Racing Industry: Grants Management

Overview

Victoria’s racing industry is estimated to have contributed around $2.8 billion to the Victorian economy in 2012-13. The racing industry encompasses greyhound, harness and thoroughbred racing—each governed by a controlling body.

Since 2009 the racing industry has received grants through the Regional Racing Infrastructure Fund (RRIF) and the Victorian Racing Industry Fund (VRIF). The Department of Justice (DOJ) manages these funds.

DOJ’s management of racing industry grants over the past five years has been administratively weak. Particularly for the now completed RRIF program, a lack of assessment guidance and records meant it was unclear whether applications had met the funding criteria or had been assessed consistently.

There were also weaknesses with how some controlling bodies managed publicly funded projects, and how DOJ oversaw these projects and gained assurance that they would achieve intended outcomes.

Since VRIF started in 2012, there has been steady improvement both in how DOJ manages applications and in how controlling bodies manage funded projects. But greater effort is needed to improve the transparency and accountability of grants assessments. DOJ also needs to demonstrate that grants have achieved the desired outcomes and brought the expected benefits—something it is currently unable to do.

Racing Industry: Grants Management: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER June 2013

PP No 284, Session 2010–13

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on the audit Racing Industry: Grants Management.

This audit assessed whether the Department of Justice has effective processes to guide assessment and funding of grants to the racing industry and whether these grants are achieving their intended outcomes.

The audit found that the Department of Justice's management of racing industry grants over the past five years has been administratively weak. While there has been steady improvement since 2012, greater effort is needed to improve the transparency and accountability of grants assessments. The Department of Justice also needs to demonstrate that grants to the racing industry have achieved the desired outcomes.

Yours faithfully

John Doyle Auditor-General

28 November 2013

Auditor-General's comments

Auditor-General |

Audit team Chris Sheard—Sector Director David Cook—Team Leader Matthew Irons—Analyst Emily Doherty—Analyst Ray Winn—Engagement Quality Control Reviewer |

Grants are given to organisations or individuals to enable the government to achieve its policy objectives. As with all distributions of public funds, the provision of grants must be transparent and accountable, and should maximise the expected benefit.

In this audit I looked at how the Department of Justice is managing grants to the racing industry. I also reviewed racing controlling bodies' management of grants for infrastructure projects.

Between 2009 and 2012 the Department of Justice administered grants to the racing industry through the Regional Racing Infrastructure Fund, and from 2011 through the Victorian Racing Industry Fund.

The audit found weaknesses with the department's administration of racing industry grants that repeatedly arise in public sector administration and which were documented in this office's review of audits tabled between 2006 and 2012. They include shortcomings in the analysis underpinning decisions, weaknesses in procurement, no assessment of the outcomes achieved, and a lack of public information on grants awarded.

I am encouraged that the Department of Justice has made a number of improvements to its racing grants administration since 2011, and that controlling bodies have either addressed, or are in the process of addressing, weaknesses in project management and procurement.

However, I am concerned that the Department of Justice, which operates a number of grants programs, has not acted earlier to ensure that grants to the racing industry are administered in accordance with better practice standards.

I have made six recommendations to strengthen the administration of racing grants programs, and five recommendations to improve project management and procurement in two controlling bodies. It is pleasing that agencies have accepted and committed to implementing my recommendations.

John Doyle

Auditor-General

November 2013

Audit Summary

Victoria's racing industry is estimated to have contributed around $2.8 billion to the Victorian economy in 2011–12. The racing industry encompasses greyhound, harness and thoroughbred racing—each governed by a controlling body. For greyhound racing and harness racing, the controlling bodies are Greyhound Racing Victoria (GRV) and Harness Racing Victoria (HRV) respectively. These are statutory authorities established under the Racing Act 1958.

Thoroughbred racing is governed differently. Its controlling body—Racing Victoria Limited (RVL)—is a private company formed under the Commonwealth Corporations Act 2001 and certified by the Minister for Racing under the Racing Act 1958.

The controlling bodies perform a range of functions. These include:

- setting the rules of racing

- setting dates and times for races

- providing integrity services—including employing stewards and establishing appropriate levels of drug testing

- registering participants, racecourses and clubs

- licensing and monitoring bookmakers registered under the Gambling Regulation Act 2003

- consulting with stakeholders.

The Victorian racing industry conducted some 2 000 greyhound, harness and thoroughbred horse race meetings in 2011–12.

The racing industry has received funding from government since 2001. Since 2009 the racing industry has received funding through the Regional Racing Infrastructure Fund (RRIF) and the Victorian Racing Industry Fund (VRIF). The Department of Justice (DOJ) manages these funds.

RRIF operated between 2009 and 2012 and provided $39.4 million for 117 infrastructure projects, with controlling bodies contributing $31.5 million. Only the racing controlling bodies were eligible to apply for RRIF funding.

VRIF will operate between July 2011 and June 2015. By June 2013, VRIF had provided $14.3 million in grants for racing infrastructure, with racing industry contributions of $16.6 million. Racing controlling bodies, racing clubs and other racing industry bodies, such as picnic racing clubs, are eligible to apply for VRIF funding.

The audit examined whether DOJ and controlling bodies are managing grants to the racing industry effectively. This included examining processes for assessing applications, making funding recommendations, managing funding agreements and delivering the outputs and outcomes intended of the grants programs.

Conclusions

DOJ's management of racing industry grants over the past five years has been administratively weak. Particularly for the now completed RRIF, a lack of assessment guidance and records meant it was unclear whether applications had met the funding criteria or had been assessed consistently. There were also weaknesses with how some controlling bodies managed publicly funded projects, and how DOJ oversaw these projects and gained assurance that they would achieve intended outcomes.

Since VRIF started in 2011, there has been steady improvement both in how DOJ manages applications and in how controlling bodies manage funded projects. But greater effort is needed to improve the transparency and accountability of grants assessments. DOJ also needs to demonstrate that grants have achieved the desired outcomes and brought the expected benefits—something it is currently unable to do.

Findings

Grant assessments

DOJ conducts all grant assessments. During the audit we found that it had set up clear application and assessment procedures, roles and responsibilities for RRIF and VRIF grants programs, and improved funding criteria and requirements of applicants for VRIF. However, there are still significant weaknesses with how DOJ assesses applications and how it records assessments.

RRIF funding criteria reflected the program's purposes and focused on need, net benefit and the adequacy of project management and consultation. DOJ has further strengthened the funding criteria for VRIF.

DOJ also set up effective application procedures for RRIF and VRIF, including clear roles and responsibilities for applicants, the Office of Racing and the Minister for Racing. DOJ was responsible for assessing RRIF and VRIF applications.

However, DOJ has not established guidelines to robustly and consistently assess proposals against the funding criteria. In addition, it only started recording its grant application assessments in August 2012—three years after the RRIF program began. These assessments do not show whether applications met each funding criterion or the extent to which they met them.

Grant approvals

The Minister for Racing decides which projects RRIF and VRIF will fund based, in part, on DOJ's advice and funding recommendations. While DOJ routinely gives advice, its recommendations are not based on clear assessments against all funding criteria. Consequently it is not clear whether all funded projects met all the funding criteria. The amount of information that DOJ gives to the minister has increased under VRIF, but further improvement is needed.

