Delivering Services to Citizens and Consumers via Devices of Personal Choice: Phase 2

Overview

This audit examined the approaches departments and agencies use to determine which services will be, or have already been, delivered online via digital devices and examined the ongoing monitoring of the effectiveness of digital service delivery.

We found successes in digital service delivery. However, not all departments and agencies have a complete list of service transactions and costs attributable to delivering the service transactions, and transactions to be transitioned to digital service delivery are not clearly identified. While audited departments and agencies are transitioning to digital service delivery, they remain hindered by pertinent issues such as proof of identity requirements, legacy or inefficient existing information technology systems and inefficient back-office processes. A whole-of-public-sector approach to digital service delivery has yet to be fully realised.

Digital service delivery performance monitoring and reporting still needs improvement. Baseline performance targets with monitoring and reporting systems and processes are required to ensure that digital service delivery performance are effectively measured and its benefits are fully realised.

Overall, government digital service delivery has yet to become the preferred channel even though it was significantly important and desired by citizens and consumers. Improving public usability and utilisation of digital service delivery continues to be an ongoing effort for the Victorian public sector.

Delivering Services to Citizens and Consumers via Devices of Personal Choice: Phase 2: Message

Ordered to be published

VICTORIAN GOVERNMENT PRINTER October 2015

PP No 97, Session 2014–15

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit the report on the audit Delivering Services to Citizens and Consumers via Devices of Personal Choice: Phase 2.

This audit examined the approaches departments and agencies use to determine which services will be, or have already been, delivered online via digital devices and examined the ongoing monitoring of the effectiveness of digital service delivery.

We found successes in digital service delivery. While a whole-of-public-sector approach to digital service delivery has yet to be fully realised, audited departments and agencies are continuing to transition to digital service delivery. However, the transition is being hindered by pertinent issues such as proof of identity verification requirements, legacy and existing inefficient information technology systems and back-office processes.

There is a need for the Victorian public sector to continuously improve the public usability and utilisation of digital service delivery, and further strengthen monitoring and reporting systems and processes to effectively measure and realise the overall benefits of digital service delivery.

Seven recommendations have been made to help address the issues identified in this audit and increase the effectiveness and efficiency of government service delivery for citizens and consumers.

We will continue to examine the information, communications and technology portfolio across the public sector.

Yours faithfully

Dr Peter Frost

Acting Auditor-General

7 October 2015

Auditor-General's comments

VAGO's June 2015 audit Delivering Services to Citizens and Consumers via Devices of Personal Choice: Phase 1 – Interim Report, focused on the whole-of-public-sector approach to digital service delivery, and highlighted a need for vital information and communications technology (ICT) governance and strategic leadership reforms, together with embedded ICT coordination, guidance and assurance processes across the public sector.

In Phase 2 of this audit, we examined the approaches departments and agencies use to determine which services will be, or have already been, delivered online and examined the ongoing monitoring of the effectiveness and public utilisation of digital service delivery.

It is encouraging to find current successes in digital service delivery in the departments and agencies included in this audit. We commend these agencies on their digital transformation journeys and urge other departments and agencies to follow suit.

However, if fundamental issues—such as inefficient proof of identity verifications, legacy and existing inefficient information technology systems, and inefficient back-office processes—are not adequately addressed, the ability for departments and agencies to move towards effective and efficient end-to-end digital service delivery will be hindered.

Consistent with other audits highlighting weaknesses in performance measurement across the Victorian public sector, we found there are still improvements to be made in digital service delivery performance monitoring and reporting. In particular, baseline performance targets need to be set, with rigorous monitoring and reporting systems and processes in place, to provide assurance that digital service delivery performance is effectively measured and its benefits are fully realised.

Overall, government digital service delivery has yet to become the preferred channel, even though the audit highlighted this to be significantly important and desired by citizens and consumers.

With Service Victoria currently in the early planning stages of developing an integrated whole-of-government service capability, this is now the right opportunity and time for the Victorian public sector to collaborate on improving the public usability and utilisation of digital service delivery.

We intend to monitor the implementation of the audit recommendations and the ongoing development of public sector digital service delivery for citizens and consumers.

The recommendations from this audit can apply to all departments and agencies in the Victorian public sector, not just the five that were assessed in this report. We therefore expect all non-audited departments and agencies to consider and implement them where applicable.

Thank you to the staff at the Department of Premier & Cabinet, the Department of Health & Human Services, the Department of Justice & Regulation, Public Transport Victoria, the State Revenue Office and VicRoads for their constructive engagement throughout the audit process.

Dr Peter Frost

Acting Auditor-General

7 October 2015

|

Audit team Karen Phillips—Engagement Leader Jeff Fang—Team Leader Rue Maharaj—Team member Engagement Quality Control Reviewer Michael Herbert |

Audit Summary

Digital devices of personal choice fall into two main types—devices like desktop personal computers, and mobile computing devices such as tablets and smartphones. Digital devices access a wide range of applications via the internet, using communication links such as Wi-Fi or other mobile data networks.

Victorian citizens and consumers expect that government services and information will be accessible online anytime, anywhere and on any device.

Digital service delivery has the potential to increase public sector efficiency, cut lengthy wait times at traditional 'bricks and mortar' locations, and reduce costs associated with traditional service delivery approaches.

This audit examined the approaches that the five audited departments and agencies use to determine which services will be, or have already been, delivered online, and examined the ongoing monitoring of the effectiveness and public utilisation of digital service delivery. This audit also considered the Department of Premier & Cabinet's (DPC) whole-of-government strategy on transactions reform.

Conclusions

The audited departments and agencies are currently delivering, or have already delivered, digital services. However, a whole-of-public-sector approach to digital service delivery has yet to be fully realised, and a successful transition by departments and agencies is being hindered by pertinent issues.

The performance of digital service delivery has yet to be effectively measured and reported on. Improving public usability and utilisation of digital service delivery continues to be an ongoing effort for departments and agencies and at whole‑of‑public-sector level. Effective performance measurement and reporting will provide assurance that the overall benefits are fully realised.

Findings

Digital service transaction identification and costs

Only three of the five audited departments and agencies that provide services to citizens and consumers have a complete list of service transactions and the costs attributable to delivering each transaction.

Not all audited departments and agencies have clearly identified and prioritised within their service transaction lists which transactions should be transitioned to digital service delivery.

Successes in digital service delivery

We found current successes in digital service delivery within the audited departments and agencies, specifically:

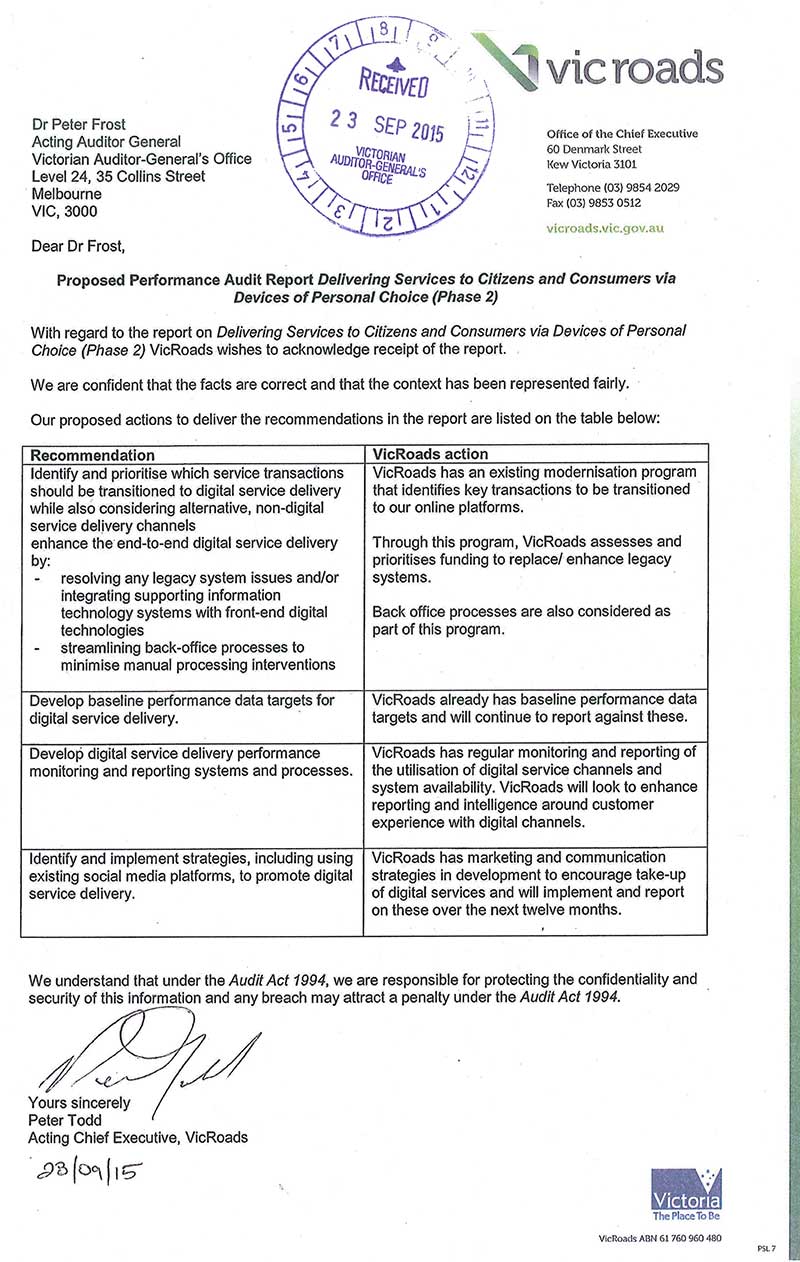

- The Department of Justice & Regulation—implemented the Working with Children Check digital service known as MyCheck recognising the need to increase operational efficiencies, and improve customer service and security.

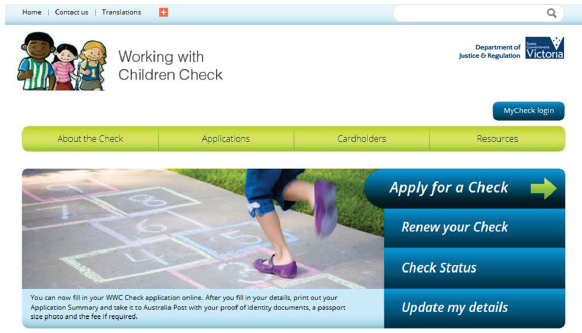

- VicRoads'—registration and licensing division implemented a digital service platform which is used across different types of devices. The division also established effective systems and processes to monitor and report its digital service delivery performance.

