Results of 2019 Audits: Technical and Further Education Institutes

Overview

The TAFE sector in Victoria is made up of 12 technical institutes and 14 controlled entities.

This report outlines the results of, and observations arising from, our financial audits of the entities within the sector, and our observations, for the year ended 31 December 2019.

We also assess the sector’s financial performance during the 2019 reporting period and assess its sustainability as at 31 December 2019.

Data dashboard

We have developed a data dashboard that summarises the financial statement data for all Victorian TAFEs.

Transmittal letter

Victorian Auditor-General’s Report

Ordered to be published

VICTORIAN GOVERNMENT PRINTER June 2020

PP No 138, Session 2018–20

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of the Audit Act 1994, I transmit my report Results of 2019 Audits: Technical and Further Education Institutes.

Yours faithfully

Andrew Greaves

Auditor-General

30 June 2020

Acronyms

Acronyms

| DET | Department of Education and Training |

| FMA | Financial Management Act 1994 |

| KPI | key performance indicator |

| RTO | registered training organisation |

| TAFE | technical and further education |

| VAGO | Victorian Auditor-General's Office |

| VET | vocational education and training |

Abbreviations

| Free TAFE | Free TAFE for Priority Courses |

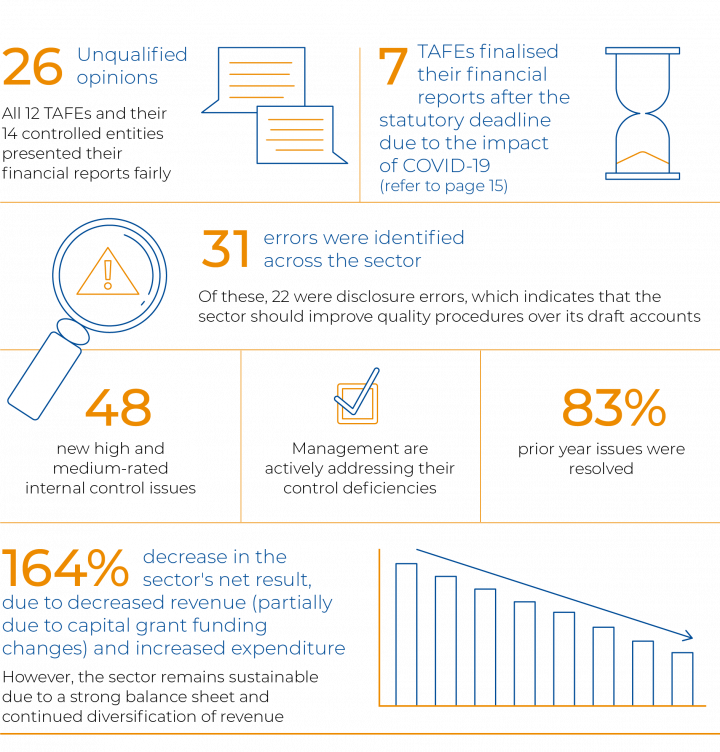

At a glance

1 Audit context

The technical and further education (TAFE) sector delivers vocational education and training (VET) to equip students with practical and educational skills for a variety of careers, and provides pathways to university courses.

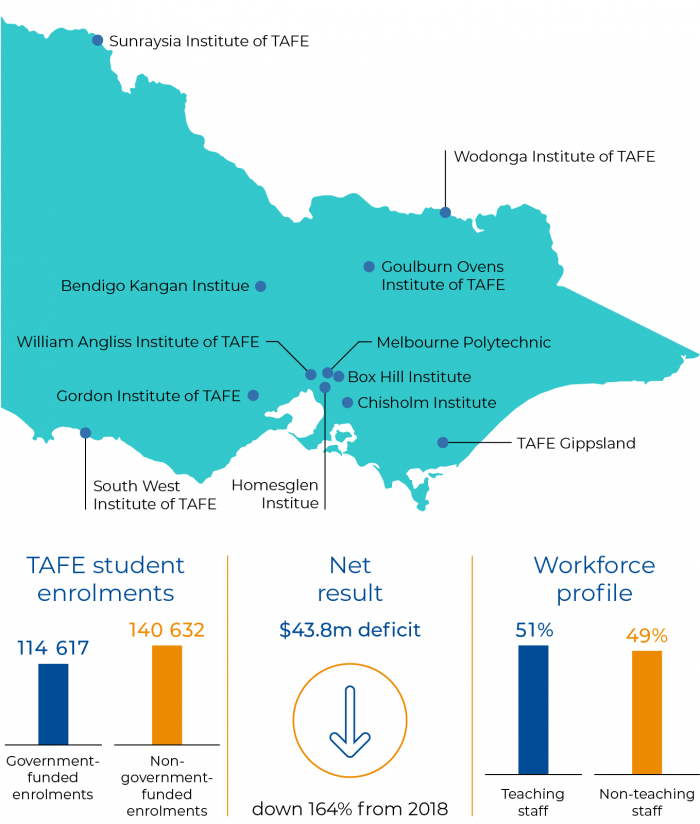

Twelve TAFE institutes and their 14 controlled entities make up the TAFE sector in Victoria.

In Victoria, private registered training organisations (RTO) also provide VET courses to students. Private RTOs are private-sector organisations and are not included in this report.

Figure 1A provides an overview of the TAFE sector in Victoria.

Figure 1A

TAFE sector at a glance

Source: VAGO

1.1 Legislative framework

TAFE institutes are established and governed under the Education and Training Reform Act 2006. This Act:

- outlines the requirements for establishing a TAFE board and its governance responsibilities

- defines the function and powers of TAFEs

- defines the objectives of TAFEs.

TAFEs aim to:

- perform functions for the public benefit

- facilitate student learning

- collaborate as part of a strong network of public training providers.

TAFEs are 'public bodies' under the Financial Management Act 1994 (FMA). They are required to comply with the FMA and with any general or specific direction given by the Assistant Treasurer. They are also subject to the Public Administration Act 2004, which provides a framework for governance in the public sector. Each TAFE board is accountable to the Minister for Training and Skills and Minister for Higher Education.

The Department of Education and Training (DET) oversees the sector on behalf of the Minister for Training and Skills and Minister for Higher Education. This includes overseeing the governance, breadth, depth and appropriateness of the training delivery provided by TAFEs. DET funds the delivery of this training through a subsidy for each training hour delivered.

1.2 TAFE funding model

The predominant revenue stream for TAFEs is from delivering training courses. In 2019, the TAFE sector earned $1 139.5 million in training revenue and government contributions to support course delivery ($1 149.7 million in 2018). The sector generates added ancillary revenue from the sale of goods, interest and other income—these streams totalled $66.7 million in 2019 ($63.3 million in 2018).

Student revenue

The TAFE sector has two broad student categories—government subsidies and full-fee paying.

Government-subsidised students are domestic students studying courses that are eligible for a government grant (also known as contestable funding).

Full fee-paying students consist of private domestic students and international students. Domestic students may self-fund their course, or access Commonwealth VET student loan funding. In this case, the Commonwealth pays the TAFE the course fees, which the students then repay through the Australian taxation system when they earn above a minimum threshold.

1.3 Report structure

In this report, we provide information on the outcomes of our financial audits of the 12 TAFEs and their 14 controlled entities for the year ended 31 December 2019. The financial results of controlled entities are consolidated into those of their respective parent entities, and we do not discuss them separately in this report.

We identify and discuss the key matters arising from our audits and analyse the information included in the TAFEs' financial and performance reports.

Figure 1B outlines the structure of the report.

Figure 1B

Structure of this report

|

Part |

Description |

|---|---|

|

2 Results of Audits |

Comments on the results of the financial and performance report audits of the 12 TAFEs for the 2019 financial year. Summarises the internal control issues observed during our audits. |

|

3 Financial sustainability |

Provides insight into the TAFE sector's financial sustainability risks, and the efficiency and effectiveness of their operations. |

Source: VAGO

Appendix B lists the 12 TAFEs and their 14 controlled entities included in this report, and details the financial audit opinions issued for the year ended 31 December 2019.

We carried out the financial audits of these entities under section 10 of the Audit Act 1994 and in accordance with Australian Auditing Standards. Each entity pays the cost of its audit.

The cost of preparing this report was $165 000 which is funded by Parliament.

1.4 Recommendation

We recommend that all technical and further education institutes:

1. review and update their risk registers and their business continuity plans to incorporate learnings from the COVID-19 pandemic.

1.5 Submissions and comments

We have consulted with DET and the 12 TAFE entities and considered their views when reaching our conclusions. As required by the Audit Act 1994, we gave them a draft copy of this report and asked for their submissions or comments. We also provided a copy of the report to the Department of Treasury and Finance for information.

The following is a summary of those responses. The full responses are included in Appendix A.

DET has noted our report and the key findings that the sector remains sustainable and that the financial and performance reports are reliable.