Managing funding agreements

DOJ established funding agreements for all grants made under RRIF and VRIF, with funds distributed according to the Minister for Racing's funding decisions.

However, DOJ incurred unnecessary risks in managing the RRIF program as it did not assure itself of the suitability of the funding agreement prior to its use. The execution of agreements was not always timely, with agreed activities often occurring without a funding agreement in place.

DOJ has processes in place to manage risks associated with payments under the funding agreements, such as not making payments without evidence of expenditure. However, it has not exercised all its rights under the funding agreements to monitor projects and assure itself of recipients' management of RRIF and VRIF funds. During the RRIF program, DOJ did not identify weaknesses in some recipients' procurement and contracting practices that could have reduced the benefits arising from public funding.

Under RRIF, recipients did not accurately plan the project completion dates listed in funding agreements, and DOJ did not enforce the agreements to improve recipients' planning and compliance. Under VRIF, the timeliness of project completion has since improved.

Controlling bodies' grant-funding governance

The three controlling bodies received $39.4 million in RRIF grants between June 2009 and September 2012, and $13.5 million in VRIF grants between July 2011 and June 2013. Overall, the racing controlling bodies are improving their capital procurement and contract management practices. However, there has been considerable variation in standards of practice.

RVL is the largest recipient of RRIF and VRIF Racing Infrastructure grants, receiving 134 grants amounting to $35.7 million, or approximately 64 per cent of funding granted for infrastructure. Thoroughbred racing clubs received 30 VRIF grants amounting to $3.2 million.

RVL's project management is sound. It has developed procurement methods to reduce reliance on specialist providers and increase competition for its capital spending. RVL's procurement processes showed attention to probity, and it has sound controls over project accounting and record keeping.

GRV received $9.5 million for 18 projects, comprising approximately 17 per cent of RRIF and VRIF Racing Infrastructure funding.

GRV is addressing the deficiencies in its procurement and project management that were identified by the Ombudsman in 2012. These improvements will ensure GRV manages procurement fairly and gets the best possible value for money. GRV plans to improve its project accounting, and is in the process of developing requirements for managing capital project records.

HRV received $7.7 million for 22 projects, comprising approximately 14 per cent of RRIF and VRIF funding for infrastructure.

HRV has identified, and is addressing, weaknesses in its procurement and contract management. HRV purchases from specialised suppliers of capital equipment and project services without obtaining multiple quotes or tenders, and does not use contracts for all consultants. Strengthening its contracting practices and procurement from specialised suppliers will allow HRV to show that it gets value for money. HRV also needs to implement standards for managing capital project records.

Outcomes and net benefit

DOJ does not know whether RRIF and VRIF have met their objectives or achieved their intended outcomes. It has not developed measures to assess the performance of these programs and has no plans to assess whether the programs are achieving their intended outcomes or producing sufficient benefit for the racing industry and wider community.

A lack of comprehensive public information on funded projects' outcomes diminishes transparency and accountability.

Recommendations

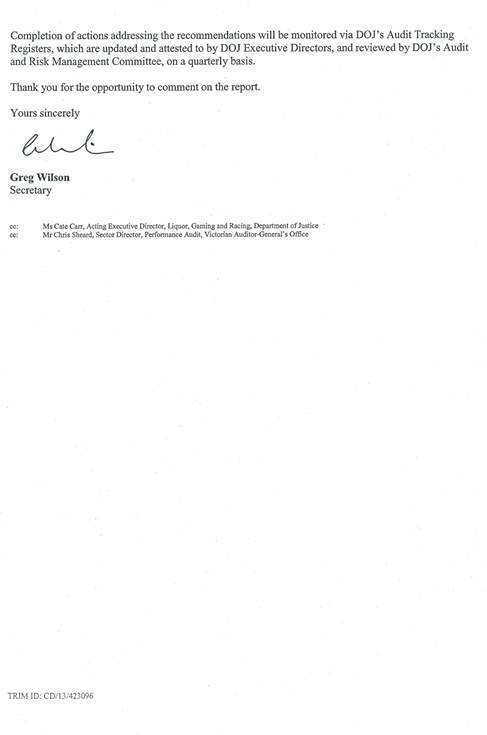

That the Department of Justice:

- implement guidelines to assess applications against Victorian Racing Industry Fund funding criteria

- require Victorian Racing Industry Fund Racing Infrastructure applicants seeking funding for large or complex projects to support their application with a business case

- improve the rigour of Victorian Racing Industry Fund Racing Infrastructure funding recommendations by advising the Minister for Racing of applications' merits against each funding criterion

- establish and report the outcomes of the Regional Racing Infrastructure Fund, and the Racing Infrastructure and Raceday Attraction programs of the Victorian Racing Industry Fund

- maintain on the Department of Justice website a list of all projects, funding sources and grants from the Regional Racing Infrastructure Fund and Victorian Racing Industry Fund

- establish processes to ensure that all Victorian Racing Industry Fund Raceday Attraction Program funding agreements are executed before the funded event.

That Greyhound Racing Victoria:

- implement requirements for managing project records that are consistent with its procurement and contract management policies.

That Harness Racing Victoria:

- include in its procurement policy minimum requirements for market testing to confirm pricing and competition in areas of specialised supply for capital projects

- implement contracts for all capital project consulting services in accordance with its new contract management policy

- establish grounds and standards of justification for exemptions from Development Fund Operating Guidelines and procurement policy and procedures

- implement requirements for managing project records that are consistent with its procurement and contract management policies.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994 a copy of this report was provided to the Department of Justice, Greyhound Racing Victoria, Harness Racing Victoria and Racing Victoria Limited, with a request for submissions or comments.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments are included in Appendix A.

1 Background

1.1 Racing industry

Victoria's racing industry encompasses greyhound, harness and thoroughbred racing, with a controlling body governing each. For greyhound racing and harness racing, the controlling bodies are Greyhound Racing Victoria (GRV) and Harness Racing Victoria (HRV) respectively. These are statutory authorities established under the Racing Act 1958.

Thoroughbred racing is governed differently. Its controlling body—Racing Victoria Limited (RVL)—is a private company formed under the Commonwealth Corporations Act 2001 and certified by the Minister for Racing under the Racing Act 1958.

The controlling bodies perform a range of functions. These include:

- setting the rules of racing

- setting dates and times for races

- providing integrity services, including employing stewards and establishing appropriate levels of drug testing

- registering participants, racecourses and clubs

- licensing and monitoring bookmakers registered under the Gambling Regulation Act 2003

- consulting with stakeholders.

Racing clubs are independent entities that work collaboratively with the controlling bodies. They act as event managers—organising the racing venue and providing catering, staff and promotions. Under the Racing Act 1958, the Minister for Racing licenses racing clubs.

In addition to the controlling bodies and racing clubs, the Office of Racing in the Department of Justice (DOJ) advises the Minister for Racing on racing legislation and regulation, racing licensing, and racing industry issues. The Office of Racing is also responsible for implementing the government's racing program, including its racing grants programs.

1.1.1 Racing industry activity

Together, the three racing codes conduct around 2 000 race meetings each year, at over 100 racing locations across metropolitan and regional Victoria.

The racing industry estimated in 2006 that breeding,

training, racing and wagering activities contributed approximately

$2 billion to Victoria's economy each year. A study in 2013 estimated that

this has increased to around $2.8 billion. Figure 1A shows

the number of race meetings by code for 2011–12.

