Managing the Municipal and Industrial Landfill Levy

Overview

The Municipal and Industrial Landfill Levy (MILL) and its distribution plays an important role in minimising the environmental impacts of waste and in promoting investment in alternatives to landfills. It was established in 1992 to encourage recycling by putting a price on every tonne of waste that goes to landfill.

These proceeds are used first to fund core activities of environmental agencies, with the remaining balance transferred to the Sustainability Fund (the fund). Payments from the fund can only be made to foster:

- environmentally sustainable uses of resources and best practices in waste management

- community action or innovation in relation to the reduction of greenhouse gas substance emissions, or adaptation or adjustment to climate change in Victoria.

This audit provides an independent assessment of, and insights into, whether the landfill levy system is being managed transparently and is meeting its intended legislative objectives. We focused on the financial management of the MILL and the fund, processes for prioritising and selecting programs funded from the fund, project management and outcomes of funding.

We audited five agencies involved with the collection of the MILL, administration of the fund and/or that are recipients of its funding:

- Department of Environment, Land, Water and Planning (DELWP)

- Environment Protection Authority

- Sustainability Victoria

- Metropolitan Waste and Resource Recovery Group

- Gippsland Waste and Resource Recovery Group.

We made 14 recommendations for DELWP in this audit.

Transmittal letter

Ordered to be published

VICTORIAN GOVERNMENT PRINTER July 2018

PP No 421, Session 2014–18

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Managing the Municipal and Industrial Landfill Levy.

Yours faithfully

Andrew Greaves

Auditor-General

25 July 2018

Acronyms and abbreviations

| CES | Commissioner for Environmental Sustainability |

| committee | Sustainability Fund Committee |

| CPI | Consumer Price Index |

| DELWP | Department of Environment, Land, Water and Planning |

| DHHS | Department of Health and Human Services |

| DPC | Department of Premier and Cabinet |

| DTF | Department of Treasury and Finance |

| EPA | Environment Protection Authority |

| ERSC | Expenditure Review Sub-Committee |

| FMA | Financial Management Act 1994 |

| FPSC | Finance and Performance Sub-Committee |

| fund | Sustainability Fund |

| GEMS | Global Engagement Management System |

| Guidelines | Sustainability Fund Guidelines |

| GWRRG | Gippsland Waste and Resource Recovery Group |

| MAC | Ministerial Advisory Committee |

| MILL | Municipal and Industrial Landfill Levy |

| minister | Minister for Energy, Environment and Climate Change |

| MoU | memorandum of understanding |

| MWRRG | Metropolitan Waste and Resource Recovery Group |

| PV | Parks Victoria |

| RFP | request for payment |

| SET | senior executive team |

| SFIP | Sustainability Fund Investment Policy |

| SV | Sustainability Victoria |

| SWRRIP | Statewide Waste and Resource Recovery Infrastructure Plan |

| TCV | Treasury Corporation of Victoria |

| team | Sustainability Fund team |

| VAGO | Victorian Auditor-General's Office |

| VFMC | Victorian Funds Management Corporation |

| VGSO | Victorian Government Solicitor's Office |

| WRRG | waste and resource recovery group |

| WS | PIDC Water Sector Productivity Inter-Departmental Committee |

Audit overview

|

A hypothecated trust account holds money collected from a specific levy for a particular purpose. Such accounts form part of the Trust Fund under section 19 of the Financial Management Act 1994. |

Since 1992, Victorians have been paying the Municipal and Industrial Landfill Levy (MILL) when they dispose of waste to landfill. The levy aims to encourage recycling by putting a price on every tonne of waste that goes to landfill.

Since 2005, approximately $1.7 billion has been collected through the levy. These proceeds are used first to fund core activities of environmental agencies, with the balance being transferred to the Sustainability Fund (the fund) that was established in 2005.

The fund was established under section 70 of the Environment Protection Act 1970 (the Act). It is a hypothecated trust account and as such under the Act, payments from the fund can be made only for the purposes of fostering:

- environmentally sustainable uses of resources and best practices in waste management

- community action or innovation in relation to the reduction of greenhouse gas substance emissions, or adaptation or adjustment to climate change in Victoria.

Good financial management and transparency is particularly important for trust account expenditure.

The Department of Environment, Land, Water and Planning (DELWP) administers the fund and provides support to the Sustainability Fund Committee (the committee) set up by the Minister for Energy, Environment and Climate Change (the minister) to support the strategic and accountable management of these trust monies. The Sustainability Fund team (the team) —established within the Finance and Planning division of DELWP —provides secretariat support to the committee, along with finance and administration support for the MILL and the fund.

|

Throughout the report we refer to 'proposals' to describe what the committee provides advice on, 'programs' to describe what the minister and Premier ultimately approve and then 'projects' to refer to project management after their approval and once funding agreements have been established. |

The committee's role is to provide impartial, strategic advice to the minister regarding allocations from the fund. Consent from both the Premier and the minister is required before money is committed to a project designed to pursue one of the fund's legislative purposes.

Fund recipients are responsible for the delivery of projects.

We audited five agencies that are involved with the collection of the MILL, administration of the fund and/or are recipients of its funding:

- DELWP

- Environment Protection Authority (EPA)

- Sustainability Victoria (SV)

- Metropolitan Waste and Resource Recovery Group (MWRRG)

- Gippsland Waste and Resource Recovery Group (GWRRG).

We focused on the financial management of the MILL and the fund, processes for prioritising and selecting programs funded from the fund, project management and outcomes of funding.

Conclusion

While we found that MILL distributions to environmental agencies and the transfer of the remaining balance to the fund accord with the Act, there is a potential risk that the MILL, and the fund, are not always used for their intended purposes, and that activities that receive fund monies are not achieving the legislative objectives of better waste management, reduced greenhouse gases or effective adaptations to climate change. This is because:

- there is no process to ensure that agencies that receive MILL funding under section 70E(3)(d) of the Act spend this money in line with legislative objectives

- committee advice to government on the eligibility and merit of proposals to fund is incomplete and inconsistent, limiting the ability of the minister to make informed decisions that allow full comparison between competing proposals

- the construct of the committee, which includes senior staff of DELWP —the main funding beneficiary —creates an inherent conflict of interest

- the lack of a formal process to ensure the committee considers proposals by departments other than DELWP, or that change significantly after feedback from the Expenditure Review Sub-Committee (ERSC), means proposals can bypass the requirement for committee assessment, as occurred in 2017–18

- there is a significant lack of evaluation of funded activities and public reporting on fund outcomes.

DELWP recognises these design and implementation issues and has taken steps to resolve them, such as ensuring all 2018–19 proposals to the fund received committee appraisal; establishing an evaluation framework; and releasing an activity report in May 2018 and committing to its annual publication. The minister has also recently approved changing the membership of the committee to make it fully independent.

These developments if sustained will help foster greater public trust and confidence in the rationale for the fund and the ability of DELWP to administer it effectively.

However, a significant proportion of funds have remained unspent over many years, representing an opportunity cost. The 2016–17 and 2017–18 State Budget (Budget) commitments will only reduce the balance of the fund in the short term. If the situation persists, where significant fund balances remain unspent over extended periods, the public may by extension, reasonably question the quantum of the charge on every tonne of waste that goes to landfill.

Findings

Fund balances

As at 31 December 2017, the balance of the fund was $562 million. DELWP expects this to be $513 million by 30 June 2018. The balance of the fund was $29 million in 2009–10. As noted below, actual and budgeted expenditure has significantly increased over the past two years, however, the balance of the fund is predicted to remain high. To date, government has made no public commitment, nor outlined a strategy or target to reduce this balance.

