Annual Plan 2019–20

Overview

We prepare and table an annual plan before 30 June each year that sets out our work program and the resources we need to deliver the program. The annual plan is a key accountability mechanism that gives Parliament, the public sector and the Victorian community the opportunity to assess our goals and understand our audit priorities.

From the Annual Plan 2017–18 onwards, we have adopted a rolling three-year planning cycle for our performance audit work program. This forecast horizon provides Parliament, the public sector and the Victorian community with foresight of our short to medium-term goals and priorities. It also provides us with opportunities to undertake early engagement with our stakeholders and allows audited agencies to make necessary preparations for scheduled audits well in advance.

Transmittal to Parliament

The Victorian Auditor-General’s Annual Plan 2019–20 was prepared pursuant to the requirements of section 7A of the Audit Act 1994, and tabled in the Victorian Parliament on 27 June 2019.

Acronyms and abbreviations

| AHV | Aboriginal Housing Victoria |

| CSV | Court Services Victoria |

| CV | Corrections Victoria |

| DELWP | Department of Environment, Land, Water and Planning |

| DET | Department of Education and Training |

| DHHS | Department of Health and Human Services |

| DJCS | Department of Justice and Community Safety |

| DJPR | Department of Jobs, Precincts and Regions |

| DoT | Department of Transport |

| DPC | Department of Premier and Cabinet |

| DSAPT | Disability Standards for Accessible Public Transport (2002) |

| DTF | Department of Treasury and Finance |

| EMCH | Enhanced Maternal and Child Health |

| EYM | Early Years Management |

| IBAC | Independent Broad-based Anti-corruption Commission |

| ICT | information and communications technology |

| MTM | Metro Trains Melbourne |

| PAEC | Public Accounts and Estimates Committee |

| PPP | public private partnership |

| PTV | Public Transport Victoria |

| SRO | State Revenue Office |

| SRP | Student Resource Package |

| VAGO | Victorian Auditor-General's Office |

| VCAL | Victorian Certificate of Applied Learning |

| VicTrack | Victorian Rail Track |

| VRGF | Victorian Responsible Gambling Foundation |

Performance audit work program 2019–2022

Central Agencies and Whole of Government |

Education |

Environment and Planning |

Health and Human Services |

Infrastructure and Transport |

Justice and Community Safety |

Local Government and Economic Development |

|

|

2019–20 |

Personnel security: Due diligence over public sector employees Sexual harassment in the Victorian public sector* Use of contractors and consultants in the Victorian public sector |

Early years management in Victorian sessional kindergartens Management of the Student Resource Package Systems and support for principal performance |

Managing native vegetation clearing* Reducing bushfire risks* Supporting communities through development and infrastructure contributions* |

Clinical governance Efficiency and economy of Victoria’s public hospitals Managing Support and Safety Hubs Victoria’s homelessness response Follow up of Access to public dental services in Victoria*

|

Accessibility of tram services Freight outcomes from regional rail upgrades* Safety on Victoria’s roads—regional road barriers* |

Managing and enforcing infringements Ravenhall prison: Rehabilitating and reintegrating prisoners* Follow up of Regulating gambling and liquor* |

Council libraries* Rehabilitating mines |

|

2020–21 |

Cyber resilience in the Victorian public sector Fraud control over grants in local government Service Victoria: Digital delivery of government services |

ICT provisioning in schools Student attendance in Victorian government schools Supporting workers in transitioning industries |

Conserving threatened species Implementing Plan Melbourne 2017–50 Meeting Victoria’s renewable energy targets Water authorities’ contributions to reducing greenhouse gas emissions

|

Clinical trials in public hospitals Health and wellbeing of the medical workforce Supporting sexual and reproductive health |

Managing railway assets across metropolitan Melbourne Melbourne Metro Tunnel project (Phase 2: main works) Planning and management of metropolitan bus services |

Administration of Victorian courts Disability services in corrections Reducing the harm caused by gambling |

Council waste management services Maintaining local roads |

|

2021–22 |

Fraud and corruption control—Victorian Secretaries’ Board initiatives Measuring and reporting on Victorian public sector performance Outcomes for Aboriginal Victorians: Community housing Revenue management

|

Delivery of the Victorian Certificate of Applied Learning Effectiveness of the Navigator Program |

Domestic building regulation and dispute resolution Electronic-waste ban Supply and use of alternative urban water sources |

Aboriginal health outcomes Effectiveness of the Enhanced Maternal and Child Health Program Managing drug and alcohol rehabilitation services Management of non-clinical services in health services

|

Integrated transport planning Major infrastructure program delivery capability Rolling stock fleet sustainability |

Corrections data Reducing the harm caused by alcohol and drugs on Victorian roads Wellbeing in emergency services |

Agricultural productivity and digital technologies Developing Fishermans Bend Parks and open space management |

*Audit commenced

Note: 2–3 follow-up audits yet to be added to each year of the program.

About our annual plan

The role of the Auditor-General is to provide independent assurance to the Parliament of Victoria and the Victorian community on the financial integrity and performance of the state.

Under the Audit Act 1994, we must prepare and table an annual plan before 30 June each year that details our proposed work program for the coming financial year.

To provide assurance, the Victorian Auditor-General's Office conducts performance audits and financial audits of public sector agencies and reports the results of these audits to Parliament. Our audits help Parliament hold government to account and help the public sector improve its performance.

Performance audits assess whether government agencies, programs and services are meeting their objectives effectively, using resources economically and efficiently, and complying with legislation. They provide assurance about activities that are performed well or represent better practice and identify opportunities for further improvement.

A financial audit is an audit of the financial statements of an agency. It provides assurance that the financial statements present fairly the financial position, cashflows and results of operations for the year.

Performance audits and financial audits integrate with and support each other. Our financial audits are our early warning systems. Intelligence obtained from our regular annual contact with agencies feeds into our performance audit program. In turn, our public reporting on the results of financial audits responds to and is shaped by our annual planning efforts.

The budgeted cost of delivering our proposed program is in Appendix A.

Performance audits

From the Annual Plan 2017–18 onwards, we have adopted a rolling three-year planning cycle for our performance audit work program. This forecast horizon provides Parliament, the public sector and the Victorian community with foresight of our short to medium-term goals and priorities. It also provides us with opportunities to undertake early engagement with our stakeholders and allows audited agencies to make necessary preparations for scheduled audits well in advance.

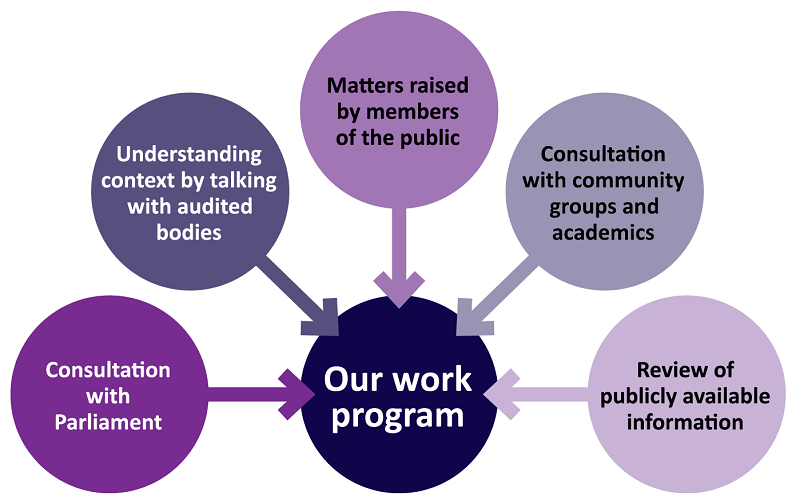

Our annual planning process has three substantive components:

- understanding the environmental context

- deciding potential areas for audit focus

- communicating these plans to relevant stakeholders and incorporating their feedback where appropriate.

