State Trustees Limited: Management of represented persons

Overview

Represented persons are those deemed incapable of managing their own affairs due to disability, mental illness, injury or other incapacitating circumstances. They are considered to be among the most vulnerable members of the community. Under the Guardianship and Administration Act 1986 (the Act) represented persons are appointed administrators who must manage their legal and financial affairs while acting in their best interest. State Trustees Limited is the administrator for over 10 000 represented persons in Victoria.

This audit assessed whether State Trustees is managing the financial and legal affairs of represented persons in their best interests.

The audit found that State Trustees is not able to clearly demonstrate that it is fulfilling its obligations to represented persons. Its focus is on measuring its commercial success and it relies predominantly on compliance with its service contract with the state as a proxy for compliance with the Act. However, this does not demonstrate the quality or effectiveness of the management of represented persons' affairs and it does not have the robust governance, monitoring and reporting mechanisms needed to do so. There is also inadequate quality assurance and review of the services provided to represented persons.

State Trustees’ direct engagement with represented persons is not sufficient for it to be assured that their needs and wishes are properly understood. In addition, poor information management and high case manager turnover means that decisions about their affairs are not always based on complete or accurate information.

State Trustees Limited: Management of represented persons: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER February 2012

PP No 102, Session 2010–12

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on the audit State Trustees Limited: Management of represented persons.

Yours faithfully

![]()

D D R PEARSON

Auditor-General

8 February 2012

Audit summary

Background

Among the most vulnerable members of the community, represented persons are those deemed incapable of managing their own affairs due to disability, mental illness, injury or other incapacitating circumstances. State Trustees Limited is the administrator for over 10 000 represented persons in Victoria. As administrator, State Trustees is obliged under the Guardianship and Administration Act 1986 (the Act) to manage the financial and legal affairs of represented persons while acting in their best interests.

Victoria's ageing population is a key challenge and priority for the community. By 2050 the estimated proportion of the population aged 65 and above will be 23 per cent compared with 14 per cent now, thus significantly raising the number of elderly people needing trustee services. Continued growth is also expected in the demand for community services with increasingly diverse and complex client needs. This will directly impact on the demand for administration services by represented persons.

This audit assessed whether State Trustees is managing the financial and legal affairs of represented persons in their best interests.

Conclusions

State Trustees' focus is on measuring its success in terms of its commercial strength. It gives less consideration to whether it is meeting its obligations under the Act.

State Trustees' governance and control frameworks align with better practice but flawed implementation, ineffective oversight, and a failure to regularly and systematically test how effective controls are in practice, limit the assurance it can provide to its board of governance about organisational compliance and performance.

State Trustees has not appropriately defined the services required to meet the Act's obligations, and its performance management framework does not have the robust monitoring, measuring and reporting mechanisms needed to track if it is effectively doing so.

Inadequate information management systems, combined with high case manager turnover, means that decisions about represented persons' affairs are not always based on complete or accurate information. State Trustees' direct engagement with represented persons is also not sufficient for it to be assured that their needs and wishes are properly understood. There is also inadequate quality assurance and review of the services provided to represented persons.

State Trustees relies predominantly on compliance with the Community Services Agreement (CSA) with the Minister for Community Services, as a proxy for compliance with the Act. But the agreement is primarily concerned with service delivery, not service quality. As a result, adherence to the CSA does not demonstrate either the quality or effectiveness of the management of represented persons' legal and financial affairs.

Accordingly State Trustees is not able to clearly demonstrate that it is fulfilling its obligations to represented persons. Nevertheless, its new Business Process Management program, designed to identify weaknesses in current business processes and practices, should lead to a direct improvement in the quality of services delivered to represented persons.

Findings

Governance framework

Compliance management

State Trustees' does not monitor its compliance with the Act which sets out its key service obligations to represented persons.

Instead it relies on its procedures as its key operational control in meeting service obligations. However, State Trustees has a well-documented history of many of its procedures being out-dated, unused, inadequate or non-existent.

Performance management

Only one of State Trustees' 21 corporate objectives relates to the quality of services provided to represented persons. Of the 58 corporate performance indicators, three are linked to that objective. However, no corporate performance reports include these indicators.

Risk management

The 2004 risk management framework aligns with better practice principles. However, it has not been fully implemented, or assessed for effectiveness in managing risks relating to the estate administration of represented persons.

Financial and investment management

To date State Trustees has undertaken only limited performance benchmarking, particularly against other public trustees. It has also recently changed its approach to the investment of client funds, which it has yet to fully evaluate.

When evaluating the investment model, State Trustees needs to consider how it meets its obligations under the Act to operate in the best interests of represented persons.

Managing the affairs of represented persons

Staff skills and capacity

Faced with ongoing issues of high case manager turnover, unsustainable case loads and the demand for specialised staff, State Trustees introduced the 'manageable caseload' project to improve competencies and caseload balances.

The project improved in-house case manager workloads and competencies, and its success led to an extensive in-house staff competency program. However, high turnover continues and there is doubt about State Trustees' ability to sustain the program in light of the increasing service demand and complexity of client needs.

Information management and IT strategy

Reviews over the past five years have identified poor information governance, the absence of a policy and framework for managing information assets, and a general inability to meet government requirements for managing records.

As it relies heavily on the information in its client information management system to make decisions on behalf of represented persons, its poor information management practices place the quality of those decisions and its services at risk.

The inconsistent quality of client records has the potential to compromise financial and legal decision-making, and backlogs in preparing financial or investment plans can adversely impact investment returns.

State Trustees is implementing an Electronic Document and Records Management System.

Client engagement

State Trustees staff need to form and maintain good relationships with clients, which is best done through regular personal contact. However, after the mandatory visit within the first 65 days of appointment, staff visit only 5 per cent of ongoing clients each year. Poor record keeping of communication with clients means State Trustees cannot demonstrate it is effectively engaging with its clients.

