Managing Private Medical Practice in Public Hospitals

Overview

Patients can choose to be public or private patients for inpatient or outpatient services. Patients should not receive preferential access to services if they choose to be private patients. To facilitate private practice, health services enter into private practice agreements with senior medical specialists.

This audit examined whether the Department of Health and Human Services (DHHS) and three audited public health services are effectively managing private practice in public hospitals to optimise outcomes for the health sector and Victorians.

We made 10 recommendations in total—seven for DHHS, two for health services and one for Western Health.

Transmittal letter

Independent assurance report to Parliament

Ordered to be published

VICTORIAN GOVERNMENT PRINTER June 2019

PP No 39, Session 2018–19

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Managing Private Medical Practice in Public Hospitals.

Yours faithfully

Dave Barry

Acting Auditor-General

20 June 2019

Acronyms

Acronyms

| ABF | activity-based funding |

| DHHS | Department of Health and Human Services |

| ESIS | Elective Surgery Information System |

| IHPA | Independent Hospital Pricing Authority |

| MBS | Medicare Benefits Schedule |

| NHRA | National Health Reform Agreement |

| NWAU | National Weighted Activity Unit |

| SPF | special purpose fund |

| SVHM | St Vincent's Hospital Melbourne |

| VACS | Victorian Ambulatory Classification and Funding System |

| VAGO | Victorian Auditor-General's Office |

| VMO | Visiting Medical Officer |

| WASE | Weighted Ambulatory Service Event |

| WIES | Weighted Inlier Equivalent Separation |

Audit overview

The Australian Government provides health funding to Victoria under the National Health Reform Agreement (NHRA), which outlines the roles and responsibilities of the Commonwealth and state and territory governments. It also provides health funding to Victoria through the Medicare Benefits Schedule (MBS).

The NHRA specifies rules for how patients can elect to be treated in public health services. Public health services must offer emergency department treatment free of charge to all Medicare-eligible patients. However, a patient in Victorian public health services may elect to be treated as a private patient when receiving inpatient or outpatient services. When this occurs, the health service should not provide the patient with preferential access.

The Health Insurance Act 1973 provides a legislative framework for health services to claim MBS payments for patient services. Outpatient clinics can bill MBS if patients provide informed financial consent. For inpatient services, patients who elect to be treated privately can be billed directly, or, with their consent, the health service will bill their private health insurer.

The three health services we audited—Latrobe Regional Hospital, St Vincent's Hospital Melbourne (SVHM) and Western Health—derived more than $207 million from private practice patients in 2016–17 and 2017–18.

To facilitate private practice in public hospitals, health services enter into private practice arrangements with senior medical practitioners. There are two types of private practice arrangements typically used in Victoria:

- 100 per cent donation model—the senior medical practitioner donates all their private practice income to the health service.

- Retention model—the senior medical practitioner keeps their private practice income and may share a portion of the income with the health service as an administration or facility fee.

While individual health services are responsible for negotiating and administering private practice arrangements, the Department of Health and Human Services (DHHS) is the steward and manager of the Victorian public health system. This includes responsibility for the overall planning, funding and oversight of Victoria's public health system, and for ensuring compliance with the NHRA.

DHHS sets objectives for what private practice in public health services is intended to achieve. The three intended benefits for health services are:

- providing an additional source of revenue

- attracting and retaining highly specialised staff because of the patient mix (public and private)

- maximising care to the community, through opportunities to reinvest revenue into expanded public service offerings.

This audit examined whether DHHS and health services are effectively managing private practice in public hospitals to optimise outcomes for the health sector and Victorians.

Conclusion

Health services have not taken enough action to ensure that their private practice activities comply with the NHRA, the Health Insurance Act 1973 and national MBS billing requirements. Non-compliant practices include not ensuring patient consent for private treatment and billing Medicare for services already paid for by the state and Commonwealth under standard activity-based funding arrangements for public services.

DHHS does not guide the management of private practice in public health services and does not monitor whether health services comply with national requirements. Health service non-compliance with national requirements places the state at risk of the Australian Government seeking repayment for incorrectly billed services.

DHHS can more strategically consider Victoria's funding approach for health. DHHS should acquire and analyse funding and activity data to better inform decisions about the best mix of state, Commonwealth and private revenue sources to support healthcare delivery. DHHS's current funding model does not incentivise health services to ensure their combination of public and private services deliver the most effective and cost-efficient services for the state. In some cases, we found that public health services have given medical specialists the use of public hospital facilities, including support staff and facilities services, to run their private operations for no or minimal cost, without assessing the cost-benefit of these arrangements.

Findings

Managing private medical practice

Compliance and oversight

DHHS does not currently have health services' data to determine whether MBS billing practices comply with the NHRA or the Health Insurance Act 1973, nor can it assess whether the current mix of public and private funding is the best mix for the state.

Forgone revenue

DHHS does not have a strategy for how Victoria can achieve the best mix of state, Commonwealth and private revenue funds. We found examples of the state forgoing revenue it could claim and opting for funding sources where alternatives may be more cost beneficial.

We examined the three audited health services' outpatient funding data for 2016–17 and 2017–18, and identified lost Commonwealth Government funding for Victoria totalling over $10.65 million through:

- unclaimed MBS billing

- forgone Commonwealth activity-based funding (ABF), paid in National Weighted Activity Units (NWAU), as a result of using MBS instead of public occasions of service.

|

MBS billing for outpatient clinics means that the patient has elected for their treatment to be billed to MBS. Patients do not pay for this service. Health services record this treatment as 'private' in their data. |

A common reason for unclaimed MBS is a health service recording a patient's outpatient service as 'private', but later determining that it has not met Medicare's requirements to make a claim—for example, because the patient does not have a valid referral. Western Health and SVHM had 28 649 unclaimed MBS outpatient services in the two years we examined, totalling over $2.37 million in unclaimed revenue.

The state can lose revenue even when health services bill Medicare for outpatient services. Our analysis found that the NWAU payment for some specialist outpatient clinics if the service was provided publicly would be greater than the MBS payment. When we compared the three audited health services' specialist outpatient MBS claims against the applicable NWAU payment for 2016–17 and 2017–18, we found that the NWAU payments would have exceeded the MBS payments by more than $8.2 million.

By not undertaking these in-scope services as public, the state forgoes the revenue under the NHRA. While the activity is reported to the Commonwealth, it does not attract Commonwealth funding and therefore does not contribute to Victoria's growth funding. In 2017–18, if Victoria had reached its 6.5 per cent activity growth cap, it could have accessed an additional $48 million of Commonwealth health funding for in-scope reported activity. While this funding would require a co‑contribution from the state, reported by DHHS as approximately $108 million—which becomes an ongoing commitment—the Commonwealth model also allows this to be made up of savings from delivering services more efficiently. DHHS has not undertaken analysis or modelling to test their current funding arrangements against such alternate approaches.

Monitoring health services' activities

Clauses 5 and G19b of the NHRA require health services to provide public patients with the same level of access to services as private patients and treat eligible patients free of charge unless they choose to be treated as a private patient.

DHHS guidance on the NHRA is outdated and spread across multiple documents. While DHHS has some data to enable it to monitor health services' compliance with the NHRA, it does not do this.

|

ABF pays health services for the number and mix of patients they treat. If a health service treats more patients, it receives more funding. ABF pays different prices based on the complexity of the patient and the treatment. The NHRA commits to funding health services using ABF, where practicable. |

Western Health's Sunbury Day Hospital provides a day-surgery facility, including support staff and supplies, at no cost to medical specialists three days a week, to operate their private medical services. Western Health then places these doctors' private patients on the public elective surgery waiting list. Medical staff predominantly place private cataract and wisdom teeth removal patients in the highest urgency category, usually reserved for emergency cases, which is inconsistent with clinical practice. Western Health bills the patient or their health insurer for these services. However, in addition, Western Health has unintentionally claimed state payment contributions through Victoria's ABF model from DHHS for these private patients. This is a breach of the NHRA. In response to this finding, DHHS advises it is undertaking a review of Sunbury Day Hospital.

Clause G20 of the NHRA stipulates that where a patient chooses to be a public patient, components of the patient's treatment such as pathology and medical imaging are bundled into the cost of the treatment, and health services cannot bill separately for them. There is a lack of clarity on correct billing practices for episodes of care. DHHS should provide health services with greater clarity on this issue to help them comply with the NHRA.

