Results of 2016–17 Audits: Local Government

Overview

Victoria’s local government sector is made up of 79 councils, 10 regional library corporations and 16 associated entities.

This report outlines the results of, and observations arising from, our financial audits of the entities within the sector, and our observations, for the year ended 30 June 2017. We also comment on the outcomes of our audits of the 79 council performance reports.

We also assess the sector’s financial performance during the 2016–17 reporting period and its financial sustainability as at 30 June 2017. Further, we considered the short and longer team impact of rate-capping on the local government sector.

Transmittal letter

Ordered to be published

VICTORIAN GOVERNMENT PRINTER November 2017

PP No 347, Session 2014–17

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Results of 2016–17 Audits: Local Government.

Yours faithfully

Andrew Greaves

Auditor-General

29 November 2017

Acronyms

| AASB | Australian Accounting Standards Board |

| DELWP | Department of Environment, Land, Water and Planning |

| DPC | Department of Premier and Cabinet |

| ESC | Essential Services Commission |

| IT | Information technology |

| LGPRF | Local Government Performance Reporting Framework |

| LGV | Local Government Victoria |

| KMP | Key management personnel |

| VAGO | Victorian Auditor-General's Office |

| VCAT | Victorian Civil and Administrative Tribunal |

Audit overview

In Victoria, the local government sector comprises 79 councils, their 10 regional library corporations and 16 associated entities. While administered under the Local Government Act 1989, each council operates autonomously and is directly accountable to ratepayers. Local Government Victoria (LGV), within the Department of Environment, Land, Water and Planning (DELWP), provides policy advice, oversees legislation and works with the Minister for Local Government and local councils.

In this report, we analyse and discuss the results of our 2016–17 audits of the financial reports and performance statements of Victoria's councils, regional library corporations and associated entities.

We assess their financial performance during 2016–17, and their financial position as at 30 June 2017. In addition, we discuss the financial sustainability of the sector based on our analysis of council budgets and the 30 June 2017 audited financial reports. We also analyse the sector's response to the introduction of the Victorian Government's rate capping policy in 2015.

Conclusion

The councils' audited financial reports and performance statements for the year ended 30 June 2017 are reliable, and Parliament and the wider community can have confidence in them.

In the short term, the sector as a whole has a relatively low financial sustainability risk. The longer-term impact of rate capping is yet to be fully determined, but it has created the impetus for councils to review their cost structures.

To mitigate and minimise any potential risks arising from issues in their internal control environment, councils need to ensure they promptly resolve the issues we have identified.

Findings

Results of audit

Financial reports

For the financial year 2016–17, we issued clear audit opinions for 104 financial reports.

The opinion for MAPS Group Limited—an associated entity that has a 30 September balance date—remains outstanding at the date of this report.

Compared to the prior financial year, in 2016–17 councils made a small improvement in the median time taken to certify their financial reports. This could be significantly improved by bringing forward key elements of the financial reporting work, such as the timing of asset revaluations.

As new Australian Accounting Standards will apply over the next few years, the timely preparation and certification of financial reports is particularly important. Councils are encouraged to assess these new standards and prepare for their implementation at their earliest opportunity.

Performance statements

We issued 78 clear audit opinions on councils' performance statements for 2016–17. We qualified our audit opinion for Towong Shire Council's performance statement. As the council did not conduct or participate in a 2016−17 community satisfaction survey, it was unable to obtain information for two indicators and, therefore, could not report the results.

Performance statements are important, as they communicate key financial and non-financial results. Currently, in their performance statements, councils explain significant variations in performance indicators in the context of results from prior years. While this information is useful, setting a target would assist readers to determine whether a council is operating efficiently and effectively.

Internal controls

We assess councils' internal controls as generally well designed and operating as intended by management.

However, we continue to observe issues in key IT internal controls and have identified this as an increasing trend across the sector. Persistent high-risk IT internal control issues include:

- unsupported systems and software

- weak user access management

- lack of software patch management.

Combined, these matters increase the risk of a successful cyber attack and could result in the destruction of data or recording of non-existent transactions.

Overall, councils have resolved over 60 per cent of the internal control issues identified in our current and prior-year audits.

Found assets

In 2016–17, 29 councils identified $175.3 million of assets that they had not known about or recorded (compared to 31 councils and $149.3 million assets in 2015–16). Councils use asset information to plan and monitor their maintenance and capital works planning. Therefore, it is important that they know about all relevant assets.

In our November 2016 report Local Government: 2015–16 Audit Snapshot, we highlighted the lack of completeness and accuracy of councils' underlying data about the assets they control as a recurring issue. This continued to be an issue in 2016–17.

Financial sustainability

We have assessed the sector as having a relatively low financial sustainability risk in the short term.

Our analysis shows a gradual decline in the asset renewal and maintenance indicators. Overall, the sector forecasts spending less on asset renewal and maintenance.

We also found that most councils are accumulating cash—in preference to acquiring debt—to replace or expand their asset base. This is shown through the declining trend in the indebtedness indicator, and the sector's increasing cash and term deposit holdings.

We note that rural and regional councils have a higher financial sustainability risk than metropolitan councils. This is linked to their relative inability to generate sufficient own-sourced revenue streams as well as steady increases in expenditure.

The impact of rate capping

Our analysis shows that, on average, councils are forecasting their revenue to decrease by 1 per cent over the next three financial years, while expenditure is set to increase by 2 per cent over the same period. Councils need to better understand the impact this disparity may have on the services that they provide to their communities.

It is encouraging that most councils have identified longer-term viability risks that may result from rate capping, but many do not yet understand how they can respond to this risk. To do this, a first step councils must take is to understand the nature and cost of all services they provide to their communities.

Councils also need to understand the impact of reduced revenue on their capital works programs. We found that, in response to rate capping, councils have started to reduce their longer-term capital expenditure programs. However, these programs typically only focus on the next four years. We recommend that councils develop longer-term plans, covering the next 10 to 20 years, to ensure they make appropriate decisions.

Recommendation

We recommend that Local Government Victoria:

- introduce targets for each of the performance indicators included in each councils' performance statements (see Part 2).

Submissions and comments

We have consulted with DELWP and the councils named in this report, and we considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions or comments. We also provided a copy of the report to the Department of Premier and Cabinet.

The following is a summary of those responses. The full responses are included in Appendix A.

DELWP notes our findings and supports in principal the report's recommendation. DELWP intends to write to all mayors and CEOs recommending that they review the report and address matters relevant to their council.

Horsham Rural City Council provides further information on its case study. City of Kingston, Moreland City Council and City of Stonnington comment on found assets. City of Moonee Valley and Moreland City Council provide information regarding their management letter issues.

1 Audit context

Victoria's Constitution recognises local government as one tier of government. Democratically elected councillors govern councils, and their operations are managed by a council-appointed chief executive officer. While administered under the Local Government Act 1989, each council operates autonomously and is directly accountable to ratepayers.

|

In this report, the local government sector refers to the 79 Victorian councils. |

The sector includes 79 councils, 10 regional library corporations and 16 associated entities. We classified councils into two categories, made up of five cohorts based on size, demographics and funding—see Figure 1A. These cohorts are consistent with LGV's classification of council types.

Appendix B lists the councils included in each cohort and the results of our audits of each entity.

Figure 1A

Council cohorts in the metropolitan, and rural and regional categories

|

Cohort |

Definition |

Number of councils |

|---|---|---|

|

Metropolitan councils |

||

|

Metropolitan |

A metropolitan council is predominantly urban in character and located within Melbourne's densely populated urban core. |

22 |

|

Interface |

An interface council is one of the nine municipalities that form a ring around metropolitan Melbourne. |

9 |

|

Total metropolitan councils |

31 |

|

|

Rural and regional councils |

||

|

Regional city |

A regional city council is urban and partly rural in character. |

10 |

|

Large shire |

A large shire is a municipality with more than 16 000 inhabitants that is predominantly rural in character. |

19 |

|

Small shire |

A small shire council is a municipality with less than 16 000 inhabitants that is predominantly rural in character. |

19 |

|

Total rural and regional councils |

48 |

|

|

Total councils |

79 |

|

Source: VAGO.

