Auditor-General’s Report on the Annual Financial Report of the State of Victoria, 2014–15

Overview

The Annual Financial Report of the State of Victoria, 2014–15 (the AFR) was neither timely nor accurate.

The Treasurer transmitted the AFR to Parliament on 4 November 2015, 15 days later than the date required by the Financial Management Act 1994. This delay was driven partly by the recent machinery-of-government changes; and partly by a loss of key financial staff in recent years at some material entities.

The AFR received a modified financial audit opinion, with two qualification matters.

Firstly, the AFR failed to record the state's obligation at 30 June 2015 to return $1.5 billion in Commonwealth funding relating to the cancelled East West Link project. Adopting the correct accounting treatment for this transaction reduces the net result from transactions for the general government sector to a deficit of $286.0 million. Therefore the state has not achieved one of its key financial measure of generating a net surplus from transactions of at least $100 million.

Secondly, the Department of Education & Training (DET) was unable to support their plant, property and equipment balance with proper accounts and records, breaching the Financial Management Act 1994. As a result, $16.8 billion of fixed assets are not supported in the AFR. Further information regarding the financial audit of DET will be provided in our report Portfolio Departments and Associated Entities: 2014–15 Audit Snapshot, to be tabled in December 2015.

Auditor-General’s Report on the Annual Financial Report of the State of Victoria, 2014–15: Message

Ordered to be published

VICTORIAN GOVERNMENT PRINTER November 2015

PP No 107, Session 2014–15

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Auditor-General's Report on the Annual Financial Report of the State of Victoria, 2014–15.

The Annual Financial Report of the State of Victoria 2014–15 (the AFR) was transmitted to Parliament on 4 November 2015. The AFR received a modified audit opinion containing two audit qualifications.

The audit qualifications highlight that the AFR fails to recognise the state's obligation to return $1.5 billion of Commonwealth Government funding relating to the East West Link project at 30 June 2015, and that there was insufficient appropriate evidence to support the property, plant and equipment balances at the Department of Education & Training.

This report reviews the liquidity and capital replacement ratios for the state, including the impact the East West Link project transaction had on these results. The state did not achieve its key financial measure of having a surplus from transactions for the general government sector of at least $100 million.

Yours faithfully

Dr Peter Frost

Acting Auditor-General

24 November 2015

Auditor-General's comments

|

Dr Peter Frost Acting Auditor-General |

Audit team Simone Bohan—Engagement Leader Helen Grube—Team Leader Engagement Quality Control Reviewer Tim Maxfield |

On 4 November 2015 the Treasurer transmitted the Annual Financial Report of the State of Victoria (the AFR) to Parliament. This was 15 days after the date required by the Financial Management Act 1994 and reflects a difficult and challenging year in financial reporting for the public sector.

I signed my audit opinion on the AFR on 30 October 2015. The AFR received a modified audit opinion, containing two audit qualification matters.

Firstly, the AFR failed to record the state's obligation at 30 June 2015 to return $1.5 billion in Commonwealth Government funding relating to the cancelled East West Link project.

The Commonwealth Government had requested the return of these funds prior to balance date, and can recover the funds by reducing future funding for other Victorian projects. The memorandum of understanding, and legislation under which the funding was provided, are both clear in the requirement to return funding if a project is cancelled. This obligation is therefore also required to be recognised in the state's AFR under Australian Accounting Standards. Subsequent to year end, the Commonwealth Government indicated that it would allow the state—on a without prejudice basis and under certain specified conditions—to treat the funding as a prepayment to fund the Commonwealth Government's future commitments to other projects.

Omitting the obligation to return the East West Link funding from the AFR has meant the reported results and the state's liquidity ratio are overstated. Consequently, the correct accounting treatment for this transaction reduces the net result from transactions for the general government sector. This means the state has not achieved its key financial measure of generating a net surplus from transactions of at least $100 million.

The second qualification matter relates to $16.8 billion of property, plant and equipment at the Department of Education & Training (DET) which is not supported by proper accounts and records—breaching the Financial Management Act 1994.

Our observations and concerns around data integrity and other issues over asset recording at DET are not new, and are a further area of concern for this office in light of our recent performance report on strategic planning at that department.

It is pleasing to note that DET have accepted the issues discussed in this report, and that they have made commitments to take action. My office will, within the bounds of our independence, provide the department with feedback and advice as they work through resolving these issues.

Dr Peter Frost

Acting Auditor-General

November 2015

Audit Summary

This report informs Parliament about the results of our audit of the Annual Financial Report of the State of Victoria, 2014–15 (the AFR), transmitted to Parliament by the Treasurer on 4 November 2015.

The report reviews the financial outcomes and performance of the State of Victoria (SoV), and assesses the general government sector (GGS).

The final Part of the report provides an update on four major projects, including three public private partnerships that the state was constructing at 30 June 2015. This Part also reviews the current status of the Port of Melbourne lease.

Conclusions

The 2014–15 AFR was not timely because the legislative time lines for reporting were not achieved. It was also not accurate as the audit opinion was qualified on two points.

The first audit qualification highlights that the AFR failed to record the obligation that the state government had at 30 June 2015 to repay Commonwealth Government funding relating to the cancelled East West Link (EWL) project. The state should have recognised a $1.5 billion liability and corresponding expense.

Secondly, the Department of Education & Training (DET) has failed to maintain a complete and accurate asset register to support the property, plant and equipment balance reported in their financial statements. This meant $16.8 billion of assets held by the state were not supported by proper underlying accounts and records during the 2014–15 financial year.

The state's financial results reported in the AFR showed mixed results. If the EWL project transaction is correctly accounted for, the government's key financial measure of a net result from transactions of at least a $100 million surplus has not been achieved; and the liquidity ratio for the state has fallen.

Findings

Qualified audit opinion

The AFR received a modified financial audit opinion, consisting of two audit qualifications:

- the AFR did not record an expense, and associated liability, recognising the state's obligation to return to the Commonwealth Government $1.5 billion of funding relating to the EWL project

- the property, plant and equipment balances of DET, which are included in the AFR, were not supported by proper accounts and records.

East West Link project

In 2013–14, the Commonwealth Government paid $1.5 billion to Victoria as part of a $3.0 billion contribution to the EWL project. This funding was correctly accounted for as revenue in that year in accordance with Australian Accounting Standard AASB 1004 Contributions. Following the state election in November 2014, the EWL project was cancelled by the state government.

The cancellation of the EWL project, and a formal request from the Commonwealth Government for repayment of the funds, pursuant to the memorandum of understanding, and the related Commonwealth legislation, means that at 30 June 2015 the state had an obligation to repay the money under AASB 1004. Importantly, the Commonwealth Government also has the ability to recover this funding by reducing future funding for other Victorian projects. The correct accounting treatment is to recognise an expense and a liability for $1.5 billion at that time.

By not recording the $1.5 billion expense and associated provision as a liability, the SoV and the GGS net result from transactions is overstated, and other provisions in the balance sheet are understated. This means that the net result from transactions for the GGS would change from a surplus of $1 214.0 million to a deficit of $286.0 million. The state's key financial measure of achieving a net surplus from transactions for the GGS of at least $100 million has therefore not been achieved.

This matter also resulted in a qualified audit opinion being issued on the financial statements for the year ending 30 June 2015 for the Department of Treasury & Finance (DTF).

As detailed in the Auditor-General's Annual Plan 2015–16, tabled in Parliament in June 2015, a Performance Audit of the EWL project has been undertaken. The audit reviewed the key project decisions, costs, events and related advice influencing the project's financial outcomes.

The report on this audit is scheduled to be tabled in Parliament in December 2015.

Department of Education & Training

A disclaimer audit opinion has been issued on the financial statements of DET for the year ending 30 June 2015. The disclaimer audit opinion was issued because DET was unable to provide, and therefore we were unable to obtain, sufficient appropriate audit evidence to support all the balances and/or transactions in the financial report, and those transactions and balances combined had a significant effect on the financial report.

The transactions and balances highlighted within the DET audit opinion are material to the AFR and it was determined that the following financial statement line items were materially impacted:

- land, buildings, infrastructure, plant and equipment—$16.8 billion impact

- land, buildings, infrastructure, plant and equipment revaluation surplus reserve—$7.4 billion impact.

As a result, the audit opinion for the AFR has been modified to include a qualification on these balances.

DET has failed to maintain proper accounts and records, including a complete and accurate asset register to support the property, plant and equipment balance reported in its financial statements. This is a breach of the Financial Management Act 1994 (the FMA), and led to the Auditor-General being unable to obtain sufficient appropriate audit evidence to support a clear opinion.

The asset register issues for property, plant and equipment are not new, having been reported to DET over the past two financial years. DET have not adequately addressed these issues which has caused the audit opinion on the AFR, and DET's financial statements to be modified.

Further comment on the results of the audit of DET will be included in our Portfolio Departments and Associated Entities: 2014–15 Audit Snapshot report, to be tabled in Parliament in December 2015.