State Trustees has a stakeholder engagement strategy for its commercial and community stakeholders and actively engages the community on issues relevant to represented persons. However, the strategy does not explicitly include clients and no client engagement strategy exists.

Client feedback

State Trustees' one corporate service delivery objective for represented persons is to improve the results of the annual client satisfaction survey, the Client Value Index. This survey is a valid measure of client and carer perception of service delivery quality, but it is State Trustees only measure of this. Internal analysis of service quality against defined quality targets does not occur. In isolation, the survey cannot be used to demonstrate whether State Trustees is acting in the best interests of each represented person.

The Client Concerns Panel is effectively handling the small proportion of serious and complex complaints. State Trustees needs to improve its handling of the other types of complaints it receives. It does not consistently use its client information system to manage complaints, preferring to record them manually in a spreadsheet-based register and/or in hard copy files. Internal reviews have identified inconsistent quality of complaint information.

State Trustees does not adequately analyse complaints data to discern trends, identify issues or target staff training, and does not seek feedback on complaints processes or resolution. An internal audit in 2009 recommended it implement both these improvements.

Recommendations

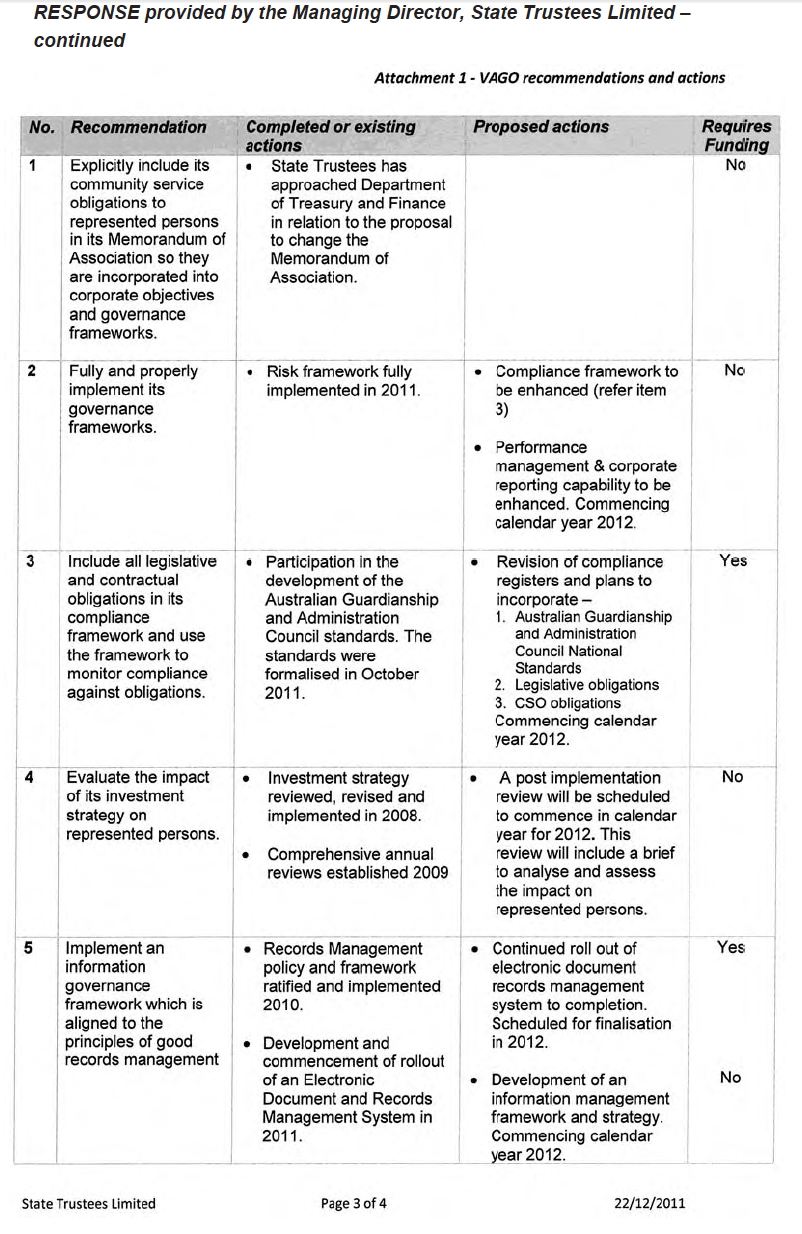

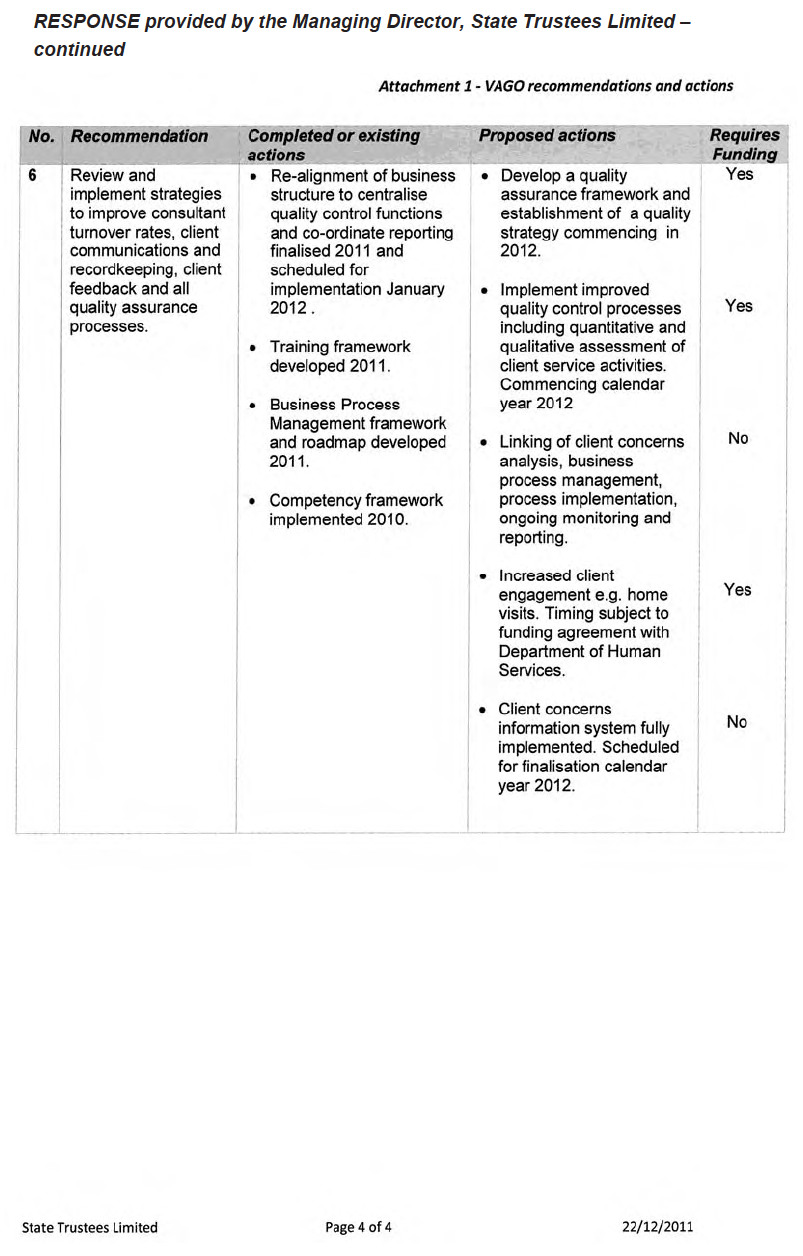

That State Trustees:

- explicitly include its community services obligations to represented persons in its Memorandum of Association so they are incorporated into corporate objectives and governance frameworks

- fully and properly implement its governance frameworks

- include all legislative and contractual obligations in its compliance framework and use the framework to monitor compliance against these obligations

- evaluate the impact of its new investment strategy on represented persons

- implement an information governance framework which is aligned to the principles of good records management

- review and implement strategies to improve consultant turnover rates, client communications, record keeping, client feedback and all quality assurance processes.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994 a copy of this report was provided to State Trustees Limited with a request for submissions or comments.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments however, are included in Appendix A.

1 Background

1.1 Represented persons

Many Victorians are unable to manage their own financial and legal affairs due to disability, mental illness, injury or other circumstances. They are among society’s most vulnerable citizens.

Under the Guardianship and Administration Act 1986 (the Act), the Victorian Civil and Administrative Tribunal (VCAT) may order the financial and legal affairs of these ‘represented persons’ to be managed on their behalf by an administrator.

Under the Act, an administrator:

- is responsible for the general care and management of the represented person’s estate

- takes possession and care of, recovers, collects, preserves and administers the property and estate of the represented person, and generally manages their affairs

- exercises all rights which the represented person might exercise if that person had legal capacity.

Section 49 of the Act requires an administrator to act in the best interests of a represented person. This includes:

- encouraging and assisting the represented person to become capable ofadministering their estate

