Technical and Further Education Institutes: 2016 Audit Snapshot

Overview

In this report, we outline the results of, and our observations from, the 2016 financial and performance report audits of the 12 state-owned Technical and Further Education institutes (TAFEs)—and their 16 controlled entities—that operate in the vocational education and training (VET) sector. We also assess the sector’s financial performance during 2016, and assess its sustainability as at 31 December 2016.

We make three recommendations directed to the TAFEs and the Department of Education and Training.

Technical and Further Education Institutes: 2016 Audit Snapshot: Message

Ordered to be published

VICTORIAN GOVERNMENT PRINTER June 2016

PP No 260, Session 2014-2017

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report Technical and Further Education Institutes: 2016 Audit Snapshot.

Yours faithfully

Andrew Greaves

Auditor-General

7 June 2016

Audit overview

In the technical and further education (TAFE) sector, there are 12 state-owned TAFE institutes, which control a further 16 entities that operate in the vocational education and training (VET) sector. We conduct the financial audits of all of these 28 entities. This report outlines the results of, and our observations from, these financial audits for the year ended 31 December 2016. We also discuss the performance reports that TAFEs prepare and we audit, and analyse the financial results and outcomes for the 12 TAFEs.

Conclusion

Financial and performance reporting are generally sound. Following a period of financial challenge, our assessment indicates that financial outcomes, such as net operating results, are improving.

Findings

Audit opinions

We issued clear opinions on the 2016 financial reports and performance reports that 11 TAFEs provided to us to audit. Our unmodified opinions mean that users can have confidence in these reports.

We have finalised the audit of the 2014 and 2015 financial reports of Federation Training. We disclaimed their 2014 financial report—in effect we gave no opinion on the transactions and balances in that report.

Management at Federation Training have worked to address issues identified in our audit of their 2014 statements. For 2015 they resolved all issues except those relating to their student management system. Although this is a positive outcome, it meant we were unable to get the evidence we needed to form an opinion on the 2015 numbers for student revenue, debtors, doubtful debts and revenue in advance. As a result, we issued a qualified audit opinion on their 2015 financial report.

We have begun our audit of their 2016 financial report and we expect the 2017 Federation Training financial report to meet the time frames in the Financial Management Act 1994.

Internal controls

To the extent we tested them, the internal financial controls at the TAFEs were adequate for reliable financial reporting. We identified a small number of new control issues in our 2016 financial audits, and most of the issues we raised in prior years had been followed up and resolved.

Financial sustainability

The short-term financial health of the TAFE sector is improving. Their net operating results over the past two financial years have improved, and there is more liquidity across the sector as a whole.

The improvement is largely due to the increase in government grants to the sector in 2015 and 2016. TAFEs received $278.6 million in government grants in 2016, up from a low of $74.6 million in 2014.

Falling student numbers over these years has meant that most of their other sources of revenue, including student fees and government contestable funding, have declined. The increase in government grant funding has more than offset the decline in other sources of revenue, allowing the TAFE sector to be more financially stable.

However, there are opportunities for the TAFEs to be more efficient and effective. The TAFEs' performance reports show that most are not achieving the ratio of training revenue to staff costs that they are aiming for.

Asset management

The TAFE sector has a challenge to fund asset maintenance and renewal for their large asset portfolios. This year we focused on TAFE management, governance and oversight of their asset maintenance.

Eight TAFEs had asset maintenance strategies in place, although there were areas where these strategies could be improved. In particular, the life span of these strategies was short when compared to the life cycle of the TAFEs' major infrastructure assets and the requirements of the Department of Treasury and Finance's Asset Management Accountability Framework. Four TAFEs do not have an asset maintenance strategy.

All 12 TAFEs report to management, boards and audit committees on asset maintenance, although the frequency and detail vary. Five TAFEs report only on the amount they spend, which makes it difficult to have sound oversight of asset maintenance.

TAFEs' ability to report on asset maintenance in more detail is limited because they do not have systems in place to capture, record and report on asset planning. Only five TAFEs have asset maintenance software, and only one of these five is able to provide detail on maintenance and condition at an individual asset level.

In their oversight role for the sector, the Department of Education and Training is doing work on asset maintenance in TAFEs. Their analysis shows that the sector is spending on average 0.7 per cent of total asset replacement value annually on maintenance. This is significantly lower than the benchmark of 2–2.5 per cent considered necessary to maintain asset condition.

Our capital replacement indicator shows a decline in the amount spent on assets when compared to depreciation from 2012 to 2015. There has been an improvement in this indicator in 2016, but this is due to spending on specific projects that received significant government funding.

An ongoing lack of asset maintenance creates a maintenance backlog that can affect asset condition. We see this as an emerging risk for the sector. The TAFEs' self‑assessments of asset condition have confirmed that there are some present risks for their asset portfolios.

While seven TAFEs' asset portfolios have been assessed as being in a good condition overall, there are five whose portfolios have been rated as in fair or poor condition. Government funding of $41.6 million for asset maintenance will be provided to TAFEs in 2017 to address these issues.

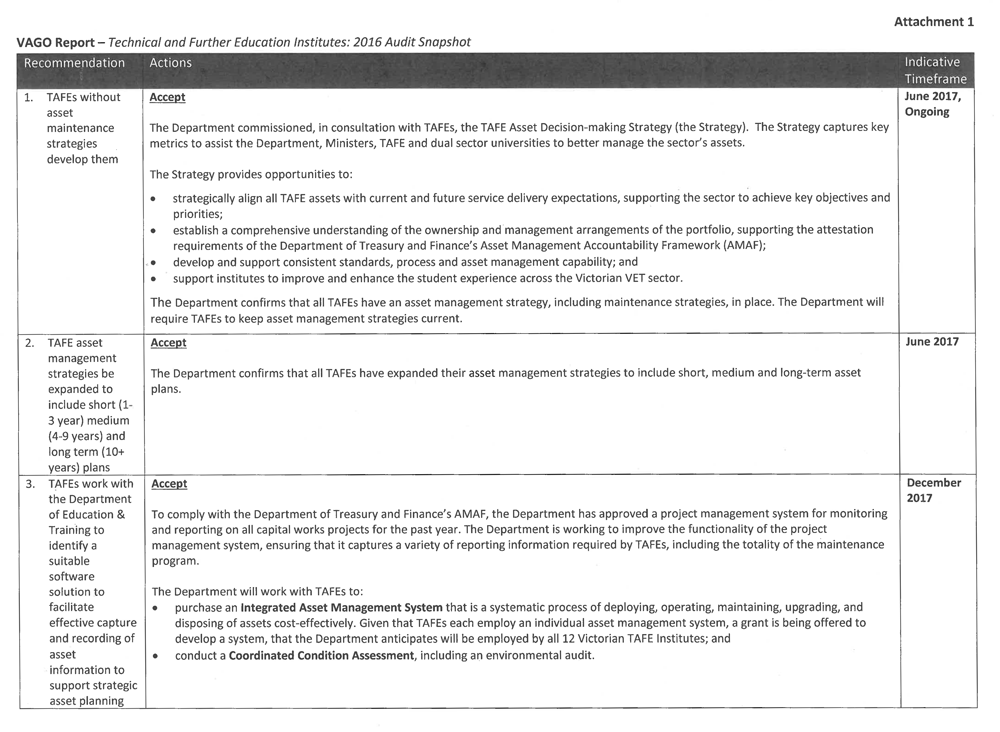

Recommendations

We recommend that technical and further education institutes:

1. develop asset maintenance strategies if they do not already have them (see Section 3.2.1)

2. expand their asset management strategies to include short-term (one to three years), medium-term (four to nine years) and long-term (10+ years) plans (see Section 3.2.1)

3. work with the Department of Education and Training to identify a suitable software solution to effectively capture and record asset information to support strategic asset planning (see Section 3.2.2).

Responses to recommendations

We have consulted with the Department of Education and Training and the 12 TAFEs, and we considered their views when reaching our audit conclusions. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report to those agencies and asked for their submissions and comments.

The following is a summary of those responses. The full responses are included in Appendix A.

The Department of Education and Training and Federation Training responded, and accepted the recommendations.

1 Context

The Victorian technical and further education (TAFE) sector delivers vocational education and training (VET) throughout Victoria. VET courses equip students with the practical and educational skills required for a variety of careers.

