Results of 2019 Audits: Universities

Overview

In Victoria, there are eight public universities, which control a further 48 entities that we are required to audit. Each year, we conduct the financial audits of these 56 entities.

This report outlines the results of these financial audits and our observations for the year ended 31 December 2019.

We discuss significant audit issues faced by the sector including implementation of the new accounting standards, and the impacts of COVID-19.

We also comment on the financial performance and sustainability of the sector in the context of information obtained and observed during our audits.

Data dashboard

We have developed a data dashboard that summarises the financial statement data for all Victorian universities.

Transmittal letter

Victorian Auditor-General’s Report

Ordered to be published

VICTORIAN GOVERNMENT PRINTER June2020

PP No 139, Session 2018–20

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of the Audit Act 1994, I transmit my report report Results of 2019 Audits: Universities.

Yours faithfully

Andrew Greaves

Auditor-General

30 June 2020

Acronyms

Acronyms

| AASB | Australian Accounting Standards Board |

| ARC | Australian Research Council |

| CGS | Commonwealth Grants Scheme |

| CSP | Commonwealth supported place |

| DET | Department of Education and Training |

| EFTSL | equivalent full-time student load |

| EOM | emphasis of matter |

| FMA | Financial Management Act 1994 |

| FTE | full-time equivalent |

| Go8 | Group of 8 |

| HESA Act | Higher Education Support Act 2003 |

| NHMRC | National Health and Medical Research Council |

| SSPO | Sufficiently specific performance obligation |

| TEQSA Act | Tertiary Education Quality and Standards Agency Act 2011 |

| VAGO | Victorian Auditor-General's Office |

| VE | vocational education |

At a glance

1 Audit context

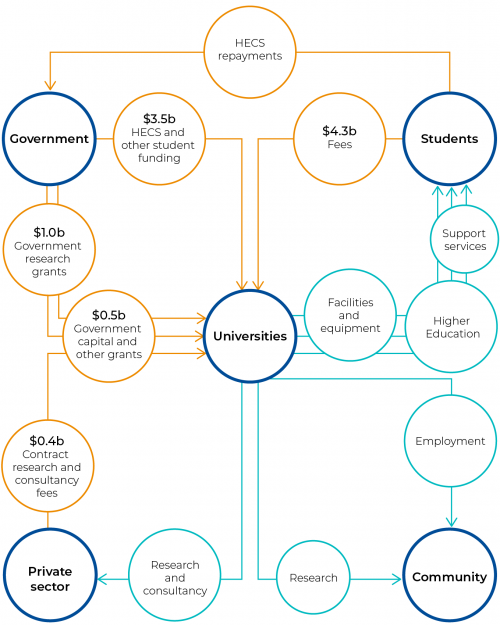

The Victorian public university sector comprises eight universities and their 48 controlled entities. Appendix B lists all entities. They principally provide higher education and conduct research. Figure 1A illustrates all main income sources, activities and key stakeholders for the sector.

Figure 1A

University sector 2019 income sources, activities and key stakeholders

Note: HECS = Higher Education Contribution Scheme.

Source: VAGO.

Figure 1B provides a financial snapshot of the university sector for the year ended 31 December 2019.

Figure 1B

University sector financial snapshot for the year ended 31 December 2019

Note: *Provisions include the sector’s estimated deferred superannuation contributions of $1.2 billion ($1.2 billion in 2018). An identical amount is included in receivables as the Commonwealth and state governments have agreed to meet this liability.

Note: 2018 figures have been adjusted for the two universities with qualified audit opinions.

Source: VAGO.

Most of the sector's income comes from student fees and Commonwealth Government student funding, both of which are driven by student numbers. Publicly and privately funded research is the sector's next largest revenue source. The majority of the sector's assets consist of the property, plant and equipment that it needs to deliver its services. The sector also holds a significant amount of cash and financial assets.

The sector's total liabilities increased significantly in 2019. This was because universities recognised $1.5 billion in contract liabilities under the new revenue standards that they would previously have recorded as revenue. However, this approach was not uniform across the sector and accounting for research grants remains a contentious and unresolved issue. The sector's total liabilities also increased because lease liabilities of $578 million were recognised as a result of accounting standard changes introduced by AASB 16 Leases.

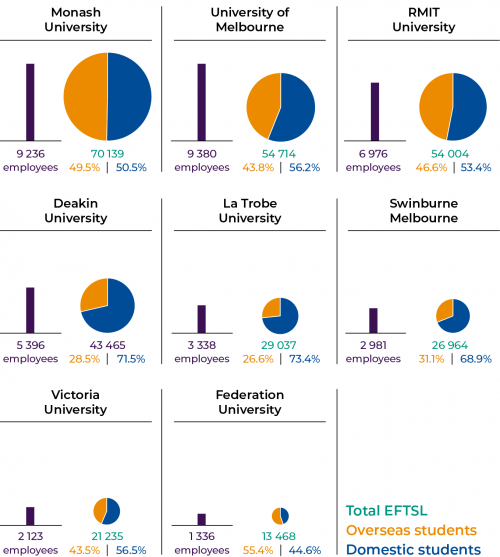

Figure 1C shows each university's relative size, based on the number of equivalent full-time students enrolled, and the number of staff employed. The two largest universities, Monash University and The University of Melbourne, are also members of the Group of 8 (Go8), a company whose members comprise Australia's leading research-focused universities.

Figure 1C

Student and full-time equivalent staff numbers by university for the year ended 31 December 2019

Note: One equivalent full-time student load (EFTSL) represents the equivalent of a student who is studying on a full-time basis for a year. Overseas EFTSL includes both onshore and offshore student loads. Where relevant, EFTSL excludes vocational education (VE) student loads.

Source: VAGO.

1.1 Legislative and reporting framework

The universities and their controlled entities are subject to a range of complex accountability and financial reporting frameworks, with many reporting requirements.

In Victoria, public universities are established by their own respective enabling legislations. As a result, they fall within the definition of a public body under the Financial Management Act 1994 (FMA) and must comply with its requirements for the preparation of financial reports. However, since the universities are not controlled by the State of Victoria, their financial results are not consolidated into the state's annual financial report.

From the perspective of the Commonwealth, universities:

- are registered with the Tertiary Education Quality and Standards Agency and are, therefore, subject to the regulation of the Tertiary Education Quality and Standards Agency Act 2011 (TEQSA Act)

- receive most of their grant funding from the Commonwealth Government and fall within the scope of any legislation associated with this funding, including the Higher Education Support Act 2003 (HESA Act).

The TEQSA and HESA Acts, and many of the funding agreements that underpin the funding universities receive for research and other purposes, also impose other financial reporting requirements on the universities in addition to the requirements of the state-legislated FMA. The Commonwealth requires some of these reporting requirements to be included in universities' financial reports. As a result, universities' financial reports contain disclosures that are not usually found in general-purpose financial reports.

Many universities and their controlled entities are registered charities with the Australian Charities and Not-for-profits Commission. This means they have further reporting obligations under the Australian Charities and Not-for-profits Commission Act 2012.

Entities controlled by the universities do not automatically fall within the scope of the FMA, but may be required by the respective enabling legislation of their parent university to produce financial reports in a form approved by the Assistant Treasurer administering Part 7 of the FMA.

1.2 Report structure

In this report, we provide information on the outcomes of our financial audits of the eight Victorian universities and their 48 controlled entities for the year ended 31 December 2019. The financial results of controlled entities are consolidated into those of their respective parent entities. We restrict our comments on the controlled entities to the extent that they are relevant and significant to the consolidated results of their respective groups.

We also report on the key matters arising from our audits and analyse the information included in the universities' financial reports. Figure 1D outlines the structure of this report.

