Annual Report 2018–19

Overview

This report covers the activities of VAGO for the period 1 July 2018 to 30 June 2019.  It is prepared in accordance with the Audit Act 1994 and the Financial Management Act 1994, and complies with the requirements of relevant Australian Accounting Standards and Interpretations, Standing Directions and Financial Reporting Directions.

It is prepared in accordance with the Audit Act 1994 and the Financial Management Act 1994, and complies with the requirements of relevant Australian Accounting Standards and Interpretations, Standing Directions and Financial Reporting Directions.

This report cost $50 000 to produce.

This year we have included some new interactive elements.

In Section 3.5 you can find an infographic about the impact of our performance audits in 2018–19.

In Section 7.1 you can find a summary of our financial performance over the past five years.

Below is an updated dashboard of our workforce data. A profile of all VAGO employees is included in Appendix A of the report, but this dashboard allows that data to be filtered and manipulated.

|

The dashboard is easiest to navigate in the full screen view. Click the button at the bottom right of the window. |

|

|

You can use the drop down menus to filter the data. You can select a single segment of data by clicking the relevant box, or can compare various segments by holding the Ctrl button and selecting multiple boxes. To clear your selection, click the ‘clear selections’ button at the top right of the pane (circled in red in the picture) which will appear when you hover over that area. |

|

|

You can also access a detailed view for each indicator. Hover over the chart and click the ‘focus mode’ button at the top right of the window. |

|

|

To return to the dashboard from ‘focus mode’, click ‘Back to report’ at the top left of the window. |

|

|

To share the dashboard via email, LinkedIn, Facebook or Twitter, click the ‘Share’ button at the bottom left of the window. |

Transmittal letter

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

I am pleased to transmit, in accordance with the Audit Act 1994, the annual report of the Victorian Auditor-General’s Office for the year ended 30 June 2019 for presentation to parliament.

Yours faithfully

Andrew Greaves

Auditor-General

29 August 2019

Accountable officer’s declaration

In accordance with the Financial Management Act 1994, I am pleased to present the Report of Operations for the Victorian Auditor-General’s Office for the year ended 30 June 2019.

Andrew Greaves

Auditor-General

29 August 2019

Foreword

This year has seen a continuation of our change agenda to position ourselves for the future and make VAGO an exemplary and modern audit office. Since I started as Auditor‑General in September 2016, the Victorian Auditor-General's Office has undergone significant internal transformation to our structures, senior personnel, systems and processes. While these changes may be less evident outside VAGO, we see their beneficial effects in the growth in our reputation and standing in the public sector, and in the quality and impact of our audits and reports. We are well on the way to making sure that what we deliver is relevant to the contemporary challenges facing the public sector, and to being a strong influencer for effecting change and improvement where needed.

Our increasing use of data analytics to underpin our audit evidence bases and drive our performance and financial audits provides new insights into many 'wicked' problems that traditional auditing methods could never deliver. This is perhaps best exemplified by the work we did this year in the health and human services sector. Our two reports into the mental health system involved analysis not previously undertaken of key datasets, which enabled us to highlight significant systemic shortcomings. These reports have also featured in the Royal Commission into Victoria's Mental Health System, which demonstrates that we are picking topics of the moment that matter to all Victorians.

Our technology updates have strengthened our data protection practices, which has enabled agencies to confidently share their data with us and enabled us to make the most of our data analytics capability. Our network improvements are also enabling staff to work remotely and to collaborate more easily. The changes we have made to our internal practices, particularly around making better use of our resources, have helped ensure that we are meeting the standards we expect of the agencies we audit.

One key focus has been the culture of our workplace. This year saw us introduce a Culture Plan and our first Diversity and Inclusion Plan. These help us continue to live up to the organisational values we chose last year. I am mindful, however, that the pace of change overlaid on what has always been a demanding workload for our staff can have negative consequences. We need to do better as an organisation to manage change and to manage workloads if we are to make sure that we bring our staff along with us on this journey. This will be a major focus for me and my executive team in the coming year.

I am also pleased that we will begin 2019–20 with an amended Audit Act 1994. Our updated legislation is another hallmark of the clear and practical modernisation of our operations. It allows us to be more relevant and responsive, which helps us to better serve Victorians.

Andrew Greaves

Auditor-General

29 August 2019

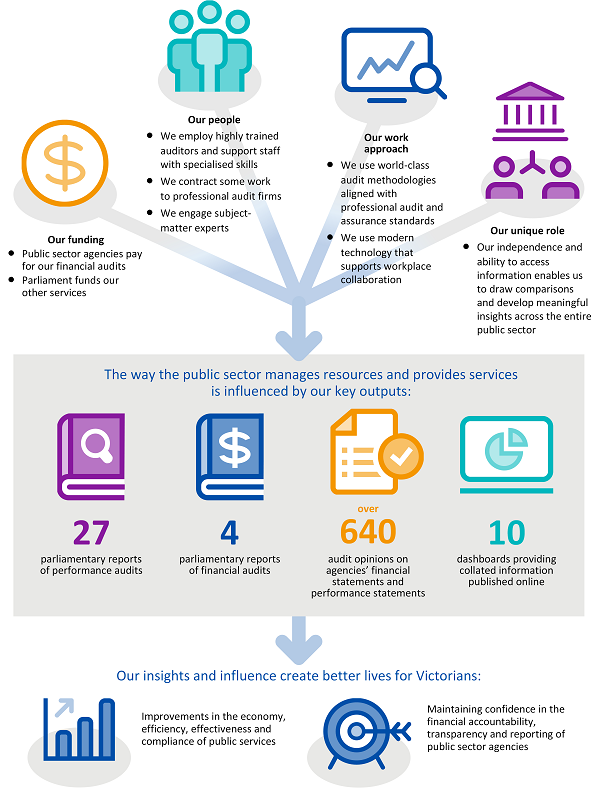

1 About VAGO

The Auditor-General is an independent officer of the Victorian parliament, appointed on behalf of Victorians to scrutinise how well government spends public money. VAGO helps hold the government to account through our financial and performance audits of public sector agencies and our resulting reports to parliament.

Along with the Independent Broad-based Anti‑corruption Commission, the Victorian Ombudsman and the Victorian Inspectorate, we are part of Victoria's modern integrity system, and we work to protect the public interest.

