Tendering of Metropolitan Bus Contracts

Overview

In 2013, the Melbourne Metropolitan Bus Franchise (MMBF) was established to service around 30 per cent of Melbourne’s metropolitan bus network. The contract is worth approximately $1.7 billion over 10 years. This audit examined whether the state has effectively secured value for money from the MMBF by assessing the MMBF tender and Public Transport Victoria’s (PTV) management of the resulting contract. The state’s progress in reforming future metropolitan bus contracts was also examined.

The audit found that the state has not yet secured full value for money from the MMBF arrangements, despite achieving almost $33 million in cost savings in 2013–14.

The MMBF tender was soundly planned and run in accordance with Victorian Government Purchasing Board requirements. However, the contract's potential is not yet being realised primarily due to unreliable performance data. This is compromising PTV's capacity to effectively manage the contract.

Of particular concern is the Department of Economic Development, Jobs, Transport & Resources' (DEDJTR) and PTV's slow progress toward reforming the balance of metropolitan bus contracts expiring in 2018. Urgent and sustained action is required to avoid limiting the state's procurement options in 2018, and compromising any opportunity to leverage better value from these services through increased competition.

Tendering of Metropolitan Bus Contracts: Message

Ordered to be published

VICTORIAN GOVERNMENT PRINTER May 2015

PP No 31, Session 2014–15

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on the audit Tendering of Metropolitan Bus Contracts.

The audit examined whether the state has effectively secured value for money from the new Melbourne Metropolitan Bus Franchise (MMBF) arrangements. It assessed the planning and conduct of the MMBF tender, and the management of the resulting contract. The audit also examined the state's progress in reforming future metropolitan bus contracts.

I found that the state has not yet secured full value for money from the MMBF arrangements. While the contract resulted in cost savings of $33 million in 2013–14, cost savings alone are note sufficient to demonstrate value for money. In particular, the contract's potential has not yet been realised due to Public Transport Victoria's (PTV) failure to resolve longstanding issues impacting the implementation of the related performance regime.

A further concern is the Department of Economic Development, Jobs, Transport and Resources' and PTV's slow progress in preparing to reform the remaining metropolitan bus contracts, which are expiring in 2018. This risks compromising the state's immediate opportunity to leverage better value from these services.

Yours faithfully

John Doyle

Auditor-General

6 May 2015

Auditor-General's comments

John Doyle Auditor-General |

Audit team Steven Vlahos—Engagement Leader Tony Brown—Acting Engagement Leader Helen Lilley—Team Leader Ray Seidel-Davies—Senior Analyst Rosy Andaloro—Analyst Engagement Quality Control Reviewer Andrew Evans |

Buses are a vital part of Melbourne's public transport system. For approximately 80 per cent of households, they are the only readily accessible form of public transport. This is particularly the case for Melbourne's middle and outer suburbs, where buses provide cross-town transport, local services and critical links to the rail network. As these services cost Victorians around $1 billion per year, it is vital that the state receives the best value possible for this money.

However, my recent audits, Coordinating Public Transport (2014) and Developing Transport Infrastructure and Services for Population Growth Areas (2013) have highlighted significant shortcomings with these services due, in part, to deficient contractual arrangements which offer minimal incentives for improving services.

Specifically, these audits found that many of Melbourne's bus routes currently have long wait times, indirect routes, and do not operate on schedules designed to harmonise well with the rail network or other bus routes. These issues are longstanding and reduce the usefulness of bus services for commuters and impede patronage growth.

In this audit, I examined whether the state has effectively secured value for money from the new Melbourne Metropolitan Bus Franchise (MMBF) which was established in 2013 to deliver around 30 per cent of Melbourne's bus services. The MMBF agreement is fundamentally different to any other contracting arrangement within Melbourne's bus network as it contains strengthened incentives and penalties designed to drive improvements in bus services.

I examined the planning and conduct of the MMBF tender, as well as Public Transport Victoria's (PTV) management of the resulting contract. I also examined the state's progress towards reforming the remaining metropolitan bus contracts—covering around 70 per cent of services—that will expire in 2018.

I found that the state has not yet secured full value for money from the MMBF agreement despite achieving almost $33 million in cost savings in 2013–14. This is because PTV has failed to:

- resolve longstanding data reliability issues impacting the operation of the performance regime by April 2015 when it was due to be fully implemented

- withhold payments for instances of non-performance to encourage timely corrective action

- reach a timely agreement with the operator on the standard for determining incentive payments for improvements in bus patronage.

PTV needs to strengthen its management of the MMBF contract and urgently address longstanding data reliability issues as this situation is compromising its capacity to reliably assess and manage the operator's performance.

Of particular concern is the Department of Economic Development, Jobs, Transport and Resources (DEDJTR) and PTV's slow progress towards reforming the balance of metropolitan bus contracts. These contracts have never been exposed to open market competition as historically they have been renewed with the incumbent operators. Their expiry in 2018 therefore means the state is now rapidly approaching a critical juncture.

My predecessor's 2009 audit Melbourne's New Bus Contracts highlighted that procurement and reform options needed to be presented to government as a matter of urgency, as any change in the delivery arrangements for these services will require extensive planning and lead time to assure the availability of critical assets and infrastructure. However, progress on this initiative has been slow as initial planning to address these issues has only recently commenced.

Consequently, the state risks having its options in 2018 severely curtailed due to a lack of time to substantively progress these reforms, meaning it may be forced to again renegotiate with incumbent operators.

This scenario, should it eventuate, represents the worst possible economic outcome for the state. It would compromise the immediate opportunity to leverage better value for the $1 billion spent on bus services each year.

I have made 13 recommendations to address these issues. The recommendations reinforce the need for PTV to remedy the problems with performance data and contract management. I also urge PTV and DEDJTR to present future reform options to government as a matter of urgency.

I intend to monitor implementation of these recommendations, and will follow up with PTV, DEDJTR and the Department of Treasury and Finance (DTF) to ensure appropriate measures have been taken.

I wish to thank the staff in PTV, DEDJTR and DTF for their constructive engagement throughout the audit process.

John Doyle

Auditor-General

May 2015

Audit Summary

Buses are a significant form of public transport, providing cross-town transport, local services and links to the rail network. They are often the only readily accessible form of public transport available for people living in Melbourne's middle and outer suburbs.

Public Transport Victoria (PTV) oversees public transport operators. It is responsible for managing all bus service contracts, which currently cost the state around $1 billion per year.

Melbourne's bus network is extensive—it consists of more than 300 routes covering over 5 500 kilometres, and is serviced by approximately 1 700 buses. These services are delivered by 12 private operators comprising of:

- 27 contracts with 11 operators, renegotiated in 2008 with longstanding incumbent providers. These contracts, which expire in 2018, cover around 70 per cent of metropolitan bus services, are largely fee-for-service, and contain minimal performance incentives and penalties.

- A new contract established in 2013 through an open competitive tender with a single operator covering around 30 per cent of services. This contract, known as the Melbourne Metropolitan Bus Franchise (MMBF) agreement, differs from the other arrangements as it contains a suite of performance incentives designed to improve bus services, patronage growth and customer satisfaction. The contract, worth around $1.7 billion, expires in 2023.

PTV leveraged competitive tension in the market when establishing MMBF, expecting this would result in a better service for customers at a reduced cost to the state. A related aim of this approach was to eventually extend this reform to all metropolitan bus services by using MMBF to assess the savings possible through increased competition, and to demonstrate the benefits of a performance-based contract.

The previous government approved the use of an open tender for establishing the MMBF agreement in September 2011. In so doing, it determined that the MMBF agreement would be considered as having achieved value if it:

- reduced costs for the state

- delivered improved services for more customers

- progressed reform of the wider bus industry.

Objectives of this audit

This audit examined whether the state has effectively secured value for money from the MMBF. It assessed the planning and conduct of the MMBF tender, and PTV's management of the resulting contract. The audit also examined the state's progress in preparing to reform future metropolitan bus contracts.

Conclusions

The state has not yet secured full value for money from the MMBF despite achieving almost $33 million in cost savings.

While the project to establish the MMBF contract was based on sound planning and was run in accordance with Victorian Government Purchasing Board (VGPB) requirements, the contract's potential is not currently being realised due to PTV's failure to resolve longstanding issues impacting the implementation of the related performance regime.

PTV needs to urgently address the lack of reliable performance data, as it compromises its capacity to effectively manage the contract, and achieve the state's broader reform objectives.

The Department of Economic Development, Jobs, Transport and Resources (DEDJTR) and PTV's slow progress in preparing to reform the 27 private metropolitan bus contracts which are expiring in 2018 is of particular concern. Despite the scale and complexity of this exercise, and the significant opportunity cost to the state from failure, substantive planning to address these issues has only recently commenced.