Figure 1A

Racing code meetings and race locations in 2011–12

Racing locations |

|||

|---|---|---|---|

Racing code |

Race meetings |

Melbourne |

Country |

Greyhound |

944 |

2 |

11 |

Harness |

498 |

1 |

25 |

Thoroughbred |

559 |

4 |

63 |

Total |

2 001 |

7 |

99 |

Source: Victorian Auditor-General's Office from racing industry data.

1.1.2 Racing industry income

The racing industry gets most of its income from its joint venture with Tabcorp, the Victorian wagering licensee.

In 2011–12, Tabcorp payments to GRV totalled $43.6 million—79 per cent of GRV's income—while payments to HRV totalled $47 million—64 per cent of HRV's income. The highest Tabcorp payments were to RVL, totalling $179.8 million. This represented 72 per cent of RVL's income and 67 per cent of all Tabcorp payments to racing's controlling bodies. Other income sources for the controlling bodies include race field fees, racing regulation and service fees, and sponsorships.

Tabcorp's payments to the racing industry comprise fees for racing product and a share of wagering profits. Racing's controlling bodies also charge fees for non-Victorian wagering organisations' use of race field information. Racing industry income is spent on prize money, infrastructure development and maintenance, club support and the costs of operating the controlling bodies.

New racing industry income arrangements

New arrangements for racing industry income started with the new wagering licence in August 2012. The new arrangements included the controlling bodies losing gaming machine income and increasing their share of wagering profits from 25 per cent to 50 per cent. The government also reduced the tax charged on wagering to offset the industry's loss of gaming revenue.

1.2 Racing industry funding

Racing's controlling bodies received compensation payments between 2001 and 2008 directly from the Victorian Government, in addition to the bulk of their income from the joint venture with Tabcorp.

Figure 1B shows the source and amount of funding that the government gave, and intends to give, between 2001 and 2015, and accountability measures for each funding program.

Figure 1B

Racing industry direct funding and accountability measures

Direct funding ($mil) |

||||

|---|---|---|---|---|

Year |

Fund |

Accountability measures |

Annual amount |

Total for period |

2001–02 to 2003–04 |

Payment on behalf of the state |

None |

4.0 |

12.0 |

2004–05 to 2005–06 |

Racing Community Development Fund |

|

4.0 |

8.0 |

Payment on behalf of the state |

None |

3.5 |

||

2006–07 to 2007–08 |

Racing Industry Development Program |

|

9.3 |

18.6 |

Payment on behalf of the state |

None |

2.0 |

||

2008–09 to 2011–12 |

Regional Racing Infrastructure Fund |

|

11.25 |

45.0 |

2011–12 to 2014–15 |

Victorian Racing Industry Fund |

|

19.88 |

79.5 |

Source: Victorian Auditor-General's Office based on DOJ data.

Between 2001 and 2004 the Victorian Government made direct payments to controlling bodies totalling $12 million. The purpose of the direct funding was to compensate the racing industry for income lost as a result of a levy on gaming machine profits. The racing industry received a share of gaming machine profits from its joint venture with Tabcorp.

From 2004–05 to 2005–06 compensation payments totalling $11.5 million were paid to controlling bodies through the Racing Community Development Fund. To increase the industry's accountability, and to acknowledge the government's support, controlling bodies were required to gain approval for project funding and to report on its use. The Racing Community Development Fund supported areas such as breeding, ownership, jockey welfare, education and training, safety, and promotion of racing.

The Racing Industry Development Program, which operated in 2006–07 and 2007–08, gave $18.6 million to the racing controlling bodies to support capital developments at racing and training venues. DOJ controlled allocations from the Racing Industry Development Program, in contrast to previous funds, which were paid directly to controlling bodies. The Victorian Government made an additional payment of $2 million to the controlling bodies in 2006–07 to compensate for an increase in the levy on gaming machine profits in November 2005.

The Regional Racing Infrastructure Fund (RRIF) was announced in November 2008 and operated until September 2012. It also aimed to support controlling bodies' capital development projects. Controlling bodies were required to contribute to each project and made an initial commitment to RRIF of $41 million, almost matching the government's commitment of $45 million.

The Victorian Racing Industry Fund (VRIF) started in July 2011 and will operate until June 2015. It gives grants for approved projects to controlling bodies, clubs and other racing industry bodies such as picnic racing clubs, generally with an equal contribution required of the applicant. It is expected that funds available through VRIF will total $79.5 million over four years.

1.2.1 Regional Racing Infrastructure Fund

RRIF was intended to ensure that Racing Infrastructure had the capacity to support the future needs of the racing industry. It was also intended to support renewal of the wagering licence and the racing industry's joint venture with the new wagering licensee through the development of Racing Infrastructure.

The purpose of RRIF was to financially support controlling bodies' projects at racing and training venues outside Melbourne, and to stimulate industry growth and development. RRIF was intended to support drought-proofing and water-saving measures, occupational health and safety improvements, infrastructure developments, and initiatives to stimulate industry growth and development.

Only racing controlling bodies were eligible to apply for RRIF grants, and DOJ accepted applications at any time. Grants were paid as contributions to individual projects with cash or in-kind contributions from racing controlling bodies, clubs and other sources. RRIF was not a competitive grants program, and the government's contribution was divided according to the racing codes' respective market share of wagering. GRV's initial allocation was $7.7 million, HRV's $6.9 million, and RVL's $30.4 million.

1.2.2 Victorian Racing Industry Fund

VRIF is part of the Victorian Government's Plan for Racing, which includes the return of unclaimed wagering dividends and on-course wagering taxes from totalisator bets to the Victorian racing industry. The level of funding available from these sources depends on the value of funds wagered and the level of unclaimed wagering dividends.

VRIF program guidelines state that the program 'provides funding support to the Victorian racing industry for improvements at racing and training venues and for selected programs designed to further stimulate industry growth and development'.

There are two components of VRIF that directly support controlling bodies, racing clubs, jumps racing, picnic and graduation clubs:

- Racing Infrastructure—which supports development of racing and training infrastructure and facilities. Funding is up to $30 million over four years from unclaimed wagering dividends.

- Raceday Attraction Program—which supports initiatives to attract attendance at race meetings. Funding was $5.8 million in the first year and $2.3 million each year thereafter, as a result of the reduction in the wagering tax rate.

VRIF Racing Infrastructure and Raceday Attraction programs benefit controlling bodies and licensed racing clubs. Funds for Racing Infrastructure are broadly divided between the codes according to their wagering market share, with the result that GRV is allocated 15.5 per cent, HRV 15.5 per cent, and RVL 69 per cent. DOJ accepts applications at any time because VRIF, like RRIF, is not a competitive grants program.

Other components of VRIF include:

- supporting breeding and sales of racehorses and greyhounds—$10 million

- welfare of retired greyhounds and racehorses—$2 million

- promotion, increased participation and safety measures for jumps racing—$2million

- picnic racing—$0.2 million

- research into drug detection—$4 million.

1.3 Audit objective and scope

The audit objective was to assess whether DOJ and controlling bodies GRV, HRV and RVL are managing racing industry grants effectively and efficiently.

