costs. DEECD was allocated $34.2 million to administer the program.

At 30 June 2011, DEECD had spent $34.2 million or 100 per cent of its administration allocation. Any further costs for administering the 15 per cent of outstanding projects will be borne by the state.

4.4.2 Victorian Schools Plan

The Victorian Schools Plan (VSP) was a 10-year plan to transform all Victorian schools by rebuilding, renovating or extending them by 2016–17. The VSP initially committed $1 831 million towards school infrastructure, recognising that high quality infrastructure is critical in delivering educational outcomes. Additional funding of $72 million has bought the total commitment to $1 903 million.

A key condition of the Commonwealth BER program was that states were to continue to fund their existing capital investment plans, with BER funds not to be used to meet existing state capital commitments.

Figure 4F shows the annual budget allocation and actual expenditure for the Victorian Schools Plan over the past four years.

Figure 4F

Victorian Schools Plan – Budget allocations and actual expenditure

for the past four years

Financial year |

Annual budget allocation ($mil) |

Actual expenditure ($mil) |

|---|---|---|

2007–08 |

239 |

215 |

2008–09 |

506 |

457 |

2009–10 |

519 |

533 |

2010–11 |

449 |

452 |

Total |

1 713 |

1 657 |

Source: Department of Treasury and Finance Budget papers and Victorian Auditor‑General's Office.

To 30 June 2011, DEECD had spent a total of $1 657 million on projects under the VSP, compared to the Budget of $1 713 million.

The government has committed to continue the upgrade of government primary and secondary schools across the state. It allocated $187 million for school capital works in the 2011–12 State Budget.

4.5 Health portfolio

4.5.1 Victorian Comprehensive Cancer Centre

The Victorian Comprehensive Cancer Centre is intended to be a world-class cancer centre to be constructed in Parkville. With a budgeted project cost of $1.05 billion, it will house 1 200 cancer researchers with a vision to increase the state's five-year cancer survival rate by 10 per cent by 2025.

Facilities of the centre will include:

- 196 patient beds

- 110 same-day treatment places

- over 20 000 square metres of specialised research space

- outpatient clinic and treatment facilities

- 700+ space car park.

The centre is to bring together some of the state's existing cancer treatment, research and education organisations so they can work together on the prevention, detection and treatment of cancer. The following entities, while still operating as individual entities, will operate in the centre:

- Peter MacCallum Cancer Centre

- Melbourne Health (which includes the Royal Melbourne Hospital)

- University of Melbourne.

The following entities are also members of the joint venture, but will not operate in the centre:

- Royal Women's Hospital

- Royal Children's Hospital

- St Vincent's Hospital

- Walter and Eliza Hall Institute of Medical Research

- Western Health.

It is anticipated that the establishment of this centre will enable its members to gain efficiencies in their work through joint research protocols, and shared use of facilities and technologies. The Department of Health will fund the public health services operating from the facility, however, other entities such as the University of Melbourne will be responsible for funding their own operations.

Ludwig Institute for Cancer Research were initially part of the joint venture agreement, however, they withdrew on 18 August 2011 following a business decision to close their Parkville branch. Western Health was subsequently admitted into the joint venture on 24 August 2011.

The Department of Health has implemented a governance framework to monitor the project's progress until completion of the facility. The Victorian Comprehensive Cancer Centre joint venture, a separately incorporated public company limited by guarantee, is managed by a board with the chair and deputy chair appointed by the Victorian Government.

The centre is to be built by a private sector consortium as a PPP. The contract between the state and the consortium is expected to be signed in November 2011. The consortium will be responsible for the design, finance and construction of the facility, including the procurement of all new furniture, fittings and equipment. It will also maintain the facilities for a 25-year period.

The Victorian Government will retain ownership of the land on which the buildings will be located.

