Annual Report 2016–17

Overview

The Annual Report 2016–17 presents a summary of the performance of the Victorian Auditor-General’s Office from 1 July 2016 to 30 June 2017. It is prepared in accordance with the Audit Act 1994, the Financial Management Act 1994, Australian Accounting Standards, and the Financial Reporting Directions and Standing Directions of the Minister for Finance.

The Annual Report 2016–17 contains our report of operations and financial statements, including the opinion of the independent external auditor appointed by the Public Accounts and Estimates Committee. It also reports on:

- our output performance measures as set out in the State Budget Papers

- the achievement of our objectives as set out in our Strategic Plan 2016–17

- the implementation of audits proposed as part of our Annual Plan 2016–17

- the impact and value of our work across the public sector

- our activities to support staff development and wellbeing.

In this year’s report, we have applied some integrated reporting principles including materiality and value creation to better report on how we add value to the services we deliver to the Victorian Parliament and the community.

Message

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

I am pleased to transmit, in accordance with section 7B of the Audit Act 1994, the annual report of the Victorian Auditor-General’s Office for the year ended 30 June 2017 for presentation to Parliament.

Yours faithfully

Andrew Greaves

Auditor-General

6 September 2017

Accountable officer’s declaration

In accordance with the Financial Management Act 1994, I am pleased to present the Report of Operations for the Victorian Auditor-General’s Office for the year ended 30 June 2017.

Andrew Greaves

Auditor-General

6 September 2017

Acronyms

| ASP | Audit service provider |

| BAU | Business as usual |

| FTE | Full-time equivalent |

| HR | Human resources |

| ICT | Information and communications technology |

| PAEC | Public Accounts and Estimates Committee |

| VAGO | Victorian Auditor-General’s Office |

| VWA | Victorian WorkCover Authority |

| WHS | Workplace health and safety |

Foreword

I am pleased to present my annual report for 2016–17.

This year has been transformative. We have undertaken a substantial program of renewal as we continue to deal with the legacy of 2015 and the impact that period had on our people, our reputation and standing, and our influence as a key financial integrity body.

I am pleased to report that we have made significant strides in a short, and at times hectic, period of change—and we now have a strong foundation from which to renew our commitment to serve the Victorian Parliament and to help the public sector improve its service delivery.

At the end of my first year, we have in place the necessary infrastructure and tools to support our people to operate at their best. We have moved to a new functional office space that enables better collaboration and communication. We have invested heavily in technologies to support our staff to work flexibly and allow our auditors to be where they need to be—talking to and serving our clients. I have streamlined the leadership in the organisation and focused our staffing in the areas where we need them most, such as emerging disciplines like data analytics.

This has come at a significant, one-off financial cost, as our operating result for this year shows—but this upfront investment will limit the growth of our future operating costs and keep us on a sustainable financial footing.

It was a testament to our past executives and staff that the triennial performance audit of VAGO, tabled earlier this year, found us to be economic, efficient and effective, and compliant with our legislation. We can always improve and are acting on the recommendations of that review, as we seek to become a model organisation and, in doing so, lead by example.

In the coming year we look forward to the prospect of new, modern audit legislation and to realising the benefits of the changes we’ve already made.

Andrew Greaves

Auditor-General

6 September 2017

About this report

This report covers the activities of the Victorian Auditor-General’s Office (VAGO) for the reporting period 1 July 2016 to 30 June 2017.

It is prepared under the Financial Management Act 1994 and incorporates the requirements of applicable Australian Accounting Standards, Financial Reporting Directions and Standing Directions for the period ending 30 June 2017. A disclosure index in Appendix I identifies VAGO’s compliance with statutory disclosure requirements.

This year, for the first time, we have applied some integrated reporting principles including materiality and value creation, which has changed some of the content. We believe this better informs our readers about how we add value to the services we deliver to the Victorian Parliament and the community.

1 Highlights of our year

We surveyed Parliamentarians’ overall satisfaction with our office and services, and the results remain strong, with a survey score of 93 out of 100. |

We surveyed nominated agency contacts for every performance audit we conducted. The results were highly positive, with a significant majority of survey participants agreeing that:

|

|

Our new activity-based office:

|

We complemented the physical changes to our environment with enhancements to our information systems, beginning with a move to Office 365, SharePoint and new telephony arrangements as part of a unified communications package. We complemented the physical changes to our environment with enhancements to our information systems, beginning with a move to Office 365, SharePoint and new telephony arrangements as part of a unified communications package. |

|

We adopted a three-year planning cycle for proposed performance audits. This forecast horizon provides us with greater opportunities to engage earlier with our stakeholders. It also enables audited agencies to prepare for scheduled audits well in advance. |

We began an audit methodology modernisation project to identify opportunities for streamlining our audit practices. Our aim is to ensure that the focus of our audit effort accurately reflects the risks associated with the areas under audit. |

|

We completely overhauled our Parliamentary performance measures, and replaced all outdated metrics with measures that better capture how efficiently and effectively we use our resources. |

We commenced a project to update, refresh and simplify all our key client communication documents, including our audit strategy (plan), audit committee briefing, closing reports, management representation letters, management letter and independent auditor’s report templates, all whilst ensuring ongoing compliance with the requirements of relevant auditing standards. |

|

We conducted a major upgrade and reconfiguration of our records management system and rolled out a new business classification scheme that more closely aligns with our service architecture. We also introduced electronic workflows, to reflect our move towards a paperless working environment. |

2 Our office

2.1 Our purpose

The Auditor-General is an independent officer of the Victorian Parliament, appointed to scrutinise the way the government spends money on behalf of Victorians. Through our reports to Parliament we help hold the government to account.

We do this through our statutory financial and performance audits of public sector agencies and local governments. We audit over 500 agencies, including government departments, statutory bodies, educational institutions, public hospitals, water corporations, insurers, councils, agencies controlled by the state or a public body, and particular bodies that provide government services under contract.

We are the longest-established agency in the modern integrity system, and together with the Independent Broad-based Anti-corruption Commission and the Victorian Ombudsman we safeguard the public interest.

The principal pieces of legislation that govern our work are:

- the Constitution Act 1975, which establishes the role of the Auditor-General and gives him complete discretion in the performance and exercise of his functions and powers

- the Audit Act 1994, which establishes the Auditor-General's mandate, provides the legal basis for his powers, and identifies his responsibilities.

Our independence and unique position gives us access to information across the entire public sector. This allows us to develop specific insights that add value to our audited clients, and provide recommendations that enable them to perform their functions more efficiently and effectively.

2.2 Our business model

Our business model underpins how we create value for Parliament and the Victorian community, and reflects the relationship between our key inputs, outputs and outcomes.

Key inputs to our services include:

- funding received—public sector agencies pay for our financial audit services and Parliament funds the other services we provide

- our people—we employ audit professionals and support staff, we contract work to professional audit firms, and we engage subject matter experts when needed

- our work approach—we use world-class audit methodologies aligned with professional audit and assurance standards, and use modern technology that supports workplace collaboration

- our unique role—our independence and ability to access enables us to draw comparisons and develop meaningful insights across the entire public sector.

Key outputs from our services include:

- Parliamentary reports of performance audits

- Parliamentary reports of financial audits

- audit opinions on the financial statements and performance statements of public sector agencies.

Key outcomes we contribute to include:

- improvements in the economy, efficiency, and effectiveness of public services—through the conduct of our performance audits

- maintaining confidence in the financial accountability, transparency and reporting of public sector agencies—through the conduct of our financial audits.

