Freight Outcomes from Regional Rail Upgrades

Overview

This audit examined whether regional rail upgrades are improving rural freight outcomes in a timely and cost-efficient way.

We examined whether:

- governance arrangements for the selected regional rail upgrades supported informed decision-making

- agencies delivered selected regional rail upgrades according to approved scope, time, cost, and quality expectations

- the selected regional rail upgrades have realised expected benefits for freight.

Transmittal letter

Independent assurance report to Parliament

Ordered to be published

VICTORIAN GOVERNMENT PRINTER March 2020

PP No 117, Session 2018–20

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of the Audit Act 1994, I transmit my report Freight Outcomes from Regional Rail Upgrades.

Yours faithfully

Andrew Greaves

Auditor-General

18 March 2020

Acronyms

Acronyms

| BCR | benefit-cost ratio |

| BLU | Ballarat Line Upgrade |

| DEDJTR | Department of Economic Development, Jobs, Transport and Resources |

| DoT | Department of Transport |

| DTF | Department of Treasury and Finance |

| FPRSP | Freight-Passenger Rail Separation Project |

| HVHR | High Value High Risk |

| KPI | key performance indicator |

| MBRP | Murray Basin Rail Project |

| MMJV | McConnell Dowell and Martinus Rail joint venture |

| MTIA | Major Transport Infrastructure Authority |

| ONRSR | Office of the National Rail Safety Regulator |

| OPV | Office of Projects Victoria |

| PAR | project assurance review |

| PSC | project steering committee |

| PTV | Public Transport Victoria |

| RPV | Rail Projects Victoria |

| RRR | Regional Rail Revival |

| SRO | senior responsible officer |

| TAL | tonne axle load |

| TSR | temporary speed restriction |

| VAGO | Victorian Auditor-General’s Office |

| V/Line | V/Line Corporation |

Abbreviations

| the business case | Improving the competitiveness of the Murray Basin region |

| the Freight Plan | Victorian Freight Plan 2018–50 |

Audit overview

In regional Victoria, the rail freight network transports commodities to national and export markets. Expected growth in global demand for Victoria’s agricultural produce, grains and mineral commodities will increase demand on this network.

This audit examines whether regional rail upgrades are improving rural freight outcomes in a timely and cost-efficient way. We reviewed two major regional rail upgrade programs:

- the $440 million Murray Basin Rail Project (MBRP), and the complementary $130 million Freight-Passenger Rail Separation Project (FPRSP)

- freight-related components of three upgrade projects within the $1.75 billion Regional Rail Revival (RRR) program. These projects are along the Gippsland, Shepparton and Warrnambool rail corridors.

The Victorian Government announced the MBRP in 2014 as a once in a generation upgrade for much of the state’s regional rail freight network. It expected to complete the project by 2018.

The MBRP and the FPRSP have the potential to improve the competitiveness and reliability of rail freight for regional Victoria. Rail freight’s contestability is key because the cost of road freight and its easily available infrastructure make it increasingly attractive for freight operators. Reliability is also key for transporting bulk commodities and containerised freight over longer distances—for example, to export ports—and aligns with the rail strategies and goals in the government’s Victorian Freight Plan 2018–50 (the Freight Plan).

The direct outcomes expected from the projects are improved freight efficiency in the Murray Basin region; rail standardisation; reduced costs; easier access to export ports; and improved logistical flexibility to support more freight on rail. There are also wider social and economic benefits expected.

For our audit, we examined whether:

- governance arrangements for the selected regional rail upgrades supported informed decision-making

- agencies delivered selected regional rail upgrades according to approved scope, time, cost, and quality expectations

- the selected regional rail upgrades have realised expected benefits for freight.

Conclusion

The regional rail upgrades we reviewed are not yet improving rural freight outcomes in a timely and cost-efficient way.

Governance arrangements for the MBRP have been suboptimal, with different agencies responsible for different elements of the project over time. This has led to patchy corporate memory for the planning and delivery of the project. It has also diffused senior officer accountability for project outcomes due to the many changes of key personnel since the project started.

The MBRP and FPRSP have not met scope, time, cost or quality expectations. These projects are late and will require a considerable injection of new funds if their intended outcomes are to be fully realised.

From a project and program management perspective we identified deficient project planning, cost estimation and scoping by the Department of Transport’s (DoT) predecessor agencies. V/Line Corporation’s (V/Line) inadequate contract and project management has also contributed to project delays and cost overruns for the MBRP Stage 2 works.

As a result, the MBRP and FPRSP rail upgrades have not yet realised the expected freight-focused benefits.

Findings

Project planning and delivery to date

Project status

At the time of this report, V/Line and DoT have delivered about half of the approved MBRP scope (Stages 1 to 4) using $381.5 million (86.7 per cent) of the originally approved budget up to Stage 4.

V/Line is responsible for completing any unfinished Stage 2 works, while Rail Projects Victoria (RPV) is now responsible for delivering any remaining stages of the project, working closely with DoT.

The government is reassessing delivery of the remaining stages of the MBRP. According to the original business case timelines, completion of Stage 2 is now three years late. Works within undelivered stages include the standardisation of track from Dunolly to Manangatang and Sea Lake, and dual-gauge track conversion from Gheringhap to Maryborough via Ballarat.

Achievement of the expected benefits from the MBRP will not occur without more funding to complete the expected and approved project scope. As a result, the economic analysis for the project in the original 2014 business case is no longer accurate and requires revision.

The RRR projects we reviewed have recently begun their procurement phase, so it is too early to say whether they will achieve expected outcomes. Although these projects are primarily passenger-oriented, they include some planned outcomes related to freight.

Without a more explicit alignment to Victoria’s wider rail freight policy goals, these RRR projects may not achieve wider freight outcomes.

Business case

The approved business case for the MBRP—Improving the competitiveness of the Murray Basin region (the business case)—included over-optimistic expectations about the level of demand from rail freight users, and untested assumptions about the project’s complexity and therefore the time required and likely cost.

The optimism bias in the expectations arose from:

- incomplete engagement with key stakeholders

- limited analysis of current and future rail freight stakeholder needs

- DoT and V/Line’s limited understanding of the dilapidated nature of the network’s assets.

These project planning expectations adversely affected project delivery.

|

DoT began operations on 1 January 2019 and absorbed most of PTV’s functions on 1 July 2019. For this report, we refer to actions taken by the former Department of Economic Development, Jobs, Transport and Resources (DEDJTR), and Department of Transport, Planning and Local Infrastructure—in operation from 2015 to 2018—and PTV as taken by DoT. |

DoT and V/Line’s lack of detailed knowledge about the condition of the rail freight network that the MBRP would upgrade also led to engineering and construction difficulties during the renewal works.

Procurement process for the MBRP

V/Line’s early contractor procurement process demonstrated that the market could not deliver the desired project scope within the approved time and cost allocations.

As a result of the tender outcome, V/Line sought to reallocate more funding to the early MBRP stages. The government agreed to this in June 2017.

This market response should have prompted DoT, as sponsor agency, to undertake more due diligence on the MBRP’s scope and query the assumptions and expectations in the business case.

However, this did not occur. Because of tight project time frames, reinforced by the government’s public announcements on expected time and cost, V/Line selected a contractor—with approval from Public Transport Victoria (PTV) and DoT—and signed an agreement.

|

A latent defect is a defect that could not have been identified through reasonable inspection. |

During the contract negotiation process, V/Line undertook a general assessment of risks but did not assess many specific project risks. In particular, it did not explicitly analyse the potential cost impact of significant risks that the contractor negotiated to transfer back to V/Line such as latent defects in the network and ground conditions. V/Line advised us that cost and risk allocation at this stage was difficult given V/Line’s lack of information on ground conditions and the extent of latent defects.

Variations, disputes and delay claims

Soon after the contractor began work on the MBRP, it lodged many variations, notices of delay, and extensions of time requests. During the MBRP delivery period, V/Line assessed 81 contractor claims and variations, and accepted 32 of them. The reasons for these claims and variations included project design changes, additional works required as a result of scope changes, and delayed delivery of materials supplied by V/Line. These claims heavily impacted V/Line’s time, cost, and risk contingency baselines for the MBRP works.

V/Line did not update key project documents to reflect these contractor variations and changes to the project scope, time, and cost expectations. Further, V/Line used a single register to record both project changes and contract variations. This meant that V/Line did not have a distinct process to monitor, report, and address a project change, as opposed to a contract variation, and it could not appropriately address risks arising from these project changes.

Some of the disputes and delay claims were because V/Line did not deliver its obligations under the contract. For example, V/Line was late supplying rail and delivered track turnouts to the contractor without the information needed to assemble them.

V/Line rejected 11 of the contractor’s claims. V/Line also commissioned specialist advice to help it consider the remaining contractor claims, and used an external expert to verify the actual works performed or materials used.

The contractor lodged variation claims amounting to 24 per cent above the originally agreed contract price. Following consideration of the claims, negotiation, and verification of the value of delivered works, V/Line settled the claims with the contractor for 11.6 per cent more than the original contact price. This indicates that the contract’s original scope, cost and timing expectations were unrealistic.

Delivery performance

V/Line underperformed during the delivery of MBRP Stage 2 works. V/Line did not adequately apply contract management processes and did not effectively mitigate manageable project delivery risks that it identified early in the delivery phase of MBRP Stage 2.

V/Line intervened in the project in March 2018 after the Office of the National Rail Safety Regulator (ONRSR) identified a safety breach at one work site. This breach resulted in V/Line immediately issuing a whole-of-project cease work order to the contractor, the McConnell Dowell and Martinus Rail joint venture (MMJV). Soon after, the contractor demobilised its project workforce, leaving elements of Stage 2 works incomplete.

V/Line and the MMJV negotiated a settlement to the various claims between the parties, signed in July 2018.

The settlement resolved most commercial risks for V/Line arising from the MBRP Stage 2 works. However, it did not resolve the risk that future stages of the MBRP would remain incomplete. Both DoT and V/Line undertook project reviews to consider the delivery of future stages of the MBRP and risk to delivery of those stages.

The government allocated responsibility for delivery of future stages of the project to RPV in June 2018. Under this arrangement, RPV has the option to use V/Line resources on a fee-for-service basis. Despite this reallocation of responsibility, the government has not yet specified a revised completion date for the MBRP as part of the review of the business case.

Stakeholder engagement

Stakeholder engagement has been inconsistent throughout the life of the project. Many agencies have been involved in discussions with various parties with an interest in the success of the MBRP. Although DoT and V/Line sought stakeholder views on project-related matters, we did not see evidence of consistent analysis of stakeholders’ perspectives in project status reports or briefings to senior decision-makers.

The Australian Government is a key stakeholder in the MBRP—they made a $220 million co-contribution to the project.

During project delivery, the Australian Government made two requests for appraisal of the status of the project. However, the interactions and information flows on specific project issues from DoT to the Australian Government were not always forthright or timely.

Project scrutiny and responses

The project failures that have occurred have happened despite review processes, reflecting lack of timely and effective action to address identified issues.

HVHR and Gateway review process scrutiny

|

A Gateway review process is undertaken by an independent external reviewer team to examine projects and programs at six key decision points in their lifecycle: 1. Concept and feasibility 2. Business case 3. Readiness for market 4. Tender decision 5. Readiness for service 6. Benefits analysis. |

The project has been subject to the Department of Treasury and Finance’s (DTF) High Value High Risk (HVHR) review mechanism, which includes the Gateway review process.

The government designated the MBRP as a HVHR project, which requires intensive scrutiny by DTF and full application of the Gateway review process at each project stage.

Although DoT and V/Line followed these DTF processes, they did not effectively mitigate problems identified at key review points.

Multiple senior responsible officers through project stages

Since inception, the project has had four senior responsible officers (SRO) in three different agencies.

The SROs and their parent agencies’ implementation of the recommendations arising from the Gateway reviews has been neither effective nor timely. New SROs joined the project, but their predecessors did not brief them on, or give them, Gateway review recommendations from previous reports.

Gateway review ratings

|

According to DTF’s guidance, a ‘red’ rating means the Gateway review team believe that the issues they have identified are critical and urgent, and to achieve success the project or program should take action immediately. |

At each of the Gateway review points, the MBRP received an overall ‘red’ rating:

- Gate 1/2 (combined): Strategic assessment/Business case (August 2015)

- Gate 3: Readiness for market (October 2016)

- ;Gate 4: Tender decision (May 2017).

