Results of 2020 Audits: Technical and Further Education Institutes

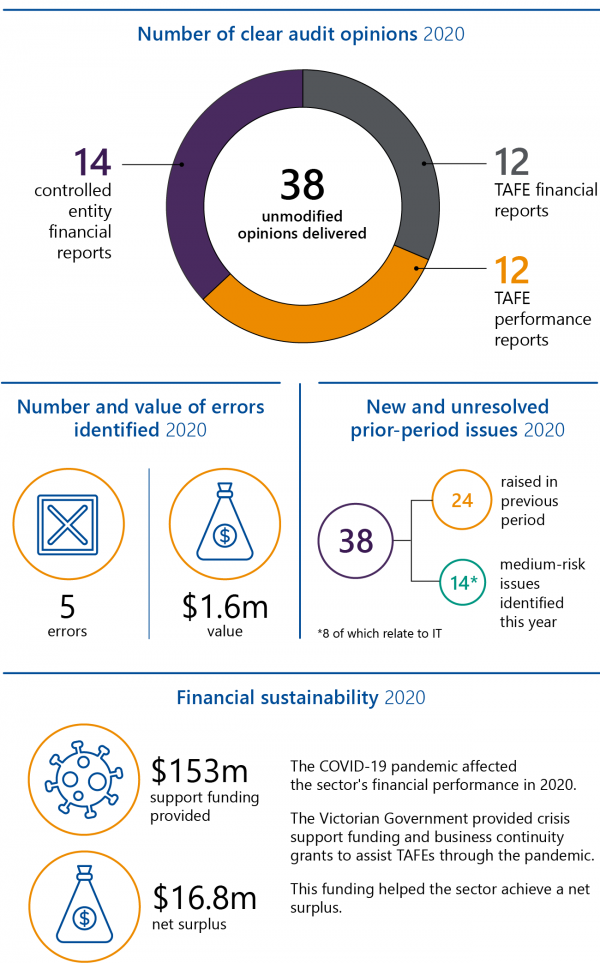

Snapshot

The technical and further education (TAFE) sector faced financial pressure caused by the coronavirus (COVID-19) pandemic, and increased government support was needed to offset the impact of it. We issued clear audit opinions across the sector, which provides confidence in the reliability of financial and performance reports.

Results of auditsWe provided clear audit opinions across the sector, which means the financial and performance reports of TAFEs and their controlled entities are reliable and Parliament and the community can use them with confidence. Financial performanceEight TAFEs received letters of comfort from the Department of Education and Training, which enables them to prepare their financial reports on a going concern basis. Key audit mattersWe continue to find weaknesses in information technology (IT) controls at some TAFEs. A number of prior year IT issues also remain unresolved. These need to be addressed as a priority. |

Video presentation

Recommendation

| We recommend that all technical and further education institutes: |

|---|

| 1. prioritise and expedite resolution of prior-period internal control issues (see Section 2.4). |

Submissions and comments received

We consulted with the Department of Education and Training (DET) and the entities named in this report, and we considered their views when reaching our conclusions.

As required by the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet (DPC) and the Department of Treasury and Finance (DTF).

The following is a summary of agency responses. The full responses are included in Appendix A:

- DET has noted our report and the key finding that the sector's financial and performance reports are reliable. It also supports our recommendation.

- South West Institute of TAFE notes our report and has continued working towards addressing the unresolved high-risk issues noted.

1. Audit context

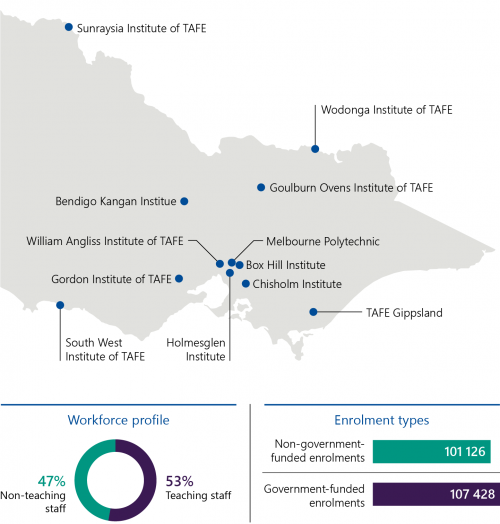

The Victorian TAFE sector consists of 12 TAFE institutes and their 14 controlled entities. Collectively, the 12 TAFE institutes operate 69 campuses across Victoria.

TAFE institutes are established and governed under the Education and Training Reform Act 2006. TAFEs are also public bodies under the Financial Management Act 1994 (FMA).

TAFEs deliver vocational education and training (VET) to equip students with practical and educational skills for a variety of careers and provide pathways to university courses.

This chapter provides background information about:

1.1 TAFE sector at a glance

The Victorian TAFE sector consists of 12 TAFE institutes and their 14 controlled entities. Collectively, the 12 TAFE institutes operate 69 campuses across Victoria. Figure 1A provides an overview of the TAFE sector in Victoria.

FIGURE 1A: The TAFE sector in 2020

Source: VAGO.

The TAFE sector delivers VET to equip students with practical and educational skills for a variety of careers and provide pathways to university courses.

