Local Government and Economic Development

Overview

Economic prosperity is important on both a national and local scale, enabling communities to improve their economic future. A number of Victorian councils, particularly non-metropolitan councils, have experienced a decline in their economic growth over the past 10 years.

A wide range of variables influence economic development in municipalities. Many of these are beyond the direct control or influence of local governments. However, local governments can play an important role in facilitating better conditions for economic development within their municipalities. Councils' roles include devising long-term economic development strategies, and creating suitable conditions for economic development.

This report examines whether councils’ economic development activities help to improve the economic viability and sustainability of their municipalities.

Our focus was on regional and rural councils because they face greater challenges to economic development compared to metropolitan councils and included Bass Coast Shire Council, Corangamite Shire Council, Loddon Shire Council, Melton City Council and Southern Grampians Shire Council.

We also examined the roles of Regional Development Victoria (RDV)—a statutory agency within the Department of Economic Development, Jobs, Transport and Resources—and Local Government Victoria (LGV), which is part of the Department of Environment, Land, Water and Planning, in assisting councils to facilitate local economic development.

We made a total of eight recommendations including three for RDV, three for councils, and two further recommendations for RDV and LGV.

Transmittal letter

Ordered to be published

VICTORIAN GOVERNMENT PRINTER March 2018

PP No 381, Session 2014–18

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Local Government and Economic Development .

Yours faithfully

Andrew Greaves

Auditor-General

8 March 2018

Acronyms and abbreviations

| ABR | Australian Business Register |

| Bass Coast | Bass Coast Shire Council |

| Corangamite | Corangamite Shire Council |

| DEDJTR | Department of Economic Development, Jobs, Transport and Resources |

| DELWP | Department of Environment, Land, Water and Planning |

| GRP | Gross regional product |

| GSP | Gross state product |

| LGPRF | Local Government Performance Reporting Framework |

| LGV | Local Government Victoria |

| Loddon | Loddon Shire Council |

| Melton | Melton City Council |

| RDA | Regional Development Australia |

| RDV | Regional Development Victoria |

| RIF | Regional Infrastructure Fund |

| RJIF | Regional Jobs and Infrastructure Fund |

| SCMP | Shipwreck Coast Master Plan |

| Southern | Grampians Southern Grampians Shire Council |

| VAGO | Victorian Auditor-General's Office |

| VGC | Victorian Grants Commission |

| Western BACE | Western Business Accelerator and Centre of Excellence |

Audit overview

Victoria is home to a quarter of Australia's population and contributes around 22 per cent to the country's economy. Economic prosperity is important on both a national and local scale, enabling communities to improve their quality of life.

A number of Victorian councils, particularly non-metropolitan councils, have experienced a decline in their economic growth over the past 10 years.

Every community has unique local conditions that affect its development and influence its decisions to facilitate economic development. Local economic development aims to build up the economic capacity of an area to improve the quality of life for residents. Local economic development involves government, business and community sector partners working collectively to create better conditions for economic growth and job creation.

A wide range of variables influence economic development in municipalities. Many of these are beyond the direct control or influence of local governments, such as Commonwealth and state support, international market trends and global economic conditions.

However, local governments can play an important role in facilitating better conditions for economic development within their municipalities. Councils' roles include devising long-term economic development strategies, and developing partnership networks that enable economic development.

In this audit, we assessed whether councils' economic development activities help to improve the economic viability and sustainability of their municipalities. Our focus was on regional and rural councils because they face greater challenges to economic development compared to metropolitan councils. Specifically, we assessed whether councils' actions to improve economic viability and sustainability are strategic and achieve their intended outcomes. The councils we audited were Bass Coast Shire Council (Bass Coast), Corangamite Shire Council (Corangamite), Loddon Shire Council (Loddon), Melton City Council (Melton) and Southern Grampians Shire Council (Southern Grampians).

We also examined the roles of Regional Development Victoria (RDV)—a statutory agency within the Department of Economic Development, Jobs, Transport and Resources (DEDJTR)—and Local Government Victoria (LGV)—part of the Department of Environment, Land, Water and Planning (DELWP) —to assist councils to facilitate local economic development.

Conclusion

In response to recent reviews, councils have taken effective steps towards developing well-aligned economic strategies that complement the government's regional priorities. The audited councils effectively identify and pursue their comparative advantages to facilitate economic development.

However, they frequently fall short of realising their intended economic development outcomes, often due to the following systemic issues:

- Other agencies, such as those providing utility infrastructure and roads, have competing or conflicting priorities when it comes to land use planning.

- Rural and smaller councils in particular lack the resources and relevant skills to access available grants, which they depend on to fund their economic development activities.

- Four-year council plans are at odds with the longer-term view needed for economic development strategies, resulting in poorly aligned and changing priorities.

- There is a lack of targets or benchmarks against which to gauge progress, and poor links between project reporting and outcome monitoring.

Findings

Creating the conditions for local economic development

Given the importance of economic development, all the audited councils identified it as a strategic objective in their 2013–17 council plans.

Economic development strategies

All the audited councils' economic development strategies incorporate some better practice elements of long-term planning. They all have economic development teams of various sizes. These teams were also generally responsible for related activities like tourism, events and agriculture.

Each council's strategy referenced or aligned with state and regional economic development priorities. Four of the five audited councils outsourced the preparation of their economic development strategies because they lacked the resources or skills required for the economic assessment aspect of the strategy. Bass Coast developed an effective strategy in-house, which reflects the council's focus on economic development, despite it being a relatively small council.

Economic assessments and access to information

Economic development strategies are built on assessments of the local economy, including its strengths, weaknesses, opportunities and challenges.

Robust data collection and analysis are essential for economic assessments. Councils could use better data in their economic assessments, especially at the municipality level. For example, councils rely on the Australian Business Register (ABR) to measure business activity. However, councils report that the ABR data can be a poor indicator of business activity as the data includes shelf companies and superannuation funds that are not trading entities. LGV is working with the Economic Development Australia Victorian State Practitioners Network to identify better data sources and indicators to measure councils' economic development performance. Councils' economic assessments also contained limited analysis of their performance against other councils.

Although RDV's data portal provides a wide range of information, the audited councils preferred using other data sources. This was partly due to their lack of awareness, but also because some of this data is available to councils through other sources. However, RDV and councils need to work towards using consistent information across the Victorian local government sector.

Stakeholder engagement

All audited councils developed effective strategic partnerships with relevant stakeholders, which is essential for local economic development.

Councils identified potential partners and consulted with local businesses and representative bodies as part of planning for their economic development strategy. They also identified collaboration with stakeholders as a strategic action in their economic development strategies. For example, Loddon included actions to collaborate with neighbouring councils to develop a settlement strategy to capitalise on growth in a neighbouring council.

The nine recently formed regional partnerships should provide additional avenues for councils to engage with strategic partners. At the time of this audit, it was too early to assess the effectiveness of these partnerships. Assessing the effectiveness of these partnerships in supporting economic development activities will help stakeholders understand whether the partnerships are achieving their intended objectives.

Barriers to economic development

Strategic land use planning is a critical foundation for local economic development. Currently, obtaining planning approvals can be complex. At times, this has significantly delayed councils' economic development initiatives, limiting their ability to facilitate local economic development.

In 2016, the Victorian Red Tape Commissioner reported to the Treasurer of Victoria on administrative problems in the planning approval process. Some of these problems present significant barriers to local economic development. Councils and referral authorities—such as utility providers—often fail to meet statutory time lines which increases time and effort required to facilitate economic development activities.

The audited councils also reported that lengthy and onerous planning approval processes hinder economic development and deter investors from committing to developments. One factor contributing to these delays was that domestic planning applications—for example, building a shed in a backyard—and economically significant local projects are subject to the same planning processes.

There are some fast-track processes available to shorten approval time frames, such as the VicSmart and Smart Planning program initiatives. However, it is too early to determine if these have improved the efficiency of approval processes.

Improving economic viability and sustainability

The long-term nature of an economic development strategy is at odds with the shorter four-year council plan. Councils' failure to address this conflict leads to changing economic development priorities and abandoned actions and initiatives.

Funding the local development actions

Common actions by audited councils to implement their local development strategies include:

- financial support for business and tourism associations

- festivals and other tourism support events

- conferences and field days

- workshops and training

- marketing and promotional materials.

