Results of 2018 Audits: Technical and Further Education Institutes

Overview

The TAFE sector in Victoria is made up of 12 technical institutes and 15 controlled entities.

This report outlines the results of, and observations arising from, our financial audits of the entities within the sector, and our observations, for the year ended 31 December 2018.

We also assess the sector’s financial performance during the 2018 reporting period and assess its sustainability as at 31 December 2018.

Data dashboard

We have developed a data dashboard, an interactive visualisation tool summarising the financial statement data for all Victorian TAFEs.

Transmittal letter

Ordered to be published

VICTORIAN GOVERNMENT PRINTER May 2019

PP No 32, Session 2018–19

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Results of 2018 Audits: Technical and Further Education Institutes.

Yours faithfully

Andrew Greaves

Auditor-General

30 May 2019

Acronyms

| DET | Department of Education and Training |

| EBA | Enterprise Bargaining Agreement |

| FMA | Financial Management Act 1994 |

| KPI | key performance indicator |

| RTO | registered training organisation |

| TAFE | technical and further education |

| VAGO | Victorian Auditor-General's Office |

| VET | vocational education and training |

| VTG | Victorian Training Guarantee |

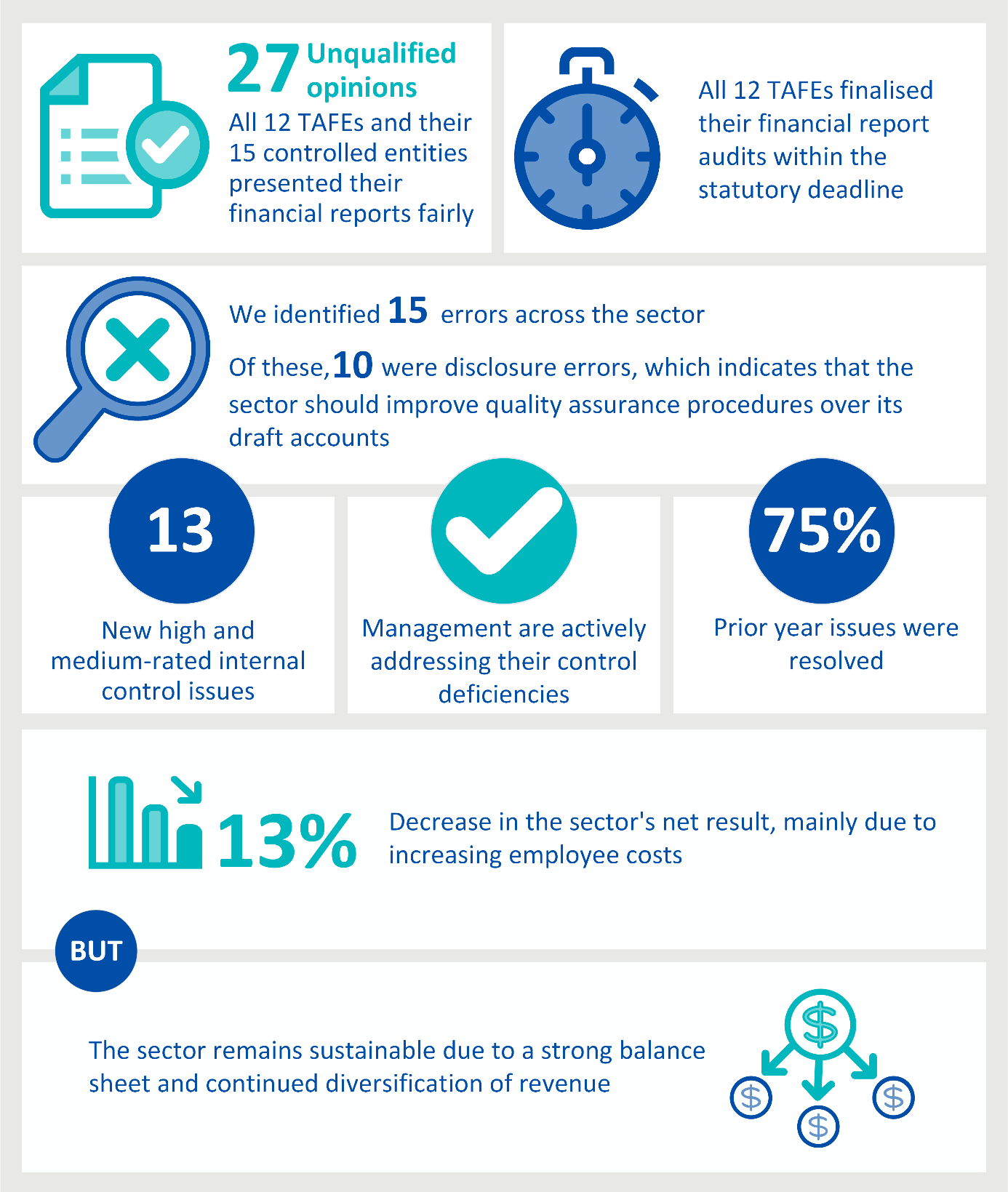

At a glance

1 Audit context

The technical and further education (TAFE) sector delivers vocational education and training (VET) to equip students with practical and educational skills for a variety of careers, and provides pathways to university courses.

Twelve TAFE institutes and their 15 controlled entities make up the TAFE sector in Victoria.

In Victoria, registered training organisations (RTO) also provide VET courses to students. RTOs are private-sector organisations and are not included in this report.

Figure 1A provides an overview of the TAFE sector in Victoria.

Figure 1A

TAFE sector at a glance

Source: VAGO.

1.1 Legislative framework

TAFE institutes are established and governed under the Education and Training Reform Act 2006. This Act:

- outlines the requirements for establishing a TAFE board and its governance responsibilities

- defines the function and powers of TAFEs

- defines the objectives of TAFEs.

TAFEs aim to:

- perform functions for the public benefit

- facilitate student learning

- collaborate as part of a strong network of public training providers.

TAFEs are 'public bodies' under the Financial Management Act 1994 (FMA). They are required to comply with the FMA and with any general or specific direction given by the Assistant Treasurer. They are also subject to the Public Administration Act 2004, which provides a framework for governance in the public sector. Each TAFE board is accountable to the Minister for Training and Skills and Minister for Higher Education.

The Department of Education and Training (DET) oversees the sector on behalf of the Minister for Training and Skills and Minister for Higher Education. This includes overseeing the governance, breadth, depth and appropriateness of the training delivery provided by TAFEs. DET funds the delivery of this training through a subsidy for each training hour delivered.

1.2 TAFE funding model

The predominant revenue source for TAFEs is derived through delivering training courses. In 2018, the TAFE sector received $1 149.7 million from course delivery ($1 083.1 million in 2017). The sector generates additional ancillary revenue from the sale of goods, interest revenue and other income—these streams totalled $63.3 million in 2018 ($60.5 million in 2017).

Student revenue

The TAFE sector has two broad student categories—government subsidised and full-fee paying.

Government subsidised students are domestic students studying courses that are eligible for a government grant. Full-fee-paying students consist of private domestic students and international students. Domestic students may self-fund their course, or access Commonwealth VET student loan funding. In this case, the Commonwealth pays the TAFE the course fees, which the students then repay through the Australian taxation system when they earn above a minimum threshold.

