Asset Management and Maintenance by Councils

Overview

Victorian councils manage around $73 billion of physical infrastructure assets and spend over $2 billion annually to maintain, renew or replace them. Poor asset management can lead to deteriorating or failing assets, reduced levels of service, higher council rates and an increased financial burden on future ratepayer generations.

Council spending on renewing or replacing existing assets is not keeping pace with their rate of deterioration, resulting in cumulative renewal gaps that grow each year.

While councils have in recent years improved their asset management practices, they need to accelerate their progress in areas such as:

- asset renewal planning and practice

- the quality of asset management plans

- linking of service levels and standards to these plans

- development of asset management information systems

- recruitment and development of appropriate staff

- monitoring, evaluation and reporting on asset management

- asset management governance.

More can also be done by Local Government Victoria in association with other sector organisations, such as the Municipal Association of Victoria, to support councils to improve their asset management capabilities and practices, including through improvements to asset management guidance and the National Asset Management and Assessment Framework self-assessment framework.

There is a pressing need for councils to carefully balance asset renewal spending against a sustainable level of service delivery.

Asset Management and Maintenance by Councils: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER February 2014

PP No 298, Session 2010–14

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on the audit Asset Management and Maintenance by Councils.

The audit assessed whether local councils effectively manage their physical infrastructure assets. It examined whether they have developed and applied sound strategic frameworks for asset management, and implemented efficient and effective asset management practices. It also reviewed the guidance and support provided to councils in managing these assets.

The report identified significant deficiencies in asset renewal planning and practice, the quality of asset management plans, the linking of service levels to these plans, the development of asset management information systems, and in councils' monitoring, evaluation and reporting on asset management.

The continuing growth in councils' asset renewal gaps remains of considerable concern. Local Government Victoria should provide improved asset management guidance and support to councils, as outlined in the report, and work more closely with them on this, and other common issues identified.

Yours faithfully

John Doyle

Auditor-General

19 February 2014

Auditor-General's comments

John Doyle Auditor-General |

Audit team Andrew Evans—Sector Director Michael Demetrious—Team Leader Peter Rorke—Analyst Kate Kuring—Engagement Quality Control Reviewer |

Victoria's 79 councils manage a significant number of infrastructure assets including—buildings, parks and gardens, roads, bridges, council land and drainage networks—which support the delivery of a wide range of important council services. These include home and community care, maternal and child health care, recreation and leisure facilities, waste and environment management, transport and economic development.

Asset management and maintenance is complex and impinges on many areas of council responsibilities and operations. Councils need to ensure that there is a close match between the assets they have and their operational condition on the one hand, and the service uses to which those assets are put, on the other. They also have legislative obligations to manage financial risks prudently and to ensure that their asset management decisions take into account economic circumstances and their financial effects on future generations. This is especially important in the current economic climate and in an environment where reliance on sources of revenue such as government grants cannot be assured.

A 1998 report to government warned that unless steps were taken to address councils' asset renewal gaps, the budget councils require for renewal would more than double by 2012. These predictions have materialised despite this warning, and the renewal gap has almost doubled as a proportion of total asset value over the past 16 years. A number of previous reports from my office have identified persistent issues with council asset management practices and recommended that councils improve their asset management frameworks and their related policies, strategies and plans. This should in turn improve asset management investment decisions and planning for capital expenditure. Although some improvements have been made, many of the previously identified deficiencies still exist.

This audit has found that in recent years councils have improved their asset management practices by applying available asset management guidance, self-assessing their asset management performance annually, and developing asset management systems, frameworks, strategies and plans. This provides a good foundation on which to build more advanced asset management practices. However, significant deficiencies remain in areas such as asset renewal planning and practice, the quality of asset management plans, linking of service levels to these plans, the development of asset management information systems, and in monitoring, evaluation and reporting on asset management.

There is a pressing need for councils to address growing asset renewal gaps. Councils are generally budgeting less than is required to renew their assets and consequently the funding needed for asset renewal continues to grow each year. Without appropriate and concerted corrective action, the provision of council services to communities is likely to be put at risk. While this may require some hard financial decisions and trade-offs, failure to address this problem now will only lead to more difficult decisions in the future.

I have made a set of recommendations for councils and Local Government Victoria. Adoption of these will significantly advance asset management practices within councils and help to address the key deficiencies and issues identified in this audit. I am pleased that the councils we audited have recognised the importance of the recommendations, have welcomed the report as raising the profile and significance of sound asset management within councils and the wider community, and are committed to improving their asset management practices.

I am therefore confident this report will contribute substantially to improvements in asset management and maintenance within Victorian councils, and councils' financial sustainability.

Lastly, I would like to acknowledge Local Government Victoria and the Ararat, Cardinia, Kingston, Port Phillip and Wodonga councils and their staff for their cooperation and invaluable assistance during this audit.

John Doyle

Auditor-General

February 2014

Audit Summary

Local councils manage and maintain a substantial number of assets that underpin their many critical economic and community activities. In 2012–13, the physical infrastructure assets held by Victorian councils—buildings, parks and gardens, roads, bridges, land and drains—were valued at around $73 billion. Councils spend over $2 billion every year to maintain, renew or replace existing assets.

How councils manage assets has direct implications for their communities. The primary aim of council asset management is to maintain an asset portfolio that allows councils to effectively meet current and future demand for services. These services include home and community care, maternal and child health care, recreation and leisure facilities, waste and environment management, transport and economic development. Poor asset management can lead to deteriorating levels of service by councils, higher council rates and an increased financial burden on future generations.

This audit assessed whether local councils are effectively managing their physical infrastructure assets. The audit focused on five local councils: Kingston City Council (inner metropolitan), Port Phillip City Council (inner metropolitan), Cardinia Shire Council (outer metropolitan), Wodonga City Council (rural city), and Ararat Rural City Council (small rural). The audited councils collectively manage around $5.4 billion in physical infrastructure assets.

Conclusions

In recent years councils have improved their asset management practices by applying available asset management guidance, self-assessing their asset management performance annually, and developing asset management systems, frameworks, strategies and plans. This has provided a foundation on which to build more advanced asset management practices, but there is still substantial room for improvement.

Progress towards better practice has been relatively slow. This is despite warnings as early as 1998 that Victoria's councils needed to improve their asset management practices and address growing asset renewal gaps. The asset 'renewal gap' refers to the difference between the funding that councils need to renew their existing assets and the money they actually allocate to this purpose. Since 1998, asset renewal gaps have almost doubled. The audited councils are generally budgeting less than is required to renew their assets and the funding needed for asset renewal continues to grow each year. This is likely to lead to council assets becoming more difficult and less affordable to manage in the years ahead. This will also likely make the council services supported by those assets less sustainable.

The effectiveness of asset management is undermined by weaknesses with councils' asset management planning, implementation and information systems. For councils to more efficiently and effectively manage their physical assets substantial improvements are required in a number of areas:

- better asset renewal planning and practice

- higher quality asset management plans, more effective implementation of these plans, and better linking of service levels and standards to these plans

- further developing asset management information systems that are integrated with other corporate information management systems

- recruiting and developing skilled and competent staff to manage assets

- improving the monitoring, evaluation and reporting on asset management.

There are numerous examples of successful collaboration between councils on asset management initiatives. Further collaboration, encouraged and supported by Local Government Victoria (LGV), would assist councils to address asset management challenges more quickly, including those related to skills, knowledge and information systems development.