Figure 1D

Report structure

|

Part |

Description |

|---|---|

|

2 Results of audits |

Evaluates the audit opinion results from our financial audits of universities, and the timeliness, accuracy and quality of their reporting. Assesses the strength of the internal controls designed, implemented and maintained by the universities. |

|

3 Significant audit issues |

Discusses the sector's implementation of the new revenue standards. Discusses the impact of COVID-19 on the 2019 financial report and comments on the future financial reporting considerations for the sector. |

|

4 Financial performance and sustainability |

Reports on the sector's financial outcomes and comments on the sustainability of the sector in the context of information obtained and observed during our audits. |

Source: VAGO.

Appendix B provides a list of all 56 entities included in this report and details the financial audit opinions issued for the year ended 31 December 2019.

We carried out the financial audits of these entities under section 10 of the Audit Act 1994 and Australian Auditing Standards. Each entity pays the cost of its audit.

The cost of preparing this report was $135 000, which is funded by Parliament.

1.3 Submissions and comments

We have consulted with the Department of Education and Training (DET) and the eight public universities in Victoria, and we considered their views when reaching our conclusions. As required by the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Treasury and Finance.

The following is a summary of those responses. The full responses are included in Appendix A.

We received one submission from the sector and a response from DET.

DET notes our conclusion that the financial reports of the universities and their controlled entities are reliable. DET also acknowledges the audit issues we raised and will work with the universities to action the areas for improvement.

The University of Melbourne has provided details on the timeliness of its financial reporting. The university has also commented on the accounting for research grants matter, which is discussed in Part 3

2 Results of audits

This Part summarises the results of our financial audits and includes observations about internal controls for the university sector for the year ended 31 December 2019.

2.1 Conclusion

The financial reports of the universities and their controlled entities are reliable. Parliament and the community can use them with confidence.

2.2 Financial report audit opinions

We carried out our financial audits of the university sector entities in accordance with Australian Auditing Standards. Figure 2A details the opinions we issued at the conclusion of our audits.

At the date of this report, the financial reports of 11 controlled entities have not been finalised because of delays experienced from the impacts of the COVID-19 pandemic. We therefore have yet to issue our audit opinions for these controlled entities.

Figure 2A

University sector financial report audit opinions issued for 2019

|

Unqualified audit opinions |

Emphasis of matter |

Material uncertainty related to going concern |

|---|---|---|

24In our opinion, these financial reports present fairly the transactions and balances for the reporting period in keeping with the requirements of relevant accounting standards and applicable legislation, and meet the needs of common users. |

19We concluded that these financial reports also present fairly. However, they contain specific matters that, in our judgement, are critical to understanding them. We emphasise those matters in our opinion. |

2We concluded that these financial reports also present fairly. However, there are events that might cast significant doubt on these entities’ ability to continue as a going concern. We draw attention to these events in our opinion. |

Source: VAGO.

Overall, the sector’s financial reports are accurate and reliable. See Appendix B for details on the date and nature of audit opinions issued.

While we issued no modified audit opinions, we included an emphasis of matter paragraph in our auditor’s reports of all eight universities and 11 of their controlled entities. The emphasis of matter paragraph draws the reader's attention to the disclosures made in notes in the financial reports regarding the effects of the COVID-19 pandemic—a material subsequent event.

The audit opinions of Datascreen Pty Ltd and Inskill Pty Ltd, two controlled entities of Federation University Australia, highlighted material uncertainties relating to going concern, due to the directors’ intention to wind up these companies. This uncertainty was adequately disclosed in their financial reports.

Financial reporting quality

Two important and interrelated quality attributes of financial reporting are the timeliness of the published financial reports and the accuracy of financial reports presented for audit.

Timeliness

Timely financial reports enable users to make better informed and prompt decisions. The later financial reports are produced after year end, the less useful they become. We measure timeliness by the time taken post-year end for each university to finalise their financial reports.

The FMA requires universities to finalise their financial reports and have them audited within 12 weeks of the end of each calendar year.

Figure 2B outlines universities' financial reporting timeliness for the years ended 31 December 2018 and 2019. As shown in this figure, the statutory deadline for finalising their financial reports was not met in 2019 partly due to the universities and audit teams working together to assess and finalise the subsequent event disclosure for the impact of the COVID-19 pandemic.

The evolving COVID-19 pandemic led to a number of government restrictions being announced throughout March 2020. This fluid situation meant that the universities were required to review and assess the impact of the pandemic as a material subsequent event and to revise the level of disclosure in their draft financial reports. We then needed more time to review and assess these disclosures before providing our clearance for signing.

The finalisation of our audit assessment of the varied approaches to research grant accounting adopted by the sector also delayed their financial reporting timelines.

Figure 2B

Weeks after 31 December balance date to finalise reports

Source: VAGO.

Accuracy

Accurate financial reports do not contain material errors, and reliably represent an entity’s financial performance and position. Material errors found during the audit must be corrected by management before we can issue a clear audit opinion.

During our 2019 audits we identified 25 financial report errors, of which eight related to disclosure errors. This is a significant improvement from the 62 errors identified in 2018 and indicates that the sector is improving its quality assurance procedures over its financial reporting processes.

We required a material adjustment to be made before we could issue a clear opinion at one university.

The values of the errors we found in the remaining seven universities were well below their respective materiality thresholds. Figure 2C summarises the common types of errors we found during the audits.

Figure 2C

Significant dollar and disclosure errors identified across the 2019 university audits

|

Dollar errors |

We identified 17 financial report errors across the eight universities and their controlled entities totalling $248 million. Common themes include:

|

|

Disclosure errors |

Common financial report disclosure errors we identified related to:

|

Source: VAGO.

2.3 Internal control observations

To the extent that we needed to test them, we found that overall, universities’ internal controls for financial reporting were generally adequate for ensuring reliable financial reporting. We identified 35 new internal control issues during our 2019 audits. Of these new issues, six were resolved by year end.

Figure 2D shows the number of new and open management letter issues in the university sector for the years ended 31 December 2016–19. As shown in this figure, the number of new issues we identify each year, as well as the number of open issues remaining at the end of each year is trending upwards in 2019. This indicates that the universities need to turn their attention to actively addressing their control deficiencies.

Figure 2D

Number of new and open management letter issues in the university sector for the years ended 31 December 2016–19

Source: VAGO.

The sector resolved 77 per cent of prior years' issues in 2019. Figure 2E summarises the university sector's new, prior year, and resolved internal control issues as at 31 December 2019, by risk ratings. Appendix C provides additional information on our risk ratings and our expected timelines for universities to resolve issues we find during our audit work.

Figure 2E

Summary of university sector's new, prior year, and resolved internal control issues as at 31 December 2019, by risk ratings

Source: VAGO.

Figure 2F outlines the themes of the 36 open issues at the end of our 31 December 2019 university audits.

Figure 2F

Themes of open internal control issues at 31 December 2019

Source: VAGO.

IT controls

The sector needs to improve user access to their systems. We identified IT control issues at six of the eight universities. While we rated none as high-risk, we continue to find weak password and user authentication settings, and a lack of monitoring and updating of user access lists. Allowing unauthorised users to access key systems increases the sector's exposure to risks, including:

- fraudulent financial reporting

- misappropriation of assets

- theft or loss of confidential and/or personal information.

Other issues

Revenue issues relate to the initial application of the new revenue standards. All eight universities received a sector-wide high-rated issue on the accounting treatment of their research grants. Refer to Part 3 for further discussion on this issue. The remaining three revenue issues relate to improvements needed in the contract assessment process.

There were no high-risk payroll issues this year. Payroll issues which were raised this year largely relate to control weaknesses around the processing of annual and long-service leave.

Governance issues covered a variety of topics including fraud monitoring, contract management, oversight of controlled entities and monitoring of outsourced services. None of the governance-related issues were rated high.

2.4 New accounting standards

For the 2019 reporting period, three new accounting standards issued by the Australian Accounting Standards Board applied to the university sector for the first time:

- AASB 15 Revenue from Contracts with Customers

- AASB 1058 Income of Not-for-Profit Entities

- AASB 16 Leases.

These new standards had the potential to change how and when entities account for student fee and related grant revenues, research and other grant revenue and leased assets.

They required changes to underlying systems, processes and business practices to enable entities to capture the necessary information and documentation for appropriate accounting and disclosure.

