Results of 2016–17 Audits: Water Entities

Overview

Victoria’s water entities provide a range of water services, including supplying water and sewerage services, managing bulk water storage and looking after specific recreational areas, such as caravan parks.

This report outlines the results of our financial audits of the water entities, and our observations, for the year ended 30 June 2017. We also discuss our audits of entities’ performance reports.

We assess the water sector’s financial performance during the 2016–17 reporting period and assess its sustainability as at 30 June 2017.

We make six recommendations directed to the water entities and one directed to the Department of Environment, Land, Water and Planning.

Transmittal letter

Ordered to be published

VICTORIAN GOVERNMENT PRINTER November 2017

PP No 346, Session 2014–17

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Results of 2016–17 Audits: Water Entities.

Yours faithfully

Andrew Greaves

Auditor-General

15 November 2017

Acronyms

| AASB | Australian Accounting Standards Board |

| AIMS | Asset information management system |

| AMAF | Asset Management Accountability Framework |

| CMA | Catchment management authority |

| CO2 | Carbon dioxide |

| DELWP | Department of Environment, Land, Water and Planning |

| DRP | Disaster recovery plan |

| EBITDA | Earnings before interest, tax, depreciation and amortisation |

| EPA | Environment Protection Authority |

| ESC | Essential Services Commission |

| EWOV | Energy and Water Ombudsman of Victoria |

| FASL | Fixed asset sub-ledger |

| FMA | Financial Management Act 1994 |

| FRD | Financial Reporting Direction |

| FTE | Full-time equivalent |

| IASB | International Accounting Standards Board |

| IT | Information technology |

| KPI | Key performance indicator |

| MRD | Ministerial Reporting Direction |

| PREMO | Performance, Risk, Engagement, Management and Outcomes |

| VAGO | Victorian Auditor-General's Office |

| VGV | Valuer-General Victoria |

| WIRO | Water Industry Regulatory Order |

| WRRG | Waste and Resource Recovery Group |

Audit Overview

Water entities provide a range of water services, including supplying water and sewerage services, managing bulk water storage and looking after specific recreational areas, such as caravan parks. Victoria's water sector is made up of 19 water entities and one controlled entity.

The board of each water entity reports to the Minister for Water through the Department of Environment, Land, Water and Planning (DELWP).

The Essential Services Commission (ESC) is responsible for regulating and approving the maximum prices each water entity charges its customers for supplying water and providing sewerage and other services.

This report outlines the results of our financial audits of the water entities, and our observations, for the year ended 30 June 2017. We also discuss our audits of entities' performance reports and analyse the financial results and outcomes for the water entities.

Conclusion

We have assessed the sector as financially sustainable, with no immediate short-term risks identified. In the longer term, some water entities will need to consider the risks associated with their ability to replace or renew assets and repay debt.

Findings

Results of financial audits

We issued clear audit opinions to the 19 water entities for the financial year ended 30 June 2017, consistent with our 2015–16 results.

We assessed the quality of financial reporting processes against better practice criteria. Overall, the water entities used good-quality processes to prepare their financial reports, and they presented timely and accurate draft statements for audit. However, they need to improve the preparation and quality of financial statements and the development of their financial report preparation plans.

The sector began to streamline its financial reports in 2016–17, to improve the structure and disclosure content of financial statements, which will enhance their readability. We commend the sector for its commitment to this process.

Overall, the sector has used the streamlined financial reporting process as an opportunity to realign and refresh the structure and content of its financial statements, however there are further areas for improvement that will allow entities to better customise their financial reports.

Results of performance report audits

We issued clear audit opinions on the performance reports for all 19 water entities, consistent with the 2015–16 reporting period.

Our past reports have highlighted that the water sector's performance reporting processes are not as mature as those used for financial reporting. This was again apparent in the 2016–17 reporting period.

We encourage the sector to focus more on the processes and quality of its performance reporting and to shift its mindset when preparing annual performance reports. Instead of being seen as a compliance document, performance reports can serve a far greater purpose in communicating key financial and non-financial results to water entities' customers.

Internal controls

To the extent that we test water entities' internal controls, we found them adequate for ensuring reliable financial reporting. However, we found instances where entities need to strengthen their key internal controls.

In particular, we identified weaknesses in two key areas in 2016–17:

- information technology (IT) controls, which protect computer applications, infrastructure and information assets from threats to security and access

- the monitoring and maintenance of infrastructure assets, property, plant and equipment records and data.

In relation to IT controls, we continue to observe weaknesses in key financial and operational systems each year, depending on which systems we test. This indicates that water entities are not taking the lessons learnt from audit issues reported against particular key systems and applying them to other relevant systems to minimise risks across the organisation.

As part of the financial audit process, we also monitored internal control weaknesses identified in previous audits, to ensure entities are resolving them promptly. Encouragingly, 77 per cent of prior-year high- and medium-risk matters were resolved during 2016–17.

Post asset revaluation implementation

Each year, we select one internal control area and perform a more detailed review of the controls and related operating environment. This year, we focused on how well water entities input their asset revaluation results from the 2015−16 revaluation into their internal systems.

Comprehensive, accurate and up-to-date asset information is vital for effective asset management, particularly in asset-intensive organisations such as water entities.

Our assessment showed mixed results. Entities with better implementation processes reported that improved quality of asset data allowed them to make better asset‑related decisions across the organisation. In contrast, entities that were unable to update their asset systems with revaluation data in a timely fashion were at an increased risk of making business decisions based on inaccurate or unreliable data.

Our review highlighted the importance of entities having a detailed plan in place to guide their actions throughout an asset revaluation process. Those entities with better implementation processes had a deeper understanding of their asset data, which enabled them to provide quality data to the valuer, in a format that could be incorporated into their existing asset systems.

Financial outcomes

The sector generated a combined net result before tax of $543.9 million in 2016–17, a decrease of $173.0 million from the year before. This was largely due to a decline in revenue because of lower consumption—2016–17 was a wetter year than 2015–16—and lower wholesaler revenue in the first year of their new pricing structure.

The sector's total asset base grew by $633.9 million to $46.2 billion, largely due to funds spent on asset works, renewal and replacement. Liabilities grew by $218.5 million to $21.4 billion, from increases in short-term payables and borrowings.

We separately assessed the financial performance, position and risks to financial sustainability of each cohort over the 2016–17 financial reporting period, given each cohort's results are affected by different circumstances.

Recommendations

We recommend that water entities:

- further refine their financial reporting processes by developing a financial statement preparation plan and preparing quality proforma financial statements (see Section 2.1)

- continue investing in streamlining their financial statements and better customising their disclosures, including only using model financial statements as a starting point for further streamlining and customisation (see Section 2.1)

- focus more on the processes and quality of performance reporting, ensuring full compliance with Ministerial Reporting Direction 01 Performance Reporting and preparing proforma performance reports prior to year end (see Section 2.2)

- assess whether any findings related to IT control weaknesses in specific systems reported by audit are relevant to other financial and operational systems, to minimise risk across the organisation (see Section 3.1)

- address issues raised in audit management letters on a timely basis so that any weaknesses in their control environment are resolved promptly (see Section 3.1)

- perform a post-revaluation review exercise to identify areas for improvement that could be carried to the next revaluation exercise or used to help prepare for the Asset Management Framework requirements of the Asset Management Framework, which supports the Standing Direction Requirement 4.2.3 Asset management accountability of the Minister for Finance in 2017–18 (see Section 3.3).

We recommend that the Department of Environment, Land, Water and Planning:

- review the effectiveness of water entities' performance reporting, focusing on whether the performance reports are meeting the overall purpose of Ministerial Reporting Direction 01 Performance Reporting, as initially intended (see Section 2.2).

Submissions and comments

We have consulted with DELWP, the 19 water entities, ESC and the Victorian Water Industry Association (VicWater), and we considered their views when preparing this report. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet.

The following is a summary of those responses. The full responses are included in Appendix A.

DELWP provided a response for inclusion in this report, stating that it is committed to conducting a comprehensive review of its performance reporting framework. This review will look at the effectiveness and appropriateness of key performance indicators (KPI) under the current Ministerial Reporting Direction (MRD) 01 Performance Reporting.

DELWP also noted its plans to address specific recommendations through water sector forums and VicWater.