Resolution of prior year qualification

The Auditor-General issued a qualified audit opinion on the Annual Financial Report of the State of Victoria, 2013–14 on 2 October 2014.

The qualified opinion was issued regarding the accounting policy applied for measuring the value of school buildings by the former Department of Education & Early Childhood Development (DEECD)—specifically, how economic obsolescence was assessed in calculating a school building's fair value.

This issue has been resolved during the 2014–15 financial year, with DEECD's successor department, DET, changing its accounting policy. An adjustment for economic obsolescence is no longer made to the valuation of school buildings still in use.

DET has made a prior year restatement in their 2014–15 financial statements, which has been incorporated into the 2014–15 AFR. As a consequence, the audit qualification relating to economic obsolescence of buildings by DET in 2013–14 has not been continued in 2014–15.

Delays to the production of the AFR

The FMA requires the AFR to be transmitted to Parliament by 15 October. This date was not met, with the AFR being transmitted by the Treasurer on 4 November 2015, and tabled in Parliament on 10 November 2015.

The timely production of the AFR requires the consolidated entities to produce complete and compliant financial reports in line with a timetable set out by DTF. For 2014–15, the timetable required 47 material entities to provide their draft financial statements to my office by 24 July 2015. Only four material entities (8.5 per cent) achieved this time line.

The financial reporting impacts of the machinery-of-government changes during 2014–15, significant and contentious financial reporting issues which arose during 2014–15, and the loss of financial knowledge and experience at some material entity finance teams in recent years all contributed to the delays in the preparation of the AFR.

Addressing prior period issues

The 2013–14 AFR audit management letter raised a number of issues relating to oversight, scrutiny, and better practice financial management which were applied to the AFR—all based on the obligations of other entities reporting under the FMA.

One important and welcome change this year is that the Treasurer has signed the certification of the AFR. However, although the FMA does not expressly prescribe who should sign the certification of the AFR, it would have been consistent with previous practice for the certification to have also been counter-signed by a chief financial officer in line with Standing Direction 4.2(c), which applies to all other reports prepared under the FMA.

DTF should seek to address our other concerns to ensure that the AFR has the same level of oversight, scrutiny and better practice financial management that is required to be applied by all public sector entities reporting under the FMA.

General government sector

The reported GGS net surplus from transactions was $1 214.0 million. Correctly accounting for the EWL project funding obligation to the Commonwealth Government would have resulted in a net deficit from transactions of $286.0 million. This means that the government has not achieved its key financial measure of a net result from transactions of at least $100 million for the GGS in 2014–15.

Included in the GGS surplus was $841.2 million in dividends received from other state entities. This was $425.1 million more than was included in the 2014–15 State Budget. The Treasurer called upon the State Electricity Commission of Victoria for a $100 million dividend in late June when one had not been budgeted, as well as receiving an additional $31.7 million in interim dividends from three water corporations at the same time.

State of Victoria

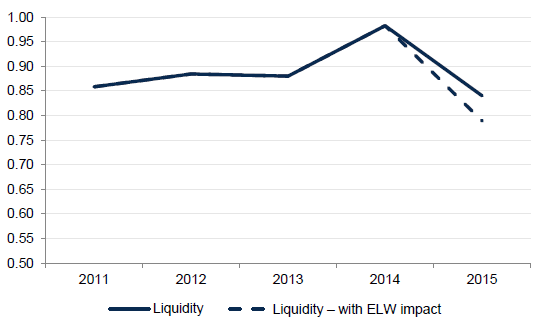

The state's reported financial results for 2014–15 were mixed with a reported deficit of $610.7 million from operations, and the state's liquidity ratio falling from 0.97 to 0.84. The state's liquidity is measured as the proportion of current assets against current liabilities held at 30 June. If the EWL project funding obligation was correctly accounted for, this would see the deficit increase to $2 110.7 million and the liquidity ratio fall to 0.79.

There are positive results for the state's debt sustainability and capital replacement indicators. Debt sustainability remains stable because debt is growing at the same rate as the gross state product. This means the state is maintaining its ability to service the debt. Similarly, the asset replacement indicator remains strong, and suggests that the state is replacing or renewing assets at the same pace at which they are being consumed at the whole-of-government level. This does not negate, however, the asset renewal concerns in specific sectors.

Recommendations

- That material entities, particularly portfolio departments, review the resources and capability of their finance teams and ensure they have the skills and experience to produce accurate and compliant financial statements in a timely manner.

- That the Department of Treasury & Finance needs to apply the same governance, oversight and better practice financial reporting principles to the Annual Financial Report of the State of Victoria that applies to public sector entities reporting under the Financial Management Act 1994.

Submissions and comments received

We have professionally engaged with agencies throughout the course of the audit. In accordance with section 16A of the Audit Act 1994 we provided a copy of this report to the Treasurer and requested his submissions or comments. In accordance with section 16(3) of the Audit Act 1994 we provided relevant extracts of this report to named agencies and requested their submissions or comments.

We have considered those views in reaching our audit conclusions and have represented them to the extent relevant and warranted. Their full section 16A and section 16(3) submissions and comments are included in Appendix C.

1 Context

1.1 Introduction

This report informs Parliament and the citizens of Victoria about the financial outcomes and position of the State of Victoria as at 30 June 2015. It does that by analysing and discussing the Annual Financial Report of the State of Victoria, 2014–15 (the AFR), which was transmitted to Parliament by the Treasurer on 4 November 2015, and tabled in Parliament on 10 November 2015. Figure 1A outlines the structure and contents of this report.

Figure 1A

Report structure

Report part |

Description |

|---|---|

Details what the AFR is; and what makes up the financial statements of the state. |

|

Discusses the audit opinion on the AFR, including the reasons for the modified audit opinion. Reviews action taken against audit findings reported for the 2013–14 AFR. |

|

Provides an analysis of the general government sector outcomes at 30 June 2015. |

|

Provides commentary and analysis on the state's financial result at 30 June 2015. Discusses the financial position of the state at 30 June 2015. |

|

Provides information on the development of significant major projects that are being delivered or planned, including current public private partnerships and the progress of the Port of Melbourne lease. |

Source: Victorian Auditor-General's Office.

This report has been produced in accordance with section 16A of the Audit Act 1994. Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated, any persons named in this report are not the subject of adverse comment or opinion.

The total cost of this report was $170 000.

1.2 What is the AFR?

1.2.1 State of Victoria

The AFR is the State of Victoria's financial statements. It is the key financial accountability document that tells Parliament and the citizens of Victoria what the state's financial position is, and how the state has performed in financial terms over the year.

The AFR consolidates the financial results and financial position of all state-controlled entities. Entities are classified into three categories as detailed in Figure 1B. Transactions between the consolidated entities are removed to avoid double counting.

Figure 1B

Categories of state government entities included in the

State of Victoria financial result

Sector name |

Explanation of sector |

Example of entities in this sector |

|---|---|---|

General government sector |

Entities that provide goods and services to the community, significantly below their production cost. |

Government departments Museums Board of Victoria Country Fire Authority |

Public financial corporations |

These entities deal with financial aspects of the state. They have the powers to borrow, accept deposits and acquire financial assets. |

Treasury Corporation of Victoria Victorian Funds Management Corporation |

Public non-financial corporations |

The primary purpose of these entities is to provide goods and/or services in a competitive market. These services are non-regulatory and non-financial in nature. |

Water corporations Alpine resort management boards Melbourne Market Authority |

Source: Victorian Auditor-General's Office.

The number of entities making up the State of Victoria varies slightly from year to year, as entities are created, merged or disbanded. At 30 June 2015 there were 277 entities (279 entities at 30 June 2014) whose financial results were combined to make up the State of Victoria.

1.2.2 General government sector

As well as showing the financial results of the State of Victoria, the AFR reports on the financial position and performance of the general government sector.

Reporting on this group of entities is important as it allows the government to demonstrate their actual results against the State Budget, published as the Estimated Financial Statements (EFS) in Budget Paper 5.

The EFS relates only to the general government sector and is reviewed (not audited) by the Auditor-General at the time of production.

