Consumer Protection

Overview

Consumer Affairs Victoria (CAV) is undertaking compliance

activities designed to identify and deter noncompliance, encourage

voluntary compliance and protect consumers. These activities are

supported by a compliance framework to guide CAV’s compliance and

enforcement officers in their activities, and to inform those it

regulates.

However, a range of administrative weaknesses undermine the

effectiveness and efficiency of elements of CAV’s compliance

activities and its compliance framework. None of the 16 badged

compliance and enforcement officers spoken to during this audit—out

of a total of 45—were aware of more than two of CAV’s 14 compliance

and enforcement guides and procedures. This lack of knowledge

increases the risk that compliance functions are not undertaken in

line with the principles of consistency, transparency and

proportionality.

Weaknesses with its compliance data, and an underdeveloped

performance monitoring and reporting framework, means that CAV

cannot be assured about the reliability of its reported performance

data. CAV also cannot determine how effective, efficient and

economical it has been in performing its regulatory functions, or

whether it is achieving its stated goals.

CAV has started to address some of the issues this audit had

identified, but needs to do more so that both consumers and traders

can have confidence in it.

Consumer Protection: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER April 2013

PP No 222, Session 2010–13

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on the audit Consumer Protection.

Yours faithfully

Dr Peter Frost

Acting Auditor-General

17 April 2013

Audit summary

Consumer protection is an important and widespread system of laws designed to safeguard the rights of consumers and promote fair trade and truthful information in the marketplace. It aims to protect consumers from:

- unfair trading practices—by educating consumers about their rights and obligations

- losses or damage—by enforcing consumer laws against unscrupulous traders

- unsafe products—by regulating and enforcing product safety standards.

Consumer protection also aims to prevent unlawful trade practices by educating traders about their rights and responsibilities and protecting the marketplace from the unlawful practices of other traders.

Consumers in Victoria are protected by a range of Victorian laws, however, the overarching consumer legislation is the Australian Consumer Law and Fair Trading Act 2012 (ACL). ACL is a single national consumer law that provides uniform consumer rights throughout Australia. ACL and other consumer laws are administered and enforced by Australia's national, state and territory consumer regulators.

Consumer Affairs Victoria (CAV), a division within the Department of Justice, is Victoria's consumer regulator. CAV regulates diverse industries including motor car trading, legal brothels, retirement villages and the retail sector.

Conclusion

CAV is undertaking compliance activities designed to identify and deter noncompliance, encourage voluntary compliance and protect consumers. This includes inspections, education and enforcement activities. These are supported by a compliance framework to guide CAV's compliance and enforcement officers in the activities they undertake, and to inform those it regulates.

However, a range of administrative weaknesses undermine the effectiveness and efficiency of elements of CAV's compliance activities and its compliance framework. None of the 16 badged compliance and enforcement officers spoken to during this audit—out of a total of 45—were aware of more than two of CAV's 14 compliance and enforcement guides and procedures. These officers should know what policies and procedures exist, even if they do not need to know the specific details of each one. This lack of knowledge increases the risk that compliance functions are not undertaken in line with the principles of consistency, transparency and proportionality—particularly for compliance and enforcement officers who are required to perform functions that are unfamiliar to them.

Weaknesses with its compliance data, and an underdeveloped performance monitoring and reporting framework, means that CAV cannot be assured about the reliability of its reported performance data. CAV also cannot determine how effective, efficient and economical it has been in performing its regulatory functions, or whether it is achieving its stated goals.

CAV has started to address some of the issues this audit has identified, but needs to do more so that both consumers and traders can have confidence in it.

Findings

Compliance framework

CAV has developed a framework to guide its compliance and enforcement officers and the activities they undertake, and to inform those it regulates. The framework is based on an integrated compliance approach where the action the regulator takes depends on the level and pattern of noncompliance. It includes a comprehensive compliance policy and procedures, and details the risk-based approach CAV takes for compliance. However, the framework is undermined by a lack of awareness among some compliance and enforcement officers about the policy and procedures.

Compliance policies and procedures

CAV has a comprehensive compliance policy, which is publicly available and transparently outlines its approach to regulating traders and protecting consumers.

Supporting CAV's compliance and enforcement policy are internal procedures and guidance. These include regional operations manuals, investigation guides and procedures which cover compliance activities such as affidavit preparation, briefs of evidence, and property and exhibit handling.

Issues relating to compliance policies and procedures

While CAV has internal procedures and guidance, there are issues around their currency and approval, resulting in uncertainty about their status.

The usefulness of the policy and procedures has also been undermined because not all badged compliance and enforcement officers were aware of the framework and policy, while others differed in their understanding and application of them.

This raises doubt about whether badged compliance and enforcement officers effectively and efficiently undertake compliance and enforcement activities in a way that is consistent, transparent and proportionate.

Before the commencement of this audit, CAV developed a draft Inspectors' Manual, which contained comprehensive guidance for compliance and enforcement officers. CAV's Strategic Management Group endorsed the manual in January 2013, during the conduct of this audit.

Risk identification and prioritisation

CAV has a sound risk identification and prioritisation framework that should enable it to identify areas to focus its compliance activities.

While CAV has a generally transparent approach to detailing how it identifies its risks, the process of translating those risks into priorities is less transparent. The lack of any documented procedures on CAV’s prioritisation process means that it is not possible to assess whether CAV has effectively identified known risks and acted to address them.

Performance reporting

CAV has a performance monitoring framework to assess its performance. CAV also has objectives to guide its actions that are outlined in its corporate plan. However, weaknesses in CAV's performance measures mean that its performance monitoring does not provide a fair representation of its actual performance.

CAV's performance is reported through its annual report, the Department of Justice's annual report and Budget Paper No. 3 (BP3).

Consumer Affairs Victoria's annual report

CAV's annual report includes information about its activities, but does not provide an adequate assessment of its performance. There are no targets or benchmarks against which to compare performance, and it is therefore not possible to assess how effectively or efficiently CAV has performed.

The annual report does not include measures to assess performance against CAV's objectives. The information presented also differs each year, making it impossible to analyse trends.

Given the freedom that CAV has with the reporting format and content of its annual report, there are significant opportunities to improve the quality and transparency of its public reporting to fairly and better represent its actual performance.

Department of Justice's annual report

The Department of Justice's annual report is required by the Financial Management Act 1994 and must contain performance indicators related to its objectives. It contains performance information on the quantity, quality, timeliness and cost of services that the department provides. The same performance information appears in BP3. The department has six output indicators to assess the performance of CAV. These indicators, which have remained generally consistent over the past five years, are identical across both reports.

CAV's three quantity measures are generally consistent with its objectives. This is because:

- information and advice would contribute to empowerment

- inspections, monitoring and enforcement would contribute to protections

- registration and licensing would contribute to a well-functioning market economy.

However, despite being consistent over a period of time and allowing trend analysis, the measures do not in themselves provide sufficient information about whether CAV has achieved its objectives.

While the cost measure reflects the costs of CAV's activities on an output basis, both the timeliness and customer satisfaction measures are not appropriate. There is inadequate information to determine which services were, and were not, provided within agreed time frames. There is also inadequate information in relation to which services customers were, or were not, satisfied with. As we discuss below, customer service measures only a small part of CAV's activities and services.

Reliability of reported data

Inadequate data collection and reporting practices have resulted in errors in reported data, which diminishes confidence in the accuracy of CAV's reported performance.

CAV's performance measure relating to inspections, compliance monitoring and enforcement activities produces unreliable data. Until recently, CAV's case management system could not differentiate between these activities which meant that CAV used unreliable manual stand-alone databases to count and report on activities in its annual report. CAV has recognised these limitations and is working to improve the way it collects and reports data to reflect its current business requirements.

Aggregating the three components into one measure also diminishes transparency. Without targets for each element, it is not possible for Parliament or the public to determine how CAV is performing in relation to each of the compliance and enforcement activities CAV has determined should be reported.

There are weaknesses in relation to CAV's quality measure, which assesses customer satisfaction. Data reported in BP3 over the past two years is inaccurate. This is because CAV used incorrect survey results—surveys from earlier years that had already been reported—to inform its reported performance. As a consequence, the results were higher than they should have been and meant that CAV reported that it has met its targets for customer satisfaction when it had not.

While the difference in reported data is not material, at issue is the inadequacy of the systems and processes supporting BP3 reporting that enabled this to occur, and the absence of transparent information explaining the results.