In Victoria, private registered training organisations (RTO) also provide VET courses to students. Private RTOs are private-sector organisations and are not included in this report because we are not required to audit them under the Education and Training Reform Act 2006 or the Audit Act 1994.

Financial context

The main student revenue stream for TAFEs is from delivering training courses. The TAFE sector has two broad student revenue categories—revenue generated by government subsidies and revenue from full-fee paying students.

Government contributions to the TAFE sector consist of government subsidies, operating grants and capital grants. Government subsidies are funds that are provided by the Victorian Government to TAFEs for domestic students who are studying courses eligible for a government grant (also known as contestable funding). Operating grants are provided to TAFEs to help them meet day to day or other specific costs. Capital grants are provided for the construction of new buildings and also for the continued maintenance of existing buildings.

Full-fee paying students consist of private domestic students and international students. Private domestic students are students who are not entitled to a government subsidy and as such, may self-fund their course or choose to access a Commonwealth VET student loan. In this case, the Australian Government pays course fees to the TAFE and the student repays the Australian Government through the Australian taxation system when they earn above a minimum threshold.

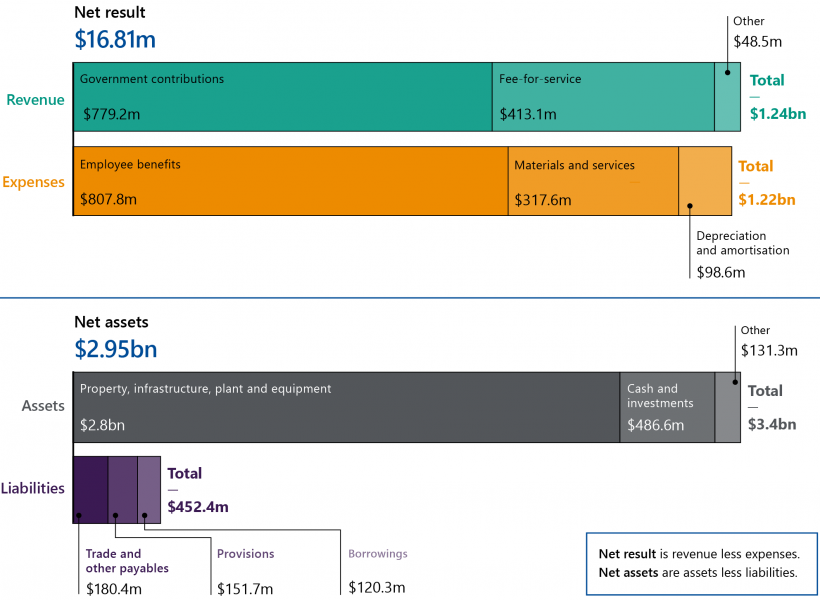

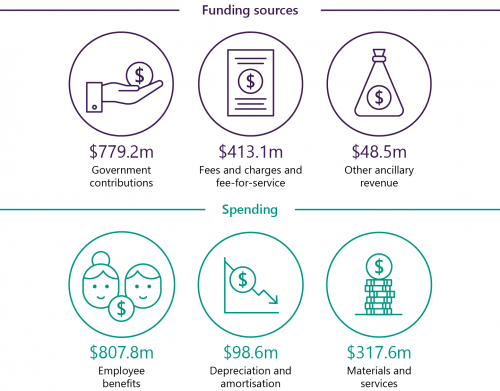

Figure 1B shows the sources of funding received by TAFEs in 2020 and what they spent this on.

FIGURE 1B: The TAFE sector's funding sources and spending in 2020

Note: Government contributions include $464 million of contestable funding.

Source: VAGO.

Figure 1C summarises the sector’s net financial performance and position for 2020.

1.2 Legislative framework

TAFE institutes are established and governed under the Education and Training Reform Act 2006. This Act:

- outlines the requirements for establishing a TAFE board and its governance responsibilities

- defines the functions and powers of TAFEs.

TAFEs aim to:

- perform functions for the public benefit

- facilitate student learning

- collaborate as part of a strong network of public training providers.

TAFEs are public bodies under the FMA. They are required to comply with the FMA and any general or specific direction given by the Assistant Treasurer. They are also subject to the Public Administration Act 2004, which provides a framework for governance in the public sector. Each TAFE board is accountable to the Minister for Training and Skills and the Minister for Higher Education.

DET oversees the sector on behalf of the Minister for Training and Skills and the Minister for Higher Education. This includes overseeing the governance, breadth, depth and appropriateness of the training delivery provided by TAFEs. DET funds the delivery of this training through a subsidy for each training hour delivered.

1.3 Our audit approach

Our method

Going concern means that an entity is expected to be able to pay its debts when they fall due and continue in operation without any intention or necessity to liquidate or otherwise cease operating.

We conduct our financial audits in accordance with the Audit Act 1994 and the Australian Auditing Standards. As part of an audit, we:

- identify and assess the risks of material misstatement of the financial report (whether due to fraud or error)

- design and perform audit procedures responsive to those risks

- obtain an understanding of internal controls relevant to the audit to design audit procedures that are appropriate

- obtain audit evidence that is sufficient and appropriate to provide a basis for an opinion

- evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures

- conclude on the appropriateness of using the going-concern basis of accounting

- evaluate the overall presentation, structure and content of the financial report, including the disclosures, and whether the financial report represents the underlying transactions and events in a manner that achieves fair presentation.

