Local Government Insurance Risks

Overview

Victoria’s 79 councils carry a range of risks across their significant assets and operations—at 30 June 2017, they controlled $91.2 billion of community assets, employed over 30 000 people and received $10.5 billion in revenue against $8.1 billion of expenditure. Councils need to identify, mitigate and, where appropriate, transfer any risks associated with their assets and operations. Councils purchase insurance as a form of risk transfer against a range of unforeseen losses.

This audit examined whether councils have been prudently managing insurable risks and procuring insurance that represents value for money. This audit assessed councils’ risk assessment policies and practices, including risk identification, risk mitigation and evaluation of insurable risks. The audit also assessed whether councils’ insurance policies adequately cover their insurable risks.

We audited seven councils, to provide comparability (four metropolitan councils and three regional or rural councils), contrast (metropolitan versus regional) and varying insurance histories.

The audited councils were:

- City of Ballarat

- Benalla Rural City Council

- Glen Eira City Council

- Kingston City Council

- Pyrenees Shire Council

- City of Stonnington

- Yarra City Council.

The audit also included the Municipal Association of Victoria (MAV) as the provider of Liability Mutual Insurance, and the Department of Environment, Land, Water and Planning (DELWP) as the lead agency supporting local government.

We made 17 recommendations—two for DELWP, five for all Victorian councils, one for Yarra City Council, one for City of Stonnington and eight for MAV.

Transmittal letter

Ordered to be published

VICTORIAN GOVERNMENT PRINTER July 2018

PP No 422, Session 2014–18

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Local Government Insurance Risks.

Yours faithfully

Andrew Greaves

Auditor-General

25 July 2018

Acronyms and abbreviations

| AFSL | Australian Financial Services Licence |

| APRA | Australian Prudential Regulation Authority |

| Ballarat | City of Ballarat |

| Benalla | Benalla Rural City Council |

| DELWP | Department of Environment, Land, Water and Planning |

| Glen Eira | Glen Eira City Council |

| Insurance Board | MAV Insurance Board |

| ISO 31000 | ISO 31000 Risk management |

| Kingston | Kingston City Council |

| LG Act | Local Government Act 1989 |

| LGV | Local Government Victoria |

| LLV | loss limit validation |

| LMI | Liability Mutual Insurance |

| MA Act | Municipal Association Act 1907 |

| MAV | Municipal Association of Victoria |

| PL/PI | insurance public liability/professional indemnity insurance |

| Pyrenees | Pyrenees Shire Council |

| RM Act | Road Management Act 2004 |

| RMP | road management plan |

| Stonnington | City of Stonnington |

| VAGO | Victorian Auditor-General's Office |

| VGRMF | Victorian Government Risk Management Framework |

| VMIA | Victorian Managed Insurance Authority |

| Yarra | Yarra City Council |

Audit overview

As part of their service delivery role, Victoria's councils carry a range of risks across their significant assets and operations. At 30 June 2017, Victoria's councils controlled $91.2 billion of community assets, employed over 30 000 people and received $10.5 billion in revenue against $8.1 billion of expenditure across their programs and infrastructure spend.

Councils need to identify, mitigate and, where appropriate, transfer any risks associated with their assets and operations. Councils purchase insurance as a form of risk transfer against a range of unforeseen losses.

|

Insurable risk—a risk that can cause a financial loss and for which insurance products are available. In the context of the audit, insurable risks may cause financial losses to council rather than a third party. |

Some key insurable risks that Victorian councils procure insurance for include:

- public liability insurance—covers holders when their negligence led to someone incurring a loss

- professional indemnity insurance—protects holders from claims when their professional advice led to loss

- property insurance—insures council assets against damage and loss.

The insurance that a council purchases does not just protect individual council members and staff, it also protects its community and the breadth of vital services they rely on. So, while the cost to a council of purchasing insurance represents only a very small part of their expenses, it is a product that bears far greater significance—as any council that has been unfortunate enough to experience a catastrophic event would attest to.

Our audit assessed whether councils are prudently managing their insurable risks by understanding and mitigating the risks they face and obtaining adequate and cost‑effective insurance coverage. We focused on councils' public liability/professional indemnity insurance (PL/PI insurance) and property insurance because they are councils' two largest insurance purchases. We also examined cyber insurance as an example of how councils respond to emerging insurable risks.

Councils purchase most of their insurance from the commercial sector, with the major exception being PL/PI insurance.

|

A mutual insurance scheme is one that the participating members of the scheme join. The scheme retains any profit it generates or distributes it to its members as a dividend. |

The Municipal Association of Victoria (MAV) manages Liability Mutual Insurance (LMI). In 1993, the government instructed MAV to offer councils PL/PI insurance through a mutual insurance scheme following the withdrawal of commercial insurers from the market. MAV initially named the scheme Civic Mutual Plus and later rebranded it LMI. The Minister for Local Government also decided in 1993 to enable councils to join LMI without tendering. Councils can choose to insure through LMI or commercial insurers where available, however, most councils have continued to obtain their PL/PI insurance from MAV through LMI. In 2017–18, 68 of Victoria's 79 councils obtained their PL/PI insurance through LMI.

Our audit included seven councils, selected to provide a mix of metropolitan and regional councils that have varied risk and insurance management histories. These audited councils were:

- City of Ballarat (Ballarat)

- Benalla Rural City Council (Benalla)

- Glen Eira City Council (Glen Eira)

- Kingston City Council (Kingston)

- Pyrenees Shire Council (Pyrenees)

- City of Stonnington (Stonnington)

- Yarra City Council (Yarra).

|

Reinsurance—insurance purchased by an insurance company to pass on financial risk to other companies. Contribution—the price of membership in LMI. It is broadly comparable to the premium paid to purchase insurance from a commercial insurer. This report will refer to the contribution as a 'premium' to enable comparability with commercial insurers' premiums. |

We audited how MAV manages LMI to deliver a value-for-money product to the sector—including its approach to premium pricing, financial sustainability, governance structures and management of the private entity that provides services and arranges reinsurance for LMI.

We also audited the Department of Environment, Land, Water and Planning (DELWP) because it oversees the Local Government Act 1989 (LG Act) and has a role in improving local government performance.

Conclusion

Councils are not always giving the purchase of their insurance the thorough consideration it deserves. At best, this means they may be paying more than they need to and, at worst, if there are gaps in their coverage it may significantly impact their operations should an undesirable event occur.

In the examples of better practice we saw in managing risk and purchasing insurance, councils had a far better understanding of their risk and insurance profile and achieved lower premiums. They did this systematically by:

- more fully assessing their risks

- appropriately determining those that require insurance and the extent of coverage needed

- competitively tendering for insurance broking, services and insurance.

These approaches enable councils, and their community, to feel more confident about their ability to deal with routine claims as well as the consequences of any major event.

LMI has delivered significant value to the sector over 25 years, providing insurance to its members with comprehensive reinsurance arrangements. Its ability to purchase reinsurance for a larger pool is a key advantage of the scheme, especially during times of market failure. Most Victorian councils roll over their insurance year on year and rely on LMI to be available for their PL/PI insurance.

However, the current insurance environment is impacting LMI's sustainability due to the loss of members and its practice of discounting premiums to retain members. MAV advised that higher-than-anticipated claim levels is another factor impacting its financial position. LMI's financial position increases the risk it may need to call on members to make additional financial contributions in future—a possibility not clearly understood by LMI members.

Other aspects such as inflexible administration costs, lack of competitive tendering for its broking and service provider, and MAV's conflict of interest in managing the LMI's service provider represent missed opportunities to more effectively and cost-efficiently manage LMI.

Findings

Insurable risk management

Councils should have robust risk management policies and implement them effectively to manage the multitude of insurable risks they face across their business. We found that the audited councils have developed adequate risk management policies. However, councils are not sufficiently monitoring the implementation of these policies to ensure they effectively mitigate the identified risks.

Risk management policies and guidance

All audited councils have risk policies that are based on the relevant international standard—ISO 31000 Risk management (ISO 31000)—and they review their risk policies on a reasonable, periodic basis.

However, most of the audited councils have not retained sufficient evidence to demonstrate how they determined their risk policy settings. Figure A shows the limited amount of information councils have retained in developing their current risk policies.

Figure A

Evidence retained by councils used in developing their risk policies

|

Council |

Analytical reports |

Data analysis |

Benchmarking |

Internal consultation |

Approval |

|---|---|---|---|---|---|

|

Ballarat |

✔ |

✘ |

✘ |

✔ |

✔ |

|

Benalla |

✔ |

✘ |

✘ |

✘ |

✔ |

|

Glen Eira |

✘ |

✘ |

✘ |

✘ |

✔ |

|

Kingston |

✘ |

✘ |

✘ |

✘ |

✔ |

|

Pyrenees |

✘ |

✘ |

✘ |

✔ |

✔ |

|

Stonnington |

✔ |

✘ |

✘ |

✔ |

✔ |

|

Yarra |

✔ |

✘ |

✘ |

✘ |

✔ |

Note: This table has been based on the evidence used to create the policies that were currently in effect during the audit.