- consulting with them and taking their wishes into account as far as possible.

VCAT determines an appropriate administrator for each represented person. Where feasible and appropriate this is often a family member; in other circumstances it may appoint a trustee. In many cases, this is State Trustees. Overall, State Trustees acts as administrator for around 50 per cent of represented persons in Victoria.

1.2 State Trustees Limited

The Public Trust Office of Victoria was established in 1939, to protect the interests of Victorians, particularly those with disabilities. It became administratively independent from government in 1987, when it became the State Trust Corporation of Victoria.

In 1994, The State Trust Corporation of Victoria became a company (State Trustees Limited). This was part of the government’s objective to make state-owned businesses more efficient by exposing them to competition from the private sector. The business activities of State Trustees expanded to include providing financial and related services to a wider market.

However, a substantial part of State Trustees’ core business is administration of represented persons’ financial affairs and estates. In 2010–11, State Trustees acted as administrator for over 10 000 represented persons. Its total client base was over 18 000.

At 30 June 2010, represented persons’ funds represented 53 per cent of the $796 million total funds invested and managed by State Trustees.

1.2.1 Community Services Agreement

State Trustees, like any trustee acting as an administrator for represented persons, may charge for the services provided.

In recognition that some represented persons may lack the resources to obtain services, the State Trustees (State Owned Company) Act 1994 makes the Minister for Community Services responsible for ensuring that members of the public who do not have the resources to manage and administer estates and property can receive such services.

The minister may enter into an agreement with a trustee company, person or body to provide these services. For represented persons who are unable to pay for these services the agreement provides for some or all of the costs to be met. A Community Services Agreement (CSA) has been in place with State Trustees since 1994 and is renegotiated every five years.

The CSA is not limited to represented persons administration, but also includes community service obligations in relation to other trustee services, deceased estate administration, and attorneyships. However, services to represented persons make up the large majority of services provided under the CSA.

The CSA requires State Trustees to achieve specific minimum service or performance standards, to report to the Department of Human Services (DHS) on the cost of services, to maintain appropriate and relevant records for DHS, and to effectively manage services for clients referred by VCAT.

DHS reimburses State Trustees for the net costs of the services provided. State Trustees charges those who can pay. Of the 10 000 represented persons for whom State Trustees acts as administrator, around 8 500 are covered by the CSA.

In 2009–10, all services provided to represented persons contributed $26.4 million (45 per cent) towards State Trustees’ total revenue. Payments made under the CSA were around $16 million.

The CSA obligations are separate and additional to the obligation to act in the best interests of each represented person, which is established in the Act and applies to all represented persons. The CSA obligations do not displace this duty, and are not intended to necessarily reflect what might be satisfactory performance in relation to the Act.