Understanding the environmental context

We consult with stakeholders and review publicly available information to inform our understanding of public sector programs and initiatives. Our understanding of the environment helps us generate potential areas of audit interest.

Our consultations include Parliamentarians, citizens and community groups, government agencies, and other key stakeholders. Their input helps us to understand the context of information we have gathered and assists in generating ideas for audit topics.

Our review of information can include research, statistical data, reports by other external sources and information we have previously gathered in the course of conducting our audits. We focus on risks, challenges and emerging issues which may influence the achievement of objectives.

Deciding which areas to audit

When we decide which areas to audit, we anticipate and respond to current and emerging risks and challenges in the Victorian public sector. We use a multi-faceted approach to identify, assess and prioritise potential topic areas. Our planning process informs the development of a work program that balances predictability and responsiveness.

Our forward program also complements our strategic plan and objectives. It is important that we increase our relevance, by delivering credible and authoritative reports and advice about things that matter and will make a difference.

We will continue to focus in 2019–20 on maintaining a balanced audit program that covers our mandate—a mix of audits that examine whether public sector objectives are being achieved effectively, economically and efficiently, and in compliance with relevant legislation.

Assessment steps

Once the environmental scan is complete, we assess potential audit topics against the following criteria:

|

|

||||||||

|

Degree of correlation between the topic idea and statewide/ sector‑specific issues, number of stakeholders affected, and extent of performance gaps between desired standards and actual results |

Consideration of the topic's financial materiality, as well as its economic, social and environmental impact |

Relevance of the topic to Parliament, public sector agencies and community groups |

||||||

|

Our ability to provide unique insights and independent perspectives that add value to the audited agency |

Consideration of time‑critical developments relevant to the proposed audit as well as our priorities |

Balance of economy, efficiency, effectiveness and compliance audits both across our performance audit mandate, as well as across the various portfolios/ sectors of government |

Consulting on our work program

Once we have considered, assessed and moderated each topic based on its merits, we consult with the Public Accounts and Estimates Committee (PAEC), and with departments and other agencies proposed for inclusion in audits. Our consultation is thorough and transparent, and provides the opportunity for considered feedback throughout the planning process.

We thoroughly analyse all the feedback we receive to refine the focus of our audits, check factual accuracy, identify issues with proposed audit timing and to better understand the impact of current or proposed public sector reforms on audit topics. We acquit the written feedback we receive, explaining where we have made amendments based on provided information and why.

Follow-up audits

Our performance audit work program also includes a commitment to undertake follow-up audits. Our follow-up audits aim to monitor agency progress in implementing actions from previous audits, and also verify that actions taken by agencies have been effective in addressing our recommendations.

To contribute to our selection of audits to follow-up, we undertake a comprehensive annual Follow-up Survey. The survey requires agencies to self-attest to the actions they have taken on recommendations over a three-year period. Their responses are assessed by VAGO staff against criteria related to the adequacy, progress and timeliness of their actions. Our 2018–19 survey included all performance audits tabled in 2016–17 and those recommendations yet to be implemented from audits tabled in 2014–15 and 2015–16.

The issues identified in the initial audit, the risk and materiality of the subject matter, and feedback received through our ongoing engagement with key stakeholders also inform the follow-up audit topics we select.

Finalising our work program

The table inside the front cover sets out the performance audits we intend to undertake over the next three years. This forecast provides us with more opportunities for early engagement with our stakeholders and allows audited agencies to prepare for scheduled audits well in advance.

Performance audits are conducted in accordance with relevant standards issued by the Australian Auditing and Assurance Standards Board. These standards cover planning, conduct, evidence, communication, reporting and other elements of performance audits. Additional information about how we deliver our performance audits can be found in Appendix B.

Financial audits

Our financial audit program delivers a range of assurance services for public sector agencies. This includes:

- audit opinions on financial reports and performance statements of public sector agencies

- an opinion on the Annual Financial Report of the State of Victoria

- a review report on the estimated financial statements of the State of Victoria

- three reports to Parliament on the results of audits

- a report to Parliament on the outcome and findings of our audit of the Annual Financial Report of the state of Victoria.

Public Accounts and Estimates Committee

The Audit Act 1994 requires that we seek comments on our draft annual plan from PAEC and include any suggested changes not adopted. We value PAEC's input and seek its suggestions on potential areas of public sector service delivery that may benefit from audit scrutiny.

PAEC suggested four topics for new performance audits, including:

- violence in Victorian prisons

- passenger rail punctuality

- Parks Victoria

- efficiency and effectiveness in Victorian Government tax collection.

The Auditor-General has included a performance audit of the State Revenue Office in this Annual Plan in response to PAEC's suggested efficiency and effectiveness in Victorian Government tax collection topic. The Auditor-General has determined not to include the ‘violence in Victorian prisons’, ‘passenger rail punctuality’ and ‘Parks Victoria’ topics in this Annual Plan.

PAEC recommended we reinstate the Information sharing to address family violence audit that was included in our 2018-19 Annual Plan.

The Auditor-General has determined not to reinstate the Information sharing to address family violence audit at this time. We will continue to monitor risk in relation to the family violence information sharing scheme through our planned 2019–20 audit Managing Safety and Support Hubs audit and the legislated independent review of the Family Violence Information Sharing Scheme by Monash University.

Amendments to the Audit Act 1994

The Audit Amendment Bill 2018 was passed in Parliament on 28 May 2019 and will commence on 1 July 2019.

The Bill was designed to restructure and modernise the current Audit Act 1994 to make it more accessible, effective and efficient.

The Bill modernised our information gathering and disclosure powers and clarifies our existing reporting obligations and powers. The Bill also gives the Auditor-General new powers to conduct assurance reviews and to report to Parliament on these reviews.

Assurance reviews are more targeted, time sensitive and smaller scaled compared to financial or performance audits. They are cost-effective and enable the Auditor-General to respond quickly and effectively to discrete and lower-risk issues brought to the Auditor-General's attention by other integrity offices, members of Parliament, or the community.

The Auditor-General has the discretion to determine when an assurance review is appropriate. They are intended to enable us to, for example, review specific operational matters, follow up on compliance with previous audit recommendations or referrals from other integrity bodies.

Assurance reviews are provided for under Australian Auditing and Assurance Standards and are available in all Australian jurisdictions, except for Queensland and South Australia.

Performance audit work program

This section sets out our proposed performance audit program for the next three years. In 2019–20, we plan to deliver 20 performance audits and two follow-up audits.

For each audit listed, we outline the audit specification, which includes our proposed objective for the audit, the issues we intend to examine, and the proposed agencies we expect to include.

|

Central Agencies and Whole of Government |

Education |

Environment and Planning |

Health and Human Services |

|

Infrastructure and Transport |

Justice and Community Safety |

Local Government and Economic Development |

Central Agencies and Whole of Government |

Personnel security: Due diligence over public sector employees

2019–20

Objectives

To determine whether fraud and corruption controls regarding personnel security are well-designed and operating as intended.

Issues

The Victorian community invests considerable trust in the public sector. Victorians expect public sector employees to act in the public interest, and with integrity. A key area of risk for fraud and corruption is in recruitment and staff promotion—studies estimate that between 20 and 30 per cent of job applications contain some form of false information.

