East West Link Project

Overview

This audit examined whether the state had effectively managed the East West Link (EWL) project by assessing the total costs of the project, appropriateness of advice supporting key project decisions and the lessons for future major projects. The audit included 10 government agencies.

The EWL project was terminated in June 2015 with more than $1.1 billion paid, or expected to be paid, by the state for little tangible benefit. This cost includes expenditure on the planning, development, procurement and termination of the project and will be partially offset by future proceeds from the sale of properties acquired for the project which the Department of Treasury & Finance estimates at $320 million.

The audit found that the EWL business case did not provide a sound basis for the government’s decision to commit to the investment and that key decisions during the project planning, development and procurement phases were driven by an overriding sense of urgency to sign the contract before the November 2014 state election.

Advice to government in the lead up to signing the contract did not sufficiently assess the benefits of delaying contract signing to mitigate risks posed by the unresolved legal challenge to the project planning approval decision. Signing the contract in these circumstances was imprudent and exposed the state to significant cost and risk.

The amount payable by the state under the termination settlement was substantially lower than the cost of terminating under the project contract. However the decision to terminate was made without full consideration of the merits to completing the project.

Over the life of this costly and complex project, advice to government did not always meet the expected standard of being frank and fearless. This highlights a risk to the integrity of public administration that needs to be addressed. The report makes recommendations to the Department of Treasury & Finance to provide guidance for development and delivery of major projects and for the Department of Premier & Cabinet to emphasise requirements for frank and fearless advice from the public sector.

East West Link Project: Message

Ordered to be published

VICTORIAN GOVERNMENT PRINTER December 2015

PP No 108, Session 2014–15

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on the audit East West Link Project.

This audit examined whether the state had effectively managed the East West Link (EWL) project by assessing the total costs of the project, appropriateness of advice supporting key project decisions and the lessons for future major projects.

I concluded that the EWL business case did not provide a sound basis for the government's decision to commit to the investment and that key decisions during the project planning, development and procurement phases were driven by an overriding sense of urgency to sign the contract before the November 2014 state election. Over the life of this costly and complex project, advice to government did not always meet the expected standard of being frank and fearless. This highlights a risk to the integrity of public administration that needs to be addressed.

The audit also found that the EWL project was terminated in June 2015 with more than $1.1 billion paid, or expected to be paid, by the state. This cost includes expenditure on the planning, development, procurement and termination of the project and will be partially offset by future proceeds from the sale of properties acquired for the project. The Department of Treasury & Finance (DTF) estimates that these properties can be resold for around $320 million.

The report makes recommendations to DTF to provide guidance for development and delivery of major projects and for the Department of Premier & Cabinet to clarify requirements for frank and fearless advice from the public sector. Disappointingly, these departments have rejected the recommendations.

Yours faithfully

Dr Peter Frost

Acting Auditor-General

9 December 2015

Auditor-General's comments

|

Dr Peter Frost Acting Auditor-General |

Audit team Steven Vlahos and Tim Maxfield—Engagement Leaders Tony Brown—Team Leader Ray Seidel-Davies—Analyst Jessica Cross—Analyst Daniel Mahoney—Analyst Engagement Quality Control Reviewer Dallas Mischkulnig |

This audit assessed the East West Link (EWL) project—its total costs and the appropriateness of advice supporting key project decisions that influenced the project's outcomes and total costs.

The decisions to proceed with the EWL project and enter into a contract with the preferred consortium were based on flawed advice. The likely net benefits of the project were not sufficiently demonstrated and the failure to properly resolve project risks before entering contracts exposed the state to additional financial risk. It was clear the advice provided to the then government was disproportionately aimed at achieving contract execution prior to the 2014 state election rather than being in the best interests of the project or use of taxpayers' money.

There were also shortfalls in terminating the EWL project. Following final settlement of outstanding costs, the state will have incurred in excess of $1.1 billion in costs on the project with little tangible benefit for taxpayers. This cost will be partially offset by the sale of properties acquired for the project, which the Department of Treasury & Finance (DTF) estimates are worth $320 million.

The new government was also not provided with updated, comprehensive information on the impacts of completing the project versus the option of cancelling it. This meant it was deprived of comprehensive advice to assure it that termination was the best use of public funds.

Further, there was a failure to adequately ensure some of the settlement payment was not a windfall gain to contractors related to the project consortium. However, weaknesses in the Audit Act 1994 meant that I could not obtain the information required to confirm this.

While the advice to government examined in this audit was generally comprehensive, in some critical instances it fell short of the required standard of frankness.

The bedrock of our system of public administration is that the public service is apolitical, impartial and has a fundamental obligation to provide frank and fearless advice to the government of the day. Frank and fearless advice should complete—it is not sufficient for the public service to avoid providing advice or recommendations simply because they believe the government of the day does not want to hear them. Doing so is at odds with the Public Administration Act 2004 and the Code of Conduct for Victorian Public Sector Employees, which require the public service to act impartially and seek to achieve the best use of resources.

This is an important matter and vigilance and leadership is required to protect the best traditions of the Victorian public service.

The EWL project has also highlighted a number of lessons that should be at the forefront of future infrastructure projects. This includes the importance of transparency and scrutiny of the business case, and the risks of entering project contracts when other relevant processes, in this case, planning approvals, are unresolved and subject to legal challenge.

Large infrastructure projects take time to properly plan and implement and they should be determined on merit. That's why it is heartening that when announcing the creation of Infrastructure Victoria the government stated that it will take short-term politics out of infrastructure planning and support government decisions by assessing business cases for major projects based on objective, transparent analysis and evidence.

I have made a series of recommendations addressed to the departments of Premier & Cabinet (DPC) and Treasury & Finance which seek to address the underlying issues highlighted by this audit. Disappointingly, they have failed to acknowledge critical deficiencies identified by the audit, and have rejected its recommendations. In their response to this audit, they have also made a number of assertions and drawn inferences which fundamentally misrepresent the content of my report. I respond to these in detail at Appendix C and I would urge anyone interested in public administration to have close regard to the audit report, the responses of DPC and DTF, and to my further audit comments.

From its inception to its termination the EWL project was not managed effectively and it will become an important marker in the history of public administration in this state. This audit points out important and sobering lessons for government, the public officials who advise and serve it, and for taxpayers.

Dr Peter Frost

Acting Auditor-General

December 2015

Audit Summary

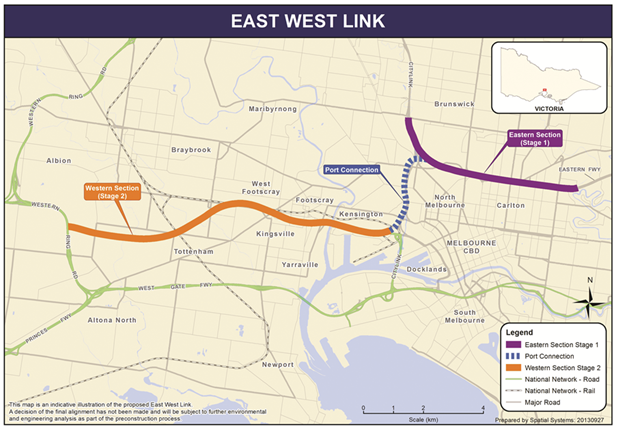

The East West Link (EWL) was to be an 18 kilometre cross city road connecting the Eastern Freeway at Hoddle Street to CityLink, the Port of Melbourne precinct and on to the Western Ring Road at Sunshine West, with a range of associated works. It would have been one of the largest transport infrastructure projects ever undertaken in Australia, and significant in terms of its impact, complexity and cost.

