Domestic Building Insurance

Review snapshot

Is the management of domestic building insurance arrangements in Victoria protecting homeowners building or renovating a home?

Why we did this review

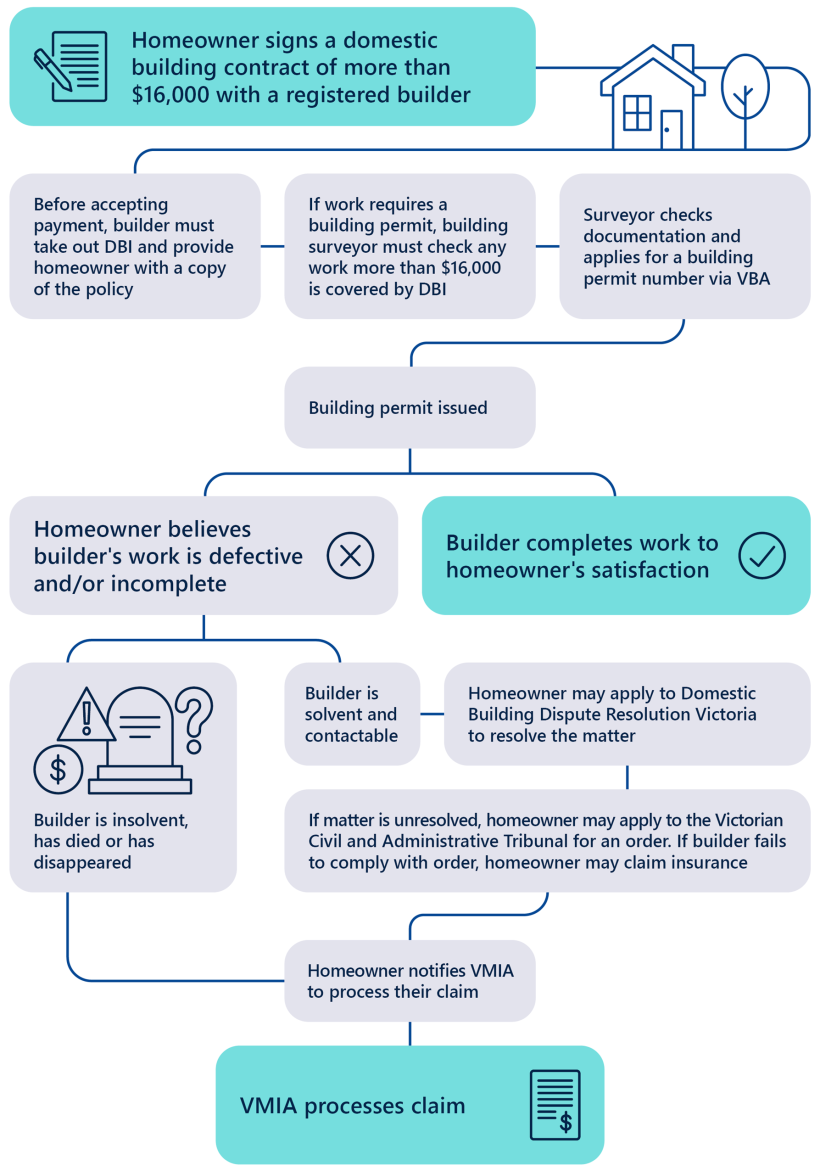

Domestic building insurance (DBI) compensates homeowners for losses relating to incomplete or defective domestic building work. This applies when the builder has died, disappeared, become insolvent or failed to comply with a tribunal order to complete the work.

In March 2023, Porter Davis Homes (PDH) became insolvent. This led to a large increase in DBI claims to the Victorian Managed Insurance Authority (VMIA), the largest provider of DBI in Victoria. Following this, there were media reports about homeowners who were dissatisfied with VMIA's processes and decisions, including lengthy delays. To recoup higher costs, VMIA increased its DBI premiums in October 2023 and July 2024.

We did this review to examine how well DBI is being managed to protect homeowners.

In October 2024, while we were finalising our planning for this engagement, the Victorian Government announced reforms to address the effectiveness of building regulation, including DBI. Following this, we decided to not proceed with a full audit. Instead, we decided to report on what we had already found out about the arrangements in place before the reforms were implemented. These matters remain relevant to the future management of DBI.

Key background information

Source: VAGO.

What we concluded

The way DBI arrangements are managed has improved, but there are still gaps.

VMIA has policies to manage its DBI product effectively. But it could be more transparent with homeowners about its claims processes and timelines and how it reaches its claims decisions. The absence of key performance indicators for the claims process, including a measure of the homeowner's experience, limits VMIA's ability to track its performance and identify areas for improvement.

The Victorian Building Authority (VBA) does not make sure building surveyors have verified if a valid DBI policy is in place before it issues a building permit number to them. This is a final step in the building permit process. To better protect homeowners, VBA should implement controls to verify DBI is in place.

Agencies improved coordination on DBI matters after the PDH insolvency.