Source: VAGO based on evidence provided by councils.

Based on the available evidence, it is not clear how the councils decided on their acceptable risk levels, and there is limited evidence that they tested that these are appropriate or relevant thresholds. Lack of evidence and retention of corporate knowledge about existing risk policies limits councils' ability to review and improve their decision-making.

There is a general lack of effective and consistent guidance to the sector on how to interpret ISO 31000 for the Victorian local government context. This contrasts with the Victorian Government Risk Management Framework (VGRMF), which provides guidance and template documents to state entities. Development of risk management guidance for the local government sector would be especially valuable for smaller councils that may not have the resources or experience to deal with complex risk management issues.

Risk identification and management practices

The audited councils use varying processes to identify their risks. In most cases, a risk manager leads an annual review, and councils may also identify risks on an ad hoc basis. As a key tool to manage risk, a council will develop a risk register, which records its risks including their severity, likelihood and the risk controls the council plans to implement.

|

Risk controls—activities undertaken by councils to reduce risk levels. |

We found that four of the audited councils' risk registers do not effectively assign responsibility for risk and/or monitor whether they are implementing identified risk controls. As a result, these councils have not been effectively managing their insurable risks, however, they are now aware of this issue and are taking steps to address the deficiencies.

A council's road management plan (RMP) is the key document it uses to reduce its PL/PI risk arising from its roads and footpaths—the most common cause of PL/PI claims for most councils. We found that all councils had an RMP. However, five of the audited councils are not adequately monitoring their compliance with the standards in their RMPs. If a council does not meet the standards set in its RMP, the plan is unlikely to provide the intended protection against claims.

Councils' understanding of their insurable risks

The majority of councils that procure their PL/PI insurance through LMI have a limited understanding of their PL/PI risk exposure. Instead they depend on MAV to determine sufficient and appropriate levels of cover.

A loss limit validation (LLV) analysis is an industry standard practice a council can use to estimate its insurable risks, including PL/PI risk. A council's broker can undertake this analysis on its behalf, however, engaging an independent third party instead would minimise any conflict of interest concerns. Of the audited councils, we found only one had commissioned an LLV analysis, and had done so through its broker. Procuring insurance without commissioning an independent LLV could result in councils being under- or over-insured.

MAV commissioned an LLV analysis for LMI in 2015 and used it to determine the level of insurance cover the scheme should offer members and to set the amount of reinsurance the scheme needs overall. The analysis did not determine each councils' individual exposure, instead it focused on the highest risks faced by any LMI member. MAV has advised councils of the level of cover it believes councils should hold, which councils' ongoing membership in the LMI indicates they have tacitly accepted.

Councils also need to ensure that they have effectively insured their assets against loss. The audited councils maintain registers of their assets, revalue them regularly, and provide the list to their insurers annually. However, not all audited councils had a robust understanding of their property insurance or held complete copies of the contracts used to insure their assets. These councils cannot have complete assurance of the level of cover provided to protect their assets.

Value for money

Councils need to assess whether they are achieving value for money when buying insurance. This includes not only getting the lowest possible premiums but also ensuring sufficient, appropriate and continuous coverage, maintaining a long-term relationship with their insurer, and evaluating additional services such as risk advice available through the contract. The Victorian Local Government Best Practice Procurement Guidelines 2013 provides guidance to councils on conducting tenders that comply with the LG Act.

Tendering for insurance

One of the ways in which councils can achieve value for money is by open and transparent tendering. However, councils have not undertaken effective tendering processes for insurance in the past.

|

Tender agent—a company that runs a tender on behalf of a council. |

The large councils we audited have historically appointed the same tender agent to run their tender process, which has recommended similar insurance options year on year. We found that the councils had only limited oversight of the process run on their behalf.

The smaller audited councils have not often had to run a tender in accordance with the LG Act, due to their insurance policies costing less than $150 000 each. Instead these councils receive a 'renewal report' through which they authorise the same company to be their insurance broker every year—that company then arranges insurance for the council. Although this provides for ease of administration, the lack of competition means the councils could not be assured they have achieved the best outcome.

We found that in 'rolling over' their existing insurance arrangements, councils could not demonstrate:

- how they decided on their purchasing approach

- how they evaluated whether their tender agent had effectively managed its declared conflict of interest, given its associated entities respond to the tender as insurance broker and property insurer

- how the process delivered value for money.

Over the past four years, increasing numbers of Victorian councils have decided to run transparent tenders to appoint an insurance broker to arrange their insurance. We have reviewed the tenders run by audited councils and are satisfied that they deliver a greater level of information to councils and transparency of decision-making. The audited councils that have tendered demonstrated a better understanding of their insurance arrangements including the quality and extent of their cover, additional services provided by brokers and/or insurers and the comparable prices on offer. Undertaking such an exercise provided more comfort to these councils on whether they are achieving value for money from their insurance arrangements.

We found that generally councils that undertook an open and transparent tender obtained premium reductions for their property and PL/PI insurance, resulting in better value for money outcomes. For example, four of the audited councils obtained property insurance premiums that were 30 to 69 per cent lower than their previous premium by running an open tender process for their insurance.

PL/PI insurance and LMI's value-for-money proposition

MAV's LMI has guaranteed the availability of insurance to all Victorian councils, and its collective purchase power aims to smooth premium increases that might arise from large claims. In addition to insurance, LMI has provided a range of services to councils, including risk policy review and compliance, risk advisory services and legal advice.

It is challenging to evaluate whether LMI provides value for money because it has limited direct competitors due to its market dominance over 25 years and its unique characteristics. However, there are several factors that can be considered:

- LMI's insurance coverage provided to councils is significantly higher than that obtained by the audited councils from the commercial market. Although some councils might not require the additional cover, the increased level of cover comes at a minimal cost to each council due toppled nature of the scheme.

- The total value of the claims LMI pays to members relative to the premiums it charges is usually higher than the industry average, which could be an indication that it delivers value for money.

- LMI's administrative expenses are inflexible and not clearly linked to its premium or membership levels, suggesting there are possible savings that could be realised in LMI's administration costs.

- LMI may offer lower pricing to members due to increased competition—councils that tender are frequently offered lower premiums by LMI. However, MAV does not distribute these lower prices evenly to LMI members.

- MAV has never tested whether alternative brokers could provide better terms for its services and reinsurance because it has never tendered for LMI's broker and service provider— of its 2016–17 premium revenue, LMI spent 14 per cent on the service provider's fee and 66 per cent on reinsurance.

The audited councils that have run tenders for their PL/PI insurance have obtained lower premiums and a lower level of cover the councils determined was sufficient based on the information available to them. The practice of councils tendering for their PL/PI insurance and purchasing it from commercial insurers rather than LMI is relatively new, so we cannot determine whether the lower premiums obtained by councils will be sustainable in the long term. Indeed, some evidence from council's 2018–19 insurance purchases indicates the commercial market for local government PL/PI insurance may be changing again.

However, regardless of the state of the insurance market, a council can ensure it is receiving value for money by running an open and transparent tender for its broking and insurance to obtain the best insurance offering in the market.

LMI governance

The Municipal Association Act 1907 (MA Act) requires MAV to manage LMI on behalf of its members and MAV. To do so, it needs a robust and modern governance framework to drive better practice and value for money. However, the current external oversight and governance arrangements could be improved.

|

Net assets—is an insurers' total assets less its total liabilities. |

External oversight of LMI is limited due to the nature of its legal structure, which has not been significantly updated to meet modern governance standards since its inception in 1993. For example, the scheme is not subject to Australian Prudential Regulation Authority (APRA) regulation, is excluded from the Insurance Act 1973, does not have ministerial oversight and, when compared to state and commercial insurers, does not need to comply fully with the external governance applied to either type of entity.

Given the reduced level of external monitoring, LMI's internal governance needs to mitigate risks and provide transparency to its members. There are several areas where MAV can improve its management of LMI:

- Ultimately, the MAV Board is responsible for LMI's performance, however, MAV has not provided evidence of how it incorporates input from LMI members to ensure it manages LMI in their interest. MAV does report annually on LMI's financial performance and has provided some evidence of advising LMI members directly about its performance. Councillors from several LMI members also sit on the MAV Board and MAV Insurance Board (Insurance Board), which the MAV Board appoints to oversee LMI. Historically, all or nearly all councils were members of both MAV and LMI, but this is changing as more councils leave LMI. This increases the risk that the interests of MAV members and LMI members are not comparable.

- MAV has a long-term relationship with—and receives financial benefit through a separate contract with—the private entity it has contracted to provide services to LMI, including arranging its reinsurance purchase. This creates a conflict of interest for MAV in managing LMI's service contract to the best interests of LMI members. Regular, open and transparent tendering of the LMI service contract would help to mitigate this issue.