1.3 Report structure

In this report, we provide information on the outcomes of our financial audits of the 12 TAFEs and their 15 controlled entities for the year ended 31 December 2018. The financial results of controlled entities are consolidated into those of their respective parent entities, and we do not discuss them separately in this report.

We identify and discuss the key matters arising from our audits and analyse the information included in the TAFEs' financial and performance reports.

Figure 1B outlines the structure of the report.

Figure 1B

Structure of this report

|

Part |

Description |

|---|---|

|

2 Results of audits |

Comments on the results of the financial and performance report audits of the 12 TAFEs for the 2018 financial year. Summarises the internal control issues observed during our audits. |

|

3 Financial sustainability |

Provides an insight into the TAFE sector's financial sustainability risks and efficiency and effectiveness of operations. |

Source: VAGO.

Appendix B provides a list of the 12 TAFEs and their 15 controlled entities included in this report, and details the financial audit opinions issued for the year ended 31 December 2018.

We carried out the financial audits of these entities under section 8 of the Audit Act 1994, the FMA and the Australian Auditing Standards. Each entity pays the cost of its audit.

The cost of preparing this report was $175 000, which is funded by Parliament.

1.4 Submissions and comments

We have consulted with DET and the 12 TAFE entities and considered their views when reaching our conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet.

The following is a summary of those responses. The full responses are included in Appendix A.

DET has noted our report and the key findings that the sector remains sustainable and that the financial and performance reports are reliable.

Goulburn Ovens Institute of TAFE noted that they incurred a small deficit for the year, due to students withholding enrolment until 2019 to take advantage of Free TAFE (see Section 3.2).

2 Results of audits

In this Part of the report, we summarise the results of our financial and performance statement audits and observations for the TAFE sector for the year ended 31 December 2018.

2.1 Conclusion

The financial and performance reports of the TAFE sector are reliable. Parliament and the community can use them with confidence.

2.2 Findings

Audit opinions

Financial reports

A clear audit opinion confirms that the financial report fairly presents the transactions and balances for the reporting period, in keeping with the requirements of relevant accounting standards and applicable legislation. Appendix B lists each TAFE sector entity, types of audit opinions issued and the sign-off dates.

For the year ended 31 December 2018, we issued clear audit opinions for all 12 TAFEs and their 15 controlled entities.

Performance reports

TAFEs are required under a ministerial instruction to report against four mandatory key performance indicators (KPI) in their annual performance reports:

- training revenue diversity

- employment costs as a proportion of training revenue

- training revenue per teaching full-time equivalent

- operating margins percentage.

They must establish targets and report on the actual results for each KPI, and also disclose the prior year's results. All TAFEs certified their 2018 performance reports on the same day as their 2018 financial reports.

We issued clear audit opinions on the performance reports of all 12 TAFEs, consistent with the prior year. A clear audit opinion confirms that the actual results for each performance indicator are presented fairly. We do not form an opinion on the relevance or adequacy of the performance indicators.

Prior to 2018, TAFEs were required to include these four mandatory indicators in their performance report, and any additional ones they wished to include. This led to significant variations in the reported number and types of indicators among TAFEs, making it difficult to compare results and benchmark sector performance. Starting with the 2018 reports, DET required TAFEs to report only on the four mandatory indicators.

Descriptions of the four indicators and the formulas used to calculate them are provided in Appendix D. The appendix also includes a summary of the targets and actual results for each TAFE.

Timeliness of reporting

Timely financial reporting enables TAFE governing boards and other stakeholders to have informed views about management's accountability for financial and operational performance. The later financial reports are produced after the end of the financial year, the less useful they become.

The FMA requires public sector entities to finalise their audited financial reports within 12 weeks of the end of the financial year. This year, all TAFEs achieved this for the first time since 2012. We commend the sector for this outcome.

The median time taken for TAFEs to certify their financial reports also improved from the prior year. In 2018, TAFEs took a median of 8.7 weeks to finalise their financial reports, compared to 9.0 weeks in 2017.

Figure 2A shows the time taken after year end for each TAFE to certify its financial report.

Figure 2A

Weeks taken after 31 December 2018 for TAFEs to certify their financial reports

Source: VAGO.

Quality of financial reporting

During our 2018 audits, we identified 15 material errors across the sector that required correction before we could issue a clear opinion. This is an improvement on past years. Ten of the 15 material adjustments were related to either how an item was classified or disclosed, which did not affect the entities' net results. The remaining five adjustments related to correcting financial errors totalling $1.2 million.

Figure 2B summarises the common audit adjustments made as a result of our audit work across the 2018 reporting period.

Figure 2B

Common adjustments identified across the 2018 reporting period

|

Dollar adjustments |

We identified five financial adjustments across the 12 TAFEs, totalling $1.2 million. Common financial adjustments related to:

|

|

Classification and disclosure adjustments |

Common classification and disclosure adjustments related to:

|

Source: VAGO.

Internal controls over financial reporting

|

Internal controls include an entity's:

|

In our financial audit process, we consider the internal controls relevant to financial reporting and assess whether TAFEs have relevant internal controls to manage the risk of material errors.

Overall, the TAFEs' internal controls remain adequate for reliable financial reporting. However, we found instances where important control activities could be improved. This year, we identified one high- and 12 medium-rated control activity issues, compared to 16 in the prior year. The number of control activity issues identified is small relative to the number of entities, and has decreased compared to the prior year. The remediation of identified issues demonstrates managements' commitment to good internal controls.

Figure 2C provides a breakdown of the internal control issues by area and risk rating. Appendix C provides additional information on our risk ratings and our expected timelines for TAFEs to resolve issues we find during our audit work.

Figure 2C

Internal control issues identified at TAFEs during 2018 audits, by area and risk rating

|

Area of issue |

Risk rating |

||

|---|---|---|---|

|

High |

Medium |

Total |

|

|

IT general controls |

– |

5 |

5 |

|

Revenue/receivable |

1 |

2 |

3 |

|

Expenditure/accounts payable |

– |

3 |

3 |

|

Financial reporting |

– |

1 |

1 |

|

Governance |

– |

1 |

1 |

|

Total |

1 |

12 |

13 |

Note: We reported 15 low-rated internal control issues in 2018. As these issues are minor and/or may present opportunities to improve existing processes, they have been excluded from this figure.

Source: VAGO.

High-rated issue

We identified one high-rated issue at William Angliss Institute of TAFE relating to non-compliance with the Victorian Training Guarantee (VTG) contract. The TAFE was not able to provide sufficient documentation to support student participation and eligibility. This lack of evidence to support compliance with the VTG contract increases the risk of a funding recall from DET.

In 2018, DET recalled $0.8 million from William Angliss Institute of TAFE due to non-compliance with the VTG contract for the 2016 financial year. The management of William Angliss Institute of TAFE is currently undertaking a business improvement project focused on addressing these compliance issues.

Medium-rated issues

Five of the 12 medium-rated control activity issues identified at four TAFEs related to control activities over IT systems. This makes up 42 per cent of total findings (it was 18 per cent in 2017). The issues can be summarised as:

- inadequate governance over the IT control environment, including a lack of formally established IT strategies and directions

- ineffective control activities to manage user accounts and the appropriateness of their levels of access

- implementing password controls that were not in line with good practice recommendations

- untested business continuity and disaster recovery plans over important business processes and systems.