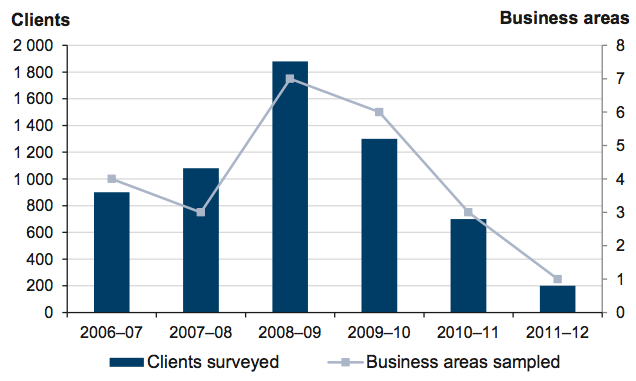

In addition, there are weaknesses in the sampling approach CAV uses to measure customer satisfaction. There has been a significant decrease in the number of people and business areas surveyed. The number of CAV customers surveyed decreased from 1 850 in 2008–09 to 200 in 2011–12 and the number of CAV business areas surveyed decreased from seven in 2008–09 to one in 2011–12. CAV has not acknowledged its limitations in sample selection in any of its reporting. Some areas within CAV have a demonstrated ability to achieve greater performance outcomes than others—licensing, the area surveyed in 2011–12, is one of those areas.

Information management

CAV has a case management system, Resolve, to capture compliance-related information, but the data it contains is unreliable and inaccurate. CAV also maintains manual stand-alone databases to supplement data in Resolve. However, the lack of effective quality control over these databases exacerbates reliability issues.

CAV accepts that there is an increased risk of error in reporting from manual databases but advised that resource constraints have limited investment in more comprehensive data management systems.

Compliance activity business rules

CAV has developed business rules to provide a consistent approach to the capture and reporting of compliance activity data, and to meet its reporting obligations. However, issues with how CAV staff interpret the business rules diminish confidence in the reported compliance activity data.

Despite the importance of a consistent approach, CAV only developed its business rules in January 2012. Before this CAV did not have any documented controls in place to manage the collection and reporting of activity data.

The business rules detail the nature of the compliance activity, including what each activity entails, and how compliance and enforcement officers should record them.

Some regional office staff were not aware that there were business rules on how to count compliance visits to traders—a business activity that commenced in January 2012. Discussions with staff in the CAV head office on how they recorded visits demonstrated there was confusion about whether certain activities were counted as one or two visits. This confusion means that different areas within CAV are recording visits differently, which further exacerbates issues with data reliability.

Compliance activities

Urgent response to serious risk

A core part of CAV's role is regulating product safety, and responding to urgent risks to public health and safety. Under ACL, CAV can place interim bans on consumer goods or product-related services if there is a risk they may cause serious injury, illness or death. Bans make it unlawful to supply, offer to supply, manufacture, possess or have control of the consumer good.

When product safety matters arise, CAV has been swift to act in obtaining interim bans of products through its minister.

Investigations

As part of its compliance activities, CAV undertakes investigations of possible breaches.

CAV has detailed processes in place to manage the decision to proceed with an investigation. However, despite assessment and review by multiple groups, decisions were not adequately documented so there is a lack of clarity about why some decisions to investigate proceeded and others did not.

In the course of this audit, CAV has sought to establish better communication procedures.

Education

CAV's education activities are guided by an overall education strategy, and specific strategies for priority areas. It routinely reviews all its education strategies to assess their effectiveness and recommends whether they should continue. Although these reviews are limited to an internal assessment of the success of individual activities, they allow CAV to more effectively direct its limited education resources.

Enforcement

CAV's documented approach to enforcement actions aligns with better practice. Specifically, this includes:

- actions that are proportionate to consumer detriment and the seriousness of the breach

- a consistent approach with the aim of consistent outcomes

- transparency

- targeting enforcement actions based on risk.

While CAV's compliance and enforcement officers generally perform these actions in line with the compliance framework and policy, there are weaknesses in documenting decisions, which results in a lack of transparency around its enforcement actions.

Staff—particularly compliance and enforcement officers—would benefit from guidelines that set out the key documentation required to be kept on Resolve. In addition, a quality control or quality assurance process would assist CAV in maintaining an appropriate level of consistency and transparency across all Resolve files.

Monitoring enforcement actions

Timeliness measures are important for determining whether matters are being dealt with expeditiously. This includes the timeliness of progressing cases through to enforcement, and on to court action. It also helps to limit consumer detriment by stopping a noncompliant trader from offering goods and services in the marketplace.

CAV has no targets or measures to track the progress of cases through to enforcement action, including the time taken for cases to proceed to court. It is not able to provide data on how long it takes a case to proceed from an initial complaint or finding through to documentation being lodged in court. Without this information, CAV's ability to plan its enforcement priorities, strategies and use of resources is hampered. Consequently, CAV is not in a position to assure itself, Parliament or the community that cases are being dealt with in a timely and efficient manner.

Training

CAV has strong legislative powers to undertake inspections. These powers are administered through compliance and enforcement officers who are appointed by the Executive Director of CAV.

To be appointed, the Executive Director must be satisfied that the person is appropriately qualified or has successfully undertaken appropriate training.

CAV provides its compliance and enforcement officers with appropriate training to be certified as inspectors. However, there is no advanced operational training that covers key activities, such as taking evidence, the seizure of goods, prosecution and situational awareness. While some CAV compliance and enforcement officers may have a strong background in undertaking inspections, there are others who would benefit from formal training.

CAV provides regular legislative training to compliance and enforcement officers, however, this is only one aspect of the training required. CAV needs to provide all compliance and enforcement officers regularly with situational awareness training to mitigate the risks associated with hostile situations when undertaking inspections.

Recommendations

Consumer Affairs Victoria should:

- assess the status and currency of its compliance and enforcement policy and procedures, and update as required

- establish processes to routinely provide compliance and enforcement officers with information about its policies and procedures, including testing their awareness

- document the process of translating compliance risks into priorities, including the allocation of resources

- develop output and outcome measures that are relevant, appropriate and provide a fair representation of performance

- improve the performance reporting in its annual report so that actual performance is reported against predetermined targets, and comparisons can be made over time

- strengthen controls around the use of data to inform performance reporting, to avoid the incorrect use of data

- provide additional information in Budget Paper No. 3 for customer satisfaction to make the method and sample size transparent

- establish robust information management systems, including quality assurance mechanisms that provide it with assurance around data reliability.

- inform all Consumer Affairs Victoria and regional office compliance and enforcement officers of its business rules for counting activities

- re-evaluate its current case progression process for investigations to identify and implement areas to improve efficiency

- establish guidelines and a quality control process about maintaining inspection and investigation files on Resolve

- establish data collection processes to measure time frames for investigations, and utilise that data to formulate investigation targets

- formalise ongoing vocational staff training for its compliance and enforcement officers

- establish a set of outcome measures for its education program and implement a performance measurement strategy.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994 a copy of this report, or relevant extracts from the report, was provided to Consumer Affairs Victoria and the Department of Justice with a request for submissions or comments.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments are included in Appendix A.

1 Background

1.1 Consumer protection

Consumer protection is a system of laws targeted at protecting the rights of consumers, and promoting fair trade and truthful information in the marketplace.

The system aims to protect the most vulnerable consumers in our society from physical and financial harm, including:

- unfair trading practices—by educating consumers about their rights and obligations

- loss or damage—by enforcing consumer laws against unscrupulous traders

- unsafe products—by regulating and enforcing product safety standards.

Consumer protection also applies to traders, by providing education about their rights and responsibilities under various consumer laws. It also works to protect the marketplace from unfair disadvantage and unlawful practices of other traders, such as price fixing or the creation of monopoly companies that have the potential to dominate the marketplace.

1.1.1 Consumer rights and fair trading

Consumers in Australia have legal rights when purchasing goods and services. Laws require that these goods and services meet certain standards and are subject to guarantees, warrantees and refunds where appropriate.

Consumer rights are protected through a range of Victorian legislation, and most notably though the Australian Consumer Law and Fair Trading Act 2012 (ACL).

ACL creates a single, national consumer law that provides consumers with the same rights regardless of where in Australia they purchase goods or services. ACL contains:

- protection against unfair contract terms

- consumer rights provisions on the purchase of goods and services

- a product safety and enforcement system

- unsolicited consumer agreement laws

- simple lay-by agreement rules

- penalties, enforcement powers and consumer redress.

Competition and unfair contract laws also protect consumers and traders from unfair trade practices and protect consumers from unfair sales practices. In some industries, such as motor car trading, real estate and legal brothels, the law requires that traders be licensed so that government can regulate the industry, and provide a higher level of protection to consumers.

ACL is enforced and administered by the Australian Competition and Consumer Commission (ACCC), the Australian Security and Investments Commission (ASIC) and each state and territory’s consumer regulator.

1.2 Consumer Affairs Victoria

Consumer Affairs Victoria (CAV) is Victoria’s consumer regulator. CAV administers and enforces specific Victorian consumer protection laws and also enforces ACL in Victoria. CAV is a division within the Department of Justice (DOJ), and provides services to businesses and consumers. DOJ’s eight regional offices also perform regulatory functions on behalf of CAV.