Lack of consistent data for economic development expenditure across audited councils meant we relied on the Victorian Grants Commission (VGC) data on business and economic services as a proxy. In 2015–16, Victorian councils spent $866 million delivering business and economic services, which includes economic development, tourism, and community development and planning. These services accounted for between 6 and 12 per cent of total council expenditure for most councils. This was in line with what the audited councils spent on these services.

Based on our site visits, interviews and discussions with councils and stakeholders, it is clear that economic development is high on councils' agenda and councils actively allocate resources towards it. However, without actual comparable data it is difficult to ascertain whether this expenditure is sufficient.

Accessing funding for economic development

As part of its 2014 election commitments, the Victorian Government committed $100 million through the Regional Infrastructure Fund (RIF) to regional cities and $70 million to rural councils. By December 2017, only $30 million of the rural council allocation was committed, with $24.3 million worth of projects in varying stages of approval.

For the four rural councils in this audit, RDV identified $8.5 million in grants for which councils had either not applied, or had applied but failed to meet the funding criteria as of December 2017. This was for 40 potential projects valued at more than $46.5 million. One audited council also advised lack of timely RDV feedback as a reason for inability to secure grants.

The lack of available and skilled staff within councils to develop high-quality business cases for grant applications means that rural councils often fail to secure available grants.

LGV works in partnership with the local government sector to improve business and governance practices. Considering LGV's sector-wide view of local governments, it should consider ways of providing further guidance to councils to improve their economic development activities including staff development in this area. Similarly, RDV's role in regional economic development means it is well placed to provide support and guidance to councils to improve their economic development activities.

Use of council powers

The Local Government Act 1989 (the Act) provides councils with specific powers to meet their mandate, including entrepreneurial powers and the power to declare special rates and charges.

The audited councils made limited use of these powers. They advised that they are reluctant to use incentive-based powers—to defer, waive or apply special rates and charges—particularly when the use of those powers may be perceived as promoting private, as opposed to public, interests.

However, these problems should not prevent councils from using their powers to facilitate economic development. We found some innovative examples of councils using their powers. For example, Corangamite advised that a $300 000 support fund it established to attract and expand businesses in the area contributed $9.2 million in direct and indirect benefits to the local economy.

Reviewing the economic development strategy

All the audited councils developed performance measures as part of their council plans or their economic development strategies. However, councils did not clearly align performance of economic development actions with identified strategic outcomes. For example, to achieve its strategic objective of developing new stakeholder relationships, a council may list an action to hold a business seminar. However, the council does not measure whether the seminar actually results in new stakeholder relationships. Actions not linked to strategic performance measures prevent councils measuring progress against their strategic economic development outcomes.

Some of the audited councils lack targets and benchmarks for their economic development outcomes. Although outcomes are not solely dependent on the actions taken by councils, a lack of targets makes it difficult to assess performance and adjust strategies. An exception was Loddon, which had clearly articulated targets for its economic development outcomes.

Recommendations

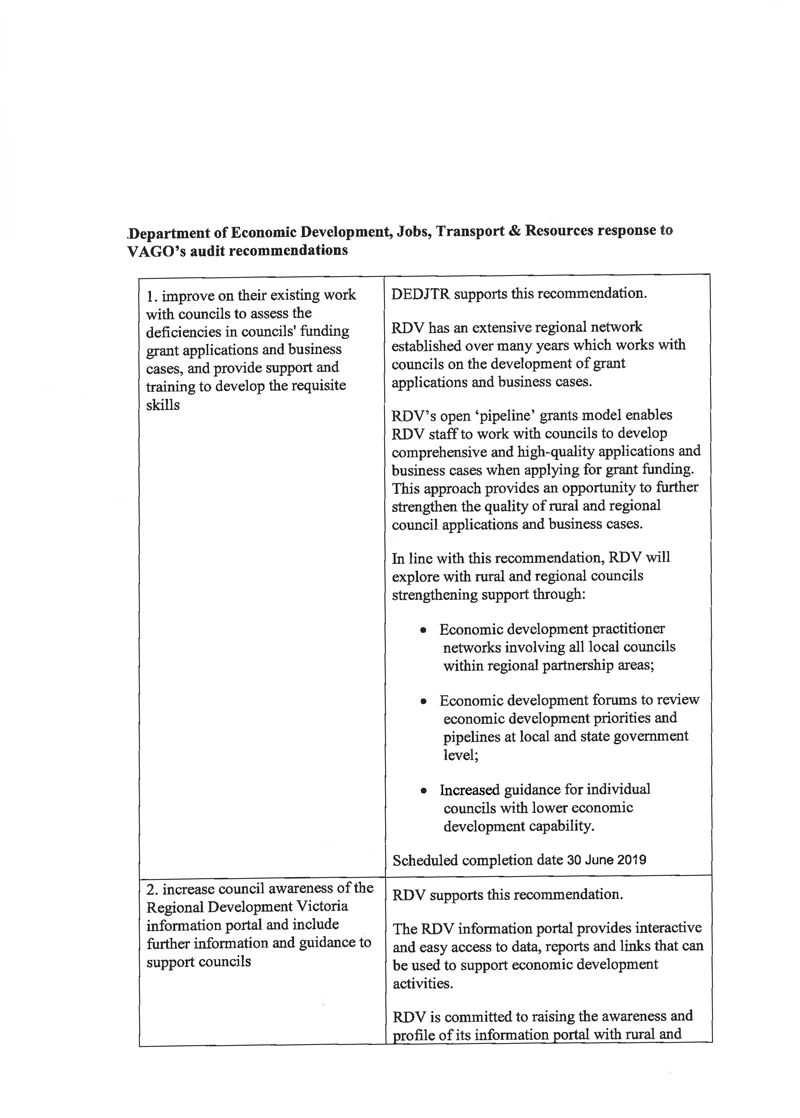

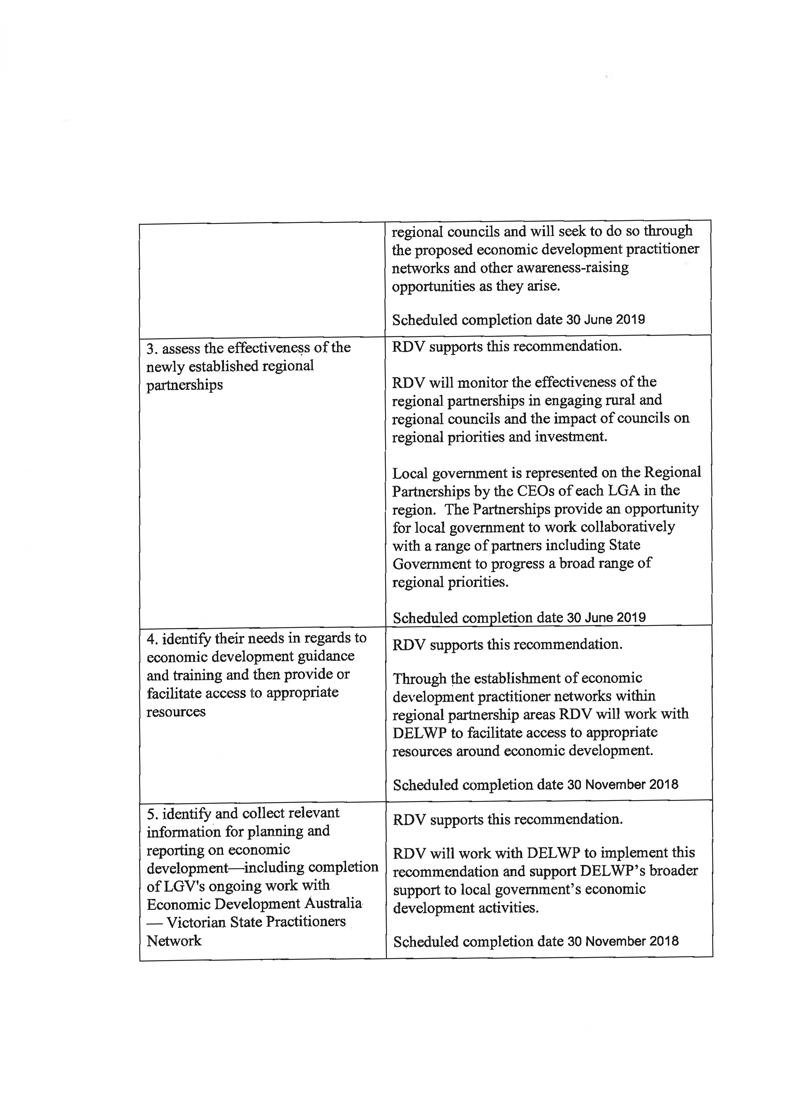

We recommend that Regional Development Victoria:

- improve its existing work with councils to assess the deficiencies in councils' funding grant applications and business cases, and provide support and training to develop the requisite skills (see Section 3.2)

- increase council awareness of the Regional Development Victoria information portal and include further information and guidance to support councils (see Section 2.5)

- assess the effectiveness of the newly established regional partnerships (see Section 2.4).