Since 2009, $401 million has been distributed from the fund —48 per cent of the $829 million that has been transferred into it over this period. Figure A shows the growth of the fund since 2009 compared to the total of MILL income raised.

Figure A

MILL income compared with fund growth

Source: VAGO.

MILL distributions

Over the past three years, MILL payments to environmental agencies have increased by 71 per cent —from $76.1 million in 2015–16 to a forecasted $130.5 million in 2017–18. This increase is primarily due to EPA reform funding. Over the next four years, the MILL is expected to collect approximately $215 million a year.

The minister determines the amount to be paid, the timing of payments and period over which they apply. Increasing direct payments from the MILL reduces the amount transferred into the fund.

In 2014, the Act was changed to include section 70E(3)(d). This allows public entities, in addition to those identified in section 70E(3), to be funded from the MILL for 'environment assessment, protection, restoration or improvement purposes'. Funding under this section of the Act increased from $5.9 million in 2015–16 to $24 million in 2017–18, with Parks Victoria (PV) being the primary recipient.

Currently DELWP policy areas suggest to the minister possible programs to be funded under this provision. There are currently no guidelines or governance processes to inform or evaluate the use of this funding from the MILL and to ensure it meets the conditions of section 70E(3)(d). Although the 22 committees of management that receive funding under section 70E(3)(d) provide financial acquittals to DELWP, PV and the Commissioner for Environmental Sustainability (CES) do not —despite accounting for over 95 per cent of the expenditure under this provision. Where the team has concerns about the alignment of a distribution it has sought legal advice. However, it has no formal responsibility to oversee these distributions. Monies paid from the MILL under this provision are not consistently subject to a financial acquittal, meaning most agencies are not required to demonstrate whether they use these funds for the specific purpose provided.

Fund program expenditure

Fund distributions have varied over time depending on government policy and priorities. Over the past two years, budget commitments from the fund have been at their highest levels since the fund was established.

Government distributed $52 million from the fund in 2016–17 and committed to spend $152 million in 2017–18. The 2017–18 Budget provides for fund expenditure of $439 million in new funding over five years between 2016–17 and 2020–21. However, the government has recently announced an allocation of only $32.7 million from the fund in its 2018–19 Budget.

The government established the MILL to incentivise waste resource recovery and reprocessing and put a price on every tonne of waste that goes into landfill. At that time the fund was designed to fund programs that foster best practices in waste management. China's recent restriction on recycling material highlights the need for the government to consider how best to address this issue. In February 2018, the Victorian Government announced a $13 million support package for councils and industry affected by this issue. The government intends to resource this from the fund.

Investment and administration

DELWP has minimised administrative overheads and maximised returns on the cash balance of the fund.

DELWP investment of the cash balance of the fund is consistent with government legislation and policies. DELWP uses the Sustainability Fund Investment Policy (SFIP) to guide its investment decisions. Investment returns are consistent with expectations and interest earnings are retained within the fund.

The cost of administering the scheme has remained constant despite a significant increase in the work associated with this role. The activity of the team and committee has increased as the value and number of programs approved for funding from the fund has gone up. The administrative budget has not significantly changed for several years —it has remained at $0.8 million.

Role of the committee

The committee plays an important role assessing proposals seeking monies from the fund. It provides advice to the minister to assist in the selection and approval of proposals, including advice about their eligibility and merit.

Since its establishment in 2016 the committee has identified issues with, and made changes to improve its engagement with potential funding recipients, project establishment and oversight, assessment methodology and processes, and program evaluation.

However, more needs to be done. There is an opportunity to further strengthen the committee's advice by:

- providing them with access to all proposals seeking funding from the fund prior to ministerial consideration

- removing conflicts of interest

- clarifying guidance

- more clearly and completely documenting how each proposal performs against the evaluation criteria in the advice to the minister.

Regular and alternative approval pathways

In 2017–18 the committee did not provide advice on all proposals that were funded. This was a breach of the statutory Sustainability Fund Guidelines (the Guidelines) which require the minister and Premier to seek advice from the Sustainability Fund Manager or committee prior to approving the use of fund money. The committee did, however, provide advice for all 2018–19 Budget proposals recommended to be approved from the fund.

There is no process to ensure the committee has access to all proposals prior to their consideration by government. In the 2017–18 Budget process only eight of the approved programs (representing 53 per cent of the value of those approved) went through the 'regular' pathway, which includes committee assessment. The remaining six programs went through one of three other possible approval pathways. This prevented the committee from reviewing, rating and providing advice to the minister on proposals prior to ERSC, which considers proposed expenditure as part of the Budget process.

Of the eight programs that followed the regular pathway, the committee rated one program and a component of another as needing 'more information'. This rating, at the time, was used interchangeably to refer to bids that required more information to enable assessment as well as those the committee assessed as not aligned with the legislation, as there was no 'do not support' advice option in 2017–18. Further, the committee did not give any rating to one component of another proposal. This means that the committee only assessed against evaluation criteria, rated and provided advice to the minister on four out of the 14 programs approved for funding in 2017–18.

The two highest value bids announced in the 2017–18 Budget, to receive funding from the fund, were Timber Plantation Establishment and Protecting Victoria's Environment —Biodiversity 2037. The committee did not review the Timber Plantation Establishment program before ERSC endorsement and it rated the Protecting Victoria's Environment —Biodiversity 2037 program as needing 'more information'. Expenditure for these programs has been committed in the 2017–18 Budget and the minister and Premier have approved funding for the biodiversity program. Further information regarding the alignment of the Timber Plantation Establishment program's legislative objectives needs to be provided before the minister and Premier approve expenditure from the fund.

For the 2018–19 Budget, the committee rated the Port Phillip Bay Beach Renourishment program 'not currently supported' because it did not align with the legislative objectives of the fund. The 2018–19 Budget announced funding for this program from the fund, but at that time the minister and Premier had not yet provided final approval for release of the funds. DELWP has advised that these proposals are now not being put forward for approval from the fund.

Due to the nature of the budget process, the committee does not always assess the final version of proposals as they may continue to change right up until the time departments submit them to ERSC for consideration. DELWP is aware of the risk this situation creates to the integrity of the approval process and advised it is seeking endorsement from the minister and Premier for a formalised system to ensure the committee reviews and provides advice on all future bids before the minister and Premier approve them.

Conflict of interest

One outcome from the 2013 Report of the Ministerial Advisory Committee on Waste and Resource Recovery Governance Reform was the transfer of fund management from SV to DELWP.The report found a perceived conflict of interest in SV's role as the administrator of the fund and being one of its primary funding recipients.

DELWP is now the primary recipient of funding from the fund, receiving $354.13 million or 79 per cent of active program funding, though a proportion of this funding is passed on through grant programs. Two of the five Sustainability Fund Committee members are DELWP employees responsible for policy areas that benefit from funding. As committee members they are also involved in assessing and providing advice on their own budget proposals.

The committee has attempted to address these conflicts through a conflict of interest policy and procedures that require members to disclose conflicts and decisions made on how they should manage them. These controls are not sufficient to address the inherent conflict of interest created by the current membership of the committee. DELWP recognises this is an issue that needs to be resolved. The minister has recently approved an update of the Guidelines, as part of DELWP's response to the audit, to change the membership of the committee to make it fully independent.

Clarifying guidance

According to the Guidelines, proposals that seek funding for their core administrative costs are not eligible for funding from the fund. We reviewed all funding proposals the committee assessed in 2017–18 and found seven examples where, due to definitional ambiguities, there is a risk that the committee recommended proposals that may contain core administrative costs and may therefore be ineligible.