Funding arrangements

The 2010–11 State Budget provided funding of $1 071.2 million. This was subsequently increased to $1 073.5 million to mitigate a change in law relating to the Environment Protection Authority landfill levy, but is expected to be reduced to $1 048.5 million due to withdrawal of Ludwig Institute of Research from the venture. Funding is being provided progressively from 2008–09 to 2015–16. Figure 4G details the funding sources for the project:

Figure 4G

Project funding sources for the Victorian Comprehensive Cancer Centre

Source |

Original budget ($mil) |

Revised budget ($mil) |

|---|---|---|

Commonwealth Government |

426.1 |

426.1 |

Victorian government |

426.1 |

428.5 |

Sale of Peter MacCallum properties |

80.0 |

80.0 |

University of Melbourne |

25.0 |

25.0 |

Ludwig Institute of Research |

25.0 |

0.0 |

Philanthropic sources |

50.0 |

50.0 |

25-year secured loan from Treasury Corporation Victoria |

33.3 |

33.3 |

Matching funds from all seven partners to cover joint venture operations |

5.6 |

5.6 |

Total |

1 071.1 |

1 048.5 |

Source: Victorian Auditor-General's Office based on data from the Department of Health.

As at 30 June 2011, $9.8 million of Commonwealth funding had been received by the Department of Health. It is a requirement of the Commonwealth funding agreement that construction of the centre must be complete by 31 December 2015, and the facility operational by February 2016. At 30 June 2011, the project was running on schedule with the successful consortium expected to be announced in November 2011.

Preparation for the campaign to attract philanthropic donations has commenced. However, as these funds are not guaranteed, a risk mitigation strategy has been established for implementation if the $50 million target is only partially achieved. The strategy details possible changes to the fit out totalling $50 million.

Enabling works

Demolition of the old Royal Dental Hospital was completed in August 2010, with minor ancillary works completed in early 2011. The $10.5 million cost of demolition was funded as part of the Victorian Cancer Action Plan 2008, a state government initiative allocating $150 million to projects directed at fighting cancer over a three-year period.

4.6 Human Services portfolio

4.6.1 Social housing

The Social Housing Initiative, a component of the Commonwealth Government's Nation Building project, provided $1 266 million to Victoria to increase the supply, and improve the quality, of affordable rental housing for people on low to moderate incomes. Key objectives of the initiative are to:

- increase the supply of social housing through construction of new properties and refurbishment of existing stock that would otherwise be unavailable for occupancy

- provide increased opportunities for persons who are homeless or at risk of homelessness to gain secure long-term accommodation

- stimulate the building and construction industry, both through funding additional dwellings and increasing expenditure on repairs and maintenance to stimulate businesses which supply construction materials.

The Office of Housing, within the Department of Human Services, is responsible for managing the delivery of project outcomes and outputs.

The initiative comprises two elements. Victoria will receive total funding of $1 266 million to:

- deliver over 4 600 new affordable rental homes ($1 166.8 million)

- improve and upgrade a proposed 7 000 existing properties ($99.2 million).

The initiative is expected to be fully funded by the Commonwealth and is to be delivered over three years, with completion due by 30 June 2012.

Figure 4H details budget, actual cost and delivered projects for the Social Housing Initiative as at 30 June 2011.

Figure

4H

Social Housing Initiative budget, actual cost and delivered projects as at

30 June 2011

Project |

Original budget ($mil) |

Revised budget ($mil) |

Funding received ($mil) |

Actual expenditure ($mil) |

Original dwellings (no.) |

Revised dwellings (no.) |

Actual dwellings (no.) |

|---|---|---|---|---|---|---|---|

Element 1: New construction |

|||||||

– Stage 1 |

171.5 |

171.5 |

171.5 |

171.2 |

572 |

716 |

712 |

– Stage 2 |

1 313.0 |

995.2 |

931.4 |

825.8 |

4 377 |

3 890 |

2 758 |

Element 2: Repairs and maintenance |

99.2 |

99.2 |

99.2 |

99.2 |

5 600 |

7 000 |

9 363 |

Total |

1 583.7 |

1 265.9 |

1 202.1 |

1 096.2 |

10 549 |

11 606 |

12 833 |

Source: Victorian Auditor-General's Office.

At 30 June 2011, Victoria had spent $1 096.2 million of the total $1 202.1 million funding received.