Findings

Asset management frameworks

The audited councils have not yet fully developed and applied sound strategic asset management frameworks and have not yet met the better practice requirements of most framework elements.

While improvements have been made, councils need to enhance the quality of asset management plans and obtain council support for them. They also need to better link council service levels and standards to their plans, and use the plans to drive their asset management practices.

Asset management governance

There is wide variation in the adequacy of council governance arrangements for asset management. The audited councils had often not effectively integrated asset management with other corporate functions, such as finance and service planning, which poses a risk to a council's ability to achieve its overall asset management objectives. All councils acknowledged that greater effort is required to involve all relevant departments to achieve better, whole-of-organisation asset management outcomes.

Asset management strategies and plans

Asset management strategies were generally underdeveloped. However, it is positive that all five councils had developed improvement plans outlining the actions needed to improve their management of assets.

While all five councils had prepared various strategies for the services they deliver, none had well developed plans for their major services that linked to asset management plans or considered asset requirements. All audited councils acknowledged that establishing service standards, and linking service delivery to asset requirements, are priorities in developing 'second generation' asset management plans.

Continuous improvement in asset management

In 2010, the Municipal Association of Victoria (MAV) set a target for councils to achieve a 'core' level of maturity in asset management by December 2012, as assessed using the National Asset Management Assessment Framework. Few Victorian councils achieved this, and none of the audited councils have achieved core maturity in all elements of the framework. Most of the audited councils are at a low to intermediate level of maturity in developing and applying these elements.

MAV delayed the original 2012 target to December 2013 when it was apparent that few councils would attain it. However, this new target for core asset maturity has not been met, with only 23 councils of 79 achieving core maturity. We also observed that small and regional councils are finding it more difficult than metropolitan ones to improve their asset management performance against the national framework, which may be partly due to resourcing issues.

Furthermore, there are weaknesses in the National Asset Management Assessment Framework and assessment process and it is timely that these be reviewed to support improved asset management practices and accountability.

Participation in MAV asset management initiatives demonstrates a commitment by councils to improve their asset management practices. However, delays in councils reaching core maturity in asset management heighten the risks associated with ineffective asset management. These risks include deteriorating and failing assets, the adverse financial implications of growing renewal gaps, and reducing the quality and number of council services available to the community.

Asset management practices

Capital works budgets and asset renewal requirements

Significant under expenditure of capital works budgets for several of the audited councils suggests there is scope to better integrate capital works programs with asset management and long-term financial planning to minimise such variations.

In most cases, spending on renewing or replacing existing assets is not keeping pace with their rate of deterioration. The audited councils are generally not able to meet existing asset renewal requirements, resulting in cumulative renewal gaps that grow each year. This situation adversely affects the condition of assets, community service levels, and councils' long-term financial sustainability.

Overall, council progress in addressing their renewal gaps has been relatively slow, despite the risks of not acting early being highlighted at least 15 years ago in a report to government Facing the Renewal Challenge – Victorian Local Government Infrastructure Study. While addressing the renewal gap may require some hard decisions, failure to make those decisions quickly will only lead to even harder decisions in the future, and will result in the continuing deterioration of assets and services.

There is a pressing need for councils to carefully balance asset renewal spending against a sustainable level of service delivery.

Capacities and capabilities to support effective asset management

Effective asset management is also being compromised by underdeveloped asset management information systems and a lack of skilled resources, particularly in smaller and regional councils.

Councils continue to rely on poor asset data and information systems and they are still not confident that all their assets have been identified and recorded. This reduces the capacity of councils to effectively monitor, evaluate and report on asset performance or to properly plan for asset rehabilitation. The audited councils recognise the importance of this, and some are currently investing heavily to improve their asset data and information systems. The costs of doing this, however, can be considerable and smaller councils find this particularly challenging.

Four of the five audited councils had not yet fully assessed the skills and knowledge they needed to effectively manage infrastructure assets. None of the five councils had developed a structured professional development program for staff with asset management responsibilities. This is critical for sound asset management, and not addressing this promptly will undermine council performance.

All five audited councils acknowledged the potential benefits of collaboration in asset management. Collaboration can generate efficiencies and cost savings, and provide support to councils less advanced than others in their asset management practices, expertise and resources. There may be some scope for considering whether the shared development of asset data and information systems could contribute to efficiency and effectiveness in this area.

None of the audited councils had robust monitoring, evaluation and reporting practices on asset management. Without these, councils cannot know, or demonstrate to their communities, how well they are meeting their asset management needs and priorities.

There is substantial scope for improving reporting to the community on asset management against performance measures and long-term financial plans by providing more detailed explanations on budget variances in capital works programs. Councils also need to improve the asset information on their websites and provide a greater awareness of asset management challenges faced by councils, their approach to them, and how they are performing.

Support and guidance by Local Government Victoria

There is an abundance of guidance available from LGV and other sources to assist councils, but councils are not making best use of this material. LGV provides limited targeted asset management support.

LGV guidance on asset management is also out of date. It does not address common challenges such as developing appropriate asset management information systems, developing a set of asset management performance indicators that will enable comparability between councils, and dealing with the growing renewal gap. This guidance should be reviewed and updated to focus more attention on these areas, and could be supplemented by other initiatives and types of support.

LGV is involved in council asset management practices in a number of other ways, including through annual surveys that measure council improvements in these practices. It should consider whether Victoria's legislative approach to asset management might be strengthened, as has been done in some other jurisdictions, to require minimum standards for certain asset management practices.

LGV should continue to work with the MAV in assisting councils. MAV's STEP program, which includes the use of the National Asset Management Assessment Framework tool, has been useful in helping councils improve their asset management frameworks and practices. However, there are limits to the program and the tool, and more could be done to support councils to improve their asset management and maintenance capabilities, as well as the reliability of their self-assessments.

Recommendations

Local councils should:

- accelerate efforts to review and update their asset management

- frameworks, policies and strategies to meet better practice standards

- make sure they have comprehensive asset management plans covering all major asset categories

- as a priority, develop a strategy for more effectively reducing their asset renewal gaps

- improve their asset management information systems and knowledge of their asset portfolios to ensure they have up-to-date information on all assets

- identify and review the skills and resources required to effectively manage infrastructure assets, including developing a skills matrix and action plan to address identified skill and resource requirements and gaps

- improve the provision of information to, and engagement with, the community on asset management

- develop and implement comprehensive asset management monitoring, reporting and evaluation systems, and publicly report their progress and performance against plans and strategies, including against capital works budgets.

Local Government Victoria should:

- review and update its asset management guidance material for councils

- review the support it provides to councils and make sure it is targeted to address common issues

- consider, in conjunction with councils, developing a set of comprehensive asset management performance indicators that will enable comparability between councils on asset management performance

- in conjunction with councils and the Municipal Association of Victoria, review the use and application of the National Asset Management Assessment Framework and its appropriateness for driving improvement in asset management performance

- consider making aspects of asset management mandatory, such as the development of asset management policies, strategies and plans

- investigate options for supporting councils to develop and upgrade their asset management information systems, including by reviewing practices in other jurisdictions.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994 a copy of this report was provided to Ararat Rural City Council, Cardinia Shire Council, Kingston City Council, Port Phillip City Council, Wodonga City Council and the Department of Transport Planning and Local Infrastructure with a request for submissions or comments.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments are included in Appendix A.

