Impact of Increased Scrutiny of High Value High Risk Projects

Overview

The government adopted the High Value High Risk (HVHR) process in late 2010 because of past cost overruns of over $2 billion attributed to inadequate management of project business cases and procurements. The process covers all public sector infrastructure and information and communications technology investments that are likely to draw on Budget funding and are over $100 million or assessed as high risk.

The goal of the HVHR process is to achieve more certainty in the delivery of intended benefits, in line with planned costs and time lines, through extra scrutiny by the Department of Treasury and Finance (DTF), together with additional Treasurer's approvals at key milestones covering the business case, procurement and monitoring after the procurement decision.

DTF's increased scrutiny through the HVHR process has made a difference to the quality of the business cases and procurements underpinning government's infrastructure investments. However, these improvements have not lifted practices so that they consistently and comprehensively meet DTF's better practice guidelines. This means government is still exposed to the risk that projects fail to deliver intended benefits on time and within approved budgets. A robust HVHR process is critical to effectively managing this risk.

DTF's scrutiny of HVHR projects was best in relation to project costs, time lines and agencies' approaches to risk management. The quality of scrutiny applied was more mixed for procurement, governance and project management and clearly inadequate when providing assurance about the expected project benefits. None of the business cases examined in the audit adequately justified the benefits of the respective projects.

The audit identified gaps and inconsistencies in DTF's approach to identifying projects to be subject to HVHR review, and the need for improved management of the process. In addition, DTF is yet to evaluate the impacts of the HVHR process on project outcomes.

The VicRoads RandL registration and licensing system project is the type of complex project that HVHR is meant to deal with and an example where significant negative deliverability risks have materialised. While the project commenced well before the HVHR process was introduced, it has been monitored through HVHR since late 2011. The government has now paused the project until February 2015. RandL is currently running at least 18 months late, has cost around $102 million and VicRoads has proposed additional expenditure of up to $135 million more than the approved budget of $158 million.

Impact of Increased Scrutiny of High Value High Risk Projects: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER June 2014

PP No 333, Session 2010–14

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on the audit Impact of Increased Scrutiny of High Value High Risk Projects.

The audit assessed the effectiveness of the High Value, High Risk (HVHR) process in improving project business cases and procurements so that they provide an adequate basis for delivering intended project benefits within approved time lines and cost.

I found that the Department of Treasury and Finance's (DTF) increased scrutiny of High Value High Risk projects has made a difference to the quality of the business cases and procurements underpinning government's infrastructure investments. However, these improvements have not lifted practices so that they consistently and comprehensively meet DTF's better practice guidelines.

This means government is still exposed to the risk that projects fail to deliver intended benefits on time and within approved budgets. This risk is most significant in DTF's assessment of the deliverability of projects' benefits where its scrutiny is clearly inadequate.

I have made eight recommendations aimed at improving the coverage, rigour of scrutiny, management and evaluation of the HVHR process.

Yours faithfully

John Doyle

Auditor-General

26 June 2014

Auditor-General's comments

John Doyle Auditor-General |

Audit team Ray Winn—Sector Director Tony Brown—Team Leader Michelle Tolliday—Manager Sid Nair—Analyst Paul O'Connor—Engagement Quality Control Reviewer |

Parliament and the community rightly expect that publicly-funded capital investments are planned and managed in a way that delivers predicted benefits on time and within allocated budgets.

It is critical that government is fully and reliably informed about projects' costs and benefits, and the risks affecting these before deciding what to do. The consequences of failing to do this, especially for high value projects, are significant—unexpected cost blow-outs affect the government's ability to deliver its wider policy agenda, unforeseen delays mean the community has to wait longer for promised benefits, and unreliable benefit estimates risk distorting government's decision-making.

VAGO's publication Reflections on audits 2006–2012: Lessons from the past, challenges for the future identified poor business case development, including gaps in the information underpinning decisions, and the inadequate consideration of available procurement options as recurring shortcomings.

The government introduced the High Value High Risk (HVHR) process to more rigorously review business cases and procurements to provide it with more certainty that claimed benefits could be delivered within the time lines and costs estimated by proponents.

I am pleased that government has recognised this gap and that the Department of Treasury and Finance (DTF) has improved business cases by applying greater scrutiny to agencies' estimates of costs and time lines, and their analyses of risks.

However, the HVHR process as currently applied falls short of consistently providing the level and quality of assurance government needs to be fully informed when deciding whether and how to invest.

While my report describes the gaps we found and how DTF should address these, two areas of particular concern are, firstly, the absence of any meaningful scrutiny of project benefits and, secondly, the inconsistent coverage of projects costing more than $100 million.

On the first point, DTF's scrutiny of project benefits is insufficient to assure government that these benefits are deliverable. The business cases we reviewed did not include all the information needed to understand and verify the benefits claimed. This is clearly not adequate.

Our previous audit findings highlight that much greater scrutiny of claimed benefits is required. For example VAGO's:

- 2010 audit, Management of Major Rail Projects, found that the quality assurance underpinning final business cases, including the documentation of project benefits, was inadequate.

- 2011 audit, Management of Major Road Projects, found that shortcomings in how agencies forecast traffic and estimated benefits risked themoverestimating benefits and giving decision-makers false confidence about the capacity of projects to cope with future traffic.

The continuing lack of adequate scrutiny of project benefits needs to be addressed. It raises the risk of government investing substantial sums in projects without understanding whether the projected benefits are well founded or achievable.

On the second point, we identified projects worth billions of dollars that are not following the standard HVHR process of having a DTF-reviewed and Treasurer‑approved business case before being considered for funding. These include major road and rail projects, funded as part of the government's 2014 election commitments, and projects funded as unsolicited bids.

I have asked DTF to keep me informed about how it will achieve the level of scrutiny and assurance needed to properly inform government decisions about these projects.

I note DTF's positive response to the audit recommendations. Given the importance of this area, I plan to conduct one performance audit each year on the HVHR process to track DTF's progress and identify emerging issues.

I would like to thank DTF, the Department of Transport, Planning and Local Infrastructure, the Department of Health, VicRoads and Public Transport Victoria for their assistance and cooperation during this audit.

John Doyle

Auditor-General

June 2014

Audit Summary

Background

In Victoria, the total value of public sector capital investments underway or commencing in 2014–15 is around $72 billion, including projects delivered as public private partnerships. This includes a commitment made in the 2014–15 Budget of up to $27 billion to build new road and rail infrastructure such as the $8 billion to $10 billion stage 2 of the East West Link and the $8.5 billion to $11 billion Melbourne Rail Link.

Previous VAGO and Ombudsman reviews have found that significant flaws with project business cases and procurement processes have led to cost and time overruns and diminished benefits.

The government adopted the High Value High Risk (HVHR) process in late 2010 because of past cost overruns of over $2 billion that it attributed to the inadequate management of project business cases and procurements. The goal of the HVHR process is to achieve more certainty in the delivery of intended benefits in line with planned costs and time lines.

The HVHR process applies to all public sector infrastructure and information and communications technology investments that are likely to draw on Budget funding that:

- have a total estimated investment greater than $100 million, or

- are identified as high risk using an approved risk assessment tool, or

- aredetermined by government as warranting the rigour of increased oversight.

HVHR investments are subject to extra scrutiny by the Department of Treasury and Finance (DTF), together with additional Treasurer's approvals at key milestones covering the business case and procurement, and monitoring after the procurement decision. HVHR reviews started in 2011 to cover projects in the 2012–13 Budget cycle.

This audit examined the effectiveness of the HVHR process in improving project business cases and procurements so that they provide an adequate basis for delivering intended project benefits within approved time lines and costs. We assessed whether the process has:

- been applied as intended to assess business cases, procurement approaches and contractual and governance arrangements for all relevant HVHR projects

- resulted in improved business cases that provide a comprehensive and rigorous basis for government project decisions

- resultedin improved procurements and, ultimately, better outcomes.

We examined the application of the process for five projects valued at $936 million:

- the registration and licensing system (RandL)

- Mitcham Road and Rooks Road rail grade separations

- Royal Victorian Eye and Ear Hospital redevelopment

- Western Highway duplication from Beaufort to Buangor

- regionalrolling stock purchase.

Towards the end of the audit we examined a further three projects to assess the impact of DTF updating its business case assessment template in late 2012.

Conclusion

Based on our review of these projects, DTF's increased scrutiny applied through the HVHR process has made a difference to the quality of the business cases and procurements underpinning government's infrastructure investments. However, DTF has not yet started formally evaluating the impacts of the application of the HVHR process on project outcomes.

These improvements have not lifted practices so that they consistently and comprehensively meet DTF's better practice guidelines. This means government is still exposed to the risk that projects fail to deliver intended benefits on time and within approved budgets. A robust HVHR process is critical to effectively managing this risk.

DTF's scrutiny and assurance of HVHR projects was not applied comprehensively or consistently across all the 'deliverability' criteria. Its performance was best when assuring project costs, time lines and agencies' approaches to risk management. It was more mixed for procurement, governance and project management, and clearly inadequate when assuring the expected project benefits. Of particular concern was the lack of substantive HVHR review of project benefits, given that none of the business cases adequately justified these.

This audit identified gaps and inconsistencies in DTF's approach to identifying projects that should be subject to HVHR review, specifically in relation to small value projects that may have high risks and projects that were delivered outside of the general government sector.

It also identified the need for more comprehensive assessment guidance for HVHR analysts, the application of a standardised file structure and comprehensive central register for managing reviews and the need for better identification and management of potential conflicts of interest.