Revenue standards AASB 15 and AASB 1058

The new revenue and income standards AASB 15 and AASB 1058 introduced significant changes in the way universities recognise revenue.

|

A modified retrospective approach includes a few practical expedients that make adoption easier. Under this approach, an entity applies the accounting standard from the beginning of the current accounting period. A right-of-use asset is an asset that the lessee has the right to use for the term of the lease. |

All universities adopted a modified retrospective approach, with no changes in comparative information. Overall, there was no significant impact for the sector as to how they accounted for their revenue or income under the new standards, except for accounting for capital and research grants.

Under the previous standards, universities would record all capital grants as income when received. Universities now recognise this income progressively—that is, as the asset is constructed—as required by AASB 1058.

There was, however, inconsistent application of these new revenue standards to research grants across the sector. We discuss this further in Part 3.

AASB 16 Leases

This standard fundamentally changed lease accounting for lessees—with the distinction between finance and operating leases removed.

Lessees now recognise all their leases on the balance sheet as ‘right-of-use’ assets with a corresponding liability for the remaining lease payments. They now depreciate these right-of-use assets and record an interest expense for the balance of the lease liability. These expenses will be higher at the start of the lease period and reduce as entities repay the lease liability.

At 1 January 2019, universities recognised $533.8 million in right-of-use assets and a corresponding lease liability of $521.8 million. All universities adopted a modified retrospective approach, with no changes in comparative information. Figure 2G shows the breakdown of this recognition by asset category.

Figure 2G

Recognition of right-of-use asset and liability by category

|

Category |

Total ($ millions) |

|---|---|

|

Leased land |

17.6 |

|

Leased buildings |

493.1 |

|

Leased plant and equipment |

23.1 |

|

Total |

533.8 |

Source: VAGO.

All universities elected not to recognise right-of-use assets and lease liabilities for short-term leases, which have a lease term of 12 months or less, or for

low-value leases where the new asset cost is less than $10 000.

The impact of adopting AASB 16 increased depreciation expense in the sector by $86.7 million. At 31 December 2019, the sector held $599 million in right of use assets and $578 million in lease liabilities.

3 Significant audit matters

3.1 Conclusion

The new revenue and income standards AASB 15 Revenue from Contracts with Customers and AASB 1058 Income of Not-for-Profit Entities led to differences in accounting treatment across the sector for research grants. While not considered to be material for this year, the inconsistent application across the sector and the impact on our audit report will need to be revisited during 2020.

Because the COVID-19 emergency was a post balance date event, it did not cause any amounts reported at 31 December 2019 to be adjusted. However, universities had to assess the impacts of the government’s response to the COVID-19 pandemic on their operations and ability to continue to operate as a going concern for the following 12 months. Universities also had to determine appropriate disclosure of these impacts in post balance date event notes of their financial reports.

3.2 Accounting for research grants

AASB 15 and AASB 1058 were effective for not-for-profit entities for annual periods beginning on or after 1 January 2019.

For a transaction to fall within AASB 15:

- there must be an enforceable contract with a customer

- the contract must include sufficiently specific performance obligations that promise the transfer of a good or service to a customer.

Under AASB 15, revenue is recognised when (or as) the performance obligations are satisfied over the research arrangement. Typically, this means when a grant is received it is recognised as a liability in the balance sheet and then progressively recognised in the income statement.

In contrast, under AASB 1058 grant revenue is recognised in full in the income statement when received.

The university sector, and more broadly the accounting industry, faced challenges interpreting and applying the new standards. Research arrangements—where a university must share research findings with the grantor and/or a third party, but keeps the intellectual property created during the research—are the key area of contention. Most of these arrangements relate to competitive research grants from the National Health and Medical Research Council (NHMRC) and the Australian Research Council (ARC).

The Australian Accounting Standards Board (AASB) developed guidance and ran information sessions across the 2019 reporting period to help the sector account for research grants.

Evidence to support sufficiently specific performance obligations

For universities to recognise grant revenue under AASB 15, the focus is on whether a university has:

- promised to transfer goods or services that are ‘outputs from the research’ (e.g. published research information or other research findings and underlying data) to the grantor (or third parties on behalf of the grantor)

- promises in the arrangement that are sufficiently specific so a university can determine:

- when they have satisfied their obligation to transfer those goods or services

- a revenue amount that can be allocated to each of those obligations.

Initially, there were varying interpretations as to what goods or services were transferred. The AASB clarified through its guidance that undertaking a research activity in and of itself does not represent a transfer of benefit to the grantor and is therefore not a basis for revenue recognition. The benefit to the grantor is the outputs from the research.

Whether sufficiently specific performance obligations (SSPO) existed in the arrangements, and the timing of when the performance obligations were satisfied, require careful consideration of all facts and circumstances in an arrangement, whether explicit or implicit, including the:

- nature or type of the goods or services

- cost or value of the goods or services

- quantity of the goods or services

- period over which the goods or services must be transferred.

In assessing the promises in the NHMRC and ARC arrangements, we reviewed agreements, supporting policies, associated legislation and position papers, and held discussions with researchers, other universities, regulators and audit offices. Our analysis is that NHMRC and ARC arrangements do not contain SSPOs, and therefore AASB 1058 applies.

|

Proposed SSPO |

Our observations |

|

Sharing research findings (including open access policies |

Both ARC and NHMRC agreements contain clauses that either required or encouraged researchers to share their findings with the research community through:

We observed the following in most cases:

|

|

Access to premises, documents and information clauses |

ARC and NHMRC agreements both contained clauses that allowed the grantor access to information related to the research project. There is no evidence these clauses were intended to facilitate the transfer of research findings or data to the grantor for their benefit. Rather, evidence indicates that these clauses were for regulation, accountability and monitoring for compliance with the agreement terms, ethical standards and other requirements. We note:

|

|

Project reporting |

Most ARC and NHMRC agreements required the university to report regularly on the status of the project to the grantor through interim and final reports, as well as reports prepared on the grantor’s request. While we noted that there were some limited descriptions of findings in some of these reports:

As a result, the information in the reports is generally not suitable to be directly cited by other researchers in their work. Given this, there was no evidence that the content of those reports transferred a benefit to the grantor or third party, apart from the university discharging its accountability for the grant funding received. On this basis the project reporting under these agreements is not a performance obligation for the purposes of AASB 15. |

|

Other |

There were also other possible performance obligations brought to our attention, such as mentoring researchers and teaching postgraduate students. No evidence was identified to support sufficiently specific performance obligations. |

Inconsistent interpretation across the sector

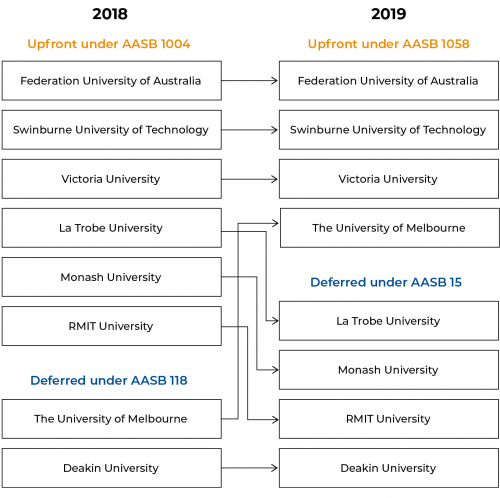

Our interpretation of the standards differed to those of four universities. These universities were of the view that such promises outlined above were sufficiently specific to allow for revenue recognition under AASB 15.

This situation is not dissimilar to the differences that existed under the former accounting standards AASB 1004 Contributions (AASB 1004) and AASB 118 Revenue (AASB 118).

However, we observe that the changes in position were not uniform or consistent as between those that previously applied AASB 1004 or those that previously applied AASB 118. Figure 3A illustrates this.

These inconsistencies show that Victorian universities were themselves unable to reach a consensus. There is also no consensus nationally either between preparers or their auditors. This is not ideal. Inconsistent interpretation inhibits comparability, a cornerstone principle of financial reporting.