Each MBRP Gateway review also identified specific ‘red’ recommendations that required an action plan to be submitted to the Treasurer, via DTF.

Oversight by senior officers

DoT and V/Line intensified senior officer scrutiny of the MBRP after the MMJV ceased project works in March 2018. However, by this point options for completing the original scope within budget had become limited.

The extra scrutiny by DoT and V/Line included:

- engaging the Office of Projects Victoria (OPV) to carry out a comprehensive review of the project

- weekly reporting to the Minister for Public Transport’s office on project status

- commissioning an independent review of the project management costs

- fortnightly meetings between RPV, V/Line and DoT to address project deficiencies in a coordinated manner

- capability support for V/Line to deliver unfinished components of Stage 2 of the project after the contractor had ceased work.

Lessons learnt review

|

A PAR is a review of a project or program’s progress, objectives, governance and readiness. A team of public and private sector reviewers undertake it, usually before a key milestone or decision point. They then provide the outcome of the review to government. PARs are designed to improve delivery confidence, reduce ‘scope creep’ and allow for wider stakeholder engagement. |

In May 2018, V/Line engaged a consulting firm to review the project to establish what lessons it could learn. The review made 25 recommendations, including five priority recommendations focused on project risk management along with others on clarifying project roles, responsibilities and accountabilities, and reviewing and updating project documentation.

Project assurance review

In June 2018 at the request of DoT, OPV completed a project assurance review (PAR) and gave the project an ‘amber’ delivery confidence rating. This rating meant that while the project had significant issues, they should not impact on cost, time and quality if addressed promptly.

The review gave 12 recommendations, including three ‘amber’ and nine ‘red’ recommendations. A ‘red’ recommendation is categorised as critical.

DoT has used the findings and observations from both reports to inform briefings to ministers as well as options to government on progressing future stages of the project.

Achieving expected benefits

The need for a reliable and fit-for-purpose rail freight network, as identified in the MBRP business case, still exists. However, DoT, RPV and V/Line need to resolve many issues before they can achieve the expected benefits.

Cost pressures

DoT has advised the government that the project’s original scope cannot be fully delivered with the remaining funds.

DoT advised us that a MBRP business case review is underway and will provide scope and phasing options, as well as identify the cost to complete the project, based on whichever option the government chooses. DoT advised us that it was aiming to present this revised business case to government in early 2020, but it had not been completed when we published this report.

Unresolved project challenges

|

TAL refers to the tonne weight bearing on the rail track. The maximum TAL is determined by factors including weight of rails, train speeds, rolling stock configuration, and strength of earthworks. Exceeding the maximum allowable TAL could damage the track or cause a derailment. All rail track in Victoria has a designated track class rating out of 5, with 1 being the highest quality. This rating determines the maximum possible speed, and the amount of maintenance and track infrastructure components required. Rail track with a 5 rating is used on short or infrequently used lines, which require less maintenance. A passing loop is a section on a single-lane railway that enables trains travelling in opposite directions to pass each other. It also allows trains going in the same direction to overtake. |

DoT and V/Line need to address a range of technical challenges to achieve the original project’s expected benefits and outcomes:

- Due to a pause in re-gauging the rail from Maryborough to Gheringhap (via Ballarat and the inland route to Geelong), rail freight users face a route from Mildura/Yelta to port that is now 128 kilometres longer than the original broad-gauge route.

- The route to key export ports has a 19-tonne axle loading (TAL) restriction for most standard gauge operators using the network, even though the MBRP project business promised to increase axle loads to 21 TAL. At present, 21 TAL is only achievable in specific technical wheel size and wagon configurations due to the limitations of the Ararat to Maryborough track section.

- The Ararat to Maryborough track section was substantially rebuilt during the MBRP Stage 2 works using mainly legacy rail. As a result, this track remains at the class 4 rating, the same as when the line last ran in the early 1990s. Under V/Line’s standards, this old rail requires lower line speeds for the section from Avoca to Ararat and low axle loads (19 TAL) for the standard gauge rolling stock used by most rail freight operators. This represents a significant missed opportunity to have improved this section of the line by including fit-for-purpose rail in the original costings and scope.

- Remaining temporary speed restrictions (TSR), particularly on the Ararat to Maryborough section, are causing slow track speeds in some sections.

Reduced operational flexibility for freight operators

During this audit, a major rail freight operator asserted that the MBRP had reduced their operational flexibility. To support this, they provided examples of decommissioned wagon storage sidings and removal of a passing loop at Maryborough Yard which, in their view, had reduced the number of trains and wagons that can stage or pre-position through the network.

DoT advised us that the decommissioning of sidings had been consented to by key freight users and that the Maryborough passing loop was removed due to new rail engineering and safety standards.

Availability of suitable rolling stock

|

Broad gauge refers to railway with a track width of |

Through the MBRP, the government sought to standardise broad-gauge sections of Victoria’s regional rail track. Although interstate connections were not specifically identified as a benefit in the business case, standardising this track would enable trains in Victoria to connect with standard-gauge interstate rail, which would increase the logistical flexibility of exporting commodities from regional Victoria. The business case did acknowledge that access to standard gauge rail in a predominantly broad-gauge state is fundamental to maintaining an efficient and cost-effective supply chain.

In anticipation of this outcome, some rail freight users divested their broad gauge rolling stock. Broad-gauge rolling stock is in limited supply, and these users may now need to lease back broad-gauge wagons at a potentially higher cost.

This could increase rail haulage costs on the unfinished components of the MBRP, which is contrary to the project’s aim to reduce rail freight costs.

Risks to achieving the original project benefit-cost ratio

|

A BCR is used in cost benefit analyses to indicate the overall value for money of a project. It is the ratio of the benefits of a project relative to its costs. Where a project has a BCR that is higher than 1.0 (a positive BCR) this means that the benefits outweigh the costs. |

Infrastructure Australia assessed the original MBRP business case as having a positive benefit-cost ratio (BCR) of 1.7.

After this assessment, the Australian Government co-funded the MBRP with an expectation that the Victorian Government would fully deliver the approved scope and proposed benefits.

At the time of this report, V/Line and DoT have delivered about half of the approved scope using 86.7 per cent of the originally approved budget up to Stage 4.

Given this, and with the MBRP main works currently paused, it is unlikely that the project will generate the economic and community benefits expected in DoT’s business case.

Impact on freight policy goals

Due to the pause on funded MBRP works and uncertainty around future strategies to improve the rail freight network, rail freight might become less attractive or less economically competitive than road.

This would undermine the government’s long-term policy goal of shifting freight from road to rail when it makes economic and environmental sense to do so.

A longer-term shift of regional freight to rail has economic benefits such as improved community amenity and road safety, as well as reduced road maintenance costs for local governments.

Rail freight also promotes integration and efficiency of national and international supply chains, particularly for bulk and containerised freight.

Reviewing the original business case

The Victorian Government’s recent desire to review the original business case and assess the state of the Murray Basin rail freight network is a pragmatic and useful way to re-baseline the time, cost and scope expectations in the MBRP approved business case.

This work should also allow V/Line and RPV to conduct appropriate due diligence on the rail freight network’s asset condition and help DoT and V/Line better understand the needs of rail freight operators and users in regional Victoria.

To help the project move forward, DoT’s Freight Victoria division, with V/Line’s support, needs to engage with industry and project stakeholders such as rural industry, packers and exporters, rail freight operators, local communities, local governments, peak bodies and the Australian Government. This engagement could include sharing and understanding lessons learnt from the MBRP delivery to date, as well as options for next steps.

A more comprehensive understanding of regional freight user needs and the network condition will help DoT and V/Line give quality and credible advice to the Victorian and Australian governments on an amended strategy to deliver the outcomes and benefits that the business case envisioned.

Recommendations

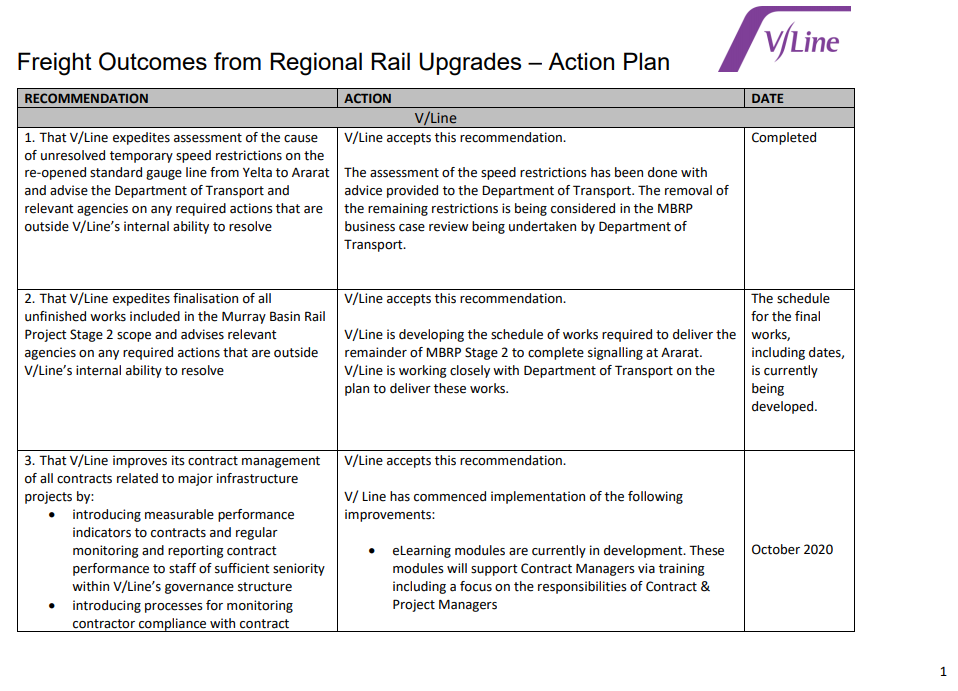

We recommend that V/Line Corporation:

1. expedites assessment of the cause of unresolved temporary speed restrictions on the re-opened standard-gauge line from Yelta to Ararat and advises the Department of Transport and relevant agencies on any required actions that are outside V/Line’s internal ability to resolve

2. expedites finalisation of all unfinished works included in the Murray Basin Rail Project Stage 2 scope and advises relevant agencies on any required actions that are outside V/Line’s internal ability to resolve

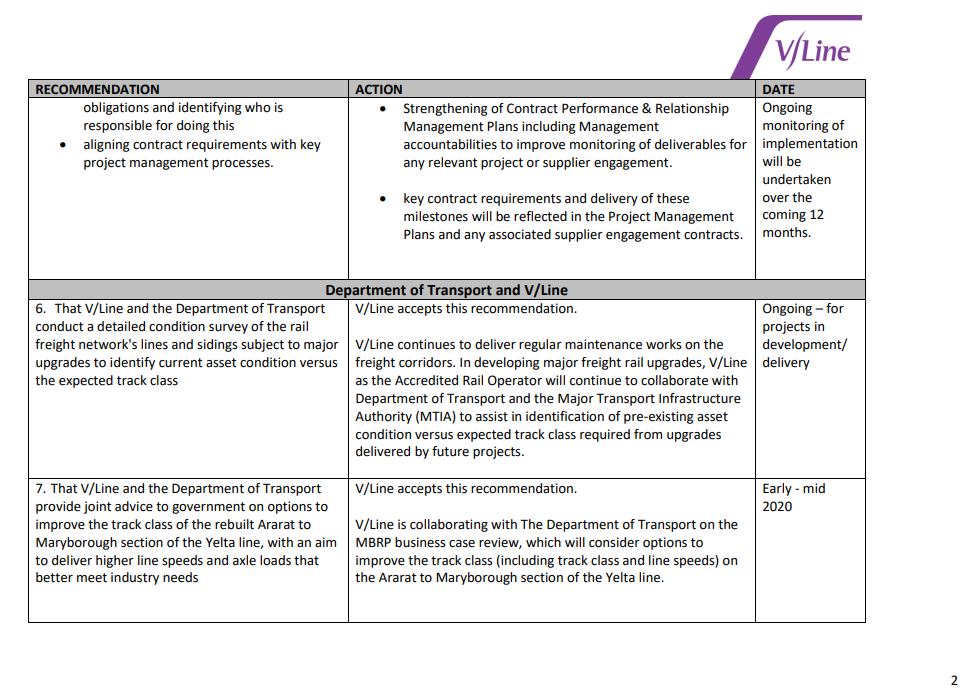

3. improves its contract management of all contracts related to major infrastructure projects by:

- introducing measurable performance indicators to contracts and regular monitoring and reporting of contract performance to staff of sufficient seniority within V/Line’s governance structure

- introducing processes for monitoring contractor compliance with contract obligations and identifying who is responsible for doing this

- aligning contract requirements with key project management processes.