The audit examined whether effective processes guide assessment and funding of grant applications, and whether grant programs are achieving their intended outcomes. The audit examined RRIF, which operated from 2008 to 2012, and the VRIF Racing Infrastructure and Raceday Attraction programs, which run from 2011 until 2015.

1.4 Audit method and cost

The audit involved:

- desktop research

- reviews of RRIF and VRIF program management documentation from 2008 to 2013, including funding applications, assessments and briefings

- grant recipients' project records and governance processes

- interviews with agencies and stakeholders

- quantitative and qualitative analysis.

The audit was conducted under section 15 of the Audit Act 1994 and in accordance with the Australian Auditing and Assurance Standards.

Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated, any persons named in this report are not the subject of adverse comment or opinion.

The total cost of the audit was $299 000.

1.5 Report structure

Part 2 examines the effectiveness of processes guiding assessment and funding of grant applications.

Part 3 examines how well grant programs are achieving intended outcomes.

2 Managing Applications

At a glance

Background

As with all distributions of public funds, the provision of grants must be transparent and accountable, and should maximise the expected benefit. This is achieved firstly by using effective selection criteria and guidance, and then by documenting assessments to explain and inform decisions.

Conclusion

The Department of Justice (DOJ) is not able to show that all projects funded through the Regional Racing Infrastructure Fund (RRIF) and the Victorian Racing Industry Fund (VRIF) met those programs' funding criteria. This is because DOJ did not start recording assessments until August 2012, and subsequent records of VRIF assessments do not show whether applications meet each funding criterion. Consequently, the grant programs lack the necessary transparency and accountability.

Findings

- DOJ set up clear application and assessment procedures, roles and responsibilities for RRIF and VRIF.

- Funding criteria were in place for RRIF and were improved for VRIF, but DOJ has not articulated the standards required to meet each funding criterion.

- RRIF applications were not managed in accordance with program guidelines.

- Application requirements for RRIF did not give DOJ enough assurance of applicants' claims, but were substantially better for VRIF.

Recommendations

That the Department of Justice:

- implement guidelines to assess applications against VRIF funding criteria

- require VRIF Racing Infrastructure applicants seeking funding for large or complex projects to support their application with a business case

- improve the rigour of VRIF Racing Infrastructure funding recommendations by advising the Minister for Racing of applications' merits against each funding criterion.

2.1 Introduction

Grants are a form of government funding, typically provided to the non-government sector as a way to achieve policy objectives. As with all distributions of public funds, grants need to be transparent and accountable, and should maximise expected benefits.

Transparent and accountable grants administration occurs firstly by using effective selection criteria and guidance, and then by documenting assessments to explain and inform decisions.

2.2 Conclusion

The Department of Justice (DOJ) is not able to demonstrate that all projects funded through the Regional Racing Infrastructure Fund (RRIF) and the Victorian Racing Industry Fund (VRIF) met those programs' funding criteria.

This is because DOJ did not start recording assessments until August 2012, and subsequent records of VRIF assessments do not show whether applications met each funding criterion. Although administration of VRIF has improved compared with RRIF, a lack of assessment guidelines means it is not possible to determine whether applications were assessed consistently. As a consequence, the grant programs lack the necessary transparency and accountability.

2.3 Grant assessments

An effective grants program requires robust planning that identifies any risks to consistent and transparent grants administration. Roles and responsibilities should be clearly assigned, and the grant administrator should develop and use funding criteria and guidelines to ensure that applications meet the policy objectives, and that assessments are consistent and equitable.

DOJ set up clear application and assessment procedures, roles and responsibilities for RRIF and VRIF grants programs, and developed funding criteria to assess applications. However, weaknesses remain, both in how DOJ assesses applications and in how it records assessments.

2.3.1 Funding criteria

DOJ developed funding criteria for RRIF that reflected the program's purposes and enabled it to assess applications for need, net benefit, and the adequacy of project management and consultation. The funding criteria for RRIF grants were:

- demonstrated consistency with the eligibility requirements of the program

- demonstrated need for the project and net benefit to the racing industry, and where applicable, the wider community

- demonstrated consultation with industry stakeholders and where applicable the broader community

- project management arrangements

- consideration given to environmental protection and water-saving opportunities.

The selection criteria for RRIF gave DOJ a reasonable basis on which to assess applications. DOJ strengthened the selection criteria for VRIF Racing Infrastructure—the main program in VRIF—to address weaknesses it had identified. In addition to the existing RRIF funding criteria, VRIF Racing Infrastructure applicants were required to demonstrate:

- economic viability, and long-term management and ongoing maintenance plans

- improvement in access for non-traditional users of racing venues

- measures to determine a successful project outcome for the club, racing industry and the broader community.

These additional criteria reduce a number of risks—applicants overstating benefits, excessive project costs, inadequate project management, and lack of success measures.

2.3.2 Assessment guidance

Assessment guidelines help to ensure that judgements of merit remain consistent where applications cannot be assessed at one time. Where applicants do not face competition for funding, as is the case for RRIF and VRIF, assessment guidelines also help to ensure that funded projects achieve consistent standards of merit.

DOJ set up clear application procedures for RRIF and VRIF, including clear roles and responsibilities for applicants, the Office of Racing and the Minister for Racing. However, it did not establish guidelines to assess proposals against the funding criteria. Assessment guidelines should describe the attributes of projects that adequately meet the funding criteria, so that proposals not meeting these standards can be either improved or rejected.

Without firm guiding standards, there is a risk that insufficient attention is paid to achieving program objectives, and funds may not bring maximum benefits to the racing industry and the community.

2.3.3 Assessing applications

Assessing applications against the funding criteria is the critical step in deciding whether to fund the applicant. Applications need to show how they meet the criteria, and the assessment needs to occur consistently, equitably and transparently.

DOJ was responsible for assessing RRIF and VRIF applications and making funding recommendations to the Minister for Racing. However, it is unclear whether all projects that received RRIF and VRIF funding met the funding criteria, or the extent to which they met it. This is because DOJ did not record its assessments until August 2012, and assessment records since then do not show whether applications meet each funding criterion.

Regional Racing Infrastructure Fund

RRIF guidelines clearly state that DOJ's role was to assess applications and make funding recommendations to the Minister for Racing. However, the application and assessment processes did not conform to the documented procedure, roles and responsibilities.

Before submitting applications, controlling bodies provided the Minister for Racing indicative lists of projects to be considered for funding, as the minister wanted the majority of RRIF funding to be committed within the first two years of the program. DOJ advised that this process effectively resulted in projects being selected for funding before applications were submitted. Consequently, this reduced both the importance and relevance of the grant application process and DOJ's assessments.

Considerable variation in the quality of RRIF applications means it is unclear whether DOJ consistently achieved confidence in applicants' claims against the funding criteria. As shown in Figure 2A, the sample of funded projects that VAGO examined contained a proportion with incomplete applications, cursory responses to funding criteria, and incomplete supporting documentation.

