Portfolio Departments and Associated Entities: Results of the 2013–14 Audits

Overview

This report presents the results of the 2013–14 financial audits of the nine portfolio departments and 201 associated entities, including the alpine resort management boards.

Parliament and the citizens of Victoria can have confidence in the 2013–14 financial reports of the portfolio departments and associated entities, other than in respect of the former Department of Education and Early Childhood Development (DEECD) which was issued with a qualified audit opinion. Confidence can nevertheless be placed on that financial report, except for the effect of the audit qualifications.

The report highlights that portfolio departments had not resolved 47 high or medium risk-rated control weaknesses identified during the 2012–13 financial year audits, or earlier. This lack of timely resolution means that the control frameworks in place at the portfolio departments are not as effective as they could be.

Of the 210 entities, 48 are considered to be self-funded entities, as a majority of their revenue is generated from their own operations. Eight of these have been consistently identified as being at a high financial sustainability risk. For these entities there are significant financial challenges, which if not addressed, may lead to a reduction in the services they provide to the community. In order for these entities to be financially sustainable over the long term, the pricing model used to generate revenue may need amendment, another funding source found or additional government support provided.

The report reviews the prudential oversight of the state's insurance agencies, which could be strengthened if the Department of Treasury and Finance appointed a prudential auditor to provide independent assurance about each insurance agency's compliance with the Prudential Insurance Standards for Victorian Government insurance agencies.

The report also comments on the Auditor-General’s eroding legislative mandate to review public expenditure on Public Private Partnerships. The report also comments on the operation of internal audit at portfolio departments, certain categories of infringements and provides a status update of significant state projects.

Portfolio Departments and Associated Entities: Results of the 2013–14 Audits: Message

Ordered to be published

VICTORIAN GOVERNMENT PRINTER February 2015

PP No 6, Session 2014–15

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit the Auditor-General's report on the Portfolio Departments and Associated Entities: Results of the 2013–14 Audits.

This report presents the outcomes and observations from the 2013–14 financial audits of the nine portfolio departments and 201 associated entities. This report finds that all completed financial reports were reliable, except for the former Department of Education and Early Childhood Developments' which received a qualified audit opinion. Confidence can nevertheless be placed on that financial report, except for the effect of the audit qualifications.

This report informs Parliament about significant issues identified during our audits and complements the assurance provided through individual audit opinions included in the entities' annual reports.

The report highlights that improvements can be made to the use of internal audit functions at portfolio departments, the management of operations at the state's alpine resorts and in the state's oversight role of the Prudential Insurance Standards. The report also identifies that the management of infringement write-offs could be improved.

Yours faithfully

Dr Peter Frost

Acting Auditor-General

12 February 2014

Auditor-General's comments

John Doyle Auditor-General |

The Portfolio Departments and Associated Entities: Results of the 2013–14 Audits report presents the outcomes and observations from the 2013–14 financial audits of the nine portfolio departments and 201 associated entities.

The Parliament and citizens of Victoria can have confidence in the 2013–14 financial reports of the portfolio departments and associated entities, except for the former Department of Education and Early Childhood Development (DEECD). As detailed in my report Auditor-General's Report on the Annual Financial Report of the State of Victoria, 2013–14, I issued a qualified audit opinion on the financial report of DEECD. Confidence can nevertheless be placed on that financial report, except for the effect of the audit qualification.

Portfolio departments had not resolved 47 control weaknesses rated as high or medium risk, identified by my audit teams during the 2012–13 audits, or earlier. This lack of action means that the control frameworks in place at the portfolio departments are not as effective as they could be.

The financial sustainability risks of 45 self-funded public sector entities have been analysed. Eight of these entities have consistently been identified as being at a high financial sustainability risk. For these entities there are significant financial challenges, which if not addressed, may lead to a reduction in the services they provide to the community. If these entities are to be financially sustainable over the long term, the pricing model used to generate revenue may need amendment, another funding source found or additional government support provided.

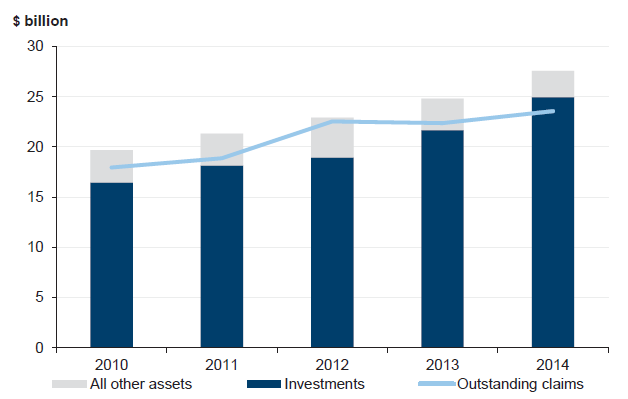

Oversight of the state's insurance agencies could be strengthened if the Department of Treasury and Finance appointed a prudential auditor to provide independent assurance about each insurance agency's compliance with the Prudential insurance standards for Victorian Government insurance agencies. The state's insurance agencies held assets of $27.6 billion and liabilities of $25.2 billion at 30 June 2014.

At 30 June 2014, 21 facilities were operating or being built in Victoria under a public private partnership. These arrangements should be subject to the same scrutiny as other public spending. While the state government increasingly seeks transactions with the private sector, the provisions of the Audit Act 1994 have failed to keep pace with these developments. Consequently, my mandate to review public expenditure on such projects has been increasingly eroded.

John Doyle

Auditor-General

February 2015

Audit Summary

This report presents the outcomes and observations from the financial audits of the nine portfolio departments and the 201 associated entities that are not addressed in our other sector based reports, including the five Victorian alpine resorts.

These 210 entities make up a significant portion of the public service and are responsible for delivering key public services and community support programs. It is important that they prepare high quality financial reports in a timely manner so that Parliament and the public can identify the revenue, expenses, assets and liabilities required to provide public services and programs.

The ability of public sector entities to operate and to report reliable, accurate and timely information is underpinned by an effective internal control framework. There are many facets to an internal control framework and we annually select areas on which to focus and comment. In this report we examined the internal audit functions at portfolio departments, the prudential supervision of the state's insurance agencies and fines—predominantly traffic fines.

Conclusions

Financial reports prepared by portfolio departments, and their associated entities, are generally timely and accurate. Their contents can be relied on by Parliament and the community, with the exception of the former Department of Education and Early Childhood Development (DEECD) which received a qualified audit report.

A number of self-funded agencies continue to have high financial sustainability risks, which, if not addressed, may affect the service potential of their assets and the services they offer to the community.

Internal audit functions across the portfolio departments were generally sound. However, improvements can be made to strengthen these functions. Portfolio departments' expenditure on internal audit has reduced since 2011–12, despite significant operational changes impacting their risk profiles over the same period.

The Prudential insurance standards for Victorian Government insurance agencies provide a framework for the management and supervision of the state's insurers. The framework could be improved with the appointment of an independent prudential auditor to review the attestations made by the insurance agencies.

The debt management practices over unpaid fines can be improved. In the categories reviewed in this report, the state wrote off fines where a warrant had been issued, predominantly traffic fines, totalling $58.2 million in 2013–14, as compared with $60.4 million in 2012–13.

Findings

Quality of financial reporting

A clear audit opinion confirms that an entity's financial report has been prepared according to the requirements of relevant accounting standards and legislation, and fairly presents the financial results of the entity's operations and its assets and liabilities, in all material respects.

Clear opinions were issued for each of the 204 entities that had finalised their financial reports at the time of preparing this report—five financial reports are still to be finalised. The former DEECD's financial report for the year ended 30 June 2014 was issued with a qualified opinion. This matter is commented upon in the Auditor-General's Report on the Annual Financial Report of the State of Victoria, 2013–14.

The financial statements of 22 entities were not finalised within the statutory time frames.

Portfolio departments had not resolved 47 control weaknesses, rated as high or medium risk, identified during the 2012–13 audits, or earlier. This lack of action means that the control frameworks in place at the portfolio departments are not as effective as they could be.

The State of Victoria's Annual Financial Report

The State of Victoria's Annual Financial Report (AFR) acquits the government's stewardship of the state's finances to Parliament, and is a consolidated financial report of 279 state-controlled entities.

The preparation of the AFR is a requirement of the Financial Management Act 1994 (FMA), however, we have noted that the AFR is not subject to the same governance and oversight arrangements as other financial reports prepared under the FMA. In particular, an audit committee has not been given responsibility for overseeing the preparation and fair presentation of the AFR.

The former Treasurer of Victoria did not sign the certification of the financial report and delegated this responsibility to specified officers of the Department of Treasury and Finance. However, the Treasurer is responsible for the preparation of the AFR under the FMA.

Audits by invitation

The Auditor-General conducted financial audits of three entities by invitation in 2013–14, as compared with four in 2012–13. This includes the annual financial audit of the Parliament of Victoria's financial statements.

When conducting financial audits by invitation under the Audit Act 1994, the Auditor-General cannot consider issues of waste, probity and the lack of financial prudence. These issues are all required considerations for all other financial audits conducted by the Auditor-General under the Audit Act 1994 and are generally expected aspects of public sector audits.

This limitation on scope means that there are lower standards of accountability for entities audited by invitation than for the rest of the public sector. We are seeking amendments to the Audit Act 1994 to address these anomalies, and to allow an audit of these entities' expenditure of public funds.

Financial sustainability risks of self-funded public sector entities

Of the 210 portfolio departments and associated entities, 45 are classified as self‑funded, because the majority of their revenue is generated from their operations. As a broad rule, self-funded entities should aim to generate sufficient revenue to meet their financial obligations, and to fund asset replacement and new asset acquisitions, if they are to be financially sustainable over the long term.

Fifteen of these entities received a high-risk rating for financial sustainability at 30 June 2014. Across the past five years, eight of these entities have been assessed as having a high sustainability risk every year. The entities are:

- Docklands Studios Melbourne Pty Ltd

- Fed Square Pty Ltd

- Melbourne Convention and Exhibition Trust

- State Sport Centres Trust

- Victorian Arts Centre Trust

- Geelong Performing Arts Centre Trust

- Melton Entertainment Trust

- Port of Melbourne Corporation.

For these entities, there are significant financial challenges, that if not addressed, may lead to a reduction in the services they provide to the community. If these entities are to be financially sustainable over the long term, the underlying pricing model used to generate revenue may need amendment, another funding source may need to be found or additional government support may be required.

Internal audit

The Standing Directions of the Minister for Finance require public sector agencies to establish, maintain and resource an internal audit function. Internal audit is a key governance and oversight mechanism.

The internal audit functions at the portfolio departments were generally sound. All portfolio departments had an internal audit function in place, with an appropriate charter and regular reporting to the audit committee and senior management.

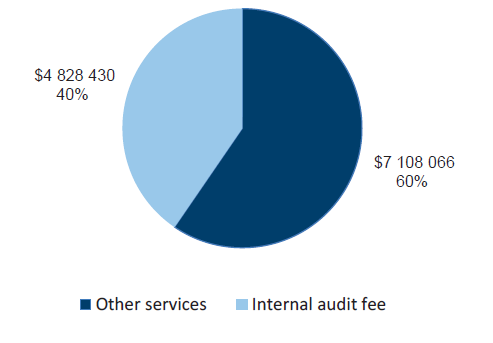

The value of fees paid to internal audit service providers for services outside the scope of internal audit, such as the provision of consulting services, exceeded the actual internal audit fee at five portfolio departments. Portfolio departments should take due care before engaging an existing internal audit service provider to perform additional work, outside the agreed scope of internal audit to ensure there are no conflicts of interest, there is adequate scrutiny of contract scope, and that there is an appropriate segregation of duties.

