Managing Development Contributions

Overview

Development contributions are payments or in-kind works, facilities or services that developers and landowners provide towards the supply of infrastructure. Councils and the state use several tools to collect development contributions. The state government oversees all these tools.

This audit examined whether development contributions provide required infrastructure to new and growing communities as intended. We examined three programs and one other legal instrument:

- Growth Areas Infrastructure Contributions (GAIC), which allow the state government to obtain funds from developers to help deliver state infrastructure in Melbourne’s fringe suburbs.

- Development Contributions Plans (DCP), which allow any council to obtain funds from developers to help deliver local infrastructure.

- Infrastructure Contributions Plans (ICP), which allow seven councils in defined growth areas to help deliver local infrastructure.

- Voluntary agreements that councils and developers enter on a project-by-project basis under section 173 of the Planning and Environment Act.

The following interactive display shows the availability and use of development contributions tools in your local government area. Simply select your council in the box below to find out more. Please note that we published these results on 18 March 2020 and will not update them.

Transmittal letter

Independent assurance report to Parliament

Ordered to be published

VICTORIAN GOVERNMENT PRINTER March 2020

PP No 116, Session 2018–20

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of the Audit Act 1994, I transmit my report Managing Development Contributions.

Yours faithfully

Andrew Greaves

Auditor-General

18 March 2020

Acronyms

| BNCF | Building New Communities Fund |

| CIL | community infrastructure levy |

| DCP | Development Contributions Program |

| DELWP | Department of Environment, Land, Water and Planning |

| DTF | Department of Treasury and Finance |

| GAIC | Growth Areas Infrastructure Contribution |

| GAPTF | Growth Areas Public Transport Fund |

| GIE | GAIC and ICP-eligible |

| ICP | Infrastructure Contributions Plan |

| LGA | local government area |

| LUV | Land Use Victoria |

| MGG | Metropolitan Greenfield Growth |

| RGG | Regional Greenfield Growth |

| SDA | Strategic Development Areas |

| SRO | State Revenue Office |

| VA/s173 | voluntary agreement/section 173 agreement |

| VAGO | Victorian Auditor-General's Office |

| VPA | Victorian Planning Authority |

Abbreviations

| Cardinia | Cardinia Shire Council |

| Casey | City of Casey |

| Golden Plains | Golden Plains Shire Council |

| Hume | Hume City Council |

| Melton | Melton City Council |

| Mitchell | Mitchell Shire Council |

| the Act | Planning and Environment Act 1987 |

| the Minister | Minister for Planning |

| Whitehorse | City of Whitehorse |

| Whittlesea | City of Whittlesea |

| Wyndham | Wyndham City Council |

Audit overview

Victoria’s growing population is placing pressure on its infrastructure. Development contributions can help the state government and local councils meet infrastructure needs within their budgets.

Development contributions are payments or in-kind works, facilities or services that developers and landowners provide towards the supply of infrastructure. Councils and the state use several tools to collect development contributions. The state government oversees all these tools.

In this audit, we assessed how well Victoria’s development contributions are delivering required infrastructure for growing communities. We examined three programs and one other legal instrument:

|

Program/Instrument |

Purpose |

|

Growth Areas Infrastructure Contribution (GAIC) (since 2010) |

Allows the state government to obtain funds from developers to help deliver state infrastructure in Melbourne’s fringe suburbs. It funds community and public transport infrastructure. |

|

Development Contributions Plan (DCP) (since 1995) |

Allows any council to obtain funds from developers to help deliver local infrastructure. It commonly funds community and transport infrastructure, such as roads. |

|

Infrastructure Contributions Plan (ICP) (since 2015) |

Allows seven councils in defined growth areas to obtain funds from developers to help deliver local infrastructure. It funds the same infrastructure as the DCP program. The program is still being implemented. The state government plans to expand it to more councils. |

|

Voluntary agreements/ section 173 agreements (VA/s173) |

Section 173 of the Planning and Environment Act 1987 (the Act) allows councils to enter a voluntary agreement with a developer on a project by project basis. |

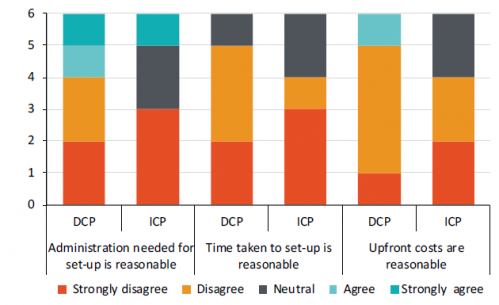

While DCPs can deliver significant financial benefits over their life span, they can take a long time to set up and place a high administrative and cost burden on councils. Recognising this, in 2015, the government introduced the ICP program as a simpler and cheaper tool.

We examined the roles of the following agencies and councils in delivering and using these tools:

|

State agencies |

Councils |

|

Department of Environment, Land, Water and Planning (DELWP) |

Cardinia Shire Council (Cardinia) |

|

Victorian Planning Authority (VPA) |

Golden Plains Shire Council (Golden Plains) |

|

State Revenue Office (SRO) |

Melton City Council (Melton) |

|

|

City of Whitehorse (Whitehorse) |

Conclusion

Victoria’s development contributions are not delivering the infrastructure needed by growing communities to support their quality of life.

This is largely because state agencies have not managed development contributions tools strategically to maximise their value and impact. Instead, they manage the tools in isolation, with overlapping roles and no overarching strategy, goals or plan to drive and measure their collective success.

The state-managed GAIC program is inefficient and lacks strategic effect because project funding decisions are split between two disconnected processes. This limits DELWP’s ability to direct GAIC project funding towards the areas of greatest benefit and perform financial management of GAIC trusts.

The ICP program’s implementation is delayed. DELWP and VPA’s effort to implement the ICP program has reduced its focus on addressing the existing issues with the DCP program, which remains unnecessarily complex, costly and time-consuming for councils to use.

For many councils, VA/s173 agreements are the only realistic option to collect contributions for infrastructure. However, these one-off agreements are not designed specifically for development contributions and are unsuitable for supporting infrastructure delivery at the scale offered by the DCP and ICP programs.

Findings

Lack of overarching strategy and coordination

State agencies have implemented development contribution tools over several decades with little consideration of how they interact, or their collective aims and impact. As a result, Victoria now has a patchwork of overlapping tools that operate in isolation. Until there is an overarching strategy or management structure to guide and coordinate development contributions tools, state agency management will remain inefficient and not fully consider how contributions could best meet community needs.

Within the individual tools, different state departments and councils are responsible for different program components. For example, four state agencies each manage elements of GAIC, meaning no one agency has a complete view of revenue collection, project assessment or stakeholder engagement. Further, DELWP and the VPA are responsible for implementing ICPs in different areas, which makes it harder to resolve issues associated with the program’s delayed implementation.

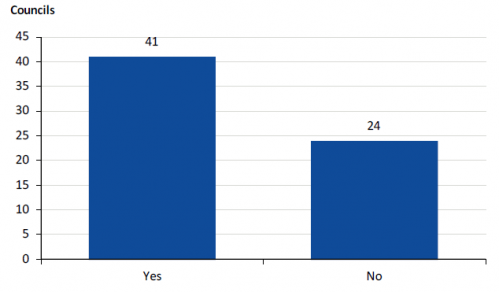

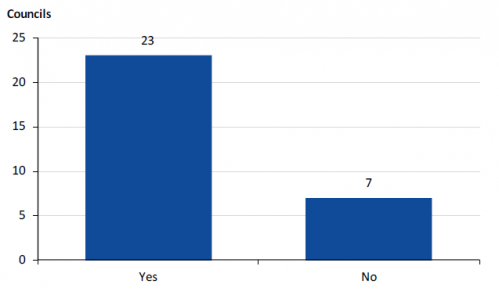

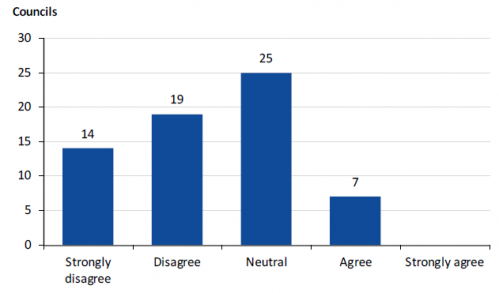

The split responsibilities mean councils often do not receive clear and consistent advice about available tools. Our survey of councils found that only seven out of 65 councils agreed that they have received the necessary state advice to make an informed decision about taking part in the DCP and ICP programs.

Lack of program-specific goals and evaluation

Individual development contributions programs also lack overarching goals and evaluation:

- Neither the GAIC nor DCP programs have established clear objectives to measure success against. As a result, DELWP has not meaningfully evaluated their impacts on infrastructure delivery.

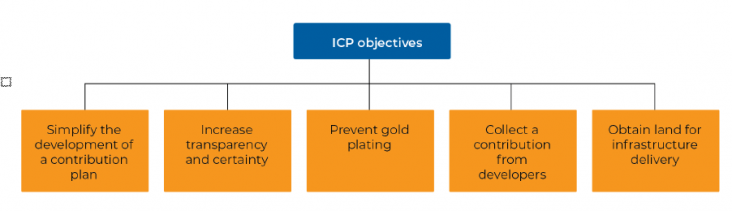

- While the ICP program has more clearly established goals, there is no evaluation framework in place to reliably measure success against these.

These gaps prevent DELWP from understanding the impact of the programs and bring into question its commitment to improving performance.

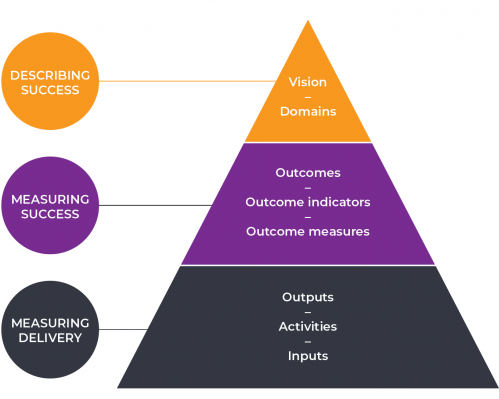

The Victorian Government’s outcomes architecture provides a suitable foundation for establishing a development contributions evaluation framework.

| The Victorian Government’s outcomes architecture provides framework for measuring the outcomes of government activity. |

GAIC funding is not strategic

GAIC projects are funded through one of two processes:

- DELWP chairs an interdepartmental panel that assesses funding proposals from agencies based on the eligibility requirements of the Act and the GAIC application guidelines.