The RandL project is one of the projects this audit examined in detail. It is the type of complex project that HVHR is meant to deal with and an example of a project where significant, negative deliverability risks have materialised. While the RandL project commenced well before the HVHR process started, the updated 2011 business case was subject to an HVHR type review and the project has been monitored under HVHR since late 2011.

However, neither the management nor oversight applied to the RandL project, including HVHR monitoring, was effective in detecting or controlling risks before they materialised to significantly delay the project and increase the estimated cost of delivery. A key reason for this was the lack of skills and depth of experience needed to manage and oversee a complex project of this type.

The government has now decided to pause the project until February 2015. It is currently running at least 18 months late, has cost around $102 million and VicRoads has proposed additional expenditure of up to $135 million more than the approved budget of $158 million.

Findings

Management of the HVHR process

There is clear scope for DTF to improve how the HVHR process is managed, to make it more efficient, transparent and accountable. DTF's May 2012 internal audit and VAGO's 2013 audit of the Gateway Review Process recommended changes that DTF has not yet fully addressed.

DTF's HVHR process captures projects valued above $100 million that rely on funding from the State Budget. However, the audit identified management weaknesses that DTF needs to address, including:

- acting on VAGO's previous findings about gaps in its approach to assessing whether projects valued between $5 to $100 million should be in the HVHR process

- providing criteria for assessing whether non-Budget-funded projects typically funded by public corporations should be captured by the HVHR process

- extending the detailed guidance and templates provided to DTF analysts for business case assessments to cover the entire HVHR process

- better administering the process by applying a standard documentation and record-keeping approach to all reviews, and maintaining a master register which comprehensively documents review activities

- improving the collation and communication of lessons learned and better practices observed across all HVHR reviews

- applyingan evaluation framework to reliably measure the outcomes of the HVHR process and understand further areas for improvement.

Improving the quality of reviews

HVHR business case reviews raised substantive issues and agencies frequently modified submissions to address these issues. However, this did not consistently occur across all projects nor for all the criteria that DTF uses to test a project's deliverability.

For four of the five business cases we looked at in detail we saw evidence of:

- substantive reviews following an HVHR review template

- DTF identifying and constructively communicating issues to departments

- responses to DTF's comments providing greater assurance about the rigour of the project and in some cases resulting in changes to business cases to reflect this information

- adviceto the Treasurer which accurately reflected review findings and conclusions.

However, there is considerable room for DTF to improve its administration and oversight of the HVHR process. Some improvements do not require much change—for example, making sure that business cases are updated where additional significant information is provided. However, other improvements, such as adequately testing the reliability of project benefits, require a step change in approach and acquisition of the skills needed to do this.

Recommendations

That the Department of Treasury and Finance:

- improves its approach to selecting projects for inclusion in the High Value High Risk process by:

- systematically reviewing projects between $5 million and $100 million to determine whether they should be subject to the High Value High Risk process through documented reviews of project risk assessments

- clarifying the criteria for selecting public projects that do not require Budget funding for inclusion in the High Value High Risk process

- recommending that projects over $100 million selected under the government's unsolicited bids policy be subject to High Value High Risk processes

- develops assessment guidance and templates covering all High Value High Risk stages to improve the consistency, rigour and transparency of High Value High Risk reviews

- improves its administration of the High Value High Risk process by:

applying a standardised file structure for managing assessment documents and supporting evidence

developing and maintaining a comprehensive central register of High Value High Risk review activity by project and High Value High Risk process stage

- identifies potential conflicts of interests of reviewers and documents how these are mitigated

- develops and applies an evaluation tool to measure the extent to which the High Value High Risk process is affecting project outcome

- provides greater assurance that High Value High Risk reviews comprehensively test compliance with its Investment Lifecycle and High Value High Risk Guidelines in areas critical for project deliverability

- checks that for complex, risky projects—particularly those involving information and communications technology transformations—the specialist skills needed to successfully manage, oversee and quality assure these projects have been assessed and acquired.

- improves how it communicates with and informs departments by:

- developing a structured approach to collating and sharing the lessons from all High Value High Risk reviews

- completing an annual satisfaction survey of agencies that have been subject to High Value High Risk reviews