In 2018, the Independent Broad-based Anti-corruption Commission (IBAC) released a report—Corruption and misconduct risks associated with employment practices in the Victorian public sector. IBAC's report highlights the risk of 'recycling' public sector employees with problematic discipline or criminal histories. Our 2018 Fraud and Corruption Control audit identified issues such as failure to complete and document references, police and qualification checks, or to respond appropriately when checks identified anomalies.

This audit will examine human resource practices that focus on integrity and identity checks, including sound recruitment practices such as declaring conflicts of interests when forming a recruitment panel. The audit will consider reference, qualification and police record checks practices.

The audit will also consider agency practices to confirm eligibility for employment, including testing whether applicants have accepted targeted separation packages and have valid Working with Children Checks where relevant.

Proposed agencies

A selection of government agencies.

Sexual harassment in the Victorian public sector

2019–20

Objective

To assess whether the Victorian public sector is providing work places that are free from sexual harassment.

Issues

A 2018 survey by the Australian Human Rights Commission found that one in three people over the age of 15 had been sexually harassed at work in the past five years, an increase from one in five in 2012.

Media and public attention on sexual harassment has also increased following the #MeToo movement.

Various reports and publications demonstrate that sexual harassment at work can have wide-ranging impacts, such as psychological harm, social isolation, health issues and economic loss.

Sexual harassment is unlawful and may also constitute a criminal offence in some instances. The public sector has a duty under Victoria's Equal Opportunity Act 2010 to take proactive, reasonable and proportionate measures to eliminate sexual harassment. The measures are supported by core values in the Public Administration Act 2004.

In the public sector, some workplaces may have increased risk of sexual harassment because of cultural or historical gender balances. Reporting and recording of sexual harassment complaints can be complicated, as the behaviour is often accompanied by other forms of victimisation. Addressing sexual harassment may involve multiple agencies depending on how the victim describes the event, which agency receives the complaint, and what legislation is then applied. Since 2016, the Victorian Public Sector Commission's People Matter Survey has included questions about sexual harassment to help improve monitoring and understanding of patterns of harassment in the public sector.

This audit will use data to investigate the prevalence of sexual harassment in the Victorian public sector and assess the effectiveness of agencies' actions to address it.

Proposed agencies

DPC, DTF, DHHS, DELWP, DoT, DJPR, DET, DJCS, Victorian Equal Opportunity and Human Rights Commission, Victorian Public Sector Commission and WorkSafe Victoria.

Use of contractors and consultants in the Victorian public sector

2019–20

Objective

To determine whether Victorian state government agencies are achieving value for money in their use of contractors and consultants and preventing deskilling of public sector staff.

Issues

Government agencies use consultants and contractors for a range of purposes, and the decision to procure such services is often driven by a need for specialist or technical skills, an external viewpoint, or to supplement internal resources. However, underlying systemic issues can lead the public service to place undue reliance on consultants and contractors, reducing the capability of their staff. Such issues include poor staff recruitment and development, a lack of planning leading to a reactive and short-term resourcing focus, a culture of risk aversion, and ineffective knowledge management. In addition, government agencies also need to demonstrate that they are achieving value-for-money outcomes when using consultants and contractors.

This audit will assess the prevalence of contractor and consultant use in the public service and whether departments are investing enough in their core capabilities to develop a capable, self-reliant public sector.

Proposed agencies

DPC, DTF, DHHS, DELWP, DoT, DJPR, DET and DJCS.

Cyber resilience in the Victorian public sector

2020–21

Objectives

To determine whether departments and agencies can prevent, respond to, and recover from cybersecurity attacks.

Issues

The Victorian Government released its cybersecurity strategy in 2017. The strategy's purpose is to develop and implement cybersecurity capabilities to protect sensitive data, ensure government resilience to cyber threats, ensure continuity of service, and coordinate Victoria's response to threats against infrastructure. In addition, the Victorian Protective Data Security Framework (VPDSF) and Victorian Protective Data Security Standards (VPDSS) provide direction for Victorian public sector agencies on their data security obligations.

Our previous audits found that agencies' inadequate information and communications technology (ICT) security controls and immature operational processes may expose them to cyberattacks. We found undeveloped disaster recovery procedures and little awareness of how agencies' ICT systems would perform if subject to a cyberattack. Further, agencies needed to significantly improve their adherence to the Australian Signals Directorate's Top 4 strategies to mitigate cyber intrusion.

This audit will assess whether the government's cybersecurity strategy and its implementation of the VPDSF and VPDSS have effectively improved government's cyber resilience.

Proposed agencies

DoT, DJPR, DELWP, DET, DHHS, DJCS, DPC, DTF, the Office of the Victorian Information Commissioner, and CenITex.

Fraud control over grants in local government

2020–21

Objective

To determine whether fraud and corruption controls over grants in local government are well designed and operating as intended.

Issues

The local government sector is primarily funded though rates and charges, and government grants to deliver services. In the 2016–17 financial year, Victorian councils recorded revenue of $10.5 billion, $1.9 billion of which was from government grants.

In 2017, the Local Government Inspectorate (LGI) released its investigation report Protecting integrity: Central Goldfields Shire Council. The LGI's investigation found that significant grant funding had been mismanaged by the council and could not be accounted for. It found that the same invoices were submitted to acquit two separate grants.

Following the LGI's investigation, the government strengthened the role of council Audit and Risk Committees and proposed legislation requiring that these committees 'monitor and provide advice on risk management and fraud prevention systems and controls'.

This audit will focus on risks associated with grant funding in the local government sector, including grants allocated by Local Government Victoria and by councils.

Proposed agencies

DELWP and a selection of local government councils.

Service Victoria: Digital delivery of government services

2020–21

Objectives

To determine whether digital delivery of government services has improved customer experiences and reduced transaction costs.

Issues

The government has made commitments to develop better digital channels and mobile services for service delivery. In May 2015, DPC launched Service Victoria with the aim of enhancing government online service delivery and improving customer experience.

With hundreds of phone hotlines and over 500 different websites, accessing Victorian Government services and information can be difficult as well as costly to government and individuals. According to government estimates, the disparate systems for Victorians to contact government entities costs around $461 million and this figure could rise to $713 million by 2026 without changes to service delivery approach.

Significant delays and cost overruns in delivering government ICT projects in the past raise questions regarding the timely delivery of services by Service Victoria and realisation of reduced transaction costs. In addition, citizens require confidence that governments will protect their privacy when they transact digitally.

The audit will assess if Service Victoria is meeting its mandate to overcome current challenges in government digital delivery.

Proposed agencies

Service Victoria and DPC.

Fraud and corruption control—Victorian Secretaries' Board initiatives

2021–22

Objective

To determine whether fraud and corruption controls initiated by the Victorian Secretaries' Board are well designed and operating as intended.

Issues

In 2015–16, IBAC investigated a number of allegations of corruption in DET. In response to IBAC's findings, the Victorian Secretaries' Board established a Corruption Prevention and Integrity Subcommittee, which developed an action plan to strengthen integrity frameworks.

The Victorian Secretaries' Board worked with the Victorian Public Sector Commission on initiatives to strengthen processes in relation to conflicts of interest, gifts, benefits and hospitality, code of conduct, tendering and procurement, integrity structure, and governance and ethical leadership. Base-level policy and practice requirements were agreed on and adopted by the Secretaries.

This audit will focus on the implementation of initiatives from the Victorian Secretaries' Board to improve integrity in the Victorian public sector following IBAC investigations and will test the effectiveness of these controls.

Proposed agencies

DET, DELWP, DHHS, DJPR, DJCS, DoT, DPC and DTF.