1. Our key findings

What we examined

Our review followed 2 lines of inquiry:

1. Does the Victorian Managed Insurance Authority (VMIA) effectively manage its responsibilities for domestic building insurance (DBI)?

2. Do relevant regulatory bodies ensure that builders obtain DBI?

To answer these questions, we examined:

- Department of Government Services (DGS), including Consumer Affairs Victoria (CAV)

- Department of Transport and Planning (DTP)

- Department of Treasury and Finance (DTF)

- Victorian Building Authority (VBA)

- VMIA.

Audit context

DBI

DBI provides compensation to homeowners for their losses when domestic building work is not completed or is defective. This applies if the builder has:

- died

- disappeared

- become insolvent

- failed to comply with a tribunal order to complete the work.

DBI covers building work such as:

- new dwellings

- renovations

- repairs

- extensions

- swimming pools.

DBI is mandatory for all building works with a contract value of more than $16,000, except when constructing a multi-unit residential building over 3 storeys.

DBI is taken out by eligible builders on behalf of homeowners, and DBI certificates are issued for each domestic building project. DBI covers costs to complete building works, limited to 20 per cent of the original contract price, up to a maximum of $300,000. This cap also applies for works to fix:

- structural defects, for 6 years after construction

- non-structural defects, for 2 years after construction.

Our review covers DBI arrangements in place as at 20 March 2025. We note that reforms announced in October 2024 will change DBI and how it is managed.

The process to purchase DBI through VMIA and for making claims is summarised in Figure 1.

Figure 1: DBI purchase and claims process through VMIA as at 20 March 2025

Source: VAGO, based on VMIA's processes.

Building reform

On 24 October 2024, the Victorian Government announced that a new regulator, the Building and Plumbing Commission, will be formed. It will combine key regulatory agencies in the building industry, including VBA, Domestic Building Dispute Resolution Victoria and the DBI functions of VMIA.

The government also announced:

- more funding for audits and inspections

- changes to improve access to DBI.

Among these proposed changes, DBI cover will be expanded so the builder must no longer be insolvent, have disappeared or died before a homeowner can make a claim.

These changes are yet to be made at the time of this report. The new regulator is expected to be established in 2025 subject to legislation being passed to enable these changes.

Our engagement

Following the announcement of a new integrated regulator and changes proposed to DBI, we changed our engagement from a reasonable assurance audit to a limited assurance review. We have obtained less assurance than we would have had we completed the audit. This is because during and after planning, we have relied primarily on agency representations and other evidence they provided. However, we have enough confidence in our conclusion for it to be meaningful. See our assurance services fact sheet for more information.

Other recent reviews

In October 2024, VBA released a report summarising the findings of an independent review it commissioned. The report, titled The Case for Transformation, included case studies on complaints made to VBA. It put forward 20 recommendations about VBA's practices and processes and it also proposed legislative changes.

To better protect homeowners, the report suggested the government consider:

- expanding DBI coverage

- increasing maximum DBI cover amounts.

One case study was about a surveyor intentionally issuing staged building permits just below $16,000 to avoid the need for DBI. The report recommended that VBA and the State Building Surveyor create guidance on how and when staged permits should be used.

VBA supported all recommendations that could be carried out through changes to its policies and processes. Among key changes, VBA has developed new regulatory policies. This includes a harms-based approach that targets inspection and enforcement activity to where homeowners are at greatest risk.

The Victorian Ombudsman is currently investigating how VMIA has managed DBI claims, with a particular focus on what happened following the Porter Davis Homes (PDH) insolvency. Its investigation is looking at whether VMIA managed claims fairly and reasonably, which includes examining individual cases.

Building surveyor

A building surveyor issues building permits and conducts inspections to make sure the building work complies with building standards and regulations.

What we found

This section focuses on our key findings, which fall into 3 areas:

1. VMIA has policies to manage its DBI product effectively. But it could improve its claims processes and performance monitoring.

2. VBA does not make sure that all relevant building permits have a valid DBI policy.

3. Agencies improved coordination on DBI matters after the PDH insolvency.

The full list of our recommendations, including agency responses, is at the end of this section.

Consultation with agencies

When reaching our conclusions, we consulted with the reviewed agencies and considered their views.

You can read their full responses in Appendix A.

Key finding 1: VMIA has policies to manage its DBI product effectively. But it could improve its claims processes and performance monitoring

VMIA's underwriting guidelines

Builders must take out DBI on behalf of homeowners. When a builder applies for DBI, VMIA assesses the risk that the policy owner (the homeowner) will claim on the policy. This assessment is known as underwriting. VMIA has underwriting guidelines for its officers to follow on how to rate insurance risks based on the amount a builder wants to be insured for.

Recent builder insolvencies led to increased claims, which damaged the financial position of VMIA's DBI product. But we found no evidence that VMIA's underwriting guidelines are not sound. External reviews of the guidelines have found them to be thorough and to meet accepted industry standards.