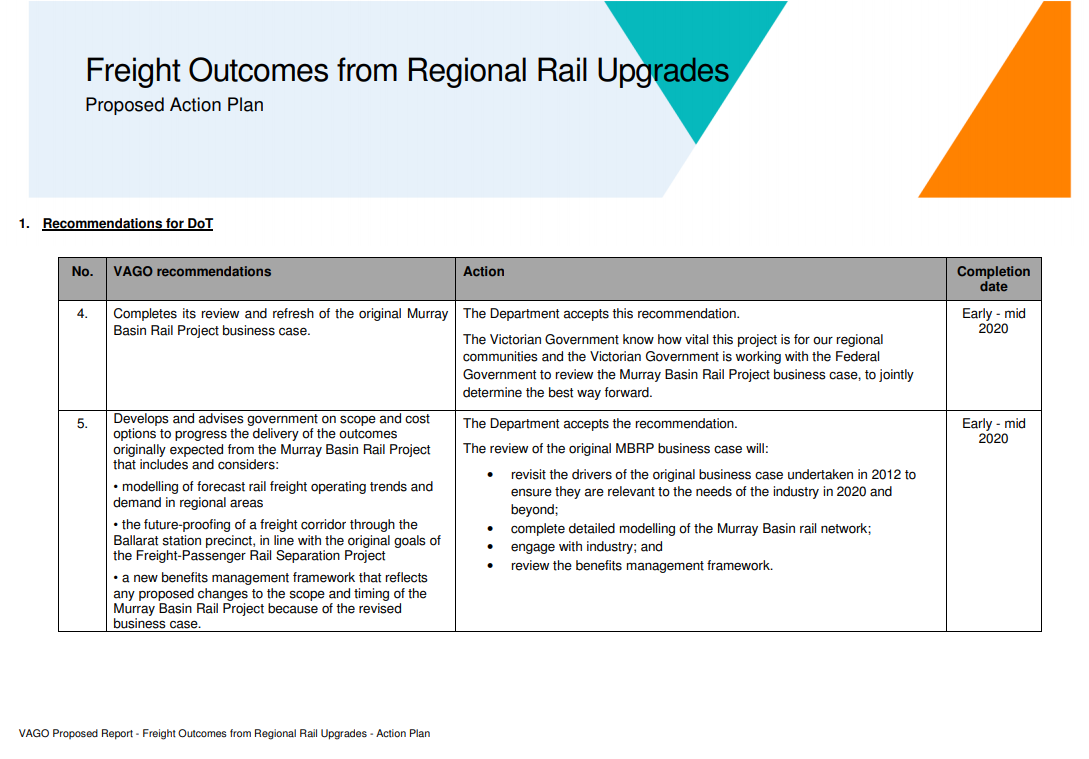

We recommend that the Department of Transport:

4. completes its review and refresh of the original Murray Basin Rail Project business case

5. develops and advises government on scope and cost options to progress the delivery of the outcomes originally expected from the Murray Basin Rail Project that includes and considers:

- modelling of forecast rail freight operating trends and demand in regional areas

- the future-proofing of a freight corridor through the Ballarat station precinct, in line with the original goals of the Freight-Passenger Rail Separation Project

- a new benefits management framework that reflects any proposed changes to the scope and timing of the Murray Basin Rail Project because of the revised business case.

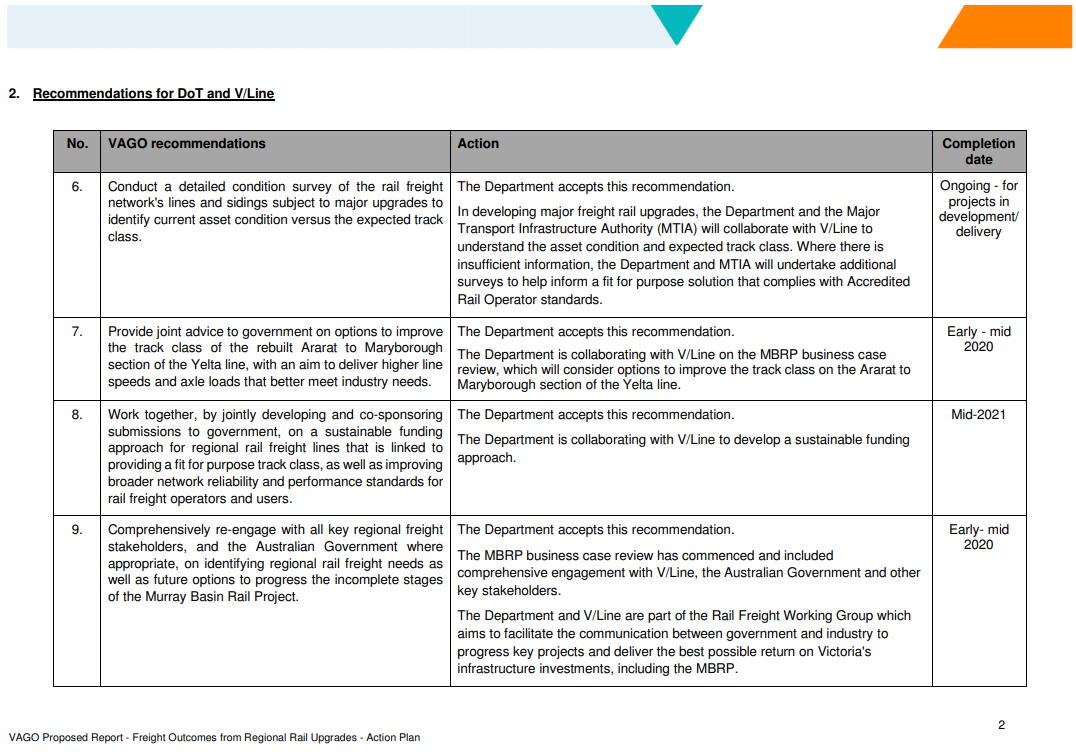

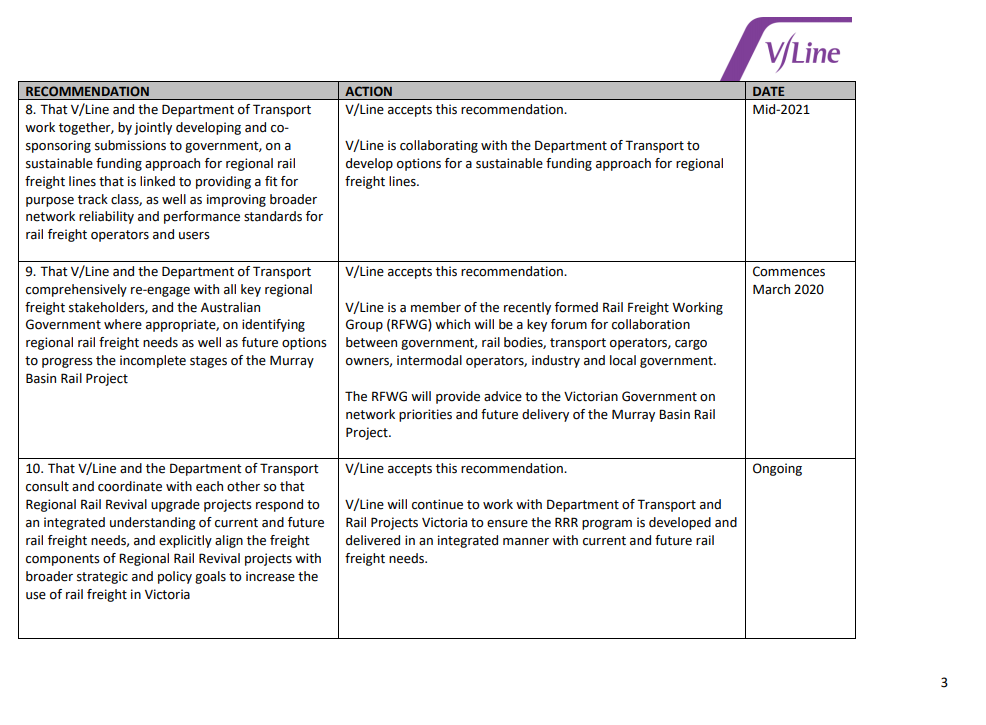

We recommend that V/Line Corporation and the Department of Transport:

6. conduct a detailed condition survey of the rail freight network’s lines and sidings subject to major upgrades to identify current asset condition versus the expected track class

7. provide joint advice to government on options to improve the track class of the rebuilt Ararat to Maryborough section of the Yelta line, with an aim to deliver higher line speeds and axle loads that better meet industry needs

8. work together, by jointly developing and co-sponsoring submissions to government, on a sustainable funding approach for regional rail freight lines that is linked to providing a fit-for-purpose track class, as well as improving broader network reliability and performance standards for rail freight operators and users

9. comprehensively re-engage with all key regional freight stakeholders, and the Australian Government where appropriate, on identifying regional rail freight needs as well as future options to progress the incomplete stages of the Murray Basin Rail Project

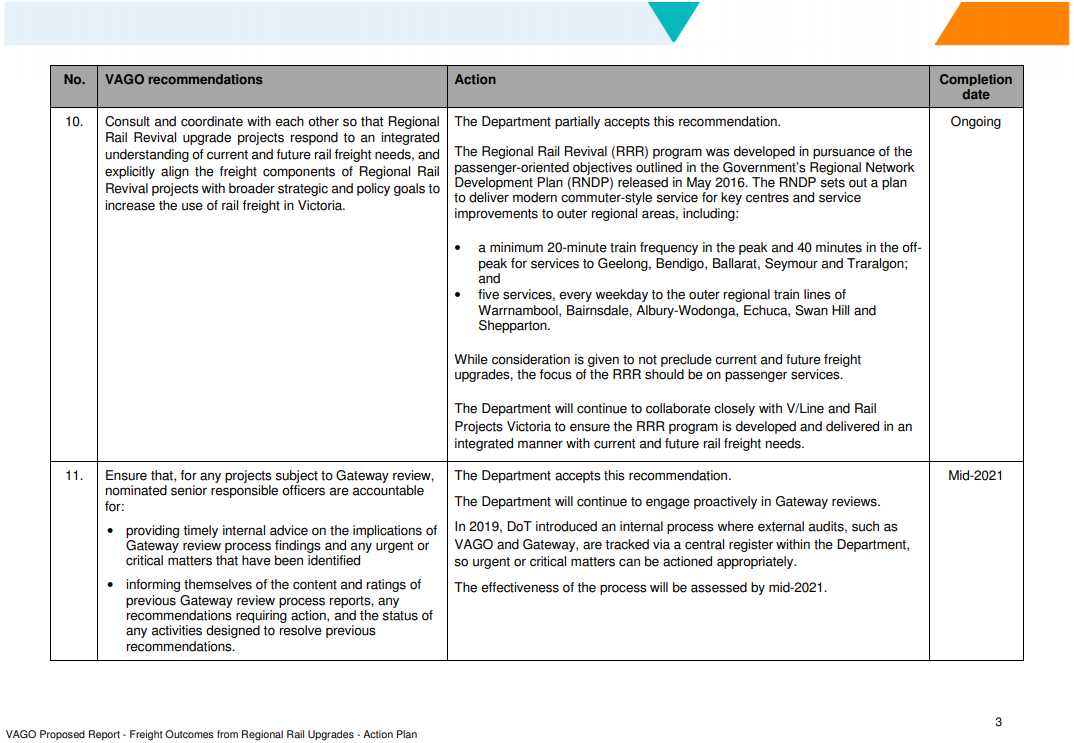

10. consult and coordinate with each other so that Regional Rail Revival upgrade projects respond to an integrated understanding of current and future rail freight needs, and explicitly align the freight components of Regional Rail Revival projects with broader strategic and policy goals to increase the use of rail freight in Victoria