We recommend that Regional Development Victoria and Local Government Victoria work with councils to:

- identify their economic development guidance and training needs, and then provide or facilitate access to appropriate resources (see Section 3.2)

- identify and collect relevant information for planning and reporting on economic development—including completion of Local Government Victoria's ongoing work with the Economic Development Australia Victorian State Practitioners Network (see Section 2.5).

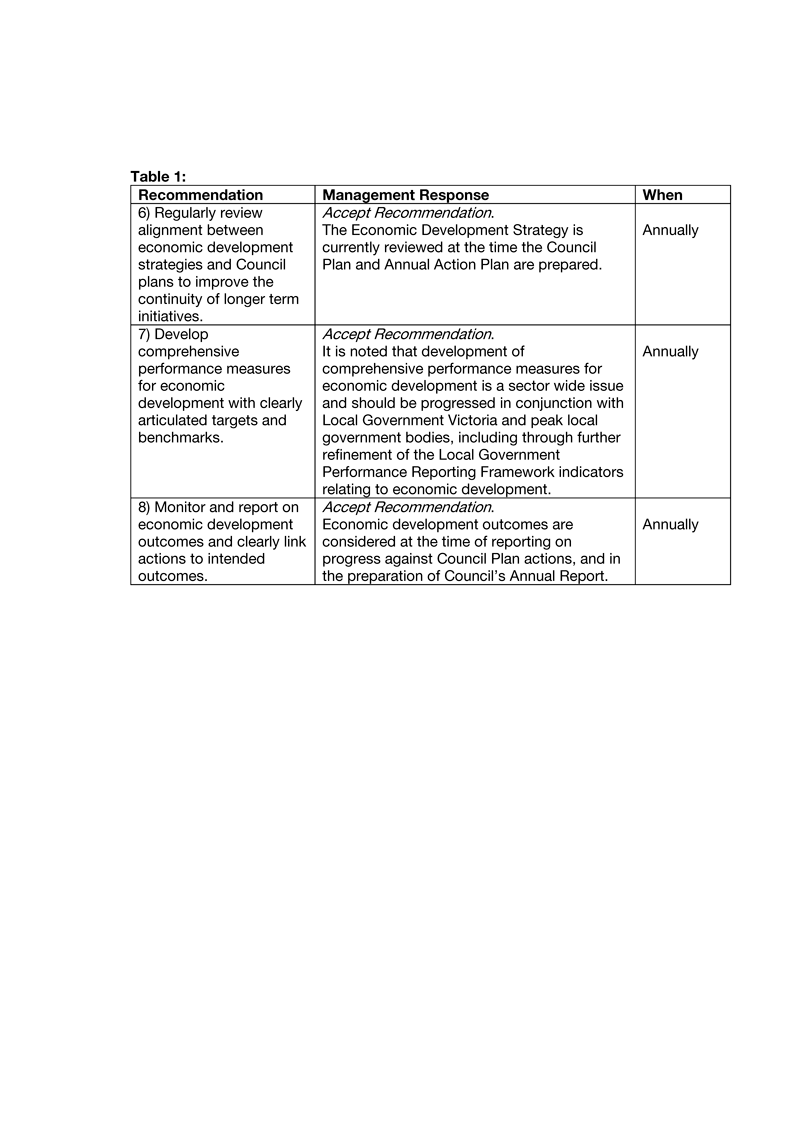

We recommend that local councils:

- regularly review alignment between economic development strategies and council plans to improve the continuity of longer term initiatives (see Section 3.4)

- develop comprehensive performance measures for economic development with clearly articulated targets and benchmarks (see Section 3.4)

- monitor and report on economic development outcomes and clearly link actions to intended outcomes (see Section 3.4).

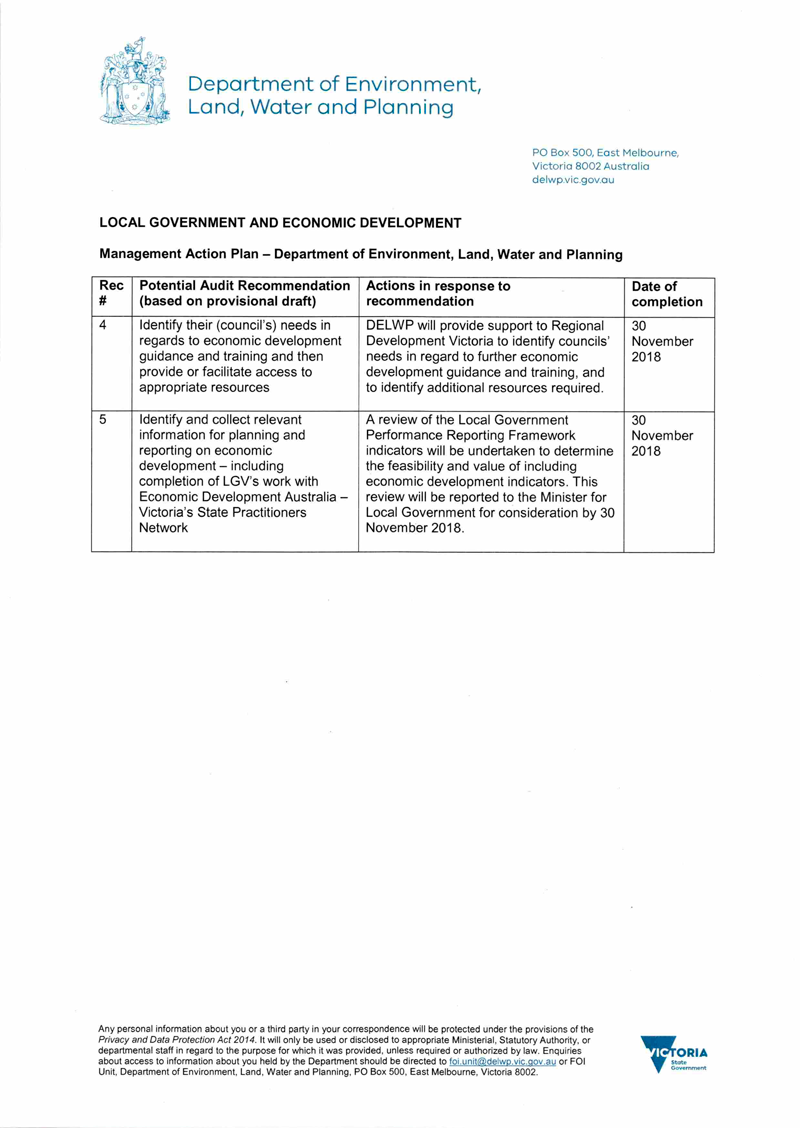

Responses to recommendations

We have consulted with DELWP, DEDJTR, Bass Coast, Corangamite, Loddon, Melton and Southern Grampians, and we considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet.

The following is a summary of those responses. The full responses are included in Appendix A.

DEDJTR, DELWP, Bass Coast, Corangamite and Southern Grampians accepted the recommendations and provided action plans noting their approach to addressing the recommendations.

Loddon broadly supports the recommendations, but also noted there are some limitations in its ability to respond to all the issues identified. Melton stated that it supports the recommendations. Melton also expressed the view that further examination of the issues facing metropolitan councils would improve the relevance of the audit's recommendations.

1 Audit context

Economic prosperity is important to a community's wellbeing. The World Bank describes local economic development as building the economic capacity of a locality to improve its economic future and the quality of life of its citizens. In this process, public, business and community sector partners work collectively to create better conditions for economic growth and job creation.

Every community has unique conditions that affect its development and should shape the design and implementation of a local economic development strategy.

1.1 Local economic development

Victoria's economic context

Statewide

Victoria is home to a quarter of Australia's population and contributes around 22 per cent to the Australian economy.