- LMI's financial situation is under pressure, with a recent history of operating losses and a negative net asset position. Increased competition has exacerbated this situation by impacting LMI's ability to match premiums to councils' individual risk profiles. LMI can request additional funds from its members if necessary, however, it is not clear if councils have sufficient information about the likelihood and financial impact of this occurring.

- MAV's application of LMI's premium pricing policy lacks transparency. When councils tender for their PL/PI insurance, MAV may offer them lower premiums to compete with commercial sector pricing. However, MAV does not offer these prices to all councils, resulting in councils which are 'rolling over' with LMI not achieving the financial benefit other councils have been able to negotiate.Some large councils―which have greater resources to run tenders for their insurance―have received premiums below their risk levels. In 2016–17, 17 of the 19 small councils paid LMI premiums above the amounts their risk levels warranted under LMI's actuarial model, however, we have been unable to assess whether these levels were still below commercial market prices available to small councils. Councils can only assure themselves they have achieved value for money from either LMI or commercial insurers by tendering.

- Total premiums received by LMI in 2016–17 were set below the levels recommended by the actuary, as the Insurance Board determined it could not raise premiums to sufficient levels and remain competitive in the market place. In the latter stages of this audit, MAV advised it is undertaking an analysis to consider LMI's future.

Recommendations

We recommend that the Department of Environment, Land, Water and Planning:

1. work with relevant stakeholders to analyse best practice options for the provision of public liability/professional indemnity insurance to the local government sector, including:

- an analysis of the Liability Mutual Insurance's financial viability and governance structure and use the recommendations from this analysis to inform the ongoing review of the Municipal Association Act 1907 (see Section 3.4)

- a review of the appropriateness of exempting the Liability Mutual Insurance scheme from procurement under the Local Government Act1989 (see Section 3.2)

2. develop guidance on risk management for the local government sector, which may include extending or supplementing the existing Victorian Government Risk Management Framework (see Section 2.2).

We recommend Victorian councils:

3. regularly review and update their risk registers to ensure they:

- effectively assign all risks to relevant business units

- document and date risk control implementation plans

- monitor the implementation and effectiveness of risk controls (see Section 2.3).

4. review their insurable risk profiles and insurance products, identify insurance gaps and evaluate loss limits to ensure they understand their insurable risks and hold sufficient insurance (see Section 2.5)

5. undertake a cost-benefit analysis to evaluate whether tendering for insurance, in line with procurement better practice, would provide better outcomes (see Section 3.2)

6. in consultation with the Municipal Association of Victoria, obtain an understanding of Liability Mutual Insurance's ability to call on its members for funds and assess the impact on their respective council (see Section 3.4)

7. review, evaluate and retain the exact policy details which provide the level of cover, especially where they are participating in a mutual property scheme (see Section 3.2).

We recommend that Yarra City Council:

8. review and evaluate its insurance procurement in 2016–17 and 2017–18 against value-for-money principles, including its documentation of these decisions and processes (see Section 3.2).

We recommend that the City of Stonnington:

9. review and evaluate its insurance procurement in 2017–18 against value-for-money principles and its procurement rules, including its documentation of these decisions and processes (see Section 3.2).

We recommend that the Municipal Association of Victoria:

10. as soon as practicable, undertake an open and transparent tender for Liability Mutual Insurance's service provider, run in accordance with Victoria's best practice procurement guides in effect at that time (see Section 3.4)

11. review the best practice options for the provision of public liability/professional indemnity insurance to the local government sector, including the governance arrangements and legislative framework of Liability Mutual Insurance, incorporating advice from relevant stakeholders including the Department of Environment, Land, Water and Planning, the Department of Treasury and Finance and the Victorian Managed Insurance Authority (see Section 3.4)

12. undertake a strategic review of Liability Mutual Insurance as a going concern, including its capital management plan, pricing policy and risk margin policy (see Section 3.4)

13. undertake an internal cost review of Liability Mutual Insurance in line with management's recommendation to the Municipal Association of Victoria Insurance Board (see Section 3.4)

14. review and evaluate its pricing model for Liability Mutual Insurance to ensure that premium pricing decisions are applied consistently to councils and are supported with robust evidence and documentation (see Section 3.3)

15. review and, if necessary, amend Liability Mutual Insurance's deed of establishment to enable it to participate in tenders (see Section 3.4)

16. review the Liability Mutual Insurance scheme's governance to ensure the Municipal Association of Victoria Insurance Board and the scheme's management are accountable to members (see Section 3.4)

17. review the Municipal Association of Victoria Insurance Board membership to ensure it meets tenure and expertise better practice standards and adopt a policy for board composition to ensure tenure and composition of the board meet better practice standards (see Section 3.4).

