Business Planning for Major Capital Works and Recurrent Services in Local Government

Overview

Victoria's 79 council's collectively spend around $7.6 billion on capital works and recurrent services each year, and manage over $60 billion in community assets and infrastructure.

This audit examined a representative selection of councils to determine whether they had effectively integrated their planning and budgeting, considered the long-term sustainability of selected investments and produced accurate and reliable budgets and forecasts.

While Glen Eira generally manages its planning and budgeting well, considerable improvement is still required by Whittlesea, South Gippsland and Hepburn. The quality of the strategic, financial and asset management plans at these three councils is poor. Objectives, strategies and actions were not clearly specified nor linked to useful performance indicators. Community input into the development of council plans was limited, and these plans, including shorter-term operational plans, are not underpinned by rigorous service and asset management strategies. Consequently, the plans are not sufficiently integrated and do not align well with their annual budgets. Further these councils could not demonstrate that all of their investment decisions were sound, that their services were appropriately targeted, or that they were effective and efficient in meeting community needs.

Business Planning for Major Capital Works and Recurrent Services in Local Government: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER September 2011

PP No 57, Session 2010–11

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my performance report on the Business Planning for Major Capital Works and Recurrent Services in Local Government.

Yours faithfully

![]()

D D R PEARSON

Auditor-General

14 September 2011

Audit summary

Background

Victoria’s 79 councils collectively spend around $7.6 billion on capital works and recurrent services each year, and manage over $60 billion of community assets and infrastructure such as libraries, halls, leisure facilities, parks, roads, and bridges that people use every day.

Councils therefore are custodians of significant public funds, and it is important that the public has assurance that this expenditure is effectively planned, budgeted and managed so that it meets community needs both now and into the future.

In 2003 the Local Government Act 1989 (the Act) was amended, introducing significant change. This included electoral reforms to ensure more democratic representation, governance changes to improve transparency and probity, and more accountable financial management and public reporting.

Following the 2003 legislative reforms a key change was the introduction of a new planning framework for local government. The framework aims to achieve more effective strategic planning for municipalities through greater public input to the development of council plans and budgets, and greater accountability by councils through more transparent performance reporting.

These changes complement previous amendments to the Act in 1999 that introduced the Best Value Principles that encourage councils to engage with their communities more, and to make their services more affordable for and responsive to their communities.

Both the Act and the 2006 Inter-Governmental Agreement Establishing Principles Guiding Inter-governmental Relations on Local Government Matters (the Agreement) commit councils to exercising sound financial management, to strengthen the quality of their planning and budgeting, and to consider the longer-term effects of their decisions.

As councils have had eight years to implement the 2003 legislative reforms, it is timely to review whether their planning and budgeting for assets and services have improved.

This audit examined Glen Eira City Council, City of Whittlesea, South Gippsland Shire Council and Hepburn Shire Council as a representative selection of councils to determine whether they had effectively integrated their planning and budgeting, considered the long-term sustainability of selected investments and produced accurate and reliable budgets and forecasts.

Conclusion

The 2003 amendments to the Act introduced major reforms designed to strengthen councils’ planning, financial management and accountability. It is clear, however, that the intent of these reforms has not been realised.

Focusing on acquitting their minimum statutory obligations, councils have developed plans and budgets without paying sufficient attention to whether they are either effectively integrated or whether they contain useful and appropriate information that supports effective decision-making.

Until they integrate and improve the quality of their planning and budgeting, councils will find it difficult to justify annual rate increases and effectively negotiate for equitable grant and other funding arrangements.

While Glen Eira generally manages its planning and budgeting well, considerable improvement is still required by the other three councils examined before they can provide adequate assurance to ratepayers they are spending their funds appropriately and effectively.

The absence of robust strategic, operational and financial plans supporting annual budget decisions at these councils means they cannot demonstrate that they are effectively managing their costs or that their expenditure decisions are sound.

Findings

Adequacy of planning and budgeting

Glen Eira’s strategic, operational and financial plans were generally sound, but there was substantial room for improvement in the other three councils examined.

Strategic and operational objectives were not clearly specified, nor were they supported by soundly developed strategies, actions and performance indicators. Operational plans also lacked sufficient detail on the service levels, resources and responsibilities required for achieving objectives.

These councils also did not adequately link their plans, nor did their corporate and divisional business plans align clearly with, and demonstrably support, the objectives and strategies in their council plans.

Longer-term financial plans, four-year strategic resource plans and annual budgets were largely consistent and aligned. However, expenditure and asset investment decisions were driven primarily by a focus on improving financial ratios, rather than by priorities emanating from service and asset planning.

While all councils had long-term financial plans going out 10–15 years, there was little assurance they were soundly based because they were not adequately supported by equivalent strategic and/or service and asset management plans. Further, none of the councils examined could demonstrate they adequately consulted their communities on the financial and other consequences of their aspirations when initially developing their council plans.

Glen Eira mitigated this through its ongoing program of community consultation informing its annual Best Value reviews, service delivery decisions and business cases for capital projects, but this was not so at the other councils.

About $1.6 billion, or 60 per cent of the total value of assets at the three councils were not supported by a sound asset management plan. While Glen Eira’s asset management framework was generally sound, significant deficiencies were evident at the other councils. None had up-to-date asset management policies, strategies and plans covering all their major classes of assets. Further, this issue had previously been raised for Whittlesea in our 2002 audit, Management of Roads by Local Government, and for South Gippsland in our 2005 audit, Results of Special Reviews and Other Investigations. It was not evident that these earlier audit findings had been addressed.

Recognising the need to improve their planning and budgeting both Whittlesea and South Gippsland have started implementing changes to their practices. Similarly, Hepburn advised that it intends to act on this audit to address weaknesses identified.

Whittlesea adopted a new planning framework in March 2011 which superseded a more simplistic version in place since 2009. The new framework aims to establish a clear link between the council plan, corporate plan and annual report. South Gippsland also adopted a new integrated planning framework in April 2011, and has since initiated action to achieve greater alignment between its 2011–12 annual budget and the priorities identified in its council plan. Further, Whittlesea, South Gippsland and Hepburn have also recently taken steps to improve their asset management practices.

Local Government Victoria (LGV) in the Department of Planning and Community Development has a role to support best practice and continuous development in local government governance, performance and service delivery. LGV has developed several good practice guidelines to assist councils improve their strategic planning, asset management and performance reporting. However, the consistency of the shortcomings observed across the councils examined indicates that LGV needs to provide more definitive support for councils to improve the quality of their planning and to better link this to their budgeting decisions.

Soundness of investment decisions

Whittlesea, South Gippsland and Hepburn could not demonstrate that councillors received enough information to assess if their proposed investment decisions were sound, or if they were providing community services at an appropriate cost and quality.