- The government is increasingly using GAIC to fund projects through the state budget process. This made up 61 per cent of GAIC allocations during 2018–19 and 2019–20 ($276.3 million).

Although DELWP is the policy owner and financial manager of GAIC, it has no direct influence over allocations made through the state budget process. This means that DELWP cannot take an overarching strategic approach to selecting GAIC projects in areas of greatest need and benefit.

The split in project funding methods also makes it harder for DELWP to address the GAIC program’s emerging financial risks. Developers can defer their GAIC payments, which makes it difficult to reliably predict future revenue levels. Despite this uncertainty, the state has committed more GAIC funds to projects than the total revenue collected to date. DELWP needs to carefully manage GAIC’s two trusts to ensure that they do not become overdrawn.

DELWP is working with the Department of Treasury and Finance (DTF) and other departments to identify reforms to the way it collects and allocates GAIC funds. This provides an ideal opportunity to better coordinate project funding decisions and manage financial risks.

DCP barriers and risks to council participation

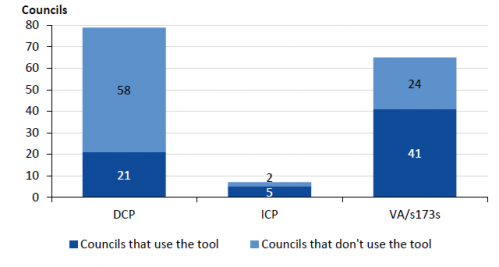

The DCP program carries significant barriers and risks for councils. Only 24 councils collected contributions through a DCP in 2017–18 or 2018–19, despite all 79 being able to create one. Issues include the:

- cost of developing a DCP

- time it takes to develop and have a DCP ministerially approved

- complexity of DCPs and the expertise required to manage them effectively

- financial risks of entering into a DCP. For example, a DCP locks in councils to deliver infrastructure projects, even if development does not proceed and the council cannot collect levies.

These barriers and risks mean that some councils do not want to participate, leaving them without a formal program to obtain development contributions and therefore missing opportunities to fund community infrastructure in this way. DELWP has not advised the government about ways to address this.

Councils' approaches to development contributions

Each audited council uses the various development contributions tools differently according to the advice they have received and each tool’s availability, features and risks. This has led to a range of outcomes and risks for councils:

- Cardinia and Melton use both the DCP and ICP programs, which they support with VA/s173s. DCPs have previously exposed these councils to financial risks, but they advised us that they have since improved their practice. Both councils could strengthen their approaches by further documenting internal processes for managing development contributions to ensure consistency in their practices.

- Golden Plains uses VA/s173s to obtain development contributions. It has a policy on how much it charges developers in its VA/s173s. While this approach has supported infrastructure delivery to date, the contribution rates it chose is not commensurate with the funding required for its emerging infrastructure needs.

- Whitehorse does not have a DCP, despite significant population growth in Box Hill. While Whitehorse advised us that it is working to inform its decision on a solution, it has missed out on contributions from the significant development that has occurred in Box Hill. We estimate Whitehorse could have raised approximately $4.16 million across 2016–17 and 2017–18 through a DCP in Box Hill.

Limited DCP and VA/s173 policy advice and transparency

DELWP has not updated the DCP and VA/s173 policy advice to councils since 2007. Reviewing and updating these documents would help councils use the tools and disseminate better practice across the sector.

DELWP improved the transparency of the DCP program in 2016–17 by requiring councils to report on their current usage of DCPs. However, given the program’s extensive history, asking councils to provide historical information would give even more transparency to the public.

Councils’ use of VA/s173s lacks transparency because there is no publicly available information about their usage. It is not possible to know or compare how councils use this tool, or its impacts on development, council revenue and infrastructure delivery.

Delays in ICP implementation mean its future success is uncertain

The incomplete rollout of the ICP program has prevented the state and councils from achieving the program’s proposed benefits. These benefits include providing a development contributions tool that is simpler and easier to use than the DCP program.

The delay is due to DELWP and VPA still determining how they will implement the program, as well as work associated with changes to the Act in 2018 that allowed developers to contribute land through an ICP. It is still not known which councils will gain access to the program, when it will happen and how the program will apply levies. This uncertainty affects councils’ ability to make informed decisions about their approach to development contributions.

If the ICP program is to be effective, its objectives must be evidence-based and its design must support their achievement. Instead, there are gaps in the evidence DELWP and VPA used to develop the ICP program. For example, the program includes measures to reduce ‘gold plating’—delivering community infrastructure that is beyond a basic and essential standard. However, there is a lack of evidence verifying and quantifying the extent of gold plating in Victoria.

Further, elements of the program’s design do not clearly support the achievement of its objectives. For example, early ICPs have followed some of the same complex set-up processes experienced in the DCP program. This is at odds with the ICP program’s objective of simplifying a contribution plan’s development.

Unaddressed DCP issues

DELWP, VPA and councils understand the barriers to, and risks of, the DCP program. However, DELWP has no plans to address these barriers and risks due to the focus on implementing the ICP program.

The delayed rollout of the ICP program further complicates this situation. It remains unclear whether the ICP program will eventually replace the DCP program in all local government areas (LGA), or just in some. Even with greater certainty about future coverage, the continued delays with the ICP program’s rollout mean that most councils can only access the flawed DCP program.

Recommendations

We recommend that the Department of Environment, Land, Water and Planning, in consultation with the Victorian Planning Authority, the State Revenue Office and councils:

1. create an overarching development contributions framework that establishes:

- a strategic direction for development contributions, including outcomes and targets for infrastructure delivery and supporting growth

- clear and holistic accountability and governance arrangements for development contributions at a system-level

- a central source of development contributions advice and guidance, including for voluntary agreements made through section 173 of the Planning and Environment Act 1987

- the development contributions tools available for each council and the relationships between them (see Sections 2.2 and 2.3).

2. develop a plan for monitoring, evaluating and reporting on the outcomes achieved by development contributions at a state and council level, using the Victorian Government’s outcomes architecture (see Sections 2.4 and 2.5).

We recommend that that the Department of Environment, Land, Water and Planning and the Victorian Planning Authority, in consultation with councils:

3. complete outstanding work to implement the Infrastructure Contributions Plan program, including:

- defining Strategic Development Areas and Regional Greenfield Growth areas

- recommending to government when the program should expand into Strategic Development Areas and Regional Greenfield Growth areas

- recommending to government which parts of Victoria should be included in these categories, using evidence-based eligibility criteria

- recommending to government how to calculate levies for Infrastructure Contributions Plans in new areas

- keeping all councils informed about implementation progress and decisions made (see Sections 4.2 and 4.3).

We recommend that the Department of Environment, Land, Water and Planning, in consultation with the Victorian Planning Authority:

4. improve the Development Contributions Plan program by:

- identifying and reducing the time, cost and administrative burdens associated with developing Development Contributions Plans based on council feedback and the objectives of the Infrastructure Contributions Plan program

- building councils’ capacity to develop and implement Development Contributions Plans through updated written guidance and ongoing support that caters to their council type (see Sections 2.3 and 3.2).

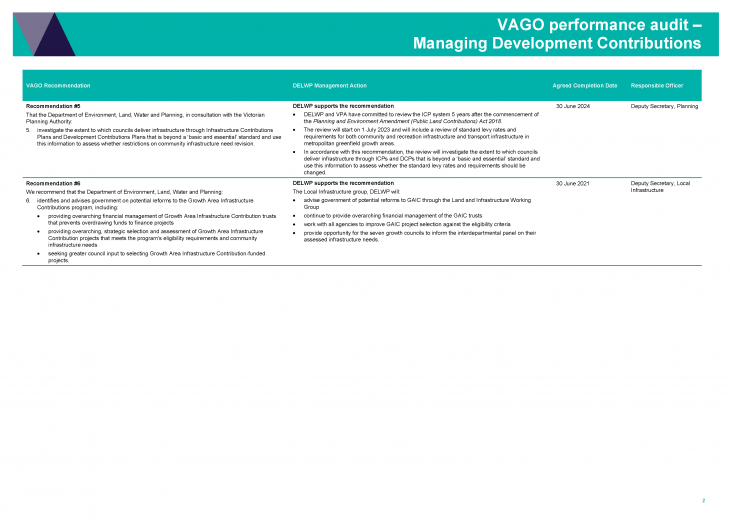

5. investigate the extent to which councils deliver infrastructure through Infrastructure Contributions Plans and Development Contributions Plans that is beyond a ‘basic and essential’ standard and use this information to assess whether restrictions on community infrastructure need revision (see Section 4.2).

We recommend that the Department of Environment, Land, Water and Planning:

6. identifies and advises government on potential reforms to the Growth Area Infrastructure Contribution program, including:

- providing overarching financial management of Growth Area Infrastructure Contribution trusts that prevents overdrawing funds to finance projects

- providing overarching, strategic selection and assessment of Growth Area Infrastructure Contribution projects that meets the program’s eligibility requirements and community infrastructure needs

- seeking greater council input to selecting Growth Area Infrastructure Contribution-funded projects (see Sections 2.4, 3.3 and 3.4).