Two principal pieces of legislation govern what we do:

- The Constitution Act 1975 establishes the role of the Auditor-General and gives the Auditor-General complete discretion in how the functions and powers of the role are performed and exercised.

- The Audit Act 1994 establishes the Auditor-General's mandate and VAGO. It provides the legal basis for our powers and identifies the responsibilities of our role. In Section 1.3, we discuss the recent changes to this Act.

We audit the financial reports of over 500 agencies each year and provide opinions on 110 performance statements. The agencies we audit include government departments, statutory bodies, educational institutions, public hospitals, water corporations, insurers and local government councils. We also conduct performance audits that assess the effectiveness, efficiency, economy and compliance of government agencies, programs and services. With our follow-the-dollar powers, we are able to audit non‑government organisations that provide government services under contract.

Our unique position and access to information across the entire Victorian public sector allow us to identify common issues and provide useful insights for the agencies we audit. We not only provide recommendations on how to improve services and function more efficiently and effectively, we now also provide collated information back to agencies through our data analytics dashboards.

1.1 Our operating model

Our operating model underpins how we create value for parliament and the Victorian community.

1.2 Our values

In May 2018, VAGO introduced a new set of organisational values:

|

We are an independent integrity organisation. We will stay true to our values and meet the high standards that Victoria's parliament, public sector and community expect from us.

|

Staff chose these values to shape our work and our culture. This year, we continued involving staff in embedding their chosen values in our day-to-day work. We held a series of events and activities, including volunteering opportunities at the Brotherhood of St Laurence and innovation workshops. We participated in Dialogue in the Dark tours and collected items to donate to Fitted for Work. We also introduced our first Diversity and Inclusion Plan, which reflects our values of innovation and respect. We discuss this plan in Section 4.2.

1.3 Our new legislation

Parliament passed the Audit Amendment Act 2019 on 28 May 2019, and it commenced on 1 July 2019.

The Act restructures and modernises the Audit Act 1994, strengthening the Auditor‑General's capacity to examine and report on the efficiency, effectiveness, and economy of the public sector.

The Audit Act 1994 now includes modern information gathering powers, widens our ability to disclose relevant information to other bodies, and introduces a new function to conduct and report on assurance reviews to parliament.

VAGO's existing information gathering powers have been strengthened to include powers to enter and inspect premises. Intended as a last resort, these new powers have strict procedural fairness and mandatory reporting obligations. The changes also clarify that VAGO can disclose information to specific entities, such as a relevant public body or minister.

Assurance reviews are more targeted, time sensitive, smaller scale and cost‑effective compared with financial or performance audits. They enable the Auditor‑General to respond quickly and effectively to discrete issues brought to the Auditor-General's attention by other integrity offices, parliamentarians or the community. We will use this new function first to report annually on agencies' progress in acquitting past audit recommendations that they agreed to implement.

1.4 Our strategic plan

In 2017, we launched our Strategic Plan 2017–2021, which sets out our objectives, our directions to achieve these objectives, and measures of what success looks like. This is our first full year of operating with the plan. In this report we detail our progress against the plan.

|

|

Increase our relevance |

Grow our influence |

Invest in our people |

Lead by example |

|---|---|---|---|---|

|

Our objectives |

Be more relevant by delivering credible and authoritative reports and advice about things that matter and will make a difference |

Be valued for our independence and more influential because of the unique perspectives we provide |

Enable high performance by our people through a supportive culture, professional development and collaboration |

Model exemplary performance in everything we do |

|

Our directions |

Modernise our auditing methods Update how we audit to reflect new and emerging technology-enabled practices Explore our full mandate Rebalance our audit programs to evenly cover efficiency and effectiveness, governance and compliance Take a longer-term perspective Analyse audit results through time to identify what works on complex and interconnecting issues |

Strengthen our engagement Build more productive relationships based on mutual respect and understanding of our respective roles and organisational contexts Better leverage our access Use our access to cross-government datasets to provide our clients with new insights they can use Increase accessibility to our work Develop new interactive channels with our stakeholders and open up access to our data to allow tailored use to meet specific needs |

Be clear about what we stand for Demonstrate leadership and accountability in how we work and live our values and culture Invest in excellence Support our people to harness new and emerging technologies by developing their technical, analytical and people management capabilities Get the mix right Ensure our workforce composition builds our capability to position us to meet future business needs |

Simplify our business Eliminate unnecessary internal red tape, and streamline and increase automation of core business processes Embrace new technology Invest in cloud technology, implement the best software solutions to integrate our business systems, and share information to improve our practice Better intelligence to drive decisions Develop a comprehensive portfolio of service, product and project performance measures |

|

What success looks like |

Our audit program effort is targeted across efficiency, effectiveness, economy and compliance The benefits realised by the public sector show an increased return on investment from our audit work |

More of our performance audits originate from requests from Parliament, the public sector and the public Use of our reports and associated datasets in government service delivery and for parliamentary purposes has increased |

Employee engagement has increased We develop, attract, and retain the talent we need

|

Workforce productivity has increased Our internal practices set the benchmark for public sector entities and other audit offices |

|

Our progress and highlights |

In 2018–19, we delivered an audit program balanced across efficiency, effectiveness, economy and compliance. We used data analytic dashboards in our annual planning for the first time. We reviewed and modernised our financial audit methodology. We created financial audit dashboards that allow us to quickly process and analyse 100 per cent of our clients' financial records. We focused on having a longer-term perspective by tabling the first of our longitudinal performance audits on the Melbourne Metro Tunnel Project. We continue to follow up with agencies post-audit to help us understand the benefits audited agencies are realising through our audit work. |

This year we have worked on strengthening our relationships with parliamentarians and audit committee chairs. We continued reviewing suggestions from parliamentarians and the public as part of our annual planning process. We have continued our focus on data sharing and have created two dashboards for agencies to use to improve the way they deliver services. We created 10 data dashboards for the public to access and use. Our audits have made a significant impact this year, helping to shape funding decisions and new initiatives. |

Our employee engagement score this year was 66, the same as in 2018. This year, we launched a Culture Plan to help us live up to our organisational values and to keep our staff engaged. We also created our first ever Diversity and Inclusion Plan, which will help shape VAGO into a fairer and more welcoming workplace. We have run major training initiatives on appropriate behaviour and plain English. |