2.3 Our 2016–17 work program

Performance audits

Our performance audit program provides assurance to Parliament and the Victorian community on the effectiveness, efficiency and economy of public sector agencies' operations and activities, and the extent of their compliance with relevant legislation. We tabled 24 of the 29 performance audit reports listed in our Annual Plan 2016–17.

Five performance audits that we originally planned to deliver in 2016–17 were either:

- deferred to a later year—Diverting young people from the criminal justice system, Hospital patient data security

- delayed as a result of operational issues—Effectively planning for growth, Internal audit programs

- discontinued after further analysis—Effectively managing freight growth.

Figure 2A lists the performance audit reports we tabled during the year.

Figure 2A

Performance audit reports tabled during 2016–17

|

Month |

Report |

|---|---|

|

August 2016 |

Enhancing Food and Fibre Productivity Audit Committee Governance |

|

September 2016 |

Meeting Obligations to Protect Ramsar Wetlands |

|

October 2016 |

High Value High Risk 2016–17: Delivering HVHR Projects Efficiency and Effectiveness of Hospital Services: Emergency Care |

|

November 2016 |

Security of Critical Infrastructure Control Systems for Trains |

|

December 2016 |

Access to Public Dental Services in Victoria Managing the Performance of Rail Franchisees |

|

February 2017 |

Managing Community Correction Orders Regulating Gambling and Liquor |

|

March 2017 |

Managing Public Sector Records Effectiveness of the Environmental Effects Statement Process Managing Victoria's Planning System for Land Use and Development |

|

May 2017 |

Public Participation in Government Decision-Making Public Participation and Community Engagement: Local Government Sector Board Performance Managing School Infrastructure ICT Strategic Planning in the Health Sector |

|

June 2017 |

Effectiveness of the Victorian Public Sector Commission Managing Victoria's Public Housing Follow Up of Selected 2014–15 Performance Audits:

Maintaining State-Controlled Roadways |

Financial audits

Our financial audit program delivers assurance services for a range of public sector agencies, including:

- reports to Parliament on the results of financial audits for particular sectors, including on their internal financial controls

- audit opinions on the financial and performance statements of public sector agencies

- a report and an opinion on the Annual Financial Report of the State of Victoria

- a review report on the estimated financial statements of the State of Victoria.

We tabled all eight financial audit reports in our Annual Plan 2016–17, as listed in Figure 2B.

Figure 2B

Financial audit reports tabled during 2016–17

|

Month |

Report |

|---|---|

|

November 2016 |

Financial Systems Controls Report: 2015–16 Auditor-General's Report on the Annual Financial Report of the State of Victoria, 2015–16 Water Entities: 2015–16 Audit Snapshot Portfolio Departments and Associated Entities: 2015–16 Audit Snapshot Local Government: 2015–16 Audit Snapshot Public Hospitals: 2015–16 Audit Snapshot |

|

June 2017 |

Technical and Further Education Institutes: 2016 Audit Snapshot Universities: 2016 Audit Snapshot |

3 Our performance and our impact

3.1 Output performance

The products and services we deliver relate mainly to two Parliamentary output groups—Output Group 1 (OG1) Parliamentary reports and services, and Output Group 2 (OG2) Audit reports on financial statements. Figures 3A and 3B show how we performed meeting our OG1 and OG2 targets in 2016–17.

Figure 3A

Performance against OG1 Parliamentary reports and services targets

|

Performance measures |

Unit of measure |

Target |

Actual |

Performance variation (%) |

Result |

|---|---|---|---|---|---|

|

Quantity |

|||||

|

Auditor-General's reports |

(number) |

36 |

34 |

–5.6 |

□ |

|

Quality |

|||||

|

Average score of audit reports by external/peer assessors |

(per cent) |

80 |

82 |

2.5 |

✔ |

|

Overall level of external satisfaction with audit reports and services—Parliamentarians |

(per cent) |

85 |

93 |

9.4 |

✔ |

|

Timeliness |

|||||

|

Inquiries from Members of Parliament and the public responded to within 28 days |

(per cent) |

95 |

98 |

3.2 |

✔ |

|

Reports completed on time |

(per cent) |

90 |

78 |

–13.3 |

□ |

|

Cost |

|||||

|

Total output cost |

($ million) |

16.9 |

16.8 |

0.6 |

✔ |

Key ✔ Target achieved or exceeded. ○ Target not achieved—within 5 per cent variation. □ Target not achieved—exceeds 5 per vent variation.

Figure 3B

Performance against OG2 Audit reports on financial statements targets

|

Performance measures |

Unit of measure |

Target |

Actual |

Performance variation (%) |

Result |

|---|---|---|---|---|---|

|

Quantity |

|||||

|

Audit opinions issued on the financial statements of agencies |

(number) |

547 |

531 |

–2.9 |

○ |

|

Audit opinions issued on non‑financial performance indicators |

(number) |

110 |

109 |

–0.9 |

○ |

|

Quality |

|||||

|

External/peer reviews finding no material departures from professional and regulatory standards |

(per cent) |

100 |

75 |

–25.0 |

□ |

|

Timeliness |

|||||

|

Audit opinions issued within statutory deadlines |

(per cent) |

98 |

99 |

1.0 |

✔ |

|

Management letters issued to agencies within established time frames |

(per cent) |

90 |

88 |

–2.2 |

○ |

|

Cost |

|||||

|

Total output cost |

($ million) |

25.7 |

29.7 |

–15.6 |

□ |

Key ✔ Target achieved or exceeded. ○ Target not achieved—within 5 per cent variation. □ Target not achieved—exceeds 5 per vent variation.

OG1

|

Quantity |

Quality |

|

|---|---|---|

|

We tabled 34 reports in 2016–17, consisting of 24 performance audit reports, eight financial audit reports, and two accountability products (our Annual Plan and Annual Report). We fell short of our target of 36, as five performance audits originally scheduled for completion in 2016–17 were either delayed, deferred, or discontinued (see additional details in Section 2.3). |

Average score of audit reports We engage a contractor each year to independently assess a sample of our reports against criteria set by the Australasian Council of Auditors-General. In 2016–17, the four performance audit reports that were sampled for assessment received an average score of 82 per cent, which exceeded our target of 80 per cent. Overall level of satisfaction We survey Parliamentarians every year to find out how satisfied they are with our reports and services. In 2016–17, 38 per cent of Parliamentarians responded to our survey (48 out of 128). Of those responding, 93 per cent indicated that overall they were satisfied or very satisfied with our reports and services, which exceeded our target of 85 per cent. |

|

|

Timeliness |

Cost |

|

|

Responses to enquiries We receive a variety of enquiries each year, in the form of letters, email messages, telephone calls and online correspondence from various groups, including the general public. In 2016–17, we responded to 98 per cent of the enquiries we received within 28 days, which exceeded our target of 95 per cent. Reports completed on time We aim to table our Parliamentary reports within one month of our original planned tabling date. This year, we tabled eight reports late (out of our target of 36) due to the additional rigour we incorporated into our audit processes, including further analysis for particular performance audits, and increased consultation with a greater number of stakeholders. |

Our revised budget for the delivery of OG1 Parliamentary reports and services in 2016–17 was $16.9 million. Our actual cost of $16.8 million was the result of marginally fewer employees contributing to this output than originally anticipated. |

OG2

|

Quantity |

Quality |

|

|---|---|---|

|

In 2016–17, we issued 531 audit opinions on the financial statements of agencies, and 109 audit opinions on non-financial performance indicators. We consider these results satisfactory as they fall within the general acceptable variation range (5 per cent of target), and are affected by factors beyond our control—such as machinery-of-government changes, which in turn affect the number of agency financial statements and performance statements we receive each year. |