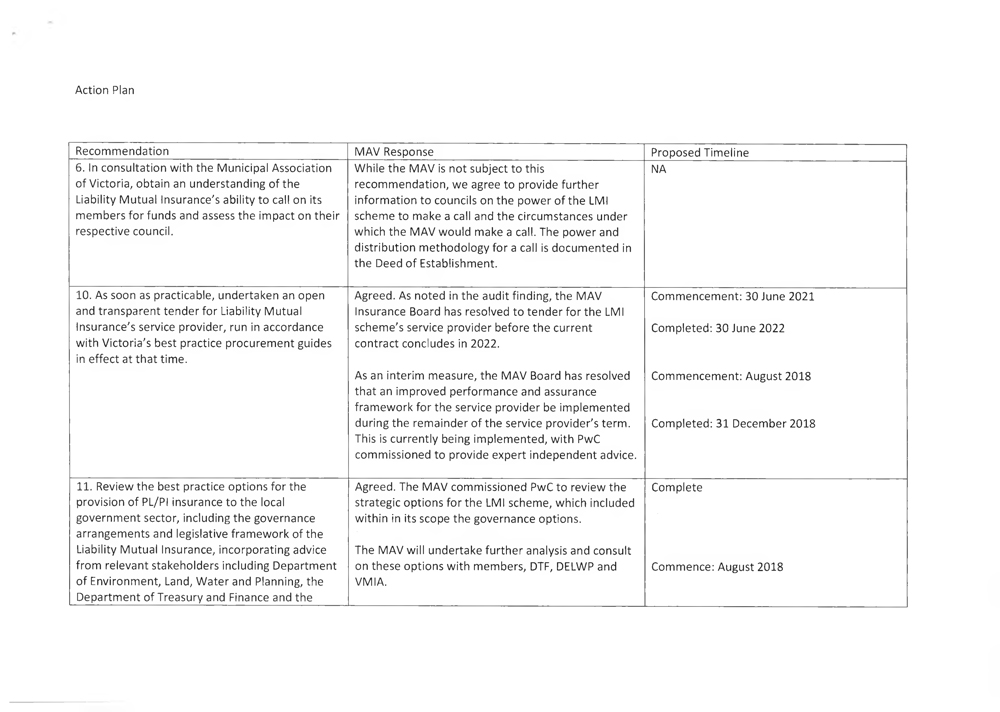

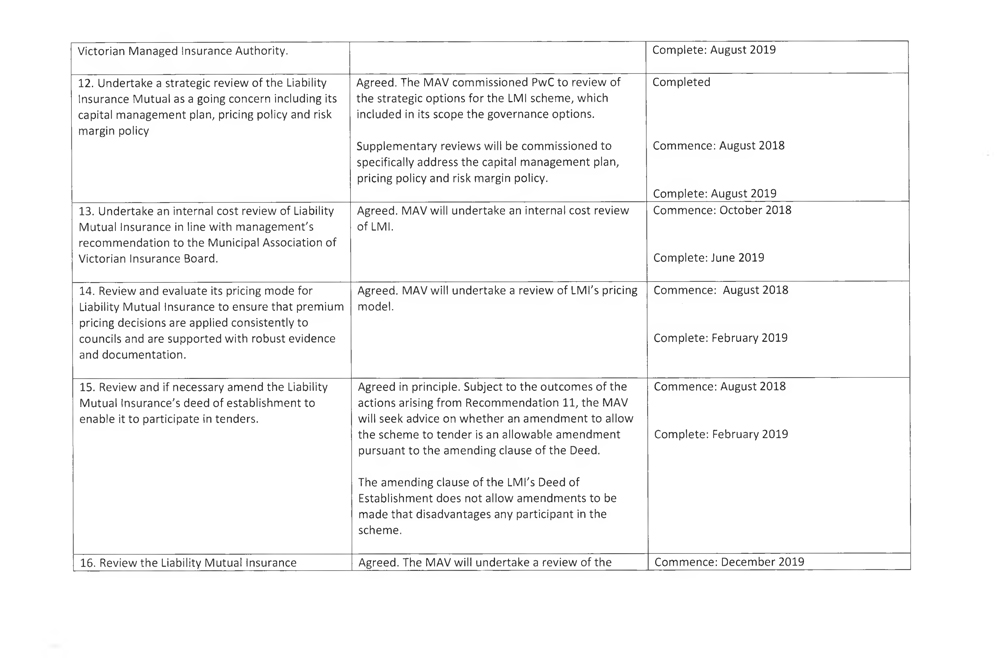

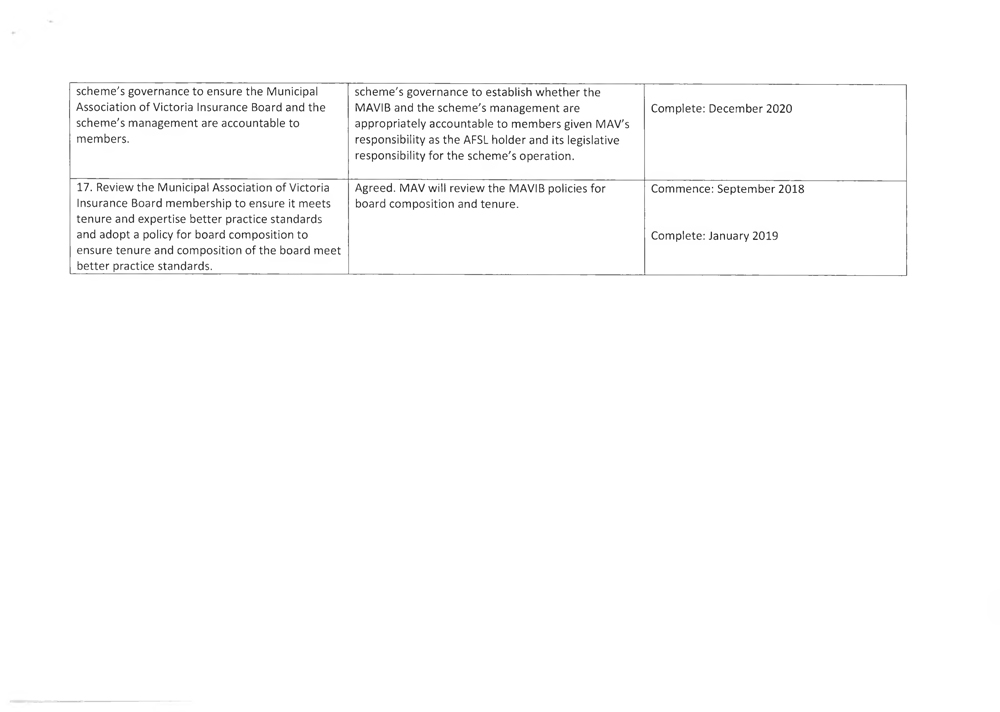

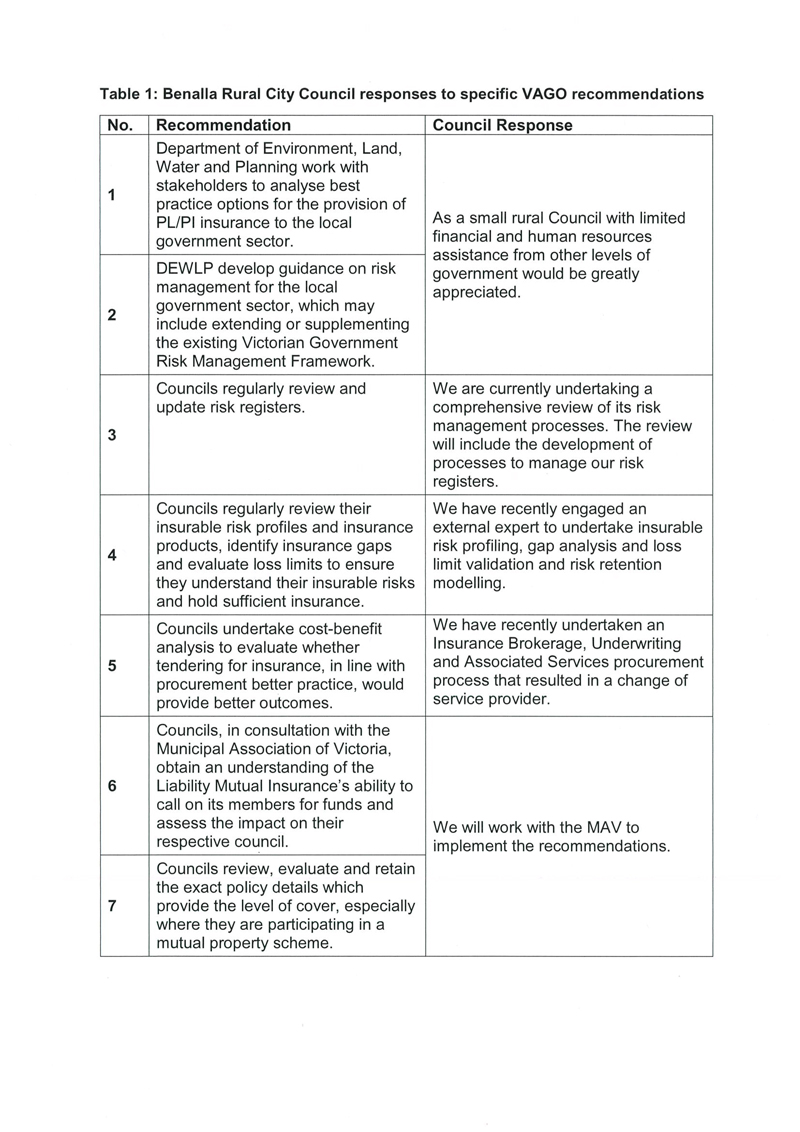

Responses to recommendations

We have consulted with DELWP, MAV, Ballarat, Benalla, Glen Eira, Kingston, Pyrenees, Stonnington and Yarra, and we considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet.

The following is a summary of those responses. The full responses are included in Appendix A.

DELWP supports the audit and has undertaken to implement the recommendations by June 2019 in line with the review of the MA Act.

MAV has noted its concerns with the conclusions of the audit, but has undertaken to implement the recommendations.

Ballarat, Benalla, Glen Eira, Kingston, Pyrenees and Yarra support the audit and have undertaken to implement the recommendations directed to Victorian councils. Yarra has also undertaken to review its insurance procurement in line with recommendation 8.

Stonnington supports the broad conclusions of the audit, but does not agree with the report's presentation of its insurance procurement for 2017−18. Stonnington has accepted the recommendations of the audit and intends to review its insurance procurement.

1 Audit context

There are 79 councils in Victoria, including 31 metropolitan and 48 rural and regional councils. At 30 June 2017, Victorian councils controlled $91.2 billion of community assets, such as roads, bridges, drains, town halls, libraries, recreation facilities, parks and gardens. Collectively, they received $10.5 billion in revenue against $8.1 billion worth of expenditure on programs and infrastructure, as shown in Figure 1A. Local councils in Victoria employ over 30 000 people.

Figure 1A

Victorian local government profile

Source: VAGO, Results of 2016–17 Audits: Local Government.

Victoria's councils carry a range of risks across their assets and operations and need to:

- identify relevant risks

- have strategies to avoid or mitigate these risks

- transfer insurable risks to insurers where appropriate and cost effective.

Risk management activities inform councils' decision-making and practices by leading them to prevent or minimise potential harm.

Insurable risks

Insurance is a mechanism through which councils can transfer their risks of financial losses to an insurer that agrees to cover their losses—up to a predefined limit—in return for a regular (mostly annual) payment known as a premium.

Councils purchase insurance as a form of protection against a range of unforeseen losses. Figure 1B identifies the key insurable risks facing councils and their associated insurance.

Figure 1B

Examples of insurable risks faced by Victorian councils

|

Insurable risks |

Insurance description |

|---|---|

|

Public liability |

Public liability insurance covers holders against findings where their negligence led to someone incurring a loss. |

|

Professional indemnity |

Professional indemnity insurance protects holders from claims when their professional advice led to loss. |

|

Property |

Insures council assets against damage and loss. |

|

Director and officer |

Insures councillors and council staff against personal liability arising from their work with councils. |

|

Cyber |

Insures councils for financial loss arising from cyber-attack. |

|

Various operational risks |

A suite of insurance products including fleet, environment and fidelity insurance to protect councils against loss across their activities and programs. |

Source: VAGO.

|

Insurable risk profile—the specific insurable risks that affect a council. |

Each council has a unique insurable risk profile, depending on their assets, population and exposure to different risks. Insurable risks vary with council size and between urban or rural councils. However, some common exposures that affect many Victorian councils including PL/PI exposure arise from road and footpath management, bushfire risks and planning decisions.

1.1 Liability Mutual Insurance

Councils have experienced fluctuations in the insurance market since the 1980s, in line with, and affected by, changes in the international financial and insurance markets.