CAV’s vision is for ‘responsible, confident and informed businesses and consumers’. In 2012–13 CAV set the following goals to help it achieve its vision:

- to empower consumers and businesses to know their rights and responsibilities

- to promote a well-functioning market economy

- to protect vulnerable and disadvantaged consumers

- to reinvigorate the organisation (CAV).

To achieve its vision and goals, CAV delivers a range of services to the community and to government. These include:

- providing information, advice and dispute resolution services to consumers, traders, tenants and landlords

- registering and licensing businesses and occupations through the Business Licensing Authority and managing tenancy bonds

- providing policy advice to government, preparing legislation relating to consumer affairs and administering and enforcing 31 Acts of Parliament

- collaborating with the ACCC, ASIC and other interstate consumer regulators on national consumer projects.

1.2.1 Compliance and enforcement

For compliance to be effective, consumers need to know their rights to be able to assess whether they have been dealt with unfairly. Conversely, traders need to understand how to comply, need to have the capacity to comply, and also be willing to comply.

To achieve compliance in the marketplace, CAV uses an integrated compliance approach. This is a model that regulators commonly use. The integrated compliance approach aims to provide a range of tools to achieve the goal of increased compliance. The tools used to deal with noncompliance are matched to the level and pattern of noncompliance by a particular trader or an industry.

CAV focuses on managing compliance through three core activities:

- encouraging compliance—through education, information and support to consumers and traders

- monitoring compliance—through regular and random inspections, audits, ‘environmental scans’, and intelligence gathering

- responding to noncompliance—by investigating suspected contraventions of the law and enforcing the law by issuing warnings, infringement notices, enforceable undertakings, placing conditions on licences, and prosecution.

Figure 1A shows a number of compliance and enforcement tools available to CAV and the frequency with which they have been used over the past five years.

Figure 1A

Compliance and enforcement activity

Activity |

2007–08 |

2008–09 |

2009–10 |

2010–11 |

2011–12 |

|---|---|---|---|---|---|

Warning letters issued |

n.a. |

332 |

n.a. |

508 |

487 |

Infringement notices issued |

130 |

77 |

119 |

50 |

29 |

Enforceable undertakings signed |

73 |

41 |

28 |

27 |

16 |

Unsafe products seized |

9 800 |

22 163 |

30 815 |

49 006 |

11 164 |

Actions before the courts |

273 |

71 |

80 |

89 |

81 |

Source: Victorian Auditor-General’s Office.

1.2.2 Funding and activities

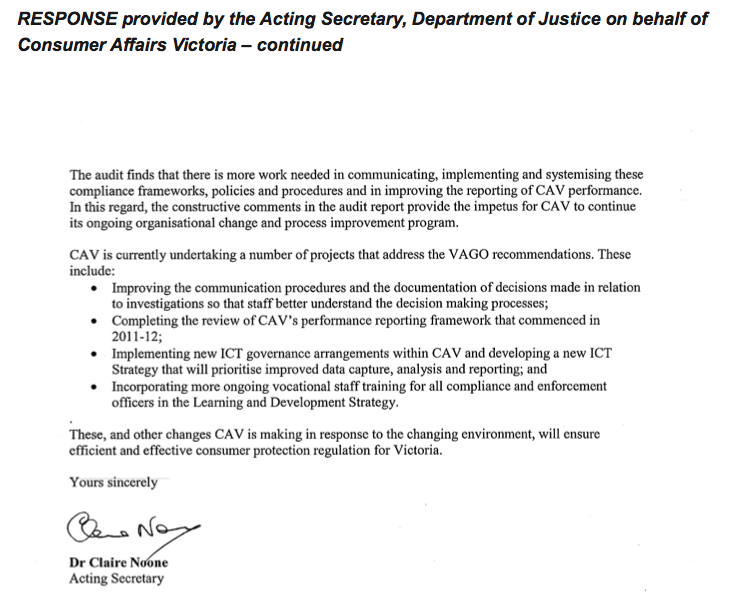

In 2011–12, CAV’s total revenue was around $151 million. Of this:

- $70 million came from estate agent and conveyancer accounts and residential tenancy bonds

- $31 million came from appropriations

- almost $20 million came from interest income—trust fund and residential bonds investment

- about $19 million came from fees income, including fees paid for licences

- $9 million came from the building levy, which the Building Commission Victoria administers

- around $2 million came from recoveries, penalties and transfers.

CAV’s total budget expenditure was around $105 million.

Figure 1B shows CAV’s income and expenditure between 2007–08 and 2011–12. The reduced expenditure in 2011–12 reflects a reduction in CAV grants of around $48 million.

Figure 1B

Consumer Affairs Victoria’s income and expenditure

Source: Victorian Auditor-General’s Office.

Consumer Affairs Victoria's activities

In addition to its core compliance and enforcement activities, CAV undertakes other activities including dealing with consumer and trader enquiries, providing education, and dispute resolution:

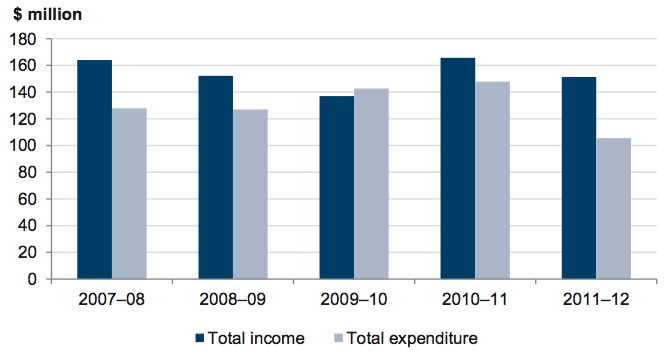

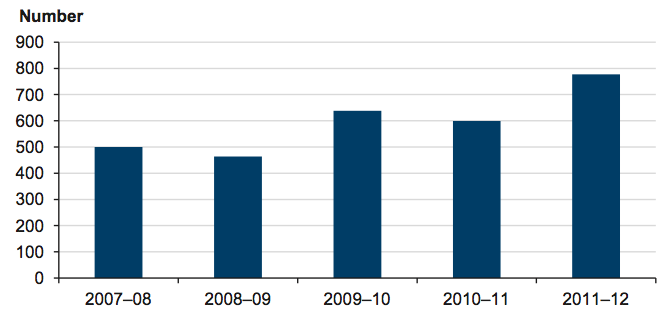

- Over the past five years, CAV has answered, on average, over 500 000 calls each year for information and advice, peaking at around 600 000 in 2008–09.

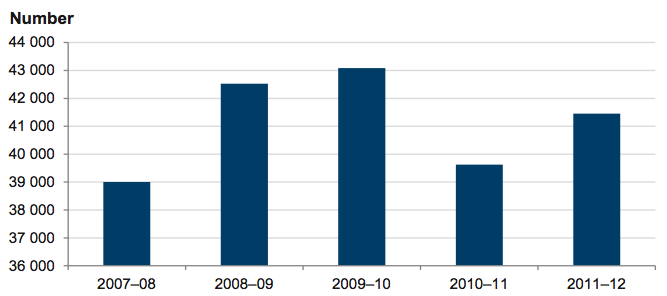

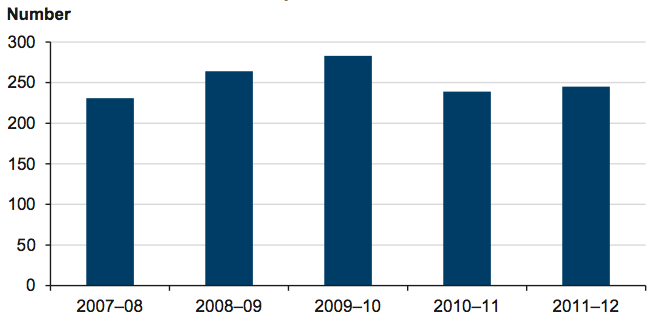

- Counter visits can be made by consumers and traders at the Victorian Consumer and Business Centre or at DOJ regional offices. Visits have been consistent at around 40 000 each year, peaking at 43 000 in 2009–10.

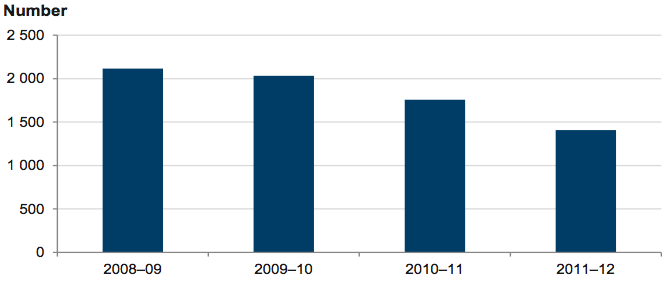

- Over the past two years, the number of community education presentations given by CAV has declined. This is primarily due to CAV shifting its priorities to referring consumers to information online and focusing its education on traders through compliance assistance, rather than consumers. From 1 January 2012—the date CAV commenced counting compliance assistance visits—to 31 December 2012, CAV conducted 5 942 compliance assistance visits. In 2011–12, CAV received 1 468 779 visitors to its website.