Measuring and reporting on Victorian public sector performance

2021–22

Objective

To determine whether Victorian Public Sector Budget Paper 3 performance measurement provides a relevant, appropriate and fair representation of actual performance.

Issues

VAGO audits in 2001, 2003, 2007, 2010 and 2014 have repeatedly found significant weaknesses in the way departments measure and report on performance. The Public Accounts and Estimates Committee’s (PAEC) Report on the 2018–19 Budget Estimates also found significant shortcomings in performance measurement and reporting systems by departments.

Key issues include, but are not limited to, poor or absent links between objectives and output and/or outcome measures, lack of meaningful analysis of results, targets that are either unchallenging or can induce perverse incentives, and important service areas without performance measurement. These limitations prevent Parliament and the public from properly understanding whether government agencies are effectively delivering their services and intended outcomes.

This audit will assist in enhancing measurement and reporting of Victorian public sector performance by continuing to shine a light on current practice in departments.

Proposed agencies

DoT, DJPR, DELWP, DET, DHHS, DJCS, DPC and DTF.

Outcomes for Aboriginal Victorians: Community housing

2021–22

Objective

To assess whether the transfer of public housing assets to Aboriginal Housing Victoria (AHV) is supporting improved housing access, stability and uptake of support services for Aboriginal Victorians.

Issues

The Aboriginal population experiences poorer outcomes than the general population on multiple indicators. Aboriginal Victorians are 8.5 times more likely to be the subject of a child protection assessment and are incarcerated at 11 times the rate of non-Aboriginal people. In 2016, 14 per cent of Aboriginal Victorians were unemployed compared with 7 per cent of non-Aboriginal Victorians. Research indicates that for Aboriginal people, access to stable housing can be a significant factor in achieving positive health, wellbeing and employment outcomes.

In 2016, the government transferred ownership of 1 448 public housing assets to AHV, valued at approximately $500 million. Transferring ownership of these properties is a key part of the government's commitment to self-determination for Aboriginal Victorians. It empowers AHV to plan for, maintain and develop a property portfolio that is financially sustainable and improves stability of housing for Aboriginal Victorians. This stability should improve referrals to support services and ultimately help to improve the health, wellbeing and employment opportunities of residents.

This audit will assess the extent to which the policy intent and transfer of ownership of assets to AHV, and the support provided to AHV post the transfer, has improved housing stability and referrals to relevant support services for Aboriginal Victorians, and contributed to positive outcomes.

Proposed agencies

DHHS, AHV, DPC and DTF.

Revenue management

2021–22

Objective

To determine whether the State Revenue Office is delivering efficient and effective revenue management services.

Issues

The State Revenue Office (SRO) is the Victorian Government's major revenue management agency and is responsible for administering a range of state taxes, duties, grants and levies, collecting more than $18.5 billion in revenue in 2017 – 18. The revenue collected by SRO is used to fund government spending on hospitals, schools, transport and other infrastructure.

Fundamental to the equitable administration of SRO's function is the need to ensure that taxpayers pay the correct amount of tax when it is due, and that those receiving a grant or rebate are entitled to do so.

The current economic environment, including the softening housing market and tighter credit standards, will have a significant impact on the state's revenue and highlights the importance of SRO's role to protect government revenue.

This audit will determine whether SRO is efficiently and effectively managing the state's revenue collection. It will focus on how SRO manages revenue collection, including its debt and compliance strategies, key information systems and recent digitalisation initiatives.

Proposed agencies

SRO and DTF.

Education |

Early years management in Victorian sessional kindergartens

2019–20

Objectives

To determine whether the Department of Education and Training (DET) has supported organisations managing sessional kindergartens to meet the outcomes of the Early Years Management Policy Framework.

Issues

Kindergarten is a one to two-year program to help three and four-year-old students develop social, emotional, cognitive and physical skills. Kindergarten is not compulsory in Victoria, however, in 2018 over 93.4 per cent of children attended a four-year-old program, the year prior to starting school.

Kindergarten programs are provided either as part of a long day care arrangement or as sessional programs—limited only to the kindergarten program hours. Sessional kindergarten can also provide 'wrap-around' care that extends beyond the funded, teacher-delivered kindergarten program.

In 2017, 68 per cent of four-year-old kindergarten students attended a sessional program. These have traditionally been managed by volunteer parents on Committees of Management and local governments. However, Committees of Management have increasingly transferred their responsibilities to independent, not-for-profit early years management (EYM) organisations due to the time commitments and expertise required of the role. In addition to sessional kindergarten programs, EYM organisations may also provide other services such as long day care, occasional care, and playgroups.

DET's role includes regulating early education and care services in Victoria through issuing approvals for providers and their services. DET is also responsible for monitoring and enforcing compliance with their requirements. It also provides funding to EYM organisations, in addition to funding provided for the delivery of kindergarten services. Local governments are responsible for planning for early years services, and many provide infrastructure. Local governments can also take on the role of an EYM organisation.

In 2016, DET released its Early Years Management Policy Framework to provide for a more integrated and sustainable early childhood education and care system. The Early Years Management Policy Framework defines five outcomes. This replaced DET's 2009 Kindergarten Cluster Management Policy Framework.

This audit will assess whether DET supports organisations involved in EYM partnerships to meet the EYM policy framework outcomes.

Proposed agencies

DET, Glen Eira City Council, Early Childhood Management Services Inc, Glen Eira Kindergarten Association, Greater Shepparton City Council, Goulburn Region Pre-School Association Inc, City of Whittlesea, TRY Australia Children's Services and Goodstart Early Learning Ltd.

Management of the Student Resource Package

2019–20

Objective

To determine whether government schools are allocated funding through the Student Resource Package fairly, consistently and transparently to support intended school outcomes.

Issues

In Victoria, government schools must deliver free instruction in the standard curriculum program to all students under the age of 20 years. DET distributes Victorian Government funding to each school through its Student Resource Package (SRP).

The SRP was introduced in 2005 to bring about improvements in learning outcomes for students. Its objectives include to provide a fair, transparent funding model that provides greater funding certainty to schools. Funds are allocated based on factors specific to individual schools including for teaching and learning, school infrastructure and programs, and targeted initiatives.

DET centrally manages approximately 90 per cent of the SRP allocated for staff wages through its eduPay system. DET provides the remaining 10 per cent directly to schools to be transferred to the school's official bank account for use by the school council.

This audit will assess DET's process for allocating the SRP funds and whether schools understand their SRP funding allocations and are using the funds for their intended purpose.

Proposed agencies

DET and a selection of schools.

Systems and support for principal performance

2019–20

Objective

To determine whether DET supports and manages principals' development and performance to optimise student outcomes.

Issues

School principals are pivotal to ensuring that students have positive learning experiences. Each principal is responsible for encouraging and supporting their teachers to deliver high-quality education for all students. Principals strategically manage their school's day-to-day operations, including staff, finances, and assets, and ensure compliance with legislation, government policies and DET requirements. Principals are also members of their school council and provide further support in their role as executive officer.

DET supports the Minister for Education to run government schools. DET employs principals for up to five years and oversees their performance and development. It is critical that DET supports principals to effectively discharge their duties because principals' management practices can influence school learning programs and the learning environment. This audit will assess how DET supports its principals to meet their obligations.

This audit will examine the assistance provided by DET's regional offices, as well as its training, guidance, templates, and tools. It will also assess DET's principal performance reviews, including its strategies for holding principals accountable for their actions and decisions.

Proposed agencies

DET.

ICT provisioning in schools

2020–21

Objective

To determine whether DET and government schools are equipped with the ICT infrastructure and resources necessary for effective ICT-facilitated teaching and learning.