Since all TAFEs are reliant on IT systems for some or all of their financial reporting, it is important to design and implement IT general controls that ensure accurate processing and availability of information, and to safeguard the integrity of systems and information from unauthorised access or changes.

We also identified several control breakdowns in expenditure that increase the risk of error or fraud, including:

- inadequate master-file review

- purchases being made without purchase orders having been completed and reviewed.

All TAFEs affected by these issues have committed to working towards rectifying them during 2019.

Status of internal control matters raised in prior-year audits

Internal control issues raised in our prior-year management letters are monitored to ensure that they are resolved in a timely manner. Where issues remain outstanding, we factor this awareness into our risk assessments for the current year's audit.

At the start of the 2018 financial year, there were 24 unresolved high and medium-rated audit issues from prior years. During 2018, the sector resolved 75 per cent of these, including the five high-risk rated issues outlined in our 2017 report, Results of 2017 Audits: Technical and Further Education Institutes, as shown in Figure 2D.

Figure 2D

Status of prior-period internal control issues as at May 2019 by risk rating

|

Issue status |

Risk rating |

||

|---|---|---|---|

|

High |

Medium |

Total |

|

|

Resolved |

5 |

13 |

18 |

|

Unresolved |

– |

6 |

6 |

|

Total |

5 |

19 |

24 |

Note: Issues rated as low risk are excluded from this analysis.

Source: VAGO.

The total number of unresolved issues is low. Three TAFEs were responsible for the six unresolved medium-rated issues—Melbourne Polytechnic, Gordon Institute of TAFE and Sunraysia Institute of TAFE. These TAFEs need to respond to the issues reported in our management letters promptly in order to strengthen the effectiveness of their internal control environment and financial reporting.

3 Financial sustainability

To be sustainable, TAFEs need to efficiently manage their resources to respond to future changes and foreseeable risks without compromising the quality of services, and avoid large fluctuations in expenditures and fees.

3.1 Conclusion

We have assessed that the sector is financially sustainable in the short term. Figure 3A shows the overview of financial results.

Figure 3A

Overview of financial results

Source: VAGO.

3.2 Financial results

In 2018, the sector generated a net surplus of $67.7 million for the year. This is $9.8 million less than last year, which was a $77.5 million surplus.

Of the 12 TAFEs, 11 generated a net surplus in 2018, compared to 12 in 2017. Goulburn Ovens Institute of TAFE recorded a small deficit this year ($173 000), due to a drop in student enrolments and fee-for-service revenue.

Sector revenue increased by $73.1 million (6 per cent) for 2018 to $1 218 million; however, sector expenditure increased by $85.8 million (8 per cent) to $1 153 million.

The increase in expenditure was mainly due to a $47.5 million (7 per cent) increase in employee benefits expenses. More staff are being employed across the sector to meet higher service demand in relation to fee-for-service revenue, and there was a new teaching Enterprise Bargaining Agreement (EBA) and general EBA pay increases.

The 12 TAFEs received $340.7 million in contestable funding in 2018, $18.9 million less than in 2017, because of lower student contact hours and lower enrolments compared to the prior year.

|

The 2018 Victorian State Budget included $172 million for Free TAFE, an initiative to subsidise the costs of 50 TAFE courses and Under the Free TAFE initiative, the government will pay course tuition costs. |

We noted the state government's announcement in May 2018 that it would introduce a number of 'Free TAFE' courses, commencing from 1 January 2019. The decline in enrolments across 2018 can partly be attributed to the impending commencement of Free TAFE. This decline in contestable funding was offset by increases in operating funding provided by DET to the sector and increases in fee-for-service generated revenue.

Fee-for-service revenue generated by TAFEs increased by $55.1 million (18 per cent) during 2018. The sector continues to increase its fee-for-service revenue from several streams, including government, international onshore and offshore sources. Fee-for-service revenue has steadily increased between 2014 and 2018, and surpassed contestable funding in 2018 for the first time. TAFEs have been diversifying their revenue streams and relying less on state government funding. This may help TAFEs mitigate funding risks that might occur from changes in funding models or declining government subsidised student enrolments.

Figure 3B shows the trend in contestable funding against fee-for-service revenues over the past five years.

Figure 3B

Contestable funding and fee-for-service revenue for the years ended 31 December 2014–18

Source: VAGO.

Fee-for-service government revenue showed the largest improvement, increasing by $33.4 million, or 38 per cent, between 2017 and 2018. This was achieved through:

- a greater number of government agencies upskilling their staff

- large government training contracts entered into in 2018.

3.3 Student enrolments

Figure 3C shows the trend in total government-funded enrolments across the 12 TAFEs over the past five years.

Figure 3C

Total government-funded enrolments and annual growth rates across the 12 TAFEs for years ended 31 December 2014–18

Source: VAGO.

New enrolments

Figure 3D shows the trend in new government-funded enrolments for the TAFE sector over the past five years.

Figure 3D

New government-funded enrolments across the 12 TAFEs for the years ended 31 December 2014–18

Source: VAGO.

From 2014 to 2015, new government-funded enrolments declined significantly as TAFEs competed for students against private training providers. In 2016 and 2017, new enrolments increased marginally; however, they declined again in 2018. Preliminary information collected by TAFEs indicates that the decline in enrolments may be partly due to students deferring enrolment in order to access the Free TAFE initiative, which commenced in 2019.

The downward trend in new enrolments results in less contestable funding for the sector. If this trend continues over the long term, TAFEs will face increased sustainability risks unless they can increase other revenue streams. However, it is forecasted that the commencement of Free TAFE will have a positive impact on commencements.

Sustainability

To be sustainable, TAFEs need to efficiently manage their resources to respond to future changes and foreseeable risks. TAFEs should achieve this without compromising the quality of their services and avoid large fluctuations in expenditures and fees.

The short-term health of the TAFE sector can be judged by evaluating its:

- annual financial results

- financial position at the end of the year

- patterns and trends in financial results over time.

We have assessed the sector's financial sustainability against two key indicators over the past five financial years:

- Net result ratio—a positive net result ratio indicates a surplus. The larger the surplus, the stronger the result. A negative result indicates a deficit. Operating deficits cannot be sustained in the long term.

- Liquidity ratio—a ratio of one or more means there are more cash and liquid assets than short-term liabilities.

Figure 3E shows the combined sector average net result ratio over the past five years. Figure 3F shows the combined sector liquidity ratio over the past five years.

Figure 3E

Combined TAFE sector average net result ratio for the years ended 31 December 2014–18

Source: VAGO.

Figure 3F

Combined sector average liquidity ratio for the years ended 31 December 2014–18

Source: VAGO.

The improvement in the average net result and liquidity ratio of the sector over the last five years has been achieved through:

- increased funding provided to the sector over 2014–18

- TAFEs continuing to increase fee-for-service revenue.

The liquidity ratio of the sector continues to remain well above 1.0, which means that there are no immediate concerns about the sector meeting its short-term financial obligations as they become due.