Urgent and sustained action is required, to avoid limiting the state's procurement options in 2018, and compromising any opportunity to leverage better value from these services through increased competition.

Findings

Performance of the MMBF

Although the MMBF has been operating for over 18 months, it cannot yet be determined whether it is achieving all of its objectives and full value for money for the state.

MMBF expenditure for 2013–14 was almost $33 million, or 18 per cent, less than the amount PTV estimated it would have spent if the previous contracts had continued.

However, MMBF cost savings alone are not sufficient to demonstrate that value for money has been achieved as this relies on the contract also delivering improved services to more customers.

The MMBF contract establishes an incentive and penalty regime to drive achievement of the operator's service improvement obligations. Effective performance monitoring by PTV is therefore critical to ensure these obligations are met, and to realise the contract's full potential.

While the MMBF performance regime is conceptually sound, PTV has yet to effectively implement it. In particular, PTV has failed to:

- reach a timely agreement with the operator on the standard for determining incentive payments for improvements in bus patronage

- resolve longstanding data reliability issues impacting the operation of the performance regime by April 2015 when it was due to be fully implemented

- withhold payments for instances of non-performance to encourage timely corrective action.

These circumstances are compromising achievement of the state's reform agenda, including PTV's capacity to reliably assess and manage the contractor's performance.

PTV recently advised that full implementation of the performance regime has been delayed.

PTV recognises that overcoming this issue is critical because it will otherwise not be able to implement the financial incentives and penalties that are due to begin after a total rebuild of the current bus timetable—known as the Greenfields timetable.

It has therefore proposed an alternative method for calculating service reliability and punctuality to the contractor, but this had not yet been implemented at the time of audit. However, we found that PTV's proposal is deficient as it relies heavily on self-reporting by the operator to determine the reliability of bus services. PTV did not have a plan or procedures in place to audit and verify the accuracy of this information.

Urgent action is required by PTV to address this issue as it risks compromising the integrity of the performance regime and of related incentive payments.

Reforming remaining bus contracts

Progressing broader reform of the remaining 27 bus service contracts will be a complex and challenging exercise for the state. These contracts do not contain any clear end-of-term rights for the state to run a competitive tender process for these services. The state's right to do so is a longstanding issue that is contested by some members of the industry. Any change in the delivery arrangements for these services will require extensive planning and lead time to assure the availability and transition of any critical assets and infrastructure.

Our 2009 audit, Melbourne's New Bus Contracts, recommended that the former Department of Transport provide early advice to government on the strategic options and constraints for future metropolitan bus contracts. While the department and PTV implemented this recommendation for the MMBF, it has not been addressed for the next tranche of bus contracts.

In July 2014, the former Department of Transport, Planning and Local Infrastructure and PTV established a joint working group that commenced initial planning for the next round of bus contract procurements. The working group commissioned initial research on bus structures in other jurisdictions and potential reform options.

An interdepartmental steering committee comprising PTV, DEDJTR, the Department of Treasury and Finance and the Department of Premier and Cabinet was also established in early 2015 to inform development of a procurement strategy for the government's consideration by August 2015.

However, progress on this initiative has been slow. Consequently, the risk is now high that a project of this significance, scale and complexity may not be effectively planned and delivered in the time remaining.

In turn, this also risks limiting the state's options in 2018. If delays mean insufficient time is left to pursue an open tender, the state may find that renegotiating with incumbent operators is the only option. This will likely compromise any immediate opportunity for the state to achieve improved value from these contracts.

Tendering the MMBF

The MMBF competitive tender process was guided by appropriate procurement principles and probity requirements, and resulted in a contract that is capable of delivering improved services and value to the state.

PTV's strategic planning for the MMBF procurement was clearly focused on producing a value for money outcome, but did not fully comply with required VGPB policies and guidance. In particular, PTV did not develop a business case or final strategic procurement plan for the MMBF. This created a risk that state decisions about the procurement were not soundly based, although our assessment of supporting documentation indicates that key costs, benefits, risks and options were adequately identified.

During tender assessment, PTV introduced the targeted improvement process—an additional assessment step that was not contemplated in the evaluation plan. Despite this, the process was managed in accordance with VGPB requirements, and assisted with optimising value from the bids and producing a value for money outcome for the state.

Managing the MMBF agreement

PTV's contract management policies and practices for the MMBF are inadequate and are further compromised by the above-noted deficiencies in performance monitoring. PTV does not have a complete contract management plan in place for the MMBF agreement. While routine tasks and processes are documented in a Contract Administration Manual and Process Administration Guides, they do not clarify where responsibility lies for specific tasks and key decisions—including for resolving complex or contentious issues, the approach for conducting regular contract reviews, and the related information management requirements.

This situation, combined with PTV's willingness to negotiate extensions to some contract deadlines rather than withhold payments or invoke penalties, risks reducing the value for money delivered by the contract and undermining achievement of the state's related reform objectives.

PTV advised that it has only waived the withholding of payments for some delayed initiatives which were offered by the contractor and formalised in the contract, but which have no impact on core services to customers. However, a key goal of introducing the performance-based MMBF contract was to create incentives to improve performance. While deadlines may need to be extended in some circumstances, the contract enables PTV to reasonably reduce payments in response, but it has never done so. This is inconsistent with the goals of the MMBF contract and the related reform agenda.

Additionally, PTV has not assessed the value for money implications of the contract variations that have so far been approved. This risks undermining MMBF's value, as it means there is little assurance that implemented variations support achievement of MMBF's objectives.

Recommendations

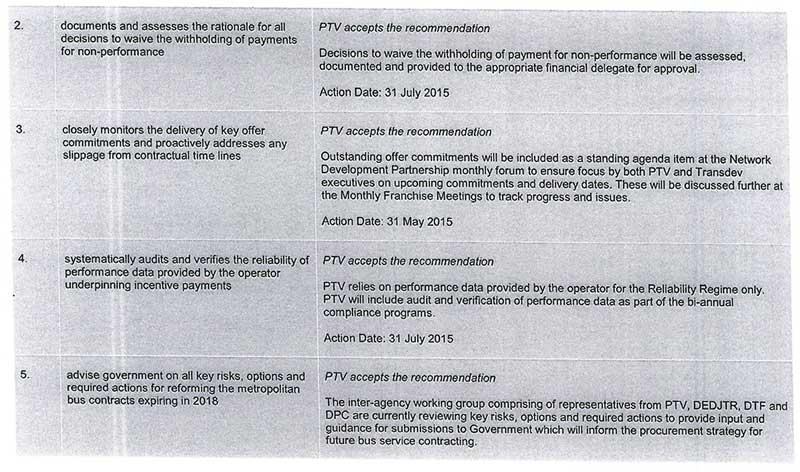

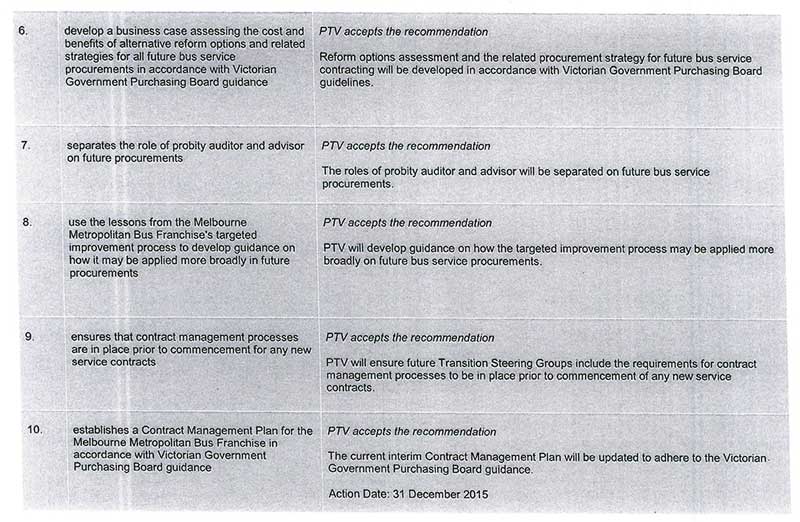

That Public Transport Victoria:

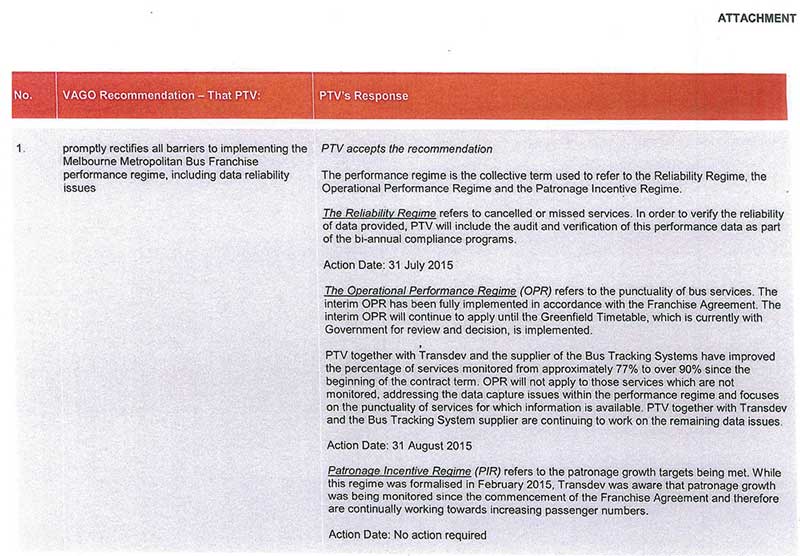

- promptly rectifies all barriers to implementing the Melbourne Metropolitan Bus Franchise performance regime, including data reliability issues

- documents and assesses the rationale for all decisions to waive the withholding of payments for non-performance

- closely monitors the delivery of key offer commitments and proactively addresses any slippage from contractual time lines

- systematically audits and verifies the reliability of performance data provided by the operator underpinning incentive payments.