Figure 3A

Universities' accounting treatment for competitive publicly funded research grants in 2018 and 2019

Source: VAGO.

Emerging issue: Termination for convenience clause

As reports were being finalised an issue emerged related to accounting for a ‘termination for convenience clause’ that is common in government contracts. Such a clause is present in both the ARC and NHMRC agreements.

There are conflicting views in the sector and the wider accounting industry on the issue. Some are of the view that a ‘termination for convenience clause’ gives rise to a financial liability at the start of an arrangement. Others believe that it gives rise to a financial liability only once there is a request for repayment by a grantor.

We are corresponding with the AASB and the Australian Council of Auditors General on this matter and urge each university to work with the sector and the AASB. If the interpretation of the clause was to change and support recognition of a financial liability at the inception of an agreement, universities will need to consider the impact of existing and past agreements and how this may be accounted for under AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors.

3.3 COVID-19

The outbreak of novel coronavirus (COVID-19) was declared as a global pandemic on 11 March 2020. This led to the Australian and state governments placing restrictions on domestic and international travel, closing non-essential services and enacting social distancing measures in an effort to contain the virus. The pandemic also resulted in volatility in economic markets.

Figure 3B shows the timeline of the COVID-19 outbreak and the impact on the sector.

Financial reporting impact—non-adjusting subsequent event

|

A non-adjusting subsequent event is an event where the circumstances occurred after the balance date and the amounts reported at the balance date are not affected and do not need to be changed. |

While COVID-19 was detected overseas in December 2019, it did not affect Australia until 2020. Universities assessed this subsequent event as material to their operations and were required to disclose its impact in the notes within their financial reports. Due to the significant uncertainty surrounding the pandemic, the universities were not able to reliably estimate its financial effect at the time they reported.

The evolving nature of the pandemic meant that universities continually revised and often expanded the level of disclosure in their financial reports, up to the date of signing them. We concluded that their disclosures were adequate before issuing our audit opinions.

Figure 3B

Timeline of COVID-19 and the impact on Victorian universities

Source: VAGO.

Going concern

The financial reports of the eight universities were prepared on a going concern basis, and we agreed with this basis of preparation. To ensure this remained appropriate and the basis of preparation had not changed as a result of COVID 19, universities prepared financial forecasts using a number of scenarios given the level of uncertainty.

Universities' scenario modelling at the end of March 2020 considered the financial impact over the next 12 months from:

- loss of international students—for all of 2020 (worst case scenario), the first semester of 2020 and no loss of international students due to learning and teaching continuing through online means (best case scenario)

- loss of domestic students—for students who did not want to transition to online learning

- decline in investment values due to the global market downturn

- potential campus closures of all activities including teaching

- higher costs incurred transitioning to online learning

- mitigation strategies to reduce operating expenditure and discretionary spending such as travel, training and conferences, freezing recruitment and deferring pay increases

- delaying non-essential capital projects.

Their modelling showed financial impacts ranging from $14 million to $900 million in best and worst-case scenarios.

At the time of finalising our audit opinions, the forecasts of each university showed there were enough cash and investment reserves for operations to continue and for universities to meet financial obligations over the next 12 months.

Additional government funding

A university degree typically runs over three years. The loss of domestic and international students from the COVID-19 pandemic will continue to impact the sector in future years.

In response, on 12 April 2020, the Australian Government announced the Higher Education Relief Package to provide universities with a level of certainty in funding. Universities are guaranteed to receive the agreed level of Commonwealth Grant Scheme funding for domestic students over the next calendar year, even if enrolment numbers fall because of COVID-19.

On 19 May 2020, the Victorian Government announced a $350 million Victorian Higher Education State Investment Fund to support universities through the COVID-19 pandemic. The funding will assist with works for new technology and infrastructure to enable the universities to conduct new research and form new research partnerships. Payroll tax deferrals of approximately $110 million were also announced to provide immediate cash relief to universities that have been heavily impacted by the loss of international students and the downturn in investment market performance. These funds are expected to be used to retain as many staff as possible.

Future financial reporting considerations

The COVID-19 pandemic will continue to affect universities’ operations and their financial condition. As a consequence, all universities will need to continually assess the impact to their financial reports.

Items that may be affected include:

- accounting and revenue recognition for government relief funding

- timing of when research services will be delivered and the impact on current and non-current classification of deferred contract revenue

- potential refunds of liability if research services cannot be delivered as promised

- recoverability of student receivables from course fees and rental income

- valuation of land and investment properties

- financial instruments

- going concern assessments.

The consequences of COVID-19 may mean that historical information is no longer relevant or reliable as a basis for determining items that are subject to estimation in the future.

Internal controls and risk assessment

The pandemic has the potential to impact the control environment of universities. Changes in working arrangements may result in an increased risk of internal controls failing, especially in an environment where manual controls have operated with a high level of management oversight within an office environment. There is also an increased risk of fraud in that the opportunities to circumvent existing controls may be greater. As employees access systems in different ways, delegations may change to cover absent staff, and workload changes may be experienced.

|

A business continuity plan sets out arrangements for managing disruptions. It helps anticipate, prevent or prepare for disruptions such as fire, flood, storms and illness, and to respond and recover from them. |

The pandemic has also changed risk assessments, business continuity plans and crisis management plans. While such plans are usually developed to respond to a one-off or short-term event, this may be inadequate in an event such as COVID-19, which has played out over multiple months.

The pandemic may affect universities in the following ways:

- changes to operating models

- IT security and cybersecurity considerations

- personnel health and safety

- flexible working arrangements

- funding mix and revenue diversity, including continuity of revenue streams in the future

- evaluation of short- and long-term liquidity.

As discussed in Part 2, IT-related control issues have been one of the larger groups of control issues we have identified across the sector in the last few years. IT security and cybersecurity considerations are increasingly important in the current environment.

Risk registers and business continuity plans should be reviewed and updated to reflect learnings from the COVID-19 pandemic, and they should be updated and tested on a regular basis.

4 Financial performance and sustainability

In this Part of the report, we summarise the financial outcomes of the university sector for the year ended 31 December 2019 and comment on the sustainability of the sector in the context of information we obtained and observed during our audits. The detailed data and calculations that underpin our financial sustainability comments of the sector are provided in Appendix D.

4.1 Conclusion

The sector continued to be financially sound during 2019. Risks to international student enrolments, in part due to COVID-19 and changes to government funding caps for domestic students, will need to be actively managed.

4.2 Financial performance

The sector's net result significantly improved in 2019 (see Figure 4A). In 2018 one-off investment losses, the result of accounting standard changes, affected the net result.

This year revenue grew in line with student numbers, reflecting strong demand for university-level higher education prior to COVID-19. Fair value gains on investments during 2019 also contributed to the revenue growth.

Figure 4A

Financial performance of the university sector for the years ended 31 December (2015–19)

Note: Figures for 2015 to 2018 have been adjusted for the two universities with qualified audit opinions.

Source: VAGO.

4.3 Financial position

The value of net assets held by the sector increased during 2019 (Figure 4B), consistent with its positive net result, and the five-year trend.

Figure 4B

Total assets, total liabilities and net assets of the university sector as at 31 December 2015–19

Note: Figures for 2015 to 2018 have been adjusted for two universities with qualified audit opinions.

Source: VAGO.

|

The adjusted liquidity ratio includes non-current financial investments as most of them can be converted to cash or cash equivalents at short notice and are available to the universities to meet any liabilities if required. |

The sector has a very strong net asset position. This reflects its large portfolio of land, buildings and equipment, which the universities use to deliver their services.

However, these assets are illiquid, and cannot be relied upon if a university requires cash to meet its debts.

The adjusted liquidity ratio is a better indication of whether the universities are likely to be able to service their debt obligations in the immediate future. Figure 4C shows the adjusted liquidity ratio for universities for the last two years.

Figure 4C

Adjusted liquidity ratio for universities at 31 December 2018–19

Source: VAGO.