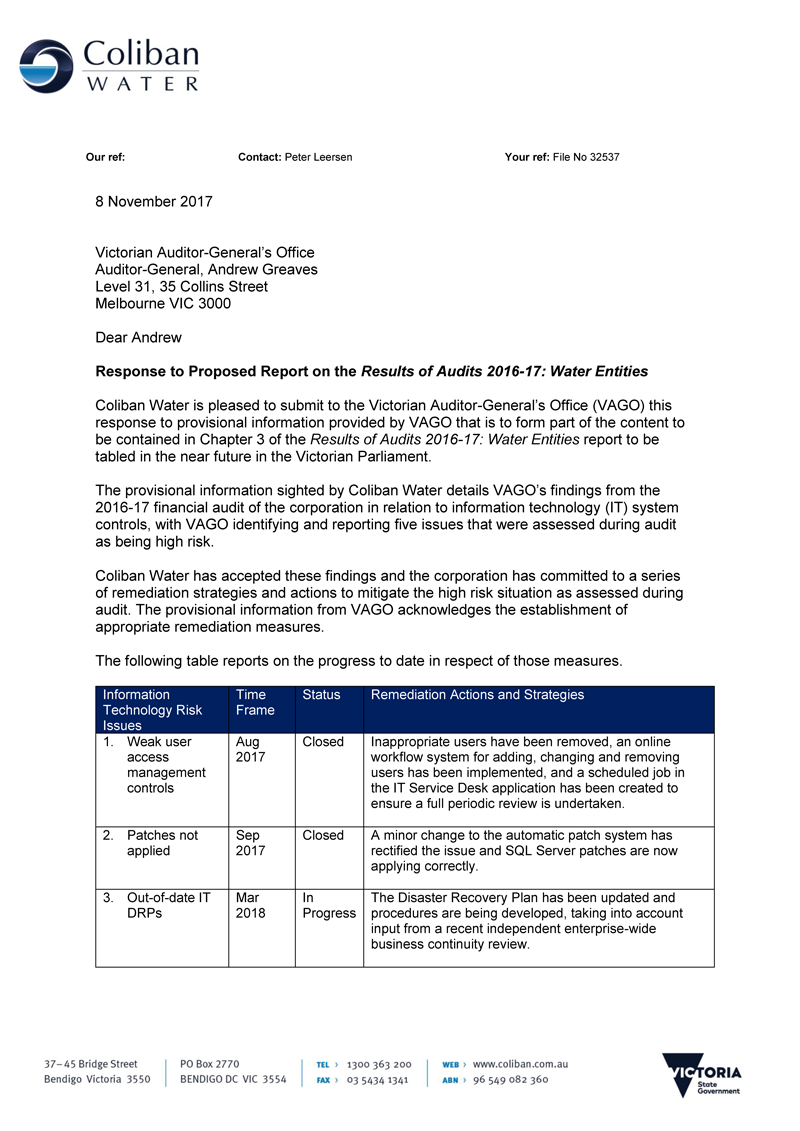

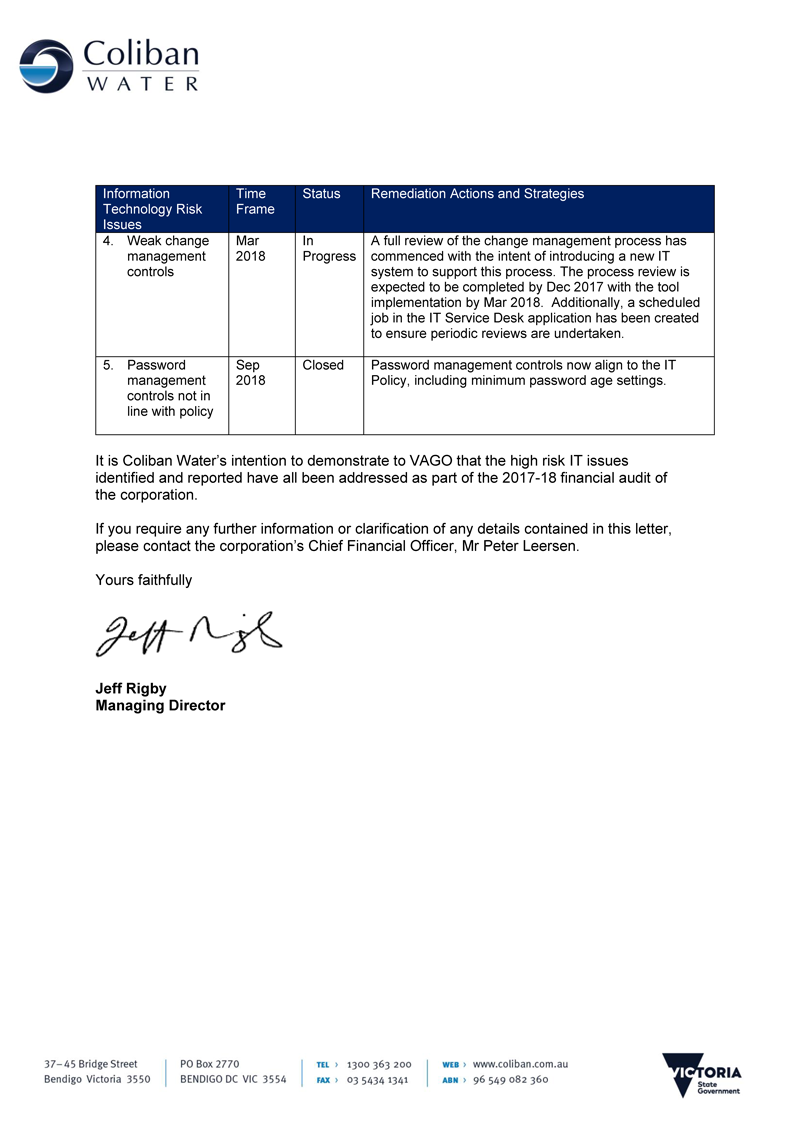

Coliban Water provided a response for inclusion in the report, outlining its remediation plans for the high-risk issues that we highlighted and its intention to demonstrate that these issues have been addressed as part of the 2017–18 audit.

1 Audit context

Water entities provide a range of water services, including supplying water and sewerage services. Entities may also manage bulk water storage and specific recreational areas, such as caravan parks. Water entities are standalone businesses responsible for their own management and performance.

Victoria's water sector is made up of 19 water entities and one controlled entity. Since the results of the controlled entity are consolidated into its parent entity, we do not discuss this entity separately in our report. Appendix B includes a list of all 20 entities.

In this report, we use the cohorts defined by DELWP and VicWater—metropolitan, regional urban and rural—to report on the sector. Figure 1A defines these cohorts.

Figure 1A

Cohorts—water entities

| Cohort | Description |

|---|---|

|

Metropolitan |

Consists of:

|

|

Regional urban |

Provide water supply and sewerage services to regional urban customers outside the metropolitan zone of Victoria. Two of these water entities also supply rural water services. |

|

Rural |

Provide rural water services for irrigation, domestic and stock purposes. These services include water supply, drainage and salinity mitigation. Some also provide bulk water supply services to other water entities in regional Victoria. |

Source: VAGO, based on information provided by DELWP.

A constituted board governs each water entity, responsible for:

- overseeing the entity's strategic direction

- setting objectives and performance targets

- ensuring that the entity complies with legislation and government policy.

Figure 1B shows the areas serviced by Victoria's metropolitan and urban regional water entities and average litres consumed, per person, per day in each specific service area. Areas serviced by the rural water entities can be found in Appendix B.

Figure 1B

Regions serviced by metropolitan and regional urban retailers, includes 2016–17 average litres consumed, per person, per day

Source: VAGO, based on information provided by DELWP.

1.1 What do water entities do?

Metropolitan and regional urban retail services

Water entities manage, maintain and operate reservoirs and water storage within their respective regions to provide water and sewerage services to households, and commercial and industrial businesses.

In Victoria, most water is captured, protected and stored in catchment reservoirs. Collected from various sources––dams, catchments and the desalination plant––water then travels through drains and pipes to water treatment plants. Here, it is treated and tested for quality before it is made available for use.

|

Catchment—an area where water is collected by the natural landscape. In a catchment, rainwater run-off will eventually flow to a creek, river, dam, lake, ocean, or into a groundwater system. |

Sewage flows down household and commercial drains to sewerage treatment plants. It undergoes various treatment processes ensuring it can be either recycled or returned to waterways.