The genesis for the EWL was the 2008 report Investing in Transport: East West Link Needs Assessment by Sir Rodney Eddington, which recommended a new 18 kilometre cross city road corridor to provide an alternative to the West Gate Bridge. During 2009, the then government developed a project proposal for what was known as the WestLink project.

Following the November 2010 state election, the WestLink project was effectively superseded by the development of a business case for the EWL.

The government considered a business case for EWL in April 2013 and decided to go ahead with the project, with the eastern section being commenced as Stage 1 of the project. The government decided to deliver the eastern section as a public private partnership (PPP), and following a competitive tender process finalised a project contract with East West Connect (EWC) to finance, design, construct, operate and maintain the road.

The contract was signed before the caretaker period leading into the November 2014 state election, just after the then Opposition indicated it would not proceed with the project. There was also an unresolved legal challenge to the planning approval for the project at the time. The Opposition had also indicated that if it formed government after the November 2014 election it would not defend the legal challenge to the planning decision.

Following the November 2014 election, the incoming government suspended work on the project and by June 2015 had reached agreement with EWC to terminate the project.

This audit assessed whether the state effectively managed the EWL project and related costs by assessing the:

- total costs of the project, including ongoing financial implications and risks associated with terminating the EWL project

- appropriateness of advice supporting key project decisions that influenced the project's outcomes and total costs

- lessons for future major projects.

Conclusions

If it had proceeded to completion, the entire EWL project would have cost in excess of $22.8 billion in nominal terms. Limitations in the business case meant there was little assurance that the prioritisation of significant state resources to this project was soundly based.

Key decisions during the project planning, development and procurement phases were driven by an overriding sense of urgency to sign the contract before the November 2014 state election. The significant risks arising from this situation were further compounded by legal challenges to the project and by the absence of comprehensive advice on the potential benefits of deferring the signing of the contract.

Signing the contract in these circumstances was imprudent and exposed the state to significant cost and risk. The risks associated with this decision were increased when the state agreed to amend the contract to provide additional compensation to EWC if the legal challenge to the project planning approval succeeded. The available evidence suggests that the state knew at the time that there was a significant risk that this would happen.

These circumstances demanded comprehensive advice to government on its options and the best course of action for the state. However, advice to government in the lead-up to signing the contract fell short because it did not sufficiently assess the benefits of delaying finalisation of the procurement and contract to mitigate the risks posed by the unresolved judicial review. Instead, achieving the government's desired time line for contract signing was given disproportionate emphasis despite the risks and implications for the state.

The amount payable by the state under the termination settlement negotiated by the new government with EWC was substantially lower than the cost of terminating under the project contract. However, the decision to terminate was made without full consideration of the merits of continuing with the project. Failure to properly assess the benefits of termination against revised costs and benefits of continuing the project means the government was deprived of comprehensive advice to assure it that termination was the best use of public funds.

Further, the validity of project costs reimbursed by the state could not be fully verified because the state accepted EWC's refusal to allow access to the financial records of its related party contractors. This created a risk that EWC's related parties had a windfall gain.

Terminating the EWL project involved the expenditure of hundreds of millions of dollars for little tangible benefit. Following final settlement of outstanding costs, the state will have incurred costs in excess of $1.1 billion. This includes costs for the acquisition of properties which the Department of Treasury & Finance estimates can be resold for around $320 million. Pre-construction activities including design and geotechnical work and elements of the complementary projects may provide some value in the future.

Over the life of this costly and complex project, advice to government did not always meet the expected standard of being frank and fearless. This highlights a risk to the integrity of public administration that needs to be addressed. Action and leadership is required from government to reinforce these standards and the related expectations for public servants.

Findings

Project business case

The EWL business case did not provide a sound basis for the government's decision to commit to the investment because it did not:

- clearly establish the need for the investment through robust analysis of the costs, benefits and risks of reasonable options

- provide a sound basis for prioritising the eastern section over other sections of the road

- include sufficient information and evidence to demonstrate the accuracy and plausibility of the assumed wider economic benefits of the project, or the validity of underlying traffic modelling

- adequately address significant issues raised about the traffic modelling by peer reviewers.

The project delivery approach proposed in the business case was sound notwithstanding that undue weight was given to the government's desire to begin work on the project prior to the 2014 state election in the assessment of available options.

Establishing the project contract

The Linking Melbourne Authority (LMA) managed the procurement process well in challenging circumstances, completing it within the tight time lines stipulated by government at the outset of the project. The analysis and advice on the assessment of bids, and selection of the preferred bidder, was generally robust and conducted in accordance with the government's procurement requirements.

The uncertainty created by the unique circumstances in the lead-up to the decision on signing the contract warranted comprehensive advice to government on its options and the best course of action for the state. However, the advice to government did not:

- comprehensively examine the merits of alternative options, including delaying finalisation of the procurement and contract

- directly support or oppose the proposed timing of the transaction and neither identified nor recommended a course of action in the best interests of the state.

Notwithstanding this, the significant implications for the state arising from the unresolved legal challenge to the project planning decision prompted the then Department of Transport, Planning and Local Infrastructure and LMA to provide advice to government in August 2014 emphasising the importance of resolving the judicial review before the contract was signed. This advice indicated that an expedited court timetable was achievable, would deliver early certainty and would provide the best mitigation to the substantial cost and risk exposures to the state that existed at that time. Despite this advice the government decided not to seek an expedited hearing and LMA was instructed to proceed to contract close for the project before the state election in November 2014.

Despite the significance and complexity of the project and the risks and implications for the state, the focus on achieving this time line was given disproportionate emphasis. As a result, subsequent advice to government focused on options to mitigate identified risks if the government determined to proceed to contract close rather than considering and emphasising the merits of delaying signing.

If contract signing had been deferred until after resolution of the judicial review, the state's exposure under the non-standard contract provisions, which were accepted to secure EWC's execution of the contract, could have been avoided.

The contract signed by the state with EWC was standard in most respects and generally consistent with the standard commercial principles established by the National PPP Policy and Guidelines and the Partnerships Victoria requirements, as well as with recent precedent transactions. However, in departures from standard practice for PPP transactions in Victoria, the state agreed to the inclusion of clause 58—Specific Key Approval Event in the contract, and signed a side letter confirming the state's commitment to honour the contract. These variations from standard contractual terms were requested by EWC.

Clause 58 increased the state's exposure in circumstances where the planning approval decision was found to be invalid, as compared to the standard provisions of the contract. The risk and exposure for the state created by clause 58 was linked to the outcome of the judicial review of the planning decision for the project.

Given that the state was aware of the significant risk that the planning approval decision would be quashed, the decision to proceed to contract signing was, in effect, a 'gamble' that the judicial review proceedings would not impact the project significantly.

The only scenario under which the side letter can be argued to have created additional exposures for the state is one in which the state did not have the power to sign the contract. Legal advice obtained by government both before and after the election indicated that this was very unlikely.

Terminating the project

The total cost of the final termination settlement will be around $642 million. This excludes state expenditure on the planning, development and procurement of the project, and is substantially less than an estimated amount—in excess of $900 million—that would have been payable under the contract's termination for convenience provisions.

However, to achieve this outcome the state accepted limited verification of the funds spent by EWC and the risk that an EWC-related party contractor had a windfall gain. The government was not able to confirm the reasonableness of the expenditure it reimbursed or the assets it received because EWC refused to allow the state or its advisers access to information at a sufficiently detailed level.