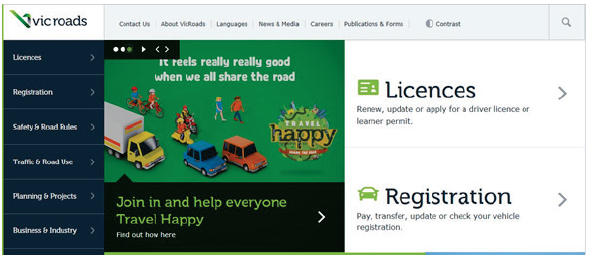

- The State Revenue Office—developed and launched the online application, Duties Online, to increase efficiencies and enhance customer experience for duties service transactions.

Digital service delivery challenges and issues

Audited departments and agencies faced common challenges and issues which are impacting successful transition.

Proof of identity verification requirements

There is no integrated digital proof of identity (POI) verification solution to efficiently and effectively authenticate a customer's identity. Citizens and consumers must complete a POI verification for each new service transaction, which is generally a manual process.

This has limited the audited departments and agencies' ability to transition fully to digital service delivery.

The POI verification process can be improved to enable citizens and consumers to access government services without the need to repeatedly authenticate their identities.

Legacy and existing information technology systems and back-office processes

Legacy and existing information technology (IT) systems and inefficient back-office processes continue to be used to support department and agency service delivery. Though still reliable, they do not provide or facilitate efficient and seamless end-to-end digital service delivery.

Efficiencies initially gained through front-end service delivery are hindered by audited departments and agencies maintaining legacy or inefficient existing IT systems or inefficient back-office processes.

Monitoring and reporting of digital service delivery performance

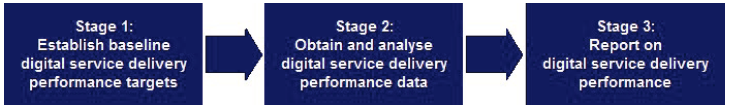

We focused on three key stages of monitoring and reporting on digital service delivery performance:

- establish baseline digital service delivery performance targets

- obtain and analyse digital service delivery performance data

- report on digital service delivery performance.

Not all departments and agencies had baseline digital service delivery performance targets. They also displayed different approaches and levels of maturity in implementing monitoring and reporting approaches to measure their digital service delivery performance.

Improving public usability and utilisation of digital service delivery

To ensure that the overall benefits of government digital service delivery are fully realised, there needs to be a continuous effort by departments and agencies and at a whole-of-public-sector level, to improve the public usability and utilisation of digital service delivery.

This can be achieved by promoting the benefits of digital service delivery:

- to citizens and consumers through improved 'ease-of-use' and by using social media platforms

- to department and agency staff through digital engagement initiatives

- through an integrated digital engagement approach at a whole‑of‑public‑sector level.

Recommendations

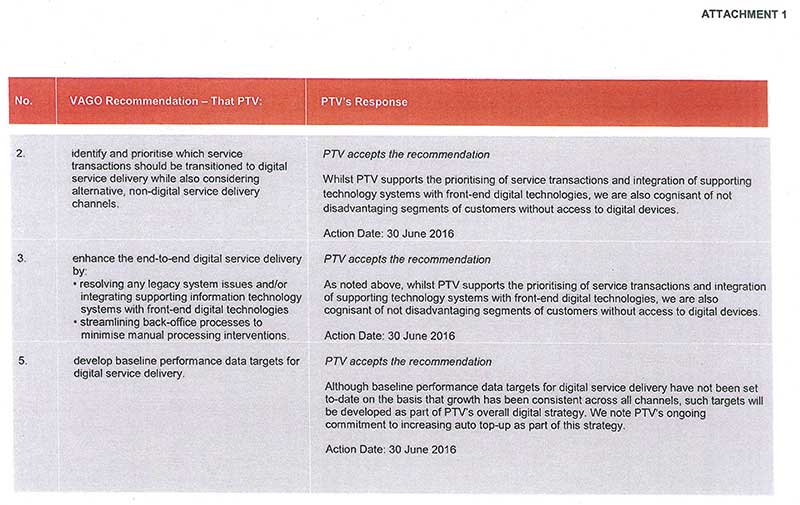

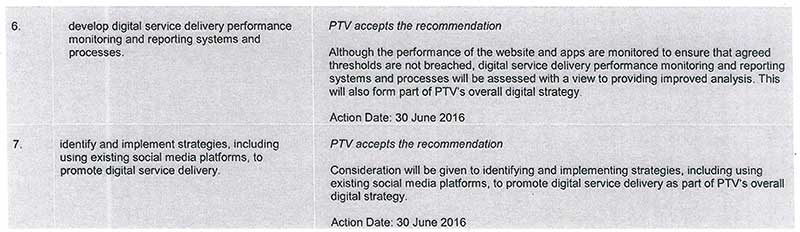

All non-audited departments and agencies are expected to consider and implement Recommendations 2, 3, 5, 6 and 7 where applicable.

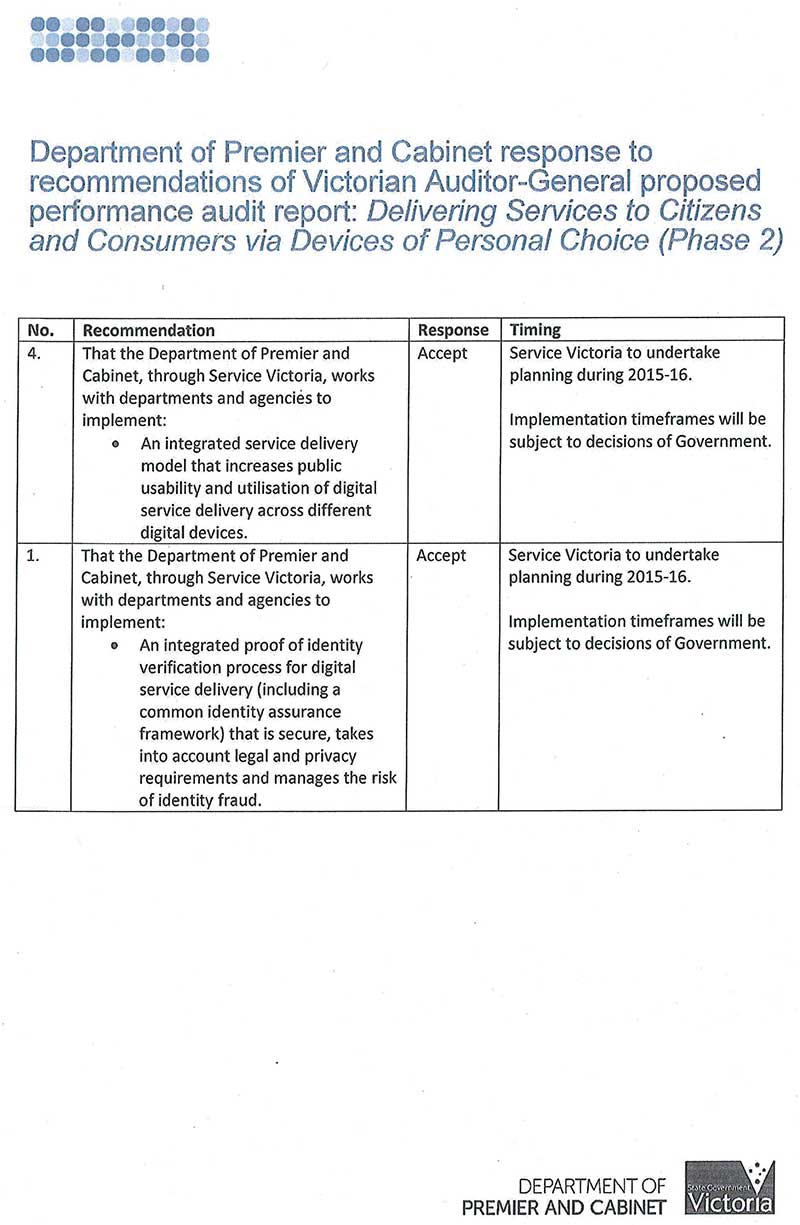

That the Department of Premier & Cabinet, through Service Victoria, works with departments and agencies to implement:

- an integrated service delivery model that increases public usability and utilisation of digital service delivery across different digital devices

- an integrated proof of identity verification process for digital service delivery (including a common identity assurance framework) that is secure, takes into account legal and privacy requirements and manages the risk of identity fraud.