Figure 4C shows that, other than RMIT University and La Trobe University, all the universities have enough liquid assets to meet their short-term liabilities. The adjusted liquidity ratio of five of the remaining six universities was lower in 2019. This was largely due to accounting changes from the initial application of AASB 15, which resulted in the sector recording significant current contract liabilities on their balance sheet.

RMIT University proactively monitors its cash position and ensures there is enough cash on hand to meet its obligations as they fall due. This is supported by its historical performance. In both 2018 and 2019, RMIT University had a strong net result and a net operating cash inflow that was significantly greater than its net current liability. The university also closely monitors expenditure levels and implemented cost control measures in 2020 such as limiting recruitment to roles that are essential to business continuity or compliance, delaying planned projects that are not considered critical, implementing senior officer salary cuts and reducing discretionary spend. Approvals were also sought to increase borrowing levels. These strategies along with confirmed federal and state funding reduce the risk of it being unable to meet its short-term obligations.

La Trobe University's adjusted liquidity ratio at 31 December 2019 shows insufficient liquid assets to meet short-term liabilities because they recognised a significant current contract liability in adopting AASB 15. In 2019, La Trobe University also had a strong net result and a net operating cash inflow significantly greater than its net current liability. To mitigate its financial sustainability risks, La Trobe University has sought to increase debt facilities and planned a number of savings initiatives such as only recruiting for crucial roles, delaying bonus payments and staff promotions, executive officer pay cuts and reducing discretionary spend. These measures along with confirmed federal and state funding reduce the risk of it being unable to meet its short-term obligations.

Risks for the sector

The sector's reliance on international student revenue and changes to government funding caps for domestic students increase the financial sustainability risk for the sector.

While the total equivalent full-time student load (EFTSL) has steadily increased over the last five years, overseas students now make up 41 per cent of the sector’s higher education student load, and contributed 33 per cent of revenue.

The travel restrictions from COVID-19 meant many international students were unable to commence studies in Victorian universities. The sector will need to continue to monitor circumstances overseas and actively manage its recruitment programs to diversify the source countries that make up the overseas student base. Universities may also need to rethink their business models and offer the teaching and learning experience in different modes to increase the markets they attract students from.

In relation to domestic enrolments there is a large gap between the number of funded and unfunded places for designated courses which universities need to fund through own-sourced revenue. The shortfall in funding for the sector is approximately $230 million in 2019.

Appendix E provides data on student volumes and Commonwealth grants scheme funding.

Appendix A. Submissions and comments

We have consulted with DET and the eight public universities in Victoria, and we considered their views when reaching our audit conclusions. As required by the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions and comments. We also provided a copy of the report to the Department of Treasury and Finance.

Responsibility for the accuracy, fairness and balance of those comments rests solely with the agency head.

Responses were received as follows:

RESPONSE provided by the Associate Secretary, DET

RESPONSE provided by the CFO, The University of Melbourne

Appendix B. Audit opinions

Figure B1 lists the entities included in this report. It details the nature of the audit opinion for their 2019 financial reports, and the date it was issued to each entity.

Figure B1

Audit opinions issued for universities and their controlled entities for the year ended 31 December 2019

|

Entity |

Clear audit opinion issued |

Auditor-General's report signed date |

|---|---|---|

|

Deakin University |

EOM(a) |

30 April 2020 |

|

Deakin Residential Services Pty Ltd |

EOM(a) |

25 April 2020 |

|

FIKA Entertainment Pty Ltd |

✔ |

25 April 2020 |

|

FLAIM Systems Pty Ltd |

EOM(a) |

25 April 2020 |

|

Unilink Limited |

✔ |

25 April 2020 |

|

Universal Motion Simulator Pty Ltd |

EOM(a) |

25 April 2020 |

|

Federation University Australia |

EOM(a) |

21 April 2020 |

|

Brisbane Education Services Pty Ltd |

✔ |

20 April 2020 |

|

Datascreen Pty Ltd |

Material uncertainty |

20 April 2020 |

|

Inskill Pty Ltd |

Material uncertainty |

20 April 2020 |

|

The School of Mines and Industries Ballarat Limited |

✔ |

20 April 2020 |

|

La Trobe University |

EOM(a) |

28 April 2020 |

|

Unitemps La Trobe Ltd |

EOM(a) |

26 May 2020 |

|

Monash University |

EOM(a) |

28 April 2020 |

|

Monash Accommodation Services Pty Ltd |

EOM(a) |

3 May 2020 |

|

Monash College Pty Ltd |

✔ |

12 March 2020 |

|

Monash Commercial Pty Ltd |

✔ |

10 May 2020 |

|

Monash Custodians Pty Ltd |

n/a |

n/a |

|

Monash Investment Holdings Pty Ltd |

✔ |

26 April 2020 |

|

Monash Investment Trust |

EOM(a) |

3 May 2020 |

|

Monash Property South Africa Pty Ltd |

n/a |

n/a |

|

Monash University Foundation Pty Ltd |

✔ |

28 April 2020 |

|

Monash University Foundation Trust |

EOM(a) |

3 May 2020 |

|

Monash University Indonesia Limited |

n/a |

n/a |

|

RMIT University |

EOM(a) |

29 April 2020 |

|

RMIT Holdings Pty Ltd |

✔ |

26 February 2020 |

|

RMIT Indonesia Pty Ltd |

✔ |

26 February 2020 |

|

RMIT Online Pty Ltd |

✔ |

26 February 2020 |

|

RMIT Spain SL |

✔ |

26 February 2020 |

|

RMIT Training Pty Ltd |

✔ |

26 February 20209 |

|

Swinburne University of Technology |

EOM(a) |

29 April 2020 |

|

Capsular Technologies Pty Ltd |

✔ |

4 May 2020 |

|

National Institute of Circus Arts Limited |

EOM(a) |

4 May 2020 |

|

Swinburne Academy Pty Ltd |

EOM(a) |

12 May 2020 |

|

Swinburne Intellectual Property Trust |

✔ |

4 May 2020 |

|

Swinburne International (Holdings) Pty Ltd |

✔ |

4 May 2020 |

|

Swinburne Student Amenities Association Ltd |

EOM(a) |

4 May 2020 |

|

Swinburne Ventures Ltd |

✔ |

4 May 2020 |

|

The University of Melbourne |

EOM(a) |

7 May 2020 |

|

Australian Music Examinations Board (Victoria) Ltd |

n/a |

n/a |

|

Goulburn Valley Equine Hospital Pty Ltd |

n/a |

n/a |

|

Melbourne University Publishing Ltd |

n/a |

n/a |

|

Melbourne Business School Foundation Ltd |

n/a |

n/a |

|

Melbourne Business School Ltd |

n/a |

n/a |

|

Melbourne Teaching Health Clinics Ltd |

n/a |

n/a |

|

Mt Eliza Graduate School of Business and Government Ltd |

n/a |

n/a |

|

Nossal Institute Ltd |

n/a |

n/a |

|

UM Commercialisation Pty Ltd |

✔ |

29 May 2020 |

|

UM Commercialisation Trust |

✔ |

29 May 2020 |

|

UOM Commercial Ltd |

EOM(a) |

29 May 2020 |

|

Victoria University |

EOM(a) |

28 April 2020 |

|

Victoria University Enterprises Pty Ltd |

✔ |

27 April 2020 |

|

Victoria University Foundation |

✔ |

8 May 2020 |

|

Victoria University Foundation Ltd |

✔ |

8 May 2020 |

|

Victoria University International Pty Ltd |

✔ |

8 May 2020 |

|

VU Online Pty Ltd |

✔ |

27 April 2020 |

(a) Refer to our discussion in Section 2.2 for further information on the audit opinions issued.

Note: n/a = not applicable. Financial reports were not yet signed, so we have not been able to issue an audit opinion for this entity at the date of this report; EOM = emphasis of matter.

Source: VAGO.

Appendix C. Control issues risk ratings

Figure C1 shows the risk ratings applied to issues raised in management letters. It also details what they represent and the expected timeline for the issue to be resolved.

