Fraud and Corruption Control—Local Government

Overview

This audit examined whether local councils' fraud and corruption controls are well designed and operating as intended. It primarily focuses on expenditure and processes involving senior council staff and councillors and reviews fraud and corruption controls and measures relating to:

· credit card and fuel card use

· reimbursements

· identifying and managing conflicts of interest

· responding to suspected incidents of fraud and corruption.

The councils included in the audit are Greater Shepparton City Council, Strathbogie Shire Council, Wellington Shire Council and Wyndham City Council, reflecting a selection of councils of varying size and location.

We made 12 recommendations to the audited councils.

Transmittal letter

Independent assurance report to Parliament

Ordered to be published

VICTORIAN GOVERNMENT PRINTER June 2019

PP No 40, Session 2018–19

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Fraud and Corruption Control—Local Government.

Yours faithfully

Dave Barry

Acting Auditor-General

19 June 2019

Acronyms and Abbreviations

Acronyms

| AIC | Australian Institute of Criminology |

| ARC | Audit and Risk Committee |

| ASIC | Australian Securities and Investments Commission |

| ATO | Australian Tax Office |

| CEO | chief executive officer |

| CFO | chief financial officer |

| EBA | Enterprise Bargaining Agreement |

| EFTPOS | electronic funds transfer at point of sale |

| HR | human resources |

| IBAC | Independent Broad-based Anti-corruption Commission |

| ICT | information and communications technology |

| KMP | key management personnel |

| LGI | Local Government Inspectorate |

| LGV | Local Government Victoria |

| PDC | Protected Disclosure Coordinator |

| PIN | personal identification number |

| RACV | Royal Automobile Club of Victoria |

| VAGO | Victorian Auditor-General's Office |

| VO | Victorian Ombudsman |

| VPSC | Victorian Public Sector Commission |

Abbreviations

| Shepparton | Greater Shepparton City Council |

| Strathbogie | Strathbogie Shire Council |

| the Accounting Standard | Australian Accounting Standards Board AASB 124 Related Party Disclosures |

| the Act | Local Government Act 1989 |

| the Australian Standard | Australian Standard 8001–2008 Fraud and Corruption Control |

| the Minister | Minister for Local Government |

| the Regulations | Local Government (Planning and Reporting) Regulations 2014 |

| Wellington | Wellington Shire Council |

| Wyndham | Wyndham City Council |

Audit overview

Elected councillors and local government employees make decisions and perform functions that affect the lives and interests of all Victorians. The community expects—and the law requires—that they do this responsibly and with integrity, accountability, impartiality, and in the public interest.

The culture of an organisation is a key control that can help it to prevent, detect and respond to fraud and corruption. If the senior leadership of an organisation does not model, communicate and support appropriate values and behaviour, this can reduce the organisation's ethical culture and leave it vulnerable to fraud and corruption. Fraud and corruption undermines public trust in local government and damage the reputation of the sector. When fraudulent and corrupt activities are undetected, or left unchecked, public money and resources are wasted.

|

Fraud is dishonest activity involving deception that causes actual or potential financial loss by an entity or others. Corruption is dishonest activity in which an employee of an entity acts contrary to its interests, abusing their position of trust to achieve personal gain or advantage. |

The objective of this audit was to determine whether local councils' fraud and corruption controls are well designed and operating as intended. We examined fraud and corruption controls at Greater Shepparton City Council (Shepparton), Strathbogie Shire Council (Strathbogie), Wellington Shire Council (Wellington) and Wyndham City Council (Wyndham). We primarily focused on expenditure and processes involving senior council staff and councillors. We reviewed fraud and corruption controls and measures to assess council practices relating to:

- councillor and senior staff credit card and fuel card use and reimbursements

- identifying and managing conflicts of interest

- responding to suspected incidents of fraud and corruption.

The testing period for our audit was July 2015 to June 2018. However, when we identified anomalies, where appropriate, we extended the testing period as far as February 2019.

Conclusion

There are gaps in the fraud and corruption controls at the audited councils and in some cases important controls are not working. The failure of these controls can foster a culture in which fraud and corruption can occur and go undetected and result in financial loss or reputational damage to the councils. While we did not find fraud or corruption in the transactions we examined, we identified:

- expenditure where it was unclear to us how residents and ratepayers benefited

- practices that may not meet public expectations

- non-compliance with legislative requirements aimed at ensuring transparency over council practices to their communities and regulators.

Some individuals in positions of authority need to take a broader view of their obligations. They must appreciate that they are accountable to ratepayers and residents and consider how their communities may perceive their actions.

Findings

Fraud and corruption controls over councillor entitlements and expenditure

Inadequate documentation to support reimbursement claims and approvals

A key control to prevent and deter fraud and corruption is maintaining an adequate audit trail of documentation and data to support reimbursements. Under the Local Government Act 1989 (the Act), councils must ensure that councillor reimbursement claims are reasonable and bona fide, and that the councillor incurred the expense when performing their role. Maintaining accurate financial records is also a financial reporting requirement. We identified issues including:

- three examples of reimbursements at Shepparton, from a selection of 12, with missing councillor claim forms

- six examples of reimbursements at Strathbogie, from a selection of 20, where the business reason, or council event, for which the expense was incurred was not detailed on the claim form.

While these expenses may be valid, the councils' failure to maintain adequate documentation inhibits full public scrutiny of these transactions.

Vehicle mileage

The audited councils' policies provide for the reimbursement of mileage to councillors when they use their private vehicles for council business. However, some of the audited councils are not ensuring councillors submit adequate documentation to support their mileage reimbursement claims.

The councils' policies vary in their requirements for supporting documentation. At present, Wellington's policy has no requirement to provide supporting documentation, such as an odometer reading or a tax invoice for fuel purchased, and Wyndham's policy only requires 'appropriate records'.

Strathbogie does not have clear requirements for supporting documentation for mileage claims, and does not, for example, require councillors to provide odometer readings. While Strathbogie's policy requires councillors to provide 'a receipt or tax invoice for any expenditure', the supporting claim form has no requirement for councillors to attach a receipt or tax invoice for mileage claims. None of the 10 approved mileage claims we reviewed at Strathbogie had any supporting documentation. Shepparton requires councillors to provide logbooks to support reimbursement claims; however, none of the five approved claims we tested had any supporting evidence attached.

Extra entitlements

Councils outline the level of benefits and support they provide to councillors in entitlement policies. These policies permit councils to provide, for example, meals for councillors when council meetings extend through normal meal times or accommodation when councillors travel for council business.

In our testing of credit card transactions, we identified four transactions at Wellington and two at Wyndham where council officers had made purchases for the benefit of councillors without a clear business need. This included the purchase of alcohol at Wellington for council meetings. We also identified one dinner at Wellington between senior council staff and new councillors and their partners that was not related to travel or council meetings. At Wyndham, we identified meals between senior council staff and councillors that were not related to travel or council meetings.

When councillor entitlements are outside policy boundaries and have unclear business purposes, it creates a risk that they do not meet community expectations.

Additional financial allowance

Under the Act, councillors receive a financial allowance for performing their role. The Minister for Local Government (the Minister) determines an allowance range, within which councils decide an amount. Councillors should not receive additional payments unless they are reimbursements for expenses incurred as part of official council business, supported by documentation that shows this.

Wyndham does not adhere to this, providing each councillor with an $800 lump sum 'hard copy printing allowance' per year to purchase a printer, paper and toner. While this allowance is included in Wyndham's reimbursement policy, the council does not require councillors to provide evidence as to how they spent the $800 printing allowance and pays the money directly to the councillor. The business need for this allowance is also unclear, as Wyndham provides councillors with a laptop or equivalent and the use of printers at council offices. Under the policy, the council will also reimburse councillors for printing costs, in addition to this printing allowance.

In contrast, Shepparton provides no printing allowance or reimbursements to councillors. Shepparton provides its councillors with tablets and the ability to use printers at council offices and does not offer any further printing entitlement.

Perception of 'double-dipping'

Councils need to consider how residents and ratepayers may perceive their actions in both providing equipment and reimbursing councillors for similar items or resources. Councils need to ensure that there is not a perception of 'double-dipping' or excessive entitlements.

We identified one example of Strathbogie reimbursing a councillor's entire private telephone and internet bill, despite the council already providing and covering the costs of a work mobile telephone. Reimbursement forms show that the councillor had not itemised the bills for reimbursement purposes, as required by policy, yet the council reimbursed them in full.

Failing to report councillor expenses as required by legislation

The Local Government (Planning and Reporting) Regulations 2014 (the Regulations) require councils to detail in their annual report each councillor's expenses in five categories—travel, vehicle mileage, childcare, information and communication technology, and conference and training expenses.

Only one of the four councils, Wellington, fully complied with this legislative requirement in 2017–18 annual report, which aims to provide transparency and enable scrutiny of councillor expenses. Shepparton did not report councillor expenses using the five required categories, Wyndham combined some of the categories, and Strathbogie combined allowances paid and expenses to report a total payment figure.

Fraud and corruption controls over council staff expenditure

While we did not identify instances of fraud or corruption in the transactions we examined, we found examples where controls are failing. These weaknesses provide an environment in which fraud and corruption can occur, potentially go undetected and breach public trust.

Credit cards

Controls over credit card use at the audited councils are, at times, inconsistently applied or are failing. We found:

- instances of inadequate documentation to confirm that transactions were made for official council business

- transactions contrary to stated council policies and procedures, including the payment of parking infringements at Strathbogie incurred by the chief executive officer (CEO) and a councillor, the costs of which were subsequently refunded after these individuals reviewed our draft report

- instances at Shepparton, Wellington and Wyndham where non-cardholders used cards allocated to others

- two instances at Wyndham where a non-cardholder used a card after the allocated cardholder left the council, and this non-cardholder also approved the transactions.

We also found inadequate scrutiny by approvers of transactions, such as:

- at Strathbogie, where a senior executive both witnessed a staff member's incomplete and undated statutory declaration, when the staff member failed to present tax invoices, and approved the transaction, contrary to policy

- at Wyndham, where the CEO incurred expenses on an administrative officer's card and approved the expenditure.

Data analytics can allow an agency to review large amounts of data and identify anomalies that may indicate fraud and corruption. We found that the audited councils did not have formalised processes to conduct data analytics of credit card transactions to identify and report anomalies. Wyndham and Shepparton have now started projects to report using data analytics.