Issues

ICT is an effective tool to support student learning in all curriculum areas. In addition, it is important that students have general ICT capabilities that allow them to use digital tools to enquire, create solutions, and collaborate in response to tasks or new challenges. The integration of ICT in the curriculum and students' ICT capabilities depends on each school's level of access to ICT infrastructure and resources. The provision of core ICT infrastructure is therefore a necessary condition for ICT-enabled learning.

DET shares responsibility with its government schools for ensuring they are appropriately equipped to implement ICT-facilitated teaching and learning. DET provides its government schools with access to core ICT infrastructure and resources, such as networks, email, school administration software, teaching and learning software and technical support. Schools are also responsible for strategic planning and budgeting for ICT products and services needed for the delivery of their teaching and learning programs and school administration. As such, DET provides a range of school policies and guidance to support schools' ICT resource planning and budget forecasting.

This audit will assess whether schools have adequate ICT infrastructure and resources to support teaching and learning, and whether DET monitors and responds to schools' ICT needs.

Proposed agencies

DET and a selection of schools.

Student attendance in Victorian government schools

2020–21

Objectives

To determine whether DET and government schools understand student attendance and effectively use this information to drive improvements.

Issues

Consistent student attendance at school is important for academic performance and success. Absenteeism is often the greatest single cause of poor achievement, which is linked to unemployment, homelessness, poor health outcomes, and poverty. In Victoria, attendance at school is compulsory for all children aged six to 17 years.

All Victorian schools must comply with the minimum standards and other requirements for school registration—including the need to monitor and maintain a register of student attendance. In January 2018, the Minister for Education issued guidelines for all Victorian schools to help them meet their legislated responsibilities to manage student attendance. DET collects and monitors student attendance data for all government schools. It also sets policy requirements for government schools to support student attendance through whole-of-school plans, targeted responses, and effective intervention strategies.

This audit will examine whether the systems and supports that oversee and manage student attendance provide appropriate assurance that schools accurately record, monitor and promote student attendance and follow up on unexplained absences. It will also examine how DET and government schools use this information to address underlying issues and improve student attendance.

Proposed agencies

DET and a selection of schools.

Supporting workers in transitioning industries

2020–21

Objective

To determine whether Victoria's education and training programs are successfully supporting workers in declining industries to transition to new employment.

Issues

Globalisation, automation, disruptive technologies, and increased demand for service and knowledge-oriented industries have collectively shifted Victoria's industrial landscape.

Industries like end-to-end manufacturing―once considered the 'backbone' of Victoria's economy―have declined in size and relevance, and the prevalence of short-term contracts have supplanted the idea of a 'job for life.' To maintain employability in this climate, individuals must continuously upgrade and expand their skillset. As a result, education and training is now considered a 'career constant' as opposed to a practice that is completed prior to entering the workforce.

Revitalising the vocational education and training sector to better support transitioning industries has been a major focus of the Victorian Government since 2014. A suite of initiatives, as well as the establishment of the Victorian Skills Commissioner, have been implemented to support the Victorian Government's objective to ensure that the vocational education and training sector system is well-resourced and able to respond to the changing needs of industry and workers.

In addition to these broader reforms, a range of specific initiatives have been implemented to support workers impacted by industrial changes, such as the establishment of Skills and Job Centres and the Jobs Victoria Employment Network. This audit will assess the effectiveness of DET's and the Victorian Skills Commissioner's activities and specific initiatives to support workers impacted by industrial changes.

Proposed agencies

DET, Department of Jobs, Precincts and Regions (DJPR) and the Victorian Skills Commissioner.

Delivery of the Victorian Certificate of Applied Learning

2021–22

Objective

To determine whether the Victorian Certificate of Applied Learning (VCAL) delivery and oversight is supporting students to meet their further education and/or employment objectives.

Issues

Victorian students in Year 11 and 12 can choose from two certificates to complete their secondary education—the Victorian Certificate of Education and the VCAL. Unlike the Victorian Certificate of Education—which is widely used as a pathway to university—the VCAL offers hands-on or 'applied' learning that aims to give students practical work experience and skills, as well as literacy and numeracy skills. The VCAL is suited to students who are interested in completing further training at a technical and further education institute, an apprenticeship, or securing a job after completing Year 12.

There are three types of VCAL delivery in the government school sector:

- The secondary school delivers VCAL subjects directly to students onsite.

- Community VCAL, where students are enrolled at a host school but external providers—known as Non-School Senior Secondary Providers, which are authorised VCAL providers in their own right—are contracted by the school to deliver the program offsite.

- Satellite VCAL, where a school delivers the program offsite. These programs are not outsourced to external providers.

The Victorian Curriculum and Assessment Authority, DET and the Victorian Registration and Qualifications Authority each play a role in ensuring that VCAL provides accessible and engaging learning pathways leading to further training or employment.

The audit will examine whether the performance of VCAL providers is being monitored and managed effectively.

Proposed agencies

DET, Victorian Registration and Qualifications Authority, Victorian Curriculum and Assessment Authority and a selection of VCAL providers.

Effectiveness of the Navigator program

2021–22

Objective

To determine the extent to which the Navigator program is effectively re-engaging students in education.

Issues

Academic attainment and school completion is strongly correlated with student engagement, which has three key dimensions:

- behavioural engagement—the extent to which students participate in academic, social, and extracurricular activities at school

- emotional engagement—the sense of belonging that students derive from their peers, teachers, and the broader school environment

- cognitive engagement—the extent that students value their education and persist at learning.

According to the 2012 Program for Student Assessment results, Australian students from high socioe-conomic backgrounds have greater average levels of engagement than those from lower socioe-conomic backgrounds. Targeted assistance may break pervasive cycles of disadvantage, as early school leavers generally have fewer employment opportunities and poorer health outcomes.

In July 2016, DET commenced the Navigator pilot program to assist disengaged young people to reconnect with education. The program funds community service organisations to deliver case management and outreach services to young people at risk of disengaging from school.

In 2018–19, the Victorian Government committed $43.8 million over four years to expand the program across the state.

This audit will assess various facets of the program, including its evidence base, funding model, monitoring and governance arrangements, and early outcomes.

Proposed agencies

DET, and a selection of participating schools and community service providers.

Environment and Planning |

Managing native vegetation clearing

2019–20

Objective

To determine whether management of native vegetation clearing is protecting native vegetation.

Issues

Victoria is the most cleared Australian state. Around 46 per cent of original native vegetation coverage has been retained on public land, while on private land 21 per cent remains.

The Victorian Government's native vegetation management programs aim to conserve plant species indigenous to Victoria—including trees, shrubs, herbs and grasses, which provide various ecological services including stable animal habitats, preventing land degradation and maintaining the land's productive capacity.

The removal of native vegetation in Victoria is regulated through the Victorian planning provisions of the Planning and Environment Act 1987. This framework is referred to as the native vegetation regulations and was reformed in December 2017.

Victoria's new biodiversity strategy Protecting Victoria's Environment – Biodiversity 2037, which was released in 2017, sets an objective of ensuring a net gain in habitat extent and condition by 2037.

There has been a decline in the quality and extent of native vegetation due to the removal of vegetation on private land and felling of old growth trees as part of planned burning and vegetation removal that is exempt from normal planning controls, such as for some road and mining activities.

The audit will examine whether responsible agencies are appropriately applying the native vegetation regulations following recent changes, as well as how effectively Victoria is managing the clearing that occurs outside of these regulations.

Proposed agencies

Department of Environment, Land, Water and Planning (DELWP), Parks Victoria, VicRoads, Colac Otway Shire and West Wimmera Shire Council.