Responses to recommendations

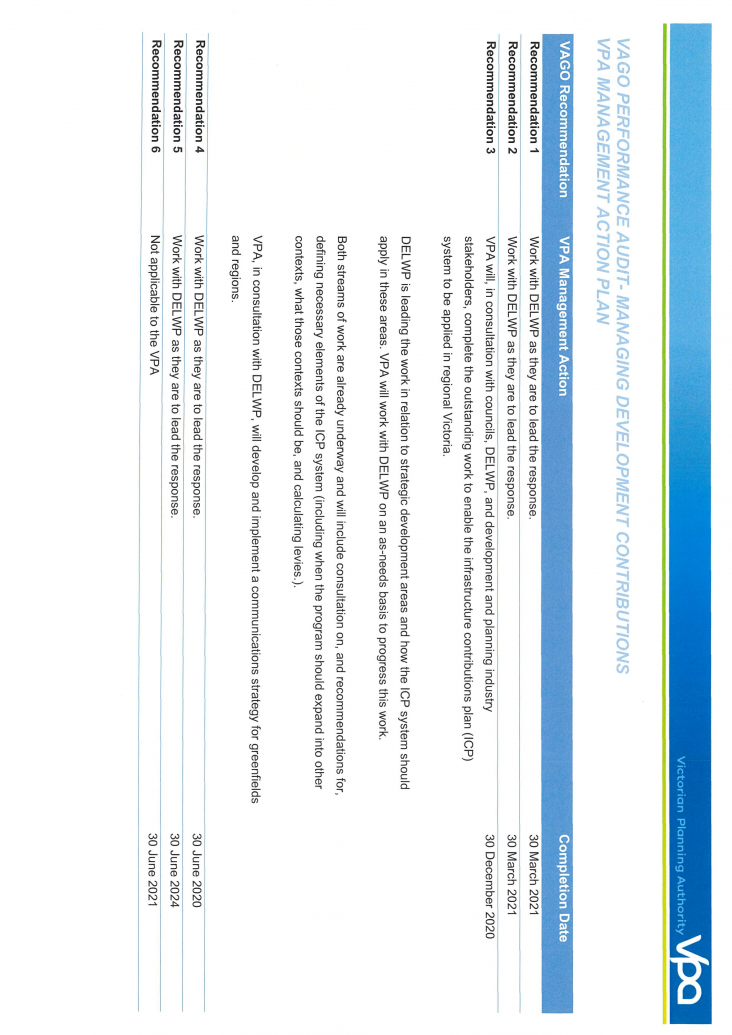

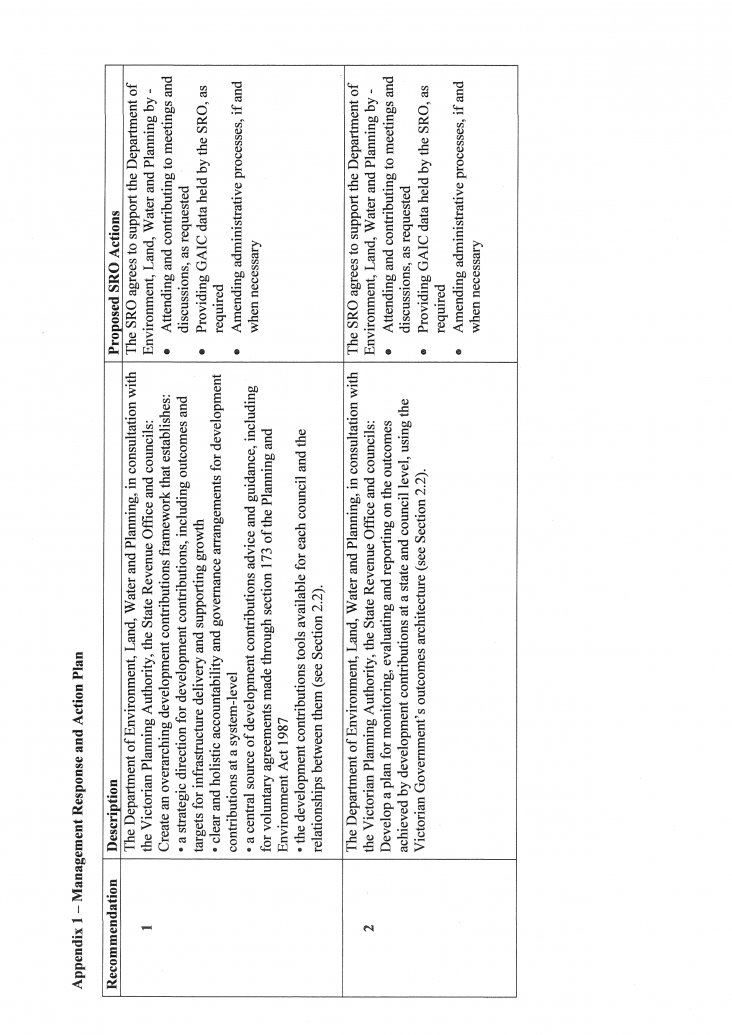

We have consulted with DELWP, VPA, SRO, Cardinia, Golden Plains, Melton and Whitehorse and we considered their views when reaching our audit conclusions. As required by the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet.

The following is a summary of those responses. We include the full responses in Appendix A:

- DELWP supports the report’s findings and recommendations, and plans to establish a dedicated development contributions unit.

- VPA accepts the report’s recommendations directed to it and notes that it has already commenced work to address them.

- SRO accepts all recommendations and notes its commitment to administering GAIC in partnership with relevant stakeholders.

- Cardinia accepts all recommendations and notes its ongoing work to improve the way it manages development contributions.

- Melton supports the report’s conclusions and recommendations. It also notes its concerns with GAIC project allocation processes, DCP cash flow issues and the implementation of the ICP program.

- Whitehorse accepts all recommendations, but does not support the report’s analysis of its approach to managing development contributions.

- Golden Plains did not comment on the draft report.

1 Audit context

As Victoria’s population grows, state and local governments need to build infrastructure to maintain Victorians’ standard of living. However, this places financial pressure on state and council budgets.

Development contributions provide governments with the opportunity to acquire additional funds to meet these needs.

1.1 Development contributions

In addition to regular revenue sources such as rates or grants, councils have other options, legislated by the Victorian Government, to collect funds from developers to help pay for infrastructure. For example, a council could create a DCP over a specified area. Any developers who build in that area then must pay the council levies on a per lot or per hectare basis.

Councils can also enter into individual legal agreements with developers called VA/s173s, which they can create when necessary.

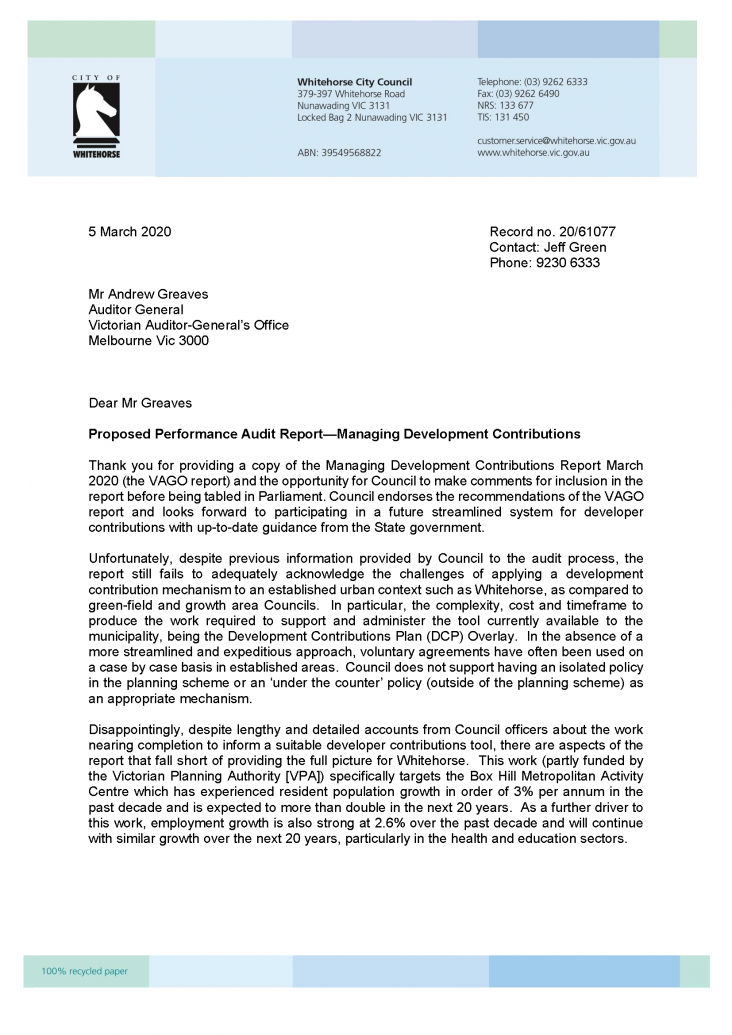

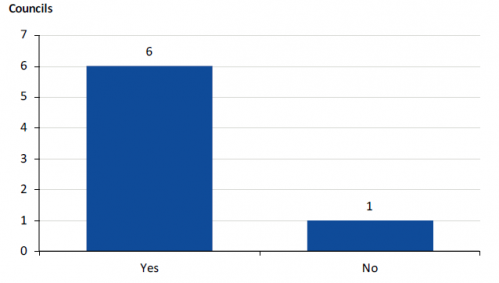

All councils can use the DCP program or VA/s173s to obtain contributions for infrastructure. Only seven councils are eligible to use ICPs, the newest development contributions tool. The Minister for Planning (the Minister) chose these councils, which comprise six interface councils and one large shire, as listed in Figure 1A.

The state government can also collect funds from developers to provide state infrastructure such as schools, health facilities, bus services and stops, and train stations. In certain growth areas, developers are liable to pay GAIC, which is a flat charge applied on a per hectare basis. To date, legislation only allows seven LGAs to receive GAIC funded projects, which are the same seven councils that can utilise ICPs. In this report, we describe these as GAIC and ICP-eligible (GIE) councils.

Only state agencies may apply for GAIC-funded projects. The state can also use DCPs or ICPs, but this is rare.

Development contributions to either the state or councils can be payments in cash, services, works, or facilities in kind.

Figure 1A

Councils included in the GAIC and ICP programs

Source: VAGO, based on DELWP information.

Growth Areas Infrastructure Contribution

The state government set up GAIC in 2010 to help fund infrastructure in seven councils on Melbourne’s expanding fringe.

Developers of land in GAIC-eligible areas are liable to pay the GAIC charge the first time one of four ‘trigger’ events occurs:

- transfer of title

- issuing statement of compliance for subdivision

- application for a building permit

- an acquisition of land valued at over $1 million.

Under the Act, a landowner liable to pay GAIC can apply to the Minister to enter into a staged payment arrangement when issuing a statement of compliance for a subdivision or applying for a building permit. If approved, this allows the developer to spread payments over years.