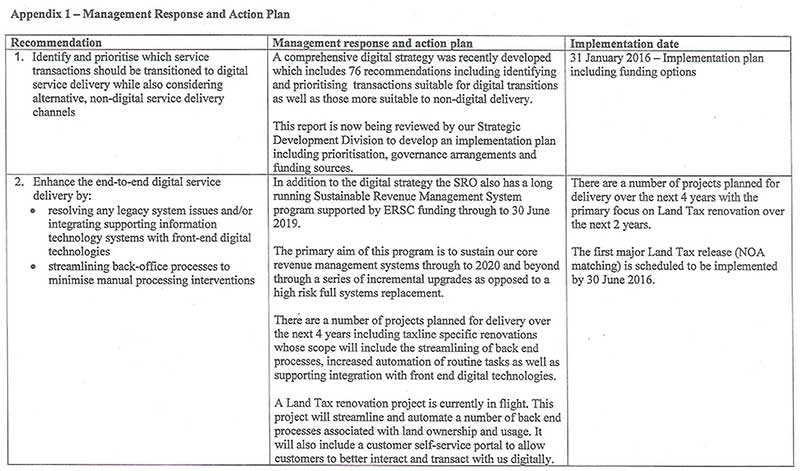

That the Department of Health & Human Services, Department of Justice & Regulation, Public Transport Victoria, State Revenue Office and VicRoads:

- identify and prioritise which service transactions should be transitioned to digital service delivery while also considering alternative, non-digital service delivery channels

- enhance the end-to-end digital service delivery by:

- resolving any legacy system issues and/or integrating supporting information technology systems with front-end digital technologies

- streamlining back-office processes to minimise manual processing interventions

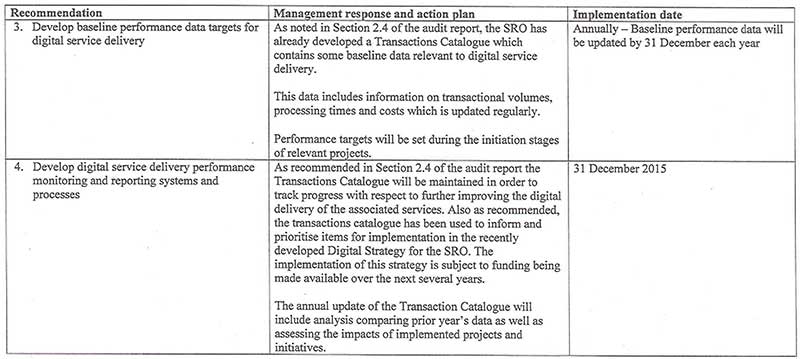

- develop baseline performance data targets for digital service delivery

- develop digital service delivery performance monitoring and reporting systems and processes

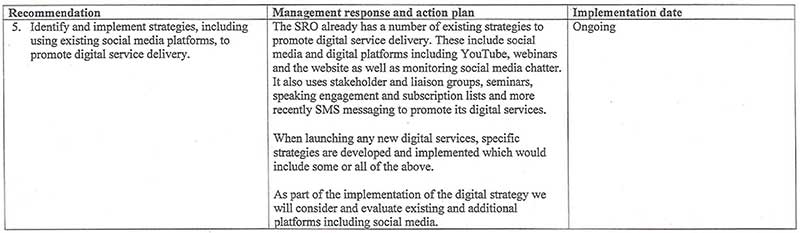

- identify and implement strategies, including using existing social media platforms, to promote digital service delivery.