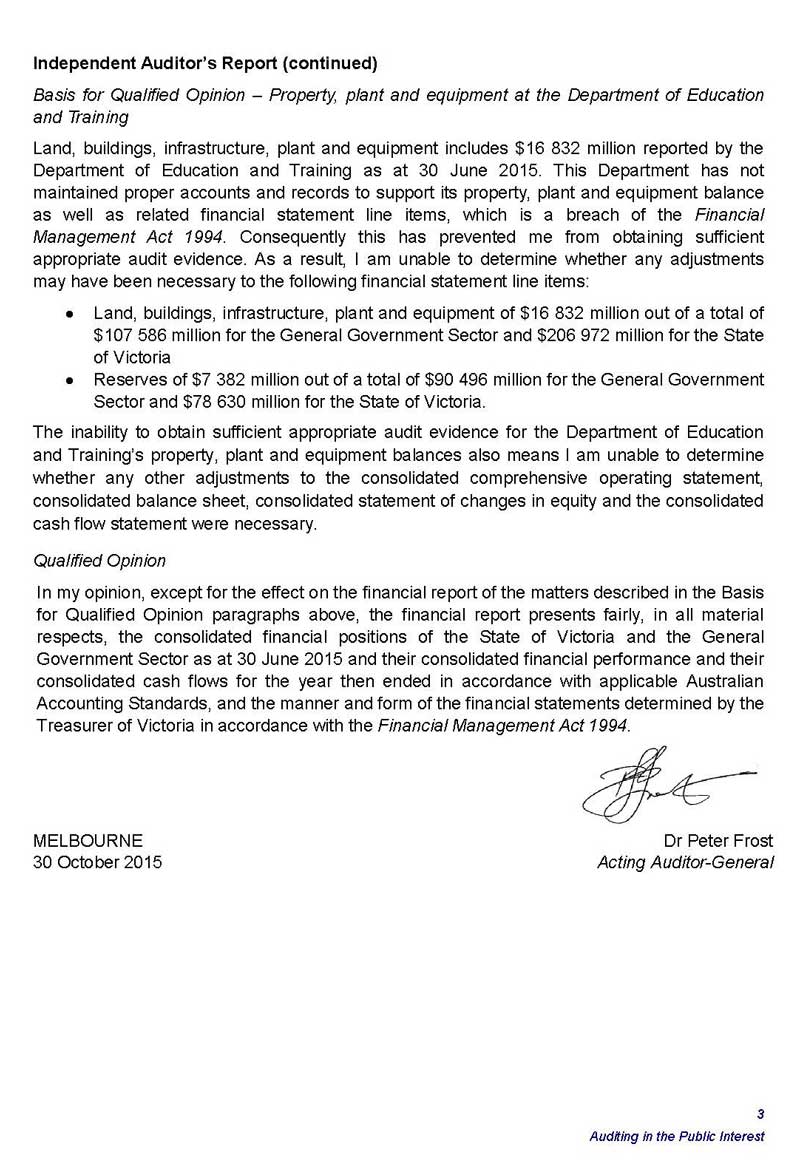

How the general government sector fits into the AFR

Figure 1C shows the difference and relationship between the AFR and the general government sector.

Figure 1C

Entities included in the Annual Financial Report of the State of Victoria

Source: Victorian Auditor-General's Office.

Material entities

Of the controlled public sector entities, 47 were deemed by the Department of Treasury & Finance and my office to be 'material' entities for 2014–15 (48 in 2013–14). A public sector entity is classified as material when its individual financial operations are significant in the reporting of the consolidated finances of the state. Collectively, material entities account for more than 90 per cent of the state's assets, liabilities, revenue and expenditure.

1.2.3 Entities excluded from the AFR

The AFR only reports on state-controlled entities. Therefore, other entities which provide public services, and which may be expected to be included in the AFR, have been excluded as they are not controlled by the state for financial reporting purposes. These entities are detailed in Figure 1D.

Figure 1D

Sectors not included in the AFR

Sector |

Rationale |

|---|---|

Local government |

Local government is a separate tier of government with councils elected by, and accountable to, their ratepayers. |

Universities |

Universities are primarily funded by the Commonwealth Government, and the state directly appoints only a minority of university council members. |

Denominational hospitals |

Denominational hospitals are private providers of public health services and have their own governance arrangements. |

State superannuation funds |

The net assets of state superannuation funds are the property of the members. However, any shortfall in the net assets related to certain defined benefit scheme entitlements of the state's superannuation funds are an obligation of the state and are reported as a liability in the AFR. |

Source: Victorian Auditor-General's Office.

2 2014–15 audit opinion

At a glance

Background

The Auditor-General undertakes a financial audit of the State of Victoria's Annual Financial Report (AFR) in accordance with section 9A of the Audit Act 1994.

A qualified audit opinion was provided on the AFR on 30 October 2015, indicating that there are transactions and balances within the statements which the Auditor-General has determined are not accurate, and some which are not supported by sufficient appropriate evidence.

Findings

- Two qualifications were included in the modified audit opinion because:

- the AFR did not record the state's obligation to return the East West Link project funding as an expense and corresponding liability

- the property, plant and equipment balances at the Department of Education & Training were not supported by proper accounts and records.

- When the obligation to return the East West Link project funding is recorded, the net result from transactions becomes a loss of $286 million and consequently the government has not achieved the key financial measure of a net result from transactions of at least $100 million for the general government sector.

- Only four of the 47 material entities achieved the Department of Treasury & Finance reporting time frames for material entities to provide draft financial statements to my office. This was a major cause of the AFR missing the legislative time frame for transmitting the AFR to Parliament by 15 October.

Recommendations

- That material entities, particularly portfolio departments, review the resources and capability of their finance teams and ensure they have the skills and experience to produce accurate and compliant financial statements in a timely manner.

- That the Department of Treasury & Finance needs to apply the same governance, oversight and better practice financial reporting principles to the Annual Financial Report of the State of Victoria that applies to public sector entities reporting under the Financial Management Act 1994.

2.1 Introduction

The Auditor-General undertakes a financial audit on the State of Victoria's Annual Financial Report (AFR) in accordance with section 9A of the Audit Act 1994.

Independent audit opinions add credibility to financial statements by providing reasonable assurance that the information reported is reliable and accurate. A clear audit opinion confirms that the financial statements present fairly the transactions and balances for the reporting period, in accordance with the requirements of relevant legislation. A qualified audit opinion is issued where a clear statement cannot be made by an auditor that financial statements are fairly presented in all material respects.

2.2 Audit opinion for year ending 30 June 2015

The Auditor-General issued a qualified audit opinion on the AFR on 30 October 2015. The qualification relates to two areas—the absence of an expense and a liability to recognise the obligation to return the East West Link (EWL) project funds, and an inability to obtain sufficient appropriate evidence for property, plant and equipment assets at the Department of Education & Training (DET). A copy of the opinion is at Appendix A.

2.2.1 East West Link project

At 30 June 2015, the state had an obligation to repay the $1.5 billion received from the Commonwealth Government for the EWL project. However, the AFR did not recognise an expense and provision for this obligation. We do not agree with this omission.

In 2013–14, the Commonwealth Government paid $1.5 billion to Victoria as part of a $3.0 billion contribution to the EWL project. This money was correctly accounted for as revenue in that year in accordance with Australian Accounting Standard AASB 1004 Contributions. Following the state election in November 2014, the EWL project was cancelled.

A memorandum of understanding (MoU) for the project signed by both the Commonwealth Government and the state, and the Nation Building Program (National Land Transport) Act 2009, under which the money was provided, both detailed what was to occur if the EWL project was cancelled. Specifically, if the project was cancelled in its entirety, any payment made on it would be repayable to the Commonwealth Government. Alternatively, the Commonwealth could withhold future funding for the state for other projects to the same amount.

On 12 May 2015, the Commonwealth Government wrote to the Minister for Public Transport and the Minister for Roads and Road Safety requesting the return of all funding previously paid to Victoria for the EWL project. In addition, the Commonwealth accounted for the return of the funding in its 2015–16 Budget.

The cancellation of the EWL project, and the formal request from the Commonwealth Government for the repayment of the funds, means that at 30 June 2015 the state had an obligation to repay the funding. The correct accounting treatment would have been to recognise an expense, and corresponding liability, for $1.5 billion at that time. Australian Accounting Standard AASB 1004 Contributions requires that a liability and an expense be recorded where the conditions of a grant will not be met and the funds are required to be returned. The recognition of a liability in the form of a provision for the return of the funds would also satisfy the requirements of AASB 137 Provisions, Contingent Liabilities and Contingent Assets.

By not recording the $1.5 billion expense and the associated provision as a liability, the State of Victoria and the general government sector's net result from transactions is overstated, and liabilities in the balance sheet are understated. This means that the net result from transactions for the general government sector would change from a surplus to a loss of $286 million, and would see the government not achieve its key financial measure of having a net result from transactions of at least a $100 million surplus.

This issue also resulted in a qualified audit opinion being issued on the financial statements for the year ending 30 June 2015 of the Department of Treasury & Finance (DTF).

While the Treasurer has consistently stated that the money will not be returned to the Commonwealth Government, this intention does not negate the requirement under Australian Accounting Standards to recognise the obligation to return the money.

Subsequent to year end, the Commonwealth Government indicated that it would allow—on a without prejudice basis and under certain specified conditions—the state to treat the funding as a prepayment to fund the Commonwealth Government's future commitments to other projects. This does not mean an obligation to return the funds at 30 June 2015 did not exist, and withholding future funding from the state would, in substance, result in the same outcome.