Water entities invest significant effort and funds in maintaining, repairing and renewing their assets to ensure availability of quality water and delivery of sewerage services.

Figure 1C details the water cycle, highlighting the key inputs, assets and outputs.

Figure 1C

Operator perspective—inputs, processes and outputs to the water cycle

Source: VAGO.

Rural services

Rural water entities own and maintain dam/reservoir infrastructure assets used to store water on behalf of their customers—typically farmers, graziers and growers.

Rural water customers:

- hold water shares, which represent an ongoing entitlement to a share of water available within a specific water region

- order water from their relevant rural water entity, which is delivered via pipelines and channels—the maximum annual amount of water available is set by their water share.

Rural water entities do not provide sewerage-related services.

1.2 Framework for water regulation

Legislative and regulatory framework

The board of each water entity reports to the Minister for Water through DELWP. In turn, the minister reports to Parliament on the performance of each water entity.

The Water Act 1989 is the central legislation for Victoria's water industry. Its objectives are to:

- promote the orderly, equitable and efficient use of water resources

- ensure that water resources are conserved and properly managed for sustainable use for the benefit of all Victorians

- maximise community involvement in making and implementing arrangements for using, conserving and managing water resources.

The Financial Management Act 1994 (FMA) establishes a governance framework mandating governance and accountability for the financial management of organisations in the public sector. The FMA aims to:

- improve financial administration of the public sector

- make better provision for the accountability of the public sector

- provide for annual reporting to the Parliament by departments and public sector bodies.

In addition to the 19 water entities, Victoria has 10 catchment management authorities (CMA), established under Victoria's Catchment and Land Protection Act 1994. CMAs are responsible for coordinated catchment management in their region. The Water Act 1989 gives them powers to manage regional waterways, floodplains, drainage and environmental water reserves. The Auditor-General's Report on the Annual Financial Report of the State of Victoria, 2016–17 includes the results for the audits of CMAs for the 2016–17 reporting period.

Figure 1D lists the key agencies involved in regulating the water sector. These agencies are responsible for setting economic, environmental and social obligations within which water entities must operate.

It also highlights key industry bodies, such as the Victorian Water Industry Association, which plays an important advocacy role, providing forums for industry discussions on priority matters and disseminating news and information to key industry stakeholders.

Figure 1D

Victoria's legislative and regulatory framework for the water sector

Source: VAGO.

1.3 How water entities fund their operations

Water entities get most of their revenue from charges for water, sewerage and other related activities, collected under the Water Act 1989 and approved through the sector regulator, ESC.

Total revenue in 2016–17 for sector service and usage charges was $5.2 billion, 89.7 per cent of the total $5.8 billion revenue generated. Figure 1E shows a breakdown of these regulated revenue streams.

Figure 1E

Service and usage charges by water entities 2016–17

Note: Melbourne Water, as the wholesaler of Melbourne's water supply to the metropolitan retail water entities, is responsible for managing catchments, waterways and major drainage systems, treating water and transferring water to the metropolitan water retailers. The costs incurred by Melbourne Water for these activities are charged to the metropolitan water retailers by way of bulk water and sewerage charges.

Source: VAGO.

ESC is responsible for regulating and approving the maximum prices each water entity charges its customers for supplying water and providing sewerage and other services. This is in accordance with the requirements of the Essential Services Commission Act 2001, the Water Industry Act 1994, the Water Industry Regulatory Order and the Commonwealth Water Charge Infrastructure Rules, where applicable.

ESC has reviewed and approved prices for metropolitan and regional urban businesses since 1 July 2005, and for rural businesses since 1 July 2006.

ESC's approach to price reviews remained largely unchanged until 23 October 2014, when the Water Industry Regulatory Order 2014 (WIRO 2014) was released in the Victoria Government Gazette, following approval from the Governor in Council. The purpose of WIRO 2014 is to provide a framework for economic regulation by ESC for services provided by the water industry. WIRO 2014 revoked the former WIRO 2012.

The revised order provides ESC with greater flexibility in how it delivers efficient pricing and service outcomes for Victorian water and sewerage customers. As a result, following extensive consultation with water entities and key stakeholders, ESC made changes to its framework for water pricing and approach to price reviews.

The new approach is designed to deliver better outcomes for Victorian water customers, with incentives for water entities to put forward quality price submissions that reflect their customers' expectations and offer value for the prices proposed.

ESC has commenced its review for the regulatory period from 1 July 2018. Figure 1F outlines the timing for this period.

Figure 1F

Timing of the new water pricing review process

Source: ESC, information sheet on proposed water pricing approach for 2018, May 2016.

Figure 1G outlines the new approach for the 2018 price review.

Figure 1G

New pricing approach

| Step 1. Outcomes for customers | Water entity will engage with customers to understand what they value and establish a set of outcomes from this process. |

|---|---|

| Step 2. Expenditure and price proposal | Water entity will develop operating and capital expenditure forecasts to deliver the outcomes from Step 1 and proposed price and tariff structures to recover required revenue from customer base. |

| Step 3. Price submission review | Water entity will rate its price submission based on performance, risk, engagement, management and outcomes. ESC will then assess the price submission. |

| Step 4. Revenue and prices | ESC confirms required revenue, price and tariff structures, and the financial viability of the water entity. |

| Step 5. Performance monitoring | Ongoing review and reporting of a water entity’s delivery against the outcomes—this includes ESC oversight. Where necessary, ESC or the water entity may adjust revenue or prices based on performance. |

Source: VAGO, based on ESC, Water Pricing Framework and Approach, Implementing PREMO from 2018, October 2016.

In the first step, each water entity will engage with its customers and community to inform the outcomes to be delivered in a pricing period.

In the second step, each water entity will develop an estimate of expenditure to deliver the outcomes identified in step 1, and any other obligations imposed by government and regulators. This results in the development of a price submission, including proposed prices and tariff structures.

The third step involves a new approach to the assessment of price submissions which influences the returns allowed in prices for each water entity. The return on equity established at the start of a pricing period could vary for each business, depending on the ‘ambition’ of its price submission.

In its price submission, a water entity will self-rate the ‘ambition’ of its submission against PREMO elements—Performance, Risk, Engagement, Management and Outcomes. ESC will also rate the submission against PREMO elements. This assessment process will inform the return on equity to be reflected in revenue and prices, which forms the fourth step.

The final step is the ongoing review of outcomes delivered by water entities.

It is important to note that the water price reviews effective for 1 July 2018 exclude Melbourne Water and Goulburn-Murray Water, as these entities are on a different price review cycle.

Government funding

In contrast to the other cohorts, the two rural water entities receive significant government funding (both state and Commonwealth) for the delivery of key of modernisation projects, such as the $2 billion Connections Project currently being delivered by Goulburn-Murray Water.

1.4 Report structure

In this report, we detail the 2016–17 financial audit outcomes of Victoria’s 19 water entities. We identify and discuss the key matters arising from our audits, and provide an analysis of information included in water entities’ financial and performance reports. Figure 1H outlines the structure of the report.

Figure 1H

Report structure

| Part | Description |

|---|---|

| Part 2—Results of audits | Evaluates the audit opinion results for financial and performance report audits, and the timeliness, accuracy and quality of reporting |

| Part 3—Internal controls | Assesses the strength of internal controls designed, implemented and maintained by the water entities |

| Part 4—Financial outcomes | Analyses the financial performance, position and sustainability of the water sector to enhance the accountability and transparency for transactions and events during the year |

The financial audits included in this report were undertaken under section 15 of the Audit Act 1994 and Australian Auditing Standards, and the audited entities pay the cost of these audits. We used the results of these audits in preparing this report. The cost of preparing this report was $185 000, which is funded by Parliament.

2 Results of audits

2.1 Financial report audit opinions

Independent audit opinions add credibility to financial reports by providing reasonable assurance that the information reported is reliable and accurate. A clear audit opinion confirms that the financial report presents fairly the transactions and balances for the reporting period, in keeping with the requirements of relevant Australian Accounting Standards and applicable legislation. We carried out our financial audits of the water entities in accordance with the Australian Auditing Standards.