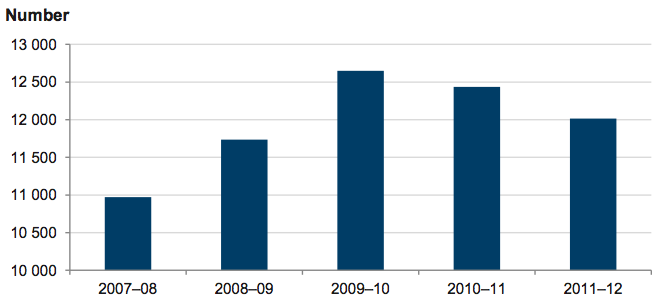

- An important part of CAV’s work is mediating and resolving disputes between consumers and traders. CAV finalises approximately 12 000 disputes per year, with building disputes accounting for around 2 000 disputes each year, and the remainder typically ‘general’ disputes.

Figures 1C–1F show trends over time in these key activity areas.

Figure 1C

Telephone enquiries received by Consumer Affairs Victoria

Source: Victorian Auditor-General’s Office.

Figure 1D

Counter visits received by Consumer Affairs Victoria

Source: Victorian Auditor-General’s Office.

Figure 1E

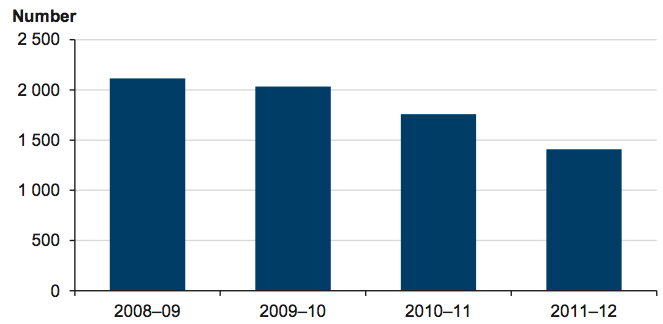

Community education presentations given by Consumer Affairs Victoria

Source: Victorian Auditor-General’s Office.

Figure 1F

Number of disputes finalised by Consumer Affairs Victoria

Source: Victorian Auditor-General’s Office.

1.3 Audit objective and scope

The audit’s objective was to determine the extent to which CAV’s compliance activities effectively and efficiently protect consumers.

In particular, the audit sought to determine whether CAV has:

- applied a sound framework for carrying out compliance and enforcement actions

- adequately assessed its performance to demonstrate its effectiveness in regulating consumer affairs.

This audit reviewed CAV’s approach to protecting consumers during the past five years, focusing on CAV’s education, inspection and enforcement functions with a particular focus on the high-risk areas of rooming houses, motor car traders, unsafe products and sex work.

1.4 Audit method and cost

The audit was performed in accordance with section 15 of the Audit Act 1994 and the Australian Auditing and Assurance Standards. Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated any persons named in this report are not the subject of adverse comment or opinion.

The total cost was $340 000.

2 Compliance framework

At a glance

Background

For Consumer Affairs Victoria's (CAV) compliance activities to be delivered effectively, consistently and proportionately they need to be underpinned by a transparent organisation-wide framework.

Conclusion

CAV has developed a framework to guide its compliance and enforcement officers. However, it is undermined by a lack of awareness among over a third of compliance and enforcement officers, a performance framework that cannot provide CAV with the information it needs to reliably assess its performance, and weaknesses in how it manages its information.

Findings

- CAV has a comprehensive and transparent compliance policy that outlines better practice elements and procedures.

- The usefulness of the policy and procedures has been undermined because over a third of compliance and enforcement officers are unaware of the majority of them.

- It is unclear what guidance some compliance and enforcement officers follow and how they assure themselves that they are adhering to rules and procedures.

- Weaknesses with CAV’s performance monitoring means its reported performance is not a fair representation of its actual performance.

- CAV has limited controls over its information management systems and is consequently unable to assure its reliability.

Recommendations

Consumer Affairs Victoria should:

- assess the status and currency of its compliance and enforcement policy and procedures, and routinely inform compliance and enforcement officers

- develop output and outcome measures that are relevant, appropriate and provide a fair representation of performance

- establish robust information management systems, including quality assurance mechanisms that provide it with assurance around data reliability.

2.1 Introduction

As a regulator, compliance activities constitute a significant part of Consumer Affairs Victoria's (CAV) functions. To enable these activities to be performed effectively and consistently—and for enforcement actions to be proportionate—they need to be underpinned by a transparent, organisation-wide framework. Typically, an effective compliance framework:

- defines an organisation's regulatory responsibilities

- establishes a compliance policy

- describes a risk-based approach to prioritising compliance activities and resources

- establishes a performance management framework to inform the regulator about how effective it has been.

In addition to a framework, regulators need to have reliable compliance information to inform activities and assessments of their effectiveness.

2.2 Conclusion

CAV has developed a generally comprehensive framework to guide its compliance and enforcement officers and the activities they undertake, and to inform those it regulates. The framework is based on an integrated compliance approach, includes a comprehensive compliance policy and procedures, and details the risk-based approach CAV takes to compliance.

However, the framework is undermined because at least one third of compliance and enforcement officers are unaware of the majority of policy and procedures. While elements of a performance framework are evident, these are not sufficient to provide CAV with all the information it needs to determine its effectiveness, efficiency and economy. This is exacerbated by weaknesses in how CAV manages its information.

2.3 Compliance framework

A compliance framework provides regulators with both principles and processes to guide and manage their compliance work. A framework also helps to align the compliance effort of multiple regulators. In the case of consumer protection, the Department of Justice's (DOJ) eight regional offices perform regulatory functions on behalf of CAV, as the regulator.

CAV has based its compliance framework on the concept and practice of integration. This is a principle-based approach that generally aligns with better practice, and is consistent with compliance models used by many regulatory bodies within Australia and around the world.

CAV has developed guidance for its staff on the integrated model, which includes detailed information to support each principle. Additionally, the guidance details the tools available to compliance and enforcement officers, the purpose of the tools and how to apply them with consideration for integration—using compliance tools from across CAV's business units that are most appropriate to the task.

2.3.1 Compliance policy and procedures

A compliance policy is fundamental to effective compliance. It guides and directs a regulator to perform its responsibilities consistently and transparently, and to be accountable for its performance. The policy also guides the regulated community on the regulator’s approach to securing compliance, typically describing its:

- objectives and principles

- responsibilities under legislation

- approach to supporting and monitoring compliance, and responding to noncompliance

- enforcement powers and criteria for using them

- commitment to publishing compliance and enforcement information.

It also provides whole-of-organisation principles and approaches for making decisions and allocating resources—its risk-based approach to compliance.

CAV has a comprehensive compliance policy, which is publicly available and transparently outlines its approach to regulating traders and protecting consumers. Specifically, the policy outlines a range of better practice elements, including:

- a focus on encouraging voluntary compliance

- the principles that underpin its compliance, including being risk based and outcomes focused

- its approach to enforcement when voluntary compliance cannot be achieved, including the enforcement criteria it applies

- the processes it follows in selecting matters for investigation and enforcement

- the compliance tools and enforcement options available to CAV compliance and enforcement officers

- its internal and external accountability mechanisms.

CAV’s transparent approach to compliance is enhanced through publicly available information relating to how it decides to proceed with an investigation, its compliance priorities, enforcement tools and infringement notices. CAV also publishes information on recent enforceable undertakings and public warnings, as well as information about legislation that it administers.

Supporting CAV's compliance and enforcement policy are a range of internal procedures and guidance. These include regional operations manuals, investigations guides and procedures covering a range of compliance activities such as affidavit preparation, briefs of evidence, and property and exhibit handling.

Issues relating to compliance policies and procedures

While the suite of guidance and procedures is generally comprehensive, there are issues around their currency and approval, resulting in uncertainty about their status. For example, of the 14 guides and procedures identified, nine had not been approved by CAV's enforcement committee, as required. It was therefore unclear if, or to what extent, these were in use. Also, none had been updated to reflect legislative changes to the Evidence Act 2008, as well as the introduction of the Australian Consumer Law and Fair Trading Act 2012 (ACL), and many were still draft documents. This creates obvious operational challenges, particularly for compliance and enforcement officers who require up-to-date information on laws, rules and procedures in order to carry out their duties efficiently and effectively.

The usefulness of the policy and procedures has also been diminished by a lack of awareness across all compliance and enforcement officers. Of 16 randomly selected compliance and enforcement officers—out of a total of 45—not all were aware of the framework and policy, while others differed in their understanding and application of them. This included what compliance and enforcement tools to use and when to use them.