Our productivity was 60 per cent (55 per cent in 2016–17 and 60 per cent in 2017–18). In 2018–19, we improved our internal processes by making significant technology updates and focusing on data protection. We continued to build our business intelligence systems that will give us simple and timely access to performance information. We implemented a new human resources system with a modern interface that has simplified tasks and reduced the duplication of effort. We reviewed our fraud and corruption controls. We have improved our reports by using infographics to highlight key messages. |

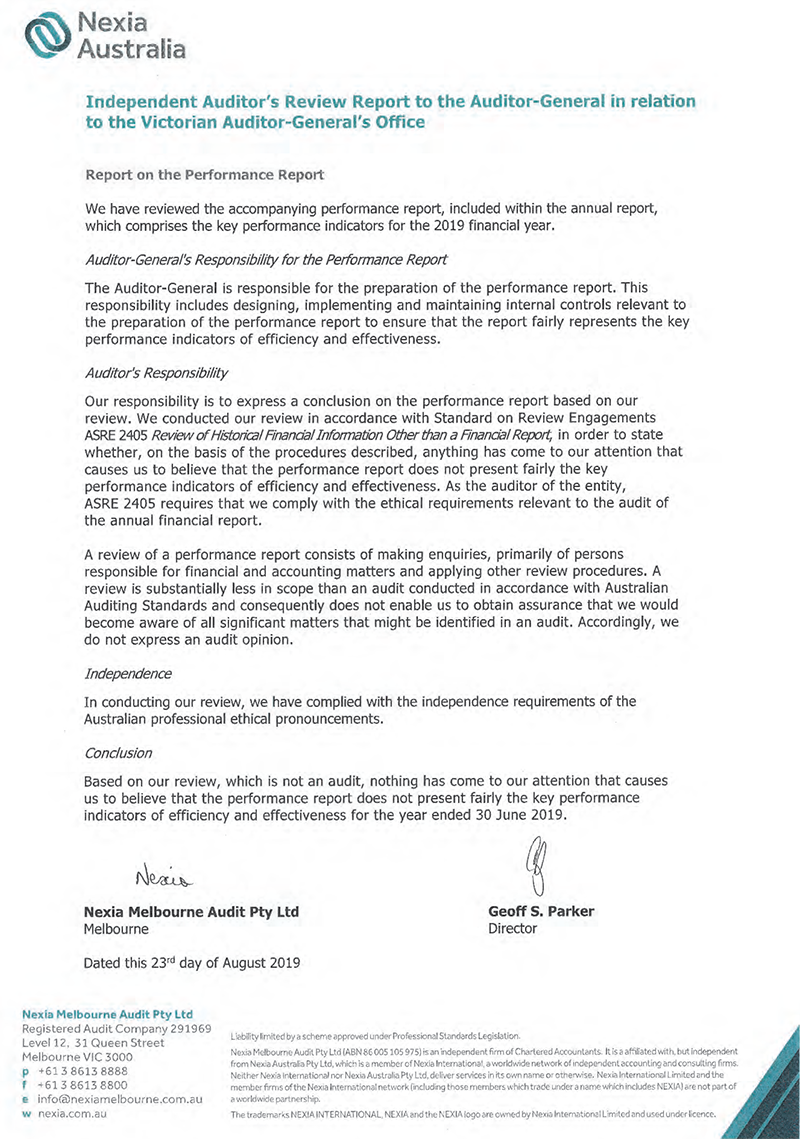

1.5 Our performance

Every year VAGO reports against the performance measures and targets set out in Budget Paper No. 3. This year, for the first time, this report includes an independently audited Performance Statement with this information, in Part 6. While not required, this approach assures readers that our non-financial performance information is reliable, in the same way that assurance is provided by the audit opinion on our financial statements.

A summary of our results is provided below.

Our parliamentary clients |

||

Performance measures |

Target |

Actual |

|

Parliamentarians' overall satisfaction level |

85% |

73.6% |

|

Average time taken to reply to parliamentarians' inquiries |

≤20 days |

17 days |

|

Every year we survey parliamentarians about how satisfied they are with our work and we receive correspondence from them about their areas of concern. This year we missed our satisfaction target by 13.4 per cent because of the increase in new parliamentarians following the November 2018 election. We responded to all correspondence |

||

Our parliamentary reports |

||

Performance measures |

Target |

Actual |

|

Average time taken to produce performance audit reports |

≤9 months |

10.1 months |

|

Average time taken to produce financial audit reports |

≤5 months |

4.8 months |

|

Average cost of parliamentary reports |

$509 000 |

$527 000 |

|

This year our parliamentary reports cost slightly more on average than our target. Our performance audits were delivered later than expected, but we have improved on this measure from last year. These cost and delays were due to resourcing issues and challenges in accessing and analysing data, as well as the impact of parliamentary tabling dates which were affected by the election, and the change in the Budget date. Our financial audit reports were delivered within our target time frame. |

||

Our performance audit recommendations |

||

Performance measures |

Target |

Actual |

|

Percentage of accepted performance audit recommendations that have been implemented |

80% |

78.4% |

|

We track whether agencies are implementing the recommendations that we made and they accepted. This year our results were within tolerance. |

||

Our financial audits |

||

Performance measures |

Target |

Actual |

|

Audit opinions issued within deadlines |

98% |

98.3% |

|

Management letters issued within deadlines |

90% |

93.7% |

|

Average cost of audit opinions on performance statements |

$5 100 |

$5 200 |

|

Average cost of audit opinions on financial statements |

$51 000 |

$48 400 |

|

This year we met our time targets for issuing audit opinions and management letters. We slightly exceeded our cost target for audit opinions issued on performance statements, but the result is in line with last year. We met our cost target for audit opinions on financial statements. |

||

Our financial audit quality controls |

||

Performance measures |

Target |

Actual |

|

External/peer reviews finding no material departure from professional and regulatory standards |

100% |

90.0% |

|

Proportion of agencies disclosing prior period material errors in financial statements |

≤5% |

0.9% |

|

We have our work externally reviewed to check for material departures from professional and regulatory standards. This is meant to measure our compliance with various auditing and accounting standards. We did not meet our target this year, however, we exceeded industry benchmarks and last year's performance. |

||

Our costs |

||

Performance measures |

Target |

Actual |

|

Total cost for parliamentary reports and services |

$16 200 000 |

$16 000 000 |

|

Total cost for audit opinions on financial performance statements |

$27 300 000 |

$27 100 000 |

|

We met our overall cost targets this year for our two output groups. |

||

As well as measuring performance thought our Budget Paper No. 3 measures, we also participate in a benchmarking exercise run by the Australasian Council of Auditors-General (ACAG) every year.