The state's due diligence adviser reported in June 2015 that they were only provided with confirmation that payments had been made from EWC to its design and construction (D&C) and operations and maintenance contractors and that they did not have access to the contractors' supporting documentation. The adviser indicated that this meant it could not verify:

- what these contractors used the money for

- whether or not further undisclosed assets existed, and noted that the list of 'hard assets' was very short and the value immaterial

- whether any expenditure had been refunded

- whether EWC and the contractors took reasonable steps to mitigate expenditure following the issuing of the state's project suspension notice in December 2014.

The due diligence adviser indicated that this created a risk that a related party to EWC, particularly the D&C contractor, was holding either surplus cash, hard assets that were yet to be identified or prepaid assets capable of conversion into cash at a later date. Ultimately, this limited verification was accepted as part of the 'price paid' by the state to secure agreement by EWC to the terms of the settlement.

In an attempt to mitigate the risks identified by the due diligence adviser, the state sought warranties from EWC and its contractors that they had identified all hard assets and intellectual property acquired, and had complied with obligations under the contracts to mitigate project expenditure. However, the warranties provided were subject to limitations that meant they did not fully mitigate or address the risks identified by the state's due diligence adviser, and in particular did not directly address the risk that the D&C contractor was holding surplus cash.

The Auditor-General requested information from EWC and its contractors in July and August 2015 to address the gaps in the due diligence process undertaken by the state. These requests were refused. The Auditor-General does not have explicit power under the Audit Act 1994 to require provision of such information by private parties.

The final termination agreements involved a different settlement outcome to that initially announced by the government in April 2015. The revised approach to the settlement was based on sound advice to government and delivered a better outcome for the state. The advice comprehensively examined the available approaches, settlement terms and related costs and risks. The strategy adopted was a practical solution to a highly complex situation.

However, only limited analysis was undertaken of the option to complete the project. Although the new government's intention to terminate the EWL project was clearly articulated at the November 2014 election when it was in Opposition, it did not at that time have access to complete and up-to-date information on the project's benefits and cost.

The new government was not provided with updated, comprehensive information on the impacts of completing the project versus the option of cancelling it, to provide a more complete assessment of the merits of terminating the contract. This meant it was deprived of comprehensive advice to assure it that termination was the best use of public funds.

Lessons

The Public Administration Act 2004 (the Act) imposes an obligation on public officials to provide frank, impartial and timely advice to government. Meeting this obligation means there is sometimes a need to provide advice that a government may not necessarily want to receive.

While the advice to government examined in this audit was generally comprehensive, in some critical instances it fell short of the required standard of frankness. These instances involved advice that did not provide recommendations or that gave too much emphasis to the benefits of approaches that were in line with the government's preferred outcome and little emphasis to alternative options that could be argued were more aligned with the state's best interests.

Presenting options to government without a recommendation in circumstances where public officials know that the option favoured by government will expose the state to significant potential risks and costs is clearly not in the best interests of the state. It is not sufficient for officials in such circumstances to stop at disclosing the potential risks and consequences of the available options, they need to provide a recommended course of action.

The departments of Premier & Cabinet and Treasury & Finance disputed this and advise that the Code of Conduct for Victorian Public Sector Employees (the Code) requires the public service to implement government policy decisions once the government of the day has made a clear policy decision. This is a quite narrow reading of the Public Administration Act 2004 (the Act) and the Code because neither the Act nor the Code explicitly state or imply that the requirement to 'implement government policy' sits at the apex of public sector values.

This suggestion is also inconsistent with the objects set out in section 3 of the Act. The Act does not oblige public servants to implement government policy at any cost. Rather, it seeks a public service which responds to government policy priorities in a manner that is consistent with public sector values. Those values include:

- providing frank, impartial and timely advice to the government

- making decisions and providing advice on merit

- objectively considering all relevant facts and fair criteria

- seeking to achieve best use of resources

- using their views to improve outcomes on an ongoing basis.

The Act and Code empower and oblige public servants to act with integrity and, most importantly, with impartiality.

Some public officials involved in this audit indicated that providing frank and fearless advice when they believe a government does not want to receive it will negatively impact their influence or career opportunities. This belief is regrettable and if it becomes common in the public sector it poses a significant risk to the integrity of government decision-making and public administration, with consequential implications for the effective management of public resources and services.

Recommendations

That the Department of Treasury & Finance:

- provides guidance to support whole-of-project cost tracking and reporting against budget for major projects that involve multiple stages managed by different agencies

- improves its business case development guidance material, the adherence to this guidance by agencies, and its quality assurance over key inputs by:

- critically reviewing the analysis of options in business cases against the requirements of existing guidance material and providing feedback to agencies

- developing further guidance on methods for transparently determining and quantifying wider economic benefits

- strengthening its processes for reviewing and advising government on the adequacy of actions taken to address findings and recommendations arising from peer or other external reviews of key business case inputs such as economic and financial analyses, demand modelling, cost estimates and procurement options analyses

- develops minimum standards and enhanced guidance for managing the risks associated with concurrent planning, scoping and procurement processes on major projects

- mandates the appointment of separate parties to undertake the probity advice and probity compliance review functions on High Value High Risk projects

- establishes clear guidance for the terms of future negotiations involving the state reimbursing expenditure by private entities, to require full disclosure and transparency of the underlying information and evidence.

That the Department of Premier & Cabinet:

- consults with the Victorian Public Sector Commission to support further guidance to clarify the requirements for frank, impartial and timely advice in the public sector by:

- establishing clear minimum standards for agencies on how to satisfactorily discharge this obligation when providing advice to government

- advising government on strategies and options for addressing any cultural issues underpinning the serious deficiencies in the advice provided to government highlighted by this report.

Submissions and comments received

Throughout the course of the audit we have professionally engaged with:

- the Department of Premier & Cabinet

- the Department of Treasury & Finance

- the Department of Economic Development, Jobs, Transport & Resources

- the Department of Environment, Land, Water & Planning

- the Department of Justice & Regulation and the Victorian Government Solicitor's Office

- the Linking Melbourne Authority

- VicRoads

- the Environment Protection Authority

- Planning Panels Victoria

- the Treasury Corporation of Victoria.

In accordance with section 16(3) of the Audit Act 1994 we provided a copy of this report to those agencies and requested their submissions or comments.

We have considered those views in reaching our audit conclusions and have represented them to the extent relevant and warranted. Their full section 16(3) submissions and comments are included in Appendix C.

1 Background

1.1 Introduction

The East West Link (EWL) project was one of the largest transport infrastructure projects ever proposed in Australia. The full project included an 18 kilometre cross city road connecting the Eastern Freeway at Hoddle Street to CityLink, the Port of Melbourne precinct and the Western Ring Road at Sunshine West. Figure 1A shows the planned EWL.

Figure 1A

Planned East West Link

Source: Commonwealth Budget 2014–15.

In May 2013, the then government announced that funding had been allocated as part of the 2013–14 State Budget for the eastern section of EWL—to become known as Stage 1—at an estimated cost of between $6 and $8 billion.

Stage 1 consisted of the following main elements:

- a new tolled motorway linking Hoddle Street and CityLink—mainly via tunnel

- upgrades to both the Eastern Freeway and CityLink

- public transport enhancements north of the central business district.