1 Background

1.1 Assets managed by local councils

In 2012–13, Victorian local councils managed over $73 billion in physical assets within their municipalities. These assets represent investments that have been built up over a long period of time, and include buildings, parks and gardens, roads, bridges, council land and drainage networks. The mix of assets varies with different types of councils. For example, for inner metropolitan councils land makes up the largest proportion of assets in terms of their value, while roads and bridges make up the greatest proportion for outer metropolitan and regional councils. Across all councils in Victoria, land makes up around 40 per cent of the total value of assets, roads 30 per cent and buildings 10 per cent.

1.1.1 Purpose of asset management

The physical assets managed by councils support the delivery of core services, facilitate economic activity and strengthen the economy in the long term. These infrastructure assets also support community activities throughout Victoria.

The primary aim of council asset management is to maintain an asset portfolio that effectively meets current and future demand for services. These services include:

- roads and drainage

- traffic and parking

- health and food safety

- waste management and the environment

- leisure facilities and public space

- cultural heritage and libraries

- welfare and community services

- land use planning and enforcement

- business and economic development.

Wodonga Aquatic Venue and Exercise Space, photograph courtesy of Wodonga City Council.

The way councils plan, acquire, operate, maintain, renew and dispose of assets can have a significant impact on council service delivery and long-term financial sustainability. Councils should manage assets effectively and efficiently to achieve the best outcomes for the community.

1.1.2 Asset maintenance and renewal

All councils face the problem of ageing assets. As the condition of assets deteriorates, the level of service supported by those assets diminishes. Councils must invest in maintaining and replacing those assets if they wish to maintain the same level of service.

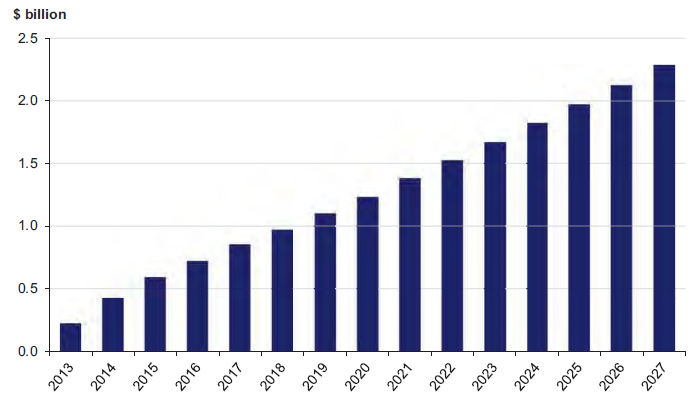

The asset 'renewal gap' refers to the difference between the funding that councils need to renew their existing assets and the money they actually allocate to this purpose. What they need and are able or prepared to fund is determined by councils after weighing up available data and evidence, competing priorities, and differing viewpoints. The renewal gap for Victorian councils is estimated to be $225.3 million in 2012 with the cumulative asset renewal gap predicted to grow to almost $2.3 billion by 2026. The nature of the renewal gap, and which types of assets it applies to, varies from council to council. Some audited councils are struggling to renew assets such as buildings and swimming pools, while others are more challenged by renewing roads and drainage systems.

Figure 1A shows the predicted cumulative growth in the renewal gap across all Victorian councils.

Figure 1A

Cumulative aggregate renewal gap

Source: Municipal Association of Victoria's STEP program overview and results, 2012–13.

The consequences of not effectively managing the renewal gap are reduced levels of services, poorer quality of community life and lower economic activity. Of course, spending more money on assets requires raising revenue by increasing council rates, increasing debt via further borrowings, or spending less on other services, so there is a need to carefully balance renewal spending against a sustainable level of service delivery.

Other potential consequences of not addressing the renewal gap are:

- the accelerated deterioration of assets if timely maintenance is not undertaken

- more expensive rectification treatments and/or earlier than planned renewal costs for some assets that have deteriorated beyond their critical intervention levels

- risks to community service levels and potential safety risks to the public if assets deteriorate to the point of failure.

Councils' cumulative renewal gaps will be significantly affected by how well they determine their maintenance, renewal, upgrade, disposal and new asset requirements each year, and how much funding they allocate towards these various elements. This balance will also have an impact on councils' cumulative renewal gap, and their asset and service outcomes well into the future.

In some circumstances, councils may choose to reduce community service levels in exchange for savings from reduced investment in asset maintenance and renewal.

Chelsea foreshore playground, photograph courtesy of City of Kingston.

1.1.3 Key Victorian bodies

Councils

Local government is recognised under the Victorian Constitution Act 1975 as a distinct and essential tier of government consisting of democratically elected councils having the functions and powers necessary to ensure the peace, order and good government of each municipal district. Victoria has 79 local councils.

Local Government Victoria

Local Government Victoria (LGV) is a division of the Department of Transport, Planning and Local Infrastructure that oversees the administration of the Local Government Act 1989. It works with the local government sector and other parts of government to strengthen business, governance and funding practices to ensure councils function effectively. LGV provides support and guidance to councils in a range of areas, including asset management. This involves developing and disseminating better practice guides, conducting annual asset management performance surveys, and other specific initiatives.

Municipal Association of Victoria

The Municipal Association of Victoria (MAV) is the peak body for Victoria's 79 councils and is governed by the Municipal Association Act 1907. The role of MAV includes advocating local government interests, building the capacity of councils and providing guidance and support in a range of areas, including asset management. MAV has taken a long and strong interest in promoting better asset management within councils through various initiatives, including its STEP program. The STEP Asset Management Improvement Program commenced in 2002 with a self-assessment model based on the International Infrastructure Management Manual. This is a capacity building program developed to assist councils to improve their asset management capability and long term sustainability.

1.1.4 Key legislation and frameworks

Local Government Act 1989

The Local Government Act 1989 states that the primary objective of local councils is 'to endeavour to achieve the best outcomes for the local community having regard to the long-term and cumulative effects of decisions'.

Councils must seek to ensure that resources are used efficiently and effectively and that services are provided to best meet the needs of the local community.

Section 136 of the Act requires councils to implement principles of sound financial management, which include:

- managing financial risks faced by councils prudently having regard to economic circumstances—including the management and maintenance of assets

- ensuring that decisions are made and actions are taken having regard to their financial effects on future generations.

The Act specifies the functions of a council, which include planning for and providing services and facilities for the local community, and providing and maintaining community infrastructure within the municipality.

There are also other Acts that govern council actions in relation to asset management, for example the Road Management Act 2004.

National Asset Management Assessment Framework

In 2006, in response to a series of reports highlighting issues with local councils' asset management practices, particularly in regard to the growing asset renewal gap, the federal government's Local Government and Planning Ministers' Council (LGPMC) agreed to develop a series of nationally consistent frameworks on financial sustainability for local government. One of these frameworks was for asset planning and management.

Following consultation with local governments and other relevant bodies, LGPMC endorsed the nationally consistent frameworks in March 2007.

The National Asset Management Assessment Framework (NAMAF) is a methodology for assessing the maturity of a council's asset management practices. It was developed jointly by the Australian Centre of Excellence for Local Government and the Institute of Public Works Engineering Australia. It is a self-assessment tool to assist local councils to identify their progress in implementing best practice asset management processes.