Staff reimbursements

At Strathbogie, we found examples of inadequate documentation to support staff reimbursements and insufficient scrutiny by approvers, including:

- $21 700 reimbursed to a senior executive for their rent, which the council described as a salary packaging arrangement, but had no supporting documentation other than an email in which the senior executive described the arrangement between the council and themselves as a 'loose agreement'

- $3 085 in relocation expenses when there was no evidence that the staff member paid the amount to warrant reimbursement

- reimbursement of 100 per cent of course fees valued at $4111.50 when the supporting documentation stated that only 50 per cent could be reimbursed.

Fuel cards

Not all councils have fuel card policies or guidelines, and those that do are out of date or do not detail consequences for misusing fuel cards.

Although councils can apply fuel card restrictions, such as preventing the purchase of different fuel types, our testing found that blocks were not in place for all fuel cards and at times councils failed to:

- assign each fuel card to a specific vehicle or equipment

- maintain accurate motor vehicle and fuel card records

- update cardholder names with fuel suppliers when the council reassigns a vehicle and fuel card to another employee

- collect fuel transaction data as accurately as possible, including odometer readings to enable data analytics

- routinely monitor fuel card use, with only one council having conducted an internal review on fuel cards in the past three years.

We identified anomalies due to these control gaps, such as the purchase of different fuel types, but these could not always be explained. The councils' failures to implement controls, including regular, routine monitoring, leave them susceptible to fuel card misuse.

Maintaining public trust

Managing conflicts of interest

All councillors and council employees have private interests. These private interests can at times conflict, or be perceived to conflict, with the performance of their public duties. Effective management of such conflicts of interest is vital to maintain public trust and ensures council decisions are free from inappropriate influence.

|

Under the Act, councillors and nominated staff must lodge interest returns, called Ordinary Returns, every six months. Under the accounting standard, key management personnel (KMP), which includes councillors, must complete Related Party Disclosures and declare associations and interests to identify transactions with related parties. |

We identified one example where a councillor at Wellington failed to have their Ordinary Return witnessed per legislative provisions. The councillor instead used a photocopy of a previous return and changed the date.

When we reviewed interest disclosures made under the Act with disclosures under the Australian Accounting Standards Board AASB 124 Related Party Disclosures (the Accounting Standard) and data from the Australian Securities and Investments Commission (ASIC), we identified anomalies across Shepparton, Wellington and Wyndham. We referred these matters to the Local Government Inspectorate (LGI) for consideration, as LGI is the responsible authority for investigating anomalies and prosecuting offences under the Act.

Strathbogie KMP did not complete Related Party Disclosures in 2016–17, when it first became a requirement.

We also identified 10 examples in our credit card transaction testing at Strathbogie of a former manager buying gifts for, and dining with, suppliers, which raises the risk of perceived or actual conflicts of interest.

Effective use of funds

Meals and alcohol

We identified transactions involving the purchase of meals and alcohol at Strathbogie, Wellington and Wyndham that were not related to travel or council meeting catering. While councils may consider that spending council funds on meals and alcohol is appropriate in some circumstances, they need to consider community expectations and perceptions that are associated with this type of expenditure.

Selling and providing vehicles to staff

At Strathbogie, we identified six instances of the council directly selling vehicles to staff, at times below market value, and providing vehicles to staff as part of exit packages. The council also incurred additional vehicle-related expenses due to this practice.

Selling vehicles under market value or providing cars to employees—as well as paying additional expenses such as new tyres before the council transfers the vehicle—risks creating a perception of inappropriate or excessive entitlements for council employees. Further, a car that a council does not dispose of through a competitive auction represents a potential financial loss to the council and its residents and ratepayers.

Staff contributions to private use vehicles

Private-use vehicles are those that a council has assigned to an employee based on their role. Private-use vehicles differ from fleet vehicles in that the assigned employee may drive the car in their private time. Offering private-use vehicles can be a way for councils to attract and retain staff.

To have a council car for private use an employee will make annual contributions, negotiated as part of their employment package and contract. Although these contributions are subject to contract negotiation, private use of a council vehicle is ultimately funded by ratepayers and so must be transparent.

We found that Strathbogie and Wellington do not have transparent processes for calculating contributions and are not complying with their own policy requirements, resulting in some staff contributions towards their vehicles remaining the same for years. This means that expected increases in vehicle-related expenses—which should be incurred by individuals receiving the benefit—are being borne by the council and its ratepayers. Wyndham uses novated leases, a private arrangement between an individual and a company—with no impact on council expenditure.

Failing to report total remuneration, including motor vehicles

The Accounting Standard requires councils to report the remuneration of their executives (including non-monetary benefits) in annual reports. Where it is not possible to determine the value of a benefit, the Accounting Standard requires councils to provide a qualitative description in a footnote. This practice provides transparency of the council's expenditure and the benefits received by senior council staff.

We found that Strathbogie's 2017–18 annual report does not include a footnote for one senior executive's remuneration to capture the benefit of a motor vehicle. As a result of contract negotiations, the senior executive ceased making contributions in the last month of the financial year. Strathbogie advised that, subsequently, it omitted to include a footnote and the council will rectify this in its 2018–19 annual report.

Responding to fraud and corruption

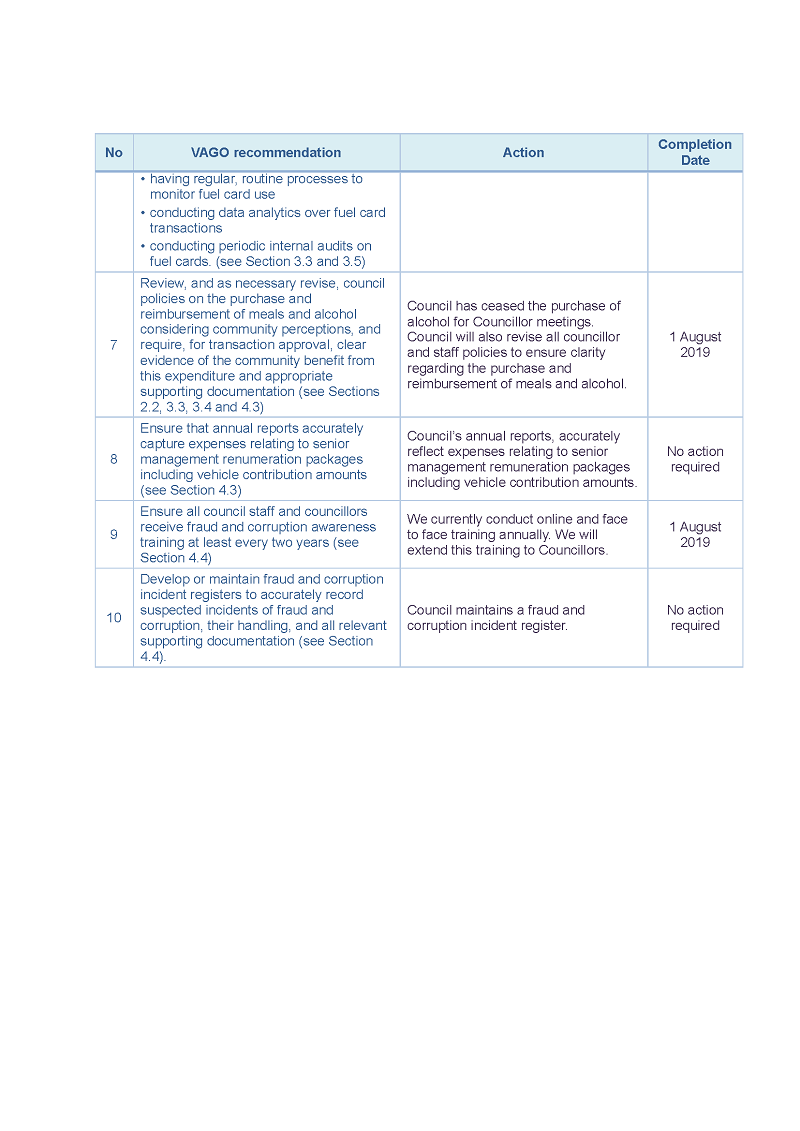

The audited councils have varying levels of tools to support responses to fraud and corruption risks, as seen in Figure A.

Figure A

Tools to support response to fraud and corruption

|

Elements of fraud and corruption control framework |

Shepparton |

Strathbogie |

Wellington |

Wyndham |

|---|---|---|---|---|

|

Protected Disclosure procedures made publicly available on council website at time of audit testing that include contact details for the Protected Disclosure Coordinator |

✔ |

✘(a) |

✔ |

✘(a) |

|

Fraud and corruption control policy implemented |

✔ |

✔ |

✔ |

✔ |

|

Fraud and corruption training provided to staff |

✔ |

✔ |

✔ |

✔ |

|

Fraud and corruption incident register maintained |

✘(a) |

✘(a) |

✔ |

✔ |

(a) Now compliant following VAGO findings.

Source: VAGO, based on council data.

Responding to potential instances of fraud and corruption

We identified instances at Strathbogie and Wyndham where the councils failed to respond appropriately to repeated non-compliance with policy.

For example, responsible staff at Strathbogie did not identify repeated non‑compliance with its purchasing card policy by a staff member as a fraud and corruption risk. At Wyndham, responsible staff did not suspend a staff member's card privileges while they were subject to an investigation for allegations of card misuse—which were ultimately substantiated—and did not maintain full records of the investigation.

We did not identify similar instances at Shepparton or Wellington.

Recommendations

All councils should consider our findings to determine if our recommendations are applicable to their operations and perform their own self-assessment of their fraud and corruption controls.