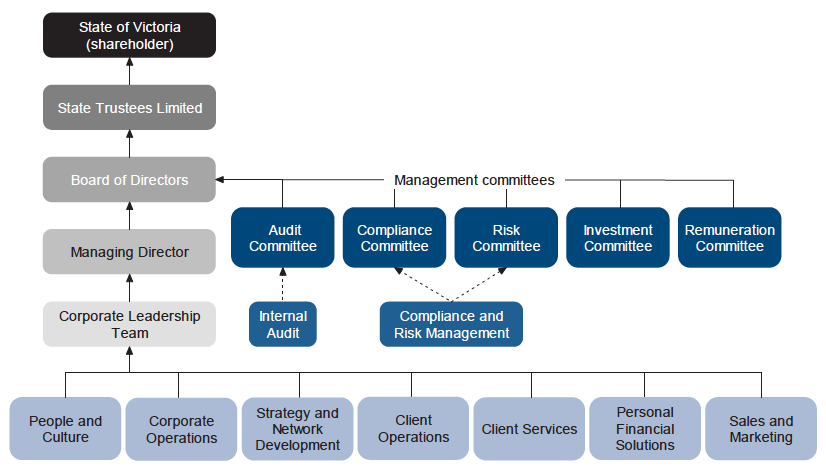

1.2.2 Governance and business structure

State Trustees’ sole shareholder is the state of Victoria. Under the State Trustees (State Owned Company) Act 1994, State Trustees reports through its board of directors to the Treasurer.

Various committees oversee the organisation and advise the board of directors on corporate risks. Figure 1A shows State Trustees’ corporate and business structure.

Figure 1A State Trustees corporate and business structure

Source: Victorian Auditor-General’s Office.

The board delegates operations and administration to the managing director who is supported by a corporate leadership team and senior management group.

In total, State Trustees has seven divisions, 26 business units and over 550 staff.

The Personal Financial Solutions division is primarily responsible for the day-to-day administration of represented persons’ estates.

1.3 Conduct of the audit

1.3.1 Audit objective and scope

The audit objective was to assess whether State Trustees is effectively managing the financial and legal interests of represented persons by assessing the:

- extent to which State Trustees is meeting its legislative and administrative responsibilities for represented persons

- performance measurement, monitoring and reporting framework, systems and processes that enable State Trustees to measure the quality, timeliness and cost effectiveness of services provided to represented persons

- adequacy of State Trustees' communication and accountability processes to represented persons.

1.3.2 Method and cost

The audit was conducted in accordance with the Australian Auditing and Assurance Standards.

The cost of the audit was $560 000.

1.3.3 Structure of the report

The report is structured as follows:

- Part 2 examines the adequacy of State Trustees’ governance structures and internal control frameworks to manage its legislative responsibilities.

- Part 3 examines whether State Trustees has sufficient resources and adequate practices in place to act in the best interests of represented persons.

2 Governance and control

At a glance

Background

State Trustees should be able to demonstrate that it acts in the best interests of represented persons through effective corporate governance frameworks that apply robust performance, risk, compliance and financial controls to oversee and meet legislative, contractual, strategic and operational goals.

Conclusion

State Trustees cannot assure itself that it acts in the best interests of represented persons. Although its control frameworks generally align with better practice, shortcomings in oversight and implementation give only limited assurance that they are working as intended.

Findings

State Trustees does not monitor or measure its compliance with the Guardianship and Administration Act 1986. It has an underdeveloped performance management system. While it has a generally sound risk management framework, it has not been fully implemented, and outstanding concerns remain in relation to the assessment and detection of fraud.

State Trustees has performed limited benchmarking of financial performance, but plans to enhance this over the next 18 months.

Recommendations

That State Trustees:

- explicitly include its community services obligations to represented persons in its Memorandum of Association so they are incorporated into corporate objectives and governance frameworks

- fully and properly implement its governance frameworks

- include all legislative and contractual obligations in its compliance framework and use the framework to monitor compliance against these obligations

- evaluate the impact of its new investment strategy on represented persons.

2.1 Introduction

State Trustees should be able to demonstrate it acts in the best interests of represented persons by using appropriate governance and internal control frameworks that focus on the best interests of represented persons, and then subjecting these to regular testing and reporting.

2.2 Conclusion

Despite numerous internal and external reviews over the past decade that identified shortcomings, State Trustees is not able to demonstrate that it has adequate systems in place that ensure the best interests of each represented person are being met. This is because it:

- does not measure or monitor its compliance with the Guardianship and Administration Act 1986 (the Act)

- has an unbalanced performance management system

- has not fully implemented its risk management framework

- has undertaken limited benchmarking of the performance of clients’ investments.

2.3 State Trustees’ governance and controls

In May 2000 the Auditor-General tabled a performance audit titled Represented Persons: Under State Trustees’ administration. Since then State Trustees has been externally reviewed several times. The reviews covered:

- complaints management

- the Community Services Agreement (CSA) and compliance with stipulated requirements, alternative funding models, best or most appropriate business and operating models, and costing and pricing methodology

- stakeholder management

- key performance indicators (KPIs).

The reviews’ findings indicated that State Trustees had improved its operations in general but further work in these areas was still required.

Further, State Trustees’ Memorandum of Association focuses on its commercial imperative rather than its duties as administrator for represented persons. While State Trustees’ predecessor body had specific legislative objectives to provide administration services in accordance with the principles of the Act, State Trustees’ Memorandum of Association sets out its principal objective as to perform its functions for the public benefit by operating its business efficiently, consistent with prudent commercial practice, and maximising its contribution to the economy and wellbeing of the state.

Consequently over the past 15 years its corporate focus has been on its commercial imperatives rather than its duties as administrator for represented persons.

Read together with the Personal Financial Solutions (PFS) Operational Plan (2010–11), services provided to represented persons operate on a commercial footing. State Trustees has recognised the need to adjust its focus and to increase the emphasis at corporate level on meeting its community service obligations. It has commenced discussions with the Department of Treasury and Finance to reflect this in its Memorandum of Association.