DELWP advised that these examples related to proposals that expand service provision into new areas and therefore do not represent core administrative costs. Our discussions with DELWP staff revealed that there is no documented definition of what constitutes core administrative costs. This highlights the need for an agreed definition of 'core administrative cost' and for the committee to apply this consistently in the assessment and recommendations for funding.

The Guidelines do not specify how to deal with proposals seeking ongoing funding or programs that are looking to shift their funding from output appropriations to the fund. Funding proposals may seek a fixed amount of funding for a period of the program, usually three to five years, plus ongoing annual funding beyond this period. DELWP advised that $20 million in ongoing funding was approved in 2017–18 and it requested over $80 million in ongoing funding as part of its proposals in the 2018–19 Budget process. The committee recognises that committing fund monies to projects on an ongoing basis could be an issue if, for example the demand, as demonstrated by the number and size of 2018–19 proposals, led to a significant decline in the fund balance. The committee noted in its advice to the minister that ongoing funding may limit innovation and the ability of government to ensure effective alignment of funded programs. It also noted funding for ongoing components could be made subject to a four-yearly evaluation to confirm alignment with the fund.

Committee assessments and advice

This year, for the first time, the value of proposals requesting funding exceeded the fund balance. The growing demand on the fund underlines the importance of providing clear and complete advice to the minister about each proposal's alignment with legislative objectives, and performance against all other evaluation criteria.

The committee rates each proposal as highly recommended, recommended, recommended subject to additional consideration, more information or not currently supported.

Five evaluation criteria (impact, quality, policy alignment, value for money and outstanding issues) inform the overall rating. However, the committee's assessment against each criterion is not included in their advice to the minister making it difficult for the minister to distinguish between the merits of each proposal.

The committee's assessments also do not consistently document consideration of alternative funding sources —a requirement in the Guidelines. In addition, the value for money assessment currently performed by the committee does not include enough information to enable the minister to determine which programs will most cost-effectively deliver on the fund's objectives. The value for money assessment included in a program's business case does not specifically consider the objectives of the fund and it is not clear how the committee uses this information in the assessment of proposals.

Committee advice also lacked sufficient detail to enable the merit of one proposal to be weighed against another; and also lacked clear and complete documentation about what proposals or proposal components may be ineligible for funding. The advice provided by the committee to the minister for different bids is inconsistent, which limits the minister's ability to fully compare and contrast bids when making funding decisions.

In addition, the committee requested more information on a number of proposals in 2017–18 which was not forthcoming prior to approval, meaning it could not make a complete assessment and fully advise the minister on particular projects to confirm alignment. These proposals were approved creating the potential risk that they may not be aligned with the fund's legislative objectives or represent the best application of fund resources.

The minister recently approved an update of the Guidelines to change the membership of the committee to make it fully independent, and to provide better clarity about the advisory function of the committee and the definition of core administrative costs.

Project delivery

Project delivery is hampered by delays in establishing project plans and funding agreements. Opportunities exist to better align the number of milestones attached to reporting and funds release with the complexity and value of funded programs. There is an opportunity for DELWP to clarify roles and responsibilities for escalation of underperforming projects.

Role of the team

DELWP directs the majority of the team's resources to managing funding agreements. The team has six staff, the Sustainability Fund manager, one financial analyst, one to support the committee and provide advice on proposals and three responsible for managing funding agreements.

The team's role during the various stages of project development and delivery is not clear, creating the potential for duplication of effort. Recognition should be given, where warranted, to the processes and mechanisms some recipients have in place to oversee the delivery of projects such as project control or independent boards who are appointed by and accountable to a minister.

Funding agreements

Following approval by the minister and Premier, funding recipients develop a project plan. The team assists as required with the development of project plans and funding agreements are developed once sufficient information is available for their completion. Recipients do not receive any money until the funding agreement is established.

We reviewed the time frames for establishing funding agreements for 16 projects from 2015 to 2018. DELWP took 213 days on average to develop a funding agreement from the point of program approval. One project took a year to establish a funding agreement after the minister and Premier approved its funding. Agencies stated that significant resources are required to develop the project plan and they absorb development costs until receipt of the first payment. Delayed establishment of project plans continues to be an issue that results in fund underspending. DELWP has advised that it aims to have project plans established by 30 June 2018 for programs approved in 2018–19 and have engaged consultants to assist with their development.

Funded projects are paid against achievement of project milestones. Our analysis of 49 funding agreements found that the average number of project milestones was 15, with the highest number for a single project being 71, and the lowest being three. There is no relationship between the number of milestones and the project cost or length. The rationale for some projects having significantly more milestones than others is not clear. Funding recipients raised concerns about the administrative burden of putting through requests for payments tied to each milestone. This illustrates the need for the team to be aware of this issue when developing funding agreements.

Monitoring

Funding agreements specify the monitoring, reporting and acquittal requirements for each initiative over the approved funding period. The team monitors and ensures recipients, with some exceptions, comply with these requirements. For example, recipients do not always provide their quarterly reports, however, where this occurs we saw evidence that the team follows this up.

Reporting

The fund's quarterly report provides the committee with the opportunity to review key aspects of project and financial management. Recipients are required to submit a quarterly progress report to the team but not all consistently comply with this requirement. According to the November 2017 quarterly report to the committee, 16 of the 56 project managers (29 per cent) had not submitted their most recent quarterly progress report. The team therefore could not accurately assess and report on the status of these projects.

DELWP recently aligned its internal management report and the committee's quarterly reporting. DELWP's report to its senior executive team now includes the status of funded programs delivered by DELWP, its portfolio agencies and DHHS. However, this report does not contain the progress of a project delivered by the Department of Treasury and Finance (DTF).

Escalation of project risks

DELWP should document a clear process for the management of underperformance or project risks for funded programs. Currently, the team raises project issues with the committee as part of its quarterly exception reporting. The exception report reviews and flags projects that may need attention or support. It raises any issues for escalation to the committee and identifies suggested committee actions. However, actions identified in these exception reports need to be clearer to ensure that the issues are being addressed. Committee meeting minutes from 14 November 2017 do not show that the committee discussed issues raised in the quarterly report or endorsed suggested actions to address the issues identified.

Financial acquittal

The team relies on the approval of the funding recipient's financial officer as evidence of financial acquittal. The team received a financial acquittal for all 17 projects that we tested. All include an expenditure report designed to include information on how funding was accounted for, what recipients spent funds on and what financial year they spent the funds in. The expenditure reports vary in the level of detail provided and may not always enable the team to confirm that recipients use the funds for their intended purpose.

Funding outcomes

Evaluation

DELWP has not been able to demonstrate the extent to which funded initiatives achieve their intended outcomes. As part of the audit, we reviewed the 18 projects that have closed in the past two years and found that all of them completed a project evaluation. The team completes a closure report that assesses the evaluation, where available, to determine whether closed projects have met their objectives.

Of the 18 projects we reviewed, only seven (39 per cent) reportedly met their objectives. Only two of the other 11 projects relate to programs that commenced during DELWP's administration of the fund. One of these programs was terminated early. The other was designed to achieve long-term behaviour change, and its outcomes have not yet been able to be assessed.

DELWP has worked to make project outcomes clearer in funding agreements with the aim of improving project evaluations on completion. DELWP has recently developed an evaluation framework to support a whole of fund evaluation and advises that this will be detailed in a 2017–18 activity report due to be released alongside the DELWP annual report.

Lessons learned

DELWP currently does not have a formal process to capture and share lessons learned from completed projects. It intends to embed these lessons into the recently developed evaluation framework. The team captures lessons learned as part of the Final Evaluation Report but these are not stored in a central location. This means they are not easily accessible to the committee when new but similar proposals come up for assessment. The current process relies on the knowledge of the team or the committee members. The team does not currently share this information with funding recipients to allow this to inform future program development.