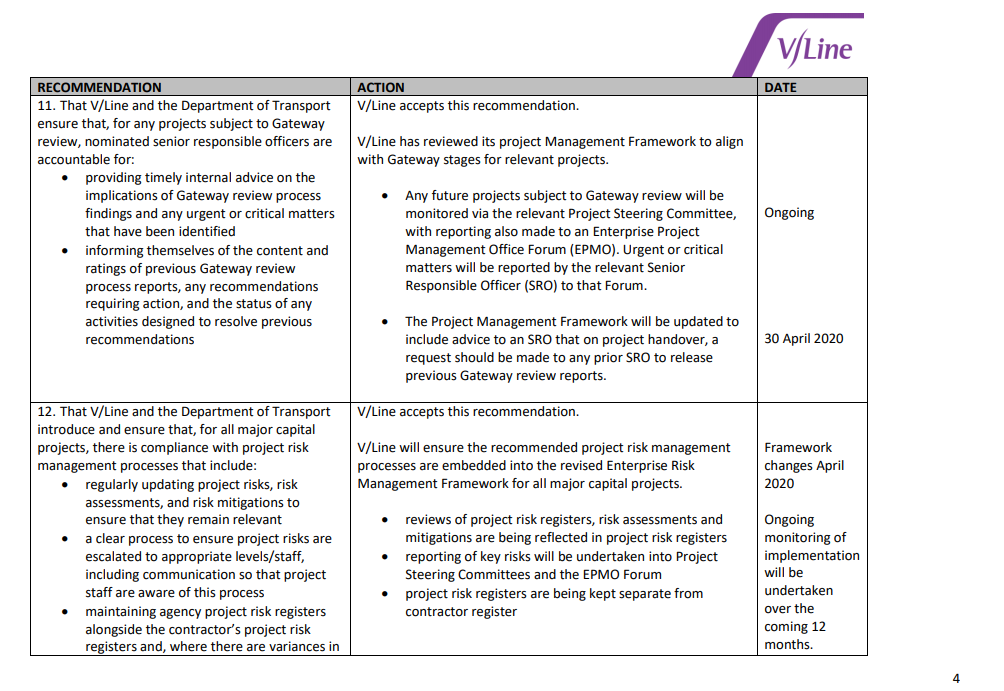

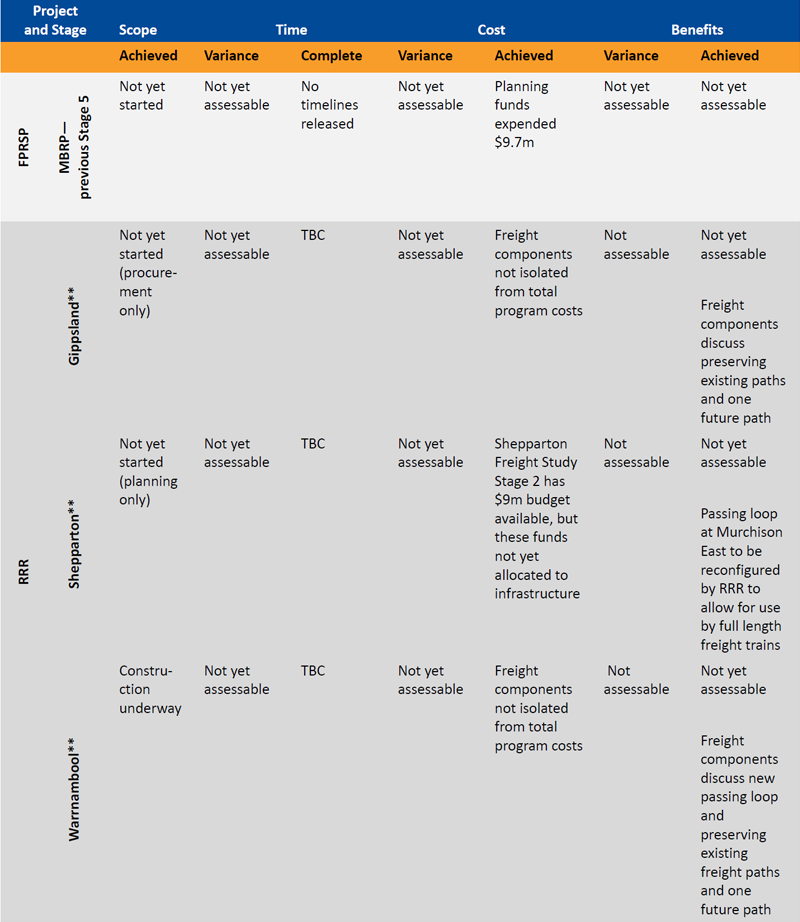

11. ensure that, for any projects subject to Gateway review, nominated senior responsible officers are accountable for:

- providing timely internal advice on the implications of Gateway review process findings and any urgent or critical matters that have been identified

- informing themselves of the content and ratings of previous Gateway review process reports, any recommendations requiring action, and the status of any activities designed to resolve previous recommendations.

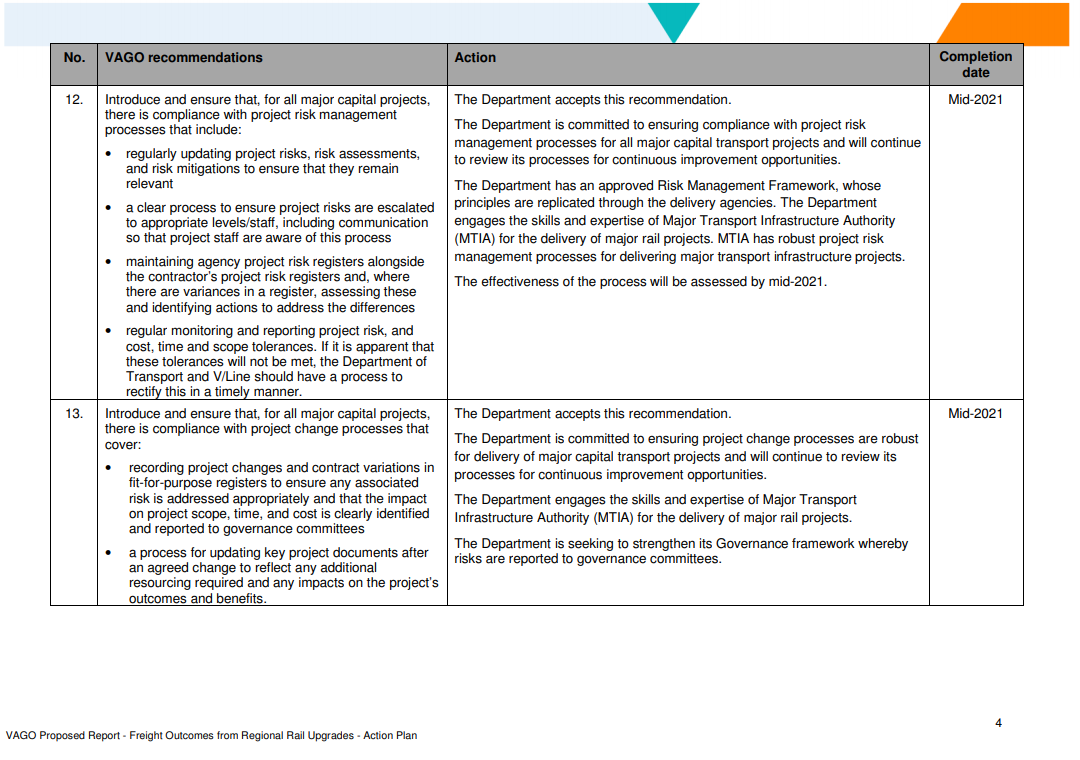

12. introduce and ensure that, for all major capital projects, there is compliance with project risk management processes that include:

- regularly updating project risks, risk assessments, and risk mitigations to ensure that they remain relevant

- a clear process to ensure project risks are escalated to appropriate levels/staff, including communication so that project staff are aware of this process

- maintaining agency project risk registers alongside the contractor’s project risk registers and, where there are variances in a register, assessing these and identifying actions to address the differences

- regular monitoring and reporting of project risk, and cost, time and scope tolerances. If it is apparent that these tolerances will not be met, the Department of Transport and V/Line should have a process to rectify this in a timely manner.

13. introduce and ensure that, for all major capital projects, there is compliance with project change processes that cover:

- recording project changes and contract variations in fit-for-purpose registers to ensure any associated risk is addressed appropriately and that the impact on project scope, time, and cost is clearly identified and reported to governance committees

- a process for updating key project documents after an agreed change to reflect any additional resourcing required and any impacts on the project’s outcomes and benefits.

Responses to recommendations

We have consulted with DoT and V/Line and we considered their views when reaching our audit conclusions. As required by the Audit Act 1994, we gave a draft copy of this report to these agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet.

The following is a summary of those responses. We include the full responses in Appendix A.

- V/Line accepted the recommendations directed to it and has produced an action plan detailing how it will address them.

- DoT accepted all but one recommendation, which it partially accepted. DoT has produced an action plan detailing how it will address the recommendations.

1 Audit context

Regional Victoria is a significant contributor to Australia’s national and export economy.

In 2017–18, Victoria’s total food and fibre exports were worth $14.1 billion, ranking the state as Australia’s largest agriculture producer. During this period, Victorian grain exports were worth $1.5 billion.

Victoria also has large deposits of rutile and zircon mineral sands. All major mining and mineral sands processing operations stopped for these minerals in 2017 but may resume if market conditions become favourable.

When ready for sale, commodities are transported by road or rail to national markets or Victoria’s three main export ports at Geelong, Melbourne and Portland.

These commodities, their freight transport mode, and their role in Victoria’s economy highlight the importance of the projects examined as part of this audit.

1.1 The important economic role of freight networks

For many primary industries, the cost of moving goods to market is a substantial part of overall production costs. Transporting freight over long distances to port is historically cheaper by rail than road, as rail can transport heavier and higher volumes over longer distances.

Investment by government in the road network, as well as the use of larger vehicles, has steadily improved road transport productivity. These trends, when combined with substandard rail network performance and a lack of investment in rolling stock and rail facilities at ports and terminals, have contributed to rail’s decline as an economically advantageous freight mode.

This has led to increasing supply chain costs for regional exporters who now move freight by road, due to an unreliable and inefficient rail network.

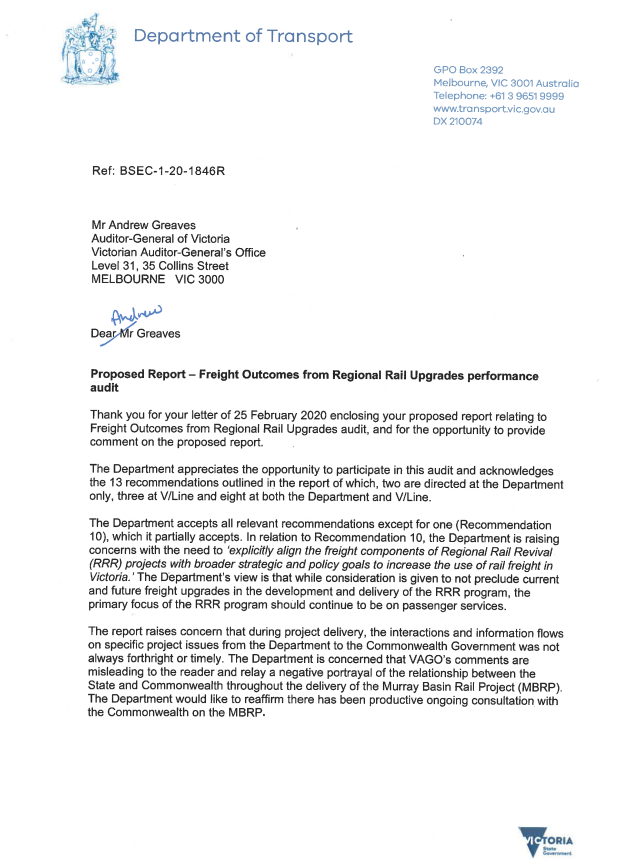

Figure 1A shows the value and impact of freight and logistics to Victoria.

Figure 1A

Freight and logistics in Victoria

Source: VAGO, based on Delivering the goods: Creating Victorian Jobs, Victorian Freight Plan 2018–50, Transport for Victoria, July 2018.

Recognising the importance of the freight sector to Victoria’s economy, the government endorsed the Freight Plan in July 2018.

The Freight Plan identifies a suite of short, medium and long-term initiatives to prepare Victoria’s freight and logistics sector for future growth, challenges and changes.

1.2 Focus of this audit

This audit examined two freight-related regional rail upgrade programs:

- the MBRP (funded for $440 million), which includes the FPRSP (funded for $130 million).