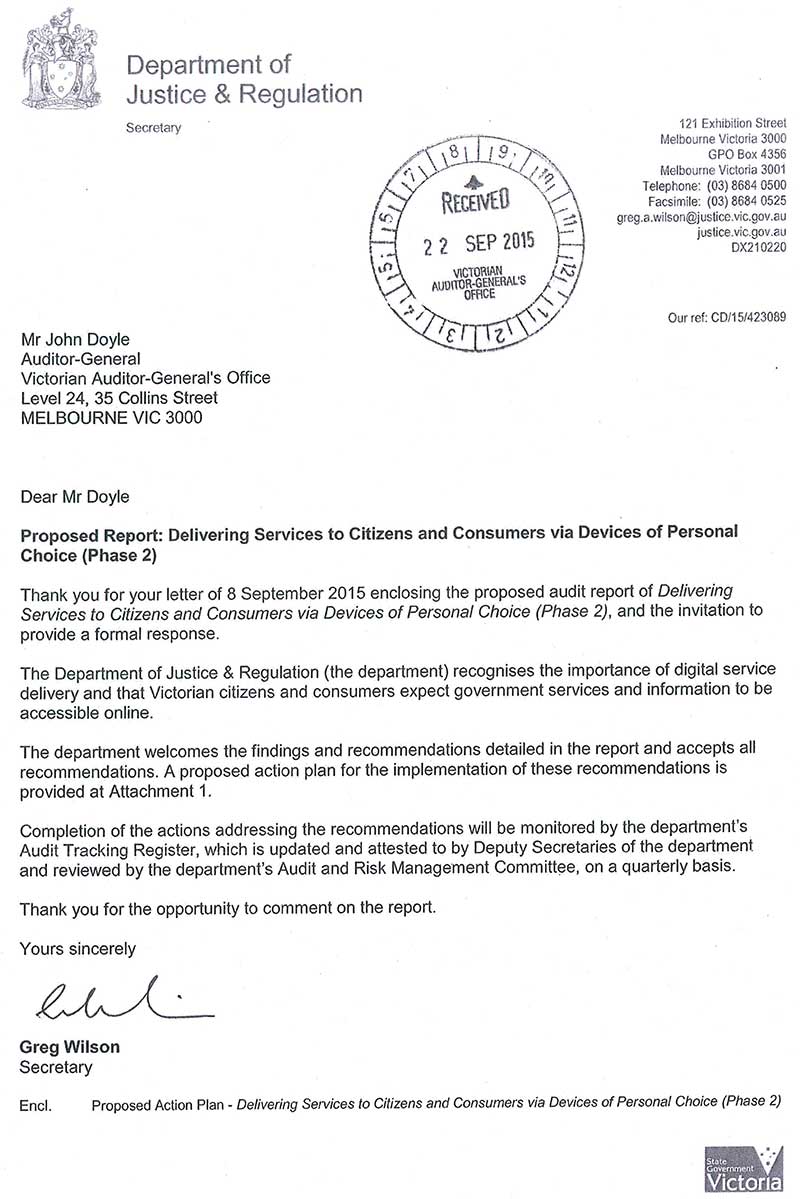

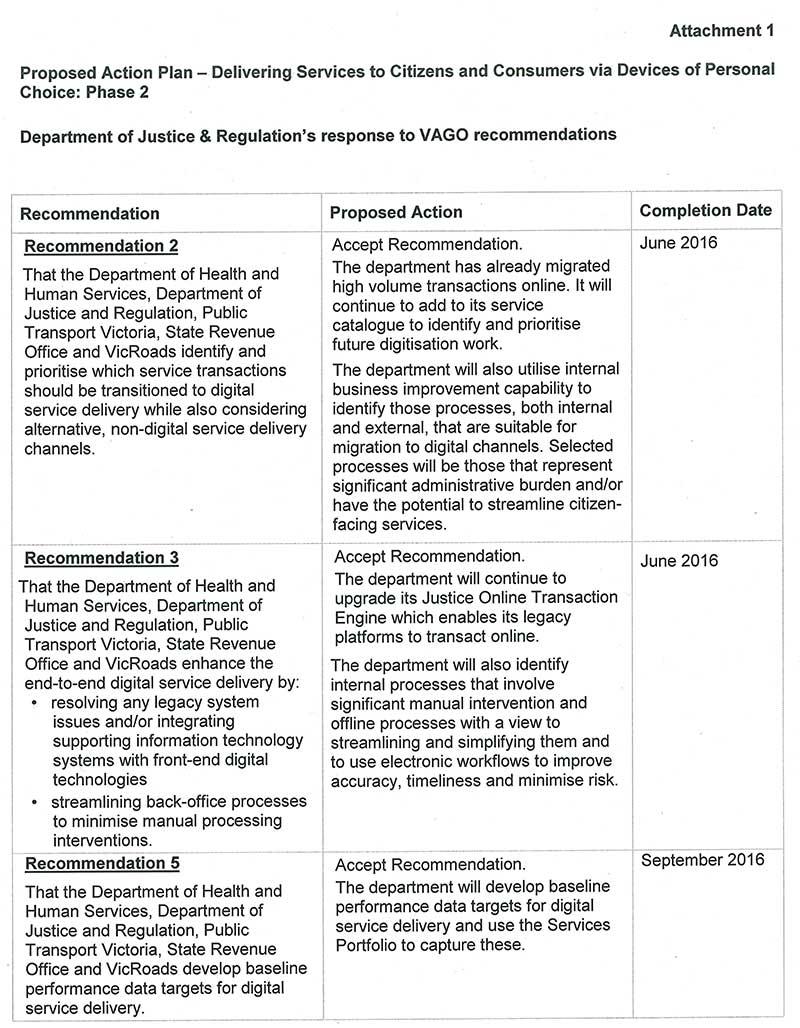

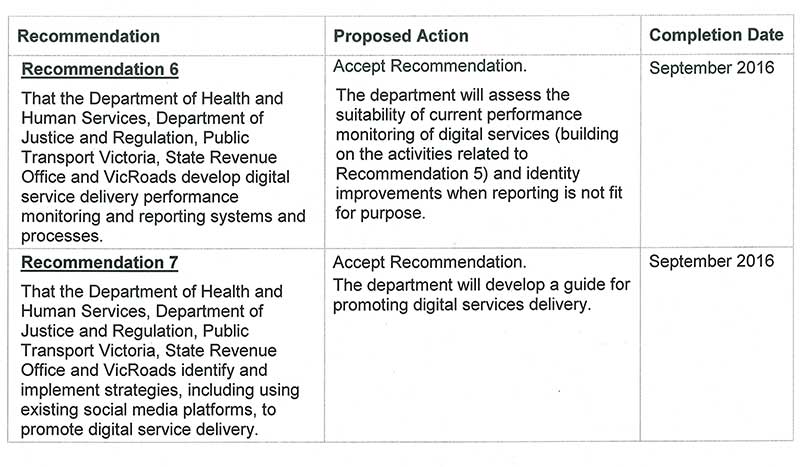

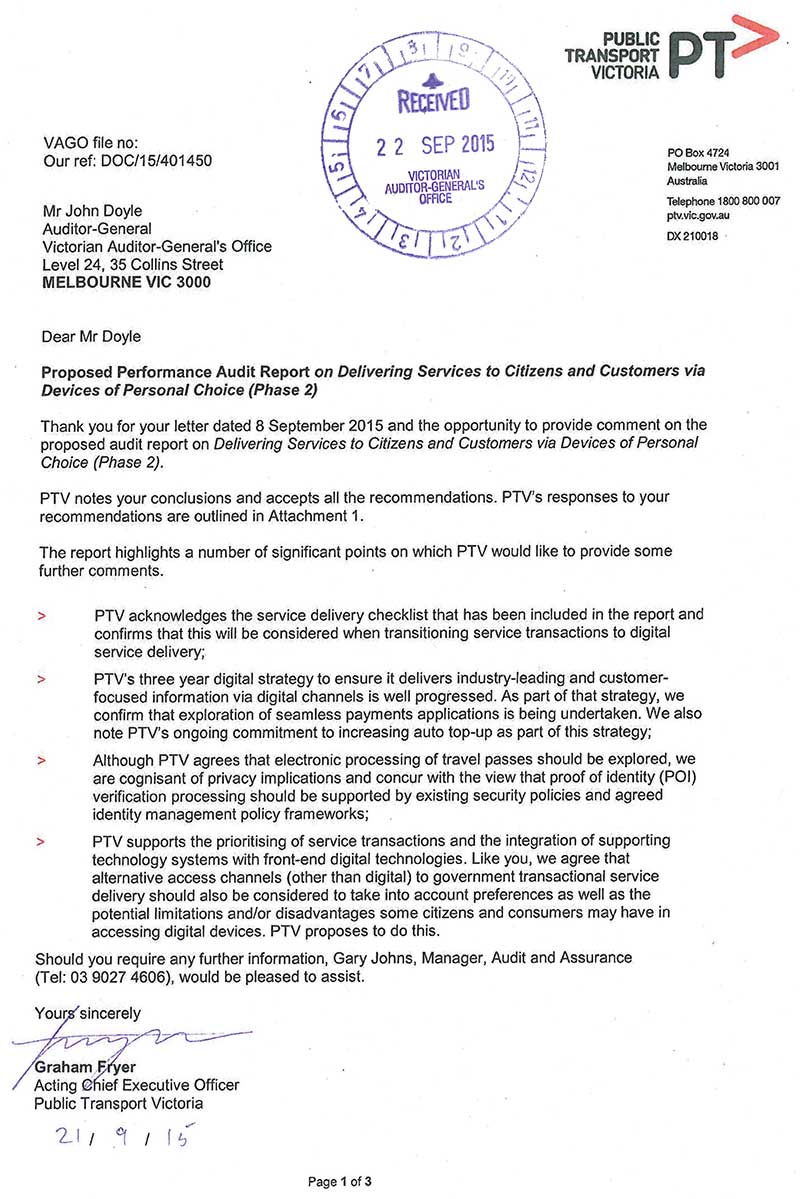

Submissions and comments received

Throughout the course of the audit, we have professionally engaged with the:

|

|

In accordance with section 16(3) of the Audit Act 1994 we provided a copy of this report to those departments/agencies and requested their submissions or comments.

We have considered those views in reaching our audit conclusions and have represented them to the extent relevant and warranted. Their full section 16(3) submissions and comments are included in Appendix C.

1 Background

1.1 Introduction

Victorian citizens and consumers expect government services and information to be accessible online 'anytime, anywhere and on any device'.

Digital devices of personal choice fall into two main types–computing devices including desktop personal computers, and mobile computing devices such as tablets and smartphones. Digital devices access a wide range of applications via the internet, using communication links such as Wi-Fi or other mobile data networks.

The Australian Communications and Media Authority's (ACMA) March 2015 Report 1—Australians' Digital Lives estimated that in the six months to May 2014, 12.5 million adult Australians used a mobile phone to access the internet for personal use, and 50 per cent of Australians used a tablet to go online. Both these figures were up 8 per cent on the previous year, signifying the increasing use of portable smart devices to go online in Australia.

1.2 Public sector digital service delivery

Digital service delivery in the public sector has the potential to increase efficiency, cut lengthy wait times at traditional 'bricks and mortar' locations, and reduce costs associated with traditional service delivery approaches.

1.2.1 Whole-of-public-sector digital service delivery

VAGO's June 2015 Delivering Services to Citizens and Consumers via Devices of Personal Choice: Phase 1 – Interim Report (Phase 1 report), examined the Victorian Government's information and communications technology (ICT) governance arrangements and delivery of the Victorian Government Digital Strategy (Digital Strategy), along with digital engagement approach and the status of transitioning service transactions online. The Phase 1 report noted the Victorian Government ICT Strategy 2014 to 2015 (ICT Strategy) contained three actions related to transitioning service transactions online, as shown in Figure 1A.

Figure 1A

ICT Strategy actions related to transitioning service transactions online

|

Number |

Title |

|---|---|

|

8. |

Agencies commence transition of key services online. |

|

9. |

Agencies complete transition of frequent transaction services online. |

|

56. |

Develop and commence delivery of a strategy to identify and improve the highest volume interactions between government and citizens—in consultation with the Victorian community. |

Source: Victorian Auditor-General's Office based on the ICT Strategy.

Following the change in government in November 2014, the ICT Strategy and Digital Strategy are no longer current. However ICT Strategy actions 8, 9 and 56 are still being implemented at a whole-of-public-sector level through the recently launched Service Victoria. Service Victoria was formerly known as the Victorian Transaction Reform Project.

In May 2015, the Department of Premier & Cabinet (DPC) launched Service Victoria with the aim of delivering a new whole-of-government service capability and enhancing government transactional service delivery with a more effective customer experience.

With funding of $15 million for 2015–16, planning has commenced for Service Victoria to develop an implementation plan for enabling changes to systems, processes and information as part of setting a new customer service standard in Victoria.

Summary of Phase 1 findings

The Phase 1 Report found that a coordinated and effective whole-of-public-sector approach to digital service delivery has yet to be achieved, due to:

- weak strategic leadership and ownership of the whole-of-public-sector ICT governance

- ineffective coordination and implementation of the Digital Strategy

- weak monitoring and reporting mechanisms resulting in departments and agencies not being held accountable for progress in delivering the Digital Strategy

- ineffective digital engagement to drive digital readiness

- challenges and difficulties faced by departments and agencies in mapping and estimating the types, volumes and costs of service transactions, as part of efforts to transition them online.

The Phase 1 Report recommended that, as part of its wider public sector reform agenda, DPC develops and implements:

- fit-for-purpose governance structures, in line with industry better practice that incorporate:

- strategic leadership and effective guidance to establish and deliver a whole-of-public-sector ICT approach—including defined roles and responsibilities—as part of a whole-of-public-sector service delivery strategy

- robust and effective monitoring and accountability mechanisms to regularly report on the development, adoption and benefit of ICT across the whole of the public sector

- a cost attribution methodology, to be used across the public sector, for determining the costs components of delivering services for a more effective and efficient transition of service transactions to online

- an integrated whole-of-public-sector digital engagement approach with effective engagement, coordination and assurance processes to drive digital readiness and service delivery using digital devices across departments and agencies.

DPC accepted all the recommendations.

1.2.2 Digital service delivery at department and agency level

Despite the limited progress at a whole-of-public-sector level, some departments and agencies are pushing ahead with delivering services to citizens and consumers via digital devices (or digital service delivery). Phase 2 of this audit examines the status of digital service delivery approaches and implementation by the following departments and agencies.

Department of Health & Human Services

As a result of the January 2015 machinery-of-government changes, the former Department of Human Services merged with the Department of Health to become the Department of Health & Human Services. This audit focused on the digital service delivery of the former Department of Human Services and this report therefore just discusses Human Services.

Human Services delivers services to support and manage clients' needs in housing, disability, child protection and youth justice.

Department of Justice & Regulation

As part of its justice-related responsibilities to ensure a safe, just, innovative and thriving Victorian community, the Department of Justice & Regulation (DJR) issues licences and certificates for business and personal use. This includes certificates and registries for births, deaths and marriages and checks for people engaged in paid or voluntary work involving children.

State Revenue Office

The State Revenue Office (SRO) is the Victorian Government's major tax collection agency and an independent service agency which administers Victoria's taxation legislation and collects a range of taxes, duties and levies. In 2013–14 the SRO collected in excess of $13 billion in revenue for the Victoria Government.

Public Transport Victoria

Public Transport Victoria (PTV) manages Victoria's train, tram and bus services. PTV is the single contact point for customers wanting information on public transport services, fares, tickets and initiatives.

VicRoads

VicRoads plans, develops and manages the arterial road network in Victoria and delivers road safety initiatives and registration and licensing services. Key VicRoads service transactions are in the areas of registration and licensing.

1.2.3 Digital service delivery in other jurisdictions

Governments in other jurisdictions have already implemented, or are in the process of implementing, an integrated approach to digital service delivery. For example, the New South Wales (NSW) state government has rolled out Service NSW with the aim of being a one-stop service, providing easier and more online access to government services.

Figure 1B

NSW Government: Service NSW

Source: http://www.service.nsw.gov.au/

The Australian Government implemented myGov with the aim of providing a fast and simple way to access Australian Government services online through one account with one username and password.

Figure 1C

Australian Government: myGov

Source: https://my.gov.au/

The Singapore Government has developed eCitizen, a similar one-stop government service portal that links to other essential online government services in one convenient place.

Figure 1D

Singapore Government: eCitizen

Source: http://www.ecitizen.gov.sg/

These examples of digital service delivery represent a concerted effort by contemporary governments to provide online services to citizens and consumers.

1.3 Audit objective and scope

The objective of this audit was to examine strategies for delivering services online via digital devices, how these strategies were being implemented, and the extent to which services were already being provided.

The audit examined:

- the implementation of underlying government strategies for migrating services online via digital devices

- approaches for determining which services would be delivered online via digital devices

- the ongoing monitoring of the effectiveness of digital service delivery.

The delivery of this audit has been split due to the January 2015 machinery-of-government changes and subsequent changes to ICT governance arrangements as well as reviews by DPC into how business services are to be delivered across the public sector.

1.3.1 Phase 1

The Phase 1 report was tabled on 10 June 2015 and focused on:

- reviewing ICT governance framework arrangements

- examining the delivery of the Digital Strategy.

Phase 1 also included better practice guidance on ICT governance arrangements and digital engagement.

1.3.2 Phase 2

Phase 2 examined department and agency approaches to determining which services will be, or have already been, delivered online via digital devices and examined the ongoing monitoring of the effectiveness of digital service delivery.

The examination of service delivery implementation included:

- an analysis of the existing end-to-end service transactions by audited agencies, including common challenges, issues and inefficiencies faced by agencies in designing and delivering services online via digital devices

- case studies of service delivery by different agencies to highlight positive service delivery approaches.

The examination of monitoring of the effectiveness of digital service delivery included:

- assessing department and agency ability to monitor and report on digital service delivery performance

- improving public usability and utilisation of government digital service delivery.

The audited departments and agencies included:

- Department of Health & Human Services (Human Services only)

- DJR

- SRO

- PTV

- VicRoads.

This audit also considered the DPC's whole‑of‑government strategy on transactions reform.

1.4 Audit method and cost

This audit included an examination of documents and interviews with staff at the audited departments and agencies. Other official documents and published research was also used.