1.1 Local government sector

The local government sector is primarily funded though rates and charges, and government grants to deliver various services for the local community. Figure 1B shows the funding sources and how the sector spends these funds.

Figure 1B

Overview of the local government sector

Source: VAGO, based on Local Government Victoria, Victoria Grants Commission—Questionnaire 2015–16 responses from councils.

The two categories of councils—metropolitan, and rural and regional—have different demographics and face separate challenges and opportunities. This is evident, for example, in rural and regional councils' reliance on grants compared to the metropolitan councils.

Figure 1C compares these two categories of councils and provides key sector information.

Figure 1C

Comparison of key elements across the two councils categories

Source: VAGO, based on Local Government Victoria, Victoria Grants Commission—Questionnaire 2015–16 responses from councils; and Australian Bureau of Statistics.

1.2 Sector events

Two recent developments—rate capping and governance interventions—have had or will have a considerable impact on the local government sector.

Rate capping

In 2015, the Victorian Government introduced rate capping legislation in the form of its Fair Go Rates System. This system introduces an annual rate cap, set by the Minister for Local Government, which controls general rate increases for all councils. The 2016–17 financial year is the first year of rate capping, with rate increases capped at 2.5 per cent (2 per cent in 2017–18).

We explore the short- and long-term implications of rate capping for the local government sector in Part 5 of this report.

Governance interventions

Effective governance is essential for maintaining strong internal controls. Although most councils have appropriate controls to govern themselves, there have been a number of recent legal interventions by the state government in response to governance failures. Figure 1D summarises the status of some recent governance issues.

Figure 1D

Current status of governance matters

|

Council |

Description |

|---|---|

|

Ararat Rural City Council |

In June 2017, a Commission of Inquiry was appointed. In August 2017, the Minister for Local Government appointed a municipal monitor to observe the council's operations. |

|

Central Goldfields Shire Council |

In October 2016, the minister appointed a municipal monitor. On 18 August 2017, the Local Government Investigations and Compliance Inspectorate released its report Protecting integrity: Central Goldfields Shire Council investigation. Following the release of the report, the state government dismissed the council on 23 August 2017. On 26 August 2017, the state government appointed an interim administrator. |

|

Casey City Council |

In June 2016, a municipal monitor was appointed. The municipal monitor report was received in September 2016. |

|

Darebin City Council |

On 25 June 2015, special inspectors were appointed. |

|

Greater Geelong City Council |

In December 2015, an independent Commission of Inquiry was appointed. The state government dismissed the council in April 2016 and appointed three administrators until the council election in October 2017. A new council was elected in October 2017. |

Note: Municipal monitors are appointed by the Minister for Local Government to observe governance processes and provide advice to councils that are experiencing governance difficulties. Commissioners are appointed by the Minister for Local Government where there are more serious governance failures.

Source: VAGO.

1.3 Report structure

In this report, we detail the outcomes of the 2016–17 financial audits of Victoria's local government sector. We discuss key matters arising from our audits, and provide an analysis of information included in councils' financial reports.

Figure 1E outlines the structure of this report.

Figure 1E

Report structure

|

Part |

Description |

|---|---|

|

Part 2—Results of audits |

Presents results of our audit of local government sector entities for the 2016–17 financial year. This section also provides commentary on:

|

|

Part 3—Internal controls |

Summarises the results of our internal control evaluations of local government sector entities for the 2016–17 financial year. |

|

Part 4—Financial sustainability |

Provides an insight into the sector's long-term viability risks, based on our analysis of financial sustainability risk indicators. |

|

Part 5—Rate capping impact assessment |

Provides commentary on the impact of rate capping on councils, based on the sector's response. |

Source: VAGO.

We undertake our financial audits according to section 8 of the Audit Act 1994 and Australian Auditing Standards. These audits are paid for by each entity.

The results of these audits were used in preparing the report. The cost of preparing this report was $250 000, which is funded by Parliament.

2 Results of audits

Councils prepare a financial report and performance statement annually. Their financial report shows the council's financial results and is prepared in line with relevant Australian Accounting Standards and applicable legislation. The performance statement outlines the council's performance against performance indicators set by the Minister for Local Government. We audit both the financial reports and the performance statements.

2.1 Audit opinions

Independent audit opinions add credibility to financial reports and performance statements by providing reasonable assurance that the information reported is accurate and reliable.

A clear audit opinion confirms that the financial report presents fairly the transactions and balances for the reporting period, in keeping with the requirements of relevant Australian Accounting Standards and applicable legislation. A clear audit opinion for the performance statement confirms that the actual results reported are fairly presented and comply with the performance indicators set by the minister. We carried out our financial audits of the local government sector in accordance with the Australian Auditing Standards.

Figured 2A outlines the status of the sector's 2016–17 financial report and performance statement audits, and the types of opinions issued to each entity. Appendix B lists the local government entities, type of audit opinion and when they were issued.

Figure 2A

Status of 2016–17 audit opinions

|

Entities |

Clear audit opinions |

Qualified opinion |

Number of opinions issued |

Incomplete |

|---|---|---|---|---|

|

Financial report |

||||

|

Council |

79 |

– |

79 |

– |

|

Regional library corporations |

10 |

– |

10 |

– |

|

Other(a) |

15 |

– |

15 |

1 |

|

Total |

104 |

– |

104 |

1 |

|

Performance statements |

||||

|

Council |

78 |

1 |

79 |

– |

(a) MAPS Group Limited has a 30 September balance date—no audit opinion had been issued at the date of this report for the year ending 30 September 2017.

Source: VAGO.

Qualified audit opinion for Towong Shire Council's performance statement

|

A qualified audit opinion is issued when the auditor concludes that a clear opinion cannot be expressed because of a conflict with the applicable reporting framework or a limitation of scope. |

We qualified the performance statement audit opinion of Towong Shire Council due to the fact that the council did not conduct or participate in the required community satisfaction survey for the 2016–17 financial year. The survey obtains information from the community on the following service-related performance measures:

- satisfaction with council decisions

- satisfaction with sealed local roads within the municipality.

Accordingly, the council was unable to report results for these performance indicators in its 2016–17 performance statement. The inability to report these performance indicators constitutes a departure from the performance statement requirements under Part 6 of the Local Government Act 1989.

2.2 Quality of financial and performance reporting

The quality of an entity's financial and performance reporting can be measured by the timeliness and accuracy of these reports.

Timeliness

Timely financial reports and performance statements enable users to make better informed and prompt decisions. The later these reports are produced, the less relevant the information is.

Councils are required to submit their financial reports and performance statements to the Minister for Local Government and have them certified by 30 September each year. Figure 2B shows when councils' reports were certified in 2016 and 2017.

Figure 2B

Timeliness of financial reports and performance statements

Note: The certification date for Central Goldfields Shire Council is omitted from this figure.

Source: VAGO.

|

Shell accounts are a set of financial reports and performance statements prepared by management prior to the balance date. These assist with planning the structure and contents of the actual financial report and performance statement. |

With the exception of Central Goldfields Shire Council's reports—which were certified on 9 November 2017 and received an extension from the minister until 30 November 2017—all councils met the statutory deadline, as in 2016.

While the sector made a small improvement in the median time taken to certify the reports compared to the prior year, further improvements could be made by bringing forward work such as:

- conducting asset valuations prior to the balance date

- evaluating and mitigating key risks during the year such as the completeness and accuracy of landfill provisions

- preparing shell accounts for audit review.