Our independence

The Auditor-General is:

- an independent officer of the Parliament of Victoria

- appointed under legislation to examine, on behalf of Parliament and taxpayers, the management of resources within the public sector

- not subject to the control or direction of either Parliament or the government.

The Auditor-General and staff of VAGO are required to meet the ethical requirements of:

- the Australian Auditing Standards and the Accounting Professional and Ethical Standards Board's APES 110 Code of Ethics for Professional Accountants

- the Code of Conduct for Victorian Public Sector Employees of Special Bodies and the Public Administration Act 2004.

Our costs

The cost of preparing this report and the supporting website dashboard was $145 000, which is funded by parliamentary appropriation.

2. Results of audits

Conclusion

We provided clear audit opinions for all financial reports and performance reports across the TAFE sector.

The financial and performance reports of the TAFE sector are reliable. Parliament and the community can use them with confidence.

This chapter discusses:

2.1 Audit opinions

A clear audit opinion adds credibility to a financial report and performance report by providing reasonable assurance that the reported information is reliable, accurate and complies with relevant legislation.

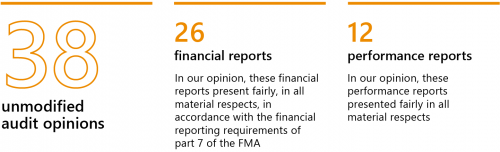

Figure 2A outlines the number of clear audit opinions we issued across the TAFE sector's 2020 financial reports and performance reports. As the figure indicates, the sector's financial and performance reports overall were accurate and reliable.

FIGURE 2A: Number of clear audit opinions issued for 2020

Source: VAGO.

Financial reports

A financial report outlines an entity’s financial performance and position. TAFEs and their controlled entities prepare their financial reports in compliance with the Australian Accounting Standards and applicable legislation. We issued clear audit opinions on the financial reports of all 12 TAFEs and their 14 controlled entities this year.

Performance reports

Each year, TAFEs are required under a ministerial instruction to report against four mandatory key performance indicators (KPI) in their performance reports:

- training revenue diversity

- employment costs as a proportion of training revenue

- training revenue per teaching full-time equivalent (FTE)

- operating margin percentage.

They must establish targets, report on actual results for each KPI and disclose the prior year's results. Descriptions of the four KPIs and the formulas used to calculate them are provided in Appendix F. The appendix also includes a summary of the targets and actual results for each TAFE.

We issued clear audit opinions on the performance reports of all 12 TAFEs, which is consistent with the prior year. Our audit is limited to an opinion on whether the actual results reported are fairly presented and comply with the ministerial instruction. We do not express an opinion on the relevance or appropriateness of the reported performance indicators.

The two KPIs in TAFEs’ performance reports that measure the efficiency and effectiveness of TAFE operations are analysed in Chapter 3.

2.2 Timelines of financial reports

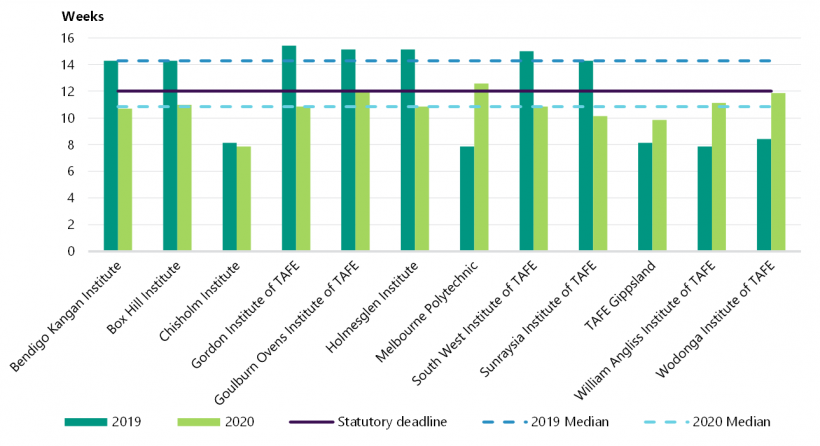

The sooner after year end that audited financial reports and performance reports are published, the more relevant and useful they are to their users. Under the FMA, TAFEs must certify their financial reports and performance reports within 12 weeks of the end of the financial year.

In 2020, TAFEs took a median of 10.8 weeks to certify their financial reports, compared to 14.2 weeks in 2019. Only Melbourne Polytechnic missed the FMA deadline.

For the 2019 reporting cycle, seven TAFEs (Bendigo Kangan Institute, Gordon Institute of TAFE, Goulburn Ovens Institute of TAFE, Holmesglen Institute, South West Institute of TAFE and Sunraysia Institute of TAFE) did not meet the FMA deadline. This was because of the evolving impact of the coronavirus (COVID-19) pandemic and the need for TAFEs to assess and disclose its impact as a subsequent event. These challenges were not present for the 2020 reporting cycle.

Figure 2B shows the time taken after year end for each TAFE to certify its financial report.

2.3 Quality of financial reporting

Material errors are significant misstatements or omissions of information in a financial report or performance report that may influence a user's decision-making.