We conduct post-audit quality reviews on a sample of our financial audit engagements each year. Our result of 75 per cent for this measure is lower than our target. The result finalises our 2015-16 program. Because of this adverse result, instead of commencing a new program of post-audit quality reviews in 2016–17, we focused our quality control resources on reviewing 'live' audits and working with teams to make sure that the quality issues identified in 2015–16 were rectified. We will recommence our post-audit quality program in 2017–18. |

|

|

Timeliness |

Cost |

|

|

Audit opinions issued within statutory deadlines We issued 99 per cent of our audit opinions in 2016–17 within the statutory deadline of four weeks of receipt of agency financial statements. This exceeds our target of 98 per cent, and continues our record of achieving excellence in this area. Management letters issued to agencies within established time frames We issued 88 per cent of our final management letters in 2016–17 within established time frames, just short of meeting our target of 90 per cent. We consider these results satisfactory as they fall within the acceptable variation range (5 per cent of target), and were due to delays in clients preparing financial reports, and some contentious and complex matters arising during the financial reporting cycle. |

Our revised budget for the delivery of OG2 Audit reports on financial statements in 2016–17 was $25.7 million. Our actual cost of $29.7 million was due to higher than forecasted consultancy costs, and more of our employees contributing to this output than originally anticipated. |

3.2 Strategic plan performance

In addition to Parliamentary performance measures, we also monitor our performance against a number of strategic indicators outlined in our Strategic Plan 2016–17. Figure 3C shows our results against these indicators for 2016–17.

Figure 3C

Performance against other strategic indicators

|

Strategic indicators |

Target |

Actual |

Result |

Commentary |

|---|---|---|---|---|

|

Average agency rating of VAGO |

75% |

76% |

✔ |

Our overall index score was in line with our benchmark. |

|

Percentage of culture program projects completed |

90% |

55% |

□ |

Twelve out of 22 proposed culture program projects were completed as at 30 June 2017. As identified from our recent 2017 Culture Survey, all completed projects correlated directly with improvements in a number of key areas such as training, strategic planning and communication. Our new executive leadership team will consider all other proposed initiatives. |

|

Percentage of training budget spent |

90% |

100% |

✔ |

This year, we have focused on technical skills training for our workforce, particularly in our operational business units. |

|

National Australian Built Environment Rating System (NABERS) rating |

At least a half star greater than the national government average |

3.5 stars |

✔ |

Our achievement of 3.5 stars is significantly above the national government average of 2.5 stars. |

Key ✔ Target achieved or exceeded. ○ Target not achieved—within 5 per cent variation. □ Target not achieved—exceeds 5 per vent variation.

Under the leadership of our new Auditor-General and executive leadership team, we began developing a new Strategic Plan to set the vision and direction for VAGO for the next four years. As part of this process, we will revisit our organisational objectives and values, reassess our strategic risks, and develop a new suite of indicators to track our progress over the next four years.

3.3 Stakeholder feedback

Surveys of Parliamentarians

Parliamentarians are our key stakeholders, and we consider our annual surveys of them to be important gauges of our performance and impact. In 2016–17, Parliamentarians' overall satisfaction with our office and services remains strong, with a survey score of 93 out of 100, which exceeded our target of 85.

The survey results also showed that Parliamentarians' perceptions of VAGO's work were highly positive, with 92 per cent of respondents agreeing that our reports and services provide valuable information on public sector performance, and 89 per cent agreeing that our reports and services help improve public sector administration.

'I value the relationship with the Auditor-General. I utilise the Audit Office's reports for scrutiny purposes and policy development purposes. The accessibility of the Office is important, the briefings to Parliamentarians are important and I have high regard for his people.'

'I would say from my view that I find the Auditor-General provides very useful reports across a range of areas of interest to me. They are always a go-to source of information when I'm looking at a particular topic.'

Surveys of audited agencies

We also conduct annual surveys of the agencies we audit to identify ways we can better meet their needs. In 2016–17, we surveyed nominated agency contacts for every performance audit we conducted. The results were highly positive, with a significant majority of survey participants agreeing that:

- our audits focused on the right areas within the audited activity (79 per cent)

- our recommendations were relevant (86 per cent)

- our reports were balanced and fair (80 per cent).

'The auditors were very responsive and conducted themselves professionally at all times. Their carefulness and consideration of feedback was similarly appreciated. In terms of the topic, they sought the appropriate level and breadth of information and it was clear that they had taken our responses into account in their execution of their findings. Where they found possible gaps in the department's work, they provided every opportunity to rectify their draft assessment.'

'VAGO staff were inclusive and approachable. This was appreciated and assisted in the audit participation experience and outcome.'

3.4 Our impact

Tougher penalties for illegal building works

Our May 2015 report Victoria's Consumer Protection Framework for Building Construction examined the performance of key agencies that provide functions central to building regulation in Victoria. We found that the builder registration system did not ensure that the only practitioners who were registered were those who were qualified, competent and of good character. We also found that the corresponding disciplinary system was not protecting consumers adequately, and that sanctions were ineffective in deterring practitioners from misconduct.

Following the audit, the government announced in December 2016 that it was introducing the Building Amendment (Enforcement and Other Measures) Bill 2016, which aims to protect consumers, stamp out home building malpractice, and reinforce confidence in the industry. Reforms to be introduced under the new legislation include:

- a maximum of five years' jail, or a $93 276 fine for an individual or a $466 380 fine for a company, for anyone who orders or carries out building work without a permit

- new injunction powers allowing courts to make any orders considered appropriate to intervene and prevent any building work that contravenes legislative requirements

- new entry and information-gathering powers to monitor compliance with building regulations

- restrictions on entitlements to payment for builders and plumbers who carry out domestic building and plumbing work without being appropriately registered.

Access to cheaper, faster insurance for builders

Our May 2015 report Victoria's Consumer Protection Framework for Building Construction also found that domestic building insurance (DBI) provided only limited protection for consumers and was significantly more costly than it needed to be. We found that previous government intervention in 2010 to direct the Victorian Managed Insurance Authority (VMIA) to provide DBI addressed the immediate risk associated with insurers withdrawing from the Victorian DBI market. However, this did not improve the level of protection for consumers and resulted in a more expensive, broker-driven model for the provision of insurance.

Following our report, the government introduced a new service model managed by the VMIA, with the aim of reducing insurance premiums by an average of 20 per cent. The new model reduces red tape and provides greater certainty for regulators and customers. It also gives customers up-to-date information and enables them to purchase cover online. Under the changes, more than 15 000 builders will be insured by the VMIA and will benefit from the premium reductions and improved services. Customers will also benefit from the elimination of an estimated $5 million in annual fees and commissions for brokers.

Improved contract management at private prisons

Our September 2010 report Management of Prison Accommodation Using Public Private Partnerships found that the then Department of Justice's administration of public private partnership contracts required improvement. In particular, the audit found that there was a lack of verification of contract management practices and ineffective governance structures overseeing the contracts.

We are pleased to note that, following our report, the department has made significant progress implementing improvements and rectifying known deficiencies with its contract management and administration. Corrections Victoria has significantly improved the resources and capability of its contract management branch, resulting in more effective oversight of the contracts with Victoria's private prisons. Contract Administration Manuals have been developed and the auditing and validation of information received from the prisons has improved.

Reforming the gambling and liquor industry

Our June 2012 report Effectiveness of Justice Strategies in Preventing and Reducing Alcohol-Related Harm found that the Department of Justice and Regulation's initiatives targeted reducing excessive alcohol consumption. However, there were no mechanisms in place to measure their effectiveness. The audit also found that the provisions of the Liquor Control Reform Act 1998 (the LCRA) were not adequately supporting liquor licensing enforcement activities.