- the RRR project (funded for $1.75 billion, which is primarily for non-freight components).

Murray Basin Rail Project

The Murray Basin is a regional area in North West Victoria that produces and exports grains, mineral sands, fruit, vegetables and wine.

Although mineral sands are not currently transported by rail, agricultural produce is exported on the road and rail network to the ports of Melbourne and Geelong.

In 2014, the Victorian Government announced funding for the MBRP. According to a brochure released by PTV that year, the MBRP would ‘better connect key freight centres in Victoria with our ports and encourage competition and private investment in our rail freight network’.

The government committed to invest up to $220 million towards this project. In April 2016, the Australian Government matched this amount.

Freight-Passenger Rail Separation Project

In June 2018, the Victorian Government announced $130 million in funding for the FPRSP. This amount comprised $95 million from the state and a $35 million contribution from the Australian Government, which the state government allocated to Stage 2 of the Ballarat Line Upgrade (BLU).

The project seeks to deliver rail track and signalling improvements in the Ballarat precinct to maximise benefits for both the MBRP and the BLU, alongside passenger rail. The government allocated the delivery of the project to RPV, with V/Line and DoT seeking freight industry feedback on the project.

Key expected outcomes from the project are to:

- separate broad-gauge passenger service rail pathways from standard-gauge freight services through the Ballarat station precinct

- enable 42 weekly return freight paths from the Murray Basin region through Ballarat, with the ability to increase this to 65 if required, via the Ararat to Maryborough line

- allow greater line speed for freight services within the Ballarat rail corridor by improving track geometry.

By separating freight and passenger rail paths and reducing interfaces with passenger trains and passenger platforms, the project aims to enable faster and more reliable paths through Ballarat for freight trains.

Regional Rail Revival

The RRR is a $1.75 billion program to provide faster and more reliable services for every regional passenger train line in Victoria by 2022. Three freight-relevant upgrades within this program are on the Warrnambool, Gippsland and Shepparton lines.

Although these three projects do not focus on freight, they accommodate existing freight services and seek to preserve their future use. Figure 1B describes the scope of these three projects.

Figure 1B

Freight-relevant works in the RRR program

Note: A train path refers to the infrastructure capacity (signalling, level crossings and rail) required to run a train on a given route over a specific time period. Because of logistical issues, such as limited train paths and resource requirements, train operators must pre-book a path for a set time.

Source: VAGO, based on RPV, Regional Rail Revival, 15 October 2019, regionalrailrevival.vic.gov.au.

Shepparton line upgrade and freight study

RPV is delivering the Shepparton Corridor Upgrade (Stages 1 and 2) project as part of the RRR program. It is not included in the RRR funding agreement with the Australian Government and was fully funded by the Victorian Government ($345.9 million) in the 2017–18 and 2018–19 budgets.

In October 2019, DoT began a study to identify infrastructure improvements to maintain and enhance freight capacity on the Shepparton Line. This study, known as the Shepparton Rail Freight Planning Study, is Stage 1 of a $10 million two-stage project funded by the Victorian and Australian governments.

The objectives of the study are to:

- maintain and enhance freight capacity, efficiency and reliability

- mitigate the impact of increased passenger services on freight operations

- provide freight paths to meet demands over the next 20 years

- accommodate longer and heavier freight trains

- facilitate increased use of rail for freight purposes

- facilitate cheaper rail freight services.

The study is still in draft form so we did not assess it as part of this audit.

Ballarat Line Upgrade

The RRR program scope also includes the $557 million BLU.

The BLU project aims to deliver benefits for passengers, with works that enable extra services during peak and off-peak times and improvements to selected stations.

Although we have not examined this upgrade as part of our audit, the Victorian Government expanded the scope of BLU to include the FPRSP, prior to its pause in April 2019, pending the review of the MBRP business case.

1.3 The Murray Basin Rail Project

In 2014, the state government announced and funded the MBRP. This project intended to deliver freight rail line upgrades to rail infrastructure around the Murray Basin.

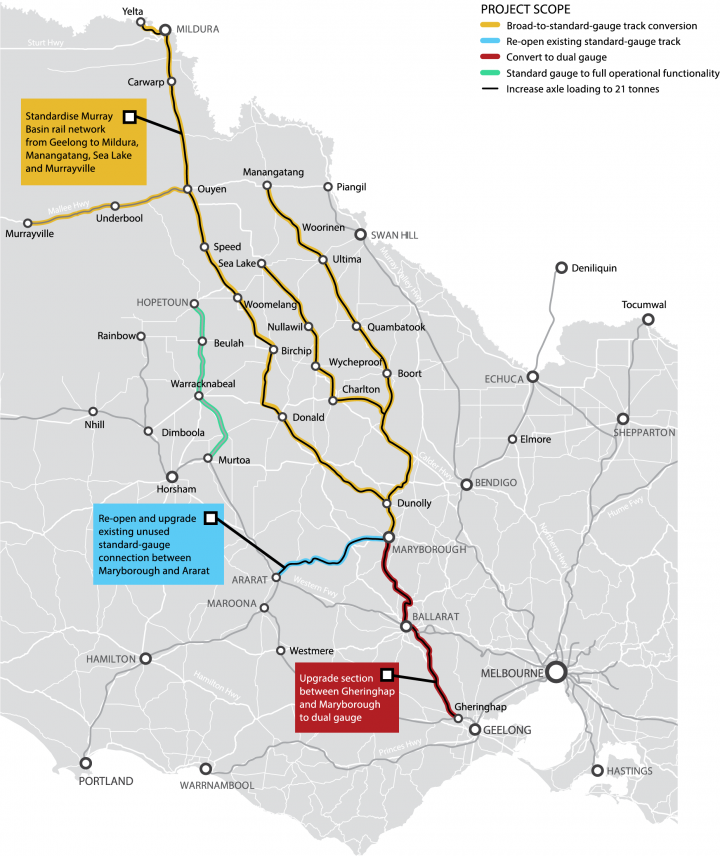

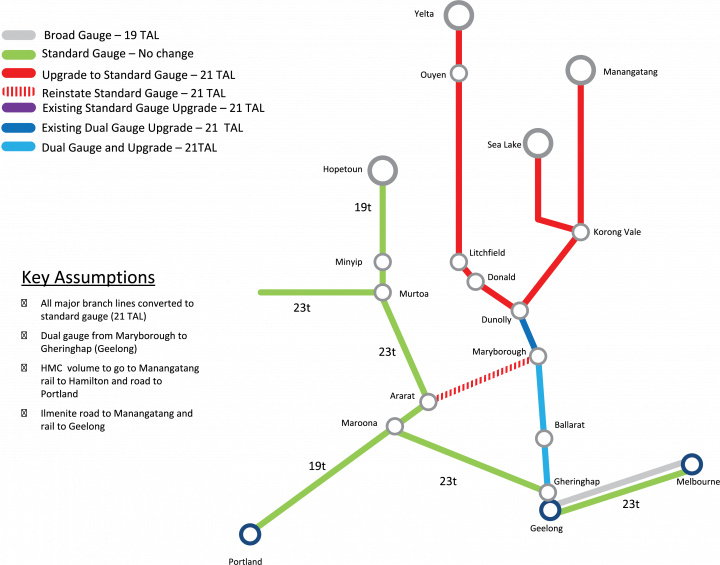

A key aim of the project was the standardisation of rail for the Yelta to Maryborough, Sea Lake to Maryborough, and Manangatang to Maryborough lines. That same year, PTV—the original client for the project—released a brochure containing the project scope map, shown in Figure 1C below.

Figure 1C

MBRP project scope map

Source: VAGO, based on Murray Basin Rail Project Summary Brochure, PTV, 2014.

By identifying these corridors for upgrade, PTV reiterated three key issues that the MBRP aimed to address:

- Lack of capacity due to lines only having an allowable 19 TAL for most freight trains operating on the network.

- Lack of competition between rail operators due to lines in the Murray Basin only allowing access to broad-gauge trains, and no access to other competitors operating standard-gauge rolling stock.

- Lack of competition between ports due to the Port of Portland being solely serviced by standard gauge, while the Port of Geelong and Port of Melbourne are serviced by broad and standard gauges.

Intended benefits and scope of the project

In 2014, PTV published the Murray Basin Rail Project Summary Brochure.

This brochure identified that the project was expected to lead to:

- up to an extra 500 000 tonnes of grain transported by rail per year

- 20 000 fewer truck trips annually to the ports of Geelong, Melbourne and Portland

- 276 construction jobs during the project’s implementation

- 1 130 kilometres of standardised rail gauge (including the Murrayville line)

- direct investment by rail operators in new rolling stock and bulk handlers in new loading facilities

- flow-on investment at the ports of Geelong, Melbourne, and Portland due to increased competition and as a direct result of the need to handle higher tonnages per train

- improved safety and liveability for communities in the region and near the ports as a result of reduced truck numbers.

DoT formalised the scope of the MBRP in the business case in July 2015. The business case characterised the MBRP as a ‘low complexity’ project.

The high-level objectives of the MBRP, according to the business case, are to:

- improve transport efficiency in the Murray Basin region

- complete Mildura to Geelong rail standardisation and enhance access to the Geelong, Melbourne and Portland ports for Victorian exports

- enable further logistical flexibility and ease of use of the Victorian rail network to support a shift to rail, thereby improving road safety, reducing road congestion and lowering road maintenance costs

- maximise opportunities to leverage private sector investment in the network and complementary infrastructure to support a commitment by government.

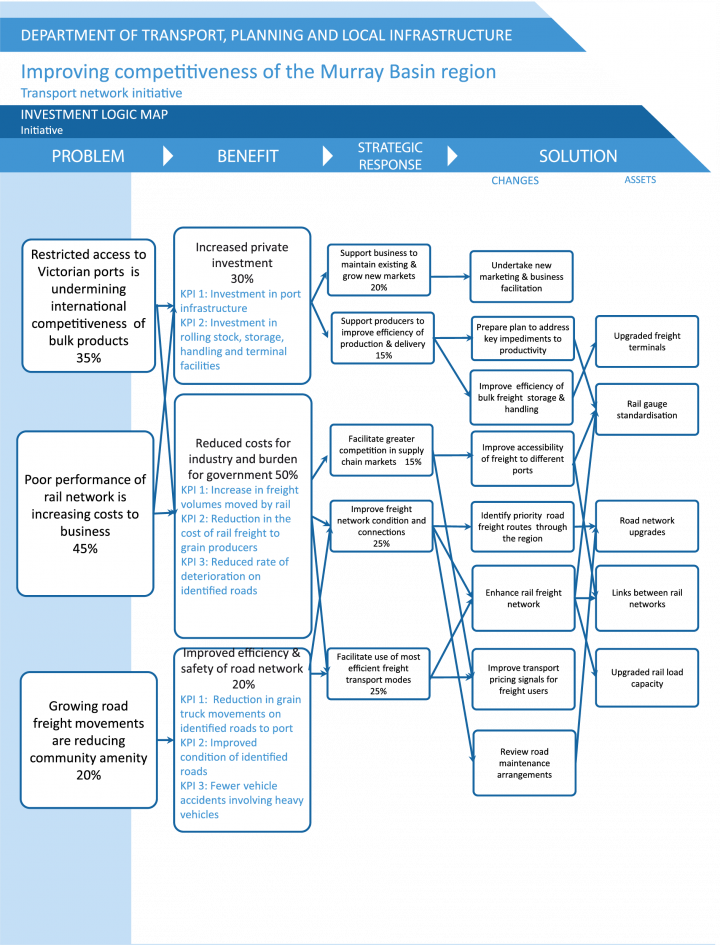

The business case for the MBRP also set three high-level benefits that were expected to accrue from the project, with eight supporting key performance indicators (KPI), as shown in Figure 1D.

Figure 1D

MBRP—benefits and KPIs

Source: Improving the competitiveness of the Murray Basin region, Transport Network Initiative—Final Business Case, DEDJTR, July 2015.

The business case identified four options to deliver these objectives and benefits. The preferred option is shown in Figure 1E.

Figure 1E

Preferred option rail configuration

Note: The ‘t’ used in the diagram (ie: 23t) refers to TAL.

Source: Improving the competitiveness of the Murray Basin region, Transport Network Initiative—Final Business Case, DEDJTR, July 2015, page 15.