DTF had previously sought legal advice which concluded that the state did not have a present obligation to return the funds—therefore there was no requirement under Australian Accounting Standard AASB 137 to recognise a liability and corresponding expense. DTF's legal advisers had also sought accounting advice in preparing their advice to DTF. It is our opinion that an expense, and corresponding liability, should be recognised; a present obligation was created when the Victorian Government discontinued the EWL project and the Commonwealth Government requested the funding to be returned, as set out in the MoU and the Nation Building Program (National Land Transport) Act 2009. In our view, this satisfies the broader accounting definitions of a contract and, consequently, an obligation for financial reporting purposes exists at 30 June 2015.

One of the key qualitative characteristics of financial reporting is that transactions and balances are to be accounted for based on substance over legal form. The legal view of the transaction does not override, or determine, the accounting treatment for the transaction. Our position on the correct accounting treatment for the EWL project funding has been confirmed by preeminent independent accounting experts.

As detailed in the Auditor-General's Annual Plan 2015–16, tabled in Parliament in June 2015, a performance audit of the EWL project has been undertaken. The audit reviewed the key project decisions, costs, events and related advice influencing the project's financial outcomes.

The report on this audit is expected to be tabled in Parliament in December 2015.

2.2.2 Department of Education & Training

A disclaimer audit opinion was issued on the financial statements of DET for the year ending 30 June 2015. The disclaimer audit opinion was issued because we were unable to obtain sufficient appropriate audit evidence to support all the balances and/or transactions in the financial report relating to fixed assets and certain school-based financial information. These transactions and balances combined represented a substantial proportion of the financial report, and had a significant effect on the financial report.

The transactions and balances highlighted within the DET audit opinion are material to the AFR and it was determined that the following financial statement line items were materially impacted:

- land, buildings, infrastructure, plant and equipment—$16.8 billion impact

- land, buildings, infrastructure, plant and equipment revaluation surplus reserve—$7.4 billion impact.

As a result, the audit opinion for the AFR has been modified to include a qualification on these balances.

DET has failed to maintain proper accounts and records, including a complete and accurate asset register to support the property, plant and equipment balance reported in its financial statements. This is a breach of the Financial Management Act 1994. Consequently, we were unable to obtain sufficient appropriate audit evidence to support a clear opinion.

Issues with the integrity of data on the asset register at DET are not new, and there has been a steady elevation of these issues by the Auditor-General. In 2012–13, data integrity issues around asset records were reported to DET as a high-risk item that required immediate action. This same issue was raised again in 2013–14 when appropriate action failed to occur. In addition, two high-risk concerns around the lack of timely asset accounting and inadequate reconciliations of the assets register were raised in 2013–14.

DET had provided commitments to:

- improve the capture, store and management of asset information, and to conduct a data cleanse by November 2014

- implement new asset register software to address weaknesses, review governance controls for reconciliation approvals, and provide training to staff on reconciliations by 30 June 2015.

Notwithstanding these commitments, the fixed asset register did not sufficiently support the account balances and transactions, and therefore we could not obtain sufficient appropriate evidence to support the property, plant and equipment balances reported for 30 June 2015.

DET's inability to address areas of concern raised by my office, within a reasonable time frame was also observed in our report Department of Education and Training: Strategic Planning tabled in October 2015. In the instance of the asset register and data integrity issues, the Auditor-General provided DET with an opportunity to work on the issues raised during 2014. However, progress has been slow and largely ineffective, leading to a modification of the audit opinion.

As shown in Appendix C, the DET Secretary's response to this report accepts the issues discussed above, and DET have made commitments to take action to address the concerns. We will, within the bounds of our independence, provide the department with feedback and advice as they work through resolving these issues.

Further comment on the results of the audit of DET will be included in our report Portfolio Departments and Associated Entities: 2014–15 Audit Snapshot, to be tabled in Parliament in December 2015.

2.3 Prior year adjustments

The Auditor-General issued a qualified audit opinion on the Annual Financial Report of the State of Victoria, 2013–14, on 2 October 2014.

The qualified opinion was issued regarding the accounting policy applied for measuring the value of school buildings by the former Department of Education & Early Childhood Development (DEECD)—specifically, how economic obsolescence was assessed in calculating a school building's fair value.

This issue was resolved during the 2014–15 financial year, with DEECD's successor department (DET) and the AFR, changing their accounting policy. An adjustment for economic obsolescence is no longer made to the valuation of school buildings still in use.

Additionally, DTF has issued updated guidance for the public sector on valuing assets as part of the Financial Reporting Directions of the Minister for Finance, promoting consistency in valuation approaches across all entities reporting under the Financial Management Act 1994 (FMA).

DET has changed its accounting policy and made a prior year restatement in its 2014–15 financial statements, which has been incorporated into the 2014–15 AFR. As a consequence, the audit qualification relating to economic obsolescence of buildings by DET and the AFR in 2013–14 has not been continued in 2014–15.

The 2014–15 AFR has also made several adjustments to the figures reported for the 2013–14 financial year. These changes are detailed in note 37 of the AFR, and consist of:

- crown land—the state has an ongoing project to reconcile records regarding parcels of crown land, resulting in the recognition and de-recognition of assets during the financial year

- superannuation—a change in accounting policy regarding the recognition of franking credits relating to the defined benefit superannuation liability, with future franking credits and other tax offsets now recognised when they arise, rather than estimated in advance.

The overall impact of these changes was a reduction in the net result from transactions for the State of Victoria for 30 June 2014 of $7.4 million; and an increase in net assets held of $990.8 million.

2.4 Timeliness of the AFR

As per section 27(d) of the FMA, the audited AFR must be transmitted to Parliament no later than 15 October. The 2014–15 AFR missed this statutory tabling date.

Figure 2A shows that the finalisation of the AFR has been getting later over the past three years.

Figure 2A

AFR finalisation dates

Financial year AFR |

Audit opinion signing date |

|---|---|

2010–11 |

10 October 2011 |

2011–12 |

5 October 2012 |

2012–13 |

27 September 2013 |

2013–14 |

2 October 2014 |

2014–15 |

30 October 2015 |

Source: Victorian Auditor-General's Office.

To meet the statutory date, the preparation and audit of the AFR depends on material entities meeting the timetable set by DTF for the collation of information, and the early identification and resolution of significant accounting and disclosure issues. On 4 August 2015, the former Auditor-General wrote to the Secretary, DTF (and other secretaries) and advised that there were risks to the timely preparation of departmental financial statements that would ultimately have a flow-on effect to the AFR.

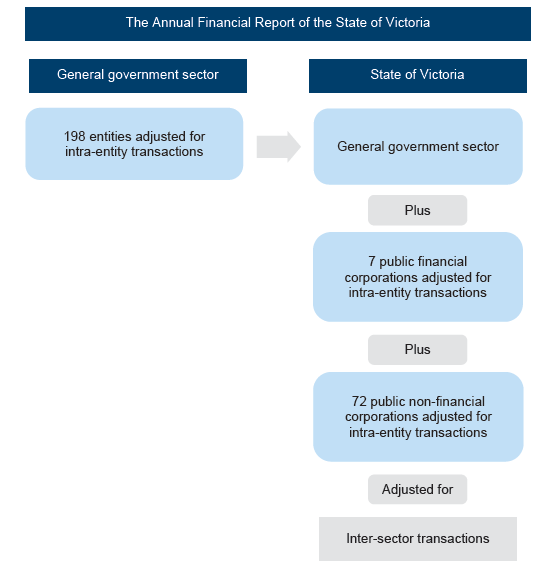

Those risks lead to the eventual delay in finalising the 2014–15 AFR with only four (8.5 per cent) of the 47 material entities providing their draft financial statements to my office by the DTF deadline of 24 July 2015. Figure 2B summarises when complete draft financial statements were provided to audit teams over the 2013–14 and 2014–15 financial years.

Figure 2B

Draft financial statements provided to audit by material

entities,

2013–14 and 2014–15 financial years

Note: Vertical

(green) line shows the date DTF expected material entities to have provided

their draft statements to their auditors.

Source: Victorian

Auditor-General's Office.

The material entity delays were caused by a number of concurrent issues, including:

- machinery-of-government changes during the 2014–15 financial year which, among other things, required the preparation of a final set of financial statements for the former departments to 31 December 2014, and amalgamated statements for the new departments for 30 June 2015

- contentious financial reporting issues in several sectors and the AFR

- a loss of financial knowledge and experience across certain finance teams following the reduction in staff through voluntary departures under the Sustainable Government Initiative, and machinery-of-government changes.

2.5 Unresolved prior period issues

The financial audit of the 2013–14 AFR raised three governance and oversight issues that were bought to DTF's attention and raised in our report Portfolio Departments and Associated Entities: Results of 2013–14 Audits (tabled in February 2015). Figure 2C provides an update on these issues as at September 2015.