Following the collapse of PDH in 2023, VMIA expanded its regular assessments of large-volume builders as part of its underwriting processes to help identify warning signs of future builder insolvencies.

Nothing has come to our attention that VMIA does not meet accepted standards when monitoring its compliance with its underwriting guidelines. VMIA appears to go beyond accepted standards by implementing a routine quality assurance report that checks officers correctly follow the underwriting guidelines when assessing DBI applications.

Underwriting

Underwriting is where an insurer assesses whether to accept an insurance application based on the risk the policy owner will make a claim.

Working well: VMIA's underwriting reviews

VMIA monitors compliance with its underwriting guidelines to the standards recommended in the Australian Prudential Regulation Authority's (APRA) Prudential Practice Guide GPG 240 – Insurance Risk. VMIA goes beyond these accepted standards by including a quarterly quality assurance report that confirms if its staff are correctly following underwriting guidelines. This is described in section 3.

Financial performance of VMIA's DBI product

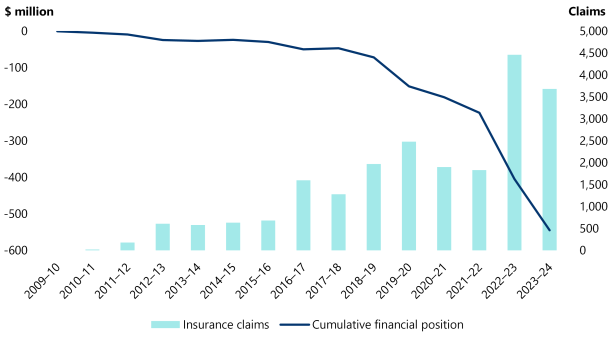

VMIA has not recouped its DBI costs. In the period from 2009–10 to 2023–24, VMIA's DBI revenue was $910 million, including premiums and investment income. Over the same period, DBI costs were $1,524 million, including claims payments, commissions, administrative costs and $399.5 million in reserves for expected claims.

DBI's financial position deteriorated sharply from 2022–23, mainly due to claims more than doubling on the previous year.

In July 2024, due to these increased costs, VMIA increased premiums by 65 per cent for single-dwelling policies and by 20 per cent for other constructions such as renovations and swimming pools, following a 43 per cent increase for all construction types in 2023.

This increase seeks to return the DBI product to a financial break-even status by 2029. It was informed by recommendations from VMIA's actuarial consultants. The actuarial methods of VMIA's actuarial consultants have been peer-reviewed and found to be sound.

VMIA provides DTF with a quarterly report on its overall finances, including an abridged balance sheet, financial key performance indicators and a section on the DBI product. VMIA consults with DTF on proposed premium changes.

Premium

A premium is the amount of money needed to purchase an insurance policy.

Actuarial consultant

An actuarial consultant assesses risks in an insurer's portfolio and analyses how to best manage these risks.

Claims processes

VMIA could improve its DBI claims processes.

Unlike for its underwriting process, VMIA does not have an ongoing quality assurance program to check that its officers comply with its claims processing guidelines. If it adopted one, this may support better claims processing in line with its internal guidelines.

VMIA could be more transparent with homeowners. This is because:

- VMIA does not provide homeowners with all the information about how it assesses how much it will offer a homeowner to satisfy a claim (known as the quantum decision)

- VMIA informs homeowners of their right to review its decisions through the Victorian Civil and Administrative Tribunal (VCAT). But it does not always inform them of the option to seek an internal review, which VMIA says would be based on a homeowner providing new information

- for steps in the claims process other than the liability decision, VMIA does not always inform homeowners of indicative timelines, and could be more proactive in informing homeowners of actions they can take to advance the claims process.

VMIA also does not have a full performance monitoring framework for its claims process, with no measurement of homeowner satisfaction. This information would help to inform improvements.

Quantum decision

The quantum decision refers to the decision an insurer makes about how much money it will provide to satisfy a claim.

Liability decision

The liability decision refers to the decision an insurer makes to either accept or deny an insurance claim.

Addressing this finding

To address this finding, we have made 3 recommendations to VMIA about:

- communicating with homeowners

- performance monitoring, including measuring homeowner satisfaction with claims processes

- quality assurance for claims handling.

Key finding 2: VBA does not make sure that all relevant building permits have a valid DBI policy

Limitations of current processes

Building surveyors cannot issue a building permit without a building permit number. VBA issues building permit numbers to building surveyors before a building permit is issued to homeowners.

VBA requires a range of information from surveyors before it will provide the building permit number. But VBA does not seek any information or assurance from surveyors that they have made sure there is a valid DBI policy before VBA issues a building permit number.

Agencies such as VBA, CAV and DTP have initiatives to support compliance with DBI requirements. But these initiatives are insufficient to make sure all relevant building works have a valid DBI policy.

Key issue: VBA does not validate DBI details when issuing a building permit number

While building surveyors are required by legislation to confirm a valid DBI policy is in place, they can obtain building permit numbers without needing to provide proof of a valid policy. This means that building work can begin without DBI, putting homeowners at risk.