The 16 compliance and enforcement officers were aware of only two of the 14 guides and procedures. It was unclear what guidance these compliance and enforcement officers followed and how they assured themselves that they had adhered to the rules and procedures that CAV has developed. Given the importance of the guidance to staff performing compliance activities, this raises doubt about the ability of these compliance and enforcement officers to effectively and efficiently undertake activities in a way that is consistent, transparent and proportionate.

Since the commencement of this audit, CAV has developed an Inspectors' Manual, which contains comprehensive guidance for compliance and enforcement officers. CAV's Strategic Management Group endorsed the manual in January 2013, during the conduct of this audit.

It is important that CAV comprehensively train all compliance and enforcement officers on the use of the Inspectors’ Manual and that it is kept up-to-date with relevant legislative and procedural changes.

2.3.2 Risk identification and prioritisation

Risk management is integral to good governance and effective regulation. It involves identifying, assessing, and prioritising threats to achieving a legislative objective or corporate outcome, and then applying limited resources to manage the highest risks of noncompliance. This includes those risks that decrease the ability or willingness of the regulated community to comply.

CAV has a sound risk identification and prioritisation framework that should enable it to identify areas on which to focus its compliance activities. It obtains information from a range of sources at the corporate level, including:

- government election commitments and priorities

- minister’s priority areas

- departmental long-term strategies and specific initiatives

- national commitments and initiatives

- market intelligences on market trends, global challenges and emerging issues

- evidence of consumer detriment

- stakeholder consultation feedback.

CAV’s framework also obtains information about risks of noncompliance from its Planning, Monitoring and Assessment (PMA) business unit. PMA undertakes regular environmental scanning and monitoring of complaints made to CAV to identify issues and trends in consumer complaints. PMA produces regular reports and ad hoc reports as required. These include weekly reports, industry specific reports and reports on CAV priorities.

While CAV has a generally transparent approach to detailing how it identifies its risks, the process of translating those risks into priorities is less transparent. For the 2012–13 financial year, CAV set the following enforcement priority areas:

- unlicensed motor car traders

- builders in breach of the Domestic Building Contracts Act 1995 where there is considerable consumer detriment or vulnerability

- unfair contract terms, particularly identified online traders

- product safety matters, especially targeting wholesalers of unsafe toys

- travelling con men as part of the national priority

- property trust account issues and unlicensed traders

- health claims

- energy marketing representations

- rogue rooming house operators

- landlords who do not lodge bonds

- debt collectors.

A lack of any documented procedures within CAV on the prioritisation process means that it is not possible to assess whether CAV has effectively identified and acted to address known risks.

2.3.3 Performance reporting

A comprehensive performance management framework is integral to demonstrating that compliance activities are effective and contribute to the achievement of legislative objectives and corporate outcomes. It also enhances transparency and accountability for those affected by regulation and the broader community.

An effective compliance performance management framework should contain the following elements:

- compliance performance information—complete and accurate quantitative or qualitative information

- compliance performance measures—measures providing relevant, appropriate and fair representation of performance

- compliance performance assessment and reporting—performance information is analysed against performance measures to assess the program/service against appropriateness, effectiveness and efficiency, and the findings are reported.

CAV has a performance monitoring framework to assess its performance. CAV also has objectives to guide the organisation’s role that are outlined in its corporate plan. Its regulatory and compliance roles have three objectives:

- empower consumers and businesses to know their rights and responsibilities

- promote a well-functioning market economy

- protect vulnerable and disadvantaged consumers.

However, weaknesses in its measures mean that CAV’s performance monitoring does not provide a fair representation of its actual performance.

Annual reports of performance

CAV reports its performance through its annual report, the DOJ's annual report and Budget Paper No. 3 (BP3).

Consumer Affairs Victoria's annual report

Under the ACL, CAV must submit an annual report on the operation of the Act to the Minister for Consumer Affairs, who must table it in Parliament. This report is called CAV's Annual Report. It is the main source of information available to the public on CAV's performance and activities.

CAV's annual report is not a report of the department, and consequently does not need to adhere to the requirements of the Financial Management Act 1994. Regardless, an annual report provides an opportunity to report meaningfully on, and be held accountable for, performance.

CAV's annual report includes information about its activities, including information on the number of calls answered, the number of visitors to its website and the number of compliance and enforcement activities undertaken. However, the report does not provide an adequate assessment of CAV’s performance. While it includes information on its performance, it details only the number of delivered outputs. There are no targets or benchmarks against which to compare performance, and it is therefore not possible to assess how effectively or efficiently CAV has performed.

The annual report does not include any other performance-related information, such as performance measures, to assess CAV’s performance against its objectives. The information presented in the annual report also differs each year, and there is no clear rationale for what information is included. For example, in 2008–09, 2009–10 and 2011–12, CAV provided detailed information on its building industry activities, such as the number of prosecutions completed, fines, penalties and consent orders, and compensation for consumers. However, in 2010–11, it only provided a figure for the number of audits/inspections. The variation in information included each year makes it impossible to perform analysis of trends.

Given the freedom that CAV has with the reporting format and content of its annual report, there are significant opportunities to improve the quality and transparency of its public reporting so that it fairly represents its actual performance.

Department of Justice’s annual report

In addition to the CAV annual report, DOJ also reports publicly on the performance of CAV in its annual report and also in BP3.

DOJ’s annual report is a requirement under the Financial Management Act 1994 and must contain performance indicators related to its objectives. BP3 is the government's key report on agency service delivery. It contains a range of performance information related to the quantity, quality, timeliness and cost of services that departments provide. Both reports include the same performance information.

DOJ has six output-related indicators to assess the performance of CAV. The indicators, which have remained generally consistent over the past five years, are identical across both reports. Figure 2A shows CAV's performance measures for 2011–12.

Figure 2A

Department of Justice's annual report and Budget Paper No. 3 measures for

Consumer Affairs Victoria, 2011–12 targets and actual

2011–12 target |

2011–12 actual |

|

|---|---|---|

Quantity |

||

Information and advice provided to consumers and traders delivered by CAV |

606 350 |

590 449 |

Inspections, compliance monitoring and enforcement activities delivered by CAV |

9 075 |

9 417 |

Registration and licensing transactions delivered by CAV |

600 000 |

650 002 |

Quality |

||

Customer satisfaction with services provided |

90.0% |

95.0% |

Timeliness |

||

Services provided within agreed time frames |

90.0% |

87.7% |

Cost |

||

Total output cost |

$114.2m |

$117.9m |

Source: Victorian Auditor-General’s Office.

To provide a reliable and accurate assessment of CAV's performance, measures that are both relevant and appropriate are needed. A relevant measure is one that has a logical and consistent relationship to the entity's objectives. An appropriate measure is one that enables assessment of achievements against objectives, outcomes and outputs, including assessing trends over time against benchmarks.

CAV’s three quantity measures are generally consistent with its objectives, and therefore likely to be relevant measures. This is because:

- information and advice would contribute to empowerment

- inspections, monitoring and enforcement would contribute to protections

- registration and licensing would contribute to a well-functioning market economy.

However, while the quantity measures are consistent with CAV's objectives, they are not appropriate to assess performance against the objectives. Despite being consistent over a period of time to allow trend analysis, the measures do not in themselves provide sufficient information about whether CAV has achieved its objectives.

While the cost measure reflects the costs of CAV’s activities on an output basis, neither the timeliness nor customer satisfaction measures are appropriate. There is inadequate information provided in the annual report to determine which services were, and were not, provided within agreed time frames, or even what the service‑specific time frames were. There is similarly inadequate information in relation to which services customers were, or were not, satisfied with. As we discuss below, customer service measures only a small part of CAV’s activities and services.

While the Financial Management Act 1994 and associated guidance provides minimum standards for performance reporting, there is nothing preventing DOJ from including measures that would more fairly represent actual performance in relation to CAV’s objectives. Together with the lack of meaningful performance information in CAV's annual report, the weaknesses in DOJ's performance monitoring and reporting represent a significant gap in CAV's compliance framework. Developing indicators that are relevant, appropriate and fairly represent actual performance should be a priority for CAV.

Reliability of reported data

Quantity measure

CAV’s second quantity measure, relating to inspections, compliance monitoring and enforcement activities produces unreliable data. While the measure seeks to count the aggregate number of activities, until recently, its case management system was unable to record these activities. Instead, CAV counted all activities as investigations, which is a different activity to inspections, compliance monitoring and enforcement under CAV's compliance framework. It is therefore unclear how CAV accurately counted and reported something its system did not support.

To report this measure, CAV relies on the manual data collections maintained by the metropolitan and regional offices, as well as data from its case management system, Resolve. Given the risk of error in this approach and the lack of quality controls, discussed in Section 2.4, it is likely that the reported results are not a reliable account of actual performance.

Aggregating inspections, compliance monitoring, and enforcement activities into one measure also diminishes transparency. Without targets for each element, it is not possible for Parliament or the public to determine how CAV is performing in relation to each of the activities CAV has determined should be reported.