One of the key economic performance measures at the state level is gross state product (GSP). It represents the total value of all goods and services produced in the state during a given year. In 2015–16, Victoria's GSP was $374 billion.

Figure 1A shows Victoria's annual GSP growth rates since 2006–07.

Figure 1A

Victoria's annual GSP growth rates, 2006–07 to 2015–16

Source: VAGO, using RDV data.

Gross regional product (GRP) measures each local government area's contribution to the state economy. Figure 1B shows that the 31 metropolitan councils account for 81 per cent of the state's GRP.

Figure 1B

Councils' contribution to state economy, 2015–16

Source: VAGO, based on RDV and Australian Bureau of Statistics data.

Regional and metropolitan partnerships

Victoria's 79 councils are grouped into 15 partnerships—six metropolitan and nine regional partnerships. Figure 1C shows the nine regional partnership groups.

Figure 1C

Regional partnerships in Victoria

Source: RDV.

Victoria's Regional Statement: Your Voice, Your Region, Your State (Regional Statement) acknowledges the contribution regions make to Victoria's economy and its way of life. The statement introduces the nine regional partnerships—which aim to increase collaboration between communities, industry, businesses and government—to address the most important challenges and opportunities in each region. The partnerships seek to have more regional community views represented in government decision‑making.

Figure 1D lists the 15 regional and metropolitan partnership groups.

Figure 1D

Metropolitan and regional partnerships in Victoria

|

Partnerships |

Councils |

|---|---|

|

Metropolitan |

|

|

Eastern |

Knox, Manningham, Maroondah, Monash, Whitehorse, Yarra Ranges |

|

Inner Metropolitan |

Melbourne, Port Phillip, Yarra |

|

Inner South East |

Bayside, Boroondara, Glen Eira, Stonnington |

|

Northern |

Banyule, Darebin, Hume, Moreland, Nillumbik, Whittlesea |

|

Southern |

Cardinia, Casey, Frankston, Greater Dandenong, Kingston, Mornington Peninsula |

|

Western |

Brimbank, Hobsons Bay, Maribyrnong, Melton, Moonee Valley, Wyndham |

|

Regional |

|

|

Barwon |

Colac-Otway, Greater Geelong, Queenscliffe, Surf Coast |

|

Central Highlands |

Ararat, Ballarat, Golden Plains, Hepburn, Moorabool, Pyrenees |

|

Gippsland |

Bass Coast, Baw Baw, East Gippsland, Latrobe, South Gippsland, Wellington |

|

Goulburn |

Greater Shepparton, Mitchell, Moira, Murrindindi, Strathbogie |

|

Great South Coast |

Corangamite, Glenelg, Moyne, Southern Grampians, Warrnambool |

|

Loddon Campaspe |

Campaspe, Central Goldfields, Greater Bendigo, Loddon, Macedon Ranges, Mount Alexander |

|

Mallee |

Buloke, Gannawarra, Mildura, Swan Hill |

|

Ovens Murray |

Alpine, Benalla, Indigo, Mansfield, Towong, Wangaratta, Wodonga |

|

Wimmera Southern Mallee |

Hindmarsh, Horsham, Northern Grampians, West Wimmera, Yarriambiack |

Source: VAGO, based on Suburban Development Victoria information.

Economic growth across partnership groups varies, ranging from an average GRP decline of 11 per cent for the Mallee group councils to an average increase of 34 per cent in the Western group, as shown in Figure 1E. The GRP growth for the state in the same period was 21 per cent.

Figure 1E

Average GRP growth of councils by Victorian partnership, 2007–16

Note: Growth represents average for councils in that partnership. See Appendix A for individual council growth.

Source: VAGO, based on RDV data.

Local councils

A locality's economic growth keeping pace with—or exceeding—its population growth is a positive indicator of economic development. From 2007 to 2016, GRP has not kept pace with population growth in 50 of the 79 councils. This includes both metropolitan and non-metropolitan local government areas, as shown in Figure 1F.

Figure 1F

GRP growth and population growth of Victorian councils, 2007–2016

Key: ● Councils whose economies have grown faster than their populations. ● Councils whose economies have grown slower than their populations.

Source: VAGO, based on RDV and Australian Bureau of Statistics data.

For audited councils, economic growth ranged from a decline of 15 per cent in Corangamite to an increase of almost 70 per cent in Melton. Appendix B has economic and population growth data for all 79 councils.

1.2 Frameworks for economic development

Legislative framework

Local Government Act 1989

The powers and accountabilities of local government are set out in the Act. According to the Act, councils' primary objective is to achieve the best outcomes for the local community, taking into account the long-term and cumulative effects of decisions. To achieve this objective, councils must have regard to:

- promoting the social, economic and environmental viability and sustainability of the municipality

- ensuring resources are used efficiently and effectively

- promoting appropriate business and employment opportunities.

Local government also has a number of specific powers that help facilitate economic development. These include entrepreneurial powers, the power to sell or lease land and the power to enter into contracts, which may also be subject to specific conditions and limitations.

Council plans

Strategic planning is an essential aspect of economic development. There are three planning requirements under the Act:

- a council plan which includes strategic objectives, plans and indicators

- a strategic resource plan, which must be included in the council plan and list the resources required to achieve the council's strategic objectives

- a budget, which includes a description of services and funded initiatives.

Figure 1G shows the three mandated planning requirements.

Figure 1G

Council planning requirements

Source: VAGO, based on Local Government Better Practice Guide: Strategic Resource Plan 2017, LGV.

LGV, a business unit of DELWP, provides better practice guidelines to help councils develop their council plan, strategic resource plan and budget.

Planning and Environment Act 1987

Land use planning is an effective tool that councils can use to facilitate economic development in their municipality. The purpose of the Planning and Environment Act 1987 is to 'to establish a framework for planning the use, development and protection of land in Victoria in the present and long-term interests of all Victorians'.

Section 4(b) of the Planning and Environment Act 1987 lists the objectives of the planning framework, including to 'enable land use and development planning and policy to be easily integrated with environmental, social, economic, conservation and resource management policies at State, regional and municipal levels'.

Regional Development Victoria Act 2012

The Regional Development Victoria Act 2012 established RDV, a statutory agency within DEDJTR, to facilitate economic and community development in rural and regional Victoria. It also established a Regional Development Advisory Committee and made RDV responsible for administering the Regional Jobs and Infrastructure Fund (RJIF), which distributes grants to support economic development in regional Victoria.

Policy framework

Ministerial Statement on Local Government

The August 2015 Ministerial Statement on Local Government (Ministerial Statement) outlined the government's reform agenda for the local government sector. The Ministerial Statement recognised that local government builds local economies and is the government closest to the Victorian community. It also outlines a range of reforms to improve councils' performance, including social procurement policies to support local economies.

Victoria's Regional Statement

In 2015, the government released the Regional Statement, which builds on a number of previous strategies to drive regional economic development. It acknowledges the contribution regional Victoria makes to Victoria's economic strength and commits to delivering a stronger voice for regional communities in government decision-making across all areas of policy and service delivery. The key reform of the Regional Statement was the introduction of nine new regional partnerships across the state to help drive economic development in regional Victoria—as discussed in Section 1.1.

The government developed the Regional Statement in response to the findings of the 2015 Regional Economic Development and Services Review.

State Planning Policy Framework

As discussed, strategic land use planning is a critical foundation of local economic development. Each of Victoria's 79 councils has a separate scheme governing land use planning.

Every planning scheme contains the State Planning Policy Framework, which requires planning policies to consider the environmental, social and economic factors necessary for sustainable development, and the Local Planning Policy Framework. Included in the Local Planning Policy Framework is the Municipal Strategic Statement, which:

- identifies long-term direction for land use and development in the municipality

- presents a vision for the community and other stakeholders

- provides the rationale for the zone and overlay requirements and particular provisions in the scheme.

The relevant planning authority—usually the local council—must select the appropriate zones and overlays from the Victorian Planning Provisions for inclusion in their planning scheme.

1.3 Roles and responsibilities

Municipal councils

The local community elects a council to govern the municipal district. Under the Act, councils must have regard to their district's social, economic and environmental viability and sustainability.

Councils' contributions to the Victorian economy are significant, including more than 43 000 employees in the sector, managing over $84 billion in public assets and spending more than $7 billion annually on services.