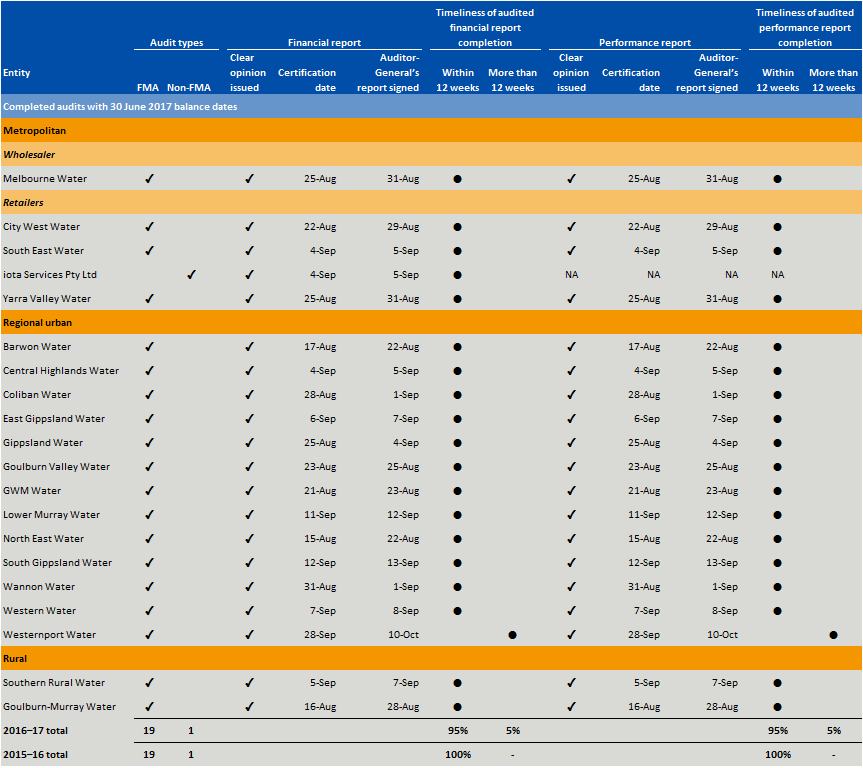

We issued clear audit opinions for the 19 water entities for the financial year ended 30 June 2017, consistent with our 2015–16 results.

Quality of financial reporting

Entities that adopt effective financial reporting practices throughout the year should be able to produce accurate and reliable financial reports in a timely manner.

The timeliness and accuracy of an entity’s financial reports are important attributes. Entities also need to have well-planned and managed processes to enable them to prepare cost-effective and efficient financial reporting.

Overall, the water entities used good-quality processes to prepare their financial reports, and they presented timely and accurate draft reports for audit.

Timeliness

Timely financial reporting is a critical element of entities’ accountability to stakeholders and enables informed decision-making. The later reports are produced and published after year end, the less useful they are.

The FMA requires entities to finalise their financial reports within 12 weeks of the end of the financial year. Appendix C sets out the dates on which entities’ 2016–17 financial reports were certified and auditor’s reports were issued.

As shown in Figure 2A, 18 of the 19 water entities met the legislated time frame for finalising their financial reports after the 2016–17 balance date. In 2015–16, all 19 water entities met the legislated time frame.

Figure 2A

Finalisation dates for water entities’ financial reports

Note: Dots may represent more than one entity if the financial reports were finalised on the same day.

Source: VAGO.

|

Management letter—a letter the auditor writes to the board, the audit committee and management of a water entity, outlining issues identified during the financial audit. |

Figure 2A shows that one entity, Westernport Water, took more than 12 weeks to finalise its financial report, beyond the statutory deadline. The delay was partly caused by resourcing challenges, with the entity's chief financial officer departing unexpectedly in July. This led to inadequate preparation for the year‑end process and audit, and impacted the quality of financial reporting. We reported this as a high-risk issue in our management letter, which Westernport Water's management team accepted. The entity has now established appropriate remediation plans.

Accuracy

The frequency and size of errors in financial reports are direct measures of the accuracy of draft financial reports submitted for audit.

Ideally, there should be no errors or adjustments required as a result of an audit. If we detect errors in draft financial reports, we raise them with the entity's management, and we expect that entities will adjust all material errors that we identify during an audit. Entities must correct material errors before we can issue a clear audit opinion.

Across the 2016–17 reporting period, we identified a number of significant financial transactions, balances and disclosure adjustments. Figure 2B summarises our findings.

Figure 2B

Significant dollar and disclosure adjustments identified across the 2016–17 reporting period

|

Dollar adjustments |

Significant dollar adjustments that we identified resulted in:

|

|---|---|

|

Disclosure adjustments |

Common financial statement disclosure adjustments we identified related to:

|

Source: VAGO.

We raised three high-risk issues in our management letters surrounding the accuracy of financial reporting in 2016–17:

- Gippsland Water—delayed resolution of a 2012–13 prior-period issue relating to untimely capitalisation of assets, which increased the risk of material misstatement in depreciation and asset classifications

- Grampians Wimmera Mallee Water (GWMWater)—omission of a Committee of Management controlled by the entity that needed to be consolidated as per AASB 10 Consolidated Financial Statements, however information was not available to adequately value assets and liabilities to allow for adequate consolidation

- Westernport Water—failure to adequately prepare for changes to AASB 124 Related Parties Disclosures.

Management accepted our recommendations and established appropriate remediation plans.

Quality of the financial report preparation process

We assessed the quality of financial reporting processes against better practice criteria, detailed in Appendix F. Overall, the financial report preparation processes of most of the water entities were sound, as summarised in Figure 2C.

Figure 2C

Assessment of financial report preparation processes against better practice criteria

|

Criteria |

Assessment |

|---|---|

|

Preparation plan |

Over 65% non-existent or developing |

|

Proforma financial statements |

Over 50% non-existent or developing |

|

Monthly financial reporting |

Over 85% developed or better practice |

|

Quality control and assurance procedures |

Over 70% developed |

|

Supporting documentation |

Over 70% developed |

|

Analytical reviews |

Over 85% developing or developed |

Note: Appendix F2 includes a detailed breakdown of the sector results of financial report preparation processes against better practice elements.

Source: VAGO.

|

Proforma financial statements—a set of financial statements prepared by management prior to balance date to assist with planning the structure and contents of the actual financial statements. |

As shown in Figure 2C, two areas that entities need to address are:

- the preparation and quality of proforma financial statements

- the development of financial report preparation plans, including the entity's approach to streamlining the financial report and materiality determination.

The quality of the financial report preparation process was a particular concern at Westernport Water and Lower Murray Water, leading to significant delays and extensive reworking over key financial reporting and accounting standard changes, which also influenced their ability to achieve internal and external deadlines. Staff resourcing challenges around balance date further compounded these issues.

Streamlining financial reports

The International Accounting Standards Board (IASB) identified a 'disclosure problem' in the information that entities disclose in its financial reports. IASB observed three main disclosure concerns:

- not enough relevant information

- irrelevant information

- ineffective communication of the information provided.

IASB is focusing on projects that will improve communication in financial reporting—a strategic theme of IASB's work plans for 2017–21.

While IASB develop and finalise their response to disclosure concerns, the accounting profession has begun to address them by streamlining their financial reports.

The objectives of streamlining financial reports are to:

- maintain compliance with accounting standards and other relevant requirements

- present only relevant information by removing disclosures that are immaterial and including only entity-specific commentary

- communicate financial information in a manner that aligns with the objectives, service delivery, financial performance and financial position ofthe entity

- enhance the readability of the financial report and making it more user‑friendly.

VAGO, the Department of Treasury and Finance and DELWP strongly encouraged water entities to streamline their financial reports, although it is not a mandatory accounting requirement.

As a result, the water sector worked proactively with its industry body, VicWater, to develop a streamlined financial statement model to assist water entities to prepare their financial reports for the 2016–17 reporting period. We commend the sector for its commitment to this streamlining process.

In the first year of this approach, we observed positive results and further areas for improvement—see Figure 2D.

Figure 2D

Key outcomes from streamlining financial reports in the water sector for 2016–17

|

Positive outcomes |

|

|---|---|

|

Areas for improvement |

|

Source: VAGO.

|

Materiality—in the context of financial reporting, information is material if its omission, misstatement or non‑disclosure has the potential to affect the economic decisions of users of the financial report, or the discharge of accountability by management or those charged with governance. The size, value and nature of the information and the circumstances of its omission or misstatement help in deciding how material it is. |

Although we were pleased that water entities took the opportunity to streamline their financial reporting processes to realign and refresh their structure and content, a number of entities continued to only use the model financial statements without modification. This resulted in immaterial and irrelevant financial report disclosures.