The tolled motorway between Hoddle Street and CityLink was to be delivered by the end of 2019 in conjunction with the private sector under an availability public private partnership (PPP). This involved the private sector financing, designing, constructing and then operating and maintaining the road for 25 years in return for payments from the state based on the availability of the road. The state was to retain toll revenues and also the associated risk that demand might be lower than expected.

In May 2014, the state announced its commitment to deliver the western section of the EWL (Stage 2) at an estimated cost of between $8 and $10 billion with initial works commencing in 2015. Stage 2 involved connecting Stage 1 to the Western Ring Road and improving freight access to the Port of Melbourne precinct. Work on Stage 2 did not proceed substantively beyond the planning stage.

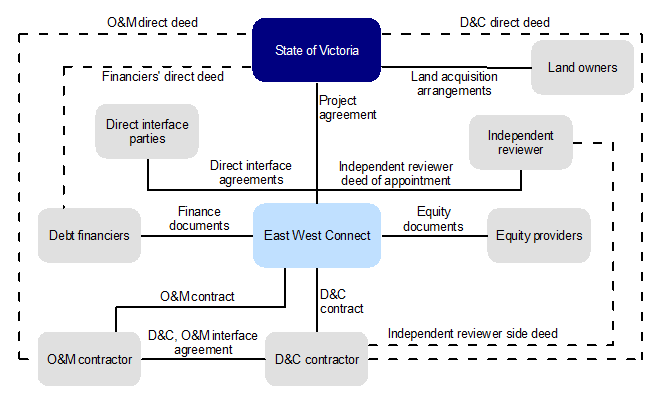

On 29 September 2014, the state appointed the East West Connect (EWC) consortium following a competitive tender, to finance, design, construct, operate and maintain the tolled motorway component of Stage 1. The project agreement (contract) included a new clause 58 in response to concerns about the potential impact of a legal challenge to the validity of the planning approval decision for the project which was pending at the time. In addition, the Treasurer issued a side letter to the consortium, reaffirming the state's commitment to honouring the contract and related payment obligations, in response to EWC's concerns about questions raised in relation to the state's power to enter the contract. Appendix A sets out the key features of the contract.

Consistent with public commitments made prior to the 2014 state election while it was in Opposition, in December 2014 the new government instructed the consortium to suspend works and commenced negotiations to terminate the contract.

On 15 June 2015, the state announced the final termination agreement and acquired the EWC business and associated project assets for $1. The state paid EWC $424 million to cover its claim for costs incurred on the project. This included $81 million spent by EWC to establish a $3.1 billion loan facility for the project. Under the termination agreements the state acquired the interest rate swap facilities established by EWC as part of the project financing to manage financing risks on the project. The cost of closing out this swap agreement position will depend on interest rate movements but was estimated at $218 million at 30 June 2015.

As part of the termination the state also negotiated a $3.1 billion uncommitted note issuance mandate, which gives the state discretionary access to future debt funding, with some members of the EWC banking group. This was a new agreement between the state—through Treasury Corporation of Victoria (TCV)—and the relevant banks and not the loan facility established by EWC for the project.

1.2 Key project events and decisions

Figure 1B outlines key events and decisions in the planning, development and management of the project up to its termination in June 2015.

Figure 1B

Key project events and decisions

|

Date |

Event |

|

|---|---|---|

|

April 2008 |

Investing in Transport: East West Link Needs Assessment report by Sir Rodney Eddington recommended a new 18 kilometre cross city road corridor to provide an alternative to the West Gate Bridge. |

|

|

2009–2010 |

Linking Melbourne Authority (LMA) developed a project proposal for the WestLink project. |

|

|

November 2010 |

State election. |

|

|

October 2011 |

New government provided $7.5 million to begin work on the EWL business case. |

|

|

November 2011 |

EWL included in Victoria's submission to Infrastructure Australia. |

|

|

December 2012 |

EWL eastern section declared under the Major Transport Projects Facilitation Act 2009 (MTPFA) making it subject to the Act's assessment, approval and delivery requirements. |

|

|

April 2013 |

Government approved the business case for the eastern section, allocated $7.96 billion (nominal) to the project and approved its submission to Infrastructure Australia. Procurement of the project as an availability PPP was also approved. |

|

|

May 2013 |

Funding provided for EWL in the Victorian 2013–14 Budget. |

|

|

July 2013 |

Expressions of Interest invitation released for the PPP procurement of the eastern section of EWL. |

|

|

September 2013 |

The government approved the short-listing of three consortia to participate in the Request for Proposal. |

|

|

October 2013 |

Request for Proposal tender documentation released to three short-listed respondents. |

|

|

November 2013 |

Comprehensive Impact Statement released for public viewing as part of the statutory planning process for the project. |

|

|

April 2014 |

Final proposals submitted by the three short-listed respondents. |

|

|

June 2014 |

$1.5 billion in funding given by the Commonwealth Government for EWL subject to a memorandum of understanding on its use. Minister for Planning issued an approval decision for the project under MTPFA. |

|

|

July 2014 |

Moreland and Yarra City Councils filed court proceedings challenging the Minister for Planning's statutory planning approval decision for the eastern section. |

|

|

September 2014 |

The Opposition announces that if elected it would scrap the EWL project—pending result of the councils' legal challenge. Project contract signed between the state and EWC. Side letter signed by the Treasurer. |

|

|

November 2014 |

State election. |

|

|

December 2014 |

Work on EWL project suspended. |

|

|

April 2015 |

State signs Heads of Agreement with EWC to facilitate contract termination. |

|

|

June 2015 |

EWL termination deal finalised. |

Source: Victorian Auditor-General's Office.

1.3 Project governance and management

1.3.1 Decision-making on the East West Link project

Key decisions on the EWL project were made by government through the Cabinet process. The Cabinet made decisions following consideration of advice and/or recommendations from the Minister for Roads and relevant departments and agencies. The Premier and Treasurer also made project decisions.

The government decision-making process was supported by a project steering committee that included senior representatives from the former Department of Transport, Planning and Local Infrastructure—now the Department of Economic Development, Jobs, Transport & Resources (DEDJTR)—LMA, VicRoads, the Department of Treasury & Finance (DTF) and the Department of Premier & Cabinet (DPC).

The EWL project was declared under MTPFA in December 2012 for statutory planning assessment, approvals and project delivery. MTPFA was selected because it is a process specifically designed for projects like EWL. MTPFA combines planning and delivery powers under one Act, and consolidates approvals under 11 separate Acts into a single decision by the Minister for Planning. In addition to consolidating approvals, MTPFA also provides time line certainty.

1.3.2 Agencies involved in planning and development of the project

Department of Economic Development, Jobs, Transport & Resources

DEDJTR was responsible for whole-of-project scope and budget as well as designing the tolling policy for when the road was operational. DEDJTR provided oversight of LMA (which managed and had financial oversight of Stage 1 of the project), and established the EWL steering committee which undertook the core coordination role. DEDJTR was responsible for preparing the final EWL project business case.

Linking Melbourne Authority

LMA was a statutory authority, established in July 2010, as the successor to the Southern and Eastern Integrated Transport Authority. LMA was established to manage complex road projects and was accountable to the Minister for Roads.

The LMA was given responsibility by the government to deliver Stage 1 of the EWL project, including financial oversight, budget monitoring and financial reporting. It was also responsible for the initial development of the business case, statutory planning, developing the Expressions of Interest and Request for Proposal procurement documents, evaluating the bidder's proposals, selecting a preferred bidder and leading negotiations with this bidder to prepare contractual documentation for the project.

In January 2015, the government announced that LMA was to be abolished following the decision to suspend and ultimately discontinue the EWL project.