Events that may be exempt from GAIC include:

- a purchase of land under five hectares

- a development that is demolishing or repairing an existing building

- a subdivision that separates an existing house from a larger piece of land

- a farm being transferred between family members.

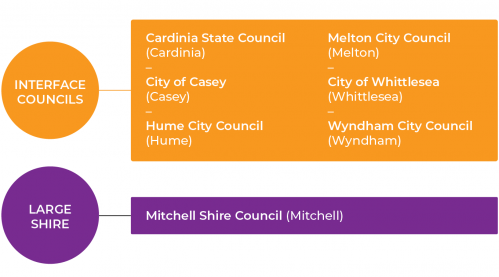

SRO collects GAIC revenue and DELWP distributes it evenly into two trusts as required by the Act. State agencies can submit an application for GAIC funding to an interdepartmental panel, led by DELWP. The panel chooses projects based on their eligibility under the Act and alignment with the application guidelines, which DELWP releases annually. DELWP manages the annual funding round to distribute funds for state projects, and financially manages the two trusts. Figure 1B outlines the process.

Figure 1B

GAIC collection and distribution

Source: VAGO, based on DELWP information.

In addition to the annual funding round, the government can also use GAIC money to fund eligible projects through the state budget process. To support this, departments need to identify the parts of their budget proposals for which they are seeking GAIC funding and demonstrate eligibility.

| The Act and the 2019–20 Growth Areas Infrastructure Contribution Policy Statement detail eligibility requirements for GAIC funded projects. |

GAIC’s two project funding processes reflect the Minister’s and Treasurer’s joint responsibilities for administration of GAIC.

VPA is responsible for:

- administering GAIC staged payment arrangements

- providing details on GAIC-eligible properties to state agencies

- facilitating GAIC work-in-kind agreements.

| Under a work-in-kind agreement, the liable person agrees to provide land and/or works instead of a cash payment to meet their liability wholly or in part. |

Development Contributions Plans

In 1995, Parliament amended the Act to enable planning authorities—including councils—to create DCPs. Under a DCP, a council can obtain funds from developers to support infrastructure delivery by collecting:

- a development infrastructure levy, which can fund roads, public transport infrastructure, basic improvements to open spaces, early childhood facilities, and associated land acquisitions

- a community infrastructure levy (CIL), which can fund construction of other facilities used for community or social purposes. The CIL is capped at $1 190 for each dwelling to be constructed for 2019–20, and in rare circumstances 0.25 cents in the dollar of the cost of building work in any other case.

| Under the Act, a planning authority can be a minister, a local council, or VPA. |

Councils usually develop their own DCPs. VPA develops DCPs on behalf of GIE councils and will sometimes develop them for other councils.

In each DCP, the planning authority identifies the:

- area for development

- required infrastructure

- proportion of the new infrastructure to be used by new and existing properties

- costs of developing the DCP

- levies that developers will pay.

Planning authorities incorporate the proposed DCPs in an amendment to their planning scheme. They make this public and may receive stakeholder feedback. The final stage is for Planning Panels Victoria to review any unresolved issues with the amendment.

| Planning Panels Victoria assesses planning proposals and major projects. It is an administrative office within DELWP and consists of a chief and five senior panel members, and a pool of sessional members. |

Once approved, all new developments pay a contribution to the council, or perform work in kind to meet their liability. Developers cannot challenge the requirement to pay these contributions.

Of Victoria’s 79 councils, 24 had active DCPs in either 2017–18 or 2018–19. As shown in Figure 1C, the seven GIE councils that the Act declared as growth areas collected 92 per cent of DCP contributions in those two years.

Figure 1C

DCP revenue by council type, 2017–18 and 2018–19

| Council type |

Payments received ($m) |

Work in kind received ($m) |

Total ($m) |

|---|---|---|---|

|

GIE council |

395.5 |

507.59 |

903.09 |

|

Metropolitan |

15.51 |

16.49 |

32.00 |

|

Regional city |

10.47 |

18.30 |

28.77 |

|

Large shire |

9.54 |

7.9 |

17.44 |

|

Interface |

1.35 |

2.36 |

3.70 |

|

Small shire |

0 |

0 |

0 |

|

Total |

432.38 |

552.64 |

985.02 |

Note: The GIE council category includes six interface councils and one large shire. We excluded GIE councils from other categories.

Note: We excluded one regional city council due to errors in its reporting on DCP outcomes.

Note: Minor variations for total amounts are due to rounding.

Source: VAGO, based on DELWP data.

Infrastructure Contributions Plans

In 2015, Parliament amended the Act to establish the ICP program. A 2016 ministerial direction made the ICP program available to the seven GIE councils. VPA has developed all eight ICPs so far, the first of which was gazetted in 2017.

Currently, when a ministerial direction brings a new area into the ICP program, it replaces the DCP program. Existing DCPs continue until they are finalised.

The intended advantages of the ICP program over the DCP program are:

- standardised levies leading to greater certainty for all parties

- increased transparency

- reduced risk of infrastructure cost increases

- simpler processes to develop plans.

The government intends for ICPs to operate in three development settings:

- Metropolitan Greenfield Growth (MGG)—land in metropolitan Melbourne that is defined as a growth area

- Strategic Development Areas (SDA)—areas in metropolitan Melbourne that are planned for significant land use change and/or growth

- Regional Greenfield Growth (RGG)—rural land outside of metropolitan Melbourne that is planned to be used and developed for urban purposes.

| A development setting is a type of land specified in the ministerial direction where an ICP may apply. |

Currently, ICPs only operate in the MGG development setting. The MGG includes seven LGAs on the fringes of Melbourne: Cardinia, Casey, Hume, Melton, Mitchell, Whittlesea and Wyndham. These are the same LGAs included in the GAIC program.

DELWP and VPA have not yet recommended to the Minister:

- when ICPs should expand into SDA and RGG development settings

- which parts of Victoria to include in these categories

- how to calculate ICP levies in these areas.

ICPs were originally designed to collect only money. The government revised legislation in 2018 to include both ‘monetary’ and ‘land’ components.

Monetary component

The ICP program has a standard levy comprising two components—a community and recreation levy, and transport construction levy. The community and recreation levy is capped.

| Net developable hectare is the land within an ICP available for urban development. |

Figure 1D shows the 2019–20 standard levy rates for MGGs. The ICP program applies the levy to each net developable hectare in a development to calculate the total amount payable.

Figure 1D

2019–20 standard levy rates

| Class of development |

Community and recreation |

Transport construction |

Total standard levy rate |

|---|---|---|---|

|

Residential |

$89 518 |

$124 344 |

$213 862 |

|

Commercial and industrial |

N/A |

$124 344 |

$124 344 |

Note: All amounts in dollars per net developable hectare.

Source: VAGO, based on DELWP information.

The ministerial direction defines the types of projects that each levy can fund. These include, but are not limited to:

|

Community and recreation |

Transport |

|

Multipurpose community facilities |

Roads |

|

Outdoor multipurpose sports fields |

Intersections |

|

Pavilions for sports fields |

Road bridges |

An ICP can include a supplementary levy for transport projects if issues such as geographical challenges increase the cost of construction. This commonly applies to bridge construction, for example.

Land component

The land component requires developers to contribute land for public infrastructure such as community centres or sports fields. The ICP outlines the land contribution, which the planning authority uses to determine the average amount of land each developer needs to contribute.

If a developer contributes more than the average, then the council compensates them with levies from developers who contribute less than the average. Those who contribute less than the average pay an additional levy to fund these payments. Overall, the payments to and from developers should balance so that the council receives the right amount of land.

Voluntary agreements/s173s

In addition to the DCP and ICP programs, councils can also form a voluntary agreement with a developer on a project-by-project basis. Voluntary agreements have the broad purpose of placing conditions on the use of land, such as obliging developers to comply with building restrictions. We only looked at voluntary agreements related to development contributions.

Councils and developers can formalise these voluntary agreements through section 173 of the Act. The council records details of the agreement on the land title to ensure future owners are bound by it, and this remains on the title until the developer makes the agreed contribution.

Unlike DCPs and ICPs, voluntary agreements:

- do not force a council to consider its holistic infrastructure needs

- rely on individual negotiations with a developer

- are not designed for collecting development contributions.

There is no public reporting on councils’ use of voluntary agreements, including the collection of revenue and delivery of infrastructure.

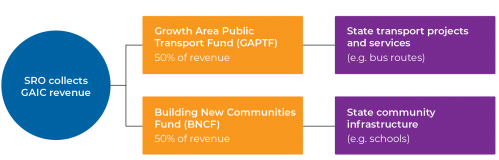

1.2 Roles and responsibilities

DELWP is the legislation and policy owner for development contributions in Victoria.

VPA is a statutory authority with functions under the Act to:

- advise and assist planning authorities, including councils where the Minister approves

- advise and assist the Minister on planning the use, development and protection of land in Victoria

- undertake integrated land use and infrastructure planning in areas designated by the Minister

- coordinate state government action in relation to planning the use, development and protection of land in areas designated by the Minister.

Under the Act, the Minister issues a statement of expectations for VPA outlining the projects that it should work on, including ICPs and DCPs in designated areas.

Councils decide on their development contributions strategy within the parameters set by the state government.

DELWP, VPA, SRO, councils and DTF all have key roles in relation to development contributions. Figure 1E outlines the agencies’ responsibilities in relation to the four audited tools.

Figure 1E

Agency roles and responsibilities for the four development contributions tools

Source: VAGO.

1.3 Legislation and regulations

The Act is the enabling legislation for the four audited development contributions tools. The Local Government Act 1989 also provides direction to councils on the provision of services and fiscal management. There are also ministerial directions for the DCP and ICP programs outlining how they operate.

The current directions and guidelines are:

- Development Contributions Guidelines (2003, amended in 2007)

- Ministerial Direction on the Preparation and Content of Development Contribution Plans and Ministerial Reporting Requirements for Development Contributions Plans (2016)

- Ministerial Direction on the Preparation and Content of Infrastructure Contributions Plans and Ministerial Reporting Requirements for Infrastructure Contributions Plans (2018)

- Infrastructure Contributions Plan Guidelines (2019).