Skate park, photograph courtesy of Port Phillip City Council.

NAMAF includes a set of elements and sub-elements against which councils can judge how they are managing their asset portfolios. The key elements include:

- strategic long-term plan

- annual budget

- annual report

- asset management policy

- asset management strategy

- asset management plans

- governance and management

- levels of service

- data and systems

- skills and processes

- evaluation.

In 2009, LGPMC agreed to enhance the national asset and financial management framework and committed to an accelerated implementation. Since 2010, MAV's STEP program has also incorporated NAMAF. Councils in Victoria self-assess against the NAMAF each year and report their results to MAV following a review and feedback on their assessments, conducted by consultants engaged by MAV.

1.2 Previous audits

Local Government: Results of the 2011–12 Audits, November 2012

This audit provided a detailed analysis of council financial and performance reporting, financial results and key internal controls. The audit analysed the trends of six key financial sustainability indicators, including capital replacement and renewal gap. Findings relevant to asset management were:

- capital budgeting should have a longer-term focus connected to councils' strategic objectives and plans

- the majority of councils—77 per cent—did not demonstrate links between their operational and capital budgets, and minimal consideration was given to asset depreciation or the ageing of existing assets in order to achieve an appropriate balance between maintaining older assets and investing in new assets

- 37 councils departed from their approved capital works budgets by 20 per cent and 45 by more than 10 per cent.

Business Planning for Major Capital Works and Recurrent Services in Local Government, September 2011

This audit found that councils' long-term financial plans were not supported by equivalent strategic plans, or service and asset management plans. There was little evidence that councils regularly reviewed their services in accordance with best value principles to inform future spending decisions.

The audit made a number of recommendations including that councils review their asset management frameworks to assure their asset policies, strategies and plans were up to date, covered all major asset classes, and adequately informed future investment decisions. The audit also recommended that LGV provide better targeted support and assistance to councils to address identified weaknesses, and that LGV monitor the impact of these support initiatives to inform its future efforts.

Management of Road Bridges, December 2011

This audit found that councils had not developed strategies for high-risk structures. Councils needed to define meaningful levels of service for road users, set targets that take account of community expectations, and publish information that measures past achievements and the expected implications of future levels of resourcing.

The audit recommended that councils define levels of service for their bridges that capture the outcomes that are important to road users, and incorporate associated targets and measures in their plans.

Results of Special Reviews and Other Investigations, May 2005

This audit found that there was a lack of forward planning by local councils and their capital budgets were seldom based on detailed analysis of actual capital requirements. Councils were not managing their capital expenditure programs well, and had not implemented comprehensive asset management plans that allowed them to plan their capital expenditure.

Moyston Hall, photograph courtesy of Ararat Rural City Council.

1.3 Audit objectives and scope

The audit objective was to assess whether local councils effectively manage their physical infrastructure assets by examining whether councils have:

- developed and applied a sound strategic framework for asset management

- implemented efficient and effective asset management practices that are consistent with better practice

- been provided with appropriate guidance and support to manage assets.

The audit focused on LGV and five local councils, which collectively manage around $5.4 billion in physical infrastructure assets:

- Ararat Rural City Council

- Cardinia Shire Council

- Kingston City Council

- Port Phillip City Council

- Wodonga City Council.

1.4 Audit method and cost

The audit was conducted in accordance with section 15 of the Audit Act 1994 and Australian Auditing and Assurance Standards. Pursuant to section 20(3) of the Audit Act 1994, any persons named in this report are not the subject of adverse comment or opinion.

The cost of the audit was $450 000.

1.5 Structure of the report

This report is set out as follows:

- Part 2 examines the asset management frameworks used by local councils and the guidance and support available.

- Part 3 examines the asset management practices used by local councils.

2 Councils' asset management frameworks

At a glance

Background

Better practice asset management requires councils to develop and apply a sound asset management framework that includes a policy, strategy, plans and governance arrangements for the effective management of all infrastructure assets.

Conclusion

Councils have improved their asset management frameworks. However, they do not yet meet better practice standards. Progress has been made with the guidance and support available to the sector, but it has been relatively slow. Local Government Victoria guidance and support needs to be reviewed and updated.

Findings

- There is wide variation in the level of competency achieved by councils in developing effective governance arrangements, strategies and plans for asset management.

- There are significant deficiencies in the asset management plans of most councils which inhibit their effective implementation. Many plans do not adequately link to councils' intended community service levels, and some are incomplete.

Recommendations

Local councils should:

- accelerate efforts to review and update their asset management frameworks, policies and strategies to meet better practice standards

- make sure they have comprehensive asset management plans for all major asset categories.

Local Government Victoria should:

- update its asset management guidance material and review its support and guidance to ensure it targets common issues facing councils

- in conjunction with councils and the Municipal Association of Victoria, review the use and application of the National Asset Management Assessment Framework and its appropriateness for driving improvement in asset management performance.

2.1 Introduction

To be able to manage their assets effectively and efficiently, councils should have a sound asset management framework that includes appropriate governance arrangements and asset management policies, strategies and plans that are well developed and integrated.

2.2 Conclusion

While improvements have been made in recent years, the audited councils remain below the 'core' level of maturity in the development of their asset management frameworks, as measured by national benchmarks. This is in keeping with the performance of most Victorian councils, the vast majority of which are below core competency.

Some areas have improved, such as the quality of asset management plans and the effectiveness of their implementation. However, intended service levels and standards need to be more clearly and urgently linked to asset management plans.

Local Government Victoria (LGV) needs to review and update its asset management guidance material. More assistance from LGV to councils with their asset management challenges could see quicker progress towards councils achieving best practice. LGV could provide more targeted support for councils to address common challenges such as developing appropriate asset management information systems, developing a set of asset management performance indicators to compare council performance, and providing advice on dealing with the growing renewal gap.

2.3 Elements of a sound asset management framework

Key components of a sound asset management framework include:

- governance arrangements incorporating an accountability structure that identifies roles and responsibilities

- an agreed policy that establishes the principles and requirements for asset management

- a strategy that sets out the actions needed to implement the policy and links the asset portfolio to service delivery needs

- asset management plans that link to the policy, strategy, long-term financial plans and intended levels of service

- current and planned levels of service established in asset management plans, prepared in consultation with the community.

2.3.1 Governance arrangements

Better practice governance arrangements include:

- identifying asset management roles and responsibilities

- establishing mechanisms to provide high-level oversight by the council, chief executive officer and executive management

- encouraging all relevant organisational areas to become involved in asset management processes.

All the audited councils have documented their governance structures and have established formal mechanisms to facilitate high-level oversight by the council, chief executive officer and executive management team. Their governance structures incorporate a hierarchy of responsibilities, accountabilities and reporting, and these are described in policy and strategy documents.

All five councils have established an asset management steering group, or equivalent, with specific responsibilities for promoting and monitoring the implementation of the asset management strategy and plans.

However, there is wide variation in the level of competency achieved by councils in developing effective governance arrangements for asset management:

- Three councils have developed a policy that identifies the positions which have responsibilities for determining levels of service, and for managing assets to meet service delivery needs. The remaining councils have yet to define or develop asset management responsibilities.

- One council noted that 'whole-of-life' costs are not considered when making capital investment decisions and that a formal assessment of asset management skills is yet to be done.

Rotunda, photograph courtesy of Cardinia Shire Council.