In 1993, the commercial insurance market withdrew from the local government sector following the collapse of a large, international insurance firm. In response, the government amended the MA Act to instruct MAV to establish a mutual liability scheme to ensure councils had access to PL/PI insurance. The government also decided to enable councils to obtain their PL/PI insurance from MAV's mutual insurance scheme without having to comply with the procurement requirements of the LG Act.

Although MAV itself is the primary insurer, it passes on most of its risk to commercial reinsurers through purchasing reinsurance. The pooled nature of LMI increases its ability to secure insurance from the commercial market at times when it has withdrawn from providing insurance to individual councils.

MAV initially named the scheme Civic Mutual Plus and later rebranded it as LMI. Since 1993, nearly all councils have continued to obtain their PL/PI from LMI.

However, over the past four to five years, some councils have obtained insurance from commercial insurers rather than LMI. Figure 1C shows the proportion of councils that insured their PL/PI risk with LMI over this period.

Figure 1C

Victorian councils that purchased PL/PI insurance through LMI

|

Financial year |

Councils with PL/PI insurance through MAV |

Per cent |

|---|---|---|

|

2012–13 |

79 |

100 |

|

2013–14 |

79 |

100 |

|

2014–15 |

77 |

97 |

|

2015–16 |

73 |

92 |

|

2016–17 |

69 |

87 |

|

2017–18 |

68 |

86 |

Source: VAGO based on LMI data.

How the mutual scheme model works

In a mutual scheme, councils join as members and the scheme sets premiums for each council. These premiums can vary depending on their deductible level, claims history, and the scheme's pricing policy.

The scheme self-insures from its funds against claims up to a set limit and purchases reinsurance to cover claims above that limit. If a claim exceeded the reinsurance limit, the council would be liable for any additional costs—this has not happened in the history of LMI. This is comparable with commercial insurers' terms and conditions, from whom audited councils have obtained lower cover limits.

|

Deductible—the portion of an insurance claim the council pays per claim. |

If the scheme has retained funds at the end of the year, it decides whether to return these funds to members or reinvest in the scheme. If, however, the scheme has insufficient funds then it can call on its members to make additional premiums. As noted, the scheme has not made a call on members. MAV advised us that, in fact, the scheme has returned funds to members on a few occasions, the last being 2003.

Figure 1D maps key processes for mutual insurance schemes.

Figure 1D

Process map of a mutual insurance scheme

Source: VAGO.

When a council elects to purchase from the insurance market they enter into an individual contract with an insurance company. A commercial insurer's contract is like an LMI contract, the key difference being that if a commercial insurer has insufficient funds it will be unable to pay claims whereas LMI can call on additional funds from its members.

Victoria's councils currently obtain their PL/PI insurance from either LMI or commercial insurers. Figure 1E contrasts key differences between LMI and a commercial insurer.

Figure 1E

Key differences between LMI and a commercial insurer

|

Topic |

LMI |

Commercial insurer |

|---|---|---|

|

Risk profile |

Reinsurers consider the group's risk profile, which disperses risk among the members to smooth pricing. |

The insurer evaluates a council's risk profile based on their individual claims history. |

|

Financial backing |

LMI can call on members for additional funds if required. |

The insurer must pay claims from its available funds. If it has insufficient funds it will be unable to honour the claims. |

|

Level of insurance |

All members receive the same level of cover. |

Councils can negotiate their level of cover with their insurer. |

|

Compulsory insurance |

LMI must offer insurance to a council that requests it. |

An insurer can refuse to offer insurance to a high‑risk council. |

Source: VAGO.

Councils in other states also participate in mutual schemes like LMI, albeit with different legislative settings. The Local Government Association of South Australia commissioned a review of its version of the mutual scheme in 2016. Unlike LMI, the South Australian scheme is a discretionary trust and managed under a joint venture with the private entity—LMI is established by MAV and it contracts the private entity to provide service to LMI. The review found that while a mutual scheme was an effective model for local government, the LGA's governance structure did not meet modern standards. The report also recommended LGA introduce market testing in the near future—rather than immediately—to improve performance without causing significant disruption to the sector.

1.2 Relevant legislation and policy

A range of legislation and policies influence and support councils' management of their risk and insurance practices. This section details the key documents, and Appendix B includes additional relevant legislation and policy.

Local Government Act 1989

The LG Act is the principal legislation that governs Victoria's councils. Section 76 requires councils to hold insurance that indemnifies, and keeps indemnified, against all actions or claims:

- each councillor

- each member of a council committee

- each member of council staff

- any person exercising any function or power on behalf of a council.

The insurance must cover them against claims lodged during and after their term of office or employment.

Section 76A requires councils to hold:

- public liability insurance for an amount of at least $30 million

- professional liability insurance for an amount of at least $5 million.

Section 186 and an associated Order in Council—a government directive—requires councils to tender any contract for goods and services valued at over $150 000.

DELWP has reviewed the LG Act through 2017 and 2018. The Local Government Bill 2018 was introduced to Parliament on 23 May 2018 which, if passed in its current form, will remove councils' requirement to hold certain types of insurance.

Municipal Association Act 1907

The MA Act defines MAV's purpose and function. Several sections of the Act are relevant to MAV's delivery of insurance to councils:

- Section 10C—MAV may, in relation to insurance, undertake all functions normally undertaken by a financial institution including arranging insurance and receiving commissions for arranging insurance.

- Section 10CB—MAV must establish a mutual liability insurance scheme and manage it to the benefit of MAV and its members.

- Section 10CC—MAV may set the conditions under which it manages the mutual scheme.

DELWP is currently reviewing the MA Act. DELWP has considered MAV's insurance functions as part of the new legislation's development.

ISO 31000 Risk management

ISO 31000 is an international standard that provides principles and guidelines for organisational risk management. Any organisation can use ISO 31000 as a basis for risk management, and it is applicable to councils.

In February 2018, the International Organization for Standardization updated ISO 31000 and renamed it ISO 31000:2018. However, we evaluated the audited councils' policies against the 2009 version of ISO 31000 as this was the version in effect at the time councils last reviewed their risk policies. The 2018 version includes two supporting standards providing additional guidance or risk management:

- IEC 31010—provides guidance on the selection and application of risk assessment techniques

- ISO Guide 73—defines generic terms related to risk management.

1.3 Roles and responsibilities

Councils assess their risks and ensure they hold adequate insurance. In addition to councils, there are state entities and commercial companies that play a role—providing insurance, advice and policy guidance.

Councils

Communities elect a council to provide leadership for the effective governance of their municipal district. Sections 3C, 3D and 3E of the LG Act define the roles of council, including ensuring:

- that resources are used efficiently and effectively and services are provided in accordance with best-value principles

- transparency and accountability in council decision-making

- maintaining the viability of the council by ensuring it manages its resources in a responsible and accountable manner.

In the context of this audit, the LG Act requires councils to evaluate risks and procure insurance to ensure they are protecting their assets and providing continuity of service.

Procurement practices in local councils

Councils are subject to procurement rules under section 186 of the LG Act for any purchase of goods and services over $150 000 and capital works over $200 000. Councils must tender for any insurance product that exceeds this threshold, except for the exempted LMI.

Councils should be seeking value for money in all their purchases, however, this does not mean councils must purchase the product with the lowest price. Section 186(4) of the LG Act notes that a council does not have to accept the lowest tender. The Victorian Local Government Best Practice Procurement Guidelines 2013, developed by the the former Department of Planning and Community Development, outlines that procurement should deliver value for money by considering the following factors:

- advancing the council's priorities

- fitness for purpose

- quality

- service and support

- whole-of-life costs and transaction costs associated with acquiring, using, holding, maintaining and disposing of goods, services or works.

The guidelines further state that councils' procurement should be open and fair so that potential suppliers and the public have confidence in the outcome.

Municipal Association of Victoria

Councils established MAV in 1879 to provide them with support. The state government passed the MA Act in 1907 to enable it to offer some insurance products to councils, and an amendment in 1967 clarified and expanded MAV's ability to provide insurance to councils.

MAV established MAV Insurance as a section within the organisation to manage the scheme. Figure 1F describes MAV's structure.

Figure 1F

MAV's organisational structure

Source: VAGO based on MAV Annual Report 2017.

As part of this approach, the MAV Board appointed the Insurance Board to oversee the operations of MAV Insurance and LMI. MAV Insurance reports annually on its performance in the MAV annual report.

Victorian and Tasmanian councils and some other entities such as water authorities can become members of LMI. The scheme offsets some of its risks by holding reinsurance, currently valued at up to $600 million. MAV also offers commercial crime, community group and WorkCover insurance to local councils.

MAV's 2016–17 annual report describes the aim of its insurance work to:

'ensure members have the widest insurance cover on all activities undertaken by local government, and that the insurance limits reflect the inherent risks attached to council operations while offering the most competitive premiums in the insurance market.'

Department of Environment, Land, Water and Planning

DELWP manages Victoria's planning, local government, environment, energy, suburban development, forests, emergency management, climate change and water functions.