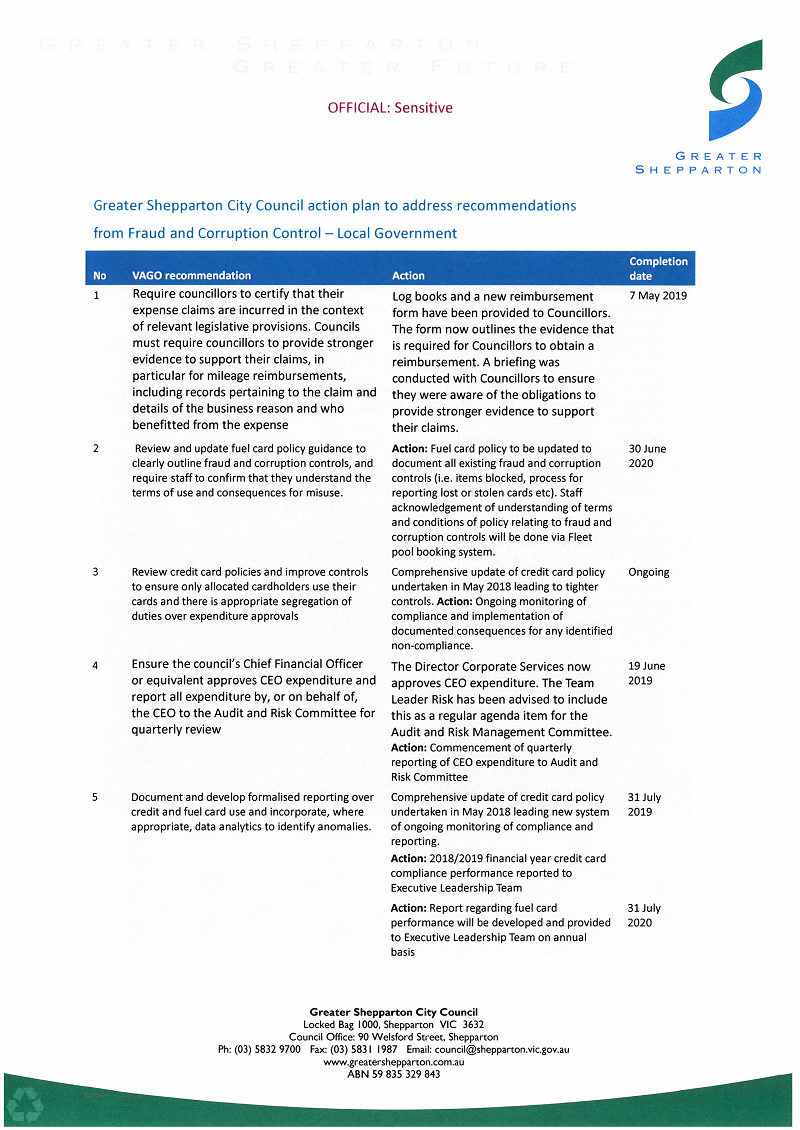

We recommend that councils:

1. require councillors to certify that their expense claims are incurred in the context of relevant legislative provisions. Councils must require councillors to provide stronger evidence to support their claims, in particular for mileage reimbursements, including records pertaining to the claim and details of the business reason and who benefited from the expense (see Section 2.2)

2. review and update fuel card policy and guidance to clearly outline fraud and corruption controls, and require staff to confirm that they understand the terms of use and consequences for misuse (see Section 3.5)

3. review credit card policies and improve controls to ensure only allocated cardholders use their cards and there is appropriate segregation of duties over expenditure approvals (see Section 3.3)

4. ensure the council's chief financial officer or equivalent approves chief executive officer expenditure and report all expenditure by, or on behalf of, the chief executive officer to the Audit and Risk Committee and/or the council for periodic review (see Section 3.3)

5. document and develop formalised reporting over credit and fuel card use and incorporate, where appropriate, data analytics to identify anomalies (see Sections 3.3 and 3.5).

6. improve fuel card controls by:

- assigning each fuel card to a specific vehicle or equipment

- maintaining accurate motor vehicle and fuel card listings

- updating cardholder names with fuel suppliers when the council reassigns a vehicle and fuel card to another employee

- collecting fuel transaction data as accurately as possible, including odometer readings

- having regular, routine processes to monitor fuel card use

- conducting data analytics over fuel card transactions

- conducting periodic internal audits on fuel cards (see Sections 3.3 and 3.5).

7. review and, as necessary, revise council policies on the purchase and reimbursement of meals and alcohol considering community perceptions, and require, for transaction approval, clear evidence of the community benefit from this expenditure and appropriate supporting documentation (see Sections 2.2, 3.3, 3.4 and 4.3)

8. ensure that annual reports accurately capture expenses relating to senior management remuneration packages including vehicle contribution amounts (see Section 4.3)

9. ensure all council staff and councillors receive fraud and corruption awareness training at least every two years (see Section 4.4)

10. develop or maintain fraud and corruption incident registers to accurately record suspected incidents of fraud and corruption, their handling, and all relevant supporting documentation (see Section 4.4).

We recommend that Greater Shepparton City Council, Strathbogie Shire Council, and Wyndham City Council:

11. publish councillor expenses for the 2017–18 year on their websites immediately and ensure their 2018–19 annual reports comply with Local Government (Planning and Reporting) Regulations 2014 (see Section 2.3).

We recommend that Strathbogie Shire Council:

12. cease all sales and the provision of vehicles to council staff as part of exit packages (see Section 4.3).

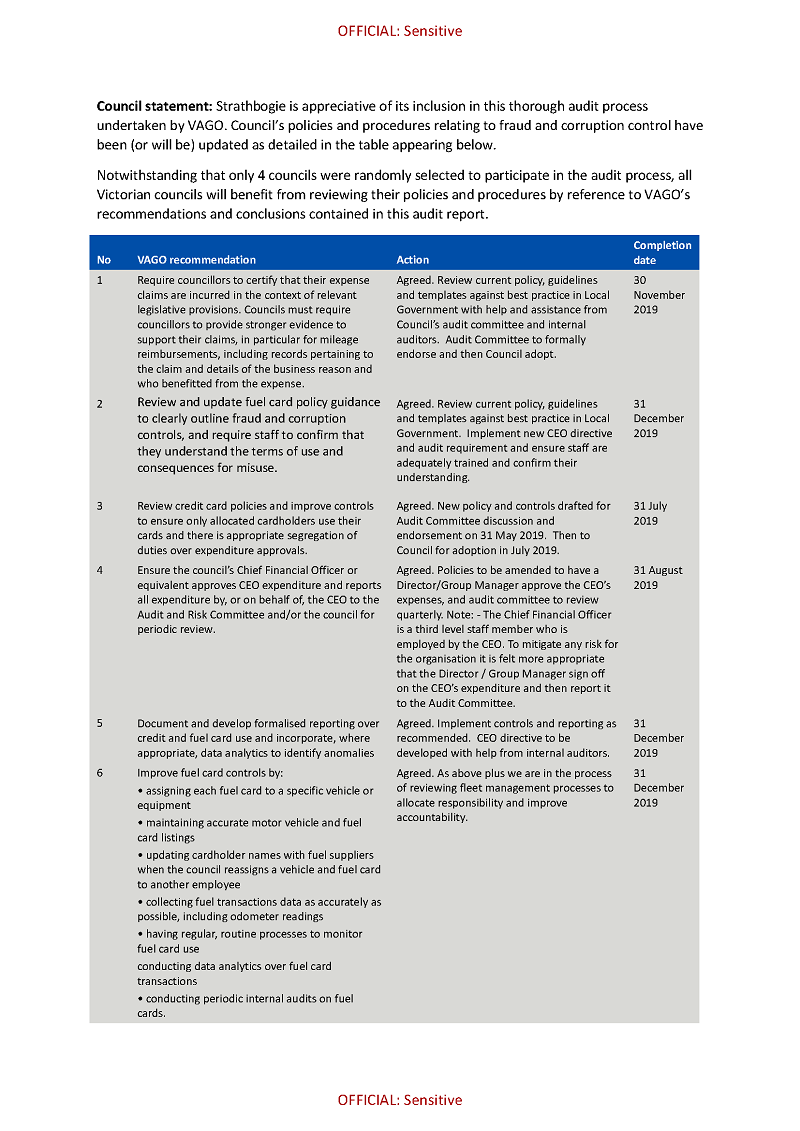

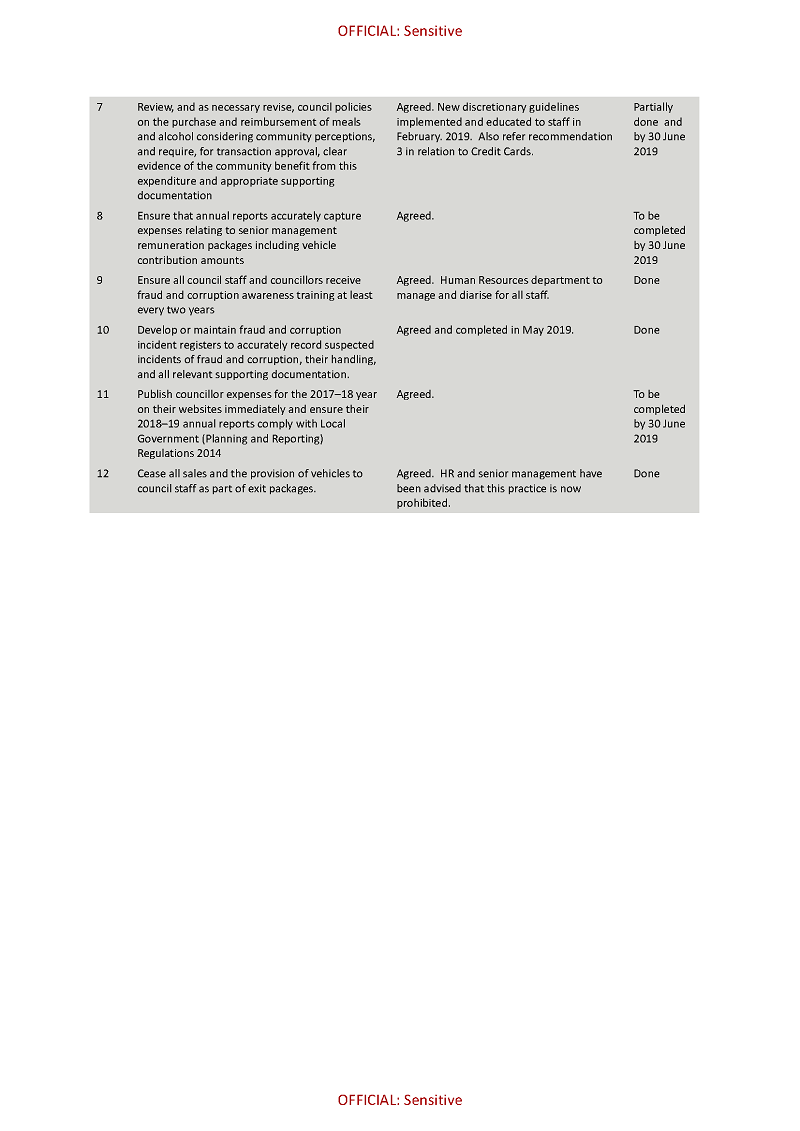

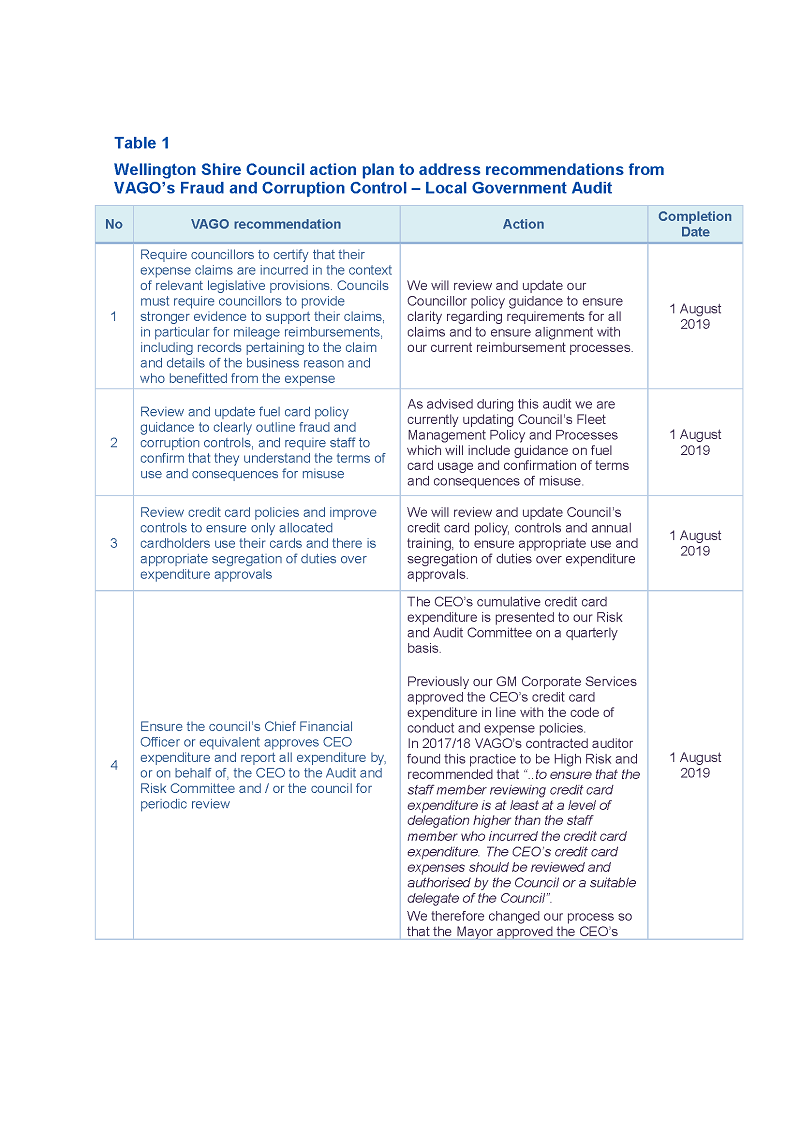

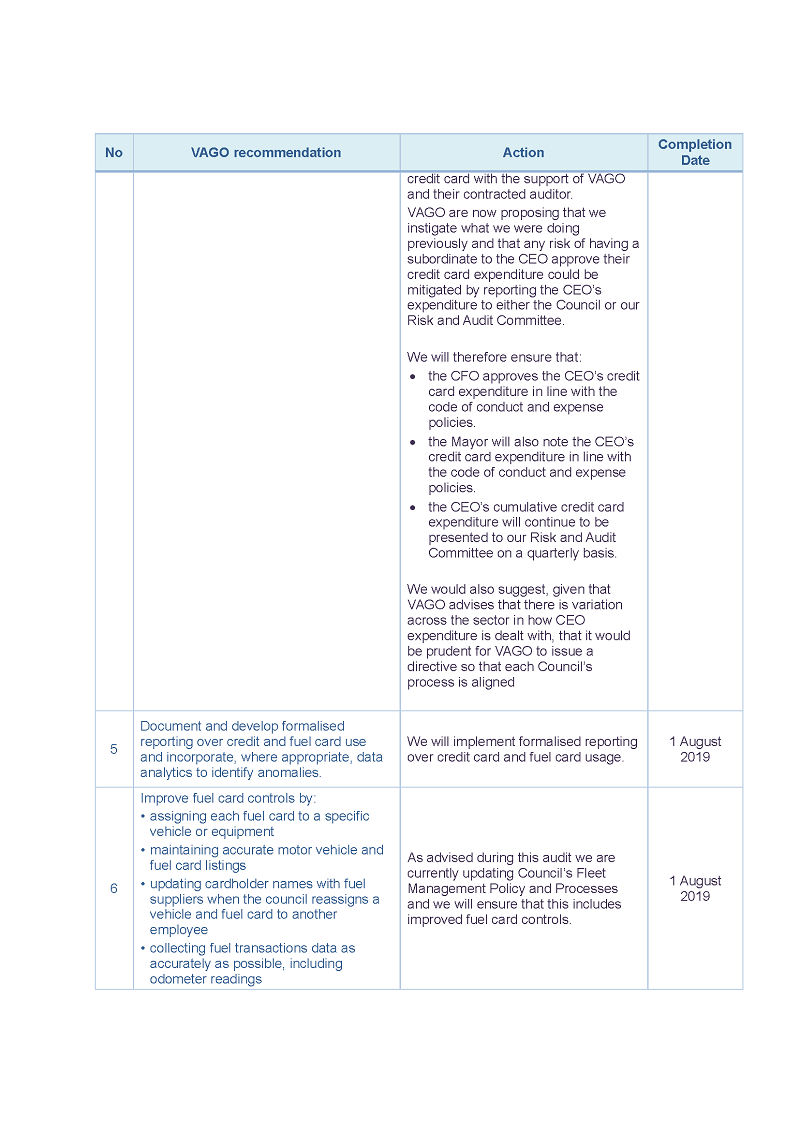

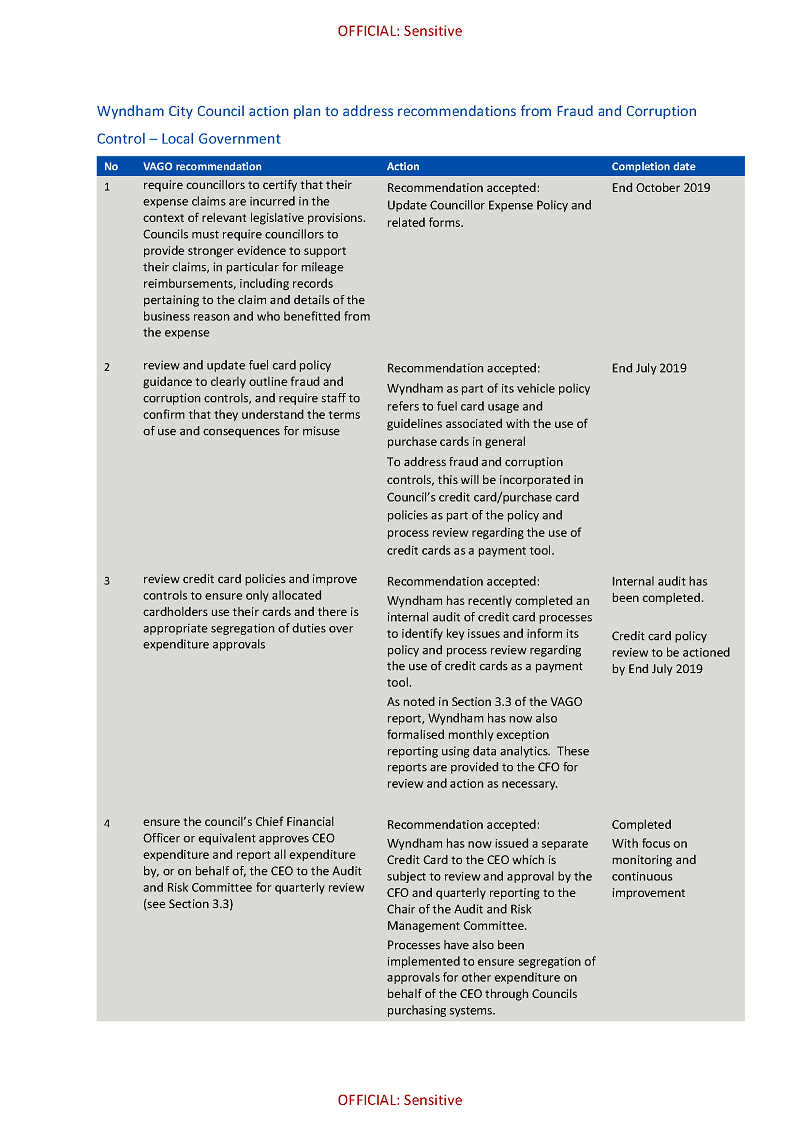

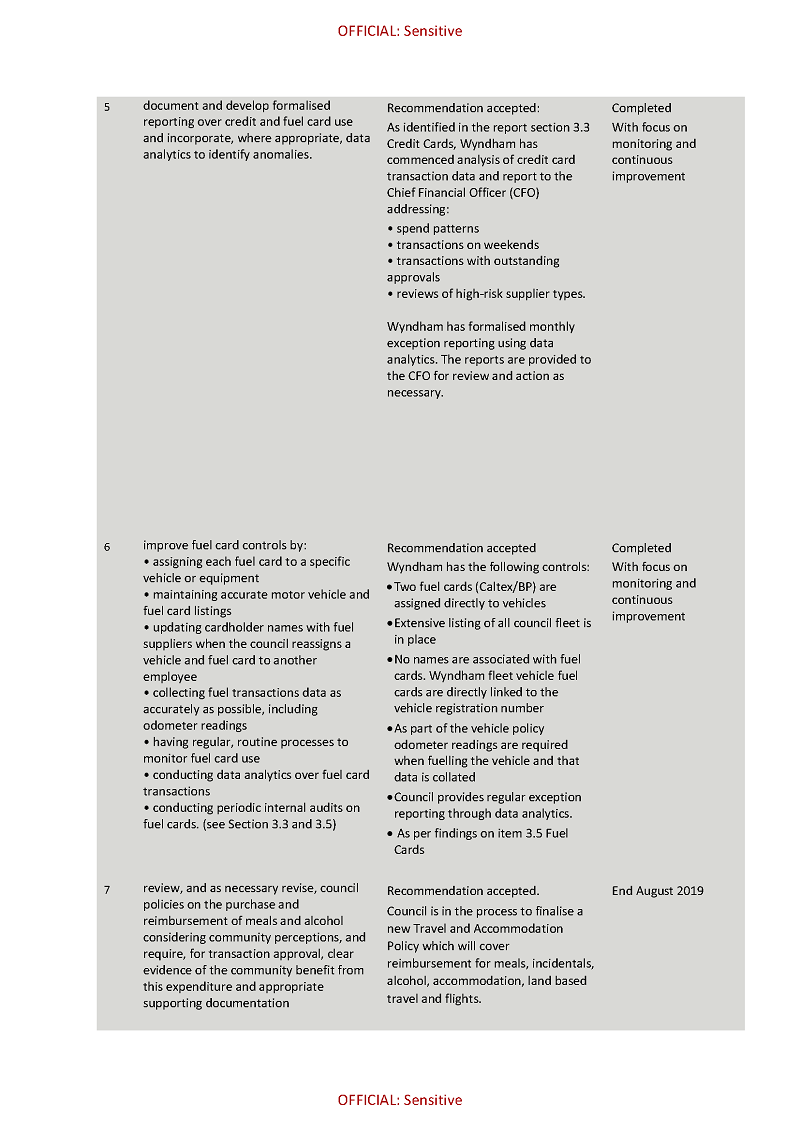

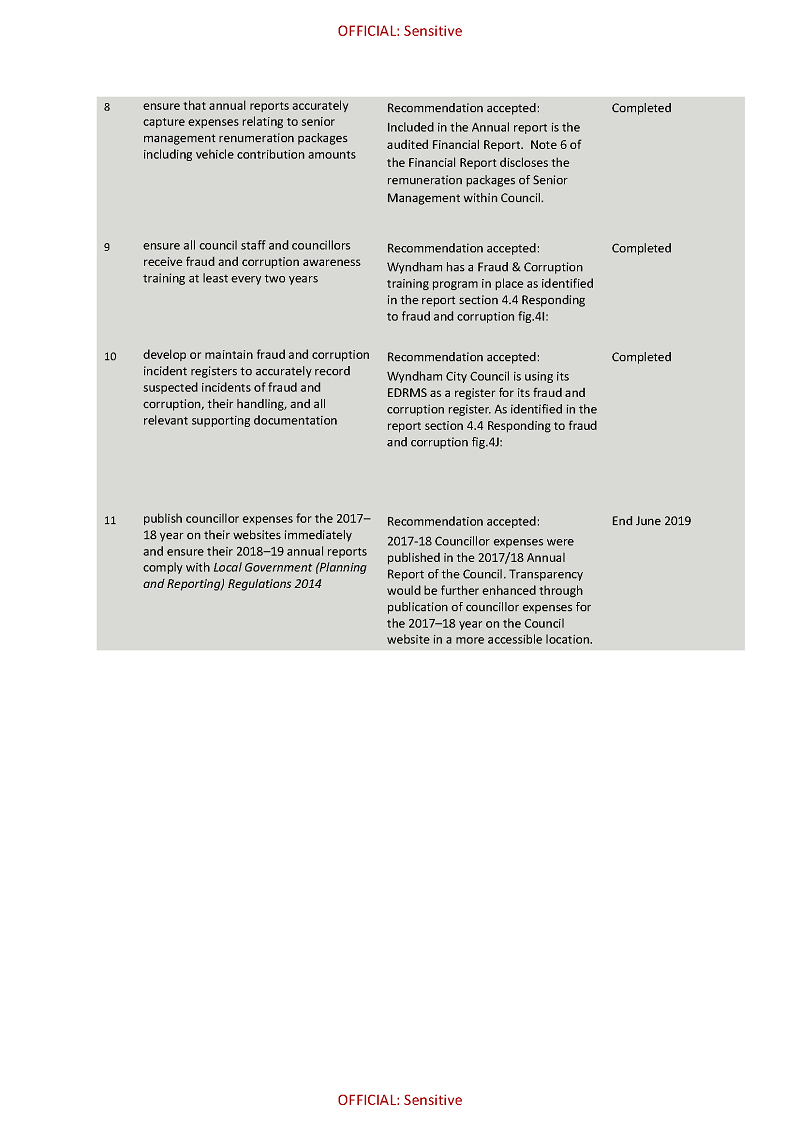

Responses to recommendations

We have consulted with Shepparton, Strathbogie, Wellington and Wyndham and considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet.

The following is a summary of those responses. The full responses are included in Appendix A.

All four councils accepted the recommendations addressed to them. The full responses are included in Appendix A.

1 Audit context

Local government employees and elected councillors make decisions and perform functions that affect the lives and interests of all Victorians.

The Independent Broad-based Anti-corruption Commission (IBAC) has repeatedly highlighted the need for agencies to develop a culture of integrity. A strong integrity culture can play a vital role in preventing, detecting and responding to fraud and corruption. Leaders must set the tone and ensure expectations are clear and that there are consequences for non-compliance.

Under the Act, councils have a duty to do all things necessary to:

- ensure that all money spent by the council is correctly used and properly authorised

- develop and maintain adequate internal control systems.

Ineffective controls can indicate that an organisation does not take fraud and corruption risks seriously and can create an environment where fraud and corruption can occur and go undetected. The financial amounts in question do not need to be significant to reduce public trust.

Transparency is crucial to maintaining public trust. In particular, discretionary spending presents perception risks to the sector, and should be able to withstand public scrutiny. Councils can jeopardise community confidence if they fail to adequately record and justify their spending decisions. In addition, if there is inconsistency between a council's stated policies and procedures and what it does in practice, this can raise suspicions about council expenditure and how well it is preventing fraud and corruption. If financial losses occur due to fraud and corruption, it can impact a council's ability to meet the needs of its community.

1.1 What is fraud and corruption?

Fraud is dishonest activity involving deception that causes actual or potential financial loss. Examples of fraud include:

- theft of money or property

- falsely claiming to hold qualifications

- false invoicing for goods or services not delivered, or inflating the value of goods and services

- theft of intellectual property or confidential information

- falsifying an entity's financial statements to obtain an improper or financial benefit

- misuse of position to gain financial advantage.

Corruption is dishonest activity in which employees act against the interests of their employer and abuse their position to achieve personal gain or advantage for themselves or others. Examples of corruption include:

- payment or receipt of bribes

- a serious conflict of interest that is not managed and may influence a decision

- nepotism, where a person is appointed to a role because of their existing relationships, rather than merit

- manipulation of procurement processes to favour one tenderer over others

- gifts or entertainment intended to achieve a specific outcome in breach of an agency's policies.

Losses resulting from fraud and corruption

It is difficult to measure total losses due to fraud and corruption. As well as financial losses, there are indirect losses, including productivity losses and damage to the community's trust in the local government sector.

The Australian Institute of Criminology (AIC) ranks fraud as the most costly type of crime. While there are no precise figures, AIC estimates that fraud costs the Australian economy $8.5 billion per year. Between October 2016 and September 2017, the total value of reported frauds exceeding $50 000 brought before Australian courts was $482 million.

At present, there is no requirement for councils to report losses due to fraud and corruption to the Victorian Auditor-General's Office (VAGO), as required of state government departments and authorities under the Standing Directions of the Minister for Finance 2016. Councils are also not required to report financial losses to LGI. However, council CEOs need to report suspected corruption to IBAC.

1.2 Legislation, policy and guidance

In May 2018, the Minister introduced the Local Government Bill 2018 into Parliament. The government intends for the bill to repeal and replace the Act with a modern, principle-based legislative framework. The proposed bill requires Audit and Risk Committees (ARC) to 'monitor and provide advice on risk management and fraud prevention systems and controls'. The proposed bill did not pass during the previous Parliamentary term and so has lapsed.

Figure 1A provides an overview of key legislative and accounting standard requirements and guidance material relevant to councils when developing their fraud and corruption strategies and controls.

Figure 1A

Key legislative and the Accounting Standard requirements and guidance material

|

Instrument |

Requirements / Guidance |

|---|---|

|

Local Government Act 1989 |

Mandatory compliance The Act describes the roles, functions and powers of councils and includes provisions relevant to fraud and corruption control, including conflict of interest, the role of audit committees, councillor reimbursements, and codes of conduct for council staff and councillors. |

|

Local Government (Planning and Reporting) Regulations 2014 |

Mandatory compliance The Regulations require councils to document in their annual report expenses for councillors in five categories. |

|

Local Government (General) Regulations 2015 |

Mandatory compliance The Local Government (General) Regulations 2015 require councils to make specific documents available for public inspection, including a document containing details of overseas or interstate travel undertaken by a councillor or council staff member within the previous 12 months. |

|

Protected Disclosure Act 2012 and Independent Broad-based Anti-corruption Commission Act 2011 |

Mandatory compliance The purpose of the Protected Disclosure Act 2012 is to encourage and facilitate disclosures of improper conduct by public officers, public bodies and others, and to provide protections for people who make disclosures. If a body can receive protected disclosures, it must have effective procedures to facilitate the making of disclosures, including notifications to IBAC. The Independent Broad-based Anti-corruption Commission Act 2011 requires all relevant principal officers of public-sector bodies, which includes council CEOs, to notify IBAC of any matter they suspect on reasonable grounds involves corrupt conduct. |

|

Australian Accounting Standards Board AASB 124 Related Party Disclosures |

Mandatory compliance The objective of the Accounting Standard is to ensure that financial statements contain disclosures to draw attention to the possibility that an entity's financial position may have been affected by the existence of transactions with related parties. Since July 2016, certain council staff and councillors are required to, for example, declare if they or close family members control or jointly control a business, club, association or sporting group that transacts or has commitments with the council. The Accounting Standard also requires that local councils note in their annual report total remuneration for key management personnel, including non-financial benefits, such as motor vehicles. |

|

Australian Standard 8001–2008 Fraud and Corruption Control |

Better practice The Australian Standard 8001–2008 Fraud and Corruption Control (the Australian Standard) provides guidance on controlling fraud and corruption within an entity. The Australian Standard views fraud and corruption control as 'a holistic concept involving implementation and continuous monitoring and improvement across three key themes—prevention, detection and response'. |

|

IBAC, LGI, VAGO and Victorian Ombudsman publications |

Better practice IBAC, LGI, VAGO and Victorian Ombudsman (VO) investigation and audit reports, reviews, media releases and resources can assist the local government sector. |

Source: VAGO.

Fraud and corruption controls

Fraud and corruption control frameworks should include controls that address the three key areas of prevention, detection and response, as outlined in Figure 1B.

Figure 1B

Fraud and corruption frameworks

Source: VAGO.

1.3 Agencies and their responsibilities

Local councils

The Constitution of Victoria recognises local government as a separate tier of government. Residents and ratepayers elect councillors to govern councils, and the councillors appoint a CEO, who manages the council's operations. While administered under the Act, all 79 councils in Victoria operate autonomously and are accountable to ratepayers and residents.

The local government sector is primarily funded though rates and charges, as well as government grants, to deliver services to the local community. In the 2017–18 financial year, our financial audit found that Victorian councils recorded revenue of $10.7 billion. Rates and charges revenue was $5.7 billion, making up over 50 per cent of total revenue. The second-largest revenue stream for councils was government grants and contributions, totalling $3.15 billion.

Figure 1C shows the populations in the audited councils' municipalities and the audited councils' incomes for 2017–18.

Figure 1C

Audited councils' populations and incomes for 2017–18

|

Council |

Population |

Income for 2017–18 |

|---|---|---|

|

Wyndham |

250 186 |

$581 856 000 |

|

Shepparton |

65 593 |

$142 810 112 |

|

Wellington |

43 747 |

$99 062 112 |

|

Strathbogie |

10 445 |

$32 548 270 |

Source: VAGO, based on council annual reports for 2017–18.

Local Government Inspectorate

LGI is the dedicated integrity agency for local government in Victoria. LGI investigates offences under the Act and monitors governance and compliance with the Act in Victorian councils.

1.4 Why this audit is important

Fraud and corruption erode public trust in local government, disrupt business continuity, deter potential suppliers, reduce the quality and effectiveness of services, and threaten a council's financial stability.

A recent investigation by LGI resulted in criminal charges against a council CEO relating to the use of a council credit card for personal expenses. The CEO had bought items on their council credit card and falsely claimed they were for council business. The court convicted the CEO in December 2018 and ordered them to pay $26 000 in fines and $10 000 towards the prosecution's legal costs.

Following a separate LGI investigation, in July 2018 a court convicted and fined a councillor for their failure to submit Ordinary Returns by the prescribed date and disclose all companies in which they had an interest, as required by the Act. The court fined the councillor $26 000, plus $15 000 in legal costs. The County Court Judge noted that LGI had issued the councillor with a previous warning and described the councillor's offending as 'persistent'.

From December 2016, when IBAC introduced mandatory reporting of suspected corrupt conduct by relevant principal officers, including council CEOs, to November 2017, 44 per cent of reports to IBAC have concerned local councils.

1.5 What this audit examined and how

This audit examined whether councils have well-designed fraud and corruption controls that operate as intended. We primarily focused on expenditure and conflict of interest processes for senior council staff and councillors.

We assessed if councillor and senior staff credit and fuel card use, and reimbursements, were valid and in accordance with legislative and policy requirements. We also considered if the audited councils responded effectively when they detected non-compliant expenditure or reimbursements.

We also assessed if controls to identify and manage conflicts of interest for senior council staff and councillors were effective and operating as intended. This included assessing the completeness of interest disclosures, required under the Act, and Related Party Disclosures, required under the Accounting Standard.

We audited four councils—Shepparton, Strathbogie, Wellington and Wyndham. We selected the four councils through:

- discussions with other integrity agencies to ensure we would not be compromising any active investigations

- ensuring a selection of different sized councils and a spread across metropolitan and rural councils.

We also consulted with Local Government Victoria (LGV), which provides policy advice to the Minister and oversees the administration of the Act, and LGI in the conduct of this audit.

This report includes adverse comments about the current Strathbogie and Wyndham CEOs. Section 20(2) of the Audit Act 1994 requires us to provide them with a reasonable opportunity to respond to the draft report. As a result, we provided draft reports to both of these CEOs on 18 April 2019 and 28 May 2019. Neither CEO provided a response to these matters in their individual capacity. The Acting Auditor-General has considered the councils' responses contained in Appendix A in making the decision to include the adverse comments in the report.

In accordance with section 20(3) of the Audit Act 1994, any other persons who are named from the information in this report are not the subject of any adverse comment or opinion.

We conducted our audit in accordance with section 15 of the Audit Act 1994 and ASAE 3500 Performance Engagements. We complied with the independence and other relevant ethical requirements related to assurance engagements. The cost of this audit was $675 000.

1.6 Report structure

The remainder of this report is structured as follows:

- Part 2 examines fraud and corruption controls over councillor entitlements and expenditure.

- Part 3 examines fraud and corruption controls over staff expenditure.

- Part 4 examines the maintenance of public trust.

2 Fraud and corruption controls over councillor entitlements and expenditure

Residents and ratepayers elect councillors to serve their communities. Councillors are responsible for setting the overall direction of the council and take an oath that they will perform their role impartially, to the best of their ability, and in the best interests of the municipality.

The Act provides for councillors to receive support from councils including an allowance, resources and facilities, and the reimbursement of expenses incurred while performing councillor duties.

Councillors must model appropriate behaviour. As highly visible community leaders, they must hold themselves to the highest standard of integrity and foster a culture of zero tolerance for fraud and corruption. Any perception of excessive entitlements may damage public trust and the maintenance of a culture of integrity.

As with any type of council expenditure, the provision of entitlements to councillors may constitute a fraud and corruption risk for which councils need adequate controls. Fraud and corruption risks over councillor entitlements can include councils:

- approving councillor expense claims or entitlements not required for official council business or for councillors to perform their roles

- approving councillor expenses not supported by adequate documentation

- misreporting councillor expenditure.

2.1 Conclusion

Audited councils are not consistently applying important fraud and corruption controls over councillor reimbursements and entitlements.

Audited councils do not consistently require and adequately scrutinise supporting documentation to confirm that councillor expenditure is valid. Shepparton, Strathbogie and Wyndham have also failed to comply with a legislative requirement to accurately report councillor expenditure in their annual reports. These control weaknesses expose councils to the risk of fraud and corruption and may damage public trust and reduce transparency.

2.2 Fraud and corruption controls

Councils decide the level of support they provide to elected councillors based on what the council can afford, and what their communities would accept as reasonable. Councillors seeking benefits outside of their entitlement may be a fraud and corruption risk. Some examples of fraud and corruption risks over councillor support include councillors seeking reimbursement for:

- petrol costs for private mileage

- meals for their families or friends

- items that have nothing to do with their official council duties

- something that the council has already provided.

Councillors must also consider how their community may perceive entitlements that appear excessive or where there is no clear business purpose, such as:

- expensive meals

- additional financial allowances

- alcohol at council meetings.

To control for these risks, we assessed whether:

- councils had clear policies outlining the level of support to which councillors are entitled, and the process for how councillors can claim these entitlements and reimbursements

- councillor reimbursements and entitlements are supported by documentation that confirms they are for genuine council business and details the beneficiaries of the expense

- standing entitlements and support that councillors receive are not excessive and meet community expectations.

Policy and process

The Act requires councils to adopt and maintain a policy that prescribes the types of councillor expenses the council must reimburse, and the procedures councillors must follow for reimbursements.

The policy should also outline the support a council will provide to councillors and mayors, including access to resources and facilities.

All audited councils have a policy detailing the support they provide to councillors and the mayor, which are available on the councils' websites. The policies vary in what entitlements they provide, such as different rates for mileage reimbursements and printing entitlements.

All council polices also outline the process by which a councillor can request a reimbursement of expenses. We assessed the councillor reimbursement forms and noted a good practice example at Wyndham that requires councillors to certify that their claims accord with the relevant legislative provisions. This may also help councils to hold councillors accountable if they fail to meet their obligations.

Documentation to support reimbursement claims and approvals

Under the Act, councils must reimburse councillors for expenses if the councillors:

- apply in writing to the council for reimbursement of expenses

- establish in their application for reimbursement that the expenses 'were reasonable bona fide Councillor out-of-pocket expenses incurred while performing duties as a Councillor'.

The Act defines councillor duties as 'necessary or appropriate for the purposes of achieving the objectives' of the council.

However, the audited councils do not always approve councillor reimbursements in line with these requirements. For example:

- from 12 councillor reimbursement claims we reviewed at Shepparton, the council was unable to provide the reimbursement claim forms for three approved transactions

- from 20 councillor reimbursement claims we reviewed at Strathbogie, we identified six examples where the councillor had failed to detail the business reason, or council event, for which the expense was incurred.

In some instances, the audited councils state with confidence that, in the absence of supporting documentation, they can confirm that the expenses were business related. However, incomplete or missing documentation means full public scrutiny cannot be applied to the transactions as the business reason and who benefited is not evident. Shepparton advised that it has now implemented a business rule where it will not process councillor reimbursements for payment without the relevant forms and conducts ad hoc 'spot checks' of councillor reimbursements.

The case study in Figure 2A outlines an example of how documentation gaps limited our ability to confirm whether reimbursements were bona fide and who benefited from the expense.

Figure 2A

Inadequate reimbursement documentation

|

We reviewed a reimbursement for $110 paid by Wellington to a councillor. The description on the reimbursement form was 'reimbursement for meal'. The documentation did not detail:

When we made enquiries, the council reviewed this councillor's calendar and advised that: '[this councillor] paid total bill for dinner although the names of attendees have not been detailed, it appears that there were 3 attendees.' The council also advised that the claim was in the context of the councillor's attendance at a business conference, although this was not evident in the supporting documentation. |

Source: VAGO, based on Wellington data.

There is no evidence that the above case study indicates fraudulent expenditure. However, the supporting documentation should have detailed the business reason for the expense and the beneficiaries.

Mileage reimbursement

Reimbursement of mileage costs for councillors to attend council meetings, functions and events is to ensure that there is no financial disincentive to becoming a councillor and performing official duties. As such, the audited councils' policies provide for the reimbursement of mileage to support councillors when they use their private vehicles.

Given the significant distances travelled by councillors, particularly in regional Victoria, mileage reimbursement amounts can be significant. The Act requires councillors to prove that their reimbursement claims are bona fide. Therefore, the council should require some level of supporting documentation for mileage reimbursement claims, such as a logbook with odometer readings, and a description of the council meeting or function attended.

Figure 2B details the supporting documentation required by councils for mileage reimbursements according to their councillor reimbursement policies and councillor reimbursement expense claim forms.

Figure 2B

Supporting documentation for mileage according to policy

|

Council |

Evidence requirement for supporting documentation in policy |

Requirement in claim form |

|---|---|---|

|

Shepparton |

Logbook |

|

|

Strathbogie |

Receipt or tax invoice |

|

|

Wellington |

No stated requirement |

|

|

Wyndham |

'appropriate records ' |

|

Source: VAGO, based on council policies.

Wyndham and Wellington need to improve their guidance to councillors. Wyndham's policy and claim form does not require councillors to detail their purpose for their travel, and Wellington's policy does not state what supporting document the council requires for mileage claims.