Glen Eira’s capital works investments were generally supported by sound business cases but the other councils examined could not demonstrate the merits and long-term viability of their capital works projects. Business cases were not developed, and there was little evidence they had considered life cycle costs, the cost-effectiveness of alternative options, or how the project connected with the council plan and wider asset management strategy.

There was also little evidence that these councils regularly reviewed their services in accordance with the Best Value Principles to inform future spending decisions. Thus, there is little assurance their ongoing expenditures are supported by an adequate understanding of community need or the effectiveness and efficiency of their services.

Whittlesea has a number of initiatives underway designed to improve its investments in capital works and recurrent services. A new major projects department is being established with responsibility for coordinating the capital works program and implementing a project management framework initiated in 2007. Business cases will also be required to support all capital works undertaken from 2011, and all departments will be required to demonstrate compliance with the Best Value Principles in developing their 2011–12 business unit plans.

Recommendations

-

Councils should:

- consult with, and engage, their communities on their ability and willingness to pay for desired services and assets when developing their initial council plans

- better integrate their planning and budgeting practices to support sound decision-making

- develop strategic and supporting divisional business plans for all major services, with measurable objectives clearly aligned to their council plans

- review their asset management frameworks to assure their asset policies, strategies and plans are up-to-date, cover all major asset classes, and adequately inform future investment decisions.

- Local Government Victoria should:

- systematically review the adequacy of council planning and budgeting and, in consultation with stakeholders, provide better targeted support and assistance to councils to address identified weaknesses

- monitor the impact of these support initiatives to inform its future continuous development efforts.

-

Councils should:

- develop business cases for proposed investments in major capital works to demonstrate they are soundly based and that they support the achievement of the council’s service delivery objectives

- rigorously analyse service need, value-for-money, cost, and financial sustainability against defined standards consistent with the Best Value Principles to inform investments in recurrent services.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994 a copy of this report, or relevant extracts from the report, was provided to the Department of Planning and Community Development, Glen Eira City Council, City of Whittlesea, South Gippsland Shire Council and Hepburn Shire Council with a request for submissions or comments.

The Glen Eira City Council acknowledged the request and elected not to make a submission. Submissions were received from the Department of Planning and Community Development, City of Whittlesea, South Gippsland Shire Council and Hepburn Shire Council.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments however, are included in Appendix A.

1 Background

1.1 Introduction

1.1.1 Councils' role in infrastructure and service delivery

Victoria's 79 councils spend around $1.6 billion on capital works each year and collectively maintain over $60 billion of community assets and infrastructure such as town halls, leisure facilities, libraries, parks, roads, bridges and drains, that people use every day.

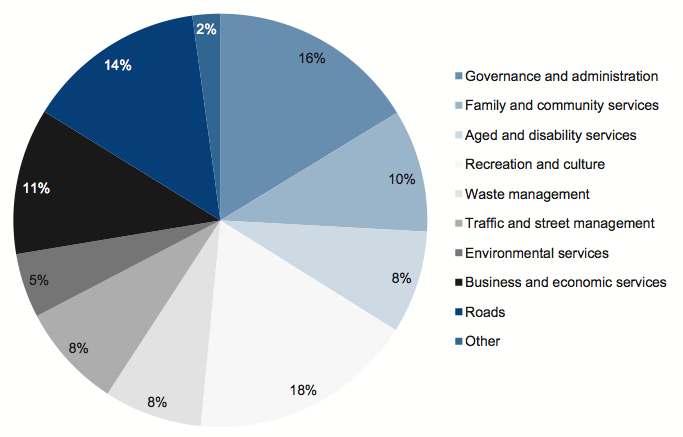

They use these assets and spend a further $6 billion annually to deliver a wide range of services including waste management, recreation, aged, family, and other human services. Figure 1A provides a break down of council recurrent expenditure across the sector.

Figure 1A

Recurrent expenditure for all councils 2009-10

Source: Victorian Auditor-General's Office based on information from the Victorian Grants Commission.

1.1.2 Principles of sound financial management

While the infrastructure and service needs of each municipality can vary, all councils need to manage their finances responsibly to assure their services and facilities meet community needs.

The Local Government Act 1989

The Local Government Act 1989 (the Act) was amended in 2003 to include a requirement that councils apply principles of sound financial management to their planning and budgeting. These principles require councils to:

- prudently manage financial risks having regard to economic circumstances

- pursue spending and rating policies that are consistent with a reasonable degree of stability in the level of the rates burden

- ensure that decisions made and actions taken have regard to their financial effects on future generations

- ensure full, accurate and timely disclosure of financial information relating to the council.

Inter-governmental agreement

The 2006 Inter-Governmental Agreement Establishing Principles Guiding Inter‑Governmental Relations on Local Government Matters further commits councils to sound public governance through good fiscal management, to consider resources and priorities when making decisions, and to improving their strategic planning and developing appropriate pricing regimes.

Sound planning and budgeting helps councils to understand and mitigate the risks of cost shifting. This occurs when other levels of government shift the cost of providing joint services on to local government without a commensurate level of funding support.

1.2 Business planning and budgeting

Effective business planning and budgeting are the basis for sound decision-making.

1.2.1 Requirements under the Local Government Act 1989

The amendments to the Act in 2003 also introduced new corporate and financial planning requirements designed to better align strategic planning with annual planning.

The four-year council plan sets out the strategic objectives of the council, strategies for meeting them, and performance indicators for monitoring their achievement. A strategic resource plan underpins the council plan, and identifies the financial and non-financial resources needed to meet the objectives.

The annual budget describes the activities, initiatives and financial requirements for the year. It should also set out how the activities will contribute to achieving the strategic objectives as well as performance measures and targets for a number of key strategic activities.

Best Value Principles

The Act also sets out the Best Value Principles that should inform council decisions on services. The application of these principles aims to improve local government services by making them affordable and responsive to local needs, and to encourage councils to engage with their communities in shaping councils' services and activities.

The Act identifies the following six principles to guide how a service should be monitored and reviewed on an ongoing basis:

- all services should be responsive to community needs

- each service should be accessible to those community members to whom the service is intended

- a council should achieve continuous improvement in the provision of services to its community

- a council should develop a program of regular consultation with its community in relation to the services it provides

- all services provided to the community should meet cost and quality standards set by the council.

Regular service reviews in accordance with the Best Value Principles enable a council to assess the effectiveness and efficiency of its services, and to take action where necessary to assure its services continue to meet the community's needs.