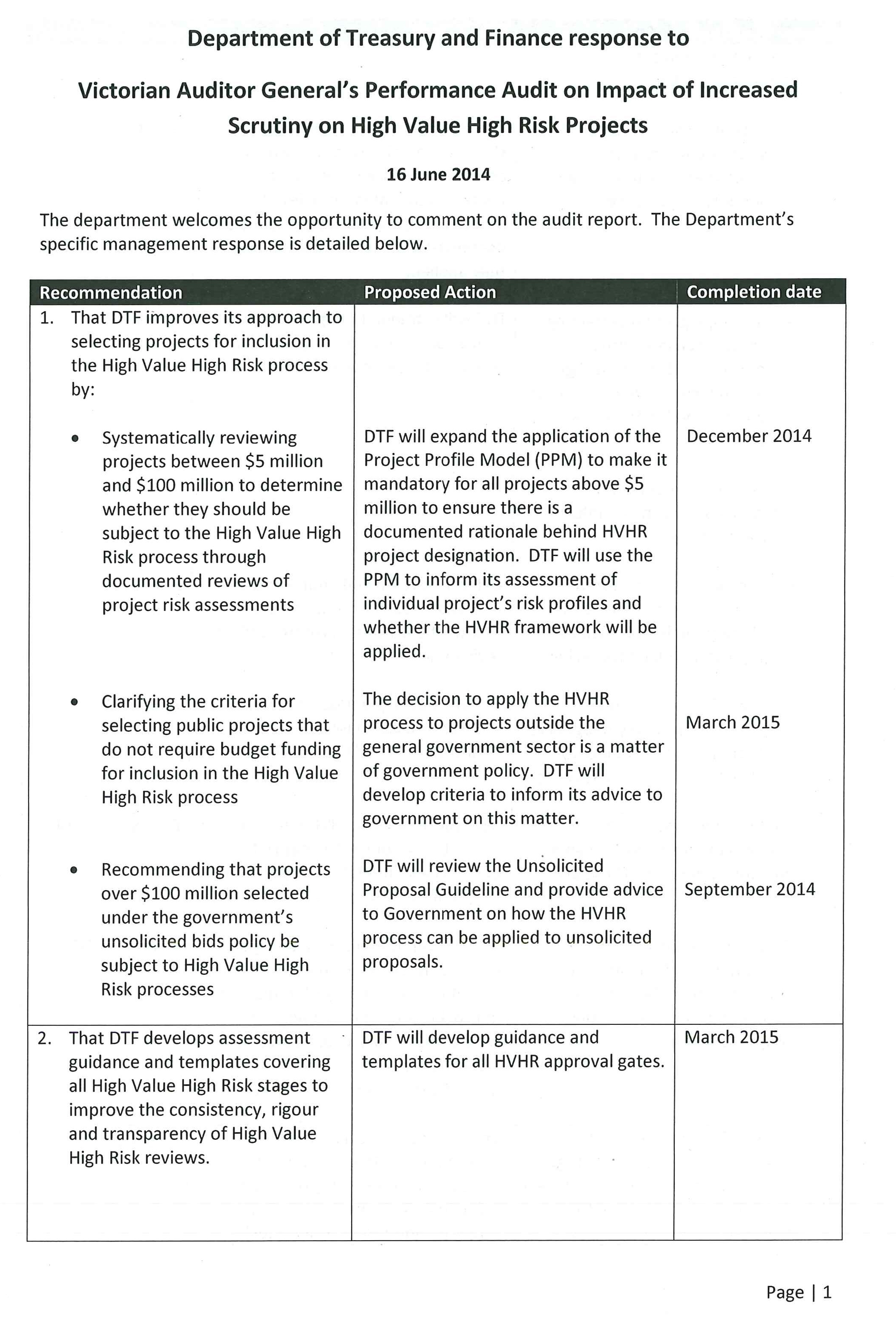

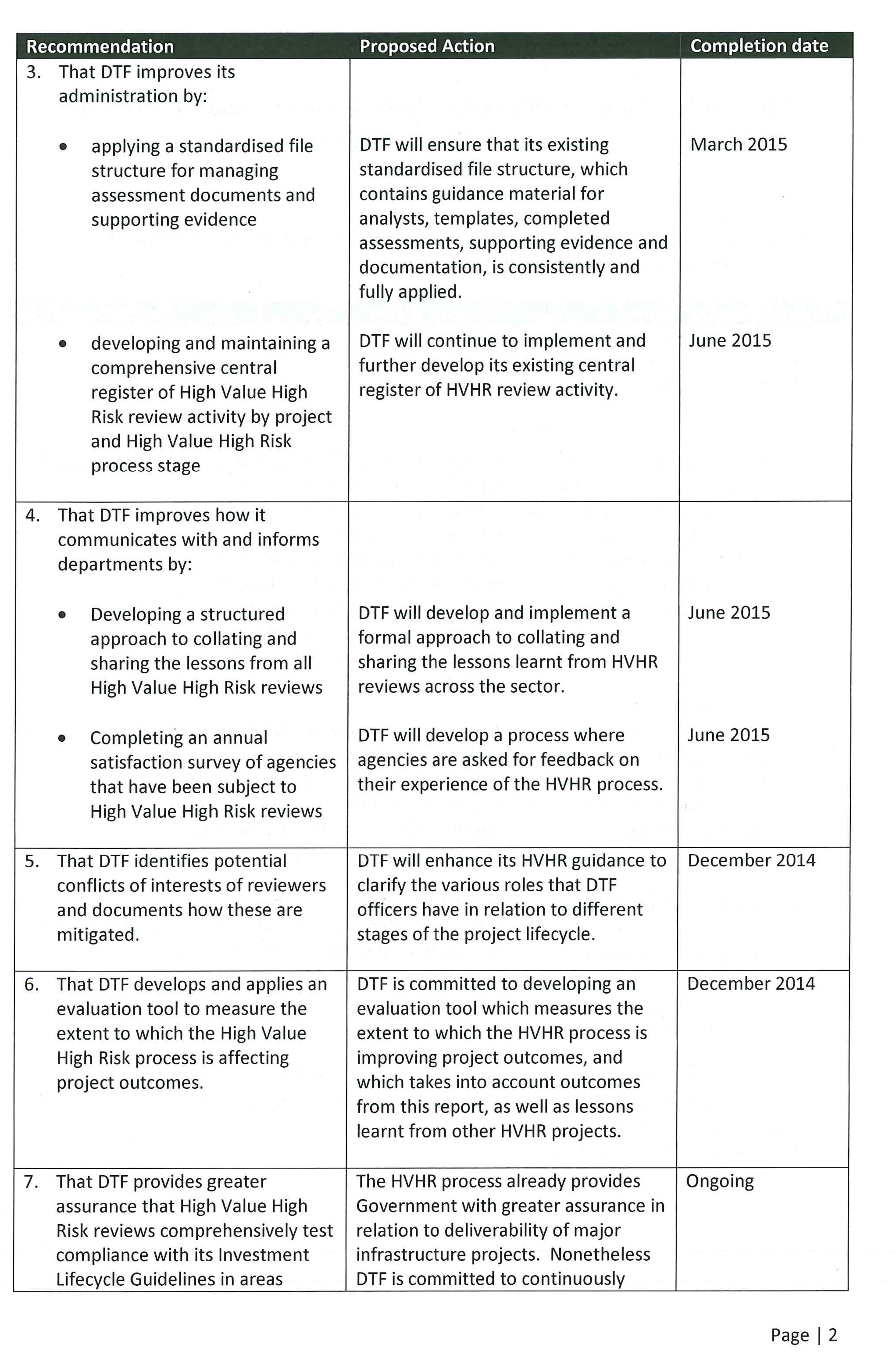

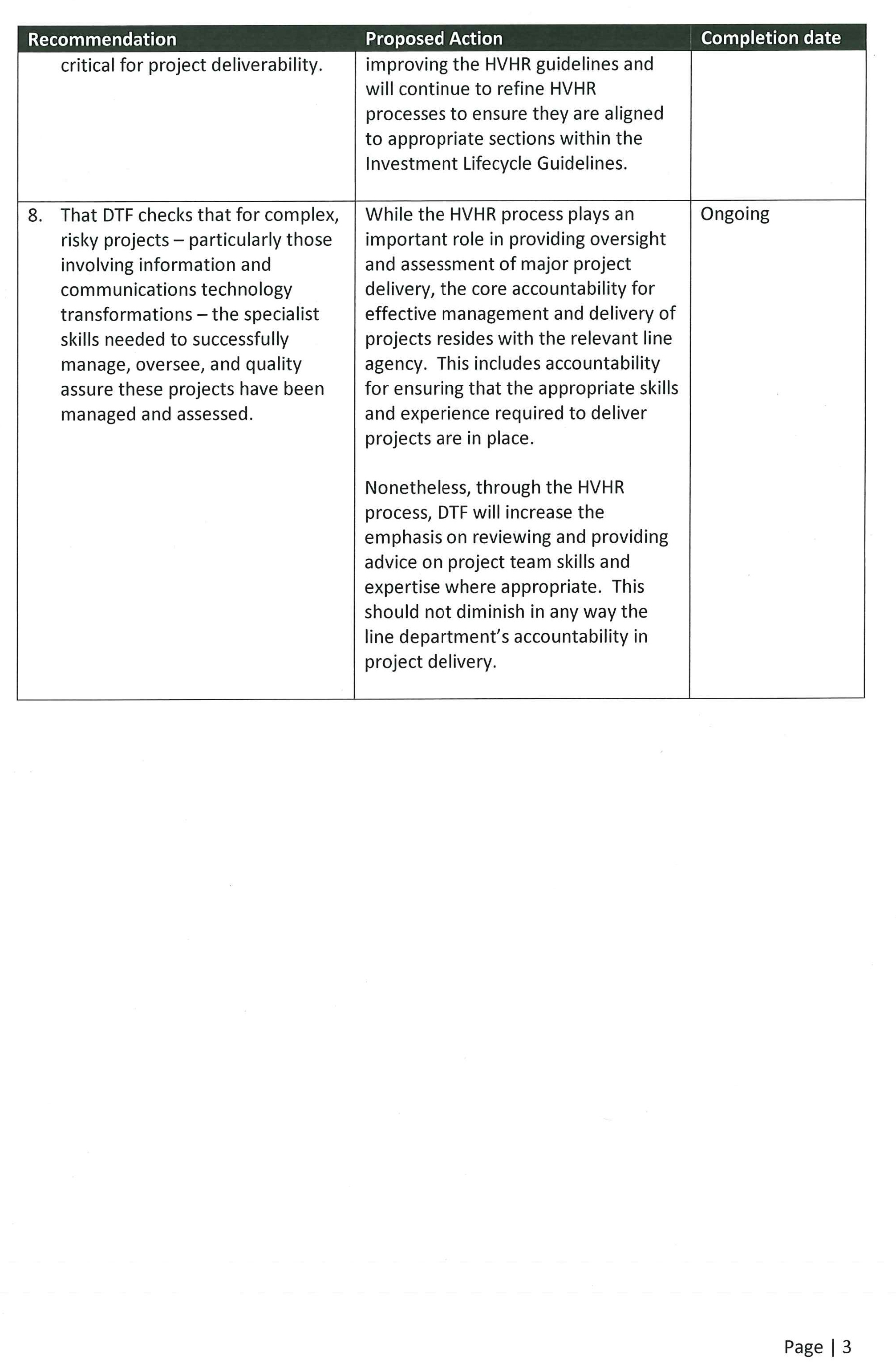

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994 a copy of this report was provided with a request for submissions or comments to:

- Department of Treasury and Finance

- Department of Transport, Planning and Local Infrastructure

- Department of Health

- VicRoads

- Public Transport Victoria.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments are included in Appendix A.

1 Background

1.1 Introduction

1.1.1 Infrastructure planning and delivery

Effective planning and delivery of major infrastructure projects is critical for governments to achieve their policy objectives. In Victoria, the total value of public sector capital investments underway or commencing in 2014–15 is around $72 billion.

The 2014–15 Budget commits up to $27 billion in new infrastructure including:

- $8.5 billion to $11 billion for the Melbourne Rail Link, which includes a tunnel linking Southern Cross and South Yarra stations and a new airport rail link

- $8 billion to $10 billion to complete the East West Link by extending the eastern section from the Tullamarine Freeway to the Western Ring Road

- $2 billion to $2.5 billion to upgrade the Cranbourne–Pakenham Rail Corridor

- $850 million to widen the Tullamarine Freeway approaches to the airport.

This substantial investment requires effective oversight. However, reviews by VAGO and the Ombudsman found that significant flaws with project business cases and procurements have led to cost and time overruns as well as diminished or unclear benefits. These findings highlight the critical importance of the more stringent review processes examined here.

1.1.2 Goal of the HVHR process

In late 2010 the government introduced the High Value High Risk (HVHR) process to address issues related to inadequate project management that resulted in cost overruns of $2 billion. The goal of the HVHR process is to achieve more certainty in the delivery of intended benefits to planned costs and time lines through more rigorous review of business cases and procurements.

By 2008 the Department of Treasury and Finance (DTF) had developed Investment Lifecycle Guidelines that were mandated for investments over $5 million. Since 2010, these guidelines have been updated so that they support the development of business cases, which are mandatory for capital investments with a total estimated investment of $10 million or more. DTF stated to the Public Accounts and Estimates Committee Inquiry into Effective Decision Making for the Successful Delivery of Significant Infrastructure Projects that the 'HVHR processÖ is directed at ensuring the guidance and processes are thoroughly and consistently applied'.

In introducing the HVHR process, DTF advised government that the priority was to:

- enforce the requirement for a robust business case with clear project objectives, well-defined benefits, a rigorous appraisal of options, selection of appropriate procurement methods and appropriate governance and management

- clearly articulate a tender proposal, appointment approach and contract management framework that appropriately allocates and manages risk, delivers benefits and effectively manages scope and cost.

1.2 Victoria's approach to managing investments

1.2.1 Guidance

DTF's investment lifecycle framework guides agencies to derive maximum benefit from investments by helping them to:

- conceptualise an investment by establishing the need and defining the benefits

- prove a solution by assessing the costs, benefits and risks of likely options

- procure the investment by awarding a contract that best delivers the solution and provides value for money

- implement the solution to realise benefits and manage costs and risks

- realise the benefits and measure the success of the investment.

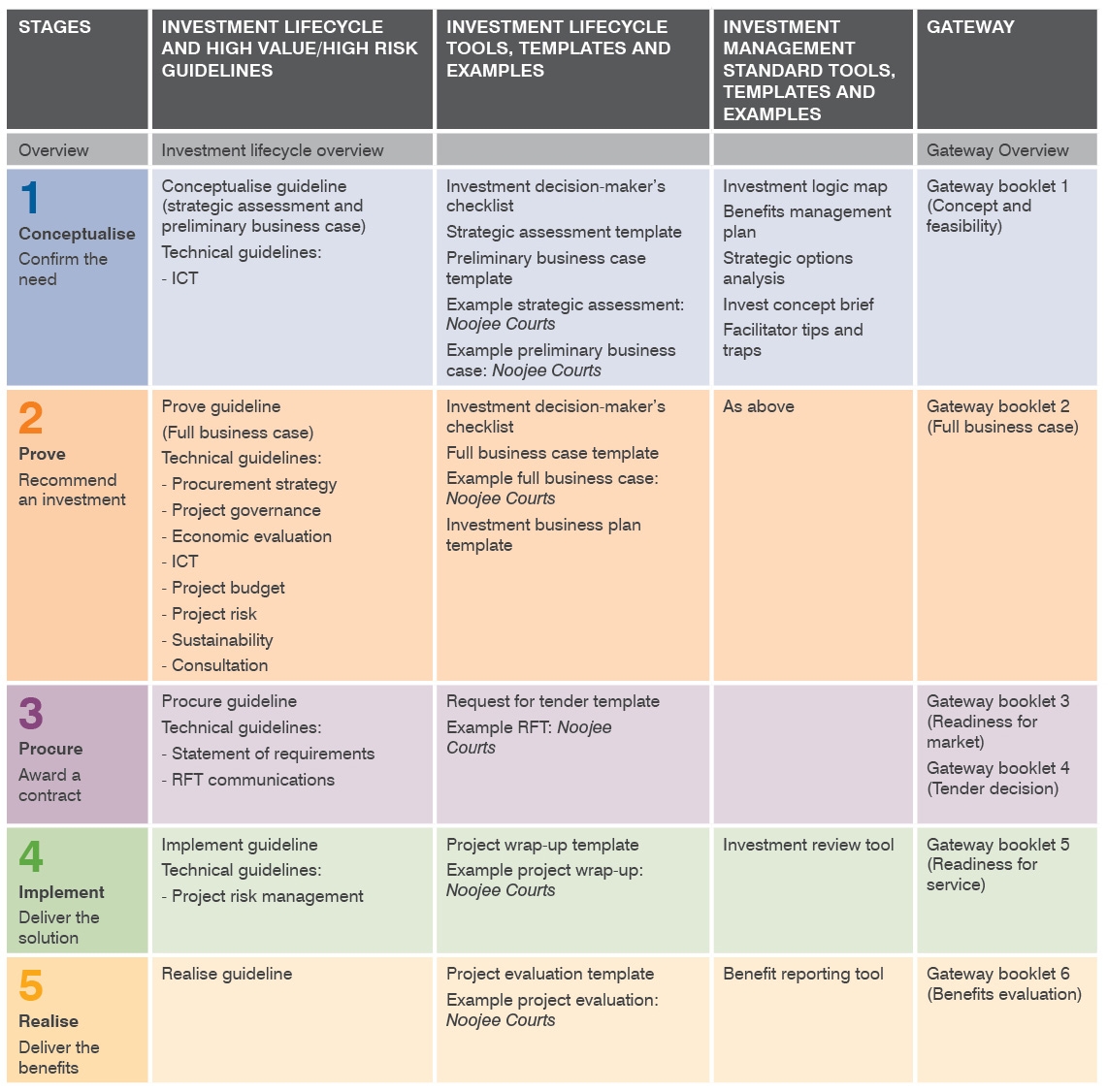

Figure 1A shows the guidelines, tools and templates DTF makes available so that agencies can effectively navigate this pathway. It also shows the role of the Gateway Review Process—or 'Gateway'.

Figure 1A

Investment lifecycle and HVHR guidelines, tools and templates

Source: Department of Treasury and Finance, Investment Lifecycle and High Value/High Risk Guidelines—Overview (2014).

1.2.2 Review and oversight of government investments

The mechanisms for reviewing the rigour and progress of investments from concept through to benefit realisation and informing government funding decisions are:

- departmental, quality-assured documentation—justifying the investment and its procurement and implementation approaches

- DTF review and advice to government—the value and complexity of each investment determining the depth and type of review applied

- the Gateway Review Process—examining investments at key decision points and providing advice to the project's senior responsible person.

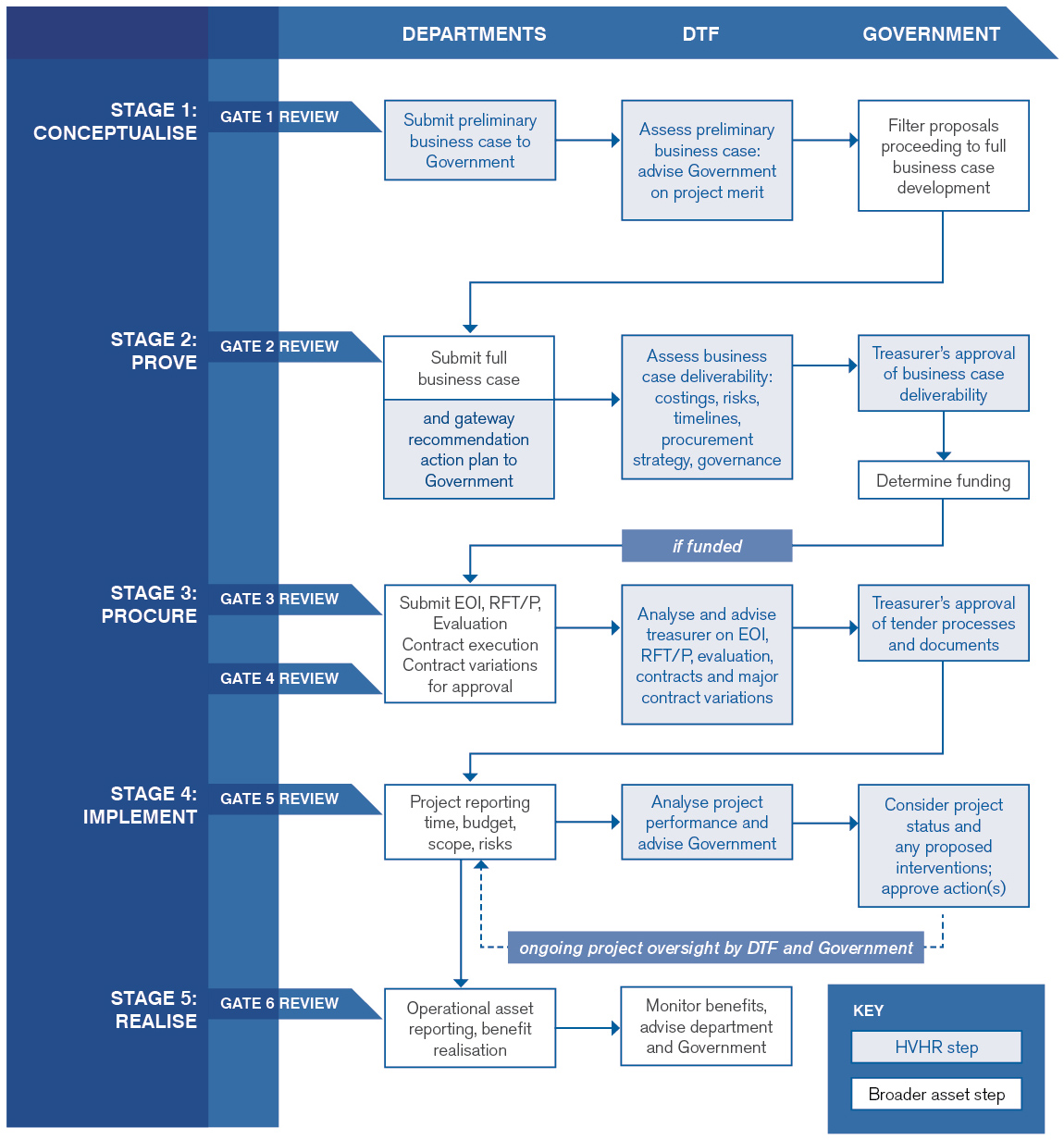

Figure 1B shows what the review process looks like for a complex, risky or high value project where all these review layers are applied. The HVHR process involves strengthening DTF's review of investments up to and including implementation and the following Section defines the scope and content of HVHR reviews.

Figure 1B

Investment review process

Source: Department of Treasury and Finance, Investment Lifecycle

1.3 Scope and content of the HVHR process

1.3.1 Investments captured by HVHR

The HVHR process applies to all general government sector infrastructure and information and communications technology investments that are likely to draw on Budget funding and:

- have a total estimated investment greater than $100 million, or

- are identified as high risk using an approved risk assessment tool, or

- are determined by government as warranting the rigour of increased oversight.

The general government sector includes approximately 200 agencies that directly provide public services such as departments, public hospitals and further education institutes.

While the process is primarily applied to Budget-funded investments, it can—at the government's discretion—be applied to investments by state-controlled corporations that sit outside the general government sector. These are the seven public financial corporations, e.g. the Treasury Corporation of Victoria, and around 80 public non‑financial corporations, e.g. the Port of Melbourne, water corporations and Alpine Resorts.

These reviews are discretionary because investments in these entities are usually not funded from the State Budget but made on a commercial basis from their own resources.

DTF's public statements around this issue are not uniformly consistent and clear, with reference to the inclusion of all investments over $100 million 'regardless of the funding source' on its website. The audit examines this clarity issue in Part 2 of this report.

1.3.2 Structure and content of the HVHR reviews

The HVHR process builds on DTF's existing Investment Lifecycle Guidelines and Gateway reviews. HVHR investments are subject to extra scrutiny by DTF and additional Treasurer's approvals at the following stages—for the business case deliverability assessment, at critical milestones during procurement and for significant variations after contract sign off.

Within the HVHR process, DTF also monitors critical recommendations arising from Gateway reviews on 'Concept and Feasibility' (Gate 1) to 'Tender Decision' (Gate 4).

Preliminary business case

DTF advises government on strategic merit and need and whether the proposal should be developed into a full business case.

This review is clearly part of the HVHR assessment because DTF's guidance documentation indicates that only HVHR projects must submit a preliminary business case. Non-HVHR projects instead submit a less extensive strategic assessment.

The key decision is whether a project should proceed to a full business case based on a preliminary assessment of strategic merit, an early options assessment and the project's likely costs, benefits and risks—including a high level cost-benefit analysis.

Full business case

DTF provides advice to inform the Treasurer's decision on whether the case is sufficiently robust to be submitted to government for funding by advising whether it is confident that the project's intended benefits can be delivered on time and within budget. The government's assessment—also informed by DTF and the Department of Premier and Cabinet—goes beyond deliverability to also review the policy merit, affordability, scale and alignment of the proposal.

DTF has a template for its analysts on the scope, approach and documentation of HVHR full business case reviews. This template was initially developed in 2011 and updated in late 2012.

DTF's assessment focuses on providing government with assurance that projects are 'deliverable'. Figure 1C outlines this definition. At this stage, DTF needs to establish whether a well thought through plan has been developed to deliver the project as outlined in the business case.

Figure 1C

Project deliverability definition

An assessment of project deliverability is DTF's judgement on whether the business cases can achieve the:

|

After it does this assessment, DTF can recommend to the Treasurer that the project:

- proceed for funding consideration—i.e. DTF assesses the project as deliverable

- proceed for funding consideration subject to further refinement of identified issues—i.e. DTF assesses the project as deliverable if the final business case submitted for funding is updated to address specific issues

- not proceed—i.e. DTF assesses the project as unlikely to be deliverable.

Figure 1D shows how DTF addresses deliverability by assessing the project as conveyed in the business case across seven key areas. Analysts should cover these areas when assessing business cases for HVHR projects, supporting responses with a clear rationale and sufficient evidence to justify their assessments.

The final DTF recommendation about whether to proceed is based on a balanced assessment, taking account of the responses in each of these areas.

Figure 1D

Business case assessment areas

|

Deliver on budget—assess the comprehensiveness, logic and level of detail of the project costs, the incorporation of risks if alternative funding forms part of the business case and, where there are multiple options, whether these have been soundly costed. Deliver to time lines—assess whether project time lines and milestones are sound and supported by sufficient evidence and adequate plans to deliver as intended. Determine whether the time lines are consistent with those used for similar projects. Deliver benefits—assess whether the business case adequately demonstrates that the project can deliver the intended benefits, and compare the predicted benefits with those achieved by similar projects. Comprehensively manage risks—assess the comprehensiveness of the risk management plan included in the business case and determine whether there are any gaps and whether there is a clear strategy to mitigate material risks. Apply appropriate governance—assess whether the governance structure includes:

Adequately justify the preferred procurement approach—assess whether all suitable procurement options have been considered and whether the business case demonstrates that the proposed procurement strategy is the most effective and value-for-money way to deliver the project. Substantiate the project management approach—assess whether the business case clearly substantiates that:

|

Procurement

DTF provides advice to inform the Treasurer's approval of:

- procurement documentation prior to its release

- the decision on the preferred bid prior to its announcement

- the final contract, prior to signing.

Reviews of tender documentation, the preferred bid decision and the final contract prior to sign-off are meant to ensure that:

- the preferred procurement approach is effectively implemented and translated into a contractual framework that delivers on the best value-for-money approach

- the risks of diminishing this outcome through unintended scope creep or a contractual form that diminishes the outcomes for the state are managed.

Post contract

The HVHR process involves DTF monitoring project progress—including emerging issues and risks and any changes to the project scope and cost that was agreed to in the signed‑off contractual arrangements—and advising the Treasurer about significant changes. The Treasurer approves significant contract variations based on advice from DTF.

Within the HVHR process DTF also monitors projects post contract signing and during delivery through its quarterly reporting process to government and representation on project steering committees or equivalent.

1.4 Reviews relevant to this audit

1.4.1 VAGO audit—Gateway Review Process

VAGO's 2013 audit, Planning, Delivery and Benefits Realisation of Major Asset Investment: The Gateway Review Process, concluded that DTF had not systematically reviewed and verified the agency self-assessments of project risk that determine whether projects are subject to the Gateway reviews.

DTF also uses these assessments to identify risky or complex projects under $100 million that should be covered by the HVHR process.

Part of VAGO's recommendation on this issue required DTF to verify that all new projects had completed robust project risk assessments.

1.4.2 Department of Treasury and Finance internal audit reviews of HVHR

DTF commissioned two internal audit reviews of the HVHR process that reported in May 2012 and May 2014.

Figures 1E and 1F summarise the findings from these internal audits, and Part 2 of this report examines whether DTF has acted on these findings.

Figure 1E

Recommendations from HVHR May 2012 internal audit

|

# |

Recommendation |

Rating / action |

Internal audit commentary |

|---|---|---|---|

|

1. |

Project business case assessment requirements should be structured and formalised. |

Moderate 30 Sep 2012. |

|

|

2. |

Bring forward time frames for submission of preliminary/full business cases. |

Moderate 30 Sep 2012. |

|

|

3. |

A standard file structure should be implemented to assist HVHR process. |

Low 30 Sep 2012. |

|

|

4. |

HVHR stakeholder engagement/communications activities should be enhanced. |

Low 30 Sep 2012. |

|

|

5. |

The relationship between HVHR and Gateway may require further clarity. |

Improvement opportunity No date set. |

|

The May 2014 audit was conducted as a separate exercise to the May 2012 audit and did not follow up on the earlier audit's recommendations. It is unclear why the later audit did not examine these earlier recommendations.

Figure 1F shows the recommendations, ratings and commentary of the later report.

Figure 1F

Recommendations from May 2014 HVHR internal audit

|

# |

Recommendation |

Rating/action |

Internal audit commentary |

|---|---|---|---|

|

1. |

Outcomes from the lessons learnt database should be incorporated into the HVHR business case review process. |

Low 30 November 2014. |

|

|

2. |

Impacts to project benefits realised should be tracked throughout the project lifecycle. |

Improvement opportunity 30 November 2014. |

|

1.5 Audit objectives, scope and criteria

This audit examined the effectiveness of the HVHR process in improving project business cases and procurements so that they provide an adequate basis for delivering intended project benefits within approved time lines and costs.

It did this by assessing whether the HVHR process has:

- been applied as intended to assess business cases, procurement approaches and contractual and governance arrangements for all relevant HVHR projects

- resulted in improved business cases that provide a comprehensive and rigorous basis for government project decisions

- resulted in improved procurements and ultimately improved delivery and outcomes.

1.5.1 Applying the HVHR process as intended

Part 2 assesses whether DTF's management and application of the HVHR process has been:

- comprehensive—in terms of identifying HVHR projects and completing required reviews

- consistently high quality—in terms of employing capable reviewers and applying a consistent, quality-assured approach to deliver high quality reviews

- underpinned by adequate monitoring and reporting—firstly to government and also to agency stakeholders

- evaluated in terms of its emerging impacts—by developing and applying a framework to measure improved timeliness, cost and benefit realisation.

1.5.2 Impacts on business cases and procurements

Part 3 examines HVHR reviews to determine their impacts on the quality of business cases and procurements and how this is likely to affect project outcomes.

For a sample of business cases we assessed whether HVHR assessments of the deliverability of intended benefits according to planned costs and time lines were robust. We did this by examining whether they provided adequate assurance that projects would:

- deliver on budget

- deliver to planned time lines

- deliver the intended benefits

- comprehensively manage risks

- apply appropriate governance

- apply a procurement strategy that represented value for money

- apply an appropriate and effective project management approach.

We also examined whether the procurement reviews were undertaken as required and contributed to assurance that the procurement approach approved as part of the business case was effectively implemented.

1.6 Audit method and cost

The audit team gathered evidence by examining the application of the HVHR process for five projects, namely:

- Registration and licensing system—this project involves replacement of VicRoads registration and licensing IT systems and changes to supporting processes. The initial estimated cost was $173 million, with completion targeted for April 2013.

- Mitcham Road and Rooks Road rail grade separations—this project is part of the Metro Level Crossing Blitz program and involves separating the rail from the road by lowering the rail tracks beneath Mitcham Road and Rooks Road, in Mitcham. The total estimated cost is $197 million and a target completion date of mid-2014.

- Royal Victorian Eye and Ear Hospital redevelopment—this project involves redeveloping the hospital at a cost of $165 million with a target completion date of December 2017.

- Western Highway duplication from Beaufort to Buangor—this project is part of the $505 million Western Highway duplication project from Ballarat to Stawell, funded by the Commonwealth and state governments on an 80/20 basis. The project budget for the duplication from Beaufort to Buangor is around $140 million. It was contracted in April 2014 and construction is expected to commence in mid-2014.

- Regional rolling stock—this investment involved the procurement of additional rolling stock for the regional rail network with total approved funding of $261 million and an expected final delivery date of August 2016.

These projects were selected to give coverage of projects of different type, scale and complexity and from more than one sector that had been subject to substantial HVHR review and had also moved into implementation.

Towards the end of audit conduct we added three projects to our sample to test whether the introduction of an updated business case assessment template in late 2012 had improved the quality of reviews.

The additional three projects were:

- Blackburn Road grade separation

- Kilmore Wallan bypass

- Southland station.

Audit evidence was gathered from DTF and the following departments and agencies responsible for planning and delivering the sample projects:

- Department of Health

- Department of Transport, Planning and Local Infrastructure

- Public Transport Victoria

- VicRoads.