Figure 2C

Update on 2013–14 management letter issues

Issue relating to 2013–14 AFR |

Update for 2014–15 AFR |

|---|---|

There is a lack of independent governance and oversight of the AFR as the DTF audit committee has no role on whole-of-government matters—including reports. |

Unresolved |

The AFR is not bound to comply with the Standing Directions of the Minister for Finance or the Financial Reporting Directions—although entities included in the AFR are. This means that the AFR does not disclose some information required by other financial reports—for example, related parties & executive remuneration. |

Unresolved |

The Treasurer does not sign the AFR; nor does the AFR note that the signatories are signing the document on his behalf. |

The 2014–15 AFR was signed by the Treasurer and the Secretary, DTF. The AFR was not signed by a chief financial officer. This is inconsistent with other entities reporting under the FMA. |

Source: Victorian Auditor-General's Office.

DTF has yet to address two of the issues raised in the audit of the 2013–14 AFR, and consequently the same level of oversight, scrutiny and better practice financial management that is required to be applied by all public sector entities reporting under the FMA has not been applied to the AFR.

In addition, while the Treasurer and Secretary, DTF, signed the 2014–15 AFR, the chief financial officer did not. This is not consistent with previous practice and with the standards set by the FMA for applicable public sector entities when preparing financial reports.

Recommendations

- That material entities, particularly portfolio departments, review the resources and capability of their finance teams and ensure they have the skills and experience to produce accurate and compliant financial statements in a timely manner.

- That the Department of Treasury & Finance needs to apply the same governance, oversight and better practice financial reporting principles to the Annual Financial Report of the State of Victoria that applies to public sector entities reporting under the Financial Management Act 1994.

3 General government sector

At a glance

Background

This Part reviews the financial position and performance of the general government sector for the financial year ending 30 June 2015, and provides a comparison of these results against the 2014–15 State Budget for the same period.

Conclusion

The Annual Financial Report (AFR) reported that the general government sector generated a net surplus from operations of $1 214.0 million in 2014–15. If the AFR had correctly recognised the state's obligation to return $1.5 billion funding to the Commonwealth Government relating to the East West Link project at 30 June 2015, the state would not have achieved its key financial measure of at least a $100 million net surplus from transactions for the general government sector.

Findings

- The general government sector reported net surplus from transactions at 30 June 2015 excludes recognition of the $1.5 billion required to be returned to the Commonwealth Government for the East West Link project. If this was correctly accounted for the net result from transactions would have been a deficit of $286.0 million.

- Based on its reported result, the state did not meet its budget target of a $1 326.7 million net result from transactions.

- The state collected $841.2 million in dividends from certain entities outside of the general government sector. This was $425.1 million more than budgeted.

3.1 Introduction

Entities in the general government sector (GGS) provide goods and services to the community, often at no or low cost to users. These goods and services are the core public services provided by the state—therefore measurement of financial performance and outcomes at this level provides information about how economically they have been delivered.

The state prepares its annual budget at this GGS level. In this Part we review and make comment on the financial position and performance of the GGS for the financial year ending 30 June 2015 including an assessment against the published budget.

3.2 Conclusion

The Annual Financial Report (AFR) reported a GGS net surplus from transactions of $1 214.0 million in 2014–15, against a budgeted outcome of $1 326.7 million.

This result excludes recognition of the $1.5 billion Commonwealth Government funding for the East West Link (EWL) project, which the state had an obligation to return at 30 June 2015. If this was correctly accounted for the net result from transactions would have been a deficit of $286.0 million. As a result, it has not achieved its key financial measure of at least a $100 million net surplus from transactions for the GGS.

3.3 Budget to actual

The estimated financial statements (EFS) are part of the State Budget and they set out the expected financial result and position for the GGS for the next financial year, as well as providing forward financial estimates for the outward three years. The EFS is a budget for the GGS sector, not the State of Victoria.

The EFS is reviewed, but not audited, by the Auditor-General, and a review conclusion is published as part of the Budget document. A clear review report was issued by the Auditor-General on the 2014–15 EFS.

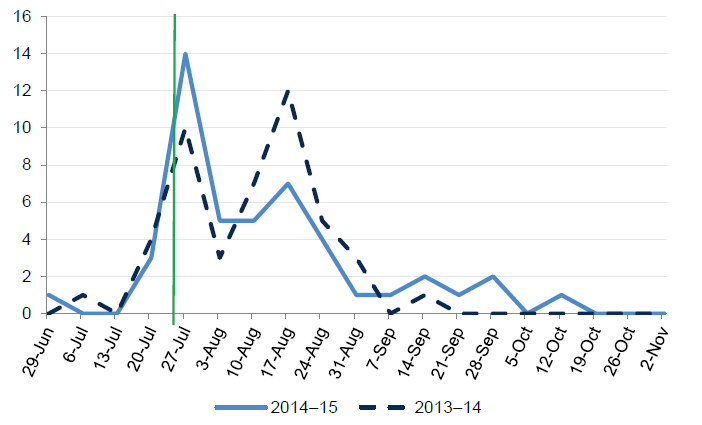

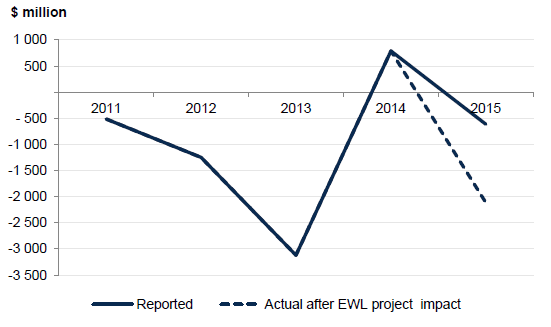

Figure 3A shows a comparison between the actual and budgeted net result from transactions for the GGS for 2014–15 and the previous four financial years. It shows that the actual result for the GGS has varied from the predicted result in most financial years.

In 2014–15, the GGS reported a net result from transactions of $1 214.0 million, against a budgeted result of $1 326.7 million. However to provide context to these results, the total revenue from transactions for the GGS for 2014–15 was $53.8 billion and the budgeted net result from transactions was 2.5 per cent of revenue and the actual net result from transactions was 2.3 per cent of revenue.

Figure 3A

Net result from transactions for the financial year

ending 30 June for the general government sector

Source: Victorian Auditor-General's Office.

The net result from transactions of $1 214.0 million was achieved by omitting the recognition of an expense for the requirement to return the EWL project funding to the Commonwealth Government. Figure 3A shows that the net result from transactions is a deficit if the expense had been correctly recognised as is required by Australian Accounting Standards. A deficit would mean that the government had not achieved its key financial measure of at least a $100 million net result from transactions surplus for 2014–15.

The net result from transactions, as published, shows the 2014–15 result also did not achieve the budgeted outcome of $1 326.7 million, falling short by $112.7 million.

3.3.1 Dividends

In 2014–15, the GGS received $841.2 million in dividends from other state entities outside the GGS. This $841.2 million is more than double the $416.1 million that was budgeted to be received. Details of the budget and actual dividends received by the GGS from other state entities are shown in Figure 3B.

Figure 3B

Dividends paid to the GGS in the 2014–15 financial year – budget to actual

2014–15 Budget ($mil) |

2014–15 Actual ($mil) |

Variance |

||

|---|---|---|---|---|

($mil) |

Percentage |

|||

Public Financial Corporations |

||||

Worksafe Victoria |

109.8 |

241.7 |

131.9 |

120.1 |

Transport Accident Commission |

189.0 |

253.2 |

64.2 |

34.0 |

Treasury Corporation Victoria |

42.6 |

50.6 |

8.0 |

18.9 |

Rural Finance Corporation of Victoria |

0.0 |

17.5 |

17.5 |

100.0 |

State Trustees Ltd |

0.8 |

1.6 |

0.8 |

100.0 |

Victorian Funds Management Corporation |

2.7 |

1.7 |

–1.0 |

–37.0 |

Total Public Financial Corporations Dividends |

344.9 |

566.3 |

221.4 |

64.2 |

Public Non-Financial Corporations |

||||

Melbourne Water Corporation |

16.7 |

21.5 |

4.8 |

28.7 |

City West Water Corporation |

6.3 |

15.6 |

9.3 |

147.6 |

South East Water Corporation |

16.0 |

52.0 |

36.0 |

225.0 |

Yarra Valley Water Corporation |

5.2 |

31.7 |

26.5 |

509.6 |

State Electricity Commission of Victoria |

0.0 |

100.0 |

100.0 |

100.0 |

Victorian Regional Channels Authority |

0.7 |

0.0 |

–0.7 |

–100.0 |

Port of Melbourne Corporation |

24.2 |

33.0 |

8.8 |

36.4 |

Other |

0.0 |

2.2 |

2.2 |

100.0 |

Total Public Non-Financial Corporations Dividends |

69.1 |

256.0 |

186.9 |

270.5 |

Non-government entities |

||||

Other |

2.1 |

18.9 |

16.8 |

800.0 |

Total non-government entities |

2.1 |

18.9 |

16.8 |

800.0 |

Total dividends to the GGS |

416.1 |

841.2 |

425.1 |

102.1 |

Source: Victorian Auditor-General's Office based on Victorian Budget 2014–15 and Annual Financial Report of the State of Victoria, 2014–15, Department of Treasury & Finance.