Consequently, we recommended that the department pilot the collection and analysis of liquor sales data from wholesalers to retailers. We also recommended that the department review the LCRA to facilitate more effective and efficient enforcement activities.

Following the audit, we are pleased to note that the department collaborated with the Victorian Commission for Gambling and Liquor Regulation to collect wholesale alcohol sales data, develop a consultation paper on the LCRA and seek stakeholder feedback on potential reforms.

Helping students with disabilities maintain access to funding

Our March 2015 Education Transitions report found that the Department of Education and Training developed a comprehensive early-years transition framework that contributed to improving early-years transition outcomes. However, we also found that there were 22 000 government school students with disabilities that received funding as part of the department's Program for Students with Disabilities (PSD), who were also required to have their PSD funding reviewed in Year 6 as part of the existing funding model. This meant that students in the program could have their funding and support potentially modified or cancelled in the period leading into a major transition.

Consequently, we recommended that DET examine the appropriateness of the timing of the Year 6 review for students who receive funding under the PSD program, and its impact on transition outcomes. We are pleased to note that the department is currently progressing work on developing a prototype funding model that does not require a review in Year 6. The government also allocated $3 million in the 2017–18 State Budget to support PSD students who cease to be eligible for the program.

Improving cultural diversity planning in departments

Our May 2014 report Access to Services for Refugees, Migrants and Asylum Seekers identified the need to improve cultural diversity planning to enhance the delivery of accessible and responsive services to culturally diverse communities. Consequently, we recommended that a more consistent, coordinated and efficient approach to service planning and provision across departments and agencies be adopted.

We are pleased to note that all departments now have cultural diversity plans in place. Most departments have also reported significant progress in cultural diversity planning and implementation compared to the previous reporting year. Areas of progress reported include:

- stronger departmental ownership and governance of cultural diversity plans

- increased delivery of cultural competence training to staff

- provision of multilingual information

- greater involvement of culturally diverse communities in decision-making

- increased commitment to monitoring and evaluation

- greater use of data to improve service planning and delivery.

Improving the management of landfills

Our September 2014 report Managing Landfills found that reforms implemented by the Environment Protection Authority (EPA) had significantly improved its oversight of active and high-risk closed landfills due to improvements to its landfill licensing system, supporting guidance, and compliance and enforcement approach. However, the report also found that the EPA's standard landfill licence conditions were not adequately targeted to site-specific risks, and were therefore not as effective in driving improvement in performance as they could be.

We are pleased to note that following the audit, the EPA established new leachate (liquid that drains from a landfill) licence conditions, and additional risk-based licence conditions for odour, noise, dust, surface water, vermin, weeds and litter. The EPA has also updated its landfill licensing and licence management guidelines to provide more support to duty holders to help them comply with regulatory requirements, and reduce the risks posed by landfills.

Increasing the use of renewable energy in public transport

Our August 2014 report Managing the Environment Impacts of Transport found that sourcing energy from renewable sources presented a significant opportunity for Victoria to reduce its greenhouse emissions. However, Public Transport Victoria had not adequately investigated the potential costs and benefits of sourcing renewable energy.

Following the audit, we are pleased to note that Public Transport Victoria and Metro Trains Melbourne have investigated the costs and benefits of purchasing 'green power' for the network. The two agencies have also collaborated to calculate the extra costs to Victoria and conducted a sample survey to gauge public appetite for increasing public transport fares to fund recuperation of the costs.

Additional funding for Gippsland Lakes

Our September 2016 report Meeting Obligations to Protect Ramsar Wetlands found that, although there was some evidence of short-term output-focused monitoring taking place at Ramsar sites, there was limited ongoing monitoring with a focus on outcomes. The report also found that, overall, the governance, coordination and oversight of the management of Ramsar sites needed to be improved for Victoria to effectively meet its obligations under the Ramsar Convention.

Following our report, the government announced the creation of a $10 million fund specifically to improve the health of Gippsland Lakes—a significant Ramsar site. The funds will be spent over four years in partnership with stakeholder groups, such as the Gippsland Lakes Coordinating Committee.

Early adoption of streamlined accounts at our water entities

In 2016–17, the Department of Treasury and Finance introduced a new, streamlined set of model financial statements aimed at presenting relevant information together, and reducing duplication and disclosures that do not provide relevant information.

Although use of the new model was not mandatory for the current financial year, we actively promoted the benefits of the new model and its impact on the readability of the financial statements as a whole. It was pleasing to see that based on the advice we provided, all 19 water entities voluntarily adopted streamlined financial reporting for the preparation of their 2016–17 financial statements.

4 Our people

4.1 Our leaders

We implemented a new senior executive structure, shown in Figure 4A, following an organisational review. The new structure lowers our future cost base, creates improved functional spans of control resulting in simpler lines of authority and accountability, and promotes greater cohesion and collaboration across our office.

As at 30 June 2017, our new executive leadership team consists of the Auditor‑General, the Deputy Auditor-General, and three Assistant Auditors-General. Collectively, our Leadership Group sets the tone for integrity and governance within VAGO, and manages our day-to-day operations through weekly meetings and regular committee meetings.

Figure 4A

VAGO leadership structure

4.2 Our commitment to a quality workforce

Our workforce is fundamental to the achievement of our goals, and we commit to ensuring that our people are the best in their field. To ensure this, we require all our audit staff to maintain their ongoing professional development through regular attendance at topical external and in-house training sessions.

During the year, we delivered intensive audit training for our financial audit and performance audit teams. The training focused on efficient and effective planning, risk assessments, and the design of appropriate risk response steps within our existing and revised audit processes, and used a combination of audit principles and practical examples.

We also developed a customised human resources (HR) strategy in 2016–17 that focused on five key areas.

Getting the right people

- We overhauled the recruitment and selection procedures at VAGO to increase consistency and streamline processes. This was supported by the development of a new policy and associated guide.

- We expanded and refined our existing suite of recruitment strategies, including:

- beginning to use LinkedIn as a recruiting tool

- redefining our 'employee value proposition'—what employees value about working at VAGO

- redeveloping and streamlining VAGO's expression of interest program for external applicants

- creating a recruitment referral program

- developing an alumni strategy to maintain engagement with former VAGO employees.

Shantelle Dawe, Auditor, Financial Audit 'I joined VAGO because I wanted to work somewhere that had a positive impact on the community.' |

Developing our employees

- We piloted a Leadership Development Program to cultivate managers and leaders to be more adaptable, responsive and resilient employees, by introducing development components that prepare them to be:

- strategic thinkers—advocating and modelling our vision in everyday work

- able to coach, mentor and train staff and to build flexible, collegiate teams

- 'leadership ready' when promotional opportunities arise.

We introduced our Manager Seminar Series—training specifically for employees with staff management responsibilities—to ensure that our people managers are equipped with the right tools and skill sets to support and manage their teams.

Supporting our employees

- We revamped our annual performance cycle policies and guides to provide clarity on the overall process, consistency of ratings required, and expected time frames. We also streamlined the process for recognising the achievements of high-performing staff.

- We engaged a new Employee Assistance Provider to provide more comprehensive support to our staff.

Strengthening our HR governance

- We revised all of our HR policies and guides to improve processes, address gaps in policy, and comply with applicable legislation.

- We reviewed our internal delegations policy and developed an overarching framework containing principles for delegating decision making, and a quick reference guide to facilitate ease of use.

- We developed compulsory online compliance modules for all staff to complete, covering topics such as appropriate behaviour, workplace health and safety, record keeping, protected disclosures, and privacy, secrecy and confidentiality.

Improving our internal reporting

- We developed a monthly staff pulse report for our Operations Committee, and began to develop a workforce metrics report to inform the annual business planning process.