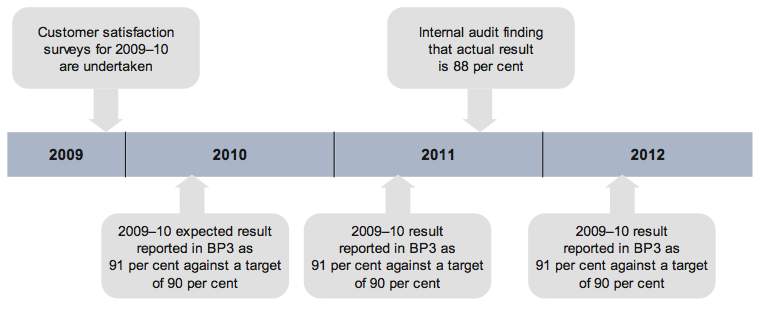

Quality measure

There are weaknesses in relation to CAV’s quality measure, which assesses customer satisfaction. Data reported in BP3 over the past two years is inaccurate. This is because CAV incorrectly used survey results—already reported from earlier years—to inform its reported performance. This led to results for 2009–10 that were higher than they should have been and meant that CAV reported its performance had met its targets for customer satisfaction, which it had not. This incorrect data for 2009–10 was used again in the following two Budget papers.

Had the correct surveys been used, CAV would not have met its customer satisfaction target—achieving 88 per cent instead of the reported 91 per cent. While the difference in reported data is not material, at issue is the inadequacy of the systems and processes supporting BP3 reporting that enabled this to occur, and the absence of transparent information explaining the results.

These issues were identified through an internal audit in September 2011, yet timely action was not taken to address them. Despite knowing about the issue, CAV continued to report the incorrect figures. It is unclear how such a fundamental breakdown in CAV’s internal controls was able to occur.

Figure 2B shows that:

- in the second quarter of 2011, CAV incorrectly reported that the customer satisfaction survey result for 2009–10 was 91 per cent

- in the third quarter of 2011, an internal audit found that the actual result for the 2009–10 survey was 88 per cent

- despite the findings of an internal audit, CAV still reported the 2009–10 survey result as 91 per cent in the second quarter of 2012.

Figure 2B

Customer satisfaction survey

Source: Victorian Auditor-General’s Office.

Customer satisfaction

In addition to these issues, there are weaknesses in the approach CAV uses to measure customer satisfaction. The sample size for 2011–12 was 200 traders who dealt with CAV's licensing area. It included only new licensees and was made up of 106 real estate agents, 44 second-hand dealers, 20 licensed motor car traders, 16 brothel licensees/managers, eight travel agents and six conveyancers. This survey is limited to only one of CAV’s functions and consequently is not a fair or accurate representation of the quality of CAV’s services as a whole.

As Figure 2C shows, there is a significant decrease on previous years, in both the number of people and business areas surveyed. The number of CAV customers surveyed decreased from 1 850 in 2008–09 to 200 in 2011–12, a difference of 1 650, or 89 per cent. Similarly, the number of CAV business areas covered in the customer satisfaction surveys decreased from seven in 2008–09 to one in 2011–12, which represents an 86 per cent decrease.

Figure 2C

Survey sampling for Consumer Affairs Victoria’s Budget Paper No.3 quality measure

Source: Victorian Auditor-General’s Office.

CAV does not consider the limitation of survey area has affected survey outcomes because the results have maintained a similar percentage score of between 88 and 95 per cent from 2006–07 to 2011–12. However, CAV's current approach to surveying—focusing on one already high performing area—has the potential to produce results that do not fairly reflect its actual performance.

The area surveyed in 2011–12—licensing—had an overall customer satisfaction level of 97 per cent in its previous survey in 2009–10, and the area to be surveyed in 2012–13—enquiries—had an average level of customer satisfaction of 94.3 per cent for the 2008–09, 2009–10 and 2010–11 financial years. The selection of these areas gives CAV greater assurance that it will achieve its target outcome of 90 per cent.

CAV’s selection also reduces the incentive to address the poorer performance of areas that do not achieve its 90 per cent target. CAV's Estate Agents Resolution Service had a customer satisfaction level of 77 per cent in 2009–10, the last year it was surveyed. During that year, this area was surveyed in conjunction with five other areas of CAV. The combined results for that year meant that CAV reported an overall customer satisfaction level of 91 per cent.

While deciding who to survey is an operational decision for CAV, given its overall reported quality performance is based on this result, there needs to be much greater transparency in its public reports around how it determines quality.

CAV's survey framework also includes neutral responses—neither satisfied nor dissatisfied—in its calculation of satisfied customers. This practice increases CAV's performance outcome percentage. CAV does not disclose this method of calculation in its BP3 report. The method that CAV uses to calculate its performance also needs to be transparent.

2.4 Information management

CAV's compliance framework relies on effective information management. Its information systems provide it with a rich source of compliance data and the ability to identify trends to inform its compliance activities. CAV's information management systems also provide it with data around its compliance activities and enforcement actions, which also informs its performance management.

Given the importance of CAV’s information management systems to performing its functions, it is essential that the management systems are effective and the data they contain is reliable.

While CAV has a case management system, Resolve, to capture compliance-related information such as complaints and compliance activities, the data it contains is unreliable and inaccurate. CAV also maintains a range of manual stand-alone databases to supplement data in Resolve. However, the lack of effective quality control over these databases exacerbates reliability issues.

2.4.1 Resolve case management system

CAV's core information management system, Resolve, is primarily a case management system that CAV uses to monitor cases, although the data it contains also contributes to reported performance data.

Prior to October 2012, Resolve had limited scope to record the types of activities undertaken. Inspections were recorded as investigations because Resolve did not provide the functionality to differentiate. An inspection is a visit to a premise for the primary purpose of monitoring a trader's compliance. Whereas, an investigation is a process of trying to find out all the facts to ascertain whether there has been a breach of the law. Including both as an investigation creates the impression that CAV is undertaking more resource intensive investigations than it actually is.

Further, Resolve did not count other activities that CAV requires its staff to report on each month, such as compliance assistance and education assistance delivered to traders. These visits were recorded as ‘Information’ in Resolve, and therefore did not accurately reflect CAV’s compliance activities.

Since the commencement of this audit, and in line with new compliance activities, CAV has made improvements to Resolve by adding additional case type functionality. Resolve now records inspections, proactive investigations and compliance activities separately. However, CAV continues to use manual data collection rather than utilising Resolve's improved reporting capacity.

Functionality limitations and a lack of effective quality controls mean that Resolve also contains a range of duplicated data. Resolve contains multiple entries for the same trader, albeit in a way that does not readily identify it as the same trader. In these cases there were between four and 10 different entries for the same trader. The different entries contained different spelling, the addition of a suburb or abbreviations of the name.

Figure 2D demonstrates the different types of input styles used by CAV, which results in the same trader being recorded as a separate entity for each complaint received.

Figure 2D

Resolve information input styles

Trader name |

Street address |

Suburb |

Telephone number |

Trader name (suburb) |

Street address |

Telephone number |

|

Trader name (Trading as) |

Street address |

Suburb |

Telephone number |

Tr'der name (abbreviated) |

Street address |

Suburb |

Telephone number |

Trader name |

PO Box |

Suburb |

Telephone number |

Tradr name (misspelt) |

Street address |

Suburb |

Telephone number |

Trader name (Pty Ltd) |

Street address |

Suburb |

Telephone number |

TRADER NAME (capitalised) |

Street address |

Suburb |

Telephone number |

Source: Victorian Auditor-General’s Office.

Resolve has the capacity to list the same trader once, record separate complaints against that trader and extract data on the number of complaints made. However, CAV's current practice of data input, as outlined above, precludes such a ready extraction of data. This is because CAV has no effective controls in place to identify and remedy data quality issues. This impedes CAV’s ability to correctly identify trends with particular traders, and consequently its ability to reliably assess the risk of noncompliance.

2.4.2 Stand-alone databases

Resolve’s limitations have led to CAV staff maintaining stand-alone spreadsheet databases to record the activities undertaken.

CAV staff use different methods to collect the data that is collated into CAV reports. Head office staff reported they used their own spreadsheets for data collation. Regional office staff receive a report from CAV's head office, generated from Resolve, on the activities of the particular regional office, and supplement this with data from their own spreadsheets to report on activities. This manually collected data is used for BP3 reporting, annual reporting, providing information to the minister and dealing with ad hoc requests.

CAV staff responsible for collecting and reporting on this data are not required to, nor do they, assure themselves about the quality of the data. CAV has no mechanisms to provide its senior management with assurance around data reliability. Collating data manually significantly increases the risk of error, particularly where there are no effective quality controls over the stand-alone databases.

CAV accepts that there is an increased risk of error in reporting from manual databases but advised that resource constraints have limited investment in more comprehensive data management systems.