2 Results of audits

In this Part of the report, we summarise the results of our financial and performance report audits and observations for the TAFE sector for the year ended 31 December 2019.

2.1 Conclusion

The financial and performance reports of the TAFE sector are reliable. Parliament and the community can use them with confidence.

2.2 Findings

Audit opinions

Financial reports

A clear audit opinion confirms that the financial report fairly presents the transactions and balances for the reporting period, in keeping with the requirements of relevant accounting standards and applicable legislation.

For the year ended 31 December 2019, we issued clear audit opinions for all 12 TAFEs and their 14 controlled entities.

| An emphasis of matter paragraph included in the auditor's report refers to a matter appropriately presented or disclosed in the financial report that, in the auditor's judgment, is of such importance that it is fundamental to users' understanding of the financial report. |

While we made no modifications to our audit opinions, we included an emphasis of matter paragraph in our auditor’s reports for seven TAFEs and two controlled entities, being:

- Bendigo Kangan Institute

- Box Hill Institute

- Gordon Institute of TAFE

- Goulburn Ovens Institute of TAFE

- Holmesglen Institute

- South West Institute of TAFE

- Sunraysia Institute of TAFE

- TAFE Kids Inc (subsidiary of Sunraysia Institute of TAFE)

- William Angliss Pte Ltd (subsidiary of William Angliss Institute of TAFE)

The emphasis of matter paragraph draws the reader's attention to the disclosures made in notes in the financial report regarding the effects of the COVID-19 pandemic—a material subsequent event.

As at the time their financial reports were signed, each of the above TAFEs disclosed:

- that local and international students were impacted by the public health measures associated with COVID-19

- that they introduced measures to assist affected students as the situation evolved and that they would continue to monitor the non-financial and financial impacts of COVID-19

- that given the significant amount of uncertainty associated with COVID-19, they were not able to quantify the full economic impact at present. However, to mitigate this risk, DET had provided assurances that financial assistance will be made available to enable them to continue as a going concern for the next 12 months.

We did not include an emphasis of matter paragraph in the audit opinions for the other five TAFEs, because they had finalised their financial reports before COVID-19 was declared an emergency. These five TAFEs are:

- Chisholm Institute

- Melbourne Polytechnic

- TAFE Gippsland

- William Angliss Institute of TAFE

- Wodonga Institute of TAFE

We discuss the impact of COVID-19 on the preparation of the financial report further in Section 2.4 of this report.

Performance reports

TAFEs are required under a ministerial instruction to report against four mandatory key performance indicators (KPI) in their performance reports:

- training revenue diversity

- employment costs as a proportion of training revenue

- training revenue per full-time teaching equivalent

- operating margin percentage.

They must establish targets and report on the actual results for each KPI, and also disclose the prior year's results.

We issued clear audit opinions on the performance reports of all 12 TAFEs, consistent with the prior year. A clear audit opinion confirms that the actual results for each performance indicator are presented fairly. We do not express an opinion on the relevance or adequacy of the performance indicators.

Descriptions of the four indicators and the formulas used to calculate them are provided in Appendix D. The appendix also includes a summary of the targets and actual results for each TAFE.

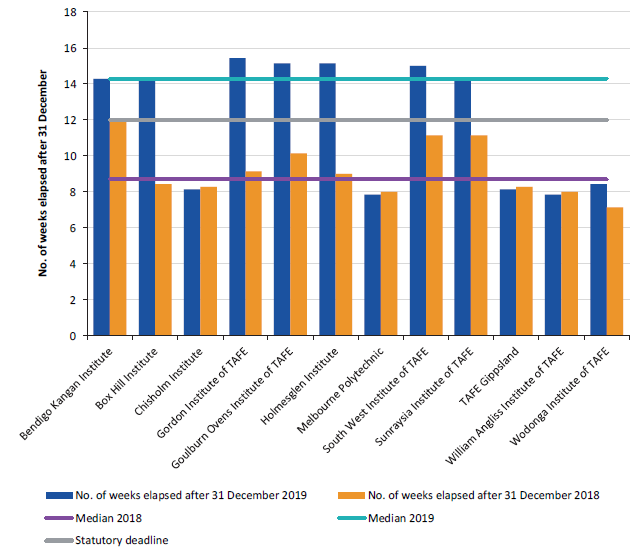

Timeliness of reporting

Timely financial reporting enables TAFE governing boards and other stakeholders to have informed views about management's accountability for financial and operational performance. The later financial reports are produced after the end of the financial year, the less useful they become.

The FMA requires public sector entities to finalise their audited financial reports within 12 weeks of the end of the financial year.

This year, TAFEs took longer to certify their financial reports than the prior year.

In 2019, TAFEs took a median of 14.2 weeks to finalise their financial reports, compared to 8.7 weeks in 2018.

Seven TAFEs—Bendigo Kangan Institute, Box Hill Institute, Gordon Institute of TAFE, Goulburn Ovens Institute of TAFE, Holmesglen Institute, South West Institute of TAFE and Sunraysia Institute of TAFE—certified their financial reports after the 12-week FMA deadline. This was due to the evolving COVID-19 pandemic, which resulted in a number of government restrictions being announced throughout March 2020.

This fluid situation meant that these entities were required to review and assess the impact of the pandemic as a material subsequent event and to revise the level of disclosure in their draft financial reports. We then needed more time to review and assess these disclosures prior to providing our clearance for signing.

Figure 2A shows the time taken after year end for each TAFE to certify its financial report.

Figure 2A

Weeks taken after balance date (31 December) for TAFEs to certify their financial reports

Note: Federation Training changed its name to TAFE Gippsland during the year.

Source: VAGO

Quality of financial reporting

During our 2019 audits, we identified 31 material errors in draft financial reports across the sector that required correction before we could issue a clear opinion. This is more than prior years. Of the 31 material adjustments, 22 related to how an item was classified or disclosed, which did not affect the entities’ net results. The remaining nine adjustments corrected financial errors totalling $2.4 million.

Figure 2B summarises the common audit adjustments made as a result of our audit work across the 2019 reporting period.

Figure 2B

Common adjustments identified across the 2019 reporting period

|

Dollar adjustments |

We identified nine financial adjustments across the 12 TAFEs, totalling $2.4 million. Common financial adjustments related to:

|

|

Classification |

Common classification and disclosure adjustments related to:

|

Source: VAGO

Internal controls over financial reporting

In our financial audits, we consider the internal controls relevant to financial reporting and assess whether TAFEs have relevant internal controls to manage the risks of material errors.

|

Internal controls include an entity’s:

|

Overall, TAFEs' internal controls remain adequate for reliable financial reporting. However, we found instances where important control activities could be improved. This year we identified six high and 42 medium-rated control issues, compared to one high and 12 medium-rated issues identified in the prior year. The number of findings has increased from the prior year with more IT system control weaknesses being identified, commensurate with our increased audit focus in this area.

Figure 2C provides a breakdown of internal control issues by area and risk rating. Appendix C provides additional information on our risk ratings and our expected timelines for TAFEs to resolve issues we find during our audit work.

Figure 2C

Internal control issues identified at TAFEs during 2019 audits

|

Area of issue |

Risk rating |

||

|---|---|---|---|

|

High |

Medium |

Total |

|

|

IT controls |

5 |

24 |

29 |

|

Revenue/receivables |

- |

2 |

2 |

|

Expenditures/payables |

– |

2 |

2 |

|

Financial reporting |

– |

2 |

2 |

|

Governance |

1 |

2 |

3 |

|

Payroll |

- |

8 |

8 |

|

Property, plant and equipment |

- |

1 |

1 |

|

Risk management |

- |

1 |

1 |

|

Total |

6 |

42 |

48 |

Note: We reported 15 low-rated internal control issues in 2018. As these issues are minor and/or may present opportunities to improve existing processes, they have been excluded from this figure.

Source: VAGO.

High-rated issues

Since all TAFEs depend on IT systems for some or all of their financial reporting, it is important to design and implement IT controls that ensure accurate processing and availability of information, and to safeguard the integrity of systems and information from unauthorised access or changes.

We identified six high-rated issues – three at Sunraysia Institute of TAFE, one at Goulburn Ovens Institute of TAFE, one at Melbourne Polytechnic, and one at South West Institute of TAFE.

These issues are summarised below:

- Logical Security—Access Management. Deficiencies were noted in managing user access to systems.

- Weaknesses in Change Management Process. Although there was a change management policy and procedures document in place, the change management process was either implemented part-way through the year with weaknesses noted, or not enforced—which resulted in inconsistencies in change management.

- Managing critical incidents. Policy and procedures for managing critical incidents, prioritising service problems, and standard handling of service problems were formally documented. However, the documented requirements and procedures were not adhered to.

Medium-rated issues

Twenty four of the 42 medium-rated control issues we identified at six TAFEs also related to control over IT systems. This makes up 57 per cent of total medium-rated findings (42 per cent in 2018).