Overall fund outcomes

DELWP does not measure overall fund outcomes. The legislation and 2016 Sustainability Fund Priority Statement (Priority Statement) provide broad objectives for the fund but DELWP does not use these to evaluate the success of the use of fund monies. The committee advised that a recently developed evaluation framework will support a whole of fund evaluation, which it intends to complete every four years. However, DELWP has not applied the framework to any projects to date, and it is not clear how this will work in practice.

Public reporting

DELWP has not publicly reported on the overall fund outcomes since it took over administration of the fund.

It is unclear how funded programs have contributed to the achievement of the fund's legislative purposes and the extent to which, if any, they have addressed the challenges posed by waste and climate change.

Until May 2018, public reporting about the activities of the MILL and the fund was limited to appendices to DELWP's annual report and general information on their website.

DELWP has recently published an activity report for 2015–17, Investing in a more sustainable future. The report was released in May 2018. It is similar to the report produced by SV. It is unclear why it has taken DELWP nearly two years to produce it. The delay in its publication affects its relevance and usefulness as a tool to improve the transparency of the fund and its management. DELWP advised it intends to publish an annual activity report each September after the close of the financial year. This process will be aligned to the annual reporting process. There has been no reporting of the fund's governance arrangements.

It is important for the public to understand not just how this money is being spent, but also the extent to which it has been used to achieve its intended outcomes. There is a lack of transparency about the activities and outcomes of the fund. This undermines public trust in the collection of the levy.

There has been improved financial transparency about the fund in Budget Papers since 2016–17. They now more clearly identify programs that receive monies from the fund.

Recommendations

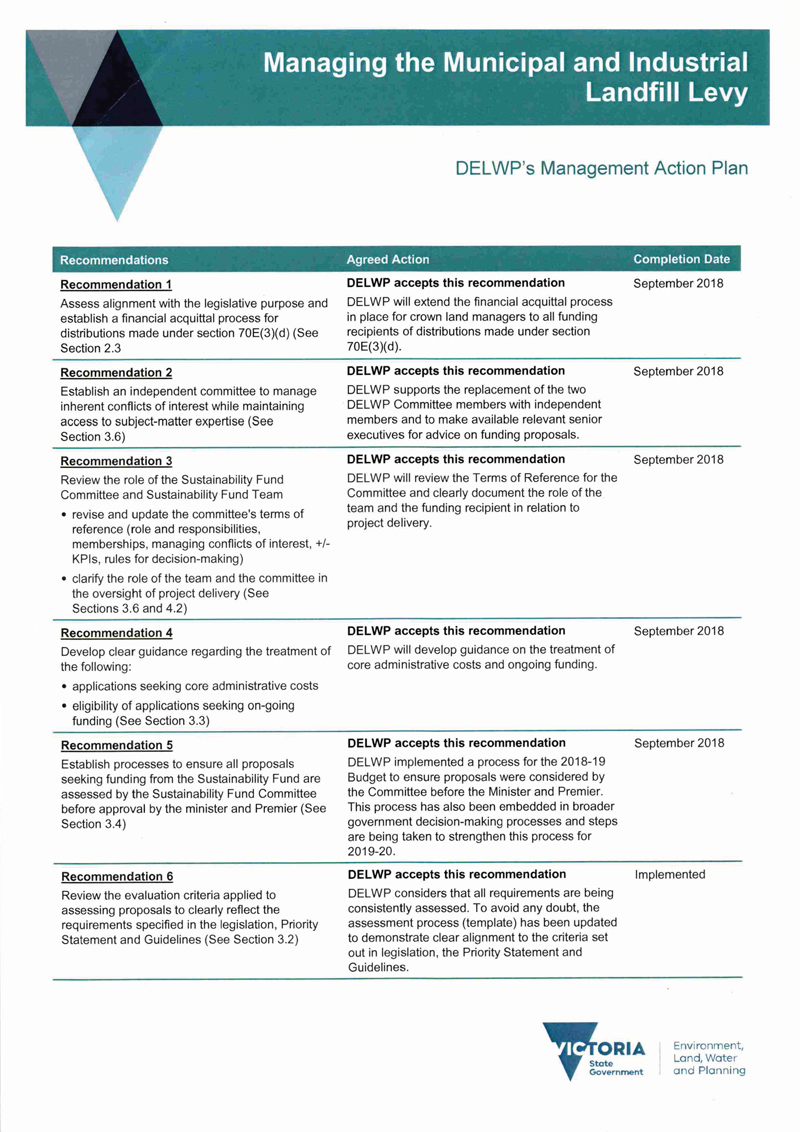

We recommend that the Department of Environment, Land, Water and Planning:

1. assess alignment with the legislative purpose and establish a financial acquittal process for distributions made under section 70E(3)(d) of the Environment Protection Act 1970 (see Section 2.3)

2. establish an independent committee to manage inherent conflicts of interest while maintaining access to subject-matter expertise (see Section 3.5)

3. review the role of the Sustainability Fund Committee and Sustainability Fund team:

- revise and update the committee's terms of reference (role and responsibilities, memberships, managing conflicts of interest, +/- KPIs, rules for decision-making)

- clarify the role of the team and the committee in the oversight of project delivery (see Sections 3.5 and 4.2)

4. develop clear guidance regarding the treatment of the following:

- applications seeking core administrative costs

- eligibility of applications seeking ongoing funding (see Section 3.3)

5. establish processes to ensure all proposals seeking funding from the Sustainability Fund are assessed by the Sustainability Fund Committee before approval by the Minister for Energy, Environment and Climate Change and the Premier (see Section 3.4)

6. review the evaluation criteria applied to assessing proposals to clearly reflect the requirements specified in the legislation, 2016 Sustainability Fund Priority Statement and Sustainability Fund Guidelines (see Section 3.2)

7. improve the quality of advice provided to the Minister for Energy, Environment and Climate Change by providing the assessment against each evaluation criteria (see Section 3.5)

8. relate the number of funding agreement milestones to the value and/or complexity of funded programs and link payment milestones to reporting requirements to minimise administrative burden (see Section 4.2)

9. examine mechanisms to encourage the earlier development of project plans for approved programs (see Section 4.2)

10. require funding recipients to provide key categories of expenditure in support of the financial acquittal of funding agreements to enable the Sustainability Fund team to review whether the funds have been used for the purpose intended (see Section 4.2)

11. implement the evaluation framework to evaluate outcomes of funded programs to clearly demonstrate the extent to which programs have contributed to the specified legislative objective (see Section 4.6)

12. identify overall Sustainability Fund outcomes to measure the extent to which expenditure has successfully delivered legislative objectives (see Section 4.6)

13. develop a formal process to consistently apply lessons learned including:

- capturing and storing them centrally to enable them to be considered by the Sustainability Fund Committee when assessing proposals

- sharing them with agencies to enable them to be considered when developing new program proposals (see Section 4.7)

14. publish an annual public report for 2018–19 and future years detailing the activities of the Sustainability Fund and outcomes achieved (see Section 4.8).

Responses to recommendations

We have consulted with DELWP, EPA, SV, MWRRG and GWRRG and we considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet (DPC).

The following is a summary of those responses. The full responses are included in Appendix A.

DELWP accepted all 14 recommendations and provided an action plan to address them. SV welcomed the audit and looks forward to supporting DELWP to address the recommendations. The two waste and resource recovery groups (WRRG) noted that the audit was consistent with their past experience as Sustainability Fund recipients and were supportive of the recommendations.

1 Audit context

Victoria's MILL was established in 1992 to create a disincentive to putting waste into landfill and to encourage resource recovery and recycling. Income generated by the MILL supports Victoria's environmental agencies, with the remainder transferred to the fund to be used only for initiatives that aim to address environmental challenges for the benefit of all Victorians.