The audit was conducted in accordance with section 15 of the Audit Act 1994 and the Australian Auditing and Assurance Standards.

Pursuant to section 20(3) of the Audit Act 1994, any persons named in this report are not the subject of adverse comment or opinion.

The total cost of the audit was $370 000.

1.7 Structure of the report

The report is structured as follows:

- Part 2 examines the management of the HVHR process

- Part 3 examines the impact of the HVHR process.

2 Management of the High Value High Risk process

At a glance

Background

Effectively managing the High Value High Risk (HVHR) process involves establishing a review capacity, applying clear policies and procedures to guide and record reviews, applying rigorous quality assurance, clearly communicating with stakeholders and monitoring and reporting on the process and its outcomes.

Conclusion

There is considerable scope for the Department of Treasury and Finance (DTF) to improve how the HVHR process is managed, making it more efficient, transparent and accountable. DTF has not yet adequately addressed the changes recommended by its May 2012 internal audit and VAGO's Gateway Review Process audit.

Findings

- DTF identifies HVHR Budget-funded projects over $100 million but does not systematically identify lower value high risk projects, or projects funded by public corporations outside the Budget sector.

- HVHR reviews are documented and justified inconsistently because guidelines and templates are not comprehensive. Not applying a standardised file structure and comprehensive central register of HVHR activities diminishes efficiency.

- Lessons from HVHR reviews are not effectively collated and communicated to agencies subject to the HVHR process.

- DTF has not made enough progress in evaluating HVHR process outcomes.

Recommendations

That the Department of Treasury and Finance:

- improves its approach to selecting projects for inclusion under HVHR

- develops assessment guidance and templates covering all HVHR stages

- improves the administration of the HVHR and how it communicates with and informs departments about HVHR

- identifies potential conflicts of interests and documents how these are mitigated

- develops and applies an evaluation tool to measure HVHR outcomes.

2.1 Introduction

Effectively managing the High Value High Risk (HVHR) process involves establishing a review capacity, applying clear policies and procedures to guide and record reviews, applying rigorous quality assurance, clearly communicating with stakeholders and monitoring and reporting on the process and its outcomes.

We assessed whether the Department of Treasury and Finance's (DTF) overall management and application of the HVHR process had been:

- comprehensive—capturing all high value and risky projects within the HVHR process and completing all prescribed reviews (Section 2.3)

- consistently high quality—employing capable reviewers, applying a consistent, quality-assured approach to deliver high quality reviews (Section 2.4)

- underpinned by adequate monitoring and reporting—firstly to government and also to departments so they could understand the process and respond to the lessons learned across all reviews (Section 2.5)

- evaluated in terms of emerging impacts—by applying a framework to measure improved timeliness, budgeting and benefit realisation (Section 2.6).

We have also drawn on VAGO's May 2013 audit Planning, Delivery and Benefits Realisation of Major Asset Investment: The Gateway Review Process and on DTF's internal audit findings and recommendations reported in May 2012 and May 2014.

2.2 Conclusion

There is considerable scope for DTF to improve how the HVHR process is managed to make it more efficient, transparent and accountable. Its May 2012 internal audit and VAGO's audit of the Gateway Review Process (Gateway) recommended changes that DTF has not yet fully addressed.

DTF effectively captures within the HVHR process projects valued over $100 million which rely on funding from the State Budget. However, the audit identified management weaknesses that DTF needs to respond to, including:

- addressing VAGO's previous findings about gaps in DTF's approach to assessing whether projects valued between $5million and $100 million should be in the HVHR process

- providing criteria for assessing whether non-Budget funded projects typically funded by public corporations should be captured by the HVHR process

- extending detailed guidance and templates provided to DTF analysts for business case assessments to cover the entire HVHR process

- better administering the process by applying a standard documentation and record-keeping approach to all reviews and maintaining a master register which comprehensively documents review activities

- improving the collation and communication of lessons learned and better practices observed across all HVHR reviews

- applying an evaluation framework to reliably measure the outcomes of the HVHR process and understand further areas for improvement.

2.3 Comprehensively applying the HVHR process

The HVHR process aims to capture Budget-funded infrastructure and information and communications technology (ICT) investments that are valued at more than $100 million or are assessed as high risk or that the government identifies as requiring more intensive review and oversight.

The five projects we reviewed in detail had been subject to the required HVHR reviews and approvals, with one exception—the regional trains rolling stock project.

For this project the most significant exception was the lack of evidence that the Treasurer approved the request for proposal document. However, DTF adequately justified this on the basis that the Treasurer had approved the procurement strategy for a single supplier to bid. There is no evidence that the absence of approval for the request for proposal document compromised the integrity of the procurement process.

In terms of coverage, DTF has included Budget-funded projects over $100 million within the HVHR process since it was first used in the 2012–13 Budget cycle. However, it is not clear that the HVHR process has been applied to all intended projects, specifically for projects:

- valued between $5million and $100 million that are high risk, because DTF cannot show that it has reviewed risk profile reports when deciding on their HVHR status

- over $100 million that are funded outside of the Budget by public corporations, because there is no systematic assessment process and inclusion is activated only through a specific request by government.

The government announced funding commitments of up to $27 billion as part of the 2014-15 Budget for infrastructure projects, with most ($24 billion) designated as HVHR projects that have not progressed through the HVHR process. These included projects funded under government's unsolicited bids policy and multi-billion dollar projects for a rail tunnel linking Southern Cross and South Yarra stations and stage 2 of the East West Link.

It is currently unclear how the HVHR process will be applied to unsolicited bids and to major projects that have been fast tracked to a funding commitment without any HVHR reviews.

The absence of a comprehensive central, up-to-date register to provide a consolidated record of risk assessments and subsequent reviews for HVHR projects makes it difficult for DTF to demonstrate that the HVHR process is comprehensively applied.

This is an essential management tool and DTF should develop and maintain a comprehensive register.

2.3.1 Identifying HVHR projects

This Section provides the evidence on our overall findings.

Total estimated investment greater than $100 million

DTF has effective processes in place to capture within the HVHR process projects worth more than $100 million that are funded through the State Budget. Most of these projects are for assets in the general government sector. This sector includes approximately 200 agencies directly providing public services such as departments, public hospitals and further education institutes. It excludes seven public financial corporations, such as the Treasury Corporation of Victoria and, around 80 public non‑financial corporations, such as the Port of Melbourne Corporation, water corporations and Alpine Resorts.

Public corporations outside of the general government sector typically rely on their own finances, not the State Budget, to fund major projects. The major exception is transport investments, which are normally funded through the State Budget but are held by a public corporation, VicTrack.

DTF does not usually include in the HVHR process projects that are funded outside the State Budget unless requested to do so by government. There is also a lack of clarity about whether projects under the recently announced unsolicited bids policy will be subjected to HVHR review.

We found that projects over $100 million listed in the State Budget since the 2011–12 Budget cycle had been reviewed under the HVHR process, with the exception of:

- projects started before the application of HVHR review

- projects funded outside of the State Budget by, for example, water corporations

- expenditure related to a program of projects rather than a single project.

The Public Accounts and Estimates Committee's (PAEC) Report on the 2012–13 Financial and Performance Outcomes of May 2014 identified 33 projects in the 2012–13 Budget Papers valued at more than $100 million that were not designated as HVHR.

DTF confirmed that it does not include non-Budget‑funded projects in the HVHR process unless specifically requested to do so by government. It has advised that HVHR exists primarily to provide Budget-related assurance, and public corporations have a commercial-based oversight overlay to manage investment risks.

However, we note that DTF did not advise PAEC of this. Instead, DTF advised that these projects were not included in the HVHR process because they had started before its application or because the expenditure related to a program of projects rather than a single project.

DTF needs to provide greater clarity by defining the criteria it uses to decide when non‑Budget‑funded projects should be captured by the HVHR process.

DTF also needs to clarify whether proposals received under the government's new unsolicited proposal process, such as the $2.5 billion Pakenham and Cranbourne rail line upgrade, will be captured by the HVHR process. The value of this bid and the absence of a competitive bidding process make the application of the HVHR process to projects like this essential.

DTF advised that it will propose to government that the Unsolicited Proposal Guideline should be updated to provide clarity on the role of the HVHR process.

Identifying high risk projects under $100 million

In 2013, VAGO concluded that DTF had not systematically reviewed and verified agencies' self-assessments used to decide which projects fall within the Gateway Review Process. DTF uses these same assessments to decide whether to include projects in the HVHR process.

Figure 2A summarises our 2013 findings and recommendations to DTF. In summary, VAGO recommended that DTF improve its processes for systematically documenting its reviews of agency risk assessments.

DTF accepted the recommendation but indicated that it was already undertaking risk assessments of projects independent of the Gateway Project Profile Model risk assessment tool.

However, 12 months later, DTF has not provided evidence to show that it now verifies the quality and comprehensiveness of risk assessments for projects under $100 million or undertakes its own risk assessments as part of the HVHR process.

Figure 2A

VAGO risk profiling recommendation and DTF's response

|

VAGO's 2013 audit on the Gateway Review Process (GRP) concluded that DTF: 'has not systematically reviewed and verified agency self-assessments of project risk, which determine whether projects are subject to the GRP. In many cases, responsible departments and agencies have not undertaken the required GRP risk assessment'. VAGO recommended that DTF: 'systematically validate whether projects should be subject to Gateway review, by verifying that robust project risk assessments are completed for new projects'. DTF's formal response to the recommendation stated that: 'As part of the High Value High Risk (HVHR) framework, DTF already undertakes risk assessments of projects to determine which projects should be classified as HVHR and subject to the Gateway Review Process (GRP). This assessment takes into account risk assessments undertaken by departments (including Project Profile Models) as well as DTF's own independent assessment of risk. DTF will examine further options to improve this process, including enhanced documentation outlining the reasons for DTF's risk assessment of projects.' |

2.3.2 Application of HVHR process to significant projects announced in the 2014–15 State Budget

The 2014-15 Budget commits up to $27 billion in new infrastructure including up to $21 billion on the following two projects:

- $8.5 to $11 billion for the Melbourne Rail Link, which includes a tunnel linking Southern Cross and South Yarra stations and a new airport rail link

- $8 to $10 billion to complete the East West Link by extending the eastern section from the Tullamarine Freeway to the Western Ring Road (stage 2).

These projects are listed as HVHR projects in the Budget Papers but have not progressed through any steps in the HVHR review process normally undertaken for funded projects. This is not how the HVHR process is usually applied to projects over $100 million, which requires the Treasurer's approval to proceed to funding based on a deliverability assessment of the full business case.

Government's funding decisions on the Melbourne Rail Link and East West Link stage 2 projects require the development of a full business case in line with the HVHR process. However, DTF has advised that it intends to apply a tailored HVHR assessment process to these projects to enable project risks to be considered while supporting accelerated time frames. This tailored HVHR process is yet to be defined.

Given the significance and scale of these projects it is critical that DTF determine how it will effectively apply the HVHR process within these truncated timelines to ensure that the project costs, benefits and time lines have been robustly determined.

2.3.3 Applying the HVHR process

There are 11 steps in the HVHR review process covering project development, procurement and post-implementation variations and monitoring, as outlined in Figure 2B. None of these steps are optional. However, during the introduction of the HVHR process in 2011, where well advanced projects were brought into the process, the early stages of review were not retrospectively applied.

This audit examined application of the HVHR process to five projects, namely:

- the registration and licensing system (RandL)

- Mitcham Road and Rooks Road Rail grade separations

- Royal Victorian Eye and Ear Hospital redevelopment

- Western Highway duplication from Beaufort to Buangor

- regional rolling stock procurement.

Figure 2B maps the 11 major HVHR steps against each of the five projects we selected for detailed review.

This shows that mandated HVHR reviews have been completed, except for RandL and regional trains. This is because the HVHR process was introduced in mid-2011, after RandL had already passed through these stages. DTF did not provide evidence that the regional trains contract review or procurement document approval steps were undertaken.

The lack of a comprehensive master register showing all HVHR review activities and a structured and consistent approach to record-keeping made it difficult to extend our process analysis beyond this small sample of projects.

Applying these improvements will provide greater assurance that DTF completes required HVHR reviews.

Figure 2B

Completion of mandatory HVHR review and approval steps

|

# |

HVHR Step |

RandL |

Mitcham |

Eye & Ear |

RRS |

W. Hwy |

|---|---|---|---|---|---|---|

|

1. |

Review preliminary business case |

N/A |

✔ |

✔ |

✔ |

✔ |

|

2. |

Review full business case |

N/A |

✔ |

✔ |

✔ |

✔ |

|

3. |

Approval of full business case |

N/A |

✔ |

✔ |

✔ |

✔ |

|

4. |

Review procurement documents |

N/A |

✔ |

✔ |

✔ |

✔ |

|

5. |

Approval procurement documents |

N/A |

✔ |

✔ |

✘ |

✔ |

|

6. |

Review preferred tender |

N/A |

✔ |

✔ |

✔ |

✔ |

|

7. |

Approval of preferred tender/bid |

N/A |

✔ |

✔ |

✔ |

✔ |

|

8. |

Review of contract |

N/A |

✔ |

✔ |

✘ |

✔ |

|

9. |

Approval of contract |

N/A |

✔ |

✔ |

✔ |

✔ |

|

10. |

Review of project performance |

✔ |

✔ |

✔ |

✔ |

✔ |

|

11. |

Approval of major variations |

✔ |

N/A |

N/A |

✔ |

N/A |

Source: Victorian Auditor-General's Office.

2.4 Supporting consistently high-quality reviews

We assessed whether DTF had deployed the processes and resources needed to support consistent, high-quality reviews providing:

- sufficient and well-trained analysts and supervisory staff

- clear guidance about assessment criteria and documenting reviews

- quality assured reviews that are consistent, transparent and free from role conflict and conflict of interest.

2.4.1 Capacity—analysts and supervisory staff

The HVHR process is managed within DTF's Infrastructure Advice and Delivery group. DTF recruited 11 analysts during 2011 to enhance its capacity to complete HVHR reviews. These new staff complemented existing resources and represented a significant increase in DTF's capacity to conduct reviews.

DTF committed to develop and train its analysts to improve the consistency and depth of reviews. There is evidence that analysts are provided with a range of relevant training opportunities. However, DTF is yet to develop and implement structured development and training activities for HVHR analysts.

We acknowledge the critical role of on-the-job coaching, mentoring and feedback about performance. However, a structured program is also needed to provide a consistent level of base training, together with tailored, technical training to address needs and gaps identified through regular assessments of HVHR reviews.

We have not seen evidence of DTF taking a structured approach to reviewing emerging needs and dealing with them using a range of mechanisms, such as a formal training program.

2.4.2 Guiding and documenting HVHR assessments

Developing a comprehensive set of review templates

DTF has developed comprehensive guidance for agencies to develop, procure and implement capital projects in the form of the Investment Lifecycle and High Value/High Risk Guidelines. This material has been progressively expanded and improved.

Achieving consistent, rigorous reviews across multiple HVHR projects using different reviewers represents a significant challenge. DTF recognises that review guidelines and templates should cover every stage of the HVHR process.

However, only the business case review process currently has a template that provides detailed questions addressing the review objectives and requires analysts to consistently document the results of each review. There is room to improve the current business case template to better align it with the requirements of the Investment Lifecycle and High Value High Risk Guidelines that fall within the scope of the HVHR business case review.

DTF also needs to extend the templates to other stages, including preliminary business case review and procurement.

Better documenting and managing HVHR review records

The May 2012 internal audit of HVHR found that 'DTF did not maintain documentation received from departments in a consistent or standardised way, impacting on the ability to obtain a clear audit trail of work undertaken'. It recommended that, 'A standard file structure should be implemented to assist the HVHR process'.

Standardising documents and files would provide a clear audit trail and make the HVHR process more efficient by making it easier for different analysts to understand past review stages when doing the next review stage.

DTF committed that by September 2012 it would develop 'a standardised file structure and assessment documentation to be used for all HVHR projects'.

DTF designed a file structure for this purpose in late 2012, but it has not been consistently applied. The project files we reviewed were not standardised or easily navigable, with significant differences in the type and detail of documentation retained.

This made it more difficult to assess reviews and led to follow-up requests during the audit because information was not on file. DTF should apply a standard file structure and assessment documentation for all stages of the HVHR process.

2.4.3 Quality assurance

When introducing HVHR, DTF committed to applying the process consistently and impartially. This is important, given the significant role of the HVHR process in providing government with assurance about the robustness of project planning and delivery.

We have seen evidence that senior DTF staff review all HVHR review briefings. However, these quality reviews are not in a standard form and do not clearly conclude whether HVHR reviews have adequately addressed the key criteria for assessing material submitted by departments.

For example, with a business case, the quality review should confirm or clarify the HVHR assessment conclusions about whether the analysis and evidence supporting the project's time lines, budget and expected benefits adheres to the Investment Lifecycle and High Value High Risk Guidelines.

At present, the only consistently documented evidence of review is the signature of the reviewer on the relevant brief. This does not provide assurance on the scope and adequacy of the review and is exacerbated by the fact that templates are not in place for HVHR reviews, except for the business case assessment.

A review based on a comprehensive template would provide greater quality assurance and clearly indicate what evidence had been relied on to support the assessment and recommended action.

2.4.4 Understanding and managing perceived conflicts

Concerns about role conflict and confusion created by DTF representatives sitting on steering committees or project boards and also advising government about a project's performance have been previously raised by VAGO, the Ombudsman and PAEC.

Figure 2C summarises the concerns reported by the Ombudsman and PAEC.

Figure 2C

Previous Ombudsman and PAEC findings

|

Victorian Ombudsman The November 2011 report Own motion investigation into ICT-enabled projects found a lack of clarity about the role of DTF representatives on project steering committees and recommended that the terms of reference for steering committees include details of the role to be played by each person on a committee. Public Accounts and Estimates Committee The December 2012 report Inquiry into Effective Decision Making for the Successful Delivery of Major Infrastructure Projects included a finding that concerns had been raised by VAGO about role confusion for DTF, which is responsible for both assisting with project proposals and assessing those proposals on behalf of government. The committee proposed a revised approach that involved DTF focusing solely on providing assurance to the investor. |

Quality reviews should verify the independence of advice by disclosing and addressing any actual or perceived conflicts of interest. We found evidence of DTF staff, and in some cases the same review analyst, having contributed to the submission development by sitting on a project steering committee. This was the case for three of the five HVHR projects examined during the audit.

DTF agreed that there could be a perception of conflict of interest as a result of fulfilling multiple roles but asserted that there is no actual conflict. It further advised that any perceived or potential conflicts are effectively managed as a result of the following review layers:

- HVHR analyst advice is subject to review by their manager, director and the Deputy Secretary and Secretary of DTF

- the Deputy Secretary Budget reviews DTF advice to the Budget and Expenditure Review Committee (BERC) of Cabinet on Budget issues but has no role in the HVHR process

- DTF's HVHR committee reviews DTF's role in the HVHR process.

These practices do not change VAGO's position that potential conflicts should be documented, together with DTF's approach to managing them, so that those receiving advice are aware of them and of how they are being managed.