1.2.2 Integrated business planning and budgeting

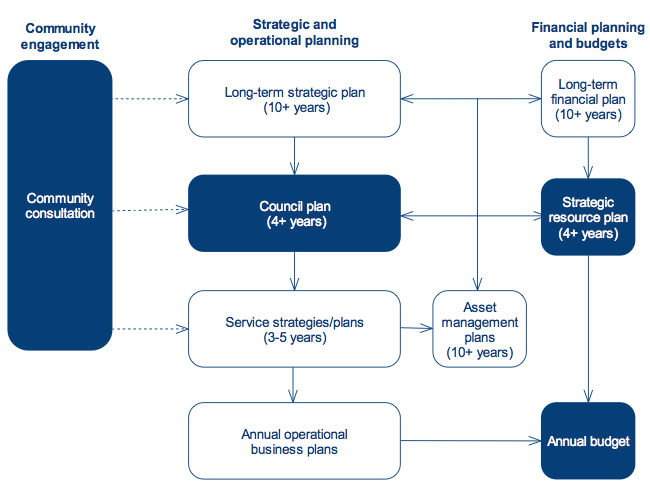

Local Government Professionals (LGPro) 2008 Embedding Community Priorities into Council Planning: Guidelines for the Integration of Community and Council Planning outlines numerous benefits to councils in linking their longer-term community plans with their shorter-term service, asset and council plans, and with their annual budgets and operational plans such as corporate and divisional business plans. Key benefits include aligning the council plan with community values and priorities, and enabling longer-term service delivery and resource allocation decisions that extend beyond the four-year council planning cycle.

The state's Sustaining Local Assets policy similarly highlights the importance of integrating asset management with councils' financial, business and budgetary planning.

Figure 1B, based on these guides, shows how strategic planning, operational planning and budgeting should integrate. The shaded components are those required under the Act. The other components, particularly longer-term strategic and financial planning, represent better practices which are mandated in other jurisdictions such as New Zealand, New South Wales, Queensland and Western Australia.

Figure 1B

Planning and budgeting framework

Source: Victorian Auditor-General's Office.

While not mandated under the Act, 10 to 20 year strategic and financial plans would assist councils acquit their obligation to plan for future generations, and provide contextual clarity for developing shorter-term council plans and annual budgets.

In this context, the council plan, which summarises the financial impact of its goals and objectives over four years, would relate both to the longer-term strategic and financial plans of council, and form the basis for annual budget proposals.

Decisions on capital works, including new projects, and changes to service delivery should be supported by service and asset management strategies, and should also clearly align with priorities in the council plan.

Putting the Best Value Principles into action can help a council improve the effectiveness and efficiency of its planning and budgeting. In 2006, the LGPro Corporate Planner's Network in partnership with the Best Value Commission and Local Government Victoria (LGV) released A guide to achieving a whole of organisation approach to Best Value.

The guide emphasises the value of community consultation, responsiveness to their needs, and accessibility of services to improve the way in which councils plan, and the quality of the plans themselves. Figure 1C, drawn from the guide, outlines how the Best Value Principles can add value to council planning processes.

Figure 1C

Applying Best Value Principles to council planning

| Planning document | Best Value Principle | How Best Value can add value |

|---|---|---|

| Community plan/ longer‑term vision The longer-term vision documents should be formed from consultation. |

Consult with the community | Best Value encourages councils to develop their plans by consulting the local community and other stakeholders. |

| Respond to community needs | The community plan should reflect current and proposed community and user needs. | |

| Council plan The council plan describes the outcomes to be achieved from services and the performance indicators to measure them against. |

Consult with the community | Outcome measures should be linked to the council plan goals. The council plan documents the scope of services agreed in consultation with the community, councillors and staff. |

| Respond to community needs | The council plan documents council's understanding of the community's needs and expectations, as well as mechanisms/strategies for planning for and managing changing needs. | |

| Continuous improvement | Best Value can be included as a council plan objective for continuous improvement. | |

| Strategic resource plan This details how the council plan objectives will be resourced, and is updated annually. |

Quality and cost standards | Councils should assess value-for-money from services and take into account affordability and accessibility. |

| Service/business plan Outlines the strategies and actions for achieving the council plan goals and objectives. |

Consult with the community | Councils can use the process of developing service/business plans to consult further on the needs of specific service users or beneficiaries. |

| Respond to community needs | The service/business plan documents the service scope, and this should reflect the needs of the general community and users, within the available resources. | |

| Quality and cost standards | The service/business plan documents the standards to which the service will be delivered. The standards should at least address quality and cost. | |

| Be accessible | The service/business plan should identify barriers to accessibility and how they will be addressed through actions. | |

| Continuous improvement | The service/business plan should document continuous improvement strategies and actions, and measures of performance improvement. |

Source: A guide to achieving a whole of organisation approach to Best Value, Local Government Professionals (2006).

1.3 The role of Local Government Victoria

LGV in the Department of Planning and Community Development has a role to encourage and support best practice and continuous development in local government governance, performance and service delivery.

The Act requires councils to submit their council plan and annual budget to the Minister for Local Government through LGV. However, LGV does not scrutinise the basis of individual council plans and budgets.

LGV has developed several good practice guidelines to assist councils to improve their strategic planning, asset management and performance reporting.

The April 2009 guide Measuring Up: Linking Planning and Performance, focuses on the links between performance reporting and strategic planning, especially the relationship between a council plan and other documents. Similarly, the March 2009 booklet account-ability sets out councillors' responsibilities in relation to understanding accountability, and highlights the importance of sound financial management including the need for long-, medium- and short-term planning.

LGV's December 2007 report Planning Together: the lessons from local government community planning in Victoria, presents numerous case studies that highlight the differing approaches to community planning adopted by councils, and the need for it to be more integrated with council plans and other planning cycles.

LGV also developed the state's December 2003 Sustaining Local Assets policy to guide the strategic management of council assets. The policy outlines principles to guide asset management planning and decision-making that focus on:

- assuring service delivery needs form the basis of asset management

- integrating asset management with corporate, financial, business and budgetary planning

- informed decision-making, incorporating a life-cycle approach to asset management

- establishing accountability and responsibility for asset condition, use and performance

- sustainability, providing for present needs while sustaining resources for future generations.

The starting point for each council in implementing these principles is to create their own asset policy which establishes the framework for the preparation of their asset management strategy and plan.

The Sustaining Local Assets policy is also supported by the following guidelines designed to help councils put the principles into practice:

-

Guidelines for Developing an Asset Management Policy, August 2004 which provide direction to councils in the preparation of their asset management policy, strategy and plan.

- Local Government Asset Investment Guidelines, August 2006 which assists councils with their asset planning, appraisal and delivery of capital projects including the preparation of business cases.

The Municipal Association of Victoria's Asset Management Improvement 'STEP' program started in 2003 and is supported by consultants who work with councils to assess and assist them improve their local asset management practices. The STEP program recognises the importance of sound asset management and planning as an essential component of effective service delivery.