The issues can be summarised as:

- inadequate governance over the IT control environment, including a lack of formally established IT strategies and directions

- inadequate control activities to manage user accounts and the appropriateness of their levels of access

- implementing password controls that were not in line with good practice recommendations

- untested business continuity and disaster recovery plans over important business processes and systems.

We also identified several control breakdowns in payroll and expenditure that increase the risk of error, fraud, and the risk of erroneous transactions being recorded including:

- expenditure delegation limits in systems not aligned to the approved Financial Delegations Policy

- instances where supporting contracts and agreements were missing for contract staff and employees.

All TAFEs with these issues have committed to rectifying them during 2020.

Status of internal control matters raised in prior-year audits

We monitor internal control issues we raised in prior-year management letters to see if they are resolved. Where issues remain outstanding, we factor this into our risk assessments for the current year's audit.

During 2019 the sector resolved 15 (83 per cent) of the 18 high and medium rated audit issues from prior years. Figure 2D shows the status of prior period internal control issues as at May 2020 by risk rating.

Figure 2D

Status of prior-period internal control issues as at May 2019 by risk rating

|

Issue status |

Risk rating |

||

|---|---|---|---|

|

High |

Medium |

Total |

|

|

Resolved |

1 |

14 |

15 |

|

Unresolved |

– |

3 |

3 |

|

Total |

1 |

17 |

18 |

Note: Five of the 18 issues were identified in 2017 and 2016.

Source: VAGO.

Two TAFEs were responsible for the three unresolved medium-rated issues—Goulburn Ovens Institute of TAFE and Gordon Institute of TAFE. These TAFEs need to respond to the issues reported in our management letters more promptly to strengthen the effectiveness of their internal control environment and financial reporting.

2.3 New accounting standards

For the 2019 reporting period, three new accounting standards issued by the Australian Accounting Standards Board applied to the TAFE sector for the first time:

- AASB 15 Revenue from Contracts with Customers

- AASB 1058 Income of Not-for-Profit Entities

- AASB 16 Leases

These new standards had the potential to change how and when entities account for student fee and related grant revenues and any leased assets. They required changes to underlying systems, processes and business practices to enable entities to capture the necessary information and documentation for appropriate accounting and disclosure.

Revenue-related standards

AASB 15 establishes a five-step model for an entity to account for revenue from a contract that contains a performance obligation to transfer goods or services:

- 1. Identifying the contract with a customer

- 2. Identifying the performance obligations

- 3. Determining the transaction price

- 4. Allocating the transaction price to the performance obligations

- 5. Recognising revenue when/as performance obligation(s) are satisfied.

All TAFEs adopted a modified retrospective approach, as recommended by the Department of Treasury and Finance, with no changes in comparative information. Overall, there was no significant impact for the sector as to how they accounted for their revenue or income under the new standards, except for accounting for capital grants.

|

A modified retrospective approach includes a few practical expedients that make adoption easier. Under this approach, an entity applies the accounting standard from the beginning of the current accounting period. A right-of-use asset is an asset that the lessee has the right to use for the term of the lease. |

Under the previous standards, TAFEs would record all capital grants as income upon receipt, as the TAFE was not giving equal value back to the grantor. TAFEs now recognise this income progressively (that is, as the asset is constructed).

As at 31 December 2019, TAFEs had a liability of $32.9 million representing cash received but for which the assets have not been fully constructed. Under the previous accounting standards, this would have been recorded as 2019 income.

AASB 16 Leases

This standard fundamentally changes lease accounting for lessees—with the distinction between finance and operating leases removed.

Lessees now recognise all their leases on the balance sheet as ‘right-of-use’ assets with an associated lease liability. They now depreciate these right-of-use assets and record an interest expense for the balance of the lease liability. These expenses will be higher at the start of the lease period and reduce as entities repay the lease liability.

At 1 January 2019, TAFEs recognised right-of-use assets and a corresponding lease liability of $97.1 million. All TAFEs adopted a modified retrospective approach, with no changes in comparative information. Figure 2E shows the breakdown of this recognition by asset category.

Figure 2E

Recognition of right-of-use asset and liability by category

|

Category |

Total ($m) |

|---|---|

|

Property |

91.4 |

|

Plant and equipment |

3.5 |

|

Motor vehicles |

1.3 |

|

Other |

0.9 |

|

Total |

97.1 |

Source: VAGO

All TAFEs elected not to recognise right-of-use assets and lease liabilities for short-term leases, which have a lease term of 12 months or less, or for low-value leases where the asset valuation is less than $10 000.

The impact of adopting AASB 16 increased depreciation and amortisation expense in the sector to $92.6 million, compared to $69.3 million in 2018. At 31 December 2019, TAFEs held right-of-use assets of $91.2 million with a corresponding lease liability of $91.0 million.

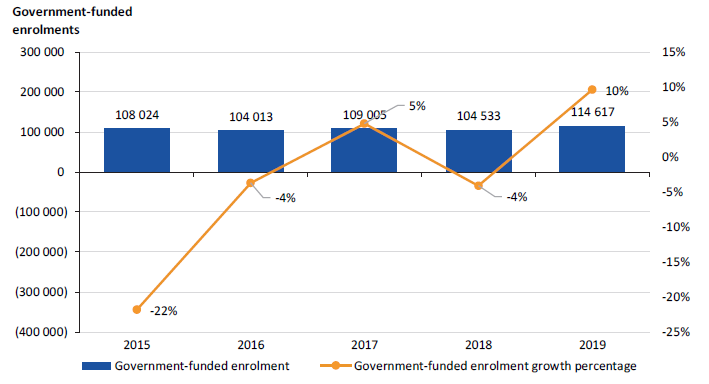

2.4 COVID-19

The outbreak of novel coronavirus (COVID-19) was declared as a global pandemic on 11 March 2020—as such it is clearly an ‘after balance date’ event. This led to the Australian and state governments placing restrictions on domestic and international travel, closing non-essential services and enacting social distancing in an effort to contain the virus. The pandemic also resulted in volatility in economic markets.

Figure 2F shows the timeline of the COVID-19 outbreak.

Financial reporting impact—non-adjusting subsequent event

While COVID-19 was detected overseas in December 2019, it did not impact Australia until 2020. For financial reporting purposes, TAFEs were required to continually review and assess the impact of the pandemic as a material but non adjusting subsequent event. This meant that the nature and future impacts of the COVID-19 pandemic was disclosed in the notes to their financial reports. As a non-adjusting subsequent event, the amounts reported as at December 2019 in their financial reports did not need to change.

Due to the evolving nature of the pandemic, TAFEs continually revised and often increased the level of disclosure in their financial reports, up to the date they signed their financial statements.

Figure 2F

Timeline of COVID-19 and impact on TAFEs

Source: VAGO

Going concern

Financial reports are prepared on a going concern basis. To ensure this remained appropriate, TAFEs prepared financial forecasts using a number of various scenarios given the level of uncertainty in the current climate.

In anticipation of the likely financial impacts that will continue to confront TAFEs, and as result of the ongoing uncertainty due to the pandemic, DET issued letters of financial support to all 12 TAFEs. Letters of financial support are an undertaking that DET will provide adequate cashflow to TAFEs, should the need arise, until April 2021. These letters have enabled TAFE financial statements to be prepared on a going concern basis. This then enabled us to conclude that the going concern basis of preparation was appropriate.

Additional government funding

Uncertainty surrounding future government restrictions to mass gatherings is likely to adversely impact TAFEs, with decreases in training revenue expected. Decreasing training revenue has the potential to impact the sustainability of TAFEs. In response to this, on 17 April 2020, the Victorian Government announced $260.8 million in funding to support TAFEs (and other training organisations) to ensure business continuity until 30 June 2020. The funding will assist in meeting employee costs, enhancing online training capacity and maintaining the safety of face-to-face training where this needs to occur.

Future financial reporting considerations

Developments throughout 2020 will continue to impact the preparation of future financial reports. All TAFEs will need to monitor, assess and regularly update how they have been affected by COVID-19 and the impact on their financial position and the reporting thereon.

Items that may be affected in the future include:

- timing of revenue recognition as it is driven by delivery of performance obligations

- items which are subject to assumptions, significant estimation uncertainty and sensitivity analysis, such as the recoverability of accounts receivable, leases and provisions

- going concern assessments.

Factors that are likely to impact the above items include:

- economic and industry factors

- financial impacts on students and suppliers

- duration of containment measures

- ongoing government initiatives, assistance and support

- modifications to lease contracts

- management plans and responses

The consequences of COVID-19 may mean that historical information is no longer relevant or reliable as a basis for determining items that are subject to estimation in the future.

Operational impact

Delivery of services

While education has continued to be deemed an essential service, and as such the operation of TAFEs has continued, from March to May 2020 many TAFEs suspended face-to-face learning and transitioned many courses online. While many courses have transitioned, some apprentice and trade courses are still conducted using face-to-face learning.