Accuracy

|

Material errors are significant misstatements or omissions of information that may influence a user's decision-making. |

The number and size of errors identified through our audit of the financial reports and performance statements is a direct measure of the quality of those documents. Ideally, there should be no errors or adjustments required as a result of an audit. When material errors are detected through the audit process, they are brought to management's attention for correction.

Material errors identified during the audit process need to be corrected before a clear audit opinion can be issued. While some errors may appear immaterial in isolation, a series of smaller errors when considered together may have a material impact on the entity's financial report or performance statement.

|

Developer contributions are physical assets such as roads and drains that are transferred to councils once their construction is complete. |

Financial reports

Aggregated errors that required adjustment include:

- a $727.7 million understatement of total assets due to incorrect valuation of non-current assets—we explore these matters further in the Section 2.3

- $81.9 million in term deposits incorrectly classified as either other financial assets or cash equivalents

- a $25.6 million overstatement in total revenue due to developer contributions reported in the incorrect financial year

- a $3.5 million understatement and a $1.7 million overstatement in total liabilities due to errors in landfill provision calculations.

In 2016–17, LGV provided guidance to the sector regarding accounting for landfills. We encourage councils to review this information when evaluating the reasonableness of their landfill provisions.

Performance statements

LGV issues the Local Government Performance Reporting Framework (LGPRF) which outlines the requirements for councils' performance statements. Based on our analysis of errors identified through the audit process, performance indicators that were more susceptible to error include:

- statutory planning—council planning decisions upheld by the Victorian Civil and Administrative Tribunal (VCAT)

- food safety—critical and major noncompliance outcome notifications

- aquatic facilities—utilisation.

These errors were generally due to a lack of awareness of the LGPRF or challenges the council faced in interpreting whether an item should be included in a specific performance indicator.

When preparing their statements, councils are required to explain significant variations in performance indicators compared to prior years. While this information is useful, the current performance reporting framework does not impose targets. As a result, management and readers of the performance statement are unable to determine if a council is operating efficiently and effectively.

Setting a target would assist management and users of performance statements to understand where a council's performance can be improved.

2.3 Key audit themes

As we plan our financial audit work across the sector each year, we seek to identify key audit risks. These risks, if not addressed, may lead to material misstatements in financial reporting. We communicate these risks in our audit strategy documents, which are presented to management and audit committees at each council prior to the end of the financial year.

The homogenous nature of local councils means that there are often common risk themes across the sector, covering governance, operations and customers. This year, the most common key audit risks we identified were:

- noncompliance with the accounting standard requirements in AASB 124 Related Party Disclosures (AASB 124) , which applied to this sector for the first time

- the valuation of non-current physical assets

- found assets recognised across the sector

- information technology (IT) risks—see Part 3.

AASB 124 Related Party Disclosures

In their financial reports for the year ended 30 June 2017, not-for-profit entities were required to apply AASB 124 for the first time. This meant that all councils needed to disclose information about material related-party transactions and relationships that may have affected their financial performance or position. The application of AASB 124 created challenges for both the councils preparing the financial report and their auditors, to ensure that the information disclosed was complete and accurate.

Across the local government sector, there was a broad range of material related‑party relationships that needed to be disclosed, including:

|

KMPs are employees who make strategic decisions for the council. |

- key management personnel (KMP) and their close family

- other entities controlled by KMPs

- all other council-controlled agencies.

While the level of disclosure varied across the sector, rural and regional councils typically reported more material related-party transactions than metropolitan councils. Common disclosures included:

- provision of goods and services to councils

- community grants to related parties

- KMP family members employed by council

- payments to related entities such as regional library corporations.

These transactions were reported to be on normal commercial terms.

Overall, we noted that most councils had appropriate processes in place to capture and disclose the information needed to meet the requirements of AASB 124.

In its first year, the implementation of AASB 124 went relatively well. Other significant changes to standards in the next few years—summarised in Appendix C—will also impact council financial reporting. Councils are encouraged to examine these changes, identify potential impacts and prepare for their implementation.

Physical asset fair value assessments and revaluations

|

The fair value is the estimated cost to purchase or replace an asset. Calculation of fair value should take into account any conditions or restrictions placed on the asset. |

At 30 June 2017, the 79 councils held $91.2 billion in infrastructure, property, plant and equipment ($84.6 billion at 30 June 2016). In particular, there was a $5.2 billion asset revaluation increment across the local government sector.

To comply with Australian Accounting Standards, each council must annually determine and disclose the fair value of its infrastructure, property, plant and equipment assets in its financial report.

There are two common methods used to calculate fair value across the local government sector:

- Market approach—based on market sales of similar assets. This method is generally used to value land and buildings.

- Current replacement cost—reflects the expected cost in today's dollars of replacing an asset to a similar standard and at a similar age. This method is generally used to value infrastructure such as roads and bridges.

As the total value of infrastructure, property, plant and equipment represents a significant percentage of a council's total assets, our audits allocate a significant amount of time and effort to verifying their fair value estimates. As valuing infrastructure, property, plant and equipment involves significant management judgement across a range of values, there is a higher risk of material financial report errors.

|

Found assets are physical assets controlled by the council that have previously been omitted from their records. Ghost assets are items recorded by a council that no longer exist. Duplicate assets are additional items recognised for an existing asset. |

We found that the practices governing asset revaluations varied across the sector. Key issues include:

- incorrect unit costs applied to assets

- underlying data integrity issues resulting in found, ghost or duplicate assets

- lack of review of underlying spreadsheets resulting in calculation errors.

All material errors identified were resolved before we signed relevant councils' financial reports.

Found assets

Included in the $91.2 billion in infrastructure, property, plant and equipment, the Victorian local government sector recognised $175.3 million in found assets this year (compared to $149.3 million in 2015–16). Figures 2C and 2D show the spread of these assets across Victoria and metropolitan Melbourne.

Figure 2C

Source: VAGO.

Figure 2D

Found assets as a proportion of revenue in metropolitan category, 2016–17

Source: VAGO.

The value of found assets varied across the local government sector. The majority of these relate to infrastructure.

Common challenges included:

- underground assets such as drains which are difficult to inspect

- uncertainty over ownership of assets between entities, such as drains with water entities.

Technological advances, including GPS information, have assisted councils in improving the accuracy of data in their asset registers. Nevertheless, further work is required to reduce the number of found assets across the sector. Those assets that are not captured are obviously not subject to regular maintenance and may continue to deteriorate, resulting in considerable long‑term costs.

3 Internal controls

Effective internal controls help entities meet their objectives reliably and cost‑effectively. Entities also require strong internal controls to deliver reliable, accurate and timely external and internal financial reports.

In our annual financial audits, we consider the internal controls relevant to financial reporting and assess whether entities have managed the risk that their financial reports may not be complete and accurate. Poor internal controls make it more difficult for entities to comply with relevant legislation and increase the risk of fraud and error.

3.1 Assessment of internal controls

As part of our audit, we assess the design and implementation of councils' internal controls and, where we identify ones that we intend to rely on, we test how effectively they are operating. If we assess an entity's internal controls as not being well designed, not operating as intended or missing, we communicate this finding to the entity's management and audit committee.

In 2016–17, we reported 359 extreme-, high- and medium-risk internal control issues across the 79 councils, comprising:

- 110 newly identified issues

- updates on 249 issues identified through previous years' financial audits.

Figure 3A summarises these control issues by area and risk. Appendix D provides additional information on our risk ratings and our expected time lines for councils to resolve issues.