Appendix E details our financial sustainability risk indicators for each TAFE.

Efficiency and effectiveness of operations

TAFEs measure and report on their efficiency and effectiveness through two KPIs included in their audited performance report:

- employment costs as a percentage of training revenue

- training revenue per full-time equivalent teaching member.

Each TAFE board sets its own targets for these measures before the start of the financial year.

Most TAFEs did not achieve their set targets for these two measures in 2018, so were not operating as efficiently or effectively as originally planned. This was partly caused by the new teaching EBA and more staff being employed across the sector.

Figure 3G provides a summary of results of these two measures against the targets for each TAFE.

Figure 3G

Target and actual 2018 efficiency and effectiveness indicator results by TAFE

|

Employment costs as a proportion of training revenue |

Training revenue per teaching FTE |

|||

|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

|

|

Bendigo Kangan Institute |

72.7% |

84.1% |

$277 108 |

$244 153 |

|

Box Hill Institute |

89.0% |

85.5% |

$200,000 |

$198,100 |

|

Chisholm Institute |

73.0% |

72.1% |

$206,000 |

$226,639 |

|

Federation Training |

94.0% |

100.0% |

$203,000 |

$179,628 |

|

Gordon Institute of TAFE |

107.0% |

107.1% |

$141,963 |

$140,177 |

|

Goulburn Ovens Institute of TAFE |

117.4% |

134.6% |

$136,475 |

$103,394 |

|

Holmesglen Institute |

80.0% |

81.0% |

>$203,000 |

$194,824 |

|

Melbourne Polytechnic |

95.0% |

97.5% |

$200,000 |

$199,000 |

|

South West Institute of TAFE |

117.0% |

130.5% |

$135,000 |

$133,492 |

|

Sunraysia Institute of TAFE |

125.0% |

144.1% |

$121,518 |

$116,126 |

|

William Angliss Institute of TAFE |

<79% |

81.5% |

$231,500 |

$206,858 |

|

Wodonga Institute of TAFE |

95.0% |

85.2% |

$141,855 |

$156,597 |

Note: Green actual results mean the target was achieved. Red actual results mean the target was not achieved.

Note: FTE = full-time equivalent

Source: VAGO.

Appendix A. Audit Act 1994 section 16—submissions and comments

We have consulted with DET and the 12 TAFE entities and we considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report, or relevant extracts, to those agencies and asked for their submissions and comments. We also provided a copy of the report to the Department of Premier and Cabinet.

Responsibility for the accuracy, fairness and balance of those comments rests solely with the agency head.

Responses were received as follows:

- DET

- Goulburn Ovens Institute of TAFE

RESPONSE provided by the Secretary, DET

RESPONSE provided by the CEO, Goulburn Ovens Institute of TAFE

Appendix B. Audit opinions

Figure B1 lists the entities included in this report, the nature of the opinion and the date the audit opinion was issued to each entity for their 2018 financial reports.

Figure B1

Audit opinions issued for TAFEs and their controlled entities

|

Entity |

Clear audit opinion issued |

Auditor-General's report signed date |

|---|---|---|

|

Bendigo Kangan Institute |

✔ |

25 Mar 2019 |

|

Box Hill Institute |

✔ |

20 Mar 2019 |

|

Box Hill Enterprises Limited |

✔ |

20 Mar 2019 |

|

Centre for Adult Education |

✔ |

20 Mar 2019 |

|

Chisholm Institute |

✔ |

7 Mar 2019 |

|

Caroline Chisholm Education Foundation |

✔ |

7 Mar 2019 |

|

TAFE Online Pty Ltd |

✔ |

7 Mar 2019 |

|

Federation Training |

✔ |

1 Mar 2019 |

|

Gordon Institute of TAFE |

✔ |

19 Mar 2019 |

|

GoTec Limited |

✔ |

15 Mar 2019 |

|

Goulburn Ovens Institute of TAFE |

✔ |

15 Mar 2019 |

|

Holmesglen Institute |

✔ |

12 Mar 2019 |

|

Glenuc Pty Ltd |

✔ |

12 Mar 2019 |

|

Holmesglen Foundation |

✔ |

12 Mar 2019 |

|

Holmesglen International Training Services Pty Ltd |

✔ |

12 Mar 2019 |

|

Melbourne Polytechnic |

✔ |

1 Mar 2019 |

|

South West Institute of TAFE |

✔ |

22 Mar 2019 |

|

Sunraysia Institute of TAFE |

✔ |

22 Mar 2019 |

|

TAFE Kids Inc |

✔ |

22 Mar 2019 |

|

William Angliss Institute of TAFE |

✔ |

14 Mar 2019 |

|

Angliss Consulting Pty Ltd |

✔ |

14 Mar 2019 |

|

Angliss Multimedia Pty Ltd |

✔ |

14 Mar 2019 |

|

Angliss (Shanghai) Education Technology Co Ltd |

✔ |

17 Apr 2019 |

|

Angliss Solutions Pty Ltd |

✔ |

14 Mar 2019 |

|

William Angliss Institute Foundation Ltd |

✔ |

14 Mar 2019 |

|

William Angliss Institute Pte Ltd |

✔ |

22 Mar 2019 |

|

Wodonga Institute of TAFE |

✔ |

21 Feb 2019 |

Note: TAFE institutes are in bold font.

Source: VAGO.

Appendix C. Control issues risk ratings

Figure C1 shows the risk ratings we apply to issues we raise, the management action required, and the expected timeline for the issue to be resolved.

Figure C1

Risk definitions applied to issues reported in audit management letters

|

Rating |

Definition |

Management action required |

|---|---|---|

|

High |

The issue represents:

|

Requires prompt management intervention with a detailed action plan implemented within two months. Requires executive management to correct the material misstatement in the financial report to avoid a modified audit opinion. |

|

Medium |

The issue represents:

|

Requires management intervention with a detailed action plan implemented within three to six months. |

|

Low |

The issue represents:

|

Requires management intervention with a detailed action plan implemented within six to 12 months. |

Source: VAGO.

Appendix D. Mandatory performance indicators

Figures D1 shows the performance statement indicators, description and methodology, while Figures D2–D13 show each TAFE institute's reported performance against the four indicators for 2016 to 2018.

Figure D1

Performance statement indicators and formula

|

Indicator |

Description and methodology |

|---|---|

|

Training revenue diversity |

Breakdown of training revenue by:

|

|

Employment costs as a proportion of training revenue |

(Employment costs – Workforce reduction expenses + third party training delivery costs)/Training revenue |

|

Training revenue per teaching full-time equivalent |

Training revenue (excluding revenue delivered by third parties) per teaching full-time equivalent |

|

Operating margin percentage |

Earnings before interest and taxes (excluding capital contributions)/Total revenue (excluding capital contributions) |

Source: VAGO.

Figure D2

Bendigo Kangan Institute

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

44.9% |

44.3% |

50.3% |

47.7% |

49.9% |

50.3% |

|

Fee for service |

41.7% |

46.4% |

31.3% |

39.7% |

34.8% |

41.0% |

|

Student fees and charges |

13.4% |

9.3% |

18.4% |

12.6% |

15.4% |

8.7% |

|

Employment costs as a proportion of training revenue |

72.7% |

84.1% |

71.9% |

75.4% |

83.1% |

81.2% |

|

Training revenue per teaching full-time equivalent |

$ 277 108 |

$ 244 153 |

$ 265 808 |

$ 278 015 |

$ 242 826 |

$ 238 521 |

|

Operating margins percentage |

8.2% |

-3.4% |

-19.8% |

0.8% |

0.3% |

-17.6% |

Source: VAGO.