High-quality financial reports and performance reports reliably represent an entity's financial performance and position and should not contain material errors. The nature, frequency and size of any error affects a financial report or performance report's quality.

We communicate material errors that we identify in a draft financial report or performance report to the reporting entity. These errors must be corrected before we can issue a clear audit opinion.

We identified:

- five financial errors in the reports of three TAFEs totalling $1.6 million

- 23 classification or disclosure errors at five TAFEs.

The value of the errors identified were not material.

This is an improvement from the 31 errors identified in 2019 and demonstrates the sector's continued focus on improving its quality assurance procedures for financial reporting processes.

We also identified three errors in draft performance reports. These errors were due to incorrect formulas being used to calculate the indicators.

2.4 Internal controls over financial reporting

Internal controls include an entity's:

- control environment

- risk-assessment process

- information systems

- control activities

- control monitoring.

Effective internal controls help TAFEs to cost-effectively meet their objectives. Good financial reporting controls are also a prerequisite for delivering sound, accurate and timely financial reports.

In our financial audits, we consider the internal controls relevant to financial reporting and assess whether TAFEs have managed the risk that their reports will not be complete or accurate. Poor internal controls increase the risk of fraud or error and also increase audit risks and costs.

Overall, TAFEs' internal controls remain adequate for reliable financial reporting. We identified fewer new control issues in 2020 compared to 2019. However, we found instances where important control activities could be improved.

New issues

We reported 14 medium-rated control issues in 2020, compared to six high and 42 medium-rated issues in 2019. Appendix D contains the risk rating definitions we use in our audit reporting to management and our expected timelines for issues to be resolved.

Figure 2C summarises the issues we identified this year categorised by rating and issue type.

FIGURE 2C: Internal control issues identified at TAFEs during 2020 audits

| Issue area | High | Medium | Total |

|---|---|---|---|

| Information technology (IT) controls | – | 8 | 8 |

| Revenue/receivables | – | 1 | 1 |

| Expenditure/payables | – | 2 | 2 |

| Financial reporting | – | 3 | 3 |

| Total | – | 14 | 14 |

Note: We reported 10 low-rated internal control issues in 2020. As these issues are minor and/or may present opportunities to improve existing processes, they have been excluded from this figure.

Source: VAGO.

Eight of the 14 medium-rated control issues we identified relate to IT weaknesses. While the number of new issues reported in 2020 is lower, control weaknesses over IT systems remains the key area that requires attention from management. These deficiencies were identified at Gordon Institute of TAFE, Goulburn Ovens Institute of TAFE and South West Institute of TAFE and make up 57 per cent of total medium rated findings (compared to 66 per cent in 2019).

The issues involve:

- password settings and controls that do not align with industry better practice

- user-access management processes and procedures that require improvement

- weakness in change-management procedures.

Effective user-access management and authentication controls reduce the likelihood of unauthorised access to an entity's systems and underlying data and decrease the risk of fraud or errors.

As TAFEs depend on IT systems for some or all of their financial reporting, it is important that they rectify these issues to ensure accurate processing and availability of information and to safeguard the integrity of systems and information from unauthorised access or changes.

We also identified control breakdowns relating to revenue, expenditure and financial reporting that increases the risk of fraud or error, including:

- supplier masterfile changes being reviewed by personnel with the ability to make changes within the system

- balance sheet reconciliations not being reviewed

- staff with key finance system access rights being able to both approve and review journals.

Unresolved prior-period issues

We monitor internal control issues raised in prior-year management letters to see if they have been resolved.

During 2020, the sector resolved 24 (50 per cent) of the 48 high and medium rated internal control issues from prior years. Five unresolved high and 19 medium-rated issues remained at 31 December 2020 (compared to three medium-rated issues remaining at 31 December 2019). Two thirds of these unresolved issues relate to IT controls.

Collectively, three TAFEs are responsible for the five unresolved high rated issues (Goulburn Ovens Institute of TAFE, South West Institute of TAFE and Sunraysia Institute of TAFE) and seven of the unresolved medium-rated issues.

While these TAFEs have started remediation work, they need to respond to the issues reported in our management letters more promptly to strengthen the effectiveness of their internal control environments.

Figure 2D summarises the status of the unresolved high-risk issues.

FIGURE 2D: Unresolved high-risk issues from prior years

| TAFE | Year raised | Status and description of issue |

|---|---|---|

|

Goulburn Ovens Institute of TAFE |

2019 |

Control deficiencies were identified in managing user access. The TAFE has implemented a user-access procedure to reflect the process for performing a user-access review. However, a review of user access has not been performed to validate the appropriateness of access assigned to users for each system. |

|

South West Institute of TAFE |

2019 |

The TAFE undertook an internal audit of its network and internal general controls. Many of the recommendations that impact change management, logical security, security administration and computer operations remain outstanding. |

|

Sunraysia Institute of TAFE |

2019 |

Control weaknesses were identified with regards to change management and user access. The TAFE has updated its change-management procedure. However, the change management policy remains out of date. Furthermore, there is no formal change register. |

|

2019 |

Control deficiencies were identified in managing user access. The TAFE has not yet established a formal policy and procedure for reviewing user access and assigning roles. An internal audit of IT system users was conducted during the year and the recommendations from this review are being addressed. |

|

|

2019 |

Documented requirements and procedures relating to information security incident management are not enforced. The TAFE has an active project in progress to address the issues. |

Source: VAGO.