The extra revenue received as dividends by the GGS was largely due to:

- interim dividends declared in 2013–14 by the Treasurer—from the Transport Accident Commission and WorkSafe Victoria—had been previously deferred; but were paid in 2014–15

- an unbudgeted interim dividend paid by the State Electricity Commission of Victoria of $100 million, determined by the Treasurer on 22 June 2015, for payment by 30 June 2015

- an additional $31.7 million in interim dividends relating to the 2014–15 financial year from three water corporations determined by the Treasurer in late June 2015 and paid on 29 June 2015.

The payment of dividends is determined by the Treasurer, in consultation with the entities impacted. Without the additional $425.1 million of dividends received in the year, the 30 June 2015 reported net result from transactions for the GGS would have been $789.0 million, 40 per cent less than the budgeted result.

4 State of Victoria

At a glance

Background

This Part reviews the financial position and performance of the State of Victoria for the financial year ending 30 June 2015.

Conclusion

The state's financial statements had mixed results for 2014–15. On the positive side, the state's ability to service debt remained stable and spending on new assets and asset renewal appears to be keeping pace with the consumption of assets at the state level. However, the state reported a net deficit from transactions of $610.7 million and has a declining liquidity ratio.

Findings

- The state generated a net deficit of $610.7 million from operations in 2014–15 ($787.6 million surplus in 2013–14). The deficit increases to $2 110.7 million when the obligation to return the East West Link project funding to the Commonwealth Government is correctly accounted for as an expense.

- Liquidity, that is the ratio of current assets over current liabilities, has fallen significantly from 0.97 at 30 June 2014 to 0.84 at 30 June 2015. Recognition of the obligation to repay the Commonwealth Government the East West Link project funding would see it fall further to 0.79. This indicates the state had more short-term liabilities than short-term assets to meet those obligations at 30 June 2015.

- The capital replacement indicator remains above one which indicates that more is being spent on new assets and asset renewal than is being consumed at the total level. However, this may not be representative across all sectors with our reports flagging concern in the hospital and water sectors, and for some state entities.

4.1 Introduction

This Part reviews the financial position and performance of the State of Victoria for the financial year ending 30 June 2015.

4.2 Conclusion

The state's financial statements had mixed results for 2014–15, generating a net deficit from transactions of $610.7 million. While we observed positive indicators for the level of asset renewal and debt sustainability, if the state correctly accounted for the $1.5 billion East West Link (EWL) project obligation at 30 June 2015, there would have been a significant decline in its liquidity position and net result.

On the positive side, although borrowings had a small increase, the state's ability to service this debt has remained stable. Spending on new assets and asset renewal also appears to be keeping pace with the consumption of assets at the state level. This is notwithstanding our sector-based reports flagging asset replacement risks at individual public hospitals, water entities and other state entities.

4.3 Financial performance of the state

To get a complete picture of how the state has performed financially in 2014–15 requires consideration of key measures on both the comprehensive operating statement and balance sheet. Figure 4A provides a summary of key measures in both main statements and a calculation of liquidity. It includes the numbers reported in the Annual Financial Report of the State of Victoria 2014–15 (AFR) and demonstrates the impact on the financial results and financial position of the state if the correct accounting treatment had been adopted for the return of the EWL project funding to the Commonwealth.

Figure 4A

Key balances for the State of Victoria for the financial year ending 30 June ($ million)

|

Year ending 30 June |

Revenue from transactions |

Expenditure from transactions |

Net result from transactions —surplus (deficit) |

Net result— surplus (deficit) |

Net assets |

Liquidity |

|---|---|---|---|---|---|---|

|

2015 – as per AFR |

61 054.0 |

61 664.7 |

(610.7) |

50.7 |

139 909.2 |

0.84 |

|

2015 – accounting for EWL funding return |

61 054.0 |

63 164.7 |

(2 110.7) |

(1 449.3) |

138 409.2 |

0.79 |

|

2014 – as per AFR |

60 273.8 |

59 486.2 |

787.6 |

1 651.9 |

132 083.2 |

0.97 |

Source: Victorian Auditor-General's Office.

The net result from transactions shows the surplus or deficit the state has made from its operational revenue and expenditure for the year. This includes revenue and expenditure attributable to government policy, but excludes changes in values of assets and liabilities due to market fair value re-measurements—such as financial investments and non-financial fixed assets.

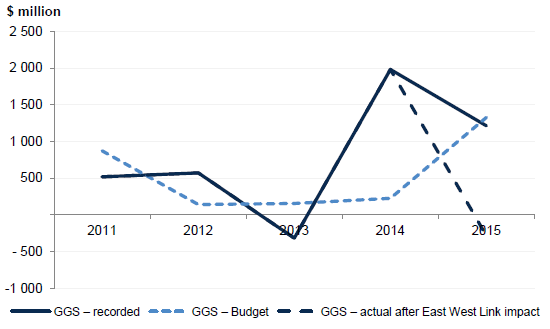

For 2014–15, the state reported a deficit from transactions of $610.7 million. This is a significant change from 2013–14 when the state achieved a net result from transactions of a surplus of $787.6 million. Figure 4B shows the net result from transactions for the state over the past five financial years, and it demonstrates that the surplus in 2013–14 was an unusual occurrence.

Figure 4B

Net result from transactions for the financial year ending 30 June for the State of Victoria

Source: Victorian Auditor-General's Office.

The accounting for the EWL project funding has had a significant impact on the state's finances in the current and previous year. The surplus in 2013–14 was achieved because $1.5 billion in grant funding for the EWL project was provided by the Commonwealth Government during June 2014, $1 billion more than the state was expecting in that year. Conversely, in 2014–15 the broken line in Figure 4B demonstrates the impact on the net result from transactions if the correct accounting treatment had been adopted for the EWL project funding. The net result from transactions would have been a deficit of $2.1 billion.

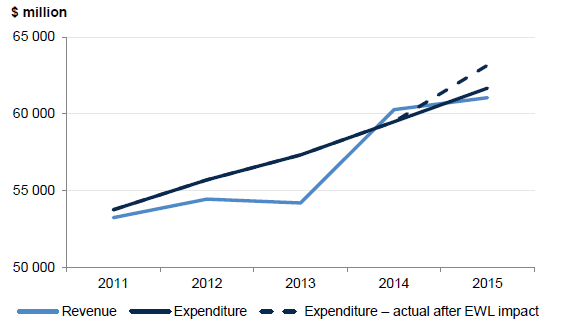

Underpinning the net result from transactions is the fluctuation in revenues the state generates and expenditures that are incurred. Figure 4C illustrates the trends in revenue and expenditure transactions for the state over the past five years.

Figure 4C

Revenue and expenditure transactions for the financial year ending 30 June for the State of Victoria

Source: Victorian Auditor-General's Office.

Figure 4C shows that revenue fluctuates year to year compared to expenditure which has had a steady growth over the past five years. The revenue fluctuations are mainly caused by receipt of Commonwealth Government grants, which are generally significant in amount, but the timing is largely outside of the state's control. Large amounts of Commonwealth Government funding can be provided for capital projects and this fluctuates depending on what projects the state is delivering.

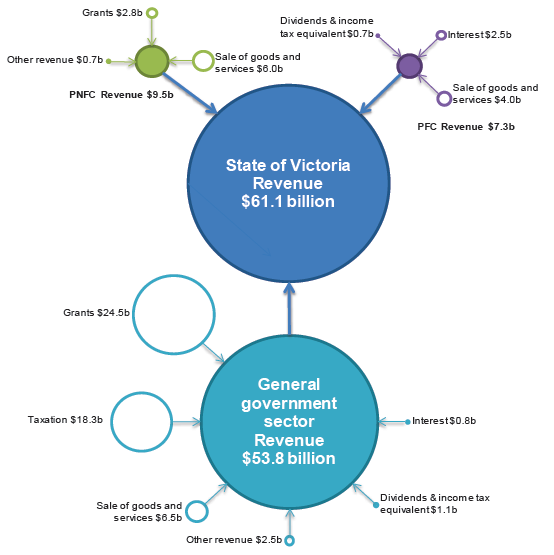

4.3.1 Sources of revenue for the State of Victoria

In 2014–15, the state received $61.1 billion in revenue from transactions ($60.3 billion in 2013–14). As shown in Figure 4D, the largest components of the state's revenue are Commonwealth grants and state taxation.

Figure 4D

Composition of revenue from transactions received by the State of Victoria in 2014–15

Note: Inter-sector transactions of $9.5 billion (in 2014–15) eliminated from consolidation to State of Victoria.

PNFC = Public Non-Financial Corporation. PFC = Public Financial Corporation

Source: Victorian Auditor-General's Office.

Grants from the Commonwealth Government accounted for 39.9 per cent of the revenue that the state received in 2014–15 (41.5 per cent in 2013–14), and is the state's largest source of revenue. Taxation made up 29.4 per cent of revenue (27.3 per cent in 2013–14).