- We developed an internal engagement model that entails monthly HR updates, and the establishment of regular, individual meetings with each business unit head and director group.

We will expand our in-house training capabilities in 2017–18 by exploring innovative e-learning solutions that will allow us to deploy training on demand. We will also run regular in‑house training sessions across a range of topics as nominated by our financial audit, performance audit and technical audit teams.

In the new year, we plan to:

- deliver a Leadership Group Development Program that will build strong working relationships and effective team dynamics within our executive leadership team

- explore dynamic and flexible ways for our managers and leaders to provide timely, positive and constructive performance feedback to their team members and to each other

- provide foundational training to our managers in support of our Office's vision of strong and effective management/leadership

- strengthen and improve our on-boarding processes for new hires, with a focus on increasing their productivity and long term performance

- define the behaviours that demonstrate our values and build an understanding and appreciation of those values across our Office.

Rue Maharaj, Manager, Technical Audit 'After a diverse IT career in a 'Big 4' professional services and financial services firm, I looked for opportunities in the public sector—something I'm passionate about. This role at VAGO was a great opportunity to consult across Victorian Government agencies and help progress the improvements we all hope for.' |

Our culture

The wellbeing of our staff is vital, and it is a priority for us to build and maintain a positive and resilient work culture, where each employee's daily experience is to arrive at work with a sense of purpose, and depart with a sense of accomplishment. In April 2016, we launched our Culture Program, a series of initiatives designed to improve our workplace culture across the following priority areas:

Leadership—developing individual and team capability within our executive leadership group to deliver our vision and the concept of 'one office'.

In 2016–17, we established a new executive management team and commenced developing a new Strategic Plan.

Behaviours and values—redefining how we manage inappropriate behaviour, modelling the behaviour we expect at VAGO, and reviewing how we recognise our staff.

In 2016–17, we reviewed our internal grievance process and introduced three new policies—on dispute resolution and grievance, appropriate behaviour, and allegations of misconduct—to provide greater clarity on methods of informal dispute resolution.

Practice management—focusing on strategic, resource and budget planning, and delivering timely corporate activities.

In 2016–17, we began developing a new Strategic Plan to drive business efficiencies across VAGO. We also reviewed our people, production and finance plans to ensure all three planning platforms were aligned and consistent.

People management and development—reviewing our learning and development processes, and delivering a cohesive and comprehensive program that fulfils the collective and separate needs of our business units.

In 2016–17, we centralised our learning and development budget and functions to improve how we assess staff development requirements. We also streamlined our approval processes for staff recruitment, and simplified our protocols for employees to access leave and flexible working arrangements.

Organisational cohesion—developing behaviours and processes that foster collaboration and reduce a 'silo' mentality in the office.

In 2016–17, we established an editorial committee to gather input for our staff forums and internal newsletter. We also re-introduced 'Boris', an internal online forum that promotes increased engagement between our staff.

Zoe Parer-Cook, Analyst, Performance Audit 'I did an internship at VAGO as part of my Masters. I really enjoyed the performance audit I was placed on, which looked at the regulation of the gambling and liquor industry. The team was really fun and supportive, so I decided to apply for a position at VAGO.' |

Culture survey

We conducted an office-wide culture survey during the year, building on similar surveys we had run in 2015 and 2013.

Encouragingly, we improved in a majority of areas since 2015. This upwards trend was reflected across all our business units. The key strengths and opportunities for further development we identified were:

|

Key strengths |

Opportunities for further development |

|

|

Many of the areas identified for further development will be the focus of standalone business improvement projects we intend to deliver in 2017–18. Once completed, we will conduct another office-wide survey to assess their effectiveness.

Katrina Rogers, Senior Manager, Performance Audit 'I joined VAGO because I believed that the government should be accountable for providing the best possible services to the community. I was keen to broaden my experience and knowledge of different public sector agencies, and I wanted to learn more about how government functions. After reading some of the VAGO performance audit reports, I thought it would be a great way to add some value to the public service.' |

5 Material developments

As we move towards full adoption of integrated reporting principles, we use the concept of materiality to improve how we report on significant changes occurring in our workspace. The following section highlights some of the material developments over the year that have changed how we think and operate.

5.1 Improving how we plan

We design our forward work program to be flexible and responsive. This allows us to direct our efforts towards doing the right audits at the right time, and using our resources to make a difference in the community.

In 2016–17, we adopted a three-year planning cycle for performance audits. This forecast horizon provides us with greater opportunities to engage earlier with our stakeholders, and enables audited agencies to prepare for scheduled audits well in advance. We significantly expanded our annual planning consultation phase to incorporate both formal and informal consultation with a broad range of stakeholders, including Parliament's Public Accounts and Estimates Committee (PAEC), government departments and agencies, portfolio ministers, community groups and academics.

Our stakeholders, including PAEC, have commented positively on our revised planning process, with most agreeing that the increased depth of engagement had improved the scope and selection of performance audit topics in the current cycle.

We will be developing specific forward-looking strategies for each of our portfolio sectors. These sector strategies will help us further improve how we identify and target potential audit topics for future planning cycles.

5.2 Improving how we work

New premises

Our previous accommodation lease expired in 2016–17, and we moved to new premises in late May 2017. Our relocation gave us a fresh start and enabled us to establish new ways of working, particularly after several challenging years. Our new workspace has been designed to reflect our new Auditor-General's integrative style and collaborative working approach.

We chose a more open and accessible layout for our office fit-out, combining traditional and activity-based working to create a more flexible and connected space that reflects modern standards of office design. As well as regular desks, we also have a variety of workspaces to accommodate the different types of work we do.

Our new workspace removes physical barriers that prevent our staff from performing at their best, encourages us to share our knowledge, ideas and opinions more freely, and increases our productivity.

Enhanced technological capabilities

We complemented the physical changes to our environment with enhanced information systems. In 2016–17, we reviewed our existing information and communications technology (ICT) infrastructure against a desired service catalogue, and compared our key ICT metrics against industry benchmarks.

We concluded that, due to evolving audit practice and industry standards, our ICT function needed to be a flexible, strategic, data-centric and solutions-based service, with the capability to support analytical tools that improve our audit practice, and help us to create an efficient and cost-effective audit program. The review found that the technology we had been using was fast approaching its end of life, and was incompatible with the transition across the Victorian Government to cloud-based computing.

We have begun to implement the recommendations of the review with an office-wide digital transformation, beginning with a move to Office 365, SharePoint and new telephony arrangements as part of a unified communications package. We will also start the process of replacing our financial and performance audit applications after reviewing our audit methodologies.

To further support a modern workspace environment, we will:

- provide wi-fi access across the office

- progressively roll out new laptops with modern mobility

- upgrade all laptops to run Microsoft Windows 10

- deploy new tablet devices to increase the mobility of our staff and reduce their reliance on paper.

We determined that our Enterprise Resource Planning solution is also approaching the end of its useful life. In 2016–17, we developed a business case and functional and business requirements documentation to prepare for procurement early in the 2017–18 financial year.

We will continue to use new technology to pursue opportunities to conduct our operations more efficiently and effectively.

Stronger communication channels

Clear and timely communication with our clients is a key component of the audit services we offer. In 2016–17, we began a project to update, refresh and simplify all of our key client communication documents—including templates for our audit strategy (plan), audit committee briefing, closing report, management representation letter, management letter and independent auditor's report—and ensuring they comply with relevant auditing standards.

This year, we:

- completely overhauled and redesigned all of our templates, including our Parliamentary reports

- simplified and grouped similar content, with a focus on interactive presentations and accessibility on tablet devices

- reduced the use of technical language where possible, and increased the emphasis on plain language communications

- redeveloped our website to improve its functionality and utility.