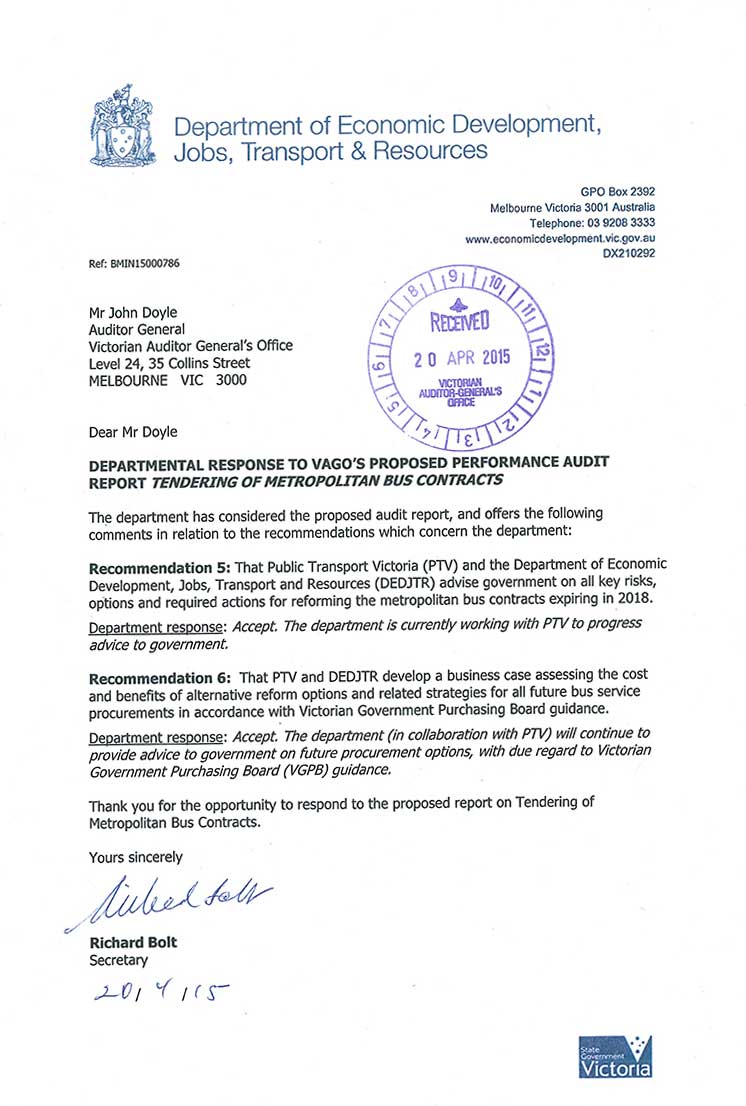

That Public Transport Victoria and the Department of Economic Development, Jobs, Transport and Resources:

- advise government on all key risks, options and required actions for reforming the metropolitan bus contracts expiring in 2018

- develop a business case assessing the cost and benefits of alternative reform options and related strategies for all future bus service procurements in accordance with Victorian Government Purchasing Board guidance.

That Public Transport Victoria:

- separates the role of probity auditor and advisor on future procurements.

That Public Transport Victoria and the Department of Treasury and Finance:

- use the lessons from the Melbourne Metropolitan Bus Franchise's targeted improvement process to develop guidance on how it may be applied more broadly in future procurements.

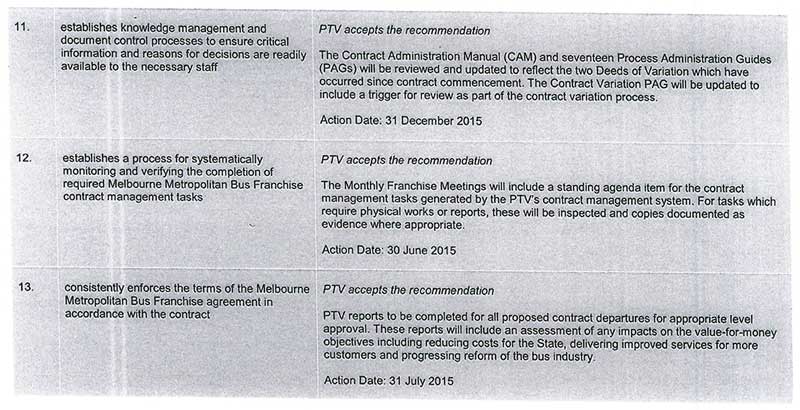

That Public Transport Victoria:

- ensures that contract management processes are in place prior to commencement for any new service contracts

- establishes a contract management plan for the Melbourne Metropolitan Bus Franchise in accordance with Victorian Government Purchasing Board guidance

- establishes knowledge management and document control processes to ensure critical information and reasons for decisions are readily available to the necessary staff

- establishes a process for systematically monitoring and verifying the completion of required Melbourne Metropolitan Bus Franchise contract management tasks

- consistently enforces the terms of the Melbourne Metropolitan Bus Franchise agreement in accordance with the contract.

Submissions and comments received

We have professionally engaged with Public Transport Victoria, the Department of Economic Development, Jobs, Transport and Resources and the Department of Treasury and Finance throughout the course of the audit. In accordance with section 16(3) of the Audit Act 1994 we provided a copy of this report to those agencies and requested their submissions or comments.

We have considered those views in reaching our audit conclusions and have represented them to the extent relevant and warranted. Their full section 16(3) submissions and comments are included in Appendix A.

1 Background

1.1 Introduction

1.1.1 The role of buses in Melbourne

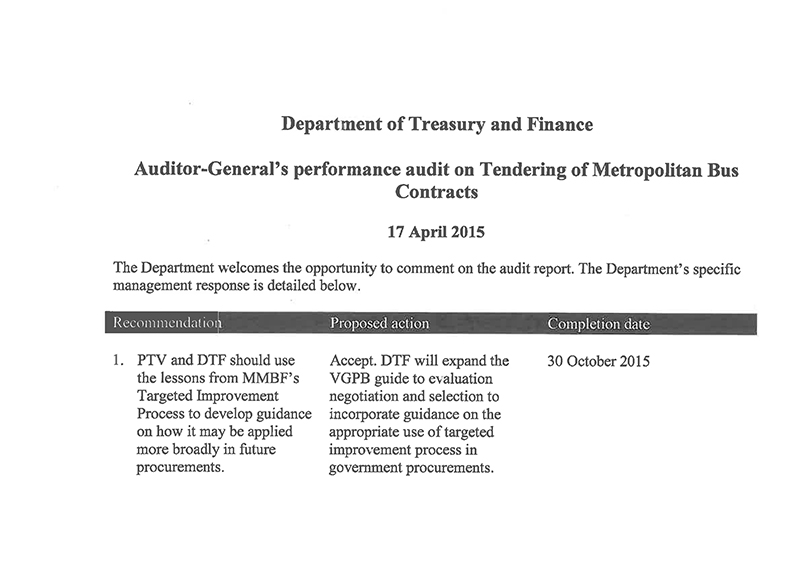

Buses are an important part of Melbourne's public transport system providing local and cross-town travel and connections to rail and tram networks. They also provide an alternative to travelling by car. Buses are often the only readily accessible form of public transport available for people living in Melbourne's middle and outer suburbs. As Figure 1A shows, around 82 per cent of Melbourne dwellings are within 400 metres of a bus route compared to around 20 and 30 per cent for trams and trains respectively.

Figure 1A

Melbourne dwellings within 400 metres of public transport, 2010

Source: Victorian Auditor-General's Office from Public Transport Victoria's, Network Development Plan—Metropolitan Rail, December 2012.