Figure D3

Box Hill Institute

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

35.0% |

33.5% |

35.0% |

35.0% |

37.0% |

32.5% |

|

Fee for service |

44.0% |

44.0% |

65.0% |

65.0% |

63.0% |

67.5% |

|

Student fees and charges |

21.0% |

22.5% |

– |

– |

– |

– |

|

Employment costs as a proportion of training revenue |

89.0% |

85.5% |

83.0% |

89.9% |

82.0% |

107.0% |

|

Training revenue per teaching full-time equivalent |

$ 200 000 |

$ 198 100 |

$ 217 000 |

$ 199 000 |

$ 156 500 |

$ 156 300 |

|

Operating margins percentage |

>0% |

1.1% |

1.0% |

0.7% |

-8.2% |

-8.8% |

Note: – = target not published by TAFE.

Source: VAGO.

Figure D4

Chisholm Institute

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

56.0% |

51.6% |

54.0% |

59.1% |

50.1% |

54.7% |

|

Fee for service |

25.3% |

30.0% |

27.0% |

22.1% |

32.1% |

25.7% |

|

Student fees and charges |

18.7% |

18.4% |

19.0% |

18.7% |

17.8% |

19.6% |

|

Employment costs as a proportion of training revenue |

73.0% |

72.1% |

70.0% |

65.6% |

65.0% |

69.8% |

|

Training revenue per teaching full-time equivalent |

$ 206 000 |

$ 226 639 |

$ 200 000 |

$ 213 150 |

$ 200 000 |

$ 192 752 |

|

Operating margins percentage |

-1.7% |

-1.8% |

>0% |

7.9% |

0.0% |

1.0% |

Source: VAGO.

Figure D5

Federation Training

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

58.0% |

59.0% |

53.0% |

60.0% |

56.0% |

54.0% |

|

Fee for service |

22.0% |

23.0% |

29.0% |

23.0% |

15.0% |

28.0% |

|

Student fees and charges |

20.0% |

18.0% |

18.0% |

17.0% |

– |

– |

|

Employment costs as a proportion of training revenue |

94.0% |

100.0% |

108.0% |

86.6% |

77.3% |

107.9% |

|

Training revenue per teaching full-time equivalent |

$ 203 000 |

$ 179 628 |

$ 154 688 |

$ 238 602 |

$ 240 139 |

$ 188 567 |

|

Operating margins percentage |

-40.0% |

2.0% |

-55.6% |

6.0% |

0.6% |

1.7% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D6

Gordon Institute of TAFE

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

73.7% |

74.1% |

71.8% |

75.9% |

69.1% |

69.2% |

|

Fee for service |

11.9% |

12.1% |

11.9% |

10.9% |

15.4% |

13.6% |

|

Student fees and charges |

14.4% |

13.8% |

16.2% |

13.2% |

15.4% |

17.2% |

|

Employment costs as a proportion of training revenue |

107.0% |

107.1% |

101.9% |

104.6% |

97.0% |

125.0% |

|

Training revenue per teaching full-time equivalent |

$ 141 963 |

$ 140 177 |

$ 145 820 |

$ 141 714 |

$ 147 905 |

$ 123 009 |

|

Operating margins percentage |

-20.2% |

-5.0% |

-4.4% |

-4.5% |

-31.8% |

-4.9% |

Source: VAGO.