We consulted with staff members to identify their communication needs and preferred means of receiving information. As a result, we reintroduced monthly staff forums and revised the content of internal newsletters. In the lead-up to the office move and introduction of new ICT systems, the Auditor-General gave fortnightly updates to inform staff members of key initiatives and changes.

In 2017–18, we will explore opportunities for redeveloping our intranet, with the aim of providing staff with more up-to-date information, and increasing its usefulness and relevance to our daily work. We will also consider further refining the design and layout of our reports, and other communication products.

Digitised records management

In 2016–17, we undertook a major upgrade and reconfiguration of our records management system and rolled out a new business classification scheme that more closely aligns with our service architecture. We also introduced electronic workflows to reflect our move towards a paperless working environment.

In 2017–18, we will consolidate particular data repositories to ensure consistency in data storage and management. We will also review and rewrite VAGO's Retention and Disposal Authority, and dispose of obsolete archive records held offsite.

5.3 Improving how we measure our performance

We must have a sound system of performance measurement and reporting if we are to be transparent and accountable in how we help government achieve its policy goals. A review of our Parliamentary performance measures conducted in 2016–17 found that some of these measures did not effectively enable us to demonstrate that we are sustainably delivering outputs and intended outcomes for the Victorian community.

As a result, we overhauled our Parliamentary performance measures, and replaced all outdated metrics with measures that better capture how efficiently and effectively we use our resources. The revised suite of measures—approved as part of the 2017–18 State Budget development process—will be used to benchmark our performance to Parliament from 2017–18 onwards.

Internally, we are developing a customised set of scorecard indicators that will also incorporate themes of efficiency and effectiveness. This new performance measurement and reporting regime will help us increase productivity and integration across all facets of our business.

5.4 Improving how we service our clients

We are committed to delivering high-quality financial and performance audit services to our clients. To achieve this, we group our audit teams into industry and sector specialisations, enabling them to build and promote audit knowledge, capabilities and efficiencies and understand key sector risks, trends and issues. We also proactively engage with our clients and other key stakeholders to ensure we understand the audit issues and the perspectives of our clients, so we can identify potential areas of audit focus.

Improved audit methodology

We continuously improve our audit methodology to ensure it is modern, adaptive, efficient and effective, and complies with required standards. In 2016–17, we began an audit methodology modernisation project to identify opportunities to streamline how we audit, and ensure that the focus of our audit effort accurately reflects the risks associated with the areas under audit.

Increased used of data analytics

We are investing heavily in building our data analytics expertise within our Technical Audit team to facilitate the use of data analytics as an input tool for all future audits. Data analytics encompasses the use of sophisticated computer aided audit tools to obtain and analyse large datasets, with a view to developing insights that can then be visualised in various digital dashboard type formats. This visualisation process often reveals insights about our clients that were more difficult to identify using traditional analysis models, and provides us with opportunities to better understand our clients and their needs.

We are currently piloting the use of data analytics as part of our planning and interim work in key audit cycles at a number of our financial audit clients. We expect data analytics to be an integral part of our financial audit processes for all our audit clients in the future, and to deliver significant efficiencies in our overall audit processes as we standardise and replicate particular data analytics tools.

We also aim to use data analytics to conduct our performance audits wherever possible. We used data analytics extensively in our final performance audit report of 2016–17, Maintaining State-Controlled Roadways. The audit examined VicRoads' maintenance of Victoria's road network, and focused on road pavement in particular, as it accounted for most of VicRoads' road maintenance expenditure. As the audit was rich in data, we developed an interactive, visual dashboard that enabled easy interpretation of the data and revealed trends. The dashboard helped us identify performance gaps and determine the areas of audit focus, and we also used it to present our findings to the agency.

6 Financial management

6.1 Current year financial review

Our primary fiscal objective is to minimise our costs to Parliament and our public sector fee-paying clients while maintaining the effectiveness and quality of our services and their delivery.

Our financial performance and position are, as a rule, predictable year on year as the nature of our business and its scale does not change substantially. This year was an exception as we implemented a major organisation transformation involving:

- a restructure to rationalise and better align positional responsibility, accountability and authority for our external and internal services

- significant downsizing of the executive to increase spans of control to more common management ratios

- moving to new activity-based premises to improve the functionality of our workplace

- investing in a modern ICT platform to better support our mobile workforce.

These changes will help us constrain the growth of our future costs so that we can deliver on our fiscal objectives.

Figure 6A

Financial summary 2016–17 and previous four years

Surplus/deficit

We aim to break even over the medium term, understanding that in some years we need to invest in new technology and update our audit methodologies. This will lead to deficits in those years, which we fund from our working capital reserves. In other years, we will make small surpluses, which will replenish our reserves.

This year we incurred a relatively large deficit as we invested in a major transformation of our business. Over the past five years we have averaged a small deficit of 0.5 per cent of total revenue, indicating that we are operating in a fiscally responsible and sustainable manner.

Figure 6B

Surplus/deficit as percentage of total revenue

This year's deficit was due largely to employment termination payments and provisions for a significant number of staff redundancies. Before taking these one-off expenses into account, our underlying result was a deficit of $942 000.

Net assets

We used our accumulated surpluses to offset our additional expenditure, resulting in a decline in our net assets of $3.14 million to $5.55 million. We remain in a strong financial position, with sufficient working capital reserves, while reducing our net equity to more appropriate levels.

Figure 6C

Net assets as percentage of total assets

The future

We budget another, smaller deficit for 2017–18 as we continue to use the accumulated surpluses in our State Administration Unit to complete our organisational transformation activities. We forecast a return to a balanced budget in 2018–19.

6.2 Financial performance

Operating statement

Our net financial result for the year was a deficit of $3 144 000 (compared with a surplus of $83 000 in 2015–16).

Figure 6D

Revenues and expenses, 2012–13 to 2016–17

Revenue

We are funded through Parliamentary appropriations and Financial Management Act 1994 section 29 revenue.

Our total revenue has been rising steadily over the past several years. It increased 6 per cent in 2016–17 through a combination of increases in section 29 revenue in line with agreed engagement fees, and inflation indexation of general appropriations.

Other revenue increased as a result of recovering costs from the Australasian Council of Auditors-General (for new annual secretariat work by Intensive Group), Financial Reporting and Accounting Council secretariat work, and the recovery of costs associated with staff seconded to other agencies.

Expenses

We spend most of our budget on employees, contract audit services including audit service providers (ASP) and miscellaneous expenses, such as accommodation, supplies and services.

Figure 6E

Expenses from ordinary activities, 2012–13 to 2016–17

(a) Gross including secondment costs. The total expenses after recovery of these costs from agencies is $46.5 million.

(b) Other expenses include human resources and recruitment, ICT costs, capital asset charge, consultancy, contractor costs, printing and stationery, office travel and vehicle expenses.

Our employee expenses increased 17 per cent in 2016–17 or $4 million, mainly as a result of:

- one-off employment termination payments and provisions from the organisational restructure program

- an increase in our annualised FTEs from 182.2 to 199.

Our depreciation and amortization expenses have also been declining over the past few years due to the increasing age of our existing assets. We also had no asset impairment issues to consider this year.

Our ASP contractor expenditure of $11.29 million is broadly in line with last year's ($11.35 million). We increased our use of contracted subject matter experts in our performance audit area ($866 000 in 2016–17 compared to $540 000 in 2015–16) to make sure we had the skills and knowledge needed to evaluate complex programs and services.