1.4 What this audit examined and how

We examined whether development and infrastructure contributions provide required infrastructure to new and growing communities as intended. To address this objective, we examined whether:

- there has been strategic oversight of development contributions

- the tools have delivered on their objectives

- agencies considered learnings from the DCP program when designing the ICP program

- councils have used DCPs and VA/s173s to obtain necessary funds for infrastructure development

- the agencies and councils have evaluation frameworks for the tools and are evaluating outcomes.

In conducting the audit, we:

- reviewed cabinet-in-confidence documents

- met with Cardinia, Golden Plains, Melton and Whitehorse staff and reviewed council documents

- spoke extensively with DELWP and VPA and reviewed their documents

- visited SRO to understand its processes

- collected and analysed data from DELWP and SRO

- spoke with urban planning experts.

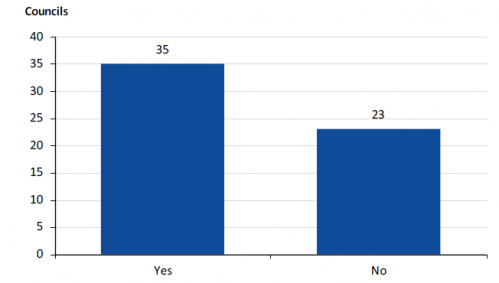

We also surveyed Victoria’s 79 councils to understand their experience using development contributions. This included their experience with the DCP program, the support they receive and their expectations for the ICP program. We received responses from 65 councils, which is an 82 per cent response rate. Appendix B details their responses to survey questions that we used to support our audit findings.

The state agencies included in this audit are DELWP, VPA and SRO. The councils in this audit are Cardinia, Golden Plains, Melton and Whitehorse.

We conducted this audit in accordance with the Audit Act 1994 and ASAE 3500

Performance Engagements. We complied with the independence and other

relevant ethical requirements related to assurance engagements. The cost of

this audit was $595 000.

1.5 Report structure

The remainder of this report is structured as follows:

- Part 2 examines how the state agencies manage development contributions at a system-wide level.

- Part 3 examines the effectiveness of the DCP and GAIC programs, and how councils use development contributions tools.

- Part 4 examines the future of development contributions, particularly the ICP program.

2 State agency management of development contributions

In this Part, we examine the management of development contributions tools by the relevant state agencies. We look at how strategically they operate, along with how policy advice, public reporting and evaluation activities contribute to effective administration of these tools.

2.1 Conclusion

Victoria’s development contributions tools operate in isolation across multiple agencies, with little focus on how they work collectively. DELWP has not performed system-level oversight, coordination or evaluation, meaning there is no statewide consideration of how development contributions, collectively, could best support infrastructure delivery.

This failure to coordinate has led to inefficient, overlapping functions across DELWP and VPA. It has also resulted in councils not receiving comprehensive and timely advice about development contributions options.

2.2 Lack of a strategic approach

Instead of an integrated, strategic approach to managing development contributions, there is:

- a lack of coordination

- duplication of effort

- multiple sources of information and advice.

The four audited development contributions tools were established at different times and were never intended to work as part of an integrated system. Responsibility for the tools is separated across various departments and branches within DELWP, and four different agencies have roles in administering them.

Despite the development contributions tools having similar purposes and overlapping geographically, state agencies have not considered their total impact and how they interact. For example, DELWP has not evaluated development contributions as an overall system and its advice to government is program specific.

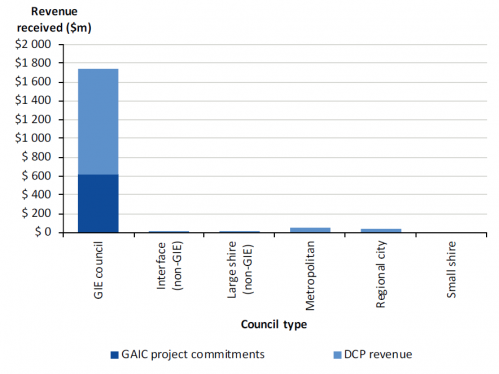

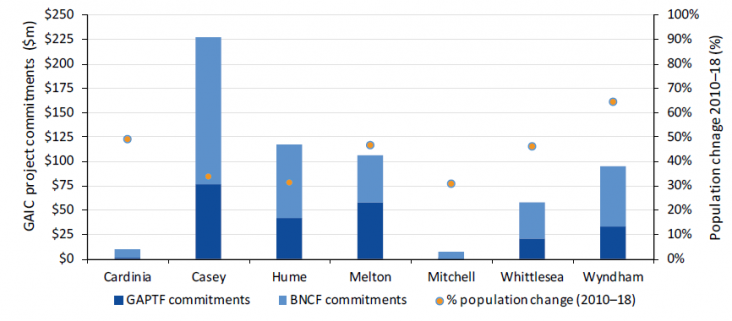

In the absence of a holistic, strategic approach, the seven GIE LGAs have received nearly all DCP revenue, as shown in Figure 2A. As determined by the Act, they are also the only recipients of GAIC projects.

Figure 2A

GAIC and DCP funding received by council type

Note: GAIC revenue is current at 31 October 2019. DCP revenue is current at 30 June 2019. There has been no ICP revenue recorded to this date.

Note: The GIE council category includes six interface councils and one large shire. We excluded GIE councils from other categories. There are three non-GIE interface councils and 18 non-GIE large shire councils.

Note: We excluded one regional council’s DCP data due to errors in reporting.

Source: VAGO, based on DELWP data.

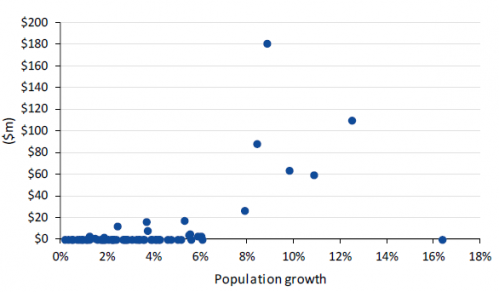

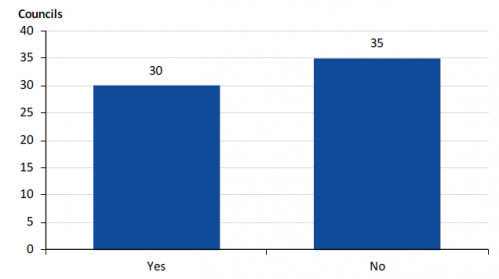

Development contributions should target areas with population growth, to help build infrastructure for new communities. Figure 2B shows councils’ population growth from 2016 to 2018 compared to DCP funds they collected in the financial years 2016–17 and 2017–18. It shows 41 councils with population growth collected no DCP contributions. We note though that these councils may already have sufficient capacity in their existing infrastructure, or may have collected contributions through a VA/s173.

Figure 2B

LGA population growth (2016–18) versus DCP revenue (2016–17 and 2017–18)

Note: We excluded councils with negative population growth.

Note: We excluded one regional council’s DCP data due to errors in reporting.

Source: VAGO, based on DELWP and Australian Bureau of Statistics data.

2.3 Policy guidance

DELWP is responsible for maintaining policy guidance across the development contributions tools. As shown in Figure 2C, some of the policy documentation is outdated and incomplete, or DELWP withdrew it for an extended period.

Figure 2C

Policy document reviews

|

Tool |

Policy advice |

|---|---|

|

GAIC |

Up to date and reviewed annually. |

|

DCP |

DELWP last reviewed the policy in 2007. The policy explains how to set up a DCP but has limited information on implementation. |

|

ICP |

DELWP released a policy in 2016 but withdrew it in June 2018 when the legislation changed. DELWP renewed and reinstated the policy in September 2019, incorporating the legislative changes governing how councils acquire land in an ICP. |

|

VA/s173s |

DELWP last reviewed the policy in 2007. It includes limited information on how councils can or should use VA/s173s. |

Source: VAGO, based on DELWP documentation.

Policy advice and reviews

DELWP publishes GAIC application guidelines annually, which provide information about GAIC’s objectives, criteria and decision-making processes. SRO also publishes advice on its website about applying for and collecting GAIC funds.

DELWP’s development contributions guidelines describe VA/s173s and provide information on how to develop a DCP. However, these guidelines have limited value because they:

- are over a decade old

- do not provide advice on:

- implementing DCPs

- how to negotiate with developers

- how to use VA/s173s

- do not disseminate better practice.

The audited councils’ use of VA/s173s varies, as we discuss in Section 2.4. While this variation reflects the flexibility of VA/s173s, stronger policy guidance would help to disseminate better practice. This would benefit councils that do not use other tools or need more help to negotiate VA/s173s with developers.

After DELWP withdrew the 2016 ICP guidelines in June 2018 in response to legislative changes, it did not update them until September 2019. During this 15 month gap, councils and VPA had no written guidance on ICP development or usage, which contributed to uncertainty about the program.

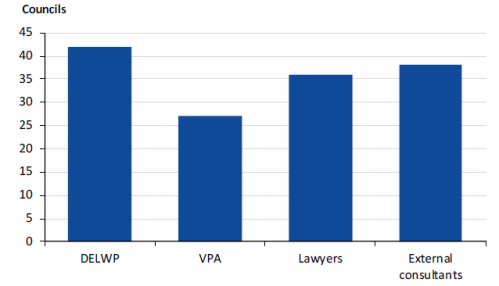

State advice to councils

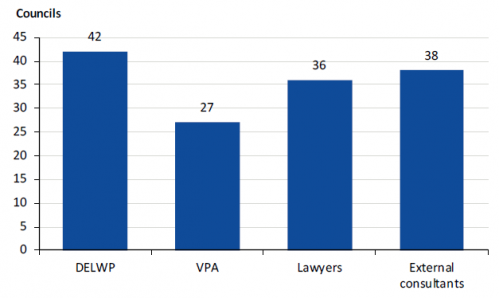

Councils obtain information on development contributions tools from different sources. Cardinia and Melton advised us that they obtained legal advice on their DCPs, but also approached VPA. Golden Plains engaged DELWP for information about development contributions, while Whitehorse has engaged both DELWP and VPA. This variation is evident in our survey results, summarised in Figure 2D.

Figure 2D

Councils’ responses to question: ‘Who would you approach to understand the development contributions system?’