1.1 Municipal and Industrial Landfill Levy

Legislation

The Act requires the MILL to be charged on each tonne of waste deposited at licensed landfills. The EPA collects the levy from landfill operators and councils.

Changes to the levy

The landfill levy system has changed significantly over the past 25 years. The metropolitan waste levy has increased from $2 per tonne in 1992 to its current rate of $63.28 per tonne. DELWP forecasts MILL income for 2017–18 to be $215 million.

In 2010, the government considered the metropolitan municipal waste levy of $9 and the regional municipal waste levy of $7 too low to drive behavioural changes. It increased the levy substantially to make recycling economically competitive compared to depositing valuable materials to landfill. Figure 1A shows the change in the Victorian levy since 2001.

The objective was to increase recycling rates and stimulate the recycling industry by making new recycling ventures more viable and create new jobs. The expected impact of the rate increase was a fall in annual volumes of waste to landfill of 34 per cent between 2009–10 and 2013–14.

Environmental groups and the waste industry supported the 2010 rate increase, which brought Victorian landfill levy rates in line with those of New South Wales. Since then, New South Wales's 2017–18 rates have increased to $138.20 per tonne for the metropolitan rate and $79.60 per tonne for the regional levy, more than double Victoria's rates.

Figure 1A

Changes in the Victorian Municipal and Industrial Landfill Levy rates

Note: Annual rate increases started in 2010–11. At that time, the industrial and municipal metropolitan rates became the same rate.

Source: VAGO based on EPA data.

Figure 1B shows the changes in the volume of waste to landfill between 2006–07 and 2016–17. While this shows a decline, there may be other contributing factors, such as community education.

Figure 1B

Volume of municipal and industrial waste to landfill (tonnes per person)

Source: VAGO based on EPA and Australian Bureau of Statistics data.

MILL collection and distribution

EPA is responsible for collecting and distributing the MILL under the Act. EPA collects the MILL from licensed landfill operators, managed by councils or commercial operators, and transfers the income to the MILL Trust Account, managed by DELWP.

Figure 1C shows MILL income since 2009.

Figure 1C

MILL income

Note: The amounts above are on an accrual accounting basis. Income is accounted for in the period it is earned, not received.

Source: VAGO.

MILL income is used first to fund the core operating activities of environmental agencies in accordance with section 70E(3) of the Act. These are the EPA, SV and Victoria's seven WRRGs under subsections 70E(3)(a)–(c).

Subsection 70E(3)(d) of the Act was inserted in 2014 and enables the MILL to fund 'a public entity or other body established for public purposes to be used for environment assessment, protection, restoration or improvement purposes'. Distributions under this provision have, to date, been made to PV, the CES and 22 committees of management.

The minister determines, on advice from DELWP policy areas, the funding levels, period and timing of payments for environmental agencies and organisations under section 70E(3). However, this determination occurs after the budget process whereby ERSC first reviews the funding for these agencies for the four‑year budget period.

1.2 Sustainability Fund

Establishment

In 2004, the government amended the Act to create the fund and directed a portion of the MILL towards it. The MILL is the sole source of revenue for the fund. Figure 1D details the flow of MILL monies to the fund under today's legislative arrangements.

Figure 1D

Flows from the MILL into the Sustainability Fund

Source: VAGO.

Purpose

The fund is a hypothecated trust account created under section 70F of the Act for the specific purpose of fostering:

- environmentally sustainable uses of resources and best practices in waste management

- community action or innovation in relation to the reduction of greenhouse gas substance emissions, or adaptation or adjustment to climate change in Victoria.

The second clause—enabling the fund to be used for greenhouse gas reduction or climate change adaptation —was introduced in 2010.

Priorities and guidance

Before any money can be distributed from the fund, the minister must issue a Priority Statement and Guidelines, under section 70A of the Act. These documents are designed to maximise the effectiveness of the fund and to ensure that a strategic approach is taken to the application of its monies.

Section 70F also requires the consent of both the Premier and the minister before fund monies can be applied to one of the fund's legislative purposes.

Priority Statement

Section 70A(1)(a) of the Act requires that the Priority Statement set out, in order of priority, how the minister and Premier intend to use the money. The Priority Statement is refreshed at intervals consistent with changes to government policy directions. The minister and Premier approved the current version in 2016.

The current Priority Statement does not order the strategic priorities for the fund but notes preference for initiatives that foster employment, new technology and innovation, resource efficiency or ongoing behaviour change. It states that the following climate change and waste policies and strategies should inform the choice of potential investments from the fund:

- climate change policies

- Victoria's Climate Change Adaptation Plan 2017–2020

- Victoria's Energy Efficiency and Productivity Statement

- Renewable Energy Action Plan

- Protecting Victoria's Environment – Biodiversity 2037 and other relevant strategies

- the Statewide Waste and Resource Recovery Infrastructure Plan (SWRRIP)

- the Regional Waste and Resource Recovery Implementation Plans and other relevant strategies.

Guidelines

The Act requires guidelines be in force that explain how the minister and Premier will exercise their powers in relation to the application of money from the fund.

The Guidelines state that the minister and Premier will seek advice from the Sustainability Fund Manager (a DELWP staff member who manages the team) directly or via the committee, before allocating fund money to a project so they are informed about:

- compliance of the proposal with legislated obligations

- its consistency with the Priority Statement

- other considerations such as value for money.

Under the Guidelines funding should be directed to support projects, programs, services or technologies that will benefit Victoria environmentally, socially and economically.

The Guidelines also identify the types of projects that the fund should not be used for, including:

- projects that seek retrospective funding, or that duplicate environmental programs already operating

- the core administrative costs of an existing organisation.

Administration

SV was initially responsible for managing the fund.

In 2013 the MAC review found issues with the administration of the fund:

- governance arrangements remained overly complicated

- perceptions of conflicts of interest and a lack of transparency, as SV was both the administrator and a recipient of funding

- that reporting of fund activity was unclear.

In 2015, in response to stakeholder concerns and the findings of the MAC review, government amended the Act and transferred responsibility for the fund from SV to DELWP. DELWP has administered the fund since 1 July 2015.

The team sits within DELWP's Finance and Planning unit and is responsible for administering the MILL Trust Account and the fund. This includes financial management, providing secretariat support to the committee, assessment of funding proposals and the establishment and management of funding agreements.

Sustainability Fund Committee

When SV administered the fund, the Sustainability Fund Advisory Panel —an independent statutory committee —was established to review and recommend projects for funding to the minister. The legislative changes that transferred fund administration to DELWP in July 2015 removed the requirement for a statutory committee.

In its place, the minister established an advisory committee to provide advice to the minister on funding proposals before fund monies are allocated to a program.

The committee has no delegated decision-making authority. Authority to apply money from the fund rests with the minister and Premier.

The Guidelines require that the committee's advice to the minister and Premier be based on:

- alignment of the proposal's objectives with the fund's legislative objectives

- alignment of the expected outcomes of the proposal against the defined priorities of the fund as stated in the Priority Statement

- achieving value for money given the immediate and long-term environmental benefits expected to be achieved by the proposal

- the availability of funding to the applicant from other sources.

The committee has five members: an independent Chair, a finance expert (currently an independent member who is also the Deputy Chair), two DELWP subject matter experts and a governance expert.

The governance position was vacant from July 2017 until March 2018. DELWP's subject matter experts are the Executive Director, Energy Policy and Programs and the Executive Director, Climate Change.

The committee held its first meeting in May 2016 but did not have its full complement of members until December 2016. The interim arrangements are explained in more detail in Section 3.4.