1.4 Previous audits

Over the past decade VAGO has tabled a number of reports relating to asset management and capital budgeting in local government including:

- Local Government: Results of the 2007–08 audits, November 2008

- Managing Stormwater Flooding Risks in Melbourne, July 2005

- Chapter 10 of Results of Special Reviews and Other Investigations, May 2005, titled 'Capital Budgeting and Management by Local Government'

- Management of Roads by Local Government, June 2002.

These reviews have consistently revealed the need for councils to improve their management of capital expenditure programs; their asset management frameworks and plans; and the linkages between their asset management plans, corporate and business planning and budgetary processes.

1.5 Audit objectives and scope

The objective of this audit was to determine the effectiveness of council business planning and budgeting for major capital works and recurrent services. Specifically, for a representative selection of councils the audit assessed whether they:

- had effectively integrated business planning and budgeting practices to address community needs

- sufficiently considered the long-term financial sustainability of proposed investments in major capital works and recurrent services

- produced accurate and reliable budgets and forecasts.

The audit examined the business planning and budgeting practices for a sample of capital works and recurrent services at the following councils:

- Glen Eira City Council—an inner metropolitan municipality

- City of Whittlesea—an outer metropolitan municipality

- South Gippsland Shire Council—a large rural municipality

- Hepburn Shire Council—a small rural municipality.

The audit examined the planning and budgeting practices at the selected councils during the period 2007–08 to 2010–11.

The audit also examined the role of the Department of Planning and Community Development in overseeing and supporting continuous improvement of council planning and budgeting practices.

1.5.1 Snapshot of audited councils

Figure 1D provides a brief overview of each of the four councils we examined.

Figure 1D

Overview of audited councils

Glen Eira City Council is an established and culturally diverse municipality located in the inner south-east metropolitan area of Victoria. It covers an area of 38.7 km2 and has a relatively stable population of more than 126 000 which is expected to increase to 144 000 by 2026.

In 2010–11 Glen Eira had a budgeted income of $109.3 million, capital works expenditure of $52.9 million and recurrent expenditure of $102.1 million.

The City of Whittlesea is an outer northern metropolitan municipality with an area of 487 km2 and a resident population of around 165 000. It has the third most culturally diverse population in Victoria and is currently the second fastest growth municipality in Australia. The population is presently increasing by 10 000 people every year and forecast to reach around 280 000 by 2026.

In 2010–11 Whittlesea had a budgeted income of $142.7 million, capital works expenditure of $57.1 million and recurrent expenditure of $140.5 million.

South Gippsland Shire Council is a large rural municipality located in Victoria's south‑east with an area of 3 300 km2. It has a resident population of around 27 800 which is forecast to increase to 31 000 by 2026. South Gippsland is home to prominent tourist sites such as Wilsons Promontory National Park, Agnes Falls, and Coal Creek Community Park and Museum.

In 2010–11 South Gippsland had a budgeted income of $40.1 million, capital works expenditure of $15.1 million and recurrent expenditure of $41.9 million.

Hepburn Shire Council is a small rural municipality located in central Victoria with an area of 1 470 km2. It has a resident population of around 14 800 which is expected to increase to 17 150 by 2026. It is a popular tourist area due to the mineral springs around Daylesford-Hepburn Springs.

In 2010–11 Hepburn had a budgeted income of $23.1 million, capital works expenditure of $11.3 million and recurrent expenditure of $21.8 million.

Source: Victorian Auditor-General's Office.

1.6 Method and cost

The audit was performed in accordance with the Australian Auditing and Assurance Standards. The cost of the audit including printing was $410 000.

1.7 Report structure

The report is structured as follows:

- Part 2 examines the adequacy of planning and budgeting

- Part 3 examines soundness of investment decisions.

2 Adequacy of planning and budgeting

At a glance

Background

Where councils' planning and budgeting is of a high quality, communities can have greater confidence that councils provide services that respond to their expectations, and are planning for the needs of current and future generations.

Conclusion

Glen Eira generally manages its planning and budgeting well. However at the other councils there is substantial scope to improve the quality of their plans, and to better align these with budgets.

Findings

- The quality of the plans submitted to the Minister for Local Government varied considerably and there is substantial scope for improvement.

- About $1.6 billion in assets, or 60 per cent of the total value of assets controlled by the three councils were not supported by a sound asset management plan.

- Apart from Glen Eira, strategic, operational and financial plans were not aligned to assure a coordinated strategic approach.

Recommendations

- Councils should:

- consult with, and engage, their communities on their ability and willingness to pay for desired services and assets when developing their initial council plans

- better integrate their planning and budgeting practices

- develop strategic and supporting divisional business plans for all major services review their asset management frameworks.

- Local Government Victoria should more purposefully support councils in improving their business planning and budgeting and monitor the impact of these initiatives.

2.1 Introduction

Effective business planning and budgeting is critical to sound decision-making. The Local Government Act 1989 (the Act) does not require councils to produce a long-term strategic or financial plan. It does, however, require their decisions and actions to have regard to the financial effects on future generations. Thus, while not specifically mandated under the Act, developing such plans is good practice as it assists them in meeting this obligation.

These plans would also assist in developing shorter-term service, asset and council plans, including annual budgets and operational plans such as organisation-wide corporate plans and lower-level departmental business plans.

Developing good quality plans is central to assuring that councils effectively and efficiently meet community needs. This requires engaging with local communities on the feasibility of their immediate and long-term priorities. It also requires measurable objectives linked to these priorities supported by clear strategies, actions and performance monitoring, and clearly identifying the service levels, resources and responsibilities for achieving them.

By closely integrating their strategic, operating and financial plans councils will be better assured that their services are sufficiently funded and delivered at an appropriate cost to the public.

This requires that the goals and objectives of their four-year council plan clearly relate to their longer-term strategic and financial plans and that these form the basis of annual budget proposals.

Additionally, changes to service delivery, including decisions on capital works and new projects, should be supported by service and asset management strategies and clearly aligned with priorities in the council plan. These initiatives should also be reflected in annual operational plans such as the council's corporate plan and in departmental business plans.

This part reviews the adequacy of strategic planning, financial management, and budgeting at the selected councils. It specifically examines the quality of developed plans, and whether the councils' strategic, operating and financial plans are sufficiently aligned to assure sound decision-making.

2.2 Conclusion

Glen Eira's planning and budgeting is well integrated and generally effective.

However, the quality of the strategic, financial and asset management plans at the three remaining councils is poor. Objectives, strategies and actions were not clearly specified nor linked to useful performance indicators. Community input into the development of council plans was limited, and these plans, including shorter-term operational plans, are not underpinned by rigorous service and asset management strategies. Consequently, the plans are not sufficiently integrated and do not align well with their annual budgets.

Accordingly there is little assurance that these three councils have sufficiently identified community needs, that they have appropriate strategies in place to address them, and that they have made sound budget decisions.