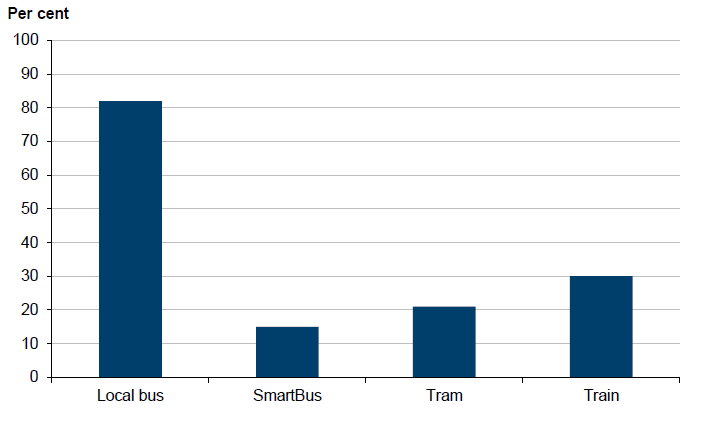

In the 10 years since 2004–05, metropolitan bus patronage has been steadily increasing overall, as Figure 1B illustrates.

Figure 1B

Total metropolitan bus boardings by year

Source: Victorian Auditor-General's Office from information provided by Public Transport Victoria.

1.1.2 Overview of Victoria's bus industry

Melbourne's bus network is extensive—it consists of more than 300 routes covering over 5 500 kilometres, and is serviced by approximately 1 700 buses. The arrangements underpinning the delivery of these services are set out in:

- 27 private contracts with 11 operators established in 2008, covering around 70 per cent of bus services

- a contract established in 2013 with a single operator, covering roughly 30 per cent of services—this contract is the Melbourne Metropolitan Bus Franchise (MMBF) agreement.

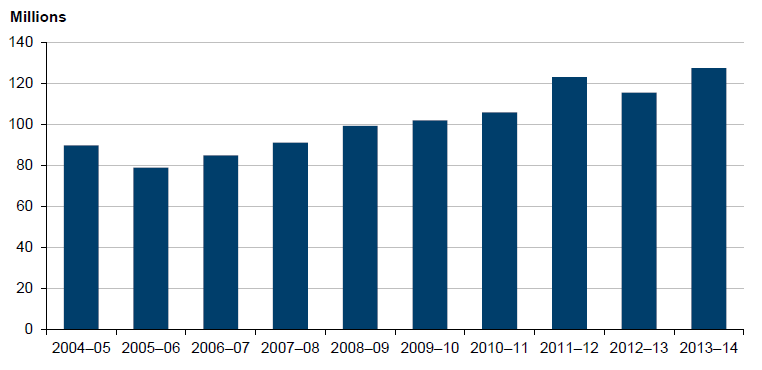

In 2013–14, bus services were the second largest transport expenditure for the state. As Figure 1C shows, 26 per cent, or around $0.6 billion, of the total paid to transport service providers was for operational payments to metropolitan bus service providers.

Figure 1C

Payments to transport service providers

Source: Victorian Auditor-General's Office from information provided by Public Transport Victoria.

1.1.3 Evolution of Victoria's bus industry

Private operators

From 1869 to 1974, bus services were provided by private, self-funded companies which developed bus routes, determined their own schedules and fares, and bought bus depots and vehicles. In 1974, the government introduced regulated fares across the whole metropolitan public transport system and began subsidising bus operators. This marked the start of contractual relationships between government and bus operators.

Despite bus operators becoming increasingly financially dependent on state subsidies throughout the 1980s and 1990s, the bus industry retained the view that its history of private investment entitled it to exclusive rights to operate the routes they had developed. Accordingly, the industry disputes the government's right to competitively tender services. However, our 2009 report Melbourne's New Bus Contracts noted that the state does not accept this position. The issue has never been legally tested and remains a potential risk and barrier to reform.

The bus industry has not been exposed to the same open market competition as Melbourne's other public transport modes. Instead, contracts have historically been renewed by negotiating with incumbent operators only. Throughout the 1990s, successive reports by the then Industry Commission, the Victorian Commission of Audit and VAGO noted that these negotiated contracts lacked incentives for operators to minimise costs and improve services.

State established routes

In the early 1990s the state sought to increase bus services while setting conditions for future bus industry reform.

The state established and privatised two companies—the National Bus Company (NBC) and Melbourne Bus Link (MBL)—to run new bus services independent of the private operators. As the private operators could not claim the same historic ownership rights over the routes they operated, the state had more control over the related procurement and contracting decisions.

Further additional routes—the SmartBus orbital routes—were established by the state in 2006 under an interim contract with the former Department of Transport, with the intention of offering the routes to tender in December 2012.

2008 bus contracts

On 1 July 2008, 29 metropolitan bus contracts came into effect. These were established through negotiation with the incumbent operators and fell into the following two categories:

- Two contracts covering around 30 per cent of services were let to NBC and MBL for a five-year term, from 1 July 2008 to 30 June 2013. These were interim arrangements, allowing the state time to run an open tender to establish successor operators. The services covered by these contracts are now part of the MMBF.

- 27 contracts for the remaining 70 per cent of services were let to existing private operators. These were established for a term of seven years, from 1 July 2008 to 30 June 2015, with an embedded right to extend a further three years to 2018.

The 27 contracts for the remaining 70 per cent of services are traditional fee‑for‑service style arrangements, with fixed routes and limited incentives or penalties available to encourage performance improvements or innovation. This has not changed significantly since the late 1980s.

1.1.4 Previous audits of Melbourne's bus services

Previous VAGO audits in 2009, 2012, 2013 and 2014 have highlighted ongoing challenges with the delivery and performance of Melbourne's bus services.

Melbourne's New Bus Contracts, 2009

This audit focused on the 27 private contracts, and found that while there were likely to be significant gains from the new contracts, the state had not fully achieved its procurement objectives.

The key areas identified where the new contract regime failed to deliver on the procurement objectives include:

- an absence of competitive tendering

- no right to tender existing local services and no agreement to tender at the end of contract

- limited access to strategic assets for government

- no rights over existing local bus services assets

- no access to operators' financial data and open book access for most operators.

The audit also found the operational performance regime for bus services needed to be strengthened to provide greater assurance about the on-time running of buses.

Public Transport Performance, 2012

This audit examined the performance of public bus, tram and train services across Victoria and found that the former Department of Transport was not prepared for the rapid growth in public transport patronage between 2004 and 2009.

The audit also found that information for measuring bus performance fell short of expectations for sufficiency and reliability. While the department introduced a rolling program of audits of contractual compliance for metropolitan buses, it had not implemented VAGO's 2009 recommendation to use its contractual rights to examine and verify operators' records of on-time running.

Developing Transport Infrastructure and Services for Population Growth Areas, 2013

This audit assessed the effectiveness of state agencies in planning and delivering transport infrastructure and services for population growth areas. It examined whether planning effectively identified current and future transport needs, and whether implementation and funding strategies supported the timely delivery of required transport infrastructure and services.

The audit found that residents in growth areas generally have less frequent and direct bus services compared to those in metropolitan Melbourne. It also noted that significant investment of more than $10 billion is required to address the current infrastructure and service backlog, and additional recurrent funding of $197 million per year is needed to improve bus services across metropolitan Melbourne.

Coordinating Public Transport, 2014

This audit examined how well Public Transport Victoria (PTV) is managing the coordination of trams, trains and buses, and specifically how its activities and existing contractual arrangements support the achievement of seamless travel within and between different modes.

The audit found that many of Melbourne's bus routes currently have long wait times, indirect routes and do not operate on schedules designed to harmonise well with the rail network or other bus routes. This reduces their usefulness for commuters and impedes patronage growth.

The audit also highlighted that the limitations with the tracking technology used on most buses mean that PTV is highly reliant on self-reporting by operators for determining penalties and other incentive payments. The absence of robust performance information and heavy reliance on self-reporting by bus operators means it is not possible to reliably use financial incentives to improve bus services.

1.2 Melbourne Metropolitan Bus Franchise

The MMBF consists of:

- 41 routes servicing the eastern suburbs and Melbourne CBD, plus approximately 107 school special services

- nine routes servicing the western suburbs, south eastern suburbs and the Melbourne CBD, plus approximately 15 school special services

- three SmartBus orbital services, which are premium cross-town bus services linking radial train lines and key activity areas in Melbourne's middle and outer suburbs.

1.2.1 Key features and benefits

A key feature of the MMBF is the performance-based incentives included in the franchise agreement, similar to those used for tram and train services. The MMBF contract incorporates financial incentives and penalties linked to key performance targets, designed to improve services and patronage performance.

The expected benefits of the MMBF agreement include:

- improved public transport coordination through timetable changes

- timetable and route changes to better meet customer needs

- enabling the MMBF network to evolve with community demands

- improved communication with customers.