Department of Treasury & Finance

DTF was responsible for the commercial principles and financial structuring of the project—including structuring revenue and tolling risk transfer. DTF was represented on the project steering committee, which had direct involvement in the governance and management of the project.

DTF also had direct involvement with the contractual and financial arrangements between the state government, Commonwealth Government and EWC. It also provided financial forecasts and assessments, and negotiated with Transurban—the operator of CityLink—on the interface of the proposed EWL with the CityLink toll road.

VicRoads

VicRoads provided technical advice for Stage 1 of the project—road based corridor planning and assessment—and was responsible for the planning and delivery of complementary works on both the eastern and western sections such as the Eastern Freeway upgrade and Doncaster Area Rapid Transit bus upgrade.

Department of Premier & Cabinet

DPC was represented on the project steering committee and provided briefings and advice to government on the progress of the project from planning through to the signing of the contract.

1.3.3 Agencies with a limited role in the planning and development of the project

Department of Environment, Land, Water & Planning

The Department of Environment, Land, Water & Planning—formerly the Department of Transport, Planning and Local Infrastructure—provided advice and support to the Minister for Planning, to inform his approval decision for the project under MTPFA.

Planning Panels Victoria

The Minister for Planning appointed an Assessment Committee under MTPFA to consider the matters associated with the proposed EWL Comprehensive Impact Statement.

The committee conducted public hearings and considered submissions on the Comprehensive Impact Statement from LMA, the Minister for Planning, several councils—Melbourne, Yarra, Moonee Valley, Moreland and Darebin—the Environment Protection Authority (EPA) and a number of community groups. The committee reported to the minister on 30 May 2014 with 43 recommendations.

Environment Protection Authority

Under the Environment Protection Act 1970 the construction of twin multi-lane road tunnels (with ventilation systems) for Stage 1 of EWL required a works approval from the Minister for Planning. EPA's role was to advise the minister whether a works approval should be issued and what conditions, if any, it should be subject to.

Treasury Corporation of Victoria

TCV was engaged by LMA to provide market interest rate benchmarking services at the signing of the project contract.

Victorian Government Solicitor's Office—Department of Justice & Regulation

The Victorian Government Solicitor's Office (VGSO) and counsel engaged by VGSO provided legal advice to the government on the legal challenges to the validity of the Minister for Planning's EWL project planning approval decision under MTPFA, as well as advice on the power of the state to enter into the contracts with EWC and the side letter.

1.3.4 Agencies involved in the termination of the project

Department of Premier & Cabinet

DPC led implementation of the new government's policy decision that the project would be terminated. DPC was responsible for negotiating a settlement and termination agreement with EWC.

Department of Treasury & Finance

DTF was responsible for seeking to achieve the 'repurposing' of the EWC project loan facility as part of the termination negotiations with EWC and its financiers.

Treasury Corporation of Victoria

TCV provided assistance to DTF on the negotiation and termination of the project finance documents. TCV also assisted DTF in the implementation and management of an interest rate hedge strategy, to limit the interest rate exposure associated with the interest rate swap that transferred from EWC to the state under the termination agreements.

1.4 Audit objective and scope

Audit objective

The objective of the audit was to determine if the state effectively managed the EWL project and related costs by assessing the:

- total costs of the project, including ongoing financial implications and risks associated with terminating the project

- appropriateness of advice supporting key project decisions that influenced the project's outcomes and total costs

- lessons for future major projects.

Audit scope

The audit examined the:

- governance and management arrangements for the project

- key project events and decisions and the soundness of the advice underpinning key government decisions

- costs associated with project planning, procurement and termination, including risks and future obligations of the state arising from the termination

- outcomes of any lessons learned analysis performed by relevant departments and agencies on this project.

The audit included the following departments and agencies:

- the Department of Premier & Cabinet

- the Department of Treasury & Finance

- the Department of Economic Development, Jobs, Transport & Resources

- the Department of Environment, Land, Water & Planning

- the Department of Justice & Regulation and the Victorian Government Solicitor's Office

- the Linking Melbourne Authority

- VicRoads

- the Environment Protection Authority

- Planning Panels Victoria

- the Treasury Corporation of Victoria.

1.5 Audit method and cost

The audit was conducted in accordance with section 15 of the Audit Act 1994 and the Australian Auditing and Assurance Standards. Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated any persons named in this report are not the subject of adverse comment or opinion.

The total cost of the audit was $630 000.

1.6 Structure of the report

The report is structured as follows:

- Part 2 examines the project cost

- Part 3 examines the project planning and business case

- Part 4 examines the procurement and contracting of the project

- Part 5 examines the termination of the project

- Part 6 sets out lessons for future major projects.

2 Project costs

At a glance

Background

The East West Link (EWL) project was one of the largest transport infrastructure projects ever proposed in Australia. It was to be delivered in two stages. Prior to the November 2014 state election, work had commenced on Stage 1, the eastern section, with limited progress on Stage 2, the western section. Following the November 2014 state election, after significant costs had been incurred, the new government terminated the project.

Conclusion

The EWL project was terminated in June 2015 with more than $1.1 billion paid, or expected to be paid, by the state for little tangible benefit. This cost will be partially offset by future proceeds from the sale of properties acquired for the project. The Department of Treasury & Finance estimates that these properties can be resold for around $320 million.

Findings

- The arrangements in place to track costs for Stage 1 were mostly comprehensive and robust.

- Monitoring of expenditure against the approved project budget was undertaken and regularly reported for Stage 1 to the EWL steering committee. However, despite only minimal costs being incurred on Stage 2, there was no whole-of‑project monitoring and reporting on costs.

Recommendation

That the Department of Treasury & Finance provides guidance to support whole-of-project cost tracking and reporting against budget for major projects that involve multiple stages managed by different agencies.

2.1 Introduction

In May 2013, the state announced its intention to proceed with Stage 1 of the East West Link (EWL) project at an estimated capital cost of $6 to $8 billion. Following a competitive tender process the state appointed a consortium—East West Connect (EWC)—to finance, design, construct, operate and maintain Stage 1.

In May 2014, the state announced its commitment to deliver Stage 2 at an estimated capital cost of $8 to $10 billion with initial works commencing in 2015.

In June 2014, the Commonwealth Government committed funding of $3 billion for the EWL project—$1.5 billion each for Stages 1 and 2. It paid the state $1.5 billion in June 2014 comprising $500 million for Stage 1 works and $1 billion for Stage 2 works.

Following the 2014 state election, the new government instructed EWC to suspend works on Stage 1 and commenced negotiating a termination settlement, which was finalised on 15 June 2015.

This Part of the report examines the financial implications of the project, considering both the termination and the outcome had the project progressed to completion. It also considers the management and reporting of costs by the key entities involved.

2.2 Conclusion

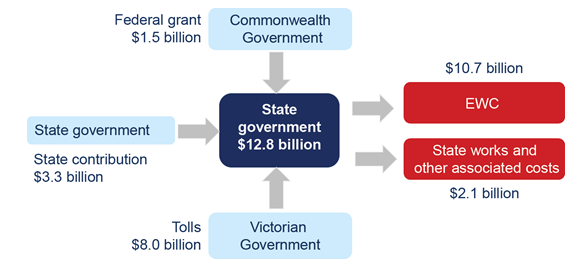

The estimated total project cost of Stages 1 and 2 of EWL, had it proceeded to completion, was in excess of $22.8 billion in nominal terms over the life of the project. This funding was to be met primarily through imposing tolls on users of the road, with $3 billion provided by the Commonwealth Government, and the Victorian Government meeting the remaining costs, including taking on the risk that toll revenue might be lower than expected.