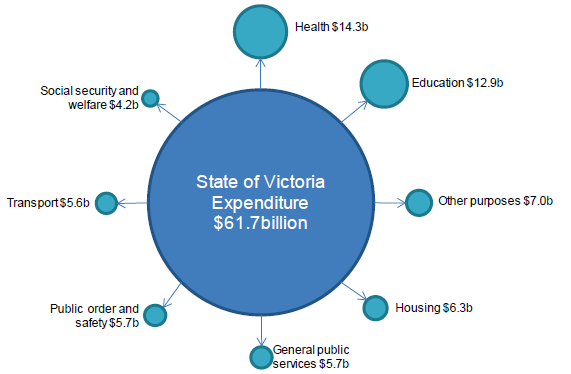

4.3.2 Expenditure reported by the State of Victoria

As reported in the AFR, in 2014–15 the state incurred expenditure of $61.7 billion ($59.5 billion in 2013–14) primarily on the delivery of services to, and maintenance of infrastructure for, the Victorian public (expenditure from transactions).

Almost half of the state's reported spending was on health and education as shown in Figure 4E which depicts the services on which the state is spending its money.

Figure 4E

Composition of expenditure from transactions reported by the State of Victoria in 2014–15

Source: Victorian Auditor-General's Office.

To deliver services, the principal costs that the state incurs are employee expenses and the purchase of goods and services. A further $4 453.7 million of expenditure is depreciation ($4 334.1 million in 2013–14) which approximates the level of assets consumed in the financial year to deliver the state's goods and services.

4.4 Financial position

4.4.1 Liquidity

An internationally accepted indicator of short-term financial health is the ability to pay all short-term financial obligations as they become due. Liquidity is measured by comparing the state's current assets against current liabilities. A ratio of more than one indicates a low risk in meeting short-term obligations as there are more cash and liquid assets than short-term liabilities. The stronger the ratio the better able you are to meet ongoing and unexpected costs.

The state's liquidity was less than one at 30 June 2015. Figure 4F graphs the state's ratio of current assets over current liabilities over the past five years, and shows that liquidity has always been below one and it has significantly declined from 2014 to 2015.

Figure 4F

Liquidity ratio as at 30 June for the State of Victoria

Source: Victorian Auditor-General's Office.

The decline in liquidity from 0.97 at 30 June 2014 to 0.84 at 30 June 2015 is driven by an increase in current borrowings of $1.4 billion; which has been moved from longer-term borrowings by the state's financial entity, Treasury Corporation of Victoria. The change in the composition of the state's borrowings has been undertaken to take advantage of low interest rates for shorter-term borrowings.

When the correct accounting treatment is applied to recognise a liability for the return of the EWL project funding, the broken line in Figure 4F shows liquidity would decline further to 0.79.

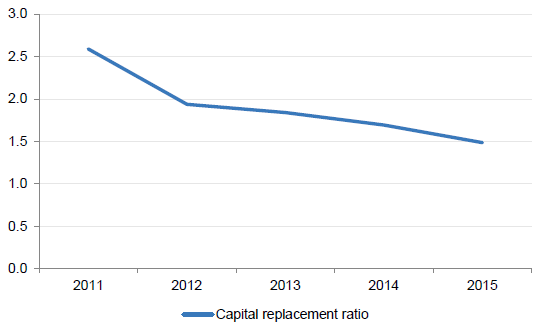

4.4.2 Capital replacement

Maintaining existing infrastructure, and providing new infrastructure, to enable the state to continue to provide services to the community is a significant challenge for the government. An indicator of how well the state is renewing or replacing assets is to compare the spend on assets in the financial year to the depreciation expense. This is illustrated in Figure 4G.

Figure 4G

Capital replacement ratio for the State of Victoria at 30 June

Source: Victorian Auditor-General's Office.

In 2014–15, the state spent $6.6 billion on new and replacement assets, against a budgeted spend of $6 971.5 million on capital projects.

Figure 4G indicates the state is renewing and/or replacing assets at a good rate against their use—as measured through depreciation. However, it should be noted that this ratio can be distorted by large projects for new assets—such as the completion of the Peninsula Link.

It is important to make sure that the state also continues to maintain existing assets, so that services to the Victorian public are not compromised through a lack of appropriate facilities. Analysis included in our sector-specific audit snapshot reports over the past financial years has continually indicated that spending on hospital, water and other state assets has not kept pace with their usage.

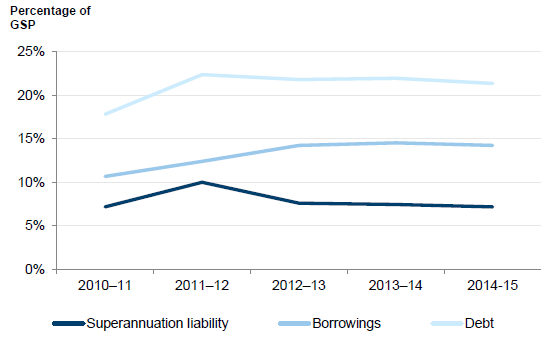

4.4.3 Debt sustainability

In purely financial terms, sustainable debt is the level of debt that can be repaid while balancing factors such as economic growth, interest rates, and the state's capacity to generate surpluses in the future.

The value of borrowings as a percentage of gross state product (GSP) is an indicator of debt sustainability. A low percentage indicates that the state is better able to service its debt obligations.

Figure 4H

Debt sustainability ratio for the State of Victoria at 30 June

GSP = Gross state product.

Source: Victorian Auditor-General's Office.

Figure 4H indicates that the state's ability to service debt is relatively unchanged from the prior year because total debt is growing at the same pace as GSP meaning the state is not making gains in this area. However, debt sustainability has improved compared to recent years when there was a sharp decline that coincided with a sharp increase in borrowings.

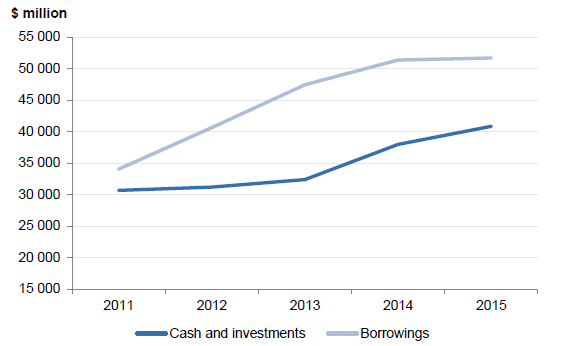

Total borrowings, as depicted in Figure 4I have stagnated this year coming after four years of consistent growth.

Figure 4I

Cash and interest bearing liabilities balances at 30 June for the State of Victoria

Source: Victorian Auditor-General's Office.

The increasing levels of borrowings indicate that the state has been funding large capital projects from borrowings and other sources—such as public private partnerships—rather than through cash. However, the ability to service this debt has not been flagged as a concern.

5 Major projects and significant items

At a glance

Background

This Part provides an update at 30 June 2015 on the following five major projects or significant transactions that impact Victoria—Bendigo Hospital, Victorian Comprehensive Cancer Centre, Regional Rail Link, Ravenhall Prison and the Port of Melbourne lease.

Findings

- The 2014–15 State Budget details around $72 billion worth of projects that were either underway or to be started in the 2014–15 financial year. The state government spent $6.6 billion on purchases of new and replacement assets in this period.

- The Regional Rail Link project was substantially completed at 30 June 2015, and the three other major projects were progressing on time and budget.

- On 5 May 2014, the Treasurer of Victoria and the Minister for Ports confirmed the state's intent to lease the commercial operations of the Port of Melbourne to help fund the government's infrastructure program. Legislation for the lease, the Delivering Victorian Infrastructure (Port of Melbourne Lease Transaction) Bill 2015, was introduced to Parliament in May 2015. In August 2015, it was referred to a Select Committee Inquiry by the Legislative Council for review.

5.1 Introduction

The 2014–15 State Budget provided details of public sector capital projects that were either underway or starting in the 2014–15 financial year. The total value of these projects is around $72 billion.

In 2014–15, the state government spent $6.6 billion on purchases of new and replacement assets.

In the Budget Papers, the government identified 36 of these projects as 'high value, high risk' (HVHR) major projects. These are projects with a budget of more than $100 million, and/or which are considered to have a higher risk profile than normal. As a result, they are subject to increased oversight, particularly from the central agencies such as the Department of Treasury & Finance (DTF), throughout their planning and development phase.

We have previously reviewed the high value, high risk system in our report Impact of Increased Scrutiny of High Value High Risk Projects, tabled in Parliament in June 2014. This report found that the increased scrutiny applied through the HVHR process has improved the quality of the business cases and procurements underpinning government's infrastructure investments. However, these improved practices are yet to ensure that project development and implementation consistently and comprehensively meets DTF's better practice guidelines. This means government is still exposed to the risk that projects fail to deliver intended benefits on time and within approved budgets. A robust HVHR process is critical to effectively managing this risk.