Figure 2A

Quality of applications for RRIF and VRIF Racing Infrastructure funding

Grant files for which criterion is satisfied |

||

|---|---|---|

Criterion |

RRIF |

VRIF Racing Infrastructure |

All sections of application completed |

95 per cent |

89 per cent |

Description of project benefits—cursory, adequate, or comprehensive(a) |

53 per cent adequate or comprehensive |

83 per cent adequate or comprehensive |

One or more project benefits are quantified with targets |

20 per cent |

22 per cent |

Description of project management—cursory, adequate, or comprehensive(b) |

30 per cent adequate or comprehensive |

67 per cent adequate or comprehensive |

Letter of commitment from funding contributors other than the controlling body |

None of the eight files for which this is relevant |

None of the three files for which this is relevant |

Plans and diagrams included with application |

76 per cent of the 38 files for which this is relevant |

88 per cent of the 16 files for which this is relevant |

Project costing included with application |

60 per cent |

94 per cent |

(a) Cursory descriptions were unclear or incomplete, adequate

contained limited information but identified at least one benefit and

comprehensive contained clear and comprehensive information and quantified

measures where relevant.

(b) Cursory descriptions were unclear or incomplete, adequate

were clear but contained limited information and comprehensive contained clear

and comprehensive information.

Source:

VAGO assessment of a sample of DOJ Racing Infrastructure grant files of

Greyhound Racing Victoria—seven

RRIF and four VRIF, Harness Racing Victoria—13

RRIF and three VRIF, and Racing Victoria Limited—20

RRIF and 11 VRIF. VRIF grant recipients include clubs and controlling

bodies.

RRIF application forms required only that applicants provide a comment against each of the funding criteria. Yet RRIF supported 13 projects with grants of over $1 million, the largest being a grant of $4.69 million for a project valued at $6.70 million. Application material did not require projects over a certain size to give more comprehensive justification, such as a business case, so that DOJ could be assured that criteria for need and benefit would be satisfied.

VAGO's assessment of RRIF files found that the majority of applications contained only limited supporting information. Of the applications from one controlling body, around two-thirds included no costing, which raises doubt about how DOJ assessed the expected net benefits of the proposals.

Despite the inconsistent quality of RRIF applications, all 117 applications attracted funding. It was not possible to understand why this was the case, because DOJ did not record its assessment of applicants' claims against RRIF funding criteria. Not documenting assessments is a fundamental breakdown of basic grants administration and invites questions about the transparency, accountability and integrity of the process.

Victorian Racing Industry Fund

The quality of applications to VRIF is markedly better than for RRIF, although the quality of assessments has not similarly improved. As Figure 2A shows, VRIF performed better than RRIF against the following criteria:

- descriptions of project benefits VAGO rated as adequate or comprehensive—83 per cent compared to 53 per cent

- applications in which one or more claimed benefits were quantified with targets—22 per cent compared to 20 per cent

- descriptions of project management arrangements that VAGO rated as adequate or comprehensive—67 per cent compared to 30 per cent

- proportion of applications supported with project costings—94 per cent compared to 60 per cent.

VRIF Raceday Attraction files also showed that DOJ thoroughly scrutinises applications, obtaining clarifications from applicants and identifying costs that are ineligible for VRIF funding.

In January 2013, DOJ revised VRIF application forms, requiring applicants to show that their procurement arrangements would meet public sector guidelines. DOJ also strengthened other information requirements, including the reasons for not including specified documentation in support of the application, such as quotations and tender documents, project budget, project plans, planning and building permits, project reports, and letters of support from controlling bodies and funding contributors.

However, as with RRIF, applicants for VRIF Racing Infrastructure grants are not required to support large or complex projects with a business case. As at 30 June 2013, VRIF had funded four projects with grants of over $1 million, the largest of which was $3 million for a project worth $9 million. While applicants may have prepared business cases for their own purposes, without evidence of such analysis, DOJ cannot be sure that applicants' claims of need, net benefit and economic viability are valid.

DOJ has not established assessment guidelines despite this being better practice since at least 2002. It is unclear whether the applications received at different times were assessed against consistent standards. This uncertainty is made worse by continued weaknesses in how DOJ records its assessments against the funding criteria. Despite this, as of June 2013, 87 of 89 VRIF Racing Infrastructure grants have been funded, with 92 of 101 Raceday Attraction Program grants also funded.

DOJ has trialled tools for assessing applications, and since August 2012 has used a standard form to record the applicant information on which its assessments are based. While it records whether the proposal is consistent with funding criteria, it does not record its judgements against each criterion, particularly whether the project's net benefit justifies the contribution of public funds. It is therefore not possible to understand how DOJ decides on its funding recommendations. As a consequence, transparency and accountability weaknesses remain.

2.4 Grant approvals

Approving grants requires that the decision-maker has sound advice and recommendations on which to base the decisions. This is fundamental to a transparent and accountable process.

For RRIF and VRIF, the Minister for Racing decides which projects will receive funding, based in part on DOJ's advice and funding recommendations. However, weaknesses with DOJ's assessments mean funding recommendations are not based on complete and robust information about the application.

2.4.1 Ministerial briefings

DOJ briefs the Minister for Racing on applications it receives under RRIF and VRIF. These briefings include recommendations about which applications to approve, supported by a range of information.

Briefings for RRIF funding decisions included information on the status of the RRIF program, the application and proposal, and DOJ's funding recommendation. Despite briefings and recommendations being supported by information to assist the minister's decision-making, DOJ's inadequately documented assessments meant the minister was unlikely to have received either comprehensive or sufficient advice on which to base decisions.

For VRIF, DOJ improved its briefings, adding:

- a breakdown of project costs, including the allocation of costs to funding sources for Raceday Attraction Program applications

- evidence of compliance with Victorian Government procurement requirements, including copies of quotes for major cost items in the case of applications for Raceday Attraction Program grants, and justification of any procurements without quotes or tenders

- a copy of the funding application, estimated project costs and DOJ's application assessment sheet.

However, ongoing weaknesses with VRIF application assessments mean the minister still does not receive comprehensive information on applications' performance against the funding criteria. While some improvements to the process have been made, DOJ has missed an opportunity to more thoroughly review its processes to improve assessments and advice to the Minister for Racing.

Recommendations

That the Department of Justice:

- implement guidelines to assess applications against Victorian Racing Industry Fund funding criteria

- require Victorian Racing Industry Fund Racing Infrastructure applicants seeking funding for large or complex projects to support their application with a business case

- improve the rigour of Victorian Racing Industry Fund Racing Infrastructure funding recommendations by advising the Minister for Racing of applications' merits against each funding criterion.

3 Managing funding agreements and projects

At a glance

Background

Understanding whether program objectives have been achieved is a key part of grants administration. Accountability for the success or failure of the activity and the value obtained from the grant ultimately lies with the funder. The funder needs to monitor the grant to ensure that conditions are being met and benefits are being achieved.

Conclusion

Department of Justice (DOJ) has not demonstrated adequate accountability in managing public funds committed to the Regional Racing Infrastructure Fund (RRIF) and Victorian Racing Industry Fund (VRIF) programs. While there is no evidence of funds being mismanaged, DOJ has not effectively managed funding agreements or adequately held controlling bodies to account for their use of grant funds. While this has improved under VRIF, the absence of any program evaluations or assessments of the outcomes achieved means there is little assurance that program expenditure is delivering sufficient benefit.

Findings

- DOJ has not consistently applied conditions of funding agreements that would assure it that project management is effective.

- Timely completion of VRIF projects is substantially better than for RRIF.

- DOJ has not sought to establish the outcomes of RRIF and VRIF, nor publish comprehensive information on RRIF and VRIF projects.