The EWL project was terminated in June 2015 with more than $1.1 billion paid, or expected to be paid, by the state. This cost will be partially offset by future proceeds from the sale of properties acquired for the project. The Department of Treasury & Finance (DTF) estimates that these properties can be resold for around $320 million.

This significant expenditure will yield little tangible benefit. Pre-construction activities including design and geotechnical work and elements of the complementary projects may provide some value in the future.

2.3 Actual and expected project costs

The EWL project was terminated in June 2015 at an expected total cost to the state in excess of $1.1 billion. This includes expenditure on the planning, development, procurement and termination of the project.

2.3.1 Costs incurred on the eastern section

Figure 2A shows the total costs for the state associated with Stage 1 including actual costs incurred up to 30 June 2015, and costs expected to be incurred after 30 June 2015 relating to the final settlement of outstanding costs on the project.

Figure 2A Stage 1 total costs

|

Item |

Costs ($ '000) |

|---|---|

|

Actual project expenditure at 30 June 2015 |

|

|

Business case development |

26 045.5 |

|

Property acquisition costs |

276 915.0 |

|

Complementary projects |

5 668.8 |

|

Other state costs |

124 784.8 |

|

Termination payments made to EWC |

424 093.8 |

|

Cost of advice on termination |

3 176.2 |

|

Total costs to 30 June 2015 |

860 684.1 |

|

Expected future costs |

|

|

Settlement of interest rate swap on EWC loan facility |

217 889.7 |

|

Settlement of outstanding property acquisitions and legal cases |

75 378.6 |

|

Completion of complementary projects |

4 003.6 |

|

Total estimated future costs |

297 271.9 |

|

Summary of actual and expected costs by project phase |

|

|

Planning, developing and establishing the EWL project(a) |

503 123.9 |

|

Terminating the EWL project(b) |

645 159.7 |

|

Other costs: complementary projects |

9 672.4 |

|

Total costs |

1 157 956.0 |

(a) The total costs for planning, developing and establishing the project includes costs for business case development, property acquisition, and other state costs including procurement and contract establishment.

(b) The total costs for terminating the project includes termination payments to EWC, the expected future cost of settling the interest rate swap and the costs of advice on termination.

Source: Victorian Auditor-General's Office.

Figure 2A includes around $350 million in costs relating to property acquisitions. These properties have been offered back to their original owners and a sales strategy is currently being developed for the remaining properties. DTF estimates that these properties can be resold for around $320 million.

The costs of the project will also be offset by rental revenue on acquired properties and any proceeds from the sale of assets acquired from EWC as part of the termination settlement.

Interest rate swaps

The termination settlement involved the state assuming the interest rate swap established by EWC for its loan facility. The state will realise a loss when it finalises this swap.

An interest rate swap is a financial instrument in which two parties agree to 'exchange' interest rate cash flows or the amount of interest they pay, which effectively results in the parties paying—or receiving—a different interest rate to the rates in their agreements with their financiers. Interest rate swaps assist entities to manage their cash-flow requirements and interest rate risk exposure.

As part of the financing arrangements, EWC entered into an interest rate swap with five of the major financiers providing the loan facility—two major Australian banks and three international banks.

The swap arrangement allowed EWC to effectively pay a fixed instead of a variable interest rate during the construction period. This is a standard component of public private partnership (PPP) financing arrangements as it provides the state with some certainty of the future payments that will be required once the PPP enters the operational period.

The value of the interest rate swap at 30 June 2015 was $217.9 million. The state will be required to pay the value of the interest rate swap when the arrangement is closed. The amount will depend on interest rates at that time.

2.3.2 Costs incurred on the western section

Stage 2 was still in early planning and development and therefore the procurement method had not been determined by the time the project was terminated. Total costs incurred on the western section to 30 June 2015 were $15.2 million, comprising:

- costs incurred by the Department of Economic Development, Jobs, Transport & Resources (DEDJTR) in completing the detailed planning work and the interim business case

- costs relating to a package of early works completed by VicRoads, which were passed on to DEDJTR.

2.4 Project costs if it proceeded

The estimated total project cost of EWL had it proceeded to completion was in excess of $22.8 billion in nominal terms over the life of the project. This estimate is detailed in Figure 2B and is based on approved business cases and budgets and the financial modelling for the PPP.

Figure 2B

Total estimated cost in nominal terms($ billion)

|

Item |

Budget (nominal) |

|---|---|

|

Stage 1 |

|

|

PPP(a) |

10.697 |

|

Other state costs |

2.095 |

|

Total Stage 1 expenditure |

12.792 |

|

Stage 2(b) |

10.000 |

|

Total project expenditure |

22.792 |

(a) The Present Value equivalent for this amount is $4.3 billion discounted to 30 June 2013.

(b) The total estimated cost for Stage 2 did not include costs for operation and maintenance during its operating phase.

Source: Victorian Auditor-General's Office.

The project was to be funded by the Commonwealth Government, state government and by road users through tolling arrangements.

2.4.1 Eastern section

Project cost and funding

Figure 2C shows the total budget for Stage 1 of the EWL project, based on the outcomes of the tender process that appointed EWC.

Figure 2C

Total budgeted eastern section costs ($ billion)

|

Item |

Budget |

|---|---|

|

Costs related to PPP agreement with EWC(a) |

|

|

Design and construction |

4.336 |

|

Operations and maintenance |

3.279 |

|

Financing costs |

3.082 |

|

Total PPP costs |

10.696 |

|

Other state costs |

|

|

Business case development |

0.027 |

|

Property acquisition |

0.515 |

|

Complementary projects |

0.400 |

|

Pre-agreed modifications |

0.169 |

|

Other design and construction period costs |

0.559 |

|

Risk and contingency |

0.382 |

|

Operations and maintenance period costs |

0.043 |

|

Total other state costs |

2.095 |

|

Total |

12.791 |

(a) As at financial close, October 2014.

Source: Cabinet submission, financial model for the PPP and Victorian Auditor-General's Office.

Figure 2D shows how the funding for Stage 1 was structured.

Figure 2D

East West Link funding structure for Stage 1

Source: Victorian Auditor-General's Office.

Toll revenue

The majority of the costs of Stage 1 of EWL were to be met by tolls on users of the road. Under the PPP terms, the government would collect and retain toll revenue. Actual toll revenue collected would not affect the payments to the road operator. This was different to the models previously used for Victorian tolled road infrastructure—i.e. CityLink and EastLink—where the private road operators charge and collect tolls directly, and therefore bear the risk that revenue will be lower than expected. In the event that EWL traffic volumes were lower than expected, the state would have been required to fund any shortfall, but the state would have benefited from higher than forecast traffic volumes.

Commonwealth Government funding

On 28 June 2014, the government entered into a memorandum of understanding (MoU) with the Commonwealth Government under the National Partnership Agreement on Land Transport Infrastructure Projects. Under the MoU, the Commonwealth committed $1.5 billion funding for Stage 1, of which $500 million was received by the state in 2013–14. The early receipt of funds allowed for interest to be earned on the contribution, which could then be applied as a further offset against the state costs.