We encourage the sector to continue their streamlining investment, including only using the model financial statements as a starting point for further streamlining and customisation.

A detailed financial reporting preparation plan can help entities to streamline their financial reports and decide what note disclosures should stay in the financial statements, and what should be reworked, regrouped or removed. Materiality has a significant impact on this plan, to ensure entities include the information that will help users of the financial report understand the entity's financial performance and position.

Entities should document materiality assessments in the plan and then communicate to key stakeholders, such as audit committees and auditors, for input.

Further, by preparing early proforma financial statements, water entities can provide the proposed document to key stakeholders such as boards, audit committees and audit well before the balance date for review and input. This helps avoid inefficiencies and reworking when it comes to the preparation of draft financial reports closer to or after balance date.

2.2 Performance report audit opinions

FRD 27C Presentation and Reporting of Performance Information requires all water entities to annually prepare a report on their performance and have it audited.

The Minister for Water updated MRD 01 Performance Reporting on 11 April 2017 under section 51 of the FMA. This update supports the requirement under FRD 27C and specifies the format, content and KPIs that water entities must include in their performance reports.

DELWP require water entities to reflect the agreed KPIs as per MRD 01 in their corporate plans, which are submitted annually for review and noting. The corporate plans must contain all KPIs, along with targets for all indicators. Appendix F provides further detail on the financial and non-financial indicators for each entity type.

We issued clear audit opinions on all 19 performance reports, consistent with the 2015–16 reporting period. A clear audit opinion confirms that the actual results reported on the performance report were fairly presented and complied with MRD 01.

We do not form an opinion on the relevance or appropriateness of the reported KPIs, as these are set by the minister. We carried out these audits in accordance with the Australian Auditing Standards.

Quality and timeliness of performance reporting

Generally, water entities prepare and finalise their performance reports concurrently with their financial reports. Our audit of the 2016–17 performance reports resulted in a number of audit adjustments. Common themes included:

- poor quality explanatory notes to support significant variances, providing limited information or purpose to the reader

- compliance issues with explanatory notes, where detailing steps taken or plans to reduce unfavourable variances in the future were not initially disclosed in performance reports, as required by MRD 01

- calculation errors in deriving variance figures, as required by MRD 01.

Our past reports have highlighted that the water sector's performance reporting processes are not as mature as those used for financial reporting. This was again apparent for the 2016–17 reporting period, where entities prioritise financial reporting over performance reporting.

Water entities need to focus more on the processes for performance reporting and its quality, ensuring their performance reports comply with MRD 01. Preparing proforma performance reports, including draft variance explanations, prior to year end can help entities to reduce the number of disclosure deficiencies in their draft performance reports and improve the efficiency of the year-end reporting process.

We also encourage the sector to shift its mindset when preparing annual performance reports—rather than being seen as a compliance document, they can help to communicate key financial and non-financial results to water entities' customers.

In light of both the quality issues we identified with entities' performance reporting, and the sector having applied a consistent performance reporting approach for four years, we recommend that DELWP review the effectiveness of water entities' performance reporting. This review should consider whether the process and final performance reporting outputs are meeting the overall purpose of MRD 01, as initially intended.

3 Internal controls

3.1 Context

Effective internal controls help entities meet their objectives reliably and cost‑effectively. Entities require strong internal controls to deliver reliable, accurate and timely external and internal financial reports.

In our annual financial audits, we consider the internal controls relevant to financial reporting and assess whether entities have managed the risk that their financial reports may not be complete and accurate. Poor internal controls make it more difficult for entities to comply with relevant legislation and increase the risk of fraud and error.

Water entity boards are responsible for establishing and maintaining internal controls that help to:

- prepare and maintain accurate financial records

- report promptly and reliably, externally and internally

- appropriately safeguard assets

- prevent and detect errors and other irregularities.

The Standing Directions of the Minister for Finance require each entity's management to build effective internal control structures.

In this section, we discuss:

- internal control weaknesses common with the 19 water entities in 2016–17

- the status of control weaknesses identified in prior years' audits.

We also discuss results of our assessment on how well entities input their asset revaluation results from the 2015–16 asset revaluation into their internal systems.

3.2 Assessment of internal controls

As part of our audit, we assess the design and implementation of water entities' controls and, where we identify controls that we intend to rely on, we test how effectively these controls are operating. If we assess an entity's internal controls as not being well designed, not operating as intended or missing controls that should be in place, the Australian Auditing Standards require us to communicate those deficiencies to the entity's management and audit committee.

To the extent that we test water entities' internal controls, we found them adequate for ensuring reliable financial reporting. However, we found instances where entities need to strengthen their key internal controls.

During our 2016–17 audits, we identified 83 internal control weaknesses across the 19 water entities. Figure 3A shows the number of issues identified by risk rating, excluding 43 low-risk issues and four business improvement opportunities that we reported directly to the entity. These are normally minor control weaknesses or opportunities to improve existing processes or internal controls. See Appendix D for definitions of our risk ratings.

Figure 3A

Reported internal control weaknesses by area and risk rating

|

Area of issue |

Risk rating |

||

|---|---|---|---|

|

High |

Medium |

Total |

|

|

IT controls |

9 |

15 |

24 |

|

Infrastructure assets, property, plant and equipment |

2 |

1 |

3 |

|

Expenses and payables |

– |

3 |

3 |

|

Revenue and receivables |

– |

2 |

2 |

|

Employee benefits |

– |

2 |

2 |

|

Other |

– |

2 |

2 |

|

Total |

11 |

25 |

36 |

Source: VAGO.

Common high- and medium-risk issues

Across our 2016–17 audits, we identified several common high- and medium‑risk control weaknesses that require improvement:

- IT controls, which are needed to protect computer applications, infrastructure and information assets from threats to security and access

- the monitoring and maintenance of infrastructure assets, property, plant and equipment records and data.

Information technology

IT controls protect computer applications, infrastructure and information assets from a wide range of security and access threats. They also promote business continuity, minimise business risk, reduce the risk of fraud and error, and help meet business objectives.

The water sector relies on IT in its operations and financial management processes. IT systems are regularly upgraded and replaced across the sector. The need to upgrade and maintain existing systems, and the vigilance needed from increasing external IT security threats, means the sector needs to maintain a strong focus on this part of the business.

|

Patch—an additional piece of software designed to fix new or emerging security vulnerabilities or operational issues. Periodic patching reduces the risk of security vulnerabilities in systems and enhances the overall security of the IT infrastructure. |

|

User access management controls—can help ensure systems are appropriately secured to prevent unauthorised access, disclosure and loss of data. Inappropriate and excessive user access rights assigned to systems may result in unauthorised access to data and programs, leading to potential errors, financial fraud and reputational loss. |

|

IT disaster recovery plan (DRP)—a documented process or set of procedures to assist in the recovery of a water entity's IT infrastructure in the event of a disaster. Periodic review and update of the DRP is critical to ensuring it can be used to adequately recover critical systems within required business timeframes. |

|

Capitalisation—the recognition of the cost of an asset, rather than an expense. This approach is used when a cost is not expected to be entirely consumed in a current period, rather over an extended period and will generate economic benefit for an entity. |

Consistent with our prior-year findings, we have again identified issues related to user access management controls, patch management, and periodic review and testing of IT disaster recovery plans (DRP).

Nine of the high-risk issues we identified in this area relate to three water entities:

- Weak user access management controls for both the finance and revenue systems were identified at Coliban Water and Melbourne Water, where several accounts held super-user access. This level of access was not required, and the entities had not performed periodic user access reviews in line with internal procedure documents for the operational system during 2016–17.

- A number of cumulative patches had not been applied to either revenue, finance and/or operating systems at Coliban Water and Yarra Valley Water. The entities had not conducted, documented or formally approved an assessment of the decision to not implement these patches. Further, patches were not applied in a timely manner to servers for operating and finance systems and the domain controller of Melbourne Water.

- IT DRPs were outdated at Coliban Water and Melbourne Water. We found shortfalls where the DRPs were not commensurate with the current system environment or lacked specific, detailed end-to-end processes. The entities had not performed required annual disaster recovery testing.