The average annual expenditure on internal audit in 2013–14 has reduced by approximately 8 per cent since 2011–12 across the nine portfolio departments. At the same time, operating expenditure has increased by approximately 2 per cent, and the operational and risk profiles of departments have changed significantly.

Prudential supervision

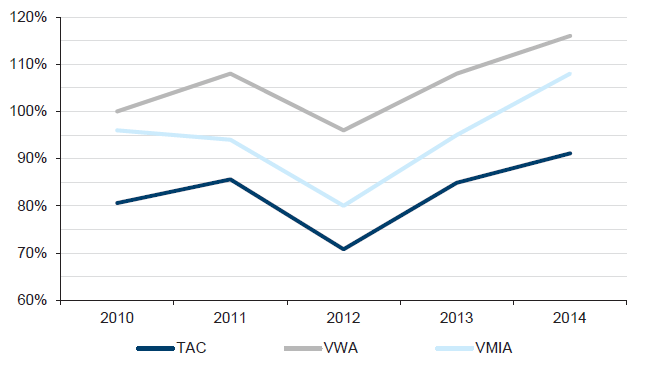

The Prudential insurance standards for Victorian Government insurance agencies (the Standard)—being the Transport Accident Commission, the Victorian WorkCover Authority and the Victorian Managed Insurance Authority (the insurance agencies)—require those agencies to submit an annual attestation to the Department of Treasury and Finance (DTF) stating that they have appropriate governance, risk management and prudential management arrangements in place. DTF, as the prudential supervisor, has the power to investigate compliance with the Standard as it considers appropriate.

The supervision approach adopted by DTF is relatively 'light touch'. DTF relies primarily on the annual compliance certifications of the insurance agencies and does not verify the accuracy of those certifications.

The state's insurance agencies managed assets totalling $27.6 billion and liabilities totalling $25.2 billion at 30 June 2014.

DTF's prudential supervision of the insurance agencies would be strengthened if it exercised its authority under the Standard to appoint an independent prudential auditor to provide independent assurance about the reliability of the insurance agencies' annual attestations of compliance with the Standard. DTF adopts this approach for other state prudential supervision regimes and it would be similar to the requirement of having an annual independent financial audit of agency financial statements.

The insurance agency boards nevertheless take reasonable steps to satisfy themselves that the Standard has been properly implemented. However, the Victorian WorkCover Authority's approach is not consistent with that of the other insurance agencies as it does not seek annual internal audit assurance regarding its compliance with the Standard.

Infringements

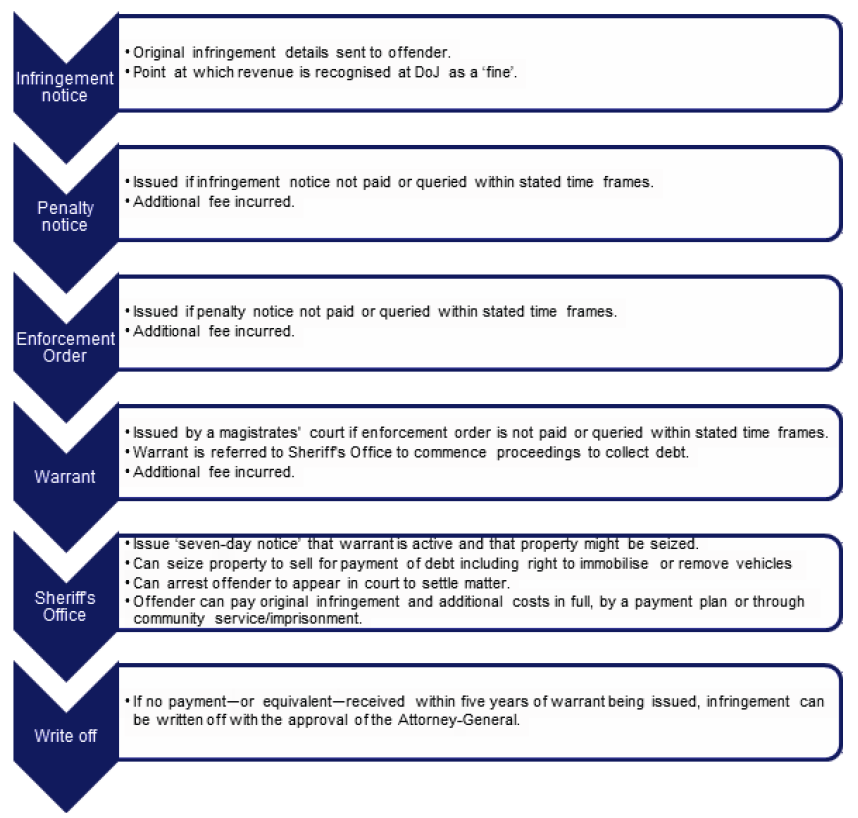

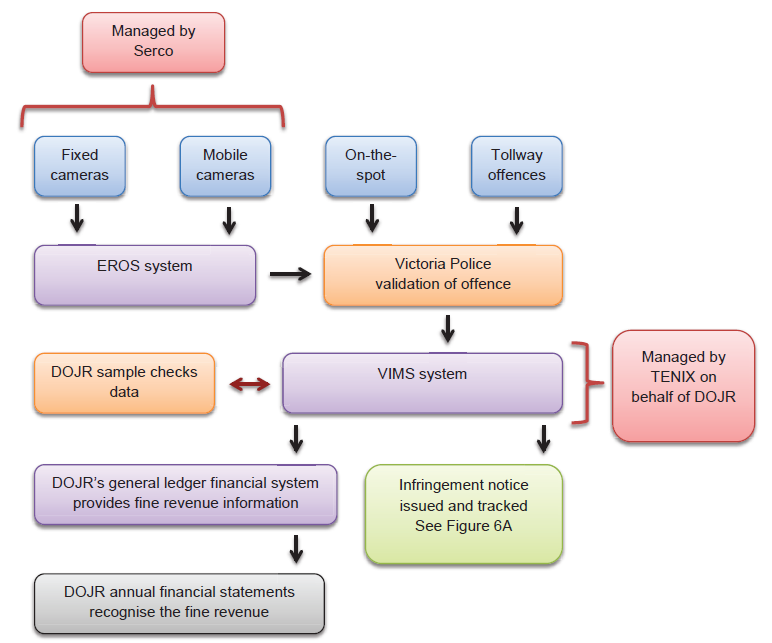

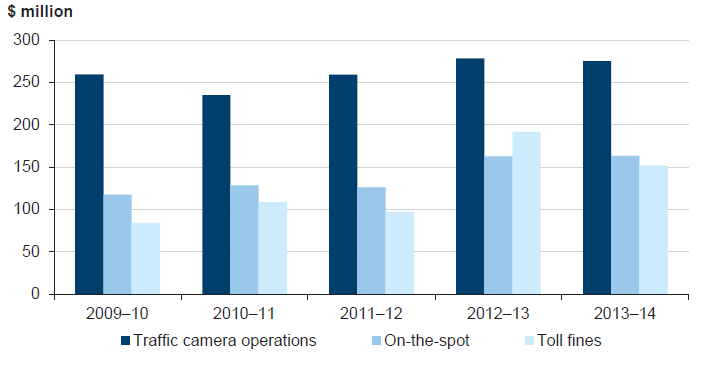

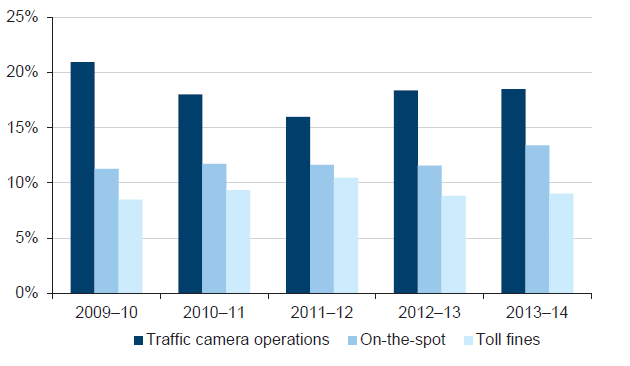

In 2013–14 over 3 million infringement notices were issued by the state in relation to mobile and fixed camera traffic offences, tollway offences, 'on-the-spot' offences and public transport offences. The state recognised revenue from these fines totalling $608 million in 2013–14, compared with $649 million in 2012–13.

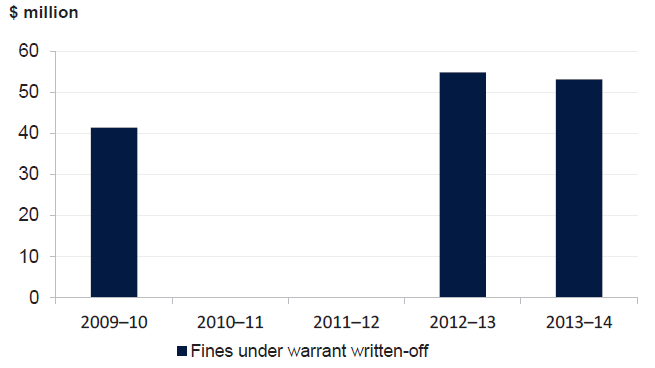

The state wrote off $58.2 million of these fines under warrants in 2013–14, compared with $60.4 million in 2012–13, as they were deemed uncollectable. The Department of Justice and Regulation's (DJR) debt management practices over unpaid fines can be improved through the development of improved management reporting, information gathering and analysis. Currently DJR does not analyse the write-off of fines by category, or type, to assist in improving the collection and enforcement of unpaid fines.

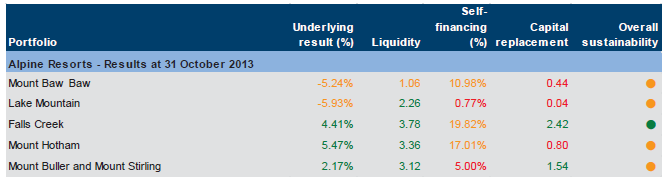

Alpine resorts

Over the five years to 31 October 2013, the state's alpine resorts have generally reported a collective operating surplus. This is largely due to ongoing funding provided by the state government.

However, the Mount Baw Baw and Lake Mountain resorts have regularly been rated a high financial sustainability risk—indicating there may be short-term financial risks that need to be managed.

Significant projects

A number of significant projects were underway at 30 June 2014 including the Port Capacity Project, Regional Rail Link and Western Highway upgrades. In the majority of cases, the significant projects reviewed are progressing on time and within budget.

However, the Regional Rail Link was originally expected to be completed by December 2014—following a 2011 review, the project completion time frame was changed to 2016.

The Western Highway upgrades include the duplication of the Western Highway between Ballarat and Stawell. Funding approvals currently in place are only sufficient to complete the duplication to Ararat, which is 30 kilometres short of Stawell. Completion of the upgrades is dependent on further funding negotiations with the Commonwealth Government.