Under the Act, the roles of a council include:

- acting as a representative government by taking into account the diverse needs of the local community in decision-making

- providing leadership by establishing and monitoring strategic objectives

- maintaining the viability of the council by ensuring that resources are managed in a responsible and accountable manner

- advocating for the interests of the local community

- acting as a responsible partner in government by taking into account the needs of other communities

- fostering community cohesion and encouraging active participation in civic life.

Department of Economic Development, Jobs, Transport and Resources

DEDJTR works across many portfolios to increase jobs, investment, exports and opportunities in Victoria. DEDJTR aims to stimulate innovation, competitiveness, confidence and sustainability in Victoria's economy.

Regional Development Victoria

RDV works closely with various Victorian government agencies including local councils to facilitate economic, infrastructure and community development in regional Victoria. RDV aims to strengthen regional Victoria through job creation, better infrastructure and new investment. RDV works with government agencies, including local councils, to:

- support business and industry development

- help new businesses to establish themselves

- assist existing industries to grow and diversify

- build prosperous, stronger regional communities.

RDV also administers the RJIF, which distributes grants to rural and regional businesses, industry groups, government agencies, not-for-profits and community groups to support economic development in regional Victoria.

RDV works with Regional Development Australia (RDA) to facilitate regional engagement and economic development. RDA is a Commonwealth Government initiative that involves all levels of government in supporting regional development.

RDA committees provide independent advice to local, state and Commonwealth government on critical issues affecting each region. They work closely with community leaders to identify funding sources and develop project proposals to support economic growth. Regional strategic plans articulate critical issues facing each region—including the economic context, priorities and actions to achieve the region's vision.

Department of Environment, Land, Water and Planning

DELWP covers Victoria's planning, local government, environment, energy, suburban development, forests, emergency management, climate change and water functions. DELWP lists its mandate as 'supporting Victoria's natural and built environment to ensure economic growth and liveable, sustainable and inclusive communities'. One of DELWP's key outcomes is 'sustainable and effective local government'.

In 2016, the Premier of Victoria created the suburban development portfolio within DELWP. The priorities for the portfolio are to:

- develop a five-year plan that considers the employment, services and infrastructure needs of Melbourne's fastest-growing

- identify and address local opportunities and priorities by overseeing the development of six metropolitan partnerships

- facilitate and coordinate the state government's social, economic and environmental investments in Melbourne's suburbs.

Local Government Victoria

LGV provides policy advice, oversees legislation and works with the Minister for Local Government and Victoria's 79 local councils to support responsive and accountable local government services. Along with providing policy advice to the minister, LGV oversees the administration of the Act and other relevant legislation.

1.4 Past reviews and inquiries

Past reviews and inquiries into local government and its contribution to economic development have identified the importance of clearly defined outcomes, performance reporting, partnerships, and utilising a range of activities to drive economic development.

Inquiry into Local Economic Development in Outer Suburban Melbourne, 2008

In 2008, the Victorian Parliament released its report Inquiry into Local Economic Development in Outer Suburban Melbourne. The report concluded that there is no 'silver bullet' solution to generating local economic development. Rather, sustainable jobs and the economic benefits that flow from them generally result from well-researched, carefully planned and adequately resourced programs implemented in partnership with government at all levels. The report made 170 recommendations.

Inquiry into Regional Centres of the Future, 2009

In 2009, the Victorian Parliament released its report Inquiry into Regional Centres of the Future. The inquiry sought to identify and consider measures to build on the government's investment in regional Victoria, through the further development of regional centres. The report identified that regional centres should be places of economic, environmental, social and cultural innovation that enable regional Victoria to meet the challenge of predicted future population growth. The report recommended that government redirect its energy and its funding efforts to regional centres, as a priority.

Inquiry into Local Economic Development Initiatives in Victoria, 2013

In 2013, the Victorian Parliament released its report Inquiry into Local Economic Development Initiatives in Victoria. The report concluded that local government is well placed to drive local economic development because of its proximity to the community, local businesses and organisations. However, it found a range of barriers including issues with the Victorian planning system, occupational health and safety compliance issues, a lack of access to skilled workers, ineffective regional collaboration, and insufficient engagement with the private sector. The inquiry found that few local councils have adopted an integrated, whole‑of‑government approach to economic development.

The report made 43 recommendations, including:

- clarifying the roles of government, the private sector and the community in economic development

- promoting and strengthening collaboration and partnerships

- improving investment attraction and the regulatory environment.

Regional Economic Development and Services Review, 2015

In February 2015, the Minister for Regional Development announced a review of DEDJTR's regional economic development strategy and service delivery model. The aim of the Regional Economic Development and Services Review was to identify best practice, evidence-based policy directions to foster regional growth and job creation.

The review developed a new approach to regional governance and service delivery and recommended a new approach to regional development. In response to the review, the government established regional partnerships to increase collaboration between communities, industry, businesses and government. It also recommended 48 policy reforms across transport and planning, industry and innovation, trade and investment, education and skills, and regulation.

1.5 Why this audit is important

Local economic viability and sustainability affects Victorian communities and their wellbeing. Given the important role of local government in facilitating economic development, this audit aims to assist councils and, in turn, their communities by identifying areas for improvement and sharing examples of better practice.

1.6 What this audit examined and how

We assessed whether councils' economic development activities improve the economic viability and sustainability of their municipalities. Specifically, we assessed whether councils' actions to improve economic viability and sustainability are strategic and achieve their intended outcomes. We also assessed the role agencies like RDV and LGV play in providing guidance and support to the local government sector.

Our preliminary analysis, which drew on multiple indicators of economic development, identified economic sustainability and capacity risks in large and small shire councils. The analysis also identified accelerated growth risks for interface councils—the 10 councils surrounding metropolitan Melbourne. We chose five councils to include in this audit that either did well or poorly on the key indicators:

- Bass Coast

- Corangamite

- Loddon

- Melton

- Southern Grampians.

We visited each council and met with members of the council's economic development team and a selection of internal and external partners, including RDV regional offices. We consulted with a range of stakeholders, including industry groups, peak bodies and business owners in each area. We also examined supporting documentation such as economic assessment material, guidelines, strategies, action plans, monitoring reports and available data.

We conducted our audit in accordance with Section 15 of the Audit Act 1994 and ASAE 3500 Performance Engagements. We complied with the independence and other relevant ethical requirements related to assurance engagements. The cost of this audit was $570 000.

1.7 Report Structure

The remainder of this report is structured as follows:

- Part 2 examines whether councils create the conditions for economic development

- Part 3 examines the outcomes of council actions to improve economic viability and sustainability.

2 Creating the conditions for local economic development

Local governments play a key role in facilitating economic development by attracting businesses and residents to municipalities. They aim to achieve this through strategic long-term actions and plans.

This part of the report focuses on whether the audited councils are creating the conditions for local economic development. We examine whether councils are strategically planning for local economic development and working collectively with strategic partners.

2.1 Conclusion

Overall, the audited councils strategically plan their local economic development activities and actively collaborate with relevant stakeholders. They have developed effective local economic development strategies. These strategies reflect available information, reference regional priorities and provide adequate resources for councils' economic development functions. Councils effectively engage with stakeholders who can influence economic development at the local level.

Councils face barriers to effectively implementing strategic land use planning to create conditions for economic development because of the competing priorities of other agencies, such as providers of utility infrastructure and roads.

2.2 Local economic development

Each community has unique local conditions that affect its economic development. Local conditions influence how attractive an area is to businesses, workers and supporting institutions.

To best respond to these conditions, communities need to build and implement a tailored local economic development strategy. Building a strong local economy through a collaborative, strategically planned process requires councils to understand and act upon their municipalities' strengths, weaknesses, opportunities and threats.

Integrated local economic development

The 2013 Inquiry into Local Economic Development Initiatives in Victoria recommended that all local councils implement economic development strategies with clear aims and measurable outcomes.

Figure 2A shows the local government sustainable planning and accountability framework based on the council planning requirements and the key local plans and strategies that guide councils' local economic development activities.

Figure 2A

Sustainable planning and accountability framework

Note: Legislative planning requirements of the Local Government Act 1989 are in orange.

Note: In 2017, the government amended the State Planning Policy Framework to recognise regional partnerships, with the regional growth plan for each partnership group included in the framework.

Source: VAGO.

The World Bank's local economic development guidance recommends that councils strategically plan, implement and review local economic development. Figure 2B shows this process.

Figure 2B

Local economic development process map

Source: VAGO, using the World Bank's Local Economic Development guidance.