2.3.1 Compliance management

State Trustees does not monitor compliance with the Act, instead using its internal procedures as a key operational control to meet its obligations to represented persons.

The compliance management framework is generally aligned with best practice. A compliance committee is responsible for managing compliance and each division is responsible for implementing the framework. However, the committee does not monitor or report on compliance with the Act; rather, it monitors and reports on compliance with the CSA.

In 2008, State Trustees’ internal auditors reviewed the compliance policy and framework, noting there was no regular compliance monitoring at corporate and divisional levels. It did not assess whether the divisions were implementing the framework effectively.

Administrative practices for represented persons are described in over 100 policies, procedures, templates and tools. There are gaps in relevant policies and procedures, with some that are inadequate, incorrect, out-dated or not followed.

2.3.2 Performance management

State Trustees is neither monitoring, measuring nor reporting on the effectiveness and quality of its performance in administering estates for represented persons.

Corporate performance management framework

State Trustees’ corporate performance management framework has 58 KPIs in the five key result areas of:

- growth

- client and community engagement

- financial sustainability

- people

- service excellence.

Although the areas of growth, financial sustainability and people potentially affect State Trustees’ capacity and capability to deliver effective estate administration services, the associated KPIs do not measure the quality of these services.

KPIs for client and community engagement measure promotion of client interests to commercial and community stakeholders. They do not measure how well they are engaging with their clients.

Only three of the 58 KPIs measure service quality, namely:

- development and implementation of a framework of client service standards, performance targets and monitoring and reporting processes by 30 June 2011

- the standardisation of client communications by 30 June 2013

- 95 per cent usage of the standardised communications.

State Trustees has yet to introduce the client service framework scheduled for 30 June 2011. It has therefore not yet effectively defined:

- the specific services represented persons require and how best to deliver them

- performance indicators to demonstrate the quality of those services

- ways to monitor, measure and report on the achievement of the performance indicators.

Performance monitoring and reporting

The PFS division, responsible for administering represented persons’ estates, provides monthly performance reports to senior management covering divisional revenue and costs. It also includes information on such things as the number of new and deceased clients, its ‘market share’ of represented persons, and its commission from the sale of client properties. Reporting on service quality is restricted to performance against the CSA. The Department of Human Services accepts that reporting against the CSA does not address the effectiveness or quality of services for represented persons.

Monthly performance reporting from the PFS division’s business unit managers to the PFS General Manager is via two key reports. The first contains data on the number of activities completed and outstanding, and the second contains commentary on those activities. These reports are not supported by qualitative data or analysis of whether State Trustees is meeting its obligations under the Act.

Client services framework

State Trustees does not have defined standards for all of the services it needs to provide to meet its obligations for the administration of represented persons’ estates. Because of this it also does not have performance targets and monitoring programs to measure and report on whether these obligations have been met. State Trustees’ relies on compliance with the CSA as a proxy for assessing whether it has met its obligations under the Act.

State Trustees has recently commenced a Business Process Management (BPM) program to strengthen business processes and improve its efficiency and effectiveness. The March 2011 BPM report recommended a focus on client needs and the use of risk management, compliance management and the development of business rules to ‘ensure our client needs are met’.

2.3.3 Risk management

Administration in the best interests of represented persons requires effective identification, assessment and management of risks.

State Trustees’ risk management framework aligns with better practice principles but has not been fully implemented in the divisions. In addition, numerous internal and external review recommendations and two recent serious fraud incidents have pointed to the need for more rigorous risk management.

The risk management framework gives overall responsibility to a Risk Committee of Management (RCoM) and requires divisional managers to confirm every six months that ‘all risks have been adequately identified, reported and reviewed with all actions being performed in an appropriate time frame’.

The framework’s effectiveness has not been assessed since it was set up in 2004 although State Trustees says that an internal analysis done in 2010 suggests it is effective. However, there is no documentation of this review to demonstrate that this analysis assured the framework’s effectiveness.

Personal Financial Solutions division

In September 2009, following an internal review of risks in the PFS division, RCoM advised State Trustees’ board that all 12 of the most serious risks related to represented person estate administration in the division were not properly mitigated.

Shortly afterwards, RCoM decided not to conduct a further review of these divisional risks until after State Trustees had aligned its risk management framework to the new best practice standard. The alignment was completed in August 2011.

Other than for recruitment and competency development activities, State Trustees’ risk management records show no evidence that these risks or their related controls have been monitored or reported on between the 2009 review and the 2011 realignment.

A 2011 internal audit of the PFS new client team found deficiencies in the monitoring of improvement initiatives, the use of procedures designed to improve the quality of client information, record keeping of quality review activities and the team’s policies and procedures.

Managing fraud risk

The State Trustees’ fraud prevention and detection framework is based on a model that aligns with better practice. However, two recent serious frauds, while not directly related to represented persons, highlight the need to properly implement the framework. The most serious of the two frauds was identified fortuitously, not as a result of an effective detection system. State Trustees’ fraud risk controls have repeatedly been found to be weak in detecting and preventing fraud.

From 2001 to 2008 internal audit reported fraud control weaknesses across the divisions. Although State Trustees advised they had been remedied, similar reports have continued, including in the Auditor-General’s annual financial audits of State Trustees from 2006 to 2010.

The most recent fraud risk assessment was performed in 2007. However, the assessment report noted that because State Trustees does not use defined benchmarks to validate risks or controls, the assessment was not an accurate measure of its risk profile.

As a result, State Trustees cannot demonstrate it has adequately managed fraud risk.

Figure 2AFraud incidents

State Trustees’ fraud register shows 11 frauds and thefts from 2007 to 2011, most of which were petty with no material loss to the organisation. However, while frequency of detected incidents is low, two were serious.

One was in the corporate operations division where an employee forged the manager’s signature on expense claims. The other was in the deceased estate administration division where it went undetected for six years until 2010, and required significant procedural change.