Key elements of this preferred option include:

|

Standard gauge refers to railway with a track width of 1 435 millimetres. It is the most commonly used gauge in the world. As of November 2018, Victoria has 1 904 kilometres of standard gauge track. |

- standardisation of the entire existing Murray Basin freight rail network

- reinstatement of the Maryborough to Ararat line, which the previous private sector lessee closed in January 2005

- improved connectivity to the national standard gauge network at both Geelong and Ararat

- conversion of all standard branch lines to 21 TAL standard gauge.

Figure 1F shows how the business case set out these works across four stages.

Figure 1F

Four stages of the MBRP as covered in the business case

Source: VAGO, based on Improving the competitiveness of the Murray Basin region, Transport Network Initiative—Final Business Case, DEDJTR, July 2015, page 16.

|

A railway sleeper refers to a component of rail infrastructure that supports the metal rail of railroad tracks. Sleepers are laid perpendicular to the rails and support the load when trains pass. Sleepers are usually made of concrete or wood. |

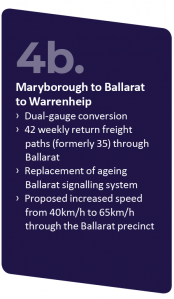

By April 2017, the government identified the need to undertake additional works through Ballarat. As a result of the MBRP and BLU, DoT advised the government that Ballarat would become a railway bottleneck due to ageing infrastructure, increasing transport demands and conflicting requirements between freight and passenger services.

Following the increased passenger services to be delivered as part of the BLU on the Ballarat Corridor, the government determined that the original MBRP scope was no longer a viable solution to address the increased demands on the Ballarat corridor.

The government subsequently identified works between Maryborough, Ballarat, and Warrenheip as the preferred option to address this issue. It named this option Stage 4b. The government recommended that Stages 2, 3 and 4 (seen in Figure 1F) of the project proceed for delivery while it would undertake a full review of scope and operations for Stage 4b to ensure that there was clear separation of freight from passenger operations. Figure 1G identifies the intended features of Stage 4b.

Figure 1G

MBRP 4b scope

Source: VAGO, based on information from DoT.

|

Dual-gauge refers to railway that allows the passage of broad and standard-gauge trains. |

In March 2018, the government renamed Stage 4b to Stage 5 of the MBRP. A key benefit expected from this stage was that it would enable standard-gauge freight trains to run from Melbourne or Geelong through Warrenheip to Maryborough. Passenger and freight trains could also run on the dual-gauge track from Ballarat to Maryborough. These works would also allow for the increase in weekly freight paths after the BLU.

In June 2018, the government incorporated Stage 5 into the scope of the BLU project (within the RRR program) and into what would become the FPRSP.

In April 2019, prior to the public announcement that the MBRP would not achieve timing expectations, the government deferred further work on the FPRSP, pending review of the MBRP business case.

Budget for the project

|

A P50 estimate is a statistical methodology used to describe the outcome of a risk event. This particular estimate states that there is a 50 per cent likelihood that the final project cost will not exceed the funding provided. A |

In August 2014, the Victorian Government allocated $220 million for the MBRP (based on a P50 estimate). The Australian Government matched this in April 2016, bringing the total to $440 million.

An independent assessment included in the business case identified the cost of the preferred option as approximately $454 million (real, using a P90 estimate). This assessment provided assurance to government that the cost of the project matched the allocated funding.

Timeline for the project

The 2015 business case stated the project would be completed by December 2018.

Contractor selection

In December 2016, V/Line ran a procurement process to select a design and construct contractor to deliver Stages 2 to 4 of the MBRP.

V/Line divided the scope of works into two work packages. Under the proposed contract agreement, the award and delivery of Work Package 2 (Stages 3 and 4) would depend on the contractor’s delivery of Work Package 1 (Stage 2) within expected time frames. Figure 1H shows the scope of the two work packages.

Figure 1H

Scope of work packages

Source: VAGO, based on information from V/Line.

|

A provisional sum is an allowance that parties insert into the contract agreement for works that are not yet defined in enough detail to be accurately priced. In the V/Line and MMJV design and construct contract agreement, the provisional sum items were rail flaw remediation, track and civil remediation, and activation of additional level crossings and signalling activities. |

In May 2017, V/Line selected the MMJV as the successful tenderer. The next month, both parties signed the contract agreement for $275 million, which included $22 million in provisional sums.

The MMJV began Work Package 1 in September 2017. One month later, it reported that it could not complete the expected works within the project schedule. To address this, the MMJV submitted a recovery proposal to V/Line, which V/Line agreed to.

Work continued until 22 March 2018, when ONRSR identified a safety breach at one work site. While ONRSR ultimately did not attribute responsibility for the breach, V/Line immediately issued a stop work notice to the MMJV on all works being undertaken. Soon after, V/Line, in consultation with DoT, agreed that the delivery of Stages 3 and 4 would not proceed as originally procured. V/Line and DoT also assessed the option of V/Line directly delivering Stages 3 and 4 as the managing contractor.

In May 2018, the MMJV signed a settlement agreement with V/Line to formally resolve matters arising from the ceased contract works.

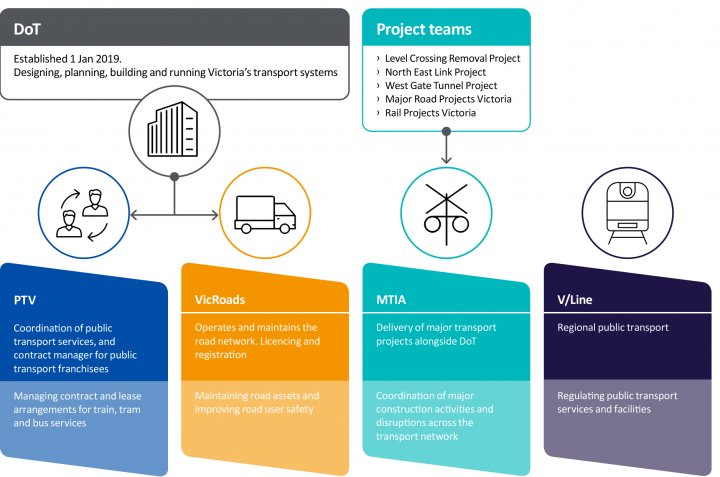

1.4 Agency roles and responsibilities

Figure 1I shows the agencies responsible for delivering the freight outcomes examined in this audit.

Figure 1I

Agencies examined as part of this audit

Source: VAGO, based on publicly available information.

Department of Transport

On 1 July 2019, DoT, PTV, and VicRoads merged. DoT is now responsible for planning and operating the transport system in Victoria.

DoT works closely with the Major Transport Infrastructure Authority (MTIA) in delivering major transport projects across Victoria. MTIA comprises five project teams, including RPV.

Freight Victoria also sits within DoT. The government established it to coordinate the development of an efficient freight and logistics system. This includes leading the delivery and reporting of the priorities and actions under the Freight Plan.

RPV project team within MTIA

RPV is a project office within MTIA responsible for the delivery of key rail transport infrastructure projects in Victoria. This role includes planning and site investigations, stakeholder engagement, and construction delivery and project commissioning.

In June 2018, the Minister for Transport Infrastructure (formerly the Minister for Public Transport) appointed RPV as the delivery agency for future stages of the MBRP, replacing V/Line.

In April 2019, V/Line and RPV jointly developed a proposal for $23 million in urgent maintenance works on the Manangatang line.

In August 2019, DoT confirmed RPV would develop and deliver the RRR.

V/Line Corporation

V/Line is the accredited rail operator and network scheduler for regional rail and coach services and maintains 3 520 kilometres of railway track used by both passenger and rail freight operators in Victoria.

DoT directed V/Line to deliver the works required for Stage 1 of the MBRP. It completed these works in September 2016. V/Line procured a design and construct contractor to undertake Stages 2 to 4 of the project.

In June 2018, the transfer of project delivery roles to RPV limited V/Line’s role to completion of Stage 2 and urgent maintenance on the Manangatang line, which the Minister for Transport Infrastructure approved in July 2019.

1.5 What this audit examined and how

This audit analysed whether regional rail upgrades are improving rural freight outcomes in a timely and cost-efficient way. Specifically, we examined whether:

- governance arrangements for the selected regional rail upgrades supported informed decision-making

- agencies delivered selected regional rail upgrades according to approved scope, time, cost, and quality expectations

- the selected regional rail upgrades have realised expected benefits for freight.

We conducted this audit in accordance with the Audit Act 1994 and ASAE 3500 Performance Engagements. We complied with the independence and other relevant ethical requirements that relate to assurance engagements. This audit cost $520 000.

1.6 Report structure

The remainder of this report is structured as follows:

- Part 2 provides a summary of the various freight-related rail upgrades.

- Part 3 examines issues and lessons from delivery of the upgrade projects.

- Part 4 examines the achievement of intended outcomes and benefits.

2 Status of regional rail upgrade projects

This Part summarises the status of the audited programs compared to the original scope, time, cost and benefits parameters approved by government.

2.1 Conclusion

The rail upgrades we examined are not yet improving the efficiency, useability or cost-efficiency of the rural freight network to better support rural freight outcomes.

Completion of the MBRP is a year overdue, with over twice the original budget now estimated as necessary to complete the project to its original approved scope. This is due to:

- insufficient initial project scoping by DoT

- incomplete planning of the detail for required works across the freight rail network by DoT and V/Line

- ineffective contract management, project management and project execution by V/Line.

Due to the project difficulties and cost overruns arising during delivery of Stage 2, delivery of the later stages of the project is now on hold.

Benefits expected to accrue from later project stages, such as an increase in private investment in new loading facilities at port, are therefore also paused.

The freight-related RRR components we reviewed are still in the procurement stage, so it is too early to assess most aspects of their performance.

2.2 Murray Basin Rail Project

The Victorian and Australian governments funded the MBRP to improve rail freight movement. While portions of the project are complete, most rail freight operators have not yet seen desired improvements to line speeds and axle loads. Some operators have seen their freight costs rise because of the inefficiency of the network and the delays in the completion of the MBRP. Further, the project will not achieve these desired improvements without significantly more investment than the government originally approved.

Specifically, the unfinished status of the MBRP has made the situation worse for standard-gauge rail freight on the Yelta to Mildura line when compared to the previous broad-gauge track:

- the new standard gauge route from Maryborough to Ararat added 128 kilometres to and from the Port of Melbourne, and has caused longer train transit and cycle times

- improved track condition has increased average track speeds on the Yelta to Maryborough section, but the longer route means that transit times to port are up to five hours longer than the previous broad-gauge route.

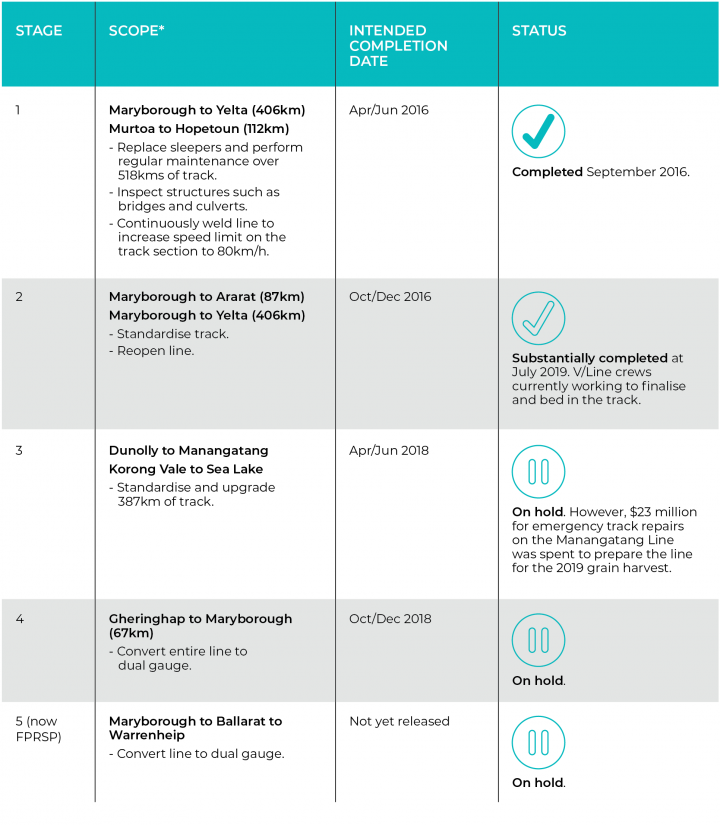

Current status

Stage 1 of the MBRP is complete and Stage 2 is substantially complete.