Addressing this finding

To address this finding, we have made one recommendation to VBA about making sure that builders and surveyors comply with DBI requirements.

Key finding 3: Agencies improved coordination on DBI matters after the PDH insolvency

In April 2023, following PDH's insolvency, a DBI interdepartmental committee was set up to share information and coordinate DBI-related actions. Members included representatives from the Department of Premier and Cabinet (DPC), DTF, DGS, DTP, VMIA, VBA and CAV.

Through the interdepartmental committee, the agencies shared information about claims and coordinated public messaging about consumer protection.

Agencies have recently improved systems and processes in relation to DBI by:

- streamlining information-sharing through multi-agency agreements

- VBA and CAV being given stronger powers to penalise builders who demand deposits without obtaining DBI

- DTP establishing a consumer-focused building information website.

The interdepartmental committee is still operating, with a shift to advise the government on the building reform.

See the next section for the complete list of our recommendations, including agency responses.

2. Our recommendations

We made 4 recommendations to address our findings. The relevant agencies have accepted the recommendations in full or in principle.

| Agency response | ||||

|---|---|---|---|---|

| Finding: The Victorian Managed Insurance Authority has policies to manage its domestic building insurance product effectively. But it could improve its claims processes and performance monitoring | ||||

Victorian Managed Insurance Authority

| 1

| Provide homeowners with improved information about:

| Accepted in principle

| |

2

| Implement a performance monitoring framework, including a measure of homeowner satisfaction, to assess claims handling performance and inform improvements to processes.

| Accepted

| ||

3

| Implement a quality assurance program to make sure officers are following claims handling procedures.

| Accepted

| ||

| Finding: The Victorian Building Authority does not make sure that all relevant building permits have a valid domestic building insurance policy | ||||

Victorian Building Authority

| 4

| Make sure that builders and surveyors comply with domestic building insurance requirements by:

| Accepted in principle

| |

3. VMIA's management of DBI

VMIA has policies and strategies to manage its DBI product effectively, including sound underwriting and claims management guidelines. It could improve its claims processes by being more transparent with homeowners and by monitoring and reporting on performance against key indicators, such as homeowner satisfaction.

Covered in this section:

- VMIA's role in managing DBI

- VMIA's underwriting guidelines meet accepted standards

- VMIA's claims handling guidelines meet industry standards. But it could improve its communication with homeowners and its performance monitoring

VMIA's role in managing DBI

VMIA's role

VMIA has offered DBI since 2010 under a series of directions from the government. Under the current direction, VMIA must:

- at its discretion, provide DBI to builders that satisfy underwriting terms and conditions set by VMIA

- set underwriting terms and conditions so as to recoup the full costs of providing DBI

- handle all DBI claims under its issued policies.

While builders can also purchase DBI from some private insurers, VMIA is by far the largest provider. VMIA provides DBI to around 15,000 residential builders in Victoria.

Claims handling

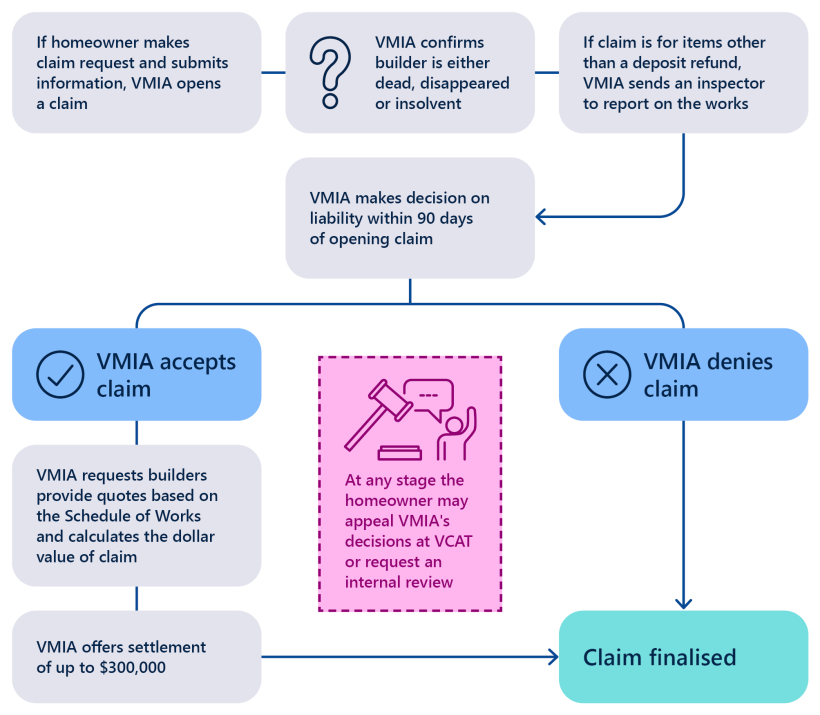

The flowchart in Figure 2 shows the typical process for a DBI claim.