This part of the report discusses the first four steps of this process. We examine the implementation and review of the audited councils' local economic development strategies in the next part of this report.

2.3 Establishing management teams

To effectively design and develop a local economic development strategy, councils need to assign responsibility for economic development. Various actions by different business units will also have an impact on the economic development outcomes of councils.

All audited councils have established teams who are responsible for economic development. Most teams also had responsibility for other related functions, such as events, tourism and agriculture.

We found some economic development actions were a shared responsibility with other business units within the council. Based on council size and our assessment, the number of staff assigned to economic development teams was reasonable.

We found councils use varying governance structures to set up their economic development function. The case studies in Figures 2C and 2D show councils' use of innovative governance structures and management support to resource economic development planning and activities.

Figure 2C

Case study: Creating cross-council groups to support economic development

|

Southern Grampians established an Integrated Planning and Design Group, which meets on a quarterly basis to discuss progress and issues with any major development projects, including discussions held with referral agency partners. The group consists of team members from the economic development, planning, infrastructure, recreation and community access teams. To improve planning and coordination, the economic development and planning teams are located within the same directorate. Strategic partners advised that the process has improved the efficiency of the overall development approval process—which is a key enabler for economic development. |

Source: VAGO, based on information provided by Southern Grampians.

Figure 2D

Case study: Creating governance structures to support economic development

|

In 2010, Melton recognised the need for a different approach to economic development planning and established a new internal governance structure—the Business Growth and Sustainability Unit. Melton also established a Planning and Assessment Committee to provide direction to council on the promotion and sale of land within key business and industrial areas. Since then, the council has grown from a large shire to a city council. As a result, responsibility for economic development moved to the council's Engagement and Advocacy Unit. This demonstrates that the council's governance structure has responded to a period of significant population growth. |

Source: VAGO, based on information provided by Melton.

2.4 Developing partnership networks

Effectively coordinating with stakeholders

Councils need to:

- identify the people and groups with interests in the local economy

- identify the skills and resources that each group brings

- establish collaborative working relationships and supporting structures.

The audited councils all identified internal and external stakeholders. Some examples are shown in Figure 2E.

Figure 2E

Examples of internal and external stakeholders for local economic development

|

Internal stakeholders |

External stakeholders |

|---|---|

|

|

Source: VAGO, based on information provided by audited councils.

All audited councils consulted with local business operators and representative bodies in planning their economic development strategy. Methods included visiting business premises, surveys, workshops, information sessions and email requests for feedback. Councillors also attended workshops and provided feedback on the development of the strategy. There was evidence of robust engagement with all relevant stakeholders at the local level.

Figure 2F is an example of a strategic partnership that Bass Coast established to address an identified challenge and priority area in the municipality.

Figure 2F

Case study: Establishing strategic partnerships

|

Bass Coast identified education as a key challenge to future economic sustainability. The percentage of 15–19 year olds not engaged in school or employment in Bass Coast was 7.18 according to the last Census, compared to the state average of 5.31 per cent. This is despite the council having higher than average rates of economic and population growth. One of the economic development performance measures in Bass Coast's economic development strategy is a reduction in the unemployment rate. The council developed the Bass Coast Shire Council Education Plan 2013–17, which aimed to promote sustainable relationships between education providers, local business, industry and the community. The plan includes the development of an education precinct in Wonthaggi. Bass Coast advised that the state government has now agreed to fund this precinct. The council's Education Reference Group, comprising schools, youth services, businesses, community groups, government agencies, sporting clubs and registered training organisations, is driving the education plan. The Bass Coast economic development team also participates in this reference group. |

Source: VAGO, based on information provided by Bass Coast.

Planning applications are often the first trigger of local economic development. As part of the planning application process, identifying strategic partners is an important step in progressing new developments and creating conditions for economic development.

All audited councils undertake meetings with potential developers and investors before they submit planning applications. These meetings with strategic partners addressed the issues, risks and opportunities of developments, and identified other potential agencies for councils to consult. These meetings were effective and provided an avenue for all relevant parties to discuss the proposal, making the application process more efficient.

Making strategic partnerships a local priority

The Regional Statement identifies the need for effective collaboration through regional partnerships to achieve shared goals.

Using partnerships strategically to capitalise on regional strengths and jointly address shared challenges can be an effective way for councils to support achievement of their strategic objectives for economic development. This can also strengthen their ability to secure available funding.

All five audited councils identified the need to collaborate with strategic partners in their economic development strategies. For example, Loddon has included actions to collaborate with neighbouring councils to develop a settlement strategy to capitalise on growth in a neighbouring council.

The nine recently formed regional partnerships should provide additional avenues for councils to engage with strategic partners. At the time of this audit, it was too early to assess the effectiveness of these partnerships. Assessing the effectiveness of these partnerships in supporting economic development activities will help stakeholders understand whether the partnerships are achieving their intended objectives.

2.5 Creating an economic development strategy

Economic development strategies

The Act defines 'strategic objectives' as the outcomes a council is seeking to achieve over the next four years. These must be included in the council plan. The Act does not mandate the development of an economic development strategy, but it does require the development of strategies to achieve the council plan.

Economic development as a strategic objective of councils

All the audited councils realise the significance of local economic development and identify economic development as a strategic objective in their 2013–17 council plans, as shown in Figure 2G.

Figure 2G

Audited councils' themes and strategic objectives for economic development

|

Council |

Themes/strategic objectives for economic development |

|---|---|

|

Bass Coast |

Economic development—our economy is supported by diverse, local and innovative businesses and employment. |

|

Corangamite |

Positioning for economic growth—grow population and support expansion of agriculture and tourism sectors. |

|

Loddon |

Grow and diversify our economy—attract investment that introduces new industries, presents opportunity for existing businesses and grows our working population. |

|

Melton |

Managing our growth—generate an innovative local economy that stimulates opportunities for investment, business and training. |

|

Southern Grampians |

Foster population and economic growth—strong economic performance and an innovative tourism sector. |

Source: VAGO, based on audited councils' 2013–17 council plans.

To achieve their council plan's strategic objectives for economic development, the audited councils listed supporting strategies, actions and performance measures.

Key elements of a local economic development strategy

The key elements required to create an effective local economic development strategy are:

- vision—agreed economic future for the community

- goals—priority areas and desired outcomes to achieve the vision

- objectives—set performance standards and targets that are time bound and measurable

- programs—collective projects to achieve goals and objectives

- projects and action plans—that describe specific program components that are prioritised, costed, time bound and measurable.

We assessed the economic development strategies of the audited councils against the key elements. The audited councils incorporated all the key elements, except one council, which was missing only one element, as shown in Figure 2H.

Figure 2H

Key elements in audited councils' economic development strategies

|

Council |

Vision |

Goals |

Objectives |

Programs |

Projects and action plans |

|---|---|---|---|---|---|

|

Bass Coast |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Corangamite |

✘ |

✔ |

✔ |

✔ |

✔ |

|

Loddon |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Melton |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Southern Grampians |

✔ |

✔ |

✔ |

✔ |

✔ |

Source: VAGO.

Integrating regional priorities

In collaboration with RDA, RDV has developed regional strategic plans that cover the nine broad RDA regions across Victoria—five regional and four metropolitan. These plans outline the priorities for each region.

Councils need to align their economic development strategies with the government's regional and state priorities if they are to compete for resources —this is a requirement of grant funding from agencies, such as RDV.

All the audited councils met this requirement.

Assessing local economic conditions

Councils need an effective local economy assessment to ensure their economic development strategy creates jobs, spurs economic growth and fosters social development.

Data collection is the first step in an economic assessment, followed by a robust analysis of the relevant data. This includes assessing local strengths and weaknesses to identify opportunities and challenges. The analysis helps create a clear economic development vision and allows prioritisation of activities.

Access to data for informing local economic development

Councils rely on multiple data sources when planning economic development actions and outcomes. Councils use sufficient and appropriate national and state level data to inform their economic development activities. However, there is room for improvement, especially in collecting data at the municipality level.

Council capacity and resources can restrict data collection and analysis. The smaller councils find it more difficult to collect all the relevant data. Southern Grampians also advised that there is a need for consistent interpretation of the available data to ensure all councils use information in a similar way.

Economic data

RDV hosts an information portal on its website, which includes economic data for each local government area. The audited councils were either unaware of the information portal or did not use it. While most of the underlying datasets are available from other sources like the Australian Bureau of Statistics, councils should take advantage of RDV's efforts to collate and present the data. RDV and councils need to work towards using consistent information across the Victorian local government sector.