Internal controls and risk assessment

The pandemic also has the potential to impact the control environment of TAFEs. Any change in working arrangements may result in an increased risk of internal controls failing, especially in an environment where manual controls have operated with a high level of management oversight within an office environment. There is also an increased risk of fraud in that the opportunities to circumvent existing controls may be greater. As employees access systems in different ways, delegations may change to cover absent staff and workload changes may be experienced.

| A business continuity plan sets out arrangements for managing disruptions. It helps anticipate, prevent or prepare for disruptions such as fire, flood, storms and illness, and to respond and recover from them. |

The pandemic has also changed risk assessments, business continuity plans and crisis management plans. While such plans are usually developed to respond to a one-off or short-term event, this may be inadequate in an event such as COVID-19, which has played out over many months.

The pandemic has affected organisations in the following ways:

- changes to operating models

- IT security and cybersecurity considerations

- personnel health and safety

- flexible working arrangements

- funding mix and revenue diversity, including ongoing continuity of revenue streams in the future

- evaluation of short and long-term liquidity.

Risk registers and business continuity plans should be reviewed and updated to reflect learnings from the COVID-19 pandemic, and they should be updated and tested on a regular basis.

3 Financial sustainability

To be sustainable, TAFEs need to efficiently manage their resources to respond to future changes and foreseeable risks without compromising the quality of services, and avoid large fluctuations in expenditure.

3.1 Conclusion

We assessed that at 31 December 2019 the sector was financially sustainable in the short term, based on its historic performance and reserves.

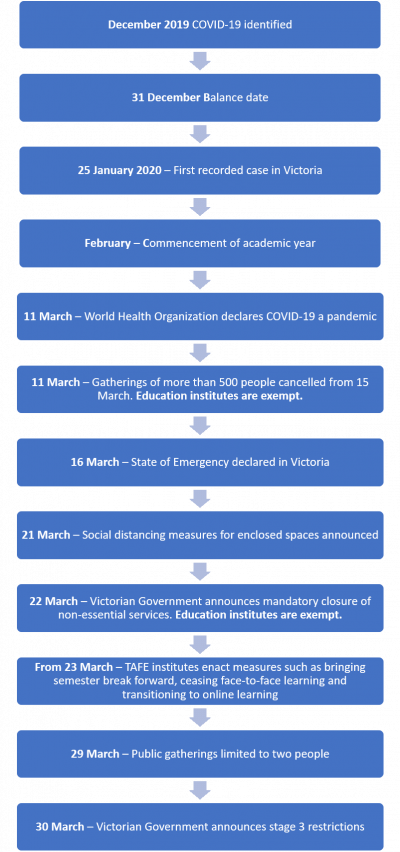

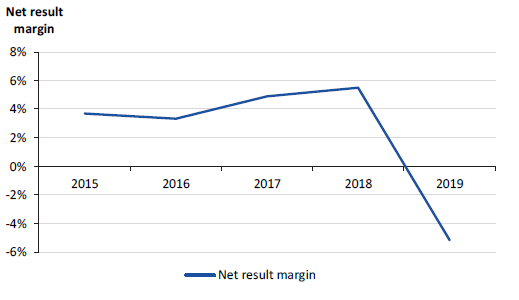

However, there were signs this year that revenue and expenditure policies require review and possible reconsideration. The subsequent COVID-19 emergency has only sharpened the need for this. Figure 3A gives an overview of the 2019 financial results.

Figure 3A

Overview of financial reports

Source: VAGO from TAFE financial reports.

3.2 Financial results

In 2019, the sector generated a net deficit of $43.8 million. This is a significant decline from the prior year, when a surplus of $67.7 million was generated.

Of the 12 TAFEs, only four generated a net surplus in 2019 compared to 11 in 2018.

Sector revenue decreased by $11.3 million to $1 206 million (less than 1 per cent); however, sector expenditure increased by $100.4 million (8 per cent) to $1 253 million.

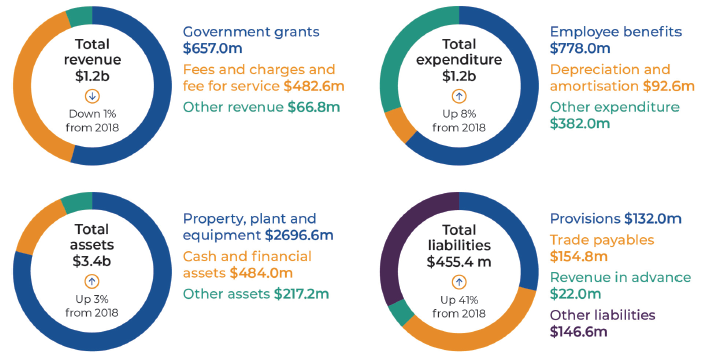

The 12 TAFEs received $418.6 million in contestable funding in 2019, $78.0 million more than in 2018 due to higher student contact hours and higher enrolments than last year, predominantly due to the introduction of Free TAFE for Priority Courses (Free TAFE).

The increase in contestable funding has been partially offset by a reduction in operating grants provided to the sector. Operating grants in 2019 of $191.3 million compare to $276.4 million in 2018—a 31 per cent decrease.

Fee-for-service revenue increased by $25.0 million (7 per cent) during 2019. The sector continues to increase its fee-for-service revenue from several streams, including government, and international onshore and offshore sources. Fee for service revenue has increased steadily between 2015 and 2019. TAFEs have been diversifying their revenue streams and relying less on state government funding. This may help TAFEs mitigate funding risks that might occur from changes in funding models or declining government subsidised enrolments.

Figure 3B shows the trend in contestable funding against fee-for-service revenues over the past five years.

Figure 3B

Contestable funding and fee-for-service revenue for the years ended 31 December 2015–19

Source: VAGO.

The increase in expenditure was mainly from a $76.9 million (11 per cent) increase in employee benefits. More staff were employed across the sector to meet the higher service demand in relation to Free TAFE and fee-for-service revenue, combined with applicable award increases. We discuss Free TAFE in more detail in Section 3.4.

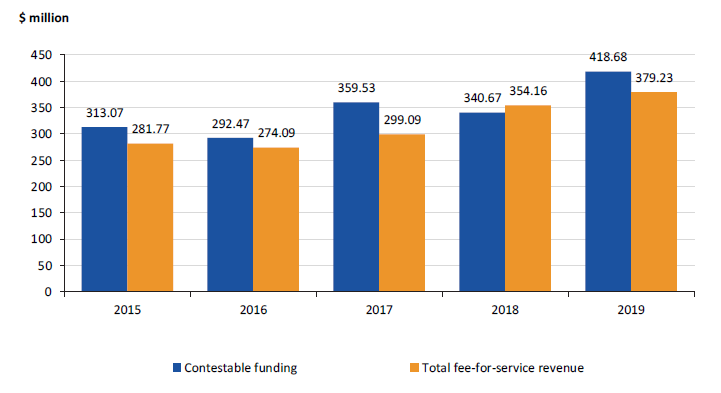

3.3 Student enrolments

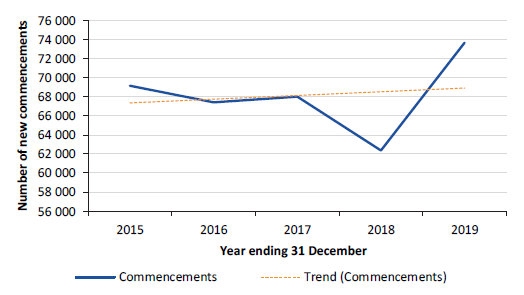

Figure 3C shows the trend in total government-funded enrolments across the 12 TAFEs over the past five years.

Figure 3C

Total government-funded enrolments and annual growth rates across the 12 TAFEs for years ended 31 December 2015–19

Source: VAGO.

Commencements

Figure 3D shows the trend in government-funded commencements for the TAFE sector over the past five years.

Figure 3D

Government-funded commencements across the 12 TAFEs for the years ended 31 December 2015–2019

Source: VAGO, based on data supplied by DET.

From 2015 to 2017, government-funded commencements remained steady, with a marginal decrease over the period. In 2018, commencements declined significantly, largely because students deferred enrolment so they could access the incoming Free TAFE initiative.

The introduction of Free TAFE has reversed the downward trend in commencements and has resulted in more contestable funding for the sector. This will help alleviate long-term sustainability risks for TAFEs. However, the sector must continue to increase other revenue streams.

3.4 TAFE funding

Funded courses

Annually, DET issues a funded course list. This represents the courses for which eligible students are able to access government-subsidised training.

The funded course list only includes courses that:

- align with industry needs and workforce demands

- represent government priorities, including rolling out the National Disability Insurance Scheme, responding to family violence, and completing Victoria’s infrastructure projects

- have strong job outcomes, such as apprenticeships

- meet other social needs, such as foundation skill courses.