2.3 Quality of planning

There was significant scope to improve the quality of the strategic, operational and financial plans of three of the four councils examined.

Glen Eira had an ongoing program of community consultation, but the remaining three councils had not adequately consulted their communities on the feasibility of their priorities in initially developing their council plans. Strategic and operational objectives were not clearly specified, nor were they supported by soundly developed strategies, actions and performance indicators. Operational plans also lacked sufficient detail on the required service levels, resources needed and responsibilities for achieving objectives.

2.3.1 Community consultation

Council planning begins with consulting the community on its needs and expectations for the future, and its ability and willingness to pay for services and assets. The community needs to be well-informed on the social, environmental and financial implications of its aspirations to give the council reliable guidance on its long-term direction.

Glen Eira, South Gippsland and Hepburn have a community engagement policy but only Glen Eira applied it as intended when developing its council plan. South Gippsland and Hepburn could not demonstrate they had adequately sought, considered and analysed community expectations when initially formulating their council plan objectives and strategies. Although both councils sought community feedback after their draft plan was developed, there is little assurance the plans adequately reflect residents' aspirations as the community was not party to its initial development.

Whittlesea does not have a community engagement policy for its council plan. In 2008 it committed to implementing one by 2010, but this is yet to occur. However, it did consult the community on new projects and in formulating its council plan but did not inform the community about the financial and other consequences of its aspirations, or about the efficiency and effectiveness of council's services. So although the results of the consultation were well documented, analysed and considered by the council, it was not evident that it had received fully informed feedback from the community. There was also little evidence to indicate that this had occurred at the other councils when initially formulating their council plans.

Glen Eira mitigated this through its ongoing program of community consultation informing its annual Best Value reviews, service delivery decisions and business cases for capital projects, but this was not so at the other councils examined.

Whittlesea advised that it was in the process of developing a community engagement policy in consultation with community representatives and that it expected to finalise this by December 2011.

2.3.2 Strategic and operational planning

Long-term strategic plans

Only Whittlesea had developed a long-term strategic plan that outlined its vision to 2025. Glen Eira indicated that it intends to start consultation on the development of a 10-year community plan in mid-2011.

Although Whittlesea's strategic plan outlines the long-term vision of the council, in itself it does not provide sufficient assurance that the long-term financial plan is reliable as its development has not been informed by long-term service and asset planning.

Council plans

All of the councils examined had a four-year council plan as required by the Act covering their medium-term objectives; the actions to achieve the objectives and the indicators that measure progress towards them. However these plans had limitations and weaknesses at three of the four councils examined.

South Gippsland's council plan scheduled 60 per cent of its actions for completion in the current year, rather than over the plan's four-year term. South Gippsland has since acknowledged this is unachievable and has developed a draft 2011–12 annual plan with more realistic targets.

Whittlesea's plan confuses lower-level operational tasks with longer-term strategic objectives. It contains 115 'strategies' linked to 30 'strategic outcomes', but many of these are lower level divisional activities, not high level strategies. In recognition of this, Whittlesea began a review of its plan in 2010 to more clearly distinguish its strategies from operational tasks. A new business planning framework has since been adopted and progress has been made in embedding this into council's strategic planning activities for the 2011–12 financial year.

Hepburn's plan does not clearly articulate the council's strategic objectives. While it sets out the councils 'key commitments' for achieving 'Good Governance', 'A More Prosperous Economy', 'Healthy Safe and Vibrant Communities', and 'Environmental Sustainability,' these are aspirational and do not adequately articulate specifically what the council is aiming to achieve. Consequently, they are difficult to measure.

Hepburn's performance indicators were not specific and had no targets. Three-quarters of the performance indicators in the remaining three council plans focused on activities, such as completion of capital works, implementation of a strategy or preparation of a report. As these indicators do not describe the expected impact of the activity they offer little insight into the achievement of objectives and intended outcomes.

Further, at South Gippsland and Whittlesea, their council plans contained 193 and 177 indicators respectively, making them difficult to manage and monitor.

Corporate plans

All councils had corporate or annual plans, but only Glen Eira's, South Gippsland's and Whittlesea's included specific yearly actions, targets and indicators. However, the weaknesses identified in supporting service and divisional business plans at Whittlesea, South Gippsland and Hepburn means there is little assurance at these councils that their corporate or annual plans were adequately focused on achieving the council plan.

Service strategies and plans

Only Glen Eira and Hepburn had strategic plans for the three services examined— aged care, children and recreation—which outline service aims and strategies and were based on community consultation. South Gippsland and Whittlesea had yet to develop strategies for their aged care services, and those in place for their children's services were out of date as they were linked to their previous council plans. Similarly, Whittlesea had no approved plan for its recreation services.

Without approved strategies and plans there is little assurance these councils have adequately identified the service types and levels required to meet community needs, or that appropriate strategies are in place to assure these needs are effectively and efficiently met.

Whittlesea advised that its service plan for children services was in the process of being updated and that adoption of its draft recreation plan by council was imminent.

Divisional business unit plans

Other than Hepburn, all councils had divisional business plans covering the services examined, but those at Whittlesea and South Gippsland were deficient. These plans did not adequately identify the nature and level of services each council was responsible for, or the associated risk and mitigation strategies, and resource requirements. Hence there was little assurance their annual budget decisions were based on a rigorous analysis of resource needs.

Additionally, these councils did not systematically monitor and report on their performance against divisional business plans and the council plan to assess the efficiency and effectiveness of their service delivery and to inform future planning. Thus, there was little assurance their business plans adequately supported the achievement of the council plan aims.

Both Whittlesea and South Gippsland have acknowledged the need to improve their planning and are developing new divisional business plan templates to cover details on service standards, risks and financial information, and how they link to the council plan. Whittlesea has established a Business Planning Steering Committee to oversee the implementation of the new divisional business plans. South Gippsland also advised that it has begun developing quality and cost standards for its services and that it has initiated training for its staff in developing business plans to emphasise these requirements.

Asset management plans

About $1.6 billion in assets, or 60 percent of the total value of assets controlled by Whittlesea, South Gippsland and Hepburn councils were not supported by sound asset management plans. This is a continuing weakness previously raised for Whittlesea in our 2002 audit, Management of Roads by Local Government, and for South Gippsland in our 2005 audit, the Results of Special Reviews and Other Investigations. Neither council has yet improved its practices sufficiently.

All four councils are using the Municipal Association of Victoria's STEP planning process to help improve their asset management planning. Benchmarking audits in 2010 found Glen Eira's asset management framework was generally outperforming the local government sector. However, the benchmarking audits in the other three councils recommended a number of priority actions. These included the need to review and update asset policies and strategies, develop asset management plans for all major classes of assets linked to the long-term financial plan, and the need to develop service standards and targets.