Element 1

Element 1 consists of two stages. Funding for Stage 1 has been received. Under the National Partnership Agreement, Victoria was required to construct a minimum of 572 dwellings by 30 June 2010. This was achieved. As at 30 June 2011, construction was on track, with 712 dwellings completed out of a revised number of 716.

Victoria's funding for Stage 2 was reduced from $1 313 million to $995 million by the Commonwealth. At 30 June 2011, $931.4 million had been received for Stage 2 and 71 per cent of projects were complete. Stage 2 is expected to be completed by 30 June 2012.

Element 2

Funding of $99.2 million for repairs and maintenance was received by 30 June 2010. The funding was for the repair and maintenance of existing social housing dwellings. All identified repairs and maintenance were completed by 31 October 2010. The number of dwellings to benefit from this funding was underestimated in the preliminary assessment for the program. This led to targets being exceeded by 2 363 dwellings.

4.6.2 Victorian Bushfire Appeal Fund

On 8 February 2009, the Victorian Government, in partnership with the Commonwealth Government and the Australian Red Cross Society, approved the establishment of a trust fund, the 2009 Victorian Bushfire Appeal Fund under section 19(1) of the Financial Management Act 1994.

The appeal fund was to receive donations and other contributions, and disburse them to individuals and communities affected by the bushfires.

Figure 4I shows the receipts and payments for the appeal fund since its inception.

Figure

4I

Victorian Bushfire Appeal Fund trust account receipts and payments

to 30 June 2011

Item |

30 June 2009 ($mil) |

30 June 2010 ($mil) |

30 June 2011 ($mil) |

Total receipts and payments |

|---|---|---|---|---|

Opening balance |

0 |

238.2 |

129.5 |

|

Donations and other contributions |

375.1 |

8.0 |

0.7 |

383.8 |

Interest earned |

2.2 |

5.8 |

5.2 |

13.2 |

Total receipts |

377.3 |

13.8 |

5.9 |

397 |

Less payments to individuals and communities |

139.1 |

122.5 |

49.5 |

311.1 |

Closing balance |

238.2 |

129.5 |

85.9 |

Source: Victorian Auditor-General's Office.

A balance of $85.9 million remained in the fund at 30 June 2011 and had been fully committed for future disbursement. Payments will continue to be made out of the appeal fund over the next six years.

4.7 Sustainability and Environment portfolio

4.7.1 Desalination plant

Construction of the Wonthaggi desalination plant commenced in September 2009. When complete it will produce up to 150 gigalitres of drinking water each year.

The Department of Sustainability and Environment (DSE) is responsible for the delivery of the plant through a PPP under which:

- the private sector consortium will design, finance and construct the plant, then operate and maintain it for 27.75 years

- the state will make monthly service payments to the consortium to make the desalination plant available. The payments are referred to as the water security payments and are subject to satisfactory performance and an abatement regime

- the state will make additional monthly payments for any water purchased. The payments are referred to as water usage payments and the amount paid depends on the volume of water ordered each year. If no water is ordered, there is no payment.

Figure 4J details the state's financial commitments to the consortium and other costs DSE expects to incur on the project.

Figure 4J

Estimated cost of the construction and operation of the desalination plant and

associated infrastructure as at 30 June 2011

Item |

Nominal value ($mil) |

Net present value ($mil) |

|---|---|---|

State's financial commitments to the consortium: |

||

Plant construction costs, including capitalised finance costs and other fees, which will lead to the recognition of a leased asset and liability of the state |

13 549 |

4 112 |

Plant operating and maintenance commitments over the 27.75-year period of operation (inclusive of GST) |

2 259 |

478 |

Subtotal(a) |

15 808 |

4 590 |

Capital commitments, and estimated operating and maintenance costs associated with an underground power supply for the project pipeline and plant refurbishment during the period of operation (inclusive of GST) |

2 373 |

611 |

less GST recoverable from the Australian Taxation Office |

(421) |

(99) |

Total(b) |

17 760 |

5 102 |

Other estimated costs of the state: |

||

Estimated project development and management costs, environmental assessments, land acquisition and compensation payments(c) |

320 |

308 |

Total estimated cost(d) |

18 080 |

5 410 |

(a) Note 33 to the 2010–11 AFR highlighted the state's commitments for the design, financing, construction, operation and maintenance costs of the plant shown in this table. Note 3 to the 2010–11 Department of Sustainability and Environment financial report stated that the leased asset and liability will be recognised upon commercial acceptance.