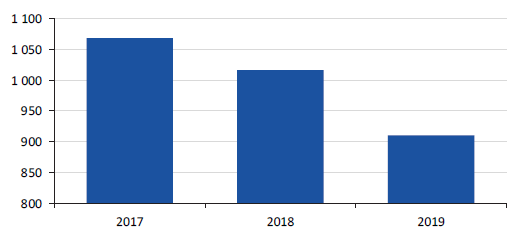

Figure 3E shows the number of funded courses over the past three years.

Figure 3E

Number of funded courses 2017–19

Source: VAGO, based on data supplied by DET.

The decline in the number of funded courses over the period is attributed to the introduction of the Skills First model, which prioritises funding for courses that align with industry needs and workforce demands and linked government priorities. We note that there is a further decline in the number of courses for the 2020 year. In 2020, 819 courses will be funded. While the number of funded courses has reduced, the amount of contestable funding provided to the sector has increased due to increases in student numbers.

Free TAFE for priority courses

The 2018 Victorian State Budget included $172 million for Free TAFE, an initiative to subsidise the costs of 40 existing non apprenticeship courses and 20 existing pre-apprenticeships in areas deemed high priorities for future growth. Under the Free TAFE initiative, the government will pay course tuition costs for eligible students. However, individual TAFEs may charge students for other fees, such as student amenities or materials. Free TAFE commenced on 1 January 2019.

Any Australian citizen, permanent resident or a New Zealand citizen is eligible to undertake Free TAFE for priority courses in Victoria, if they meet one of the following criteria:

- under 20 or upskilling—

- applicants who are aged under 20 (regardless of any other qualifications they might hold)

- applicants who are aged 20 or older and enrolling in a course that is a higher qualification than any they have previously attained.

- Victorians who need additional support—

- unemployed and clients of the Jobs Victoria Employment Network

- retrenched workers

- automotive supply-chain workers

A student may only enrol in one subsidised Free TAFE course.

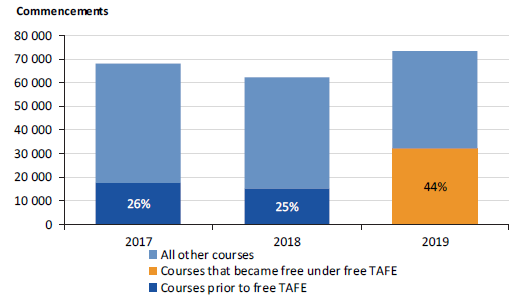

Figure 3F shows the comparison of Free TAFE course commencements versus all other course commencements over the past three years.

Figure 3F

Free TAFE course commencements as a percentage of government funded commencements (2017–19) with the introduction of Free TAFE in 2019

Source: VAGO.

From 2017 to 2018, enrolments in courses earmarked to be included in the Free TAFE program decreased. The introduction of Free TAFE in 2019 resulted in a significant increase in commencements in these courses. However, it was countered to a degree by a reduction of commencements in all other courses.

The overall increase in commencements due to Free TAFE has resulted in more students starting further studies and has encouraged a transition to courses designated as high priority for future growth, with Free TAFE courses making up 44% of commencements in 2019.

3.5 Sustainability

To be sustainable, TAFEs need to efficiently manage their resources to respond to future changes and foreseeable risks. TAFEs should achieve this without compromising the quality of their services and avoid large expenditure fluctuations.

The short-term health of the TAFE sector can be judged by evaluating:

- annual financial results

- financial position at the end of the year

- patterns and trends in financial results over time

We have assessed the sector's short-term financial sustainability against two key indicators over the past five financial years:

- Net result ratio—a positive net result ratio indicates a surplus. The larger the surplus, the stronger the result. A negative result indicates a deficit. Operating deficits cannot be sustained in the longer term.

- Liquidity ratio—a ratio of one or more means there are more cash and liquid assets than short-term liabilities.

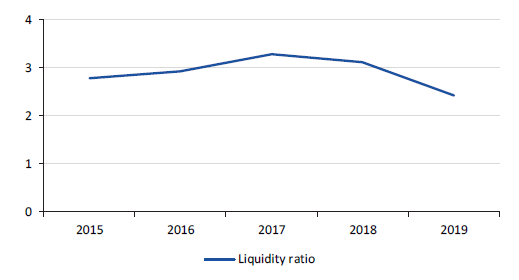

Figure 3G shows the combined sector average net result ratio over the past five years. Figure 3H shows the combined sector liquidity ratio over the past five years. Both have started to trend down.

Figure 3G

Combined TAFE sector average net result ratio for the years ended 31 December 2015–19

Source: VAGO.

Figure 3H

Combined sector average liquidity ratio for the years ended 31 December 2015–19

Source: VAGO.

Despite the net result of the sector this year, its liquidity ratio remains well above 1, which means there were no immediate concerns at balance date about the sector meeting its short-term financial obligations as they become due. The ongoing COVID-19 pandemic may change this position.

Efficiency and effectiveness of operations

TAFEs measure and report on their efficiency and effectiveness through two KPIs included in their audited performance report:

- employment costs as a percentage of training revenue

- training revenue per full-time equivalent training member.

Each TAFE board sets its own targets for these measurers before the start of the financial year. Most TAFEs did not achieve their set targets for 2019, so were not operating as efficiently or effectively as planned. This was partly caused by increased employee expenditure for the sector.

Figure 3I provides a summary of results of these two measures against the targets for each TAFE.

Figure 3I

Target and actual 2019 efficiency and effectiveness indicator results by TAFE

|

Employment costs as a proportion of training revenue |

Training revenue per teaching FTE |

|||

|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

|

|

Bendigo Kangan Institute |

87.2% |

79.8% |

$268 986 |

$285 595 |

|

Box Hill Institute |

87.0% |

86.6% |

$205 000 |

$217 400 |

|

Chisholm Institute |

72.0% |

73.5% |

$208 000 |

$225 391 |

|

Gordon Institute of TAFE |

105.4% |

106.8% |

$151 930 |

$152 117 |

|

Goulburn Ovens Institute of TAFE |

117.0% |

125.1% |

$140 394 |

$139 893 |

|

Holmesglen Institute of TAFE |

<80% |

87.4% |

>$195 000 |

$194 507 |

|

Melbourne Polytechnic |

94.0% |

91.5% |

$205 000 |

$250 000 |

|

South West Institute of TAFE |

119.7% |

126.0% |

$140 920 |

$150 018 |

|

Sunraysia Institute of TAFE |

123.0% |

131.7% |

$127 593 |

$134 706 |

|

TAFE Gippsland |

104.0% |

106.0% |

$192 168 |

$189 315 |

|

William Angliss Institute of TAFE |

<78% |

76.8% |

$234 700 |

$226 179 |

|

Wodonga Institute of TAFE |

96.0% |

98.5% |

$175 372 |

$173 089 |

Note: Green actual results mean the target was achieved. Red actual results means the target was not achieved.

Source: VAGO.

Appendix A. Submissions and comments

We have consulted with all audited entities and we considered their views when reaching our audit conclusions. As required by the Audit Act 1994, we gave a draft copy of this report, or relevant extracts, to those agencies and asked for their submissions and comments.

Responsibility for the accuracy, fairness and balance of those comments rests solely with the agency head.

Responses were received as follows:

RESPONSE provided by the Associate Secretary, DET

Appendix B. Audit opinions

Figure B1 lists the entities included in this report, the nature of the opinion and the date the audit opinion was issued to each entity for their 2018 financial reports.

Figure B1

Audit opinions issued for TAFEs and their controlled entities

|

Entity |

Clear audit opinion issued |

Auditor-General's report signed date |

|---|---|---|

|

Bendigo Kangan Institute |

✔(a) |

17 Apr 2020 |

|

Box Hill Institute |

✔(a) |

16 Apr 2020 |

|

Box Hill Enterprises Limited |

✔ |

14 Apr 2020 |

|

Chisholm Institute |

✔ |

1 Mar 2020 |

|

Caroline Chisholm Education Foundation |

✔ |

1 Mar 2020 |

|

TAFE Online Pty Ltd |

✔ |

1 Mar 2020 |

|

Gordon Institute of TAFE |

✔(a) |

20 Apr 2020 |

|

GoTec Limited |

✔ |

22 Apr 2020 |

|

Goulburn Ovens Institute of TAFE |

✔(a) |

16 Apr 2020 |

|

Holmesglen Institute |

✔(a) |

21 Apr 2020 |

|

Glenuc Pty Ltd |

✔ |

11 Mar 2020 |

|

Holmesglen Foundation |

✔ |

11 Mar 2020 |

|

Holmesglen International Training Services Pty Ltd |

✔ |

11 Mar 2020 |

|

Melbourne Polytechnic |

✔ |

28 Feb 2020 |

|

South West Institute of TAFE |

✔(a) |

15 Apr 2020 |

|

Sunraysia Institute of TAFE |

✔(a) |

14 Apr 2020 |

|

TAFE Kids Inc |

✔(a) |

23 Apr 2020 |

|

TAFE Gippsland |

✔ |

13 Mar 2020 |

|

William Angliss Institute of TAFE |

✔ |

5 Mar 2020 |

|

Angliss Consulting Pty Ltd |

✔ |

5 Mar 2020 |

|

Angliss Multimedia Pty Ltd |

✔ |

5 Mar 2020 |

|

Angliss (Shanghai) Education Technology Co Ltd |

✔ |

5 Mar 2020 |

|

Angliss Solutions Pty Ltd |

✔ |

5 Mar 2020 |

|

William Angliss Institute Foundation Ltd |

✔ |

5 Mar 2020 |

|

William Angliss Institute Pte Ltd |

✔(a) |

23 Apr 2020 |

|

Wodonga Institute of TAFE |

✔ |

10 Mar 2020 |

(a) Clear audit opinion issued with an emphasis of matter paragraph.