Note: Surveyed councils could select multiple responses to this question.

Source: VAGO.

As councils seek development contributions advice from both DELWP and VPA, the state is speaking with ‘two voices’ to the sector. This means DELWP and VPA may:

- duplicate effort in research, analysis and stakeholder engagement

- need to retain staff with expertise in relation the same tools

- provide inconsistent advice to councils.

Our survey results emphasise the need for clearer advice to councils. Only 11 per cent of councils agreed that they have received the required information or advice from state agencies to make an informed decision about participating in the DCP or ICP programs.

While councils are responsible for their own decisions, they rely on clear information to make informed ones. DELWP has not communicated with councils about the status of the ICP program. VPA communicated the status of the ICP program to councils and other stakeholders in September 2019. However, it is not VPA’s responsibility to advise all Victorian councils.

2.4 Public reporting and transparency

DELWP, VPA, SRO and councils report publicly on development contributions through their annual reports and program websites. This leads to duplicated effort and no single source of information. Collating this information would help the public understand the outcomes achieved by development contributions tools.

Reporting on GAIC

Under legislation, both DELWP and VPA report on GAIC. This increases the risk of error:

|

While ... |

there is an issue because ... |

|

DELWP, VPA and SRO all have GAIC websites |

they each report on different aspects of the program. This means the public needs to read all three sites to understand the program |

|

DELWP and VPA both report on GAIC revenue and expenditure in their annual reports |

past annual reports had different results for payment timing, interest earned and fund balance |

|

SRO’s website reports on GAIC ‘revenue collected’ (meaning the total liability incurred |

DELWP refers to ‘revenue received’ for the actual amount of payments. This causes confusion for the public |

Adopting common terminology and one complete source of information would increase transparency in the management of GAIC.

DELWP and VPA work to make their figures consistent. However, their annual reports for 2013–14, 2015–16 and 2016–17 have discrepancies on:

- which of GAIC’s two accounts payments came from

- the amount of interest accumulated in GAIC funds

- when developers made payments for projects.

DELWP performed an expenditure review in late 2019 to identify various discrepancies and subsequently revised its expenditure records.

The discrepancies in GAIC reporting mean that the public does not have a clear view of where GAIC money is coming from and going.

Reporting on DCPs and ICPs

Since 2016, the Act has required councils to report on their DCP and ICP revenue and project status. DELWP collates this information and the Minister reports to Parliament annually on statewide outcomes.

This significantly improves the system’s transparency, which is an objective for the ICP program and a stated principle in the DCP guidelines. The public can more easily compare their council’s DCP and ICP income against similar councils.

However, we identified that one council had significantly misreported its DCP revenue when collating this information, leading to the Minister’s reports to Parliament including this error in 2016–17 and 2017–18. DELWP has not corrected this error. This indicates there is room for improvement in DELWP’s quality assurance.

Reporting on VA/s173s

Neither councils nor the state report on contributions towards infrastructure from VA/s173s. DELWP does not collect data on voluntary agreements, except where they relate to affordable housing.

Therefore, it is impossible for either the government or the public to know which councils use these agreements and what contributions towards infrastructure they have received. It is also not possible to find the outcomes of councils’ individual approaches using VA/s173s.

Based on our consultation, we found that the audited councils use VA/s173s to support development contributions in different ways:

- Cardinia and Melton use VA/s173s to support DCP implementation. For example, if a developer agrees to provide infrastructure in lieu of payment, councils will use VA/s173s to lock in its timing and quality.

- Golden Plains uses VA/s173s to implement its development contribution policy.

- Whitehorse uses these agreements on a development-by-development basis to obtain contributions towards infrastructure.

In addition, our survey found that:

- 63 per cent of councils reported using VA/s173s to obtain development contributions to support infrastructure delivery

- 77 per cent of councils that have either a DCP or ICP are using VA/s173s to support their implementation.

Implementing a reporting system similar to that used for the DCP and ICP programs would improve transparency and enable evaluation of councils’ performance.

2.5 Evaluation of development contributions

Good program design should incorporate an evaluation framework at the outset. This includes goals, measures and targets at every stage through to delivery so that agencies collect the required data to measure the achievement of intended outcomes.

DELWP has no plan to evaluate how development contributions tools operate as an overall system. Additionally, none of the four audited tools have their own evaluation framework. As such, there has been no analysis of the collective or individual impact of the development contributions tools on issues such as:

- timely delivery of infrastructure

- equity between regions

- social outcomes that result from infrastructure, such as access to education or public transport

- consequences for housing affordability.

While state agencies have improved their revenue monitoring since 2016, the absence of evaluation frameworks, data collection and analysis means they cannot show the impacts of the development contributions tools or how the state could improve them.

Evaluating GAIC

GAIC exists to obtain funds for growing communities, but DELWP has not identified any specific social or economic outcomes for the program. Further, DELWP has not set measures or targets to assess whether GAIC is successful.

Evaluating the DCP program

As with GAIC, the DCP program does not have an evaluation framework, and DELWP has not set goals to measure success against.

However, the transition to ICPs has led DELWP and VPA to evaluate some aspects of the DCP program. For example, they have engaged consultants to analyse:

- DCP levy data

- community infrastructure requirements

- standard costs for infrastructure

- how to apply levies to different areas—for example, converting farming areas versus developed industrial areas.

DELWP and VPA have also consulted with developers and councils throughout the ICP program’s development, which meant they heard stakeholders’ experiences implementing DCPs.

DELWP and VPA’s knowledge of the problems with DCPs—including that they are costly and lengthy to develop—is clear in the advice they provided to the government on ICP design. Despite this, these issues remain unaddressed.

As the DCP program is the only choice for 72 of Victoria’s 79 councils—and may continue as such for most of them—it is important to develop an evidence base for changes to improve its accessibility and outcomes.

Evaluating the ICP program

The ICP program does not have an evaluation framework at either the state or individual ICP level to allow it to assess achievement against its objectives of:

- simplifying the development of a contribution plan

- increasing transparency and certainty of infrastructure delivery

- obtaining land for infrastructure delivery

- preventing infrastructure delivery that is beyond a ‘basic and essential’ standard

- collecting a contribution from developers to the delivery of infrastructure.

VPA advised that the government plans to conduct a five-year review of the program. However, the value of this review may be limited without a formal evaluation framework. There is still time to develop a framework based on the Victorian Government’s outcomes architecture, shown in Figure 2E.

Figure 2E

Victorian Government outcomes architecture

Source: VAGO, based on the Department of Premier and Cabinet.

A comprehensive, program-wide evaluation may not be possible for some time, because:

- the first ICPs are only a year old

- the program is still being implemented

- councils will receive revenue over approximately 20 years

- councils need to deliver the infrastructure before realising benefits.

However, an upfront evaluation framework will enable DELWP to perform a comprehensive, long-term evaluation, as well as conduct interim evaluations.

3 Existing program effectiveness

In this Part, we examine state agencies’ design and implementation of the DCP and GAIC programs. We also look at councils’ use of development contributions tools.

3.1 Conclusion

The DCP and GAIC programs have design weaknesses that impact on their ability to provide required infrastructure to growing communities.

Councils seeking to establish a DCP must overcome significant time and cost barriers to establish a plan. This makes the DCP program less attractive for councils, despite it being the only formal development contributions tool available in 72 out of 79 LGAs.

GAIC’s capacity to fund state infrastructure projects has improved after an initial lag in receiving revenue. However, GAIC project selection arrangements remain split between the state budget process and DELWP’s process. This limits DELWP’s ability to take an overarching strategic approach that targets GAIC funds based on the areas of greatest need and benefit.

Developers can defer GAIC payments, which limits the reliability of the government’s forecasting of future GAIC revenue. As the state has committed more GAIC funds to projects than the total revenue collected to date, DELWP needs to carefully manage GAIC’s two trusts.

3.2 DCP program effectiveness

Throughout 2017–18 and 2018–19, 24 councils used DCPs to obtain funds that supported infrastructure development.

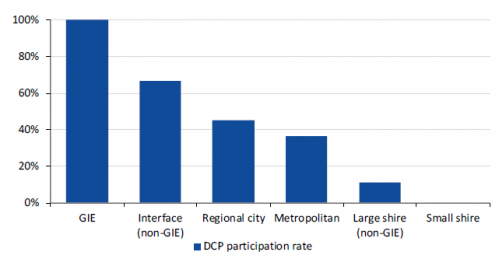

Significant barriers to councils’ participation in the DCP program include the complexity, cost and time lag in establishing a DCP. Figure 3A shows participation in the DCP program by council type and indicates that the barriers may be larger for smaller councils or those with lower population growth.

Figure 3A

Councils with DCP contributions by council type, 2017–18 and 2018–19

Note: The GIE council category includes six interface councils and one large shire. We excluded GIE councils from other categories.

Source: VAGO, based on DELWP data.

Cost

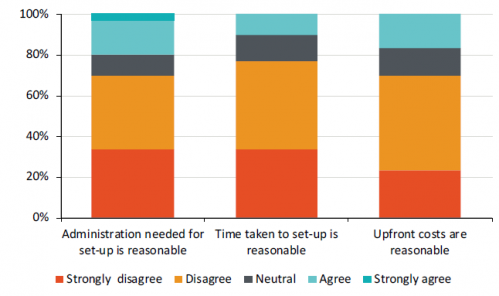

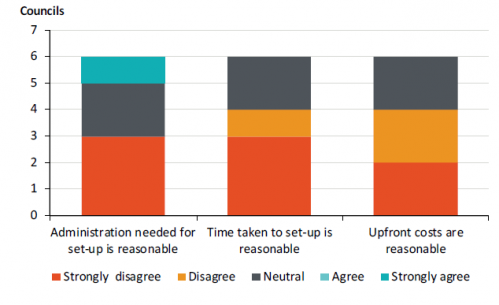

Our survey results found that the high cost of developing a DCP is a barrier to council participation. Of councils that have had DCPs, 70 per cent said that their upfront costs were not reasonable.

We reviewed a selection of 13 DCPs and found the average cost was $585 077. Four of them cost over $1 million. It is unclear how councils and VPA divided these costs.