Figure D7

Goulburn Ovens Institute of TAFE

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

62.4% |

58.9% |

56.7% |

57.3% |

70.6% |

58.1% |

|

Fee for service |

21.7% |

20.9% |

43.3% |

42.7% |

29.4% |

41.9% |

|

Student fees and charges |

15.9% |

20.2% |

– |

– |

– |

– |

|

Employment costs as a proportion of training revenue |

117.4% |

134.6% |

106.4% |

110.5% |

108.7% |

109.8% |

|

Training revenue per teaching full-time equivalent |

$ 136 475 |

$ 103 394 |

$ 140 416 |

$ 111 196 |

$ 151 568 |

$ 127 815 |

|

Operating margins percentage |

-21.0% |

0.2% |

-22.5% |

3.2% |

-39.8% |

3.6% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D8

Holmesglen Institute

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

41.2% |

38.4% |

40.0% |

40.2% |

32.0% |

36.6% |

|

Fee for service |

42.6% |

46.3% |

60.0% |

59.8% |

68.0% |

63.4% |

|

Student fees and charges |

16.2% |

15.3% |

– |

– |

– |

– |

|

Employment costs as a proportion of training revenue |

80.0% |

81.0% |

<80% |

76.7% |

74.0% |

76.4% |

|

Training revenue per teaching full-time equivalent |

>$203 000 |

$ 194 824 |

>$190 000 |

$ 198 385 |

$ 213 034 |

$ 195 111 |

|

Operating margins percentage |

>0% |

3.5% |

>2% |

5.5% |

0.3% |

3.6% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D9

Melbourne Polytechnic

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

30.0% |

30.5% |

31.0% |

35.7% |

40.2% |

34.4% |

|

Fee for service |

56.0% |

58.8% |

69.0% |

64.3% |

59.8% |

65.6% |

|

Student fees and charges |

14.0% |

10.7% |

– |

– |

– |

– |

|

Employment costs as a proportion of training revenue |

95.0% |

97.5% |

95.8% |

98.3% |

88.4% |

97.4% |

|

Training revenue per teaching full-time equivalent |

$ 200 000 |

$ 199 000 |

$ 212 533 |

$ 189 027 |

$ 153 492 |

$ 198 008 |

|

Operating margins percentage |

-13.9% |

1.5% |

-9.0% |

-7.5% |

0.0% |

-6.2% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D10

South West Institute of TAFE

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

71.0% |

75.0% |

68.2% |

67.4% |

65.3% |

64.0% |

|

Fee for service |

7.0% |

8.1% |

31.8% |

32.6% |

34.7% |

36.0% |

|

Student fees and charges |

22.0% |

16.9% |

– |

– |

– |

– |

|

Employment costs as a proportion of training revenue |

117.0% |

130.5% |

110.4% |

120.5% |

96.4% |

133.0% |

|

Training revenue per teaching full-time equivalent |

$ 135 000 |

$ 133 492 |

$ 145 547 |

$ 145 865 |

$ 164 003 |

$ 120 002 |

|

Operating margins percentage |

0.0% |

11.0% |

-10.7% |

0.2% |

-25.4% |

-1.1% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D11

Sunraysia Institute of TAFE

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

51.8% |

56.7% |

74.0% |

71.0% |

71.0% |

74.0% |

|

Fee for service |

21.4% |

18.7% |

26.0% |

29.0% |

29.0% |

26.0% |

|

Student fees and charges |

26.8% |

24.6% |

– |

– |

– |

– |

|

Employment costs as a proportion of training revenue |

125.0% |

144.1% |

135.0% |

133.0% |

85.0% |

138.0% |

|

Training revenue per teaching full-time equivalent |

$ 121 518 |

$ 116 126 |

$ 121 492 |

$ 114 101 |

$ 200 000 |

$ 117 517 |

|

Operating margins percentage |

1.5% |

15.0% |

-84.0% |

1.4% |

0.0% |

-51.0% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D12

William Angliss Institute of TAFE

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

21.5% |

21.9% |

39.0% |

22.0% |

22.0% |

20.0% |

|

Fee for service |

61.2% |

61.6% |

61.0% |

78.0% |

78.0% |

80.0% |

|

Student fees and charges |

17.3% |

16.5% |

– |

– |

– |

– |

|

Employment costs as a proportion of training revenue |

<79% |

81.5% |

<74% |

77.6% |

65.0% |

73.1% |

|

Training revenue per teaching full-time equivalent |

$ 231 500 |

$ 206 858 |

$ 244 000 |

$ 217 000 |

$ 220 000 |

$ 223 740 |

|

Operating margins percentage |

-5.1% |

0.9% |

n/a |

1.5% |

n/a |

9.3% |

Note: – = target not published by TAFE

Note: n/a = target not set by TAFE

Source: VAGO.

Figure D13

Wodonga Institute of TAFE

|

Performance indicator |

2018 |

2017 |

2016 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

51.8% |

37.4% |

49.2% |

52.9% |

52.0% |

50.0% |

|

Fee for service |

37.5% |

56.2% |

50.8% |

47.1% |

48.0% |

50.0% |

|

Student fees and charges |

10.7% |

6.4% |

– |

– |

– |

– |

|

Employment costs as a proportion of training revenue |

95.0% |

85.2% |

86.3% |

91.0% |

86.9% |

97.7% |

|

Training revenue per teaching full-time equivalent |

$ 141 855 |

$ 156 597 |

$ 197 483 |

$ 159 538 |

$ 165 178 |

$ 171 123 |

|

Operating margins percentage |

-9.0% |

8.1% |

1.8% |

1.4% |

-11.8% |

-0.1% |

Note: – = target not published by TAFE

Source: VAGO.

Appendix E. Financial sustainability risk indicators

Figure E1 shows indicators used in assessing the financial sustainability risks of TAFE institutes. These indicators should be considered collectively and are more useful when assessed over time as part of a trend analysis.

Figure E1

Financial sustainability risk indicators, formulas and descriptions

|

Indicator |

Formula |

Description |

|---|---|---|

|

Net result margin (%) |

Net result/Total Revenue |

A positive result indicates a surplus, and the larger the percentage, the stronger the result. A negative result indicates a deficit. Operating deficits cannot be sustained in the long term. The net result and total revenue are obtained from the comprehensive operating statement. |

|

Liquidity (ratio) |

Current assets/ Current liabilities |

This measures the ability to pay existing liabilities in the next 12 months. A ratio of one or more means there are more cash and liquid assets than short-term liabilities. |

|

Capital replacement (ratio) |

Cash outflows for property, plant and equipment/ Depreciation |

Comparison of the rate of spending on infrastructure with its depreciation. Ratios higher than 1:1 indicate that spending is faster than the depreciating rate. This is a long-term indicator, as capital expenditure can be deferred in the short term if there are insufficient funds available from operations, and borrowing is not an option. Cash outflows for infrastructure are taken from the cashflow statement. Depreciation is taken from the comprehensive operating statement. |

|

Internal financing (%) |

Net operating cashflow/Net capital expenditure |

This measures the ability of an entity to finance capital works from generated cashflow. The higher the percentage, the greater the ability for the entity to finance capital works from their own funds. Net operating cashflows and net capital expenditure are obtained from the cashflow statement. Note: The internal financing ratio cannot be less than zero. Where a calculation has provided a negative result, this has been rounded up to 0%. |

Source: VAGO.

Financial sustainability risk-assessment criteria

We assessed the financial sustainability risk of each TAFE using the criteria outlined in Figure E2.

Figure E2

Financial sustainability risk indicators—risk-assessment criteria

|

Risk |

Net result margin |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

High |

Negative 10% or less |

Less than 0.75 |

Less than 1.0 |

Less than 10% |

|

Insufficient revenue is being generated to fund operations and asset renewal. |

Immediate sustainability issues with insufficient current assets to cover liabilities. |

Spending on capital works has not kept pace with consumption of assets. |

Limited cash generated from operations to fund new assets and asset renewal. |

|

|

Medium |

Negative 10%–0% |

0.75–1.0 |

1.0–1.5 |

10–35% |

|

A risk of long-term run down to cash reserves and inability to fund asset renewals. |

Need for caution with cashflow, as issues could arise with meeting obligations as they fall due. |

May indicate spending on asset renewal is insufficient. |

May not be generating sufficient cash from operations to fund new assets. |

|

|

Low |

More than 0% |

More than 1.0 |

More than 1.5 |

More than 35% |

|

Generating surpluses consistently.

|

No immediate issues with repaying short-term liabilities as they fall due. |

Low risk of insufficient spending on asset renewal. |

Generating enough cash from operations to fund new assets. |

Source: VAGO.

Financial sustainability risk analysis results

Figures E3 to E6 show the financial sustainability risk indicators for each TAFE from 2014 to 2018, the annual sector average, and the five-year average for each TAFE.

Figure E3

Net result margin as a percentage

|

Net result margin |

||||||

|---|---|---|---|---|---|---|

|

2014 |

2015 |

2016 |

2017 |

2018 |

Average |

|

|

Bendigo Kangan Institute |

-13.42% |

2.17% |

2.71% |

4.87% |

1.35% |

-0.46% |

|

Box Hill Institute |

-7.15% |

7.15% |

2.11% |

1.37% |

7.71% |

2.24% |

|

Chisholm Institute |

20.67% |

4.84% |

9.53% |

20.05% |

14.51% |

13.92% |

|

Federation Training |

-26.76% |

0.28% |

2.56% |

0.64% |

1.60% |

-4.33% |

|

Gordon Institute of TAFE |

-18.48% |

-1.64% |

1.61% |

4.28% |

1.51% |

-2.54% |

|

Goulburn Ovens Institute of TAFE |

-31.21% |

-2.97% |

2.05% |

4.17% |

-0.31% |

-5.65% |

|

Holmesglen Institute |

-7.90% |

9.88% |

10.39% |

15.25% |

1.51% |

5.83% |

|

Melbourne Polytechnic |

-16.90% |

-2.50% |

-1.84% |

0.09% |

5.33% |

-3.16% |

|

South West Institute of TAFE |

-31.46% |

3.36% |

0.38% |

1.61% |

10.92% |

-3.04% |

|

Sunraysia Institute of TAFE |

-44.32% |

16.92% |

1.15% |

2.59% |

12.74% |

-2.18% |

|

William Angliss Institute of TAFE |

-1.65% |

5.09% |

9.09% |

1.59% |

0.60% |

2.94% |

|

Wodonga Institute of TAFE |

2.44% |

1.60% |

0.25% |

2.09% |

8.44% |

2.96% |

|

Average |

||||||

|

Sector average |

-14.68% |

3.68% |

3.33% |

4.88% |

5.49% |

0.54% |

Source: VAGO.