These benefits were expected to be realised in two stages:

- Between the commencement of the contract in August 2013 and April 2015, the new operator was expected to develop an understanding of the MMBF business and customers, and to develop changes intended to improve the business model and customer experience.

- From April 2015 more significant changes are expected when the operator's rebuilt timetable takes effect. This is expected to result in improvements in punctuality, patronage, and coordination with other public transport modes.

1.2.2 Reform agenda

In approving the open tender for the MMBF in September 2011, the then government also approved a reform agenda and determined that it would consider MMBF as having achieved value if it:

- reduced costs for the state

- delivered improved services for more customers

- progressed reform of the bus industry.

Figure 1D summarises the main priorities of the reform agenda.

Figure 1D

Key reform agenda priorities

|

Establishing incentive-based contracts to improve coordination of the public transport network and promote continuous service improvement through incentive and penalty regimes. Increasing value for money through the introduction of restructured contracts, which are more aligned with train and tram contracts, to drive improved service delivery and customer experience. Driving innovation through the procurement process by encouraging operators to submit proposals focused on improving services—including timetabling, routes, safety, staff training and the customer experience. Improving risk sharing by introducing clearer incentives to grow patronage, innovate and share the risk of depot development and management. Including step-in rights and end of term provisions in new contracts in the event of operator non-performance to provide clarity on the arrangements for procuring and transferring assets at the end of the contract term. Increasing transparency by collecting financial and operational information to allow the state to better understand where productivity gains can be made, and to monitor the sustainability of the contracts. |

Source: Victorian Auditor-General's Office.

These reform priorities were reflected in the MMBF agreement, making it fundamentally different to any other contracting arrangement within Melbourne's bus network. It contains a suite of incentives and penalties designed around performance targets—including reliability, punctuality, patronage growth and customer satisfaction. It also gives the operator flexibility to design and propose route changes in collaboration with PTV, and requires the operator to review all routes and do a total rebuild of the current bus timetable—known as a Greenfields timetable—in 2015.

These reforms are intended to establish an environment for wider reforms when the contracts for the remaining 70 per cent of services expire in 2018.

1.2.3 Objectives and outcome of the tender

The MMBF agreement was awarded through a competitive open tender process, referred to as the Metropolitan Bus Services Project (MBSP). This process was expected to reduce the cost to the state and increase competition in Melbourne's bus market.

The MBSP had the following objectives:

- to encourage sustainable competition in the provision of services

- to establish new contracts that:

- provide safe, integrated, accessible and reliable services

- support the efficient operation of passenger transport services

- promote innovation in the delivery of services

- provide value for money.

The open tender process for the MMBF was approved in September 2011 and on 26 April 2013 the government announced the chosen operator.

The MMBF agreement became operational in August 2013. It is worth approximately $1.718 billion in nominal terms over 10 years and comprises 50 bus routes, 100 school special routes, 504 buses and around 1 000 drivers operating from seven depots across Melbourne.

1.3 Roles and responsibilities

Public Transport Victoria

PTV became operational in April 2012. Its primary objective is to plan, coordinate, provide, operate and maintain a safe, punctual, reliable and clean public transport system. PTV's core functions include managing ongoing network improvements, planning for future public transport needs and ensuring public funds are spent prudently and efficiently.

PTV oversees public transport operators who are responsible for the day-to-day operation of services and, subject to PTV's specifications, for improving scheduling to support better connectivity between transport modes.

PTV is responsible for planning, tendering, negotiating and managing all bus service contracts. While PTV was responsible for managing the MMBF procurement process, initial planning occurred prior to its creation, and was the former Department of Transport's responsibility.

The Department of Economic Development, Jobs, Transport and Resources

The MBSP was initiated by the former Department of Transport in April 2009, now incorporated within the Transport Division of the Department of Economic Development, Job, Transport and Resources (DEDJTR). However, when PTV became operational in April 2012, most of the staff in the public transport division transferred to PTV along with responsibility for MBSP.

DEDJTR is currently part of a bus services reform joint working group with PTV. This group is responsible for formulating plans on the future of bus services, contractual and legislative issues, options for dealing with expiring contracts, and any other elements of reform.

The Department of Treasury and Finance

The MMBF was designated a complex procurement and was therefore subject to additional oversight from the Department of Treasury and Finance (DTF) and the Treasurer under the High Value High Risk framework. DTF worked with PTV in trying to achieve value for money procurement outcomes at both the working group and steering committee level.

1.4 Audit objectives and scope

This audit examined whether the state has effectively secured value for money from the new MMBF arrangements by assessing whether:

- the project to establish the MMBF was based on sound planning and was conducted in accordance with purchasing, probity and ethical conduct requirements and guidelines

- management of the franchise agreement is delivering value for money and improved performance.

The audit also examined whether appropriate planning to optimise value for money in future metropolitan bus contracts is underway, including progress on implementing the lessons learned from the MMBF procurement.

The audit includes PTV, DEDJTR and DTF due to their involvement in the MMBF procurement process and future bus contract planning.

1.5 Audit method and cost

The audit involved:

- desktop research

- consultation with agencies and stakeholders

- qualitative evaluation against best practice principles.

The audit was performed in accordance with the Australian Auditing and Assurance Standards. Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated, any persons named in this report are not the subject of adverse comment or opinion.

The total cost of the audit was $475 000.

1.6 Structure of the report

The report is structured in the following parts:

- Part 2 discusses the performance of the MMBF

- Part 3 discusses the tendering process

- Part 4 discusses the adequacy of contract management of the agreement.

2 Performance of the MMBF

At a glance

Background

The Melbourne Metropolitan Bus Franchise (MMBF) is intended to improve services, reduce costs and progress reform of the bus industry. This Part of the report examines the MMBF's progress in achieving these outcomes.

Conclusion

Public Transport Victoria (PTV) cannot yet reliably demonstrate that MMBF is achieving full value for money for the state due to shortcomings with performance data. Unless PTV promptly addresses these deficiencies, MMBF's full benefits are unlikely to be achieved.

Findings

- In 2013–14, the cost of MMBF services was almost $33 million less than the previous year under the old arrangements.

- PTV's failure to resolve longstanding data issues has meant that the performance regime could not be effectively implemented by April 2015 as intended.

- PTV has begun work to reach agreement with the operator on a proposal to address these data issues, but it has yet to be satisfactorily resolved.

- Any further delays to planning or project approval for future bus service procurements risks compromising wider bus industry reform.

Recommendations

- That Public Transport Victoria rectifies barriers to implementing the MMBF performance regime, promptly addresses offer commitment time line slippages, and documents and assesses the rationale for all decisions to waive the withholding of payments.

- That Public Transport Victoria and the Department of Economic Development, Jobs, Transport and Resources advise government on all key risks, options and required actions for reforming the metropolitan bus contracts expiring in 2018.

2.1 Introduction

The state used an open tender procurement method to establish the new Melbourne Metropolitan Bus Franchise (MMBF) because it expected that this would result in a better service to customers at a reduced cost to the state.

It also sought to use the MMBF to test the savings achievable through increased competition and the potential benefits of an enhanced performance-based contract as a precursor to extending these reforms to the rest of Melbourne's metropolitan bus industry.

The state expected the MMBF would achieve value if it:

- reduced costs for the state

- delivered improved services for more customers

- progressed reform of the bus industry.

This Part of the report examines whether the MMBF is on track to achieve improved value for money for the state.

2.2 Conclusion

Although the MMBF has been operating for over 18 months, it cannot yet be determined with any certainty whether it is achieving full value for money for the state.

The MMBF has proven less expensive than previous arrangements by reducing the cost to the state in 2013–14 by almost $33 million. However, as it also sought to improve services for more customers and progress reform of the bus industry, this metric alone is not sufficient for demonstrating value for money.

Public Transport Victoria (PTV) failed to establish reliable performance data by April 2015 when the performance regime was due to be fully implemented. This means that the performance regime could not be effectively applied as originally intended to manage the contractor's performance. While full implementation of the regime has since been delayed pending approval of the Greenfields timetable refresh, PTV needs to urgently address these issues as they are compromising its capacity to reliably manage the contractor's performance, including achievement of the state's reform agenda.

PTV's rationale for waiving the withholding of some operator payments for delays in delivering required service improvements is also at odds with the MMBF's reform goals, and is a missed opportunity to enforce the principles of the contract and leverage better value for the state.

Substantive action is still required to establish the preferred procurement method for the remaining metropolitan bus contracts that expire in 2018. Consequently, there is a significant risk that the state will miss the opportunity to significantly progress reform of the bus industry and achieve better value for money.

2.3 Reduced costs for the state

The actual cost of MMBF services is less than under the previous procurement arrangements, and is in accordance with the tender price and advice provided to the state by PTV following tender evaluation.