3. Financial results and performance

Conclusion

In 2020, the sector generated $1.24 billion of revenue (compared to $1.21 billion in 2019) and outlaid $1.22 billion (compared to $1.22 billion in 2019) to produce a net surplus of $16.8 million (compared to a $43.8 million deficit in 2019).

The COVID-19 pandemic affected the sector's financial performance in 2020. Increased government support was required to help TAFEs manage the impacts of COVID 19 during the year.

The sector is financially sustainable in the short term based on its historical performance and reserves.

This chapter discusses:

3.1 Financial performance

In 2020, the sector generated a net surplus of $16.8 million, which is an improvement from the prior year when the sector generated a deficit of $43.8 million. Of the 12 TAFEs, six generated a net surplus, compared to four in 2019.

To interpret this year's results, it is important to first understand the impact of COVID 19 on the sector.

As the pandemic evolved, TAFEs faced changes to their daily operations. Face to face learning was largely suspended—many courses transitioned to online learning and staff worked remotely where possible. Where courses were unable to be transitioned, reduced class sizes were required. The above measures resulted in:

- delays in some students being able to complete their courses

- difficulties for students to obtain practical placement positions as part of their studies

- reduction in enrolments and training revenue (as reported by TAFEs)

- student withdrawals.

Fair value is the price that would be received if an asset was sold or the price paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Each TAFE made adequate disclosures in their financial reports regarding the impacts of COVID-19. These disclosures included operational impacts along with the impact on the financial performance and position of the entity. Common disclosures included:

- transfer to remote learning and restrictions on campus attendance

- enactment of business continuity plans and scenario planning for finances and training delivery

- reduction in enrolments and training revenue

- the Victorian Government providing crisis and business continuity funding

- increased expenditure relating to additional teachers required due to smaller class sizes

- increased security, cleaning costs and purchases of protective equipment

- increased course development costs due to the transition to remote learning

- less annual and long-service leave being taken by staff

- estimation uncertainty relating to the fair value of property, plant and equipment.

Revenue

In 2020, the sector's revenue increased by $34.5 million to $1 240.8 million (or 2.9 per cent).

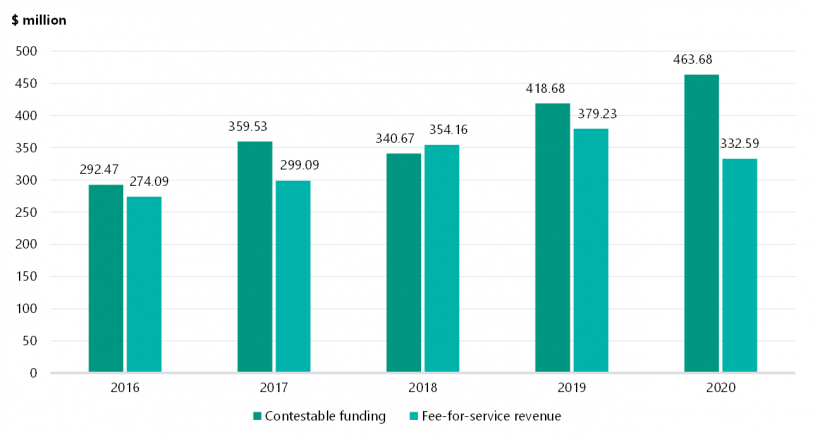

The 12 TAFEs received $463.7 million from the Victorian Government in contestable funding in 2020, which is $45.0 million more than 2019.

The COVID-19 pandemic resulted in a decrease in student contact hours and reductions in training delivery by TAFEs. To assist the sector, the government adjusted funding arrangements during the year. From April to December 2020, each TAFE received minimum monthly payments for government-funded training activity. If the minimum training activity was not achieved, business continuity grant payments funded the shortfall.

These business continuity grant payments were provided to TAFEs to support them to retain staff, transition to online and remote learning and maintain government funding at pre-pandemic levels.

The government also provided $260.3 million in operating grants to the sector, which is $41.8 million more than last year. The increase in operating grants is attributed to COVID-19 crisis funding received that was provided to assist TAFEs with their immediate responses to the pandemic.

Fee-for-service revenue decreased by $46.6 million (12 per cent) during 2020 from $379.2 million in 2019. This is a direct result of the COVID-19 pandemic, which reduced TAFEs’ ability to deliver training and led to a decrease in enrolments during the year.

In prior years, TAFEs worked hard to diversify their revenue streams as much as possible, with the intention of relying less on government funding. Due to the COVID 19 pandemic, which placed restrictions on student attendance numbers and class sizes, TAFEs were less able to deliver fee-for-service courses and therefore relied on more government support to sustain their operations during 2020. Figure 3A shows how the trend towards increasing fee-for-service revenue reversed in 2020.

FIGURE 3A: Contestable funding and fee-for-service revenue for the years ended 31 December 2016 to 2020

Source: VAGO.