Figure 3A

Reported internal control issues, by area and risk rating, 2016–17

|

Area of issue |

Extreme |

High |

Medium |

Total |

|---|---|---|---|---|

|

Governance |

– |

2 |

48 |

50 |

|

Information systems |

4 |

36 |

69 |

109 |

|

General ledger |

– |

– |

10 |

10 |

|

Revenue and receivables |

– |

– |

20 |

20 |

|

Expenditure and payables |

– |

2 |

33 |

35 |

|

Employee benefits |

– |

– |

23 |

23 |

|

Infrastructure, property, plant and equipment |

1 |

8 |

91 |

100 |

|

Cash and other assets |

– |

1 |

11 |

12 |

|

Total |

5 |

49 |

305 |

359 |

Note: We reported 339 low-risk internal control issues in 2016–17, made up of 93 newly identified issues and an update on 246 previously reported ones. As these matters are minor and/or may present opportunities to improve existing processes, they have been excluded from this figure.

Source: VAGO.

Extreme-risk issues

Figure 3B shows the extreme-risk issues we identified and their current status. There were two extreme-risk issues carried forward from 2015–16 and three new issues raised in 2016–17.

|

Extreme-risk issues are internal control issues that could cause severe disruption to operations and/or result in a material misstatement in the financial report. |

Figure 3B

Summary of extreme-risk issues reported in 2016–17

|

Council |

Description of finding |

Year raised |

Current status |

|---|---|---|---|

|

Cardinia Shire Council |

Insufficient software patch and support management |

2015–16 |

Closed |

|

Casey City Council |

Insufficient software patch and support management |

2015–16 |

Closed |

|

Bayside City Council |

Inappropriate password management controls |

2016–17 |

Closed |

|

Bayside City Council |

Weak user access management controls |

2016–17 |

Closed |

|

West Wimmera Shire Council |

Lack of a detailed asset register |

2016–17 |

Open |

Source: VAGO.

Cardinia Shire Council and Casey City Council

Both Cardinia Shire Council and Casey City Council had severe weaknesses relating to their IT. Specifically:

- critical software patches had not been applied to numerous devices

- some devices had been missing software patches since 2007

- council was still using software that was no longer supported by the vendor.

We note that unsupported and unpatched software increases the risk that a cyber attacker may gain access to systems and sensitive information.

We confirmed that these deficiencies were resolved in 2016–17. These councils have since implemented procedures to address these controls in the future.

Bayside City Council

Our review of the Bayside City Council's IT environment identified internal control issues regarding password and user access management.

Key issues concerning password management included:

- passwords being maintained insecurely on the network

- active account passwords being configured to never expire

- system password settings and an organisational policy that did not comply with industry better practices.

If passwords are not stored securely, there is a high risk that accounts might be exploited—particularly those with 'super user' privileges. Additionally, permitting users to select weak passwords that are not changed periodically increases the risk of unauthorised access to systems.

Key issues concerning user access management included:

- accounts being assigned 'super user' privileges when they were not required

- 'super user' access being assigned to shared accounts, which limited the ability to make individual users accountable for their usage.

Inappropriate and excessive user access rights may result in unauthorised access to data and programs or potential financial fraud.

The council has undertaken corrective actions for password and user access management to strengthen its IT environment.

West Wimmera Shire Council

West Wimmera Shire Council does not have a detailed fixed asset register that lists individual items such as bridges, road segments and drainage assets. As a result, we determined movements for each asset class by referring to other supporting documentation or calculations.

West Wimmera Shire Council accepted this finding and is currently arranging a complete network revaluation to the segment level. This will provide a new detailed asset register that should improve asset management in 2017–18 and beyond.

|

High-risk issues are internal control issues that could cause a major disruption to operations or are likely to result in a material misstatement in the financial report. |

High-risk issues

We reported 49 high-risk internal control issues, comprising:

- 13 newly identified issues

- updates on 36 issues identified in previous years' financial audits.

Figure 3C shows these high-risk issues by council and area.

Figure 3C

Summary of high-risk issues reported in 2016–17

|

Council |

Issue type |

Issue status(a) |

||||

|---|---|---|---|---|---|---|

|

IT controls |

Fixed assets |

Other |

Total |

Resolved |

Unresolved |

|

|

Ballarat City Council |

3 |

– |

– |

3 |

3 |

– |

|

Bayside City Council |

3 |

– |

– |

3 |

– |

3 |

|

Benalla Rural City Council |

– |

2 |

– |

2 |

– |

2 |

|

Boroondara City Council |

2 |

– |

– |

2 |

2 |

– |

|

Borough of Queenscliffe |

1 |

– |

1 |

2 |

2 |

– |

|

Campaspe Shire Council |

– |

– |

1 |

1 |

1 |

– |

|

Cardinia Shire Council |

2 |

– |

– |

2 |

2 |

– |

|

Casey City Council |

1 |

– |

– |

1 |

1 |

– |

|

Central Goldfields Shire Council |

1 |

– |

– |

1 |

– |

1 |

|

East Gippsland Shire Council |

– |

1 |

– |

1 |

– |

1 |

|

Frankston City Council |

– |

1 |

– |

1 |

1 |

– |

|

Greater Dandenong City Council |

3 |

– |

– |

3 |

2 |

1 |

|

Greater Geelong City Council |

2 |

– |

– |

2 |

2 |

– |

|

Hobsons Bay City Council |

2 |

– |

– |

2 |

2 |

– |

|

Mitchell Shire Council |

– |

1 |

1 |

2 |

2 |

– |

|

Moonee Valley City Council |

4 |

– |

– |

4 |

1 |

3 |

|

Moreland City Council |

1 |

– |

– |

1 |

– |

1 |

|

Mornington Peninsula Shire Council |

– |

1 |

– |

1 |

1 |

– |

|

Port Phillip City Council |

1 |

– |

– |

1 |

1 |

– |

|

South Gippsland Shire Council |

2 |

– |

– |

2 |

1 |

1 |

|

Southern Grampians Shire Council |

1 |

– |

1 |

2 |

1 |

1 |

|

Strathbogie Shire Council |

– |

1 |

1 |

2 |

– |

2 |

|

West Wimmera Shire Council |

1 |

1 |

– |

2 |

1 |

1 |

|

Whitehorse City Council |

4 |

– |

– |

4 |

4 |

– |

|

Wodonga City Council |

2 |

– |

– |

2 |

2 |

– |

|

Total |

36 |

8 |

5 |

49 |

32 |

17 |

(a) Status of issue as reported to management.

Source: VAGO.

|

A cyber attack is a deliberate act by a third party to gain unauthorised access to an entity's data, with the objective to damage, deny, manipulate or steal information. To reduce the risk of a successful cyber attack, it is imperative that IT control issues are addressed in a timely manner. |

Poor IT controls and cyber risk

IT control activities support the operating capability of an IT system. Strong IT controls ensure smooth day-to-day operations of councils and the reliability of data used for financial reporting and preparing performance statements. They reduce the risk that employees or third parties can circumvent processes and help maintain the integrity of information and the security of data.

In our audits of the 79 councils, we identified 18 with high-risk IT control issues related to:

- unsupported systems and software

- user access controls

- software patch management controls

- other general IT controls.

Appendix E lists IT control issues for each council.

The severity of these IT control issues determined whether they were rated extreme, high or medium.

|

Medium-risk issues are internal control issues that could cause moderate disruption to operations or a misstatement that is not material in the financial report. |

Poorly designed and implemented IT controls increase the risk of unauthorised access to systems, which may result in the destruction of data or recording of non-existent transactions. They also increase the risk of a successful cyber attack.

Medium-risk issues

We reported 305 medium risk internal control issues, comprising:

- 94 newly identified issues

- updates on 211 issues identified through previous years' financial audits.

Figure 3D shows the number of issues by area and current status.

Figure 3D

Summary of medium-risk issues reported in 2016–17

Source: VAGO.

Information systems and fixed assets continue to be areas of major internal control weakness across the sector. Nevertheless, it is pleasing to note that councils resolved a number of issues during the 2016–≠17 audits.

3.2 Status of matters raised in previous audits

We monitor the status of prior-year internal control issues in our management letters, to ensure they are resolved. Figure 3E shows the status of these issues, as reported in our management letters to councils.