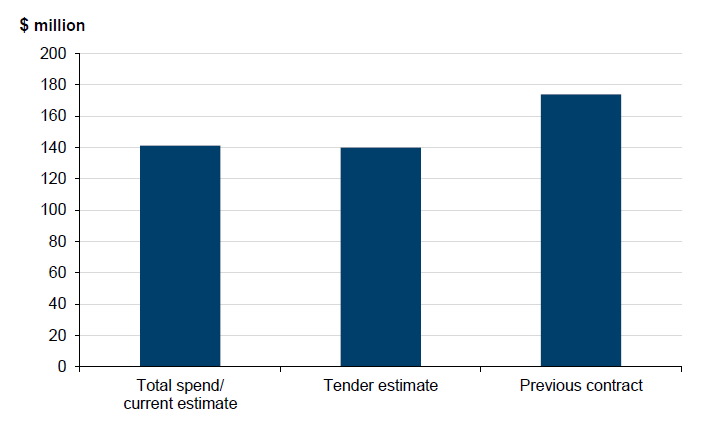

As shown in Figure 2A, MMBF expenditure for 2013–14 was almost $33 million, or 18 per cent, less than the amount PTV estimated it would have spent if the previous contracts had continued.

Figure 2A

2013–14 actual MMBF expenditure compared to tender estimate and previous contracts

Source: Victorian Auditor-General's Office based on PTV financial reports.

The MMBF cost savings have been consistent with PTV's estimates, and are expected to total approximately $380 million over the 10-year life of the agreement. These savings are attributable to efficiencies achieved by merging five contracts into one, as well as the new operator's proposed innovations and willingness to accept a greater share of the risk for poor service delivery.

However, MMBF cost savings alone are not sufficient for assessing its achievement of value for money. As noted in Part 1 of this report, the state determined in 2011 that MMBF will have achieved value for money if it:

- reduced costs for the state

- delivered improved services for more customers

- progressed reform of the bus industry.

2.4 Improved services for more passengers

A key goal of the state's reform agenda in establishing the MMBF incentive-based contract was to provide the state with the means to continuously improve and grow bus services through clearly defined performance standards and monitoring arrangements.

In this context, the MMBF contract established key obligations for the operator to:

- continuously improve bus punctuality, reliability, safety and customer services—including the provision of information to passengers

- increase bus passenger numbers

- identify opportunities to improve existing bus services—including improving connections between buses and other public transport modes.

The MMBF contract contains an incentive and penalty regime to support the achievement of these obligations. Effective monitoring by PTV of the operator's performance, including enforcing penalties when necessary, is therefore critical for assuring these obligations are met, and for realising the contract's potential to deliver better services.

Although the performance mechanisms are soundly based, they are impacted by longstanding data reliability issues, and delays in achieving full implementation. These issues risk compromising achievement of value for money from the contract, and PTV's capacity to effectively manage the contractor.

PTV failed to resolve longstanding data reliability issues by April 2015, when they were originally due to be fully implemented under the contract. It also failed to reach a timely agreement with the operator on the standard for determining incentive payments for improvements in bus patronage—in effect delaying the operation of this regime by 12 months.

PTV advised towards the end of this audit that implementation of the performance regime and related Greenfields timetable has since been delayed, and that it has begun work to reach agreement with the operator on a proposal to address these data issues.

It will be critical for PTV to effectively resolve these issues as they are compromising achievement of the state's reform agenda—including PTV's capacity to reliably assess and manage the contractor's performance.

2.4.1 Performance regime

The MMBF performance regime comprises the Patronage Incentive Regime (PIR), Operational Performance Regime (OPR) and Reliability Regime (RR), and uses financial incentives and penalties attached to service targets.

The regime is intended to encourage the operator to improve performance and increase passenger numbers. The performance regime supports achievement of the state's reform agenda by:

- providing financial incentives for improved performance

- encouraging innovative ways to improve services

- shifting some of the financial risk for poor service to the operator.

However, PTV failed to resolve longstanding data reliability issues by April 2015, which meant that the OPR was not able to be implemented as planned. It also failed to reach a timely agreement with the operator on the standard for determining incentive payments for improvements in bus patronage—in effect delaying the operation of this regime by 12 months.

PTV recently advised that full implementation of the OPR has since been delayed as the state has yet to approve the Greenfields timetable refresh proposed by the contractor.

As a result, a key aspect of the MMBF agreement remains inoperative, which compromises the achievement of the reform objectives—including value for money.

Patronage Incentive Regime

The PIR is intended to provide the operator with a financial incentive to introduce service improvements and other innovations that lead to increased passenger numbers above a benchmark agreed with PTV. Conversely, poor services leading to a decrease in passengers results in a financial penalty.

The MMBF contract and PIR measure patronage by myki touch‑ons. However, due to concerns with the reliability of myki data, and protracted negotiations with the operator over setting the PIR benchmark, it was not operational until February 2015—more than 12 months after it was due to be implemented under the contract. This issue is examined further in Part 4 of this report.

PTV resolved the myki data issue in July 2014. However, agreement with the operator was not reached until January 2015. The failure to reach a timely agreement on the passenger benchmark is unsatisfactory. While it is clear that passenger numbers have been increasing, the absence of an agreed benchmark meant PTV could not be certain that the operator was meeting its expectations during this period. Similarly, the operator did not necessarily know if more work was needed to further increase passenger numbers.

Operational Performance Regime

An MMBF service is considered punctual if it is observed at the specified service monitoring location, and had arrived there no more than 4:59 minutes late and departed no more than 59 seconds early.

PTV set an interim OPR punctuality benchmark of 70 per cent for all services at the start of MMBF operations, based on its estimate of the previous operators' performance. It proposes to set the permanent benchmark at 90 per cent when the new Greenfields timetable commences—at which point the OPR's financial penalties will start to be applied. The OPR penalises the operator by up to $2 million annually if it fails to meet its punctuality benchmark. It also provides for PTV to terminate the contract if punctuality drops below 75 per cent for a year without due cause. However, reliable bus punctuality data is not yet available—impeding the operation of the OPR.

The contract initially required the Greenfields timetable to be implemented by April 2015, but this has been delayed. As noted earlier, PTV is currently working with the contractor to resolve reliability issues with the data.

Reliability Regime

Reliability is the number of service kilometres scheduled compared to the number of service kilometres actually travelled, expressed as a percentage. The RR came into force at the commencement of the contract.

If reliability falls below 95 per cent for a quarter, or below 99 per cent for three quarters within a 24-month period, PTV can immediately terminate the contract. Reliability below 98 per cent in a quarter, or below 99 per cent for three quarters in 24 months, triggers a noncompliance event, compelling the operator to commit to remedial action.

However, data concerning bus reliability has been problematic.

Absence of reliable performance data

The effective operation of the performance regime depends on the availability of accurate and reliable data.

The MMBF agreement's OPR and RR were designed to use data gathered by PTV's bus tracking system (BTS). While PTV knew there were issues with the reliability of the BTS in June 2011 when it was developing the OPR and RR, it assumed that these issues would be overcome by March 2012, prior to the OPR and RR becoming operational. However, this did not occur and PTV's progress in addressing this issue has been unsatisfactory.

Our 2014 audit Coordinating Public Transport noted that PTV advised that it expected the new BTS to be fully operational by July 2014, however, this has yet to occur.

The BTS data issues stem from the number of services being monitored. The OPR and RR require 100 per cent of MMBF services to be monitored by the BTS. However, PTV now recognises that no technology solution is capable of 100 per cent functionality as there will always be periods, however brief, where hardware breaks down or software fails.

PTV has improved the monitoring of services throughout the MMBF contract from 89 per cent in 2014, to the current level of 93 per cent. While this is encouraging, the unmonitored services affect the bus reliability calculation required under the contract as these services are recorded as missed service kilometres, even if the service ran as scheduled. Punctuality is similarly affected as a bus is considered not punctual if it is not observed at a contract monitoring point, even if this is due to a BTS malfunction.

PTV documents supplied in March 2015 acknowledge that while this improvement in coverage better supports operational and service planning activities, it is not sufficient for assessing the punctuality of services as required by the contract.

PTV has proposed an alternative method to calculate service reliability and punctuality to the contractor, but this had not yet been implemented at the time of audit. PTV recognises that overcoming this issue is critical because it will otherwise not be able to implement the financial incentives and penalties that are due to begin after the Greenfields timetable refresh. PTV could not demonstrate that it was on track to address this issue by April 2015 when the Greenfields timetable refresh was initially due to occur.

Furthermore, we found that PTV's proposed alternative method for calculating reliability and punctuality is currently deficient as it relies heavily on self-reporting by the operator for determining reliability. PTV did not have a plan or procedures in place to audit and verify the accuracy of this information.

Urgent action is required by PTV to address this issue as it risks compromising the integrity of the performance regime and of related incentive payments.