- Although 20 per cent of VRIF Raceday Attraction Program agreements are executed on or after the funded event, DOJ has improved execution of funding agreements.

- Greyhound Racing Victoria and Harness Racing Victoria are improving capital procurement and project management practices following identified weaknesses.

Recommendations

That the Department of Justice:

- establish and report the outcomes of RRIF and VRIF

- establish processes to ensure that all VRIF Raceday Attraction Program funding agreements are executed before the funded event.

3.1 Introduction

Understanding whether program objectives have been achieved is a key part of grants administration. Accountability for the success or failure of the activity and the value obtained from the grant ultimately lies with the funder. The funder needs to monitor the grant to gain assurance that conditions are being met and benefits are being achieved.

For the Regional Racing Infrastructure Fund (RRIF) and Victorian Racing Industry Fund (VRIF) grant recipients are responsible for delivering funded projects. The Department of Justice (DOJ) is accountable for ensuring recipients deliver projects consistent with funding agreements, and for the overall outcomes of RRIF and VRIF.

3.2 Conclusion

DOJ has not shown adequate accountability in managing the public funds committed to the RRIF and VRIF programs. While there is no evidence of funds being mismanaged, DOJ has not effectively managed funding agreements or adequately held controlling bodies to account for their use of grant funds. Although this has improved under VRIF, the absence of any program evaluations or assessment of outcome achievement means there is little assurance that program expenditure is achieving sufficient benefit.

3.3 Managing funding agreements

The making of grants should be supported by effective funding agreements that are enforceable and that limit risks to funds and grant program outcomes. Agreements should establish clear roles and responsibilities, and give the funder rights to monitor projects and recipients, withhold funds, and require recipients to report on projects' contributions to program objectives.

All RRIF and VRIF grants were covered by funding agreements that gave DOJ the right to monitor projects and recipients. While DOJ has improved how it manages funding agreements over the course of RRIF and VRIF, it has not routinely required recipients to report progress. Nor has it consistently sought assurance of recipients' management of funds and projects through statutory declarations and audits of project finances.

3.3.1 Developing funding agreements

DOJ used its own funding agreements for all grants made under RRIF and VRIF until September 2012, when the whole-of-government Common Funding Agreement was adopted. Prior to September 2012, DOJ did not assure itself of the suitability of its funding agreement before using it. It also did not satisfy itself that the agreement could be fully enforced, and that there were no consequential risks to the state. Specifically, it did not conduct a risk review to inform development of the funding agreement, or obtain legal advice.

VAGO's assessment of the terms of the RRIF and VRIF funding agreements indicate that they:

- limited the state's financial obligation in respect of individual projects, and fixed the proportion of grant funds in the event of projects being completed under budget

- allocated responsibility for project management and risk for completion of projects to the funding recipient

- gave the state the right to withhold funds in the event of noncompliance

- gave the state the right to review the recipient's finances and activities associated with funded projects

- obliged the recipient to produce:

- monthly project reports

- a final project audit report

- evidence of project expenditure

- statutory declaration of final project cost, completion of the project and finalisation of all supplier obligations.

The agreements also gave DOJ the ability to monitor projects and recipients. Additionally, they gave DOJ rights to require reasonable compliance with recipients' nominated project completion dates, assurance that projects were completed as planned, and validation of the accuracy of recipients' project spending and funding claims.

3.3.2 Executing funding agreements

DOJ established agreements with funding recipients in accordance with the decisions of the Minister for Racing. However, the execution of funding agreements was not always timely. Delays in finalising funding agreements create the risk that applicants start projects without formally accepting the terms of funding. Particularly for VRIF Raceday Attraction Program grants, agreed activities have often occurred without a funding agreement in place—around 20 per cent had agreements executed on or after the funded event. This practice places the ability of DOJ to enforce the terms of its agreements at risk.

Figure 3A shows the average time taken to execute RRIF and VRIF Racing Infrastructure funding agreements after the Minister for Racing's approval. DOJ's performance in finalising agreements has varied substantially and appears unrelated to the number of applications received. Its performance improved from 2009 to 2010, before declining in 2011 when DOJ required up to 57 business days on average, or nearly three months, to finalise agreements. Since January 2012, DOJ has again steadily reduced the time required.

Figure 3A

Time required to execute RRIF and VRIF Racing Infrastructure funding agreements

|

RRIF |

VRIF Racing Infrastructure |

||||

|---|---|---|---|---|---|

|

Period in which application received |

Applications received |

Average time to execute funding agreement (business days) |

Applications received |

Average time to execute funding agreement (business days) |

|

|

2009 |

Jan–June |

12 |

16 |

||

|

July–Dec |

15 |

38 |

|||

|

2010 |

Jan–June |

13 |

17 |

||

|

July–Dec |

21 |

16 |

|||

|

2011 |

Jan–June |

12 |

54 |

||

|

July–Dec |

12 |

52 |

14 |

57 |

|

|

2012 |

Jan–June |

30 |

21 |

22 |

44 |

|

July–Dec |

1 |

16 |

27 |

31 |

|

|

2013 |

Jan–June |

20 |

17 |

||

Note: Analysis of all RRIF and VRIF Racing Infrastructure grants approved before 30 June 2013. Time to execute funding agreement is the time between minister's approval and finalisation of the funding agreement.

Source: Victorian Auditor-General's Office based on DOJ data.

Figure 3B shows the proportion of VRIF Raceday Attraction Program funding agreements executed on or after the date of the funded event between July 2011 and June 2013. DOJ has substantially improved the management of these funding agreements, although 20 per cent of funding agreements for January to June 2013 were still finalised on the day of, or after, the funded event.

Figure 3B

VRIF Raceday Attraction Program funding agreements executed after the funded event

|

Period in which application received |

Applications received |

Number of funding agreements executed late |

Proportion of funding agreements executed late (per cent) |

Late agreements average business days late |

|

|---|---|---|---|---|---|

|

2011 |

July–Dec |

11 |

9 |

82 |

30 |

|

2012 |

Jan–June |

16 |

6 |

38 |

27 |

|

July–Dec |

45 |

18 |

40 |

17 |

|

|

2013 |

Jan–June |

20 |

4 |

20 |

3 |

Note: Analysis of all Raceday Attraction Program applications received between July 2011 and June 2013. Late agreements are those signed on the day or after the funded event.

Source: Victorian Auditor-General's Office based on DOJ data.

3.3.3 Monitoring funding agreements and recipients

DOJ has not exercised all rights under the funding agreements to monitor projects and assure itself of recipients' management of RRIF and VRIF funds. It did not adequately hold controlling bodies to account for project completion dates. Nor did it adequately monitor funded projects or enforce accountability requirements for the expenditure of public funds. Consequently, a large number of projects were delivered later than the agreements stipulated, and few projects had audited project finances as required.

Project reports

DOJ has not consistently applied terms of the funding agreements that require recipients to provide regular project reports. Only 20 per cent of RRIF files VAGO reviewed contained project reports, compared to 41 per cent of VRIF Racing Infrastructure files. Without project reports, DOJ has little oversight of the progress of projects it funded, and little oversight of the expenditure of public funds.

Project finances

DOJ has not used the terms of the funding agreements open to it to review recipients' project finances and activities, in either the RRIF or VRIF programs. During the RRIF program, such a review would have been justified by the poor quality of many applications, the late completion of projects, and controlling bodies' failure to consistently produce project reports.