The $440 million project budget is almost fully expended. V/Line recently completed urgent repairs on the Manangatang line costing $23 million. In June 2019, the Minister for Transport Infrastructure put the remaining two stages of the MBRP on hold pending a review of the MBRP business case.

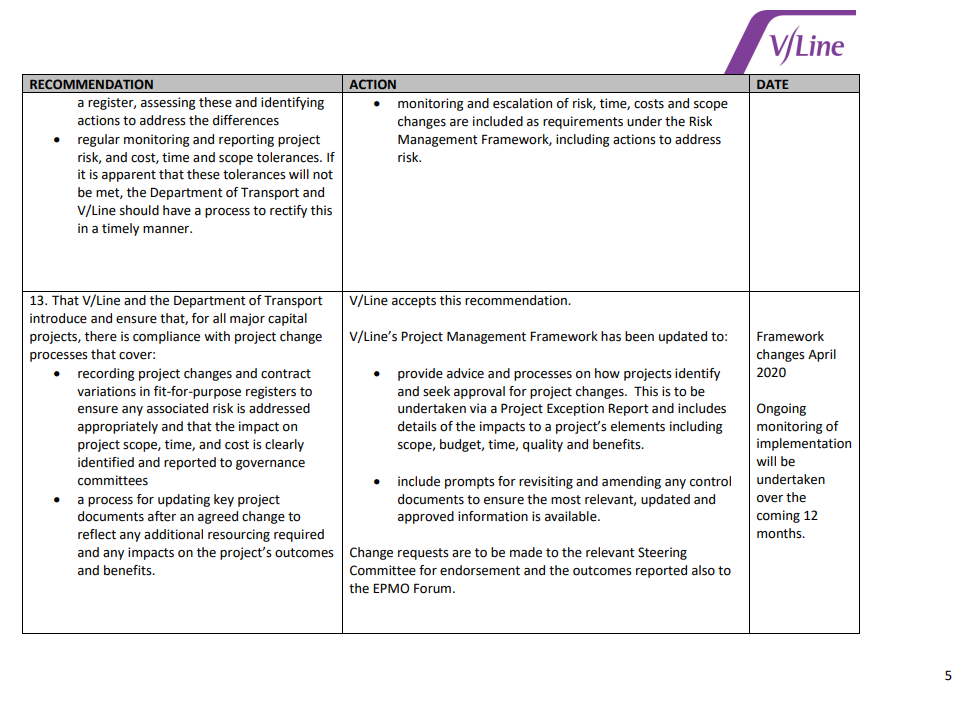

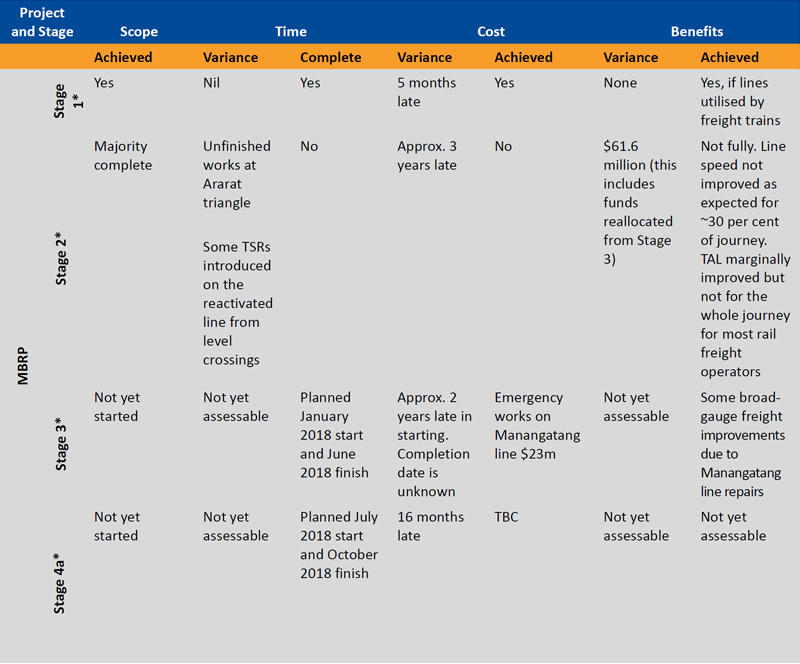

Figure 2A shows the present status of the MBRP.

Figure 2A

Current status of the regional rail upgrade

Note: *Scope as identified in the MBRP Business Case (July 2015).

Source: VAGO.

Cost

As of 12 June 2019, when the government put the MBRP on hold, funds spent on the project totalled $358.5 million. Figure 2B shows the budget status for the MBRP and FPRSP at December 2019 after V/Line’s urgent maintenance works on the Manangatang line.

Figure 2B

Budget status for the MBRP and FPRSP

| Project |

Original budget |

Funds spent |

Balance of |

|---|---|---|---|

|

MBRP |

*$440.0 |

**$381.5 |

$58.5 |

|

FPRSP (formerly Stage 5 MBRP) |

$130.0 |

$9.7 |

$120.3 |

|

Total |

$570.0 |

$391.2 |

$178.8 |

Note: *State government and Commonwealth contribution.

Note: **Stage 1–2 and urgent maintenance works on the Manangatang line only.

Source: VAGO, based on information from DoT, V/Line and PTV.

To date, the project has delivered about half of its approved scope but consumed 86.7 per cent of the total originally approved MBRP budget.

Figure 2C shows project costs at key lifecycle points.

Figure 2C

MBRP and FPRSP funding and spend to date

* Total cost estimate based on a P90 estimate of real cost.

** These figures show the actual costs approved by government in June 2017.

*** This covers signalling configuration, contingency, project management, and risk allowance costs.

^ Manangatang line repairs.

Source: VAGO, based on information from DoT, V/Line and PTV.

Timeliness

According to the timelines in the business case, completion of the full MBRP scope is now 15 months late. Due to the pause in the main works, the project is unlikely to be completed in two years’ time, as originally intended in the business case without additional funding.

Recent work by DoT and its advisers to review the original MBRP business case was not finished at the time of this audit. The Australian Government may also require further assessments and consideration of a refreshed business case, such as a review by Infrastructure Australia, if it is to continue as a co-funder.

This could further delay project delivery and expected project benefits.

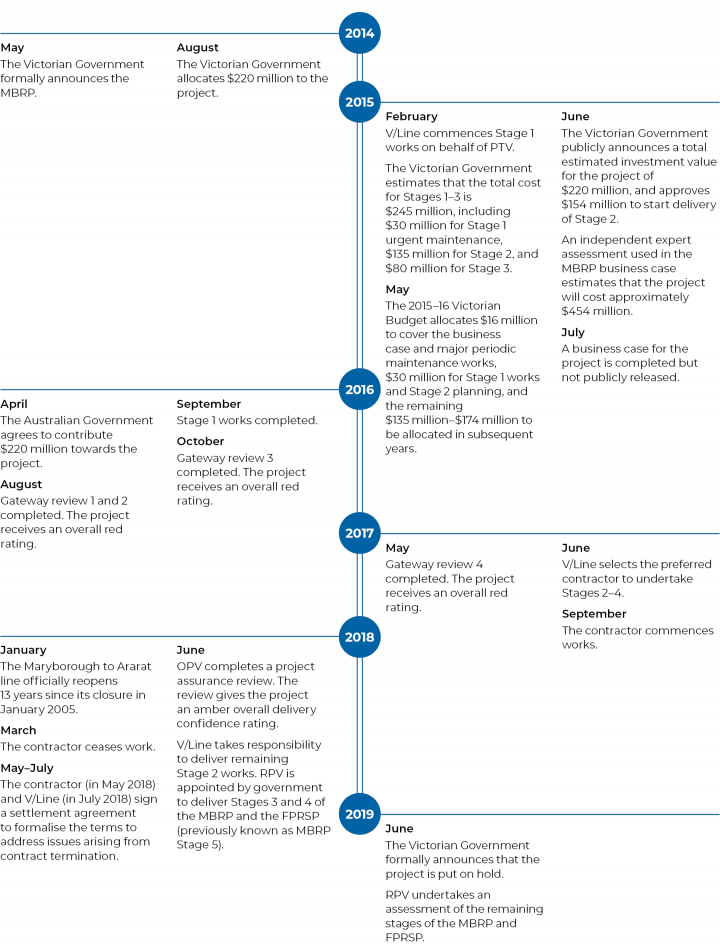

Figure 2D shows key MBRP events, while Figure 2E shows the variance of expected and achievement dates. Appendix B summarises our findings of the current status of the reviewed regional rail freight upgrades.

Figure 2D

Timeline of key MBRP events

Source: VAGO, based on information from DoT, V/Line, PTV and publicly available information.

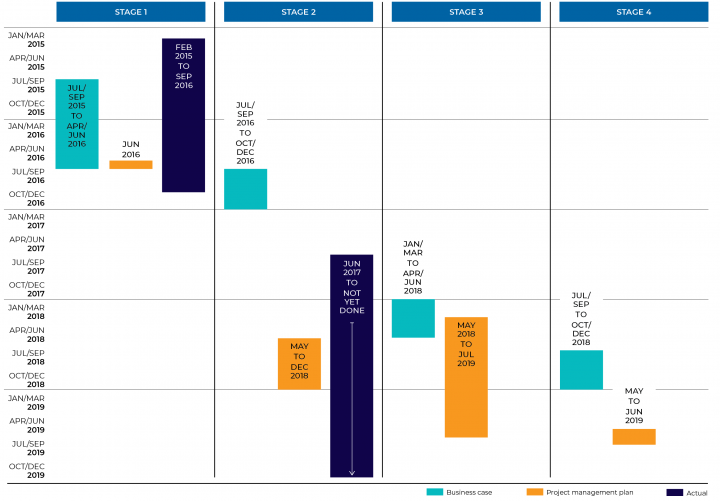

Figure 2E

Change in MBRP expected timelines

Source: VAGO, based on information from DoT, V/Line and PTV.

2.3 Regional Rail Revival

Initial RRR scoping and planning documents show that DoT identified existing rail freight needs. However, these documents do not explicitly focus on improving future rural freight outcomes.

Future flexibility for rail freight infrastructure—such as longer passing loops and wagon sidings—was not explicitly considered beyond preserving the current small number of freight train paths on the Gippsland, Shepparton and Warrnambool corridors.

This means that a small increase in the length or number of freight trains will likely require further track adjustments at a later date. DoT advised us that, for the Warrnambool line, a new passing loop is being lengthened specifically for freight needs. However, the length of trains is currently limited by terminal capacity.

While the primary investment focus of the RRR program is on achieving passenger rail improvements, the RRR could also have a positive impact on freight trains as improved track should also allow higher speeds and axle loads.

3 Project planning, issues and lessons from delivery

Before government approved the rail freight upgrades we examined in this audit, the rail freight network in Victoria had extensive maintenance backlogs. The projects were an opportunity to rectify existing maintenance issues while upgrading the system to operate in a sustainable and fit-for-purpose manner.

In this Part, we examine the planning and delivery of the upgrade projects, and any lessons learnt from works to date.

Our analysis primarily focused on the MBRP and examined:

- the adequacy of planning, including the assumptions and estimates that DoT and V/Line advised the government of

- whether project delivery achieved the expected time, cost and scope

- lessons learnt from delivery to date.

We did not examine the RRR components in scope for this audit, as these projects have not yet begun delivery.

3.1 Conclusion

During delivery of the MBRP, V/Line and DoT faced many project challenges that consumed most of the available budget for planned future stages.

Many of these challenges arose because DoT’s predecessor agencies and V/Line did not fully understand the dilapidated state of the regional rail freight network before the MBRP began. This led to over-optimistic assumptions on project complexity as well as underestimation of time and cost requirements.

V/Line and its contractor (the MMJV) faced many difficulties when attempting to deliver the approved scope, while concurrently dealing with emerging project risks, scope changes and additions, and issues related to the condition of existing rail infrastructure.

The numerous claims and disputes arising from this stage of works contributed to V/Line and the MMJV suspending their contract early during Stage 2 of the five expected stages of the MBRP.

Transport agencies can learn many lessons from these delivery challenges, and V/Line and DoT have commissioned independent reviews to better understand how these problems occurred.

Regional Rail Revival

For the RRR freight components we examined, we found there is no specific governance body with a focus on rail freight issues.

Freight Victoria was created in DoT in 2018 to consult with and adequately consider the freight sector during project scoping and development; however, its functions are mainly focused on policy advice and it has no governance authority.