Note: Federation Training changed its name to TAFE Gippsland during the year.

Source: VAGO.

Appendix C. Control issues risk ratings

Figure C1 shows the risk ratings we apply to issues we raise, the management action required, and the expected timeline for the issue to be resolved.

Figure C1

Risk definitions applied to issues reported in audit management letters

|

Rating |

Definition |

Management action required |

|---|---|---|

|

High |

The issue represents:

|

Requires prompt management intervention with a detailed action plan implemented within two months. Requires executive management to correct the material misstatement in the financial report to avoid a modified audit opinion. |

|

Medium |

The issue represents:

|

Requires management intervention with a detailed action plan implemented within three to six months. |

|

Low |

The issue represents:

|

Requires management intervention with a detailed action plan implemented within six to 12 months. |

Source: VAGO.

Appendix D. Mandatory performance indicators

Figures D1 shows the performance statement indicators, description and methodology, while Figures D2–D13 show each TAFE institute's reported performance against the four indicators for 2017 to 2019.

Figure D1

Performance statement indicators and formula

|

Indicator |

Description and methodology |

|---|---|

|

Training revenue diversity |

Breakdown of training revenue by:

|

|

Employment costs as a proportion of training revenue |

(Employment costs – Workforce reduction expenses + third party training delivery costs)/Training revenue |

|

Training revenue per teaching full-time equivalent |

Training revenue (excluding revenue delivered by third parties) per teaching full-time equivalent |

|

Operating margin percentage |

EBIT (excluding capital contributions)/Total revenue (excluding capital contributions) |

Source: VAGO.

Figure D2

Bendigo Kangan Institute

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

45.9% |

46.7% |

44.9% |

44.3% |

50.3% |

47.8% |

|

Fee for service |

45.2% |

44.1% |

41.7% |

46.4% |

31.3% |

39.7% |

|

Student fees and charges |

8.9% |

9.2% |

13.4% |

9.3% |

18.4% |

12.6% |

|

Employment costs as a proportion of training revenue |

87.2% |

79.8% |

72.7% |

84.1% |

71.9% |

75.4% |

|

Training revenue per teaching full-time equivalent |

$268 986 |

$285 595 |

$277 108 |

$244 153 |

$265 808 |

$278 015 |

|

Operating margins percentage |

-11.4% |

-6.4% |

8.2% |

-3.4% |

-19.8% |

0.8% |

Source: VAGO.

Figure D3

Box Hill Institute

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

35.0% |

37.0% |

35.0% |

34.0% |

35.0% |

35.0% |

|

Fee for service |

40.0% |

47.0% |

44.0% |

44.0% |

65.0% |

65.0% |

|

Student fees and charges |

25.0% |

17.0% |

21.0% |

23.0% |

– |

– |

|

Employment costs as a proportion of training revenue |

87.0% |

86.6% |

89.0% |

85.5% |

83.0% |

89.9% |

|

Training revenue per teaching full-time equivalent |

$205 000 |

$217 400 |

$200 000 |

$198 100 |

$217 000 |

$199 000 |

|

Operating margins percentage |

>0% |

-3.8% |

>0% |

1.1% |

1.0% |

0.7% |

Note: – = target not published by TAFE.

Source: VAGO.

Figure D4

Chisholm Institute

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

53.2% |

59.0% |

56.0% |

51.6% |

54.0% |

59.1% |

|

Fee for service |

28.0% |

27.5% |

25.3% |

30.0% |

27.0% |

22.1% |

|

Student fees and charges |

18.8% |

13.5% |

18.7% |

18.4% |

19.0% |

18.7% |

|

Employment costs as a proportion of training revenue |

72.0% |

73.5% |

73.0% |

72.1% |

70.0% |

65.6% |

|

Training revenue per teaching full-time equivalent |

$208 000 |

$225 391 |

$206 000 |

$226 639 |

$200 000 |

$213 150 |

|

Operating margins percentage |

-1.3% |

-0.9% |

-1.7% |

-1.8% |

>0% |

7.9% |

Source: VAGO.

Figure D5

Gordon Institute of TAFE

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

75.2% |

75.3% |

73.7% |

74.1% |

71.8% |

75.9% |

|

Fee for service |

13.7% |

13.1% |

11.9% |

12.1% |

11.9% |

10.9% |

|

Student fees and charges |

11.1% |

11.7% |

14.4% |

13.8% |

16.2% |

13.2% |

|

Employment costs as a proportion of training revenue |

105.4% |

106.8% |

107.0% |

107.1% |

101.9% |

104.6% |

|

Training revenue per teaching full-time equivalent |

$151 930 |

$152 117 |

$141 963 |

$140 177 |

$145 820 |

$141 714 |

|

Operating margins percentage |

-22.6% |

-15.7% |

-20.2% |

-5.0% |

-4.4% |

-4.5% |

Source: VAGO.

Figure D6

Goulburn Ovens Institute of TAFE

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

61.7% |

70.4% |

62.4% |

58.9% |

56.7% |

57.3% |

|

Fee for service |

13.6% |

16.1% |

21.7% |

20.9% |

43.3% |

42.7% |

|

Student fees and charges |

24.7% |

13.5% |

15.9% |

20.2% |

– |

– |

|

Employment costs as a proportion of training revenue |

117.0% |

125.1% |

117.4% |

134.6% |

106.4% |

110.5% |

|

Training revenue per teaching full-time equivalent |

$140 394 |

$139 893 |

$136 475 |

$103 394 |

$140 416 |

$111 196 |

|

Operating margins percentage |

-20.0% |

-20.7% |

-21.0% |

0.2% |

-22.5% |

3.2% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D7

Holmesglen Institute

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

43.1% |

45.3% |

41.2% |

38.4% |

40.0% |

40.2% |

|

Fee for service |

40.8% |

42.9% |

42.6% |

46.3% |

60.0% |

59.8% |

|

Student fees and charges |

16.1% |

11.8% |

16.2% |

15.3% |

– |

– |

|

Employment costs as a proportion of training revenue |

<80% |

87.4% |

80.0% |

81.0% |

<80% |

76.7% |

|

Training revenue per teaching full-time equivalent |

>$195 000 |

$194 507 |

>$203 000 |

$194 824 |

$190 000 |

$198 385 |

|

Operating margins percentage |

>0% |

0.1% |

>0% |

3.5% |

>2% |

5.5% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D8

Melbourne Polytechnic

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

30.0% |

32.0% |

30.0% |

30.5% |

31.0% |

35.7% |

|

Fee for service |

57.0% |

59.0% |

56.0% |

58.8% |

69.0% |

64.3% |

|

Student fees and charges |

13.0% |

9.0% |

14.0% |

10.7% |

– |

– |

|

Employment costs as a proportion of training revenue |

94.0% |

91.5% |

95.0% |

97.5% |

95.8% |

98.3% |

|

Training revenue per teaching full-time equivalent |

$205 000 |

$250 000 |

$200 000 |

$199 000 |

$212 533 |

$189 027 |

|

Operating margins percentage |

-6.7% |

-5.9% |

-13.9% |

1.5% |

-9.0% |

-7.5% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D9

South West Institute of TAFE

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

67.0% |

81.5% |

71.0% |

75.0% |

68.2% |

67.4% |

|

Fee for service |

11.0% |

7.3% |

7.0% |

8.1% |

31.8% |

32.6% |

|

Student fees and charges |

22.0% |

11.2% |

22.0% |

16.9% |

– |

– |

|

Employment costs as a proportion of training revenue |

119.7% |

126.0% |

117.0% |

130.5% |

110.4% |

120.5% |

|

Training revenue per teaching full-time equivalent |

$140 920 |

$150 018 |

$135 000 |

$133 492 |

$145 547 |

$145 865 |

|

Operating margins percentage |

-69.4% |

-15.2% |

0.0% |

11.0% |

-10.7% |

0.2% |

Note: – = target not published by TAFE.

Source: VAGO.