The sector is made up of 12 TAFE institutes and their 16 controlled entities. Since the financial result of each controlled entity is consolidated into its parent entity, we do not discuss them separately. Appendix B lists all 28 entities.

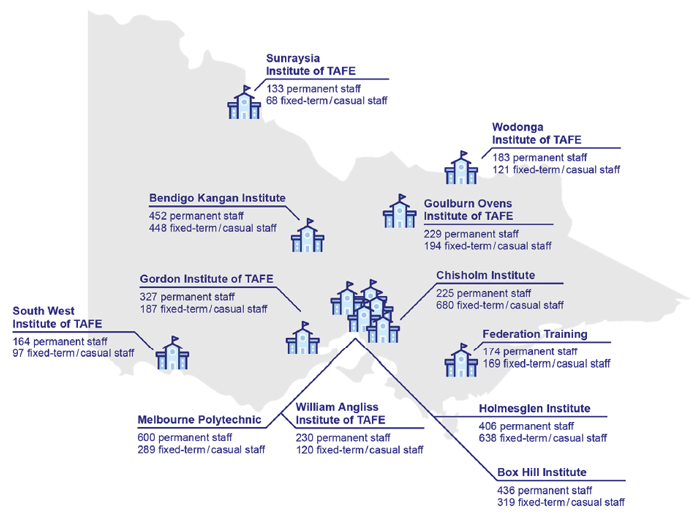

Figure 1A shows the TAFEs that operate across Victoria.

Figure 1A

TAFE locations and staff profiles in Victoria

Source: VAGO.

In addition to the 12 TAFE institutes, four dual-sector universities also operate within the VET sector. They are included in our Universities: 2016 Audit Snapshot report.

TAFE institutes are established and governed under the Education Training and Reform Act 2006 (ETRA). The main provisions of ETRA are to:

- outline the requirements for establishing a TAFE board and its governance responsibilities

- define the function and powers of TAFEs

- define the objectives of TAFEs.

The objectives of TAFEs are to:

- perform functions for the public benefit

- facilitate student learning

- collaborate as part of a strong network of public training providers.

TAFEs are 'public bodies' under the Financial Management Act 1994 (FMA). They are required to comply with the FMA and with any general or specific direction given by the Minister for Finance. They are also subject to the Public Administration Act 2004, which provides a framework for governance in the public sector. Each TAFE board is accountable to the Minister for Training and Skills (the minister).

The Department of Education and Training (DET) is responsible for overseeing the sector on behalf of the minister. This includes the quality of the training TAFEs provide under VET contracts with Registered Training Organisations (RTO). DET funds the delivery of this training via a subsidy for each training hour delivered—known as contestable funding. RTOs compete with one another for this funding.

TAFEs compete directly with private training providers to deliver training to students in Victoria. Both the TAFEs and private providers are registered as RTOs with either the Victorian Registration and Qualifications Authority or the Commonwealth equivalent, the Australian Skills and Qualifications Authority.

1.1 TAFE funding model

The TAFE funding model in Victoria has changed significantly over the past five years. In 2013 and 2014, TAFEs received only contestable funding and no recurrent grants from government. TAFEs were given one-off grants to fund the structural adjustments needed to transform their business operating models so that they could be competitive in a contestable environment.

We noted in our Technical and Further Education Institutes: 2014 Audit Snapshot report that most TAFEs were not able to adjust quickly enough to the funding model changes, and this resulted in significant deficits across the sector.

In November 2014, the government announced additional funding for TAFEs. This funding was to address the significant losses and the emerging going-concern risk in the short term because TAFE student numbers were falling.

Figure 1B illustrates the pattern of student enrolments from 2012 to 2015.

Figure 1B

Number of government-subsidised students in accredited and pre-accredited training by sector, 2012–2015

|

2012 |

2013 |

2014 |

2015 |

|

|---|---|---|---|---|

|

Private RTO |

259 723 |

254 229 |

253 998 |

210 579 |

|

Learn Local(a) |

57 414 |

51 656 |

47 851 |

48 344 |

|

TAFE |

192 660 |

178 880 |

141 838 |

118 908 |

|

Total |

509 797 |

484 765 |

443 687 |

377 831 |

|

TAFE market share |

38% |

37% |

32% |

31% |

(a) In the Learn Local program, accredited community organisations offer tailored education and training.

Note: 2016 data was not available at the time of publishing this report.

Source: VAGO, based on Table 5-1, Victorian Training Market Report 2015, DET.

A TAFE Rescue Fund was introduced, with funding to be allocated over five years starting in 2014–15. The Rescue Fund included $200 million for Community Service Funding over four years, and $20 million to provide cash support where necessary across the sector.

The government has also set up additional funding to assist the sector:

- $50 million—TAFE Funding Boost to improve training levels

- $50 million—TAFE Back to Work Fund.

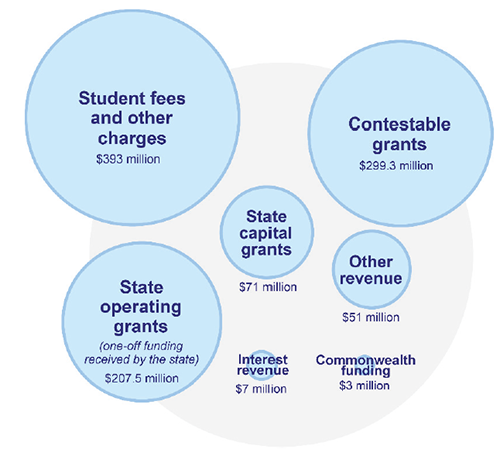

Figure 1C illustrates the TAFE funding sources for 2016.

Figure 1C

TAFE funding sources for 2016

Source: VAGO.

To address the longer-term structural funding issue, an independent VET funding review was conducted and a report published in December 2015. The report made 109 recommendations on how to improve the TAFE sector in Victoria.

The government's response to this report included an outline of a new funding model, known as Skills First, which began in January 2017. The new model provides an initial $114 million to TAFEs for the additional costs they face as public providers, and gives them opportunities to apply for additional funding for:

- high needs learners

- training in new, emerging and priority areas

- training in regional and rural communities

- community service obligations to support students

- building organisational capabilities.

1.2 What we cover in this report

In this report, we provide information on the outcomes of our financial audits of the 12 TAFEs and their 16 controlled entities for the year ended 31 December 2016.

We identify and discuss the key matters arising from our audits, and provide an analysis of the information included in the TAFEs' financial and performance reports. Figure 1D outlines the structure of the report.

Figure 1D

Report structure

|

Part |

Description |

|---|---|

|

2 Results of audits |

Comments on the results of the financial and performance report audits of the 12 TAFEs for the 2016 financial year. Includes a short overview of the performance reporting framework. |

|

3 Internal controls |

Summarises the internal control issues observed during our audits and comments on the asset maintenance policies and processes in place in the sector. |

|

4 Financial sustainability |

Provides an insight into the TAFE sector's financial sustainability risks and financial challenges. |

Source: VAGO.

We carried out the financial audits of the 28 entities included in this report in accordance with section 8 of the Audit Act 1994 and the Australian Auditing Standards. Each entity pays the cost of its audit.

The cost of preparing this report was $154 000, which is funded by Parliament.

2 Results of audits

2.1 Financial report audit opinions

Independent audit opinions add credibility to financial reports by providing reasonable assurance that the information reported is reliable and accurate. A clear audit opinion confirms that the financial report presents fairly the transactions and balances for the reporting period, in line with relevant accounting standards and applicable legislation. We carried out our financial audits of the technical and further education (TAFE) sector entities in accordance with the Australian Auditing Standards.

We issued 27 clear audit opinions for the financial year ended 31 December 2016 to 11 TAFEs and their 16 controlled entities. This year we did not need to include any emphasis of matter paragraphs in these opinions to draw attention to matters disclosed in the financial reports. We had included such a paragraph in some of our 2014 and 2015 audit opinions—Sunraysia in 2014 and 2015 and Melbourne Polytechnic in 2014—to highlight disclosures about their status as a going concern.

Each year, as part of our audit, we assess each TAFE's ability to meet its financial obligations. Although there were some TAFEs where this was considered a risk, these TAFEs provided adequate disclosure of their risks in the notes to their accounts, and received support from the Department of Education and Training (DET). As a result, we have not needed to mention any going-concern issues in our audit opinions in 2016.