Figure E4

Liquidity ratio

|

Liquidity ratio |

||||||

|---|---|---|---|---|---|---|

|

2014 |

2015 |

2016 |

2017 |

2018 |

Average |

|

|

Bendigo Kangan Institute |

2.35 |

2.37 |

3.03 |

2.48 |

2.58 |

2.56 |

|

Box Hill Institute |

2.19 |

2.83 |

1.50 |

1.40 |

1.93 |

1.97 |

|

Chisholm Institute |

3.02 |

4.10 |

4.55 |

5.60 |

2.76 |

4.01 |

|

Federation Training |

0.90 |

2.00 |

2.53 |

6.38 |

7.19 |

3.80 |

|

Gordon Institute of TAFE |

5.30 |

6.28 |

5.77 |

4.98 |

4.07 |

5.28 |

|

Goulburn Ovens Institute of TAFE |

3.60 |

3.55 |

3.90 |

3.33 |

3.31 |

3.54 |

|

Holmesglen Institute |

1.80 |

2.16 |

2.54 |

2.79 |

2.28 |

2.31 |

|

Melbourne Polytechnic |

0.62 |

1.08 |

1.19 |

1.13 |

1.08 |

1.02 |

|

South West Institute of TAFE |

0.86 |

2.75 |

2.21 |

2.48 |

2.79 |

2.22 |

|

Sunraysia Institute of TAFE |

0.72 |

1.53 |

1.86 |

2.22 |

3.09 |

1.88 |

|

William Angliss Institute of TAFE |

1.37 |

1.49 |

1.89 |

1.92 |

1.70 |

1.67 |

|

Wodonga Institute of TAFE |

2.56 |

3.13 |

4.06 |

4.57 |

4.55 |

3.77 |

|

Average |

||||||

|

Sector average |

2.11 |

2.77 |

2.92 |

3.27 |

3.11 |

2.84 |

Source: VAGO.

Figure E5

Capital replacement ratio

|

Capital replacement ratio |

||||||

|---|---|---|---|---|---|---|

|

2014 |

2015 |

2016 |

2017 |

2018 |

Average |

|

|

Bendigo Kangan Institute |

0.11 |

0.23 |

0.53 |

1.76 |

1.26 |

0.78 |

|

Box Hill Institute |

0.66 |

1.18 |

5.10 |

2.30 |

2.11 |

2.27 |

|

Chisholm Institute |

3.83 |

0.58 |

0.98 |

2.06 |

9.06 |

3.30 |

|

Federation Training |

0.66 |

0.12 |

0.28 |

0.71 |

1.27 |

0.61 |

|

Gordon Institute of TAFE |

0.33 |

0.37 |

0.96 |

1.82 |

3.69 |

1.43 |

|

Goulburn Ovens Institute of TAFE |

0.27 |

0.34 |

0.33 |

1.22 |

0.36 |

0.50 |

|

Holmesglen Institute |

0.73 |

0.68 |

0.79 |

1.21 |

3.26 |

1.33 |

|

Melbourne Polytechnic |

0.23 |

0.04 |

1.12 |

1.43 |

2.38 |

1.04 |

|

South West Institute of TAFE |

0.22 |

0.25 |

1.76 |

0.48 |

0.47 |

0.63 |

|

Sunraysia Institute of TAFE |

0.98 |

1.81 |

2.50 |

0.52 |

0.59 |

1.28 |

|

William Angliss Institute of TAFE |

0.17 |

0.25 |

2.06 |

0.78 |

1.59 |

0.97 |

|

Wodonga Institute of TAFE |

0.75 |

0.31 |

0.34 |

0.29 |

0.50 |

0.44 |

|

Average |

||||||

|

Sector Average |

0.75 |

0.51 |

1.40 |

1.21 |

2.21 |

1.22 |

Source: VAGO.

Figure E6

Internal financing as a percentage

|

Internal financing |

||||||

|---|---|---|---|---|---|---|

|

2014 |

2015 |

2016 |

2017 |

2018 |

Average |

|

|

Bendigo Kangan Institute |

488% |

751% |

166% |

89% |

105% |

320% |

|

Box Hill Institute |

0% |

194% |

25% |

61% |

325% |

121% |

|

Chisholm Institute |

116% |

391% |

362% |

216% |

53% |

228% |

|

Federation Training |

0% |

533% |

783% |

351% |

141% |

362% |

|

Gordon Institute of TAFE |

0% |

869% |

238% |

123% |

40% |

254% |

|

Goulburn Ovens Institute of TAFE |

0% |

87% |

444% |

152% |

694% |

275% |

|

Holmesglen Institute |

0% |

138% |

404% |

129% |

49% |

144% |

|

Melbourne Polytechnic |

0% |

29 783% |

64% |

123% |

110% |

6 016% |

|

South West Institute of TAFE |

0% |

23% |

80% |

614% |

542% |

252% |

|

Sunraysia Institute of TAFE |

30% |

188% |

60% |

347% |

626% |

250% |

|

William Angliss Institute of TAFE |

0% |

1 666% |

142% |

237% |

14% |

412% |

|

Wodonga Institute of TAFE |

200% |

754% |

1 471% |

165% |

548% |

628% |

|

Average |

||||||

|

Sector average |

69% |

2948% |

353% |

217% |

271% |

772% |

Source: VAGO.

Appendix F. Glossary

Accountability

Responsibility of public-sector entities to achieve their objectives in the reliability of financial reporting; effectiveness and efficiency of operations; compliance with applicable laws; and reporting to interested parties.

Amortisation

The systematic allocation of the depreciable amount of an intangible asset over its expected useful life.

Asset

An item or resource controlled by an entity that will be used to generate future economic benefits.

Audit Act 1994

Victorian legislation establishing the Auditor-General's operating powers and responsibilities and detailing the nature and scope of audits that the Auditor-General may carry out.

Audit opinion

A written expression, within a specified framework, indicating the auditor's overall conclusion about a financial (or performance) report based on audit evidence.

Capital expenditure

Money an entity spends on:

- new physical assets, including buildings, infrastructure, plant and equipment

- renewing existing physical assets to extend their service potential or life.

Capital-grant/capital-purpose income

Government funding for an agency to acquire or build capital assets such as buildings, land or equipment.

Clear audit opinion

A positive written expression provided when the financial report has been prepared, which fairly presents the transactions and balances for the reporting period in keeping with the requirements of the relevant legislation and Australian Accounting Standards. Also referred to as an unqualified audit opinion.

Contestable funding

Government-subsidised funding awarded to an entity based on the course that a student is completing. The amount an entity receives is linked directly to student enrolment.

Control environment

Processes within an entity's governance and management structure that provide reasonable assurance about the achievement of an entity's objectives in the reliability of its financial reporting, the effectiveness and efficiency of its operations, and compliance with applicable laws and regulations.

Controlled entities

Entities that TAFEs receive benefits from. TAFEs can influence the extent of those benefits through any rights they have to direct the activities of those entities.

Current asset

An asset that will be sold or realised within 12 months of the end of the financial year being reported on, such as term deposits maturing in three months or stock items available for sale.