Between 2019–20 and 2023–24, VMIA received 14,342 DBI claims. As of October 2024, it had:

- fully accepted 24 per cent

- partially accepted 42 per cent

- denied 32 per cent, with the rest to be assessed.

Note that these figures are not equivalent to the proportion of homeowners who have accepted claims, as individual homeowners may make several claims against a policy. Also, a claim that is originally denied or partially accepted may later be fully accepted when resubmitted if circumstances have changed.

For denied claims, the most common reasons VMIA found were:

- the homeowner had suffered no loss (23 per cent)

- the builder was not insolvent (21 per cent)

- the item in dispute was not a structural defect (21 per cent).

For accepted claims, the median settlement amount was $34,942 and the mean was $61,698.

Figure 2: Typical process for a DBI claim

Note: The ‘Schedule of Works’ sets out every item that the VMIA accepts liability for under the homeowner’s DBI policy.

Source: VAGO, based on VMIA's processes.

VMIA's underwriting guidelines meet accepted standards

Underwriting criteria

When a builder applies for DBI, VMIA assesses the risk of a potential claim, considering factors such as the builder's financial assets and project history. This assessment is known as underwriting.

An insurer's underwriting guidelines should include information to help decide if it approves a policy or not, based on the price set for it to cover its risk. The guidelines may have different levels of acceptable risk based on the size of the policy that the builder has requested (the eligibility limit).

VMIA’s underwriting guidelines clearly state:

- its risk appetite for particular eligibility limits and the process for setting them

- the criteria for risk assessment.

We found no evidence that VMIA does not meet the standards recommended by APRA in its Prudential Practice Guide GPG 240 – Insurance Risk.

VMIA's underwriting guidelines meet APRA's standards as its risk management framework includes methods for monitoring compliance, such as:

- internal audits

- reviews by senior officers.

VMIA's underwriting guidelines say that the initial assessment by a risk analyst will be reviewed by a manager before VMIA issues a letter of eligibility to the builder. If the analyst recommends VMIA should decline the application, VMIA's builder assessment committee will review the decision.

A 2019 report by the Essential Services Commission found:

- VMIA's underwriting standards were appropriate in determining the risk of builders

- its process was broadly in line with a commercial insurer.

A 2024 internal audit completed for VMIA found 'thorough detail' in VMIA's guidelines to guide staff through DBI eligibility processes.

In response to one of the audit's recommendations, VMIA introduced a further quality assurance process. A DBI contract specialist will review 25 randomly sampled applications each quarter to assess if they comply with underwriting guidelines. This goes beyond APRA's standards.

VMIA's first quality assurance report found that some officers had not properly confirmed builders' registration details. VMIA then updated the guidelines and no such issue was found in the next report.

Eligibility limit

The eligibility limit is the total contract value that a builder is pre-approved to apply to purchase insurance for.

The DBI product's financial position

DBI is a ‘long-tail’ insurance scheme, as homeowners can make claims up to 6 years after the contract is completed for the insured work. This means there is a risk to the insurer that the pool of premium funds may not cover claims when they are lodged. An insurer sets aside money, also known as a 'claims reserve', to cover future claims based on an estimate of what those claims will eventually cost.

Since VMIA began issuing DBI in 2010, the product has not recouped its costs.

The ministerial direction initially required VMIA to set underwriting terms and conditions to meet commercial criteria. It gave VMIA the discretion to charge builders an additional loading in order to recoup the taxpayer-funded costs of providing DBI.

In 2016, the ministerial direction changed to require VMIA to set underwriting terms and conditions to recoup full cost of the DBI product and associated services.

VMIA's DBI revenue and costs are compared below.

| In the period from 2009–10 … | was/were … | which included … |

|---|---|---|

VMIA's DBI revenue

| $910 million

|

|

VMIA's DBI costs

| $1,524 million

|

|

Note: Under the AASB 1023 General Insurance Contracts accounting standard, the claims reserve and insurance claims payments include VMIA's best estimate of expected claims payments. This includes a risk margin that has a 75 per cent probability that the claims reserve will be sufficient.

Mainly due to the PDH insolvency, DBI claims rose sharply in 2022–23 and remained relatively high in 2023–24. This led to the DBI product's financial position deteriorating more sharply. VMIA recouped its costs on a cash basis until 2022–23, when its deficit grew beyond the $399.5 million held as a claims reserve.

Figure 3: VMIA's DBI financial position from 2009–10 to 2023–24 ($ million) and number of insurance claims

Source: VAGO, based on data from VMIA.

In July 2024, following an independent actuarial review, VMIA's board increased premiums by 65 per cent for single-dwelling policies and multi-unit policies. VMIA's own analysis showed that this increase would return the DBI product to surplus within 4 years.

After the PDH insolvency, VMIA engaged an external advisory panel on an ongoing basis to assess the financial viability of the top 20 volume builders. It did this to help identify warning signs of future insolvencies. These measures, plus its premium rises, have been put in place following consultation with DTF on managing the DBI product's financial sustainability.