Figure D10

Sunraysia Institute of TAFE

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

51.7% |

62.3% |

51.8% |

56.7% |

74.0% |

71.0% |

|

Fee for service |

21.5% |

18.3% |

21.4% |

18.7% |

26.0% |

29.0% |

|

Student fees and charges |

26.8% |

19.4% |

26.8% |

24.6% |

– |

– |

|

Employment costs as a proportion of training revenue |

123.0% |

131.7% |

125.0% |

144.1% |

135.0% |

133.0% |

|

Training revenue per teaching full-time equivalent |

$127 593 |

$134 706 |

$121 518 |

$116 126 |

$121 492 |

$114 101 |

|

Operating margins percentage |

1.6% |

7.7% |

1.5% |

15.0% |

-84.0% |

1.4% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D11

TAFE Gippsland

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

75.0% |

71.0% |

58.0% |

59.0% |

53.0% |

60.0% |

|

Fee for service |

15.0% |

19.0% |

22.0% |

23.0% |

29.0% |

23.0% |

|

Student fees and charges |

10.0% |

10.0% |

20.0% |

23.0% |

18.0% |

17.0% |

|

Employment costs as a proportion of training revenue |

104.0% |

106.0% |

94.0% |

100.0% |

108.0% |

86.6% |

|

Training revenue per teaching full-time equivalent |

$192 168 |

$189 315 |

$203 000 |

$218 770 |

$154 688 |

$238 602 |

|

Operating margins percentage |

-25.0% |

-18.0% |

-40.0% |

2.0% |

-55.6% |

6.0% |

Note: – = Federation Training changed its name to TAFE Gippsland during the year.

Source: VAGO.

Figure D12

William Angliss Institute of TAFE

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

22.0% |

24.9% |

21.5% |

21.9% |

39.0% |

22.3% |

|

Fee for service |

61.0% |

62.7% |

61.2% |

61.6% |

61.0% |

77.7% |

|

Student fees and charges |

17.0% |

12.4% |

17.3% |

16.5% |

– |

– |

|

Employment costs as a proportion of training revenue |

<78% |

76.8% |

<79% |

81.5% |

<74% |

77.6% |

|

Training revenue per teaching full-time equivalent |

$234 700 |

$226 179 |

$231 500 |

$206 858 |

$244 000 |

$217 000 |

|

Operating margins percentage |

-4.5% |

-6.1% |

-5.1% |

0.9% |

n/a |

1.5% |

Note: – = target not published by TAFE

Source: VAGO.

Figure D13

Wodonga Institute of TAFE

|

Performance indicator |

2019 |

2018 |

2017 |

|||

|---|---|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

Target |

Actual |

|

|

Training revenue diversity: |

||||||

|

Victorian Training Guarantee |

36.6% |

37.5% |

51.8% |

37.4% |

49.2% |

52.9% |

|

Fee for service |

55.4% |

58.4% |

37.5% |

56.2% |

50.8% |

47.1% |

|

Student fees and charges |

8.0% |

4.1% |

10.7% |

6.4% |

– |

– |

|

Employment costs as a proportion of training revenue |

96.0% |

98.5% |

95.0% |

85.2% |

86.3% |

91.0% |

|

Training revenue per teaching full-time equivalent |

$175 372 |

$173 089 |

$141 855 |

$156 597 |

$197 483 |

$159 538 |

|

Operating margins percentage |

-8.4% |

0.5% |

-9.0% |

8.1% |

1.8% |

1.4% |

Note: – = target not published by TAFE

Source: VAGO.

Appendix E. Financial sustainability risk indicators

Figure E1 shows indicators used in assessing the financial sustainability risks of TAFE institutes. These indicators should be considered collectively and are more useful when assessed over time as part of a trend analysis.

Figure E1

Financial sustainability risk indicators, formulas and descriptions

|

Indicator |

Formula |

Description |

|---|---|---|

|

Net result margin (%) |

Net result/Total Revenue |

A positive result indicates a surplus, and the larger the percentage, the stronger the result. A negative result indicates a deficit. Operating deficits cannot be sustained in the long term. The net result and total revenue are obtained from the comprehensive operating statement. |

|

Liquidity (ratio) |

Current assets/ Current liabilities |

This measures the ability to pay existing liabilities in the next 12 months. A ratio of one or more means there are more cash and liquid assets than short-term liabilities. |

|

Capital replacement (ratio) |

Cash outflows for property, plant and equipment/ Depreciation |

Comparison of the rate of spending on infrastructure with its depreciation. Ratios higher than 1:1 indicate that spending is faster than the depreciating rate. This is a long-term indicator, as capital expenditure can be deferred in the short term if there are insufficient funds available from operations, and borrowing is not an option. Cash outflows for infrastructure are taken from the cashflow statement. Depreciation is taken from the comprehensive operating statement. |

|

Internal financing (%) |

Net operating cashflow/Net capital expenditure |

This measures the ability of an entity to finance capital works from generated cashflow. The higher the percentage, the greater the ability for the entity to finance capital works from their own funds. Net operating cashflows and net capital expenditure are obtained from the cashflow statement. Note: The internal financing ratio cannot be less than zero. Where a calculation has provided a negative result, this has been rounded up to 0%. |

Source: VAGO.

Financial sustainability risk-assessment criteria

We assessed the financial sustainability risk of each TAFE using the criteria outlined in Figure E2.

Figure E2

Financial sustainability risk indicators—risk-assessment criteria

|

Risk |

Net result margin |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

High |

Negative 10% or less |

Less than 0.75 |

Less than 1.0 |

Less than 10% |

|

Insufficient revenue is being generated to fund operations and asset renewal. |

Immediate sustainability issues with insufficient current assets to cover liabilities. |

Spending on capital works has not kept pace with consumption of assets. |

Limited cash generated from operations to fund new assets and asset renewal. |

|

|

Medium |

Negative 10%–0% |

0.75–1.0 |

1.0–1.5 |

10–35% |

|

A risk of long-term run down to cash reserves and inability to fund asset renewals. |

Need for caution with cashflow, as issues could arise with meeting obligations as they fall due. |

May indicate spending on asset renewal is insufficient. |

May not be generating sufficient cash from operations to fund new assets. |

|

|

Low |

More than 0% |

More than 1.0 |

More than 1.5 |

More than 35% |

|

Generating surpluses consistently.

|

No immediate issues with repaying short-term liabilities as they fall due. |

Low risk of insufficient spending on asset renewal. |

Generating enough cash from operations to fund new assets. |

Source: VAGO.

Financial sustainability risk analysis results

Figures E3 to E6 show the financial sustainability risk indicators for each TAFE from 2015 to 2019, the annual sector average, and the five-year average for each TAFE.

Figure E3

Net result margin as a percentage

|

Net result margin |

||||||

|---|---|---|---|---|---|---|

|

2015 |

2016 |

2017 |

2018 |

2019 |

Average |

|

|

Bendigo Kangan Institute |

2.17% |

2.71% |

4.87% |

1.35% |

-5.22% |

1.18% |

|

Box Hill Institute |

7.15% |

2.11% |

1.37% |

7.71% |

-5.26% |

2.62% |

|

Chisholm Institute |

4.84% |

9.53% |

20.05% |

14.51% |

0.52% |

9.89% |

|

Gordon Institute of TAFE |

-1.64% |

1.61% |

4.28% |

1.51% |

-10.70% |

-0.99% |

|

Goulburn Ovens Institute of TAFE |

-2.97% |

2.05% |

4.17% |

-0.31% |

-19.64% |

-3.34% |

|

Holmesglen Institute |

9.88% |

10.39% |

15.25% |

1.51% |

6.17% |

8.64% |

|

Melbourne Polytechnic |

-2.50% |

-1.84% |

0.09% |

5.33% |

-5.89% |

-0.96% |

|

South West Institute of TAFE |

3.36% |

0.38% |

1.61% |

10.92% |

-14.77% |

0.30% |

|

Sunraysia Institute of TAFE |

16.92% |

1.15% |

2.59% |

12.74% |

5.89% |

7.86% |

|

TAFE Gippsland |

0.28% |

2.56% |

0.64% |

1.60% |

-5.28% |

-0.04% |

|

William Angliss Institute of TAFE |

5.09% |

9.09% |

1.59% |

0.60% |

-7.86% |

1.70% |

|

Wodonga Institute of TAFE |

1.60% |

0.25% |

2.09% |

8.44% |

0.08% |

2.49% |

|

Average |

||||||

|

Sector average |

3.68% |

3.33% |

4.88% |

5.49% |

-5.16% |

2.45% |

Source: VAGO.