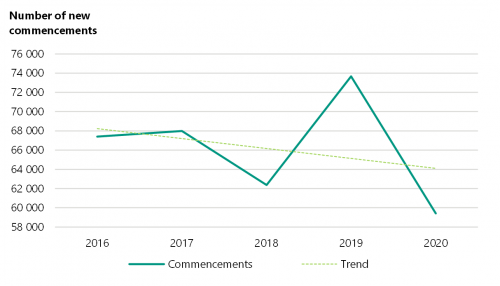

Figure 3B shows the number of government-funded commencements across the 12 TAFEs for 2016 to 2020.

FIGURE 3B: Government-funded commencements across the 12 TAFEs for the years ended 31 December 2016 to 2020

Source: VAGO.

Free TAFE covers tuition costs for eligible students studying priority courses determined by the government.

From 2016 to 2017, government-funded commencements remained steady, with a decrease in 2018. The decline in 2018 was due to students deferring enrolment, so they could access Free TAFE, which started in 2019 and led to a sharp increase in commencements. Government-funded commencements rapidly declined in 2020 due to the restrictions imposed on TAFEs for in-person course delivery as a result of the COVID-19 pandemic.

Financial performance indicator

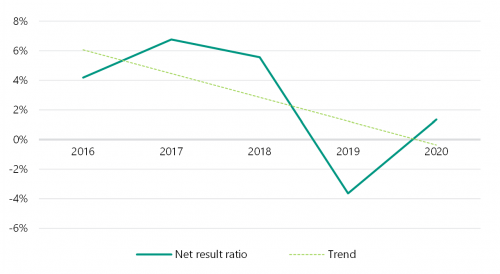

The net result ratio is calculated by dividing the sector's net result by its total revenue.

We have assessed the sector's short-term financial sustainability against the net results ratio, which is a key financial performance indicator, over the past five years.

For this indicator, a positive net result ratio indicates a surplus. The larger the surplus, the stronger the net result. A negative result indicates a deficit. Operating deficits cannot be sustained in the long term.

Figure 3C shows the TAFE sector net result ratio for 2016 to 2020.

FIGURE 3C: The TAFE sector’s net result ratio for the years ended 31 December 2016 to 2020

Source: VAGO.

The ratio has trended down over the last five years, which indicates declining financial performance by TAFEs over the period. This has mainly been driven by increasing expenditure levels for the sector, which was not matched with a corresponding increase in revenue. The improvement in 2020 is partly attributable to the support funding provided to the TAFE sector by the Victorian Government.

Expenditure

The sector’s expenditure decreased by $26.2 million to $1.224 billion in 2020.

Employee expenditure continues to be the most significant cost to the sector. The sector incurred $807.8 million in employee expenses, which is an increase of $29.5 million (or 3.8 per cent) on the prior year.

Overall, employee expenditure accounts for 66 per cent of total expenditure. The Victorian Government supported TAFEs to retain their staff numbers at pre-pandemic levels in accordance with government requirements. As government entities, TAFEs were not eligible for Australian Government assistance mechanisms (such as JobKeeper Payments). Therefore, TAFEs were constrained during the pandemic in relation to controlling these costs.

Activities within the TAFE sector's control that helped contain employee expenditure were limited to activities such as recruitment freezes, not renewing fixed-term contracts and not engaging casual staff. The sector implemented cost saving measures for its discretionary expenditure, which reduced expenditure from $379.2 million to $317.6 million. These costs represented reductions in day to day operating costs for items such as supplies and services, contract payments, fees and charges and third party training providers.

Key performance indicators reported by TAFEs

TAFEs measure and report on their efficiency and effectiveness through two KPIs included in their audited performance reports:

- employment costs as a percentage of training revenue

- training revenue per FTE training member.

Each TAFE board sets its own targets for these measures before the start of the year. The higher that employment costs and teaching FTEs are relative to training revenue, the less efficient and effective the operations of TAFEs become, as the cost of delivering training is increasing.

Most TAFEs did not achieve their set targets for 2020. This was in part due to the COVID-19 pandemic, which resulted in declining training revenue without a corresponding decrease in employee expenses, as TAFEs were required to maintain staff numbers at pre-pandemic levels.

With the impact of the COVID-19 pandemic likely to continue into 2021, it will be important for TAFEs to initiate either cost-saving measures or revenue growth strategies to remain financially sustainable into the future.

Figure 3D shows the results of these two measures against the targets for each TAFE.

FIGURE 3D: Target and actual 2020 efficiency and effectiveness indicator results by TAFE

| Employment costs as a proportion of training revenue | Training revenue per teaching FTE | |||

| Target | Actual | Target | Actual | |

| Bendigo Kangan Institute | 90.8% | 83.8% | $300 638 | $296 979 |

| Box Hill Institute | 82.8% | 96.9% | $224 800 | $212 700 |

| Chisholm Institute | 79.7% | 77.8% | $213 010 | $226 883 |

| Gordon Institute of TAFE | 108.1% | 117.4% | $173 445 | $156 059 |

| Goulburn Ovens Institute of TAFE | 111.7% | 125.5% | $198 453 | $162 382 |

| Holmesglen Institute | <80% | 89.4% | >$195 000 | $203 225 |

| Melbourne Polytechnic | 91.6% | 93.6% | $280 000 | $206 000 |

| South West Institute of TAFE | 120.0% | 122.0% | $150 000 | $173 963 |

| Sunraysia Institute of TAFE | 123.6% | 118.0% | $147 157 | $171 259 |

| TAFE Gippsland | 102.0% | 114.0% | $196 110 | $172 915 |

| William Angliss Institute of TAFE | <73% | 92.0% | >$234 000 | $211 988 |

| Wodonga Institute of TAFE | 101.1% | 97.6% | $155 929 | $184 535 |

Note: Green actual result = target achieved; red actual result = target not achieved.