Recommendations

Consumer Affairs Victoria should:

- assess the status and currency of its compliance and enforcement policy and procedures, and update as required

- establish processes to routinely provide compliance and enforcement officers with information about its policy and procedures, including testing their awareness

- document the process of translating compliance risks into priorities, including the allocation of resources

- develop output and outcome measures that are relevant, appropriate and provide a fair representation of performance

- improve the performance reporting in its annual report so that actual performance is reported against predetermined targets, and comparisons can be made over time

- strengthen controls around the use of data to inform performance reporting, to avoid the incorrect use of data

- provide additional information in Budget Paper No. 3 for customer satisfaction to make the method and sample size transparent

- establish robust information management systems, including quality assurance mechanisms that provide it with assurance around data reliability.

3 Compliance activities

At a glance

Background

Compliance and enforcement activities provide a regulator with a framework to deter and address noncompliance.

Conclusion

Consumer Affairs Victoria’s (CAV) compliance framework is theoretically sound. However, CAV cannot provide assurance that its enforcement procedures are efficient and effective.

Findings

- It is not possible to understand the frequency and coverage of CAV’s inspections from publicly available information.

- CAV performs a comprehensive range of compliance education activities.

- CAV does not provide adequate procedural guidance to compliance and enforcement officers.

- CAV does not have measures to track the progression of enforcement cases.

Recommendations

Consumer Affairs Victoria should:

- inform all Consumer Affairs Victoria and regional office compliance and enforcement officers of its business rules for counting activities

- re-evaluate its current case progression process for investigations to identify and implement areas to improve efficiency

- establish guidelines and a quality control process about maintaining inspection and investigation files on Resolve

- establish data collection processes to measure time frames for investigations, and utilise that data to formulate investigation targets

- formalise ongoing vocational staff training for its compliance and enforcement officers

- establish a set of outcome measures for its education program and implement a performance measurement strategy.

3.1 Introduction

Compliance and enforcement activities aim to deter and address noncompliance, and provide both the regulator and the community with assurance about how well regulations are being met.

Better practice approaches use a combination of activities for promoting and monitoring compliance, as well as responding to and deterring noncompliance. Activities range from supporting voluntary compliance through education and licensing, to monitoring compliance and prosecuting serious offences. These activities can be both planned, such as education campaigns and targeted compliance monitoring, and reactive, in response to compliance breaches or other incidents.

3.2 Conclusion

Consumer Affairs Victoria (CAV) is undertaking a range of compliance activities designed to identify and deter noncompliance, encourage voluntary compliance and protect consumers. Key activities include inspections and education, complemented by a range of enforcement activities.

While compliance activities do occur, there is no reliable understanding of the extent of these activities due to issues around how CAV collects and reports its activity data. Administrative weaknesses diminish the effectiveness and efficiency of some compliance and enforcement activities.

3.3 Compliance activity business rules

The Department of Justice's regional structure means that, in addition to CAV, there are eight other offices performing regulatory functions. Given this, it is essential that there is clear and consistent guidance on how to collect information and report on compliance activities.

CAV has developed business rules to provide a consistent approach to the capture and reporting of compliance activity data, and to meet its reporting obligations. However, there are issues with the awareness and interpretation of the business rules that diminish confidence in the reported compliance activity data.

Business rules development

Despite the importance of a consistent approach, CAV only developed its business rules in January 2012. Before then, CAV did not have any documented controls in place to manage the collection and reporting of activity data. Without documented controls in place, it is unclear how the regional offices compiled their data reliably and accurately.

Business rules awareness and interpretation

CAV's business rules detail the nature of the compliance activity, including what each activity entails, and how compliance officers should record them. They cover three broad areas—education, compliance assistance and inspections/investigations.

The business rules also detail that some visits can be counted as multiple activities, for example:

- if a compliance and enforcement officer visits a retail store to provide an education pack but also checks the trader’s refund signage and layby policy, and provides advice, both education and compliance assistance activities are recorded

- when a CAV officer visits a motor car trader for compliance assistance, this activity can also be recorded as a visit to a small business.

At least one-third of regional office staff were not aware that there were business rules on how to count compliance visits to traders—a business activity that commenced in January 2012. Discussions with staff at head office on how they recorded visits demonstrated there was confusion about whether these activities were counted as one or two visits. This confusion leads to areas within CAV recording activities differently, which exacerbates issues with data reliability.

CAV has taken on responsibilities, such as rooming houses, as part of its regulatory role. As highlighted in Figure 3B, CAV has undertaken a substantial number of visits to properties suspected of being rooming houses, and recorded these as inspections.

However, based on CAV’s business rules, ‘each visit, where a case officer (compliance and enforcement officer) has formally presented their inspection badge and an entry power under the Act (Australian Consumer Law and Fair Trading Act 2012) has been used, is to be recorded as one inspection’.

Of the 24 inspections sampled for this audit, which CAV undertook in 2011–12:

- no compliance and enforcement officer gained entry to the property being inspected

- seven inspections were registered as taking one minute or less to complete

- in five, the compliance and enforcement officer spoke to a resident at the address

- nine properties were suspected to be rooming houses, however, seven were marked as having ‘no further action required’

- two properties suspected of being rooming houses were checked with the Residential Tenancy Bond Authority

- one case was reported to the local council as an unregistered rooming house.

In some instances in other financial years, the addresses inspected were residential properties, businesses or vacant blocks of land. While these visits should constitute an activity, it is not an inspection as defined by CAV’s business rules.

CAV has recognised this issue with the business rules, and is proposing amendments to the inspection definition so that all visits are reported as legitimate activities that contribute to the rooming house program’s objectives.

3.4 Compliance activities

3.4.1 Compliance inspections

Compliance inspections are a key regulatory function of CAV. They typically involve a visit to a business or residential address to assess whether there is compliance with the legislation or regulations that CAV administers.

It is not possible to determine the number, frequency and coverage of CAV’s inspections from publicly reported data. Given the issues with the reported performance data combining three compliance related activities, as described above, as well as the data reliability issues discussed in Part 2, the following data should be considered, at best, as indicative.

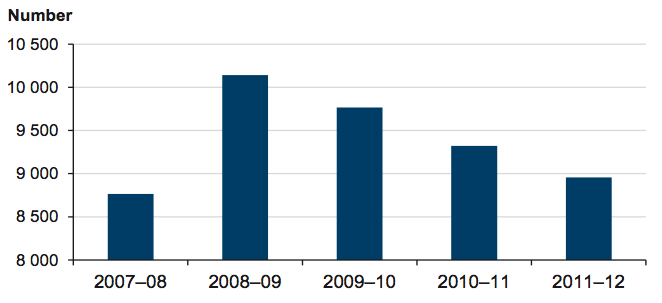

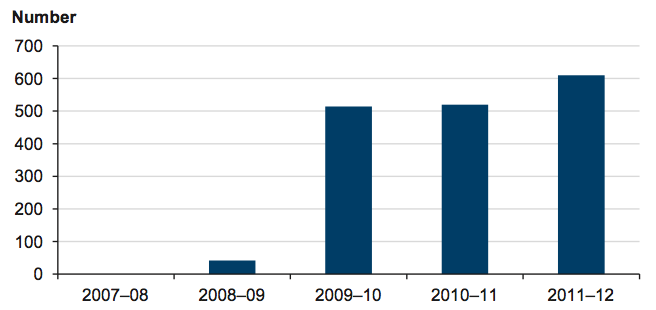

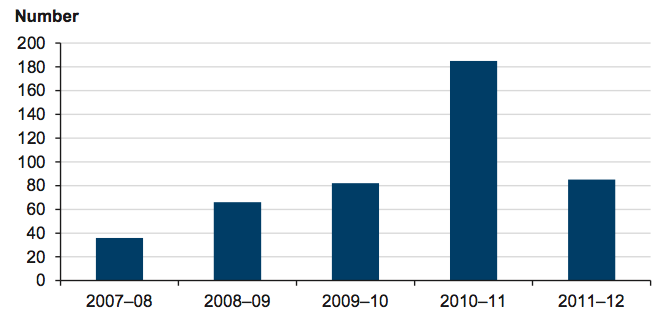

Data from a range of CAV’s stand-alone spreadsheet databases, shown in Figures 3A to 3E, indicates that:

- Compliance inspections generally relate to CAV’s stated priorities.

- Since peaking at 10 141 in 2008–09, the number of compliance inspections has steadily decreased to 8 956 in 2011–12. This reflects a shift in CAV’s focus towards compliance assistance activities, of which it conducted 5942 between 1 January 2012—the date it commenced counting the activity—to 31 December 2012.

- Product safety had the second largest number of inspections, with 2 978 conducted. This represents 6.3 per cent of all inspections.

- Rooming houses had the most significant change in the number of inspections, increasing from 42 in 2008–09 to 610 in 2011–12. This represents an increase of around 1 352 per cent.