State government funding

As part of the business case, it was identified that for very large projects—those with a capital cost in excess of $2 billion—a funding contribution from the state may be required to address issues associated with the size of the debt funding required and available funding from debt markets. As a result, in October 2013, the government approved contributions to be made to the selected PPP partner for Stage 1:

- $2 billion to be made available during construction—$1.5 billion of which was to be funded from the Commonwealth Government funding contribution plus $0.5billion from the state

- $1 billion to be made available two years after construction was complete, fully funded by the state.

2.4.2 Western section

The 2014–15 State Budget included an initial capital budget for Stage 2 of the project of $10 billion. This included $4 million of funding in 2013–14 and $100 million in 2014–15 to finalise the business case and commence planning work.

The MoU with the Commonwealth Government also included $1.5 billion in funding for Stage 2, $1 billion of which was received in 2013–14.

The initial package of works for Stage 2—the upgrade of Paramount Road and Ashley and Dempster Streets—was to commence construction by the end of 2015 to meet the Commonwealth Government's funding conditions.

2.5 Monitoring of project costs

The arrangements in place for agencies to track EWL costs were mostly comprehensive and robust. However, there was no regular monitoring and reporting of costs against budget at the whole-of-project level.

2.5.1 Eastern section

As part of the project governance arrangements, the then Department of Transport, Planning and Local Infrastructure (DTPLI) established the EWL steering committee whose responsibilities included endorsing all recommendations to the Minister for Roads and to Cabinet, including those in regards to whole-of-project scope and budget management.

The steering committee's meeting agendas and minutes indicate that regular reports were provided by the key operational entities for the project—the Linking Melbourne Authority (LMA), DTPLI, DTF and VicRoads. LMA tracked its own expenditure against the approved project budget together with costs for which other departments and agencies sought reimbursement. LMA reported this information to the EWL steering committee.

The regular reports from departments and agencies were generally noted in the steering committee meetings. However, there was little documentation of discussions that may have occurred and questions that may have been asked. The steering committee only considered Stage 1 and not Stage 2.

2.5.2 Western section

For Stage 2, DEDJTR established a project code in its finance system against which project costs were charged. There was no evidence of regular monitoring and reporting of costs against budget for Stage 2 or at the whole-of-project level.

2.5.3 Departments and agencies

Figure 2E summarises the responsibilities of departments and agencies and to what extent project costs were tracked.

Figure 2E

Agency responsibilities and cost tracking

|

Agency |

Role |

Costs tracked |

|---|---|---|

|

LMA |

Lead development of the business case and project manager of Stage 1. |

All costs were tracked and recorded. |

|

DEDJTR |

Lead department for the project. Stage 2 development was managed by an administrative office within the department. |

Staffing costs were not tracked. Other costs were recorded and tracked for Stages 1 and 2. |

|

VicRoads |

Contributor to development, as well as project manager for a number of separate components. |

All costs were tracked and recorded, however, not all were passed on to LMA. |

|

DTF |

Involved in reviewing the business case and the structuring of the PPP arrangement. After suspension of the project, involved in assessing solutions for the financing arrangements. |

Staffing costs were not tracked. External costs during the PPP procurement process were the only costs passed on to LMA. |

|

Department of Premier & Cabinet |

Represented on the steering committee prior to termination. Responsible for managing termination negotiations with EWC. |

Staffing costs were not tracked. External costs during the termination were tracked. |

|

Department of Environment, Land, Water & Planning |

Provision of advice and performance of statutory functions in relation to the statutory planning assessment and approvals processes. |

Staffing costs were not tracked. Planning functions were transferred from DEDJTR—formerly DTPLI—as a result of machinery‑of‑government changes. Relevant financial information resided in DEDJTR systems and it provided information on external costs. |

|

Victorian Government Solicitor's Office |

Provision of legal advice relating to the project, including in relation to court action. |

Operates on a fee-for-service model, with all costs passed on to the relevant agency. |

|

Planning Panels Victoria |

Provision of administrative support to the Assessment Committee appointed under the Major Transport Projects Facilitation Act 2009. |

Operates on a full cost recovery basis, with all costs passed on to LMA. |

|

Environment Protection Authority |

Assessment of the Comprehensive Impact Statement and works approval application, including making a submission to the Assessment Committee. |

Costs were not tracked, however, the Environment Protection Authority was able to provide a reasonable estimate of the costs they incurred. |

|

Treasury Corporation of Victoria |

Interest rate benchmarking services at financial close of the PPP and involvement in assessing and managing solutions for the financing arrangements. |

Work conducted prior to termination was under a fee-for-service arrangement. Costs after project termination were not tracked, however, TCV was able to provide a reasonable estimate. |

Source: Victorian Auditor-General's Office.

Some departments did not capture the staff costs attributable to the EWL project. For example DTF, Department of Premier & Cabinet, and DEDJTR staff do not complete timesheets, and therefore internal staff costs were not captured and included as part of the project cost. These departments only passed on costs associated with external consultants to LMA.

Recommendation

- That the Department of Treasury & Finance provides guidance to support whole-of-project cost tracking and reporting against budget for major projects that involve multiple stages managed by different agencies.

3 Planning the project

At a glance

Background

The East West Link (EWL) project was one of the most significant investments ever proposed for the state in terms of impact, complexity and cost. In October 2011 the government approved funding for the development of a business case for the project. In April 2013, the government approved the eastern section of EWL to proceed as Stage 1 of the project, based on the March 2013 business case.

Conclusion

The business case, which is a critical step in any major project, did not provide a sound basis for the government's decision to commit to the investment because it did not clearly establish the need for the investment through a robust analysis of the costs, benefits and risks of reasonable options.

Findings

- The business case did not provide a sound basis for prioritising the eastern section over other sections of the road.

- There was insufficient information and evidence in the business case to demonstrate the accuracy and plausibility of the assumed wider economic benefits of the project, or the validity of underlying traffic modelling.

- The business case did not address significant issues raised by peer reviewers.

Recommendation

That the Department of Treasury & Finance improves its business case development guidance material, the adherence to this guidance by agencies, and its quality assurance over key inputs to project business cases.

3.1 Introduction

The East West Link (EWL) project was one of the most significant investments ever proposed for the state in terms of impact, complexity and cost. In October 2011 the government approved funding for the development of a business case for the project. The business case was developed between late 2011 and mid-2013.

In April 2013, the government approved the eastern section of EWL to proceed as Stage 1 of the project based on a March 2013 business case. The business case was subsequently updated with the final version noted by government in September 2013.

The former Department of Transport and former Department of Transport, Planning and Local Infrastructure—now the Department of Economic Development, Jobs, Transport & Resources (DEDJTR)—were responsible for developing the business case, and were supported by the Linking Melbourne Authority.

3.2 Conclusion

The EWL business case did not provide a sound basis for the government's decision to commit to the investment. Gaps and weaknesses in the business case—including a failure to adequately address the issues raised by external reviews of key underlying information—meant that it did not clearly establish the need for the investment through a robust analysis of the costs, benefits and risks of reasonable options.

Further, the business case did not provide a sound basis for prioritising the eastern section over other sections of the proposed road.

These issues mean there was little assurance that the prioritisation of significant state resources for this project was soundly based.

The proposed project delivery approach was sound, however, the assessment of options appears to have given undue weight to the government's desire to begin work on the project prior to the 2014 state election.

3.3 Project planning and development timing

While no public commitments were made on the timing of the project in 2011 when the government agreed to fund the business case, it is clear that the government was focused from the outset on accelerating the planning and development of the project.

Figure 3A outlines key events in the project planning phase.