Despite all councils having governance arrangements in place, each acknowledged it is a challenge to integrate asset management with other corporate functions. This requires, for example, more effective working relationships between the engineers responsible for asset performance, the staff responsible for service planning and delivery, and the finance staff. All councils advised that greater effort is required to involve all the relevant departments in asset management activities to achieve better outcomes.

Councils have traditionally located asset management functions within their technical or engineering areas, rather than within the broader corporate context. This inhibits the development of relationships between those who plan for future services, those who deliver the services, and those who maintain and develop infrastructure to support the delivery of those services. During this audit, Port Phillip adopted a new corporate structure that aims to address this organisational misalignment and promote better integration of asset management with financial management.

2.3.2 Asset management policies

A good asset management policy:

- establishes clear goals and objectives for asset management

- integrates asset management with other corporate and strategic planning processes

- requires an asset management strategy and plans to be adopted for each category of assets

- defines governance arrangements for asset management including roles and responsibilities, and communication and training, including monitoring the evaluation and reporting of asset performance

- outlines an asset performance reporting process, including internal and community reporting

- includes audit and review procedures.

All five councils had an asset management policy that is consistent with their Council Plan—a plan developed every four years outlining council's strategic objectives—and is formally approved by council. In most cases the policy provides clear directions for asset management and incorporates elements of best practice, including objectives for integration with other corporate and strategic planning processes. However, there were some exceptions:

- One council's policy does not contain sufficient detail to guide progress towards better practice asset management. Other than stating the council goals and objectives for asset management and a requirement to develop an asset management strategy and plan for each asset category, it contains no additional information, such as the importance of integrating asset management with other corporate and strategic planning, defining governance arrangements or identifying an asset performance reporting process.

- Another council's policy does not adequately demonstrate links with other corporate activities, for example, with the long-term financial plan and the annual planning processes. This makes it difficult for the council as a whole to work effectively towards achieving its objectives for asset management.

One council commented that its asset policy is due for review in early 2014 and believes the Department of Transport, Planning and Local Infrastructure (DTPLI) should provide guidance on a current, standardised approach to asset management policies for all councils.

2.3.3 Asset management strategies

Better practice asset management strategies:

- provide current details of infrastructure assets and their management, including current and future forecast needs and the adequacy of funding

- demonstrate how the asset portfolio can meet the service needs of the community in the short, medium and long term, with available resources

- are linked to the asset management policy and integrated into strategic long-term financial planning and the annual budget process

- incorporate actions required to implement the policy, including developing asset data information systems, identifying resource requirements and establishing time frames and performance measures for implementing the strategy.

All five councils had developed and formally adopted an asset management strategy. These vary in the quality and level of detail provided. One council provided only a brief overview of particular aspects of asset management, such as recognition of the renewal gap challenge, whereas other councils provided a more detailed analysis.

A good practice by all five councils is the inclusion of improvement plans documenting the actions needed to advance their management of assets. While these plans allocate responsibilities and set time frames to implement actions, it is too early to assess progress against them. Councils have indicated that the actions in these plans must compete with other council priorities for funding. Councils do not publicly report progress against their improvement plans.

Carrum foreshore and Surf Life Saving Club,photograph courtesy of Kingston City Council.

2.3.4 Asset management plans

Best practice asset management plans include a description of assets and services and the current condition of assets, set agreed levels and standards of service, and incorporate risk management strategies.

All five councils had developed asset management plans for their major asset categories. We reviewed a sample of 15 plans within the five councils, focusing on the asset categories listed below:

- Kingston—drainage, pavements, footpaths, community facilities, pavilions

- Port Phillip—parks and open spaces, stormwater drainage, facilities such as buildings and recreational facilities

- Cardinia—bridges, drainage

- Wodonga—bridges, buildings

- Ararat—buildings, drainage, parks and recreational facilities.

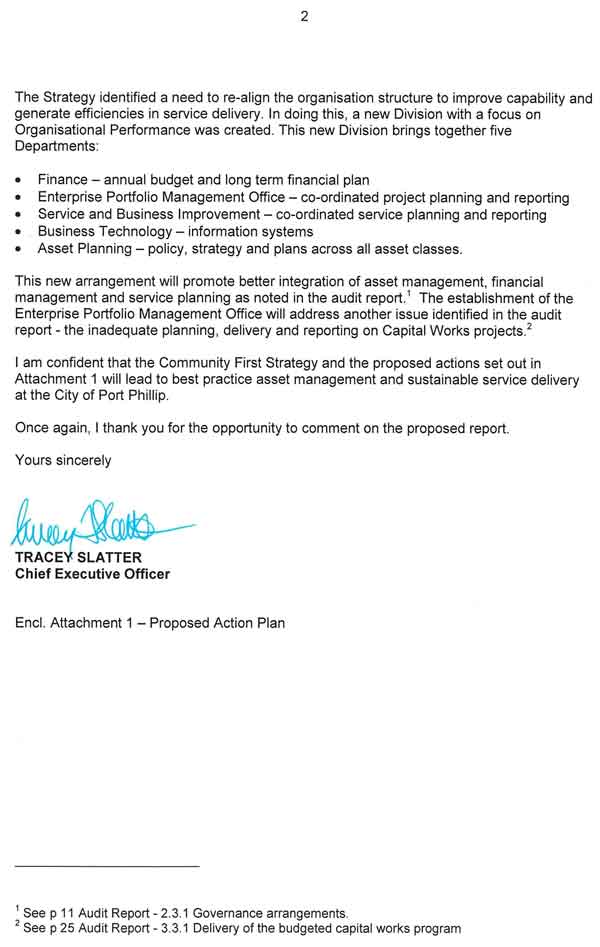

Figure 2A summarises the results of our assessment of councils' asset management plans against better practice criteria.

Figure 2A

Assessment of asset management plans against key criteria

VAGO assessment |

|||

|---|---|---|---|

| Better practice criteria | Met |

Partially met |

Not met |

Is consistent with government policy objectives |

15 |

0 |

0 |

Is adopted by the council |

8 |

0 |

7 |

Describes the assets and services to be delivered |

15 |

0 |

0 |

Is clearly linked to the council's asset management policy, strategy, strategic long-term financial plans, and capital works and maintenance programs |

12 |

3 |

0 |

Provides clear linkages with current and future community service needs |

2 |

2 |

11 |

Sets agreed levels and standards of service for each asset class and significant asset |

4 |

4 |

7 |

Describes the current condition of assets |

11 |

0 |

4 |

Contains demand forecasts and long-term cash flow projections for various types of costs, such as maintenance and operational, renewal, upgrade, replacement, disposal, etc. |

9 |

1 |

5 |

Incorporates risk management strategies |

11 |

0 |

4 |

Explains how the performance of the plan will be monitored |

0 |

3 |

12 |

Contains evidence of engagement and consultation with the local community |

5 |

10 |

0 |

Provides for periodic reviews of the plan document |

12 |

0 |

3 |

Source: Victorian Auditor-General's Office.

The quality of the sample asset management plans was mixed. There were some good practices identified in our assessment of the plans, including:

- consistency with government policy

- clear descriptions of assets and services to be delivered

- initiatives in plans to determine the condition of assets.

However, there were also deficiencies in the quality of plans, which inhibit their implementation:

- Some plans were still incomplete after almost three years in development.