Despite these actions, risks to DBI's financial sustainability remain. In 2024, as part of VAGO's audit of VMIA's financial report for the 2023–24 year, we found that while VMIA's actuarial consultants had reasonably estimated VMIA's DBI liability using appropriate methodology, pressures on the building sector have made the future liability estimate less certain.

VMIA also commissioned a peer review of its actuarial arrangements in November 2023. It accepted the review's recommendation to consider a higher risk of builder insolvency in the near future.

VMIA's claims handling guidelines meet industry standards. But it could improve its communication with homeowners and its performance monitoring

Claims handling guidelines

VMIA's claims handling guidelines show the process VMIA officers must follow when assessing claims. The guidelines include:

- clearly defined delegations of authority

- consistent procedures for claims settlement

- clear criteria for accepting or rejecting claims.

The guidelines also note that, following an initial assessment by an officer, the assessment must be approved by another officer with delegated financial authority. And if a homeowner requests an internal VMIA review of a decision, a different portfolio lead must review the case. This meets APRA's standards and VMIA has told us that it follows these guidelines.

Unlike for its underwriting process, VMIA does not have an ongoing quality assurance program to check officers comply with its claims handling processes. A quality assurance program may provide more assurance that officers are following appropriate processes.

VMIA commissioned an internal audit on its claims management controls, which was delivered in March 2023. The audit found strong controls were in place, noting a high degree of efficiency and consistency in VMIA's claims management processes.

However, it recommended that VMIA consider establishing surveys with homeowners to see how they experience the claims process. VMIA has not issued these.

Measuring homeowner satisfaction would provide useful information as part of a broader performance reporting framework.

Timeliness of claims processing

VMIA includes expected claims processing timelines in its internal service standards (see Figure 4). It uses these to decide how it allocates its resources. But VMIA told us that these timelines have not been established to set standards for performance reporting or to give to homeowners.

Figure 4: VMIA's internal service standards for claims processing timelines

| Action | Timeline |

|---|---|

| Acknowledge receipt of all necessary information, or inform homeowner more information is necessary | 2 to 5 business days after receiving claim |

| Inform homeowner policy has not been triggered, if this is the case | 5 to 10 business days after confirming no trigger exists |

| Appoint building consultant to conduct inspection to assess claim | 5 to 10 business days after receiving required information |

| Accept or deny the claim (the liability decision) | Within 90 days (total) of receiving claim |

| Obtain quotes for work | Within 28 to 40 business days of claim decision |

| Make offer to homeowner (the quantum decision) | Within 15 to 21 business days of receiving quotes |

| Settle the claim | Within 28 days (total) of receiving signed release and authority, and other necessary documents |

Source: VAGO, based on VMIA's internal service standards.

In its DBI policy, VMIA says that if it does not make a liability decision within 90 days of receiving the claim, the claim is automatically accepted.

VMIA told us that many actions beyond its control can impact overall case timelines.

Using its internal service standards as benchmarks, since 2020–21, VMIA has:

- met its liability decision service standard in 99.8 per cent of cases

- met its liability decision to quantum decision service standard in 46 per cent of cases

- met its claim receipt to quantum decision service standard in 65 per cent of cases.

VMIA's claims handling system includes markers within each claim that show if it has met its internal service standards.

Aside from its 90-day liability decision standard, VMIA does not formally track its performance against its timelines. And it does not inform customers of indicative timelines for key steps in the claims process.

VMIA notes that it cannot fully control timelines for the claims process, as this depends on prompt information from homeowners, reports from inspectors and quotes from builders. However, VMIA is missing opportunities to better inform homeowners about when they might typically expect information on matters that are highly important to them.

Communicating with homeowners

When VMIA communicates with homeowners about liability decisions, it clearly explains reasons for accepting or rejecting a claim.

For quantum decisions, VMIA tells the homeowner which builder has been selected to do the work to satisfy the claim (if necessary) and the disbursed amount. VMIA also tells the homeowner they have the right to lodge an appeal with VCAT.

However, VMIA does not fully inform the homeowner about its process for calculating the homeowner's loss and the quote it then selects to satisfy the claim.

Additional information about VMIA's process could help the homeowner understand VMIA's decision.

Dispute resolution

The Australian Government Treasury's 2015 Key Practices for Industry-based Customer Dispute Resolution and the Victorian Ombudsman's 2016 Good Practice Guide to Handling Complaints list key practices to make sure there is procedural fairness in industry-based dispute resolution. They note that agencies should give complainants:

- information on other options for review at any stage

- timely, ongoing communication on the investigation's progress

- the reason for any decision in writing.

VMIA has an informal internal review process. It says that additional documentation is necessary for the review and that it is unlikely to reach a different decision if the review is based on the same information as the original claim.

However, in its letters to homeowners about liability decisions and quantum decisions, VMIA does not tell the homeowner about the option for an internal review. It only mentions the homeowner's right to appeal the decision with VCAT.