1.3 Sustainability Fund distributions

Access to funds

The Guidelines state that funding recipients may be direct grant recipients or government departments or agencies. When SV administered the fund, open grant rounds were available. However, there have been no open grant rounds announced since 2009.

|

Open grant rounds refer to the ability of potential recipients, including community groups, councils, government departments, statutory entities, non-government organisations and businesses, to apply directly for a grant from the fund. |

All distributions now occur through the budget process with departments and agencies as recipients. A proportion of these funded initiatives involve grant programs that provide subsequent opportunities for councils and non‑government organisations to access monies from the fund.

The team handles public enquiries seeking direct funding from the fund. It attempts to refer people to currently available grant programs, funded from the fund, or to direct them to alternative government grant programs. The team shares details of enquiries with relevant DELWP policy areas and portfolio agencies. Details of public enquiries are included in the team's quarterly report to the committee and the committee's annual report to DELWP's Secretary.

Developing funding proposals

Department policy areas or agencies develop funding proposals as part of the government's annual budget cycle. To request funding from the fund applicants nominate it as the source of funding on the State Budget Bid Template. In some cases, the government or central agencies recommend the fund as the funding source.

Assessing funding proposals

Role of the team

The Sustainability Fund Manager and the team receive a copy of DELWP's funding proposals prior to its minister's presentation of initiatives to ERSC for endorsement. It prepares an assessment of each funding proposal against the legislative objectives for the committee's review. The team liaises with DELWP policy areas and its portfolio agencies if more information is required.

Role of the committee

The committee reviews funding proposals submitted by DELWP and its portfolio agencies prior to submission to ERSC and any other department proposals provided to them. All bid information is provided to the independent members. The independent members have an established practice of reading and forming their own initial views on the merit of funding proposals prior to reviewing the team's proposed recommendations. The two independent members of the committee meet with the team to consider and test draft positions before they are put to the committee. The whole committee then reviews each proposal based on documentation collated by the team and reaches a recommendation.

The committee chair subsequently provides written advice to the minister with the committee's recommendations on which proposals it supports for funding.

The committee's review occurs as part of the budget cycle. The timing of its meetings is coordinated so that they occur after the policy areas develop funding proposals and prior to ERSC's consideration of funding proposals.

The nature of the budget process means that the time frame for development, assessment and recommendation can be tight and proposals may continue to change up to the point that departments lodge proposals with the Cabinet office for consideration by ERSC.

Expenditure Review Sub-Committee

ERSC considers and endorses all funding proposals from all sources as part of the budget process. The minister and Premier then approve the endorsed proposals for release from the fund. Figure 1E shows the standard approval process for proposals seeking funding from the fund.

Figure 1E

Funding approval process

Source: VAGO.

1.4 Sustainability Fund balances

The fund balance had grown to $562 million as at 31 December 2017. Figure 1F shows the growth of the fund balance since 2009–10. The forecast closing balance of the fund at 30 June 2018 is $513 million. By the end of the forward estimates, 2021–22, the balance is expected to be $552 million. This balance assumes no new funding from the fund is announced between now and 2021–22.

Figure 1F

Sustainability Fund balance

Note: Balances are at 30 June each year.

Source: VAGO based on EPA and DELWP data.

Rate of future expenditure

The rate of expenditure from the fund against income has been low when compared to other trust funds such as the Community Support Fund and the New South Wales Environment Trust Fund that typically distribute over 90 per cent of their annual income.

Reducing the balance of the fund can be achieved by:

- reducing the income to the fund by distributing more money from the MILL Trust Account

- increasing distributions from the fund.

The government has increased funding to environmental agencies, from $76.1 million to $130.5 million in the past two years, a 71 per cent increase. This has resulted in less MILL income transferred to the fund.

Figure 1G shows MILL income transferred to the fund and distributions from the fund from 2009–10 to 2016–17 and budgeted income and expenditure for the period 2017–18 to 2021–22.

The 2017–18 Budget provides for fund expenditure of $439 million in new funding approved over five years between 2016–17 and 2020–21. The forecast amounts included in Figure 1G are more than this as they include future distributions for existing programs.

Figure 1G

Fund income and distributions

Note: Fund distributions for 2015–16 and 2016–17 are on a cash accounting basis. Forecast and Budget figures for 2017–18 onwards are on an accrual basis and exclude administration costs.

Note: The total cash transferred into the fund may not equal the sum of the accrual revenue less distributions in Figure 2A due to timing differences.

Source: VAGO based on DELWP and SV annual reports and DELWP forecast data.

Figure 1G shows that the government distributed $52 million in 2016–17 and expects to spend $152 million in the 2017–18 financial year. Despite the government's commitment to spend, actual program expenditure is falling behind budget, resulting in lower than expected expenditure from the fund.

From 2016–17 to 2017–2018, budget commitments from the fund have been at their highest levels since the fund was established. However, Figure 1H shows also that commitments from the fund in the 2018–19 Budget drop significantly from $320.1 million in 2017–18 to $32.7 million 2018–19.

Figure 1H

State Budget commitments from the fund in 2016–17 to 2018–19

Source: VAGO.

Figure 1I shows the income and expenditure from the fund over the past three years and the impact on the balance of the fund.

Figure 1I

Sustainability Fund Trust Account

Note: The amounts above are on a cash accounting basis. The total cash transferred into the fund may not equal the sum of the accrual revenue less distributions in Figure 2A due to timing differences. The amount in distributions to fund programs includes administrative costs.

Note: Prior to the establishment of the Sustainability Fund Trust Account, the money was held in the Environment Protection Fund. As a result, its balance was $0 in 2015 when it was established.

Source: VAGO based on DELWP data and annual reports.

1.5 Stakeholder interest

There has been substantial interest in the MILL and the fund in recent years. The waste industry and local councils supported the introduction of the levy and the subsequent increases to the levy on the basis that it would fund environmental agencies and the remainder would support innovative waste and resource recovery initiatives.

Waste industry groups, councils and environmentalists have expressed concern over the growth of the fund and the low level of expenditure from the fund on waste and resource recovery initiatives. A recent decision by China to restrict the importation of some recyclable material has further highlighted concerns about the future of the recycling industry. Waste industry advocates, councils and environmental organisations are lobbying the Victorian Government to access the fund to invest in future solutions for recycling.

In February 2018, the Victorian Government announced a $13 million support package for councils and industry affected by the recent Chinese restriction on recycling imports. This has been approved to be funded from the fund.

1.6 Why this audit is important

The MILL and its distribution is designed to play an important role in minimising the environmental impacts of waste and in promoting investment in alternatives to landfills.

The SWRRIP states that based on the current rate of population growth total waste generation is likely to increase by 57 per cent from 12.7 million tonnes in 2015–16 to 20 million by 2046.

There is significant community concern about how the government and its agencies spend funds generated through the MILL. Some stakeholders are concerned that government may not direct enough funds towards waste management activities.

This audit provides an independent assessment of, and insights into, whether the landfill levy system is being managed transparently and is meeting its intended legislative objectives.

1.7 What this audit examined and how

This performance audit examined DELWP's management of MILL income, including its distribution and expenditure. It assessed how the money is spent and whether and to what extent it aligns with the legislative objectives of the MILL Trust Account and the fund.

The audit examined the management of the MILL Trust Account and the fund since responsibility transferred to DELWP on 1 July 2015. We examined the administrative practices of DELWP since this transfer, considered the impact of legislative changes and compared the structure of funding agreements established prior to the transfer.

We conducted our audit in accordance with section 15 of the Audit Act 1994 and ASAE 3500 Performance Engagements. We complied with the independence and other relevant ethical requirements related to assurance engagements. The cost of this audit was $520 000.