These positive outcomes mean the financial reports of the sector are materially correct and reliable, with the exception of Federation Training.

2.1.1 Federation Training

We issued our audit opinion on Federation Training's 2014 financial report on 29 July 2016. We disclaimed our opinion on this financial report, which means we gave no assurance that the numbers were materially correct, because we could not obtain enough appropriate evidence to support them.

As explained in our opinion, Federation Training encountered a number of issues that adversely affected the preparation of its 2014 financial report:

- difficulties combining the financial records of Advance TAFE and Central Gippsland TAFE, which had merged to form Federation Training

- its inability to substantiate the records of Advance TAFE at 30 April 2014, the date of the merger

- issues with the implementation of a new student management system

- non-performance of key internal control activities

- the departure of senior staff.

As a result of these issues, we were unable to obtain enough appropriate evidence to substantiate the completeness, accuracy and validity of:

- underlying transactions and balances

- adjustments made to correct numbers coming from the student management system

- the classification of 2014 numbers and the reclassification of some of the 2013 numbers.

As the impact of these factors was material, and affected the whole financial report, we determined that we could not provide an audit opinion.

In our disclaimed opinion we also drew attention to the following matters:

- references in the notes to the financial report that some information was unaudited, which could be incorrectly interpreted as information outside the scope of the audit

- events that occurred after the balance date of 31 December, which should have been disclosed but were not

- a breach of the Financial Management Act 1994(FMA) because bank reconciliations were not performed each month

- discrepancies and inconsistencies between the main statements and the notes to the financial report.

Management at Federation Training have been working to address all of the issues we raised with them in the 2014 audit process. They have resolved many of these issues and improved their financial reporting. We have therefore been able to complete the audit of the 2015 financial report of Federation Training. We issued a qualified audit opinion on 9 May 2017.

We moved from a disclaimed financial report to a qualified financial report for 2015. We were unable to issue a clear opinion because not all issues relating to recording and recognition of revenue balances had been resolved in time to ensure the completeness and accuracy of information derived from the student management system. We were therefore unable to form an opinion on the transactions and balances drawn from this system for both 2014 and 2015. Those transactions and balances include sale of goods and services revenue, accounts receivable, revenue received in advance and the provision for doubtful debtors.

Due to the work done by management, we were able to go back and conduct audit testing that verified the 2014 transactions and balances that were not drawn from the student management system. As a result, we did not qualify these numbers in our 2015 audit opinion.

We have started our audit of the 2016 financial report of Federation Training. We expect to finish that audit in 2017. In future years, we expect that Federation Training will be able to report in line with the FMA time frames.

2.2 Performance report audit opinions

The Education and Training Reform Act 2006 requires TAFEs to submit an annual statement of corporate intent (SOCI) to the Minister for Training and Skills (the minister), for the minister's agreement for each calendar year.

The SOCI includes compulsory key performance indicators (KPI) set by the minister, as well as performance indicators developed by the particular TAFE, and approved by its board.

TAFEs must establish a target for each KPI and report the actual result achieved against the target in their annual performance statement. We also audit these performance statements and they are published in each TAFE's annual report.

We issued clear audit opinions on 11 TAFE performance reports for the financial year ended 31 December 2016. We have not yet begun to audit Federation Training's 2016 performance report. A clear audit opinion confirms that the actual results are fairly presented. We do not form an opinion on whether the KPIs are relevant or appropriate as a measure of the performance of the TAFE.

A summary of the targets and actual results for each TAFE against the four mandatory KPIs is provided in Appendix E of this report. We provide some analysis and commentary of each TAFE's performance against the KPIs that measure efficiency and effectiveness in Part 4 of this report.

In our Technical and Further Education Institutes: 2015 Audit Snapshot, we commented that there was an opportunity for performance reporting to be enhanced if TAFEs linked performance indicators to strategic objectives in the performance report, and provided more comprehensive explanations of the variation between the target and the actual result for each KPI. These opportunities for improvement remain.

Assessment of a TAFE's performance needs to take into account what the TAFE was planning to achieve in the year. The performance indicators should measure whether and how well the TAFE achieved these objectives set out in the SOCI.

Our review of the 11 performance statements found that only Gordon TAFE demonstrated the link between its strategic objectives and performance indicators. Without this link, it is difficult for the public to determine if a TAFE is delivering as intended, and in all areas of strategic importance.

Explanations of variations between targets and results would be more useful if they included information about the underlying reason for the difference between a performance result and the target. The explanations provided often don't reveal the root cause or how a target was estimated. The absence of such information reduces understanding of how a TAFE has actually performed.

2.2.1 Performance reporting framework

DET implemented a performance reporting framework for the vocational education sector in March 2016 for the December 2015 year end.

The framework contains 29 indicators that measure performance on training delivery, outcomes, operating effectiveness, sustainability and compliance. DET has developed and implemented a web-based performance reporting tool to collect data for these indicators.

DET collects the underlying data from the sector at specific intervals:

- monthly collection of data on training delivery

- quarterly collection of data on sustainability

- annual collection of data on student satisfaction, operational effectiveness, compliance and outcomes.

The tool captures all of the performance data for the sector and can be accessed by all TAFEs, enabling them to benchmark their performance against a group of similar providers or the sector as a whole.

The tool can also be used by TAFE chief executive officers, chief finance officers, some chief operating officers, and relevant DET employees, who use it to monitor activities of the sector.

Of the 29 indicators recorded in the tool:

- 12 form a dashboard overview for each TAFE

- 16 are updated quarterly, with the remainder updated every year

- four are mandatory and are reported annually in the performance statement of each TAFE's audited and published performance report.

DET has a long-term plan to publicly report the outcome survey results for all Registered Training Organisations in the market. We support this plan as it will provide transparency on the sector's performance for students and the community.

DET is considering including additional mandatory indicators as part of this plan. Until then, the published performance statement will not include any measures of outcomes, so that TAFEs are not disadvantaged by reporting what could be commercial data.

3 Internal controls

Effective internal controls help entities to meet their objectives reliably and cost‑effectively. Strong internal controls are a prerequisite for delivering sound, accurate and timely external and internal financial reports.

In our annual financial audits, we consider the internal controls relevant to financial reporting and assess whether entities have managed the risk that their financial reports will not be complete and accurate. Poor internal controls make it more difficult for management of entities to comply with relevant legislation, and increase the risk of fraud and error.

3.1 Assessment of internal controls

To the extent we test them, we found that the internal controls at technical and further education (TAFE) institutes for financial reporting were adequate for ensuring that their financial reporting is reliable. However, we found some instances where important internal controls need to be strengthened, and financial reporting matters need to be addressed.

During our 2016 audits, we identified 25 internal control weaknesses and financial reporting issues across the 11 TAFEs, excluding Federation Training. This is a small number of issues and is a positive outcome for the sector.

We communicated all internal control weaknesses and financial reporting issues identified at TAFEs to their management and audit committees. Figure 3A shows the risk rating of the issues we identified, excluding the seven low-risk issues we reported. Low-risk issues are normally minor control weaknesses or opportunities to improve existing processes or internal controls. We define our risk ratings in Appendix C.

Figure 3A

Reported issues by area and risk rating

Area of issue |

Risk rating |

|||

|---|---|---|---|---|

Extreme |

High |

Medium |

Total |

|

Property, plant and equipment |

– |

1 |

4 |

5 |

Expenditure/accounts payable |

– |

– |

2 |

2 |

Financial reporting |

– |

– |

2 |

2 |

Governance |

– |

1 |

1 |

2 |

Information technology (IT) controls |

– |

1 |

3 |

4 |

Revenue/receivables |

– |

– |

2 |

2 |

Reconciliations |

– |

– |

1 |

1 |

Total |

– |

3 |

15 |

18 |

Source: VAGO.

Common issues across the sector related to:

- identification and recording of property, plant and equipment at some TAFEs

- IT controls, which are needed to protect computer applications, infrastructure and information assets from threats to security and access.

Some of the issues we reported related to poor access controls, and weaknesses in system user security.

Status of matters raised in previous audits

As part of the financial audit process, we monitor internal control weaknesses and financial reporting issues identified in previous audits to ensure they are promptly resolved. We provide information to TAFE management and their respective audit committees about the status of these issues.

Figure 3B shows the number of internal control weaknesses and financial reporting issues raised in previous audits, with the resolution status by risk.