Figure 3A

Key events in the project planning phase

|

Timing |

Events |

|

|---|---|---|

|

October 2011 |

Government committed funding for development of a business case for the EWL project. |

|

|

June 2012 |

Government approved a forward program for the project requiring:

|

|

|

October 2012 |

Government was advised that the business case was on track for completion by the end of 2012 and that:

|

|

|

March 2013 |

The business case was completed and this formed the basis for key government decisions on the project. |

|

|

April 2013 |

The government considered the March 2013 business case and endorsed the base case and a number of complementary works including an Eastern Freeway upgrade and public transport enhancements to the north of the Melbourne central business district. |

|

|

June 2013 |

The March 2013 business case was revised and finalised. The state publicly released an updated 'short-form' summary business case and presented a more detailed version of the short-form business case to Infrastructure Australia that did not include the analysis and assumptions underpinning the updated economic assessment. |

|

|

September 2013 |

Government endorsed the final consolidated business case, which was an update to the March 2013 case considered by government in April 2013, and consolidated relevant work completed up until June 2013 for the purposes of preparing the publicly available short-form business case. This last business case included the final economic assessment, and related financing, tolling and procurement strategies. |

Source: Victorian Auditor-General's Office.

In April 2012, the government was advised of the risk of legal challenges to the progress of the project. Other advice to government on the project similarly highlighted risks to robust decision-making due to the emphasis on meeting the government's challenging time frame.

The government considered this advice but did not agree to allow additional time for project planning and development. In June 2012 the government approved a target forward program for the project that required construction to commence in October 2014, before the caretaker period for the November 2014 state election. This required concurrent activity on project development and statutory planning processes including approvals, procurement and contracting.

In addition, the government's target time line for the project was given undue weight by the then Department of Transport in arriving at their recommendation in the business case on the procurement and project delivery approach, and associated risk allocation.

3.4 The business case

The Department of Treasury & Finance (DTF) defines a business case as a 'document that forms the basis of advice for executive decision-making for an asset investment. It is a documented proposal that considers alternative solutions and identifies assumptions, benefits, costs and risks'. It is generally accepted that a robust business case is critical to the success of an investment.

The business case initially completed for the project in March 2013 formed the basis for government decisions. This business case was subsequently revised and finalised in June 2013.

The March 2013 business case indicated that the eastern section of the project had weak direct economic benefits arising from the core eastern section project scope and the investment merit relied on wider economic benefits (WEB).

A benefit cost ratio (BCR) of less than 1 indicates the benefits of the investment are less than the costs. Excluding complementary projects and WEBs, the direct BCR was 0.45. Including both WEBs and a range of complementary projects achieved a BCR above 1. This position was not significantly changed when the business case was revised in June 2013.

Figure 3B shows the BCRs disclosed in the March 2013 and June 2013 business cases.

Figure 3B

East West Link project (eastern section) benefit cost ratios

|

BCR |

||

|---|---|---|

|

March 2013 business case |

June 2013 business case |

|

|

Base case(a) |

||

|

Excluding WEBs |

0.45 |

|

|

Including WEBs |

0.84 |

|

|

Base case plus complementary projects(b) |

||

|

Excluding WEBs |

0.7 |

0.8 |

|

Including WEBs |

1.2 |

1.4 |

(a) Comprised the eastern section and a package of integrated land use and public transport initiatives, but not complementary projects such as the Eastern Freeway upgrade.The BCR analysis excluded costs and benefits from urban renewal and public transport initiatives.

(b) Comprised the eastern section and a package of integrated land use and public transport initiatives plus complementary projects including the Eastern Freeway upgrade, public transport improvements and CityLink widening. The BCR analysis excluded costs and benefits from urban renewal and active transport initiatives.

Source: Victorian Auditor-General's Office.

DTF guidelines on economic evaluation for business cases acknowledge that traditional BCR analysis has limitations and is not recommended as the sole quantitative assessment tool for decision-making purposes because it is biased towards small projects and those with early returns.

The March 2013 and later updated business cases:

- set out the strategic rationale for pursuing EWL over other transport investments

- proposed the eastern section as the preferred option for Stage 1 of the project over the other sections—despite the western section likely having a higher BCR

- presented a base case comprising a tolled motorway between Hoddle Street and CityLink, as well as additional options for complementary public transport works with the potential to deliver added benefits over the base case.

However, these business cases did not provide a sound basis for the government's decision to commit to the investment due to weaknesses in the:

- rigour of the economic assessment—specifically the accuracy of the estimates of WEBs and the reliability of the traffic modelling

- basis for prioritising the eastern section over other sections.

As a result the business case did not clearly establish the need for the project by robustly assessing the costs, benefits and risks of reasonable options.

3.4.1 Economic assessment

DTF's Investment Lifecycle guidance emphasises that robust economic evaluation of investment proposals is a vital component of the business case, to support informed investment decision-making by government.

The economic analysis underpinning the EWL business case was developed by a consultant in 2012 and updated during 2013. This analysis was subject to a range of qualifications and caveats due to its preliminary nature given the tight time frames for completing the business case.

Figure 3C summarises the results of the economic assessment in the March 2013 business case as well as the revised assessment in the June 2013 business case.

Figure 3C

Economic assessments in business cases ($ million in present value terms)

|

Costs and benefits |

March 2013 |

June 2013 |

Difference |

Percentage difference |

|---|---|---|---|---|

|

Costs |

||||

|

Capital costs |

3 707 |

3 739 |

32 |

1 |

|

Recurrent operating and maintenance costs |

293 |

339 |

46 |

15 |

|

Total costs |

4 000 |

4 078 |

78 |

2 |

|

Benefits |

||||

|

User benefits |

||||

|

1 083 |

2 079 |

996 |

92 |

|

5 |

240 |

235 |

4 700 |

|

88 |

192 |

104 |

118 |

|

420 |

651 |

231 |

55 |

|

66 |

66 |

0 |

0 |

|

Externalities |

||||

|

33 |

27 |

–6 |

–18 |

|

–41 |

–141 |

–100 |

–244 |

|

23 |

39 |

16 |

70 |

|

Avoided public transport costs |

n/a |

35 |

35 |

100 |

|

Residual value of assets |

136 |

153 |

17 |

13 |

|

WEBs |

||||

|

1 514 |

2 153 |

639 |

42 |

|

31 |

61 |

30 |

97 |

|

Total benefits |

3 358 |

5 555 |

2 197 |

65 |

|

Economic appraisal results |

||||

|

BCR |

0.8 |

1.4 |

0.6 |

75 |

|

Net present value |

–642 |

1 476 |

2 119 |

330 |

Note: The June 2013 business case was based on the final approved project scope which included a number of complementary projects.

Source: Victorian Auditor-General's Office.

Figure 3C shows significant increases between the March and June 2013 business cases in the value of estimated benefits in a number of important categories, such as travel time and reliability savings and WEBs. It is important to note that these increases were primarily due to the refinement and resolution of the project scope following the government's consideration of the March 2013 business case. Despite this, the June 2013 business case did not fully explain the basis for these increases in claimed benefits.

Wider economic benefits

The EWL business case relied heavily on the inclusion of estimated WEBs to support the assertion that the project was of net benefit. Without these WEBs, which were unusually high as a proportion of total benefits, the project cost was clearly higher than the expected benefits.

WEBs relate to economic benefits that are not typically captured in traditional cost-benefit analysis. Commonly considered WEBs include:

- 'agglomeration' impact (an increase in productivity due to improved proximity to suppliers and labour markets)

- the impact of transport on increasing competition

- competition related user benefits.