Our subsequent report Applying the High Value High Risk Process to Unsolicited Proposals, tabled in Parliament in August 2015, highlighted that DTF has not consistently applied the HVHR process to unsolicited proposals. DTF's guidance falls short of providing the transparency needed to enable affected stakeholders and the wider community to understand the full impacts of these projects.

Section 5.4 provides an update on another significant project impacting the State of Victoria—the proposed Port of Melbourne lease. This item is discussed as a subsequent event in note 38 of the 2014–15 Annual Financial Report of the State of Victoria (the AFR), but does not impact the financial transactions reported in the AFR. It was included in the 2015–16 State Budget, and may impact assets held by the state in the future.

5.2 Different types of major projects

Of the 34 projects identified by the government as high value, high risk, some are delivered by the government, while others are being delivered using a public private partnership (PPP).

The 19 PPPs for which the state government had outstanding commitments at 30 June 2015 are detailed in note 34(b) of the 2014–15 AFR. Of these, three PPPs are not yet commissioned, meaning that their construction has not been completed. This Part provides an update on these PPPs as at 30 June 2015. They are:

- Bendigo Hospital

- Victorian Comprehensive Cancer Centre (VCCC)

- Ravenhall Prison.

This Part also details the status of the Regional Rail Link—a major project—as at the same date.

What are public private partnerships?

A PPP is a long-term contract between the public and private sectors generally covering the design, construction, maintenance, management and financing of an infrastructure asset. Common characteristics of a PPP are:

- the private entity funds the design and construction of the asset

- the private entity manages the asset for an extended period—usually over 20 years—and usually leases it to a public sector entity

- the public sector uses the asset to deliver services and usually makes a regular payment to the private entity for leasing and maintaining the asset

- after the lease period, the asset is returned to public sector ownership, which can then continue to use, or dispose of, the asset as required.

Auditing PPP arrangements

Due to the complex nature of PPP arrangements, and the high level of public money that will be spent on these arrangements over the life of the contract, it is important that these arrangements are subject to the same scrutiny as other public spending.

However, as the state has increasingly sought partnerships, alliances or other service delivery models involving the private sector, the provisions of the Audit Act 1994 have failed to keep pace with these developments. As a result, the Auditor-General's mandate to review public expenditure on large projects has diminished. This means that PPPs cannot be held to the same level of transparency or accountability as other areas of public spending.

5.3 Analysis of selected major projects

5.3.1 Bendigo Hospital Redevelopment PPP

The Bendigo Hospital development involves the construction of a new hospital on a site adjacent to the existing hospital. The project is being delivered in the following stages:

- stage 1—development of a new hospital, an integrated cancer centre, 372 inpatient beds and an 80 bed integrated mental health facility

- stage 2—development of a multi-storey car park and helipad.

The Department of Health & Human Services (DHHS), in consultation with Bendigo Health, is responsible for delivering the project.

In May 2013, the state entered into a PPP with a private sector consortium to design, finance, build and maintain the new hospital for 25 years, before transferring ownership to the state.

Construction of stage 1 commenced in June 2013 and is scheduled to be completed in December 2016. At 30 June 2015, the concrete structure had been completed and the building facade was progressing.

Construction of stage 2 is scheduled to commence in January 2017 and be completed in June 2018.

Cost to the state

Figure 5A details the state's financial commitments to the consortium and other costs it expects to incur over the life of the PPP.

At 30 June 2015, the PPP is progressing on time and on budget. The completed leased asset and liability will be reported in Bendigo Health's financial statements on completion which is expected to occur in December 2016.

Figure 5A

Bendigo Hospital and associated infrastructure:

estimated cost of construction and operation, as at 30 June 2015

Item |

Nominal value ($mil) |

Net present value ($mil) |

|---|---|---|

State's financial commitments to the consortium |

||

Design and construction of the hospital, which will lead to the recognition of a leased asset and liability of the state upon completion of construction—inclusive of GST |

1 367 |

949 |

Quarterly service payments for operation and maintenance over the 25-year term—inclusive of GST(a) |

1 594 |

603 |

Total including GST |

2 961 |

1 552 |

Less GST recoverable from the Australian Taxation Office |

(269) |

(141) |

Total excluding GST |

2 692 |

1 411 |

Other estimated costs of the state |

||

Other project costs—exclusive of GST(b) |

46 |

46 |

Total estimated cost—exclusive of GST |

2 738 |

1 457 |

(a) Discount rate of 8.06 per cent and 8.07 per

cent used to calculate the net present value of the interest portion of stage 1

and stage 2 costs, respectively. Discount rate of 7.18 per cent used to

calculate the net present value of all other operating costs.

(b) Direct costs associated with establishing the

contractual and lease arrangements, critical infrastructure work, fire services

upgrade, demolition, enabling work, and relocation and building of five new

ambulance stations around Bendigo.

Source: Victorian

Auditor-General's Office.

The expected value of the asset will include construction costs which will be funded by a $566.0 million state contribution, payable to the consortium upon commercial acceptance of stage 1 work. As at 30 June 2015, the state had incurred $79.8 million of expenditure relating to this project.

5.3.2 Victorian Comprehensive Cancer Centre PPP

The VCCC is intended to be a world-class cancer centre. Scheduled to be operational by June 2016, the facility will:

- house the relocated Peter MacCallum Cancer Centre

- provide new cancer research and clinical care facilities for Melbourne Health

- provide cancer research space for The University of Melbourne.

VCCC will consist of a north and south facility. In December 2011, the state entered into a PPP with a private sector consortium to design, finance and construct the south facility. The consortium will maintain the south facility for a 25-year period after which ownership will revert to the state. The consortium will also complete the north facility, however, these works do not form part of the PPP and are being delivered under a traditional procurement approach.

At the north facility, four new floors will be constructed on top of an existing Royal Melbourne Hospital building.

At the south facility, a new 13 floor building will be constructed on the site formerly known as the Royal Dental Hospital.

The north and south facilities will be connected by enclosed bridge links crossing Grattan Street, Carlton.

As at 30 June 2015, construction was progressing to schedule.

Construction of the four additional floors is near completion, with internal building fit-out well progressed. The three new clinical floors were handed over to Melbourne Health (the hospital operator) in October 2015. The north facility is scheduled to be completed and available for service delivery in late 2015.

Construction is underway for the south facility, with the building's facade being substantially complete and the internal fit-out progressing. Commercial acceptance of the south facility is scheduled for June 2016.

Cost to the state

North facility

A breakdown of budget, actual and committed expenditure, and the expected completion date for the north facility as at 30 June 2015 is provided in Figure 5B.

Figure 5B

VCCC north facility: budget, actual and committed expenditure, and expected

completion date, as at 30 June 2015

Project component |

Initial Budget ($mil) |

Revised Budget ($mil) |

2013–14 Budget ($mil) |

2014–15 Budget ($mil) |

Expenditure to date ($mil) |

Committed expenditure ($mil) |

Expected completion |

|---|---|---|---|---|---|---|---|

Construction costs |

93.8 |

103.7 |

129 |

132 |

104 |

28 |

2015 |

Source: Victorian Auditor-General's Office.

As at 30 June 2015, costs of $104.0 million had been incurred by the state for the north facility. Upon completion, the state will be responsible for the ongoing operation and maintenance of the north facility.

South facility

Figure 5C details the state's financial commitments to the consortium and other costs it expects to incur on the south facility. As at 30 June 2015, costs of $310.4 million had been incurred by the state for the south facility.

Figure 5C

Victorian Comprehensive Cancer Centre south facility:

estimated cost of construction and operation, as at 30 June 2015

Item |

Nominal value ($mil) |

Net present value ($mil) |

|---|---|---|

State's financial commitments to the consortium |

||

Design and construction of the VCCC south facility, which will lead to the recognition of a leased asset and liability of the state upon completion of construction (inclusive of GST)(a)(b)(c) |

2 312 |

1 155 |

Quarterly service payments for the operation and maintenance over the 25-year term subsequent to construction completion (inclusive of GST) (d) |

888 |

281 |

Total including GST |

3 200 |

1 436 |

Less GST recoverable from the Australian Taxation Office |

(291) |

(131) |

Total excluding GST |

2 909 |

1 305 |

Other estimated costs to the state |

||

Other project costs (exclusive of GST)(e) |

98 |

98 |

Total estimated cost (exclusive of GST) |

3 007 |

1 403 |

(a) The leased asset and liability will be

recognised on commissioning of the new south facility which is expected to

occur in June 2016. The finance leased asset and liability will be reported in

the Peter MacCallum Cancer Centre financial statements in 2015–16.

(b) Includes $300 million that the state will

contribute towards the design and construction of the VCCC south facility

during the construction phase.

(c) Discount rate of 9.17 per cent used to

calculate net present value.

(d) Discount rate of 8.33 per cent used to

calculate net present value.

(e) Management of project development, state

delivered works, ICT, enabling works and relocation allowance.

Source: Victorian

Auditor-General's Office.

5.3.3 Ravenhall Prison PPP