The audit team attended and observed back-end support operations for processing transactions at selected agencies. The capability and functionality of the information technology systems currently used for delivering government services via digital devices were also analysed.

The audit was performed in accordance with the Australian Auditing and Assurance Standards. Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated any persons named in this report are not the subject of adverse comment or opinion.

The cost of the audit was $270 000.

1.5 Report structure

The report is structured as follows:

- Part 2 examines the successes in digital service delivery and the common challenges, issues and inefficiencies being faced by audited departments and agencies in designing and delivering services to be accessed via digital devices.

- Part 3 examines how audited departments and agencies monitor and improve their digital service delivery.

- Appendix A provides details on case studies of successes in digital service delivery.

- Appendix B provides a checklist of considerations for Victorian public sector entities when transitioning to digital service delivery.

2 Delivery of government transactional services

At a glance

Background

This Part examines existing digital service delivery by audited departments and agencies, including current successes, as well as the common challenges, issues and inefficiencies faced in designing and delivering services online.

Conclusion

Departments and agencies are currently implementing, or have already transitioned to, digital service delivery. However, they still face pertinent issues which are hindering the successful transition, and a whole-of-public-sector approach to digital service delivery has yet to be fully realised.

Findings

- There are current successes in digital service delivery.

- There is an incomplete list of government service transactions and the costs attributable to delivering these services. Service transactions to be transitioned online are not clearly identified and prioritised.

- Government service delivery has not yet fully transitioned online as:

- proof of identity verification processes are inefficient and not yet integrated

- legacy and inefficient information technology systems together with inefficient back-office processes do not facilitate efficient and seamless end-to-end digital service delivery.

Recommendations

- That the Department of Premier & Cabinet, through Service Victoria, works with departments and agencies to implement an integrated proof of identity verification process.

- That the Department of Health & Human Services, Department of Justice & Regulation, Public Transport Victoria, State Revenue Office and VicRoads:

- identify and prioritise service transactions to be transitioned to digital service delivery while also considering alternative delivery channels

- enhance the end-to-end digital service delivery.

2.1 Introduction

This audit focused specifically on the delivery of transactional services, or service transactions, to citizens and consumers. Examples of existing service transactions include:

- making a payment for a government service, such as purchasing or 'topping up' a myki card

- renewing or modifying a driver's licence

- completing and submitting an application form for public housing, a birth certificate or a Working with Children (WWC) Check.

This part examines the current successes in digital service delivery and common challenges, issues and inefficiencies being faced by audited departments and agencies in designing and delivering services to be accessed via digital devices.

2.2 Conclusion

Departments and agencies are currently at different stages of implementing services accessible to customers via digital devices, and there are some early success stories. However departments and agencies still face pertinent issues in their quest towards implementing end-to-end digital service delivery.

With the exception of information updates and application renewals, applying for government services still requires manual intervention and processing, meaning that service transactions are yet to be fully transitioned online.

Legacy and inefficient existing information technology (IT) systems, together with inefficient back-office processes, are being used to support service delivery operations and processes. This has limited the efficiency and seamlessness of end-to-end digital service delivery.

Proof of identity (POI) verification processes are inefficient and are not yet integrated for cross-validating customer identity across departments and agencies.

While these issues remain, a whole-of-public-sector approach to digital service delivery has yet to be fully realised.

2.3 Digital service delivery at department and agency level

While a whole-of-public-sector digital service delivery approach is currently being planned by Service Victoria, progress towards digital service delivery continues to be made at a department and agency level.

2.3.1 Strategies for digital service delivery

All the audited departments and agencies are planning to transition selected transactions to digital channels or have commenced doing so. The status of the development and implementation of digital strategies by the audited departments and agencies is at varying stages, as shown in Figure 2A.

Figure 2A

Status of audited department and agency digital strategies

Digital strategy in place |

|

|---|---|

Department of Health & Human Services (Human Services) |

✘ |

Department of Justice & Regulation (DJR) |

✔ |

State Revenue Office (SRO) |

In progress |

Public Transport Victoria (PTV) |

✔ |

VicRoads |

✔ |

Source: Victorian Auditor-General's Office based on the audit fieldwork.

Department of Health & Human Services

Human Services does not have a digital strategy or an implementation plan for digital service delivery.

Human Services has however delivered new digital initiatives to meet citizen and consumer needs:

- housing services website

- social media services for the department

- services connect practice manual

- Sport and Recreation Victoria website.

In addition, a number of digital initiatives not related to this audit are in progress:

- vulnerable children and youth area partnerships website

- child protection mobile workforce and new mobile ready manual

- emergency relief and recovery website

- social media platforms for Human Services' informational services such as Twitter, LinkedIn and FaceBook

- digitalisation of ward records (children removed from their families and placed either in the direct care of the State of Victoria or private institutions).

Due to the recent merger of the former Department of Health and the former Department of Human Services, a review has been initiated to consolidate and reconcile strategic approaches to digital service delivery. Going forward, the Department of Health & Human Services will develop an overarching digital strategy to assist in the planning and implementation of new initiatives.

Department of Justice & Regulation

As part of a three-year digital strategy, covering 2013 to 2015, DJR developed 39 initiatives categorised into five thematic actions to assist with the digital migration process:

- leadership and governance—three initiatives

- drive business engagement and digital adoption—three initiatives

- transform DJR services through digital delivery—15 initiatives

- deliver new digital capability and ways of working—14 initiatives

- support ongoing operations—four initiatives.

Figure 2B

Delivery status of Department of Justice & Regulation

Digital Services Strategy

2013–15

Digital strategy actions |

Initiatives completed and ongoing |

Initiatives in progress |

Initiatives not commenced |

|---|---|---|---|

Leadership and governance |

3 |

– |

– |

Drive business engagement and digital adoption |

1 |

– |

2 |

Transform DJR services through digital delivery |

1 |

3 |

11 |

Deliver new digital capability and ways of working |

2 |

2 |

10 |

Support ongoing operations |

3 |

– |

1 |

Source: Victorian Auditor-General's Office based on information and findings obtained from DJR.

Where initiatives had not yet commenced this was due to:

- no available funding or resources

- refinement of the digital strategy after reviewing the external environment and changing business unit needs and priorities.

Despite this, business units within DJR such as the Victorian Registry of Births, Deaths, and Marriages (BDM) and the WWC Check are implementing strategies for digital service delivery.

State Revenue Office

SRO's 2014–17 corporate strategic plan includes a strategic goal to 'make it easier for customers to do business with SRO' by continuing to enhance its suite of digital services, continuing to improve its website and eliminate the need for customers to attend the office in person etc. The Five Year Information Technology Strategy (2014–2019) was also developed to establish a work program that aligns with this strategic intent.

SRO is in the process of developing a digital strategy to provide a roadmap and a program of implementable initiatives to deliver additional services digitally over the next five years. SRO's Strategic Development division was recently created and its responsibilities include reviewing current and emerging technology and trends, and developing strategies and options for new ways of delivering services—including fee-for-service and self-service where appropriate.

Public Transport Victoria

PTV developed a three-year digital strategy with three key performance indicators to ensure it delivers industry-leading and customer-focused information via digital channels, as shown in Figure 2C.

Figure 2C

Delivery status of Public Transport Victoria's Digital Strategy 2015

Key performance indicator |

Delivery status |

|---|---|

Consistent trip planning and disruption messaging across all digital channels (due May 2015) |

Completed and ongoing |

Real time information for all transport modes in all major digital channels (due December 2015) |

Not yet commenced |

Seamless digital payments, touch on/off and top-up experience for myki ticketing (due December 2017) |

Evaluating options for seamless payments applications being planned |

Source: Victorian Auditor-General's Office based on information and findings obtained from PTV.

VicRoads

In January 2015, VicRoads implemented its digital strategy which includes 26 initiatives categorised into five thematic actions. These initiatives aim to:

- strengthen digital leadership and governance—three initiatives

- drive business engagement and digital adoption—four initiatives

- transform VicRoads services through digital delivery—nine initiatives

- deliver new digital capability and ways of working—six initiatives

- enable and support ongoing operations—four initiatives.

Figure 2D

Delivery status of VicRoads' Digital Strategy 2015

Digital strategy actions |

Initiatives completed and ongoing |

Initiatives in progress |

Initiatives not commenced |

|---|---|---|---|

Strengthen digital leadership and governance |

2 |

1 |

– |

Drive business engagement and digital adoption |

– |

4 |

– |

Transform VicRoads services through digital delivery |

4 |

3 |

2 |

Deliver new digital capability and ways of working |

2 |

4 |

– |

Enable and support ongoing operations |

2 |

2 |

– |

Source: Victorian Auditor-General's Office based on information and findings obtained from VicRoads.

VicRoads is currently embarking on a Web Application and Remediation Program to further enhance its online registration and licensing (R&L) services. This program aims to refresh and remediate existing digital R&L transactions and develop new digital service offerings, such a single payment application and a customer portal.

2.4 Digital service transaction identification and costs

In order to understand current department and agency service transactions, a complete baseline list of service transaction types, volumes and costs is required. This is also needed to determine whether digital service delivery is measurably more effective and cost efficient and which transactions should be transitioned to digital delivery.

As reported in our June 2015 Delivering Services to Citizens and Consumers via Devices of Personal Choice: Phase 1 – Interim Report (Phase 1 report), as part of the Victorian Transaction Reform Project, a preliminary analysis was undertaken by the Department of Premier and Cabinet (DPC) to identify the key service transactions that should be delivered online. Critical to this process was the collection and analysis of service transaction data via different delivery channels—both non-digital and digital—from participating departments and agencies.

This service transaction data, collected in 2014, was, however, inaccurate and did not represent a full inventory of service transaction types, volumes and costs or delivery channels. Our Phase 1 report recommended the development and implementation of a cost attribution methodology, to be used across the public sector, for determining the cost components of delivering services.

Specific to this audit, only three out of the five audited departments and agencies that deliver services directly to citizens and consumers have a complete list of service transactions and the costs attributable to delivering each of the service transactions. However, not all audited departments and agencies have clearly identified and prioritised within their service transaction lists which transactions should be transitioned to digital service delivery.

A summary of the progress made by the five audited departments and agencies to identify and cost their service transactions is detailed in Figure 2E.