Public private partnerships

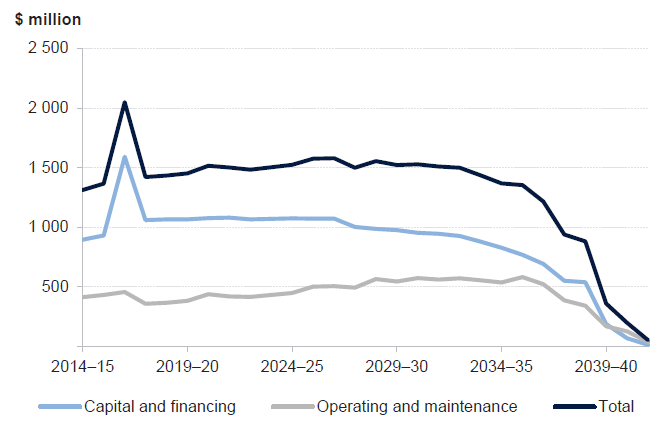

At 30 June 2014, 21 facilities were operating, or were being built in Victoria, under a public private partnership (PPP) arrangement. The total nominal cost of these PPPs over the remaining life of the contracts is $36.6 billion. It is important these arrangements are subject to the same scrutiny by the Auditor-General as other public spending.

While the state has increasingly sought such partnerships, alliances or other service delivery models involving the private sector, the provisions of the Audit Act 1994 have failed to keep pace with these developments. Consequently, the Auditor-General's mandate to review public expenditure on large projects has been eroded. Simultaneously there has been continued, if not increased, expectations from the community about transparency and accountability.

There is currently no Australian accounting standard, or other whole-of-Victorian-government guidance, which prescribes how PPP transactions should be accounted for.

Recommendations

-

That the State of Victoria's Annual Financial Report be subject to review by an independent audit committee.

-

That the Financial Reporting Directions and Standing Directions under the Financial Management Act 1994 be applicable to the State of Victoria's Annual Financial Report.

-

That the Treasurer of Victoria signs the certification of the State of Victoria's Annual Financial Report.

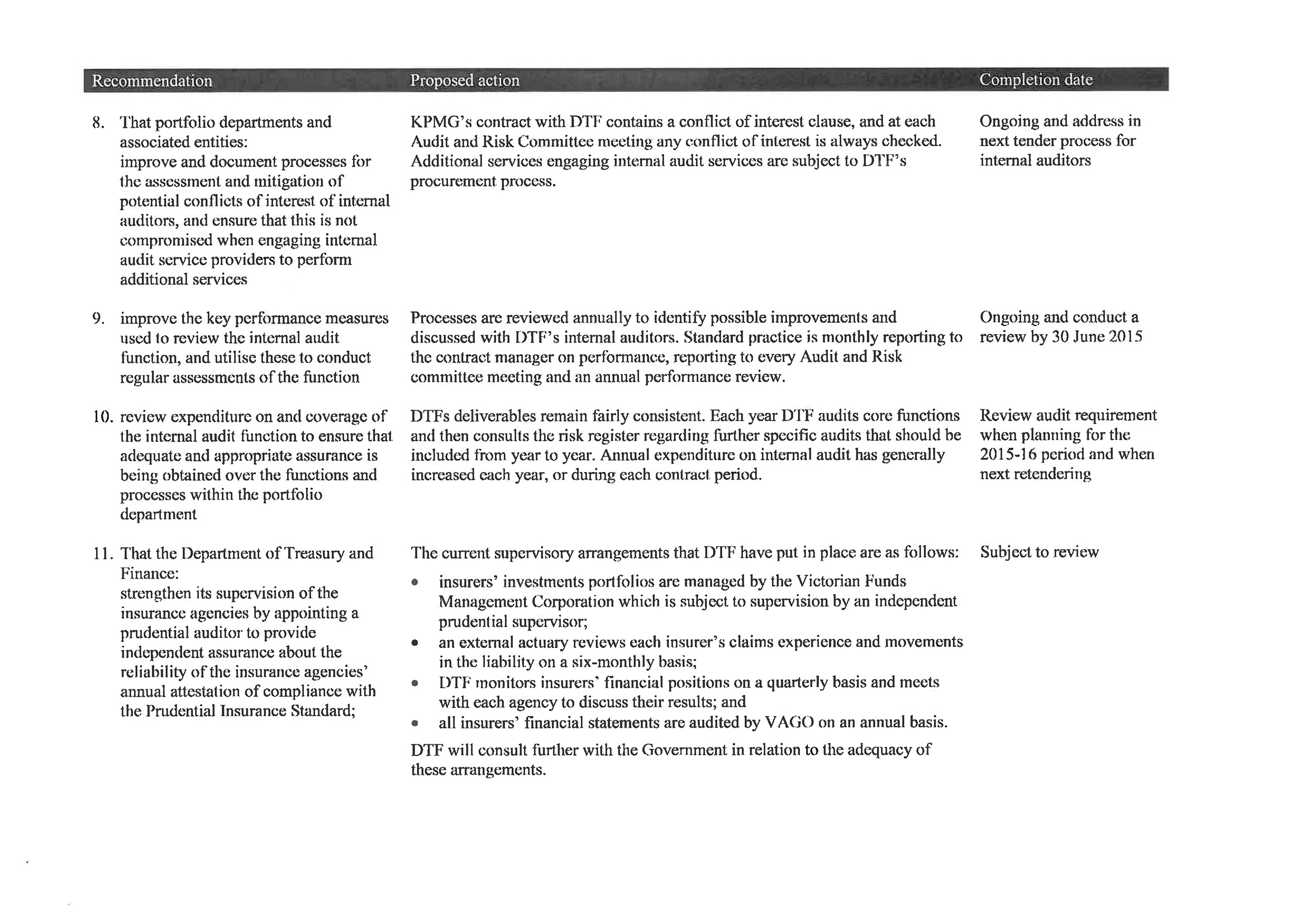

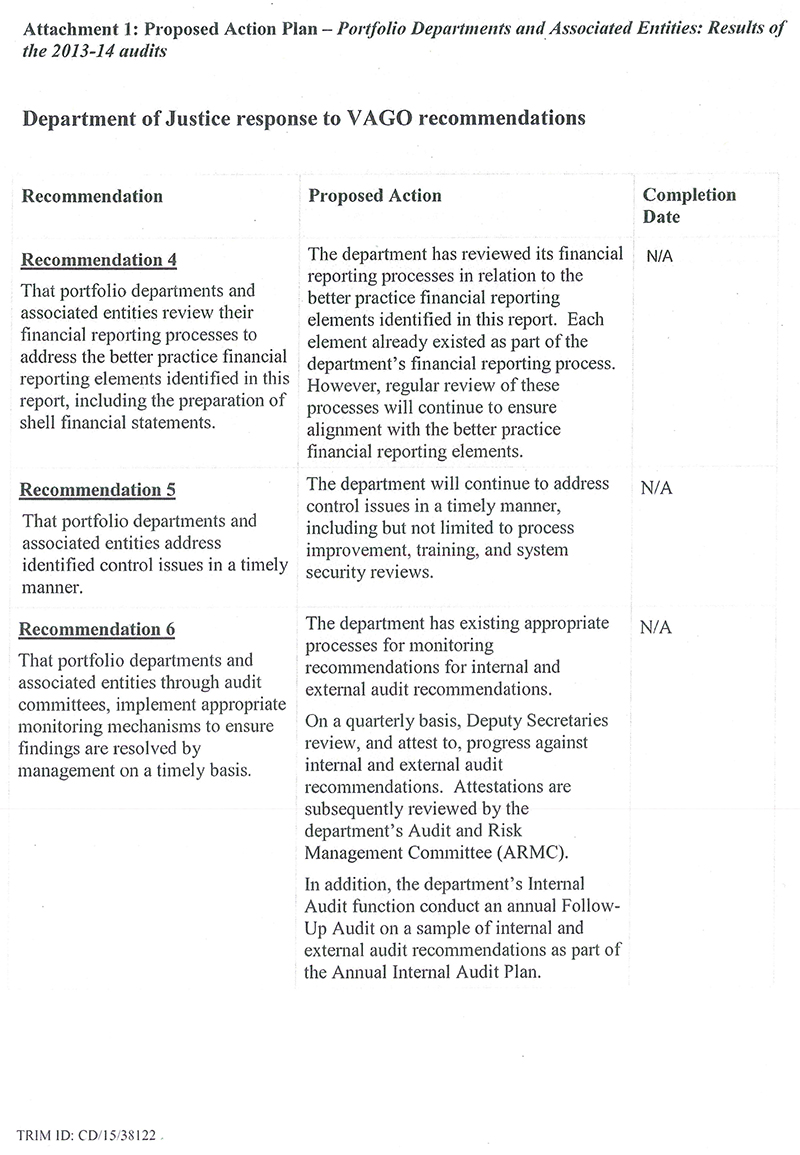

That portfolio departments and associated entities:

- review their financial reporting processes to address the better practice financial reporting elements identified in this report, including the preparation of shell financial statements

-

address identified internal control issues in a timely manner

-

through audit committees, implement appropriate monitoring mechanisms to ensure audit findings are resolved by management on a timely basis.

That the Department of Treasury and Finance:

-

works with self-funded entities to review their underlying pricing model and sources of funding, in order to improve their long-term financial sustainability.

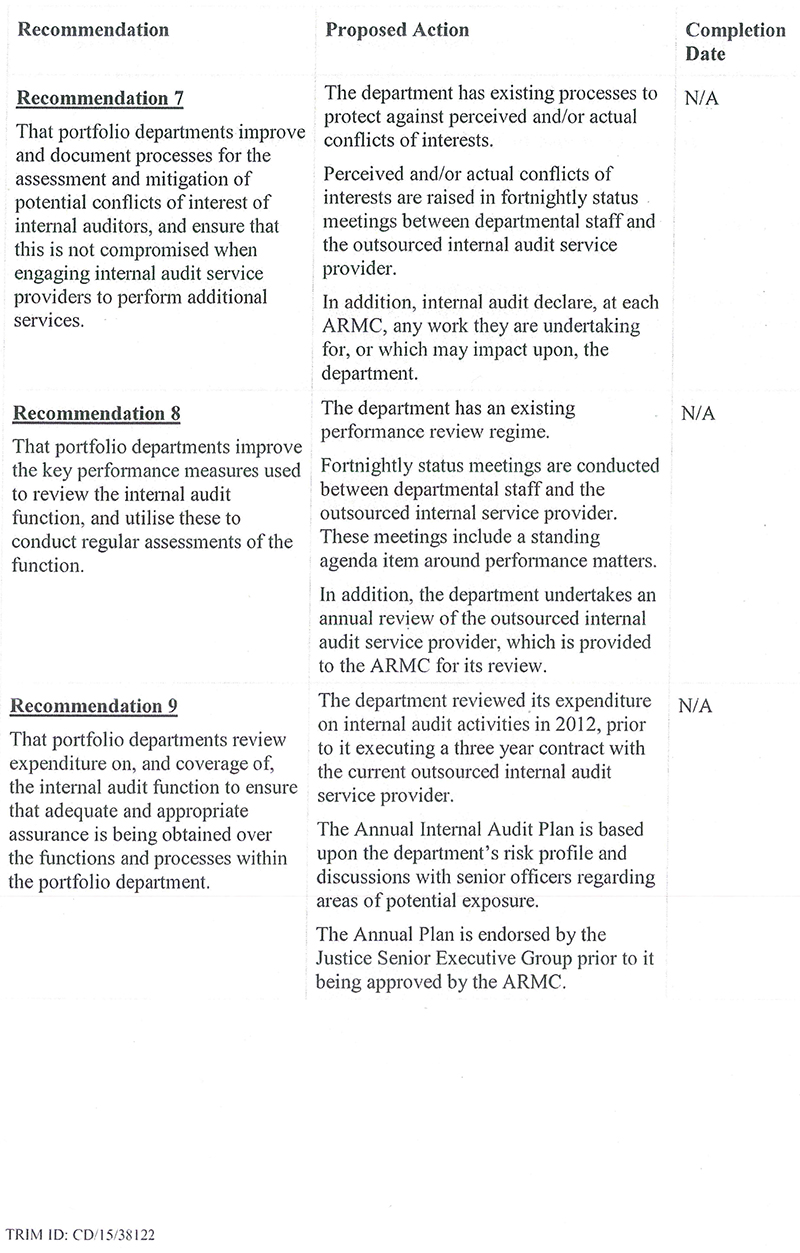

That portfolio departments:

-

improve and document processes for the assessment and mitigation of the potential conflicts of interest of internal auditors, and ensure that this is not compromised when engaging internal audit service providers to perform additional services

-

improve the key performance measures used to review the internal audit function, and utilise these to conduct regular assessments of the function

-

review expenditure on, and coverage of, the internal audit function to ensure that adequate and appropriate assurance is being obtained over the functions and processes within the portfolio department.