- None of the sample plans included a comprehensive process to monitor and evaluate the progress of implementing the plans.

- Eleven plans did not adequately connect current and future community service delivery needs to asset management plans.

- Seven of the sample plans had not been formally adopted by the council but are considered to be working documents.

- Seven plans did not adequately establish levels and standards of service for each asset class. Levels and standards of service were based primarily on historical experience and the results of general community surveys.

Among other things, these deficiencies indicate:

- different levels of commitment by councils to the importance of having approved asset management plans

- the development of plans may not adequately support current and future council services

- a lack of monitoring and measurement mechanisms that can provide objective assurance that the plans are working.

The current asset management plans are considered by councils to be 'first generation' plans under the national framework. Our review identified significant scope for improving these plans, although Kingston's plans were closer to better practice.

The Cube, photograph courtesy of the Wodonga City Council.

In our review of asset management plans, we did not specifically assess the management of roads, although they account for a substantial portion of councils physical infrastructure assets. Previous VAGO audits such as Management of Road Bridges 2011, and Maintaining the States Regional Arterial Road Network 2008, focused on the road network and it was scoped out of the current audit.

It is worth noting that roads, bridges and paths form a substantial part of a council's asset management business. These assets are governed by the Road Management Act 2004 and supporting regulations which prescribe the way councils must manage these assets under a Road Management Plan. Some councils have suggested that a more rigorous approach to other asset categories along these lines would improve council asset management generally.

2.3.5 Levels of service

The primary purpose of a council's asset portfolio is to effectively support its community's current and future service needs. Councils should prepare service delivery plans that establish both current and desired levels of service and that identify the optimal mix and capability of assets needed to support these services.

While all five councils had prepared various strategies for the services they deliver to the community, none has well-developed plans for their major services that link to asset management plans or asset requirements. One council was more advanced in developing service delivery plans, although their current and desired service levels and standards are not yet fully developed. Another council advised it has no service plans and that it believes most councils are struggling in this area.

All five councils had established and documented service levels for their drainage assets in compliance with the requirements of the Road Management Act 2004. However, councils acknowledged in their plans that more work is required to develop service level matrices which address service levels and standards, that link to asset requirements.

All five councils' asset management plans indicated that service levels and standards of service are determined largely on the basis of results from the annual community satisfaction survey undertaken by DTPLI. However, these surveys are generally conducted over the phone and do not constitute robust consultation or engagement on service levels and standards, and the information is of limited relevance to asset management. To illustrate, two councils' asset management plans—for bridges and drainage—indicated there is no specific area in the DTPLI survey that is designed solely for these asset categories and that standards are inferred from the results of more general survey questions. The surveys should not be used as a substitute for councils' own local engagement activities on service levels and standards.

All five councils consulted with their communities on specific asset initiatives, such as the use of playgrounds and the future of an outdoor swimming pool.

All audited councils identified that establishing service standards, and linking service delivery to asset requirements, are priorities in the development of 'second generation' asset management plans.

2.4 Measuring the adequacy of asset management frameworks

In 2010, councils were directed to achieve a 'core' level of maturity under the National Asset Management Assessment Framework (NAMAF) by December 2012. Few Victorian councils achieved this, and none of the audited councils had achieved 'core' maturity in all elements. Most of the audited councils are at 'low' to 'intermediate' levels of maturity in the development and application of key elements.

However, the audited councils have shown some improvement since 2010. The five councils' improvement in their aggregate NAMAF scores over the period 2010 to 2012 ranged from 3 per cent to 37 per cent, averaging around 17 per cent. The average improvement of all Victorian councils over this period was around 30 per cent.

Because the majority of Victorian councils did not meet the original 2012 target—only 14 of 79 councils achieved 'core' maturity by December 2012—this target was extended to December 2013. Twenty-three councils had achieved this level by December 2013. In this context it is important to note that 'core' maturity is still not best practice. Under NAMAF, best practice is the highest level of competence, called 'advanced' maturity.

2.4.1 Issues with the National Asset Management Assessment Framework

NAMAF scores are based on councils' annual self-assessments, with some moderation by external consultants appointed by the Municipal Association of Victoria (MAV) who review the scores.

We undertook our own assessment of each of the five councils by reviewing key documents related to asset management. Although VAGO's assessment criteria were similar to those for NAMAF, they were not identical. We focused on a smaller set of sub-elements within each NAMAF element that we considered to be the most important for councils to achieve. We did not set out to replicate each council's full self-assessment process or the MAV STEP Asset Management Improvement Program consultant's review process.

Overall, VAGO's assessment results for councils were similar to the scores councils gave themselves, however, we found there is a slight bias in councils towards overestimating maturity levels. One example is where a council gave itself a high rating for defining asset management roles, responsibilities and a reporting framework, yet there was no detail in its policy document regarding these.

The audited councils advised us that their assessments were fair and accurate using the NAMAF rules and validation process. We agree that the councils' own assessments are consistent with the current rules and process. However, our assessment suggests there are weaknesses in the framework itself and in the assessment process. These affect the reliability of NAMAF scores as indicators of asset maturity, and raises concerns about their consistency and comparability over time and across councils.

Our assessment and advice from councils identified several issues with NAMAF:

- Element and sub-element are often ambiguously defined. This increases the likelihood of subjectivity in self-assessments.

- Methods for converting NAMAF scores into conclusions about asset management competency are inconsistent. MAV suggests that 'core' maturity is achieved when a council reaches a score of 95–100 for each asset management element. However, MAV also considers that 'core' maturity overall is achieved when the aggregate score across all elements is above 1 000, which requires an average element score of only 91.

- Councils have pointed out the crudeness of the scoring system whereby councils with very close scores can end up in very different asset maturity groups.

- Councils also emphasised that while their self-assessment scores were previously externally audited, they no longer are.

- One council cautioned that a distinction should be made between 'strategic asset management' which has a corporate-centred approach and 'on-ground asset management', which has a traditional engineering department approach. Many councils are still in transition towards implementing a strategic approach to asset management which requires councils to apply more resources. However, high NAMAF scores do not register the difference and may not always indicate better 'on-ground asset management' practices.

- Another council advised that while it submits NAMAF self-assessment reports annually, it doesn't see itself as part of the MAV STEP process and is planning to align itself with the new ISO-55000 Asset Management standard. This reflects the council's view that there are deficiencies in NAMAF in its current form.

Having an unbiased and accurate assessment of asset management maturity is important because it will inform councils of what is required to address deficiencies. Overestimating competencies and relying solely on NAMAF to reflect councils' asset maturity creates the risk that significant problems are not adequately addressed.

This all points to a need to review NAMAF to improve how its elements are defined and measured, and how scores should be interpreted by councils and independent auditors. Validation processes for councils' self-assessments should also be reviewed to ensure reliable and consistent methods are used across all councils. Improving these areas would likely lead to greater council confidence in NAMAF benchmarking, and greater transparency and accountability about councils' asset management performance. The results should be made publicly available through councils' annual reports, as well as via a central website to allow easy comparison between councils.

While it is timely to review the use of NAMAF, councils and MAV acknowledge that it has helped to put asset management more firmly on councils' agendas, provided useful guidance and direction for self-assessment of asset performance, and encouraged councils to improve against shared benchmarks.