Reducing bushfire risks

2019–20

Objective

To assess whether responsible agencies are effectively working together to reduce Victoria's bushfire risk.

Issues

Victoria is one of the most bushfire prone areas in the world. The increasing severity of weather conditions in Australia and across the world may lead to even greater bushfire risk in the future.

While it is not possible to eliminate the threat of bushfires, the Victorian Government plays a key role in reducing the risk of bushfires and their impact on people, property and the environment.

In 2013, the Bushfires Royal Commission Implementation Monitor concluded that the previous planned burning target of five per cent of public land to reduce bushfire risk was not achievable, affordable or sustainable. The Inspector General of Emergency Management agreed and recommended that the government replace the hectare-based target with a risk reduction target that measures the impact of fuel management activities on the overall risk of bushfires.

Fuel management is the main method of managing bushfire risk, as reducing the leaves, bark, twigs and shrubs that fuel bushfires can reduce their intensity and make them easier for firefighters to control. Fuel management includes planned burning, that is, lighting and managing fires in the landscape at times of the year when bushfire risk is lower. Other fuel management treatments include mowing, mulching and applying herbicides.

In 2015, the Victorian government accepted the Inspector General of Emergency Management's recommendation. From 1 July 2016, a statewide target to maintain bushfire risk at or below 70 per cent of Victoria's maximum bushfire risk was implemented. DELWP's 2017–18 Fuel Management Report estimates the state's bushfire risk at 66 per cent.

This audit will examine whether responsible agencies are effectively and efficiently reducing the state's bushfire risks.

Proposed agencies

DELWP, Parks Victoria, Country Fire Authority, Department of Justice and Community Safety (DJCS) (Emergency Management Victoria), Energy Safe Victoria, Murrindindi Shire Council, City of Whittlesea and East Gippsland Shire Council.

Supporting communities through development and infrastructure contributions

2019–20

Objectives

To determine whether development and infrastructure contributions provide required infrastructure to new and growing communities as intended.

Issues

Between 2015 and 2031, the population of Victoria is projected to grow by 1.8 million to reach 7.7 million. Accommodating population growth requires significant planning and development, and the creation of essential infrastructure to support the health, wellbeing, and social and economic participation of growing communities.

The Victorian Government and councils currently operate multiple developer contribution schemes that help to fund essential works and services such as roads, parks, local sports grounds and community facilities. The Infrastructure Contributions Plans system, introduced in 2016, applies to greenfield growth areas and strategic developments within existing urban areas. The Growth Areas Infrastructure Contribution scheme operates in newly developing areas. Councils can also require a contribution through section 173 of the Planning and Environment Act 1987.

This audit will examine whether the development and infrastructure contribution schemes effectively support the creation of essential infrastructure for new and growing communities.

Proposed agencies

DELWP, Department of Jobs, Precincts and Regions (DJPR), Victorian Planning Authority, State Revenue Office, Melton City Council, Cardinia Shire Council, Golden Plains Shire and Whitehorse City Council.

Conserving threatened species

2020–21

Objective

To determine whether threatened species are being conserved.

Issues

Victoria's native plants and animals contribute major economic benefits to the state as well as holding intrinsically high environmental value.

The historic clearing of native vegetation in much of Victoria has resulted in the widespread loss of habitat and the decline of many species. Victoria is the most cleared state in Australia, with nearly two-thirds of the state's landscape now modified for agriculture and urban development. This loss of habitat, combined with ongoing pressures such as further clearing, habitat fragmentation, changed river flows, inappropriate land use, and invasive species and diseases, has put enormous stress on our native species.

Victoria's most recent State of the Environment report in 2013 identified that only 11 of 294 threatened species showed signs of recovery. There are many signs that the state's threatened species continue to decline and some formerly common species are also threatened.

The Flora and Fauna Guarantee Act 1988 is the primary piece of Victorian legislation for conserving threatened species and ecological communities and managing the processes that threaten the state's native flora and fauna.

Our 2009 audit Administration of the Flora and Fauna Guarantee Act 1988 identified that the main threatened species management tools were either not working or were not being used. A review of the Act is currently being finalised. This audit will examine whether DELWP is appropriately managing and applying the available laws and tools cost effectively to prevent further declines in threatened species.

Proposed agencies

DELWP and Parks Victoria.

Implementing Plan Melbourne 2017–50

2020–21

Objective

To determine whether actions to implement Plan Melbourne 2017–50 are sustained and coordinated at a statewide, regional and local level.

Issues

Melbourne is the fastest growing city in Australia. The city's population is projected to grow from 4.6 million to almost 8 million—with Victoria's total population set to top 10 million—by 2051. Population growth, increased congestion, a changing climate, and increased globalisation are already testing the resilience of Melbourne's built and natural environment.

Plan Melbourne 2017–50 is the government's overarching policy for responding to this challenge. The plan is accompanied by a separate Five-Year Implementation Plan. The implementation plan outlines the necessary actions to realise Plan Melbourne 2017–50's outcomes and allocates these actions to government departments and agencies. DELWP oversees the implementation plan.

Implementing Plan Melbourne 2017–50 requires coordinated action at all levels of government, the private sector, and the community. This audit will examine whether a sound and integrated governance framework underpins the implementation of this major statewide plan.

Proposed agencies

DELWP, DJPR and a selection of local councils.

Meeting Victoria's renewable energy targets

2020–21

Objectives

To determine whether the Victorian Renewable Energy Auction Scheme provides value for money for the state and will help support Victoria to meet its renewable energy targets.

Issues

The Renewable Energy (Jobs and Investment) Act 2017 legislates the Victorian Renewable Energy Targets, which require that 25 per cent of electricity generated in Victoria will come from renewable energy sources by 2020 and 40 per cent by 2025. The Victorian Government has also committed to establishing a new target of 50 per cent by 2030.

The Victorian Government established the Victorian Renewable Energy Auction Scheme to support achievement of the Victorian Renewable Energy Targets. The first auction was finalised in February 2018. The total capacity of the six successful projects aims to generate 928 MW of power, producing enough electricity for 646 273 households and a 16 per cent reduction in Victoria's electricity sector greenhouse gas emissions by 2034–35.

There remains a risk that the projects chosen through the reverse auction will not provide the best or most cost-effective option to reach the state's energy targets. Concerns relate to how the 'strike' price was set by government, specifically:

- the potential cost to the government/taxpayers over the 15-year life span of the contracts

- the cost to the state if contracts are cancelled early

- a potential failure to take into account the extra expenses associated with investment in transmission and distribution needed to connect these renewable projects to the grid.

This audit will assess Victorian Renewable Energy Auction Scheme's contribution to achieving Victoria's renewable energy targets and whether the projects chosen represent value for money.

Proposed agencies

DELWP.

Water authorities' contributions to reducing greenhouse gas emissions

2020–21

Objectives

To determine whether water authorities are on track to achieve their emissions reduction targets.

Issues

The Victorian water sector produces 24 per cent—the largest proportion—of state government carbon emissions. In 2016, Water for Victoria committed to achieving net-zero emissions in the water sector by 2050, consistent with the broader state government target of net zero emissions by 2050. Water for Victoria also commits water corporations to an interim emissions reduction target to be achieved by 2025.

In 2018, the Minister for Water issued a Statement of Obligations (Emissions Reduction), which set the collective emissions reduction target at 42 per cent by 1 July 2025. The Statement also sets an individual emissions target for each water authority, and requires them to:

- achieve emissions reduction efficiently, making full use of the time available to do so

- pursue actions and targets at the lowest possible cost, seeking to minimise impact on water consumer bills

- have regard to price impacts on their vulnerable customers.