As yet none of the three councils has an asset management framework complying with the state's Sustaining Local Assets policy, which requires a council to develop a local asset management policy, strategy and plans for all major classes of assets.

In the absence of a robust asset management framework, these councils cannot accurately determine their capital expenditure needs or assure that these needs are adequately reflected in their long-term financial plans or annual budgets.

South Gippsland affirmed this situation and advised that there are potentially significant funding requirements for pools, waste management and buildings within its municipality that are currently not reflected in the long-term financial plan because of the absence of adequate asset management plans.

Recognising the need to strengthen their asset management practices these councils have taken steps to improve their asset management. Specifically, Whittlesea advised it is prioritising its resources to improve its asset data and that it intends to commence developing asset management plans for the already identified priority areas.

South Gippsland advised it initiated and completed the Australian Centre of Excellence for Asset Management Stepwatch Program for both its buildings and roads portfolios in the past 12 months. South Gippsland intends to use the insights gained to establish a link between service delivery and asset planning.

Hepburn established a Service and Asset Working Group in 2010 whose role is to review existing asset management practices and assure a coordinated and integrated approach to asset management across the council.

2.3.3 Financial planning

Long-term financial plans

All four councils examined had a long-term financial plan covering 10 to 15 years, designed to assure services are provided in a financially sustainable manner. However, they were not paired with equivalent long‑term strategic plans in any council except Whittlesea.

Further, although these plans were based on assumptions about future demand, the observed weaknesses in service planning and asset management at Whittlesea, South Gippsland and Hepburn means there is little assurance their long-term financial plans accurately reflect future needs.

In the absence of defined service standards and soundly developed asset management plans, the long-term financial plans of these councils have been developed focusing on progressively improving financial ratios to strengthen each council's financial position. As a result, these ratios in isolation rather than in conjunction with rigorous service planning have driven their divisional plans and annual budget decisions.

Strategic resource plans

The audit compared each council's current operating and capital works budgets with the forecasts published in their 2009-10 strategic resource plans to assess the accuracy and reliability of their budgeting and forecasting. The variances in total revenue and expenditure were not material. However, the councils had greater difficulty estimating future capital expenditure, with variances of 14 per cent in Glen Eira, 19 per cent at Hepburn and in excess of 50 per cent for both Whittlesea and South Gippsland.

South Gippsland staff noted that the uncertainty and timing of Commonwealth and state government grant approvals for capital works affected the accuracy of their planning and budgeting. At Whittlesea, the council advised that the 2010–11 budget includes unspent allocations of $15.8 million from the previous year which were not included in the initial Strategic Resource Plan. In addition there was a further variation of around $3.8 million as not all capital works projects adopted in the 2010–11 budget were considered 'fixed'.

Annual budgets

The annual budget process at all councils informs councillors in a timely way of the assumptions underpinning the budget. However, the shortcomings identified at Whittlesea, South Gippsland and Hepburn mean there is little assurance councillors have sufficient, appropriate information to assess the soundness of proposed investment decisions or whether services are of appropriate cost and quality.

2.4 Integrating planning and budgeting

Whittlesea, South Gippsland and Hepburn did not adequately integrate their council plans and budgets to assure councillors could make fully informed and sound decisions. Nor did their corporate and divisional business plans clearly align with, and demonstrably support, the objectives and strategies in their council plans.

Longer-term financial plans, four-year strategic resource plans and annual budgets were largely consistent and therefore demonstrably aligned. However, expenditure and asset investment decisions are primarily driven by a focus on improving financial ratios, rather than by priorities emanating from service and asset planning.

These councils require closer integration between their operational plans and their council plan.

Hepburn did not have divisional business plans to support and implement its council plan. Hence there was little assurance its activities were appropriately focused on achieving its strategic objectives.

South Gippsland had divisional business plans for the three services examined, aged and disability, family, and recreational services. These divisional plans cross‑referenced the key initiatives they contained to actions in the council plan to demonstrate alignment. However, about a third of the initiatives were not clearly linked to the council plan and associated objectives. For example, the aged services business plan identifies reviewing the meals on wheels service as an activity, yet the council plan cross-references this to the unrelated action of 'Community Safety'. Similarly the Maternal and Child Health Services divisional plan lists delivering a range of services to families with children aged 0–6 years as a key activity, but links this to an unrelated council plan action—'Developing a Community Engagement policy'.

Similarly around one-third of the activities in South Gippsland's 2010–11 annual budget were not clearly linked to, or demonstrably aligned with, actions in its council plan.

About half the actions in Whittlesea's 2010–11 corporate plan cannot be identified in its council plan.

The lack of clear linkages and the inconsistencies found between the high level council plans and the supporting plans provides little assurance that the actions these councils are pursuing annually are aligned and will achieve their longer-term council plan strategic objectives.

Whittlesea and South Gippsland have since recognised the need to produce a more coherent planning framework by linking their plans better. Whittlesea adopted a new planning framework in March 2011 which superseded a more simplistic version in place since 2009. The council intends to use the new framework to establish a clear link between the council plan, corporate plan and annual report.

South Gippsland advised that its capacity to address issues with its strategic planning has been adversely affected in recent years by the high turnover of its senior executive staff, but that it has directed significant effort at implementing strategies to reduce debt and strengthen its financial position. South Gippsland also adopted a new integrated planning framework in April 2011, and has since initiated action to achieve greater alignment between its 2011–12 annual budget and the priorities identified in its council plan.

2.5 Local Government Victoria's support to councils

Local Government Victoria (LGV) has a role to encourage and support best practice and continuous development in local government governance, performance and service delivery.

While the Act requires councils to submit their council plan and annual budget to the Minister for Local Government through LGV, the basis of individual council plans and budgets is not scrutinised by LGV. In consequence systemic coordination and continuous improvement opportunities are not being realised.

LGV has several good practice guides to assist councils to improve their strategic planning, asset management and performance reporting. While positive contributions, these are relatively passive initiatives which have not been sufficient to achieve notable progress and improvement in business planning across the local government sector.

LGV advised that it is committed to supporting councils further develop their practices, but that its capacity to do so is limited by its internal resources. However, the consistency of the shortcomings identified across the councils examined indicates a need for LGV to more purposefully assist councils improve their planning and budgeting.

Recommendations

- Councils should:

- consult with, and engage, their communities on their ability and willingness to pay for desired services and assets when developing their initial council plans

- better integrate their planning and budgeting practices to support sound decision-making

- develop strategic and supporting divisional business plans for all major services, with measurable objectives clearly aligned to their council plans

- review their asset management frameworks to assure their asset policies, strategies and plans are up-to-date, cover all major asset classes, and adequately inform future investment decisions.