2.5 Guidance and support provided to councils

There is an abundance of guidance available to assist councils but they are not making best use of this material. Figure 2B summarises selected asset management better practice guidance material available to councils.

Figure 2B

Better practice guidance material

Title |

Description |

Provided by |

|---|---|---|

Sustaining Local Assets(2003) |

Provides the overall policy framework to guide the strategic management of council infrastructure assets |

LGV |

Asset Management Policy, Strategy and Plan (2004) |

Guidelines for developing an asset management policy, strategy and plan |

LGV |

National Asset Management Assessment Framework |

A self-assessment tool to assist councils to identify progress in implementing best practice asset management |

Institute of Public Works Engineering Australia (IPWEA)/Australian Centre of Excellence for Local Government (ACELG) |

STEP asset management improvement program (since 2003) |

A program for councils covering asset management and planning as essential for the effective delivery of services |

MAV |

Local Government Asset Investment Guidelines (2006) |

Guidelines for planning and business case analysis through to asset investment and evaluation for significant capital investments |

LGV |

International Infrastructure Management Manual (2011) |

Provides best practice guidance on asset and financial management practice for infrastructure assets |

New Zealand National Asset Management Steering Group/ IPWEA |

Australian Infrastructure Financial Management Guidelines (2012) |

Provides guidance on developing best practice asset and financial management for infrastructure assets |

IPWEA |

Long-term Financial Planning (2012) |

Developed to assist organisations that are involved in service delivery and long-term asset management in preparing a long-term financial plan |

IPWEA/ACELG |

Source: Victorian Auditor-General's Office.

2.5.1 Local Government Victoria

LGV's role includes working in partnership with local councils to improve business and governance practices that maximise community value and accountability.

As part of this, LGV has developed and promoted asset management guidance materials. The guidelines, Asset Management Policy, Strategy and Plan, were developed around 10 years ago. Audited councils advised that many councils developed their asset management frameworks some time ago using these guidelines, and that updated guidance that provides a standardised approach for all councils would be helpful. LGV advised VAGO that its 2004 asset management guidelines will be reviewed and updated in 2014.

The audited councils advised that support from LGV, though appreciated, is limited, so they do not often seek guidance or assistance with developing their asset management frameworks and practices directly from LGV. Three councils advised they have used some of LGV's guidance material to develop sustainable asset management practices. There is scope for LGV to provide more targeted guidance and support to councils to address common problems, such as improving their asset management planning and practices, and dealing with the renewal gap challenge.

Councils advised that the State Library of Victoria previously provided open access to a website portal for sharing asset management information. This was extensively used and valued by councils and other organisations, but is no longer available. LGV, councils and MAV should collaborate to review the value of such a central asset management website. We understand MAV is already doing some work in this area.

LGV also coordinates annual surveys designed to identify improvements in asset management practices and assess progress by councils. Some councils have queried the usefulness of these surveys and suggested that LGV could engage councils on how the surveys could be of greater mutual benefit.

LGV is currently developing a Local Government Performance Reporting Framework to be applied by councils from July 2014. However, the asset management indicators proposed are not sufficiently detailed to support comprehensive monitoring and reporting of councils' asset management practices. LGV advises that the indicators proposed have been developed to provide a high level view of a council's asset management performance and strategies. In addition to these indicators, it would be desirable to consider further disaggregated or detailed indicators and information to support deeper analysis. Councils have also raised the issue of duplication of asset data requirements by LGV and MAV, and as part of this, the under-utilisation of Victorian Grants Commission data. LGV could work more closely with councils and MAV to discuss and resolve such data issues.

In Victoria, the Local Government Act 1989 is silent on how councils should manage their assets. In other states, legislation has been put in place to promote better asset management planning. In 2005, South Australia legislated that councils prepare a long-term financial plan and an infrastructure and asset management plan, both covering a period of at least 10 years. In 2009 New South Wales introduced the same requirements.

LGV should review the relative merits of different legislative approaches with a view to strengthening Victorian legislation to help achieve best practice asset management. Legislation recently has been passed by Parliament to strengthen performance reporting and accountability across a wide range of areas within councils. LGV expects this to result in greater alignment between asset management and financial planning, and better council benchmarking on asset management.

2.5.2 Municipal Association of Victoria

The MAV STEP program, which commenced in 2003, was designed to assist councils improve their asset management capabilities. It is built on a continuous improvement model and setting 'stretch' targets. Since 2010, the STEP program has incorporated NAMAF to assist councils in a practical way to meet national framework standards for asset management.

MAV has also collected data around asset management practices from Victorian councils, and benchmarked this data to gain an understanding of councils' asset management maturity. MAV was also provided $1.4 million from the federal government's Local Government Reform Program in 2010 for the Regional Asset Management Program.

Under NAMAF, and with MAV and LGV support, councils have improved their asset management practices. However, two audited councils questioned the ongoing usefulness of the STEP program for asset management, especially in terms of value for money. Another suggested it was timely for MAV to review the relevance of its current asset management support programs via a survey.

Bridge, photograph courtesy of Ararat Rural City Council.

Recommendations

Local councils should:

- accelerate efforts to review and update their asset management frameworks, policies and strategies to meet better practice standards

- make sure they have comprehensive asset management plans covering all major asset categories.

Local Government Victoria should:

- review and update its asset management guidance material for councils

- review the support it provides to councils and make sure it is targeted to address common issues

- consider, in conjunction with councils, developing a set of comprehensive asset management performance indicators that will enable comparability between councils on asset management performance

- in conjunction with councils and the Municipal Association of Victoria, review the use and application of the National Asset Management Assessment Framework and its appropriateness for driving improvement in asset management performance

- consider making aspects of asset management mandatory, such as the development of asset management policies, strategies and plans.

3 Councils' asset management practices

At a glance

Background

Better asset management practice helps councils to manage their infrastructure planning and spending well. To achieve this they must implement, monitor and review their asset plans, and report on their progress to the council and their communities.

Conclusion

While council asset management practices are improving in various areas, they do not yet meet better practice. Councils are not adequately addressing asset renewal. This affects the level of service councils can provide to their communities and, without timely and appropriate action, will likely affect council financial sustainability in the longer term.

Effective asset management is being inhibited by a combination of underdeveloped asset management information systems and a lack of skilled resources. This prevents councils from effectively monitoring, evaluating and reporting on their progress in implementing plans.

Findings

- Spending on existing assets is not keeping pace with the consumption of these assets. Councils are not able to meet existing asset renewal requirements, resulting in renewal gaps growing and accumulating each year.

- None of the councils has adequate monitoring, evaluation and reporting processes in place for asset management.

- Community engagement around assets is poor.

Recommendations

Local councils should:

- develop a strategy for reducing their asset renewal gaps

- improve their asset management information systems

- improve the provision of information to the community, and engagement with the community on asset management

- develop and implement monitoring, reporting and evaluation systems and publicly report on their asset management performance.

3.1 Introduction

Councils should operate within a sound and strategic asset management framework, but for this framework to be effective they must also follow through with robust asset management practices. This requires them to make many complex decisions and take appropriate action in asset operation, maintenance, renewal, upgrade and disposal, including new capital spending when needed to meet changing community demands and service levels.

If councils are making these decisions well, it will be evident in a number of areas including the state of their asset management plans, their capital works budgets, the management of their renewal gaps, and how they monitor, evaluate and report progress on asset management.