Current liability

A liability that will be settled within 12 months of the end of the financial year being reported on, such as payment of a creditor for services provided to the entity.

Debt

Money owed by one party to another party.

Deficit

When total expenditure is more than total revenue.

Depreciation

Systematic allocation of the value of an asset over its expected useful life, recorded as an expense.

Entity

A corporate or unincorporated body that has a public function to exercise on behalf of the state or that is wholly owned by the state, including departments, statutory authorities, statutory corporations and government business enterprises.

Equity or net assets

Residual interest in the assets of an entity after deducting its liabilities.

Expense

The outflow of assets or the depletion of assets an entity controls during the financial year, including expenditure and the depreciation of physical assets. An expense can also be the incurrence of liabilities during the financial year.

Fee-for-service revenue

Represents revenue generated from international students, short courses and contract training delivered by TAFEs. This can also include training provided to government agencies and staff.

Financial Management Act 1994

Victorian legislation governing public sector entities, as determined by Assistant Treasurer, including their financial reporting framework.

Financial report

A document reporting the financial outcome and position of an entity for a financial year. It contains financial statements, including a comprehensive income statement, a balance sheet, a cashflow statement, a comprehensive statement of equity, and notes.

Financial Reporting Directions

Issued by the Assistant Treasurer for entities reporting under the Financial Management Act 1994, with the aim of:

- achieving consistency and improved disclosure in financial reporting for Victorian public entities by eliminating or reducing divergence in accounting practices

- prescribing the accounting treatment and disclosure of financial transactions in circumstances where there are choices in accounting treatment, or where existing accounting procurements have no guidance or requirements.

Financial sustainability

An entity's ability to manage financial resources so it can meet its current and future spending commitments, while maintaining assets in the condition required to provide services.

Financial year

A period of 12 months for which a financial report is prepared.

Going concern

An entity that is expected to be able to pay its debts when they fall due, and continue in operation without any intention or necessity to liquidate or otherwise wind up its operations.

Governance

The control arrangements used to manage and monitor an entity's activities to achieve its strategic and operational goals.

Impairment (loss)

The amount by which the value of an entity's asset exceeds its recoverable value.

Income

The inflow of assets or decrease of liabilities during the financial year, including receipt of cash and the reduction of a provision.

Intangible asset

An identifiable non-financial asset, controlled by an entity, which cannot be physically seen, such as software licences or a patent.

Internal control

A method of directing, monitoring and measuring an entity's resources and processes to prevent and detect error and fraud.

Investment

The expenditure of funds intended to result in medium to long-term service and/or financial benefits arising from the development and/or use of infrastructure assets by either the public or private sectors.

Issues

Weaknesses or other concerns in the governance structure of an entity identified during a financial audit, which are reported to the entity in a management letter.

Liability

A present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow of assets from the entity.

Management letter

A letter the auditor writes to the governing body, the audit committee and the management of an entity outlining issues identified during the financial audit.

Material error or adjustment

An error that may result in the omission or misstatement of information, which could influence the economic decision of users taken on the basis of the financial statements.

Materiality

Information is material if its omission, misstatement or non-disclosure has the potential to affect the economic decisions of users of the financial report, or the discharge of accountability by management or those charged with governance. The size, value and nature of the information and the circumstances of its omission or misstatement help in deciding how material it is.

Modified opinion

The auditor's expressed qualified opinion, adverse opinion or disclaimer of opinion.

Net result

The value that an entity has earned or lost over the stated period—usually a financial year—calculated by subtracting an entity's total expenses from the total revenue for that period.

Non-current asset

An asset that will be sold or realised later than 12 months after the end of the financial year being reported on, such as investments with a maturity date of two years or physical assets the entity holds for long-term use.

Non-current liability

A liability that will be settled later than 12 months after the end of the financial year being reported on, such as repayments on a five-year loan that are not due in the next 12 months.

Other comprehensive income

Revenues, expenses, gains and losses under Australian Accounting Standards that are excluded from net income on the income statement and are instead listed after net income.

Performance report

A statement detailing an entity's predetermined performance indicators and targets for the financial year, and the actual results achieved, along with explanations for any significant variations between the actual result and the target.

Physical asset

A non-financial asset that is a tangible item an entity controls, and that will be used by the entity for more than 12 months to generate profit or provide services, such as building, equipment or land.

Qualified audit opinion

An opinion issued when the auditor concludes that an unqualified opinion cannot be expressed because of:

- disagreement with those charged with governance, or

- conflict between applicable financial reporting frameworks or limitation of scope.

A qualified opinion is considered to be unqualified except for the effects of the matter that relates to the qualification.

Relevant measures and indicators

Measures and indicators an entity uses if they have a logical and consistent relationship to its objectives and are linked to the outcomes to be achieved.

Revenue

Inflows of funds or other assets or savings in outflows of service potential, or future economic benefits in the form of increases in assets or reductions in liabilities of an entity, other than those relating to contributions by owners, that result in an increase in equity during the reporting period.

Risk

The chance of a negative or positive impact on the objectives, outputs or outcomes of an entity.

Unmodified opinion

The audit opinion that the auditor expresses when concluding that the financial (or performance) report is prepared, in all material respects, in keeping with the applicable reporting framework.

Victorian Training Guarantee

A contract between DET and training providers, including TAFE institutes, for the delivery of government-subsidised training.

Dashboard for the Results of 2018 Audits: Technical and Further Education Institutes

Our dashboard is interactive visualisation tool summarising the financial statement data for all Victorian technical and further education (TAFE) institutes.

Do you need help using the dashboard? Read our dashboard instructions.

Dashboard instructions

|

General instructions for all pages |

|

|

To navigate between pages in the dashboard, use the page navigation buttons on the left side of each page. |

|

| The dashboard is easiest to navigate in the full screen view. Click the button at the bottom right of the window. | |

| To access a detailed view of each chart, hover over the chart and click the ‘Focus Mode’ button at the top right of the window. |

|

| To return to the dashboard from ‘Focus Mode’, click ‘Back to Report’ at the top left of the window. |

|

| To share the link to the dashboard via email, LinkedIn, Facebook or Twitter, click the ‘Share’ button at the bottom right of the window. |

|

|

Specific selection instructions |

|

|

Home page |

|

|

When opening the dashboard for first time, you will reach the home page.

|

|

|

Period (financial year) selection |

|

|

The dashboard contains data from the past five financial years.

Note: the years selected in a page will be applied across all pages of the dashboard. |

|

|

TAFE selection |

|

|

You can explore the data by selecting TAFEs in the dashboards.

Note: the TAFEs selected in a page will be applied across all pages of the dashboard. |

|

|

Sector summary |

|

|

There are two selection types for the sector summary page which show different charts. The dark grey colour shows the selected option.

When you are in the financial composition option, the page will show composition selection options. Click the downward button to expand and make your selection. |

|

|

TAFE financial composition |

|

|

Click the downward button to expand and make your selection. |

|

|

TAFE comparison analysis |

|

|

This page allows you to visualise up to two charts. Select a data type that you want to show (financial statements results or financial sustainability indicators). The dark grey colour shows the selected option.

Click the downward button to expand and make your selection. Repeat the above process for the second chart. |

|