Local Government Victoria (LGV) is a division of DELWP whose role is to work in partnership with the sector to improve performance. It provides policy advice and oversees legislation supporting local government. LGV is the administrator of the LG Act, so it has a role to support councils in complying with the LG Act's insurance and procurement requirements and to provide advice to the Minister for Local Government.

Victorian Managed Insurance Authority

The Victorian Managed Insurance Authority (VMIA) is the Victorian state insurer and it advises and insures more than 4 300 clients including Victorian Government departments, statutory authorities and agencies, as well as hospitals, tertiary institutions, health centres, community service organisations, national parks, museums and cemetery trusts. VMIA also insures infrastructure such as state roads, rail and bridges. VMIA does not currently insure the Victorian local government sector, except when they act as committees of management over Crown land on behalf of DELWP.

Insurance/reinsurance companies and brokers

Insurance companies provide insurance policies to clients, including councils, thereby accepting risk from those organisations in exchange for an annual premium.

Reinsurance companies provide insurance policies to insurance companies—they are essentially insurance companies for insurance companies and operate to disperse the risk across multiple companies.

Insurance brokers are service companies that councils can engage to arrange insurance on their behalf. It is common practice for councils to engage an insurance broker due to the complexity of the insurance market. Brokers may arrange for more than one insurance company to hold a council's policies, which spreads the risk across multiple companies.

1.4 Past reviews and inquiries

VAGO has tabled two reports relevant to local government insurable risks—Effectiveness of Support for Local Government in 2015 and Managing Risk Across the Public Sector: Toward Good Practice in 2007.

Effectiveness of Support for Local Government (2015)

In 2015, VAGO released its report Effectiveness of Support for Local Government. The audit found that since MAV established the original management agreement for the provision of insurance in July 1993, no subsequent agreements had been subject to a competitive tender process.

The report recommended that MAV review its procurement policies to ensure that they comply with better practice standards. The report also recommended that DELWP review MAV's functions, roles and responsibilities and routinely monitor MAV's compliance with the MA Act.

Follow up audit on Effectiveness of Support for Local Government (2017)

The follow up audit reviewed MAV and LGV's responses to the recommendations in the 2015 audit. We found that MAV had responded by reviewing many of its internal governance documentation and performance management practices. LGV is currently conducting a review of the MA Act focused on clarifying MAV's functions and modernising its governance and accountability framework.

Managing Risk Across the Public Sector: Toward Good Practice (2007)

In June 2007, we released the report Managing Risk Across the Public Sector: Towards Good Practice. The audit found that risk management was not a mature business discipline and that public sector entities did not rigorously assess risks or evaluate their controls. While the audit did not directly examine local government, it recommended better practices that could be applicable to councils.

The audit recommended that VMIA issue guidance to the public sector and that departments and agencies document risk management policies and ensure they align with relevant standards.

1.5 Why this audit is important

Failing to identify, mitigate and insure risks exposes councils to potentially unmanageable claims against them, resulting in an inability to maintain their property, infrastructure and service delivery to their communities. Consequently, councils need to have effective policies and procedures relating to the various risks they face if they are to identify, avoid, reduce and transfer their risks. Insurance is necessary because councils cannot avoid all risks.

Increasing financial pressures on councils, including the introduction of rate capping, means it is important that councils are effectively managing their costs. It is also important that councils can demonstrate they are achieving value for money in their acquisition of insurance.

1.6 What this audit examined and how

This audit examined whether councils have been prudently managing insurable risks and procuring insurance that represents value for money. The audit assessed councils' risk assessment policies and practices, including risk identification, risk mitigation and evaluation of insurable risks. The audit also assessed whether councils' insurance policies adequately cover their insurable risks.

We audited seven councils to provide comparability (four metropolitan councils and three regional or rural councils), contrast (metropolitan versus regional) and varying insurance histories.

The audited councils were Ballarat, Benalla, Glen Eira, Kingston, Pyrenees, Stonnington and Yarra.

The audit also included MAV as the provider of LMI, and DELWP as the lead agency supporting local government practice.

We conducted our audit in accordance with section 15 of the Audit Act 1994 and ASAE 3500 Performance Engagements. We complied with the independence and other relevant ethical requirements related to assurance engagements. Under section 16(2A) of the Audit Act 1994, we also conducted a 'public interest' test, and the Auditor-General is satisfied that the public interest requires the commercial matters discussed in this report to be included. The cost of this audit was $515 000.

1.7 Report structure

The structure of the remainder of the report is as follows:

- Part 2 examines how local councils identify, mitigate and quantify their insurable risks, as well as reviewing the support that is available to local councils to do this

- Part 3 examines whether councils' insurance delivers value for money.

2 Managing insurable risks

Identifying and mitigating risk is an important way a council can manage insurance claims against it.

This part focuses on the evidence and processes councils use to develop their risk policies. It also examines how councils are identifying and documenting their risks, devising ways to mitigate them and monitoring their progress in controlling insurable risks. It also evaluates whether councils are using better practice approaches to understand and quantify their insurable risks and looks at how councils assess the benefit of new insurance products, using cyber insurance as a case study.

2.1 Conclusion

Many of the audited councils are not effectively monitoring and mitigating their insurable risks. This potentially exposes councils to excessive risks which can impact on their financial sustainability, especially in the case of increased numbers of, and possibly larger, insurance claims.

Councils' risk policies are well documented, regularly reviewed and generally align with the relevant international standard. However, councils have not retained sufficient evidence of how they developed key components of these policies like risk thresholds, categorisations and assessments. This lack of documentation reduces corporate knowledge retention and affects future development of risk-related policies.

We found that some councils do not effectively monitor and review their risk controls or the risk mitigation programs to ensure they have reduced their insurable risks. This exposes councils to potentially more frequent and higher claims, which affects their ability to reduce insurance premiums.

Councils identify their insurable risks, but generally do not undertake analysis to quantify their level of risk or evaluate whether their insurance coverage is comprehensive and sufficient. Instead, they are heavily reliant on advice from their broker or insurer, which have a potentially vested interest when advising councils. Independent, expert advice can support councils to identify any gaps in their coverage and avoid being either under- or over- insured.

There is also a lack of guidance to the sector on how to develop risk policies that are relevant and adhere to the international standard. The development of guidance for councils would support them to develop policies, which would be particularly beneficial for smaller councils that may not have access to risk and insurance expertise.

2.2 Risk management policies and frameworks

The first step in effective risk management is for a council to establish a policy framework that outlines its strategic approach to risk and identifies how it will manage its specific risks. ISO 31000 is the key standard for these policies.

The audited councils all have risk management policies, which they regularly review. Each audited council's risk policy and framework has a different structure and includes a range of documents with different titles and content including risk policies, risk frameworks and risk guidelines. Due to the different names and structures of these documents, we have used a holistic 'risk policy' term to describe the full suite of documents we evaluated, to provide greater overall comparability.

Risk management policy development

The audited councils have developed their risk policies using varying combinations of evidence, consultation and expertise. Each council references ISO 31000 as the key risk guideline, as well as supporting standards and occupational health and safety legislation and guides.

Councils advised that they used a range of inputs to develop and review their risk documents, including:

- internal reviews and external consultant reports evaluating practices and processes (analytical reports)

- evaluation of internal data about risks, such as insurance claims (data analysis)

- comparison with risk policies at similar councils (benchmarking)

- meetings or discussions with managers and executive within council (internal consultation)

- sign-off of the policy by council executive (approval).

However, as shown in Figure 2A, the audited councils have not retained sufficient documentation of the information they considered in developing their suite of risk policies.

Figure 2A

Evidence retained by councils used in developing their risk policies

|

Council |

Analytical reports |

Data analysis |

Benchmarking |

Internal consultation |

Approval |

|---|---|---|---|---|---|

|

Ballarat |

✔ |

✘ |

✘ |

✔ |

✔ |

|

Benalla |

✔ |

✘ |

✘ |

✘ |

✔ |

|

Glen Eira |

✘ |

✘ |

✘ |

✘ |

✔ |

|

Kingston |

✘ |

✘ |

✘ |

✘ |

✔ |

|

Pyrenees |

✘ |

✘ |

✘ |

✔ |

✔ |

|

Stonnington |

✔ |

✘ |

✘ |

✔ |

✔ |

|

Yarra |

✔ |

✘ |

✘ |

✘ |

✔ |

Note: This table has been based on the evidence used to create the policies that were in effect during the audit.

Source: VAGO based on evidence provided by councils.

It is not clear from the evidence retained by the audited councils:

- what information they used to develop their policies

- the extent of any internal consultation

- which councils they compared themselves to.

The lack of retained evidence has several impacts:

- Evaluating risk settings—it is not clear how councils used evidence to determine the risk settings in their risk management policies.

- Policy review—councils regularly review their risk management policies, however, not retaining the underlying evidence reduces their ability to evaluate previous decision-making.

- Transfer of knowledge—as staff, including risk managers, change at a council, the lack of retained evidence limits their ability to understand the council's risk settings.

Councils' risk appetite

A council should define its willingness to accept risk—its 'risk appetite'—outlined in ISO 31000. This includes:

- its overall strategic approach to risk

- how it views specific risks in its operations.

Each council can determine the level of risk it is willing to accept based on its specific circumstances and risk appetite. However, it is important that councils make evidence-based decisions and document them sufficiently.

The audited councils vary significantly in how they consider risk, even when they are of comparable size, population and budget. Variation occurs in their assessment of risk:

- categories—councils consider various categories of risk, though there are commonalities such as loss of life, reputation and financial loss

- consequence—what level of loss/impact is a high, medium or low risk

- likelihood—what frequency does a council consider to be 'often' or 'rare'.

We found that councils' categories of risk are reasonably consistent and comprise most categories recommended in the VGRMF. We evaluated whether each council's risk policy includes the corresponding component of the VGRMF's risk policy template.

Overall, the audited councils' individual efforts have resulted in mostly complete policies, as shown in Figure 2B.

Figure 2B

Risk management policy completeness

|

VGRMF policy component |

Ballarat |

Benalla |

Glen Eira |

Kingston |

Pyrenees |

Stonnington |

Yarra |

|---|---|---|---|---|---|---|---|

|

Document history |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Purpose |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Scope |

✔ |

✔ |

✘ |

✔ |

✔ |

✔ |

✔ |

|

Risk governance |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Risk management process |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Integration with other systems and processes |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Risk categories |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Risk register policy |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Risk reporting |

✔ |

✔ |

✘ |

✔ |

✔ |

✔ |

✔ |

|

Risk management performance |

✔ |

✘ |

Partial |

✘ |

✔ |

✔ |

✔ |

|

Risk appetite |

✔ |

✘ |

✔ |

Partial |

✘ |

✔ |

✔ |

|

Review and approval |

✔ |

✔ |

Partial |

Partial |

Partial |

✔ |

Partial |

|

References and related documents |

✔ |

✔ |

✔ |

✔ |

✘ |

✔ |

✔ |

Key: ✔ = the council's risk policy includes information about this component of the VGRMF template. Partial = the council's risk policy contains some of the information about this component of the VGRMF template. ✘ = the council's risk policy is silent on this component of the VGRMF template.

Source: VAGO based on VGRMF risk management policy template and the audited councils' risk management policies.

Despite this, Figure 2C shows that there is significant variation between the audited councils in how they assess the consequence and likelihood of a risk occurring under their current risk policies.

Figure 2C

Variation in council risk assessment

|

Definitions of selected risk categories(a) |

Definitions of likelihood(b) |

|||||

|---|---|---|---|---|---|---|

|

Health and safety |

Legal/regulatory compliance |

Almost certain |

Possible |

Very unlikely |

||

|

State framework |

||||||

|

VGRMF standard |

Extensive injury or impairment to one or more persons |

Major breach of regulation with punitive fine, and significant litigation involving many weeks of senior management time and up to $3 million legal costs. |

Every year or more frequently |

Every 10 years |

Every 100 years |

|

|

Council |

||||||

|

Ballarat |

Totally or permanently disabled |

Breach of contractual or statutory obligations resulting in legal action. Or partial suspension of licences and permits. |

Certain to occur |

Given time, likely that it will occur |

Unlikely that it will occur |

|

|

Benalla |

Serious or life-threatening injury or multiple serious injuries causing hospitalisation |

Regulatory breach. Fine and short-term disruption to service delivery. |

90 per cent chance of occurring in a given year |

50 per cent chance of occurring in a given year |

May occur in exceptional circumstances |

|

|

Glen Eira |

Crippling injury or death |

Not included. |

Greater than 80 per cent chance of occurring |

Between 50 and 30 per cent chance of occurring |

Less than 10 per cent chance of occurring |

|

|

Kingston |

Multiple fatalities |

Significant prosecution and fines. Very serious litigation including class actions. |

Is expected to occur in most circumstance (>10 times in 3 years and 6 months) |

Might occur at some time (once in 3 years and 6 months) |

May occur only in exceptional circumstances |

|

|

Pyrenees |

Extreme injury/ long-term illness |

Major breach with fines and litigation, long-term significance and major financial impact. |

Expected to occur in most circumstances |

Might occur in some circumstances |

May only occur in exceptional circumstances |

|

|

Stonnington |

Hospitalisation of more than two days, or long-term injury or disability |

Activity does not meet all of the requirements of relevant legislation. |

91 to 100 per cent chance of risk occurring |

41 to 60 per cent chance of risk occurring |

0 to 10 per cent chance of risk occurring |

|

|

Yarra |

Loss of life Serious health impact on multiple members of public or staff. |

Major breach of legislation involving litigated court action with possible substantial fine. |

99 per cent chance of risk occurring |

>20 per cent chance of risk occurring |

<1 per cent chance of risk occurring |

|

Note: We have matched councils' risk categories against the VGRMF framework based on the council's description of the risk, as they may not have used the same terminology as the VGRMF.

(a) We used the audited councils' second highest risk category because this more clearly demonstrates the variability in councils' risk categorisation. The audited councils usually define highest risk category with a similar impact level.

(b) Councils use different terms to define likelihood, and use up to five categories. We have aligned their highest, medium and lowest likelihood categories against the VGRMF.

Source: VAGO based on audited councils' risk policies.

Councils' risk assessment varies, as demonstrated by examples from the audited councils:

- Pyrenees' highest risk category identifies a $5 million loss or 50 per cent of a project as its most significant risk. Five million dollars equates to 19 per cent of their 2016–17 budget which is significantly higher than for the other audited councils.

- Stonnington describes itself as risk averse and Yarra describes itself as willing to accept higher levels of risk, yet both have a threshold of $5 million for their highest financial risk category.

There are no standards that determine the 'correct' setting, instead this is a decision for each council based on their risk appetite and resources available to control for risk. The variation is either a function of the councils' willingness to accept risk or insufficient benchmarking among peers. The creation of guidelines targeted at councils—similar to the VGRMF for state entities—would support greater consistency among councils.

2.3 Councils' risk response

It is common practice for organisations, including councils, to conduct regular reviews to identify their risks and record them in risk registers.

The audited councils have demonstrated generally consistent approaches to identifying their insurable risks, but there are significant differences in their risk registers and effective implementation of risk controls.

Risk identification

The audited councils described having an annual process to review known risks, while also identifying risks as they arose either within council or the sector. At most councils, risk managers lead this review, except at Benalla, which does not currently employ a risk manager due to financial constraints.

|

Strategic risks—generally risks that relate to the corporate objectives of the agency. Operational risks—arise from day-to-day business activities. |

Councils capture their identified risks in a risk register, which takes different forms among councils, ranging from being recorded on simple spreadsheets to dedicated software programs.

The audited councils all use a similar approach to risk identification:

- The risk manager leads engagement with operational areas to identify risks.

- Councils compile their risks in a risk register, which may split them into strategic and operational risks.

- The council identifies and assigns risk controls and ownership to staff.

- Council executive reviews and approves the risk register.

- Risk managers track the implementation of risk controls.

We found that MAV has provided information to LMI members on known and emerging risks. This practice has supported the dissemination of information throughout the sector. MAV's advice has been predominantly issue focused, such as advising councils on their risk arising from flammable cladding on buildings, and based on its widespread knowledge of the sector's insurable risks.

Councils cannot test their identified risks against an industry standard or policy guidelines for completeness to identify gaps in their risk register. In contrast, the VGRMF identifies 92 sources of risk across five categories for state entities. Councils could use the VGRMF document as it is broad enough to be relevant to the sector, however, we have not found evidence of councils using it as a key reference. Councils also receive advice from their brokers, internal auditors or contracted experts to improve their risk policies.

Examples of better practice in risk identification

Yarra actively monitors how its operational managers review their risk registers, including identifying when a manager's reviews are due. The risk manager takes active steps to explain the review process and associated time frames to staff and follows up when reviews are late.

During the review process, Yarra uses a questionnaire that requires operational areas to identify new risks before reviewing the existing register. This is a better practice example because it drives council staff to consider emerging risks not yet captured in their risk register.

Stonnington provided evidence of benchmarking its risk register against other councils in 2018, which is also better practice because it helps it identify if there are gaps in its risk register.

Using claims data to identify risks

Councils regularly receive insurance claims, which they can use to understand their insurable risk profile. Yarra, for example, reports annually on changing claim numbers to understand how its risk profile is changing over time.

The four metropolitan councils and Ballarat provided evidence of recording claims and reporting on the number of claims made against them. However, councils capture data in diverse ways and in multiple data sets, which reduces their ability to comprehensively understand and report on claims against them and build an effective insurable risk profile.

For example, Kingston manages small claims in its client relationship management system which does not enable reporting, while also receiving separate reports from its claims manager and insurer for claims lodged with those two service providers.