Figure 3E

Status of prior-period internal control issues, by risk rating, 2016–17

|

Issue status |

Extreme |

High |

Medium |

Total |

|---|---|---|---|---|

|

Resolved |

2 |

28 |

121 |

151 |

|

Unresolved |

– |

8 |

90 |

98 |

|

Total |

2 |

36 |

211 |

249 |

Note: Issues rated as low risk are excluded from this analysis.

Source: VAGO.

We found that councils showed significant improvement in resolving extreme- and high-risk internal control issues. The eight remaining unresolved high-risk matters primarily relate to six IT control issues that councils are still addressing.

While there was an improvement in resolving medium-risk issues, further work is required to address these matters within the recommended six-month time frame.

4 Financial sustainability

|

Rate capping introduces an annual rate cap set by the Minister for Local Government, which controls general rate increases for all councils. |

In this part, we analyse the financial sustainability risks that local councils face, including the impact of emerging funding challenges due to rate capping and reduced government grants.

We discuss the trends in key balances, such as types of revenue, expenses, capital expenditure and borrowings. We also analyse the sector against seven financial sustainability risk indicators, from financial years 2012–13 to 2019–20. The information is drawn from councils' audited financial reports for the five years 2012–13 to 2016–17, and the unaudited 2017–18 budget for the three future financial years.

We include a new sustainability risk indicator this year—the adjusted underlying result. Our analysis of this indicator is based on six financial years' data from 2014–15 to 2019–20, sourced from councils' published performance statements.

Appendix F details the seven financial sustainability indicators, risk assessment criteria and benchmarks we use in this report. Appendix F also contains the results for each council against the seven sustainability risk indicators.

4.1 Conclusion

As at 30 June 2017, we assessed the local government sector as having a relatively low financial sustainability risk. The sector as a whole continues to generate positive results, display strong liquidity ratios and hold low levels of debt.

The sector's short-term financial sustainability risk indicators remain strong. However, our analysis of the data shows a declining trend in the financial sustainability risk indicators for asset renewal and maintenance. Councils are reducing their capital spending in response to rate capping and a reduction in government grants. To meet community expectations, they need to identify and respond to long-term asset replacement and renewal requirements for infrastructure in a timely manner.

We note that rural and regional councils have a higher financial sustainability risk than metropolitan councils. This is mainly due to smaller year-on-year revenue increases, steady increases in expenditure, and their relative inability to generate significant own-sourced revenue streams.

4.2 Financial sustainability risks

To be financially sustainable, councils should make enough money from their operations to meet their financial obligations and fund their asset management plans.

Figure 4A summarises the sector's financial sustainability risk indicators for 30 June 2017.

Figure 4A

Financial sustainability risk indicators, by cohort, 2016–17

Source: VAGO.

4.3 Overall analysis

The sector, overall, generated a surplus from operations this year.

At 30 June 2017, councils collectively held current assets valued at $4.4 billion in the form of cash and term deposits ($3.4 billion at 30 June 2016) and borrowings of $1.2 billion ($1.2 billion at 30 June 2016). Those councils with debt are able to service it.

The indebtedness indicator shows that, as a sector, councils prefer not to borrow funds. Instead, most prefer to accumulate cash to replace or expand their asset base. This raises questions of intergenerational equity, as the investment in new assets is effectively being funded by past and current ratepayers.

We note that the asset renewal and maintenance indicators are gradually declining and are forecast to decline further.

4.4 Analysis of council categories

Financial performance analysis

Net result indicator

|

The net result indicator measures the net result of the council as a percent of revenue. |

In 2016–17, councils collectively recorded revenue totalling $10.5 billion ($9.3 billion in 2015–16). Rates revenue of $5.4 billion ($5.2 billion in 2015–16) makes up more than 50 per cent of total revenue. The second largest revenue stream for the sector was government grants revenue, totalling $1.9 billion is ($1.4 billion in 2015–16).

Combined, employee expenses of $3.3 billion ($3.2 billion in 2015–16) and a materials and services expense of $2.9 billion ($2.7 billion in 2015–16) make up 77 per cent of councils' total expenses.

Figure 4B shows the split of revenue and expenditure.

Figure 4B

Sector revenue and expenditure for 2016–17

Source: VAGO.

Figure 4C shows a summary of the net result indicator from 2011−12 to 2019−20.

|

Normalised result is net result adjusted for receipts of Commonwealth financial assistance grants ahead of need. |

Figure 4C

Net result compared to normalised result for the local government sector, 2011–12 to 2019–20

Source: VAGO.

Taken as a whole, the local government sector has been able to generate a surplus from operations in each of the past five years. The sector is budgeting a surplus over the next three years. However, the net result indicator is forecast to decline over this period as the impact of rate capping on revenue growth takes effect. The impact of rate capping and the sector's response is discussed in Part 5.

The net result indicator for the sector during the last five years is distorted by the timing of Commonwealth financial assistance received by the sector. In Figure 4C, the spike in the reported net result indicator during 2014–15 and 2016–17 is mainly due to the advance receipt of Commonwealth grant funds and does not reflect operational performance. Figure 4C also presents the normalised net results—that is, after adjusting for the advance receipt of Commonwealth grant funding.

Looking forward

Over the budget period, our analysis shows that councils are forecasting an average increase in rate revenue of 3 percent—in line with rate capping—and an average 10 per cent reduction in government grant revenue. However, over the same period, expenses are budgeted to increase at 2 per cent.

Figure 4D summarises the key changes to councils' revenue and expenditure over the next three years.

Figure 4D

Council revenue and expenditure going forward

Source: VAGO.

Councils must formulate effective strategies to manage the impact of this growing funding gap on the key services that they provide to the community. Councils need to engage and assess community expectations to critically review the services they provide.

We analysed councils' responses to a rate capping questionnaire, which show that councils are planning to reduce spending in response to the new rate capping environment. This is more pronounced within the rural and regional councils due to their limited ability to increase alternative revenue streams.

We note that the average increase in expenditure projected to occur over the next three years is less than 1 per cent for rural and regional councils, against a rate cap of 2 per cent in 2017–18.

Adjusted underlying result indicator

This indicator measures a council's ability to generate surplus from its ordinary course of business. Figure 4E shows the results of this indicator across two categories of councils.

|

The adjusted underlying result indicator excludes non-recurrent capital grants, non-monetary asset contributions, and other contributions to fund capital expenditure from net result. |

Figure 4E

Adjusted underlying surplus analysis for the local government sector, 2014–15 to 2019–20

Note: Councils began preparing performance statements in 2014–15.

Source: VAGO.

For metropolitan councils, the actual and forecast adjusted underlying result are consistently above 5 per cent. This highlights their ability to generate surpluses from various revenue streams and service larger populations.

Rural and regional councils are budgeting to spend more that they can raise. More than 30 per cent of councils in this category are forecasting deficits for the next three years. The majority of councils in this category are facing additional financial pressures due to smaller year-on-year revenue increases and steady increases in expenditure.

A longer-term negative trend in this indicator will have an adverse impact on the services that these councils are able to offer to their communities. It is important that councils can generate positive surpluses, and councils' ability to do so will assist them in the longer term to generate sufficient funds to keep delivering the service levels that their communities expect.

Analysis of financial position indicators

As at 30 June 2017, the sector held $4.4 billion in cash and term deposits ($3.4 billion at 30 June 2016). This compares to borrowings of $1.2 billion ($1.2 billion at 30 June 2016). Councils' ability to adequately service their borrowings varies. Figure 4F shows the split of cash and borrowings held across the two categories.

Figure 4F

Cash and borrowings held by the sector at 30 June 2017

Note: Cash refers to both cash and term deposits.

Source: VAGO.