- Local Government Victoria should:

- systematically review the adequacy of council planning and budgeting and, in consultation with stakeholders, provide better targeted support and assistance to councils to address identified weaknesses

- monitor the impact of these support initiatives to inform its future continuous development efforts.

3 Soundness of investment decisions

At a glance

Background

Each year councils collectively spend about $1.6 billion on capital works and $6 billion on a wide range of services. Given the sums involved, investment decisions need to be soundly based so they support their long-term objectives.

Conclusion

Apart from Glen Eira, the other three councils examined could not demonstrate that all of their investment decisions were sound, that their services were appropriately targeted, or that they were effective and efficient in meeting community needs.

Findings

- Glen Eira's capital works projects were generally supported by sound business cases.

- Around 80 per cent of capital works projects at the other three councils had some elements of a sound business case, but these were not adequate to justify the merits and long-term viability of their projects.

- Whittlesea, South Gippsland and Hepburn have not adequately addressed the Best Value Principles in their service planning.

Recommendation

Councils should:

- develop business cases for each proposed investment in major capital works

- consistent with the Best Value Principles, rigorously analyse service need, value‑for-money, cost and financial sustainability against defined standards to inform decisions to invest in recurrent services.

3.1 Introduction

Councils make significant investment decisions on behalf of their communities, spending around $6 billion in recurrent services and $1.6 billion a year on capital works.

Central to meeting their obligations for sound financial management under the Local Government Act 1989 is the need for councils to demonstrate that their investments focus on significant community priorities, and offer value-for-money to ratepayers.

This requires that councils consider carefully the need for each proposed investment; the risks and cost effectiveness of alternatives; and how the proposed investment supports the sustainable delivery of effective council services. Rigorous business cases supporting proposed capital works, together with effective service planning and review, provide assurance that this is happening.

This part examines whether the councils examined sufficiently consider the long-term financial sustainability of proposed investments in major capital works and recurrent services. Specifically we examined the rigour of councils' business cases for capital works in addition to how well councils analysed their aged care, children, and recreation services before making ongoing investments.

The audit reviewed 40 capital works projects across the four councils examined worth $130 million. Associated expenditure in 2010–11 for these projects across all councils was $76.3 million, accounting for 56 per cent of their budgeted capital expenditure. Similarly, spending on the three services examined totalled $52 million and accounted for 17 per cent of their total combined recurrent budget in 2010–11.

3.2 Conclusion

Investments in capital works are not supported by rigorous business cases at the councils examined except for Glen Eira. This provides little comfort that these councils' investment choices are sound and adequately support the achievement of their long‑term objectives.

Similarly, except for Glen Eira, investments in recurrent services by the other three councils are not supported by adequate analysis of service need, value-for-money, cost and financial sustainability. None of these councils had established cost and quality standards as required under Best Value Principles. Nor had they adequately identified service level and infrastructure requirements to meet anticipated demand.

As a result, these councils cannot demonstrate that their service mix is appropriate, or that their services are efficiently and effectively meeting community needs.

3.3 Investment in capital works

3.3.1 Business cases

It is good practice for investments in capital works to be supported by business cases that demonstrate the feasibility of the preferred option, and how it best meets the service needs of the community. A comprehensive business case includes:

- the scope of the project and the expected outcomes including the anticipated benefits to the community

- details on how the proposed capital expenditure links to the council plan and the asset management plan for the relevant class of assets

- an analysis of alternative options, including a cost-benefit analysis

- the funding sources for the asset such as loans, rates, government grants and/ or private contributions

- an analysis of life cycle costs, including all costs of construction, operation and maintenance over the life of the asset, to assure that the asset will be financially sustainable for its whole lifetime

- expected time lines and milestones, including commencement and completion dates, for the critical stages of the project

- an analysis of risks and mitigation strategies.

The degree of analysis in a business case should reflect the complexity and risks of the project.

At Glen Eira, capital works investments were generally supported by sound business cases, but this was not so at the other three councils examined.

While some elements of a good business case were identified in 80 per cent of the projects assessed at the other three councils, these were not adequate to justify the merits and long-term viability of the projects.

There was no consistency in the good practice adopted by different business units.

The main types of information missing were:

- life cycle costs

- assessment of alternative options

- cost-benefit analyses

- assessments of how the projects aligned with the councils' asset management strategies and plans.

The absence of this information reduces assurance in each case that the project was necessary, that the most feasible option had been identified and assessed, or that the council had adequately considered the costs, benefits and risks associated with the project.

Figures 3A and 3B highlight the cost implications of such deficiencies at Whittlesea and Hepburn.

Figure 3A

Redevelopment of Thomastown Recreation and Aquatic Centre – Whittlesea

Whittlesea's redevelopment of the Thomastown Recreation and Aquatic Centre was adversely affected because a robust business case reflecting the project's final design was not sufficiently developed.

A feasibility study was completed in January 2007 that identified the project's need, various delivery options and an initial budget estimate of $17 million. However, the design of the preferred option was not sufficiently developed at the time construction started in mid‑November 2008. The decision to start the project in the absence of a robust business case was not consistent with good business practice.

The design was changed substantially prior to, and during, the construction phase following consultation with various stakeholders. The ongoing design changes meant that the initial feasibility study was no longer relevant as it did not examine the impact of these changes.

The design changes led to the project's budget being revised to $24.6 million, and to a dispute and negotiated financial settlement with the contractor who was paid a further $570 300 in additional costs incurred as a result of the incomplete design at the start of construction.

The project is presently around $12.9 million (75 per cent) over the initial budget and $5.3 million (21 per cent) over the revised budget.

Source: Victorian Auditor-General's Office.

Figure 3B

Construction of elderly persons units – Hepburn

Hepburn's decision to invest in the construction of three elderly persons units without a business case resulted in it committing $591 000 in its 2010–11 capital budget to a project that it later discovered was not feasible on the selected site.

The risks and costs associated with the project were not sufficiently considered in identifying the preferred option, resulting in the need for an additional $150 000 for unforeseen remedial works on the chosen site rendering the project impractical.

The initial proposal was not soundly based, and to date Hepburn has spent $15 000, including staff time, on the original plans.

Hepburn has since decided to carry forward the project's budget into 2011–12 and to explore alternative sites. A comprehensive business case developed at the outset could have averted this situation.

Source: Victorian Auditor-General's Office.

Although Glen Eira had developed sound business cases for the vast majority of projects examined, three instances of inadequate practice were identified and are outlined in Figure 3C.

Figure 3C

Opportunities to improve business cases for capital projects – Glen Eira

In one case, $300 000 was included in the 2010–11 capital works budget for a dog agility park without a supporting business case. The project was added at the request of councillors but it had not gone through the usual capital evaluation process.