Figure 2C shows the mileage reimbursement rates for councillors according to council policies. The audited councils use three different sources for the rates, meaning councillors are provided with varying levels of support. This decision is at the audited councils' discretion, but they should consider public perception in determining these rates.

Figure 2C

Mileage reimbursement rates for councillors according to council policies

|

Shepparton |

Strathbogie |

Wellington |

Wyndham |

|

|---|---|---|---|---|

|

Cents per kilometre |

66 cents |

97 cents |

72 to 88 cents |

80 to 97 cents |

|

Source of rate |

Australian Tax Office (ATO) |

Victorian Local Authorities Award 2001 |

Royal Automobile Club of Victoria (RACV) |

Victorian Local Authorities Award 2001 |

Note: The award rates differ depending on engine sizes. Strathbogie does not check engine sizes and pays all claims at the highest available rate.

Source: VAGO, based on council data.

Shepparton

Shepparton's policy states that councillors must support their claims for reimbursement with a logbook, which the council can provide on request. The councillor reimbursement claim form also requires the attachment of a 'Tax Invoice / Receipt / Copy of Log Book'. We selected five mileage reimbursement claims and found that even though none of the claims we reviewed had any supporting documentation, the council processed all five claims.

We also identified that Shepparton reimbursed three of the five claims in error, at a rate of 99 cents per kilometre, instead of the 66 cents in their policy. The council explained that the claims were processed in error at the council employee Enterprise Bargaining Agreement (EBA) rate, instead of the stated councillor reimbursement policy rate. The overpayments ranged from $43 to $126.

Shepparton advised that it has now provided councillors with logbooks and a new reimbursement form. We have confirmed that the new form outlines the evidence that councillors need to provide to obtain a reimbursement and alerts administrative staff who process these claims to the requirements.

Strathbogie

Strathbogie uses the Victorian Local Authorities Award 2001 to reimburse councillors for mileage at a rate of 97 cents per kilometre and does not check engine sizes, which could result in a lower rate being applicable (80 cents per kilometre).

Strathbogie does not have clear requirements for supporting documentation for mileage claims, and does not, for example, require councillors to provide odometer readings. While Strathbogie's councillor reimbursement policy requires that councillors provide 'a receipt/tax invoice for any expenditure', its associated claim form does not require councillors to provide evidence in support of mileage claims. None of the 10 approved mileage claims we reviewed provided any tax invoices or receipts. While we found that six claims included details about the council event the councillors attended, four claim forms only stated the date and locations travelled between, without providing any detail on the actual business purpose for the travel.

We found one instance where Strathbogie reimbursed a councillor $1 018.50 over a three-week period. In support of these mileage reimbursements, the councillor noted the kilometres travelled and the travel purpose. However, the councillor did not provide a tax invoice or receipt to support any of these reimbursements, which is a requirement under the council's policy, but not on its councillor claim form. Strathbogie does not require councillors to provide odometer readings to confirm the number of kilometres travelled.

In response to our findings, Strathbogie stated that it is committed to providing councillors with training to reinforce its policy requirements for reimbursements and ensure that councillors understand that any claim for reimbursement must be reasonable.

Wellington

Wellington uses the RACV vehicle expense rate to reimburse councillors for mileage. These rates vary depending on the size and type of the vehicle, and RACV revises them each year. The RACV rates for 2017 were 6 to 22 cents higher than ATO rates. The council states that the ATO rate does not provide a fair reimbursement rate, as it does not consider engine size or reflect the true expense in using a private vehicle for council business.

Wellington requires councillors to submit a reimbursement form that lists the date, cylinder size, distance travelled, reason for the trip, and destination. It does not require councillors to provide other supporting documentation, such as a logbook or odometer readings for mileage reimbursements or a receipt to confirm spending on fuel. However, the council advises that it takes steps to ensure that claims for mileage are for council business as follows:

- The support officer who books and records councillor meetings and events in a diary checks the entries against the councillor claim forms.

- The council uses Google Maps to confirm distances travelled.

We reviewed seven claims for mileage reimbursement. Wellington provided the reimbursement forms for all claims, which listed the destinations, kilometres travelled and the business purpose.

Wellington's claim form states that councillors should complete reimbursement claim forms at the end of every month and that claims submitted later than three months after the expense is incurred will not be paid. This is to enable appropriate scrutiny so that the business purpose for travel can be easily confirmed. We identified two paid claims from our review of 20 approved reimbursements where the councillors submitted these claims outside of this timeframe. Figure 2D outlines this.

Figure 2D

Delayed claims for reimbursement

|

We identified one reimbursement claim for mileage of 3 698 kilometres with a total claim value of $2 662.56. A councillor submitted the claim form in April 2017 and it covered the period November 2016 to April 2017. The council acknowledged this delay and noted that it was an isolated incident. We identified a second claim for reimbursement for a different councillor who submitted a claim in September 2018, for the period July to September 2018 for $1 652.78. Wellington stated in response to these findings that:

The council noted that it had added a monthly calendar reminder in each councillor's diary to help reduce delays and that it can 'only ask/remind Councillors to submit claims'. |

Source: VAGO, based on Wellington data.

Wyndham

Wyndham uses the Victorian Local Authorities Award 2001 rates to reimburse councillors for mileage. The council is of the view that this rate is consistent with its EBA and ensures councillors receive the reimbursement as council staff. As a metropolitan council, Wyndham has fewer claims for mileage reimbursements.

Extra entitlements

Meals and alcohol

Councils may provide meals for councillors when council meetings extend through normal meal times or when they require councillors to travel for councillor business. In rural councils, councillors may travel significant distances to attend council meetings.

In our testing of credit card transactions, further described in Section 3.3, we noted transactions at two of the four audited councils and we provide examples in Figure 2E.

Figure 2E

Expenditure for councillors

|

Council |

Audit findings |

|---|---|

|

Wellington |

We note in response to these transactions that the council has stated that councillors do not consume alcohol during work hours. |

|

Wyndham |

|

Source: VAGO, based on council data.

The transactions listed above are not instances of fraud or corruption. However, they are instances where councils have provided benefits to council staff and councillors that their own policies do not necessarily support and are not transparently reported back to their communities.

Wyndham has acknowledged that such expenditure, where material, should be included in the reporting of councillor expenses for greater transparency. Wyndham advised it will review its guidelines on councillor expenses to capture expenditure more broadly.

When entitlements exceed stated policy, have unclear business purposes, or councils do not transparently report these expenses to ratepayers, councils risk losing their communities' trust.

Additional financial allowances

Councillors should not receive additional payments unless they can prove they incurred an expense for official council business. For example, this would include a reimbursement of accommodation or meals costs where the councillor attended approved council business and provided supporting documentation.

We noted the following practice at Wyndham in the form of a printing allowance, which Figure 2F describes.

Figure 2F

Councillors receiving printing allowance

|

Wyndham's councillor reimbursement policy states that the council will provide each councillor with an $800 lump sum per year 'hard copy printing allowance' to purchase a printer, paper and toner. The council does not require councillors to provide evidence as to how they spend the $800 printing allowance and pays the money directly to the councillor. We note that:

The council details the $800 printing allowance in the councillor reimbursement policy, which is available for public inspection. However, it is an additional financial allowance as opposed to an actual reimbursement, which means Wyndham councillors are receiving the maximum allowance plus an $800 lump sum. |

Source: VAGO, based on Wyndham data.

In comparison, Shepparton, as a better-practice example, provides no printing allowance or reimbursements to councillors. Shepparton provides its councillors with tablets and the ability to use printers at council offices. The council does not consider that any further printing entitlement is necessary.

For any payments or reimbursements, councils must collect documentation that confirms that councillors are using this money for genuine council business.

Perception of 'double-dipping'

Councils need to carefully consider how residents and ratepayers may perceive their actions in providing equipment, as well as reimbursing councillors for similar items or resources. Councils need to ensure that there is not a perception of 'double-dipping' or excessive entitlements.

Figure 2G shows an example of Strathbogie reimbursing a councillor's entire private telephone bill, despite the council already providing and covering the costs of a work mobile telephone.

Figure 2G

Councillor provided with a mobile telephone and reimbursed for home telephone bill

|

The council issued a councillor with a work mobile telephone. In addition to the provision of a work mobile, the council's policy also provides for a maximum reimbursement of $100 per month for 'Council business' telephone calls on their private mobile or home telephone. Between 31 August 2015 and 31 March 2018, the councillor claimed reimbursements for their home telephone and internet totalling $3 474.23. Reimbursement forms show that the councillor had not itemised the telephone bills for reimbursement purposes, as required by policy. The council approved all these reimbursement claims. |

Source: VAGO, based on Strathbogie data.

We understand that the council did not approve one reimbursement claim submitted by the councillor for telephone charges in March 2018 and the councillor has not sought reimbursement for their private home or internet charges since this time.

In response to our draft report, Strathbogie advises that it is reviewing its policy and that it has sought to recover these inadvertent overpayments.

Mayoral fuel cards

We completed analytics over fuel card use by mayors at Shepparton, Wellington and Wyndham. We were unable to complete analytics for Strathbogie, as transaction times, odometer readings and the volume of fuel purchased was not available to enable analysis. For the councils we were able to complete analytics for, we identified no fuel card misuse by the mayors.

2.3 Reporting councillor expenses in annual reports

The Regulations require councils to detail in their annual report a breakdown of each councillor's expenses in five categories:

- travel

- car mileage

- childcare

- information and communication technology

- conference and training expenses.

Reporting of councillor expenses in annual reports provides transparency and enables external scrutiny of councillor expenses.

We reviewed council annual reports for 2017–18 to determine if the audited councils comply with this legislative requirement. Only one of the four councils fully complied with the Regulations as detailed in Figure 2H. This illustrates not only a breach of the Regulations, but also limits opportunity for external scrutiny.

Figure 2H

Council compliance with annual reporting requirements for councillor expenses

|

Council |

Compliance with councillor expenses in 2017–18 annual reports |

Non-compliance |

|---|---|---|

|

Shepparton |

Not compliant |

The council has not detailed in its annual report the councillor expenses in the five required categories. |

|

Strathbogie |

Not compliant |

The council has reported the total expenses paid per councillor, instead of reporting the five required categories. |

|

Wellington |

Compliant |

N/A |

|

Wyndham |

Not compliant |

The council has combined the travel category with the training and conference category. |

Source: VAGO, based on council annual reports for 2017–18.