At the time of the audit, four of the five audited councils subscribed to economic modelling software. They used various economic modelling programs to analyse and interpret data, and to produce supply-chain reports and impact modelling. However, the smallest council in our sample, Loddon, found such software to be too expensive for its needs. Close to the conclusion of our audit, Loddon advised that it has also recently subscribed to an economic modelling software.

As part of our fieldwork, we observed one council apply its economic modelling software to assess a proposal for the construction of a new secondary school. The modelling report was informative and showed the:

- projected number of jobs that the project would create

- industry sectors that these jobs would be in

- flow-on effect for other sectors in the supply chain.

Business activity data

Business activity data is a key information source of local economic activity. Councils access the ABR for business registration data. The audited councils and the Economic Development Australia Victorian State Practitioners Network have raised issues with the usefulness of this data as it requires extensive filtering and data cleansing. The data includes shelf companies and superannuation funds that are not trading entities. Lack of reliable data—especially of actual ongoing businesses—affects the planning and monitoring of economic development. Councils use their own stakeholder networks to work around these challenges.

In 2013, LGV, in consultation with local councils, established economic development indicators for councils as part of the Local Government Performance Reporting Framework (LGPRF). LGV advises that, as economic development is a complex area of activity with many externalities, the indicators are optional and indicative only. Councils use ABR data to report on three of the four indicators in the LGPRF. While these indicators are optional, the limitations of the ABR data highlight potential issues with the robustness of performance reporting to LGV.

In 2015, the Economic Development Australia Victorian State Practitioners Network surveyed its members to understand the performance measures utilised by local government economic development practitioners and to test the LGPRF's proposed performance measures. Forty-one councils responded and the majority reported that using ABR data as a measure of business activity and council's economic development performance was poor or meaningless.

LGV is working with the Economic Development Australia Victorian State Practitioners Network to identify better data sources and indicators to measure councils' economic development performance.

Assessing strengths and weaknesses

Some strategic theoretical frameworks are available to councils to help them undertake effective economic assessments and understand their competitive advantages relative to other councils. Competitive advantages are conditions that allow a municipality to produce goods or services at a lower price or in a more desirable fashion for the community.

Strategic frameworks that councils use to assess their economic context include:

- competitive advantage analysis

- problems or issues analysis

- SWOT—Strengths, Weaknesses, Opportunities and Threats—analysis.

Four of the audited councils outsourced their local economic assessments because of the skill and time required to complete them. Bass Coast developed an effective economic development strategy in-house that had a clearly articulated vision and provided strategic direction for key areas of economic development.

The breadth of the economic assessments were appropriate for the size and complexity of the councils, but there were some areas for improvement. For example, there was limited analysis of how each municipality performed relative to other municipalities, or whether they produced specific goods and services more efficiently or desirably than other municipalities.

We found that councils generally focused on their strengths while planning for economic development, to capitalise on local conditions. For example, Southern Grampians and Loddon both identified a need to focus on agriculture as part of their most recent council plans. To facilitate this, both councils appointed an agribusiness specialist. In the final stages of the audit, Loddon advised that the role is now vacant due to budgetary constraints and council's assessment of its future direction.

2.6 Barriers to economic development

World Bank guidance on local economic development states that municipalities should improve the processes and procedures, and remove the expensive complex regulations, that impact businesses. This will improve the investment climate and make the municipality more appealing to businesses.

The Treasurer of Victoria asked the Victorian Red Tape Commissioner to consult with stakeholders in regional Victoria in 2016. The Commissioner identified red tape issues with the Planning Scheme Amendment approval process, some of which are also significant barriers to economic development:

- Council and referral authorities are not adhering to statutory time lines for determining planning applications.

- Relevant authorities have little regard for, and appreciation of, the commercial implications of poor process, especially regarding the costs, delays and rework imposed on businesses.

- Businesses experience a one-size-fits-all process, with little difference in treatment between simple and complex matters.

The state government is planning to address these issues through its Smart Planning program, a two-year initiative it launched in mid-2016 that aims to remove significant barriers to growth in regional Victoria.

Strategic land use planning

Strategic land use planning is a critical foundation for local economic development. Councils face three main land use barriers to local economic development.

Lack of public utility infrastructure

While councils can create the conditions for economic development, they rely on strategic partners to plan and fund public infrastructure like water and sewerage services, roads and electricity. The cost of such public infrastructure is significant. The councils rely on private investors and referral agencies, such as VicRoads, Parks Victoria, catchment management authorities, the Environmental Protection Authority and water corporations.

Councils advised that they are not able to progress developments if the referral agencies have competing priorities when it comes to the timing of public infrastructure delivery. RDV and councils advised that the referral agencies might agree to supply the infrastructure ahead of time, but at a higher cost. This puts rural councils in particular at a disadvantage, because the costs of the project could become too high.

There is an opportunity here for improved communication and more collaboration between councils and referral agencies. Regional partnership arrangements provide the opportunity for key strategic partners to collaborate on regional priorities. However, there is currently limited involvement from referral authorities in these.

Extended time frames for development approvals

Consistent with the Victorian Red Tape Commissioner's findings, council staff and stakeholders reported that the time taken to get feedback or approval from referral agencies on proposed developments is a problem. For some projects, councils may be required to seek feedback from 10 or more referral agencies, which can take considerable time.

Lengthy planning approval processes deter investors from committing to investments. One key issue delaying approval processes is that domestic planning applications—for example, a shed in a backyard—and economically significant local projects are subject to the same planning processes.

There are limited fast-track processes available to shorten approval time frames. The Geelong and Latrobe Valley Authorities—regional planning bodies that the government established in response to declining economic conditions— introduced some arrangements to fast-track development applications. In addition, DELWP expedites some low-risk planning permit applications through VicSmart, which is a more streamlined assessment process. When an application qualifies for VicSmart, councils must make a determination within 10 business days. However, VicSmart does not capture all simple proposals and is not well integrated into the planning system. The state government's Smart Planningprogram aims to address planning delays as well as improve and broaden VicSmart.

Figure 2I and 2J provide case studies of some challenges that councils face in pursuing economic development initiatives.

Figure 2I

Case study: Shipwreck Coast Master Plan

|

Parks Victoria's Shipwreck Coast Master Plan (SCMP) aims to promote sustainable tourism on the Shipwreck Coast, a 28-kilometre stretch along the state's south-west coast that includes the Twelve Apostles. The implementation of the SCMP, for which Corangamite is a project partner, demonstrates how relying on referral agencies and extended approvals processes can delay economic development in local government areas. The SCMP provides a strategic plan for the future economic development of Corangamite by improving infrastructure and visitor accommodation. A 2010 Tourism Opportunity Study showed that 85 per cent of visitors to Corangamite did not stay overnight, partly due to a lack of available accommodation. In 2011, a council review identified opportunities to develop accommodation in the region but noted that the planning framework was a potential barrier to this. After the release of the SCMP in 2015, the Minister for Environment announced an immediate investment in the area with a partnership between Parks Victoria and Wannon Water to build a $4.4 million sewer pipeline—to connect the visitor site at the Twelve Apostles to Wannon Water's sewage treatment facilities at Port Campbell. Although Parks Victoria and Wannon Water have progressed planning for the project, construction of the sewer pipeline has not yet commenced. In 2016, an investor proposed an eco-tourism resort at Princetown, a site that the SCMP identified for development. Outcomes expected from the development include 21 jobs during construction and 78 ongoing jobs once operational. The council has issued a conditional planning permit for the proposal. However, at the time of this report, the proposal was yet to obtain a works approval from the Environment Protection Authority in relation to on‑site waste treatment. |

Source: VAGO, based on information from Corangamite.

Figure 2J

Case study: Hamilton Structure Plan

|

The Southern Grampians' Hamilton Structure Plan, finalised in 2011, plans for future growth in Hamilton. It is an example of a council liaising effectively with a referral agency. For rural councils, a lack of available reticulated sewerage is a barrier to attracting investors. For example, a cafe relying on septic tanks may need to limit its seating due to planning restrictions, making the business unviable. However, the council is dependent on a referral authority to resolve these issues. Wannon Water, not Southern Grampians, is responsible for developing plans to connect residents and businesses to the sewerage system. When developing the Hamilton Structure Plan Southern Grampians sought input from community and business groups as well as government and sector agencies, including Wannon Water. The council advises that the plan will allow Wannon Water to better plan where to place sewerage infrastructure in Hamilton. |

Source: VAGO, based on information from Southern Grampians.