Source: VAGO.

3.2 Financial position

As at 31 December 2020, the sector’s total assets increased by $8.2 million (or 0.2 per cent) to $3.407 billion, and total liabilities increased by $3.9 million (or 0.9 per cent) to $452.4 million compared to the prior year.

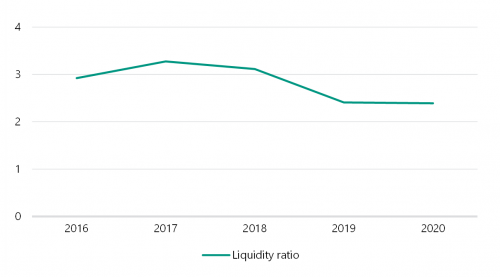

The liquidity ratio is calculated by dividing an entity's current assets by its current liabilities.

Despite the COVID-19 pandemic, the net asset position of the sector is still strong. This reflects its large portfolio of land, buildings and equipment, which TAFEs use to deliver their services.

However, these are illiquid assets, and cannot be relied upon if a TAFE requires cash to meet its short-term debts.

The liquidity ratio is a better indication of whether TAFEs are likely to be able to service their debt obligations in the immediate future. Figure 3E shows the sector’s average liquidity ratio for 2016 to 2020.

FIGURE 3E: The TAFE sector's average liquidity ratio for the years ended 31 December 2016 to 2020

Source: VAGO.

The liquidity ratio of the sector remains well above 1. This means that there were no immediate concerns at balance date about the sector meeting its short-term financial obligations as they become due. This is partly attributable to the continued financial support the government provided to TAFEs during 2020.

3.3 Going concern

Financial reports are prepared on a going-concern basis. This assumes that an entity is able to continue operating unless its management intends to either liquidate the entity, cease operating, or has no realistic alternative but to do so.

Due to the government restrictions relating to COVID-19, management at each TAFE continue to assess whether these events or conditions cast significant doubt on their TAFE's ability to continue as a going concern. Throughout 2020, TAFE management prepared financial forecasts using several different scenarios given the level of uncertainty the pandemic presented.

To mitigate the risk of TAFEs being unable to pay their debts when they fall due, DET issued letters of comfort to TAFEs that require it. Letters of comfort are an undertaking that DET will provide adequate cashflow to those TAFEs, should the need arise, until April 2022. This enabled the following eight TAFEs to prepare their financial reports on a going-concern basis:

- Bendigo Kangan Institute

- Box Hill Institute

- Goulburn Ovens Institute of TAFE

- Melbourne Polytechnic

- South West Institute of TAFE

- Sunraysia Institute of TAFE

- TAFE Gippsland

- Williams Angliss Institute of TAFE.

3.4 Skills for Victoria's Growing Economy review

In 2019, the government commissioned the Skills for Victoria's Growing Economy review. This review focused on developing a post-secondary education and training system that meets the needs of the economy, students and community.

The review identified that there are significant funding issues that need to be addressed to provide stability to the VET system. Issues identified in the review include the following:

- TAFE funding needs to be sufficient to meet the costs associated with TAFEs' unique public role, which includes workforce arrangements, public asset maintenance requirements and public sector compliance requirements. These matters and associated costs are not applicable to private RTOs.

- TAFE subsidies have remained constant since 2017 and there is no annual indexation of subsidies or regular review of rates to ensure they reflect the real cost of training delivery.

- Students are being charged different fees for the same course depending on which TAFE institute they attend.

This review included recommendations designed to ensure the sustainability of the TAFE sector. These included:

- developing a new VET funding model

- considering the establishment of shared corporate services across the TAFE sector.

In direct response to the review, the recent 2021–22 State Budget announced the establishment of the Victorian Skills Authority and the Office of TAFE Coordination and Delivery (a business unit within DET), which will aim to promote collaboration and sharing of services in the sector and provide better training and employment outcomes for students.

Funding model

Under the current funding model, each TAFE course is allocated a funding rate per student contact hour. The government then provides this funding to each TAFE for every student contact training hour they deliver.

The review identified that the current subsidies do not cover the true cost of delivering training and that a new model for financing the VET system should be developed. The review recommended that a new funding model be indexed annually, reviewed every three years and recognise the basis of cost differentials between public and private providers.

The review also recommended that student payments for VET courses become more standardised. This would involve placing a cap on fees to prevent providers maximising profits and including a pricing 'floor' to prevent providers from undercutting fees.

The Heads of Agreement for Skills Reform was signed in August 2020 by the Australian and state governments which is a step towards negotiating a new national skills agreement. A key priority of the proposed agreement is creating a new funding model for the TAFE sector that will provide more consistency in the prices students are charged. The expected time frame for the new pricing structure to be implemented for all VET qualifications is 1 July 2022.