For homeowners who have requested a review, VMIA does not give the estimated timeframe for the internal investigation. In its letter on the outcome of the review, VMIA explains the reasoning for its final decision and tells the homeowner about their right to appeal with VCAT.

VMIA’s claims handling guidelines say that a portfolio lead will examine the documentation for the review and will confirm their findings with the head of claims. But the guidelines do not contain any instructions to guide the portfolio lead to do this.

Better communication with homeowners about the internal review process and more formalised internal guidance on doing a review may help VMIA:

- effectively manage homeowner expectations

- support better decision-making.

4. DBI compliance and the role of agencies

Various agencies promote compliance with DBI requirements. Following the PDH insolvency, agencies coordinated better on DBI matters. While VBA implemented more compliance and enforcement activities, it does not make sure all relevant building permits have a valid DBI policy.

Covered in this section:

- Various agencies promote compliance with DBI requirements

- VBA has processes and strategies to detect DBI noncompliance, but there is a gap in the building permit approval process

- Agencies recently improved coordination on DBI matters

- Agencies coordinated on legislative reforms

Various agencies promote compliance with DBI requirements

VBA regulates the building industry

VBA regulates Victoria's building industry. It is a portfolio agency of DTP.

VBA supports builders and building surveyors to comply with their obligations, including in relation to DBI. To do this, VBA:

- provides information and guidance

- registers and issues licences to eligible builders

- does compliance and enforcement activity.

Role of surveyors

Builders must purchase DBI on behalf of homeowners for projects valued at more than $16,000.

Building surveyors are required to make sure that builders have a valid DBI policy before they issue a building permit.

The surveyor must be satisfied that the named builder on the building permit is identical to:

- the named builder on the domestic building contract

- the certificate of insurance from the insurer.

CAV provides information on building contracts

DGS oversees the consumer affairs portfolio, which includes CAV.

CAV provides information about requirements for domestic building contracts, including any insurance requirements. CAV also manages a building information line that gives advice to building owners and tradespeople on their rights and responsibilities when building or renovating.

VBA has processes and strategies to detect DBI noncompliance, but there is a gap in the building permit approval process

VBA's compliance and enforcement strategy

VBA's compliance and enforcement policy outlines its approach to regulating the building industry.

VBA makes sure compliance and enforcement happens through:

- its registration and licensing processes

- providing guidance and education to practitioners

- taking enforcement actions

- publishing the outcomes of its compliance and enforcement activity.

VBA does not check DBI is in place when issuing building permit numbers

Building surveyors cannot issue a building permit without a building permit number. VBA issues building permit numbers. VBA issues over 90,000 building permit numbers each year.

VBA requires a range of information from surveyors before it will provide a building permit number. But VBA does not ask surveyors for information or assurance that a DBI policy exists.

VBA relies on surveyors following their obligations to check that DBI is in place. VBA then monitors surveyors' compliance through audits and inspections.

VBA told us that it considered capturing DBI policy numbers in its initial design of the permit application system in 2019, but this was made less of a priority.

VBA should strengthen controls to validate DBI is in place before issuing a building permit number to surveyors.

Oversight of practitioners

To monitor if building surveyors comply with their obligation to check DBI is in place when issuing building permits, VBA regularly audits documentation related to issued building permits.

As part of the audit, VBA checks surveyors have made sure the DBI policy details match those in the building permit, such as the builder's and homeowner's name. VBA showed us examples where building permit details did not match DBI policy details.

VBA told us it sent letters to the audited surveyors to make sure they provided the necessary information or fixed any mistakes.

But VBA does not know how many instances of DBI noncompliance have been found since the audit program started, because it does not track this.

VBA inspects active building sites through its Proactive Inspection Program. This program identifies examples of noncompliance before occupancy. When VBA inspects building sites, it also checks that DBI is in place for building works valued at more than $16,000.

In 2023–24, VBA inspected 8.18 per cent of all permits issued.

VBA carries out disciplinary actions against builders who do not comply with DBI requirements. In 2023–24, VBA took disciplinary actions against 3 builders that had taken deposits or started building work without getting DBI.

VBA also oversees buildings through builders' registration and licensing processes. VBA prompts builders to provide proof they are eligible for DBI cover:

- every year

- when they register or renew their licences.

VBA also publishes reports that summarise all audit activities and investigations. It publishes these on its website twice a year.

Investigations

VBA told us that it applies a risk-based approach when it investigates registered builders. VBA identifies high-risk builders by looking at data from the Australian Business Register, VBA’s complaints portal, registration and inspection databases and media sources.

A recent VBA investigation found a builder used falsified DBI certificates. This led to a $250,000 fine and the builder being disqualified.

Specific DBI audit after PDH insolvency

In June 2023, after PDH's insolvency, VBA began a DBI compliance audit program that targeted the top volume builders.

The VBA audit asked builders to provide DBI policy details and documentation to check if builders received deposits before securing DBI. VBA's progress report on this audit program in December 2023 shows that of the 14 audited volume builders, all of them demonstrated examples of taking deposits before the DBI start date.