Three internal fraud investigations were carried out over 2010–11 as a result of the discovery of the fraud in the deceased estate administration division. These found:

- fraud control weaknesses and recommended strengthening and adding controls

- fraud control was under-resourced, poorly managed and inadequately reviewed

- State Trustees had poorly implemented or was not applying the improved or additional controls recommended in the first review.

Two external reviews in the same period:

- recommended a continuous fraud review program that included testing fraud controls and fraud awareness training

- found that changes in processes and controls recommended in the first internal review had not been implemented or were not being followed.

State Trustees is currently reviewing its fraud prevention and detection framework and although its audit committee initially rejected recommendations for enhanced fraud management, it is now considering the use of fraud detection software.

Source: Victorian Auditor-General’s Office.

2.3.4 Financial and investment management

A core element of State Trustees’ business is managing the assets of represented persons and in particular, their financial assets.

Consultants manage represented persons’ day-to-day financial affairs using a budget based on their individual circumstances. They are required to review the budgets annually and/or if a client’s financial circumstances change.

In the second half of 2010 State Trustees discovered that 10 per cent of represented persons financial and/or investment plans had not been updated as required. It has consistently worked to clear the backlog and currently there are only a few outstanding.

Investment management

State Trustees’ current investment strategy is relatively new and it will be some years before its performance can be fully evaluated.

The investment of represented persons’ financial assets varies depending on whether the value is:

- less than $30 000

- between $30 000 and $75 000

- more than $75 000.

For clients with less than $30 000, State Trustees prepares a standard financial plan and places the funds in one of its two cash common funds (CCF) which provide a monthly income. For client funds up to $75 000, they also prepare a standard financial plan and place the first $30 000 in a CCF, investing the balance in other funds. Clients with more than $75 000 get a tailored investment plan.

As of June 2011 around 65 per cent of represented persons have their funds solely invested in the CCFs. This makes the performance of CCF funds crucial to the majority of represented persons. State Trustees’ CCFs, when compared to similar funds of other public trustees such as New South Wales, provide a smaller return. This is because the New South Wales public trustee charges around half that of State Trustees for CCF management. State Trustees’ other funds, for represented person with greater than $30 000 outperform their New South Wales counterparts, with the exception of the Australian equities/shares fund.

State Trustees also operates five investment funds known as ‘inveST funds’.

Figure 2B shows total funds under management at 30 June 2010. Of the $796 million in total funds invested by State Trustees, $420 million, or 53 per cent, are financial assets of represented persons. Almost $192 million, or 46 per cent, of their funds are invested in CCFs.

Figure 2B State Trustees – funds under management as at 30 June 2010Investment fund |

Represented person funds |

Total funds |

Ownership of funds by represented persons |

|---|---|---|---|

Cash common fund 1 |

87.2 |

87.2 |

100 |

Cash common fund 2 |

105.5 |

390.9 |

27 |

inveST Australian Equity Fund |

38.1 |

54.4 |

70 |

inveST Balanced Fund |

22.6 |

30.5 |

74 |

inveST Diversified Income Fund |

131.9 |

183.1 |

72 |

inveST International Equity Fund |

20.8 |

28.9 |

72 |

inveST Property Fund |

13.9 |

21.1 |

66 |

Total |

420.0 |

796.1 |

53 |

Source: State Trustees Limited.

Until 2009 State Trustees used ‘passive investment’ where investment activities try to mirror those of different investment markets such as stock and property markets.

In 2009 it began ‘active multi-manager investment’ that selects specific investments based on the expected return and associated risk level rather than following market trends. While the requirement for closer attention to individual investments costs the client more, State Trustees expects them to make higher long-term returns.

Investment strategies are long term in nature and require a reasonable amount of time before their results can be evaluated. As such, the overall impact of State Trustees’ new investment strategy cannot be effectively evaluated for some years.

As represented persons have limited choice about how their funds are invested, State Trustees needs to be sure that its decision to change to the more expensive ‘active multi-manager’ style of investment was a prudent one that is in the best interests of these clients.

Financial benchmarking

Meaningful benchmarking can identify underperformance and trigger improvement. State Trustees has done limited benchmarking against other public trustees and expects to do more in the next 18 months.

State Trustees has internally benchmarked all its investment fund performances against a commercial peer group and some of its funds against other public trustees. It has advised that the limited performance benchmarking against other public trustees has been due to a lack of public information and comparability.

The Trustee Corporations Association of Australia represents public trustees and most of the private trustees in Australia. State Trustees contributes to the association’s annual statistics, with the data used to monitor growth rates across the industry.

State Trustees takes part in benchmarking studies including human resource performance and investment management services. In September 2010, it set up an investment group with other Australian public trustees to standardise investment so benchmarking could occur in the next 18 months.

Recommendations

- That State Trustees explicitly include its community services obligations to represented persons in its Memorandum of Association so they are incorporated into corporate objectives and governance frameworks.

- That State Trustees fully and properly implement its governance frameworks.

- That State Trustees include all legislative and contractual obligations in its compliance framework and use the framework to monitor compliance against these obligations.

- That State Trustees evaluate the impact of its new investment strategy on represented persons.

3 Meeting the needs of represented persons

At a glance

Background

State Trustees is required to act in the best interests of represented persons. Represented persons have diverse, changing, and often complex needs. Decisions on their behalf must be made with full information, be transparent, and be subject to effective quality assurance.

Conclusion

State Trustees cannot assure itself that it acts in the best interests of each represented person. More attention is needed to improve record keeping systems, to increase client engagement, and to invest in more sophisticated quality assurance systems.

Findings

In the area responsible for looking after the interests of represented persons, State Trustees has a high rate of staff turnover and generally poor management of client information. Together, these mean that decisions about represented persons are not supported by complete and accurate information, or necessarily reflect the wishes or needs of represented persons.

These concerns are reinforced by limited direct engagement with represented persons, underdeveloped feedback and complaints systems, and an overall lack of quality assurance.