Figure C1

Risk definitions applied to issues reported in audit management letters

|

Rating |

Definition |

Management action required |

|---|---|---|

|

High |

The issue represents:

|

Requires executive management to correct the misstatement in the financial report, or address the issue, as a matter of urgency to avoid a modified audit opinion. Requires immediate management intervention with a detailed action plan to be implemented within one month. |

|

Medium |

The issue represents:

|

Requires management intervention with a detailed action plan implemented within three to six months. |

|

Low |

The issue represents:

|

Requires management intervention with a detailed action plan implemented within six to 12 months. |

Source: VAGO.

Appendix D. Financial and non-financial sustainability indicators

Figure D1 shows financial and non-financial sustainability indicators used to assess the financial sustainability risks of universities. These indicators should be considered collectively and are more useful when assessed over time as part of a trend analysis.

Our analysis of financial sustainability risk in this report reflects on the position of each university.

Figure D1

Financial and non-financial sustainability indicators, formulas and descriptions

|

Indicator |

Formula |

Description |

|---|---|---|

|

Net result margin (%) |

Net result/Total revenue |

A positive result indicates a surplus, and the larger the percentage, the stronger the result. A negative result indicates a deficit. Operating deficits cannot be sustained in the long term. The net result and total revenue are obtained from the comprehensive operating statement. The adjusted net result margin is the net result margin adjusted for the one-off accounting changes introduced by AASB 9 in 2018. |

|

Liquidity (ratio) |

Current assets/ Current liabilities |

This measures the ability to pay existing liabilities in the next 12 months. A ratio of one or more means that there are more cash and liquid assets than short-term liabilities |

|

Adjusted liquidity (ratio) |

(Current assets + Non-current financial investments)/ Current liabilities |

Liquidity ratio adjusted to include non-current financial investments, since most of these can be converted to cash or cash equivalents at short notice and are available to the universities to meet any liabilities if required. The ratio should ideally be above 1, indicating that there are sufficient liquid assets to meet short-term liabilities. |

|

Capital replacement (ratio) |

Cash outflows for property, plant and equipment/ Depreciation |

Comparison of the rate of spending on infrastructure with its depreciation. Ratios higher than 1:1 indicate that spending is faster than the depreciating rate. This is a long-term indicator, as capital expenditure can be deferred in the short term if there are insufficient funds available from operations and borrowing is not an option. Cash outflows for infrastructure are taken from the cashflow statement. Depreciation is taken from the comprehensive operating statement. |

|

Internal financing (%) |

Net operating cashflow/Net capital expenditure |

This measures the ability of an entity to finance capital works from generated cashflow. The higher the percentage, the greater the ability for the entity to finance capital works from their own funds. Net operating cashflows and net capital expenditure are obtained from the cashflow statement. Note: The internal financing ratio cannot be less than zero. Where a calculation has produced a negative result, this has been rounded up to 0%. |

|

Debt to equity (%) |

Total borrowings/ Equity |

This measures the reliance on debt as a source of funding. A higher ratio indicates greater reliance on debt and an increased risk of insolvency. |

|

Cost of debt (%) |

Finance costs/Total borrowings |

This measures the effective rate of interest and other costs paid on borrowings. |

|

Employee benefits ratio (%) |

Employee expenses/ Total revenue |

This measures how efficiently each university uses its staff to deliver revenue-generating services. Generally, a smaller ratio indicates a more efficient and sustainable workforce. |

|

Repairs and maintenance to depreciation (%) |

Repairs and maintenance expenses /Depreciation |

This measures the rate of assets being replaced or renewed. Generally, a ratio above 100 per cent indicates long-term assets are being adequately renewed. |

|

Effective Full-Time Student Load (EFTSL) to Employee Full-Time Equivalent (FTE) (ratio) |

Total EFTSL/Total FTE employees |

This measures the adequacy of available resources per student load. |

|

Employee expenses per EFTSL (ratio) |

Employee expenses/ Total EFTSL |

This measures the cost of employees per student. Generally, a smaller ratio indicates greater cost efficiency. |

|

Operating expenses per EFTSL (ratio) |

Operating expenses/ Total EFTSL |

This measures the operational cost per student. Generally, a smaller ratio indicates greater cost efficiency. |

Source: VAGO.

Financial and non-financial sustainability analysis results

Figures D2 to D9 show the financial and non-financial sustainability indicators for each university and its controlled entities (each consolidated university), for the financial years ended 31 December 2015–19.

Figure D2

Deakin University

|

2015 |

2016 |

2017 |

2018 |

2019 |

|

|---|---|---|---|---|---|

|

Net result margin |

7.16% |

5.10% |

9.72% |

4.45% |

7.98% |

|

Adjusted net result margin |

N/A |

N/A |

N/A |

7.50% |

N/A |

|

Liquidity |

1.28 |

0.93 |

0.96 |

0.77 |

0.53 |

|

Adjusted liquidity |

2.14 |

2.02 |

2.10 |

2.05 |

1.91 |

|

Capital replacement |

1.42 |

2.01 |

1.61 |

1.84 |

2.14 |

|

Internal financing |

165% |

110% |

145% |

126% |

91% |

|

Debt to equity |

N/A |

N/A |

N/A |

N/A |

N/A |

|

Cost of debt |

N/A |

N/A |

N/A |

N/A |

N/A |

|

Employee benefits ratio |

54.19% |

56.50% |

54.07% |

54.79% |

53.60% |

|

Repairs and maintenance to depreciation |

61.54% |

63.81% |

54.27% |

54.98% |

53.98% |

|

EFTSL to Employee FTE |

8.79 |

8.39 |

8.45 |

8.03 |

8.06 |

|

Employee expenses per EFTSL ($'000) |

13.86 |

15.10 |

15.38 |

16.10 |

16.68 |

|

Operating expenses per EFTSL ($'000) |

21.44 |

23.22 |

23.36 |

25.07 |

26.24 |

Source: VAGO.

Figure D3

Federation University Australia

|

2015 |

2016 |

2017 |

2018 |

2019 |

|

|---|---|---|---|---|---|

|

Net result margin |

2.33% |

0.20% |

-2.54% |

2.00% |

8.99% |

|

Adjusted net result margin |

N/A |

N/A |

N/A |

2.00% |

N/A |

|

Liquidity |

3.18 |

2.78 |

2.36 |

1.76 |

1.83 |

|

Adjusted liquidity |

3.31 |

4.05 |

3.91 |

3.18 |

3.72 |

|

Capital replacement |

0.50 |

0.48 |

1.26 |

1.52 |

1.21 |

|

Internal financing |

206% |

12% |

25% |

166% |

77% |

|

Debt to equity |

0.03% |

N/A |

N/A |

N/A |

N/A |

|

Cost of debt |

18.90% |

N/A |

N/A |

N/A |

N/A |

|

Employee benefits ratio |

47.33% |

57.05% |

59.99% |

48.03% |

39.09% |

|

Repairs and maintenance to depreciation |

62.49% |

35.62% |

50.11% |

44.13% |

33.74% |

|

EFTSL to Employee FTE |

10.06 |

8.56 |

8.52 |

10.65 |

11.54 |

|

Employee expenses per EFTSL ($'000) |

10.17 |

12.98 |

14.46 |

11.57 |

10.34 |

|

Operating expenses per EFTSL ($'000) |

19.60 |

21.28 |

23.20 |

22.28 |

22.59 |

Note: EFTSL for the calculation of the above ratios where relevant, includes VE student loads.

Source: VAGO.