Figure 2E

Summary of audited department and agency service transaction data

Human Services |

DJR |

SRO |

PTV |

VicRoads |

|

|---|---|---|---|---|---|

Service transaction list developed |

✘ |

Partially |

✘ |

✘ |

✘ |

Total volume of service transactions (million) |

Cannot be determined |

18.5(a) |

4.5(b) |

42.1(c) |

22.7(d) |

Cost attributable to serving each service transaction |

✘ |

Partially |

Partially |

✔ |

✘ |

Transactions to be transitioned to digital service delivery identified and prioritised |

✘ |

Partially |

✘ |

✘ |

✘ |

(a) Year ending June 2014—excludes small transaction types.

(b) Year ending June 2014—estimated.

(c) Year ending June 2014—myki card full fare and concession top-up

transactions only.

(d) Year ending June 2014—VicRoads R&L transactions only.

Source: Victorian

Auditor-General's Office based on the audit fieldwork.

To measure the effectiveness and cost efficiencies of digital service delivery compared to traditional service delivery channels, departments and agencies should develop a service transactions list, or continue to review their current one. The list should define the service transactions delivered, specify the volume of transactions processed and the costs attributable to delivering the service transactions using the relevant service delivery channels in use. Costs should be determined using the cost attribution methodology to be developed by DPC, as recommended in our Phase 1 report.

The service transaction list should also be used by departments and agencies to identify and prioritise which service transactions should be transitioned to digital service delivery.

Alternative access channels (other than digital) to government transactional service delivery should also be considered to take into account the expansive behaviour and preferences of citizens and consumers as well as the potential limitations and/or disadvantages some citizens and consumers may have in accessing digital devices.

2.4.1 Department of Health & Human Services

Human Services has yet to develop a complete baseline list of service transactions and associated volumes and costs.

Human Services is a service delivery organisation that supports vulnerable Victorians by providing targeted housing, community services and programs to individuals and families. This includes young people and families involved with child protection services, young people involved with youth justice service and people with disabilities.

Many of its service users require support across more than one service area due to their multiple and often complex needs. Social and demographic changes are increasing the complexity of the kind of support people need. This means that transactions with service users tend to be highly individualised.

While the department has taken some steps to move towards digital service delivery, the nature of its work means that face-to face approaches will remain its primary service delivery channel. On this basis, we found the large majority of these service transactions to be unsuitable for digital service delivery.

This audit focused on two Human Services' service transactions, public housing services and bond loan scheme applications. While these transactions are considered suitable for digital service delivery, they are yet to be transitioned online and delivering them remains manual and inefficient. The extent of the manual processing involved is detailed in Figure 2F.

Figure 2F

Case study: The Department of Health & Human Services'

public housing service and bond loan scheme

|

Public housing applications Human Services is responsible for the management of public housing for low-income people in difficult circumstances, especially those who recently experienced homelessness or have other special needs. This housing is generally long-term rental accommodation that is government owned and managed. There were a total of 64 886 household tenancies at 30 June 2014 in direct tenured public housing, with an additional estimated 33 933 applicants on the public housing waiting list in March 2015. The public housing application is a predominantly manual process and is inefficient:

Bond loan scheme A bond loan is an interest-free repayable loan for eligible households who intend to rent privately in Victoria but cannot afford to pay the rental bond. The bond loan is used as a security deposit on the property required by private landlords for private rental accommodation. The bond loan application process is manual and inefficient:

|

Source: Victorian Auditor-General's Office based on the audit fieldwork.

There is an opportunity for Human Services to maximise the efficiency and effectiveness of public housing services and bond loan scheme application transactions by transitioning these to digital service delivery.

Human Services recognises the client experience and efficiency benefits of transitioning to digital service delivery for public housing services. As a first step, an online housing application form is being developed and is due for completion in March 2016.

2.4.2 Department of Justice & Regulation

DJR's Services Portfolio Model (SPM) was developed to provide quantitative and qualitative information on service transactions. Quantitative information included the volume of transactions, the service delivery channel—such as staffed, telephone, digital—and the current cost to process the transaction (where available). Qualitative information includes a description of each service, identified constraints and potential future opportunities.

However, the SPM focused only on high-value and high-level transactions without costing all of DJR's transactions. The SPM therefore is an incomplete list. We also found gaps in the collation and analysis of its service transaction data—this is discussed in detail in Section 3.3.2.

This audit focused on two key DJR service transactions identified in the SPM, namely the WWC Check and BDM registrations and applications for certificates.

WWC Check service transactions have been successfully transitioned to digital service delivery and this is discussed further in Section 2.5 as a current success.

Service transactions relating to BDM registrations and applications for certificates are largely manual, particularly on the assessment of POI of the applicant, which hinders its transition to digital service delivery. Failure of the online payments systems require manual intensive follow up, reconciliations and processing at the back-office. The issues with transitioning these transactions online are outlined in Section 2.6.

2.4.3 State Revenue Office

SRO has developed a baseline transaction list for the year ending 30 June 2014 and is currently in the process of updating the list. The list is used as a basis to guide further analysis and develop business case options and recommendations for future digital service delivery offerings. SRO is also currently reviewing the unit costs—which currently capture only labour costs—and processing times to deliver each service transaction. SRO, as part of developing the Digital Strategy, will include details of service transactions to be identified and prioritised.

This audit focused on two SRO service transactions, land tax and land transfer duty. Both these transactions are recognised by SRO as critical business services and suitable for digital service delivery.

The transition of land transfer duty transactions to digital service delivery is further described in Section 2.5 as a current success.

2.4.4 Public Transport Victoria

PTV has developed a list of myki transactions, which details the costs attributable to delivering each transaction.

This audit focused on myki 'top-up' transactions, free travel pass and concession card application transactions for the myki card. While the free travel pass and concession card applications can be considered suitable for digital service delivery, PTV currently does not have any plans to transition them online. Delivering these service transactions remains manual and inefficient. The extent of manual processing is detailed in the case study in Figure 2G.

Figure 2G

Case study:

Public Transport Victoria's travel pass and concession applications

Application for free travel passes and travel concessions Due to certain circumstances and needs, some individuals are entitled to apply for free travel passes or concessions, subject to verification. In 2014, 11 158 new and replacement travel pass applications and 11 023 concession applications for asylum seekers were being processed at the PTV Pass Office. As of 20 July 2015, there were 70 328 active free travel and concession myki cards.

Application for student travel concessions PTV, as well as Metro Trains, processes myki concession card applications for primary, secondary and tertiary students. In 2014, there were 128 247 concession card applications.

The above two application processes are inefficient for both the applicant and PTV Pass Office staff:

|

Source: Victorian Auditor-General's Office based on the audit fieldwork.

Transitioning free travel pass and concession card application transactions to digital service delivery would be both efficient and effective for consumers and PTV.

Although there is a range of ways to perform myki 'top-up' transactions, PTV has yet to encourage customers to 'top up' online via its myki website—www.mymyki.com.au—even though surveys conducted highlighted the need for PTV to improve its digital service offerings for myki card transactions. This is discussed further in Section 3.3.2. PTV instead believes that the customers should decide for themselves which delivery channel to use.

2.4.5 VicRoads

This audit focused specifically on service transactions undertaken by VicRoads' R&L division. This division has identified and developed a complete list of R&L service transactions including both non-digital and digital service transactions.

VicRoads' R&L division effectively utilised the service transactions list—together with the costs attributable to delivering the service transactions—to make strategic decisions relating to service delivery channel strategies. Appendix A provides further detail on how VicRoads successfully developed its R&L service transactions list.

In 2014, VicRoads identified a total of 16 million out of 22.7 million service transactions completed in the financial year 2013–14 that were either delivered, or had the potential to be delivered, online. Some service transactions cannot be fully transitioned online as they still require a component of the transaction to be administered and facilitated onsite at a VicRoads customer service centre. For example, applying for a new driver's licence requires a customer to visit a VicRoads customer service centre to undertake a driving assessment.

The transition to digital service delivery for VicRoads' R&L transactions is further described in Section 2.5 as a current success.

2.5 Successes in digital service delivery

We found current successes in digital service delivery within the audited departments and agencies.

2.5.1 Department of Justice & Regulation Working with Children Check 'MyCheck' website

The WWC Check is designed to help protect children from sexual or physical harm by ensuring that people who work with, or care for, children are subject to a screening process.

When introduced in 2005, the WWC Check back-office operations were manually processed, with high volumes of transactions and high associated costs. In recognition of the need to increase operational efficiencies, and improve customer service and security for the WWC Check credential service, DJR commenced the digital transformation of the service.

In 2012, the WWC Check digital service known as MyCheck went live. Customers can utilise the following WWC Check service transactions online:

- request a WWC Check—applicants are, however, required to lodge the application via Australia Post, in order to confirm their POI

- update personal, contact and organisational details

- request a replacement WWC Check card where cards have been lost, stolen or damaged

- renew a WWC Check card

- change from a volunteer WWC Check to an employee WWC Check.

Figure 2H

Working with Children Check 'MyCheck' website

Source: http://www.workingwithchildren.vic.gov.au/

Appendix A provides further details of the WWC Check's digital transformation journey.

2.5.2 VicRoads registration and licencing

VicRoads' has two key service transactions:

- Vehicle registration—registration is required for any light and heavy vehicle or vessel intended for use on public roads or waterways in Victoria. This includes cars, motorcycles, trailers/caravans, imported vehicles and boat/ship trailers.

- Licensing—to drive in Victoria you need a current driver licence or learner permit.

In 2014, VicRoads implemented a digital service delivery channel that linked to its core R&L systems. The digital platform was designed to be used across different digital devices as part of improving the overall customer experience when interacting online with VicRoads.

VicRoads has transitioned the following transactions online:

- change of address

- book, change or cancel licence or learner permit test

- order a Driver History report

- order a replacement licence or learner permit

- pay vehicle registration

- check vehicle registration

- order a replacement registration label/certificate for heavy vehicles or a replacement certificate for light vehicles

- order a custom plate

- apply for an unregistered vehicle permit.

Figure 2I

VicRoads website

Source: https://www.vicroads.vic.gov.au/

VicRoads estimated the digital service delivery costs to be 60 to 95 per cent cheaper than traditional channels for 'simple' service transactions, such as license and registration renewals.