Figure 3A

Total compliance inspections 2007–08 to 2011–12

Source: Victorian Auditor-General’s Office.

The majority of CAV’s inspections relate to residential tenancies, representing around 81 per cent of all inspections. Figure 3B to 3E relate to the other types of inspections conducted by CAV.

Figure 3B

Rooming house inspections 2007–08 to 2011–12

Source: Victorian Auditor-General’s Office.

Figure 3C

Licensed brothel inspections 2007–08 to 2011–12

Source: Victorian Auditor-General’s Office.

Figure 3D

Product safety inspections 2007–08 to 2011–12

Source: Victorian Auditor-General’s Office.

Figure 3E

Motor car trader inspections 2007–08 to 2011–12

Source: Victorian Auditor-General’s Office.

It is difficult to compare the figures over time due to the changing nature of CAV’s business and recording methods. CAV has also refocused its education and information provision activities to online services—in 2011–12 it received 1 468 779 visitors to its website.

CAV has also changed its recording methods over time. For example, prior to January 2012, CAV counted all activities as inspections, including trader walks, visiting locations of suspected rooming houses and education visits.

Urgent response to serious risk

A core part of CAV’s role is regulating product safety, and responding to urgent risks to public health and safety. Under the Australian Consumer Law and Fair Trading Act 2012, CAV can place interim bans on consumer goods or product-related services if there is a risk they may cause serious injury, illness or death. Bans make it unlawful to supply, offer to supply, manufacture, possess or have control of the consumer good.

There are two types of bans:

- interim—imposed by the responsible minister of either the Commonwealth, state or territory

- permanent—imposed by the Commonwealth minister.

The supply of a consumer product is banned when all of the following criteria are met:

- it has been established that the product is being (or will be) distributed within Victoria

- the product is dangerous, that is, likely to cause death or serious injury to the body or health of any person, whether directly or indirectly

- there is no consumer product safety standard that would adequately protect the community from unreasonable risk of injury

- the product is not voluntarily withdrawn from the marketplace

- the Commonwealth minister has not introduced an interim ban

- there is a particular need for rapid action.

When CAV is satisfied that an interim ban is required, it requests the Minister for Consumer Affairs to impose the ban as soon as practicable. CAV then issues media releases and posts information on its website to communicate details of the ban to the public.

As Figure 3F shows, CAV undertakes a significant number of product safety activities.

Figure 3F

Product safety activities

|

Product safety activity |

2007–08 |

2008–09 |

2009–10 |

2010–11 |

2011–12 |

|---|---|---|---|---|---|

|

Products seized |

9 800 |

22 163 |

30 815 |

49 006 |

11 164 |

|

Products destroyed |

19 000 |

0 |

>20 000 |

0 |

40 000 |

|

Products investigated |

n.a. |

180 |

247 |

n.a. |

n.a. |

|

Premises inspected |

500 |

464 |

638 |

599 |

777 |

|

Companies/directors prosecuted |

3 |

9 |

1 |

2 |

0 |

|

Civil proceedings |

0 |

1 |

2 |

7 |

3 |

|

Parties signed to enforceable undertakings |

14 |

3 |

10 |

2 |

12 |

Source: Victorian Auditor-General’s Office.

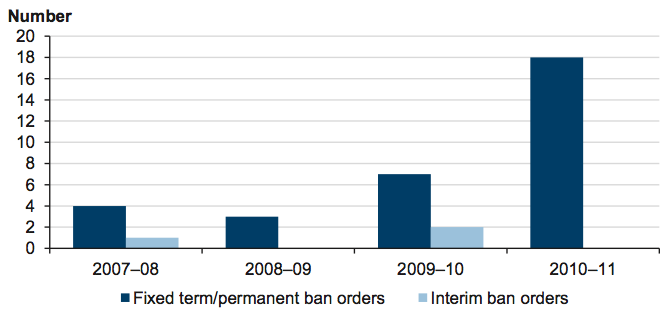

Figure 3G shows the number of fixed term/permanent and interim ban orders issued by CAV. There were no bans issued by CAV in 2011–12 as the responsibility for permanent ban orders transferred that year to the Australian Competition and Consumer Commission (ACCC). There are currently 22 permanent ban orders in Victoria.

Figure 3G

Ban orders issued

Source: Victorian Auditor-General’s Office.

When product safety matters arise, CAV has been swift to act in obtaining interim bans. The case study in Figure 3H illustrates CAV’s effectiveness in this area:

Figure 3H

Case study: high powered magnets

High powered magnets may be used in a variety of ways including in toys, games, puzzles and jewellery. Although these items are marketed to adults, they can cause serious injury or death if swallowed or inhaled by children.

In response to one death and several serious injuries to children in other states, CAV urgently obtained an interim ban order on 23 August 2012, which was effective, via an extension of operation, until 23 December 2012. CAV’s action provided protection for Victorian consumers until the Commonwealth’s permanent ban came into effect on 15 November 2012.

Source: Victorian Auditor-General’s Office.

3.4.2 Investigations

The purpose of a CAV investigation is to discover if there has been a breach of an Act and to gather evidence to prove the breach or contravention.

Investigations are conducted by CAV’s compliance and enforcement officers who are based at its head office. These officers have a variety of experience and qualifications—some are lawyers or have law degrees and some are former police officers. Once a decision has been made to investigate a matter, the case is allocated to a compliance and enforcement officer based on the complexity of the case and the officer’s level of experience.

Investigations can focus on any conduct within CAV’s jurisdiction, from unlicensed motor car traders to unscrupulous builders. There are a number of considerations, including the extent of the consumer detriment, the seriousness of the conduct and the history of the alleged offender.

CAV was unable to quantify the number of investigations it has undertaken over the past five years. It does not report this information publicly. It was also unclear how CAV managed the number of investigations underway at any given time.

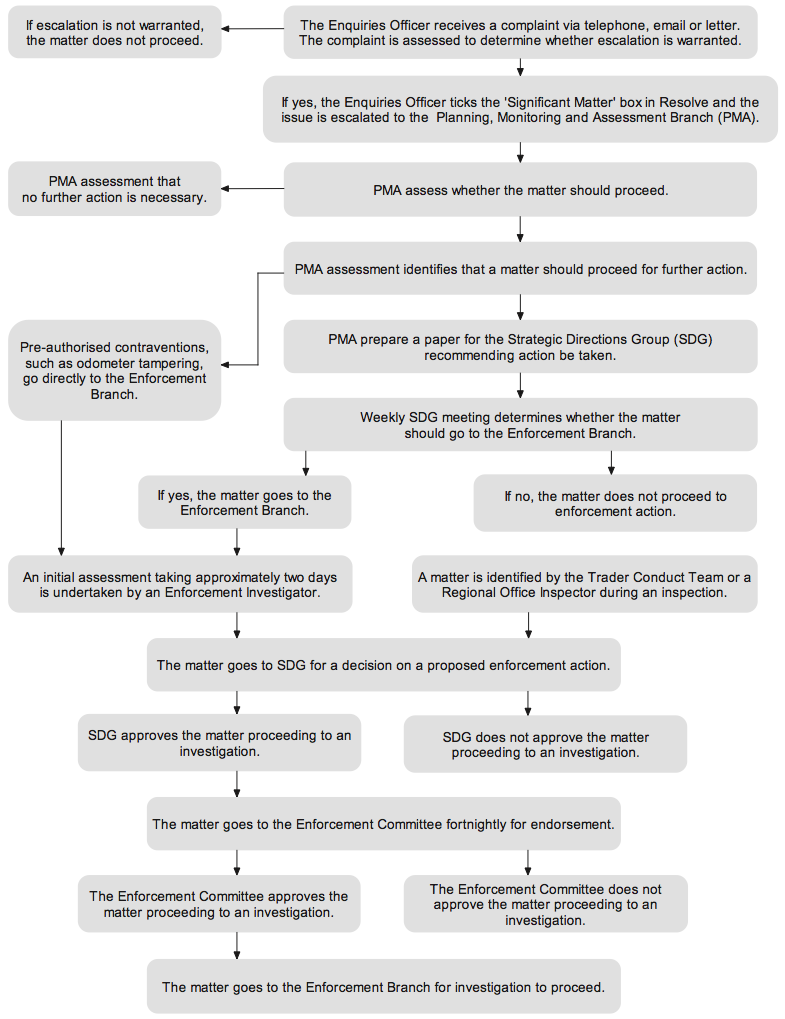

CAV has detailed processes in place to manage the decision to proceed with an investigation. This includes having the matter assessed by its Planning, Monitoring and Assessment Branch (PMA), as well as further review by the Strategic Directions Group (twice), senior management, and the Enforcement Committee. Figure 3I shows CAV’s decision-making process.

Figure 3I

Enforcement flowchart for serious matters

Source: Victorian Auditor-General’s Office.