In 2016–17 and 2017–18, Western Health, SVHM and Latrobe Regional Hospital did not comply with the NHRA or the Health Insurance Act 1973 due to claiming MBS payments that were already covered as part of the public treatment. However, non-compliance at Latrobe Regional Hospital was significantly less than the other two health services due to practice improvements implemented in 2018. These wrongful claims total over $5.8 million and made up about 6 per cent of all records we examined. The Australian Government could require Victoria to repay money wrongfully claimed under clause G20, but DHHS does not monitor health services' compliance with this clause.

Section 19(2) of the Health Insurance Act 1973 allows medical practitioners to undertake private practice and use the 100 per cent retention model only when the arrangement exists within a 'broader' employment arrangement with the public health services. SVHM may not comply with this section, because it has retention model arrangements with six fee-for-service Visiting Medical Officers (VMO) who do not have an employment arrangement with SVHM. These fee-for-service VMOs do not receive a salary or sessional fee from SVHM, and directly bill their services to MBS.

DHHS does not issue guidance on the types of private practice arrangements health services may establish. Consequently, the audited health services do not manage these arrangements consistently. Arrangements at Western Health are particularly complex, with various types of agreements across the health service leading to an uneven distribution across medical staff and difficulty with compliance oversight.

While DHHS's private practice principles state that one of the benefits of private practice is that it provides an additional income source for health services, DHHS has never sought to examine its true cost. Our observations of each audited health service demonstrate that managing private practice arrangements is administratively burdensome, and none of the health services know the cost of administering them.

DHHS notes in its guidance that another benefit of private practice is staff recruitment and retention. While it is difficult to assess this benefit, we found no evidence that private practice arrangements encourage the recruitment or retention of medical practitioners. DHHS has also not measured or monitored this.

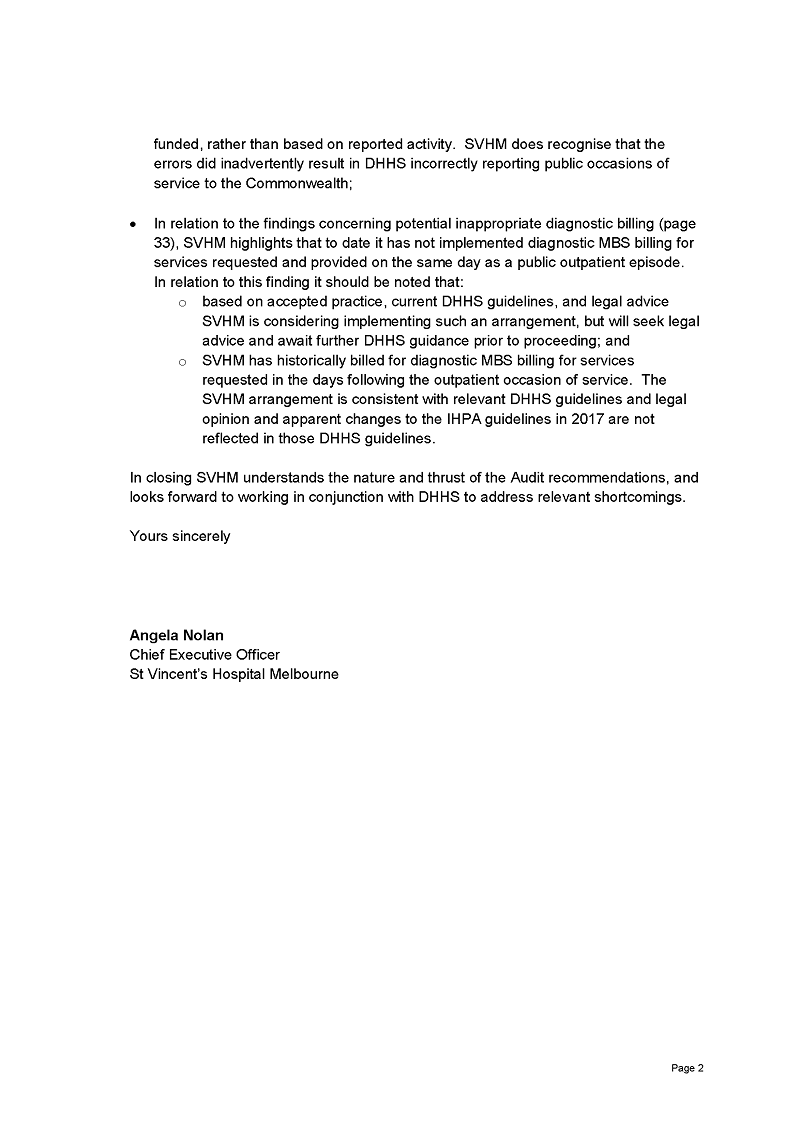

Recommendations

We recommend that the Department of Health and Human Services:

1. form a network within the Department of Health and Human Services—comprising its finance, health policy, and hospital performance areas together with representatives from health services—that reports to a responsible Deputy Secretary, to lead a comprehensive review of Victoria's health funding in relation to Commonwealth and private funding sources, including the funding model for outpatient services, to ensure the funding model represents the best mix of state, Commonwealth and private revenue (see Section 2.2)

2. subsequent to the funding review, create guidance for health services to align their practice with the Department of Health and Human Services' chosen funding approach explaining best-practice arrangements for utilising Commonwealth and/or other revenue sources (see Section 2.2)

3. examine section 19(2) of the Health Insurance Act 1973 and clarify for health services whether medical practitioners can undertake private practice on a 100 per cent retention model when not employed by the health service (see Section 2.3)

4. evaluate private practice arrangements to measure and monitor the benefits and share results with health services to inform their practice (see Section 2.3)

5. review its Medicare Benefits Scheme billing guidance to provide health services with clarity and ensure health services comply with Australian Government legislation and Independent Hospital Pricing Authority criteria (see Section 2.2)

6. monitor whether health services comply with the National Health Reform Agreement and other key Commonwealth legislation (see Section 2.2)

7. provide clear guidance to health services that they should not include private patients from specialists' private surgical lists on the health service's elective surgery waiting list system and monitor health services' compliance with this (see Section 2.2).

We recommend that health services:

8. examine unclaimed Medicare Benefits Schedule services from outpatient clinics and ensure they are either claimed or reported as public occasions of service (see Section 2.2)

9. examine and ensure their compliance with the National Health Reform Agreement, Medicare Benefits Schedule billing, Department of Health and Human Services' guidelines and Independent Hospital Pricing Authority criteria (see Section 2.2).

We recommend that Western Health:

10. examine its current private practice arrangements at its Sunbury Day Hospital to ensure they are compliant with Department of Health and Human Services requirements, properly documented and cost-effective (see Section 2.2).

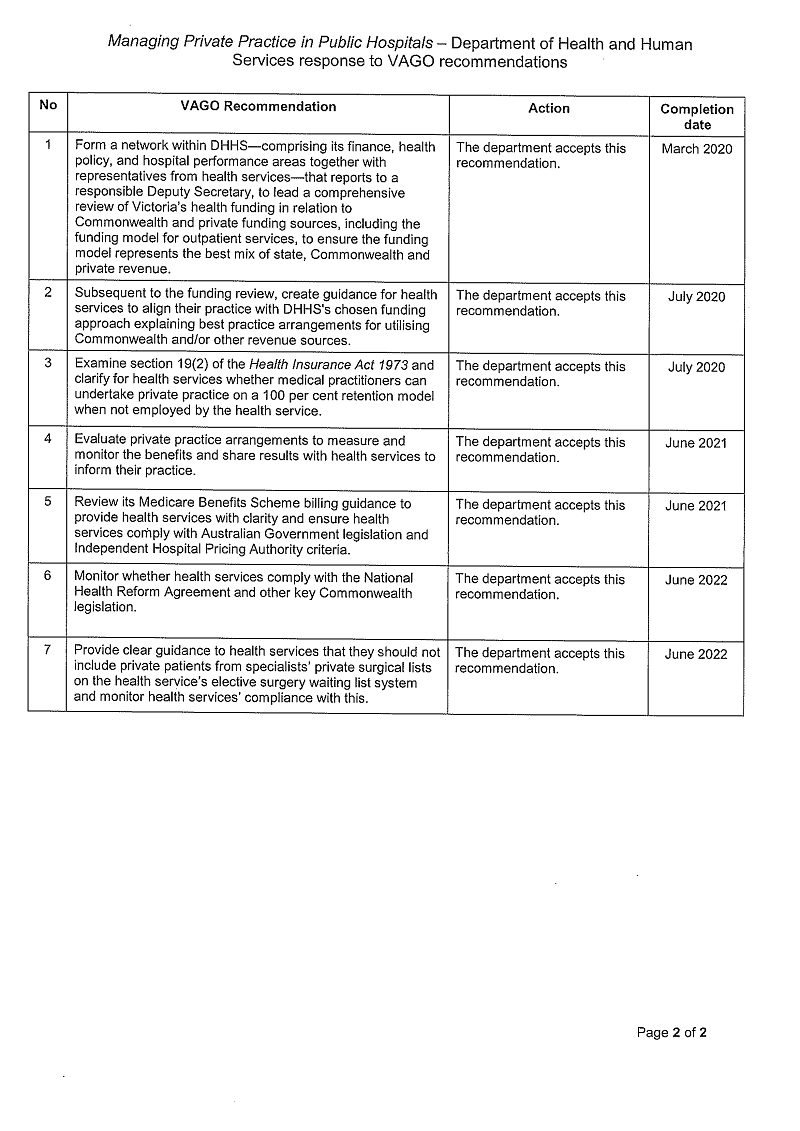

Responses to recommendations

We have consulted with DHHS, Latrobe Regional Hospital, SVHM and Western Health, and we considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet.

The following is a summary of those responses. The full responses are included in Appendix A.

All agencies have accepted our recommendations, with DHHS noting work is currently underway to address several of the recommendations.

Western Health has accepted the majority of findings relating to Sunbury Day Hospital. However, Western Health does not agree with or accept some of our findings on outpatient services or billing.

1 Audit context

Public health services in Australia receive a combination of funding from the Commonwealth and state and territory governments. This provides free healthcare to all Medicare-eligible patients. Victoria currently has 85 publicly funded health services, including public health services, public hospitals, multipurpose sites, and denominational and privately operated public hospitals.

The Commonwealth Government provides health funding to Victoria under the NHRA, which outlines the roles and responsibilities of the Commonwealth and state governments with respect to the provision of healthcare. The NHRA specifies the business rules for treating private patients in a public hospital, seeking consent from patients to be a private patient, and how to charge for private patients.

The Australian Government's Department of Health administers MBS. MBS benefits include medical consultations, procedures, and tests that are subsidised. The Commonwealth Government also provides block funding and grants for some health services, such as for regional and remote multipurpose sites that provide integrated health and aged-care services.

The Commonwealth Government funds efficient ABF growth for in-scope public health services through NWAUs. It also provides health funding through MBS and the Pharmaceutical Benefits Scheme.

Victoria's health system follows a devolved governance model. Under the Health Services Act 1988, DHHS is the manager and steward of the public health system. Independent boards appointed by the Minister for Health are responsible for the strategic management and governance of Victorian public health services. Denominational and privately operated public hospitals are exceptions to this.

1.1 Health system funding

Commonwealth funding for Victoria public health services

|

The national efficient price is based on the average cost of an admitted acute episode of care provided in public hospitals during a financial year. It determines the amount of Commonwealth Government funding for public hospital services and provides a price signal or benchmark about the efficient cost of providing public hospital services. The national efficient cost is used when activity levels are not suitable for funding based on activity, such as small rural hospitals. In these cases, services are funded by a block allocation based on size, location and the type of services they provide. Public hospitals also receive block funding to support teaching and research, and for some services where it is more appropriate. |

The Independent Hospital Pricing Authority (IHPA) is an independent government agency established by the Council of Australian Governments as part of the National Health Reform Act 2011 to give independent and transparent advice about the funding of public hospitals.

IHPA sets the national efficient price and national efficient cost to enable ABF in Australian public health services. To do this, IHPA developed the NWAU as a measure of health service activity expressed as a common unit, against which the national efficient price is paid. NWAU price weights are adjusted annually and applied to all past years to reflect changes in reported activity and costs.

NWAUs provide a way of comparing and valuing public health service activities by weighting clinical complexity. For example, an average inpatient service is worth one NWAU—$5 012 in 2018–19—while more complex and intensive services are worth multiple NWAUs. Simpler services are worth a fraction of an NWAU.

The Commonwealth Government contributes to states and territories approximately 42 per cent of the cost of base-level health activity and then will pay Victoria 45 per cent of the national efficient price for annual growth in inpatient and outpatient services delivered in Victorian public health services, up to a cap of 6.5 per cent of the base level. This cap was set in 2017–18, prior to which there was no cap. The NWAU base plus growth becomes the base for the next year. Victoria must then contribute 55 per cent of the base funding in the next year.

If a state exceeds the 6.5 per cent growth cap, it has the opportunity to access NWAU growth funding of other states that have not reached their full 6.5 per cent growth, in the form of a once-off payment.

Health funding in Victoria

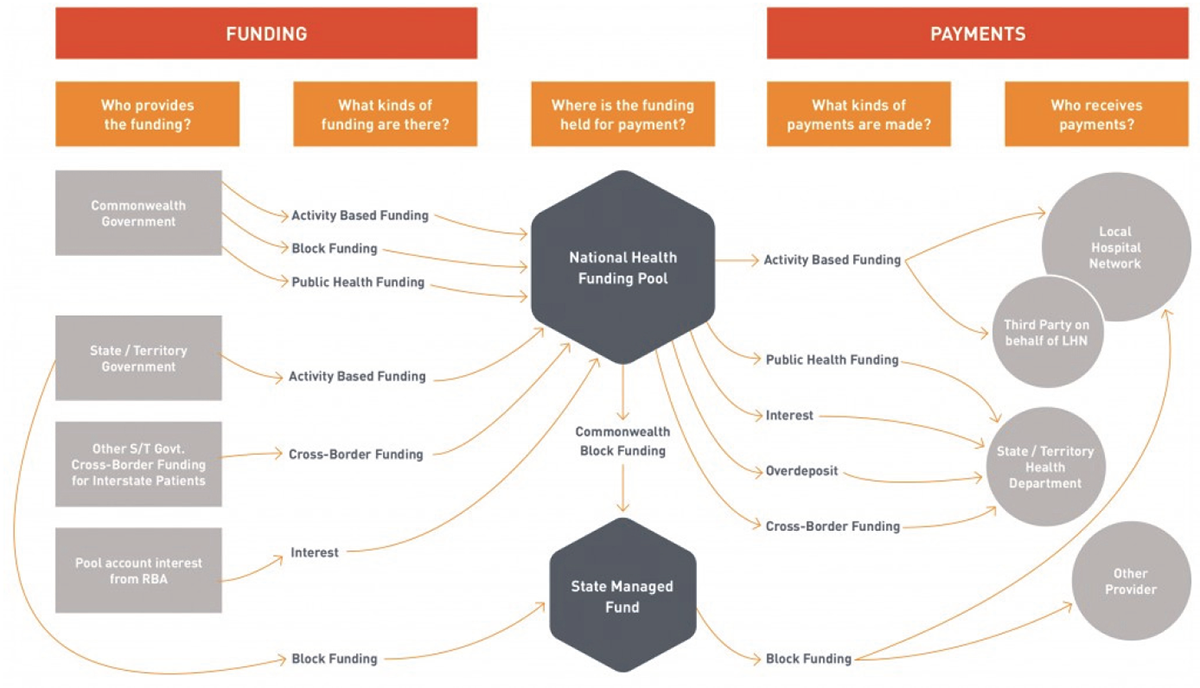

Health funding is a combination of Commonwealth and state and territory government money, as shown in Figure 1A.

Figure 1A

National health reform payment and funding flows

Source: National Health Funding Body.

Victoria introduced ABF in 1993 for acute inpatient services, and health services have collected and reported on activity-based data since then. DHHS takes into account the Commonwealth Government funding received by Victorian public health services when allocating capped funding and grants to health services using Weighted Inlier Equivalent Separation (WIES), which is used for acute inpatient activity. WIES is specific to Victoria and is determined by DHHS using clinical costing data.

DHHS makes WIES payments to health services for each acute patient treated or 'separated' from the hospital. A 'separation' refers to the patient's journey from admission to discharge. Like NWAUs, a WIES unit has a set price, which DHHS determines and which is different to the NWAU price. In 2018–19, the WIES unit is $4 883 for metropolitan health services and regional health services and $5 083 for sub-regional and local health services for public patients. DHHS adjusts the number of WIES units paid according to the patient's condition, treatment and length of stay.

For private patients, DHHS makes a private WIES payment, which is about 76 per cent of the cost of a public WIES payment. For 2018–19, a single private WIES unit was $3 560 for metropolitan health services and regional health services and $3 741 for sub regional and local health services. Figure 1B shows the public and private WIES targets set by DHHS for the audited health services against actual figures for 2016–17 and 2017–18. The WIES targets are estimates of activity in health services to determine budget and overall activity targets.

DHHS caps the WIES funding it provides to health services. If health services provide inpatient services beyond this cap, they do not receive state funding to cover those costs. However, health services can access a 50 per cent payment for services between 100 to 104 per cent of the cap.

Figure 1B

WIES public and private targets and actual figures, 2016–17 and 2017–18

|

2016–17 |

2017–18 |

|||||||

|---|---|---|---|---|---|---|---|---|

|

Public |

Private |

Public |

Private |

|||||

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Western Health |

80 708 |

82 800 |

6 770 |

6 969 |

83 886 |

82 059 |

6 983 |

6 618 |

|

Latrobe Regional Hospital |

19 384 |

19 647 |

1 656 |

1 613 |

23 280 |

19 903 |

1 947 |

1 761 |

|

SVHM |

45 731 |

48 073 |

6 806 |

6 940 |

49 279 |

46 072 |

7 460 |

6 294 |

Source: DHHS.

DHHS funds specialist outpatient clinics differently. From 1997 to 2017, Victoria used an output-based funding model called the Victorian Ambulatory Classification and Funding System (VACS). VACS was a way for DHHS to estimate the weighted cost of providing a service. It was based on 35 weighted medical, surgical and clinical specialties and 11 unweighted allied health specialties. DHHS used VACS to fund 19 health services and provided block funding for the remaining health services.

|

Public hospitals receive block funding to support teaching and research, and for some services where it is more appropriate. Smaller rural hospitals are block funded to ensure certainty of funding, irrespective of activity. |

In 2017–18, DHHS introduced an ABF model, Weighted Ambulatory Service Event (WASE), which replaced VACS and the block grant funding for specialist outpatient services in all Victorian public health services. The WASE model includes a public and private price for outpatient services. DHHS sets WASE targets for health services that match historical specialist outpatient clinic funding and take into account the public and private activity split. DHHS monitors outpatient activities in each health service against WASE.

On average, government funding covers approximately 80 per cent of the total costs incurred by health services. The caps on activity, and the gap between the price paid and health service costs, creates an incentive for health services to seek alternate revenue, including through private practice arrangements.

1.2 Governance arrangements for Victorian health services

National Health Reform Agreement

The NHRA provides a framework for the Commonwealth and state and territory governments to jointly fund public health services. It aims to improve healthcare outcomes and create a more sustainable funding arrangement. It specifies financial and funding arrangements and outlines the roles of the governments. Premiers and chief ministers of states and territories and the Prime Minister of Australia signed the NHRA in August 2011.

The NHRA specifies the business rules for treating private patients in a public hospital, requirements for seeking consent from patients to be a private patient, and how to charge for private patients.

The NHRA defines the role of the states and territories, and makes Victoria responsible for:

- establishing the legislative basis and governance arrangements for public health services

- setting policy and procedures for public health services

- system-wide planning and performance

- monitoring service delivery

- state-wide industrial relations functions, including negotiating enterprise bargaining agreements.

Department of Health and Human Services

The Health Services Act 1988 gives the DHHS Secretary a range of principal functions to ensure its objectives are met, such as to:

- develop policies and plans with respect to healthcare provided by health services

- fund or purchase health services and monitor, evaluate and review publicly funded or purchased health services

- in consultation with health services, develop criteria or measures that enable comparisons to be made between the performance of health services that provide similar services

- encourage safety and improvement in the quality of healthcare provided by health services

- collect and analyse data to enable the Secretary to undertake their functions under the Act.

DHHS is also responsible for administering the NHRA on behalf of Victoria.

DHHS guidance to Victorian public health services is important to provide consistent information on how to best manage key processes and comply with funding rules. For example, DHHS, through its Policy and Funding Guidelines, sets business rules for public health services. While guidance does not need to be prescriptive, it should aim to help health services comply with legislation or required policy. Guidance should also be strategic, recognising that public health services are partners in ensuring that Victoria can access its proper share of Commonwealth Government funds, as per the NHRA.

Public health services

Under the Health Services Act 1988, the Minister for Health appoints independent boards for health services, except for denominational and privately owned public hospitals. The boards have a range of duties, including setting the health service's overall strategy, determining service offerings, setting the budget and governance arrangements and ensuring there is appropriate executive talent in place. The chief executive officer is responsible for managing the public health service in accordance with the framework set by the board, such as ensuring compliance with all relevant rules and guidelines, as well as the day-to-day operations, management and governance. This includes employing staff and negotiating and entering into private practice arrangements with senior medical practitioners.

1.3 Private patients in public health services

Patients in Victorian public health services can choose to be public or private patients for inpatient or outpatient services. However, emergency department treatment must be provided on a public basis and free of charge to all Medicare-eligible patients. Patients should not receive preferential access to services if they choose to be private patients.

Inpatient care

|

An admission is a process whereby a hospital accepts responsibility for a patient's care or treatment. Admission follows a clinical decision that a patient requires same-day, overnight or multi-day care or treatment. |

Health services admit inpatients because they require treatment and/or monitoring (same day, overnight or multi-day). Health services can admit patients through an emergency department, referrals from external providers, and referrals from internal outpatient services when they require elective procedures, such as surgery.

The NHRA states that all Medicare-eligible patients will be treated as public patients unless they elect to be treated privately. If this is the case, patients must sign an informed financial consent either on admission or as soon as practicable after admission. These private patients may choose their treating medical practitioner.

Private patients may have some components of their care billed to MBS. The remainder is either paid by the patient directly, or by their private health insurance company, or a combination of both. Some private health insurers require patients to pay an excess payment when they make a claim on their policy. All three audited health services cover a patient's excess when patients choose to be treated privately. Health services do not charge patients a gap payment—that is the difference between what their health insurance provider pays and what their doctor charges. In addition, patients eligible through the Transport Accident Commission, WorkCover or the Department of Veterans' Affairs are compensated for the cost of their treatment.

DHHS's guidance document Private patients: Principles for public health services, published in 2016, sets out the principles that apply to private patients who receive care in public health services. The document notes that health services must not prioritise private patients above other patients for the care provided or timeliness of treatment.

Outpatient care

Patients in specialist outpatient clinics receive medical care to treat acute health conditions in a non-admitted setting. Public health services run a wide range of specialist outpatient clinics, such as pre-admission or fracture clinics. Patients can be referred to a specialist outpatient clinic by treating staff within the health service, or external medical practitioners such as general practitioners.

Specialist outpatient clinics can be funded as a public clinic, where health services record a public occasion of service. This contributes to Victoria's NWAU growth. Specialist outpatient clinics can also be funded using MBS, where a health service has private practice arrangements in place. These appointments are billed to MBS and do not contribute to Victoria's NWAU.

The requirement for informed consent applies to patients attending MBS specialist outpatient clinics in public health services. Clause G19 of the NHRA states that an eligible patient presenting at a public hospital outpatient department will be treated free of charge as a public patient unless:

- there is a third-party payment arrangement with the hospital or the state or territory to pay for such services, or

- the patient has been referred to a named medical specialist who is exercising a right of private practice and the patient chooses to be treated as a private patient.

DHHS provides the following guidance to health services for specialist outpatient clinics:

- Specialist clinics in Victorian public hospitals: A resource kit for MBS-billed services (2011)

- Specialist clinics in Victorian public hospitals: Access policy (2013)

- Specialists clinics service improvement guide (2013).

1.4 Right of private practice

The history of right of private practice in Victoria

DHHS guidance specifies that public health service specialist outpatient clinics cannot be exclusively private. The guidance also requires health services to display signage to inform patients whether a clinic is public, private or mixed, and that patients have a choice of public or private treatment.

Dillon Review

The October 1959 report to the Hospitals and Charities Commission, titled Salaries, Terms and Conditions of Service of Medical Officers Employed in Public Hospitals, was chaired by John Dillion SM and became known as the Dillon Review. The review included the first documented analysis and assessment of private practice in Victoria's public health system. It recommended, among other things, that full-time medical specialists put all of their private practice income into private practice funds, which later became speciality group special purpose funds (SPF). These funds could be used for research, tools and resources. This system aimed to promote collegiality within specialty groups because specialists who earn more private income share with those who have a lower capacity. Some health services still refer to SPFs as 'Dillon funds'.

Other reviews

Since the Dillon Review, there have been further reviews of the salaries, terms and conditions of medical specialists that have also touched on the role and arrangements of private practice income in the overall remuneration of full-time medical specialists in Victoria. These reviews include the:

- June 1995 report of the Ministerial Review of Medical Staffing in Victoria's Public Hospital System, chaired by Ben Lochtenberg (the Lochtenberg Review)

- June 2000 unpublished report of the Ministerial Review of Victorian Public Health Medical Staff,chaired by Dr Heather Wellington (the Wellington Review).

The reviews note that over time the Dillon arrangements for private practice had fractured and some specialties have less capacity for private practice earnings than other specialties. Both reviews recommended supplementing the salaries of full-time medical specialists in specialties with less earning capacity with wage increases of 10 and 25 per cent respectively.

Current models of private practice arrangements

Senior medical practitioners employed by a public health service may carry out private practice within that health service, if they have an agreement with the health service to do so.

There are typically two types of private practice arrangements in Victoria:

- 100 per cent donation model—the senior medical practitioner donates all their private practice income to the health service.

- Retention model—the senior medical practitioner keeps their private practice income and may share a portion of the income with the health service as an administration or facility fee.

Fee-for-service VMOs may also conduct private practice at public health services, however, they are generally not employed by the health service. VMOs bill their services directly to health services, MBS or other funders such as private health insurers. Health services may or may not charge VMOs for the use of facilities.

Donation model

Under the donation model, senior medical practitioners donate private practice revenue to the health service. Senior medical practitioners allow the health service to use their Medicare provider number to bill on their behalf. The health service accepts risks and liabilities associated with billing errors, however, senior medical practitioners are liable for non-compliance with the Health Insurance Act 1973.

All senior medical practitioners who follow the 100 per cent donation model have access to medical indemnity insurance through the Victorian Managed Insurance Authority.

Under the donation model, health services may donate a percentage of the private practice income to an SPF. The medical or surgical specialty that the senior medical practitioner belongs to, for example, cardiology or dermatology, manages the SPF. SPFs are typically spent on training, equipment, or research to support their specialty.

Retention model

Under the retention model, senior medical practitioners keep all or a portion of their private practice billing income. Under this arrangement, the senior medical practitioner is responsible for their own billing. However, health services may bill on their behalf if both parties agree.

Under an agreement with their employer, the senior medical practitioner may share a percentage of their private practice income with the health service in return for administration services or as a facility fee.

Medical Specialists Enterprise Agreement 2018–2021

The Medical Specialists Enterprise Agreement 2018–2021 sets out the working conditions and pay scales for medical specialists working in public health services. The agreement has two separate base pay scales for 'full-time doctors' and 'full-time doctors (who receive additional private practice income)'. The 'full‑time doctors' pay scale is between 19 and 25 per cent more than the 'full-time doctors (who receive additional private practice income)' pay scale.

The agreement specifies that health services are able to pay the lower base rate to full-time doctors (who receive additional private practice income) if the combination of their salary and private practice earnings is equal to or greater than the higher base rate.

Under the agreement, health services must correctly bill for services and provide the medical specialist with the details of what it has billed against their provider number. The agreement also specifies that health service processes must be consistent with national healthcare agreements.

1.5 Why this audit is important

There is limited public information available about private practice in Victoria's public health services. DHHS sets out the benefits of private practice in its document Private patients: Principles for public health services. DHHS asserts that private practice:

- provides health services with an additional source of revenue

- helps health services attract and retain highly specialised staff

- maximises services provided to the community, through opportunities to reinvest revenue into expanded public service offerings.

However, there is no assurance that private practice achieves its intended outcomes or delivers efficient, effective or economical health services to Victorians.

This audit provides insight into an area of the health system where there is currently limited visibility.

1.6 What and who this audit examined

This audit examined whether DHHS and three audited public health services are effectively managing private practice in public hospitals to optimise outcomes for the health sector and Victorians.

Department of Health and Human Services

DHHS is the manager and steward of Victoria's public health system. It is responsible for reporting to and advising the Victorian Minister for Health on the operations of the Health Services Act 1988.

The Health Services Act 1988 gives the DHHS Secretary a range of principal functions to ensure the objectives of the Act are met. DHHS is also responsible for administering the NHRA on behalf of Victoria. The NHRA provides a framework for the Commonwealth Government and states and territories to jointly fund healthcare and sets out agreed rules for states' health systems.

DHHS guidance provides Victorian public health services with consistent information on how best to manage key processes and comply with funding rules. For example, DHHS's Policy and Funding Guidelines and other documents set business rules for public health services.

Latrobe Regional Hospital

Latrobe Regional Hospital offers medical and specialty services for the Gippsland region, servicing a population of 260 000. It has 313 beds and treatment chairs, and services about 130 000 patients each year, with about a quarter of those through its emergency department. It employs about 1 900 staff and is one of the largest employers in the region.

Latrobe Regional Hospital offers elective surgery, emergency care, aged care, obstetrics, mental health, pharmacy, rehabilitation and medical and radiation oncology.

Western Health

|

Ambulatory clinics provide healthcare to individuals with chronic diseases, or those that are frail or recovering from surgery. Ambulatory clinics aim to prevent or reduce the need for hospital admissions. |

Western Health services Melbourne's western suburbs. It has three acute public hospitals located in Footscray, Sunshine and Williamstown. It also operates the Sunbury day hospital, and a transition care program at Hazeldean in Williamstown.

Western Health has more than 1 000 beds and services a population of approximately 800 000. It employs nearly 6 500 staff.

Western Health provides acute tertiary and subacute care, including emergency medicine, intensive care, medical and surgical services and specialist ambulatory clinics.

St Vincent's Hospital Melbourne

SVHM is a denominational tertiary public healthcare service, with a main campus in Fitzroy and two other campuses in Kew. It has 880 beds and more than 5 000 staff. It primarily services the municipalities of Yarra, Boroondara, Darebin and Moreland, yet only 43 per cent of SVHM patients live in these municipalities.

SVHM provides a range of services, including acute medical and surgical services, emergency and critical care, aged care, diagnostics, rehabilitation, allied health, mental health, palliative care and residential care.

1.7 How we conducted this audit

We analysed DHHS's oversight of private practice, including its guidelines, monitoring, and whether private practice achieves the intended outcomes outlined by DHHS.

We examined how three Victorian health services administer right of private practice: SVHM, Western Health and Latrobe Regional Hospital. We selected these health services based on their diverse geographic location, based in inner Melbourne, metropolitan Melbourne and regional Victoria respectively.

We examined how health services implement private practice arrangements, including:

- whether the three audited public health services comply with the NHRA when undertaking billing

- how patients elect to be private

- whether they receive the same access to services as public patients.

We also examined the types of private practice arrangements in the audited public health services, how health services collect and account for private practice revenue, and whether health services use that revenue to expand services. To do this, we collected data from SVHM, Western Health and Latrobe Regional Hospital for the 2016–17 and 2017–18 financial years.

We spoke to staff at all three audited public health services involved in administering right of private practice. This included:

- patient liaison officers, who provide public patients with information to obtain their informed financial consent to be treated as private patients

- senior medical practitioners employed by the audited health service

- staff responsible for human resources, finance, and billing related to private practice

- Chief Medical Officers and senior administrators of each audited health service.

We conducted our audit in accordance with section 15 of the Audit Act 1994 and ASAE 3500 Performance Engagements. We complied with the independence and other relevant ethical requirements related to assurance engagements. The cost of this audit was $560 000.

1.8 Report structure

Part 2 covers DHHS's management of private medical practice in public hospitals. Findings from the three audited public health services are outlined throughout the report.

2 Managing private medical practice

DHHS's management and oversight of private medical practice in public hospitals is essential to ensure that Victoria optimises its NWAU growth funding from the Commonwealth Government and that health services comply with the NHRA and relevant legislation. DHHS should also ensure that private patients are not prioritised over public patients.

At a system-wide level, DHHS should know whether using private practice in public health services is beneficial to Victoria and delivers the intended outcomes for patients and health services.

2.1 Conclusion

Victoria does not have a strategic approach to determine what mix of state, Commonwealth and private revenue would best support healthcare provision. DHHS's lack of system-wide management and oversight of private practice arrangements means that Victoria has forgone Commonwealth Government health funding. In 2017–18, Victoria could have accessed an additional $48 million in capped NWAU growth funding. Prior to this year, NWAU growth was uncapped, which means that Victoria could have claimed an unlimited amount of NWAU growth funding from the Commonwealth Government. This would require Victoria to make a co-contribution of 55 per cent to match the Commonwealth Government's funding. However, Victoria's contribution can include savings from delivering health services more efficiently. DHHS has not undertaken any planning or forecasting to assess whether it would be beneficial for Victoria to access greater NWAU growth funding.

Health services have not actively managed their compliance with legislative and funding obligations. DHHS has failed to provide up-to-date essential guidance to health services to encourage compliance with these obligations. Consequently, the audited health services have inconsistent practices and are non-compliant with the NHRA and the Health Insurance Act 1973.

DHHS does not guide or oversee the development of private medical practice arrangements in public hospitals. It therefore does not know whether private practice is achieving its intended outcomes of attracting and retaining specialist medical practitioners and providing additional health services, as well as more revenue for services.

2.2 Compliance and oversight

DHHS does not monitor whether public health services comply with the NHRA, IHPA rules, and the Health Insurance Act 1973. DHHS notes that it sets the parameters in which public health services operate and it could do more to monitor health services' compliance with the NHRA and other national legislation.

The NHRA says that health services should:

- provide public patients with the same level of access to services as those provided to private patients in public hospitals (clause 5)

- treat eligible patients presenting at a public hospital outpatient department free of charge as a public patient unless the patient has been referred to a named medical specialist who is exercising their right of private practice and the patient chooses to be treated as a private patient (clause G19b).

DHHS has visibility of the statewide specialist outpatient services through current reporting, which means it could monitor compliance of the Victorian health system with clauses 5 and G19 of the NHRA. However, it does not use existing data to monitor or evaluate compliance.

Clause G20 of the NHRA states that where a patient chooses to be a public outpatient, components of the patient's treatment, such as pathology, are bundled in the price of a public occasion of service. DHHS does not examine compliance with clause G20 of the NHRA because it does not have the necessary MBS billing data. While DHHS has unsuccessfully tried to access this data from the Commonwealth Government, it has not attempted to access it from health services. Given DHHS's role as steward, it should assure itself that health services are compliant with clause G20.

Non-compliance with the NHRA means Victoria could be required to repay money under IHPA's Cost-Shifting and Cross Border Dispute Resolution Framework. Currently, DHHS does not have controls in place to prevent or detect incorrect claims.

Forgone revenue for the Victorian health system

Commonwealth Government funding calculations determined by the Administrator of the National Health Funding Pool rely on activity-based reporting from the states and territories. Victorian health services are required to provide activity data to DHHS. The Victorian Agency for Health Information—an administrative office in DHHS—then provides this data to IHPA on behalf of Victoria. The Commonwealth Government uses this data and IHPA's national efficient price and national efficient cost to determine its payment to Victoria. Victoria receives a base payment each year, plus up to 6.5 per cent extra in growth funding. The total amount of the base payment and the growth funding becomes Victoria's base for the next financial year.

Victoria must co-contribute 55 per cent to access the 6.5 per cent growth funding. DHHS reports this would total $108 million, with this then becoming an ongoing commitment. However, Victoria can make its co-contribution in savings from delivering health services more efficiently. It may be in Victoria's best interest to claim the maximum 6.5 per cent growth funding, however, DHHS has not done any planning or forecasting to determine Victoria's strategy for accessing NWAU growth funding.

DHHS advises that Victoria received $196 million in Commonwealth growth funding for 2017–18. This equates to 5.4 per cent of the available 6.5 per cent NWAU growth cap. Victoria could have accessed a further $48 million if its reported activity level had reached the cap.

We examined Latrobe Regional Hospital, SVHM and Western Health's outpatient funding data for 2016–17 and 2017–18 to ensure these health services were correctly reporting and billing all outpatient services.

For Latrobe Regional Hospital, it proved impractical to accurately quantify the amount of unclaimed MBS billing. This is because of the differences between the software utilised in recording occasions of service in the billing system and the reporting system, which led to inaccurate data matching. Despite undertaking further matching attempts, it was not possible to accurately identify the number of unbilled occasions of service. For this reason, we have removed Latrobe Regional Hospital's unclaimed MBS data.

The data established that Latrobe Regional Hospital does have unclaimed MBS services, but the number is not quantifiable due to the incompatible systems. Testing of a sample of 50 occasions of service for 2016–17 and 2017–18, which raw data suggested appeared to be unbilled, revealed that 37 of the sample had been billed. None of the verified unbilled occasions related to the 2017–18 financial year.

We identified two areas of forgone funding (MBS and NWAU) for Victoria totalling $10.65 million, as outlined in Figure 2A.

Figure 2A

Total Commonwealth Government funding for outpatient services forgone by Western Health and SVHM, 2016–17 and 2017–18

Note: *The 2016–17 forgone NWAU calculation is an underestimate as this was derived using the 6.5 per cent cap. Given that there was no cap in place in 2016–17, the actual forgone NWAU is higher.

Source: VAGO.

Unclaimed MBS payments in specialist outpatient clinics

Unclaimed MBS payments occur when health services record or deliver a service as 'private', but cannot meet Medicare's requirements for making a claim. Reasons health services cannot claim MBS funds include:

- a patient having an expired or invalid referral, or no referral

- a senior medical practitioner not providing the treatment.

We found 28 649 unclaimed public MBS outpatient services in Western Health and SVHM for 2016–17 and 2017–18, as seen in Figure 2B.

Figure 2B

Number of unclaimed outpatient services in Western Health and SVHM, 2016–17 and 2017–18

Source: VAGO.

Health services should work to ensure that all outpatient service activity not claimed under MBS is reported to DHHS as a public occasion of service, so DHHS can report this activity to the Commonwealth Government. The Commonwealth would then include this activity when calculating Victoria's NWAU growth funding. DHHS is responsible for monitoring Victoria's progress towards the NWAU growth cap. Reaching the full 6.5 per cent NWAU growth cap would maximise Victoria's share of the overall health funding from the Commonwealth Government, though this would require an additional financial commitment from the state.

We calculated that the forgone potential NWAU funding to Victoria as a result of the unreported 28 649 occasions of service is $3.78 million. Figure 2C breaks down this figure for Western Health and SVHM by year.

Figure 2C

Value of unclaimed outpatient services if changed to NWAU in Western Health and SVHM, 2016–17 and 2017–18

Source: VAGO.

While health services still receive WASE funding for these services from DHHS, this activity is unclaimed by DHHS from the Commonwealth as a public occasion of service. DHHS should ensure it claims these services, so that this activity is not 'hidden' and therefore contributes to Victoria's NWAU growth.

We found that DHHS's siloed management of health funding is impacting its ability to understand and strategically consider its mix of revenue streams. This is because different parts of DHHS separately manage parts of the funding arrangements. This includes:

- the health funding and policy area developing policies and guidance for health services

- the finance branch tracking Victoria's NWAU growth

- the performance team managing activity targets and acting as the main conduit with health services

- the intergovernmental relations team managing Victoria's negotiations with the Commonwealth Government.

To effectively manage Victoria's health funding, these teams should work together.

Choice of funding streams for specialist outpatient clinics

Public health services offer some specialist outpatient clinics as public MBS clinics to meet demand. These also generate additional revenue. This means that public health services claim an MBS payment rather than reporting it as a public occasion of service and accessing state WASE funds.

In some instances, specialist outpatient clinics attract higher NWAU payments from the Commonwealth Government to Victoria than MBS payments. However, health services charge services to MBS because they do not directly receive NWAU growth payments for providing additional services. Health services therefore do not realise any immediate financial benefit.

We compared the three audited health services' specialist outpatient clinic MBS claims against the potential NWAU funding for 2016–17 and 2017–18 (the difference between the MBS payment compared to the applicable 45 per cent NWAU payment). We found that NWAU payments exceed MBS payments by more than $8.27 million. Figure 2D provides a breakdown of this figure.

Figure 2D

Revenue forgone by health services using MBS instead of public occasions of service in 2016–17 and 2017–18

|

Health service |

Revenue forgone in 2016–17 ($) |

Revenue forgone in 2017–18 ($) |

Total ($) |

|---|---|---|---|

|

Western Health |

2 398 830 |

2 714 861 |

5 113 691 |

|

1 051 463 |

850 429 |

1 901 892 |

|

464 582 |

799 349 |

1 263 931 |

|

Total ($) |

3 914 875 |

4 364 639 |

8 279 514 |

Note: *The figure for Latrobe Regional Hospital is likely to be higher because we were not able to accurately identify all MBS billing.

Source: VAGO.

Episodes of care and billing

Clause G20 of the NHRA states that where a patient chooses to be a public outpatient, components of the patient's treatment, such as pathology, are bundled in the price of a public occasion of service. For example, where a patient attends a public specialist outpatient clinic and has radiology or other tests as part of their visit, the health service cannot additionally claim any imaging or testing as an MBS payment. We confirmed this interpretation of the NHRA with IHPA and the Australian Government's Department of Health.

We found that all three audited health services were not compliant with clause G20, the Health Insurance Act 1973 and MBS, and incorrectly claimed more than $5.8 million in the 2016–17 and 2017–18 financial years, as Figure 2E and 2F show.

Figure 2E

Amount of funding incorrectly claimed by health services due to incorrect count of episode of care, 2016–17 and 2017–18

|

Health service |

Revenue wrongly claimed 2016–17 ($) |

Revenue wrongly claimed 2017–18 ($) |

Total ($) |

|---|---|---|---|

|

Western Health |

1 140 333 |

1 177 519 |

2 317 852 |

|

Latrobe Regional Hospital |

209 |

– |

209 |

|

SVHM |

573 185 |

478 624 |

1 051 809 |

|

Total ($) |

1 713 727 |

1 656 143 |

3 369 870 |

Source: VAGO.

Western Health's radiology department made the majority of these incorrect MBS claims. There is a lack of clarity on correct billing practices in this area. For instance, Western Health offers services to the community through which patients may come in for unrelated diagnostic tests, such as an X-ray ordered by a general practitioner prior to attending their outpatient appointment. Consequently, the numbers reported in Figure 2E may be overstated. DHHS should provide health services with greater clarity on this issue to help them comply with the NHRA.

For SVHM, the largest proportion of incorrect MBS claims came from its neurology clinic. Both Western Health and SVHM have no controls in place to prevent non-compliance with clause G20 and the Health Insurance Act 1973.

Health services' non-compliance with clause G20 exposes Victoria to needing to repay incorrectly claimed money under IHPA's Cost-shifting and Cross Border Dispute Resolution Framework. Despite this risk, DHHS does not monitor health services' compliance with clause G20.

This lack of compliance with clause G20 also represents non-compliance with the Health Insurance Act 1973, because the service has been covered as part of the NHRA and a Medicare benefit is not payable.

Incorrectly billing MBS for consultations

The Medicare Benefits Schedule Book, published on 1 December 2018, states that 'Charging part of or all of an episode of hospital treatment or a hospital substitute treatment to a non-admitted consultation is prohibited. This would constitute a false or misleading statement on behalf of the medical practitioner and no Medicare benefits would be payable'. This means that health services cannot claim an MBS payment and report the same service as a public occasion of service, therefore deriving state funding as well. This is essentially 'double dipping'.

We found that all three audited health services were not compliant with MBS and incorrectly claimed almost $2.5 million in 2016–17 and 2017–18 for consultations that were also claimed as a public service, as Figure 2F shows. This includes more than 23 000 visits where MBS was claimed, and the outpatient visits were reported as a public occasion of service.

Figure 2F

Amount of funding incorrectly claimed by health services due to claiming MBS for consultations and public occasions of service, 2016–17 and 2017–18

|

Health service |

Revenue wrongly claimed 2016–17 ($) |

Revenue wrongly claimed 2017–18 ($) |

Total ($) |

|---|---|---|---|

|

Western Health |

301 080 |

399 802 |

700 882 |

|

Latrobe Regional Hospital |

5 672 |

5 210 |

10 882 |

|

SVHM |

901 195 |

826 342 |

1 727 537 |

|

Total ($) |

1 207 947 |

1 231 354 |

2 439 301 |

Source: VAGO.

Health services need controls to ensure compliance with all funding rules. Latrobe Regional Hospital had the lowest number of incorrectly claimed services. Figure 2G explains the MBS billing processes at Latrobe Regional Hospital.

Figure 2G

Case study: Latrobe Regional Hospital's MBS billing processes

|

Latrobe Regional Hospital transitioned all outpatient services to its newly constructed Gippsland Private Consulting Suites in 2018. As part of the move, Latrobe Regional Hospital has centralised all its data entry and MBS processing. We found that Latrobe Regional Hospital had no instances of a public occasion of service and an MBS consult after it centralised its data entry and MBS processing. Latrobe Regional Hospital has taken the following steps to ensure its data entry and billing process are correct:

|

Source: VAGO.

DHHS guidance for MBS billing

DHHS published its Specialist clinics in Victorian public hospitals: A resource kit for MBS billed services in 2011 to assist health services to manage MBS billed activities (public MBS specialist outpatient clinics).

DHHS's resource kit defines what health services can claim from MBS during specialist clinics. DHHS's guidance states that where a patient chooses to be treated as a public patient (in a specialist clinic service), components of the public hospital service (such as pathology and diagnostic imaging) will be regarded as part of the patient's treatment and will be provided free of charge. DHHS's guidance states that procedures undertaken during a public specialist clinic appointment must be provided free of charge.

However, IHPA's 2017 guidance on the NHRA differs from DHHS's resource kit (see Figure 2H). IHPA's guidance notes that, for example, diagnostic imaging undertaken for review in a public clinic three days prior to an appointment is also included within the occasion of service and therefore cannot be separately claimed through MBS.

Figure 2H

IHPA guidance for specialist outpatient clinics

Source: IHPA.

This means that while public health service practices may comply with DHHS's resource kit, they could still be non-compliant with the NHRA, according to IHPA's guidance.

DHHS's resource kit also outlines two remuneration models for MBS private practice arrangements in public hospitals—the 100 per cent donation model and the 100 per cent retention model. It outlines how specialists should operate under each model.

The resource kit states that for the 100 per cent retention model, specialists should not be paid by the health service for their time. In addition, it states that health services would normally negotiate a facility fee with the specialist to cover the costs of the clinic.

The information in this resource kit is the only guidance DHHS has provided health services on private practice models. DHHS has not provided health services with guidance or information on using private practice more widely across health services, for example, in relation to inpatient services.

Treatment for private patients

DHHS's Elective surgery access policy 2015 and Elective Surgery Information System Manual 2018–19 apply to public and private elective surgery patients treated in a public health service. DHHS's policy states that 'insurance status or patients' willingness to pay should not result in preferential treatment or access to services within public health services'. All patients included in the Elective Surgery Information System (ESIS) are subject to this guideline.

Our analysis of DHHS's ESIS data for 2016–17 and 2017–18 shows that Western Health provided faster access to private ophthalmology (cataract surgery) and plastic surgery (wisdom teeth removal) patients at Sunbury Day Hospital, which offers services including day surgery and some outpatient appointments. This practice is not compliant with clause 5 of the NHRA. We did not find evidence that SVHM and Latrobe Regional Hospital employ the same practices.

Figure 2I shows that Sunbury Day Hospital provided access to private cataract patients almost four times faster than for public patients. For wisdom teeth removals, Western Health provided access to private patients about eight times faster.

Figure 2I

Sunbury Day Hospital ophthalmology and plastic surgery total patients and average wait days for admission, 2016–17 and 2017–18

|

Number of admissions |

Average wait days |

|||

|---|---|---|---|---|

|

Public |

Private |

Public |

Private |

|

|

Ophthalmology |

1 070 |

1 083 |

39 |

9 |

|

Plastic surgery |

247 |

561 |

107 |

14 |

Source: VAGO.

We examined why Western Health was treating private patients faster than public patients at its Sunbury Day Hospital.

Western Health advises that it is only state-funded for two days of surgery a week at Sunbury. For the remaining three days a week, it has service level agreements with private surgeons to use its surgery facilities to conduct private medical services. Western Health advises that these private surgeons do not pay a facility fee. However, Western Health was unable to find a copy of the service level agreement. During the time that private surgeons use the facility, Western Health provides staffing to run the facility, such as nursing staff, administrative staff and cleaning staff, at Western Health's cost.

According to DHHS's Elective surgery access policy 2015, patients being treated at Western Health during the three days that it conducts private medical services, and managed on private surgery waiting lists, should not be a part of the public waiting list and recorded on ESIS. However, if private surgeons are using Western Health's facilities at Sunbury Day Hospital to treat private patients, and listing them on the public waiting list and in ESIS, they are subject to the same rules prohibiting preferential treatment based on insurance status. That is, higher priority patients must be treated first when compared within the respective patient group. Western Health acknowledges it should not have recorded these patients on ESIS and believes that treatment time for public patients was not affected.

We examined the waiting times and the urgency of cataract surgery at Sunbury Day Hospital. We found a very high number of private patients (73) who had an urgency rating of 1, which requires an admission within 30 days as the patient's condition has the potential to deteriorate quickly, to the point that it may become an emergency. In comparison, category 2 patients have a recommended wait time of 90 days and category 3 patients 365 days.

Most of the category 1 patients were private (73 compared with one public). Western Health advises that private patients are categorised as urgent because of more streamlined assessment processes, where patients have pre-operative eye measurements confirmed prior to waitlisting. The recommended clinical urgency category of cataract surgery listed in DHHS's Elective surgery access policy 2015 is category 3. Assigning a clinical urgency rating of category 1 to these patients would mean they would be next to be treated, in line with ESIS guidelines. In addition, these patients should not be classified as category 1 because their condition is not at risk of becoming an emergency, in line with category 1 guidelines.

The current inclusion of private patients from private surgeons on Western Health's public wait list may also artificially improve its performance on time to treatment measures for elective surgery, which are monitored by DHHS and publicly reported. Figure 2J breaks down the waiting times for cataract surgery at Sunbury Day Hospital for public and private patients.

Figure 2J

Waiting times for cataract surgery at Sunbury Day Hospital, 2016–17 and 2017–18

|

Category |

Type |

Number |

Average wait days |

|---|---|---|---|

|

1 |

Private |

73 |

4 |

|

Public |

1 |

5 |

|

|

2 |

Private |

3 |

5 |

|

Public |

6 |

28 |

|

|

3 |

Private |

1 007 |

10 |

|

Public |

1 063 |

35 |

Source: VAGO.

We also examined Sunbury Day Hospital's waiting times and urgency of treatment for wisdom teeth removals for 2016–17 and 2017–18. We found that category 3 private patients waited only 14 days on average, whereas category 3 public patients waited 340 days. Figure 2K shows these waiting times.

Figure 2K

Waiting times for wisdom teeth removal at Sunbury Day Hospital, 2016–17 and 2017–18

|

Category |

Type |

Number |

Average wait days |

|---|---|---|---|

|

1 |

Private |

10 |

8 |

|

Public |

116 |

12 |

|

|

2 |

Private |

5 |

41 |

|

Public |

95 |

69 |

|

|

3 |

Private |

546 |

14 |

|

Public |

63 |

340 |

Source: VAGO.

We analysed the financial class of the patients from Western Health's public list and those treated by private surgeons. Figure 2L shows that the majority of the patients treated at Sunbury Day Hospital by private surgeons are self-funded.

Figure 2L

Financial class of patients from Sunbury Day Hospital's ophthalmology and plastic surgery lists

Source: VAGO.

To understand whether Western Health claimed public funding for these private surgeries, we linked the Sunbury patient data from Western Health and DHHS's Victorian Admitted Episodes Dataset for ophthalmology and plastic surgery. This data is used for allocating health services' WIES funding and it is reported to the Commonwealth Government.

We found that in 2016–17 and 2017–18, Western Health has unintentionally claimed WIES funding for 99.7 per cent of the private patients treated by private surgeons at Sunbury Day Hospital. Over 1 200 of these patients are self-funded, which means these patients are paying for faster access to a service and that Western Health wrongly received state and Commonwealth funding.

2.3 Private practice arrangements

In Victoria, each public health service employs its own staff and enters into private practice arrangements directly. As a result, DHHS has no oversight of the types and number of private practice arrangements across the state. Therefore, DHHS cannot determine the true benefit or cost of administering private practice arrangements to the state.

DHHS does not review whether public health services implement its guidance—Private patient: principles for public health services—and therefore does not know whether private practice is delivering the intended benefits.

We found broad variation in private practice arrangements in Latrobe Regional Hospital, Western Health and SVHM. Three models exist across the three audited public health services:

- 100 per cent donation

- 100 per cent retention

- mixed (partial donation and retention).

Some arrangements, such as the 100 per cent donation model, are common across health services. Figure 2M summarises the arrangements across the three audited health services.

Figure 2M

Types of private practice arrangements across the three audited health services

|

Type of arrangements |

Latrobe Regional Hospital |

SVHM |

Western Health |

|---|---|---|---|

|

100 per cent donation |

✔ |

✔ |

✔ |

|

100 per cent retention |

✘ |

✔ |

✔ |

|

Mixed model |

✘ |

✘ |

✔ |

Source: VAGO.

Lack of compliance

Section 19(2) of the Health Insurance Act 1973 allows medical practitioners to undertake private practice and use the 100 per cent retention model only when the arrangement exists within a 'broader' employment arrangement with the public health service. We identified that SVHM may not comply with this section.

At SVHM, all medical practitioners with 100 per cent retention private practice arrangements are VMOs. The two types of VMOs on the retention model are:

- salaried VMOs who are employees

- fee-for-service VMOs who are contractors.

SVHM's six fee-for-service VMOs do not receive any salary or sessional fees or accrue employee benefits from SVHM when working under the 100 per cent retention model. VMOs bill directly for their services, for example, to MBS.

SVHM does not centrally administer these 100 per cent retention private practice arrangements and there are no formal agreements in place. Instead, SVHM's specialist departments enter into informal agreements with VMOs. While SVHM's current approach of using fee-for-service VMOs generates no administrative burden, it may not comply with section 19(2) of the Health Insurance Act 1973.

DHHS should clarify this area of private practice and issue guidance to health services. Figure 2N outlines a number of actions currently being implemented by SVHM to address a range of issues associated with its private practice arrangements.

Figure 2N

Case study: SVHM's improvements to private practice arrangements

|

SVHM completed a review of its private practice arrangements in 2018. Its review identified many of the issues highlighted in this report. SVHM is currently implementing actions to improve its governance of private practice. These include:

|

Source: VAGO.

Unknown administrative costs

Western Health has the most complex private practice arrangements of the three health services. Most of Western Health's senior medical practitioners have 100 per cent donation private practice arrangements, which distribute a percentage of revenue back to the senior medical practitioner's craft group SPF.

However, we also identified Western Health has complex arrangements, such as varying private practice contribution rates depending on the type of service delivered, and, in one case, an agreement with a private company owned by a consortium of medical practitioners. Western Health does not know whether all its private practice arrangements are beneficial for the health service.

Figure 2O describes the complex arrangement in place with one specialist craft group at Western Health. Western Health has not assessed whether this longstanding arrangement is in its best interest, or whether the facility fee meets the costs to the health service.

Figure 2O

Case study of one specialist craft group at Western Health

|

All senior staff medical practitioners in one specialist craft group at Western Health, employed over 0.5 full-time equivalent, are partners in a private company. Currently, the group has about 45 partners. The group's current annual turnover is $1.5 million. The group's partnership executive includes senior clinical staff of Western Health. The executive group is responsible for the day-to-day administration and use of funds held by the group. The group bills MBS on behalf of all its partners when they are exercising their right of private practice. All revenue received by the group is held in a separate bank account. The group:

At the end of each financial year, partners in the group consider research interests of their speciality and assess overall income tax liabilities to determine its donation to Western Health. In the past, the group donated $200 000 to Western Health to support research. Other donations have contributed to purchases of equipment for Western Health, renovations and information technology improvements. The group also uses funds for a range of social and networking events. For example, the group funds dinners for all staff in their speciality group every six months that coincide with registrar departures. |

Source: VAGO.

Health services bear a proportion of the administrative costs of private practice arrangements. This includes processing, billing and accounting for private practice funds. Where there is a variety of private practice arrangements such as at Western Health, the health service bears an increased cost of administering the different arrangements. We found that none of the health services we audited know what it costs them to administer their right of private practice arrangements.

Intended benefits

DHHS lists three benefits of private practice in Private patients: Principles for public health services, namely that it:

- is an additional source of revenue

- attracts and retains highly specialised staff because of the patient mix (public and private)

- maximises care to the community, through opportunities to reinvest revenue into expanded public service offerings.

DHHS does not review whether health services implement the private practice principles above, and consequently has no understanding of whether it is delivering the benefits intended.