3.2 Conclusion

Council asset management practices have improved, but do not yet met best practice in a number of areas.

Audited councils have underdeveloped asset management information systems and a lack of skilled resources, particularly the smaller and regional councils. Councils also have poor systems for monitoring, evaluating and reporting on the progress of implementing plans. Community engagement around assets is generally poor.

Spending on existing assets is not keeping pace with the consumption of these assets. Audited councils are not able to meet existing asset renewal requirements, resulting in cumulative renewal gaps growing every year. This situation is likely to adversely impact the condition of assets, service levels and councils' long-term financial sustainability.

There are significant differences in expenditure against capital works budgets for the audited councils. Underspending by several councils suggests there is scope to better integrate capital works programs with asset management and long-term financial planning.

3.3 Asset management practices

In order to assess how well councils in our sample perform in their asset management practices, we focused on whether they had:

- implemented asset management plans as intended

- effectively managed their capital works budgets and the asset renewal gap

- made the best use of the available resources to effectively deliver the intended services to their local communities

- evaluated and reviewed the implementation of their asset management strategies and plans.

3.3.1 Delivery of the budgeted capital works program

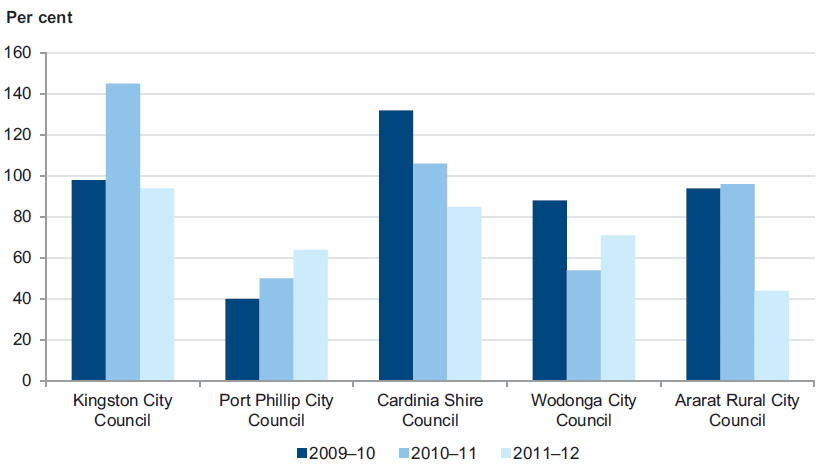

Developing and adhering to a capital works budget is a key aspect of effective asset management. We analysed councils' capital works budgets against their actual capital spend from 2009–10 to 2011–12.

Figure 3A illustrates the wide fluctuations between audited councils, with several significantly underspending against their capital works budget targets over the three-year period. Adhering to capital works budgets is an indicator of sound financial planning and management and is consistent with good asset management practice, although variations from budget may occur for a range of reasons, some of which may be outside the control of councils. It is therefore important that there is transparent reporting on the reasons for budget variations.

Figure 3A

Comparison of actual capital spend to capital budget

Source: Victorian Auditor-General's Office.

Councils are required to provide explanations in their annual reports for major differences between budgeted and actual capital works expenditure. Common explanations are work delays, reprioritised and reallocated works, works carried over from the previous year, unplanned works, and capital works brought forward. However, these explanations were more descriptive than explanatory and often did not fully detail the reasons for such significant variations. For example, councils frequently reported that the project was delayed, but usually did not identify the underlying cause of the delay or the potential impacts. This provides limited transparency and accountability to ratepayers.

The large deviations from budgets points to a need for some councils to better integrate their capital works budgets and programs with asset management plans and long-term financial plans. They should also set realistic and achievable levels of capital expenditure that are determined by identified community service needs and standards. Several councils commented that when they rely significantly on federal or state grants, it is more difficult to match budgeted and actual capital spend.

3.3.2 Managing the renewal gap

A key challenge for councils is to ensure their municipalities' assets are adequate for supporting the services the council provides to its community. This requires councils to systematically plan for, and continually invest in, asset maintenance, renewal and replacement. Failure to invest in these in a timely way results in an asset renewal gap that grows and becomes worse over time, putting the quantity and quality of council services at risk.

The need for action to address the renewal gap is not new. A report prepared in 1998 for Local Government Victoria's (LGV) predecessor, Facing the Renewal Challenge – Victorian Local Government Infrastructure Study, warned that unless steps were taken to address the renewal gap, the amount required for renewal would more than double by 2012. In 1997, the five-year renewal cost for Victorian councils was around 4 per cent of total asset value, but by 2011–12, this figure had risen to 7.5 per cent. Overall, councils are not making sufficient progress in addressing their renewal gaps. While addressing the renewal gap may require some hard decisions, failure to make those decisions will only lead to harder decisions in the future, and will result in the continuing deterioration of assets and services.

Renewal gap analysis in audited councils

Each year, councils determine their asset renewal requirements, which include the costs of renewing, restoring and replacing existing assets. Figure 3B shows the estimated funding needed to renew assets for the audited councils.

Figure 3B

Infrastructure renewal, 2011–12 to 2015–16

|

Kingston ($mil) |

Port Phillip ($mil) |

Cardinia ($mil) |

Wodonga ($mil) |

Ararat ($mil) |

All audited councils ($mil) |

|

|---|---|---|---|---|---|---|

|

Year 1 renewal cost (2011–12) |

22.4 |

17.7 |

24.7 |

5.4 |

3.6 |

73.8 |

|

Year 1 council budgeted funding |

19.2 |

11.2 |

24.7 |

3.4 |

5.4 |

63.9 |

|

Year 1 renewal gap variance |

3.2 |

6.5 |

0 |

2.0 |

–1.8 |

9.9 |

|

5-year renewal cost (2011 to 2016) |

120.6 |

94.1 |

123.5 |

25.6 |

21.2 |

385.0 |

|

5-year council budgeted funding |

93.5 |

55.9 |

123.5 |

23.1 |

26.8 |

322.8 |

|

5-year renewal gap variance |

27.1 |

38.2 |

0 |

2.5 |

–5.6 |

62.2 |

|

5-year average annual renewal gap |

5.4 |

7.6 |

0 |

0.5 |

–1.1 |

12.4 |

Note: In Ararat's case, only 2010–11 data was available.

Source:Victorian Auditor-General's Office, using data from Municipal Association Victoria's benchmarking survey – reported in STEP Program Overview and Results 2012–13.

This analysis shows that for 2011–12, funding of $73.8 million was needed to renew assets in the five audited councils. However, councils collectively budgeted for around $63.9 million—14 per cent less than required.

The estimated required funding for the five-year period to 2015–16 is $385 million, but councils budgeted $322.8 million, a shortfall of 16 per cent. This suggests that some councils are unable or unwilling to fund their identified asset renewal requirements. As a result, their asset renewal gaps continue to grow annually. This will likely adversely impact the condition of asset portfolios and levels of service that councils can provide to their communities.

For councils individually, Figure 3B highlights that:

- Kingston planned to underspend in 2011–12 by $3.2 million, or 15 per cent, and planned to underspend over the five years to 2016 by $5.4 million per year, or 22 per cent

- Port Phillip and Wodonga both planned to underspend in 2011–12 by 37 per cent and Port Phillip by a proposed 41 per cent over the 5-year period

- Cardinia planned to fully meet its renewal requirements in the short and medium terms