- Weak change management controls were in place at Coliban Water—we found numerous instances where changes to the finance and revenue systems were not actioned through the internal change management system and no evidence of testing was available.

- Password management controls were not in line with policy for both the finance and revenue systems at Coliban Water.

We reported these high-risk issues and they were accepted by the entities' management. The entities have established appropriate remediation plans.

We continue to identify these significant IT issues each year—however, they relate to varying key financial and operational systems within the water entities, depending on which systems we actually test. For example, in one audit cycle, we may raise issues relating to untimely patches or inappropriate user access relating to a finance system and, in a subsequent cycle, we may test controls over an operational system, such as a billings system, where patching and unauthorised access issues are again identified for that specific system.

This indicates that water entity management teams are not taking the lessons learnt from audit issues reported against particular key systems and applying them to other relevant systems to minimise risks across the organisation.

Monitoring, maintenance and accounting for infrastructure assets, property, plant and equipment

In 2016–17, the 19 water entities controlled more than $44.2 billion of physical assets. Entities need to appropriately record and maintain these assets, and monitor their condition and use, so that decisions can be made about whether they are appropriately valued and when they need to be replaced. Inadequate recording and monitoring of assets can lead to poor asset management or may trigger material misstatements in financial reports.

We found several common issues:

- poor records management over asset data

- untimely capitalisation of work in progress and developer-contributed assets

- inappropriate capitalisation of labour costs

- failure to upload asset valuation data into the fixed-asset ledger following the asset valuation in 2015–16.

The high-risk issues we identified in this area related to two water entities:

- At Goulburn-Murray Water, poor project management and lack of supporting documentation led to a backlog of decommissioned assets during the 2016–17 reporting period and contributed to a further $16.8 million impairment of assets.

- At Gippsland Water, asset valuation results from the 2015–16 scheduled valuation were not processed in the fixed-asset ledger until April 2017. As aresult of this delay, the fixed asset module for the 2016–17 financial year was not activated until April 2017, impacting asset accounting across the reporting period.

Status of matters raised in previous audits

As part of the financial audit process, we monitor internal control weaknesses identified in previous audits to ensure that entities resolve them promptly. We provide information to management and their respective audit committees about the status of these issues.

Figure 3B shows the number of internal control weaknesses raised in previous audits, with the resolution status by risk rating.

Figure 3B

Prior-year issues by resolution status and risk rating

|

Status of prior year issues |

Risk rating |

||

|---|---|---|---|

|

High |

Medium |

Total |

|

|

Unresolved issues |

2 |

7 |

9 |

|

Resolved issues |

7 |

23 |

30 |

|

Total |

9 |

30 |

39 |

Source: VAGO.

Thirty-nine control weakness issues remained open at the start of 2016–17. Encouragingly, 77 per cent of these matters were resolved during 2016–17.

However, two high-risk and seven medium-risk issues raised in previous years remain unresolved. The two unresolved high-risk issues were both in relation to the 2015–16 asset revaluation exercise:

- Lower Murray Water did not have a formal asset valuation policy to establish its valuation methodologies and accounting requirements. In addition, the independent valuer reported issues with the quality of asset data provided for valuation.

- Gippsland Water initially provided incomplete asset data to the Valuer‑General Victoria (VGV). Data that the entity subsequently provided toresolve this issue did not contain sufficient detail for the VGV to perform avaluation. This resulted in management conducting a desktop valuation exercise in 2016–17, noting that the majority of this balance related to assets placed in service in the preceding 12–36 months.

Failure to resolve these issues reduces the effectiveness of the internal control environment. This could lead to water entities being unable to achieve their process objectives, comply with relevant legislation or identify material misstatements.

Appendix D includes information about time lines for resolution.

3.3 Post asset revaluation implementation

Each year, we select one internal control area and perform a more detailed review of the controls and related operating environment. For our 2016–17 audits, we focused on how well water entities input their asset revaluation results from the 2015–16 asset revaluation into their internal systems.

Comprehensive, accurate and up-to-date information on assets is vital for entities to effectively manage their assets, particularly for asset-intensive organisations such as water entities. Such information allows entities to make informed decisions about the physical and financial performance of assets they control. If entities do not have ready access to the necessary information, they cannot make these decisions effectively.

The upcoming Asset Management Accountability Framework (AMAF) requirements imposed under the Standing Direction 4.2.3 Asset management accountability raise the importance of quality asset information. Beginning with the 2017–18 financial year, water entities must attest in their annual report that they comply with AMAF requirements.

In 2015–16, the 19 water entities undertook an asset revaluation process in accordance with the requirements of FRD 103F Non-Current Physical Assets. In our report Water Entities: 2015–16 Audit Snapshot, we commented that the planning and preparation of the 2015–16 revaluation was much more effective than the previous valuation process in 2010–11, as key stakeholders acted early and managed to better scrutinise their valuation results. Despite the improvements, we highlighted that water entities needed to further enhance the quality of their asset data.

For most entities last year, the results of the 2015–16 asset revaluation were processed directly to the balance sheet and not reflected in entities' supporting systems. The tight timing of the revaluation process and the statutory financial reporting deadlines did not allow for a direct upload of the revaluation results.

We expected water entities to have uploaded the valuation data to supporting systems early in the 2016–17 year. Revaluation planning processes should have included a post revaluation result phase, to implement the revaluation results into key systems.

Information management and record keeping requirements

The AMAF, which supports Standing Direction 4.2.3 Asset management accountability, addresses the importance of information management and record keeping over assets. To meet operational needs and to satisfy relevant accounting standards and disclosure requirements, managing directors of water entities must establish appropriate record keeping processes.

Assessment of the post asset revaluation implementation

Figure 3C shows our approach for reviewing the post asset revaluation implementation into asset accounting systems.

Figure 3C

Our approach to reviewing post asset revaluation implementation into asset accounting systems

Source: VAGO.

Regional and rural water corporations determine the fair value of their assets based on the cost of replacing them, adjusted for accumulated depreciation. Known as a depreciated replacement cost method, it is applied to all not‑for‑profit water entities. Results of the full asset revaluation exercise are generally reflected in the water entities' fixed asset sub-ledger (FASL) and asset information management system (AIMS) via updates to each individual asset.

|

Income approach—a discounted cash-flow valuation method that requires the determination of an appropriate discount rate and the projection of future cash flows. Each year, an independent valuer assists the metropolitan water corporations to perform this valuation. |

Metropolitan water entities, which are 'for-profit' businesses, use an income approach as the fair value methodology for their infrastructure assets, which does not assign values to individual assets. In contrast to the regional and rural water entities, metropolitan water entities do not perform the valuation exercise at the level of individual assets. Therefore, metropolitan water entities did not update their individual infrastructure assets within their FASL and AIMS.

Due to the different valuation methodology adopted by the metropolitan water entities and the rest of the sector, our comments below relate solely to the regional urban and rural water entities.

Our assessment showed mixed results.

Best performance

We assessed entities as having the best post asset revaluation processes if they uploaded their revaluation results within the first quarter of 2016–17 and experienced only insignificant issues with the upload process.

We found common traits of entities with best performance:

- prior to providing data to the VGV for revaluation in 2015–16, they prepared data in a format consistent with their internal systems, which meant that, upon receipt of revaluation results, the data was in a format that could be easily uploaded

- they had an integrated system for AIMS and FASL

- they had a detailed revaluation plan that identified the key steps of the revaluation process (from commencement to upload), responsible individuals, accountabilities and time lines

- they scrutinised in detail the VGV results prior to uploading the data—two entities formed specific working groups to manage this process, to verify unit rates, unusual rates and significant differences between existing data.

We also acknowledge Coliban Water's establishment of a post asset valuation group—its purpose was to reflect on lessons learnt from the revaluation exercise, establish new data templates and assess compliance against the requirements of the AMAF in preparation for 2017–18.

Better performance

Compared to the best performing entities, this group generally:

- had no—or a less detailed—revaluation plan in place

- did not have integrated systems for AIMS and FASL

- experienced some data mismatches between the AIMS and FASL

- provided incomplete or inaccurate data to the VGV for valuation

- provided data to the VGV that was not in a suitable format to be uploaded into their FASL—as a result, revaluation results returned from the VGV required further manipulation or formatting before they could be uploaded.