|

This year 46 per cent of all paid hours worked by all VAGO staff were charged to audit work. This is slightly lower than the average result for all states and territories of 48 per cent. but is better than our 2017–18 result of 44 per cent. |

This year our audits cost 25 cents for every $1 000 in public sector transactions. This continues our downward trend from 30 cents in 2016–17, and 27 cents in 2017–18. The average cost for all states and territories was 35 cents. |

This year our financial audit staff spent 67 per cent of their available time directly on financial audits and our performance audit staff spent 70 per cent of their available time directly on performance audits. These results are the same as in 2017–18. |

2 Increasing our relevance

|

Our objectives |

Our directions | What success looks like | |

|---|---|---|---|

|

|

Be more relevant by delivering credible and authoritative reports and advice about things that matter and will make a difference |

Modernise our auditing methods Explore our full mandate Take a longer-term perspective |

Our audit program effort is targeted across efficiency, effectiveness, economy and compliance The benefits realised by the public sector show an increased return on investment from our audit work |

To strengthen accountability, transparency and integrity in the public sector we have to ensure that our reports and advice are relevant and timely. We are ensuring our audit program covers our full mandate and balances efficiency, effectiveness, economy and compliance.

A better coordinated mix of audit topics allows us to take a longer view of complex problems and makes our work more valuable. It is also important that we keep our practices up to date. This year we invested in updating our financial audit methodology to reflect the most recent changes to standards and the emergence of data-driven audit approaches.

2.1 Acquitting our 2018–19 work program

Performance audit

This year we tabled 27 performance audit reports in parliament. Eighteen of these were listed in our Annual Plan 2018–19, including one follow-up audit, and nine were from our Annual Plan 2017–18.

Four audits were not tabled during the year as planned. Two audits were delayed due to resourcing issues and/or challenges in accessing and analysing data (Cenitex: Meeting Customer Needs for ICT Shared Services and Enrolment Processes at Technical and Further Education Institutes). One audit, Managing Registered Sex Offenders, has run late and the remaining audit, Market-led Proposals, was intentionally extended. Once we began analysing the relevant data it became clear that more time was needed to complete a meaningful audit. All four of these audits are scheduled to table in the first half of 2019–20.

2018–19 performance audit reports tabled: by sector

| Central Agencies and Whole of Government | ||

| Contract Management Capability in DHHS: Service Agreements* | (report 11, September 2018) |

|

| Security of Government Buildings | (report 21, May 2019) |

|

| State Purchase Contracts* | (report 12, September 2018) |

|

| Education | ||

| Professional Learning for School Teachers* | (report 15, February 2019) |

|

| School Compliance with Victoria's Child Safe Standards | (report 31, June 2019) |

|

| School Councils in Government Schools* | (report 3, July 2018) |

|

| Environment and Planning | ||

| Follow Up of Oversight and Accountability of Committees of Management | (report 7, September 2018) |

|

| Managing the Environmental Impacts of Domestic Wastewater | (report 10, September 2019) |

|

| Managing the Municipal and Industrial Landfill Levy* | (report 2, July 2018) |

|

| Recovering and Reprocessing Resources from Waste | (report 27, June 2019) |

|

| Security of Water Infrastructure Control Systems ($) | (report 22, May 2019) |

|

| Health and Human Services | ||

| Access to Mental Health Services* | (report 16, March 2019) |

|

| Child and Youth Mental Health | (report 26, June 2019) |

|

| Managing Private Medical Practice in Public Hospitals | (report 30, June 2019) |

|

| Managing Rehabilitation Services in Youth Detention* | (report 4, August 2019) |

|

| Security of Patients' Hospital Data | (report 23, May 2019) |

|

| Infrastructure and Transport | ||

| Compliance with the Asset Management Accountability Framework | (report 20, May 2019) |

|

| Melbourne Metro Tunnel Project—Phase 1: Early Works ($) | (report 28, June 2019) |

|

| Justice and Community Safety | ||

| Crime Data* | (report 6, September 2018) |

|

| Police Management of Property and Exhibits | (report 5, September 2018) |

|

| Local Government and Economic Development | ||

| Delivering Local Government Services | (report 8, September 2018) |

|

| Fraud and Corruption Control—Local Government | (report 29, June 2019) |

|

| Local Government Assets: Asset Management and Compliance | (report 19, May 2019) |

|

| Local Government Insurance Risks* | (report 1, July 2018) |

|

| Outcomes of Investing in Regional Victoria | (report 17, May 2019) |

|

| Reporting on Local Government Performance | (report 18, May 2019) |

|

| Security and Privacy of Surveillance Technologies in Public Places | (report 9, September 2018) |

|

Key: * indicates audits from our Annual Plan 2017–18. ($) indicates follow-the-dollar audits.

We cancelled one audit from our 2018–19 Annual Plan, on sharing information to address family violence. We will continue to monitor risk in relation to the family violence information sharing scheme through our planned 2019–20 audit Managing Support and Safety Hubs and the legislated independent review of the Family Violence Information Sharing Scheme by Monash University. The terms of reference for this review mirrored our planned audit and we judged that it would not be the best use of resources to duplicate the work.

Financial audit

In 2018–19, we issued 532 audit opinions on the financial statements of public sector agencies. We also issued 110 audit opinions on the performance statements of local councils, water agencies and technical and further education institutes.

We tabled four parliamentary reports on the results of our financial audits. In previous years we have produced six reports, but due to the 2018 state election and early closure of parliament, we included a summary of our results for the water and public hospital sectors in our Auditor-General's Report on the Annual Financial Report of the State of Victoria: 2017–18.

2018–19 reports tabled on the results of financial audits

| Auditor-General's Report on the Annual Financial Report of the State of Victoria: 2017–18 |

(report 13, October 2018) |

| Results of 2017–18 Audits: Local Government | (report 14, December 2018) |

| Results of 2018 Audits: Technical and Further Education Institutes | (report 25, May 2019) |

| Results of 2018 Audits: Universities | (report 24, May 2019) |

2.2 Improving our performance and the benefits of our work

Balancing our performance audit program

To maximise the value we provide to parliament, the public sector, and the community, we focus our resources on the areas where we can have most impact. It is important that we explore our full mandate of economy, efficiency, effectiveness and compliance audits.