Figure 3B

Prior year issues by resolution status at 31 December 2016

Status of prior period issue |

Risk rating |

|||

|---|---|---|---|---|

Extreme |

High |

Medium |

Total |

|

Resolved |

1 |

4 |

10 |

15 |

Unresolved |

– |

3 |

2 |

5 |

Total |

1 |

7 |

12 |

20 |

Source: VAGO.

Twenty issues remained open at the start of 2016. Encouragingly, 75 per cent of these matters were resolved during 2016, including one extreme risk relating to a breach of the Standing Directions of the Minister for Finance in the Financial Management Act 1994, regarding delegations.

TAFEs are responding to the issues in our management letters, and as a result are strengthening the effectiveness of their internal control environment and financial reporting.

3.2 Asset maintenance

Each year we select one area of internal control and perform a more detailed review of the controls and related operating environment. For our 2016 audits we focused on asset maintenance, which underpins the value and useful lives assigned to assets.

TAFEs need well maintained assets to help them deliver educational services to the community efficiently and effectively. They also need to ensure that the assets they use are safe, in line with a legal and expected standard.

At 31 December 2016, the TAFE sector owned a portfolio of property, plant and equipment assets valued at $1.95 billion. Seventy per cent of these assets require ongoing maintenance, and include buildings, plant and equipment, classroom fitout facilities and IT equipment.

Asset maintenance involves continuously monitoring the state of an asset, and undertaking works to keep it in a pre-determined state. To do this, each TAFE should have a sound asset maintenance framework in place.

The key elements of an effective asset maintenance framework are detailed in Figure 3C. We created Figure 3C from the following sources:

- Sustaining Our Assets policy, Department of Treasury and Finance, 2012

- Guidelines for Developing an Asset Management Policy, Strategy and Plan, Department for Victorian Communities, 2004

- Better Practice Guide on the Strategic and Operations Management of Assets by Public Sector Entities, Australian National Audit Office, 2010

- Asset Management Accountability Framework, Department of Treasury and Finance, 2016.

Figure 3C

Elements of an asset maintenance framework

Component |

Key elements |

|---|---|

Asset management policies and strategies |

An asset maintenance strategy is in place that aligns with business strategy and comprises:

An asset maintenance policy exists that includes:

|

Management practices |

|

Governance and oversight |

|

Source: VAGO

Having an appropriate asset maintenance framework in place helps TAFEs plan and undertake targeted asset maintenance at the appropriate time for each asset. It also helps TAFEs comply with their legislative framework.

Under the TAFE Commercial Guidelines—which help TAFEs to comply with section 5.2.1 of the Education and Training Reform Act 2006—TAFEs must have an asset management plan in place. The plan needs to provide general guidance on the acquisition, operation and maintenance, renewal and disposal of assets.

Identifying the necessary level of investment in assets is important, but having enough money to meet this investment can be a challenge. This has been particularly so in the TAFE sector, which has faced significant financial challenges over the past three financial years. We discuss the spending on asset maintenance and the maintenance gap in Part 4 of this report.

3.2.1 TAFE asset maintenance frameworks

We observed many better practice components of an asset maintenance strategy in place at TAFEs. All TAFEs with asset maintenance strategies had incorporated them into their strategic plans. The linking of these key documents means capital works plans take into account the life of each asset, its potential maintenance needs and the time frame for replacement.

However, four TAFEs did not have an asset maintenance strategy in place during 2016. Of those TAFEs that did have asset maintenance strategies, we found that some did not have all elements of better practice.

The common weaknesses across the plans included:

- aspects of asset maintenance procedures not specified, such as who conducts and approves maintenance

- qualifications and experience not documented of those assessing asset maintenance requirements

- no contingency plans for maintenance of assets after natural disasters

- the level of accepted asset maintenance and associated risk not stated.

We noted that the asset maintenance strategies in place were focused on the short to medium term. These plans typically looked at time frames of five years or less. The Department of Treasury and Finance Asset Management Accountability Framework requires an asset maintenance strategy to incorporate plans for the short term (one to three years), medium term (four to nine years) and long term (10+ years). Given that most depreciating assets have a useful life of between five and 50 years, a long-term plan would enable TAFEs to make more accurate decisions about their asset maintenance and replacement needs.

All TAFEs have developed an asset maintenance program outlining the level of work to be achieved in a year. The actual delivery and spending against this program is regularly reported to management. At 10 TAFEs, the asset maintenance program contains detailed current information on asset condition. This is updated at least yearly, which assists with asset planning.

Other components of better practice we found at TAFEs included the existence of a current asset register and regular reporting to the board.

3.2.2 Governance and oversight

Management oversight of a TAFE's asset maintenance strategy, plan and spending is essential for ensuring that asset performance remains at appropriate levels to support the TAFE's goals.

All 12 TAFEs report information on asset maintenance to management, their boards and audit committees. At five TAFEs, this reporting is limited to just the amounts spent on asset maintenance. The frequency and detail of the reporting varied significantly between TAFEs.

Asset maintenance reporting could be improved by:

- better monitoring and reporting of compliance with policy requirements, including acquisition, operation and disposal policies

- periodically engaging internal audit to review compliance and practice

- including long-term maintenance requirements and progress against those requirements.

A lack of system support to capture, record and report on asset planning and maintenance contributes to limitations in reporting. Although five TAFEs use asset maintenance software, only one was able to provide us with:

- maintenance expenditure per asset

- ranking of assets based on risk

- condition assessment information for each asset.

For those TAFEs without asset maintenance software, manual reporting on asset performance such as budgeting and tracking expenditure against individual assets, condition assessments and life cycle information is time consuming and difficult.

DET is aware of this gap in the sector, and is currently considering options as part of its work on TAFE asset management.

4 Financial sustainability

An entity is considered to be financially sustainable if it can maintain operations over the long term based on existing revenue and expenditure policies. It must also be able to absorb short-term fluctuations to income and expenditure from reasonably foreseeable internal and external factors.

If an entity needs to significantly alter revenue or expenditure policies to maintain operations, in the absence of major external shocks, this indicates that the entity is not operating sustainably. Observations about sustainability can be made from examining past and projected trends in underlying financial data and in key indicators.

In this Part of the report, we analyse data for the past five years. The detailed data and calculations that underpin the analysis are provided in the appendices. Appendix D lists our financial sustainability risk indicators, risk assessment criteria, benchmarks and results against each indicator for the 12 TAFEs over the five financial years 2012 to 2016. Appendix E contains a summary of the four mandatory performance indicators that each TAFE reports on, with results and targets for 2015 and 2016.

4.1 Short-term health of the sector

The short-term financial health of the TAFE sector can be judged by looking at:

- the financial results achieved in a year

- the financial position at the end of the reporting year, and

- patterns and trends in financial results over time.

We have considered all these elements and find improvements across the board in the short-term financial health of the TAFE sector, which indicate to us that the financial health of the TAFE sector is improving. We looked at the net result over the past five years and noted a positive outcome at the sector level in 2016. Figure 4A shows that this is the second year of positive operating results for the sector—a turnaround from losses in 2013 and 2014—with a resulting improvement in liquidity.

Figure 4A

The TAFE sector's short-term sustainability 2012 to 2016

|

Indicator |

Average across all entities in the sector per year |

||||

|---|---|---|---|---|---|

|

2012 |

2013 |

2014 |

2015 |

2016 |

|

|

Net result |

5.42% |

–5.71% |

–13.57% |

4.01% |

3.41% |

|

Liquidity |

1.87 |

1.81 |

2.25 |

2.89 |

3.06 |

Note: Figures from 2012–2015 will not match prior year snapshot reports because Federation Training, Advance TAFE and Central Gippsland TAFE were not previously included.

Note: 2015 figures include Federation Training's qualified revenue figures and 2016 includes Federation Training's unaudited figures.

Source: VAGO.

Despite losses in 2013 and 2014, the liquidity of the sector has been strong and is getting stronger. Liquidity measures whether the sector has enough liquid assets, such as cash, to meet short-term commitments. The sector average result of 3.06 for 2016 indicates that the sector as a whole should be able to meet all commitments as they fall due during 2017.

The TAFE sector generated a combined net profit of $42.9 million in 2016. This is an increase of $5.1 million (13 per cent) on 2015 and a significant turnaround of $139.5 million from the $96.6 million loss in 2014.