Water authorities must report their progress to the minister against the target and report any non-compliance with the requirements within 30 days including a plan to rectify any issues.

Despite this requirement, there is a risk that efforts by water authorities to meet their targets may result in an increased cost on water consumer bills. Water is an essential service and any increase in cost may have an impact on vulnerable customers. In addition, the ability of water authorities to meet their collective target may be impacted if several authorities do not meet their individual targets.

This audit will provide an assessment of the progress water authorities are making toward achieving their emissions reduction targets.

Proposed agencies

DELWP and a selection of water authorities.

Domestic building regulation and dispute resolution

2021–22

Objective

To determine whether the Victorian Building Authority and Domestic Building Dispute Resolution Victoria provide effective protection to domestic building consumers.

Issues

The Victorian Building Authority oversees the regulation of Victoria's building and plumbing industries and is responsible for registering and disciplining building practitioners and undertaking inspections. Domestic Building Dispute Resolution Victoria was established in April 2017 as an independent government agency that provides free services to help resolve domestic residential building disputes. The service aims to resolve building disputes before they reach the Victorian Civil and Administrative Tribunal.

Given that a home construction or renovation is often the single largest investment an individual makes in their lifetime, it is vital that consumers are protected by a well-functioning regulatory and dispute resolution framework. Our 2015 audit Victoria's Consumer Protection Framework for Building Construction found that the existing consumer protection framework did not provide consumers with adequate protection.

This audit returns to the themes of our 2015 audit to assess whether changes made to the domestic building regulation system have been effective in protecting consumers.

Proposed agencies

Victorian Building Authority, Domestic Building Dispute Resolution Victoria, and DJCS (Consumer Affairs Victoria).

Electronic waste ban

2021–22

Objectives

To determine whether responsible agencies are maximising the recovery and reprocessing of electronic waste.

Issues

Electronic waste, or 'e-waste', refers to any device or piece of equipment that requires an electric current to operate. It includes, but is not limited to, televisions, computers, mobiles and toys with electronic components.

Despite e-waste only making up 1 per cent of waste to landfill, it is one of the fastest growing waste materials. In Victoria, DELWP estimates that e-waste will increase from 109 000 tonnes in 2015 to approximately 256 000 tonnes in 2035.

In December 2014, the Victorian Government committed to banning e-waste from landfill. DELWP estimates that over 20 years, the costs of meeting the additional regulatory requirements for e-waste are approximately $215 million. Councils are also concerned about the readiness of both the community and waste sector to effectively implement the e-waste ban.

This audit will review the Victorian Government's implementation of the e-waste ban, including whether intended benefits are being achieved and whether operational and financial issues raised during its planning are being addressed.

Proposed agencies

DELWP, Sustainability Victoria, Environment Protection Authority Victoria, Goulburn Valley Regional Waste and Resource Recovery Group and a selection of local councils.

Supply and use of alternative urban water sources

2021–22

Objectives

To assess whether responsible agencies are increasing the use of alternative water sources to meet future demand.

Issues

Liveability and economic security depend on a safe, reliable supply of water. According to government projections, the demand for water in Melbourne and the surrounding peri-urban regions could almost double over the next 50 years due to population growth. However, annual water flows from major catchments could decrease by more than 40 per cent due to climate change. Also, urban encroachment and degraded surface and groundwater sources are putting pressure on the peri-urban irrigation districts.

Using alternative water sources can improve water supply and offset the demand for potable water. There are many examples of alternative water usage across Melbourne, including private household rainwater tanks and the use of recycled water for non-potable uses in growth areas for homes and irrigation of crops. The use of alternative water sources also provides environmental benefits by reducing the amount of stormwater and treated wastewater discharged to our waterways and bays.

To optimise the use of alternative water sources, government agencies need to address potential barriers such as cost effectiveness compared to other water sources, poor demand forecasting, varying risk appetites and mixed community attitudes to water recycling.

This audit will examine whether alternative water sources are being best utilised to meet Melbourne's water needs now and in the future.

Proposed agencies

DELWP, Environmental Protection Authority Victoria, and a selection of water authorities and local councils.

Health and Human Services |

Clinical governance

2019–20

Objectives

To determine whether clinical governance has improved across the public health system through implementation of the accepted recommendations of Targeting Zero: Supporting the Victorian hospital system to eliminate avoidable harm and strengthen quality of care.

Issues

In 2016, the Minister for Health commissioned a wide-ranging review of clinical governance in response to the avoidable deaths of seven infants at Bacchus Marsh Hospital, part of Djerriwarrh Health Services. The review, Targeting Zero: Supporting the Victorian hospital system to eliminate avoidable harm and strengthen quality of care identified systemic clinical governance issues, which increase the risk of harm occurring in hospitals across the system. The review made 178 recommendations focused on improved data collection and analysis, better engaging clinical expertise and enhancing safety in the system.

The Department of Health and Human Services (DHHS) accepted all recommendations and incorporated them into a response plan, Better, Safer Care: Delivering a world-leading healthcare system. These recommendations require that DHHS significantly improve its collection and analysis of data, and how it enacts its role in ensuring strong clinical governance in the public hospital system. The changes are underpinned by new structures and two specialist agencies within DHHS—the Victorian Agency for Health Information and Safer Care Victoria.

This audit will examine whether DHHS, its specialist agencies and a selection of health services have implemented accepted recommendations and the impact of these activities on clinical governance across the sector.

Proposed agencies

DHHS (including Safer Care Victoria and Victorian Agency for Health Information), Melbourne Health, Ballarat Health Services, Peninsula Health and Djerriwarrh Health Services.

Efficiency and economy of Victoria's public hospitals

2019–20

Objectives

To determine the relative efficiency and economy of Victorian metropolitan acute public hospitals.

Issues

Population changes, changes in patient complexity, and new technology are increasing costs and influencing the efficient and economical delivery of health care. Since the early 1990s, worldwide healthcare spending per capita has risen by over 70 per cent in real terms. These challenges place increasing pressure on acute health services, which must meet demand growing in both size and complexity, while also maintaining quality care provision.

The Victorian public health system, due to its devolved governance model, has limited access to cross-agency, benchmarked data to show and explore variation in service costs, efficiency and outcomes.

This audit aims to address the data gap and assist public health services to understand and respond to demand pressures by examining and analysing cost and demand drivers across acute metropolitan health services.

Proposed agencies

DHHS, Melbourne Health, Alfred Health, Austin Health, Barwon Health, Eastern Health, Western Health, Northern Health, St Vincent's Health and Peninsula Health.

Managing Support and Safety Hubs

2019–20

Objectives

To determine whether DHHS's Support and Safety Hubs are providing effective and efficient service coordination for women and families.

Issues

Family violence has been a major issue in Victoria. The Royal Commission into Family Violence and the government's Roadmap to Reform recommended that Victoria introduce Support and Safety Hubs in a bid to prevent and respond to family violence in Victoria, and help women and children experiencing family violence. In response to the commission's recommendation, DHHS established Support and Safety Hubs. The aim of the hubs is to connect people directly to services and provide a coordinated response to a range of different needs identified through risk and needs assessments. This includes a role in providing an entry point to services for perpetrators.

Victoria is making a significant investment in these hubs, with $448 million committed over four years from 2017–18 to establish 17 Support and Safety Hubs statewide by 2021. It will be important that the hubs achieve intended outcomes.

This audit will examine how Support and Safety Hubs are operating and whether they have been effective in addressing family violence issues in Victoria.