Recommendations

That State Trustees:

- implement an information governance framework which is aligned to the principles of good records management

- review and implement strategies to improve consultant turnover rates, client communications, record keeping, client feedback and all quality assurance processes.

3.1 Introduction

State Trustees should be able to demonstrate it acts in the best interests of represented persons through attention to staff skills and capabilities, decision-making supported by accurate and complete information, effective engagement with clients, and robust quality assurance mechanisms. As a public body, State Trustees must not only act in the best interests of represented persons, but must be able to demonstrate that it does.

3.2 Conclusion

State Trustees cannot demonstrate it is meeting its legislative and administrative obligations to represented persons. High case manager turnover, poor information management, inconsistent engagement with clients and a lack of quality assurance mean that State Trustees cannot demonstrate it is making decisions about represented persons in their best interests.

The outcomes for represented persons rest with the skills and dedication of their assigned consultants. State Trustees has taken steps to improve the competency of staff, but the interests of represented persons remain at risk due to inadequate information management combined with high staff turnover.

Inadequacies in its client complaints management, and an inability to assure the accuracy and currency of the client information that informs its legal, financial, investment and service delivery decision-making, raises concerns about whether these decisions are meeting client needs.

3.3 The interests of represented persons

Under the Guardianship and Administration Act 1986 (the Act), State Trustees must act in the best interests of each represented person.

State Trustees should be able to demonstrate this by putting in place appropriate internal control frameworks that focus on the best interests of represented persons, and subjecting these to regular quality assurance and testing.

To be consistent with the Act, these frameworks should include:

- encouraging and assisting the represented person to become capable ofadministering the estate

- consulting with them and taking their wishes into account as far as possible.

Critical steps in ensuring that State Trustees acts in the best interests of represented persons include:

- adequate training of staff

- access to complete and accurate information when making decisions

- transparent documentation of decisions and reasons

- sufficient and effective engagement with represented persons

- quality assurance.

3.3.1 Staff skills and capacity

Administering the estates of represented persons can be complex, intensive and specialised. The requirements of the Act demand a large, well trained, competent and stable workforce that can establish and maintain personal relationships with up to 10 000 represented person clients.

At the time of the audit there were about 140 Personal Financial Solutions (PFS) staff managing the estates of over 10 000 represented persons. About 88 of those staff are caseload managers, referred to as consultants, who can be responsible for up to 400 clients at any one time.

State Trustees has been actively developing its workforce capability with an in-house staff competency program.

Staff competency

State Trustees recognised that heavy workloads, the need for unique skill sets that can only be developed in-house and consistently high staff turnover, raised the risks of poor quality service and of overlooking critical client information.

In 2006, it began a Manageable Caseload Project (MCP) to improve staff competency and the caseload balance of consultants in the PFS division. All newly recruited PFS staff now receive six to seven weeks in-house training and competency assessments. Mandatory ongoing training is also provided to all consultants according to their duties.

Anecdotal evidence suggests that the MCP improved service quality, competencies, workload balance and staff morale. State Trustees has since adopted the principles of the MCP for the whole organisation.

3.3.2 Information management

Making decisions in the best interests of represented persons requires accurate and relevant information to be available. This not only promotes better decision-making, but enables quality assurance, reduces the risks associated with staff turnover, and assists in meeting accountability obligations.

State Trustees staff base estate management decisions primarily on the information in client records, kept in State Trustees’ Asset and Information Management System, depending on it to be timely, relevant and complete.

Reviews over the past five years have consistently identified poor governance and management of information.

Three information management reviews between 2008 and 2010 found weaknesses:

- a 2008 Auditor-General’s report on Records Management in the Victorian Public Sector found it did not meet the requirements of sound records management

- a 2008 internal review on the Security of Information Assets found no organisational information management and security policy, framework or supporting standards and an over-reliance on information technology (IT) for information security

- a 2010 internal corporate risk review on data integrity found the absence of a policy and framework for data integrity contributed to poor data management practices across the business.

Developed in 2007, State Trustees’ IT strategy aimed to, among other things, understand the key issues for the next five years and develop a strategic plan.

The strategy identified that while existing business systems lacked the capacity to meet business needs, some system performance issues had more to do with poor information management than poor information technology.

State Trustees recognised that over the following decade technology initiatives costing $10.1 million needed to be budgeted for.

When consultants refreshed the IT strategy in 2009 they noted that, except for some activities that related to client relationship management, only one of the five initiatives had been carried out.

They also noted that staff were entering unreliable and incomplete client information into State Trustees’ primary client information management system. The review recommended this be resolved and that State Trustees introduce a client information governance framework. To date, neither has occurred.

State Trustees recognises that it needs to improve its information management and began work to implement an Electronic Document and Records Management System in early 2011.

State Trustees has asserted that qualitative information about services to represented persons is often captured at a client or file level, and not expressly summarised in high‑level reports. However, information in client files has often been found to be incomplete or inaccurate, and State Trustees still considers records management and data integrity risk controls within the PFS division to be deficient.

The lack of complete and accurate information on client files prevents the demonstration of effective engagement with clients.

Most information on client files comes from telephone conversations with clients and contact with carers, support workers and others. The quality of the information in communications records is inconsistent. Some are comprehensive while others are so minimal even the topic is unclear, and understanding the matter recorded would require personal knowledge of the client.

Staff turnover

Staff play an important part in effective information management. High staff turnover puts quality decision-making at risk where knowledge about individual clients and reasons for past decisions rests with the assigned consultants.

State Trustees is aware of the effect of high staff turnover and delays in replacing staff due to the extensive training required and has taken steps to improve retention rates.

From 2007–08 to 2009–10 there has been a steady fall in overall staff turnover with turnover in the PFS division in particular falling from 26.5 to 18.4 per cent overall. However, retention rates for PFS consultants have not improved between 2006 and 2011. Almost half of State Trustees’ consultants have been in the role for less than two years, with almost one quarter for 12 months or less.