Our rental expenditure comprises base rental costs, common tenancy maintenance costs and other outgoings. Our relocation in late May 2017 saw our base rent increase by 37 per cent, although this is offset by the smaller office area we now occupy.

The 38 per cent increase in remaining expenses is due to increases in building consulting fees from our recent accommodation upgrades. We also spent more on ICT consultants, ICT consumables, human resources recruitment fees and learning and development.

6.3 Financial position

Balance sheet

Our financial position at 30 June 2017 remained adequate, with total assets of $32.1 million, total liabilities of $26.5 million and net assets of $5.6 million.

Figure 6F

Asset and liability movement, 2012–13 to 2016–17

Assets

Our total financial assets increased by $8.7 million, largely due to a public account advance of $8.5 million under section 37 of the Financial Management Act 1994. This balance comprises mainly $4.7 million of landlord lease incentive and $20.7 million of Victorian Government inter-agency account. The total amount recognised as owing from the Victorian Government was $20 735 000 ($16 789 000 in 2015–16). The amount recognised as owing from the Victorian Government comprises previously applied Parliamentary appropriations not yet drawn down. The balance represents accumulated surpluses, payables, movements in provisions and accumulated depreciation and amortisation net of asset acquisition. The amounts represent funding for all commitments incurred through the appropriations and are drawn from the Consolidated Fund as the commitments fall due.

Non-financial assets increased by $5.1 million, mainly due to our accommodation refurbishment. Our office fit-out has been subsidised by the landlord's lease incentive program of $4.7 million, which included carpet and staircase incentives.

Liabilities

Our liabilities increased by $16.9 million (175 per cent), primarily due to the public account advance of $8.5 million and accrual of $4.7 million of lease incentive. The increase in liabilities is also partly a result of one-off payments for accommodation ($1.85 million), employee termination payments and provisions ($2.9 million), with some offset from lower provisions in other areas, such as employee annual leave and long service leave ($1 million).

6.4 Cash flows

Cash flow statement

We keep a base cash balance of $900 in our petty cash. All other bank balances are transferred overnight to the state government as part of our government banking arrangement.

Figure 6G

Cash flow statement

Our net deficit for the year under an accrual basis is $3.14 million. If we remove the effects of accrual accounting on the deficit—a total of $7.26 million from payables and provision, receivables and prepayments, depreciation and other non-cash movements—we have a total of $4.12 million of positive cash flows from our operating activities. A key contributor to this is the increase in payables of $15.9 million, which does not have to be settled until after 30 June 2017.

This cash stream is used to fund our fixed asset additions such as the new leasehold improvement. The leasehold improvement will be subsequently recouped from our landlord's lease incentive reimbursement in 2017–18.

6.5 Other financial matters

Financial report

Under Standing Direction 4.2 of the Financial Management Act 1994, the financial statements of government departments must be presented fairly and in accordance with the requirements in the model financial report. This annual report complies with this requirement.

Consultancies

In 2016–17, we engaged two consultancies that each had total fees payable greater than $10 000, as outlined in Figure 6H. We also engaged one consultancy where the total fees payable were less than $10 000, with a total expenditure of $2 000 (excluding GST).

Figure 6H

Consultancies: Details of individual consultants—payments in excess of $10 000

|

Purpose of consultancy |

Start date |

End date |

Total approved project fee (exc. GST) ($'000) |

Expenditure 2016–17 (exc. GST) ($'000) |

Future expenditure (exc. GST) ($'000) |

|---|---|---|---|---|---|

|

Mercer Consulting (Australia) Pty Ltd |

|||||

|

Organisation review and redesign |

11 Oct 2016 |

21 Dec 2016 |

103 |

103 |

0 |

|

UXC |

|||||

|

Enterprise Resource Planning review |

2 Sept 2016 |

30 Jun 2018 |

300 |

224 |

76 |

Performance audit contractors

In 2016–17, we paid $0.87 million ($0.54 million in 2015–16) to 22 contractors for services related to our performance audits.

Figure 6I

Payments made to performance audit contractors

|

Performance audit contractor |

2016–17 ($'000) |

2015–16 ($'000) |

|---|---|---|

|

Aginic |

272 |

0 |

|

Australian Survey Research Group Pty Ltd |

45 |

45 |

|

Chappell Dean Pty Ltd |

12 |

77 |

|

Civic Ways Pty Ltd |

23 |

0 |

|

Clear Horizon Consulting Pty Ltd |

0 |

108 |

|

Dench McLean Carlson Pty Ltd |

82 |

0 |

|

Eassure |

31 |

0 |

|

Ernst & Young |

70 |

0 |

|

E W Russell & Associates Pty Ltd |

0 |

16 |

|

Glossop Town Planning Pty Ltd |

28 |

0 |

|

Guidera Consulting Group Pty Ltd |

0 |

77 |

|

Keaney Planning |

23 |

0 |

|

Orima Research Pty Ltd |

22 |

30 |

|

Ovum Pty Ltd |

22 |

24 |

|

Paul Edney |

27 |

20 |

|

PEECE Pty Ltd |

44 |

0 |

|

P G Rorke |

59 |

46 |

|

Project Planning & Development |

28 |

0 |

|

Security Infrastructure Solutions |

0 |

68 |

|

Tract Consultants |

23 |

0 |

|

Other—6 service providers (7 in 2015–16) |

55 |

29 |

|

Total |

866 |

540 |

Financial audit service providers

In 2016–17, we paid $11.3 million ($11.4 million in 2015–16) to 25 audit firms that provided services related to our financial statement audits.

Figure 6J

Payments to financial audit service providers

|

Financial audit service provider (ASP) |

2016–17 ($'000) |

2015–16 ($'000) |

|---|---|---|

|

Accounting and Auditing Solutions |

63 |

47 |

|

Coffey Hunt Audit |

384 |

411 |

|

Crowe Horwarth |

671 |

461 |

|

Crowe Horwarth Albury |

418 |

428 |

|

Crowe Horwarth Vic |

576 |

706 |

|

Crowe Horwarth West Vic |

177 |

215 |

|

Davidsons Assurance Services Pty Ltd |

48 |

56 |

|

Deloitte Touche Tohmatsu |

0 |

92 |

|

DFK Kidsons |

81 |

74 |

|

DMG Audit and Advisory |

199 |

178 |

|

Ernst & Young |

826 |

1 163 |

|

Grant Thornton Audit Pty Ltd |

54 |

76 |

|

HLB Mann Judd (Vic Partnership) |

2 536 |

2 365 |

|

Johnsons MME |

315 |

227 |

|

KPMG |

422 |

370 |

|

LD Assurance |

138 |

102 |

|

McLean Delmo Bentleys Pty Ltd |

681 |

812 |

|

MGR Accountants Pty Ltd |

0 |

17 |

|

PPT Professional Pty Ltd |

26 |

0 |

|

PricewaterhouseCoopers (Vietnam) Ltd |

0 |

38 |

|

Richmond Sinnott & Delahunty |

1 184 |

1 102 |

|

RSM Australia Pty Ltd |

2 420 |

2 288 |

|

UHY Haines Norton Melbourne Pty Ltd |

0 |

16 |

|

University of Melbourne (a) |

0 |

82 |

|

Other—6 service providers (4 in 2015–16) |

69 |

27 |

|

Total |

11 288 |

11 353 |

Information and communications technology expenditure

In 2016–17, we had a total ICT expenditure of $2 310 000.