The lack of a specific governance body risks a disconnection in planning and decisions made between V/Line, Freight Victoria and RPV in terms of broader strategic policy outcomes for rail freight and network engineering decisions.

3.2 Project planning

Advice from DoT and V/Line to government at the planning stages of the MBRP did not support informed decision-making. This was mainly due to:

- DoT and V/Line’s limited understanding of the dilapidated nature of the network assets when developing the business case and project scope

- incomplete engagement by DoT and V/Line with key stakeholders and limited analysis of current and future rail freight needs

- DoT and V/Line’s optimistic assumptions about the project’s cost, time and complexity.

DoT and V/Line’s insufficient planning impacted V/Line’s ability to deliver the project within cost, time and scope expectations.

To compound this, DoT and V/Line’s governance structures changed as the project evolved and moved between agencies, which diluted corporate knowledge and accountability for project outcomes.

Once DoT and V/Line became aware that the project was underperforming, senior officers intensified their attention, and the agencies focused efforts on recovering the project. Appropriate senior oversight is now in place.

Understanding the network condition

Our 2009 audit Buy-back of the Regional Intrastate Rail Network confirmed the dilapidated state of the regional rail freight network. The report found that there was a known maintenance backlog on the network in 1999, when the state leased it to a private company.

Figure 3A describes the rail freight network’s historical condition issues.

Figure 3A

Rail freight network historical condition issues

|

During the period of private control of the regional rail network from 1999 to 2007, the private sector lessees took a contractually compliant ‘minimum maintenance’ approach to freight-only lines, and effectively allowed some lines to fall out of service. On some sections of track, the lessees restricted speeds to only 20 kilometres per hour. Due to the ineffective maintenance obligations in the lease, the infrastructure deteriorated further, which compounded the previous maintenance backlog. These allowed parts of the rail freight network to deteriorate to a very poor condition. This lack of investment in the freight-only network, and resulting poor operational performance, accelerated a shift by freight users from rail to road freight, increasing the potential for adverse environmental, social and economic consequences. Our 2009 audit observed that closure of the freight-only network could result in at least 100 000 more truck trips on regional roads each year, which could have dramatic implications for road safety and the environment, as well as reduce economic and logistics supply chain efficiency. The Victorian and Australian governments recognised these problems and jointly funded a Mildura line upgrade project in 2006, allocating $53 million and $20 million respectively. At the time of funding, they expected the project to upgrade the 525-kilometre broad gauge line between Mildura and Gheringhap (near Geelong) to allow freight trains to run at a line speed of 80 kilometres per hour. |

Source: Buy-back of the Regional Intrastate Rail Network, VAGO, 24 June 2009.

A DoT predecessor agency requested a detailed line survey from V/Line in 2012 to help scope a potential re-opening of the Ararat to Maryborough line. This work highlighted serious corridor condition issues, but DoT did not use this document to inform the MBRP planning or procurement process. Figure 3B shows the pre-existing track issues on the Maryborough to Ararat line.

Figure 3B

Pre-existing track issues on the Maryborough to Ararat line

Source: Maryborough to Ararat: Proposal to Restore Freight Operations, V/Line, December 2011, page 8, ‘Medium size track washaway’.

DoT, V/Line, and rail operators expected the MBRP to rehabilitate track on sections of the network to restore sustainable operating speeds and improve axle loads. Apart from this 2012 report, we did not see evidence that DoT asked V/Line, as network manager, for formal advice on the condition of the network that the MBRP would upgrade.

Since the government paused the project during Stage 2, RPV has done some work on asset condition on the remaining sections of the Murray Basin freight track, which we assess as useful and high-quality.

This detailed review relied on physical inspection of current track conditions, supported by photographs and analysis of track condition using technical data from vehicle-based inspections. Based on these inspections, the review estimated the track components that would need to be replaced and likely costs, based on the estimated volume of sleepers, rail or ballast required for remediation. This work has helped inform RPV’s cost estimate to complete the original project scope.

It is not clear why DoT and V/Line did not do this type of detailed work during the original project scoping and business case development.

Considering stakeholder views

DoT’s multiple reorganisations over the last five years has contributed to the inconsistent way it identified, engaged, analysed and managed stakeholders for the MBRP.

While DoT did seek stakeholder views at specific project planning points, it did not routinely analyse or seek to understand these views as the project moved from concept to delivery.

Further, DoT’s early stakeholder consultation during the business case development phase is not well documented, partly because responsibility for stakeholder engagement moved between agencies.

The government established a ministerial advisory council during the early stages of the project, but it ceased meeting after DoT and V/Line focused their efforts on recovering the project.

Many stakeholders, including exporters, rail operators, and producers, became frustrated with the lack of responsiveness from official consultation channels and expressed their views on the project through the media and public statements.

Once the contractor ceased work in early 2018, DoT stopped providing direct updates on the project’s activities to the Australian Government, a co-funder and key project stakeholder. In late 2019, DoT re-engaged with the Australian Government on the MBRP.

We consider that many concerns from stakeholders, such as TSRs in place for indefinite periods of time, are legitimate. Due to heavy public and media scrutiny of the project’s challenges, as well as internal management pressures to resolve them, V/Line and DoT found it difficult, at times, to engage with relevant stakeholders in an authoritative or timely manner. V/Line advised us that this was limited to the period when V/Line and DoT were reassessing the project.

Some letters and specific requests from the Deputy Prime Minister to Victoria’s Minister for Transport Infrastructure went unanswered, with DoT not preparing briefings on these letters for the Minister’s office.

Freight Victoria has recently started re-engaging with key rail freight stakeholders. However, its authority and influence over the project is not clear. This lack of clarity is because the project’s planning, decision-making and budget responsibilities operate in separate organisational structures. Within DoT, Freight Victoria is responsible for overall strategic planning and policy development for the sector in the Policy and Innovation area. Project decision making occurs in the Network Integration part of DoT. RPV (part of MTIA) holds the remaining project budget and sits outside the main DoT structure.

V/Line, as the rail freight network maintainer and access provider, and Freight Victoria, the main policy body advising DoT on freight matters, need to coordinate and manage their interactions with industry counterparts to achieve the government’s policy of increasing rail’s share of freight transport.

3.3 Project delivery performance

Project delivery

V/Line’s project management and the MMJV’s delivery of Stage 2 works resulted in Stage 2 of the project not being delivered as expected. Disputes and claims between V/Line and the MMJV resulted in a variance between the scope, time and cost parameters and the achieved outcomes that the business case identified and government approved.

Procurement of design and construct contractor

V/Line received three tender responses in its procurement of a design and construct contractor for Stages 2 to 4 of the MBRP. V/Line prepared a tender evaluation report that identified a number of issues with the feasibility of project delivery:

- At the time that V/Line tendered for these works, there was uncertainty about the final scope. V/Line also believed that the $240 million budget was insufficient for the expected scope. Despite this, V/Line still proceeded with the tender process.

- Each of the three tender responses V/Line received exceeded its nominated budget for Stages 2 to 4.

- Two of the three respondents could not commit to delivering the project scope within V/Line’s timelines. The tender evaluation report attributed this to tight deadlines.

As described in Figure 3C, V/Line accepted risks in the contract it signed, without the capacity to understand their potential cost implications for the wider project. These risks eventuated for V/Line once the contractor exercised the legal rights the contract gave them.

Figure 3C

Excluded risks negotiated by the contractor and V/Line

|

Prior to signing the design and construct contract, V/Line and the MMJV negotiated the inclusion of certain items in the final agreement. One of these items was a new clause on excluded risks. In this clause, V/Line agreed that the contractor’s risk would not extend to items of work that could not be reasonably determined from:

The items of work included:

V/Line agreed to insert excluded risks in the final contract agreement so that tenderers would not price unknown risks because the tenderers did not have enough time to undertake extensive site testing during the tender phase. In internal briefing documents, V/Line justified these excluded risks by stating that although it would have to pay claims if the risks were to eventuate, it would not pay a risk premium for risks that may not occur. By inserting excluded risks into the contract V/Line also gave itself the ability to direct the MMJV to perform part or all of any additional required work. However, deficient project planning by DoT’s predecessor agency and deficient asset condition information in the MBRP business case meant that V/Line did not anticipate the extent of the additional work, time and cost that would be needed. As a result, V/Line bore the risk and cost of works that were not identified in the original scope. Because the MMJV did not bear this risk, it had no obligation to incorporate these works into its specification and program of works. This also meant that V/Line and the MMJV could not appropriately forecast any cost and time contingency arising from these risks in their planning. |

Source: VAGO, based on V/Line documents.

Governance and decision-making arrangements

DoT and V/Line’s governance processes for the MBRP were not always clear and were expressed inconsistently in key MBRP project planning documents in the lead up to project approval and delivery. In addition, V/Line, and DoT used various governance and decision-making approaches that they did not consistently apply and that did not operate in accordance with project plans. This made assessing compliance with processes difficult.

DoT and V/Line introduced their contract management arrangements in the design and construct contract, and further defined them in the contract management plan. As the project evolved and faced setbacks, V/Line did not formally update these contract management arrangements in a timely manner.

The contract management plan aimed to clarify V/Line’s processes to manage the provision of the MMJV contract. Despite having this plan, V/Line did not follow it and their approach to project delays was reactive, dealing with setbacks as they arose.

We also noted unmanaged role conflicts in the governance arrangements. For example, the lessons learnt report states that the contract’s terms assigned the role of Superintendent to the Project Director, despite there being conflicts between the two roles:

- As Project Director, they were V/Line’s representative on the contract with responsibilities that included proactively responding to risk, reporting to the project steering committee (PSC), and delivering the project.

- As the Superintendent, they also acted in the role of certifier and valuer of work undertaken by the contractor, with a contractual obligation to act honestly and arrive at a reasonable measure or value of work.

The conflict between these two roles meant that the Project Director could not impartially deliver either set of responsibilities.

Monitoring and reporting

V/Line’s design and construct contract clearly defined the frequency and content of reports required from the MMJV. However, these requirements were diluted in the contract management plan, which did not fully consolidate the contract agreement’s clauses.

For example, the contract management plan only referred to KPI reporting, not wider project reporting and monitoring expectations. Although the contract agreement required the MMJV to submit monthly reports to V/Line, this was not specified in the contract management plan. V/Line also did not specify how contract reports fed into V/Line’s internal project reporting.

Performance expectations

V/Line did not clearly document performance expectations and deliverables for the MMJV.

During our audit, V/Line could not locate a useable version of the contract management plan. Although V/Line noted that it is a live document, key sections of the version that we reviewed were incomplete.

KPIs, in particular, were not well described. In the contract management plan V/Line identified 20 KPIs, but did not describe them in detail, or how it would measure and monitor them. The contract management plan states that these details are specified in the design and construct contract, but the contract also did not cover these expectations in any useable detail. Further, V/Line did not cover them in any subsequent project document.

Although the contract management plan identified the expectations for the content of KPI reports, V/Line did not develop any further guidance on the frequency of this reporting or determine who would be responsible for this monitoring. As a result, there is no evidence that V/Line routinely monitored or tracked these expectations.

Managing contract variations and changes

Although V/Line had a suite of documents detailing change management processes, they did not revisit or update these processes as project expectations changed.

|

A contract variation refers to an increase or decrease or omission of any part of the contract works, any change in the character or quality of materials or equipment, or any change in the method, sequencing or timing of works. A project change is anything that transforms or impacts the project, tasks, processes, or structures. This can include changes to project scope, funding, or milestone dates. Project changes can be significant, which means they may require greater scrutiny by project owners. |

During the period that it engaged the contractor, V/Line used a single variation register to capture both contract variations and project changes.

This process was flawed because it meant V/Line did not have a clear process for distinguishing a variation from a project change or detailing how a variation or a project change would be addressed, monitored and reported.

Further, there was no requirement in V/Line’s change management documents to log changes in a register. This suggests a reactive approach to addressing issues arising from project changes. Because there was no set detail for what a change register should cover, V/Line also risked inconsistencies in how it recorded and monitored risk.

Scope, time, cost and quality expectations

Scope, time, cost and quality expectations for the whole MBRP were broad, constantly changing, and not well documented by V/Line. Many of these expectations were unreasonable at the time DoT and V/Line set them. For instance, DoT’s advice to government in 2015 acknowledged that the options identified in the business case would cost more to deliver than the funding available in the budget forward estimates.