Maintaining Railway Assets Across Metropolitan Melbourne

Snapshot

Are Melbourne’s metropolitan railway assets maintained to deliver safe, reliable and punctual train services, and to optimise asset cost and performance?

Why this audit is important

In 2019, the metropolitan rail network carried over 240 million passengers. To operate, Melbourne’s trains rely on a range of supporting infrastructure and technology, from tracks and signals to information displays and computer systems.

The Department of Transport and Planning (the department) pays a private operator, Metro Trains Melbourne (Metro), $2.7 billion to maintain and renew these supporting assets over a 7 year franchise agreement (the agreement).

These assets need to be effectively maintained and periodically replaced to keep trains running safely and reliably.

Who we examined

- The department, which manages the railway assets and the agreement.

- Metro, the private train operator, which maintains and renews the assets.

- Victorian Rail Track (VicTrack), the asset owner.

What we concluded

Metro is maintaining Melbourne’s metropolitan railway infrastructure and technology to support reliable and punctual train services and keep passengers safe.

However, the department has not assessed whether Metro is optimising asset costs, and if the current maintenance and renewal approach will sustain asset performance in the long-term.

The department does not have a long-term strategy for its railway infrastructure and technology assets. It also does not have an effective way to measure asset performance and assess Metro's work.

The department needs this information to ensure the current agreement and any future contracts deliver value for money.

What we recommended

We made 10 recommendations to the department, including:

- 5 about assessing how railway assets perform

- 3 about better guiding how Metro plans maintenance and renewal works

- 2 about overseeing the works that Metro delivers.

Video presentation

Key facts

What we found and recommend

We consulted with the audited agencies and considered their views when reaching our conclusions. The agencies’ full responses are in Appendix A.

Achieving punctual, reliable and safe train services

Punctuality

Metro Trains Melbourne (Metro) aims to have at least 92 per cent of its trains arrive and depart on time each month. It only achieved this target two-thirds of the time to December 2022. Asset failures cause fewer delays than external factors, such as trespassers and weather, which are the main cause of missed punctuality targets since 2020.

Reliability

The punctuality target is that trains arrive and depart on time 92 per cent of the time.

The reliability target is that 98.5 per cent of scheduled train services are run.

Train services have only met the monthly public reliability target half of the time, but maintenance and renewal are not the main reasons for this. Train services mostly missed this target because of other factors, such as driver availability, trespassers and police operations.

Passenger safety

The Department of Transport and Planning (the department) does not publicly report on a safety target, but Metro has kept passenger safety incidents and injuries low across the metropolitan network. For example, from November 2020 to November 2021, there were 1.67 reported injuries per million passengers.

Metro focuses its maintenance works on making sure operations are safe. Railway infrastructure and technology are designed to ‘fail safe’. For example, when signals fail, they raise a red signal and trigger track protections that physically stop trains from passing the red signal. These mechanisms are designed to ensure that asset defects, faults and failures do not injure passengers.

The main causes of passenger injuries are passenger slips, trips and falls, such as people tripping while running to catch a train.

The department’s monitoring of Metro’s performance

Performance frameworks are used to define, measure, monitor and report on important aspects of an organisation or activity's objectives and aims.

The department does not have an overarching performance measurement and reporting framework for how it manages the train network, including the $2.7 billion of maintenance and renewal works over the 7-year term of the agreement.

The department included a range of key performance indicators (KPIs) and reporting requirements in the agreement. But it did not design these to collectively assess and monitor Metro’s performance against all of the agreement's objectives and aims for the network.

As a result, some of the department’s KPIs and targets for measuring Metro's performance, and how it affects the performance, condition and cost of assets, are not useful.

This lack of a framework also means the department:

- does not know whether Metro is on track to achieve all aims of the agreement and intended improvements to the network

- does not fully know how asset condition is changing and if Metro's maintenance and renewal work is optimising asset costs

- has limited ability to find performance issues and require Metro to address them before the agreement ends

- cannot gauge whether Metro is working cost-efficiently and delivering value for money.

The department has started revising the infrastructure KPIs without determining how they help it to assess whether Metro meets the agreement's objectives and aims.

Asset KPI performance

Metro has 78 infrastructure and technology performance KPIs. We checked 37 infrastructure KPIs to see how they performed between December 2017 and December 2021.

Performance stayed steady for 26 of these KPIs but improved for 10, while the performance of 1 declined, related to rail defects.

Examples of KPIs that have stayed steady are:

- mean time to repair track, electrical network and signals

- track faults

- number of signal cable failures.

KPIs that have improved include reductions in:

- temporary train speed restrictions

- signal faults.

Data quality

Metro's data is largely accurate. Where there are deficiencies, they are minor. Metro has a thorough approach to improving the quality of its data.

The Victorian Government's 2018 Data Quality Information Management Framework Standard (Data Quality Standard) requires the department to have a plan to manage and improve its critical data assets. The department does not comply with this standard because it has not defined its critical data assets and does not have a plan to manage data quality across all critical data assets.

Future asset management agreements

The agreement spans 7 years to November 2024. It focuses on achieving punctuality and reliability targets and supporting safety during this term.

However, the lifespans of many of the assets are far longer than 7 years. The department has not assessed whether Metro is maintaining and renewing these assets in a way that optimises their performance and delivers value for money across their lifespans.

The department can use any future agreement to change or add contract requirements on the operator's maintenance and renewal, and its own oversight and assurance of the operator's work. It is considering options for doing this, including to get better information about what asset maintenance and renewals it needs for the next agreement.

The department is also considering whether to extend the current contract for up to 3 years. The current agreement restricts the department’s ability to change contract requirements as part of any extension.

There is a risk that the department will not improve any future franchise arrangements as much as it needs to because it has not comprehensively assessed asset maintenance and renewal performance under the current agreement, or ensured it has the capacity and capability to do this work.

Recommendations about assessing railway assets performance

| We recommend that: | Response | |

|---|---|---|

| Department of Transport and Planning | 1. Develops an overarching performance measurement and reporting framework for the metropolitan train network (see section 2.2). | Accepted by: Department of Transport and Planning |

|

2. Uses the performance measurement and reporting framework (developed in response to recommendation 1) to inform the requirements it sets for maintaining and renewing the assets in any future metropolitan train franchise agreement, including:

|

||

| 3. Assesses whether maintenance and renewal under the current metropolitan train franchise agreement is achieving its objectives and aims and uses the results to guide the development of its performance measurement and reporting framework (see sections 2.2 and 2.4). | ||

| 4. Defines its critical data assets and develops and implements a plan to manage and improve them, to comply with the Victorian Government's 2018 Data Quality Information Management Framework Standard (see section 2.3). | ||

| 5. Publicly reports on the safety performance of its metropolitan railways (see section 2.1). |

Asset planning

Long-term asset management strategy

During the previous agreement, the department did not define its long-term strategic aims for railway infrastructure and technology. This meant the department was not well-placed to set aims for the current agreement that balanced the need for assets to support safe, reliable train services now, with the long-term needs of the railway network. This made the department more reliant on Metro's advice about what works it needed to do.

The department has started to develop a long-term asset strategy. But it has not made sure it has the staff capability, capacity and detailed planning it needs to successfully deliver this work by June 2023 as intended.

Maintenance and renewal plans

The franchise management plans and annual works plans are current. But updates to many of Metro's technical maintenance plans are overdue or not yet approved.

This means that there is a risk that the department does not know whether the technical maintenance plans continue to align with the agreement’s objectives and aims.

The department’s oversight of Metro’s renewal prioritisation

The department does not know enough about how Metro prioritises work to assure it that Metro targets the most needed renewals, rather than the cheapest or easiest ones. It also cannot readily confirm that the renewal priorities appropriately balance the network's current and future performance.

The main gaps in the department’s oversight are that it does not:

- know whether Metro’s prioritisation is systematic, objective and consistent

- check how Metro's renewal priorities align with the agreement aims.

Metro's annual works plans and supporting documents record elements of how it prioritises renewals and how it is improving its approach. These include the information sources Metro relies on to identify new renewal needs or re-prioritise existing planned renewals, and its rationale for some asset renewals.

However, aside from the signals asset discipline, Metro has not documented the processes and criteria it uses for each asset discipline to prioritise the assets that need to be renewed in the next 3 years from its longer renewal list.

Metro's plans focus on achieving targets for train punctuality, reliability and safety but not some of the agreement's other aims, such as how it minimises obsolescence costs.

Recommendations about planning maintenance and renewals

| We recommend that: | Response | |

|---|---|---|

| Department of Transport and Planning | 6. Develops and finalises a long-term management strategy for its railway assets, including maintenance and renewal, in time to inform any metropolitan train franchise agreement extension or future agreement, including by:

|

Accepted by: Department of Transport and Planning |

| 7. Establishes a system to ensure that planning documents are updated and approved on time, according to requirements of the metropolitan train franchise agreement (see section 3.2). | ||

8. Strengthens its oversight and assurance over Metro Trains Melbourne's maintenance and renewal plans by requiring Metro Trains Melbourne to:

|

The department’s oversight of Metro’s maintenance and renewal

Metro’s delivery of planned maintenance and renewal works

Metro has completed most of its planned maintenance activities and done this on time.

Metro has renewed 95 per cent of infrastructure assets as planned since the start of the agreement.

However, it has a significant backlog of technology (operational control and management system) asset renewals that it did not complete in earlier lease years. It still plans to complete them by the end of the agreement.

The department does not have assurance that Metro can complete these outstanding works by the end of the agreement.

Cost of maintenance and renewal works

The department and Metro track the quantity of maintenance and renewal works that Metro completes, when it completes them, and how much they cost each month.

However, the department does not monitor the trend in maintenance and renewal costs and quantities across lease years. This means it cannot track Metro's overall progress in delivering the works, assess the full extent of outstanding works or understand how efficiently Metro is working.

We assessed Metro's progress over the agreement's first 5 years using the department’s interim data on works to date. This shows Metro is doing the work at a lower cost than planned. For example, Metro delivered 86 per cent of its planned technology asset renewals using 68 per cent of what it had planned to spend.

The major transport projects are a pipeline of government projects to improve the state's rail and road networks. The government calls this pipeline the Big Build. Projects that affect the metropolitan railway include removing level crossings, building the Metro Tunnel and upgrading the Sunbury line.

The department did not have final costs for this period that we could use. This is because:

- the department and Metro only reached agreement in June 2022 on how to cost maintenance for new infrastructure and technology added to the network by major transport projects since 2017. The department and Metro are still calculating how much this increases the planned cost

- Metro has completed extra renewals at the department’s request, to support major transport projects. The department has not yet calculated how much this adds to the planned cost

- the department has not assessed all Metro's claims for works completed.

The department’s oversight of works’ quality, location and scope

The department has not asked Metro to show whether the works meet quality and scope requirements. This means the department is missing information that is essential for it to know whether Metro is delivering value for money.

Because the department does not monitor location, it does not know if the spread of works across the 15 train lines and between inner and outer metropolitan areas supports passengers equitably across the network.

The department’s oversight of agreement objectives, aims and principles

The department has assurance that Metro's maintenance and renewal is achieving some of the agreement objectives, aims and commitments, such as supporting punctual and safe train services.

However, the department does not assess whether these works collectively optimise asset cost and performance. The department also does not check that Metro works on non operation facing assets, such as train stations and fencing, in balance with track and other operation facing assets.

This leaves the department without a comprehensive understanding of how well Metro's maintenance and renewal work is performing. This means it is unable direct and influence future works to ensure the agreement achieves its aims.

The department’s review of proposed changes to the works plans

As the government announces new major transport projects, and works progress on existing ones, Metro continues to adjust and change its planned works.

The department and Metro have improved their tracking of these changes over time and Metro's justification for the changes. However, the department’s review is sometimes too slow to allow Metro to deliver the changed works at the best time.

The department also does not assess whether these changes pose a cumulative risk to the network or annual works plans. Nor does it review whether these changes have any cumulative, unintended impact across the network.

Recommendations about maintaining and renewing assets

| We recommend that: | Response | |

|---|---|---|

|

Department of Transport and Planning |

9. Strengthens its oversight and assurance that Metro Trains Melbourne fully delivers the planned works by:

|

Accepted by: Department of Transport and Planning |

| 10. Sets information requirements and approval timeframes for change requests, including a process and timeframe for escalating urgent and complex changes (see section 4.2). |

1. Audit context

More passengers travel on metropolitan trains than any other type of public transport in Melbourne. Before the COVID-19 pandemic, the network carried 4.7 million passengers each week.

For these trains to run safely and as scheduled, the infrastructure and technology assets that support them need to be maintained and periodically renewed.

Under a franchise agreement with the Department of Transport and Planning, private rail operator Metro plans and delivers maintenance and renewal works across the network.

The department manages the agreement and oversees Metro's maintenance and renewal works.

VicTrack, a state-owned enterprise, owns the assets but is not part of the franchise agreement.

In this chapter

1.1 Melbourne’s metropolitan railway network

Melbourne has the largest metropolitan railway network in Australia. As Figure 1A shows, the network's 15 lines spread from the central business district to Frankston in the south, Lilydale in the east, Craigieburn in the north and Werribee in the west.

Figure 1A: Melbourne’s metropolitan railway network

Source: The department, amended by VAGO.

Figure 1B shows some key characteristics of this network.

Figure 1B: Key characteristics of Melbourne’s metropolitan railway

Source: VAGO, based on public and department information.

From 2009 to 2022, the number of scheduled yearly train services on the metropolitan network increased by 21 per cent to 799,121, as Figure 1C shows. In 2022, on average there were 2,189 daily services compared to 1,805 in 2009. Passenger numbers increased 5 per cent between July 2010 and February 2020 but dropped significantly from March 2020 when the pandemic started.

Figure 1C: Quantity of passengers and train services, 2009 to 2022

Note: Passengers is a count of people aged over 5 boarding trains and excludes train transfers that do not involve a change in direction.

Source: VAGO, based on department data.

Network improvements and upgrades continue to add new assets to the network. Since 2017–18 there have been over $40 billion worth of new transport projects involving the metropolitan train network, though this also includes road and tram assets (e.g. level-crossing removals).

Railway assets

Figure 1D summarises the categories, disciplines and classes of railway assets we examined in this audit.

Figure 1D: Railway asset categories, disciplines and classes

Source: VAGO.

This audit did not examine trains and carriages.

Figures 1E and 1F show examples of infrastructure and technology assets on railways.

Figure 1E: Infrastructure assets on railways

Source: VAGO.

Figure 1F: Technology assets on railways

Source: VAGO.

1.2 Maintenance and renewals

Planned maintenance is routine inspections and works done to keep an asset performing.

Reactive maintenance is work done to fix an asset defect, fault or failure.

Maintenance is the ongoing work done to check an asset’s operational performance and ensure this performance continues. Examples include:

- inspecting parts

- grinding the rails

- testing servers and security systems

- patching software.

Renewal involves replacing an existing asset or part with a new one, such as replacing a section of track or obsolete technology.

Maintenance and renewals are either planned or reactive. Defects, faults or failures in assets trigger reactive work.

An occupation is a scheduled closure of a train line or section for works, such as maintenance and renewal activities or level crossing removals occurring as part of Victoria’s major transport projects.

Metro does most of its planned works overnight between the last and first train, or during occupations. Reactive works can involve closing parts of a train line during the day or night.

1.3 Roles and responsibilities

Figure 1G shows the department, Metro and VicTrack’s roles and responsibilities over railway asset maintenance and renewal.

Figure 1G: Agency roles and responsibilities for metropolitan railway assets

| Entity | Role | Responsibilities |

|---|---|---|

| The Department of Transport and Planning | Lead transport agency and asset manager | Oversees Metro’s management of the railway assets. |

| Metro Trains Melbourne | Metropolitan train franchisee and operator | Maintains the metropolitan railway assets. |

| Victorian Rail Track | Owner of the railway assets | Manages the telecommunications assets but leases the railway assets to the department. No responsibility over maintenance and renewal of metropolitan railway assets. |

Source: VAGO.

1.4 The agreement between the department and Metro

The agreement between the department and Metro governs the operations of Melbourne’s metropolitan railway.

The agreement started in November 2017 for an initial 7-year term, with the option to extend the contract for between 6 months and 3 years. The value of the 7-year term in the 2017 agreement was $6.2 billion. Figure 1H shows the timeline of train franchise agreements.

Figure 1H: Timeline of train franchise agreements

Note: Lease year 1 was only 7 months. Lease year 7 covers the last 17 months of the agreement.

Source: VAGO.

Public Transport Victoria managed the previous agreement and the start of the current agreement before 2019, when the Victorian Government established the Department of Transport, now the Department of Transport and Planning. The department took over Public Transport Victoria's responsibilities.

Maintenance and renewal under the agreement

Over the initial 7 years of the agreement, the department will pay Metro up to $2.7 billion of the agreement's $6.2 billion total to maintain and renew all railway assets.

Up to September 2022, the department has paid Metro $2.1 billion:

- $1.58 billion to maintain and renew infrastructure

- $585 million to maintain and renew technology assets.

The department holds these funds in separate accounts for infrastructure and technology assets.

The department and Metro have joint governance groups and working groups that oversee the planning, delivery, costs, payments, and performance of Metro's maintenance and renewal work.

The agreement modules, supported by key plans, set out how Metro will maintain and renew the assets and how the department will oversee this work, as Figure 1I explains. Appendix D provides further detail.

Figure 1I: Key agreement modules and plans

Source: VAGO.

Maintenance and renewal performance aims and commitments

The agreement contains modules and required plans that describe objectives, aims and commitments for railway asset maintenance and renewal, as Figure 1J outlines.

Figure 1J: Examples of agreement objectives and aims and Metro’s commitments related to railway assets

Source: VAGO, based on agreement modules and franchise management plans.

Key performance indicators

The agreement contains 78 key performance indicators (KPIs) specific to maintaining and renewing the railway assets.

The department also publicly reports on the agreement’s 2 key performance targets: train service punctuality and reliability. Figure 1K shows these monthly targets and how they are calculated.

Figure 1K: Punctuality and reliability targets

| Measure | Monthly target | Definition and calculation |

|---|---|---|

| Punctuality | 92% | The percentage of on-time events at specified points. A train is on time if it arrives no later than 4 minutes and 59 seconds after the scheduled time and departs no earlier than 59 seconds before the scheduled time. Trains arriving outside of this time are referred to as delayed. |

| Reliability | 98.5% | The proportion of timetabled services the operator delivers. Services that are not delivered are referred to as cancelled. |

Source: VAGO, based on agreement documents.

The department publishes the data on train service performance on its Public Transport Victoria website. We have included this in Figure 1L.

Figure 1L: Train service punctuality and reliability performance during previous and current agreements

Source: VAGO, based on Public Transport Victoria 's Power BI monthly performance app, available to the public on its website.

1.5 Asset and data standards for government agencies

The agreement requires Metro to adhere to the ISO 55001:2014 Asset management – Management systems – Requirements (ISO 55001) and maintain its accreditation. Metro must also comply with other standards, including for:

- infrastructure

- environmental management systems

- quality management systems.

As Victorian government agencies, the department and VicTrack must also comply with government requirements for managing assets and data.

Asset Management Accountability Framework

Victorian government agencies must follow the asset management requirements the Department of Treasury and Finance sets in its 2016 Asset Management Accountability Framework.

The Asset Management Accountability Framework applies to non-current (or long term) assets, including information and communication technology assets, that government entities control.

These requirements guided aspects of our work. But we have not assessed agency's asset management against them for this report.

The Data Quality Standard

The Data Quality Standard defines an approach to setting and maintaining the quality of data assets within the Victorian Government. It has 7 dimensions:

- completeness

- representative

- timeliness

- fit for purpose

- consistency

- collection

- accuracy.

We used these dimensions to assess the department and Metro’s data quality.

2. Assessing how railway assets are performing

Conclusion

Metro maintains and renews railway infrastructure and technology sufficiently to support train service punctuality and reliability and minimise passenger injuries.

However, the department does not have an overarching performance measurement and reporting framework for the $6.2 billion agreement. As a result, it does not effectively monitor Metro’s performance in maintaining and renewing these assets. The department also does not check if Metro’s asset maintenance and renewal works will support train service performance into the future.

In this chapter

2.1 Achieving punctual, reliable and safe train services

Maintenance and renewal support punctuality and reliability

Metro plans and delivers its maintenance and renewal program to support punctual and reliable trains.

Metro met the monthly punctuality target of 92 per cent two-thirds of the time to December 2022 (see Figure 1L). While it achieved the target 9 out of every 10 months since 2020, it did not achieve the target at all in 2019. However, asset failures were not the main reason for the missed targets. External factors, such as weather, commonly caused these, as did passenger-related delays.

Train services only met the monthly reliability target of 98.5 per cent half of the time to December 2022. This also was not primarily because of infrastructure and technology failures but caused by other factors. For example, driver unavailability has been a key cause of missed targets since 2021. External factors such as trespassers and police operations have been the next biggest cause.

Why trains were not punctual in 2019

In 2019, Metro did not meet its train punctuality target. In October 2019, the department and Metro found that the main reasons for this were:

- trains spending too long at stations

- timetable updates since 2012 not meeting growth in service demand

- faults with the trains.

Failures in signals and overhead wires were a smaller contributing factor.

Train delays

Metro has reduced the percentage of train service delays caused by infrastructure failures, as Figure 2A shows. This decrease is not statistically significant because the reduction is small enough that it could also reasonably be caused by chance.

Figure 2A: Percentage of train delays caused by infrastructure failures

Source: VAGO, based on Metro data.

External factors include weather, graffiti, vandalism, police operations, trespassers, and external power-loss incidents.

Passenger factors include slow boarding and disembarking on crowded trains and ill passengers needing treatment.

External factors influence punctuality

Since March 2020, infrastructure faults have been the second highest contributor to delays, as Figure 2B shows.

External factors consistently contribute more to delays than infrastructure faults.

Before April 2020, passenger factors also consistently caused more delays than infrastructure. But their impact dropped with passenger numbers during the pandemic.

Figure 2B: Top 3 factors that delayed trains between September 2017 and December 2022

Note: Minor contributors to percentage of services delayed have been removed for clarity.

Source: VAGO, based on Metro data.

Maintenance and renewal help safety

Metro is responsible for train safety. The department primarily relies on Metro's external safety accreditations and audits for assurance that Metro is delivering safe train services.

Metro’s monthly reports show that slipping, tripping and falling are the main ways passengers are injured. These incidents usually happen because of how passengers interact with railway assets rather than the assets themselves. For example, a passenger might trip on a platform while running to catch a train.

Infrastructure defects, faults or failures, such as broken tracks and wire detachments, rarely injure passengers.

While the department does not publicly report on a safety target, Metro's data shows that passenger safety incidents and injuries across the metropolitan network are low.

For example, from November 2020 to November 2021, there were 1.67 reported injuries per million passengers.

One reason for this is that infrastructure and technology assets are designed to ‘fail safe’. For example, when signals fail, they default to red and trigger track protections that physically stop trains from passing the red signal (for example, see the train stop track protection in Figure 1E). Metro’s maintenance works also aim to keep the railway system safe.

2.2 Measuring asset performance, condition and cost

The department relies on Metro to measure assets’ performance and condition to know how maintenance and renewal affects them, and to manage the assets’ longevity.

The department does not have an overarching performance measurement and reporting framework. It considers the agreement to be its performance measurement and reporting tool.

However, this does not integrate overall performance against key objectives. This means the department is not effectively measuring and monitoring Metro's performance. The department’s KPIs and information about assets’ cost and condition have weaknesses and gaps.

The department does not produce any regular, consolidated reports that enable it to assess Metro's performance, asset performance and condition or cost performance.

Metro’s reporting to the department is spread over multiple different reports. It focuses on monthly progress and some annual review and does not assess cumulative progress across lease years.

Key performance indicators

The agreement's KPIs and targets do not enable the department to comprehensively monitor how well Metro is maintaining and renewing the assets.

The department included 78 KPIs in the agreement to measure Metro's performance in maintaining and renewing railway assets. There are 64 KPIs for infrastructure and 14 KPIs for technology assets. The department set targets for many of these KPIs.

The KPIs measure several aspects of performance. Most focus on how well Metro maintains and renews the assets, and the assets’ current performance, rather than on measuring asset condition or long-term durability.

|

There are KPIs for … |

Which measure ... |

Including ... |

|---|---|---|

|

maintenance and renewal performance |

how Metro does its maintenance and renewal work |

|

|

asset performance |

how well assets are performing currently |

|

| asset condition | how the asset is performing over time |

|

|

train service performance |

how train services are performing |

|

Relevance and usefulness of KPIs and targets

Several factors reduce the relevance and usefulness of these KPIs and targets for monitoring performance:

- The department did not set expectations for whether Metro's performance should remain steady or improve against the targets over the agreement term.

- In late 2018, the department and Metro subject matter experts agreed that the KPIs and targets were not good measures for monitoring trends. For example, they found that the KPIs that measured the mean time between signal failures were not relevant.

- The KPIs do not measure all asset-related aims in the agreement and key plans. For example, no KPIs measure whether Metro minimises obsolescence cost and ensures that the average asset lasts its expected lifespan.

- The department did not develop these KPIs and targets with a comprehensive approach (such as a performance measurement framework) to ensure they measure Metro's progress towards achieving the objectives and aims.

The department and Metro stopped monitoring KPI trends in 2019 and agreed to review the infrastructure KPIs.

In 2022, the department and Metro reviewed the KPIs for signal discipline, improved how they measure failures and started monitoring signal KPI trends again.

The department does not have a project plan or timeline to review the KPIs across all asset disciplines.

Metro’s performance

We checked 37 infrastructure KPIs to see how Metro performed between December 2017 and December 2021. We selected the KPIs to cover a range of asset classes and KPI types. We excluded the signal KPIs that the department changed and used the data that Metro reports to the department.

Our statistical analysis shows asset KPI performance stayed steady for 26 of these KPIs and improved for 10, while the performance of 1 declined.

|

Performance has … |

That include … |

|---|---|

|

been steady for 26 KPIs |

|

|

improved for 10 KPIs |

|

|

declined for 1 KPI |

|

Figure 2C: Temporary train speed restrictions between 2006 and 2022

Note: The dotted line indicates when the current agreement started.

Source: Metro.

The agreement also set asset management maturity rating targets for Metro to achieve by December 2020 and before June 2024. Metro's external assessment rated it as exceeding its 2020 target.

Asset condition

The department does not fully understand how Metro's maintenance and renewal work is changing asset condition, for multiple reasons:

- The department did not know enough about the condition of railway assets at the end of the previous agreement to set asset condition KPIs for this agreement. It started a $28 million condition assessment program in 2018 to collect this information, which is still underway.

- Metro does not have consolidated asset condition metrics for all of its railway assets and the agreement does not require it to. The department has not told Metro what condition it now expects assets to be in by the end of the agreement.

- Metro does not collect long-term asset condition data to enable it and the department to assess condition trends. Metro assesses condition ratings every 3 to 4 years but cannot compare new ratings with previous ratings because it improves its assessment methods over time.

Objectives for asset condition

The department's objectives in the agreement for asset condition are contradictory. The department set improving asset condition as an objective. However, on the department's advice, the government funded Metro with the objective that Metro would meet its core obligations under the agreement but return the assets in deteriorated condition.

It is not clear what the department intends Metro to achieve for the condition and performance of railway infrastructure and technology.

The department is planning to use its condition assessment work to set clear requirements in any future agreement for how the train operator collects, models and reports on the condition of the assets.

Asset condition ratings

Metro aims to keep assets spread evenly across the spectrum of condition ratings, from new to end-of-life. This helps Metro keep its yearly maintenance and renewal spending relatively consistent, with no sudden renewal spikes for any particular asset class, and manage operational risk.

Metro uses existing asset condition data and life cycle modelling to estimate how its planned maintenance and renewal spend will affect asset’s future condition.

Asset condition expectations

The department has not told Metro what condition rating or spread of condition ratings it expects Metro to achieve for each asset class by the end of the agreement. This includes which asset classes, if any, the department expects to be in similar or improved condition by the end of the agreement and which will have deteriorated.

Metro also does not clearly articulate this. Metro advised us that it gives the department this information through lifecycle modelling presentations.

However, Metro does not report its forecasted condition distributions to the department in a consolidated way that allows the department to see how conditions are changing, and the department does not ask it to.

It also does not ask Metro for a consolidated summary of the asset conditions it expects will change when renewal priorities and the timing of works change.

Metro has no method to evaluate whether a particular asset condition distribution is better or worse than another. It also cannot precisely tell whether the overall condition distribution for each asset class has improved or degraded since the start of the agreement. It has modelled distributions for 39 of the 48 longer-lived asset classes.

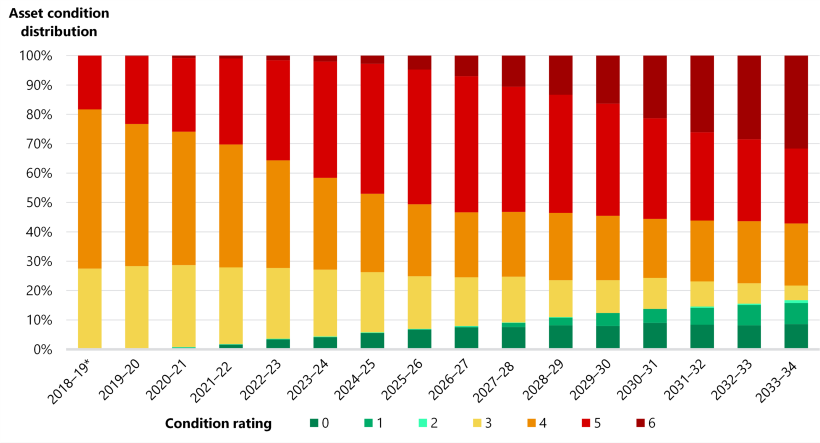

We checked Metro's most recent forecast distributions for 7 asset classes, from 2019 to 2034. We found that 2 of these – lifts and rail sidings – have an uneven spread of condition ratings. By 2026 they had more than 50 per cent of these assets approaching the end of their useful life (ratings 5 and 6) and less than 20 per cent of assets in relatively new condition (see the rail sidings example in Figure 2D).

Figure 2D: Distribution of actual and projected condition ratings for rail sidings assets, 2018–19 to 2033–34

Note: *2018–19 figures are actual. All other years represent projected distributions.

New assets have a condition rating 0 and life-expired assets have a condition rating of 6. The ratings between this are a sliding scale of condition, with ratings 1 to 5 set at different percentages of remaining useful life.

Source: VAGO, based on Metro data.

The asset lifecycle has 4 phases, which cover when an asset is:

- planned

- acquired

- operated

- disposed of.

Metro maintains assets in the operating phase and renews them during the disposal phase.

Optimising asset costs

The department does not know whether Metro is maintaining and renewing railway assets in a way that optimises cost across the asset lifecycle. The department cannot access financial data at the asset level because Metro does not know how much it costs to maintain or renew individual assets.

Metro only has high-level cost information about asset groups. Metro is aware of this gap and has started recording costs at an individual asset level. It aims to complete this by June 2023.

Maintenance and renewals links to asset faults

There is no direct relationship between asset faults and the level of investment in maintenance and renewal since 2017.

Signals have more faults than other kinds of assets (see Figure 2E). However, Metro invests most maintenance and renewal funding on tracks because of their volume and the cost of materials (Figure 2F). Investment in maintaining and renewing track also helps ensure the signals work properly.

The department and Metro focus on train service punctuality, reliability and safety when they plan and prioritise works, rather than just faults (as we discuss in Section 3.2).

Figure 2E: Infrastructure faults that cause delay or cancellation by asset discipline, 2018 to 2022

Source: VAGO, based on department and Metro data.

Figure 2F: Metro's spending on infrastructure maintenance and renewal by asset discipline, 2018 to 2022

Source: VAGO, based on department and Metro data.

2.3 Managing asset data and information

The department’s information and data quality management

The department, Metro and VicTrack can each access the asset information they need. Metro collects and manages the main sources of asset information. The department uses this information and shares a subset with VicTrack. The department and VicTrack recently improved their sharing arrangements.

Information responsibilities

The department, VicTrack and Metro still do not have a shared definition of their asset data and information responsibilities. In our 2016 report, Managing the Performance of Rail Franchisees, we recommended that Public Transport Victoria (now part of the department) clearly define roles and responsibilities for all agencies and the franchisee.

Metro and VicTrack's asset and information responsibilities are now clear but the department’s are not. This has not caused any barriers to accessing information that we are aware of.

However, it is a barrier to the overall transparency of the department and VicTrack's asset management responsibilities under the Asset Management Accountability Framework and could be a risk if a new franchisee is appointed in the future.

Data quality management

The Data Quality Standard requires the department to have a plan to manage and improve its critical data assets. The department's planning shows that it intends to improve data quality. But it does not comply with this standard because it has not yet defined its critical data assets or planned to manage data quality across all critical data assets. It is planning to assess some dimensions of data quality for asset condition data.

Metro’s information and data quality management

When we assessed Metro's infrastructure asset data against the 7 data quality dimensions that Figure 2G summarises. Metro's data was largely accurate. However, minor deficiencies in the completeness, timeliness and consistency dimensions collectively prevent it from meeting the fit for purpose dimension. The gaps in cost and condition data are examples of this.

Figure 2G: Data quality dimensions

Source: Department of Premier and Cabinet, 2018, Data Quality Guideline, Information Management Framework.

Metro has introduced a sophisticated approach to assess and manage the quality of its data. This should improve the department’s ability to use Metro’s data for strategic decision-making.

2.4 Planning for future franchise arrangements

The agreement's initial 7-year term with Metro ends in November 2024. The department is considering options to extend the current agreement and improve the asset management requirements for any future agreement, as well as its oversight. The department also aims to finalise its strategic asset plans and build its capability and capacity to develop any future franchise contracts.

Improving future agreements

The department may not be able to improve its oversight of maintenance and renewal in any extension to agreement or any future agreement. This is because the department does not have enough:

- staff capability and capacity

- project planning and accountability to deliver its planned improvements for overseeing asset maintenance and renewal, such as its KPI review (see Section 2.2) and quality checks (see Section 4.1)

- information exchange between the separate internal teams working on this agreement and planning the future agreement.

We discuss these first 2 points further in Section 3.1.

The department is assessing options for whether to extend the agreement for up to 3 years, and for any future agreement. However, it has not based its planning on a comprehensive, evidence-based review of Metro's performance under the agreement.

Since 2017, the department and Metro have improved their knowledge of how the assets support punctuality, reliability and safety. Although many of the asset are long-lived, the department and Metro have not improved their understanding of how to maintain and renew the assets to sustain them in the long-term and deliver value for money.

The department has noted the benefits of improving aspects of the agreement and its oversight, such as through:

- strategic asset planning

- performance measures

- standards management.

It has started work to do this, including getting better information about what maintenance and renewal any future private operator will need to deliver and what this should cost.

3. Planning to maintain and renew railway infrastructure and technology

Conclusion

The department has not defined its long-term strategic aims and priorities for managing railway assets. This limits its ability to meaningfully assess Metro’s maintenance and renewal planning and set suitable requirements for any future agreement.

Metro’s renewal priorities, and the department’s review of these, consider the need to support safe, reliable and punctual train services.

However, it is not transparent how Metro prioritises works to achieve the agreement’s other aims and commitments, and the department does not check whether Metro targets the works most needed.

In this chapter

3.1 Planning for long-term asset needs

As the asset manager, the department is responsible for planning the long-term needs for railway assets. These extend beyond the life of the agreement. The department needs to inform this planning with knowledge of:

- the current network and its assets

- how passengers and train services will likely grow in the future

- how train services link with trams, buses, regional trains and freight trains.

Long-term asset management strategy

The department has not planned its long-term strategic aims and priorities for railway assets.

It has not planned the composition, condition and functionality of the assets Melbourne needs to support integrated, responsive and resilient train services and public transport into the future.

This lack of long-term strategic planning limits the department’s ability to:

- check that Metro's maintenance and renewal plans and works optimise asset performance in a way that supports future network and service needs

- target the way it oversees the current agreement and any extension

- prepare for any future agreement once this one ends in November 2024.

Previous agreement

Our 2016 audit Managing the Performance of Rail Franchisees found that Public Transport Victoria did not have a long-term asset management strategy during the previous agreement. This reduced its ability to influence how Metro maintained and renewed the assets. It also meant Public Transport Victoria relied heavily on Metro's advice about the maintenance and renewal work needed for this agreement.

Recent developments

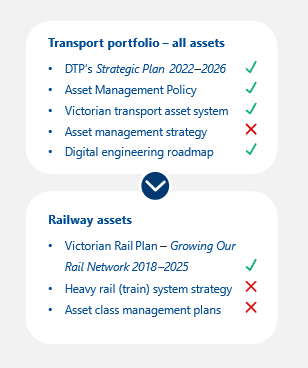

The department is developing strategic asset plans for railway assets and overarching strategies for all transport assets, as Figure 3A shows. The department acknowledges that it needs to build its capability and capacity to do this. It intends to analyse these gaps and fill them during 2022 and 2023.

It will be challenging for the department to build its resources and deliver the strategies by June 2023 as planned because in December 2022 it had not done the gap analysis yet.

Figure 3A: The department’s strategic plans for transport assets, including railway assets

Note:✔ means plans finalised and ✕ means plans not finalised.

Source: VAGO

3.2 Maintenance and renewal plans

The franchise management plans and annual works plans are current, but many of the technical maintenance plans (TMPs) are not. Since these key plans underpin the rail network's safe operations, the department and Metro need to regularly check their currency and relevance to the network's needs.

In December 2022, 6 of the 7 TMPs were either overdue for their yearly review or 3-yearly update, or updated but not approved.

Reasons why TMPs have not been promptly updated and approved include that:

- the department has not set timelines for approving TMP changes

- the department does not have a documented process to track when TMPs are due for review and update. It relies on Metro to do this when necessary.

The department does not have a process to prioritise urgent TMP updates needed to address safety concerns. None of the risk registers that the department or Metro manage name the risk and impact of planning documents being out of date.

3.3 Determining renewal priorities

Metro has to prioritise the different tasks it does to maintain and renew the assets, to make sure it does the work most needed within the funding that the department provides. We assessed how it prioritises planned renewals and how the department approves these priorities.

Metro initially prioritised its renewal works in the franchise management plans it submitted with its 2017 bid. We did not review this prioritisation because Metro and the department have changed their information sources and processes since then. The agreement allows the plans to be varied over time.

Instead, we reviewed how Metro prioritised the renewal works in the annual works plan for lease years 6 to 8 (starting July 2022), and how the department approved this.

The department's oversight of Metro's renewal prioritisation

Metro uses a wide range of relevant information and assessments to identify, prioritise and schedule selected renewals into its annual works plans. This includes:

- asset condition

- remaining useful life

- risk and criticality

- performance

- cost.

The department oversees Metro's work through discussions and presentations, including through:

- annual works plan approvals

- department–Metro joint governance group meetings.

However, aside from for the signals asset discipline, the department does not know enough about Metro's considerations, judgements and decisions to check that Metro's renewal priorities are helping achieve the overall objectives and aims for railway assets.

Metro’s prioritisation of renewals

The department reviews Metro's plans and supporting documents. But these do not show that Metro applies systematic and objective approaches to prioritising works across the asset classes. This is because Metro has not:

- described its prioritisation processes – its separate planning processes and tools for infrastructure and technology assets do not consistently explain what the prioritisation processes need to include to ensure a systematic approach

- consistently defined its prioritisation criteria to ensure an objective approach, such as what condition ratings it applies when it prioritises assets in 'poor' condition

- recorded all the assessments and considerations that influence its priorities, including how the renewals help it to achieve the agreement’s aims and commitments for assets.

Metro's annual works plans must present the strategy and objectives for its maintenance and renewal activities, along with their intended scope, deliverables, works program and costs. Metro describes its renewal priorities and the aims that guided their selection, such as the need to support punctual, reliable and safe operations.

However, the department does not know whether Metro appropriately balances the most needed renewals with those most convenient to do. This is because Metro does not explain how it decides which of its many renewal needs are the priorities it will focus on.

The department told us that it asked Metro to make this transparent in the annual works plans for lease year 5 and that Metro met this request.

Aside from the signals asset discipline, Metro's annual works plans for lease year 6 still do not transparently record how it decided which renewal needs for the other asset classes were the priorities.

Metro decides which renewals are needed by assessing different factors, including:

- defects, faults and failures, particularly through its daily fault reviews and planning how it can improve asset performance

- impacts of major transport projects, including opportunities to schedule work during planned line closures

- emerging risks and issues, such as the recent unexpected failure of some overhead wire supports.

But Metro does not explain how it decides which of these renewal needs are the priorities, including:

- how it weighs these different factors

- the influence of renewal costs on selecting priorities within the funding cap

- how the prioritised renewals collectively optimise asset cost, condition, lifespan and performance compared to other combinations of renewal choices.

Continuous improvement

Metro has started to better define which assets need renewing and record the information and assessments it uses to determine the priorities. However, the asset class lifecycle strategies that document this planning do not:

- explain its prioritisation processes and criteria

- summarise the considerations and judgements behind why it prioritises some renewals over others.

There is rarely a simple formula that can determine the priorities for the next 3 years. This does not prevent Metro from summarising how and why it selects some renewals as priorities out of all the renewal needs it identifies.

The department and Metro plan to work together to give the department better oversight over and assurance about works priorities. This will include involving the department at key points of Metro's prioritisation process.

Alignment with all objectives and aims

The department set objectives and aims for railway infrastructure and technology over the agreement's 7-year term. Metro's key plans include commitments to how it will achieve these aims. Figure 1J has examples of the objectives, aims and commitments for assets and maintenance and renewal included in the agreement modules and key plans.

The department does not use its works plan approvals to holistically consider the impact that Metro's proposed renewal priorities will have on the network. Rather, its approvals check that the plans comply with content requirements. This means the department does not know how Metro's priorities:

- align with all the objectives, aims and commitments

- target the renewals most needed rather than the cheapest or easiest to do

- help achieve the department’s long-term asset needs.

The department also does not assess how the renewal priorities support the network's planned capacity and capability, such as highlighted through the department’s Growing Our Rail Network 2018–2025 plan for how it will develop the network. The agreement's key plans and Metro's strategic network planning say this is needed.

Metro's prioritisation documents show it focuses on supporting punctual, reliable and safe train services. They do not record how it assesses its renewal priorities against many of the agreement's other objectives, aims and commitments, such as how it minimises obsolescence costs.

4. Maintaining and renewing railway assets

Conclusion

Metro is largely maintaining the railway assets as planned. It is behind in renewing its technology assets and has spent significantly less on these to date than it had planned.

The department does not know the size of this renewal backlog for technology assets, why Metro is spending less than planned and where or how well Metro does the work.

The department does not effectively monitor if Metro is maintaining and renewing assets according to all of the agreement's requirements.

Without this information, the department cannot fully understand the risks to the network and to its future asset funding needs from Metro not delivering the works as agreed. It also cannot make sure that Metro is managing those risks effectively.

In this chapter

4.1 Monitoring works delivered

Maintenance works

Metro is largely completing its planned maintenance activities for rail infrastructure and technology. It also completes this work promptly.

For example, in lease year 5 (2021–22) it completed an average of 93 per cent of its work on critical infrastructure assets, and 95 per cent of its work on non-critical assets, on time.

Since lease year 3 (2019–20), Metro has met its commitment to reduce reactive maintenance. Each month, Metro monitors asset defects, faults and failures and has a daily view of critical network issues. This has enabled Metro to find critical infrastructure issues and respond to them quickly, reducing failures.

Metro is committed to doing less reactive maintenance, because keeping infrastructure in good condition is cheaper than fixing it when it fails. But this commitment conflicts with the agreement's requirement that Metro spends at least 85 per cent of its planned monthly spend on reactive work.

Renewal works

Metro is behind with its renewal works. The department does not have assurance that Metro can complete all outstanding renewals by the end of the agreement.

Minimum targets for core infrastructure renewals

The department had concerns that under the previous agreement Metro had neglected infrastructure that was not essential to trains running, such as pedestrian crossings, drainage and fencing. It called these 'non-operation facing assets.'

To remedy this, the current agreement set a minimum number for each of 24 specific renewal activities, for Metro to complete over the agreement's potential 10-year term. These mostly focus on non-operation facing assets.

In September 2022, Metro anticipated that it would not meet its 7-year interim target for 7 of the 24 activities these apply to. Metro advised the department that 2 of these activities related to level crossing assets that no longer existed after level crossings removals. The department and Metro are revising the minimum quantities for these 2 activities.

Figure 4A shows Metro's forecast and actual delivery for the 5 activities that were behind the interim target in September 2022.

In December 2022, Metro advised the department that it now plans to meet the minimum requirements for all of the remaining 22 activities by the time the agreement ends. The department is confident that Metro can deliver on what it considers are minor variances. Metro has not told the department what it is changing to ensure it can do this. We are unable to verify if it is likely to achieve these revised numbers.

Figure 4A: Renewal activities falling short of the interim minimum targets as at September 2022

Source: VAGO, based on Metro reporting.

Figure 4B gives an example of 2 minimum renewal activities that Metro forecast would not meet minimum quantities.

Figure 4B: Case study – 2 minimum renewal activities that were at risk of not meeting interim targets in September 2022

Source: VAGO, adapted from Metro.

Other infrastructure renewals

Metro’s data shows it has completed 95 per cent of the other infrastructure renewals it had planned to since the agreement started, as Figure 4C shows.

Figure 4C: Metro’s infrastructure asset renewals

Source: VAGO, based on Metro reporting.

Renewals for technology assets

Metro has outstanding planned technology renewals. It fell behind with some renewals in lease year 1 (2017–18) and the number outstanding has increased since then, to 13 per cent at the end of lease year 5, as Figure 4D shows.

Figure 4D: Metro’s technology asset renewals

Source: VAGO, based on Metro reporting.

Dark territory is a section of track where the signalling system does not give train location information to signal control staff. The track is ‘dark’ because the signallers cannot see the train’s position.

Many of the outstanding renewals are for projects managing obsolete technology that Metro rates at high criticality. Metro uses maintenance and software patches to keep the obsolete technology working until Metro can renew it.

Metro plans to complete the outstanding renewals concurrently with planned renewals before the agreement ends in November 2024. It will not complete one critical renewal until a year after the agreement ends. This is the work to remove ‘dark territory’ from the network, that Metro was originally due to complete in 2023.

Metro has explained to the department that reasons for the backlog include that:

- Metro does not have enough staff available, including experienced staff. Its staff have had extra work to do on major transport projects and Metro has had difficulty in recruiting technology workers in a competitive jobs market

- technology equipment that Metro needs to buy has either not been available or as been slow to arrive because the pandemic has slowed production and supply

- fewer suppliers are interested in doing the works, because they have limited capacity or are asking higher prices.

The department does not have good oversight of the outstanding renewals. For example:

- Metro’s current annual works plan does not explain how it will address these challenges or provide consolidated information on the cost implications of the delays

- Metro is managing the risks of these projects through its internal system but the main source of information the department receives are Metro’s updates on individual renewals at their joint governance meetings

-

recommendations from the department’s June 2022 review of the issues delaying the obsolete train control and monitoring system (TCMS) renewal included that the department strengthen its own oversight of this work.

The TCMS monitors and controls train movements in the network according to the timetable. Its components include servers, network and signal control panels.

Metro and the department are working together to resolve some renewal backlogs but have made slow progress. For example, Metro and the department knew the TCMS was obsolete and had planned to renew it by 2019. Metro will now not complete these works until July 2024, 4 months before the agreement ends. Metro and the department have taken steps to sustain the current TCMS:

- Metro introduced new contract arrangements to make it easier for the supplier to keep maintaining the current system and investigated the potential to use an alternative TCMS on parts of the network.

- In June 2022, the department identified that it could manage risks with measures such as upgrading hardware components to make them simpler and help speed up system development.

But these remedies have not sped up its renewal.

Total cost of works to date

The department does not monitor maintenance and renewal costs across lease years. Without this information, the department cannot:

- confirm the size of any backlogs of works not completed since 2017 and fully assess the risks to the department and the network of Metro not delivering these before the agreement ends

- compare cumulative costs against the planned costs, to check Metro’s progress

- compare how much Metro is spending to deliver the works against the quantities delivered, to understand how efficiently Metro is working.

Figure 4E shows that this level of monitoring can be and is done internationally.

Figure 4E: Case study of monitoring railway infrastructure costs in the United Kingdom

The United Kingdom’s Office of Rail and Road regulates Britain’s rail network and monitors the costs of Britain’s railway infrastructure operator each year.

The office uses data from 2013–14 onwards to track the trend in maintenance and renewal costs over time.

This helps it understand the main drivers of the operator’s spending and the operator's ability to make this spending more efficient.

Source: VAGO.

Figure 4F shows the proportion of cumulative costs to maintain and renew the assets from lease years 1 to 5 against planned costs. It compares these costs with Metro’s progress in delivering the quantities of works planned.

We could only access interim data on the cumulative cost of works because the department has not updated the planned costs to include additional agreed costs and has not checked the validity of some of Metro’s claims.

Figure 4F: Comparison of Metro’s interim cumulative spend and quantities delivered between lease years 1 and 5 (November 2017 to June 2022)

| % planned cost spent | % planned quantity delivered | |

|---|---|---|

| Infrastructure assets | ||

| Maintenance | 112 | 98 |

| Renewal | 91 | 95 |

| Technology assets | ||

| Maintenance | 83 | 99 |

| Renewal | 68 | 87 |

Source: VAGO, based on data that Metro reports to the department.

Our analysis indicates that while Metro has spent 98 per cent of its planned budget for all maintenance works:

- for some line items, Metro is delivering the quantities of works at lower cost than planned

- Metro is spending more than planned to maintain the infrastructure (112 per cent), but less than planned for other works (80 per cent of planned budget for all renewals), particularly for technology assets.

Metro bears any increased costs that arise over time, for example, because prices of parts increase or it underestimated the cost when it bid for the works. The overspend on maintaining infrastructure assets is likely because:

- the department has agreed to pay Metro extra to maintain new assets but has not increased the planned cost by this amount

- the agreement requires the department to pay Metro's claims for work done each month, based on the invoices Metro submits. The department can still reject claims once it finishes validating them, and Metro will reimburse the department for these.

The department has not assessed whether Metro’s underspend on technology assets is solely because of the renewals backlog, or because Metro also:

- delivered more of the simpler, cheaper renewals in earlier lease years

- overestimated the cost of works in its 2017 bid, because it had less knowledge about maintenance and renewal needs for technology assets at the start of the agreement than for infrastructure assets

- completed some works more efficiently or got a better price than it had originally forecast.

The department’s oversight of costs

The department checks monthly cost but not across years.

The department and Metro follow established processes to track the quantity, cost and timing of maintenance and renewal works each month. They review Metro's progress together at regular governance group meetings. Through these processes:

- Metro reconciles the works it plans and delivers in each asset disciplines and reports these to the department, along with claims and invoices for the costs it incurs

- the department reconciles actual and planned quantities and costs and checks a sample of Metro's records. It pays Metro's claims each month and checks the works completed each quarter. At this quarterly review, the department will pay completion costs if Metro has provided all the relevant records.

Metro also contracts an external finance auditor to review its reconciliation statement before it submits it to the department.

The department also confirms annual results at the end of each lease year but it does not monitor trends across years. This means the department does not know how the cumulative cost or quantities compare against planned over time.

Metro’s interim cumulative spend data since lease year 1 show that the overall spend has been less than the planned spend since lease year 2 (2018–19), and the gap widened in lease year 5 (2021–22) for technology assets. Figures 4G and 4H show these trends for infrastructure and technology assets. Infrastructure maintenance was the only category that spent more than the planned cost.

Figure 4G: Metro's costs for maintaining and renewing railway infrastructure assets

Note: * Lease year 1 was only 7 months. Lease year 7 covers the last 17 months of the agreement (1 July 2023 to 30 November 2024).

Source: VAGO, based on data that Metro reports to the department.

For technology assets, Figure 4H shows that Metro has spent 83 per cent of the maintenance budget and only 68 per cent of the renewals budget up to lease year 5 (2021–22).

Figure 4H: Metro's costs for maintaining and renewing railway technology assets

Note: * Lease year 1 was only 7 months, and lease year 7 covers the last 17 months of the agreement (from 1 July 2023 to 30 November 2024).

Source: VAGO, based on Metro reporting.

Funding maintenance of new assets

Since the agreement started, major transport projects have added more new infrastructure assets to the network than the department anticipated. The department had not funded Metro to maintain these assets, so it paid Metro out of the existing infrastructure and technology assets maintenance accounts, depleting these 2 accounts quicker than planned.

The agreement includes a process for the department to pay Metro’s claims for unplanned additional costs such as these (Schedule 3 claims), but the department did not agree with how Metro estimated the extra costs.

In 2019, the department sought independent advice on how to cost maintenance for new assets, which the department and Metro have now agreed on. The department will pay less for these works than Metro's original cost estimates.

The department and Metro implemented a new cost model in June 2022, so we could not yet see how it affects the processing of Schedule 3 claims and the maintenance costs shown in Figure 4F.

This means the department does not know the full cost of works 5 years into the agreement's 7-year term.

Updating planned costs

Other gaps in the department’s knowledge of costs arise because:

- the department has not yet updated the planned cost to include extra renewal works that it asked Metro to do in lease year 3 (2019–20), which were not part of the agreement but were needed to support major transport projects

- the department is yet to verify some of Metro’s claims, because there is a lag between when it:

- receives the monthly update on changes to the works plan

- receives Metro’s monthly report

- pays Metro's claims.

The department's oversight of planned quality, location and scope requirements

When the department assesses Metro's claims it checks the quantity and cost of works against Metro's plans, but not their scope and locations. This means the department cannot comprehensively assess whether Metro maintains and renews assets as planned, or understand how the works are spread across the network.

Metro holds 2 accreditations that include quality components:

- rail transport operator with the Office of the National Rail Safety Regulator

- ISO 55001 certification, which includes ISO 9001:2015 Quality management systems.

Aside from these, Metro does not report to the department on how it confirms the quality of works and the department does not check the quality of Metro's work itself.

|

Not monitoring ... |

Creates risks that ... |

|---|---|

|

quality |

|

|

location |

|

|

scope |

|

In October 2022, the department introduced a new program that aims to check the quality of works through a rolling schedule of field inspections for selected assets.

Meeting all the agreement's aims, principles and commitments

The department knows that Metro's maintenance and renewal works are achieving some of the agreement's objectives, aims and commitments, such as the punctuality and safety examples we include in Sections 2.1 and 2.2.

But the department does not assess Metro's maintenance and renewal against other key aims and commitments. For example:

- the department has not assessed whether the maintenance and renewal works collectively optimise asset cost and performance across the network and deliver value for money, even though Metro's works plan has changed many times since the agreement started

- the department has not checked that Metro balances its works investment between operation and non-operation facing assets, and Metro does not monitor or report on this

- the department has not required Metro to show how it is meeting the agreement's key principles, established under the franchise management plans. Metro must accompany its amendments to the plans with a notice showing how its proposed changes are consistent with the key principles. Metro does not do this and the department does not check for this.

The department’s monitoring focuses on Metro's monthly progress in delivering works and meeting KPIs. Its reviews focus on Metro's compliance and on reconciling the cost and quantities of works delivered. The department only included one option for a contract review in the agreement. This had a compliance focus, not a performance focus.

None of these activities give the department a consolidated understanding of Metro's performance. The department does not otherwise analyse the data available to it or regularly assess or evaluate performance against the agreement's aims.

This means the department does not have a comprehensive understanding of how well Metro's maintenance and renewal plan is working. The department is therefore unable to direct and influence the remaining works to ensure the agreement achieves its aims.

4.2 Varying works plans

Adjusting infrastructure renewal plans

Metro adjusts and changes its planned works as new major transport projects end and works on existing assets progress.

Metro has proposed over 4,000 infrastructure asset renewal changes to the original and updated plans since 2019, when the department started a change register to record the changes.

Figure 4I shows that there is no clear trend in the number of change requests proposed, pending, and approved since the department revised this process. The department does not separately track how many proposed changes it rejects.

Figure 4I: Number of infrastructure renewal change requests proposed, approved and pending

| Lease year 3 (2019–20) | Lease year 4 (2020–21) | Lease year 5 (2021–22) | |

|---|---|---|---|

| Metro proposed | 1,216 | 1,609 | 1,382 |

| Department approved | 1,016 | 448 | 1,047 |

| Unapproved* | 200 | 1,161 | 335 |

| Budget impact of all change requests | The department has not finalised this** | -$25,267,080 | -$5,458,929 |

* These include:

- changes that the department rejects

- changes that are currently with the department for review and approval

- changes that Metro needs to resubmit with further information.

** The department told us that it cannot finalise this until it finalises the costing for new assets and all change requests.

Source: VAGO, based on Metro reporting.

The department told us lease year 4 (2020–21) had many unapproved change requests because Metro requested changes that did not align with the types of renewals works it had originally planned. Metro aligned its changes better in lease year 5 (2021–22).

The budget impact was high in lease year 4 (2020–21) because Metro made many requests for expensive structure and track work deferrals (327) and removals (311) compared to 140 deferrals and 253 removals in lease year 5 (2021–22).

Recording reasons for changes and associated risks

The change register has improved the way the department and Metro record the reasons for and costs of changes. The department also introduced a more detailed approval process for complex changes.

Metro includes a reason for all changes or variations it proposes. However, Metro does not:

- identify the location, potential impact and timing of risks when it plans the changes

- include these types of risks in its risk registers

- discuss and record risk or the cumulative risk of minor changes at its fortnightly joint change management meetings, even when Metro has needed to make changes before the department’s approval.

Metro records the risks that simple changes pose to individual assets, but not to the network or other works.

The department’s review and approvals