Basic performance

These entities experienced significant delays or were yet to upload valuation results to their FASL and AIMS by 30 June 2017. They also encountered significant issues which not only impacted the timing of implementation, but also indicated poor-quality asset data and highlighted a general lack of preparedness for the overall revaluation exercise. These entities generally:

- lacked a detailed revaluation plan

- had resourcing constraints

- did not perform reconciliations between the AIMS and FASL

- experienced significant data mismatches between the AIMS and FASL, which were only identified toward the end of the revaluation process—for example, once the VGV issued the revaluation results to the water entity

- encountered errors with the initial asset data provided to the VGV for valuation

- failed to consider the complexities and resources required to perform the data upload into the AIMS and FASL.

The delays and issues with the upload of asset data had a number of consequences:

- manual maintenance of fixed assets transactions and balances occurred outside of the FASL across the 2016–17 reporting period

- controls that would have normally existed, such as reconciliation of the FASL to the general ledger, did not exist, increasing the risk that asset data was not complete and accurate

- project managers lacked visibility of the actual status of work in progress

- depreciation impact of asset additions, disposals and write-offs for the year was required to be manually calculated

- lack of up-to-date asset information resulted in suboptimal reporting to those charged with governance.

Benefits

The best-performing entities reported that the improved quality of their asset data allowed them to make better asset-related decisions across the business. Opportunities included:

- improved condition assessments, resulting in more accurate asset life-cycle planning and costing

- forming a post-revaluation review group to reflect on lessons learnt and to assist with preparing for the AMAF requirements

- increased reliability of asset data used across the overall business, including by engineers

- having an extremely detailed understanding of their asset base and reliable data to allow for a full revaluation exercise to be conducted in-house on an annual basis

- enhanced costing of future capital projects.

In contrast, entities that were unable to update their asset systems with revaluation data in a timely fashion are at an increased risk that business decisions are based upon inaccurate or unreliable data.

Our review highlights the importance of having a detailed plan in place to guide the asset revaluation process. Entities with better performing implementation processes had a deeper understanding of their asset data which enabled them to provide quality data to the valuer, in a format that could be readily incorporated into their existing systems.

However, we noted that the majority of entities are yet to perform a formal post revaluation review exercise, to consider lessons learnt and identify areas for improvement that could be carried for the next revaluation exercise or to assist in preparing for AMAF requirements in 2017–18.

4 Financial outcomes

We consider an entity to be financially sustainable if it can maintain operations over the long term based on existing revenue and expenditure policies. It must also be able to absorb short-term fluctuations in income and expenditure from reasonably foreseeable internal and external factors.

We separately assess the financial performance and position of each cohort over the 2016–17 financial reporting period, because their results are affected by varying circumstances.

We analyse financial data for the past five years, and consider whether water entities generate enough surpluses from operations to provide services, maintain or renew assets and repay debt. Their ability to do so is subject to the regulatory environment in which they operate and their ability to minimise costs and maximise revenue. We also consider forecast data, where appropriate, for the next five years based on data obtained from the water entities' most recent 2017–18 corporate plans.

4.1 Overview of the sector's financial results

Figure 4A provides an overview of the financial results of the Victorian water sector for 2016–17, by cohort—metropolitan, regional urban and rural.

Figure 4A

Financial performance and financial position for the sector

Source: VAGO.

The metropolitan water cohort––comprising the metropolitan wholesaler and three metropolitan retail water entities––contributes to a significant proportion of the sector's transactions and balances, followed by the 13 regional urban water entities, and the two rural water entities.

Appendix E includes the detailed data and calculations that underpin our analysis. This appendix lists our financial sustainability risk indicators and results against each indicator for the 19 water entities over the last five financial years 2012–13 to 2016–17.

The indicators highlight potential risks to ongoing financial sustainability in either the short or longer term. However, forming a definitive view of any entity's financial sustainability requires an analysis that moves beyond historical financial considerations to include the entity's financial forecasts, strategic plans, operations and environment, including the regulatory environment.

4.2 Metropolitan water entities

Understanding financial performance

The four metropolitan water entities generated a combined net result after income tax of $416.6 million for 2016–17, an increase of $42.1 million, or 11.2 per cent, on 2015–16.

Average net result

The average net result margin is calculated based on the net result after tax, as a percentage of an entity's total revenue. Figure 4B shows the average net result margin of the cohort for a five-year period. Since 2012–13, the increase in the average net result margin for this cohort aligns with upward trends in revenue and net result after tax, indicating strong historical financial performance. This continued in 2016–17.

|

Average net result margin—shows how much of each dollar collected by the metropolitan cohort translates into operating profit. |

Figure 4B

Average net result margin for the metropolitan cohort

Source: VAGO.

We analyse the key drivers behind the financial performance results of the metropolitan cohort below.

Events affecting revenue

In 2016–17, the four metropolitan water entities generated total revenue of $4.5 billion. Figure 4C shows the key revenue components for the metropolitan cohort.

Figure 4C

Key revenue components for metropolitan water entities in 2016–17

| Wholesaler revenue | $1 332.1 million |

|---|---|

| Metropolitan retailer service and usage charges | $2 327.8 million |

| Developer contributions | $429.8 million |

Source: VAGO.

The metropolitan water entities' combined revenue decreased by $109.6 million (2.4 per cent) in 2015–16, due to a significant decrease of $174.8 million in Melbourne Water's bulk water and sewage services, and revenue from waterways and drainage charges.

|

Government Water Rebate initiative (from the retailer perspective)—a rebate back to customers provided by the metropolitan retailer on behalf of the state government on water bills of residential water customers. It was first issued in 2014–15 on the first quarter bill (July, August, September) and is due to be provided each year until 2017–18. |

Effective from 1 July 2016, Melbourne Water commenced the first year of its four-year ESC price determination. The new price determination decreased bulk water and sewage tariff rates, incorporating efficiency savings from the Government Water Rebate initiative, which was previously provided to the metropolitan retailers as a separate rebate.

The decline in revenue is further compounded by a reduction in water supplied to the metropolitan retailers due to:

- lower consumption by metropolitan households, commercial and industrial businesses across the 2016–17 reporting period

- the metropolitan region experiencing higher-than-average rainfalls compared to the prior year.

Both of these factors have resulted in a decline in service and usage charge revenue of the metropolitan retailers.

The decline in total revenue was offset by developer contributions increasing by $36.0 million from 2015–16, reflecting the continual expansion of services in Melbourne's outer suburbs and growth corridors.

Events affecting expenditure

In 2016–17, the four metropolitan water entities incurred $3.9 billion in total expenditure, a decrease of $71.4 million (1.8 per cent) from the prior year. Figure 4D shows the metropolitan cohort's key expenses.

Figure 4D

Key expenditure components for metropolitan water entities in 2016–17

|

Finance cost |

$929.1 million |

|---|---|

|

Bulk water purchase from the wholesaler |

$1 317.8 million |

|

Operating, admin and other expenses |

$737.7 million |

|

Depreciation and amortisation |

$618.4 million |

|

Employee expenses |

$262.7 million |

Source: VAGO.

The main factor affecting the cohorts' expenditure is the bulk water charges paid by the metropolitan retailers to Melbourne Water, which decreased by approximately $91.7 million. This is due to the reduction in tariff rates and water consumption, in line with Melbourne Water's revenue movement explained in our revenue analysis.

Further, total finance costs for the cohort decreased by $15.3 million, or 1.6 per cent. This decline is largely a result of Melbourne Water experiencing lower interest expenses of $10.9 million due to repaying some debt and refinancing maturing debt at lower interest rates in 2015–16. There was also a reduction in finance costs associated with the Victorian Desalination Plant of $8.6 million, due to refinancing savings.

While Melbourne Water's finance costs decreased by $19.5 million, this was offset by the metropolitan retailers—their finance costs increased by a combined $4.1 million, due to a $177.8 million increase in borrowings held.

Other movements in expenditure items include:

- depreciation and amortisation increasing by $12.6 million (2.1 per cent), driven by a net revaluation increment of $217.2 million for the metropolitan water entities' physical assets from prior year's formal valuation exercise

- employee benefits increasing by $14.1 million (5.7 per cent), due to an increase in the overall full-time equivalent (FTE) base of 3.9 per cent for the cohort and increases in salaries and wages in line with enterprise bargaining agreements.

|

National Tax Equivalent Regime (NTER)—an administrative arrangement that results in government-owned enterprises paying a tax equivalent to the state government. |

Events affecting income tax expense

The metropolitan water entities are subject to the National Tax Equivalent Regime (NTER), administered by the Australian Taxation Office.