Figure D4

La Trobe University

|

2015 |

2016 |

2017 |

2018 |

2019 |

|

|---|---|---|---|---|---|

|

Net result margin |

8.85% |

5.10% |

3.77% |

3.76% |

2.23% |

|

Adjusted net result margin |

N/A |

N/A |

N/A |

3.62% |

N/A |

|

Liquidity |

0.99 |

0.78 |

0.62 |

0.66 |

0.53 |

|

Adjusted liquidity |

1.39 |

1.15 |

1.01 |

1.09 |

0.96 |

|

Capital replacement |

1.63 |

2.30 |

2.11 |

1.72 |

2.73 |

|

Internal financing |

111% |

87% |

101% |

103% |

49% |

|

Debt to equity |

4.84% |

4.64% |

4.06% |

3.68% |

9.26% |

|

Cost of debt |

14.63% |

6.09% |

5.29% |

4.28% |

0.95% |

|

Employee benefits ratio |

49.21% |

52.19% |

54.44% |

52.44% |

53.15% |

|

Repairs and maintenance to depreciation |

26.50% |

23.00% |

22.83% |

23.73% |

25.40% |

|

EFTSL to Employee FTE |

9.06 |

9.35 |

9.08 |

9.22 |

8.70 |

|

Employee expenses per EFTSL ($'000) |

12.59 |

13.31 |

14.18 |

14.24 |

15.88 |

|

Operating expenses per EFTSL ($'000) |

20.80 |

21.67 |

22.64 |

23.61 |

26.46 |

Source: VAGO.

Figure D5

Monash University

|

2015 |

2016 |

2017 |

2018 |

2019 |

|

|---|---|---|---|---|---|

|

Net result margin |

7.98% |

7.80% |

5.97% |

6.06% |

11.84% |

|

Adjusted net result margin |

N/A |

N/A |

N/A |

8.95% |

N/A |

|

Liquidity |

0.47 |

0.35 |

0.40 |

0.56 |

0.50 |

|

Adjusted liquidity |

1.75 |

1.48 |

1.70 |

1.86 |

1.49 |

|

Capital replacement |

3.13 |

3.16 |

3.47 |

2.42 |

2.01 |

|

Internal financing |

82% |

86% |

59% |

87% |

114% |

|

Debt to equity |

15.93% |

17.46% |

23.78% |

25.56% |

23.35% |

|

Cost of debt |

5.87% |

5.44% |

5.03% |

4.94% |

5.39% |

|

Employee benefits ratio |

48.35% |

48.02% |

48.81% |

46.73% |

44.79% |

|

Repairs and maintenance to depreciation |

35.32% |

37.73% |

38.31% |

33.21% |

24.07% |

|

EFTSL to Employee FTE |

7.33 |

7.41 |

7.80 |

7.99 |

7.65 |

|

Employee expenses per EFTSL ($'000) |

16.29 |

16.38 |

15.99 |

16.60 |

17.58 |

|

Operating expenses per EFTSL ($'000) |

28.71 |

29.04 |

28.58 |

30.02 |

31.66 |

Note: EFTSL for the calculation of the above ratios where relevant, includes student loads for significant operations within the Monash University Group.

Source: VAGO.

Figure D6

RMIT University

|

2015 |

2016 |

2017 |

2018 |

2019 |

|

|---|---|---|---|---|---|

|

Net result margin |

5.81% |

7.62% |

5.43% |

6.21% |

4.14% |

|

Adjusted net result margin |

N/A |

N/A |

N/A |

6.65% |

N/A |

|

Liquidity |

0.59 |

0.53 |

0.53 |

0.48 |

0.51 |

|

Adjusted liquidity |

0.83 |

0.77 |

0.80 |

0.77 |

0.82 |

|

Capital replacement |

3.35 |

2.84 |

2.60 |

1.67 |

1.54 |

|

Internal financing |

69% |

93% |

69% |

121% |

105% |

|

Debt to equity |

11.78% |

11.94% |

13.42% |

10.96% |

13.28% |

|

Cost of debt |

3.18% |

2.97% |

2.59% |

3.95% |

2.64% |

|

Employee benefits ratio |

56.96% |

55.23% |

56.14% |

55.45% |

56.66% |

|

Repairs and maintenance to depreciation |

34.17% |

51.03% |

22.85% |

19.62% |

27.77% |

|

EFTSL to Employee FTE |

9.98 |

9.96 |

10.04 |

9.82 |

9.03 |

|

Employee expenses per EFTSL ($'000) |

12.11 |

12.13 |

12.60 |

13.26 |

13.67 |

|

Operating expenses per EFTSL ($'000) |

18.42 |

18.67 |

19.35 |

20.17 |

21.06 |

Note: EFTSL for the calculation of the above ratios where relevant, includes vocational education (VE) student loads.

Source: VAGO.

Figure D7

Swinburne University of Technology

|

2015 |

2016 |

2017 |

2018 |

2019 |

|

|---|---|---|---|---|---|

|

Net result margin |

2.71% |

3.25% |

15.60% |

-1.13% |

4.44% |

|

Adjusted net result margin |

N/A |

N/A |

N/A |

0.97% |

N/A |

|

Liquidity |

1.28 |

0.90 |

0.90 |

0.87 |

0.51 |

|

Adjusted liquidity |

2.20 |

2.40 |

2.67 |

2.27 |

2.10 |

|

Capital replacement |

0.48 |

0.44 |

1.83 |

1.56 |

2.39 |

|

Internal financing |

393% |

545% |

118% |

21% |

43% |

|

Debt to equity |

N/A |

N/A |

N/A |

N/A |

N/A |

|

Cost of debt |

N/A |

N/A |

N/A |

N/A |

N/A |

|

Employee benefits ratio |

49.11% |

48.34% |

45.06% |

53.79% |

50.53% |

|

Repairs and maintenance to depreciation |

45.59% |

40.77% |

43.17% |

35.88% |

28.00% |

|

EFTSL to Employee FTE |

12.67 |

13.36 |

12.67 |

11.90 |

11.99 |

|

Employee expenses per EFTSL ($'000) |

9.24 |

9.50 |

10.31 |

11.50 |

11.08 |

|

Operating expenses per EFTSL ($'000) |

16.90 |

17.74 |

18.34 |

20.07 |

19.69 |

Note: EFTSL for the calculation of the above ratios where relevant, includes vocational education (VE) student loads.

Source: VAGO.

Figure D8

The University of Melbourne

|

2015 |

2016 |

2017 |

2018 |

2019 |

|

|---|---|---|---|---|---|

|

Net result margin |

6.58% |

7.39% |

9.33% |

3.26% |

11.90% |

|

Adjusted net result margin |

N/A |

N/A |

N/A |

7.77% |

N/A |

|

Liquidity |

1.10 |

1.38 |

1.61 |

1.87 |

1.63 |

|

Adjusted liquidity |

4.78 |

4.92 |

5.65 |

5.72 |

5.17 |

|

Capital replacement |

1.41 |

1.15 |

1.58 |

2.88 |

1.29 |

|

Internal financing |

170% |

256% |

320% |

209% |

283% |

|

Debt to equity |

6.46% |

11.02% |

10.49% |

10.61% |

9.56% |

|

Cost of debt |

4.31% |

4.52% |

4.49% |

4.95% |

5.26% |

|

Employee benefits ratio |

49.79% |

48.88% |

47.39% |

48.99% |

48.99% |

|

Repairs and maintenance to depreciation |

48.91% |

65.86% |

51.69% |

55.98% |

41.50% |

|

EFTSL to Employee FTE |

5.77 |

5.87 |

5.88 |

5.86 |

5.83 |

|

Employee expenses per EFTSL ($'000) |

23.90 |

23.91 |

24.57 |

25.40 |

26.21 |

|

Operating expenses per EFTSL ($'000) |

41.37 |

41.74 |

43.32 |

44.50 |

43.23 |

Source: VAGO.