1.8 Report structure

We have structured the remainder of the report as follows:

- Part 2 examines the distribution and management of the MILL

- Part 3 examines the administration of the fund

- Part 4 examines program outcomes of the fund.

2 Financial management of trust funds

Public monies are set aside in trust accounts for specific purposes, and as such are quarantined from the rest of a department's operations. This places an added premium on good financial management and control, and transparency.

In this part of the report, we consider how well the monies in the two trusts are controlled. We place emphasis on making sure the systems of financial control that support their operation are sound, and operate so that:

- funds are distributed only for approved purposes

- unused cash balances are managed and invested to maximise return

- administration costs are relevant and not excessive.

2.1 Conclusion

DELWP is exercising appropriate financial control over, and management of, trust balances, transfers and disbursements. Administration costs are reasonable and investment performance is meeting the objectives of the investment policy.

However, there are significant control weaknesses in distributions made under section 70E(3)(d) of the Act from the MILL Trust Account —namely ensuring that money is being used for the purpose provided. Money distributed under this provision is not subject to assessment against the legislative objectives. In addition, only 5 per cent of these distributions are subject to financial acquittals to ensure they are used for their intended purpose. This creates a risk that programs may be funded that are not in line with the legislative purpose.

2.2 Transfers

EPA —MILL collection and transfer

EPA is responsible for the collection of the MILL from licensed landfills and for the transfer of the income to DELWP's MILL Trust Account. Section 70E(2) requires EPA to credit funds to the MILL Trust Account by 15th day of the following quarter. We are satisfied that EPA transfers MILL income to DELWP in a timely manner, consistent with legislative requirements.

DELWP —MILL Trust Account and Sustainability Fund

When DELWP took over responsibility for distribution of the MILL and administration of the fund on 1 July 2015, the minister approved the establishment of the MILL Trust Account and the Sustainability Fund Trust Account, as required by the Act.

MILL Trust Account

DELWP has established appropriate internal controls around transfers to and from the MILL Trust Account. However, not all agencies that receive distributions made under section 70E(3)(d) are required by DELWP to demonstrate that funds provided were used for their intended purpose.

Section 70F(2) of the Act requires the remaining balance of the MILL Trust Account to be transferred to the fund by the end of each quarter.

Sustainability Fund Trust Account

We independently confirmed the balance of fund investments as at 30 June 2017.

Payments are subject to DELWP's standard internal controls, financial delegations and supported by evidence of approval by the minister and the Premier.

2.3 Distributions

Distributions from the MILL Trust Account

Distributions from the MILL Trust Account primarily support the core operating activities of specified environmental agencies and from 2014 can also be used to fund a broad range of agencies provided that these monies are 'used for environment assessment, protection, restoration or improvement purposes'. Figure 2A shows MILL income distribution over the past three years.

Figure 2A

MILL Trust Account distribution

Note: The increase in EPA's distribution from 2016–17 to 2017–18 was a direct result of EPA reform funding initiatives. The amounts above are shown on an accruals basis. Amounts shown in Figures 1G and 1I differ as they are shown on a cash accounting basis.

Source: VAGO based on DELWP data.

Expenditure from the MILL Trust Account is not subject to the same governance framework as the fund. In line with the legislation, the minister determines the amount to be paid from the MILL Trust Account, the timing of payments and period over which they are to be applied.

DELWP's Energy, Environment and Climate Change policy team brief the minister seeking an approved determination based on DTF-approved estimates of available funding in the MILL Trust Account. These briefings are made collaboratively with the team to ensure there is sufficient funding available for any existing and new commitments made from the fund. The team is responsible for processing agency distributions made under ministerial determination. The team maintains contact with DELWP policy areas to monitor the cash flow impacts of distributions from the MILL Trust Account on the fund.

Over the past two years, funding distributed under section 70E(3)(d) has increased from $5.9 million in 2015–16 to $24 million in 2017–18. PV, CES and committees of management have received funding under this provision. Figure 2B shows funding received by each agency under section 70E(3)(d).

Figure 2B

Agencies funded under section 70E(3)(d)

Source: VAGO based on DELWP data.

There are currently no guidelines or governance processes to inform or evaluate the use of this funding from the MILL Trust Account and ensure it meets the conditions of section 70E(3)(d). In addition, only committees of management are required to provide financial acquittals to demonstrate that they have used these funds for the purpose provided. These control weaknesses need to be resolved to address the risk that this money is spent on programs that do not align with its legislative purpose. The current arrangement means that it is difficult to identify any unspent funds to ensure they are transferred back to the fund.

DELWP should consistently assess and provide advice on the alignment of any distributions made under this provision and require recipients to provide financial acquittals for this expenditure.

DELWP recognised the importance of ensuring these funds are used as intended by the legislation and has made an effort to assess alignment for the distributions to PV and CES. It obtained legal advice on whether proposed funding for PV and the CES met the intended purpose of the legislation: that is, whether the allocations were consistent with the legislative purpose of 'environment assessment, protection, restoration or improvement purposes'. The advice received stated that funding for the CES met the purpose for environmental assessment and the funding for PV broadly met the legislative purpose of section 70E(3)(d).

2.4 Sustainability Fund investment performance

Investing unused funds

DELWP has developed an investment policy compliant with legislative requirements that aims to maximise returns and minimise risk.

DELWP's SFIP sets out the general principles that govern the investment of monies held in the fund. The minister delegated the power to approve investments with the Victorian Funds Management Corporation's (VFMC) Capital Stable Fund to DELWP's Executive Director, Finance and Planning in February 2016. The minister did so on the condition that the agency provide a six-monthly report on the fund's cash balance and investments.

DELWP designed the SFIP to operate within the Financial Management Act 1994 (FMA) and Victorian Government and DELWP investment policies.

The FMA governs DELWP's cash reserve investment, administration and management. The Treasurer's centralised treasury and investment policy, which applies to all Victorian public sector agencies, requires agencies to undertake all investments and financial arrangements with the Treasury Corporation of Victoria (TCV) and/or VFMC. DELWP's Trust Fund Policy requires all trust accounts to maintain a positive balance and be in interest-bearing deposits approved by the Minister for Finance. Agencies investing with VFMC are required to have an investment strategy.

The SFIP is reviewed annually and DELWP's Risk and Audit Committee note revisions. DELWP obtained independent advice on the SFIP as part of the revision that occurred in 2016–17. The advice found that the fund complied with legislation and government policy. It examined how the fund could preserve its balance, minimise risk and maximise return, and recommended the appropriate mix of investments to achieve this outcome. DELWP incorporated all of the recommendations in their policy update in 2017–18.

Investment objectives

|

Funds 'at call' are available for access quickly when needed to make contract payments to fund recipients. |

DELWP's investment objectives for the fund are to maximise returns on the available cash balance, to ensure that funds are available at call to meet funding distributions, and to comply with legislative requirements.

To guide the strategic allocation of long-term investments, the SFIP specifies the following risk and return investment objectives:

- return —Consumer Price Index (CPI) plus 1.5 per cent on a rolling three-year basis for long-term investments

- risk —experience an annual investment loss no more than once every 10years, and experience a loss greater than 1 per cent no more than once every 20 years.

Investment profile

DELWP has established investments with TCV and VFMC, consistent with the SFIP. DELWP's short-term investments are with TCV and its long-term investments are in VFMC's Capital Stable Fund, the most conservative investment option offered by VFMC. Figure 2C shows the investment profile of the fund as at 31 December 2017.

Figure 2C

Fund investment profile as at 31 December 2017

Source: VAGO based on DELWP Quarterly Compliance Report, 31 December 2017.