Our Annual Plan 2019–20 is our third annual plan that sets out three years of planned audits, a well-received approach. It makes our short and medium-term goals and priorities clear to our stakeholders. We dedicated more time and resources to understanding the environmental context at the start of the annual planning process, which has improved the scope and selection of our audit topics. We increased engagement across the year with our stakeholders at an informal level, which has meant we have needed fewer formal consultations.

We use a rigorous assessment process to choose our topics and aim to balance predictability and responsiveness. Recently, we sought to rebalance our performance audit program with more targeted reviews focusing on efficiency, such as Delivering Local Government Services and Enrolment Processes at Technical and Further Education Institutes. We have also focused on issues of current public concern, such as fraud and corruption, cybersecurity and sexual harassment.

Our data analytics team developed new annual planning dashboards, shown below, which aided our planning process this year. These visual dashboards helped us better align our work program with our planning objectives by linking publicly available datasets from different sources and integrating variables such as risk and materiality, resource requirements, audit agencies and audit types. This provides us with better information to drive our decision-making for a more relevant work program.

Tracking our performance audit recommendations

Every year we do a follow-up survey to determine if agencies are acting on our audit recommendations. We issued the 2018 survey to 74 agencies, seeking feedback on 53 audits with 503 recommendations, from 2014–15 through to 2016–17. We received completed surveys from 58 agencies (78 per cent), addressing 441 recommendations (88 per cent of all recommendations), none of which had been rejected by agencies.

|

98% of responses |

Agencies advised that |

|

66% of the 441 |

On average, agencies t |

|

For 8% of recommendations |

28% of agencies said there |

Modernising our financial audit methodology

One of our major projects this year was to review and update our financial auditing methodology. It had become outdated and needed refreshing.

Some of the auditing standards used as a basis for our previous methodology were not created with the public sector in mind. This resulted in some unnecessary procedures and effort.

Our updated methodology addresses these issues. It is more streamlined, allowing our auditors to be more effective and efficient. It is better focused on key risks and uses decision aids to help auditors best target their audit program. We also integrated data analytics into the planning procedures.

The new process has four stages: engage, plan, implement and conclude (EPIC). Staff were trained in November 2018 and May 2019. The new methodology is already being piloted in selected audits. Early feedback suggests that auditors find it more efficient.

Our next step is finding the best audit software to complement the new methodology. We are currently evaluating options. In the coming year, we will select and begin to implement new, modern audit software to support our new audit approach.

Developing our financial audit dashboards

This year we developed the first version of our financial audit dashboard. Dashboards are valuable audit tools. As well as freeing staff up from manual data collection and analysis, it can help them pinpoint areas of concern and focus on the right things.

This innovative and ambitious approach, often known as audit data analytics, allows us to automate the collection and analysis of massive amounts of data for auditors. When complete, it will streamline a range of manual audit tasks.

This year we began systemically collecting financial data from 35 of our larger audit clients for the dashboard. Contributing agencies can provide data in almost any format, through a secure IT portal. We then transform their data into a common format for analysis and check it for completeness

This approach allows us to be more thorough. Traditional auditing methods rely on transaction sampling for analysis. With our new approach, we can quickly process and analyse 100 per cent of our clients' financial records. Another benefit of this innovative approach is that it allows us to run many tests against the data for signs of potential fraud or errors. These can yield insights into unusual patterns of financial transaction activity to bring to management's attention for follow-up.

A data analytics capability needs a large amount of computer processing power and storage. Recent improvements in our IT approach will enable a secure and scalable data analytics environment. This includes strengthening our data security and protecting access to our dashboards.

3 Growing our influence

|

Our objectives |

Our directions | What success looks like | |

|---|---|---|---|

|

|

Be valued for our independence and more influential because of the unique perspectives we provide |

Strengthen our engagement Better leverage our access Increase accessibility to our work |

More of our performance audits originate from requests from parliament, the public sector and the public Use of our reports and associated datasets in government service delivery and for parliamentary purposes has increased |

To increase our influence, and ultimately the impact of our work, we rely on our relationships and our products.

To strengthen our relationships and provide credible advice, we need to have a good understanding of developments in the public sector and a meaningful dialogue with our stakeholders. We are constantly engaging with public sector agencies through our audit work, and we also foster strong cooperative relationships at the senior management level. This year we have worked on strengthening our relationships with parliamentarians and audit committee chairs. We have also spent more time with peak bodies and chief financial officers across all sectors.

VAGO has access to all administrative and financial datasets across all state and local government entities. This unique and privileged position creates a significant obligation for us to maximise the value we can create from this access. This year we have continued our focus on data sharing and have created several valuable dashboards for agencies and the public.

We are also continually trying to improve our reports and other products, and accessibility to them, so that the unique perspectives we provide can be turned into meaningful action. Several of our audits have made a significant impact this year.

3.1 Engaging with our stakeholders

Our primary stakeholders are the Victorian parliament and the public sector agencies we audit. This year, in time with the formation of the 59th parliament, we turned our attention to strengthening our engagement with parliamentarians. We created a webpage for new parliamentarians to inform them about our role, our processes and our services. We also sent information to all new and returning parliamentarians about the role of the Auditor-General, any upcoming audits that would be of interest, and how they could engage with VAGO. parliamentarians have been taking the opportunity to meet with the Auditor-General to discuss audit and accountability issues and make suggestions for audit topics.

We also focused on our relationships with audit committee chairs this year and hosted a forum in early June. We invited the audit committee chairs of all Victorian public sector agencies and organisations and 125 attended. The aim of the day was to share insights and advice on how agencies can improve their own internal audit practices and ensure good governance and accountability in their organisations.

The Auditor-General and senior VAGO executives presented on the strategic risks and challenges we have observed, our coverage of these through our audit program, and how digital disruption and data analytics will affect the way public sector agencies operate in the future.

Feedback from the forum made it clear that audit committee chairs across the state value the opportunity to network with their peers about common challenges in overseeing governance and auditing functions in their organisations. They found the insights provided by the Auditor-General and VAGO staff valuable.

One key benefit of having strong relationships with the agencies we audit is that we can use these relationships to extend the influence and impact of our reports. Throughout the year, VAGO staff present on our audit findings directly to those who can affect the most change, as the following examples demonstrate.

|

Our audit into the Security and Privacy of Surveillance Technologies in Public Places tabled in September. In November we presented about this audit to the Victorian Privacy Network. The forum was attended by about 200 privacy practitioners across the public and private sectors and the presentation was streamed live on the web. |

In August we tabled our report on Managing Rehabilitation Services in Youth Detention. VAGO staff presented on this audit at the Prisons 2019 conference held in Brisbane in July 2019. |

|

We also engage with public sector agencies on broader integrity issues. In May, we presented at a regional integrity event in Horsham, organised by the Independent Broad-based Anti corruption Commission. |

3.2 Feedback from our stakeholders

We survey parliamentarians every year to understand how well we are serving them. The survey told us that parliamentarians appreciate our independent position but would like our products to be more accessible and have a more digestible format. In response we are exploring new ways of presenting our audit findings while maintaining the evidentiary standards of our reporting.

Our overall satisfaction rating dropped, which we anticipated as the same thing happened after the previous election. A third of our survey respondents this year were new parliamentarians who are still learning about our work and how they can make use of our reports. We know this because we received a high number of neutral responses for many of our questions.

|

Our reports and services help improve public sector administration. 74.1% overall(20.9% neutral) new parliamentarians 67.6% returning parliamentarians 77.0% |

Our reports and services assist parliamentarians with their role. 74.0% overall(24.1% neutral) new parliamentarians 55.3% returning parliamentarians 81.9 % |

We provide valuable information on public sector performance. 83.1% overall(12.2% neutral) new parliamentarians 70.5% returning parliamentarians 88.8% |

The difference between new and returning parliamentarians' perceptions of our value varies greatly, up to 26.6 percentage points. We expect our survey results will improve again over time as new parliamentarians come to use and understand our products more. We will also continue focusing on our products and communication channels with them to try and make our services more relevant, accessible and useful.

We also survey the agencies involved in our performance audits about our process, reporting and value. We aim for our average score across the year to be at least 75 per cent on each of these measures. These are our interim 2018–19 results, as surveys for the audits that tabled between March and June have yet to be completed. Each area has improved since 2017–18, with the average overall score increasing from 74.9 per cent to 78.0 per cent.

|

Process 78.9% |

Reporting 79.8% |

Value 75.9% |

Overall 78.0% |

Our financial audit survey this year showed some very positive results. As with our performance audits surveys, we ask chief financial officers about our process, reporting and value. Here are some highlights of our interim 2018–19 results.

|

Process 96% believed our auditors conducted themselves professionally during the audit 93% believed our auditors had the right professional skills and knowledge 89% believed that our auditors were responsive to their needs and communicated with them effectively |

Reporting 100% believed that our management letters were issued in a timely manner, an improvement of 13% on 2017–18 96% believed audit opinions were issued in a timely manner, an improvement of 10% on 2017–18 96% believed our management letters communicated the audit findings and issues clearly 92% believed our management letters were balanced and fair |

Value 93% believed that our recommendations improve the financial management and internal controls of their organisation 89% valued the assurance obtained from our audit |

3.3 Where our audit topics come from

As discussed in Section 2.2, we consult the agencies we audit to develop our annual plan of audit topics, and this year we have used our new annual planning dashboards to gather information and choose the most worthwhile topics. However, we also want to ensure that we are reflecting issues of concern to parliamentarians and the public, so we aim to increase the number of our audits that originate from these sources.

Work is being undertaken this year to establish a baseline of how many of our audit topics come from parliamentarians, the public sector and the public. Our annual planning process now gathers information on where topics have come from.

|

In 2018–19 we received 141 requests and comments from the public and elected officials:

|

|

Some of the reports we tabled this year cover topics raised in these requests, including Fraud and Corruption Control—Local Government and Outcomes of Investing in Regional Victoria. |

|

Some of our planned audits are related to issues that have been raised by parliamentarians:

|

|

Some of our planned audits are also related to topics raised with us by the public since 2017:

|

3.4 Leveraging our access to data

Another way we are increasing our influence is through our datasets and interactive dashboards. We are making the most of our access to data by providing the agencies we audit with valuable datasets. For two of our performance audits this year, Contract Management Capability in DHHS: Service Agreements and State Purchase Contacts, we provided our datasets to the audited agencies, enabling them to use our analysis to improve their delivery of government services.

We also publish dashboards on our website that everyone can access. This is a key way to increase the accessibility of our work because these datasets allow people to use the information in a way that is valuable to them. While we have included similar information in our reports in the past, the dashboards allow people to manipulate and filter the data, which makes this information much more useful to individuals.

This year we published two dashboards on our website related to performance audits and eight related to financial audits. Our five most used dashboards are listed below.

|

1 |

Our dashboard for Reporting on Local Government Performance enables councils and the public to compare the performance of all 79 Victorian councils across the nine service areas reported in the Local Government Performance Reporting Framework. |

|

2 |

Our dashboard for Outcomes of Investing in Regional Victoria provides information about the distribution of Regional Development Victoria's grants to each regional local government area. It also provides a snapshot of economic and social indicators for those areas. |

|

3 |

Our metropolitan hospitals dashboard was published as part of the Auditor-General's Report on the Annual Financial Report of the State of Victoria: 2017–18. We are refining our dashboard content each year, and adding to the existing data, making it possible to track and compare financial performance over time. |

|

4 |

Our regional hospitals dashboard, published with the Auditor‑General's Report on the Annual Financial Report of the State of Victoria: 2017–18, was also popular. |

|

5 |

We published our data on the performance of local councils this year for the first time with our financial audit Results of 2017–18 Audits: Local Government. |

3.5 Our impact in 2018–19

Our performance audits continued to make an impact this year. Some of these audits are recent and others are continuing to be relevant and useful years after their publication.

Note: An accessible version of this infographic is at the bottom of this Part.

Another way our audits make an impact is their use by parliamentary committees. Several committees referred to our reports this year.

|

The Public Accounts and Estimates Committee's (PAEC) Report on the 2018–19 Budget Estimates made a recommendation that the Department of Treasury and Finance introduce new measures in the budget papers that increase the transparency of the performance of private prisons, and measure the impact of initiatives to reduce unmet demand for child protection services. This is directly in line with recommendations from our reports Safety and Cost Effectiveness of Private Prisons and Maintaining the Mental Health of Child Protection Practitioners. PAEC recommended that the former Department of Economic Development, Jobs, Transport and Resources include additional performance measures in the budget papers to assist parliament to scrutinise Public Transport Victoria's related performance with myki, as identified in our report Follow Up of Selected 2014–15 Performance Audits. PAEC also referred to findings and recommendations from other audits including The Victorian Government ICT Dashboard, Financial Systems Controls Report: 2015–16, Digital Dashboard: Status Review of ICT Projects and Initiatives, Regulating Gambling and Liquor and Managing School Infrastructure. |

|

The Electoral Matters Committee made 36 recommendations for improving civics and electoral participation in Victoria in its Inquiry into civics and electoral participation in Victorian state parliamentary elections. It refers to our 2016 audit Victorian Electoral Commission and echoes our recommendation about the need to evaluate, measure and improve the Democracy Ambassador program. |

|

The Law Reform, Road and Community Safety Committee released an interim report for the Inquiry into VicRoads' management of country roads. It heavily references our 2017 report Maintaining State-Controlled Roadways and notes 'the need for recommendations made by VAGO in its road network reports to be implemented' and the importance of monitoring and publicly reporting on VicRoads' commitments in these areas. It also references our 2008 report Maintaining the State's Regional Arterial Road Network. |

|

The Family and Community Development Committee's Inquiry into Perinatal Services drew on our 2017 report Effectively Planning for Population Growth. They summarised findings and recommendations made in the report about maternal and child health service governance, participation rates, data collection, and the service's ability to meet the demands of a growing population. The Secretary of the Department of Health and Human Services noted the progress the department had made since the 2011 VAGO report Maternity Services: Capacity. |

Our financial audits have also made a measurable impact on internal controls this year. Part of our financial audit process is to issue management letters to agencies highlighting the internal control weaknesses we find and making recommendations to resolve them. Agencies respond to these letters with their intended actions. We follow up on all these issues with management and report progress to audit committees to ensure appropriate action is taken. This year we saw a significant improvement in the number of issues being resolved.

For example, at the start of 2018–19 the technical and further education sector had 24 unresolved audit issues from prior years. During the year 75 per cent of these issues were resolved, including the five high-risk issues we had found. In the university sector, 79 per cent of issues from prior years were resolved.

Over the past three years, across all sectors, we have seen the average number of open issues remaining at the end of each year steadily decline. This demonstrates agency management's commitment to a strong control environment and the positive, long-term impact of our approach.

Note: Below is an accessible version of the infographic in Section 3.5.

|

Before tabling |

Date of tabling |

After tabling |

|---|---|---|

|

Recovering and Reprocessing Resources from Waste |

||

|

$34.9 million package of recycling reforms announced On 2 June 2019, just days before our audit tabled, the Minister for Energy, Environment and Climate Change announced a $34.9 million package of recycling reforms aimed at creating a more stable and productive recycling sector. This included a new $14.3 million Recycling Industry Development Fund, aimed at enhancing Victoria’s domestic remanufacturing capabilities. |

Recovering and Reprocessing Resources from Waste |

|

|

Local Government and Economic Development |

||

|

|

Local Government and Economic Development The audit found that rural and smaller councils lack the resources and capability to access available grants, which are intended to support councils’ economic development activities. |

Government announced $20 million Rural Council Support Program The program was announced in August 2018. Successful projects will improve the quality, effectiveness and affordability of services, and allow councils to raise revenue through new streams. |

|

Managing Rehabilitation Services in Youth Detention |

||

|

The agency acted on our findings during audit conduct The former Department of Justice and Regulation (DJR) incorporated clearer waiting list requirements and regular reporting into service specifications, responding to our findings on service demand. DJR used preliminary audit findings to support a budget bid In May 2018, the 2018–19 State Budget provided $160 million to increase the number of beds at youth justice centres and $18.7 million to increase health and mental health services, including additional nurses, general practitioners and psychologists. |

Managing Rehabilitation Services in Youth Detention |

|

|

Mental health audits |

||

|

|

Access to Mental Health Services The audit found that Victoria’s mental health system is operating in crisis mode. It found that until the system capacity is improved, the Department of Health and Human Services (DHHS) cannot make meaningful improvements to clinical care or Victorians’ mental health. |

After tabling Auditor-General invited to appear as a witness at the Royal Commission into Victoria's Mental Health System The Auditor-General was asked to discuss our report findings and contribute to broadening knowledge of the conditions within the mental health sector. Our two audits were extensively referenced throughout the commission’s hearings during July 2019. |

|

Child and Youth Mental Health The audit found that not all children and young people receive the mental health services they need. It found that DHHS needed to do more to strategically plan and lead the system to improve access and the coordination of services. |

||

|

Before tabling |

Date of tabling |

After tabling |

|

Maintaining the Mental Health of Child Protection Practitioners |

||

|

The 2018–19 State Budget allocated $225.5 million to employ more than 450 child protection workers Announced on 1 May 2018, this is largest expansion of the workforce in Victoria’s history. The issues of a lack of staff and heavy caseloads were well known in the sector and were highlighted by our audit. |

Maintaining the Mental Health of Child Protection Practitioners |

$1.24 million Child Protection Wellbeing Program introduced in response to audit recommendations This program was announced in January 2019, and will provide child protection practitioners and managers with a holistic mental health support program that is tailored to their specific needs. |

|

Access to Public Dental Services in Victoria |

||

|

|

Access to Public Dental Services in Victoria The audit focused on the accessibility of public dental services and getting the balance right between preventative and curative intervention. |

Audit recommendation implemented In May 2018, the 2018–19 Budget Paper No. 3 introduced a performance measure on the percentage of dental emergency clients treated within 24 hours. Audit referenced in new guidelines In August 2018, the Department of Health and Human Services published its Policy and Funding Policy Guidelines 2018: “In response to the audit, an extra $12.1 million was provided for a dental waiting list blitz to drive down delays for dental treatment. The department is working closely with Dental Health Services Victoria to progress the implementation of these recommendations.” |

|

Fraud and Corruption Control—Local Government |

||

|

|

Fraud and Corruption Control— Local Government The audit found councils spending money in ways where it was unclear how residents and ratepayers benefited and also found practices that may not meet public expectations. |