PTV is also aware of a reliability issue with its myki touch-on data. At times myki machines can temporarily stop functioning—preventing bus passengers from touching on. While the system flags when a myki machine stops operating and for how long, PTV has no practical way of assessing the number of passenger boardings that are not recorded. However, PTV believes the completeness and accuracy of touch-on data is not materially affected.

2.4.2 Offer commitments

The MMBF requires the operator to deliver 21 service improvement projects—described as offer commitments—by time lines the operator committed to in its tender response. If the operator fails to deliver a project on time PTV can withhold payments until a satisfactory remedy has been implemented or remedial plans have been agreed to.

PTV has not exercised its contractual powers in relation to the operator's failure to deliver some projects as committed. This risks diminishing the effectiveness of the offer commitments performance incentive mechanism.

Projects not completed by due date

Four offer commitment projects have not been completed by the time frames originally agreed by the operator. Three projects had their due dates extended, as the operator was not able to complete these projects on time. Had PTV not chosen to extend the deadlines, it would have been able to withhold more than $200 000 of contract payments and require the operator to remedy the underperformance.

Additionally, PTV did not take any action for the operator's failure to deliver on its bus refurbishment offer commitment. At the end of the first contract year, PTV could have withheld up to $180 000 for buses that had not been refurbished.

PTV advised that it has only agreed to extend some contract time lines for initiatives offered by the contractor and now formalised in the contract, but which have no impact on core services to customers. PTV also wanted to build a business relationship with the operator.

While PTV has the discretion to withhold payments in response to these circumstances, it has never done so. This approach does not provide appropriate incentives for the operator to comply with its contractual obligations, and risks compromising achievement of the state's reform goals.

Delivery of key improvement projects

Three key offer commitment projects require the operator to reduce fare evasion, develop and implement a new bus timetable known as Greenfields, and increase customer satisfaction. As these projects directly relate to the reform agenda, they are important for assessing whether the state is getting better value for money from the MMBF.

Fare evasion

The fare evasion project requires the operator to reduce the fare evasion rate on its services to 5 per cent by 1 August 2015 and then to 2.3 per cent by 30 June 2021. By May 2014, the fare evasion rate had risen to 13.1 per cent from 10.1 per cent in October 2013. In October 2014 the rate was 8 per cent indicating that reaching the target rate will be challenging for the operator.

While it is evident that the operator has taken a range of remedial actions, failure to achieve this result would entitle PTV to formally notify the operator that its noncompliance with the MMBF risks termination of its contract, or withholding of contract payments until a satisfactory remedy has been implemented.

In August 2014, the operator raised concerns that the methodology of the survey that PTV uses to calculate the level of fare evasion was not representative of the areas it operated. Although PTV subsequently reviewed and made some minor adjustments to the survey, it is unclear if these have been accepted by the operator.

Greenfields timetable

A total rebuild of the current bus timetable, known as the Greenfields timetable, is another key offer commitment. By having the operator develop and propose a rebuilt timetable, PTV aims to improve the efficiency of these bus services and increase patronage at no additional cost to the state. Implementation of the Greenfields timetable was scheduled for April 2015. However, this has now been delayed, as the state has not yet given its approval to proceed.

The initial step toward Greenfields implementation was the July 2014 timetable refresh. The operator implemented a suite of service changes, including route changes, route cancellations and timetable changes. The timetable refresh was not as extensive as the full Greenfields implementation will be, but was still a much more significant change than bus patrons are accustomed to. These changes met with passenger resistance and criticism of the consultation processes—following passenger complaints and highly critical media coverage over the cancellation of one bus route, the then Minister for Public Transport intervened to reinstate this service.

The operator subsequently acknowledged that improved communication to passengers about the changes needed to occur, such as providing more information at bus stops, more media releases and earlier availability of printed timetables. The operator submitted its draft business case for the Greenfields timetable on time. However, as this was before the full impact of the July 2014 refresh was known, it did not take into account the concerns raised by customers. PTV advised that the draft was subsequently finalised after considering passenger feedback on the July 2014 service changes and proposed Greenfields timetable.

PTV further advised during the audit that, while it is not possible to achieve 100 per cent acceptance by the public of proposed service changes, it was confident the operator would implement the Greenfields timetable in April 2015 as originally intended by the contract. However, the state has since delayed its implementation. Failure to implement it successfully, and learn from past experiences, will have negative consequences in terms of service improvement.

Customer satisfaction

The operator is required to improve its overall customer satisfaction rating to 80 per cent or more by 31 December 2016. If this result is not achieved, the operator will be required to implement remedial plans to address the factors negatively impacting on the rating.

Although PTV reviews the results of quarterly customer satisfaction surveys and discusses the results with the operator, it does not complement this work with specified interim targets to more rigorously track the operator's progress towards meeting the target.

2.4.3 Service specifications

Service specifications are performance standards set by the MMBF agreement that include:

- general obligations covering the quality of service provision

- ensuring staff are properly trained and experienced, and that drivers are appropriately authorised

- maintaining sufficient numbers of buses to meet operational requirements

- ensuring bus depots and other bus-related infrastructure meets all legislative requirements.

PTV has not defined the qualitative elements of the general obligations. For example, the operator is required to perform its obligations in a 'timely and expeditious way' and in a 'proper, competent, courteous, safe and reliable manner' but these standards are not defined. Nor does PTV undertake any form of monitoring of the operator's compliance with the service specifications, preferring to address issues as they arise.

As such, PTV is not as well placed to identify and respond to any noncompliance or to challenge the operator where PTV believes its standards have not been met.

2.5 Progressive reform of the bus industry

The MMBF was intended to form the basis for further reform of the Victorian bus industry. In this regard, the next round of procurements will be for the remaining 70 per cent of metropolitan services that are currently provided through 27 private contracts that expire in July 2018.

PTV and the Department of Economic Development, Jobs, Transport and Resources' (DEDJTR) slow progress in determining the preferred procurement option and tight project time frame for establishing follow-on contracts risks the state not achieving further bus industry reform and improving value for money.

2.5.1 Procurement risks

Establishing new contracts to replace the 27 that expire in July 2018 will be a complex and time-consuming project. The number and severity of risks facing this project will depend on how much further the state elects to pursue its reform agenda.

Absence of clear end-of-term rights

Throughout the 1990s, successive reports by the then Industry Commission, the Victorian Commission of Audit and VAGO all noted that the practice of establishing contracts through negotiation with incumbent operators, without exposing them to competition, minimises the state's ability to gain best value for money. Moreover, the Victorian Government Purchasing Board's guidelines are based on the presumption that all major procurements will be open for tender to ensure the market is fully tested, and that all qualified providers can compete for government work.

The 27 private contracts do not contain any clear end-of-term rights for the state or an explicit right to offer the services through tender. However, the bus operators claim their financial investment in establishing the services gives them proprietary rights over their routes, and deny the state has the right to offer their routes to tender. The state does not share this view, but has not yet tested its position.

Consequently, pursuing an open tender could lead to the current operators taking legal action against the state, thereby potentially delaying any tender process until a settlement is reached or a legal ruling is obtained.

Negotiating contractual reforms

If the state elects to establish new contracts through negotiation with incumbent operators, it is unlikely to be able to pursue contractual reforms as extensive as those sought during the MMBF's procurement.

When contracts were negotiated in 2008 the incumbent operators were resistant to major reforms, including open book access to their financial data, establishing end‑of‑term rights and asset rights. Our 2009 audit of this process, Melbourne's New Bus Contracts, found that only modest cost reductions were achieved, and that on a like-for-like basis, the costs of the contracts negotiated in 2008 were very close to the costs of those they replaced.

2.5.2 Timeliness of planning

As the state faces risks no matter which procurement option is chosen, early advice to government is critical to ensure that all risks are appropriately assessed during the decision-making process.

Our 2009 audit recommended the former Department of Transport provide early advice to government on the strategic options and constraints for future metropolitan bus contracts. While the department and PTV implemented this recommendation for MMBF, it has not been addressed in relation to the next tranche of bus contracts.

The project to establish the MMBF required multiple approaches to government over 14 months before the decision to proceed with the open tender was reached. A further 22 months elapsed before the MMBF commenced operating.

Achieving further bus industry reform through new contracts will be much more complex, high risk and time intensive, and consequently will be likely to require more than a three-year lead time. PTV and DEDJTR established a joint working group in July 2014 to commence preliminary planning for the next round of bus contact procurements. The working group commissioned initial research on bus structures in other jurisdictions and potential options for reform. An interdepartmental steering committee comprising PTV, DEDJTR, the Department of Treasury and Finance and the Department of Premier and Cabinet was also formed in early 2015 to inform the development of a related procurement strategy for the government's consideration by August 2015.

However, progress on this initiative has been slow, meaning the remaining time for planning and implementing this project is ambitious and not commensurate with the significant scale and complexity of the task.