Figure D9

Victoria University

|

2015 |

2016 |

2017 |

2018 |

2019 |

|

|---|---|---|---|---|---|

|

Net result margin |

-2.81% |

-2.52% |

-6.57% |

1.53% |

5.06% |

|

Adjusted net result margin |

N/A |

N/A |

N/A |

1.72% |

N/A |

|

Liquidity |

1.26 |

0.68 |

0.71 |

1.05 |

0.90 |

|

Adjusted liquidity |

1.28 |

1.26 |

0.89 |

1.95 |

1.93 |

|

Capital replacement |

0.74 |

0.82 |

1.30 |

1.67 |

2.24 |

|

Internal financing |

151% |

109% |

51% |

57% |

229% |

|

Debt to equity |

N/A |

0.07% |

0.04% |

1.24% |

0.01% |

|

Cost of debt |

N/A |

77.93% |

173.16% |

4.04% |

241.73% |

|

Employee benefits ratio |

67.52% |

64.77% |

68.05% |

58.67% |

57.86% |

|

Repairs and maintenance to depreciation |

59.22% |

54.98% |

76.99% |

57.27% |

46.17% |

|

EFTSL to Employee FTE |

13.12 |

12.75 |

13.42 |

13.53 |

13.60 |

|

Employee expenses per EFTSL ($'000) |

10.20 |

10.31 |

11.18 |

9.85 |

9.64 |

|

Operating expenses per EFTSL ($'000) |

14.45 |

15.02 |

16.18 |

14.80 |

13.93 |

Note: EFTSL for the calculation of the above ratios where relevant, includes vocational education (VE) student loads.

Source: VAGO.

Appendix E. Student enrolments and government funding

Student volumes

Student enrolments drive the sector's operational activity, including its two largest sources of income—student fees and Commonwealth student assistance grants.

Figure E1 shows the total EFTSL has steadily increased over the last five years.

Figure E1

University sector number and proportion of domestic and overseas EFTSL for the years ended 31 December 2015–19

Source: VAGO.

Domestic EFTSL decreased in 2019 for the first time in five years, highlighting that the sector’s growth is driven by overseas students, who now make up 41 per cent of the sector’s higher education student load. Domestic enrolment numbers have also been impacted by the government funding cap which is discussed below.

Figure E2 shows the university sector revenue concentration for the year ended 31 December 2019. As seen in this figure, the second highest source of revenue for the university sector is from international student fees.

Figure E2

University sector revenue concentration for the year ended 31 December 2019

Source: VAGO.

Figure E3 shows the proportion of revenue from domestic and international students for each university. Three universities have greater reliance on international students with a higher proportion of revenue from this source than from domestic students in 2019.

Figure E3

Revenue from domestic and international students for the year ended 31 December 2019

Source: VAGO.

Commonwealth Grants Scheme funding

The sector receives its Commonwealth government student funding primarily through the Commonwealth Grants Scheme, which subsidises course fees for eligible students. An enrolment that is eligible for this subsidy is known as a Commonwealth supported place (CSP).

Designated courses

|

Designated courses are non-research postgraduate courses, medicine courses, enabling courses and courses of study leading to a diploma, advanced diploma or associate degree. |

The Commonwealth Government designates courses which have their funding capped at an agreed number of enrolments in any given year. In December 2017, it announced a reduction in the number of CSPs it would fund because postgraduate courses were overall, historically under enrolled. The funding was reallocated to courses that are pathways to a bachelor degree. Designated courses make up 12 per cent of the sector's total CSP enrolments.

Figure E4 shows the number of enrolments allocated compared to the actual number of enrolments for the sector over the last four years. It also shows the dollar value of capped funding and the estimated amount of government grant if every enrolled CSP were funded.

Figure E4

University sector number of enrolments and funding for designated courses from 2016 to 2019

Source: VAGO.

The demand and actual number of places offered by the sector continues to increase.

As shown in Figure E5 'Education' enrolments have the lowest number of unfunded places. Humanities has the lowest number of enrolments for the sector, but has the highest number of unfunded places.

Figure E5

University sector number of funded and unfunded enrolments in designated courses, by area of study for 2019

Source: VAGO.

The number of funded and unfunded places in designated courses for each university in 2019 is shown in Figure E6.

Figure E6

Number of funded and unfunded places in designated courses in 2019

Source: VAGO.

Non-designated courses

In contrast to designated courses, non-designated courses had their funding pooled and capped at the total level of funding received in 2017, leaving the universities discretion to determine the optimal mix of enrolments across these courses. Although the sector reached this cap during the year, universities continued enrolling students in these courses, charging them the subsidised fee while not receiving any Commonwealth contribution funding for these places.

Figure E7 shows the total CSP EFTSL enrolled in non-designated courses for the university sector from 2016 to 2019. The figure demonstrates little growth in the number of CSP enrolments taken by the sector in the first year of the funding cap. In the second year, the overall intake for non-designated places for the sector declined.

Figure E7

Total CSP EFTSL enrolled in non-designated courses for the university sector from 2016 to 2019

Source: VAGO.

There is a demand for higher education and the sector has continued to enrol students above the capped levels. Figure E8 shows the capped funding provided to the university sector and estimated funding based on actual enrolments for non-designated courses for the years 2016–19. The figure illustrates that the estimated shortfall in funding for the sector’s non-designated courses was $14 million in 2018 and $47.5 million in 2019.

Figure E8

Capped funding provided to the university sector and estimated funding based on actual enrolments for non-designated courses for the years 2016–19

Source: VAGO.

The reduction in government funding has meant universities have had to find other ways to maintain and expand operations such as:

- exploring alternative sources of income to make up the funding gap including increasing international offerings

- reviewing programs delivered and offering new programs where shortages in the market exist

- reviewing and changing the CSP placements strategy, focusing on finding ways to maximise enrolment numbers in each area of study to ensure the highest amount of government funding is received

- focusing on increasing growth in courses that have more profitable margins

- exploring strategies to reduce reliance on designated student loads as a pathway into non-designated courses

- seeking opportunities to reduce the cost of delivery, while maintaining quality outcomes.

Universities continue to offer domestic places above the levels funded by government to meet the social and economic need for an educated and skilled population. As these additional places are not subsidised, the financial strain is borne directly by the sector, increasing its sustainability risk.

From 2020 onwards, universities will be able to grow their CGS funding for non designated courses above capped levels if performance criteria are met. Performance will be assessed across four measures – graduate employment outcomes, student success, student experience and participation of Aboriginal, low socio-economic status, and regional and remote students. This is to ensure that universities deliver quality teaching and produce skilled graduates for Victoria's workforce.

Appendix F. Glossary

Accountability

Responsibility of public sector entities to achieve their objectives in the reliability of financial reporting; effectiveness and efficiency of operations; compliance with applicable laws; and reporting to interested parties.

Asset

An item or resource controlled by an entity that will be used to generate future economic benefits.

Audit Act 1994

Victorian legislation establishing the Auditor-General’s operating powers and responsibilities and detailing the nature and scope of audits that the Auditor-General may carry out.

Audit committee

Helps a governing board to fulfil its governance and oversight responsibilities and strengthen the accountability of senior management.

Audit opinion

A written expression, within a specified framework, indicating the auditor’s overall conclusion about a financial (or performance) report based on audit evidence.

Calendar year

The period of a year beginning with 1 January and ending with 31 December.

Clear audit opinion

A positive written expression provided when the financial report has been prepared, which fairly presents the transactions and balances for the reporting period in keeping with the requirements of the relevant legislation and Australian Accounting Standards. Also referred to as an unqualified audit opinion.

Control environment

Processes within an entity’s governance and management structure that provide reasonable assurance about the achievement of an entity’s objectives in the reliability of its financial reporting, the effectiveness and efficiency of its operations, and compliance with applicable laws and regulations.

Controlled entities

Those that universities receive benefits from and are able to influence the extent of those benefits through any rights they have to direct the activities of those entities.

Current asset

An asset that will be sold or realised within 12 months of the end of the financial year being reported on, such as term deposits maturing in three months or stock items available for sale.

Current liability

A liability that will be settled within 12 months of the end of the financial year being reported on, such as payment of a creditor for services provided to the entity.

Debt

Money owed by one party to another party.

Depreciation

Systematic allocation of the value of an asset over its expected useful life, recorded as an expense.

Disclaimer of opinion

Statement expressed if the auditor is unable to obtain sufficient appropriate audit evidence on which to base an audit opinion, and the auditor concludes that the possible effects on the financial (or performance) report of undetected misstatements, if any, could be both material and pervasive.

Disclosure error