A review would have informed DOJ of whether funding recipients adequately considered projects' net benefit during their planning, as DOJ was not able to adequately assess this based on funding applications. A review would also have identified risks associated with controlling bodies' procurement and project management. During the RRIF program there were weaknesses in procurement and contract management at Greyhound Racing Victoria (GRV) and Harness Racing Victoria (HRV), and weaknesses in GRV's project financial monitoring.

Until September 2012, funding agreements required recipients of grants over $20 000 to include a report of audit with their final funding claim. However, DOJ did not enforce this requirement and it did not obtain any project audit reports.

DOJ also requires recipients to provide it with a statutory declaration of final project costs. The total project cost determines whether the final payment should be reduced to maintain the agreed balance of grant and contribution when projects are completed under budget. Without a statutory declaration, DOJ does not have assurance of whether a recipient should receive the full final grant payment.

Figure 3C shows that only 77 per cent of RRIF files contained statutory declarations. However, DOJ is now more consistently applying terms of funding agreements—VAGO found all of the 20 completed VRIF Racing Infrastructure files contained statutory declarations.

Figure 3C

Completion of RRIF and VRIF Racing Infrastructure projects at 30 June 2013

|

Factor |

RRIF |

VRIF Racing Infrastructure |

|---|---|---|

|

Completion date |

||

|

Projects late to complete |

93 per cent |

70 per cent |

|

Average number of business days late |

121 business days |

39 business days |

|

Projects more than 60 business days late to complete |

55 per cent |

20 per cent |

|

Average time late beyond 60 business days |

124 business days |

24 business days |

|

Assurance |

||

|

Report of audit of project finances for projects of $20 000 and over in value(a) |

0 per cent |

0 per cent |

|

Statutory declaration included with final funding claim(b) |

77 per cent |

100 per cent |

|

Budget |

||

|

Completed projects within 5 per cent of planned budget(c) |

79 per cent |

75 per cent |

(a) Not required under new funding agreement introduced in September 2012.

(b) Statutory declarations on file and provided at the time of final funding claim.

(c) GRV projects not included in analysis, as GRV's final project accounting information was not available for all projects.

Source: VAGO's assessment of 40 of DOJ's RRIF grant files: GRV—seven, HRV—13 and Racing Victoria Limited (RVL)—20, and 20 of DOJ's VRIF Racing Infrastructure files for completed projects of clubs and controlling bodies.

Despite these weaknesses in financial monitoring, RRIF and VRIF projects were generally completed within their budgets. Of 28 RRIF projects for which final cost information was available, only six were outside 5 per cent of planned budget. Of 20 finalised VRIF Racing Infrastructure projects, 75 per cent were within 5 per cent of planned budget.

Project timeliness

Projects funded through RRIF and VRIF have generally not been delivered according to agreed time frames. The dates for finalising RRIF projects, nominated by funding recipients and included in funding agreements, were not accurately planned. Nor did DOJ take action to require funding recipients to improve their planning of these dates.

DOJ did not enforce completion dates in RRIF funding agreements, despite the then Minister for Racing's expectation that funds would be substantially committed within two years. VAGO's review identified four projects with RRIF funding applications dated between December 2011 and February 2012 that were completed more than 150 business days late.

Figure 3C shows that 93 per cent of 39 RRIF projects reviewed had not been finalised by the expected completion date, with late projects exceeding expected completion date by approximately six months. Around 55 per cent of projects VAGO reviewed were not completed 60 business days after the expected completion date.

Timely completion has improved for VRIF Racing Infrastructure projects when compared to RRIF. Around 70 per cent of 20 completed projects VAGO reviewed were late by an average of 39 business days after the completion dates in funding agreements. The percentage of projects completed more than 60 business days late was reduced from 55 per cent for RRIF, to 20 per cent for VRIF.

3.4 Controlling bodies' grant-funding governance

Grant recipients need robust systems and processes to manage projects in accordance with funding agreements and to account for their use of public funds. To obtain value for money, grant recipients' procurement needs to be managed fairly, promote market competition, and help them effectively control supplier costs.

Procurement and project accounting

Poor procurement practices create risks, including a lack of transparency and fairness in procurement decisions, inadequate competition leading to reduced value for money, unnecessary costs arising from poorly managed processes, and failure to deliver the goods and services intended.

Greyhound Racing Victoria

Before 2012, GRV's capital procurement practices did not comply with better practice. GRV did not adequately manage tender processes, and engaged consultants without contract. GRV had limited controls over procurement, and its accounting system did not support project-based recording of costs. As a consequence, GRV was not able to supply reliable finalised accounts for all its RRIF and VRIF projects.

Since June 2012, GRV has acted to address these weaknesses. It is implementing improved procurement and financial control processes for its capital projects, including those funded through VRIF. GRV has voluntarily delayed capital project activity since June 2012 until these improvements are complete.

GRV is significantly improving its procurement and accounting arrangements. It is now introducing a procurement system that helps control commitments, goods receipt and payments, and is using service contracts for all suppliers. This will give GRV the basis to achieve value for money, and to effectively control supplier costs.

To establish these arrangements, GRV's senior executives are closely overseeing GRV's first capital project since June 2012. Even though there is currently no legal requirement for GRV to adhere to public sector procurement guidance, other than for VRIF funded projects, GRV has advised that it is voluntarily complying with the Victorian Government Purchasing Board's procurement policies.

Harness Racing Victoria

HRV adequately monitors and controls project financial records, and is able to track spending against project-specific account codes for each of HRV's racing clubs. However, HRV has identified weaknesses in its procurement and contract management, and is introducing controls to address these weaknesses.

HRV's procurement practices during RRIF and VRIF programs did not allow it to show that it always achieved value for money, or promoted open and fair competition for its capital spending:

- HRV has used the same specialised consultants for design and other services for the past 10 years, and a single supplier of track maintenance equipment.

- HRV has not sought assurance that it achieves value for money from its specialised suppliers. It does not regularly test market prices, or develop alternative suppliers to expand the provider market and promote competition for its capital spending.

- HRV engages its capital works consultants on an hourly rate without contracts, on the basis that an hourly rate is more efficient than entering into fixed-rate contracts.

- HRV's hourly-rate consultants are often involved in projects from initial assessment, to design, tendering, and project management. Without staged works contracts and price caps, HRV is not able to show that it always controls consulting costs and achieves value for use of public funds.

- HRV could not show that tendering undertaken on its behalf is always fair and promotes market competition. There was insufficient evidence of fair handling of additional tendering information, sign-off of evaluation criteria, and recording of tender box opening.

HRV makes grants to clubs under its Development Fund Operating Guidelines, which include requirements for tenders and quotations. Between 2008 and 2012, HRV approved grants in several cases where clubs' applications did not show these requirements had been fulfilled. HRV noted that these decisions were justified because works were urgent, there were health and safety risks, it knew of only one supplier, it wished to avoid delaying a club's project, or because the club had already made the purchase. However, the Development Fund Operating Guidelines do not include acceptable grounds for granting exemptions. As a result, HRV may not adequately control clubs' spending to promote fair market competition and achieve value for money.

Racing Victoria Limited

RVL adequately recorded and monitored project progress, budgets, variations, supplier costs and funding. Its project accounting arrangements allow regular monitoring of project spending, budgets and variations.