Total income tax expense for the 2016–17 reporting period was $207.7 million. This represents a decline of $77.3 million, largely driven by a reduction in income tax payable by Melbourne Water, resulting from a change in the income tax treatment associated with the Victorian Desalination Plant.

Understanding financial position

Assets

|

Property, plant, equipment and infrastructure assets represented 95.6 per cent of the total asset base in the metropolitan cohort. |

At 30 June 2017, the four metropolitan water entities had assets of $25.9 billion, an increase of $491.8 million, or 1.9 per cent, compared to the prior year. The cohort's most significant assets are property, plant, equipment and infrastructure (PPEI) worth $24.7 billion.

PPEI assets grew by $437.6 million in 2016–17. The key drivers affecting this growth are:

- a $19.3 million net revaluation increase in infrastructure assets, comprising:

- Yarra Valley Water and City West Water's increments of $41.0 million and $36.4 million respectively

- South East Water's decrement of $58.1 million.

- additions to infrastructure assets across all four water entities of $418.3million relating to asset renewal and replacement across the Melbourne metropolitan network.

Asset management is a key area that impacts the long-term financial sustainability of a water entity. A key financial challenge is how well water entities plan and carry out asset renewal and replacement. To understand this challenge, we analyse a longer-term indicator—capital replacement.

Capital replacement

|

Capital replacement ratio—in 2016–17, for every $1 of depreciation expense incurred, entities have spent on average $2.12 on infrastructure, property, plant and equipment. |

The capital replacement ratio illustrates whether water entities are spending more on replacing or renewing assets each year compared with their depreciation expense—depreciation being considered an indicator of consumption.

We calculate this ratio based on a five-year rolling average, as can be seen in Figure 4E. The five-year rolling average allows for better phasing of asset spending by the four metropolitan water entities, as it closely aligns to their water pricing cycle.

Figure 4E

Five-year rolling average of the capital replacement ratio of the metropolitan cohort

Note: The information used in this figure comes from water entities' audited financial reports from 2005–06 to 2016–17 and 2017–18 corporate plans, which contain forward estimates for the 2017–18 to 2021–22 financial years. Dashed lines represent unaudited data taken from the water entities' corporate plans.

Source: VAGO.

Figure 4E indicates that the level of capital spending on asset renewal or replacement has kept pace with the consumption of assets, as it has remained above 1.0, however over time the trend has declined.

The downward trend was significantly impacted by increases in the values of PPEI assets since 2009–10. In 2009–10, metropolitan water entities revalued their infrastructure assets to fair value for the first time. Because this revaluation significantly increased asset values, depreciation expenses increased significantly from 2010–11 onwards.

The corporate plan forecast to 2021–22 indicates stabilisation at around 2.0, assuming a consistent trend across the cohort. However, when we look more closely at individual entity results within the cohort, this average is distorted. Melbourne Water experiences a declining trend in contrast to the upward trend of the three metropolitan retailers.

Liabilities

At 30 June 2017, the four metropolitan water entities had combined liabilities of $16.3 billion, an increase of $140.6 million (0.9 per cent) on 2015–16. This is due to an increase in borrowings of $257.5 million to meet working capital requirements, fund capital expenditure programs and fund statutory obligations.

This increase is offset by:

- a reduction of $46.3 million in the annual finance lease payments by Melbourne Water for the Victorian Desalination Plant

- a decrease of $81.7 million in Melbourne Water's current tax liability from the prior year, because of a change in income tax status for the Victorian Desalination Plant.

Figure 4F shows the key types of liability balances for the metropolitan cohort.

Figure 4F

Total liabilities for metropolitan waters entities by nature at 30 June 2017

| Borrowings | $8 672.4 million |

|---|---|

| Finance leases | $4 130.5 million |

| Deferred tax liability | $2 709.5 million |

Source: VAGO.

Gross debt to revenue

At 30 June 2017, the metropolitan water entities collectively held $8.7 billion in borrowings. The loans held are secured by guarantees from the state—meaning that the state holds the risk of entities not paying the principal and interest on loans.

In the metropolitan cohort, there has been and continues to be significant dependency on debt to finance capital projects, as these entities do not hold sufficient reserves or generate sufficient funds from operations to fund this investment.

The gross debt to revenue ratio assesses an entity's ability to pay the principal and interest on borrowings from the funds that the entity generates. Figure 4G shows the ratio for the past five years and the forecast ratio to 2021–22.

Figure 4G

Gross debt to revenue

Note: The information from this figure comes from water entities' audited financial statements from 2005–06 to 2016–17 and entities' 2017–18 corporate plans, which contain forward estimates for the 2017–18 to 2021–22 financial years. Dashed lines represent unaudited data taken from the water entities' corporate plans.

Source: VAGO.

Historically, debt levels are approximately 2.5 times total revenue—meaning the metropolitan water entities require at least three years' worth of total revenue generated to pay off the cohort's debt. When analysing the 2017–18 corporate plans, the level of borrowings for the metropolitan cohort are forecast to increase by $2.8 billion (22.0 per cent) over the period to 2021–22. This will result in a gross debt to revenue ratio trending upward to 3.0 times total revenue.

Our analysis of revenue generated by the entities shows that, after meeting operational and statutory obligations, only a small surplus remains at the end of each year to invest in either capital replacement or pay down debt. This indicates that the metropolitan cohort has little capacity to pay down debt from the revenue generated.

The entities have the power under the Borrowing and Investment Powers Act 1987, to rollover (refinance) their maturing debt and, in recent years, they have done so. All four entities intend to refinance their maturing debt to 2021–22.

Funding capital projects from debt is appropriate, particularly when the funds are used to construct larger-scale assets with extended useful lives, as costs associated with the assets are spread across future years. However, longer-term financial risks exist for the cohort if maturing debt continues to be rolled over without any plan for repayment.

|

Cash interest cover—measures an entity's ability to meet ongoing interest payments and ability to service debt. |

As shown in Appendix E, the metropolitan water entities maintain strong cash interest cover, indicating that this cohort has the ability to service its debt by having sufficient funds to cover interest and financial accommodation levy payments.

4.3 Regional urban water entities

Understanding financial performance

The 13 regional urban water entities generated a combined net profit after income tax of $13.9 million for 2016–17, a decrease of $53.1 million (79.3 per cent) on 2015–16.

Average net result

The regional urban cohort's average net result margin has fluctuated over the five-year period, peaking in 2015–16 before a significant decline in the 2016–17 reporting period, falling below zero. Figure 4H shows the average net result margin of the cohort for a five-year period.

Figure 4H

Average net result margin for the regional urban cohort

Source: VAGO.

The decline in the average net result margin illustrates a weakening in the financial performance of the cohort, caused by 11 of the 13 regional urban entities experiencing a decline in their performance from 2015–16.

The average negative result in 2016–17 occurred because of the three water entities that generated the largest net losses for the year—GWMWater, Lower Murray Water and South Gippsland Water.

GWMWater's net deficit for the 2016–17 reporting period was due predominantly to an increase in depreciation expenditure as a result of the prior year revaluation exercise and the completion of two large infrastructure projects; and lower water consumption and developer contribution revenue.

Lower Murray Water continued to report a net loss as a result of an increase in repair and maintenance costs caused by flood damage, an increase in employee expenses and lower water consumption revenue.

South Gippsland Water's net loss was less in the prior year due to revenue received for a one-off capital project.

|

Service and usage charges $932.0m |

Events affecting revenue

In 2016–17, the regional urban cohort generated revenue of $1.1 billion, a decrease of $25.3 million (2.23 per cent) on 2015–16. This was largely due to a decrease of $25.0 million in water and sewerage service revenue from lower water consumption by their customers, as regional Victoria experienced higher‑than-average rainfall.

|

Developer contributions $118.4m |

The decline was slightly offset by an increase in developer contributions of $9.3 million from 2015–16, with growth across key regional areas covered by Barwon Water, Coliban Water, Central Highlands Water and Goulburn Valley Water.

Events affecting expenditure

|