Council staff advised that they do not retrospectively develop business cases when councillors exercise their prerogative to fund such projects. However, this may result in committing funds to projects whose need, scope and feasibility has not been sufficiently recognised. In this case, after $54 500 had been spent, councillors decided in February 2011 not to proceed with the project and to re-evaluate its need following the outcomes of a dog off-leash review by the council.

The business cases for a new maternal child health and kindergarten centre worth $600 000, and the upgrade of ageing shopping centre infrastructure valued at $640 000, did not contain key information needed to demonstrate the rationale for proceeding with the projects: such as a description of why they were needed, an analysis of risks, whole-of-life cost, outcomes of consultations and a cost‑benefit analyses were not included. Nevertheless, funding for each project was approved in the 2010–11 capital works budget.

In the absence of this key information, it cannot be shown that the need, scope and long‑term viability of the projects were adequately considered.

Source: Victorian Auditor-General's Office.

Whittlesea advised that local Precinct Structure Plans and Development Contribution Plans (DCP) for its growth areas identify their infrastructure needs and thus provide the justification for related capital works. It also advised it has a statutory obligation to deliver projects identified within such plans by virtue of their inclusion within the planning scheme. However, while these plans identify future infrastructure needs for some growth areas and estimated costs and timing of construction, they are neither equivalent to, nor preclude the development of, detailed business cases for individual projects.

For example, they do not identify whole-of-life cost for each project such as recurrent maintenance and operating costs, or identify a detailed project scope based on a cost‑benefit analysis of alternative design options, stakeholder consultation, or consideration of project-specific risks and mitigation strategies. This level of detail is normally found within a project-specific business case and is not usually contained within higher level municipality-wide planning documents such as structure plans and DCPs.

Further, as the actual cost of planned infrastructure may vary from present day estimates in the DCP, additional funding may be required to deliver it. This situation emphasises the importance of preparing a detailed business case prior to commencing individual projects identified within such long-term plans.

Whittlesea has a number of initiatives underway designed to improve its management of capital works. A new Major Projects Department is being established with responsibility for coordinating the capital works program, implementing a project management framework initiated in 2007, and delivering major projects. Additionally, Whittlesea advised that business cases will now be required to support every item of capital works that is undertaken from 2011.

3.3.2 Achievements against capital works plans

Glen Eira, Hepburn and South Gippsland spent most of their capital works budgets during the three-year period 2007–08 to 2009-10, collectively spending around 93 per cent of their budgets on average over this time.

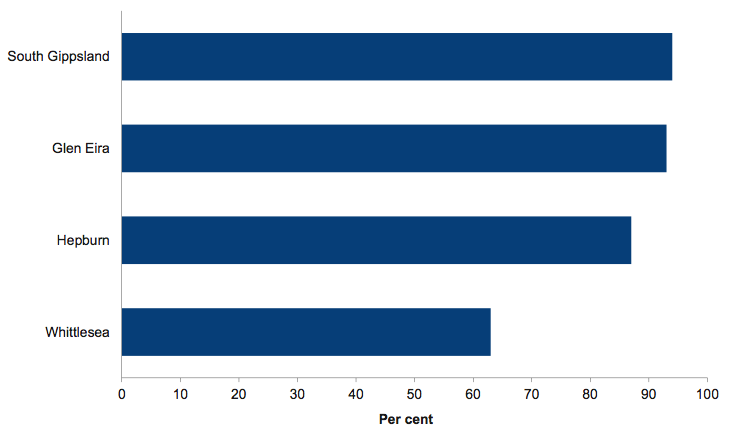

However, Whittlesea only achieved 63 per cent of its budgeted capital works during the same period, representing an under spend of $27.7 million. Figure 3D shows the proportion of capital works expended by each council on average during this three‑year period.

Figure 3D

Proportion of budgeted capital works delivered, 2007–08 to 2009–10

Source: Victorian Auditor-General's Office.

Whittlesea advised that the result was partly due to the receipt of unanticipated extra grants arising from the Commonwealth government's economic stimulus funding. This resulted in scope changes to some of its projects and to the reprioritisation of others. Whittlesea also advised that its response to the February 2009 bushfires significantly impacted on the availability of its internal resources and on the delivery of some capital works projects.

Notwithstanding these recent challenges, council has a history of underspending its capital works budget resulting in a backlog of capital works. This is a further indication of shortcomings in the planning and delivery of its capital works program.

3.4 Investment in services

3.4.1 Achieving Best Value

Whittlesea, South Gippsland and Hepburn have not adequately addressed the Best Value Principles in their service planning. The principles require councils to:

- set service cost and quality standards

- consider value-for-money

- consider community expectations and values

- balance affordability with accessibility of the services.

There was no evidence the three councils had systematically analysed these issues in the services examined. As a result, they were not supporting their recurrent expenditure with an adequate understanding of either community need or the effectiveness and efficiency of their services.

Whittlesea indicated these issues were periodically considered by staff, but acknowledged they were not well documented or systematically reported to council. The council used several ways to get customer feedback on services including regular surveys, focus groups and performance benchmarking. However, these activities were ad hoc, and not part of a systematic program of continuous feedback and improvement.

Whittlesea advised that service level indicators and Best Value reviews will inform the development of its 2011–12 business plans and that all of its departments will be required to demonstrate compliance with the Best Value Principles. The council is also planning to pilot a sustainability review of selected services in September 2011, with the intention of rolling the program across the council.

Glen Eira did Best Value reviews that assessed the quality, cost and responsiveness of its services. However the cost and quality indicators for aged care and recreation services were of limited use. For example, there was no quality standard/target for aged care services and the cost standard used was for the total cost of community care services, incorporating aged care, not the unit cost. Similarly, while quality standards were evident for recreation services, there was no cost standard.

Despite these limitations, Glen Eira did have a range of other useful measures to monitor its services, which if incorporated would enhance its Best Value reviews.

Recommendation

1. Councils should:

- develop business cases for proposed investments in major capital works to demonstrate they are soundly based and that they support the achievement of the council's service delivery objectives

- rigorously analyse service need, value-for-money, cost, and financial sustainability against defined standards consistent with the Best Value Principles to inform investments in recurrent services.

Appendix A.Audit Act 1994 section 16—submissions and comments

Introduction

In accordance with section 16(3) of the Audit Act 1994 a copy of this report was provided to the Department of Planning and Community Development, Glen Eira City Council, City of Whittlesea, South Gippsland Shire Council and Hepburn Shire Council with a request for submissions or comments.

The Glen Eira City Council acknowledged the request and elected not to make a submission. Submissions were received from the Department of Planning and Community Development, City of Whittlesea, South Gippsland Shire Council and Hepburn Shire Council.

The submissions and comments provided are not subject to audit nor the evidentiary standards required to reach an audit conclusion. Responsibility for the accuracy, fairness and balance of those comments rests solely with the agency head.