Among the large number of providers RVL engages, it has repeatedly used a small number for their expertise. Engagement of a specialised drainage contractor for two projects in 2011 that expanded well beyond their anticipated scope was not in accordance with better practice procurement. RVL has now implemented a fixed-price investigation stage to identify the scope and cost of the required works, and procures services to undertake identified works in accordance with tendering requirements. To develop competition, RVL has progressively engaged and developed the capability of other suppliers for similar work.

RVL also repeatedly used a single design consultant between 2010 and 2012 following changes to its arrangements for managing projects. While RVL used contracts to control costs, it did not seek quotes from other consultants. RVL has recently adopted the practice of obtaining three quotes for all consultancy services. This provides assurance that RVL is seeking to identify expertise available in the market, and is achieving value for money.

RVL consistently uses contracts and works orders to confirm terms of engagement for consultants and contractors. Where the price of a task cannot be fixed, RVL policy requires that supplier contracts, including consultancy contracts, cap the total cost of the task. This allows RVL to effectively control costs and achieve the planned net benefit of its projects.

Maintaining project management records

Maintaining appropriate records enables decisions to be reviewed and decision-making processes to be improved. Record keeping also allows agencies to review and demonstrate their compliance with internal policies and relevant legislation.

Greyhound Racing Victoria

GRV is currently introducing policy and guidelines for records management, and is considering purchase of a system to manage electronic records. This action is intended to address deficiencies in its management of records, including RRIF and VRIF files.

VAGO's review of GRV's RRIF and VRIF files for projects before 2013 found the files were not in a state that would allow review or justification of management decisions or processes, particularly if staff directly responsible for the records had left the organisation. GRV's records for each project were not complete or organised into files, it had no checklist for the contents of project files, and no management processes to control the quality of project files.

Harness Racing Victoria

HRV does not have policy or controls for maintaining capital project records, including records for RRIF and VRIF projects. HRV identified the need for a standard approach to managing corporate records in May 2013, but has not yet introduced requirements for records of capital projects.

The absence of appropriate controls for project records means HRV cannot easily review compliance of capital projects with its policy and procedures, or effectively justify management decisions. HRV does not systematically recover all records of tenders undertaken by its consultants, and its project files do not show that tendering probity requirements are always met. Its business activity is also at risk as it is overly dependent on the knowledge of staff directly responsible for project management records.

Racing Victoria Limited

RVL has sound arrangements for managing project documentation. Project documentation was readily accessible, consistently filed, and generally held records showing procurement processes, including handling of probity requirements such as fair handling of tendering information, setting tender evaluation criteria, and recording tender box opening. RVL holds project records in physical and electronic form.

3.5 Outcomes and net benefit

Grants are a form of funding designed to achieve policy and/or program objectives. Understanding whether objectives have been achieved is fundamental to grants administration, and in determining whether the use of public funds is achieving intended benefits.

DOJ did not develop measures to assess the performance of the RRIF or VRIF programs against their objectives, and is unable to demonstrate the achievement of intended outcomes. DOJ has not publicly reported comprehensive information on the projects funded by RRIF and VRIF, nor whether the RRIF or VRIF grant programs are achieving intended outcomes or achieving sufficient benefits.

3.5.1 Demonstrating outcomes

The purpose of RRIF was to support controlling bodies' capital works and improvements and to stimulate industry growth. Projects eligible for RRIF funding were focused on areas where outcomes were clearly measurable. The then Minister for Racing advised the Public Accounts and Estimates Committee in May 2010 of the nature of the outcomes that RRIF projects were to achieve:

- drought-proofing projects to reduce the reliance on town water supplies

- better and safer facilities for all participants in the industry

- much better quality of racing including increased race fields.

The purpose of VRIF is also to support the racing industry to improve racing and training venues, and to stimulate industry growth. Similar to RRIF, the objective of VRIF Racing Infrastructure funding is to drought-proof racetracks, improve racing and training infrastructure, and improve facilities for the public. The VRIF Raceday Attraction Program aims to achieve sustainable increases in attendance at race meetings.

VRIF requires applicants to include measures to show a successful outcome for the club, racing industry and broader community. Despite this, neither DOJ nor the controlling bodies have assessed the extent to which the measures have been met for completed projects. Neither DOJ nor the racing industry has plans to review the extent to which RRIF and VRIF Racing Infrastructure programs are achieving their purposes and producing benefits for the racing industry and wider community.

The Raceday Attraction Program has run for two years. By 30 June 2013 it had supported 92 grants worth $2.36 million. Raceday attendance information is readily available, and must be reported by grant recipients. However, DOJ has not assessed whether there are consistent increases in attendance, and whether these increases can be sustained without public funding.

A recent study of the racing industry shows its annual economic contribution has increased by 33 per cent, from $2.1 billion in 2006 to $2.8 billion in 2011–12. However, further analysis would be required to identify the net economic benefit arising from RRIF and VRIF, and whether continued funding is needed to maintain the economic contribution of the racing industry.

DOJ has noted that outcomes of the wagering re-licensing process exceeded expectations and so justify RRIF funding. However, DOJ has not indicated what these expected outcomes were or whether they could have been achieved without RRIF. DOJ itself identified in 2006 that the Victorian racing industry performed well ahead of other states' industries, because Victoria was the only state in which the racing industry received income from both gaming and wagering, and had done so since 1994.

3.5.2 Reporting outcomes

DOJ does not publish complete and consistent information on racing industry projects and the funds used to support them. This contrasts with other grants programs that DOJ administers, for which information is published on the DOJ website.

Reporting of racing industry grants has previously been the subject of a Parliamentary Accounts and Estimates Committee recommendation. In its Report on the 2006–07 Budget Estimates, the Committee recommended that DOJ should publish on its website the details of the particular projects funded from the Racing Industry Development Program. DOJ has not adopted this recommendation for RRIF and VRIF.

Recommendations

That the Department of Justice:

- establish and report the outcomes of the Regional Racing Infrastructure Fund, and the Racing Infrastructure and Raceday Attraction programs of the Victorian Racing Industry Fund

- maintain on the Department of Justice website a list of all projects, funding sources and grants from the Regional Racing Infrastructure Fund and Victorian Racing Industry Fund

- establish processes to ensure that all Victorian Racing Industry Fund Raceday Attraction Program funding agreements are executed before the funded event.

That Greyhound Racing Victoria:

- implement requirements for managing project records that are consistent with its procurement and contract management policies.

That Harness Racing Victoria:

- include in its procurement policy minimum requirements for market testing to confirm pricing and competition in areas of specialised supply for capital projects

- implement contracts for all capital project consulting services in accordance with its new contract management policy

- establish grounds and standards of justification for exemptions from Development Fund Operating Guidelines and procurement policy and procedures

- implement requirements for managing project records that are consistent with its procurement and contract management policies.

Appendix A. Audit Act 1994 section 16—submissions and comments

Introduction

In accordance with section 16(3) of the Audit Act 1994 a copy of this report was provided to the Department of Justice, Greyhound Racing Victoria, Harness Racing Victoria and Racing Victoria Limited.

The submission and comments provided are not subject to audit nor the evidentiary standards required to reach an audit conclusion. Responsibility for the accuracy, fairness and balance of those comments rests solely with the agency head.

Responses were received as follows: