Victoria’s Consumer Protection Framework for Building Construction

Overview

This audit assessed the effectiveness of the consumer protection framework for domestic building construction. The audit examined the performance of Victorian Building Authority (VBA), Building Practitioners Board (BPB), Consumer Affairs Victoria (CAV) and Victorian Managed Insurance Authority (VMIA) as they provide functions key to building regulation and to the consumer protection framework in domestic building.

The audit found that the existing consumer protection framework for domestic building does not adequately protect consumers who experience problems and there is a pressing need to improve consumer awareness and understanding of the framework. The registration system does not ensure that the only practitioners who are registered are those who are qualified, competent and of good character. The current disciplinary system is not operating effectively to protect consumers, and the sanctions are ineffective in deterring practitioner misconduct.

Building conciliation and dispute resolution functions provide only limited consumer protection because CAV lacks both the power to compel parties to conciliate or to enforce compliance with outcomes negotiated during conciliation. Domestic building insurance is widely misunderstood. It provides only limited protection for consumers and is significantly more costly for builders and consumers than it needs to be.

The report makes recommendations to the Department of Environment, Land, Water and Planning, VBA, BPB, CAV, Department of Treasury and Finance and VMIA to improve the framework and its implementation. Prompt action is required to ensure domestic building consumers are appropriately protected.

Auditor-General's comments

John Doyle Auditor-General |

Audit team Andrew Evans—Engagement Leader Dale Thistlethwaite—Team Leader Tony Brown—Manager-Manager Sophie Fisher—Analyst Engagement Quality Control Reviewer Ray Winn |

Building or renovating a house involves a significant financial and emotional investment for consumers and is often the most expensive investment that people make in their lifetime.

Yet in the 2011 Australian Consumer Survey report nearly one in three building consumers reported experiencing a problem, mainly to do with poor workmanship. Throughout this audit, I have received correspondence from consumers highlighting the issues that they have faced and the personal, sometimes profound, impact that trying to resolve these issues has had on their lives.

Given these impacts, and the significance of the building industry to the Victorian economy, Victorians are entitled to a consumer protection framework for domestic building construction that provides appropriate protection when they need it. This is not just important for consumers, but also for builders themselves who have an interest in maintaining a personal and industry reputation for quality workmanship, professionalism and value for money.

At a minimum, an effective building consumer protection framework should include the following features:

- consumers are able to easily understand and navigate the system

- assurance that only competent practitioners are involved in building works

- confidence that buildings are constructed to required standards and that where standards are not met this is detected and addressed early

- scope to hear and resolve any disputes in a timely manner by an authority with power to require conciliation and enforce outcomes

- recourse to an appropriate safety net of insurance protection where a builder does not fulfil their obligations.

My audit found few of these features are in the existing framework and as a consequence Victorian consumers are not receiving the protection they deserve.

The Victorian consumer protection framework for building construction is far too complex with multiple agencies responsible for different elements. While there is a lot of information, it can be very difficult for consumers to navigate the system and to find timely and cost effective solutions.

The current registration and discipline regimes do not ensure that the only practitioners who are registered are qualified, competent, and of good character. Current dispute resolution services, consisting of voluntary conciliation with unenforceable outcomes, provide only minimal protection. Oversight of building surveyors is also deficient and monitoring and compliance activities do not yet provide assurance that domestic building construction complies with minimum standards.

The 'last resort' domestic building insurance scheme provides only limited protection for consumers and is significantly more costly than it needs to be—costing consumers an estimated additional $21 million over the past four years. It is questionable whether this provides value for money for consumers who otherwise have no alternative recourse.

For more than a decade, the glaring shortfalls and weaknesses in the framework have been well known. VAGO's 2011 Compliance with Building Permits audit highlighted the pervasive failures of the then Building Commission, especially its fundamental failure to effectively discharge its legislative and regulatory responsibilities. In 2012, the Ombudsman also raised concerns with the 'vulnerability, integrity and administration of the registration system for building practitioners.' However, key agencies have failed to take sufficient, timely action to address these and other deficiencies.

Successive governments have consistently and regularly received advice about potential legislative and policy improvements to the consumer protection framework. However, recent proposed legislative and policy reforms failed to comprehensively address all of the issues and have again stalled, and consumers are paying the price. These issues now require urgent attention.

While there is no doubt that legislative reform is needed, agencies and regulators have sometimes been too quick to point to the technical boundaries and limits of their responsibilities and too slow to work together to ensure the existing consumer protection framework, flawed as it is, works as well as it can to protect consumers.

I have made a series of recommendations that focus on the key areas requiring improvement—practitioner registration and discipline, monitoring and compliance, dispute resolution and conciliation, consumer awareness, and the provision of builders' warranty insurance. Addressing these recommendations will go a long way to providing an appropriate level of consumer protection and tackling the well acknowledged gaps and issues in the current framework.

In this audit, agencies themselves have not disputed my findings and I am pleased that they have accepted my recommendations and outlined actions to address them. I intend to revisit the issues identified in this report to examine progress.

I want to thank the staff from the agencies involved in the audit and the consumers and industry stakeholders who took the time to share their perspectives.

John Doyle

Auditor-General

May 2015

Audit Summary

Building or renovating a house is typically the single biggest investment an individual consumer will make in their lifetime. While most consumers do not experience significant issues and problems with their builder, a significant number do. Consumers may be ill-equipped to manage a building contract and resolve building construction issues. For those consumers that do experience problems, the impacts can be profound—ranging from significant additional costs and time delays to extreme frustration, stress and anxiety.

A 2011 analysis published in the Australian Consumer Survey report found that 28 per cent of building and renovating consumers in Victoria reported experiencing problems, with the most common problem reported across Australia being poor workmanship, accounting for 63 per cent of problems. Throughout this audit, consumers told us of the personal impact that building disputes had on their lives.

A well-functioning customer protection regime is essential to ensure that both the incidence and impacts of building disputes and issues are minimised. It benefits not just consumers but also builders operating in the market who want to maintain an industry reputation for quality, service and integrity.

An effective consumer protection framework for building construction should have a number of critical features:

- Consumers and building practitioners should be aware of and have access to clear, comprehensive and timely information and advice on their rights and obligations.

- Rigorous registration, monitoring and disciplinary processes should ensure that only qualified, competent and suitable practitioners are allowed to operate.

- Independent, consistent and thorough monitoring of compliance with building standards and codes should enable the early identification and addressing of defects.

- Dispute handling processes should be easily navigable, low cost, simple and timely, and should achieve binding and enforceable resolutions.

- Consumers should have recourse to appropriate insurance which protects them in circumstances where they cannot otherwise achieve a timely and effective resolution of building defects and issues.

The current Victorian building consumer protection framework does not possess these features, and needs strengthening. Successive governments, reviews, inquiries and audits have acknowledged that the current framework has failed to provide adequate protection to consumers.

This audit examined whether the key elements of the current building consumer protection framework are effectively managed by relevant entities.

Conclusions

The consumer protection framework for building construction does not adequately protect consumers. While critical weaknesses in the framework are well understood, proposed legislative and policy reforms have stalled and this has delayed the resolution of these weaknesses and compounded the detriment suffered by consumers. Key agencies have failed to take sufficient, timely action to address deficiencies identified in VAGO's 2011 Compliance with Building Permits audit, and numerous other investigations and inquiries.

There is a pressing need to improve understanding of the consumer protection framework, and awareness of the available tools and assistance, so that consumers and building practitioners alike have access to straightforward and timely information, and can understand their rights and obligations.

The current framework does not ensure that the only practitioners who are registered are qualified, competent and of good character because of the weaknesses of the registration system and the Building Practitioners Board's (BPB) ineffective management of both its registration and discipline regimes. Deficiencies in the Victorian Building Authority's (VBA) oversight of building surveyors, and a lack of coordination of monitoring and compliance activity across agencies, mean there is little assurance that domestic building construction complies with minimum standards. However, since its inception in July 2013, VBA has begun to address a number of VAGO's 2011 audit recommendations and to establish an appropriate governance framework in collaboration with BPB.

Existing dispute resolution services provide minimal consumer protection because parties cannot be compelled to undergo conciliation, and Consumer Affairs Victoria (CAV) cannot enforce the negotiated outcomes. Ultimately, it is unclear whether CAV's activities are reducing overall consumer detriment because it does not have performance measures that focus on outcomes.

Domestic building insurance (DBI) provides only limited protection for consumers and is significantly more costly than it needs to be. Government intervention in 2010 to direct the Victorian Managed Insurance Authority (VMIA) to provide DBI addressed the immediate risk associated with insurers withdrawing from the Victorian DBI market. However, this did not improve the level of protection for consumers and resulted in a more expensive, broker driven model for the provision of insurance. This higher-cost model has been in place for almost five years due to ongoing uncertainty about VMIA's future role in DBI, and has cost consumers an estimated additional $21 million between July 2011 and July 2015. Decisions are needed on the future provision of and model for DBI.

While extensive, the 2013 Victorian Domestic Building Consumer Protection Reform Strategy and associated Building Legislation Amendment Bill 2014 were not framed to address some of the fundamental deficiencies in the current building consumer protection framework. This includes the adverse impact of having non‑mandatory conciliation on the capacity for early resolution of building disputes, and the fundamental conflict private building surveyors face between performing their statutory roles and looking after their business interests.

Successive governments have consistently and regularly received advice about potential improvements to the consumer protection framework, including resolving these issues. However, these issues have failed to be adequately addressed and now require urgent attention as part of deliberations on any future reforms to improve the overall effectiveness of Victoria's consumer protection framework for building construction.

Findings

Registration and discipline of building practitioners

The practitioner registration system administered by the BPB does not ensure that only practitioners who are qualified, competent and of good character are registered. This issue is compounded by the permanent nature of building registrations and the lack of effective triggers or mechanisms for reviewing practitioner competence.

The practitioner discipline system is critical to addressing practitioner misconduct and competence issues that may arise. However, the system is not operating effectively to protect consumers and current sanctions are not effective in deterring practitioner misconduct. Despite the critical role that building surveyors play in monitoring and enforcing building standards, they are over-represented in disciplinary inquiries, registration suspensions and cancellations, and reoffending. Yet, BPB does not systematically record, analyse or share the outcomes of its disciplinary system with other agencies to inform training or compliance programs which may reduce offending.

Monitoring and compliance

VBA's performance and building permit levy audits are effectively the only forms of proactive, direct monitoring of building practitioner compliance, particularly for surveyors. However, longstanding legislative limitations to the effective administration of the building levy remain. The current regulatory framework also entrenches a long-recognised conflict of interest for private building surveyors who are assessing the compliance of other building practitioners while often also relying on them for work. This undermines the building surveyors' statutory role.

The effectiveness of VBA's monitoring programs in achieving the objectives of the Building Act 1993 cannot be measured because VBA, like its predecessor the Building Commission, operates without an effective monitoring and evaluation framework. However, VBA has commenced action over the past year to address several of the recommendations from VAGO's 2011 audit report.

Dispute handling

Participation in conciliation for domestic building disputes is voluntary, and its outcomes are unenforceable. CAV's building conciliation and dispute resolution functions provide only limited consumer protection due to CAV's inability to compel parties to undergo conciliation or to enforce compliance with the negotiated outcomes.

CAV is aware of the legislative limitations it faces and the extent to which these mitigate its effectiveness. It has repeatedly advised government and departmental heads about potential improvements to the consumer protection framework— including the need for mandatory conciliation and binding rectification orders.

CAV has also taken positive steps to address these limitations focusing on education and information programs that aim to help consumers avoid detriment and reduce noncompliance before it occurs.

A lack of relevant and appropriate performance measures for both CAV's and VBA's activities means that their effectiveness is not clear. CAV cannot be assured that all of its conciliation services are actively assisting consumers and reducing detriment.

Correspondence to the Auditor-General from building consumers indicates that CAV's functions are not well understood and are perceived as ineffective.

Domestic building insurance

While government intervention in 2010, directing VMIA to provide DBI, addressed the risks to ongoing DBI provision associated with insurers withdrawing from the Victorian market, it did not improve the level of protection for consumers, indeed it added significantly to the cost of providing the insurance.

There was no comprehensive implementation plan in place before the government announced its intervention in the DBI market. This resulted in VMIA adopting a high‑cost DBI delivery model as an interim measure and this has continued for almost five years as a result of ongoing uncertainty about its future role. The additional costs of this model, which we estimate at around $21 million between July 2011 and July 2015, have ultimately been borne by consumers for little, if any, tangible benefit. An alternative delivery model would enable consumers to benefit from lower premiums and/or better coverage.

While VMIA's processes for managing DBI arrangements are robust, it has not fully exercised its rights under the agreement to assure itself about the adequacy of the systems and performance of the agent it appointed to manage many aspects of DBI provision, including the interface with brokers, assessing applications for DBI and recording details of all DBI policies issued.

The Department of Treasury and Finance (DTF) has overseen and supported VMIA's involvement in providing DBI. DTF and VMIA need to provide comprehensive advice to government on opportunities to improve the cost efficiency and consumer protection offered by DBI, or any replacement scheme.

Information sharing and agency coordination

There is insufficient coordination and information sharing between agencies involved in the domestic building consumer protection framework. This means that despite the large volume of education and information provided, it is difficult for consumers to locate and use it.

CAV and VBA should, at a minimum, make the disciplinary register and other tools more prominent and linked between their websites to assist in educating consumers and reducing consumer detriment.

Systematic information sharing between all organisations could also assist others in identifying practitioners and businesses which represent potential compliance risks and in identifying trends in noncompliance.

Currently CAV shares information with VBA and BPB on a case by case basis, but there is no systematic exchange of intelligence between CAV, VBA and BPB on respective compliance activities, including practitioners who are party to a conciliation, currently under investigation, or are awaiting a disciplinary hearing.

A more coordinated approach to exchanging intelligence about practitioners would enable CAV to assist BPB and VBA to target their practitioner monitoring functions more effectively.

Recommendations

- That the Department of Environment, Land, Water & Planning and the Building Practitioners Board, in consultation with the Victorian Building Authority, reviews the practitioner registration and discipline regimes, and advises government accordingly, so that:

- only qualified, competent and suitable practitioners are allowed to trade

- practitioners have necessary building, business and financial skills and experience, appropriate resources and character, and fully understand their responsibilities and obligations

- monitoring provides assurance that practitioners maintain and update their skills over time and as building practices evolve

- practitioners' suitability for registration can be reassessed at the expiration of a finite registration period

- disciplinary systems and sanctions ensure that there is sufficient disincentive to engage in misconduct and that registered practitioners who do so can be excluded from trading

- data from registration and discipline regimes is collected and analysed to inform system improvements.

- That the Department of Environment, Land, Water & Planning reviews the regulatory arrangements governing the engagement of building surveyors to ensure they support the independent and objective performance of their function to provide appropriate independent oversight of building and the building system.

- That the Victorian Building Authority reviews its monitoring and compliance framework, and takes action, including advising the Department of Environment, Land, Water & Planning where necessary, to:

- identify poor practitioner performance and appropriately prosecute and/or refer for discipline

- prioritise the monitoring and enforcement oversight of relevant building surveyors

- clarify respective agency responsibilities for monitoring and compliance including expediting the establishment of a memorandum of understanding to clarify the roles of the Victorian Building Authority and councils for monitoring and enforcing compliance with the Building Act 1993

- effectively administer the building permit levy including expediting the establishment of arrangements to allow the Victorian Building Authority to reassess and recoup underpaid levies, and require surveyors to remit levies promptly.

- That Consumer Affairs Victoria reviews its dispute resolution and conciliation activities and advises government on options to improve their effectiveness, so that they are:

- easy to access

- low cost, simple and timely

- objective and outcome focused

- supported by necessary powers to compel participation in conciliation and enforce compliance with negotiated outcomes

- underpinned by relevant and appropriate performance measures and effective monitoring, reporting and evaluation to demonstrate effectiveness.

- That Consumer Affairs Victoria and the Victorian Building Authority review their consumer education and awareness activities to ensure consumers have access to straightforward and timely information and advice aimed at enabling consumers and builders to:

- understand their rights and obligations under building contracts

- understand the consumer protection framework and access required information to make informed decisions

- be aware of the services available to assist with addressing consumer issues, and their limitations.

- That the Department of Treasury and Finance works with the Victorian Managed Insurance Authority to review the adequacy and cost of the current domestic building insurance scheme and provide advice to government on options to lower premiums and/or enhance coverage for consumers.

That the Victorian Managed Insurance Authority:

- obtains certainty about its ongoing role in domestic building insurance provision and implements the most efficient delivery model

- alters the domestic building insurance policy certificate to show the base premium amount

- enhances the performance indicators and level of assurance gained on its agent's performance.

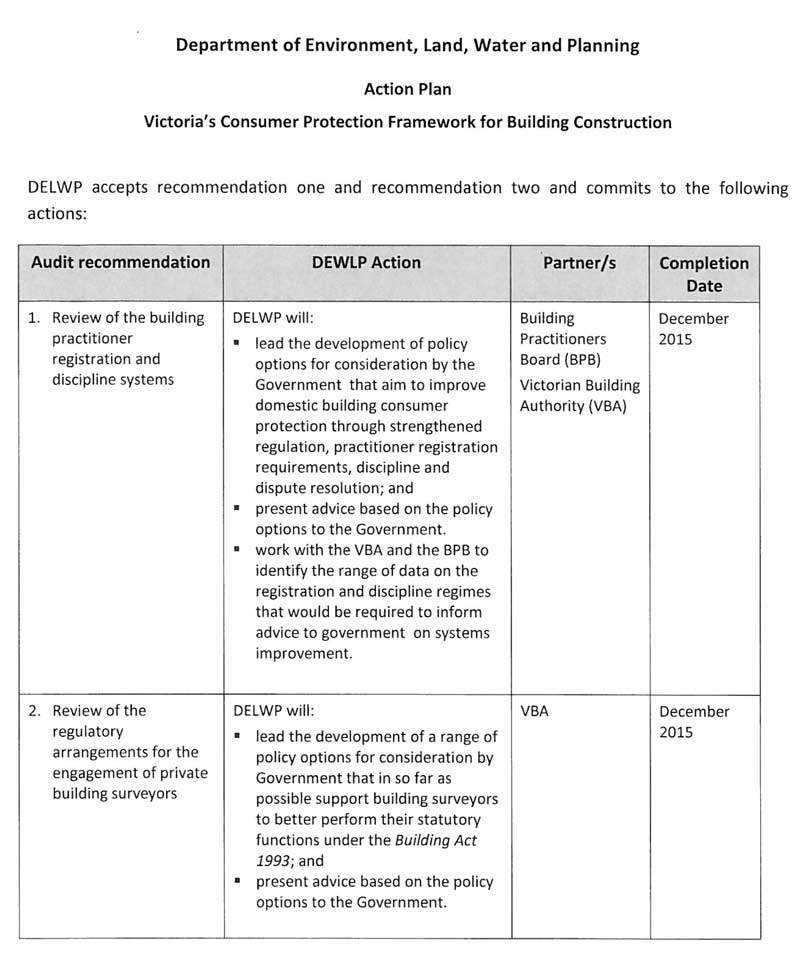

Submissions and comments received

We have professionally engaged with the Victorian Building Authority, Building Practitioners Board, Department of Justice & Regulation (Consumer Affairs Victoria), Victorian Managed Insurance Authority, Department of Environment, Land, Water & Planning, Department of Treasury and Finance, and the Essential Services Commission throughout the course of the audit. In accordance with section 16(3) of the Audit Act 1994 we provided a copy of this report to those agencies and requested their submissions or comments.

We have considered those views in reaching our audit conclusions and have represented them to the extent relevant and warranted. Their full section 16(3) submissions and comments are included in Appendix B.

1 Background

1.1 Introduction

Domestic building is a significant area of economic activity. In 2013–14, over 101 000 permits were issued for building works in Victoria with an estimated value of more than $25.3 billion. Domestic building work made up around 82 per cent of all permits and accounted for half of this value.

For individual consumers, the construction or renovation of a house is often the single largest investment in their lifetime. They may be ill-equipped to resolve building quality or contractual issues that may arise. The process of seeking to resolve such issues can be confusing, long and expensive and, for some consumers, can have serious financial and personal consequences. As a result, a robust consumer protection framework is important to minimise these potential adverse consequences.

A significant number of Victorian consumers experience problems with domestic building. Research published by Consumer Affairs Victoria (CAV) in 2009 estimated that 16 per cent of consumers in the Victorian domestic building market sector experienced problems. This sector had the highest proportion of consumers reporting detriment across all market sectors. More recently, the Commonwealth and state Governments' 2011 Australian Consumer Survey report indicated that 28 per cent of consumers in Australia had experienced a problem related to building or renovating—with the most common problem reported, accounting for 63 per cent, being poor workmanship.

Victoria's current building consumer protection framework has been in place and largely unchanged since 2002. In addition to general consumer protection laws, the framework consists of the building practitioner registration system, building regulations, practitioner discipline system, a dispute conciliation service, access to the Victorian Civil and Administrative Tribunal (VCAT) and a 'last resort' mandatory insurance scheme.

Successive governments have acknowledged that consumer protection policies in domestic building have not provided adequate protection for consumers. A series of reviews, inquiries and audits since 2000 have identified weaknesses in both the design and implementation of the current consumer protection framework. While the previous government initiated a reform process to address weaknesses in the framework to improve the level of protection for consumers, those reforms were not enacted and it is unclear at this stage what reforms, if any, will progress.

The Victorian Competition and Efficiency Commission's 2005 inquiry into Housing regulation in Victoria: building better outcomes identified the importance of an effective consumer protection regime for building construction in Victoria. It noted that while most markets feature information asymmetries—where information is known to some people but not others—these are 'relatively more significant for housing construction markets'. The reasons for this include:

- the long-lived nature of housing means that flaws may only become apparent years after construction is complete

- consumers are infrequent purchasers of building services and so lack the experience to monitor the quality and cost of work

- consumers are not well qualified to compare the quality and cost of building services from different suppliers

- many decisions about houses involve technical considerations and are therefore made by builders rather than consumers.

The Victorian Competition and Efficiency Commission highlighted the important role that government intervention and effective regulation could play in addressing the potential costs, equity issues and significance of market failures in housing construction.

1.2 The framework and key agencies

The building consumer protection framework comprises protections aimed at:

- preventing disputes from arising, and limiting the time taken and cost to resolve those disputes where they do arise

- providing a safety net for consumers, where there is no longer a builder to pursue, for a structural defect or for non-completion of the building project.1

This framework is established by legislation which sets out roles and responsibilities for a number of government agencies.

1Victorian Domestic Building Consumer Protection Framework Public consultation paper April 2012

1.2.1 Agency roles and responsibilities

The current building consumer protection framework involves a range of entities with functions extending from protections, including the registration and monitoring of building practitioners, to dispute handling and the provision of domestic building insurance (DBI).

Victorian Building Authority (successor to the Building Commission)

Amendments to the Building Act 1993 (the Act) established the Victorian Building Authority (VBA) on 1 July 2013 as the statutory agency responsible for regulating the state's building and plumbing industries. These amendments integrated functions of the former Building Commission and Plumbing Industry Commission into VBA.

VBA's functions most relevant to consumer protection include:

- monitoring and enforcing compliance with the Act and the Building Regulations 2006 (the Regulations)

- providing information—including to consumers—on matters relating to:

- building standards and plumbing standards

- the regulation of buildings, building work and building practitioners

- providing information and training to assist people and bodies to carry out functions under the Act and the Regulations

- promoting the resolution of consumer complaints

- conducting or promoting research relating to the regulation of the building and plumbing industries in Victoria

- monitoring the collection of the building permit levy and administering the VBA Fund.

VBA's functions are funded by consumers through a levy on building permits, registration fees paid by practitioners and fines and costs levied through the practitioner discipline system. In 2013–14 the total permit levy collected was $24.5 million. Around $8 million of this levy income was paid to CAV to fund its domestic building activities.

Building Practitioners Board

The Building Practitioners Board (BPB) is an independent statutory body established under the Act. It administers the practitioner registration and discipline systems and monitors the conduct and ability of registered building practitioners. This role is critical to maintaining the quality and performance of practitioners in the building industry.

BPB has no independent dedicated staff or resources. VBA provides administrative and other support to BPB in the performance of its functions.

Building Appeals Board

The Building Appeals Board (BAB) is an independent statutory body established under the Act. BAB is empowered to determine any matter relating to the Regulations, the Building Code of Australia and specified provisions of the Act.

Specifically, BAB hears appeals and disputes in relation to building control matters and can waive, modify or vary the provisions of particular regulations based on the particular case.

Before July 2013, BAB was also the forum for reviewing BPB's decisions. This function was transferred to VCAT under amendments to the Act.

Local government

Under the Act, councils are responsible for the administration and enforcement of Parts 3, 4, 5, 7 and 8 and the Regulations within their municipal district.

Consumer Affairs Victoria

CAV is the state's consumer affairs regulator. At 30 June 2014, CAV was responsible for administering 29 Acts of Parliament. CAV's role is to:

- review and advise the government on the consumer protection framework

- provide information and advice to consumers, tenants, businesses and landlords on their rights, responsibilities and changes to relevant laws

- register and license businesses and occupations

- enforce and ensure compliance.

CAV aims to assist Victorian builders, owner-builders and consumers to avoid home building disputes by providing information about domestic building contracts and through its compliance activities, including the Better Business Initiative. It aims to assist consumers and builders to work together to solve building disputes. Its services include advice and conciliation.

CAV has administrative responsibility for the Domestic Building Contracts Act 1995 (the DBCA). The objects of the DBCA are to:

- provide for the maintenance of proper standards in the carrying out of domestic building work in a way that is fair to both builders and building owners

- enable disputes involving domestic building work to be resolved as quickly, as efficiently and as cheaply as is possible having regard to the needs of fairness

- enable building owners to have access to insurance funds if building work under a major domestic building contract is incomplete or defective.

The DBCA provides for CAV's conciliation services in relation to domestic building disputes. CAV is constrained by the DBCA to only accept complaints or disputes for conciliation which are reasonably likely to be resolved. Under the DBCA, participation in conciliation is voluntary and CAV cannot enforce conciliation outcomes.

While the DBCA aims for timely low cost dispute resolution, in practice some building disputes are either not accepted for conciliation or not satisfactorily resolved through the conciliation process. In these cases the consumer or building practitioner's only remaining options are to pursue the matter through VCAT or court.

Victorian Civil and Administrative Tribunal

VCAT is established under the Victorian Civil and Administrative Tribunal Act 1998. It has two main areas of involvement in the framework:

- a domestic building list for disputes between home owners, builders, subcontractors, architects, engineers and other building practitioners

- hearing appeals of BPB's practitioner registration and disciplinary decisions.

Victorian Managed Insurance Authority

The Victorian Managed Insurance Authority (VMIA) is a statutory authority established by the Victorian Managed Insurance Authority Act 1996. VMIA assists government departments and agencies in the area of risk management and acts as an insurer for departments, agencies and related bodies.

DBI has been a mandatory feature of Victoria's consumer protection framework since 1996. The original DBI scheme was 'first resort', allowing consumers to lodge a claim regardless of their builder's status. In 2002, DBI was changed to a 'last resort' scheme to keep remaining insurers in the market following the collapse of the HIH insurance group.

VMIA has provided DBI since mid-2010 in accordance with a direction from government. DBI is an important part of the building consumer protection framework. The Act requires that building practitioners must be eligible for DBI to gain registration and must possess DBI cover when undertaking domestic building works over $16 000 in value.

The Essential Services Commission monitors the VMIA's pricing and performance in delivering DBI, and reports on these publicly and to the Minister for Finance.

Department of Treasury and Finance

Department of Treasury and Finance led the development of the government's 2013 Domestic Building Consumer Protection Reform Strategy.

Department of Treasury and Finance also supports and provides advice to the Minister for Finance on his portfolio responsibilities including for insurance policy.

Department of Environment, Land, Water & Planning

The Department of Environment, Land, Water & Planning (DELWP) is responsible for providing advice to the Minister for Planning on building and plumbing policy, legislation, regulation and standards. This includes working with portfolio agencies, industry bodies and other stakeholders. Through the machinery-of-government changes effective 1 January 2015, DELWP became responsible for building policy and legislation in Victoria. Previously it was the responsibility of Department of Transport, Planning and Local Infrastructure (and formerly the Department of Planning and Community Development).

1.2.2 Operation of the framework

Figure 1A shows the steps that a consumer who is not an owner-builder follows when undertaking building work under the current building consumer protection framework.

The key consumer protections under the current framework are:

- the contractual protections and statutory checks protecting consumers against faulty or incomplete work—critical to the effectiveness of these protections are:

- consumers understanding their rights and the terms and implications of the contracts they sign

- builders applying the skills and required financial resources to complete works as intended and to applicable standards

- building surveyors properly reviewing works and taking appropriate action to have faults addressed

- complaint handling and dispute resolution processes, where it is critical that:

- consumers understand how to pursue and resolve a claim

- dispute resolution is capable of reaching a fair outcome

- regulatory and professional bodies are able to detect and address poor practices by surveyors and builders

- insurance is effectively and efficiently applied where the builder is dead, has disappeared or is insolvent.

Figure 1A

Domestic building process

(a) The exceptions to this are the re-blocking or restumping of a home, or the demolition or removal of a home. These must be performed by a registered practitioner regardless of value.

Note: BACV is Building Advice and Conciliation Victoria, which is part of CAV.

Source: Victorian Auditor-General's Office.

Figure 1B shows the complex and multiple entry points and pathways for consumers wishing to have a concern or dispute with a building practitioner resolved under the current building consumer protection framework.

Figure 1B

Pathways for domestic building disputes

Source: Victorian Auditor-General's Office based on a presentation by the former Building Commission to the Legislative Council's Standing Committee on Finance and Public Administration's Inquiry into Builders Warranty Insurance in April 2010.

A key aim of the May 2013 proposed Victorian Domestic Building Consumer Protection Reform Strategy was to set up VBA as the one-stop-shop for registering practitioners, monitoring and overseeing the industry—including disciplinary activity—providing consumer information and preventing and resolving disputes. The reforms proposed that VBA would assume Building Advice and Conciliation Victoria's current conciliation functions and the functions of BPB which was to be abolished. These reforms included the establishment of VBA, however, they were not completed.

1.2.3 Previous reviews of the framework

Since 2000 a number of reviews, inquiries and audits have identified weaknesses in both the design and implementation of the building consumer protection framework in the following areas:

- the robustness and integrity of the system and processes for registering building practitioners

- the adequacy of practitioner compliance monitoring

- a lack of cohesion and accountability in the operation of the framework

- the extent to which consumers understand and are protected by DBI

- a lack of focus on measuring the performance and effectiveness of regulatory and other activities.

VAGO's performance audit of the building control system, Building control in Victoria: Setting sound foundations, 2000

This audit found:

- weaknesses in the then Building Control Commission's monitoring—including its identification of building control risks and targeting of monitoring and enforcement activities

- a need to improve the rigour and suitability of registration and renewal processes

- that the Building Control Commission lacked a framework to measure its effectiveness

- the BPB was constrained in fulfilling its legislative responsibility to monitor the conduct and ability of building practitioners to practise, due to a lack of resources.

Victorian Competition and Efficiency Commission's inquiry into Housing regulation in Victoria: building better outcomes, 2005

The inquiry found:

- significant opportunity for improvement, particularly in establishing a more closely defined regulatory environment and improved performance reporting to enhance transparency and accountability

- a need for the then Building Commission to improve its performance reporting and a recommended that it publish the rationale behind its monitoring and enforcement strategy and performance indicators.

Legislative Council Standing Committee on Finance and Public Administration Inquiry into Builders Warranty Insurance, 2010

The inquiry found:

- that government policy on builders' warranty insurance had developed primarily in reaction to market conditions since 2002 with inadequate consultation with consumer interests and insufficient regard to the aim of the scheme—consumer protection

- it was too early to determine the impact of the government's reforms to builders' warranty insurance in 2010—the reforms had not yet addressed consumer complaints about the 'last resort' nature of the scheme

- first and 'last resort' schemes both require consumers to try to resolve problems directly with builders in the first instance—if the consumer is unsuccessful, 'last resort' schemes only become involved in limited circumstances such as the death, insolvency or disappearance of the builder, whereas first resort schemes can assist unsuccessful consumers even when the builder is still trading

- administration of Victoria's builders' warranty insurance scheme, and consumer protection in the building industry generally, was fragmented and poorly coordinated

- poor accountability and transparency measures, along with reports of enforcement inaction and poor handling of consumer complaints, were adding to concern about Victoria's builders' warranty insurance scheme.

VAGO's performance audit Compliance with Building Permits, December 2011

This audit found:

- the then Building Commission could not demonstrate that the building permit system was working effectively or that building surveyors were effectively discharging their role to uphold and enforce minimum building and safety standards

- results of testing a sample of building permits revealed a system marked by confusion and inadequate practice—including a lack of transparency and accountability for decisions made

- the absence of leadership, guidance and rigorous scrutiny from the commission meant councils adopted a largely reactive approach to enforcing the Act that offered little assurance of compliance within their municipalities

- there was little assurance that surveyors carried out their work competently, that the Act was being complied with, and the risk of injury or damage to any person was being minimised

- the BPB's assessment process for registering building surveyors was not well documented, nor supported by clear criteria and standards—gaps in guidance and documentation reduced accountability for decisions and did not provide assurance that assessments were soundly based.

Ombudsman Victoria, Own motion investigation into the governance and administration of the Victorian Building Commission, December 2012

The Ombudsman found:

- concerns with the vulnerability, integrity and administration of the registration system for building practitioners overseen by the BPB with administrative support from the then Building Commission

- BPB's lack of rigour or proper oversight of the building practitioner registration system created risk and opportunities for maladministration and misconduct to occur—this included registration as a licensed builder being given to people who failed parts of the competency assessment, and others being registered without having to sit assessment tests

- particular concerns with the conduct of the former Registrar of BPB who failed to declare business interests in the industry and approved applications for people he knew

- significant questionable spending by commission executives on entertainment, hospitality and sponsoring industry bodies' events and awards

- recruitment practices involving both contractors and internal staff that were in breach of the then Building Commission's policies and government procurement guidelines.

1.2.4 Victorian Domestic Building Consumer Protection Reform Strategy

Following a public consultation process in 2012, the government responded to weaknesses in the current framework by releasing the Victorian Domestic Building Consumer Protection Reform Strategy in May 2013.

The strategy acknowledged that the current framework provides only modest levels of protection for consumers and has significant gaps and opportunities for improvement in relation to:

- practitioner registration, licensing and re-registration standards

- the need to extend the scope of regulation beyond individual practitioners to corporations and partnerships

- the regulator's disciplinary powers

- the absence of binding rectification orders where building works are assessed as defective

- oversight of building surveyors and the building permit system

- the range, depth and accessibility of consumer information including information on building practitioners' disciplinary history

- the extent of protection provided by DBI.

The aim of the strategy was to address these issues and reduce the number of building disputes, and, where they do arise, to help them be resolved quickly, fairly and cost efficiently. The strategy proposed significant changes to administrative arrangements for regulation and oversight of the building sector.

While extensive, the reform strategy did not fully address the key issues with the current domestic building consumer protection framework identified in previous reviews and submissions to the reform process, including the:

- effect of having non-mandatory conciliation on the capacity for early resolution of building disputes

- conflicts of interest for private building surveyors between performing their statutory roles and their business interests.

Implementation of the reform strategy commenced in 2013 with stage 1 involving the establishment of VBA on 1 July 2013. Since the December 2011 VAGO report, the former Building Commission and VBA have had five chief executive officers with the first stable leadership team being established by VBA in April 2014.

The most significant of the stage 2 reforms relied on the Building Legislation Amendment Bill 2014 which sought to enable:

- the transfer and enhancement of functions and powers from BPB, BAB and CAV to VBA to create a one-stop-shop for the registration and oversight of building practitioners

- provision of additional consumer information

- additional mechanisms to resolve domestic building disputes, including giving VBA the power to issue binding rectification orders to parties where building work is assessed as defective or incomplete by a VBA inspector

- the extension of the triggers for access to domestic building insurance.

This Bill did not proceed through Parliament in 2014. The new government is yet to announce whether it will pursue or re-examine these reforms.

1.3 Audit objective and scope

The audit objective was to assess whether key elements of the current domestic building consumer protection framework are effectively managed by relevant entities. To do this we examined whether:

- VBA, BPB and CAV are performing existing functions and using powers effectively

- VMIA's provision of domestic building insurance is effectively and economically managed.

This audit included the following relevant departments, agencies and statutory boards:

- Victorian Building Authority

- Building Practitioners Board

- Building Appeals Board

- Consumer Affairs Victoria

- Department of Environment, Land, Water & Planning

- Victorian Managed Insurance Authority

- Essential Services Commission

- Department of Treasury and Finance.

The audit examined relevant organisational arrangements and priorities, and evidence on how current responsibilities are met, measured and reported on.

1.4 Audit method and cost

The audit involved:

- desktop research and interviews with relevant departmental and agency staff, members of statutory boards, consumers and practitioners

- examination of relevant policy and procedure documents

- document and file reviews and analysis of sampled registrations, monitoring and enforcement activity, disciplinary reviews, consumer complaints, records of outcomes of disputes, etc.

- examination of any other relevant evidence held by departments, agencies and statutory boards

- examination of consumer correspondence.

The report includes quotes taken from correspondence received by the Auditor‑General from domestic building consumers. These quotes are included for illustrative purposes only and individual cases were not investigated as part of the audit.

The audit was performed in accordance with the Australian Auditing and Assurance Standards. Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated, any persons named in this report are not the subject of adverse comment or opinion.

The total cost of the audit was $595 000.

1.5 Structure of the report

The report is structured as follows:

- Part 2 examines the registration, monitoring and discipline of building practitioners where the effectiveness of these processes underpin the contractual protections and statutory checks by building surveyors designed to prevent disputes

- Part 3 assesses CAV's role in preventing and resolving disputes by educating consumers about their rights and obligations, managing complaints and conciliating disputes, undertaking compliance and enforcement activities, and advising government on how best to achieve its policy goals

- Part 4 examines the effectiveness and efficiency of the domestic building insurance scheme.

2 Building practitioner registration, discipline and compliance monitoring

At a glance

Background

The Victorian Building Authority (VBA) monitors and prosecutes noncompliance with the Building Act 1993. Private and municipal building surveyors also play a key role in compliance. The Building Practitioner's Board (BPB) registers and disciplines practitioners. Consumer Affairs Victoria (CAV) educates building practitioners about their obligations under the Domestic Building Contracts Act 1995 and enforces this Act.

Conclusion

BPB's practitioner registration system does not ensure that the only practitioners who are registered are qualified, competent and of good character. There are significant deficiencies in VBA's oversight of building surveyors and in the coordination of compliance and practitioner performance monitoring across agencies. However, over the last year VBA has commenced action to address many of VAGO's 2011 audit recommendations and to establish an appropriate governance framework.

Findings

- There is limited assurance that BPB performs its registration and disciplinary functions effectively.

- The role of building surveyors is undermined by a conflict of interest arising from surveyors typically relying on builders for recurrent work.

- BPB sanctions appear ineffective in deterring practitioner misconduct.

- VBA lacks an effective monitoring and evaluation framework for its activities.

- CAV provides practitioner information, advice and training, but lacks outcome focused performance measures to gauge the effectiveness of these programs.

Recommendations

That the Department of Environment, Land, Water & Planning reviews the regulatory arrangements governing the engagement of building surveyors to ensure they support the independent and objective performance of their function to provide appropriate independent oversight of building and the building system.

2.1 Introduction

Building practitioner information and education services, registration and discipline, compliance monitoring and enforcement all play a part in ensuring that building practitioners meet required standards and that consumers are protected. The Victorian Building Authority (VBA) and Consumer Affairs Victoria (CAV) share responsibility for monitoring and compliance in domestic construction. Local councils are responsible for the administration and enforcement of parts 3, 4, 5, 7 and 8 of the Building Act 1993 (the Act) and the Building Regulations 2006 (the Regulations) within their municipalities.

VBA is primarily responsible for monitoring compliance with the Act and the Regulations. This includes auditing the collection of building levy payments and the compliance of building permits issued by building surveyors.

Building surveyors—both private and municipal—play a critical role in implementing, enforcing and monitoring the building standards prescribed by the Act and the Regulations through conducting inspections and issuing building permits. CAV and VBA provide educational resources, guidance and support programs for practitioners—VBA in technical building matters and CAV in issues of a contractual and customer focused nature.

The Building Practitioners Board (BPB) is responsible for supervising and monitoring the conduct and ability to practise of registered building practitioners. It operates a discipline and sanction regime which aims to reinforce the incentives for practitioners to behave appropriately, discourages those practitioners who have been found guilty of misconduct from repeat offending, and suspends or cancels registration for those practitioners whose misconduct is particularly harmful.

In 2011 VAGO undertook an audit, Compliance with Building Permits, which focused on both building permits and the role and oversight of surveyors. We found that 96 per cent of permits examined were noncompliant and we made a series of recommendations aimed at strengthening the regulation of building surveyors.

2.2 Conclusion

There has been little improvement in the registration and oversight of building surveyors, and the coordination of compliance and practitioner performance monitoring since VAGO's 2011 report. The administration and monitoring of the building levy system is still hindered by VBA's lack of powers to reassess and recoup underpaid levy and to require building surveyors to remit levy promptly.

BPB's practitioner registration and discipline systems do not ensure that the only practitioners who are registered are qualified, competent and of good character. Registration assessment practices are inconsistent and no objective standards are in place. Deficiencies in this system are compounded by the open-ended nature of building registrations under the Act and the lack of effective triggers or mechanisms to review practitioner competence. In addition, sanctions imposed in BPB's disciplinary processes appear ineffective in deterring practitioner misconduct.

The independence of compliance monitoring by surveyors is weakened by a long‑recognised conflict of interest for private building surveyors which undermines confidence in the system. This conflict, combined with building surveyors' disproportionately high representation in BPB inquiries, registration suspensions and cancellations, and reoffending, is concerning given their critical role in assuring building standards. Similarly, VBA's risk-based monitoring and compliance activities, while promising, are newly established and lack an evaluation framework to assess their effectiveness. However, over the past year VBA has taken action to address many of VAGO's 2011 audit recommendations and establish an appropriate governance framework, including developing a memorandum of understanding (MOU) with BPB to define governance arrangements between the bodies.

2.3 Practitioner registration and education

The practitioner registration system assesses a range of relevant factors including competence, solvency, character and work history. We evaluated the adequacy of these assessment processes by spot sampling a randomly chosen selection of 23 building practitioner registration assessment records. For a description of the practitioner classes chosen and the number of practitioner records in each class reviewed see Figure 2A. These classes were chosen as the most relevant to domestic building and most likely to directly impact on consumer protection. A full description of practitioner categories and classes is available at Appendix A.

Figure 2A

Practitioner categories and classes

|

Category and class |

Description |

Number of records reviewed |

|---|---|---|

|

Domestic builder-unlimited |

May personally carry out, manage or arrange for subcontractors to carry out all components of domestic work. |

4 |

|

Domestic builder-manager |

May manage or arrange for domestic builders registered in another class to carry out components of domestic building work specified in their Certificate or Registration which is generally quite specific—for example, work on retaining walls or work on garages and carports. |

3 |

|

Domestic builder-limited |

May carry out, manage or arrange to carry out only the components of domestic building work specified in their Certificate of Registration. |

8 |

|

Building surveyor-unlimited |

May conduct building surveying functions—ensure construction projects meet building regulations—for all buildings. |

4 |

|

Building surveyor-limited |

May conduct building surveying functions—ensure construction projects meet building regulations—for buildings up to three storeys high with a maximum floor area of 2 000 square metres. |

3 |

|

Building inspector |

Permitted to inspect certain classes and components of buildings and varieties and types of construction. |

1 |

Source: Victorian Auditor-General's Office based on information from VBA.

We also examined BPB's supporting documentation for the registration system, relevant programs, activities and legislation.

We found:

- a lack of objective guidance and standards for assessing applications

- a poor standard of documentation of assessment decisions

- a lack of competency assurance for 'grandfathered' practitioners—whose existing registrations were transferred into the new system without assessment—and practitioners applying for mutual recognition of qualifications from other states or territories

- inadequate assessments of practitioners' financial and business skills.

The current practitioner registration system does not ensure that the only practitioners who are registered are qualified, competent and of good character. VAGO's 2011 audit found significant deficiencies with the registration system and records for surveyors. Our spot sampling of records for both building surveyors and domestic builders—who undergo a similar registration process—shows that these deficiencies remain.

2.3.1 Registration assessment and approval processes

Under the Act practitioner registration lasts until cancelled, subject to the payment of an annual renewal fee and an insurance premium. This amplifies the significance of initial registration assessments and the consequences of allowing unsuitable practitioners to gain registration. Despite this, the registration process effectively provides absolute discretion to individual assessors.

All practitioner registration applications are assessed by an individual assessor—either a VBA in-house assessor, a BPB member, or in the case of DB-U applications, by a contracted assessor, whose assessments are then reviewed by a BPB member or assessor.

VAGO's 2011 audit recommended that BPB 'develop criteria and guidelines for evaluating the competency of applicants to be registered as building surveyors and clearly document the basis of all decisions'. Objective criteria and standards would ensure consistency and objectivity in assessment. They would also provide transparency given that BPB members, and therefore assessors, are usually appointed from, and may be currently active within, the construction industry.

The need for objective criteria and standards is reinforced by our spot sampling of registration files which revealed significant inconsistencies between assessors and a poor standard of documentation of decisions. Several issues were identified:

- Assessors' recommendations and the outcomes of individual assessment stages are not recorded clearly—two of the files contained assessors' reports that have both 'approve registration' and 'do not approve registration' boxes checked.

- Required supporting documentation is not recorded accurately.

- Assessors' commentary and/or annotations are inconsistent and often ambiguous—for example, some registration records provide detail against all checklists and components, while others leave sections blank, several files indicate the insufficiency of supporting evidence, but appear to approve registration regardless.

- Assessors have an inconsistent understanding of assessment evidence requirements—for example, some assessments contain detailed narrative descriptions of the applicants working history, demeanour, and the initial conversations between the assessor and applicant, while others contain no explanatory notes.

Despite requiring applicants to provide extensive supporting documentation including example building contracts, health and safety plans, business and financial plans, site plans etc., there is no guidance in place to support qualitative assessment of this documentation beyond a checklist evidencing that it has, in fact, been provided. The registration files we examined showed inconsistent practices and in some cases limited evidence that the supporting documentation had been assessed at all.

BPB needs to determine what supporting documentation is critical to the assessment process and then develop specific criteria for assessing the adequacy of this documentation beyond relying on the individual discretion and knowledge of assessors.

BPB advised that its registration subcommittee began work to address VAGO's relevant 2011 recommendation in January 2012, however, little progress was made. During 2013, VBA assumed oversight of this work given that legislative reforms were expected to transfer these functions from BPB to VBA. While together VBA and BPB made some progress, BPB still lacks a current registration policy and comprehensive standards and/or guidance for assessing the knowledge, skills, and suitability of applicants for registration. Consequently, there is no assurance around the adequacy, consistency and objectivity of registration application assessments.

The BPB's consideration of applications

While BPB officially approves all registration applications individually, in practice these decisions are made on large numbers of applications at each meeting on the basis of limited information. The Ombudsman's December 2012 report recommended that BPB should 'ensure the board receives detailed information, including the results of applicants for each stage of the assessment to inform its consideration of applicants for registration'. Prior to this recommendation, BPB members received only a list for approval, showing the number of applicants that had been assessed for registration in each practitioner category.

From December 2013, BPB papers included a table indicating the qualifications and years of experience of each applicant and the computer-based test results for some classes of practitioner. However, these documents are often provided to members the day prior to the relevant meeting. This does not allow BPB members sufficient time to examine and inquire about any issues of concern related to the applicant's suitability in accordance with the requirements of the Act.

While these changes may technically address the Ombudsman's recommendations, they are not sufficient to address VAGO's 2011 concerns that the registration assessment and approval process provides little assurance that decisions are soundly based. BPB provides only limited applicant information in part because it is impractical for BPB to consider at length the large number of registration applications that it receives. However, introducing benchmark standards for assessing and evaluating applications prior to seeking BPB approval, would practically address this issue and provide greater assurance that registration approvals were based on objective and critical assessments of practitioner competence and suitability. Advice provided by BPB indicates that as of February 2015 all BPB agenda items, including registration application recommendations, are circulated with at least five days for members to review.

2.3.2 Competence

Qualifications

The Act does not include specific minimum standards for qualification and experience, which could act as a baseline for practitioner competency. Such minimum standards would improve the objectivity and robustness of the practitioner registration system. Under the Act, BPB has limited discretion in granting or refusing registration. It must register an applicant if it is satisfied that the applicant has:

- provided proof of suitable insurance coverage

- submitted a suitable and complete application

- provided any more information that BPB reasonably requires, and either:

- holds an appropriate prescribed qualification, or

- holds a qualification that BPB considers is, either alone or together with any further certificate, authority, experience or examination equivalent to a prescribed qualification

- is of good character

- complied with any other condition prescribed for registration in that category or class.

In December 2012, the Ombudsman recommended that BPB 'review the registration process for all categories of registration and develop minimum standards for qualifications and experience of applicants, and clearly identify the supporting documentation to be submitted with an application'.

Under the Act, one of BPB's three functions is to make recommendations to the Minister about the qualifications for registration. However, it took until November 2013 for BPB to provide advice to the Minister for Planning recommending that Schedule 7 of the Regulations be amended to allow for minimum qualifications to be prescribed. The Minister responded in late February 2014 indicating that he had referred the Chair's advice to the then Department of Transport, Planning and Local Infrastructure to consider as part of the review of the Regulations review process in 2016.

'Grandfathered' practitioners

In late 1996, when the current practitioner registration system was introduced, the government directed BPB to 'grandfather' existing building practitioners—to transfer them directly into the new registration system without assessment. There were 26 242 practitioners eligible to have their registrations transferred, of whom 12 382 subsequently registered with BPB.

The risks posed by the grandfathering of practitioners into the current registration system and their continued trading are unknown. This issue was first raised by VAGO 15 years ago, but no attempt has been made to assess the competence of these practitioners or address this risk. Our spot sample of registration files examined only one 'grandfathered' practitioner. The relevant file did not show any evidence that the practitioner had formal qualifications.

When we first raised the issue of grandfathered practitioners in our 2000 report Building control in Victoria: Setting sound foundations we recommended that the competence of practitioners in categories and classes assessed as high risk should be assessed on a progressive basis, observing:

'The 20 600 existing building practitioners, registered under transitional arrangements between July 1994 and June 1997, have not been assessed for suitability in terms of qualifications, skills or experience. In my opinion, the decision to 'grandfather' in such a large number of practitioners was an expedient process for the Board to follow in the circumstances.'

While this issue is diminishing over time as grandfathered practitioners age and retire, there are currently 5 677 grandfathered practitioners registered with BPB, accounting for 5 694 registrations—practitioners may be simultaneously registered in multiple classes. BPB advised us in the course of this audit that it believes that grandfathered practitioners do not represent any greater risk than any other practitioners. It also noted that the current legislative framework does not allow for the competency of grandfathered practitioners to be reviewed. BPB considers that the major flaw in the current legislation is the ongoing nature of practitioner registration.

Mutual recognition

Mutual recognition is enabled by Commonwealth legislation and involves registering applicants in Victoria if they can demonstrate that they hold an equivalent registration in another state or territory and do not have an adverse disciplinary history in that jurisdiction. While BPB is precluded from conducting competency assessments of mutual recognition applicants it does subject these applicants to a police check.

Analysis of BPB registration data indicates that the number of mutual recognition applications increased by around 130 per cent between 2012 and 2014. The practitioner classification with the highest increase in mutual recognition applications was DB-L which increased by 273 per cent from 97 applications in 2012 to 362 in 2014.

Analysis of registration data identified 20 cases where BPB rejected applications for Victorian building practitioner registration, typically due to insufficient qualifications and/or experience, but the practitioner subsequently obtained registration under mutual recognition provisions.

In March 2013, BPB's registration subcommittee meeting raised concerns about the significant increase in mutual recognition applications and resolved to write to the Minister to point out concerns about the mutual recognition loopholes. While BPB advised that it has recently raised its concerns about mutual recognition in a submission to the Productivity Commission on its review of mutual recognition schemes, it has not advised the Minister on this issue.

2.3.3 Solvency, business and financial management

Insolvency is a trigger for insurance claims under the domestic building insurance (DBI) scheme and the most common reason for DBI claims. Given the prevalence of this issue, BPB should be actively considering this risk when it assesses registration applications.

BPB's assessment of solvency and financial and business management skills of registration applicants is inadequate and implicitly relies on the Victorian Managed Insurance Authority (VMIA) conducting a thorough assessment when it decides to offer DBI. Registration assessors are appointed on the basis of technical building background and are unlikely to be suitably qualified to assess financial probity.

Spot sampling of financial information provided in registration files indicated that:

- plans provided by applicants were typically very basic and aspirational

- there was no requirement to provide evidence of current financial standing or credit history—either as a trader or individual

- there was little evidence of any detailed assessment by BPB of financial information provided by applicants.

BPB's reliance on VMIA's assessment is inappropriate given VMIA focuses on solvency and does not assess key issues including the capacity of practitioners to successfully plan and run a business.

To gain registration certain practitioners must provide evidence that they are covered by DBI or that they are eligible to be covered. VMIA provides advice to BPB when denying an application for DBI eligibility—for further discussion of this refer to Part 4.

2.3.4 Character

VAGO's 2011 report recommended that BPB 'systematically verify a sample of character declarations supplied by applicants for registration to gain reasonable assurance they are reliable'. This recommendation was addressed by amendments made in July 2013 to the Act which make it mandatory for registration applicants to authorise a police check with their applications.

BPB began using police checks as a screening mechanism on all building practitioner registration applicants from March 2014. Police checks that return anything other than minor offences are referred to a Probity Panel of three BPB members including the Chair.

To date no candidate has been refused registration on the basis of the outcome of their police check alone, and no convictions for very serious offending have been disclosed in police check results. Prior to the introduction of police checks, BPB members contacted a sample of applicant supplied character referees by phone.

Registration period and compulsory professional development

Once registered, a building practitioner can continue to operate subject to the payment of an annual fee and insurance premium. VAGO's 2011 report noted that the ongoing nature of registrations means that 'a practitioner does not have to demonstrate they have maintained their capability to the level that they can discharge their duties', and that this was 'a gap in the regulatory framework'.

The report recommended that the then Department of Planning and Community Development (DPCD), in consultation with stakeholders, seek approval from the Minister to:

- introduce a system of compulsory continuing professional development for building surveyors

- amend the Act to make registration renewal contingent on building surveyors satisfying minimum compulsory continuing professional development requirements.

In response, the then DPCD sought legal advice which advised that amendments would be required to both the Act and the Regulations in order to mandate compulsory continuing professional development for registered building surveyors.

The May 2013 Victorian Domestic Building Consumer Protection Reform Strategy committed to improve re-registration standards by limiting the registration period to 'no more than five years, with renewal being required on expiration of the period'.

DPCD subsequently commissioned a cost-benefit analysis that found that there was a lack of compelling evidence that introducing mandatory continuing professional development would improve professional standards. In light of this, DPCD advised government to strengthen the legislative requirements by introducing five-year re‑registration periods. This was designed to provide the regulator with the capacity to assess the practitioner's ongoing competence as part of the registration renewal process.

Amendments to enact this change were included in the Building Legislation Amendment Bill 2014 (the Bill). However, as the Bill did not pass Parliament, there is still no requirement for practitioners to demonstrate their ongoing competency. Legislative change to introduce a finite registration period remains the most direct way to address this issue.

CAV's practitioner information and education services

CAV provides a range of practitioner information and education services for building practitioners including:

- practitioner information sessions at registered training organisations

- presentations in partnership with VBA at trade shows

- email updates to practitioners on their obligations.

CAV's reporting on its practitioner information and education services is largely narrative—for example, descriptive reports of trade show appearances. It cannot measure the effectiveness of these programs because it lacks outcome-based performance evaluation measures.

Better Business Initiative

CAV's Better Business Initiative (BBI), described in Figure 2B, is primarily a compliance tool aimed at practitioners who generate large volumes of complaints. While BBI has resulted in positive outcomes, it is a targeted program. CAV needs to ensure that its broader practitioner education and information programs are similarly effective.

Figure 2B

BBI

|

The BBI supports participating businesses to adopt practices to assist them in improving compliance with the Domestic Building Contracts Act 1995. CAV targets builders who undertake a large volume of building works and also have a large volume of complaints. It develops an action plan for each builder which outlines the number of meetings, skills and resources needed to assist the builder. Follow-up meetings are held with BBI participants to determine whether they have experienced any reduction in complaint volumes. BBI participants may be subject to compliance measures to reduce complaints. If the builder does not respond to such measures this may lead to enforcement action. In 2013, there was a 24.2 per cent reduction in complaints about the builders that CAV had engaged under the BBI. The BBI effectively assists CAV to reduce the volume of complaints from specific building practitioners, by educating practitioners to improve industry practice and consumer experience. |

Source: Victorian Auditor-General's Office.

2.4 Monitoring compliance

2.4.1 The role of building surveyors

Building surveyors are responsible for making sure that buildings are safe and accessible. They issue building permits and manage the inspection process from foundations through to completion. In 1994, regulations were introduced to allow private building surveyors to issue building permits to increase competition. Prior to these reforms, all building permits were issued by municipal councils.