Short-term assets

As at 30 June 2017, the local government sector had a strong current asset position and held a high level of cash and term deposits. Figure 4G shows the cash and term deposit balances held by the two categories of councils at year end. Overall, this has been increasing at more than 25 per cent annually. This is partly due to the advance receipt of Commonwealth financial assistance grants.

Figure 4G

Cash and term deposit balance held by councils, 2012–13 to 2019–20

Source: VAGO.

As shown in Figure 4G, metropolitan councils holds substantially more cash than the rural and regional category. However, we note that the majority of associated liabilities for metropolitan councils are longer term, to fund the infrastructure needs of growing communities.

Rural and regional councils show a stable level of cash and term deposits in the forecast period.

Indebtedness indicator

|

The indebtedness indicator looks at whether entities are able to meet their longer-term liabilities from their own‑sourced revenue. |

Our indebtedness indicator assesses whether councils are able to meet their debt servicing and repayment obligations from their own-sourced revenue. Figure 4H details the results of this indicator for the sector.

Of the 79 councils, 69 had some level of debt on their balance sheet at 30 June 2017. Analysis of these councils shows:

- interest-bearing liabilities to total revenue of 12 per cent

- net borrowing costs to total revenue of less than 1 per cent and net borrowing costs to rate revenue of less than 2 per cent.

Figure 4H

Indebtedness indicator analysis for the local government sector, 2012–13 to 2019–2020

Source: VAGO.

Across the sector, the average percentage of indebtedness over the five-year period to 2016–17 is around 24.5 per cent. This percentage is trending lower, underlining the sector's preference to avoid borrowing. The average debt balance of the sector over a five-year period from 2012–13 to 2016–17 was $1.1 billion, compared to the average cash and term deposit balance of $2.9 billion.

Figure 4I shows the borrowings balance from 2012–13 to 2019-20 by the two categories and across the sector.

Figure 4I

Borrowings balance for the local government sector, 2012–13 to 2019–20

Source: VAGO.

Figure 4I shows stable levels of long-term debt by rural and regional councils. In contrast, metropolitan councils are forecasting an increase in borrowings. We note that this increase in partly due to borrowings planned by Melbourne City Council for infrastructure redevelopment.

Internal financing indicator

This indicator examines the capacity of the sector to fund capital expenditure using cash generated from operations and government funding each year. Figure 4J shows the results of the sector for this indicator between 2012–13 and 2019–20.

Figure 4J

Internal financing indicator for the local government sector, 2012–13 to 2019–20

Source: VAGO.

The internal financing indicator result is influenced by the timing of Commonwealth grant funding received by the sector. In most of the past five years, a proportion of this annual funding has been granted toward the end of the financial year. However, this is not always the case—the dip in 2013–2014 is due to the receipt of Commonwealth grant funding after 30 June for that year. In contrast, the significant increase in this indicator at 30 June 2017 is also due to the advance receipt of a Commonwealth funding for 2017–18 on 7 June 2017.

Asset renewal and maintenance indicators analysis

A key risk for councils is maintaining and renewing their extensive infrastructure networks while operating at sustainable levels. We assess councils' spending on assets through the capital replacement and renewal gap indicators.

Capital replacement indicator

|

The capital replacement indicator measures the level of spending on new and renewed assets compared to the depreciation expense associated with these assets. |

The sector's result for this indicator is shown in Figure 4K.

Figure 4K

Capital replacement indicator analysis for the local government sector, 2012–13 to 2019–20

Source: VAGO.

Figure 4K shows that the sector is budgeting for a sharp increase in capital spending during 2017–18. This spending is then forecast to decline. Councils are reducing their capital spending mainly in response to rate capping and a reduction in government grants.

Although spending on capital replacement is budgeted to improve significantly in the near term for the sector as a whole, our analysis shows that this longer‑term asset planning measure has been declining across the majority of councils in the last three years.

As shown in Figure 4L, metropolitan councils are increasing their asset base at a higher rate than their rural and regional counterparts. The challenge for rural and regional councils is to generate enough cash through own-sourced revenue streams to invest in new and replacement assets. This will also have a direct impact on the level of service these councils can provide to their communities.

Figure 4L

Infrastructure, property, plant and equipment balance the local government sector, 2012–13 to 2019–20

Source: VAGO.

Renewal gap indicator

The renewal gap indicator provides more information on the types of assets being acquired by councils. It provides an indication of whether spending has focused on purchasing new assets or renewing and upgrading existing ones.

|

The renewal gap indicator compares the rate of spending through renewing, restoring and replacing existing assets to its depreciation expense. Spending above the rate at which an asset is being used indicates that an entity is sufficiently renewing its assets and optimising their use. |

Figure 4M shows the results of this indicator over eight financial years, for the two categories.

Figure 4M

Renewal gap indicator analysis for the local government sector, 2012–13 to 2019–20

Source: VAGO.

The renewal gap indicator broadly mirrors the trend of the capital replacement indicator. Similar to capital replacement, 2017–18 council budgets for asset renewals do not reflect the historic declining trend.

With regard to the renewal gap indicator, rural and regional councils are trending below 1:1. This highlights the need for councils to prioritise asset maintenance as part of their planning processes. This renewal gap is forecast to trend sharply downward in response to rate capping. In order for these councils to meet community needs and expectations, they must actively monitor their rate of spending and remain focused on maintaining assets at serviceable levels as they age.

In the short to medium term, rural and regional councils may need to defer spending on new assets or consider adding debt as a funding measure, to improve their existing assets. This will ensure current ratepayers who are using these assets now—rather than future ratepayers— bear the costs associated with them.

5 Rate capping impact assessment

In 2015, the Victorian Government introduced rate capping legislation in the form of its Fair Go Rates System. This system controls general rate increases for all councils. The annual rate cap is set by the Minister for Local Government.

We assessed local councils' response to the rate capping regime in the short term and their budgeting process from a medium- to long-term perspective.

5.1 Conclusion

|

The 2016–17 financial year is the first year of rate capping—rate increases are capped at 2.5 per cent (2 per cent in 2017–18). |

The majority of councils identified rate capping as a long-term viability risk.

Longer-term planning tools—for the next 10 to 20 years—are essential for assessing and responding to community expectations. Further, this will assist councils to develop robust asset maintenance programs.

Councils need to clearly identify the individual services they provide and determine the cost of providing them to the community. This will assist them to determine the community's service requirements and find efficient ways to provide them. In this regard, community consultation is critical.

Councils must also consider collaborative arrangements with other councils as a cost-effective way to deliver services.

5.2 Rate revenue

Rate revenue, as a proportion of total revenue, increased between 2012–13 and 2016–17, as shown in Figure 5A. Councils forecast this trend to continue despite the impact of rate capping. This is partly due to decreases in government grant funding for the sector.

Figure 5A

Rate revenue as a percentage of total revenue, 2012–13 to 2019–20

Source: VAGO.

Councils—especially rural and regional cohorts—have a limited capacity to generate additional own-sourced revenue. Therefore, reducing expenditure and prioritising service delivery become key considerations for managing their cash flow in the future. Figure 5B shows the estimated impact of the rate capping regime across the local government sector.

Figure 5B

Rate revenue forecast before and after rate capping, 2011–12 to 2020–21

Source: VAGO, based on analysis of published council budgets prepared before and after rate capping.

The sector forecasts that the cumulative projected rate revenue gap is approximately $1.6 billion over the next three years. This highlights the requirement for councils to use the budgeting process appropriately, to adjust their operational and capital spending in future years. In responding to this shortfall, councils must also assess community expectations on service delivery and its financial viability.

Review of council services and cost of provision

The cost of individual services that councils provide—broken down into direct and overhead elements—is a key tool for council management to assess efficiencies in service provision. Coupled with service reviews to identify non‑essential services, a comprehensive costing analysis of services would be a powerful tool for councils to mitigate some of the expected funding pressures that the sector will face as a result of rate capping.