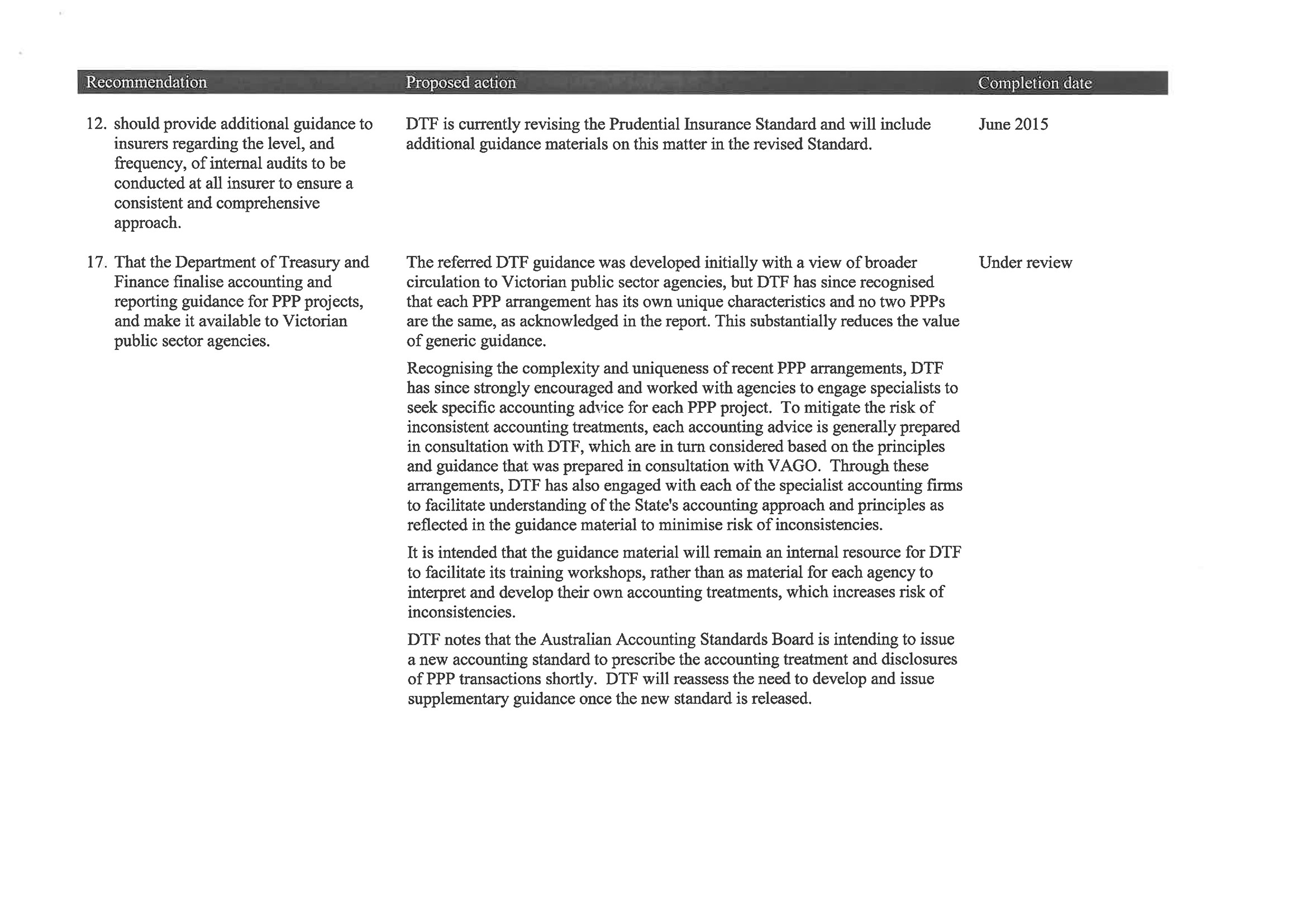

That the Department of Treasury and Finance:

- strengthens its supervision of the insurance agencies by appointing a prudential auditor to provide independent assurance about the reliability of the insurance agencies' annual attestation of compliance with the Prudential insurance standards for Victorian Government insurance agencies

- provides additional guidance to insurers regarding the level and frequency of internal audits to be conducted at all insurers, to ensure a consistent and comprehensive approach.

That the Victorian WorkCover Authority:

- engages its internal auditors to conduct an annual assessment of its compliance with the Prudential insurance standards for Victorian Government insurance agencies, to bring its practices in line with the better practice undertaken by the other insurers.

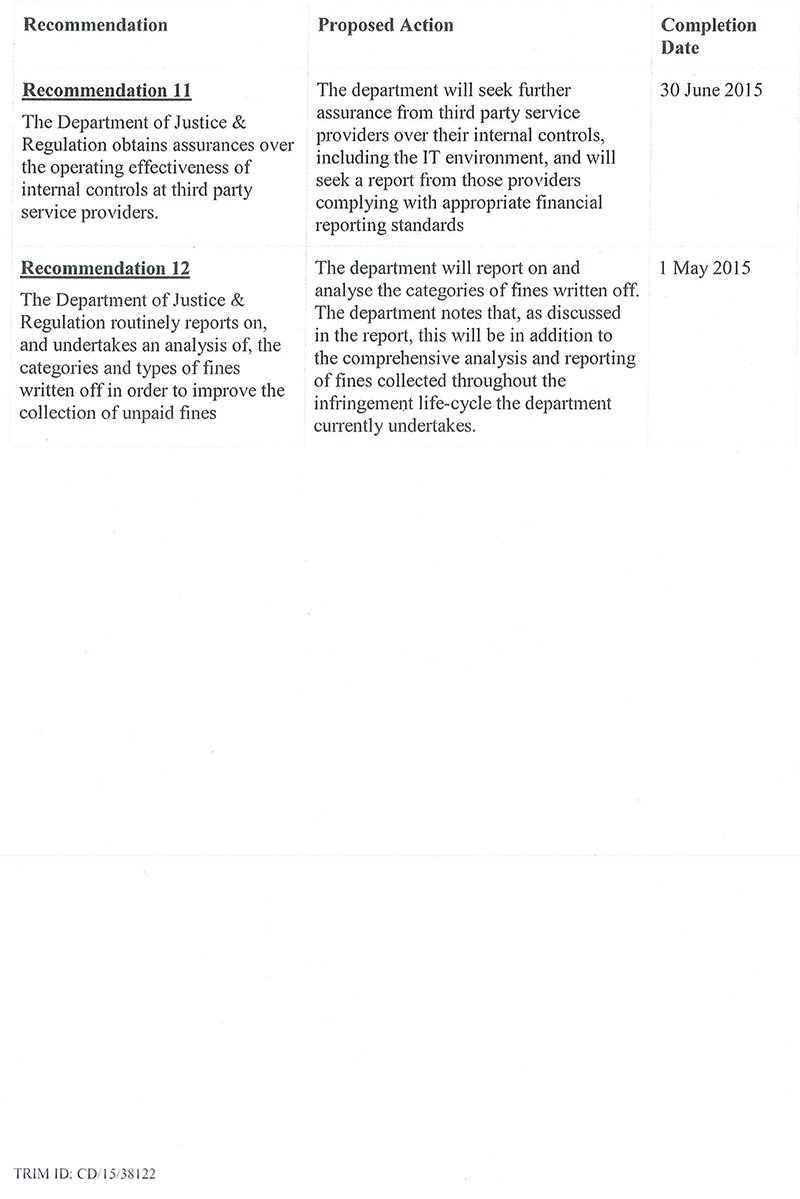

That the Department of Justice and Regulation:

- obtains assurance over the operating effectiveness of internal controls at third-party service providers

- routinely reports on, and undertakes an analysis of, the categories and types of fines written off in order to improve the collection of unpaid fines.

That the alpine resorts:

- develop strategies to improve their long-term financial sustainability.

That the Department of Treasury and Finance:

- finalises accounting and reporting guidance for public private partnership projects, and makes it available to Victorian public sector agencies.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994 a copy of this report, or relevant extracts from the report, was provided to all portfolio departments and named agencies with a request for submissions or comments.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments are included in Appendix F.

1 Background

1.1 Introduction

This report covers the nine portfolio departments and 201 associated entities with 30 June 2014 balance dates. Included in these associated entities are the five alpine resort management boards (alpine resorts) which have an annual balance date of 31 October. The most common reporting frameworks for these entities are the Financial Management Act 1994 (FMA), the Corporations Act 2001 and the Australian Accounting Standards. Details of the entities covered in this report are set out in Appendix C.

This is the first time the alpine resorts have been included in our parliamentary report covering the portfolio departments and associated entities. Previously the alpine resorts have been included in our annual parliamentary report on the education sector.

1.2 Structure of this report

The structure of this report is set out in Figure 1A.

Figure 1A

Report structure

Parts |

Description |

|---|---|

Part 2: Quality of reporting by financial entities |

Comments on the quality of the financial reports prepared by portfolio departments and associated entities. |

Part 3: Financial sustainability risks of self-funded entities |

Provides insight into the financial sustainability risks of self‑funded public sector bodies, based on the trends of four financial sustainability indicators over the past five years. |

Part 4: Internal audit |

Assesses the policies, management and governance practices regarding internal audit at portfolio departments. |

Part 5: Prudential supervision |

Comments on certain practices relating to state insurance agencies' compliance with the Prudential insurance standards for Victorian Government insurance agencies. |

Part 6: Infringements |

Comments on the policies, management and governance practices relating to on-the-spot, traffic camera, tollway and public transport offences. |

Part 7: Alpine resorts |

Comments on the financial results and financial sustainability risks of the five Victorian alpine resorts. |

Part 8: Significant projects |

Provides information on the developments of significant Victorian infrastructure projects during 2013–14. |

Part 9: Public private partnerships |

Provides information on the developments of significant public private partnerships during 2013–14. |

Source: Victorian Auditor-General's Office.

1.3 Audit of financial reports

An annual financial audit has two aims:

- to give an opinion consistent with section 9 of the Audit Act 1994, on whether the financial statements are presented fairly, and in accordance with the relevant financial reporting framework

- to consider whether there has been any wastage of public resources or a lack of probity or financial prudence in the management or application of public resources, consistent with section 3A(2) of the Audit Act 1994.

1.3.1 Audit of internal controls relevant to the preparation of the financial report

Integral to the annual financial audit is an assessment of the adequacy of the internal control framework and governance processes related to an entity's financial reporting. In making this assessment, consideration is given to the internal controls relevant to the entity's preparation and fair presentation of the financial report, but this assessment is not used for the purpose of expressing an opinion on the effectiveness of the entity's internal controls.

Internal controls are systems, policies and procedures that help an entity to reliably and cost-effectively meet its objectives. Sound internal controls enable the delivery of reliable, accurate and timely external and internal reports. An entity's governing body is responsible for developing and maintaining its internal control framework.

Internal control weaknesses we identify during an audit do not usually result in a modified audit opinion because often an entity will have compensating controls that mitigate the risk of a material error in the financial report, or we can undertake alternative audit procedures to gain sufficient assurance. A modification is warranted only if weaknesses cause significant uncertainty about the accuracy, completeness and reliability of the financial information.

Weaknesses in internal control found during the audit of an individual entity are reported to its governing body, management and audit committee in a management letter.

Our reports to Parliament raise systemic or common weaknesses identified during our assessments of internal controls over financial reporting and selected focus areas. This report includes the results of our review of the internal audit function at portfolio departments, compliance with prudential insurance supervision standards by the state's insurers, and comments on certain infringements. This report also considers the financial results and sustainability risks of alpine resorts and provides an update on significant projects and public private partnerships within Victoria.

1.3.2 Financial audits of portfolio departments and associated entities

A breakdown of the entities covered by this report is set out in Figure 1B.

Figure 1B

Entities by portfolio and legislative reporting framework

Portfolios as at 30 June 2014 |

Financial Management Act | Corporations Act | Other | Total |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

2013–14 |

2012–13 | 2013–14 |

2012–13 | 2013–14 |

2012–13 | 2013–14 |

2012–13 |

||||

Parliament |

2 |

2 |

0 |

0 |

0 |

0 |

2 |

2 |

|||

Education and Early Childhood Development |

5 |

5 |

1 |

2 |

0 |

0 |

6 |

7 |

|||

Environment and Primary Industries |

51 |

38 |

2 |

0 |

1 |

0 |

54 |

38 |

|||

Health |

13 |

13 |

0 |

0 |

2 |

2 |

15 |

15 |

|||

Human Services |

3 |

3 |

0 |

0 |

0 |

0 |

3 |

3 |

|||

Justice |

26 |

27 |

2 |

2 |

2 |

2 |

30 |

31 |

|||

Planning and Community Development |

0 |

13 |

0 |

1 |

0 |

0 |

0 |

14 |

|||

Premier and Cabinet |

13 |

11 |

0 |

0 |

1 |

1 |

14 |

12 |

|||

Primary Industries |

0 |

10 |

0 |

2 |

0 |

1 |

0 |

13 |

|||

State Development, Business and Innovation |

9 |

7 |

4 |

4 |

0 |

0 |

13 |

11 |

|||

Transport, Planning and Local Infrastructure |

20 |

11 |

7 |

6 |

0 |

0 |

27 |

17 |

|||

Treasury and Finance |

14 |

15 |

7 |

6 |

25 |

24 |

46 |

45 |

|||

Total |

156 |

155 |

23 |

23 |

31 |

30 |

210 |

208 |

|||

Note: The

alpine resort management boards are included in the Department of Environment

and Primary Industries total for 2013–14.

Source: Victorian

Auditor-General's Office.

The overall number of entities audited and covered in this report increased by two since 2012–13. A list of changes is provided in Figure 1C.

Figure 1C

Changes to audited entities in 2013–14

Moved between parliamentary reports |

|

|---|---|

Falls Creek Alpine Resort Management Board |

Previously included in our Parliamentary report on the Education sector. |

Lake Mountain Alpine Resort Management Board |

Previously included in our Parliamentary report on the Education sector. |

Mount Baw Baw Alpine Resort Management Board |

Previously included in our Parliamentary report on the Education sector. |

Mount Hotham Alpine Resort Management Board |

Previously included in our Parliamentary report on the Education sector. |

Mt Buller and Mt Stirling Alpine Resort Management Board |

Previously included in our Parliamentary report on the Education sector. |

NMIT International Limited |

Previously included in this report, will now be included in the Parliamentary Report on the tertiary and further education entities. |

New entities in 2013–14 |

|

Metropolitan Planning Authority |

Entity established 9 October 2013 to take up the functions of the Growth Areas Authority which was wound up on 9 October 2013. |

VMFC Inflation Linked Bond Trust |

New trust managed by the Victorian Funds Management Corporation, established 5 September 2013. |

VMFC International Equity Trust 1 |

New trust managed by the Victorian Funds Management Corporation, established 5 September 2013. |

Victorian Building Authority |

Entity established 1 July 2013 to take up the functions of the Building Commission and the Plumbing Industry Commission. |

Victorian Public Sector Commission |

Entity established 1 April 2014 to undertake the functions of the State Service Authority which was wound up on 1 April 2014. |

Yorta Yorta Traditional Owners Land Management Board |

Entity established 11 July 2013. |

Entities wound up in 2013–14 |

|

Building Commission |

Entity ceased on 30 June 2013. Functions transferred to the Victorian Building Authority. |

Department of Planning and Community Development |

Entity ceased on 30 June 2013. Functions transferred to other portfolio departments. |

Department of Primary Industries |

Entity ceased on 30 June 2013. Functions transferred to other portfolio departments. |

Growth Areas Authority |

Entity ceased on 9 October 2013. Functions transferred to the Metropolitan Planning Authority. |

Office of Police Integrity |

Entity ceased on 9 February 2013. |

Plumbing Industry Commission |

Entity ceased on 30 June 2013. Functions transferred to the Victorian Building Authority. |

State Services Authority |

Entity ceased on 1 April 2014. Functions transferred to the Victorian Public Sector Commission. |

Transport Ticketing Authority |

Entity ceased on 30 June 2013. Functions transferred to the Public Transport Development Authority. |

Source: Victorian Auditor-General's Office.

1.4 Machinery of government changes

Machinery of government changes amend the administrative structure of government agencies. These can be small changes, such as the transfer of a function from one portfolio department to another, or significant changes, such as the merging of portfolio departments, or the creation or discontinuation of an entity or portfolio department.

On 9 April 2013, the then Premier announced machinery of government changes that affected some of the portfolio departments and included:

- changes to the number and scope of portfolio departments

- new departmental secretaries

- changes to ministerial allocations.

An Order in Council was issued under the Public Administration Act 2004. It renamed three existing departments with immediate effect:

- the Department of Transport was renamed to the Department of Transport, Planning and Local Infrastructure

- the Department of Sustainability and Environment was renamed to the Department of Environment and Primary Industries

- the Department of Business and Innovation was renamed to the Department of State Development, Business and Innovation.

The Department of Planning and Community Development and the Department of Primary Industries, ceased to exist for financial reporting purposes effective from 1 July 2013. The operations of these departments were mainly amalgamated into the new Department of Transport, Planning and Local Infrastructure and the Department of Environment and Primary Industries respectively; although some functions were moved to the Department of Premier and Cabinet, including Veterans Affairs, and to the Department of State Development and Business Innovation, including CenITex and EnergySafe Victoria.

On 3 June 2013, the Premier made a declaration under section 30 of the Public Administration Act 2004 that transferred staff and functions between portfolio departments on that day, to affect the machinery of government changes.

The financial impacts of the machinery of government changes have been recognised in the 2013–14 financial statements for the relevant portfolio departments, with the assets, liabilities, income and expenditure transferring to the new portfolio department on 1 July 2013.

During December 2014, the new government initiated machinery of government changes which will impact the 2014–15 financial year.

1.5 Reporting framework

Financial statements are required to be prepared in accordance with Australian Accounting Standards, and the applicable legislated reporting frameworks. Under the FMA, the Minister for Finance has the authority to issue directions in relation to financial administration and reporting issues.

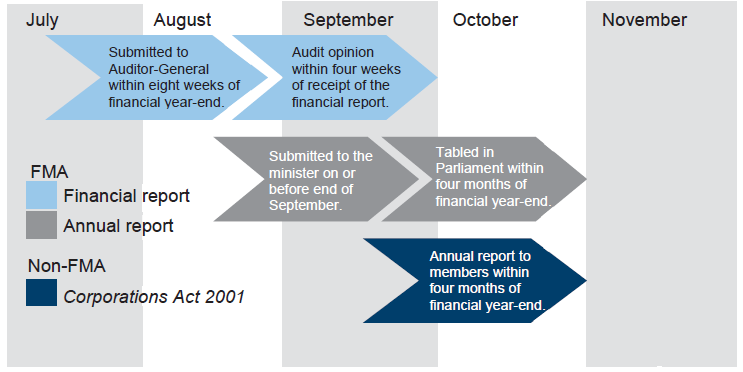

The FMA requires annual reports to be submitted to the relevant minister and tabled in Parliament within four months of the end of the financial year. These reports should include financial reports for the entity and any controlled entities, and are required to be prepared and audited within 12 weeks of the financial year end.

Entities reporting under the Corporations Act 2001 are required to report to their members within four months of the end of the financial year. A summary of the FMA and Corporations Act 2001 reporting time frames is provided in Figure 1D.

Figure 1D

Legislated financial reporting time frames

Source: Victorian Auditor-General's Office.

1.6 Audit content

The audits of the portfolio departments and associated entities were undertaken in accordance with Australian Auditing Standards.

Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated any persons named in this report are not the subject of adverse comment or opinion.

The total cost of preparing and printing this report was $275 000.

2 Quality of reporting by financial entities

At a glance

Background

This Part covers the results of the 2013–14 audits of nine portfolio departments and 201 associated entities. It also compares the financial reporting practices in 2013–14 against better practice, legislated time lines and 2012–13 performance.

Conclusion

Parliament can have confidence in the financial reports of the 204 entities given unqualified opinions for 2013–14. The financial report of the former Department of Education and Early Childhood Development received a qualified audit opinion.

We undertook three financial audits by invitation in 2013–14, including the Parliament of Victoria and the Senior Master of the Supreme Court of Victoria. When conducting financial audits by invitation under the Audit Act 1994, the Auditor-General cannot consider issues of waste, probity and the lack of financial prudence. We are seeking amendments to the Act to address these anomalies, and to give the Auditor-General the ability to audit these entities' expenditure of public funds.

Findings

- The former Department of Education and Early Childhood Development received a qualified opinion in 2013–14.

- The preparation of the State of Victoria's Annual Financial Report (AFR) is a requirement of the Financial Management Act 1994, however, we have noted that the AFR is not subject to the same independent governance and oversight arrangements as other financial reports prepared under the FMA.

Recommendations

- That the AFR be subject to review by an independent audit committee.

- That the Treasurer of Victoria sign the certification of the AFR.

- That portfolio departments and associated entities, through audit committees, implement appropriate monitoring mechanisms to ensure audit findings are resolved by management on a timely basis.

2.1 Introduction

This part covers the results of the 2013–14 audits of nine portfolio departments and 201 associated entities. It also compares the financial reporting practices in 2013–14 against better practice, legislated time lines and 2012–13 performance.

2.2 Conclusion

The financial reports of portfolio departments and their associated entities for 2013–14 were of a high standard, with the exception of one department. At the date of preparing this report, 204 unqualified audit opinions had been issued. The former Department of Education and Early Childhood Development (DEECD) received a qualified opinion and the financial reports of five entities had not been finalised at the time this report was prepared—including three of the alpine resorts. The financial statements of 22 entities were not finalised within the statutory time frames.

2.3 Audit opinions issued

Independent audit opinions add credibility to financial reports by providing reasonable assurance that the information reported is reliable and accurate. An unqualified audit opinion confirms that the financial statements fairly present the transactions and balances for the reporting period, in accordance with the requirements of relevant accounting standards and applicable legislation.

Unqualified audit opinions were issued on 204 financial reports, compared with 203 in 2012–13, although a number of these opinions were issued with an emphasis of matter. One qualified opinion was issued.

Qualified opinion

DEECD received a qualified audit opinion for its 2013–14 financial report. The reasons for the qualification of the opinion issued in respect of the DEECD financial statements were set out in detail in the Auditor-General's Report on the Annual Financial Report of the State of Victoria, 2013–14. A summary of these findings is presented below.

The audit opinion on DEECD's 2013–14 financial report was qualified with respect to a $1.58 billion economic obsolescence adjustment to the carrying value of school buildings at 30 June 2014, and the reclassification of the prior period's school building impairment of $2.15 billion as a fair value adjustment.

The audit opinion was qualified because:

- the accounting policy adopted to fair value school building assets, specifically including an economic obsolescence adjustment, was not appropriate

- the key valuation assumptions and judgements were not be supported by sufficient appropriate evidence

- the reclassification of previously reported 30 June 2013 balances did not accord with Australian Accounting Standards

- DEECD included comments in the accountable officer's and chief finance officer's declaration on the 2013–14 financial report that were inappropriate.

DEECD's accounting policy for economic obsolescence resulted in a significant write down of taxpayer investments in school buildings which continue to deliver educational outcomes. Further, in our review of the practices applied across other Australian jurisdictions we found that Victoria is alone in its approach to this matter.

Emphasis of matter

An auditor can draw a reader's attention to a matter or disclosure in the financial report to provide important context, including where the financial report has been prepared using a special purpose financial framework. Financial reports that include an emphasis of matter (EoM) paragraph in the audit opinion still present the entity's financial information fairly and can be relied upon by the user.

In 2013–14, 26 entities covered by this report prepared special purpose financial reports. These entities received an EoM paragraph in their opinion to draw attention to this basis of preparation. In addition, four entities received an audit opinion containing an EoM for other reasons, as detailed in Figure 2A.

Figure 2A

30 June 2014 opinions with an emphasis of matter paragraph

Entity |

Reason |

|---|---|

Architects Registration Board of Victoria |

The EoM paragraph drew the users' attention to the recently introduced legislation which, when passed, will repeal the Architects Registration Act 1991 and transfer the operations, assets and liabilities of the repealed board to the Victorian Building Authority. |

Domestic Building (HIH) Indemnity Fund |

The EoM drew the users' attention to the fact that the report was prepared on the basis that the entity would cease, due to the intended winding up of the entity. Legislation has been introduced into Parliament which would, amongst other provisions, wind up the fund on, or before, 1 July 2016. |

Legal Services Board Legal Services Commission |

The EoM paragraph drew the users' attention to Note 1 of the financial report that explains that both entities are included in the financial report as a single composite entity pursuant to section 53(1)(b) of the Financial Management Act 1994. |

VFMC Ontario Inc |

The EoM drew the users' attention to the fact that the report was prepared on the basis that the entity would cease due to the intended winding up of the entity. |

Source: Victorian Auditor-General's Office.

2.4 Quality of reporting

The quality of an entity's financial reporting can be measured in part by the timeliness and accuracy of the preparation and finalisation of its financial report, as well as against better practice criteria.

Appendix C details the legislative and reporting framework for the entities covered by this report.

2.4.1 Accuracy

The frequency and size of errors in the draft financial reports submitted to audit are direct measures of the accuracy of those reports. Ideally, there should be no errors or adjustments required as a result of an audit.

Our expectation is that all entities will adjust any errors identified during an audit, other than those errors that are clearly trivial or clearly inconsequential to the financial report, as defined under the auditing standards. The public is entitled to expect that any financial reports that bear the Auditor-General's opinion are accurate and of the highest possible quality. Therefore, all errors identified during an audit should be adjusted, other than those that are clearly trivial, as defined in the Australian Auditing Standards.

Material adjustments

Material errors need to be corrected before an unqualified audit opinion can be issued. It is noted that 21 material financial adjustments were made across the nine portfolio departments during the 2013–14 audits, compared with 23 in 2012–13. Of these 21 adjustments, four were greater than $100 million—all relating to DEECD—and a further eight were greater than $10 million—relating to DEECD, the Department of Treasury and Finance (DTF) and the former Department of Environment and Primary Industries.

A further 28 material adjustments were made to the disclosures in the notes accompanying the financial statements, compared with 21 in 2012–13.

The most common areas of material financial and disclosure adjustments identified during the 2013–14 audits were:

- commitment disclosures—adjustments to the financial and narrative information relating to the portfolio departments future commitments, including disclosures regarding public private partnerships

- property, plant and equipment disclosures—the introduction of Australian Accounting Standard AASB13 Fair Value Disclosures required all entities to disclose significantly more information in their 2013–14 financial statements than in prior years regarding the nature of assets held, and the factors used in determining their valuations

- recognition of and/or transfer of assets—adjustments arose following the transfer of assets from one portfolio department to another as a result of the machinery of government changes and from the incorrect recognition of the valuation of fixed assets held by an entity.

Other than two adjustments relating to the DEECD qualified audit opinion, all material errors were adjusted prior to the completion of the financial reports.

Adjustment of other misstatements

Other errors should also be corrected before the audit opinion is issued. While some errors may appear quantitatively immaterial in isolation, in aggregate, a series of small errors may have a significant impact on an entity's financial statements or an entity's operating result.

During the 2013–14 audits, a number of misstatements above clearly trivial thresholds, but below materiality levels, were identified. Most were subsequently adjusted in entities' financial statements, however, some were not adjusted either because they were identified too late in the financial statement preparation process, or could not be processed in a timely manner without raising an unacceptable risk of creating further errors. In these instances the misstatement was raised with management and will be rectified during 2014–15.

Given their nature, these items do not affect the fair presentation of the entity's financial information, meaning the financial reports can still be relied upon by the user.

2.4.2 Timeliness

Timely financial reporting is key to providing accountability to stakeholders and enables informed decision-making. The later reports are produced and published after year end, the less useful they are.

Financial statements prepared pursuant to the Financial Management Act 1994 (FMA) are required to be finalised within 12 weeks of the end of financial year—while the relevant annual reports should be tabled in Parliament within four months of the end of the financial year.

In 2013–14, 183, or 87 per cent, of the 210 entities covered by this report completed their financial reports within the required legislated time frame, compared with 97 per cent, in 2012–13.

Twenty-two entities failed to finalise their financial reports within the relevant time frame, compared with 9 in 2012–13. Five entities, including three alpine resorts, had not finalised their financial statements as at 14 January 2015.

These delays are partially attributable to the entities' failure to prepare for the new Australian Accounting Standard AASB13 Fair Value Disclosures, which imposed increased reporting requirements. These entities should review their financial reporting preparation to ensure that they are able to report on any changed or new accounting standards in an accurate and timely manner, without compromising their legislative obligations.

Another common reason for the delays was a lack of timely preparation of draft financial reports for audit. By not providing complete draft statements to the auditors by the date agreed, any issues identified may not be resolved in a timely manner, impacting the entity's ability to meet their reporting time frame. Entities should work with their auditors to agree on appropriate timetables that enable them to meet their legislative obligations.

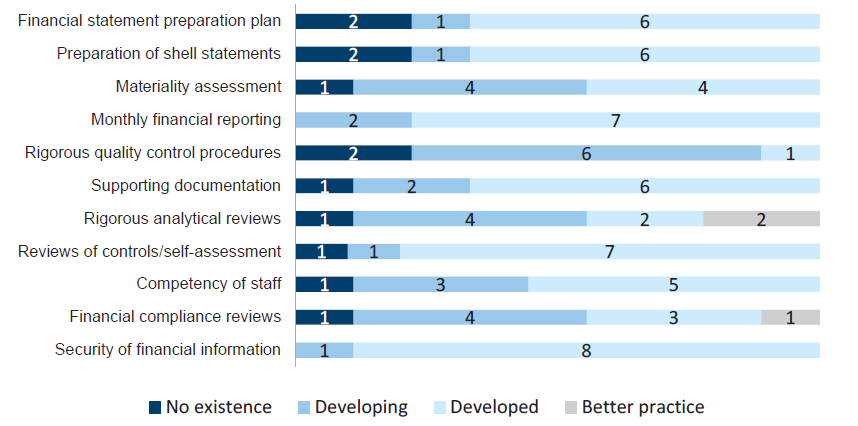

2.4.3 Portfolio department financial reporting

An assessment of the quality of the financial reporting process of the nine portfolio departments was conducted against better practice criteria, detailed in Figure 2B, using the following scale:

- no existence—process not conducted by the department

- developing—partially encompassed in the entity's financial reporting process

- developed—entity has implemented the process, however, it is not fully effective or efficient

- better practice—entity has implemented efficient and effective processes.

Figure 2B

Financial report preparation better practice

Key area |

Better practice |

|---|---|

Financial report preparation plan |

Establish a plan that outlines the processes, resources, milestones, oversight, and quality assurance practices required in preparing the financial report. |

Preparation of shell statements |

Prepare a shell financial report and provide it to the auditors early to enable early identification of amendments, minimising the need for significant disclosure changes at year end. |

Materiality assessment |

Assess materiality, including quantitative and qualitative thresholds, at the planning phase in consultation with the audit committee. The assessment assists preparers to identify potential errors in the financial report. |

Monthly financial reporting |

Adopt full accrual monthly reporting to assist in preparing the annual financial report. This allows the year-end process to be an extension of the month-end process. |

Quality control and assurance procedures |

Require rigorous review of the supporting documentation, data and the financial report itself by an appropriately experienced and independent officer prior to providing it to the auditors. |

Supporting documentation |

Prepare high-standard documentation to support and validate the financial report and provide a management trail. |

Analytical reviews |

Undertake rigorous and objective analytical review during the financial report preparation process to help to improve the accuracy of the report. |

Reviews of controls/ self-assessment |

Establish sufficiently robust quality control and assurance processes to provide assurance to the audit committee on the accuracy and completeness of the financial report. |

Competency of staff |

The preparers of the financial report have a good understanding of, and experience in, applying relevant accounting standards and legislation. They also have effective project management and interpersonal skills. |

Financial compliance reviews |

Undertake periodic compliance reviews to identify areas of noncompliance or changes to legislation that impact the financial report. |

Adequate security |

Protect and safeguard sensitive information throughout the process to prevent inappropriate public disclosure. |

Source: Victorian Auditor-General's Office, and Australian National Audit Office Better Practice Guide Preparation of Financial Statements by Public Sector Entities, June 2009.

The results are summarised in Figure 2C.

Figure 2C

Results of assessment of report preparation processes

against better practice elements

Source: Victorian Auditor-General's Office.

While most elements were developing or developed, with some portfolio departments having achieved better practice, the most significant element to be addressed is the need to consider materiality when preparing the financial statements. The need to undertake rigorous analytical review and strong quality control procedures during the financial report preparation process are essential to ensure the accuracy and completeness of the financial statement disclosures. As part of this process, portfolio departments need to build in detailed financial compliance reviews over the financial statements to ensure that all key elements of the Australian Accounting Standards are complied with.

All of these areas are a significant part of the financial statement preparation process and by not having these elements built into the process, portfolio departments could potentially jeopardise the quality of their financial statements as well as their ability to meet legislated time lines.

2.4.4 The State of Victoria's Annual Financial Report

The State of Victoria's Annual Financial Report (AFR) acquits the government's stewardship of the state's finances to Parliament, and is a consolidated financial report of the 279 state-controlled entities.

The preparation of the AFR is a requirement of the FMA, however, we have noted that the AFR is not subject to the same independent governance and oversight arrangements as other financial reports prepared under the FMA. In particular, while DTF has an audit committee, that committee does not have responsibility for overseeing the preparation and fair presentation of the AFR.

Additional disparities in the governance structure for the AFR compared to other FMA financial reports were identified:

- The Treasurer of Victoria is responsible for the preparation of the AFR in accordance with applicable Australian Accounting Standards, and determines the manner and form of the financial statements in accordance with the FMA. Consequently, the Treasurer is both responsible for preparing the AFR but also determines the manner and form of the AFR. The form and content of all other financial reports prepared under the FMA are determined by the Minister for Finance. Further, the AFR is not bound to comply with the Financial Reporting Directions or the Standing Directions of the Minister for Finance despite these frameworks applying to other entities prepared under the FMA. This means that the AFR does not disclose some information required by other financial reports, such as related party transactions or executive remuneration.

- The former Treasurer of Victoria did not sign the certification of the financial report and has delegated this responsibility to specified officers of DTF. The AFR does not formally note that the signatories are doing so on behalf of the Treasurer. This is inconsistent with other financial reports prepared under the FMA which are certified by the respective responsible persons.

The objectivity and credibility of financial reporting is diminished when appropriate governance structures are not in place. As the consolidating report to Parliament, the AFR's governance processes should be in line with better practice, and we recommend the above issues are addressed by the Treasurer and DTF.

2.5 Audits by invitation

An entity that does not meet the definition of an authority under the Audit Act 1994 is not required to have the Auditor-General conduct its financial audit. However, under section 16G of the Audit Act 1994, the Auditor-General can accept an invitation to conduct the financial audit of an entity that is not an 'authority'.

Before accepting such an invitation, the Auditor-General must be satisfied that the person or body exists for a public purpose and that it is practicable, and in the public interest, for the Auditor-General to conduct the audit.

The Auditor-General conducted financial audits of three entities by invitation in 2013–14:

- Parliament of Victoria

- Australian Health Practitioner Regulation Agency

- Senior Master of the Supreme Court of Victoria.

When conducting financial audits by invitation under section 16G, the Auditor-General cannot consider issues of waste, probity and the lack of financial prudence. These issues are all required considerations for all other financial audits conducted by the Auditor-General and are generally expected aspects of public sector audits.

This limitation on scope means that there are lower standards of accountability for these entities audited by invitation than for the rest of the public sector. We are seeking amendments to the Audit Act 1994 to address these anomalies, and to allow an audit of these entities' expenditure of public funds.

2.6 Internal controls relevant to the preparation of financial reports

Internal controls at the nine portfolio departments, to the extent that they were reviewed as part of our audit, were adequate for reliable external financial reporting. However, a number of control weaknesses were reported to departmental secretaries and management during the course of the 2013–14 audits.

When issues are identified, the financial audit team will issue a management letter to the secretary of a portfolio department, as the accountable officer, listing details of the issues. Internal control weaknesses reported to the secretary should be actioned and resolved in a timely manner.

There were 65 internal control weaknesses in total that were identified and reported to secretaries at the nine portfolio departments in 2012–13 that remained unresolved at the time of the 2013–14 audits. Forty-seven of these weaknesses were rated as high or medium risk. This lack of timely resolution means that the control frameworks in place at the portfolio departments are not as effective as they should be, and management should seek to address all the issues raised on a timely basis.

During the 2013–14 financial audits, common control weaknesses identified across the nine portfolio departments were related to information technology, account reconciliations and maintaining key policy documents. These were all identified as common weaknesses in the previous year.

2.6.1 Information technology

Information security is important for protecting information technology (IT) applications, infrastructure and information from threats, in order to enable business continuity and minimise risks. Effective IT security controls mitigate the risks that information will be inappropriately released and that information will be incomplete, unreliable or inaccurate.

Six of the nine portfolio departments had common IT issues in 2013–14. These issues related to:

- user access and password management

- system change management procedures

- disaster recovery arrangements

- IT strategic plans

- IT network and system penetration testing.

A lack of monitoring of these issues over an extended period of time may compromise the security of information and expose the portfolio departments to internal and external threats. Resolving these issues can reduce risks to the ongoing operations of the departments.

Our October 2014 report, Information and Communications Technology Controls Report 2013–14, provides further information regarding these IT general controls issues.

2.6.2 Account reconciliations

A financial report is prepared from information captured in an entity's financial system. Balances within the system are supported by various sources of information. Periodic reconciliation of these balances confirms the completeness and accuracy of data.

The timely preparation and independent review of reconciliations decreases the risk that errors remain undetected or are not resolved in a timely manner.

Three of the nine portfolio departments had deficiencies in relation to the preparation and review of key reconciliations. While critical departures from expected practices were not identified, their processes surrounding the timely preparation, review and approval of account reconciliations could be improved.

2.6.3 Policies and procedures

Most departments had documented policies and procedures for their key financial processes, however deficiencies identified included:

- the timeliness of policy document reviews

- the establishment of policies regarding ex-gratia payments

- non-compliance with policies

- excessive annual leave balances.

All of the nine portfolio departments have had staff with excessive annual leave balances for a number of years. This is inconsistent with departmental policies and may reduce the effectiveness of key internal controls and is also generally considered to be an increased fraud risk.

Portfolio departments should ensure policy and procedure documents are regularly reviewed and complied with.

Recommendations

- That the State of Victoria's Annual Financial Report be subject to review by an independent audit committee.

- That the Financial Reporting Directions and Standing Directions under the Financial Management Act 1994 be applicable to the State of Victoria's Annual Financial Report.

- That the Treasurer of Victoria signs the certification of the State of Victoria's Annual Financial Report.

That portfolio departments and associated entities:

- review their financial reporting processes to address the better practice financial reporting elements identified in this report, including the preparation of shell financial statements

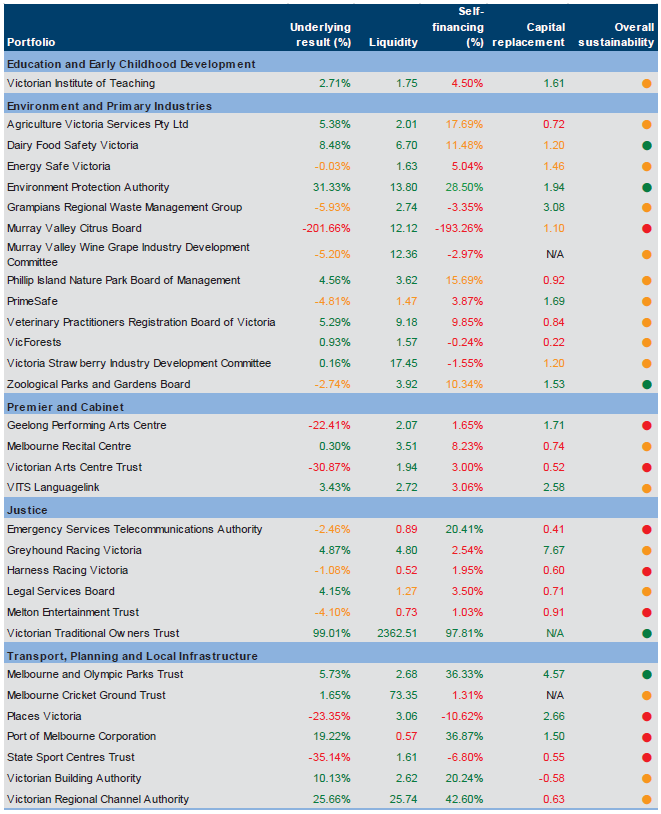

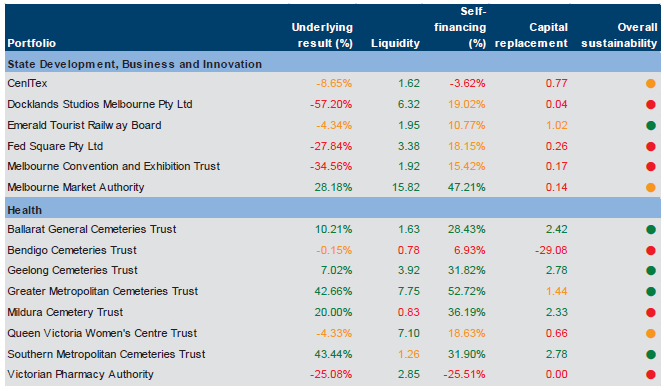

- address identified internal control issues in a timely manner

- through audit committees, implement appropriate monitoring mechanisms to ensure audit findings are resolved by management on a timely basis.

3 Financial sustainability risks of self-funded entities

At a glance

Background

In this Part we review the financial sustainability risks of 45 self-funded entities. These entities generate the majority of their revenue from their own operations, rather than depending upon government funding.

The self-funded entities should aim to generate sufficient revenue from their operations to meet their financial obligations and to fund asset replacement.

Conclusion

A review of state entities that have been rated as high risk for each of the past five years indicates that it is difficult for these entities to set their fees and charges at a level that would enable them to generate enough revenue to meet their obligations as they fall due, and to ensure the long-term maintenance of their assets. Over the long term, such financial challenges may reduce the service potential of assets and consequentially, reduce the services that can be provided to the community.

Findings

- Fifteen of the 45 self-funded entities assessed in 2013–14 were rated as having a high financial sustainability risk, compared with 12 in 2012–13.

- High-risk entities are not generating enough revenue to fund their depreciation costs, which means they may not be able to renew their assets as required to continue offering services to the community.

- Eight self-funded entities have been rated as high risk in each of the past five years.

Recommendation

That the Department of Treasury and Finance works with self-funded entities to review their underlying pricing model, and sources of funding, in order to improve their long-term financial sustainability.

3.1 Introduction

In this Part we review the financial sustainability of entities that primarily generate revenue from their own operations, rather than depend upon government funding. Forty-five entities have been identified as being self-funded in 2013–14, compared with 47 in 2012–13.

The nine portfolio departments and the other entities predominately funded through government grants have been excluded from this assessment. The financial sustainability of public hospitals, local government, water and tertiary education entities is assessed and reported to Parliament in our sector-specific reports, the details of which can be found in Appendix A.

Self-funded entities should aim to generate sufficient revenue from their operations to meet their financial obligations, and to fund asset replacement and asset acquisitions. Their ability to do this depends largely on their expenditure and revenue management practices, which are reflected in the composition and rate of change of their operating revenue and expenses.

3.2 Conclusion

There has been a deterioration in the financial sustainability of the self-funded entities over the past five years. Fifteen, or 33 per cent, of the 45 entities assessed in 2013–14 were rated as having a high financial sustainability risk, compared with 26 per cent in 2012–13.

A review of state entities that have been rated as high risk for each of the past five years indicates that many may not be able to set their fees and charges at a level that would enable them to generate enough revenue to meet their obligations as they fall due and ensure the long-term maintenance of their assets. In many cases, if these entities were to set their prices at a point that would allow them to do this, the community may not use the services available.

If these entities are to be financially sustainable over the long term, the underlying pricing model used to generate revenue may need amendment, another funding source may need to be found or additional government support may be required. The Department of Treasury and Finance should work with self-funded entities to try to find an appropriate balance between the fee-setting model and their ability to improve their long-term financial sustainability.

3.3 Financial sustainability risks

We analysed the financial trends and patterns of the self-funded entities by examining four core indicators over a five-year period. The indicators used were the underlying operating result, liquidity, self-financing and capital replacement, as they reflect an entity's funding and expenditure policies, and indicate whether the policies are financially sustainable.

Financial sustainability should be viewed from both the short- and long-term perspective. The short-term indicators, in this case, the underlying operating result and liquidity indicators, measure an entity's ability to maintain adequate liquid assets, and to generate an operating surplus over the short term. The long-term indicators, that is, the self-financing and capital replacement indicators, identify whether adequate funding is available and being spent on asset renewal to maintain the quality of service delivery, and to help meet community expectations and the demand for services.

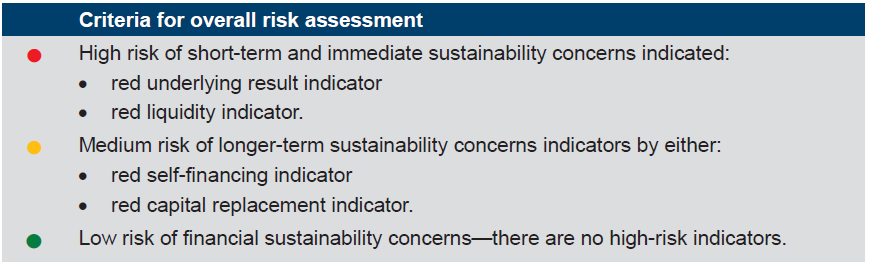

Appendix B describes the financial sustainability indicators, risk assessment criteria and the benchmarks we use in this report. Figure B4 in Appendix B provides the results of our analysis for each of the 45—47 in 2012–13—self-funded entities as at 30 June 2014.

Financial sustainability risks assessments 2009–10 to 2013–14

We have published a financial sustainability analysis for self-funded entities annually since 2008–09 in this report.

Figure 3A provides a summary of the financial sustainability results of self-funded entities in each of the five years since 2009–10.

Figure 3A

Financial sustainability risk assessment, 2009–10 to 2013–14

|

Risk rating |

2009–10 |

2010–11 |

2011–12 |

2012–13 |

2013–14 |

|---|---|---|---|---|---|

|

High |

11 (24%) |

12 (27%) |

13 (29%) |

12 (26%) |

15 (33%) |

|

Medium |

21 (47%) |

20 (43%) |

16 (34%) |

16 (34%) |

20 (45%) |

|

Low |

13 (29%) |

14 (30%) |

17 (37%) |

19 (40%) |

10 (22%) |

|

Total |

45 |

46 |

46 |

47 |

45 |

Source: Victorian Auditor-General's Office.

The number of entities rated as having a high financial sustainability risk has been increasing since 2009–10.

A major driver behind the number of entities recording high-risk financial sustainability indicators is the difficulty in setting their fees and charges at a level that would enable them to meet their obligations as they fall due and ensure the long-term maintenance of their assets. In many cases, if self-funded entities were to set their prices at a point that would allow them to do this, they may experience a reduction in public demand for their services.

The Department of Treasury and Finance should work with self-funded entities to find an appropriate balance between the fee-setting model and the ability for self-funded entities to improve their financial sustainability.

3.4 High-risk entities

Figure 3A indicates that there has been a deterioration in the financial sustainability of self-funded entities. A total of 15 of 45, or 33 per cent of entities were assessed as having a high financial sustainability risk in 2013–14, compared with 26 per cent in 2012–13.

This deterioration is due in part to the way these entities charge for their services. Given the nature of these entities, their governing boards and trusts have a limited ability to improve their financial sustainability. These entities may be unable to generate enough revenue to cover costs, including the long-term maintenance of their major assets, as measured by depreciation. This potentially compromises the services that they will be able to offer the public in future years.

The following entities have been rated as having a high financial sustainability risk in each of the five years since 2009–10:

- Docklands Studios Melbourne Pty Ltd

- Fed Square Pty Ltd

- Melbourne Convention and Exhibition Trust

- State Sport Centres Trust

- Victorian Arts Centre Trust

- Geelong Performing Arts Centre Trust

- Melton Entertainment Trust

- Port of Melbourne Corporation.

A detailed analysis of each of these entities follows.

The financial sustainability indicators for the 45 self-funded entities are set out in Appendix B.

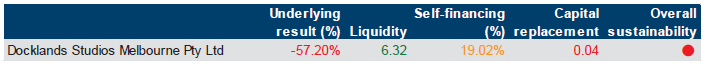

3.4.1 Docklands Studios Melbourne Pty Ltd

Docklands Studios Melbourne Pty Ltd provides film and television studio facilities for hire. Dockland Studios has been rated high risk for the past five years, mainly due to significantly unfavourable underlying operating results, as shown in Figure 3B.

Figure 3B

Financial sustainability results 30 June 2014 – Docklands Studios Melbourne Pty Ltd

Source: Victorian Auditor-General's Office.

The Docklands Studios has recorded a deficit in each of the past five years. In four of those they reported a deficit greater than 50 per cent of revenue. The deficit in 2013–14 was $1.9 million, compared with $1.5 million in 2012–13, and depreciation expenses were $2.3 million, compared with $2.0 million in 2012–13. This, combined with an unfavourable capital replacement indicator, indicates that the Docklands Studios may have insufficient revenue to renew their assets as required. This indicates that the Docklands Studios has short- and long-term financial challenges.

3.4.2 Fed Square Pty Ltd

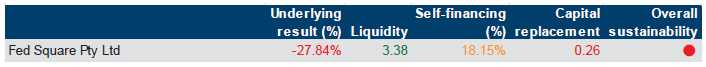

Fed Square Pty Ltd has also been rated as a high risk for the past five years. In 2013–14, it reported a deficit of $6.6 million and incurred depreciation expenses of $11.7 million. Fed Square Pty Ltd continues to have short- and long-term sustainability issues, as shown in Figure 3C.

Figure 3C

Financial sustainability results 30 June 2014 – Fed Square Pty Ltd

Source: Victorian Auditor-General's Office.

3.4.3 Melbourne Convention and Exhibition Trust

The Melbourne Convention centre opened in 2009 as a public private partnership (PPP). The private sector partner designed, constructed and financed the centre. The private sector partner will also maintain the centre for 25 years, after which time it will be returned to the state.

The Melbourne Convention and Exhibition Trust (MCET) is to meet half the costs of the PPP by repaying a $227.7 million loan to the former Department of State Development, Business and Innovation. The loan will be repaid over the period of the PPP. At 30 June 2014 approximately $200 million of this amount was still outstanding.

The underlying operating result for MCET continues to record a deficit. In 2013–14 it recorded a deficit of $18.6 million, which compares to a deficit of $28.7 million in 2012‑13. The depreciation expense for 2013–14 was $23.1 million, compared with $27.0 million in 2012–13. The indicators shown in Figure 3D indicate short- and long‑term financial challenges for MCET.

Figure 3D

Financial sustainability results 30 June 2014 – Melbourne Convention and Exhibition Trust

Source: Victorian Auditor-General's Office.

3.4.4 State Sport Centres Trust

The State Sport Centres Trust (SSCT) is a statutory authority which governs the Melbourne Sports Hub's four venues—the Melbourne Sports and Aquatic Centre (MSAC), the State Netball Hockey Centre, Lakeside Stadium and the MSAC Institute of Training.

As at 30 June 2014, SSCT's financial sustainability risks had not improved. SSCT reported a deficit of $9 million, compared with $6.7 million in 2012–13. This result included operating and capital funding of $8.1 million and depreciation expenses of $8.9 million. SSCT has also had an unfavourable liquidity indicator for the previous two financial reporting periods. As we have noted in previous years reports, SSCT does not have the ability to generate sufficient revenue to renew its asset base, which was $337.5 million at 30 June 2014—$323 million at 30 June 2013.

Figure 3E

Financial sustainability results 30 June 2014 – State Sport Centres Trust

Source: Victorian Auditor-General's Office.

3.4.5 Victorian Arts Centre Trust

The Victorian Arts Centre Trust (VACT) manages key performance venues in Melbourne, including Hamer Hall, the Arts Centre and the Sydney Myer Music Bowl.

VACT has had a high sustainability risk for each of the past five years due to unfavourable underlying operating result, capital replacement and self-financing indicators. By not being able to generate enough revenue to fund the depreciation costs of assets, the ability of VACT to renew these assets as required is put at risk.

For the year ended 30 June 2014, VACT reported an operating deficit of $13 million—$22.6 million in 2012–13—which included $16 million of depreciation expenses—$15.4 million in 2012–13. While the short-term financial sustainability of VACT has improved over 2013–14, the entity continues to face major financial challenges, as shown in Figure 3F.

Figure 3F

Financial sustainability results 30 June 2014 – Victorian Arts Centre Trust

Source: Victorian Auditor-General's Office.

3.4.6 Geelong Performing Arts Centre Trust

The Geelong Performing Arts Centre Trust (GPACT) manages the performing arts venue in Geelong, and, like the Victorian Arts Centre Trust, has received a high-risk rating due to unfavourable underlying operating result and self-financing indicators.

As with VACT, GPACT is not generating enough income to cover its depreciation expenses. For the year ended 30 June 2014, GPACT reported an operating deficit of $0.98 million, which included $1.03 million of depreciation expenses. Again, this means that GPACT may not be able to renew their assets as required, potentially impacting the services it is able to offer.

Figure 3G

Financial sustainability results 30 June 2014 – Geelong Performing Arts Centre Trust

Source: Victorian Auditor-General's Office.

3.4.7 Melton Entertainment Trust

The Melton Entertainment Trust (MET) operates the Harness Racing and Entertainment Complex (Tabcorp Park), situated in Melton which includes a harness racing track, hotel, bar, function centre, gaming and wagering facilities.

MET has had a high financial sustainability risk for each of the past five years due to unfavourable liquidity and self-financing ratios. MET has also reported operating losses in each of the past five years, generating an operating deficit of $0.84 million in 2013–14—$0.32 million in 2012–13. The depreciation expense for 2013–14 was $0.28 million—$0.22 million in 2012–13.

MET has had a liquidity issue in each of the past five years as well as a high sustainability risk for the self-financing indicator. This indicates that MET may have difficulty replacing assets using cash generated by operations.

MET's financial sustainability indicators for the year ending 30 June 2014 are shown in Figure 3H.

Figure 3H

Financial sustainability results 30 June 2014 – Melton Entertainment Trust

Source: Victorian Auditor-General's Office.

3.4.8 Port of Melbourne Corporation