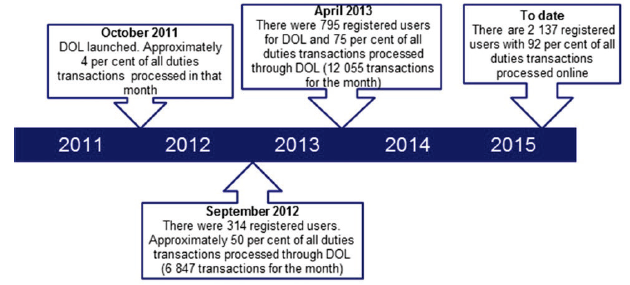

2.5.3 State Revenue Office Duties Online

In 2011, SRO launched the online application, Duties Online (DOL), to increase efficiencies and enhance the customer experience for duties service transactions.

DOL enables customers and their representative agents to electronically submit details of the most common types of property transfers and Declarations of Trust for assessment to SRO. DOL guides users through the duties transaction process and automates duties assessment calculations.

Figure 2J

State Revenue Office's Duties Online website

Source: http://www.sro.vic.gov.au/dutiesonline

Appendix A provides further details of SRO's digital transformation journey of its duties transactions.

2.6 Digital service delivery challenges and issues

There are common challenges and issues being faced by audited departments and agencies which have resulted in a whole-of-public-sector approach to government digital service delivery that has yet to be fully realised. The challenges and issues found were:

- POI verification requirements

- legacy and existing IT systems and back-office processes.

2.6.1 Proof of identity verification requirements

As each government agency is responsible for delivering transactional services specific to its statutory mandate and programs, application processes still operate in isolation of the respective department and agency.

Traditionally the POI verification process is applied to every new service application. This requires the applicant to visit an agency customer service centre or its representative agent for authorised personnel to prove their identity through the physical/in-person sighting of appropriate photographs, and/or certified 'true copies' of relevant documentation.

Inefficient and non-integrated proof of identity verification process

There is no integrated digital POI verification solution to efficiently and effectively authenticate customers' identity. Citizens and consumers must complete the POI verification for each new service transaction, which is generally a manual process.

This has limited the ability of audited departments and agencies, which require the identity of citizens and consumers to be validated prior to undertaking or completing service transactions, to transition fully to digital service delivery.

As a result, departments and agencies still operate in isolation without an integrated approach to sharing or cross-verifying customers' identity and common background information to simplify the application process. Transactions that have been limited are detailed in Figure 2K.

Figure 2K

Proof of identity verification requirements by departments and agencies

Department / agency |

POI verification requirements |

|---|---|

DJR |

|

Department of Health & Human Services |

|

SRO |

|

PTV |

|

VicRoads |

|

Source: Victorian Auditor-General's Office based on the audit fieldwork.

Improving the proof of identity verification process

While each department and agency continues to improve its own service delivery process, there is an opportunity for DPC, with the launch of Service Victoria, to work with departments and agencies to integrate a POI verification process that is secure, takes into account legal and privacy requirements and manages the risk of identity fraud. Specifically, the integrated POI verification process should be supported by existing security policies, agreed identity management policy frameworks, standards and systems incorporating an information usage arrangement in accordance with the Privacy and Data Protection Act 2014.

This integrated POI verification process should also include a common identity assurance framework at a whole-of-public-sector level to enable departments and agencies to share and retain POI outcomes while minimising duplications across the public sector. This would enable citizens and consumers to access government services without having to repeatedly authenticate their identities.

2.6.2 Legacy and existing information technology systems and back-office processes

Efficiencies gained through front-end service delivery are being hindered by audited departments and agencies maintaining legacy or inefficient existing IT systems or inefficient back-office processes. While some audited departments and agencies have improved the legacy or existing IT systems and back-office processes, some continue to operate with legacy and inefficient existing IT systems and inefficient back-office processes.

Legacy or existing technologies, though still reliable in performing the operations, do not enhance or promote an efficient and seamless end-to-end digital service delivery solution. Inefficient back-office processes, like manual data verification of hardcopy forms, manual application processing into core systems, and reconciliation processes of applications and payments received, have impacted audited departments and agencies digital service delivery.

Business requirements for system use continue to evolve and require enhancements to continuously meet the ongoing needs of departments and agencies.

Figure 2L outlines examples of audited departments' and agencies' legacy or existing IT systems or back-office processes which are impacting the efficiency and effectiveness of digital service delivery.

Figure 2L

Legacy or existing IT systems / back-office processes and implications

Department / agency |

Issues with legacy or existing IT systems / back-office processes |

Implications |

|---|---|---|

DJR |

|

|

Department of Health & Human Services |

|

|

SRO |

|

|

PTV |

|

|

VicRoads |

|

|

Source: Victorian Auditor-General's Office based on the audit fieldwork.

Recommendations

All non-audited departments and agencies are expected to consider and implement Recommendations 2 and 3 where applicable.

- That the Department of Premier & Cabinet, through Service Victoria, works with departments and agencies to implement an integrated proof of identity verification process for digital service delivery (including a common identity assurance framework) that is secure, takes into account legal and privacy requirements and manages the risk of identity fraud.

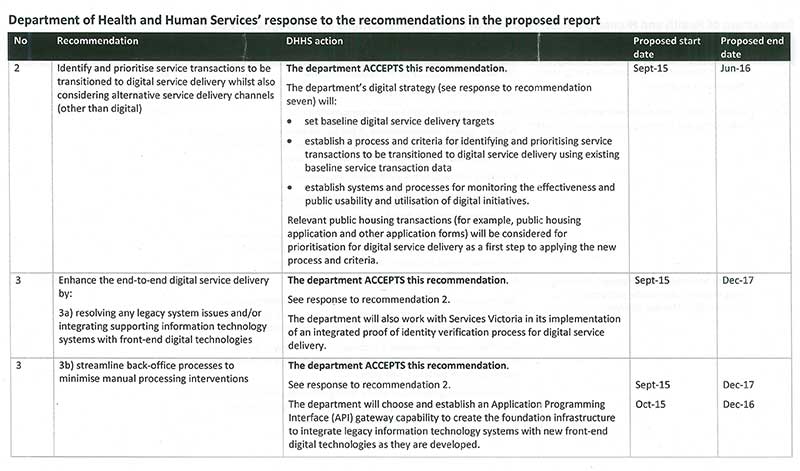

That the Department of Health & Human Services, Department of Justice & Regulation, Public Transport Victoria, State Revenue Office and VicRoads:

- identify and prioritise which service transactions should be transitioned to digital service delivery while also considering alternative, non-digital service delivery channels

- enhance the end-to-end digital service delivery by:

- resolving any legacy system issues and/or integrating supporting information technology systems with front-end digital technologies

- streamlining back-office processes to minimise manual processing interventions.

3 Monitoring and improving digital service delivery

At a glance

Background

This Part examines the monitoring of the effectiveness of digital service delivery. This includes the monitoring and reporting systems and processes used to measure and improve digital service delivery performance.

Conclusion

Digital service delivery performance has yet to be effectively measured and reported on. Improving public usability and utilisation of digital service delivery is an ongoing effort for departments and agencies and at a whole-of-public-sector level to ensure that the overall benefits are fully realised.

Findings

- Not all audited departments and agencies have baseline digital service delivery performance targets.

- Audited departments and agencies are at different levels of maturity and have implemented different monitoring and reporting approaches to measure their digital service delivery performance.

Recommendations

- That the Department of Premier & Cabinet, through Service Victoria, works with departments and agencies to implement an integrated service delivery model that increases public usability and utilisation of digital service delivery.

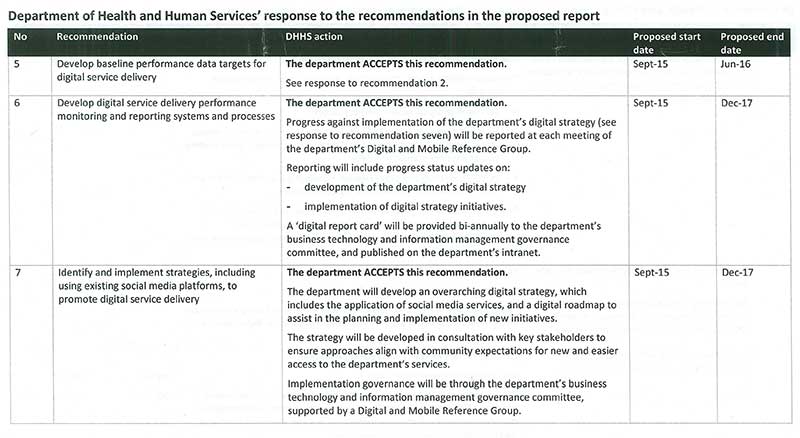

- That the Department of Health & Human Services, Department of Justice & Regulation, Public Transport Victoria, State Revenue Office and VicRoads:

- develop baseline performance data targets for digital service delivery

- develop digital service delivery performance monitoring and reporting systems and processes

- identify and implement strategies, including using existing social media platforms, to promote digital service delivery.

3.1 Introduction

Ongoing monitoring and reporting on the effectiveness and public utilisation of digital service delivery is crucial to ensuring that service delivery across government remains both effective and cost efficient.

This Part examines how audited departments and agencies monitor and improve their digital service delivery.

3.2 Conclusion

Digital service delivery performance has yet to be effectively measured and reported on.

Not all departments and agencies have baseline digital service delivery performance targets. Further, there were varying levels of monitoring and reporting systems and processes in place at audited departments and agencies.

There needs to be a continuous effort by departments and agencies and at a whole-of-public-sector level, to improve the public usability and utilisation of digital service delivery through effective performance measurement. This will provide assurance that the overall benefits of digital service delivery are fully realised.

3.3 Monitoring and reporting of digital service delivery performance

To continuously improve the efficiency and effectiveness of digital service delivery, it is essential to have rigorous monitoring and reporting systems and processes in place. Audited departments and agencies displayed different approaches and levels of maturity in implementing monitoring and reporting approaches to measure their digital service delivery performance.

This audit focused on three key stages of digital service delivery performance monitoring and reporting, as shown in Figure 3A.

Figure 3A

Key stages of digital service delivery performance monitoring and reporting

Source: Victorian Auditor-General's Office.