Appendix A. Submissions and comments

Click the link below to download a PDF copy of Appendix A. Submissions and comments.

Appendix B. Acronyms and abbreviations

| Acronyms | |

|---|---|

| DET | Department of Education and Training |

| DPC | Department of Premier and Cabinet |

| DTF | Department of Treasury and Finance |

| EBIT | earnings before interest and taxes |

| FMA | Financial Management Act 1994 |

| FTE | full-time equivalent |

| IT | information technology |

| KPI | key performance indicator |

| RTO | registered training organisation |

| TAFE | technical and further education |

| VAGO | Victorian Auditor-General’s Office |

| VET | vocational education and training |

| Abbreviations | |

|---|---|

| COVID-19 | coronavirus |

Appendix C. Audit opinions

Figure C1 lists the entities included in this report. It details the type of audit opinion for their 2020 financial reports and performance reports and the date we issued them to each entity.

FIGURE C1: Audit opinions issued for the TAFE sector for the year ended 31 December 2020

| Entity | Financial report | Performance report | ||

| Clear audit opinion issued | Audit opinion signed date | Clear audit opinion issued | Audit opinion signed date | |

| Bendigo Kangan Institute | ✓ | 21 Mar 21 | ✓ | 21 Mar 21 |

| Box Hill Institute | ✓ | 1 Apr 21 | ✓ | 1 Apr 21 |

| Box Hill Enterprises Ltd | ✓ | 31 Mar 21 | N/A | N/A |

| Chisholm Institute | ✓ | 10 Mar 21 | ✓ | 10 Mar 21 |

| Caroline Chisholm Education Foundation | ✓ | 10 Mar 21 | N/A | N/A |

| TAFE Online Pty Ltd | ✓ | 10 Mar 21 | N/A | N/A |

| Gordon Institute of TAFE | ✓ | 20 Mar 21 | ✓ | 20 Mar 21 |

| Gotech Limited | ✓ | 20 Mar 21 | N/A | N/A |

| Goulburn Ovens Institute of TAFE | ✓ | 26 Mar 21 | ✓ | 26 Mar 21 |

| Holmesglen Institute | ✓ | 26 Mar 21 | ✓ | 26 Mar 21 |

| Glenuc Pty Ltd | ✓ | 21 Mar 21 | N/A | N/A |

| Holmesglen Foundation | ✓ | 26 Mar 21 | N/A | N/A |

| Holmesglen International Training Services Pty Ltd | ✓ | 21 Mar 21 | N/A | N/A |

| Melbourne Polytechnic | ✓ | 12 Apr 21 | ✓ | 12 Apr 21 |

| South West Institute of TAFE | ✓ | 26 Mar 21 | ✓ | 26 Mar 21 |

| Sunraysia Institute of TAFE | ✓ | 19 Mar 21 | ✓ | 19 Mar 21 |

| TAFE Kids Inc | ✓ | 18 Mar 21 | N/A | N/A |

| TAFE Gippsland | ✓ | 20 Mar 21 | ✓ | 20 Mar 21 |

| William Angliss Institute of TAFE | ✓ | 30 Mar 21 | ✓ | 30 Mar 21 |

| Angliss Consulting Pty Ltd | ✓ | 30 Mar 21 | N/A | N/A |

| Angliss Multimedia Pty Ltd | ✓ | 30 Mar 21 | N/A | N/A |

| Angliss (Shanghai) Education Technology Co Ltd | ✓ | 12 Apr 21 | N/A | N/A |

| Angliss Solutions Pty Ltd | ✓ | 30 Mar 21 | N/A | N/A |

| William Angliss Institute Foundation | ✓ | 30 Mar 21 | N/A | N/A |

| William Angliss Institute Pte Ltd | ✓ | 27 May 21 | N/A | N/A |

| Wodonga Institute of TAFE | ✓ | 8 Apr 21 | ✓ | 8 Apr 21 |

Note: N/A = not applicable.

Source: VAGO.

Appendix D. Control issues risk ratings

Figure D1 shows the risk ratings we applied to the issues raised in our audit management letters. It also details what they represent and the expected timeline for the issue to be resolved.

FIGURE D1: Risk rating definitions

| Rating | Definition | Management action required |

|---|---|---|

|

High |

The issue represents:

|

Requires executive management to correct the misstatement in the financial report or address the issue as a matter of urgency to avoid a modified audit opinion. Requires immediate management intervention with a detailed action plan to be implemented within one month. |

|

Medium |

The issue represents:

|

Requires management intervention with a detailed action plan implemented within three to six months. |

|

Low |

The issue represents:

|

Requires management intervention with a detailed action plan implemented within six to 12 months. |

Source: VAGO.

Appendix E. Financial sustainability indicators

Click the link below to open a PDF copy of our financial sustainability risk analysis results.

Click here to download Appendix E: Financial sustainability indicators.

Appendix F. Mandatory performance indicators

Click the link below to open a PDF copy of each TAFE institute's reported performance against the mandatory performance indicators for 2018 to 2020.

Click here to download Appendix F: Mandatory performance indicators.