These include direct costs such as consultant and legal fees. It is unclear which councils include staff costs in their cost estimates. Melton, which set up three of the 13 DCPs we analysed, advised us that it does not include council staff costs in its preparation costs. If this is consistent across councils, then they are understating their actual costs to prepare a DCP.

While a council can include set-up costs in the DCP and recoup the expense over its life through the levy, it may wait decades to recover the funds if development is slow. Where VPA incurs costs from preparing a DCP, it has no way to recover these costs.

Timeliness

When setting up a DCP, the planning authority—either the council or VPA:

- identifies the infrastructure required and costs the projects

- develops a draft DCP

- receives feedback from stakeholders

- publicly exhibits the draft DCP—It is then subject to a Planning Panels Victoria process, which involves the formal input of stakeholders, including developers and their lawyers

- seeks ministerial approval to gazette the planning scheme amendment.

The length of each step in the process varies, and no data is available to determine the average time taken to set up a DCP. However, Cardinia advised us that DCPs take between two and four years to prepare, draft and gain approval. Of surveyed councils that have had a DCP, 77 per cent said that the time taken to set up a DCP is not reasonable.

A council only receives revenue after the DCP is in place and development occurs. Again, there is no data on how long and at what rate councils will receive revenue through a DCP.

The significant period of time needed for councils to see a return on their investment may discourage them from participating in the DCP program.

Complexity

Councils also need a significant level of expertise—both in-house and from consultants—to design a DCP and ensure they have estimated project costs accurately. Required consultants’ advice often includes:

- traffic analysis

- site analysis to determine if there are geological challenges to building the proposed infrastructure

- drainage studies

- land valuations

- assessments of community and recreation needs

- construction cost analysis.

Cardinia and Melton advised us that their staff have gained significant expertise in developing and managing DCPs over time. However, Melton noted it is a challenge to find and retain experienced staff. This indicates there is a shortage of expertise in the sector that may impact other councils’ participation in the DCP program.

Financial risk exposure

The financial risks to councils are also a barrier to their participation in the DCP program. Once the Minister approves a DCP, councils must complete all of its projects, even if the costs of completing the project increase or it is no longer needed.

Cardinia and Melton advised us that their more recent DCPs are better costed, after they experienced financial loss in earlier DCPs. We cannot test this assertion based on the data we have received because the newer DCPs are still in progress.

DCPs have become more expensive for developers as councils have better managed financial risk by:

- factoring in contingency

- locking in the price of required land early in a DCP’s implementation to avoid the impact of escalating land prices

- using indexation methods that reflect increases in construction costs.

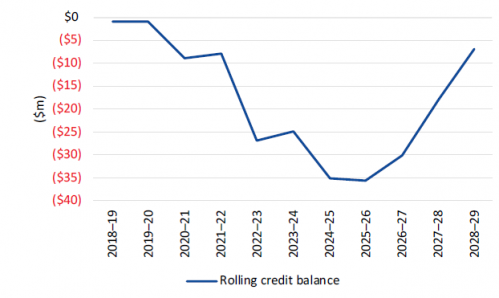

A DCP can leave a council with cashflow problems as the receipt of funds does not necessarily occur before it needs to deliver projects. For example, as shown in Figure 3B, Melton forecasts it will be $35 million in arrears by 2024–25 due to receiving revenue after it has to deliver infrastructure.

While the DCP will eventually recoup this money, Melton will need to fund the interim shortfall from other revenue sources or with debt. These cashflow issues are worse for councils with slower growth—common in regional areas—because they are less sure that growth will happen, and that levies will be collected. As such, fast-growing areas such as MGGs are best placed to deal with these issues.

Figure 3B

Melton’s projected cash transactions, 2018–19 to 2028–29

Source: Melton.

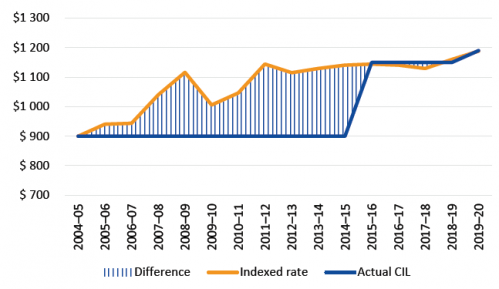

Under the Act, a DCP also includes a cap on the CIL. As shown in Figure 3C, the cap remained $900 per lot between 2004 and 2016. During this period building construction costs increased while the rate remained the same, meaning councils were underfunded. A consultant advised DELWP in 2015 that DCPs led to a 12 per cent shortfall in funding for the community infrastructure included in the DCP, partly attributing this to the CIL cap.

The government raised the rate to $1 150 in 2016, and introduced indexing in 2019 so that the rate keeps pace with the costs of building construction.

Figure 3C

Comparison of the actual DCP CIL cap with cap levels that include indexing

Note: We calculated the indexed rate using the Producer Price Index for Non-Residential Building Construction in Victoria. The index is published by the Australian Bureau of Statistics.

Note: The first annual indexation of the maximum levy amount and the payable dwelling amount is on 1 July 2019. Therefore, this indexation was applied to the 2019–20 actual CIL cap.

Source: VAGO.

3.3 GAIC program effectiveness

DELWP, VPA, SRO, Land Use Victoria (LUV) and DTF all have roles in managing GAIC, including:

- financial management

- revenue forecasting

- identifying GAIC events and collecting revenue

- policy and legislative advice

- fund allocation.

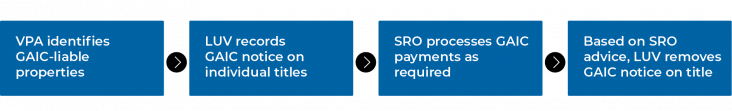

Collection of GAIC revenue

Identifying GAIC events and collecting revenue involves three agencies that each manage separate datasets, which have limited interactivity. This separation of responsibility and data increases the risk that SRO has not collected all GAIC revenue. Figure 3D shows each agency’s role in the process.

Figure 3D

GAIC liability identification and collection

Note: The timing of GAIC payments to SRO depends on whether developers enter staged payment arrangements, which VPA administers.

Note: A developer can also make GAIC payments through a work-in-kind agreement.

Source: VAGO, based on information from SRO and DELWP.

After SRO confirms that a developer has addressed their GAIC liability, it provides them with a document giving consent for the land transaction to proceed. The developer must then print and manually lodge this document with LUV. This process is inconvenient for developers and potentially open to fraud, as there is no confirmation between the agencies to verify the validity of the document.

Despite this risk, SRO’s evidence of the limited manual reconciliation it has undertaken with LUV data since 2009 has only identified three cases in which it did not charge a developer their GAIC liability.

SRO and LUV have addressed some of the flaws in the collection and recording of GAIC payments through recent changes:

|

Prior to 2019 |

From 2019 |

|

When a developer paid their GAIC levy, SRO provided the developer with a certificate and consent form showing they had met their GAIC obligations. The developer then took the consent form back to LUV. |

Conveyancing is moving to a digitised system. This will remove the need to provide paper-based evidence of GAIC payment. |

|

SRO and LUV did not conduct regular reconciliations of their records of GAIC-liable developments. |

Since July 2019, SRO has been piloting monthly reconciliations with LUV. |

Distribution of GAIC funds

DELWP improved the way it assesses potential GAIC-funded projects after the distribution of funds was initially delayed. However, distribution remains based on processes that prevent DELWP from taking a strategic approach to obtain the best outcomes from available funds.

How GAiC funds are used

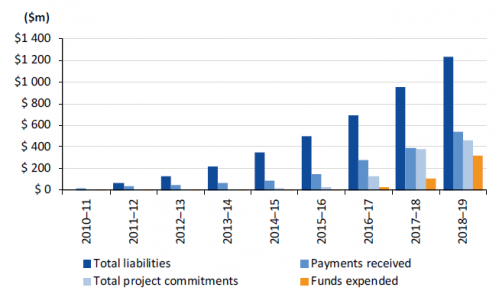

DELWP’s ability to recommend GAIC-funded projects to the Minister was initially delayed because actual developer contributions to the fund were either deferred or paid via staged payment agreements over multiple years. DELWP recommended this decision to government based on consultation with the sector, but it resulted in a significant lag from the program’s set up in 2010 to its first commitment to significant projects.

Between 2011–12 and 2015–16, developers incurred $500 million in GAIC liabilities, but paid only $146 million to the state. It took until 2016–17 before the state had built a sufficient level of funds in the trust to make significant project commitments.

Figure 3E shows the cumulative amount of accrued liabilities, revenue actually received by DELWP, the value of projects committed to and the actual expenditure on those projects.

Figure 3E

GAIC cumulative values

Note: Data as of July 2019.

Note: All figures are cumulative over financial years.

Note: There is no total liability data available for 2010–11.

Source: VAGO, based on SRO and DELWP data.

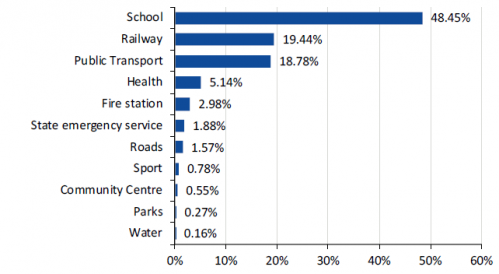

GAIC has funded a range of project types, with 48.5 per cent for building schools, as shown in Figure 3F.

Figure 3F

GAIC committed funds by project type

Note: Data as of 31 October 2019.

Source: VAGO, based on DELWP information.

In GAIC’s legislation, funds received by SRO are split evenly between the Building New Communities Fund (BNCF) and Growth Areas Public Transport Fund (GAPTF). Projects that are funded from these follow one of two approval processes:

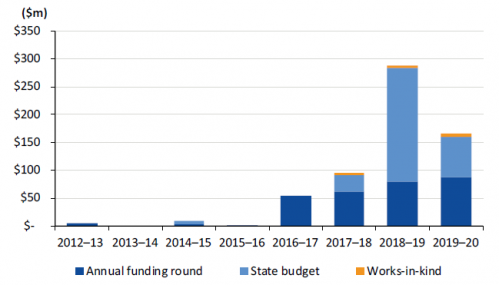

- Annual funding round—since 2016–17 DELWP has chaired an interdepartmental panel that receives and assesses applications for funding from departments for approval by the Minister and the Treasurer. The panel assess applications to ensure their eligibility under the Act and the GAIC application guidelines.