3.3.1 Stage 1: Establish baseline digital service delivery performance targets

In order to monitor and report on the effectiveness and public utilisation of digital service delivery, baseline performance targets are required.

While the five audited departments and agencies that deliver services directly to citizens and consumers have plans to transition service transactions to digital service delivery, only VicRoads has clearly developed baseline performance targets to enable success to be measured, as shown in Figure 3B.

Figure 3B

Audited department and agency baseline digital service delivery performance targets

|

Baseline digital service delivery performance targets developed |

|

|---|---|

|

Department of Health & Human Services (Human Services) |

✘ |

|

Department of Justice & Regulation (DJR) |

✘ |

|

State Revenue Office (SRO) |

✘ |

|

Public Transport Victoria (PTV) |

✘ |

|

VicRoads |

✔ |

Note: Excludes informational services such as information accessed through websites, smartphone applications and social media.

Source: Victorian Auditor-General's Office based on the audit fieldwork.

To improve the monitoring and reporting of the efficiency and effectiveness of digital service delivery, departments and agencies should set baseline digital service delivery performance targets.

3.3.2 Stage 2: Obtain and analyse digital service delivery performance data

Data related to the efficiency and effectiveness of digital service delivery at audited departments and agencies is in the form of market research and service transaction data. While only VicRoads has baseline digital service delivery performance targets defined, four out of the five have obtained and analysed market research and the available service transaction data. However, as shown in Figure 3C only VicRoads utilised market research data on a regular basis while DJR, SRO and PTV conducted market research on an ad hoc basis.

As part of monitoring customer behaviour usage of websites, all the audited departments and agencies used Google Analytics to obtain and analyse website‑related data, including the number of web pages viewed, the most popular web pages and content viewed, average time spent on their web page, and which forms were being downloaded.

Figure 3C

Audited department and agency digital service delivery performance data

|

Department / agency |

Service transaction data obtained and analysed |

Market research data obtained and analysed |

|---|---|---|

|

Human Services |

No |

No |

|

DJR |

Yes (annually) |

Yes (ad hoc) |

|

SRO |

Yes (monthly) |

Yes (ad hoc) |

|

PTV |

Yes (monthly) |

Partial (ad hoc) |

|

VicRoads |

Yes (monthly) |

Yes (annually) |

Note: Market research data excludes website data collected from Google Analytics.

Source: Victorian Auditor-General's Office based on the audit fieldwork.

Department of Health & Human Services

As Human Services had yet to implement any digital service delivery, it did not have any formal processes to report on digital service delivery performance.

Human Services used Google Analytics to collate, track and analyse website-related data for its housing services website, www.housing.vic.gov.au, against set key performance indicators. Human Services also undertook a review with key stakeholders on a quarterly basis.

Department of Justice & Regulation

DJR developed the Services Portfolio Model (SPM) as part of collating initial service transaction data. The decision to use market research sits with the responsibility and requirements of DJR's business units rather than as a centralised process.

Service transaction data

Based on DJR's SPM which was last updated in 2014, 34 per cent of DJR service transactions were performed via a digital service delivery channel. However we found gaps in the collation and analysis of DJR's service transaction data, specifically:

- the SPM did not have any criteria set for data inclusion or exclusion and only captured high-value and high-level service transaction data, meaning not all the service transactions and associated costs were represented

- the data in the SPM was not effectively collated as it was manually compiled through individual requests for data sheets from business units with different assumptions, definitions and calculations to derive and collect the operational data.

While the SPM concept proved useful, the collected transaction data was assessed as not yet fully reliable.

Despite this, DJR continued to use the SPM as it provided a shared view of the provision of services and assisted in identifying common issues, opportunities and capabilities to help focus future resourcing and business decisions for digital service delivery.

Market research data

DJR last conducted an in-house user needs assessment of its website in 2012. Based on this assessment, public utilisation of DJR's digital service delivery at that time was low:

- 64 per cent of its users accessed the website for information on DJR's services

- 2 per cent of its users applied for a license or permit via the website.

In 2013, the Working with Children (WWC) Check unit conducted an online survey of 295 respondents to assess and analyse the effectiveness of its online services. The survey method was effective and the results showed:

- about 80 per cent of the respondents had a positive experience with the online service

- improvements were still required to the navigation and content of the WWC Check unit's online service.

In 2013, the Victorian Registry of Births, Deaths and Marriages (BDM) conducted an online feedback survey of 1 852 respondents to examine the views of its customers regarding the types of services BDM should offer. The survey method was effective and the results showed a strong preference for digital service delivery with 50.2 per cent of the respondents in support of applying for BDM services online, followed by 21.5 per cent in support of applying via email.

State Revenue Office

SRO uses business intelligence systems to collect service transaction data from relevant systems and collates the data in a data warehouse for analysis. SRO has also engaged consultants to undertake market research.

Service transaction data

As detailed in Figure 3D, the majority (92 per cent) of duties lodgement transactions were processed online. This was a result of SRO's implementation of Duties Online (DOL) in October 2011.

Figure 3D

Duties lodgement and land tax digital service delivery usage, 2014

|

Transaction type |

Transactions processed online (per cent) |

|---|---|

|

Duties lodgement using Duties Online |

92 |

|

Land tax assessment using Land Tax Express—where a customer has a need to respond or query a land tax assessment |

6 |

Note: Land Tax Express is only used if a customer has a need to respond to or query land tax assessments. Approximately 10 per cent of total customers have a need to respond or query land tax assessments. The remaining 90 per cent of customers would receive correct assessments and only respond by making a payment.

Source: Victorian Auditor-General's Office based on information and findings obtained from SRO.

While only 6 per cent of land tax assessment transactions are currently processed online, SRO is developing plans to update the end-to-end process, including automating back‑office systems, to increase usability and utilisation of its land tax digital service delivery.

Market research data

In 2014, market research consultants were engaged to understand:

- customer behaviour when using the SRO website.

- SRO's digital channel usage and customers experiences when using the digital services.

The survey to understand customer behaviour when using SRO website included 321 respondents and noted:

- respondents had difficulty navigating the website and interacting with its associated links and resources.

- respondents had difficulty understanding the website contents and information

- general information searches account for 58 per cent of the respondents' website tasks followed by online payments (24 per cent) and use of online tools (18 per cent).

The survey to understand SRO's digital channel usage and customers experiences when using the digital services included 409 respondents and 18 in-depth interviews. This research revealed:

- inconsistent levels of service experience across channels which required further improvement through integrating people, processes and technology

- the need to improve the navigation and search functionality of the website

- customers desired an online mobile application and online web-chat functionality.

Public Transport Victoria

PTV obtains service transaction data from its myki ticketing system for analysis. It also conducts market research in-house and through external consultants.

Service transaction data

On a monthly basis, PTV obtains and collates myki ticketing data about sales channels, card types, value and the proportion of revenue. However to date, PTV has not effectively used the data it has to implement channel strategies that increase digital service delivery offerings such as the ability to 'top up' myki cards online.

As shown in Figure 3E, on average 5.6 per cent of myki Money transactions and 21.8 per cent of myki Pass 'top up' transactions were made online during 2014.

Figure 3E

myki card value 'top up' service transactions

|

Transaction type |

Period |

Average percentage of transactions processed |

||||

|---|---|---|---|---|---|---|

|

Online |

Retail |

Metropolitan train stations |

Automatic 'top up' |

Commuter club |

||

|

myki Money 'top up' |

2013 |

6.1 |

20.2 |

58.0 |

7.1 |

N/A |

|

2014 |

5.6 |

17.0 |

53.9 |

8.1 |

N/A |

|

|

myki Pass 'top up' |

2013 |

24.5 |

11.3 |

54.8 |

N/A |

6.1 |

|

2014 |

21.8 |

11.7 |

53.2 |

N/A |

8.1 |

|

Note: Not all service transaction channels have been included, therefore the average percentage of transactions does not add up to 100 per cent.

Source: Victorian Auditor-General's Office based on information and findings obtained from PTV.

Online 'top up' transactions declined in 2014 compared to 2013. For the same period, however, automatic 'top-ups' for myki money, and commuter club programmes for myki pass increased.

Market research data

In June 2014, PTV engaged a consultant to conduct market research to better understand customer needs and help it develop suitable products. The survey highlighted the need for PTV to improve its digital services for myki card transactions. Specifically, the 210 respondents rated the following features as having medium or high importance:

- instantaneous myki card 'top up' via phone and internet (83 per cent)

- myki card 'top up' on a smartphone via an app (68 per cent)

- the ability to view the myki card balance on a mobile phone (77 per cent).

VicRoads

VicRoads effectively used a business intelligence system to collect its service transaction data from three different business systems—Queue Management System (QMS), Contact Centre Systems and Corporate Payment Systems. Data from these systems were collated into a business intelligence system called SAP Business Objects and utilised to extract, collate and analyse transaction service data for analysis.

VicRoads also utilised market research to measure its digital service delivery performance.

Service transaction data

Public utilisation of VicRoads' registration and licensing (R&L) digital service delivery—based on VicRoads' R&L service transaction data between 1 July 2014 to 30 June 2015—is shown in Figure 3F.

Figure 3F

Public utilisation of VicRoads registration and licensing digital service delivery, 1 July 2014 to 30 June 2015

|

Number of transactions |

Digital service delivery |

||

|---|---|---|---|

|

Target of transactions processed (%) |

Average transactions processed (%) |

||

|

Registration renewal (Full fee) |

4 431 400 |

77 |

73 |

|

Registration renewal (Concession) |

1 069 000 |

30 |

32 |

|

License renewal (Reused photo) |

269 300 |

73 |

67 |

|

Change of address |

916 000 |

49 |

38 |

|

License and learner permit appointment (including boats) |

490 300 |

44 |

35 |

|

Driver license history report |

104 000 |

36 |

33 |

|

Unregistered vehicle permit(a) |

162 100 |

26 |

20 |

(a) The online unregistered vehicle permit service was launched in early January 2015.

Source: Victorian Auditor-General's Office from the VicRoads R&L Channel Management Report (2014–15).

Market research data

On an annual basis, VicRoads engages an external consultant to conduct a customer satisfaction survey for online R&L transactions and general website use. The 2015 survey had 706 respondents and found:

- customers rated the VicRoads R&L website with a mean satisfaction score of 7.7 out of 10