Transparency

From a sample of client files, this audit found that client files had minimal documentation of needs assessments to inform budget decisions, both at the initial stage and ongoing. The majority of records reviewed contained little evidence of assessment of the client’s physical needs and financial circumstances, or detail about their wishes regarding their assets.

The majority of communication records did not include sufficient detail to adequately understand the matter discussed in the record. In most cases, staff rely on their personal knowledge of, and experience with, the client to ‘interpret’ the information in a communication record.

Other files indicated that actions had been taken, for example in complaints files, but contained no information on follow-up or the outcome of the action.

For two clients, the consultant was unable to locate the records required for review by the audit.

3.3.3 Engagement with represented persons

As it makes decisions daily on behalf of society’s most vulnerable individuals, State Trustees must have a relationship with each client to understand their circumstances, what they want, what their current needs are and how they would like to live their lives.

State Trustees has a stakeholder engagement strategy that includes promoting client interests to commercial and community stakeholders. However, the strategy does not extend to client engagement and communication. State Trustees has advised that it will review its stakeholder engagement strategy in 2012–13.

The Community Services Agreement (CSA) requires State Trustees to visit represented persons within 65 days of being appointed by the Victorian Civil and Administrative Tribunal to assess their personal and financial circumstances. However, it is not required to visit them again.

The CSA does require some type of contact with each represented person or their carer at least once a year to determine whether their needs or circumstances have changed. This also enables State Trustees to adjust their client records accordingly.

Regardless of the CSA obligations, State Trustees has a responsibility under the Act to consult with represented persons to ensure it is acting in their best interests.

State Trustees has substantial point-of-service contact with represented persons. Throughout the year, its call centre receives almost 300 000 phone calls from clients and carers, and it provides front counter services, such as cash collections, to around 13 000 clients.

However, quality client engagement directly between represented persons and their consultants is infrequent. After the initial visit, only around 5 to 8 per cent of clients are visited each year.

A review of client files found one client who had never received a visit from a State Trustees consultant.

Staff are expected to notify clients, carers or family in writing when there is a change in the assigned consultant. This has not occurred in many cases. One case file showed that the client had been assigned 15 different consultants over the past five years, but few letters had been sent to advise the client of these changes.

State Trustees has no client engagement strategy. State Trustees’ Service Excellence Plan noted a lack of consistency in the way it engaged with clients.

3.3.4 Quality measurement and assurance

State Trustees performs limited quality assurance of the services it provides to represented persons.

State Trustees asserts that qualitative information about services to represented persons is often captured at a client level. State Trustees relies on team leaders to observe consultants, review files, and discuss decisions. This is not documented, and State Trustees has no system to check if this occurs.

The PFS quality review team is responsible for reviewing each represented person’s file at least once every two years. However the review focuses on the accuracy of client file data at the time of the review rather than the quality of ongoing estate administration. Reviewers do not assess the quality of decisions when doing the review, making it an inadequate way to monitor whether the best interests of represented persons are being met.

State Trustees’ two methods of ascertaining represented persons’ satisfaction with its services are through a client satisfaction survey, which is not validated against internal performance benchmarks, and a complaints process that lacks quality assurance.

Client satisfaction survey

The Client Value Index (CVI) is State Trustees’ only corporate measure of service quality, with improving CVI results its only service quality objective.

The CVI is an annual measure of client satisfaction with services. The CVI also meets the CSA obligation to independently survey represented persons. In 2010 the CVI results for represented persons showed 82 per cent satisfaction compared to 78 per cent in 2009, passing the target of 80 per cent. However, the measure was reported at 75 per cent in 2011.

Quantitative data from the CVI survey is analysed and used to recommend improvements. However, there is no documentary evidence that State Trustees monitors and reports on their implementation or effectiveness. State Trustees plans to analyse and develop initiatives from the qualitative data for the first time in 2011 to contribute to improvements.

While a valid method to monitor client satisfaction at an aggregate level, the CVI is not supported by internal analysis of service quality against defined quality targets. In isolation the survey is not sufficient to demonstrate that the best interests of each represented person are being met.

Complaints management

State Trustees’ complaints management framework consists of a complaints handling and dispute resolution policy and operational procedures, and is generally aligned to better practice.

However, its use demonstrates inconsistent quality of complaints record keeping, insufficient analysis and no systems for complainant feedback.

Although the client concerns panel is effectively handling the small proportion of serious and complex complaints, State Trustees needs to improve its handling of the other types of complaints it receives.

A 2009 review recommending implementation of complaints handling functionality in the client information management system was rejected on the basis that it would not result in sufficient improvements on the existing spreadsheet-based complaints register and hard copy files that were being used for complaints handling. However, staff use the complaints system inconsistently, with some recording complaints on the register but not on the client’s electronic file and others recording complaints on this file but not on the register.

Complaints data reporting to State Trustees’ board has not been sufficiently analysed to identify and address performance issues and opportunities for continuous improvement, despite a 2009 internal audit recommending this.

The same internal audit recommended seeking feedback on satisfaction with the complaints process, but this is still not occurring.

During this audit, State Trustees advised it has begun to improve its complaints management with:

- a review of complaints governance and reporting, including better data analysis

- a review of its client concerns panel charter with a view to giving it greater powers to direct action and mandate systemic changes in complaints processing

- the development and implementation of complaints management functionality in its client information management system.

However, it has not advised how it intends to collect feedback from complainants about their satisfaction with complaints handling and resolution.

Recommendations

- That State Trustees implement an information governance framework which is aligned to the principles of good records management.

- That State Trustees review and implement strategies to improve consultant turnover rates, client communications, record keeping, client feedback and all quality assurance processes.

Appendix A. Audit Act 1994 section 16—submissions and comments

Introduction

In accordance with section 16(3) of the Audit Act 1994 a copy of this report was provided to State Trustees Limited with a request for submissions or comments.

The submission and comments provided are not subject to audit nor the evidentiary standards required to reach an audit conclusion. Responsibility for the accuracy, fairness and balance of those comments rests solely with the agency head.