Pyrenees and Benalla have not historically tracked claims made against them, however, Pyrenees has begun to do so in 2018. The number of actual insurance claims experienced by these councils is negligible. For example, neither council has had a claim on its PL/PI insurance since 2013.

To monitor and control their risks effectively, councils need to manage and monitor their data to ensure they have a comprehensive view of the sources of their risks. Ballarat and Yarra demonstrated better practice in this area by classifying claims in relation to source and identifying trends over time.

Effective monitoring of risk controls

Councils implement risk controls—actions and policy changes—to reduce the impact of identified risks. To be effective, councils need to assign responsibility to a person or area within council, set time frames for them to implement risk controls and have reporting mechanisms to monitor progress.

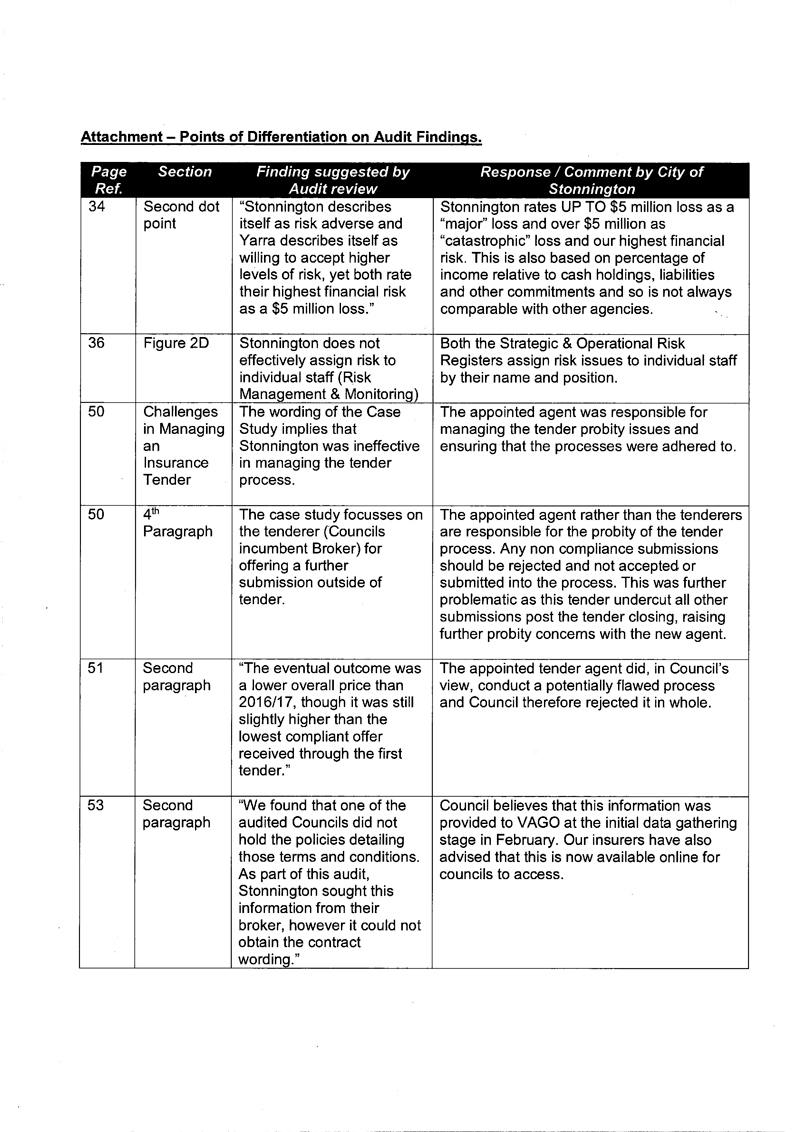

Except for Yarra and Ballarat, all the audited councils had some gaps in the implementation of their risk registers that affect their ability to monitor the implementation of risk controls. They either do not effectively assign risk and time lines, or there is limited monitoring of the risk controls' implementation, as shown in Figure 2D.

Figure 2D

Completeness of risk management and monitoring

|

Risk Register practice |

Ballarat |

Benalla |

Glen Eira |

Kingston |

Pyrenees |

Stonnington |

Yarra |

|---|---|---|---|---|---|---|---|

|

Effectively assigns risk to individual staff |

✔ |

✘ |

✘ |

✘ |

✘ |

✘ |

✔ |

|

Assigns time lines for risk controls |

✔ |

✘ |

✔ |

✘ |

✔ |

✔ |

✔ |

|

Risk register is easy for council staff to access and use |

✔ |

✘ |

✔ |

✘ |

✘ |

✘ |

✔ |

|

Monitoring of risk review and risk control implementation |

✔ |

✘ |

✔ |

✘ |

✘ |

✔ |

✔ |

|

Executive and/or audit committee oversight reporting |

✔ |

✘ |

✔ |

✔ |

✔ |

✔ |

✔ |

Note: This table is based on the evaluation of risk registers in place at the time of the audit. Several of the audited councils are currently reviewing their approach to monitoring their risk registers, which may improve performance in the future.

Source: VAGO based on data supplied by audited councils.

In the past, Kingston did not assign risks and completion dates to staff. Kingston identified this issue in March 2017 and devised a response plan in December 2017, which it is implementing throughout 2018.

Stonnington engaged a consultant in 2015–16 to review its risk register, with a view to improve its existing register and ensure it was aware of all its risks. However, the consultant produced a register containing more than 600 risks in over 30 spreadsheets. Council staff describe the register as complex and difficult to implement, which diminished Stonnington's capacity to implement risk controls. Stonnington is currently implementing steps to resolve this issue.

Benalla does not currently employ a risk manager, which affects its ability to monitor risks and their controls. Instead, it relies on departmental managers to manage its risks. Benalla's Manager of People and Performance is the person responsible for having centralised oversight of its risks, along with managing other functions of the portfolio. Benalla undertook a review of its risk processes in 2017 and is developing a new risk management policy.

Pyrenees commenced a review of its risk register in 2017 following the appointment of an experienced risk manager. Prior to that, the council did not have systems to track and manage its risks systematically. Pyrenees is now implementing an IT system to track risks, including the assignment of responsibility and time lines.

Better practice for monitoring identified risks

Ballarat demonstrated better practice in monitoring its risk controls by producing regular 'traffic light' reports on the progress of risk controls that it circulates among relevant council staff. Figure 2E is an extract from this report. This report provides Ballarat with effective monitoring of its risk control implementation.

Figure 2E

Extract of Ballarat's report on risk control implementation

Source: Ballarat.

2.4 Reducing insurable risks

This section focuses on how councils reduce their PL/PI insurable risks, which is a key driver of claims on councils.

Sources of PL/PI risk

Councils face PL/PI risks across a range of operations as they exercise their professional judgement and deliver services to their communities. It is therefore incumbent on councils to understand sources of risks within their operations, and minimise and transfer risk.

Councils' claims history establishes that the top five sources of PL/PI risks are:

- roads and footpaths

- drains and sewers

- council trees, including property damage by trees

- statutory functions, such as planning approvals

- managing events and programs for their community.

Figure 2F shows the frequency with which the top five overall sources of PL/PI risk occurred at the audited councils between 2006–07 and 2016–17.

Figure 2F

Audited councils' top five causes of PL/PI claims lodged with their insurers, 2006–07 to 2016–17

Note: Not all claims lodged with an insurer will be paid to the claimant. We have reported total claims lodged because each claim requires recording and administrative effort regardless of the outcome.

Note: Councils do not lodge claims with their insurer that fall below their deductible level. The audited councils have either $20 000 or $50 000 as their deductible and this may have an impact on the number of claims reported in this chart.

Source: VAGO based on LMI and council claim data.

Across their operations, councils regularly undertake actions to mitigate their PL/PI risks, including:

- complying with relevant standards, such as for swimming pools and leisure centres

- undertaking regular safety audits, for example at public playgrounds

- maintaining public roads and footpaths to a safe standard

- monitoring and pruning council trees to minimise damage to property

- implementing public safety strategies at public events

- inspecting and maintaining council property.

We evaluated the audited councils' PL/PI risk mitigation with a focus on how they manage their roads and footpaths, because this affects all councils. Roads and footpaths are also a major source of insurance claims, and there is variability in council practice to mitigate this risk.

Road management plans

Under the Road Management Act 2004 (RM Act), councils can develop RMPs to define standards for road and footpath maintenance. If councils develop and effectively implement an RMP, it provides them with a defence against PL/PI claims arising from their management of roads and footpaths. Councils individually create their RMP and set the standards for their own road and footpath maintenance. Each audited council has an active RMP, which shows they are actively attempting to minimise this insurable risk. Appendix C details how councils develop RMPs.

Councils were generally unable to provide sufficient evidence of the information and analysis they used to develop their RMP standards. This affects councils' ability to review their decision-making, make changes over time and, if challenged, prove how they decided that their RMP was reasonable.