This situation risks limiting the state's options in 2018—if delays result in insufficient time to pursue an open tender, negotiating with incumbent operators may be left as the only way to proceed. Such an outcome will likely compromise any opportunity for the state to achieve improved value for money from these bus contracts.

Recommendations

That Public Transport Victoria:

- promptly rectifies all barriers to implementing the Melbourne Metropolitan Bus Franchise performance regime, including data reliability issues

- documents and assesses the rationale for all decisions to waive the withholding of payments for non-performance

- closely monitors the delivery of key offer commitments and proactively addresses any slippage from contractual time lines

- systematically audits and verifies the reliability of performance data provided by the operator underpinning incentive payments.

That Public Transport Victoria and the Department of Economic Development, Jobs, Transport and Resources:

- advise government on all key risks, options and required actions for reforming the metropolitan bus contracts expiring in 2018.

3 Tendering the MMBF

At a glance

Background

The Melbourne Metropolitan Bus Franchise (MMBF) was established using a competitive tender process. This Part of the report examines the planning and conduct of the MMBF tender.

Conclusion

The former Department of Transport's strategic planning was clearly focused on producing a value-for-money outcome, but did not fully comply with the required policies and guidance. Public Transport Victoria's (PTV) competitive tender process was guided by the appropriate procurement principles and resulted in a contract that is capable of delivering value for money.

Findings

- The former Department of Transport did not prepare a business case for the MMBF or finalise a strategic procurement plan.

- Despite this, value for money was considered from the start of strategic planning, and directly informed the development of the MMBF tender and contract.

- The tender evaluation process was well managed and focused on achieving value for money for the state.

- PTV managed most probity requirements effectively, however, the independence of the probity auditor at times was at risk of being compromised.

Recommendations

- That the Department of Economic Development, Jobs, Transport and Resources and Public Transport Victoria develop a business case for future bus service procurement

- That Public Transport Victoria and the Department of Treasury and Finance use the lessons from the targeted improvement process and develop guidance.

3.1 Introduction

The state chose an open tender process to establish the Melbourne Metropolitan Bus Franchise (MMBF) to advance reform of Melbourne's bus industry, and to maximise value by increasing competition in the Victorian bus market.

The former Department of Transport (DOT) managed the strategic planning and most of the tender planning, until Public Transport Victoria (PTV) became operational in April 2012. DOT personnel involved in tender planning were transferred to PTV, which assumed responsibility for the remaining tender planning and the tender conduct. The Department of Treasury and Finance (DTF) was also directly involved throughout the planning and procurement stages, with representatives sitting on the project and tender steering committees, as well as the tender evaluation panel.

PTV employed a two stage approach to market, involving an expression of interest (EOI) followed by a request for tender (RFT) issued to shortlisted applicants. The MMBF's value and its significance to the state as a critical element of Melbourne's public transport network led the state to apply additional scrutiny to the tender under the High Value High Risk (HVHR) process. PTV also committed to complying with Victorian Government Purchasing Board (VGPB) requirements to ensure the tender was run in accordance with better practice.

Figure 3A provides an overview of the MMBF procurement process.

Figure 3A

The MMBF procurement process

|

Stage |

Description |

|---|---|

|

Preliminary approval |

In July 2010, the government endorsed using an open tender to establish new contracts for the Orbital SmartBus services, and services run by the National Bus Company (NBC) and Melbourne Bus Link (MBL). Endorsement was subject to additional pre-procurement work. |

|

Approval of project |

On 22 September 2011, the government approved the joint tender of the NBC, MBL and Orbital SmartBus services. The project was intended to improve the state's contracting of bus services by delivering reform and was also formally brought under the HVHR framework. |

|

Expression of interest |

Expression of interest documents were issued to the market on 6 June 2012 following the Treasurer's approval. Responses closed on 19 July 2012 and were evaluated by PTV in conjunction with DTF. |

|

Request for tender |

Request for tender documents were issued to five shortlisted bidders following the Treasurer's approval on 29 October 2012. However, two of the shortlisted bidders subsequently withdrew, and three submitted a proposal. Responses closed on 31 January 2013 and were evaluated by PTV in conjunction with DTF. |

|

Targeted improvement process |

The evaluation panel recommended this process to seek adjustments in specific areas of risk allocation and cost. The process was undertaken with all three bidders. It was approved by the project steering committee on 14 March 2013 and issued to each bidder on 19 March 2013. Improved bids were received on 5 April 2013 and re-evaluated. The ranking of the bids did not change, however, the risks to the state and the cost of all proposals were reduced. |

|

Tender award endorsement |

The project steering committee endorsed the evaluation panel recommendation to award the tender to the preferred bidder on 22 April 2013. The Minister for Public Transport also approved the preferred tender decision on 22 April 2013. |

|

Treasurer approval |

On 24 April 2013 the Treasurer approved the preferred bidder. |

Source: Victorian Auditor-General's Office.

3.2 Conclusion

Strategic planning for the MMBF tender was clearly focused on producing a value‑for‑money outcome, but did not fully comply with the required VGPB policies and guidance. Despite this, our assessment of supporting documentation indicates that the key costs, benefits, risks and options were adequately identified and considered.

The competitive tender process was guided by the appropriate procurement principles and probity requirements, and resulted in a contract that is capable of delivering value for money.

While the targeted improvement process (TIP) introduced at the end of the RFT assessment was not planned for, it contributed to achieving a value-for-money outcome for the state.

3.3 Strategic planning for the procurement

VGPB sets policies and minimum standards for departments' procurement of non‑construction goods and services. These cover procurement planning, conduct, awarding of contracts, and contract management.

VGPB has recently moved to more principles-based policies under the procurement reform process. However, the MMBF procurement was planned and implemented between 2010 and 2013 and was subject to the more prescriptive VGPB policy requirements in place at that time.

3.3.1 Approach to government and procurement options

DTF has provided advice to successive governments since the 1990s on the need to seek competitive reform of the bus industry to deliver better services for commuters and better value for money for the state. Its advice to the Treasurer and government during 2011 clearly demonstrated the case for competitively tendering the MMBF procurement. This advice also outlined the strategic advantages of tendering these bus services to support longer-term reform—including plans for the future tendering of the remaining 70 per cent of metropolitan bus services.

DTF and the former DOT considered a range of procurement options, including direct negotiation with incumbent operators, and tendering the services provided by NBC, MBL and SmartBus as individual packages. In March 2011 these options were presented to government, along with a recommendation to proceed with an open tender. The government did not initially accept this recommendation and instead sought additional advice on the merits of negotiating with the incumbent operators.

In September 2011, after considering additional advice from DTF and the former DOT, the government approved the use of an open tender and the application of the HVHR process. It also approved the reform agenda—a series of reform goals that the MMBF project was to pursue. Responsibility for future MMBF project approvals was also delegated to the Treasurer and Minister for Public Transport. This decision marked the end of strategic planning and the start of project development.

3.3.2 Developing a business case

The former DOT did not develop a business case or a final strategic procurement plan (SPP) for the MMBF. VGPB policy in place at the time required an SPP for procurements over $10 million, and for high risk or complex acquisitions regardless of value.

The SPP is intended to detail how the project will meet the identified business needs, and is supported by a business case. The business case should contain all the information needed to decide whether to support a proposed procurement activity, including the costs and benefits of the project, the proposed procurement method and conduct, and how the project intends to achieve the best value for money.

Our 2009 audit, Melbourne's New Bus Contracts, stated that for new major bus procurements the former DOT should use VGPB guidance to develop a business case as part of the SPP, because the business case format is a clear and disciplined way to compare the costs, benefits and risks of the procurement options.

This departure from VGPB requirements created a risk that government decisions on the procurement project were not based on comprehensive advice. However, our assessment of MMBF-related Cabinet and ministerial submissions indicates that key costs, benefits, risks and options were properly identified and considered. In particular, the final approved submission to Cabinet in September 2011 contained the critical elements of an SPP, including a description of how the procurement meets the business need, procurement options for achieving the desired outcomes, details of stakeholders and departmental resources, and risk management issues.

This informed the development of the EOI and RFT documentation.

3.4 Procurement planning

Between project approval and the release of the EOI in June 2012, the former DOT, DTF and PTV continued planning the practical conduct of the tender. This was informed by the approved reform agenda, VGPB and HVHR policy requirements, and a market sounding exercise undertaken in November 2011. This culminated in the development of a procurement conduct plan (PCP) as an overarching framework for managing the tender process.

3.4.1 Procurement conduct plan

The PCP was approved by the steering committee in May 2012. It documented the governance structure, and the required procurement processes to be followed to achieve an impartial, transparent and accountable tender process. It provided an adequate framework for addressing probity risks, as it described the need to engage a probity auditor and clear processes for dealing with conflicts of interest and for ensuring the confidentiality of submitted tender information. It also documented communication protocols with tenderers and related information management requirements.