4.1.1 How the sector improved

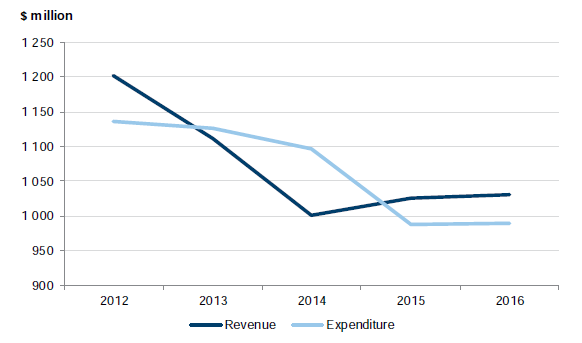

The net result of the sector has improved because revenue has been increasing in 2015 and 2016 while expenditure continues to decline. Figure 4B shows the trend in both revenue and expenditure for the sector over the past five years.

Figure 4B

Financial overview of TAFE sector, 31 December 2012 to 2016

Source: VAGO.

From 2012 to 2014, the TAFE sector's revenue decreased substantially due to a change in the way government funded the sector.

Government funding became contestable in 2013. This meant TAFEs no longer received financial support for operations and were funded based on student enrolments. They had to compete with the private sector for students, while total student numbers were falling, which reduced the available revenue pool.

This change in the funding model, coupled with declining student numbers, led to financial viability issues for the sector in 2013 and 2014.

The improvement in revenue in 2015 and 2016 has been driven by additional government grant funding, rather than growth in revenue. Student numbers continued to fall, and all other sources of revenue such as student fees and contestable funding declined in 2015 and 2016.

The decline in revenue from income rather than grants ultimately reduces TAFEs' financial flexibility, and thereby their fiscal autonomy. The sector received a total of $278.6 million in state government grants in 2016, up from a low of $74.6 million in 2014 and $211.9 million in 2015.

The new Skills First funding model will apply in 2017. This is expected to provide opportunities for TAFEs to receive further government financial support in targeted areas. As a result, we expect revenue growth to be maintained, and there are opportunities for the financial sustainability of the sector to further improve.

4.1.2 Opportunity for further improvement

The sector continues to focus on efficiency and reducing expenditure to improve its financial outcomes.

Total expenditure in the sector declined by $147.3 million (13 per cent) from 2012 to 2016. Most of these savings were achieved by reductions in employee benefits payments. Redundancy payments made in 2013 and 2014 added to employee costs, while recent decreases reflected no further significant redundancies and savings achieved through lower staff numbers.

The results from the TAFEs' performance reporting indicate they expect to achieve further efficiencies in operations. Efficiency and effectiveness is measured in the performance statement of each TAFE through two measures:

- employment costs as a percentage of revenue

- training revenue per full-time-equivalent (FTE) teaching staff member.

The board of each TAFE sets targets for these measures before the start of the financial year.

The performance statement results for 2016 show that most TAFEs have not achieved their own set targets for these two measures. They also show that for some TAFEs the actual result in 2016 is less than what was achieved in 2015.

Figure 4C provides a summary of the results of these two mandatory indicators against the target for each TAFE. The 2015 targets and results are included in Appendix E.

Figure 4C

Results for mandatory indicators reporting in TAFE performance reports, at 31 December 2016

|

TAFE institute |

Employment costs as a proportion of training revenue |

Training revenue per teaching FTE |

||

|---|---|---|---|---|

|

Target |

Actual |

Target |

Actual |

|

|

Bendigo Kangan Institute |

83.1% |

81.2% |

$242 826 |

$238 521 |

|

Box Hill Institute |

82.0% |

107.0% |

$156 500 |

$156 300 |

|

Chisholm Institute |

65.0% |

69.8% |

$200 000 |

$192 752 |

|

Gordon Institute of TAFE |

97.0% |

125.0% |

$147 905 |

$123 009 |

|

Goulburn Ovens Institute of TAFE |

108.7% |

109.8% |

$151 568 |

$127 815 |

|

Holmesglen Institute |

74.0% |

76.4% |

$213 034 |

$195 111 |

|

Melbourne Polytechnic |

88.4% |

97.4% |

$153 492 |

$198 008 |

|

South West Institute of TAFE |

96.4% |

134.0% |

$164 003 |

$120 002 |

|

Sunraysia Institute of TAFE |

85.0% |

133.0% |

$200 000 |

$117 517 |

|

William Angliss Institute of TAFE |

65.0% |

73.1% |

$220 000 |

$223 740 |

|

Wodonga Institute of TAFE |

86.9% |

97.7% |

$165 178 |

$171 123 |

Note: Actual results in red = target not achieved. Actual results in green = target achieved.

Source: VAGO.

Declining student revenue would have affected the results in Figure 4C. However, taking this into account, the results against the targets show that the TAFEs themselves expected to operate more efficiently and effectively in 2016 than they did.

Figure 4C also shows that there is a wide variation in the targets set by TAFEs for each indicator. There is no benchmark as to what the targets for these measures should be for an efficient and effective TAFE.

Some variation in targets would be expected to account for the different metropolitan, regional and rural locations where courses are delivered, and differences in the mix of courses and teaching requirements. However, the absence of a benchmark makes it difficult to determine whether the targets we are using to assess the actual performance of TAFEs are reasonable.

4.2 Maintaining and replacing assets

Asset maintenance and renewal is an emerging risk for the sector. The TAFE sector is asset rich and its large investment in long-lived physical assets presents longer-term financial sustainability challenges.

With such a large portfolio of assets and a constrained financial environment, it is difficult for the TAFE sector to make funding available for new assets, major maintenance and renewal.

We have flagged this challenge in previous reports and noted that, if not addressed, over time the assets of the TAFE sector may no longer be fit to deliver the educational outcomes the community is seeking. This has not changed in 2016.

At the end of 2016, the TAFE sector had total assets of $2 659.7 million, of which about 73 per cent is property, plant and equipment. Figure 4D provides a summary of the total assets of the TAFE sector from 31 December 2012 to 2016.

Figure 4D

Summary of TAFE sector assets at 31 December, 2012 to 2016

|

Indicator |

2012 ($m) |

2013 ($m) |

2014 ($m) |

2015 ($m) |

2016 ($m) |

|---|---|---|---|---|---|

|

Total assets |

2 455.3 |

2 509.2 |

2 419.8 |

2 495.3 |

2 659.7 |

Note: 2014, 2015 and 2016 figures include Federation Training results.

Source: VAGO.

Figure 4D shows that a decrease in assets occurred in 2014. At that time, some TAFEs sold off assets as part of their response to the changing funding environment and the need to reduce costs and overheads. The recent growth in 2016 is due to the revaluation of existing assets.

We measure the level of spending on asset renewal and replacement using a capital replacement indicator. It compares spending on asset renewal and replacement in a year to depreciation, which is an approximation of the level of assets consumed.

Figure 4E shows our capital replacement indicator results for the sector for the past five financial years.

Figure 4E

Financial sustainability of the TAFE sector, 2012 to 2016

|

Indicator |

Average across all entities in the sector per year |

||||

|---|---|---|---|---|---|

|

2012 |

2013 |

2014 |

2015 |

2016 |

|

|

Capital replacement ratio |

1.47 |

1.15 |

0.69 |

0.55 |

1.48 |

Note: Figures from 2012–2015 will not match prior year snapshot reports because Federation Training, Advance TAFE and Central Gippsland TAFE were not previously included.

Source: VAGO.

Figure 4E shows a downward trend from 2012 to 2015, with the TAFE sector only spending half the amount on asset replacement and renewal compared to the amount of assets consumed. This is significantly below a ratio of one to one, which is the long‑term benchmark we consider is needed to maintain asset function.

The improvement in capital replacement results in 2016 is because the sector received $71 million in capital grants from government. The bulk of this funding was for three TAFEs and specific projects:

- $22.6 million to Bendigo Kangan Institute, of which $17.7 million is for a new Health and Community Centre of Excellence

- $17.8 million to Chisholm Institute, most of which is for the Frankston campus redevelopment

- $9.1 million to Box Hill for the Yarra Ranges technical school.

This funding on a limited number of projects masks much lower expenditure on self‑funded asset renewal and replacement in the 2016 year than our capital replacement ratio recommends.