2.5 Monitoring and reporting

2.5.1 Communicating with government

DTF committed to more proactive monitoring of investment delivery under the HVHR process when it advised government on its introduction.

DTF's quarterly reports to BERC on HVHR projects and its regular DTF HVHR accountability report are effective in informing DTF senior staff and government on project progress in terms of outputs, time lines and budgets, and about project risks.

However, these reports do not routinely address the achievement of intended project benefits, and projects are typically removed from these reports once implemented.

In addition, these reports have not comprehensively covered all HVHR projects from when they were designated as being subject to the review process. Our analysis shows a lag of over three months for some projects between the time they were designated as HVHR and when they were first included in major project monitoring reports to government and DTF.

The May 2014 internal audit identified the need for more robust monitoring of, and reporting on, progress against proposed benefits—financial and non-financial—throughout the project lifecycle.

DTF recently developed and released to agencies a template to track broader project benefits against those proposed in the business case for all asset investments—i.e. HVHR and non-HVHR investments.

2.5.2 Sharing lessons and better practice with agencies

Periodically reporting on progress and emerging lessons, as well as understanding agencies' views on the benefits and drawbacks from reviews, is critical to realising the potential of the HVHR process.

DTF previously committed to sharing and applying lessons learned and to completing an annual satisfaction survey across participating agencies.

DTF has not fully met these commitments and needs to act on these overdue actions. The evidence shows that:

- DTF manages HVHR reviews on a project-by-project basis and has not systematically communicated key lessons across the sector

- the May 2012 internal audit also recommended that DTF enhance stakeholder communication and engagement. While engaging constructively and intensively around individual project reviews, DTF does not have a structured approach to understanding and learning from agencies' combined experiences of the HVHR process because it does not formally survey them.

Notwithstanding this, DTF provided evidence of actions taken to share some lessons with agencies through presentations and ongoing informal communication. DTF has also progressively updated and enhanced the Investment Lifecycle and High Value High Risk Guidelines material and shared feedback on the quality of HVHR business cases with the Victorian Infrastructure Policy Reference Group. This group includes representatives from government departments.

We sought feedback from agencies on their experience of, and perspectives on, the HVHR process. This feedback was largely positive but agencies were consistent in their desire to see DTF communicate any common lessons or issues identified from distilling the results of HVHR reviews undertaken to date. Other commonly raised issues and comments included:

- a lack of clarity about the timing and scope of application of the HVHR process during its initial introduction

- a gradual improvement in clarity about information requirements for reviews

- time pressures in preparing business cases and adequately addressing issues raised by HVHR reviews

- some projects costing over $100 million are not necessarily complex or high risk because they have common characteristics and are routinely delivered successfully by agencies and so do not necessarily warrant additional scrutiny under the HVHR process.

2.6 Evaluating the impacts of the HVHR process

Like any government-funded program, the most important thing to understand is how well the investment has achieved intended objectives—i.e. making projects more predictable in terms of delivering on time and within budget and realising the benefits that underpin business cases.

DTF committed to undertaking an independent evaluation of the HVHR process and reporting the results to government by June 2014. This review has not been commissioned, and we have seen no evidence of progress towards this. DTF has not developed an evaluation framework, nor collected and processed the data needed to measure the outcomes attributable to the HVHR process.

This is a significant gap that DTF needs to address.

VAGO's recent audit on the Gateway Review Process found that in 2004 the Department of Premier and Cabinet developed a detailed review tool to be used over time to assess the impact of the Gateway process against its underlying objectives, outlined when the process was introduced. This tool was developed in consultation with DTF and departments. The Gateway Supervisory Committee and the government endorsed the review tool in August 2004

The review tool provides a sound basis for ongoing review of the impact of the Gateway Review Process. Despite this, and the government's endorsement, DTF informed us that it has not implemented this tool to evaluate Gateway, nor adapted the tool to evaluate the impact of the HVHR process.

This tool was developed for the Gateway Review Process and would be a good starting point for DTF to measure the impact of the HVHR process.

Recommendations

That the Department of Treasury and Finance:

- improves its approach to selecting projects for inclusion in the High Value High Risk process by:

- systematically reviewing projects between $5 million and $100 million to determine whether they should be subject to the High Value High Risk process through documented reviews of project risk assessments

- clarifying the criteria for selecting public projects that do not require Budget funding for inclusion in the High Value High Risk process

- recommending that projects over $100 million selected under the government's unsolicited bids policy be subject to High Value High Risk processes

- develops assessment guidance and templates covering all High Value High Risk stages to improve the consistency, rigour and transparency of High Value High Risk reviews

- improves its administration of the High Value High Risk process by:

- applying a standardised file structure for managing assessment documents and supporting evidence

- developing and maintaining a comprehensive central register of High Value High Risk review activity by project and High Value High Risk process stage

- improves how it communicates with and informs departments by:

- developing a structured approach to collating and sharing the lessons from all High Value High Risk reviews

- completing an annual satisfaction survey of agencies that have been subject to High Value High Risk reviews

- identifies potential conflicts of interests of reviewers and documents how these are mitigated

- develops and applies an evaluation tool to measure the extent to which the High Value High Risk process is affecting project outcomes.

3 Impact of the High Value High Risk process

At a glance

Background

The High Value High Risk (HVHR) process was introduced to provide more certainty that expected outcomes and benefits for projects would be delivered. This would occur by strengthening the Department of Treasury and Finance's (DTF) support for and scrutiny of projects classified as HVHR.

Conclusion

DTF has improved the scrutiny and quality of business cases and procurements captured by the HVHR process. However, these improvements have not lifted practices so they consistently and comprehensively meet DTF's better practice guidelines. There are gaps and inconsistencies which DTF needs to address if it is to realise the potential benefits of the process.

Findings

- There is clear evidence that HVHR reviews have stimulated agencies to address significant business case and procurement issues.

- However, some business case submissions do not fully meet DTF's better practice guidelines. The observed weaknesses relate to reliable estimation of benefits, justifying a preferred procurement strategy and governance and project management arrangements.

- The problems with the RandL registration and licensing system project flag important lessons about getting appropriately skilled and experienced people in key project and board positions.

Recommendations

That the Department of Treasury and Finance:

- provides greater assurance that HVHR reviews comprehensively test compliance with its Investment Lifecycle and High Value High Risk Guidelines in areas critical for project deliverability

- checks that for complex, risky projects—particularly those involving ICT transformations—the specialist skills needed to successfully manage, oversee and quality assure these projects have been assessed and acquired.

3.1 Introduction

This Part examines the impacts of High Value High Risk (HVHR) reviews on the quality of business cases and procurements for the following five projects:

- registration and licensing system (RandL)

- Mitcham Road and Rooks Road rail grade separations (Mitcham Road)

- Royal Victorian Eye and Ear Hospital redevelopment (Eye and Ear Hospital )

- Western Highway duplication from Beaufort to Buangor (Western Highway)

- regional rolling stock procurement (regional trains).

Towards the end of the audit we examined a further three projects to assess the impact of the Department of Treasury and Finance (DTF) updating its business case assessment template in late 2012.

Section 3.3 examines whether HVHR assessments of business case deliverability were robust. Section 3.4 examines the procurement reviews and Treasurer's approval of tender documents, preferred bid decisions and the final contracts. Both use the relevant parts of DTF's Investment Lifecycle and High Value High Risk Guidelines as the basis for these assessments.

Section 3.5 summarises our findings for the RandL project, which is the one project that most clearly failed the deliverability test. We also use this section to explain why this happened and the lessons to be drawn from this.

3.2 Conclusion

DTF has improved the scrutiny and quality of business cases and procurements captured by the HVHR process. However, these improvements have not lifted practices so they consistently and comprehensively meet DTF's better practice guidelines. There are gaps and inconsistencies which DTF needs to address if it is to fully realise the potential benefits of the process.

HVHR business case reviews raised substantive issues and agencies modified submissions to address these issues. However, these positive findings were not consistently reflected across all projects nor for all the criteria that DTF uses to test projects' deliverability.

DTF's level of scrutiny and assurance needs to improve across all the 'deliverability' criteria. Its performance was best for assuring project costs, time lines and agencies' approaches to risk management, more mixed for procurement, governance and project management and clearly inadequate for assuring the expected project benefits.

None of the business cases adequately justified projects' benefits and this makes the absence of any substantive HVHR review of the area a cause for concern.

RandL was not fully captured by the HVHR process because its procurement happened well before the process started. However, the updated late-2011 business case was subject to a HVHR type review, and the project was included in the process from late 2011.

The management and oversight applied to the RandL project was not effective in detecting and controlling risks before they materialised to significantly delay the project and increase the estimated cost of delivery. The single most critical cause of this was the absence of sufficiently skilled resources.

3.3 Business case reviews

We tested the quality of the assurance provided by HVHR reviews against the criteria in the HVHR Business Case Deliverability Assessment Guidance document, which replaced an earlier, less detailed guide that used the same criteria.

We applied the Investment Lifecycle and High Value High Risk Guidelines criteria to assess the quality of assurance. Our assessment is based on the documentation provided by DTF.

Figure 3A describes our assessment of HVHR reviews of the business cases of the different projects against six criteria that include a combined assessment of governance and project management.

DTF applied the greatest amount of scrutiny and achieved the highest level of assurance in the areas of project budgets, time lines and risk management.

In contrast, the level of assurance in relation to project benefits, preferred procurement approach and governance and management was lower. In particular, DTF applied little scrutiny to, and asked few questions about, the reliability of project benefits, even though business cases did not contain sufficient information to verify the scope and quantum of these benefits.