VBA is considering further disciplinary actions or investigations. VBA told us that these audits are still underway as it takes time to gather evidence for formal disciplinary actions. Its annual report says that it aims to complete 40 DBI audits in 2024–25.

Practitioners' awareness

VBA reminds builders and surveyors about their DBI obligations through practice notes and communications. After PDH's insolvency, VBA:

- sent out newsletters

- updated their website

- posted on social media.

VBA provides educational webinars in its Practitioner Education Series to share knowledge with surveyors. But this material does not include DBI-related content. We found no evidence that VBA monitors surveyors' awareness on DBI or insurance requirements in relation to building permits.

Agencies recently improved coordination on DBI matters

Agencies' coordination

Multiple agencies are involved in promoting compliance with DBI requirements, so effective communication between them is important.

VBA has multiple inter-agency information-sharing agreements with CAV, VMIA and other professional bodies.

In April 2023, following PDH's insolvency, the DBI interdepartmental committee was set up to share information and coordinate actions about DBI. Members included representatives from DPC, DTF, DTP, DGS, VMIA, CAV and VBA.

The DBI interdepartmental committee met weekly from 19 April 2023 to 9 August 2023. It coordinated a DBI-related communications strategy and delivered the PDH compensation fund.

In August 2023, the DBI interdepartmental committee was brought under another building reform interdepartmental committee that involved DPC, DTF, DTP and DGS.

CAV's website update

On its website, CAV provides guidance on building work including:

- an example building contract

- checklists to remind them to check DBI is in place for projects of more than $16,000.

Following PDH's insolvency, CAV updated their website to provide more information on DBI and links to other regulators' websites.

Joint communications campaign

After PDH's insolvency, VBA led a joint communications campaign with CAV and VMIA. It targeted builders, surveyors and homeowners to raise awareness of:

- DBI requirements

- builders' and surveyors' roles

- VBA's role in regulating surveyors' and builders' compliance.

CAV and VBA used emails, newsletters and social media posts to deliver these key messages to builders, surveyors and homeowners.

Compensation fund

More than 500 PDH customers lost their building deposits as PDH did not take out DBI for them. In April 2023, the government offered a one-off relief payment for PDH customers who were left without insurance. DGS worked with VMIA to check claims and deliver compensation.

This payment was later extended to customers of other builders. By the end of 2023–24, a total of $19.3 million was paid to 864 applicants.

Agencies coordinated on legislative reforms

Improvement since the expert panel reviews

In December 2019, the government appointed an expert panel to review how it regulates the building sector. The panel membership includes the Commissioner for Better Regulation (now VBA's CEO) and other experts from the building industry, law and consumer protection sectors.

The expert panel review was done in 3 stages.

In 2023, the panel released 2 reports that identified and advised the government on early initiatives that can be done to improve the building system. The panel's terms of reference say that the stage 3 report will consider recommendations for a new building act. The report is yet to be published.

Key recommendations made in the first 2 stages of the review led to legislative amendments and system improvements. Those related to DBI were:

- amending the Building Act 1993 to broaden the circumstances in which VBA can enter into information-sharing arrangements with one or more agencies

- establishing a building consumer information website managed by DTP.

New offences to enforce DBI compliance

Following PDH's insolvency, the Domestic Building Contracts Act 1995 and the Building Act 1993 were amended to:

- insert 2 new offences penalising builders who demand or receive money under a major domestic building contract if they have not made sure that DBI is in place

- provide powers for VBA to compel a person to provide information if they are suspected of committing an offence in relation to DBI.

The new legislation was enacted on 27 February 2024.

Prior to this amendment, builders were only considered breaching legislation if they:

- carried out building work under a major domestic building contract without required insurance

- claimed to be insured when they were not

- demanded a deposit of more than 5 per cent of any contract price above $20,000 or 10 per cent of any contract price below $20,000 before starting any work under the contract.

The amendment made clear that if a builder demands money for contracted building work without obtaining DBI, it is an offence. It seeks to make sure that homeowners and their money are protected.

The amendment allows VBA to take stronger actions against builders who do not comply with DBI requirements.

Addressing gaps in legislation

When introducing the Building Legislation Amendment (Domestic Building Insurance New Offences) Bill 2023, the Minister for Planning acknowledged that PDH's insolvency revealed another issue. This is where builders deliberately use multiple agreements to avoid the $16,000 threshold at which DBI is mandatory.

In response, in September 2024 DGS completed a review of the Domestic Building Contracts Act 1995, which sets out the rules around contract deposits and payments. DGS is now considering feedback received during the review and it plans to provide further updates on its website when the legislative reform has progressed.

Appendix A: Submissions and comments

Download a PDF copy of Appendix A: Submissions and comments.

Appendix B: Acronyms and glossary

Download a PDF copy of Appendix B: Acronyms and glossary.

Appendix C: Review scope and method

Download a PDF copy of Appendix C: Review scope and method.