- State budget process—the government may also use GAIC to fund eligible departmental funding proposals during the annual state budget process. Departments must identify which parts of their proposals are eligible.

Figure 3G shows that 61 per cent of GAIC project commitments since 1 July 2018 were funded through the state budget process. These projects were eligible for GAIC funding under the Act and the GAIC policy statement. Thirty seven per cent were funded through the annual funding round, while the remaining 2 per cent covered work-in-kind agreements.

Figure 3G

Annual GAIC project commitments by funding method

Note: Data as at 31 October 2019.

Note: Further project commitments may be made during the remainder of 2019–20.

Source: VAGO, based on DELWP data.

While the Act requires that GAIC funds be divided evenly, it does not require the same split for project commitments. As at 31 October 2019, GAIC had committed $387.7 million to BNCF projects and $232.6 million to GAPTF projects, despite each fund receiving $310.1 million. The committed amounts include cash outflows for forward years.

The even division of GAIC funds into two trusts has the following impacts:

- As a higher proportion of BNCF funds have been committed, DELWP is monitoring fund allocation to avoid overdrawing on this trust.

- Legislatively dedicating funds to the GAPTF despite having fewer project commitments means DELWP cannot fund additional BNCF projects with this money.

- If the allocation to GAPTF continues to exceed project commitments, money will increase in the trust without delivering infrastructure to the communities as intended.

Strategic approach to project selection

DELWP publishes GAIC’s application guidelines each year and receives submissions from agencies through the annual funding round. DELWP advised that where necessary it proactively engages with agencies to increase their awareness of the program and encourage bids for funding.

However, the ability to fund GAIC projects separately through the state budget process—which is outside of DELWP’s control—means that it cannot take an overarching strategic approach to:

- selecting projects in areas of greatest need and benefit

- financial management of GAIC’s two trusts.

A newly formed subgroup of the government’s Land and Infrastructure Working Group is working to improve the way GAIC projects are selected. DELWP—as a member alongside DTF (as chair), VPA, SRO and a selection of other departments—advised us that this includes the development of demand assessments to establish a pipeline of works for future funding. It is unclear whether this work will prompt changes to GAIC’s legislative and policy requirements, or to DELWP’s role.

| The Land and Infrastructure Working Group formed in response to our August 2017 Effectively Planning for Population Growth audit. Its role includes reviewing mechanisms used to fund infrastructure provision and identify potential reforms. |

Lack of council input

GIE councils have no formal input into the processes DELWP uses to fund state infrastructure. As a result, the provision of schools and public transport projects may not align with council plans for residential, commercial or industrial developments.

While DELWP does not formally consult councils, it considers relevant Precinct Structure Plans—which VPA develops in conjunction with councils—and considers demand assessments during the annual GAIC funding round. This is consistent with the GAIC application guidelines, which ask applicants to identify which Precinct Structure Plan a proposed project is supporting.

| Precinct Structure Plans are master plans for development and investment in a local area. They usually cater for between 5 000 to 30 000 people, 2 000 to 10 000 jobs or a combination of both. |

Equal funding over time

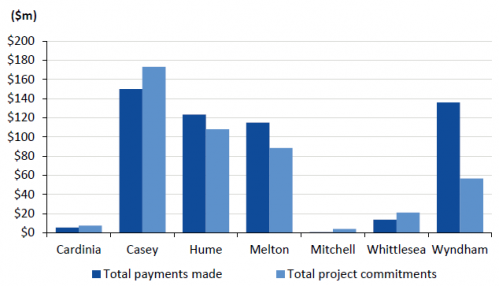

GAIC policy recommends that DELWP distributes funds to LGAs proportionate with developers’ contributions to the same areas over time. However, this is not a legislative requirement. Figure 3H shows that, as of 30 June 2019, DELWP has distributed funds largely in line with where developers made payments, with the exception of Wyndham.

Figure 3H

GAIC payments versus commitments

Note: Data as of 30 June 2019.

Source: VAGO, based on DELWP data.

As GAIC’s objective is to support infrastructure in growing communities, funding should have a strong relationship to population growth. However, the GAIC application guidelines do not explicitly require consideration of population growth when assessing funding proposals. Figure 3I shows that population growth is not directly informing fund distribution.

Figure 3I

GAIC project commitments compared to LGA population increases

Note: Some population growth may occur outside of GAIC-eligible areas.

Note: GAIC data as of 31 October 2019.

Source: VAGO, based on DELWP and Australian Bureau of Statistics data.

3.4 GAIC future revenue forecasting

DELWP uses DTF’s forecasts of future GAIC revenue to manage its two trusts. DELWP needs to understand this forecasting to correctly advise government and recommend projects while minimising financial risk to the state.

Total GAIC revenue

DELWP has used different DTF forecasts of total GAIC revenue to advise government. These forecasts have ranged from:

- a 2008 estimate of $1.8 billion, which covered a 24-year period between 2008 and 2032, to

- a revised 2019 estimate of $3 billion to $3.5 billion, which covered a 30 year period between 2010 and 2040.

| In this report, references to DELWP include former departments that were responsible for Victoria’s planning system. |

DTF advised us that the reliability of the 2008 estimate was limited due to a lack of available data, and uncertainty about how much developers would defer GAIC payments. DELWP did not communicate the limitations of this estimate to government.

DTF also advised us that its 2019 estimate of $3 billion to $3.5 billion is more accurate because it included additional data and used more sophisticated forecasting tools. However, DTF did not provide sufficient evidence to test this.

Both the original and revised revenue forecasts estimate that GAIC will fund approximately 15 per cent of required infrastructure in growth areas. However, there is no evidence detailing the basis for this estimate.

Year-by-year forecasts

Accurately predicting GAIC revenue each year is challenging:

- Staged payment arrangements make up more than 80 per cent of GAIC revenue. SRO can report on when staged payment arrangements are due, but their timing can change because developers can amend these arrangements.

- At 30 April 2019, developers had collectively deferred payment of $500 million in GAIC liabilities. As payment depends on the development going ahead, it is not possible to predict when developers will make these payments.

- GAIC work-in-kind agreements reduce revenue received.

If Victoria’s growth in GAIC-eligible areas slows, the amount of money coming to the state will slow. This could jeopardise the delivery of projects that the state commits to in advance. There is an increasing risk that the projected revenue will not meet future commitments, considering that:

- a high proportion of GAIC liabilities are subject to a staged payment arrangement

- as at 31 October 2019, total GAIC project commitments ($620.2 million) exceeded the total collected revenue ($592.7 million).

DELWP advised us that it is actively managing both GAIC trusts to ensure they are not overdrawn. This includes:

- working with DTF to estimate available cash in both GAIC trusts prior to the state budget

- reviewing all commitments to identify payments that could be moved into future years if actual revenue falls short of forecast revenue

- delaying future annual funding rounds until after the government makes state budget funding decisions. While this gives DELWP greater certainty about available funding, it would likely increase the number of funding allocations made outside of its process.

3.5 Councils' approach to development contributions

Different tools suit different councils. For example, it may not be worth the time and money it takes to set up a DCP for a rural council that has slow growth. Similarly, if a council has a fast rate of development and needs to build extensive infrastructure, it may find it expensive and inefficient to negotiate an individual VA/s173 with every developer.

Figure 3J shows councils’ use of the development contributions tools available to them. At least 22 councils do not use any of these tools.

Figure 3J

Councils’ use of development contributions tools to collect levies

Note: (i) VA/s173s data was based on 65 councils that responded to our survey. (ii) DCP and ICP data is based on information from DELWP. (iii) ICPs are limited to the seven GIE councils. (iv) One GIE council is awaiting ministerial approval of their ICP.

Source: VAGO.

We examine the four audited councils’ approaches to development contributions in detail below.

Cardinia and Melton

Cardinia and Melton rely on DCPs and ICPs to collect money to fund necessary infrastructure. With more than a decade managing DCPs, both councils have developed expertise and internal processes, and are now applying these to their new ICPs.

Resourcing

Both councils dedicate significant staff resources to managing DCPs and ICPs.

Cardinia advised it:

- has two full-time equivalent strategic growth area planners contributing to ICP and DCP preparation

- commits two staff to monitoring the implementation of and financial contribution to their DCPs and ICPs, but both have other additional responsibilities

- dedicates resources to building projects that the DCPs partially fund.

Cardinia also advised it would like to resource further staff to the financial management of DCPs.

Melton advised it has:

- one and a half full-time equivalent strategic planners preparing DCPs

- four statutory planners who perform development contributions work, with future plans to create a second team that will share this work

- two accountants monitoring DCPs’ and ICPs’ financial status

- a DCP/ICP working group of 15 to 20 council staff who prioritise project delivery.

The staff resources Cardinia and Melton dedicate to managing DCPs and ICPs shows the high administrative and financial burden of participating in these programs. While DCPs can deliver significant financial benefits, councils cannot recover these ongoing administrative costs, which may explain why smaller councils have not engaged in the DCP program. DELWP has acknowledged the substantial resources and costs required to develop a DCP in its advice to government on the ICP program.

Policy approach and documentation

Cardinia and Melton advised that their financial management of DCPs has improved over time, but that shortfalls have occurred because:

- they did not lock in land prices with VA/s173s early in their initial DCPs

- they did not include contingency amounts in their project costings

- construction costs escalated at a higher rate than the indexation rate they set in the DCPs.

Cardinia and Melton both now use VA/s173s to support the implementation of DCPs. Both councils advised that their practices have evolved over time in response to experiences implementing DCPs.

Cardinia and Melton use VA/s173s to:

- lock in land prices so they are less exposed to financial shortfalls as land prices increase

- ensure developers deliver works in kind on time and to council specifications

- provide clarity to both the developer and council on expectations regarding work-in-kind agreements.

Melton developed a policy document in 2015 to support staff in their negotiations with developers. It is now reviewing this policy to improve its approach to development contributions. The 2015 policy guides staff to consider:

- the timing of infrastructure provision

- the community benefit

- financial impacts for the council

- the council’s infrastructure priority list.