4.2.1 Asset maintenance spending

We also looked at the level of spending on asset maintenance across the TAFE sector to see if this spending mirrored the trend in capital replacement. The results show that the level of spending on maintenance is not enough to sustain the TAFE asset portfolio.

Asset maintenance spending has remained consistently low over the past five years, fluctuating between $15.8 million and $19 million.

During 2016, the Department of Education and Training (DET) gathered detailed information from the TAFEs and performed an analysis to quantify the maintenance spending and needs of the sector.

The DET analysis of maintenance spending has been done in the context of asset replacement value, which is the amount that will be required to replace an asset if the asset is lost. It is different to the fair value that is reported in the financial statements, which is the market value or written down value of the asset.

Figure 4F shows each TAFE's asset maintenance expenditure for 2016 as a percentage of the estimated total asset replacement value.

Figure 4F

Spending on maintenance as a percentage of asset replacement value for each TAFE in 2016

|

TAFE institute |

Maintenance expenditure 2016 ($m) |

Asset replacement value ($m) |

Percentage |

|---|---|---|---|

|

Bendigo Kangan Institute |

1.154 |

461.2 |

0.3% |

|

Box Hill Institute |

2.203 |

354.4 |

0.6% |

|

Chisholm Institute |

2.878 |

372.0 |

0.8% |

|

Federation Training |

1.459 |

180.5 |

0.8% |

|

Gordon Institute of TAFE |

1.589 |

86.3 |

1.8% |

|

Goulburn Ovens Institute of TAFE |

0.766 |

175.0 |

0.4% |

|

Holmesglen Institute of TAFE |

2.932 |

447.9 |

0.7% |

|

Melbourne Polytechnic |

2.159 |

225.9 |

1.0% |

|

South West Institute of TAFE |

0.403 |

91.8 |

0.4% |

|

Sunraysia Institute of TAFE |

1.152 |

87.9 |

1.3% |

|

William Angliss Institute of TAFE |

1.498 |

120.0 |

1.25% |

|

Wodonga Institute of TAFE |

0.844 |

71.4 |

1.2% |

|

Total |

19.037 |

2 674.3 |

0.7% |

Source: VAGO, based on data from DET.

DET's general guideline is that a TAFE should spend between 2 and 2.5 per cent of the asset replacement value on asset maintenance every year.

Figure 4F illustrates that in 2016 the TAFE sector did not achieve this, and spending in the sector was significantly lower than needed at an average of only 0.7 per cent. No individual TAFE achieved the 2 per cent benchmark.

Over time, the year-on-year underspend on asset maintenance creates a backlog of maintenance that increases the cost of bringing an asset up to an acceptable standard. This is currently creating challenges for some TAFEs.

DET asked each TAFE to estimate the condition of its assets and its maintenance backlog. The results are summarised in Figure 4G.

Using the backlog figure, DET has been able to calculate a facilities condition index for each TAFE. This measure allows comparison of relative asset condition across the sector.

Figure 4G

Backlog maintenance estimate and facilities condition index

|

TAFE institute |

Maintenance backlog estimate ($m) |

Asset replacement value ($m) |

Facilities condition index (FCI) |

Condition scale assessment(a) |

|---|---|---|---|---|

|

Bendigo Kangan Institute |

15.3 |

461.2 |

3.30% |

Good |

|

Box Hill Institute |

5.4 |

354.4 |

1.53% |

Good |

|

Chisholm Institute |

17.0 |

372.0 |

4.57% |

Good |

|

Federation Training |

10.1 |

180.5 |

5.59% |

Fair |

|

Gordon Institute of TAFE |

9.9 |

86.3 |

11.48% |

Poor |

|

Goulburn Ovens Institute of TAFE |

3.3 |

175.0 |

1.88% |

Good |

|

Holmesglen Institute of TAFE |

6.9 |

447.9 |

1.55% |

Good |

|

Melbourne Polytechnic |

32.8(b) |

225.9 |

6.9% |

Fair |

|

South West Institute of TAFE |

2.2 |

91.8 |

2.36% |

Good |

|

Sunraysia Institute of TAFE |

10.1 |

87.9 |

11.47% |

Poor |

|

William Angliss Institute of TAFE |

2.1 |

120.0 |

1.78% |

Good |

|

Wodonga Institute of TAFE |

5.7 |

71.4 |

7.98% |

Fair |

|

Total |

120.8 |

2 674.3 |

5.03% |

Fair |

(a) Good = 0–5, Fair = 5–10, Poor = 10+.

(b) This excludes $100 million required for the Aradale Asylum site, which was allocated to Melbourne Polytechnic and is currently in very poor condition.

Source: VAGO, based on data from DET.

DET's assessment shows that the condition of assets has been rated as good at seven TAFEs. There is a larger challenge at the five TAFEs whose asset condition is rated as fair or poor. At the two TAFEs with assets assessed as poor, there is a higher risk that some of their assets may become unfit for purpose due to a lack of maintenance.

All the evidence shows that asset maintenance is an emerging risk for the sector. DET is aware of the risk and has begun work on the strategic asset planning and maintenance issues in the TAFE sector.

TAFEs are to receive maintenance funding from government starting in 2017, with $41.6 million to be distributed to the sector in 2017, followed by more in future years to address the maintenance backlog. It is important that TAFEs quickly use the funding to reduce the maintenance backlog.

Appendix A. Audit Act 1994 section 16—submissions and comments

We have consulted with all technical and further education institutes and the Department of Education and Training throughout the course of the audit. As required by section 16(3) of the Audit Act 1994, we gave a draft copy of this report, or relevant extracts, to those entities and asked for their submissions and comments.

Responsibility for the accuracy, fairness and balance of those comments rests solely with the entity head.

Responses were received as follows:

- Department of Education and Training.

- Federation Training.

RESPONSE provided by the Secretary, Department of Education and Training

RESPONSE provided by the Managing Director, Federation Training

Appendix B. Audit opinions issued

Figure B1 lists the entities included in this report. It details the date an audit opinion was issued to each entity for their 2016 financial statements, and the nature of that opinion.

Figure B1

Audit opinions issued

Entity |

Clear audit opinion issued |

Auditor-General's report signed |

|---|---|---|

TAFEs |

||

Bendigo Kangan Institute |

✔ |

6 Mar 17 |

Box Hill Institute |

✔ |

23 Mar 17 |

Chisholm Institute |

✔ |

7 Mar 17 |

Federation Training |

Not signed yet |

Not signed yet |

Gordon Institute of TAFE |

✔ |

22 Mar 17 |

Goulburn Ovens Institute of TAFE |

✔ |

17 Mar 17 |

Holmesglen Institute |

✔ |

23 Mar 17 |

Melbourne Polytechnic |

✔ |

7 Mar 17 |

South West Institute of TAFE |

✔ |

23 Mar 17 |

Sunraysia Institute of TAFE |

✔ |

30 Mar 17 |

William Angliss Institute of TAFE |

✔ |

17 Mar 17 |

Wodonga Institute of TAFE |

✔ |

9 May 17 |

Controlled entities |

||

William Angliss Institute Foundation |

✔ |

10 Mar 17 |

William Angliss Institute Pty Ltd |

✔ |

17 Mar 17 |

Angliss Consulting Pty Ltd |

✔ |

10 Mar 17 |

Angliss Multimedia Pty Ltd |

✔ |

10 Mar 17 |

Angliss Solutions Pty Ltd |

✔ |

10 Mar 17 |

Box Hill Enterprises Ltd |

✔ |

23 Mar 17 |

Caroline Chisholm Foundation |

✔ |

7 Mar 17 |

Chisholm Academy Pty Ltd |

✔ |

10 Mar 17 |

Driver Education Centre Australia |

✔ |

9 May 17 |

Glenuc Pty Ltd |

✔ |

10 Mar 17 |

Gotec Limited |

✔ |

23 Mar 17 |

Controlled entities |

||

Holmesglen Foundation |

✔ |

10 Mar 17 |

Holmesglen International Training Services Pty Ltd |

✔ |

10 Mar 17 |

|

John Batman Consultancy and Training Pty Ltd |

✔ |

18 May 17 |

TAFE Online Pty Ltd |

✔ |

7 Mar 17 |

TAFE Kids Incorporated |

✔ |

24 Mar 17 |

Source: VAGO.

Appendix C. Management letter risk ratings

Figure C1 shows the risk ratings applied to management letter issues raised during a financial audit.

Figure C1 Definitions of risk ratings for issues reported in audit management letters

Rating |

Definition |

Management action required |

|---|---|---|

Extreme |

The matter represents:

|

Requires immediate management intervention with a detailed action plan to be implemented within one month. Requires executive management to correct the material misstatement in the financial report as a matter of urgency to avoid a qualified audit opinion. |

High |

The matter represents:

|

Requires prompt intervention by managers with a detailed action plan implemented within two months. Requires executive management to correct the material misstatement in the financial report to avoid a qualified audit opinion. |

Medium |

The matter represents:

|

Requires intervention by managers with a detailed action plan implemented within three to six months. |

Low |

The matter represents:

|

Requires management intervention with a detailed action plan implemented within six to 12 months. |

Source: VAGO.

Appendix D. Financial sustainability risk indicators

Figures D1 and D2 set out the definitions and criteria applied in this report from prior years that we use when assessing risks to financial sustainability in the TAFE sector.

The financial sustainability indicators used in this report are indicative and highlight risks to ongoing financial sustainability at a sector level.

It is important to note that forming a definitive view of financial sustainability requires a holistic analysis that moves beyond historical financial considerations to also include consideration of financial forecasts and plans, operations and an entity's environment.

Figures D1 shows the indicators we used to assess the financial sustainability risks of the entities covered in this report. These indicators should be considered collectively, and are more useful when assessed over time as part of a trend analysis.

Figure D1

Financial sustainability risk indicators

|

Indicator |

Formula |

Description |

|---|---|---|

|

Net result (%) |

Net result / Total revenue |

A positive result indicates a surplus, and the larger the percentage, the stronger the result. A negative result indicates a deficit. Operating deficits cannot be sustained in the long term. Net result and total revenue is obtained from the comprehensive operating statement. |

|

Liquidity (ratio) |

Current assets / Current liabilities |

This measures the ability to pay existing liabilities in the next 12 months. A ratio of one or more means there are more cash and liquid assets than short-term liabilities. |

|

Capital replacement (ratio) |

Cash outflows for property, plant and equipment / Depreciation |

Comparison of the rate of spending on infrastructure with its depreciation. Ratios higher than 1:1 indicate that spending is faster than the rate of depreciation. This is a long-term indicator, as capital expenditure can be deferred in the short term if there are not enough funds available from operations, and borrowing is not an option. Cash outflows for infrastructure are taken from the cash-flow statement. Depreciation is taken from the comprehensive operating statement. |

|

Internal financing (%) |

Net operating cash flow / Net capital expenditure |

This measures the ability of an entity to finance capital works from generated cash flow. The higher the percentage, the greater the ability for the entity to finance capital works from their own funds. Net operating cash flows and net capital expenditure are obtained from the cash flow statement. |

Source: VAGO.

Our analysis of financial sustainability risk in this report reflects on the position of each TAFE and its controlled entities (each consolidated TAFE).

Financial sustainability risk assessment criteria

The financial sustainability risk of each TAFE has been assessed using the criteria outlined in Figure D2.

Figure D2

Financial sustainability risk indicators—risk assessment criteria

|

Risk |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

High |

Negative 10% or less |

Less than 0.75 |

Less than 1.0 |

Less than 10% |

|

Insufficient revenue is being generated to fund operations and asset renewal. |

Immediate sustainability issues with insufficient current assets to cover liabilities. |

Spending on capital works has not kept pace with consumption of assets. |

Limited cash generated from operations to fund new assets and asset renewal. |

|

|

Medium |

Negative 10%–0% |

0.75–1.0 |

1.0–1.5 |

10–35% |

|

A risk of long-term rundown of cash reserves and inability to fund asset renewals. |

Need for caution with cash flow, as issues could arise with meeting obligations as they fall due. |

Could indicate that not enough is being spent on asset renewal. |

Might not be generating enough cash from operations to fund new assets. |

|

|

Low |

More than 0% |

More than 1.0 |

More than 1.5 |

More than 35% |

|

Generating surpluses consistently. |

No immediate issues with repaying short‑term liabilities as they fall due. |

Low risk of not spending enough on asset renewal. |

Generating enough cash from operations to fund new assets. |

Source: VAGO.

Figures D3 to D17 show the financial sustainability risk for each consolidated TAFE institute from 2012 to 2016.

Figure D3

Advance TAFE

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

–3.36% |

1.65 |

0.84 |

34% |

|

2013 |

–50.94% |

1.01 |

0.22 |

0.00% |

|

2014 |

– |

– |

– |

– |

|

2015 |

– |

– |

– |

– |

|

2016 |

– |

– |

– |

– |

Note: Advance TAFE merged with Central Gippsland Institute of TAFE on 1 July 2014 to form Federation Training.

Source: VAGO.

Figure D4

Bendigo Kangan Institute

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

0.53% |

1.10 |

0.60 |

286% |

|

2013 |

0.30% |

1.37 |

0.30 |

134% |

|

2014 |

–13.42% |

2.35 |

0.11 |

488% |

|

2015 |

2.17% |

2.37 |

0.23 |

751% |

|

2016 |

2.72% |

2.86 |

0.53 |

166% |

Note: Bendigo TAFE merged with Kangan Institute on 1 July 2014. Results for 2012 to 2014 represent Bendigo TAFE only. From 2015, the combined results of Bendigo Kangan Institute are shown.

Source: VAGO.

Figure D5

Box Hill Institute

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

7.99% |

2.44 |

2.85 |

81% |

|

2013 |

–2.77% |

2.27 |

3.49 |

0% |

|

2014 |

–7.50% |

2.14 |

0.66 |

0% |

|

2015 |

7.23% |

2.83 |

1.18 |

194% |

|

2016 |

2.13% |

2.16 |

5.10 |

25% |

Source: VAGO.

Figure D6

Central Gippsland Institute of TAFE

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

12.65% |

1.10 |

2.91 |

148% |

|

2013 |

–14.96% |

1.28 |

1.05 |

1.57% |

|

2014 |

– |

– |

– |

– |

|

2015 |

– |

– |

– |

– |

|

2016 |

– |

– |

– |

– |

Note: Advance TAFE merged with Central Gippsland Institute of TAFE on 1 July 2014 to form Federation Training.

Source: VAGO.

Figure D7

Chisholm Institute

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

2.66% |

1.48 |

1.02 |

78% |

|

2013 |

22.65% |

2.40 |

2.73 |

160% |

|

2014 |

20.67% |

3.02 |

3.83 |

116% |

|

2015 |

4.84% |

4.10 |

0.58 |

391% |

|

2016 |

9.51% |

4.55 |

0.98 |

362% |

Source: VAGO.

Figure D8

Federation Training

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

– |

– |

– |

– |

|

2013 |

– |

– |

– |

– |

|

2014 |

–26.76% |

0.87 |

0.49 |

0% |

|

2015 |

–0.65% |

2.02 |

0.10 |

1192% |

|

2016 |

1.96% |

2.44 |

0.27 |

804% |

Note: Advance TAFE merged with Central Gippsland Institute of TAFE on 1 July 2014 to form Federation Training.

Note: 2014 figures are disclaimed, 2015 are qualified and 2016 are unaudited.

Source: VAGO.

Figure D9

Gordon Institute of TAFE

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

13.16% |

3.98 |

1.49 |

200% |

|

2013 |

0.79% |

4.49 |

0.23 |

305% |

|

2014 |

–18.51% |

5.30 |

0.33 |

0% |

|

2015 |

–1.65% |

6.28 |

0.37 |

869% |

|

2016 |

1.61% |

5.77 |

0.96 |

238% |

Source: VAGO.

Figure D10

Goulburn Ovens Institute of TAFE

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

15.40% |

3.29 |

0.72 |

506% |

|

2013 |

11.21% |

3.19 |

0.50 |

741% |

|

2014 |

–31.23% |

3.60 |

0.27 |

0% |

|

2015 |

–2.97% |

3.55 |

0.34 |

87% |

|

2016 |

2.05% |

3.90 |

0.33 |

444% |

Source: VAGO.

Figure D11

Holmesglen Institute

|

>Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

5.35% |

1.02 |

1.75 |

127% |

|

2013 |

–4.20% |

0.41 |

0.64 |

937% |

|

2014 |

–7.90% |

1.80 |

0.73 |

0% |

|

2015 |

9.88% |

2.16 |

0.68 |

138% |

|

2016 |

10.43% |

2.54 |

0.79 |

404% |

Source: VAGO.

Figure D12

Kangan Institute of TAFE

|

>Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

–0.71% |

1.69 |

1.13 |

26% |

|

2013 |

3.18% |

1.41 |

0.97 |

199% |

|

2014 |

– |

– |

– |

– |

|

2015 |

– |

– |

– |

– |

|

2016 |

– |

– |

– |

– |

Note: Kangan Institute merged with Bendigo TAFE on 1 July 2014. The combined results are shown as Bendigo Kangan Institute.

Source: VAGO.

Figure D13

Melbourne Polytechnic

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

3.34% |

2.19 |

2.07 |

100% |

|

2013 |

–28.05% |

1.03 |

1.06 |

0% |

|

2014 |

–16.90% |

0.62 |

0.23 |

0% |

|

2015 |

–2.50% |

1.08 |

0.04 |

29783% |

|

2016 |

–1.84% |

1.18 |

1.12 |

64% |

Source: VAGO.

Figure D14

South West Institute of TAFE

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

–1.73% |

1.08 |

0.97 |

78% |

|

2013 |

–12.59% |

1.45 |

0.67 |

0% |

|

2014 |

–31.60% |

0.86 |

0.22 |

0% |

|

2015 |

3.47% |

2.75 |

0.25 |

23% |

|

2016 |

0.38% |

2.21 |

1.76 |

80% |

Source: VAGO.

Figure D15

Sunraysia Institute of TAFE

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

0.28% |

1.68 |

0.62 |

199% |

|

2013 |

4.54% |

1.61 |

1.40 |

166% |

|

2014 |

–44.34% |

0.72 |

0.98 |

30% |

|

2015 |

16.92% |

1.53 |

1.81 |

188% |

|

2016 |

1.15% |

1.86 |

2.50 |

60% |

Source: VAGO.

Figure D16

William Angliss Institute of TAFE

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

–2.22% |

1.38 |

0.65 |

0% |

|

2013 |

–11.34% |

1.20 |

0.46 |

0% |

|

2014 |

–1.65% |

1.37 |

0.17 |

0% |

|

2015 |

5.09% |

1.49 |

0.25 |

1666% |

|

2016 |

9.09% |

1.89 |

1.92 |

144% |

Source: VAGO.

Figure D17

Wodonga Institute of TAFE

|

Year |

Net result |

Liquidity |

Capital replacement |

Internal financing |

|---|---|---|---|---|

|

2012 |

22.52% |

2.12 |

3.00 |

149% |

|

2013 |

2.19% |

2.28 |

2.39 |

0% |

|

2014 |

2.44% |

3.00 |

0.75 |

200% |

|

2015 |

1.60% |

3.66 |

0.31 |

754% |

|

2016 |

0.25% |

4.73 |

0.27 |

1471% |

Source: VAGO.

Appendix E. Mandatory performance indicators

Figures E1 to E12 show each technical and further education (TAFE) institute's reported performance against the four mandatory performance indicators for 2016 and 2015.

Figure E1

Bendigo Kangan Institute

Performance indicator |

2016 |

2015 |

||

|---|---|---|---|---|

Target |

Actual |

Target |

Actual |

|

Training revenue diversity:

|

49.9% 50.2% |

50.3% 49.7% |

48.9% 51.0% |

49.5% 50.5% |

Employment costs as a proportion of training revenue |

83.1% |

81.2% |

75.3% |

82.2% |

Training revenue per teaching FTE(a) |

$242 826 |

$238 521 |

$289 751 |

$241 853 |

Operating margin percentage |

0.3% |

–17.6% |

–6.6% |

1.5% |

(a) FTE = full-time equivalent.

Source: VAGO.

Figure E2

Box Hill Institute

Performance indicator |

2016 |

2015 |

||

|---|---|---|---|---|

Target |

Actual |

Target |

Actual |

|

Training revenue diversity:

|

63.0% 37.0% |

68.0% 33.0% |

66.0% 34.0% |

64.0% 36.0% |

Employment costs as a proportion of training revenue |

82.0% |

107.0% |

63.0% |

89.0% |

Training revenue per teaching FTE |

$156 500 |

$156 300 |

$334 400 |

$217 400 |

Operating margin percentage |

–8.2% |

–8.8% |

10.0% |

–2.0% |

Source: VAGO.

Figure E3

Chisholm Institute

Performance indicator |

2016 |

2015 |

||

|---|---|---|---|---|

Target |

Actual |

Target |

Actual |

|

Training revenue diversity:

|

50.1% 32.1% 17.8% |

54.7% 25.7% 19.6% |

56.5% 29.2% 16.8% |

51.1% 31.1% 17.8% |

Employment costs as a proportion of training revenue |

65.0% |

69.8% |

65.7% |

67.3% |

Training revenue per teaching FTE |

$200 000 |

$192 752 |

$199 067 |

$174 932 |

Operating margin percentage |

0.0% |

1.0% |

2.7% |

3.4% |

Source: VAGO.

Figure E4

Federation Training

Performance indicator |

2016 |

2015 |

||

|---|---|---|---|---|

Target |

Actual |

Target |

Actual |

|

Training revenue diversity:

|

– – |

– – |

– – |

– – |

Employment costs as a proportion of training revenue |

– |

– |

– |

– |

Training revenue per teaching FTE |

– |

– |

– |

– |

Operating margin percentage |

– |

– |

– |

– |

Note: Federation Training performance statements were not complete at the time of reporting.

Source: VAGO.

Figure E5

Gordon Institute of TAFE

Performance indicator |

2016 |

2015 |

||

|---|---|---|---|---|

Target |

Actual |

Target |

Actual |

|

Training revenue diversity:

|

69.1% 30.8% |

69.2% 30.8% |

n/a n/a |

70.2% 29.8% |

Employment costs as a proportion of training revenue |

97.0% |

125.0% |

n/a |

110.0% |

Training revenue per teaching FTE |

$147 905 |

$123 009 |

n/a |

$134 517 |

Operating margin percentage |

–31.8% |

–4.9% |

n/a |

–6.9% |

Note: n/a = target not set by TAFE.

Source: VAGO.

Figure E6

Goulburn Ovens Institute of TAFE

Performance indicator |

2016 |

2015 |

||

|---|---|---|---|---|

Target |

Actual |

Target |

Actual |

|

Training revenue diversity:

|

70.6% 29.4% |

58.0% 41.9% |

62.0% 38.0% |

57.9% 42.0% |

Employment costs as a proportion of training revenue |

108.7% |

109.8% |

58.3% |

109.7% |

Training revenue per teaching FTE |

$151 568 |

$127 815 |

$176 729 |

$126 679 |

Operating margin percentage |

–39.8% |

3.6% |

–8.9% |

–3.6% |

Source: VAGO.

Figure E7

Holmesglen Institute

Performance indicator |

2016 |

2015 |

||

|---|---|---|---|---|

Target |

Actual |

Target |

Actual |

|

Training revenue diversity:

|

32.0% 68.0% |

34.9% 65.1% |

n/a n/a |

30.7% 69.3% |

Employment costs as a proportion of training revenue |

74.0% |

76.4% |

74.1% |

81.4% |

Training revenue per teaching FTE |

$213 034 |

$195 111 |

n/a |

$215 128 |

Operating margin percentage |

0.3% |

3.6% |

0.5% |

0.9% |

Note: n/a = target not set by TAFE.

Source: VAGO.

Figure E8

Melbourne Polytechnic

Performance indicator |

2016 |

2015 |

||

|---|---|---|---|---|

Target |

Actual |

Target |

Actual |

|

Training revenue diversity:

|

40.2% 59.8% |

34.4% 65.6% |

32.4% 67.6% |

30.5% 69.5% |

Employment costs as a proportion of training revenue |

88.4% |

97.4% |

75.4% |

83.1% |

Training revenue per teaching FTE |

$153 492 |

$198 008 |

$213 795 |

$255 141 |

Operating margin percentage |

0.0% |

–1.9% |

–8.1% |

–2.5% |

Source: VAGO.

Figure E9

South West Institute of TAFE

Performance indicator |

2016 |

2015 |

||

|---|---|---|---|---|

Target |

Actual |

Target |

Actual |

|

Training revenue diversity:

|

65.3% 34.7% |