In addition, Wellington and Wyndham are not currently capturing the instances we identified of council staff purchasing meals and alcohol for councillors in Figure 2E as councillor expenses, reporting these back to the community.

3 Fraud and corruption controls over staff expenditure

Councils deliver vital services including health, community support, economic development, and waste and environmental management. To perform these functions, councils collect funds, in the form of rates and charges, to deliver services to the community. Council staff are responsible for using these funds responsibly to further council objectives.

The expenditure of council funds by council staff is a fraud and corruption risk that each council must mitigate. Fraud and corruption risks include a council staff member:

- using a council credit card for personal use

- using a council fuel card to fill-up their own vehicle

- seeking reimbursement for items not bought, or not for genuine council business.

Under the Act, councils must ensure that all money they spend is correctly used and properly authorised and develop and maintain adequate internal control systems. We assessed whether councils had adequate fraud and corruption controls over:

- council credit cards

- council fuel cards

- reimbursements made to staff.

3.1 Conclusion

At some of the audited councils, staff have been inconsistently applying fraud and corruption controls over credit and fuel cards and staff reimbursements, and in some cases these controls have failed. Incomplete or inaccurate data, a lack of monitoring for anomalies, and failure to implement and comply with controls have limited the ability of councils to detect fraud and corruption should it occur. Instances where councils have not implemented or enforced their policies and processes show that councils need to do more to strengthen existing controls and undertake proper monitoring to protect council funds.

3.2 Control framework

Figure 3A outlines the key features of a good practice framework to control for fraud and corruption risks over expenditure.

Figure 3A

Control framework over expenditures

Source: VAGO.

We assessed the control framework over credit and fuel card use and reimbursements made to staff at each of the audited councils.

3.3 Credit cards

Council staff use credit cards to buy high-volume and low-value goods and services. The use of credit cards can save time and money by avoiding lengthy procurement processes for goods and services that staff must purchase frequently. While credit cards are a flexible and efficient way to make purchases, for this reason they also constitute a fraud and corruption risk.

Policy

Clear and accessible credit card policies and procedures are an important fraud and corruption control. Policies should provide employees with clear instructions on how to use their council credit card and should take a strong stance against fraudulent and corrupt use. Policies can also act to deter inappropriate behaviours when they clearly outline controls to detect fraud and the consequences of inappropriate use. It is also essential that councils require cardholders to acknowledge that they have read and understood the policy before being issued with a card.

Policy strengths

Each council's credit card policy clearly states that:

- the use of a credit card should be for official council business only

- the council may take disciplinary action in the event of card misuse or breach of the policy

- cardholders are responsible for keeping their card details and personal identification number (PIN) secure and that they must immediately report lost cards

- cardholders must provide adequate documentation or a signed statutory declaration for each credit card purchase

- a manager or supervisor must approve every transaction

- the withdrawal of cash is prohibited, and card limits must not be exceeded.

While a policy cannot outline the appropriateness of every possible type of purchase, policies should provide examples of inappropriate use, especially where there may be ambiguity. The credit card policies at Shepparton, Strathbogie and Wyndham councils all gave examples of inappropriate use, for example the purchase of fuel, the payment of fines and purchase of alcohol not required to advance council business.

Policy weakness

We identified a policy weakness and associated control risk for Strathbogie, as its policy does not clearly define what is considered sufficient supporting documentation for a transaction. The other councils' policies clearly state that an electronic funds transfer at point of sale (EFTPOS) receipt is not adequate, as it does not itemise what a cardholder purchased. We identified multiple transactions at Strathbogie where there was insufficient documentation to support the spend (see the testing results in Figure 3D).

Data analytics and review

An important part of a fraud and corruption control framework over credit card use is the review and analysis of transaction data to detect potential fraudulent use. Officers who are independent of cardholders and card approvers should conduct these review activities. The level of review activity will differ between councils depending on the number of transactions and credit cards in circulation. Activities range from reviewing a percentage of transactions each month, to a more sophisticated approach using data analytics over all transaction data to detect potential misuse. More sophisticated data analytics could include comparing transaction data against staff leave data and identifying purchases made on weekends and public holidays or out of office hours. We expect that councils with large numbers of credit cards and high spends would have more sophisticated analytics given the increased risk.

Figure 3B details the number of credit cards used across the audited councils and the total spend on cards, according to data provided by the audited councils and their banks.

Figure 3B

Number of credit cards in use at the audited councils and total spend in data provided during the audit

|

Council |

Cards used during testing period |

Total spend on cards |

|---|---|---|

|

Shepparton |

24 |

$633 300 |

|

Strathbogie |

27 |

$228 700 |

|

Wellington |

106 |

$1 000 000 |

|

Wyndham |

256 |

$4 900 000 |

Source: VAGO, based on council data.

At the time of the audit, the councils did not have formalised processes to conduct data analytics over credit card transactions. However, both Wyndham and Shepparton have started projects to use data analytics to report on fraud and corruption risks over credit cards. Figure 3C outlines specific findings for each council.

Figure 3C

Use of data analytics by audited councils

|

Council |

Findings |

|---|---|

|

Shepparton |

Shepparton has the lowest number of cards in circulation compared with the other councils and does not conduct data analytics over transactions. Instead, the finance team conducts 'spot checks' on a number of transactions each month. The team applies a risk-based strategy with more scrutiny applied to transactions from staff to whom the council has recently allocated a credit card. Shepparton could consider formalising this process by documenting checks conducted and undertaking data analytics over all transaction data to identify specific fraud and corruption risks. In early 2019, Shepparton began a project to develop a new performance report on credit card transactions that will go to the executive leadership team each year. This is a positive step towards increased reporting and trend analysis over credit card transactions. |

|

Strathbogie |

Strathbogie does not conduct data analytics over transactions. A finance officer undertakes ad hoc reviews over transaction records and refers potential anomalies to managers. However, this is not a formal process of consistent trend analysis and reporting. |

|

Wellington |

Wellington does not conduct data analytics over transactions. A manager reviews at least 10 per cent of total card transactions each month, checking that cardholders have followed processes, that an employee has attached the correct receipt, and that the item they purchased was for a business use. |

|

Wyndham |

At the time of our audit, Wyndham had already begun a project to analyse credit card transaction data and report to the chief financial officer (CFO) on:

Wyndham has now formalised monthly exception reporting using data analytics. The reports are provided to the CFO for review and action as necessary. If Wyndham can report consistently, this will be a positive addition to their fraud and corruption control framework. |

Source: VAGO, based on council data.

Credit card testing

To test the effectiveness of credit card controls, we examined a selection of purchases made on council credit purchasing cards to confirm that they were for official council business and in accordance with council policies and procedures. Appendix B outlines our testing methodology.

Control 1: adequate receipts and supporting documentation

Council staff must be able to provide adequate documentation to prove that each transaction was for genuine council business.

We identified examples where the documentation supporting transactions was inadequate, as detailed in Figure 3D. These instances also demonstrate insufficient scrutiny by approvers who ultimately approved these transactions.

Figure 3D

Examples of inadequate supporting documentation

|

Council |

Audit findings |

|---|---|

|

Shepparton |

|

|

Strathbogie |

It should be noted that all these examples are attributable to one former manager. We discuss this further in Section 4.4. |

|

Wellington |

|

|

Wyndham |

|

Source: VAGO, based on council data.

Although each of these transactions represents a differing level of risk of fraudulent spend, all demonstrate the need for council controls to ensure staff support spends with adequate documentation.

In response to our findings, Strathbogie advised that it had reviewed its policy to address issues, with the policy now:

- describing the circumstances in which entertainment expenses can be incurred

- prohibiting the purchase of alcohol without written approval from the CEO

- outlining the revised internal controls and auditing that apply, including the requirement to identify the business purpose for the expense.

Wyndham has acknowledged the deficiencies in its documentation. It has also noted that there were review and assurance processes that existed in relation to these transactions, such as travel registers and purchased goods being sighted, that were not formally captured within its established credit card transaction system. Wyndham advises that it has taken steps to ensure greater compliance with existing controls.

Control 2: only the allocated cardholder may use the credit card

Banks that issue credit cards require in their terms of use that only the allocated cardholder use the card. Council staff using a credit card that the bank has not allocated to them is a fraud and corruption risk, as it:

- misrepresents who is making a purchase

- increases the risk that a bank may not refund illegitimate spends due to lax controls over card security and the failure to abide by the bank's terms of use

- may limit a council's ability to accurately monitor an individual cardholder's expenditure

- is a way that a council officer can bypass controls, including approval processes, to commit fraud, as there is no way to ensure that the card approver is not also the person who incurred the expense

- results in cardholders submitting and confirming statements that include transactions for which they are not responsible.

We matched the council's transaction data with its staff leave data and identified transactions at Shepparton, Wellington and Wyndham that occurred while the allocated cardholder was on leave. These transactions range from purchases made for accommodation, food and beverage to tourist attractions. Although the audited councils advise that all transactions were for official council business, they could not always confirm exactly who made the transaction, significantly weakening this fraud and corruption control. We have outlined these transactions in Appendix C.

Shepparton implemented card management software in 2019 that allows the council to suspend credit cards while cardholders are on leave. The council now also requires all cardholders to sign a credit card acknowledgement form that states the cardholder must be present for all purchases.

Wyndham notes that it is satisfied through other controls such as sighting the goods, multiple staff being present for transactions listed, and activities being promoted or reported on, that a business purpose existed and none of the transactions were fraudulent in nature.

We also identified two transactions at Wyndham, described in Figure 3E, which occurred after a cardholder's termination date. These transactions represent:

- an employee using a card not allocated to them

- a failure of the council to cancel a card when a staff member left the council

- the likely purchase and approval of a transaction by the same staff member.

Figure 3E

Credit card transactions after employee termination date

|

At Wyndham, two transactions occurred five days after a staff member (the cardholder) had left the council, for amounts of $564.87 at a supermarket and $23.90 at a hardware store. The council informed us that both transactions were for supplies for a staff Christmas party. The manager of the staff member stated that they collected the card from the departing staff member and 'As the credit card was in my possession I would therefore have authorised the use of the card and may have even been the one that actually used the card. I suspect this is the case as it is very unlikely I would have provided the PIN to another person to use—but I also don't specifically recall whether this was the case. At this stage this was the only credit card available for the [business unit] to use as it was prior to a card being issued to me'. |

Source: VAGO, based on Wyndham data.

This case study suggests that the person who likely made the transactions on an allocated cardholder's card also approved the transactions. We discuss this control weakness and the need for segregation of duties further in Figure 3F.