Figure 6K

ICT expenditure

|

Business as usual (BAU) ICT expenditure ($'000) |

Non-BAU ICT expenditure ($'000) |

Operational expenditure ($'000) |

Capital expenditure ($'000) |

|---|---|---|---|

|

1 854 |

456 |

159 |

297 |

ICT expenditure refers to our costs in providing business-enabling ICT services. It comprises business-as-usual (BAU) ICT expenditure and non-business-as-usual (non-BAU) ICT expenditure. Non-BAU ICT expenditure relates to extending or enhancing our current ICT capabilities. BAU ICT expenditure is all remaining ICT expenditure which primarily relates to ongoing activities to operate and maintain the current ICT capability.

Whole-of-government financial statements

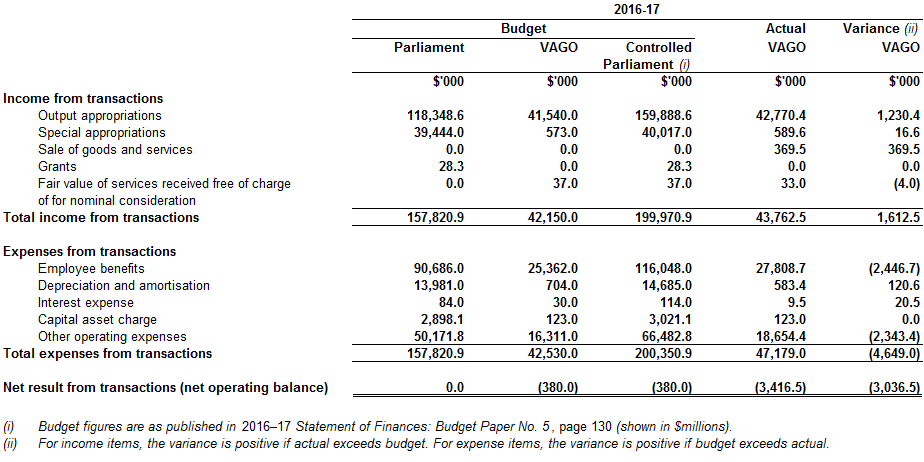

Figure 6L is a comprehensive operating statement for the Parliament portfolio that provides a comparison between our actual financial statements and the forecast financial information published in the Budget Paper No.5 Statement of Finances 2016–17 (BP5). The financial data has been prepared on a consolidated basis and includes all general government sector entities within the portfolio. Financial transactions and balances are classified into either controlled or administered categories, as agreed with the Treasurer in the context of the published statements in BP5. The following statements are not subject to audit and are not prepared on the same basis as VAGO's financial statements as they include the consolidated financial information of the Parliament entity.

Figure 6L

Comprehensive operating statement for Parliament

6.6 Financial statements

- Declaration in the financial statements

- Independent auditor's report

- Comprehensive operating statement

- Balance sheet

- Cash flow statement

- Statement of changes in equity

- Notes to financial statements

- 1 About this report

- 2 Funding delivery of our services

- 3 The cost of delivering services

- 4 VAGO's controlled and administered items

- 5 Key assets available to support output delivery

- 6 Other assets and liabilities

- 7 How we financed our operations

- 8 Risks and valuation judgements

- 9 Other disclosures

Accountable Officer's and Chief Financial Officer's declaration

The attached financial statements for the Victorian Auditor-General's Office (VAGO) have been prepared in accordance with Direction 5.2 of the Standing Directions of the Minister for Finance under the Financial Management Act 1994, applicable Financial Reporting Directions, Australian Accounting Standards including Interpretations, and other mandatory professional reporting requirements.

We further state that, in our opinion, the information set out in the comprehensive operating statement, balance sheet, statement of changes in equity, cash flow statement and accompanying notes, presents fairly the financial transactions during the year ended 30 June 2017 and financial position of VAGO at 30 June 2017.

At the time of signing, we are not aware of any circumstance which would render any particulars included in the financial statements to be misleading or inaccurate.

We authorise the attached financial statements for issue on 31 August 2017.

|

Andrew Greaves Melbourne |

Chiang Yip Melbourne |

Comprehensive Operating Statement

for the financial year ended 30 June 2017

(i) Operating lease payments (including contingent rentals) are recognised on a straight-line basis over the lease term, except where another systematic basis is more representative of the time pattern of the benefits derived from the use of the leased asset.

The accompanying notes form part of these financial statements.

Balance Sheet

as at 30 June 2017

The accompanying notes form part of these financial statements.

Cash Flow Statement

for the financial year ended 30 June 2017

(i) Goods and Services Tax paid to the ATO is presented on a net basis.

The accompanying notes form part of these financial statements.

Statement of Changes in Equity

for the financial year ended 30 June 2017

1. About this report

The principal pieces of legislation governing and guiding the Victorian Auditor-General's Office (VAGO) and the Auditor-General are:

- the Constitution Act 1975, which establishes the role of the Auditor-General and gives the Auditor-General complete discretion in the performance and exercise of his functions and powers

- the Audit Act 1994, which establishes the Auditor-General's mandate, provides the legal basis for his powers, and identifies his responsibilities.

VAGO is an administrative agency acting on behalf of the Crown. Our address is Level 31, 35 Collins Street, Melbourne VIC 3000.

A description of the nature of VAGO's operations and its principal activities is included in the report of operations, which does not form part of these financial statements.

Compliance information

These general purpose financial statements have been prepared in accordance with the Financial Management Act 1994 (FMA) and applicable Australian Accounting Standards (AASs) which include Interpretations, issued by the Australian Accounting Standards Board (AASB). In particular, they are presented in a manner consistent with the requirements of AASB 1049 Whole of Government and General Government Sector Financial Reporting (AASB 1049).

Where appropriate, those AAS paragraphs applicable to not-for-profit entities have been applied. Accounting policies selected and applied in these financial statements ensure that the resulting financial information satisfies the concepts of relevance and reliability, thereby ensuring that the substance of the underlying transactions or other events is reported.

Basis of preparation

These financial statements cover the Victorian Auditor-General's Office as an individual reporting entity and include all of its controlled activities.

These financial statements:

- are in Australian dollars

- use the historical cost convention unless a different measurement basis is specifically disclosed in the note associated with the item measured on a different basis

- apply an accrual basis of accounting whereby assets, liabilities, equity, income and expenses are recognised in the reporting period to which they relate, regardless of when cash is received or paid.

Consistent with the requirements of AASB 1004 Contributions:

- contributions by owners (that is, contributed capital and its repayment) are treated as equity transactions and, therefore, do not form part of the income and expenses of VAGO

- additions to net assets which have been designated as contributions by owners are recognised as contributed capital

- other transfers that are in the nature of contributions to or distributions by owners have also been designated as contributions by owners.

Judgements, estimates and assumptions are made about financial information being presented:

- significant judgements are in the notes where amounts affected by those judgements are disclosed

- estimates and associated assumptions are based on professional judgements derived from historical experience and various other factors believed reasonable under the circumstances. Actual results may differ from these estimates

- revisions to accounting estimates are recognised in the period in which the estimate is revised and also in future periods that are affected by the revision

- judgements and assumptions made by management in applying AASs that have significant effects on the financial statements and estimates, with a risk of material adjustments in the next year, are disclosed in the notes under the heading: 'Significant judgement or estimates'.

All amounts in the financial statements have been rounded to the nearest $1 000, unless otherwise stated.

Objectives

- Provide assurance to Parliament about the accountability and performance of the Victorian public sector through the provision of audits.

- Be authoritative and relevant and be highly regarded by Parliament.

- Leverage our systems and processes to improve organisational performance.

- Foster a stimulating working environment.

- Foster productive relationships with audit clients.

2. Funding delivery of our services

Introduction

The Victorian Auditor-General's Office's objective is to provide independent assurance to Parliament and the Victorian community on the state's financial reporting and performance. It does this by receiving parliamentary appropriations.

2.1 Appropriations