Our review of DELWP's quarterly compliance reports for the current financial year indicates that the fund mix of investments complies with the SFIP. Figure 2D shows the current fund investment profile compared with the SFIP investment parameters.

Figure 2D

Actual fund investment profile against the SFIP as at 31 December 2017

Source: VAGO based on DELWP data.

Investment performance

The fund is achieving SFIP targets and maximising returns. The SFIP target return for long-term investments of 1.5 per cent greater than the CPI, on a rolling three-year basis, equated to 3.2 per cent as at 31 December 2017. VFMC reported that the fund achieved a three-year return of 3.89 per cent to 31 December 2017, 0.69 per cent ahead of the target, and 0.16 per cent ahead of VFMC's performance benchmark. TCV short-term deposits currently return 1.45 per cent to 1.77 per cent.

Interest

The Minister for Finance granted approval, under section 20 of the FMA, for interest to be earned and retained by the fund when administrative responsibility was transferred to DELWP in 2015.

Prior to its transfer to DELWP, EPA was responsible for the financial management of the fund and retained the interest earned (consistent with the Act) on the fund as a revenue stream to support its operations.

The transfer of the fund to DELWP resulted in a revenue shortfall for EPA. To address this shortfall, the Treasurer approved up to $15 million in additional funding to EPA for both 2015–16 and 2016–17. EPA received these payments in addition to its distribution from the MILL Trust Account, equivalent to the value of actual investment returns on the fund balance: $13.80 million in 2015–16 and $14.65 million in 2016–17.

Interest earnings since the fund transferred to DELWP, total $36.5 million to 31 December 2017. The interest earned for the year to 31 December 2017 was $10.5 million. Forecast interest for 2017–18 is $15.3 million.

Cash flow forecasting

DELWP invests surplus cash in accordance with the SFIP.

The team monitors cash flows by updating a rolling cash flow forecast monthly. Estimates of MILL income from EPA, distributions to portfolio agencies, investment income and expected milestone payments to funding recipients are progressively replaced with actuals as they become known.

DELWP bases investment decisions on the SFIP and monthly cash requirements of the fund. DELWP uses a milestone payment report from its grant management system, Global Engagement Management System (GEMS), to determine the expected timing of distributions.

DELWP reports indicate that budgeted funding distributions have been underspent since it has administered the fund. This is mainly due to project management issues which are discussed further in Section 4.5 of this report.

As at 30 September 2017, GEMS shows that actual payments were $18.2 million compared with an expected $36.7 million for the quarter —a 50 per cent underspend. As at 31 December 2017, performance had improved, with year‑to‑date payments of $52.6 million, in line with the forecast of $52.1 million. DELWP advised that budgeted cash flows had undergone significant reworking as part of the mid-year State Budget update in December 2017 to align them with contracted milestones and to include the impact of contract variations. We discuss the challenges with project management further in Section 4.5.

Overestimating expected expenditure results in DELWP holding more liquidity than required. However, the variance in return for amounts held at call, in short‑term investments and investments for a fixed 12-month period is minimal.

2.5 Sustainability Fund administration costs

Administration costs have remained constant despite a significant increase in the activity of the fund. Figure 2E shows administration costs compared to fund distributions over time. The current cost of fund administration compared with distributions is very low. While fund distributions provide an indication of the level of activity, the amount distributed does not reflect the effort involved in other administrative activities such as establishing memorandums of understanding (MoU) for new projects.

Figure 2E

Administration costs compared to fund distributions

Note: Administrative cost for 2017–18 is the budgeted amount.

Source: VAGO based on DELWP and SV data.

The activity of the team and committee has increased as the value and number of programs approved for funding from the fund has gone up. However, the administrative budget has remained at $0.8 million for 2016–17 and 2017–18.

3 Sustainability Fund management

The public's trust in government depends on transparency and accountability. The fund's governance and transparency issues identified by the 2013 MAC report eroded this trust and undermined public and industry confidence. It is important therefore, that the current operating arrangements address past governance issues. The committee, which replaced the independent statutory committee, has a significant role to play in this regard as, under the Guidelines it should:

- oversee fund management to support fund transparency and accountability

- provide impartial, strategic advice regarding allocations from the fund.

The committee's advice to the minister is important to ensure proposals meet legislative and eligibility requirements and that sufficient information is provided to ensure proposals with the greatest merit are prioritised.

In this part of the report, we examine how proposals seeking money from the fund are selected and the role of the committee and the team in supporting the minister prior to, and after, government deliberations about the merits of these proposals.

3.1 Conclusion

The committee has identified and made attempts to address a range of procedural, structural and governance issues. However, more needs to be done to enable it to effectively fulfil its role:

- The committee should support its advice to the minister with clearer, and more definitive, comprehensive information. This information should provide sufficient detail to enable merit based decisions that prioritise proposals seeking funding and clearly describe the degree to which proposals comply with the legislation.

- The committee should improve its record keeping to ensure it has complete and reliable records of its deliberations, to improve transparency and accountability.

- DELWP should put in place a formal process for the committee to review and comment on the final version of all proposals considered by the Premier and minister before their approval to stop proposals being approved that bypass the committee, in contravention of the Guidelines.

- The inherent conflicts of interest that result from the administrator also being a major beneficiary of funding must be addressed.

The Guidelines are unclear on how to deal with requests that seek a component of ongoing funding, or move programs from annual appropriations. There is also lack of clarity about what constitutes 'core administrative costs', which are ineligible for funding. These ambiguities are particularly sensitive in the context of a hypothecated fund, where a levy is collected for a particular purpose with the public therefore reasonably expecting that fund expenditure should meet that purpose.

While there is no evidence that any program that received funding from the fund does not align with its legislative objectives, there is a potential risk this may be the case. This is because the committee has not considered and provided advice on all approved programs. In addition, some of those that it has considered were approved despite concerns about legislative alignment.

3.2 Evaluation criteria

The Guidelines state that the committee will provide impartial strategic advice to the minister and Premier regarding allocations from the fund, based in the first instance on:

- alignment of the objectives with the legal objectives under the Act

- alignment of the expected outcomes of the proposal against the defined priorities of the fund as included in the Priority Statement

- the value for money and funding requirements of the project in light of the immediate and long-term environmental benefits that will be achieved

- the availability of funding to the applicant from other funding sources.

Ineligibility criteria

The Guidelines include six ineligibility criteria:

- proposals that seek retrospective funding for projects or programs that have already started or that have been completed

- applications for funding to supplement the core administrative costs of an existing organisation

- projects that duplicate programs already operating with respect to a specific environmental priority

- projects that are considered inconsistent with government policy objectives

- projects not meeting state and national legislative requirements, and other relevant statutory approvals and permits

- applications not made in accordance with the guidelines.

DELWP advised that the team considers the eligibility of a proposal prior to providing advice to the committee. They only bring eligible proposals to the committee for consideration. However, the team does not document its eligibility assessment. This diminishes accountability and is inconsistent with the record keeping requirements that apply to decision-making.

Application of evaluation criteria

The team and the committee assess proposals according to their:

- Impact—does the proposal address the problem it aims to fix and deliver social outcomes?

- Quality—does it have clearly stated objectives, outcomes and deliverables, a well-developed budget and plans to complete a project evaluation?

- Policy alignment—is there alignment with legislative objectives and priorities?

- Value for money (new for 2018–19, previously included in the Impact criterion)—what is the potential return on investment? Is the proposal 'shovel-ready'? Is it scalable? Is there potential for the project to leverage additional or new investment?

- Outstanding issues—this deals with any concerns that the committee might have about the project. It includes questions raised that the policy area has not responded to or concerns about the project based on the experience of similar projects or proposals.