This costing could be partially informed by councils' analysis and reporting for their annual baseline data submissions to the Essential Services Commission.

5.3 Short-term impacts of rate capping

A majority of councils have predicted short-term impacts on their operations following the introduction of rate capping. Common council responses through the budgeting process include:

- seeking additional revenue streams, such as full user-pays models for service delivery and the sale of council-owned surplus assets

- reducing capital programs, including freezing new capital works in the short term and focusing more on asset renewal than asset acquisitions

- increasing efficiency in service delivery through the use of new technology and cost reduction.

We note that a small number of councils are also opting to apply for a rate increase above the capped amount, as a short-term funding measure.

Importance of community consultation

To understand the impact of rate capping on the users of their services, councils need to engage with their communities. This can provide a council with a clear idea of the services and projects that their community expects and values. It is also a useful tool for communicating the actions that the council needs to take in response to having less revenue to fund the services that it provided previously.

Where councils are engaging with the community, consultation varies from workshops to media campaigns, to promote awareness, engage community members and collect valuable input for council decision-making.

Figure 5C is a case study of better practice community engagement at Casey City Council.

Figure 5C

Case study: Community engagement at Casey City Council

|

Background Casey City Council is located in Melbourne's south-eastern suburbs, covering an area of 409 square kilometres. It includes Berwick, Cranbourne, Hallam, Hampton Park and Narre Warren. Casey is Victoria's largest council, with an approximate population of 304 000 residents, which is forecast to grow to over 500 000 by 2040. Council assessment of the impact of rate capping on future operations Due to rate capping, the council forecast a $168 million decrease in rate revenue over 10 years and estimated a decrease of $3 million per year in funds available for capital works. The expected impact on operations included:

Council responses to rate capping In March 2016, Casey applied to the Essential Services Commission for a rate capping variation of 0.97 per cent above the cap limit of 2.5 per cent for 2016–17. Council performed a detailed assessment on the impact of rate capping as part of the application process. The Essential Services Commission's reasons for rejecting the application included the council's underspending on its capital expenditure budget. Over the past five years, Casey had on an average underspent its capital expenditure budget by $14 million per year. The Essential Services Commission concluded that it was reasonable to expect Casey to manage its overall capital works program to match available funding. During 2015–16, the council informed the community about the rate cap variation application through targeted community engagement programs, Casey Let's Chat and Building Our Future. Further community engagement activities—People's Panel and Casey Next—took place in 2016–17. Feedback from Casey Next included recommendations on what the community thought the council should focus on. This feedback was captured by the council and conveyed through its planning document. People's Panel provided recommendations about how the council should manage long-term financial challenges. The council incorporated all recommendations from this community consultation process into its long-term plan. Casey also formulated strategic programs to manage council assets, expenditure and revenue:

Conclusion

|

Source: VAGO.

5.4 Longer-term impact and responses

Most councils identified rate capping as a strategic risk in their risk registers. In response, they are planning various initiatives to assess the impact on the services they provide and their asset renewal and maintenance programs.

Responses include:

- increasing revenue through:

- instituting a full user-pays model for selected council services

- identifying additional revenue streams

- reducing asset renewal programs over the medium to long term

- funding new assets by borrowing rather than accessing cash reserves

- reducing expenditure by:

- setting enterprise bargaining agreement negotiations so that wage and salary costs increase in line with forecast rate cap increases

- initiating collaborative projects and shared-service models between councils in the same region

- introducing efficiency measures, particularly using new technologies such as automated solutions that allow customers to access council services online.

Longer-term capital project planning

Councils need to focus on delivering services to their communities now and ensuring they can continue to meet community expectations in the future. The sustainability issues that we highlighted across the sector require a longer-term planning response. Given the nature of the assets involved, this longer-term plan should incorporate robust asset management strategies as well.

Through our review, we identified Horsham Rural City Council as a better practice example of a council reviewing their capital works program—see Figure 5D.

Figure 5D

Case study: Longer-term capital project planning at Horsham Rural City Council

|

Background Horsham Rural City Council is a small council situated in the Wimmera region of Victoria, approximately 300 kilometres north-west of Melbourne. It has a population of 19 774 and covers an area of 4 267 square kilometres. At 30 June 2017, Horsham had $341 million of infrastructure assets, of which $279 million represented road assets. The council's existing road network consists of 2 976 kilometres of local roads, of which 32 per cent represents sealed roads. Road asset renewal versus asset additions The council identified a growing gap in the level of renewal funding it required to maintain its existing road assets. Due to external factors such as soil conditions, the use of the local road network by larger vehicles and farming practices in the Wimmera region, the council's road network deteriorates at an accelerated rate. The council also noted that when road assets deteriorate beyond a certain point, the renewal cost exponentially increases. Horsham engaged an independent contractor during 2013–14 to perform a condition assessment of the council-owned road network. The report costed the gap in renewal funding at $6.5 million. The contractor recommended that the council increase its annual expenditure on road asset renewal by 3 per cent per annum over the subsequent 10 financial years. The table below illustrates how the council plans to increase infrastructure renewal funding over the medium term by reduce funding allocations for new capital works.

Source: VAGO. Internally, the council allocates a portion of each year's rate increase as an infrastructure levy intended to close the asset renewal gap. One of the council's objectives is to ensure that rate increases establish sustainable capital funding for asset renewal. Increase in rate capping Horsham successfully submitted an application to the Essential Services Commission for a rate capping exemption for the 2016–17 financial year. The council requested an increase of 1 per cent over the rate cap of 2.5 per cent. The main reason the council cited was the growing gap in the renewal funding it required to maintain the condition of its existing road assets. |

Source: VAGO.

Currently, many budgeting tools used by councils include only a four-year strategic report plan and a one-year detailed budget. Proposed legislative changes require councils to have longer-term forecasts. This will help councils to manage funding pressures more proactively and deliver services more efficiently.

Shared-service arrangements

One way that councils plan to rationalise costs is by sharing various services and functions with other councils, to take advantage of collective bargaining arrangements.

Appendix A. Audit Act 1994 section 16—submissions and comments

We have consulted with DELWP and the councils named in this report, and we considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report, or relevant extracts, to those agencies and asked for their submissions and comments. We also provided a copy of the report to the Department of Premier and Cabinet.

Responsibility for the accuracy, fairness and balance of those comments rests solely with the agency head.

Responses were received as follows:

- DELWP

- —Auditor-General's response to the Secretary, DELWP

- Horsham Rural City Council

- City of Kingston

- City of Moonee Valley

- Moreland City Council

- City of Stonnington

RESPONSE provided by the Secretary, DELWP

Auditor-General's response to the Secretary, DELWP

Since sending the proposed report to DELWP for comment, we have issued three additional audit opinions—two for Central Goldfields Shire Council (financial report and performance statement) and one for MomentumOne Shared Services Pty Ltd. All three were clear audit opinions, and this report reflects the final number of clear audit opinions issued.

RESPONSE provided by the Chief Executive, Horsham Rural City Council

RESPONSE provided by the Chief Executive Officer, City of Kingston

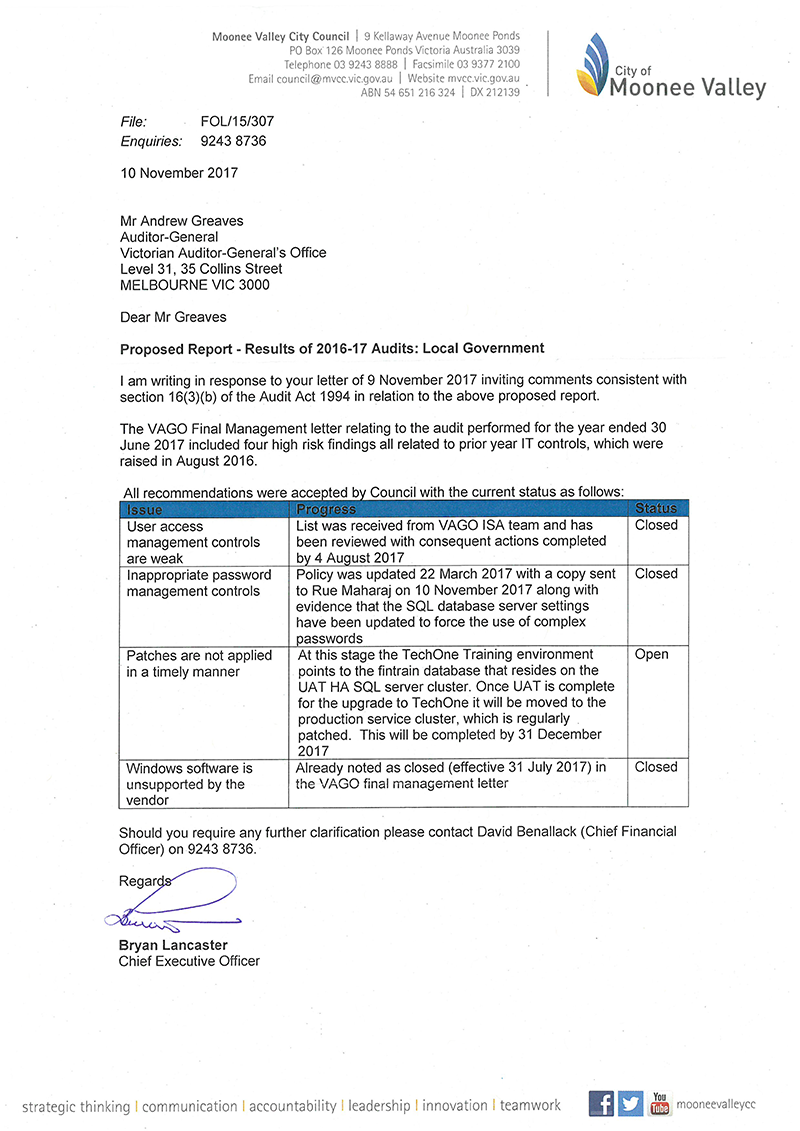

RESPONSE provided by the Chief Executive Officer, City of Moonee Valley

RESPONSE provided by the Chief Executive Officer, Moreland City Council

RESPONSE provided by the General Manager Corporate Services, City of Stonnington

Appendix B. Audit opinions issued

Figure B1 lists the entities included in this report. It details the date an audit opinion was issued to each entity for their 2016–17 financial report and performance statement and the nature of that opinion.

Figure B1

Audit opinions issued to the local government sector for 2016–17

|

Entity |

Financial report |

Performance statement |

||

|---|---|---|---|---|

|

Clear audit opinion issued |

Auditor-General's report signed |

Clear audit opinion issued |

Auditor-General's report signed |

|

|

Metropolitan |

||||

|

Banyule City Council |

✔ |

20 Sep 2017 |

✔ |

20 Sep 2017 |

|

Bayside City Council |

✔ |

20 Sep 2017 |

✔ |

20 Sep 2017 |

|

Boroondara City Council |

✔ |

7 Sep 2017 |

✔ |

7 Sep 2017 |

|

Brimbank City Council |

✔ |

21 Sep 2017 |

✔ |

21 Sep 2017 |

|

City of Monash |

✔ |

12 Sep 2017 |

✔ |

12 Sep 2017 |

|

City of Stonnington |

✔ |

8 Sep 2017 |

✔ |

8 Sep 2017 |

|

✔ |

28 Sep 2017 |

n/a |

n/a |

|

Darebin City Council |

✔ |

8 Sep 2017 |

✔ |

8 Sep 2017 |

|

Frankston City Council |

✔ |

27 Sep 2017 |

✔ |

27 Sep 2017 |

|

✔ |

15 Aug 2017 |

n/a |

n/a |

|

Glen Eira City Council |

✔ |

14 Sep 2017 |

✔ |

14 Sep 2017 |

|

Greater Dandenong City Council |

✔ |

14 Sep 2017 |

✔ |

14 Sep 2017 |

|

✔ |

14 Aug 2017 |

n/a |

n/a |

|

Hobsons Bay City Council |

✔ |

22 Sep 2017 |

✔ |

22 Sep 2017 |

|

Kingston City Council |

✔ |

5 Sep 2017 |

✔ |

5 Sep 2017 |

|

Knox City Council |

✔ |

8 Sep 2017 |

✔ |

8 Sep 2017 |

|

Manningham City Council |

✔ |

14 Sep 2017 |

✔ |

14 Sep 2017 |

|

Maribyrnong City Council |

✔ |

15 Sep 2017 |

✔ |

15 Sep 2017 |

|

Maroondah City Council |

✔ |

5 Sep 2017 |

✔ |

5 Sep 2017 |

|

Melbourne City Council |

✔ |

11 Sep 2017 |

✔ |

11 Sep 2017 |

|

✔ |

30 Aug 2017 |

n/a |

n/a |

|

✔ |

4 Sep 2017 |

n/a |

n/a |

|

✔ |

25 Sep 2017 |

n/a |

n/a |

|

✔ |

4 Sep 2017 |

n/a |

n/a |

|

✔ |

4 Sep 2017 |

n/a |

n/a |

|

Moonee Valley City Council |

✔ |

14 Sep 2017 |

✔ |

14 Sep 2017 |

|

Moreland City Council |

✔ |

25 Sep 2017 |

✔ |

25 Sep 2017 |

|

Port Phillip City Council |

✔ |

12 Sep 2017 |

✔ |

12 Sep 2017 |

|

Whitehorse City Council |

✔ |

22 Aug 2017 |

✔ |

22 Aug 2017 |

|

Yarra City Council |

✔ |

25 Sep 2017 |

✔ |

25 Sep 2017 |

|

Interface |

||||

|

Cardinia Shire Council |

✔ |

19 Sep 2017 |

✔ |

19 Sep 2017 |

|

Casey City Council |

✔ |

8 Sep 2017 |

✔ |

8 Sep 2017 |

|

City of Whittlesea |

✔ |

12 Sep 2017 |

✔ |

12 Sep 2017 |

|

Hume City Council |

✔ |

13 Sep 2017 |

✔ |

13 Sep 2017 |

|

Melton City Council |

✔ |

25 Sep 2017 |

✔ |

25 Sep 2017 |

|

Mornington Peninsula Shire Council |

✔ |

22 Sep 2017 |

✔ |

22 Sep 2017 |

|

Nillumbik Shire Council |

✔ |

5 Sep 2017 |

✔ |

5 Sep 2017 |

|

Wyndham City Council |

✔ |

21 Sep 2017 |

✔ |

21 Sep 2017 |

|

✔ |

14 Sep 2017 |

n/a |

n/a |

|

Yarra Ranges Shire Council |

✔ |

24 Aug 2017 |

✔ |

24 Aug 2017 |

|

Regional |

||||

|

Ballarat City Council |

✔ |

18 Sep 2017 |

✔ |

18 Sep 2017 |

|

Greater Bendigo City Council |

✔ |

22 Sep 2017 |

✔ |

22 Sep 2017 |

|

Greater Geelong City Council |

✔ |

8 Sep 2017 |

✔ |

8 Sep 2017 |

|

Greater Shepparton City Council |

✔ |

25 Sep 2017 |

✔ |

25 Sep 2017 |

|

Horsham Rural City Council |

✔ |

27 Sep 2017 |

✔ |

27 Sep 2017 |

|

Latrobe City Council |

✔ |

13 Sep 2017 |

✔ |

13 Sep 2017 |

|

Mildura Rural City Council |

✔ |

27 Sep 2017 |

✔ |

27 Sep 2017 |

|

✔ |

27 Sep 2017 |