(b) Payments subject to satisfactory performance and an abatement regime.

(c) Costs to the Department of Sustainability and Environment. At 30 June 2011, $218.9 million had been spent.

(d) The net present value represents the present value of the estimated cost to the state of the plant, including construction costs, fixed operating and maintenance costs over the 27.75‑year period, the capital costs of an underground power supply and the cost of plant refurbishment during the period of operation, and the estimated cost of operating and maintaining the underground powerlines, at the time of completion and commercial acceptance.

Source: Victorian Auditor-General's Office.

The total estimated cost to the state of the desalination plant for the 27.75-year operating term is $18 080 million in nominal terms or $5 410 million in net present value terms. This has not changed from 2009–10, however, contracts for the electricity supply are still being negotiated by the state.

The consortium first advised the state of a likely delay during 2010–11. On 27 October 2011, the consortium advised the state that it had received notification from its contractor of revised dates for achieving commercial acceptance and project completion.

The date of commercial acceptance—the date that the plant will be capable of supplying water at the rate of 150 gigalitres per annum—is now expected to be 15 November 2012, revised from the original date of 19 December 2011. The completion date, which includes a reliability testing period, is now expected to be 28 February 2013 against the original date of completion of 30 June 2012. The consortium also advised the state that it is still under discussion with its contractor over these revised dates.

The delay could result in the consortium paying $14.048 million to the state. However, the payment is still subject to various conditions within the agreement.

The cost of water purchased will be additional to the costs in Figure 4J. If the state purchased the maximum 150 gigalitres each year for the entire operating term the total water usage cost payments would be $5 834 million in nominal terms, or $1 260 million in net present value terms.

4.7.2 Food Bowl Modernisation

The Food Bowl Modernisation program aims to provide the Goulburn Murray Irrigation District with an irrigation delivery system that will reduce water losses and assist with the region's economic viability. The State Owned Enterprise for Irrigation Modernisation in Northern Victoria, trading as NVIRP, was established in December 2007 to deliver the $2 billion system.

Ownership and responsibility for the operation of the new irrigation infrastructure is being transferred from NVIRP to Goulburn-Murray Water (G-MW) as discrete parts of the capital works are completed.

The project is being delivered in two stages.

Stage 1

Stage 1 commenced in 2008. Completion is expected by June 2013 at a cost of $1 004.5 million. The breakdown of the total cost is provided in Figure 4K.

Figure 4K

Food Bowl Modernisation Stage 1 cost by component as at 30 June 2011

Component |

Original budget ($mil) |

Revised budget ($mil) |

Actual cost ($mil) |

|---|---|---|---|

Construction works |

688.6 |

662.8 |

360.1 |

Farm connections |

265.5 |

291.3 |

162.4 |

NVIRP operating costs |

50.4 |

50.4 |

36.4 |

Total |

1 004.5 |

1 004.5 |

558.9 |

Source: Victorian Auditor-General's Office.

The cost will be funded by contributions of $300 million from Melbourne Water Corporation (MWC), $100 million from G-MW and $604.5 million from the Victorian Government. At 30 June 2011, MWC had contributed $223.3 million, with a further $26.7 million recognised as being payable at balance date. G‑MW is due to pay $50 million in 2011–12 and $50 million in 2012–13.

The completion date was revised from 31 December 2012 following delays to access caused by the 2010–11 floods. The level of water savings per kilometre of channel remediation has also been less than anticipated and the costs associated with the remediation works (i.e., channel lining) higher than the original business case estimates. The identification of alternative channel remediation solutions will require additional time to implement.

Write down of water shares

Water shares of $54.3 million were acquired by NVIRP during 2010–11 and subsequently written down to zero at balance date as they will be cancelled and ultimately transferred to the Victorian Environmental Water Holder (VEWH).

VEWH was established to hold and manage environmental water entitlements and allocations to achieve the best environmental outcome with the water available.

Stage 2