Proposed agencies

DHHS (including Family Safety Victoria).

Victoria's homelessness response

2019–20

Objective

To determine whether DHHS has reduced the incidence and impacts of rough sleeping through implementation of Victoria's Homelessness and Rough Sleeping Action Plan.

Issues

Homelessness results in significant social and economic costs, not just to individuals and families but also communities and the nation. For individuals, homelessness makes it difficult to maintain school or further study and leaves people vulnerable to long-term unemployment and chronic ill health.

The Australian Bureau of Statistics estimates that more than 20 000 Victorians are homeless. Further, DHHS notes that there are approximately 1 100 people sleeping rough in Victoria each night.

In January 2018, the government launched Victoria's Homelessness and Rough Sleeping Action Plan. The plan is the first phase in the development of a long-term homelessness strategy. Victoria has several plans to address homelessness, including elements of the response to the Royal Commission into Family Violence.

This audit will examine DHHS's implementation of the Homelessness and Rough Sleeping Action Plan and the extent to which it is achieving intended outcomes.

Proposed agencies

DHHS, Launch Housing, Haven, Home Safe and Neami National.

Follow up of Access to public dental services in Victoria

2019–20

Objective

To assess whether DHHS and Dental Health Services Victoria have effectively implemented the recommendations made in our Access to public dental services in Victoria audit (2016–17) and addressed the underlying issues that led to the recommendations being made.

Issues

We ask agencies each year to attest to their progress in responding to and monitoring recommendations from previous performance audits. Using these attestations and other sources of intelligence, we then select past performance audits to follow up. The follow-up performance audits are limited to the review of the recommendations made by the Auditor-General to the selected agencies, including whether and how effectively:

- agencies have responded to the performance audit recommendations

- the actions taken have addressed the root issues that led to the recommendations.

Proposed agencies

DHHS and Dental Health Services Victoria.

Clinical trials in public hospitals

2020–21

Objectives

To determine whether the governance of clinical trials in Victorian public hospitals ensures patient safety.

Issues

Clinical trials in medicine help to determine the safety and effectiveness of medications, devices, diagnostic products, biologicals and treatment regimens intended for human use. The Therapeutic Goods Administration is a division of the Commonwealth Department of Health, which is responsible for regulating medications, devices and biologicals. The Therapeutic Goods Administration conducts a pre-market assessment before goods are available for sale and use. To show the efficacy of the goods, this pre-market assessment relies on clinical trials often conducted within public hospitals.

Public hospitals are responsible for ensuring their staff adhere to the significant range of governance and regulatory requirements while undertaking clinical trials. In addition, the pharmaceutical industry makes a significant investment in research, which means that public entities should have rigorous processes in place to avoid conflicts of interest.

This audit will examine whether audited agencies have, and implement, a robust governance framework for ensuring clinical trials align with governance and regulatory requirements.

Proposed agencies

DHHS and a selection of public health services.

Health and wellbeing of the medical workforce

2020–21

Objectives

To determine whether health services, DHHS and WorkSafe Victoria have effective systems to ensure that the medical workforce maintains good health and wellbeing.

Issues

Medical practitioners need to be healthy to deliver high-quality health care to their patients and the community, and to find reward and satisfaction in healthcare. Under occupational health and safety legislation, health services are obliged to eliminate or minimise the risks to the health and safety of their employees. For the medical workforce, risks include bullying and harassment, occupational violence, fatigue, and mental health stressors such as long and unpredictable working hours, repeated exposure to trauma, violence and death, difficult interpersonal interactions and high professional expectations. These workplace risks can be eliminated or minimised with a range of controls, such as positive cultural initiatives, policies, training and education.

Studies such as Beyond Blue's 2014 report Creating a mentally healthy workplace: Return on investment analysis indicate that a mentally healthy workplace, on average, may deliver benefits worth more than double the original investment.

This audit will examine the effectiveness of DHHS, WorkSafe Victoria and health service initiatives on improving the health and wellbeing of the medical workforce.

Proposed agencies

DHHS, WorkSafe Victoria and a selection of public health services.

Supporting sexual and reproductive health

2020–21

Objective

To determine whether Victorian women have sufficient access to sexual and reproductive health information and services to support their health and wellbeing.

Issues

Sexual and reproductive health issues affect the wellbeing of Victorian women. These issues include endometriosis, polycystic ovarian syndrome, and the symptoms of menopause.

To better support the health of Victorian women, the government has launched the Women's sexual and reproductive health key priorities 2017–2020. The priorities include improving citizens' knowledge and capacity to manage fertility, providing services in respectful and culturally safe ways, improving access to reproductive choices, and services for women with endometriosis, polycystic ovary syndrome or those who are undergoing menopause.

This audit will examine whether, through the implementation of the key priorities, women's access to sexual and reproductive health information and services is improving in line with intended outcomes.

Proposed agencies

DHHS, Royal Women's Hospital, Monash Health, Goulburn Valley Health and Ballarat Health Services.

Aboriginal health outcomes

2021–22

Objectives

To assess whether the DHHS is making progress in improving health outcomes for Aboriginal Victorians.

Issues

There is a significant gap between the health status of Victoria's Aboriginal population and the non-Aboriginal population. The Victorian Government has several initiatives designed to give better access for Aboriginal people to healthcare services to improve their health and life expectancy, and to reduce child mortality.

Koolin Balit: Victorian Government strategic directions for Aboriginal health 2012–2022 is the Victorian Government's and Aboriginal community's strategic direction for Aboriginal health over the 10 years to 2022. It sets out what DHHS, together with Aboriginal communities, other parts of government and service providers, will do to achieve the government's commitment to improve Aboriginal health.

Korin Korin Balit-Djak: Aboriginal health, wellbeing and safety strategic plan 2017–2027 details how DHHS will work with Aboriginal communities, community organisations, other government departments and mainstream service providers to improve the health, wellbeing and safety of Aboriginal people in Victoria.

This audit will examine the progress and outcomes of these two key Aboriginal health initiatives in improving the overall health status of Victoria's Aboriginal population.

Proposed agencies

DHHS and a selection of Aboriginal health service providers.

Effectiveness of the Enhanced Maternal and Child Health Program

2021–22

Objective

To determine whether the Enhanced Maternal and Child Health (EMCH) Program leads to improved access, participation, and outcomes for vulnerable children and their families targeted by the program.

Issues

DHHS administers the Maternal and Child Health service to all Victorian families with children from birth to school age. It recognises that adverse prenatal or early childhood experiences, such as neglect, abuse, family violence and sustained poverty, may negatively impact a person's health, wellbeing, learning, and development. The Maternal and Child Health service offers holistic, multidisciplinary care that targets infants, children, and the parent-child relationship. It includes the EMCH program, which supplements the universal care provided to all parents and their children across Victoria. The EMCH program offers an additional 20 hours of care to families at greater risk of poor outcomes (with a further 2.67 hours available to rural and remote families), as well as case coordination services.

Prior to 1 January 2019, Department of Education and Training (DET) oversaw the EMCH program. The EMCH transferred to DHHS following changes made after the November 2018 state election. DHHS now leads, funds, monitors, and evaluates the EMCH program, while local government coordinates and contracts service delivery.

In 2017–18, the Victorian Government committed $37.7 million to progressively expand the EMCH program. As part of this, DET raised the maximum age threshold from 12 months to three years and increased the average hours of care delivered to each family from 15 to 20.

This audit will assess the EMCH program's methodology, delivery and outcomes.

Proposed agencies

DHHS, DET, Municipal Association of Victoria, and a selection of local councils.