Figure E4

Liquidity ratio

|

Liquidity ratio |

||||||

|---|---|---|---|---|---|---|

|

2015 |

2016 |

2017 |

2018 |

2019 |

Average |

|

|

Bendigo Kangan Institute |

2.37 |

3.03 |

2.48 |

2.58 |

1.63 |

2.42 |

|

Box Hill Institute |

2.83 |

1.50 |

1.40 |

1.93 |

1.50 |

1.83 |

|

Chisholm Institute |

4.10 |

4.55 |

5.60 |

2.76 |

1.89 |

3.78 |

|

Gordon Institute of TAFE |

6.28 |

5.77 |

4.98 |

4.07 |

>2.83 |

4.79 |

|

Goulburn Ovens Institute of TAFE |

3.55 |

3.90 |

3.33 |

3.31 |

2.34 |

3.29 |

|

Holmesglen Institute |

2.16 |

2.54 |

2.79 |

2.28 |

2.12 |

2.38 |

|

Melbourne Polytechnic |

1.09 |

1.19 |

1.13 |

1.08 |

0.80 |

1.06 |

|

South West Institute of TAFE |

2.75 |

2.21 |

2.48 |

2.79 |

1.93 |

2.43 |

|

Sunraysia Institute of TAFE |

1.53 |

1.86 |

2.22 |

3.09 |

2.88 |

2.31 |

|

TAFE Gippsland |

2.00 |

2.53 |

6.38 |

7.19 |

3.95 |

4.41 |

|

William Angliss Institute of TAFE |

1.49 |

1.89 |

1.92 |

1.70 |

1.74 |

1.75 |

|

Wodonga Institute of TAFE |

3.13 |

4.06 |

4.57 |

4.55 |

5.55 |

4.37 |

|

Average |

||||||

|

Sector average |

2.77 |

2.92 |

3.27 |

3.11 |

2.43 |

2.90 |

Source: VAGO.

Figure E5

Capital replacement ratio

|

Capital replacement ratio |

||||||

|---|---|---|---|---|---|---|

|

2015 |

2016 |

2017 |

2018 |

2019 |

Average |

|

|

Bendigo Kangan Institute |

0.23 |

0.53 |

1.76 |

1.26 |

1.00 |

0.96 |

|

Box Hill Institute |

1.18 |

5.10 |

2.30 |

2.11 |

0.39 |

2.21 |

|

Chisholm Institute |

0.58 |

0.98 |

2.06 |

9.06 |

2.45 |

3.02 |

|

Gordon Institute of TAFE |

0.37 |

0.96 |

1.82 |

3.69 |

1.43 |

1.65 |

|

Goulburn Ovens Institute of TAFE |

0.34 |

0.33 |

1.22 |

0.36 |

1.40 |

0.73 |

|

Holmesglen Institute |

0.68 |

0.79 |

1.21 |

3.26 |

0.72 |

1.33 |

|

Melbourne Polytechnic |

0.04 |

1.12 |

1.43 |

2.38 |

0.54 |

1.10 |

|

South West Institute of TAFE |

0.25 |

1.76 |

0.48 |

0.47 |

1.08 |

0.81 |

|

Sunraysia Institute of TAFE |

1.81 |

2.50 |

0.52 |

0.59 |

1.41 |

1.37 |

|

TAFE Gippsland |

0.12 |

0.28 |

0.71 |

1.27 |

2.23 |

0.92 |

|

William Angliss Institute of TAFE |

0.25 |

2.06 |

0.78 |

1.59 |

0.17 |

0.97 |

|

Wodonga Institute of TAFE |

0.31 |

0.34 |

0.29 |

0.50 |

1.00 |

0.44 |

|

Average |

||||||

|

Sector Average |

0.51 |

1.40 |

1.21 |

2.21 |

1.15 |

1.29 |

Source: VAGO.

Figure E6

Internal financing as a percentage

|

Internal financing |

||||||

|---|---|---|---|---|---|---|

|

2015 |

2016 |

2017 |

2018 |

2019 |

Average |

|

|

Bendigo Kangan Institute |

751% |

166% |

89% |

105% |

251% |

272% |

|

Box Hill Institute |

194% |

25% |

61% |

325% |

105% |

142% |

|

Chisholm Institute |

391% |

362% |

216% |

53% |

80% |

221% |

|

Gordon Institute of TAFE |

869% |

238% |

123% |

40% |

9% |

256% |

|

Goulburn Ovens Institute of TAFE |

87% |

444% |

152% |

694% |

0% |

275% |

|

Holmesglen Institute |

138% |

404% |

129% |

49% |

183% |

181% |

|

Melbourne Polytechnic |

29 783% |

64% |

123% |

110% |

0% |

6 016% |

|

South West Institute of TAFE |

23% |

80% |

614% |

542% |

0% |

252% |

|

Sunraysia Institute of TAFE |

188% |

60% |

347% |

626% |

201% |

284% |

|

TAFE Gippsland |

533% |

783% |

351% |

141% |

90% |

380% |

|

William Angliss Institute of TAFE |

1 666% |

142% |

237% |

14% |

696% |

551% |

|

Wodonga Institute of TAFE |

754% |

1 471% |

165% |

548% |

87% |

605% |

|

Average |

||||||

|

Sector average |

2 948% |

353% |

217% |

271% |

142% |

786% |

Source: VAGO.

Appendix F. Glossary

Accountability

Responsibility of public sector entities to achieve their objectives in the reliability of financial reporting; effectiveness and efficiency of operations; compliance with applicable laws; and reporting to interested parties.

Amortisation

The systematic allocation of the depreciable amount of an intangible asset over its expected useful life.

Asset

An item or resource controlled by an entity that will be used to generate future economic benefits.

Asset valuation

The fair value of a non-current asset on a specified date

Audit Act 1994

Victorian legislation establishing the Auditor-General’s operating powers and responsibilities and detailing the nature and scope of audits that the Auditor-General may carry out.

Audit opinion

A written expression, within a specified framework, indicating the auditor’s overall conclusion about a financial (or performance) report based on audit evidence.

Calendar year

The period of a year beginning with 1 January and ending with 31 December.

Capital expenditure

Money an entity spends on:

- new physical assets, including buildings, infrastructure, plant and equipment

- renewing existing physical assets to extend the service potential or life of the asset.

Capital grant/capital purpose income

Government funding for an agency to acquire or build capital assets such as buildings, land or equipment.

Clear audit opinion

A positive written expression provided when the financial report has been prepared, which fairly presents the transactions and balances for the reporting period in keeping with the requirements of the relevant legislation and Australian Accounting Standards. Also referred to as an unqualified audit opinion.

Control environment

Processes within an entity’s governance and management structure that provide reasonable assurance about the achievement of an entity’s objectives in the reliability of its financial reporting, the effectiveness and efficiency of its operations, and compliance with applicable laws and regulations.

Current asset

An asset that will be sold or realised within 12 months of the end of the financial year being reported on, such as term deposits maturing in three months or stock items available for sale.

Current liability

A liability that will be settled within 12 months of the end of the financial year being reported on, such as payment of a creditor for services provided to the entity.

Debt

Money owed by one party to another party.

Deficit

When total expenditure is more than total revenue.

Depreciation

Systematic allocation of the value of an asset over its expected useful life, recorded as an expense.

Entity

A corporate or unincorporated body that has a public function to exercise on behalf of the state or that is wholly owned by the state, including departments, statutory authorities, statutory corporations and government business enterprises.

Equity or net assets

Residual interest in the assets of an entity after deducting its liabilities.

Expense

The outflow of assets or the depletion of assets an entity controls during the financial year, including expenditure and the depreciation of physical assets. An expense can also be the incurrence of liabilities during the financial year, such as increases to a provision.

Fair value

The price that would be received if an asset was sold or the price paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Financial Management Act 1994

Victorian legislation governing public sector entities, as determined by the Assistant Treasurer, including their financial reporting framework.

Financial report

A document reporting the financial outcome and position of an entity for a financial year. It contains an entity’s financial statements, including a comprehensive income statement, a balance sheet, a cashflow statement, a comprehensive statement of equity, and notes.

Financial sustainability

An entity’s ability to manage financial resources so it can meet its current and future spending commitments, while maintaining assets in the condition required to provide services.

Financial year

A period of 12 months for which a financial report is prepared, which may be a different period to the calendar year.

Going concern

An entity that is expected to be able to pay its debts when they fall due and continue in operation without any intention or necessity to liquidate or otherwise wind up its operations.

Governance

The control arrangements used to administer and monitor an entity’s activities to achieve its strategic and operational goals.

Impairment (loss)

The amount by which the value of an entity’s asset exceeds its recoverable value.

Income

The inflow of assets or decrease of liabilities during the financial year, including receipt of cash and the reduction of a provision.

Intangible asset

An identifiable non-financial asset, controlled by an entity, that cannot be physically seen, such as software licences or a patent.

Internal control

A method of directing, monitoring and measuring an entity’s resources and processes to prevent and detect error and fraud.

Investment

The expenditure of funds intended to result in medium- to long-term service and/or financial benefits arising from the development and/or use of infrastructure assets by either the public or private sectors.

Issues

Weaknesses or other concerns in the governance structure of an entity identified during a financial audit, which are reported to the entity in a management letter.

Liability

A present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow of assets from the entity.

Management letter

A letter the auditor writes to the governing body, the audit committee and the management of an entity outlining issues identified during the financial audit.

Material error or adjustment