3 Improving economic viability and sustainability

The Act states that the primary objective of a council is to endeavour to achieve the best long-term outcomes for the local community, including by:

- promoting the social, economic and environmental viability and sustainability of the municipal district

- ensuring that resources are used efficiently and effectively

- promoting appropriate business and employment opportunities.

This part of the report assesses whether councils are implementing and reviewing their economic development strategy and whether council actions are achieving their intended outcomes.

3.1 Conclusion

Councils have dedicated significant resources and undertaken many actions to implement and review their economic development strategies. However, the four-year council plans are at odds with the longer-term economic development strategies. This often results in poorly aligned and changing priorities.

Economic development in rural and smaller councils is dependent on state government grants. The lack of staff skilled in developing robust business cases has resulted in rural councils failing to secure available grants. This has resulted in missed opportunities for economic development in these areas.

Councils have sufficient strategic performance measures for economic development in their economic development strategies and council plans, but these lack targets and benchmarks. Councils monitor and report on project actions, but as these do not link to strategic performance measures, they do not allow councils to measure their progress against their strategic economic development outcomes.

3.2 Implementing the local economic development strategy

In Part 2 of this report we discussed the first four steps of the World Bank's local economic development process, which focuses on strategic planning. The final two steps in the process are highlighted in Figure 3A.

Figure 3A

Local economic development process map

Source: VAGO, using the World Bank's Local Economic Development guidance.

Implementing the local economic development strategy requires councils to identify and allocate the resources—financial and human—needed to support its delivery, and to develop individual project action plans.

Funding economic development actions

We examined the economic development budgets for the five audited councils, and found that the budgets mostly comprise funding for business support activities including:

- financial support for business and tourism associations

- festivals and other tourism support events

- conferences and field days

- workshops and training

- marketing and promotional materials.

In rural councils, economic development budgets also provide for the management of saleyards, airports and caravan parks.

Councils prioritise budgets based on their municipality's identified strengths. For example, Bass Coast identifies tourism as its key strength and allocates the majority of its economic development budget to deliver its tourism and events activities. These include:

- working with event partners

- supporting regional tourism boards

- providing grants to facilitate events

- operating visitor information centres.

Expenditure on economic development

Councils have different structures for categorising economic development activities and expenditure. For example, some councils' economic development expenditure includes tourism expenditure, while others do not. It is therefore difficult to identify exactly how much councils spend on economic development.

VGC allocates financial assistance grants from the Federal Government to local councils in Victoria. To do this, VGC collects data from a range of sources, including directly from councils.

Lack of consistent data for economic development expenditure, across audited councils, resulted in the audit team relying on VGC data on business and economic services as a proxy.

According to VGC data, in 2015–16, Victorian councils spent $866 million on business and economic services including:

- community development and planning

- building control

- tourism and area promotion

- community amenities

- non-road transport (for example, ferries)

- markets and saleyards

- administration of mining and manufacturing industries

- business undertakings (for example, management of industrial estates, commercial properties and businesses).

Our analysis of the VGC data indicates that in 2015–16, councils spent an average of 9.3 per cent of their total expenditure on business and economic services. Melbourne City Council spent 50.6 per cent of its total expenditure on these services, which was the highest of any council. The majority of councils—62 out of 79—spent between 6 and 12 per cent, and the audited councils spent between 6 and 10 per cent of their total expenditure, as shown in Figure 3B.

Figure 3B

Expenditure on business and economic services for audited councils, 2015–16

|

Council |

Business and economic services total expenditure ($m) |

Percentage of total council expenditure (%) |

|---|---|---|

|

Southern Grampians |

3.8 |

9.78 |

|

Bass Coast |

6.77 |

9.55 |

|

Corangamite |

3.03 |

7.63 |

|

Loddon |

1.86 |

7.00 |

|

Melton |

8.28 |

6.38 |

Source: VGC.

The expenditure above does not account for any revenue that councils receive as part of their economic development activities—such as income generated by Southern Grampians in operating their saleyards. Inclusion of such revenue is likely to reduce net expenditure on economic development.

Without actual comparable data, it is difficult to ascertain whether this expenditure is sufficient. Based on our site visits, interviews and discussions with councils and stakeholders it is clear that economic development is high on councils' agenda and councils actively allocate resources towards it.

Accessing regional funding opportunities

One of the opportunities that exists for regional councils to promote economic development in their municipality is to access funds from the RJIF. The RJIF, administered by RDV, is the Victorian Government's overarching regional development package. It focuses on major projects, employment and communities. There are three streams within RJIF:

- RIF

- Regional Jobs Fund

- Stronger Regional Communities Plan.

By 31 December 2017, the RJIF had contributed $317.6 million towards 467 projects in regional city and rural councils. Of these, 265 projects were in rural councils. Figure 3C shows RJIF funding, by the nine regional partnership groupings.

Figure 3C

Approved RJIF grants by regional partnership, 31 December 2017

Note: The RJIF was officially launched in July 2015.

Source: VAGO, using information from RDV.

Each partnership group includes at least one regional city. Collectively, Ballarat City Council and Geelong City Council received 47 per cent of the RJIF allocation to regional and rural councils.

Figure 3D provides a case study showing how councils can use grant funding to support economic development.

Figure 3D

Case study: Using grant funding to facilitate economic development

|

In 2016, Bass Coast received $160 000 in funding from the RDV Planning for Growth initiative. The purpose of the funding was to undertake strategic planning for Wonthaggi. This funding enabled the council to:

The funding facilitated economic development and resulted in positive outcomes for the community which included:

|

Source: VAGO, based on information provided by Bass Coast.

Failing to take advantage of available funding

One of the three RJIF streams is the RIF. The RIF invests in major infrastructure projects to create or enhance the conditions for economic growth in regional Victoria and build diversified, resilient and sustainable regional economies. The RIF provides funding under four program streams:

- visitor economy

- productive and liveable cities and centres

- enabling infrastructure

- rural development.

As part of its 2014 election commitments, the Victorian Government committed $100 million in RIF funding to regional cities and $70 million in RIF funding to rural councils. By December 2017, only $30 million of the rural council allocation was committed, and $24.3 million worth of projects were in varying stages of approval. In contrast, regional cities have accessed all of their allocated RIF funding.

For the four rural councils in this audit, RDV identified $8.5 million in grants for which councils had either not applied, or had applied but failed to meet the funding criteria as of December 2017. This was for 40 potential projects valued at more than $46.5 million.

RDV is working to identify the reasons why some councils do not apply for grants, and why applications often fail to meet the criteria. Most of the audited councils and RDV suggest that a lack of staff with skills and experience in developing business cases is a possible factor. However, Southern Grampians advises that inadequate and delayed feedback from RDV is another reason for the under‑utilisation of grants.

While RDV is willing to assist councils in determining the most appropriate funding stream to meet their project requirements, RDV considers that it is councils' responsibility to make sure they sufficiently resource and position themselves to compete for project funding.

Staff capacity and capability

Having sufficient and appropriately trained staff is important for an effective economic development strategy and enables councils to better access available grants.

In all audited councils, there were dedicated economic development staff. The number of staff varied based on the size of the councils. For example, Loddon—the smallest council in our sample—had fewer than two full-time-equivalent team members responsible for economic development.

Economic development staff undertook varied learning and development activities. Most of the councils had accessed courses or training provided by:

- the Municipal Association of Victoria

- Economic Development Australia

- Rural Councils Victoria.

Regional teams also attended industry sector conferences, the Regional Living Expo and agribusiness-related field days and events.

Skills based training was less evident in economic development staff learning and development plans. As discussed earlier, a lack of appropriate skills or resources means most of the audited councils have outsourced the formulation of their economic development strategies. Only two of the five councils had sent teams on business case writing workshops. However, we did find that three of the five councils had supported staff to complete business degrees.

LGV works in partnership with the local government sector to improve business and governance practices. Considering LGV's sector-wide view of local governments, it should consider ways of providing further guidance to councils to improve their economic development activities, including staff development in this area. Similarly, RDV's role in regional economic development means it is well placed to provide support and guidance to councils to improve their economic development activities.

3.3 Innovative approaches to economic development