Minister wrote to councils In June 2019, the Minister for Local Government personally wrote to every Victorian council encouraging them to implement our recommendations |

|

Managing the Municipal and Industrial Landfill Levy |

||

|

The Victorian Government Sustainability Fund 2015–2017 Activities Report is released In May 2018, our Managing the Municipal and Industrial Landfill Levy audit was in draft. The Department of Environment, Land, Water and Planning (DELWP) had released very little information to the public about the use of the levy prior to publishing this report. Audit discussed in Parliament In June 2018, during the second reading of the Environment Protection Amendment Bill 2018, MPs discussed our audit. The government committed to reporting on expenditure from the Sustainability Fund account to Parliament each year. |

Managing the Municipal and Industrial Landfill Levy |

The Victorian Government Sustainability Fund 2017–18 Activities Report was released in September 2018. This showed DELWP’s commitment to continuing this reporting |

|

Managing Private Medical Practice in Public Hospitals |

||

|

|

Managing Private Medical Practice in Public Hospitals |

Minister for Health announced review of private practice in public health services In June 2019 it was announced that Professor David Watters will examine hospital practices to ensure they are clinically appropriate and adhere to the principle of access based on clinical need. |

4 Investing in our people

|

Our objectives |

Our directions

|

What success looks like

|

|

|---|---|---|---|

|

|

Enable high performance by our people through a supportive culture, professional development and collaboration |

Be clear about what we stand for Invest in excellence Get the mix right |

Employee engagement has increased We develop, attract, and retain the talent we need |

Our people are our most valuable and important assets. We have a highly qualified, professional workforce with a breadth of experience across a range of disciplines and fields relevant to public audit.

To help our workforce keep pace with the changes in our environment, we invest in the expertise our staff need. This year we have run training on appropriate behaviour as well as more technical training on Office 365, plain English and data analytics. We launched two key plans to shape our workplace into the future, a Culture Plan, and our first Diversity and Inclusion Plan. We also commenced re-evaluating how we outsource work, ensuring that we have the right mix of capability both internally and externally.

4.1 Our staff

Appendix A includes a profile of all VAGO employees. We have also updated our online workforce data dashboard, which is available at: www.audit.vic.gov.au/report/annual-report-2018-19.

The dashboard shows our employees by age, seniority, whether they are part‑time or full-time, on fixed-term or ongoing contracts, and by gender. VAGO employed 85 women in 2018–19, making up 52.8 per cent of our workforce. However, women made up 100 per cent of our part-time workers and 50 per cent of our fixed-term employees. Our gender pay gap is 1.9 per cent, or about $2 080.

Organisational structure

Andrew Greaves

|

Dave Barry

|

Renee Cassidy

|

Bill Gilhooly

|

4.2 Human resources improvements

Improving our workplace culture

In May 2018, VAGO launched a new set of values that staff developed. Our values are respect, innovation, collaboration and accountability. The official launch included an eight-week campaign, with various values-focused activities occurring from June to August 2018.

We also received our 2018 People Matter Survey responses in June 2018 and analysed the results to understand how we could improve the everyday experience of our employees. Our employee engagement score was 66, and employee satisfaction was rated at 65. The areas that needed attention included appropriate behaviour and avenues of redress, wellbeing and workloads, and a lack of diversity focus.

To respond to staff feedback from the People Matter Survey and to keep the momentum from the launch of our new values, we developed our 2018–19 Culture Plan in consultation with the Staff Consultative Committee.

So far, we have:

- implemented appropriate behaviour resources specific to VAGO and reviewed our policies

- designed and delivered onsite appropriate behaviour training

- continued promoting positive mental health and wellbeing activities

- developed and launched VAGO's inaugural Diversity and Inclusion Plan

- established a values subcommittee to continue activities to embed our values

- reviewed our corporate processes and practices—including communications, recruitment, induction and training—to embed VAGO's values in our day-to-day work.

For the 2019 People Matter Survey, employee engagement was rated at 66, the same as 2018, but employee satisfaction fell to 60. We will continue implementing the Culture Plan initiatives into next year and will respond to the results of the 2019 survey.

Improving our diversity and inclusion

In March we launched our first Diversity and Inclusion Plan to help us become a more respectful, diverse and equitable organisation. We developed the plan in consultation with our employee representative groups.

We also engaged external stakeholders, including the Koorie Heritage Trust, the Aboriginal Employment Unit from the Victorian Public Sector Commission, the Victorian Public Sector (VPS) Pride Network, the National Institute for Challenging Homophobia Education and the VPS Enablers Network.

We will implement the action plan over a three-year period, so that the implemented changes are successfully and meaningfully embedded.

The plan has three phases:

1. raising awareness

2. internal education and introduction of new practices

3. external engagement.

Five employee representative groups were set up to champion, consult and advise on our focus areas, including:

- Aboriginal inclusion

- cultural diversity

- disability inclusion (focus on ability)

- lesbian, gay, bisexual, transgender and intersex inclusion

- women at work.

We launched the plan at our March Staff Forum where we welcomed Victorian Treaty Advancement Commissioner Jill Gallagher AO as our keynote speaker. We also hosted a panel discussion with Helen Kapalos from the Victorian Multicultural Commission, Thomas Fyfield from the VPS Pride Network and Adam Walton from the VPS Enablers Network.

It was encouraging to hear from our panellists, who are experts in diversity and inclusion, that VAGO is setting an example—especially in the public sector—in proactively raising awareness and putting attainable actions in place to build a more inclusive workplace.

We have hosted other diversity and inclusion events during the year. On International Women's Day in March, we focused on women in the workplace when we hosted Katie Miller, Deputy Commissioner at the Independent Broad‑based Anti-corruption Commission. She spoke about her success and experience in government, specifically how she progressed her career as a woman in leadership, and the changing nature of workplace culture.

Improving our skills

This year our learning and development program focused on mandatory training across the organisation in appropriate behaviour and plain English. The appropriate behaviour training aimed to help address some of the issues raised in the previous People Matter Survey. Staff found the sessions engaging and thought-provoking, and they aligned with our focus on diversity and inclusion.

The plain English training aims to help staff communicate clearly and succinctly. Some of the information we need to convey in our correspondence and reports is very complex. Being able to express ourselves well is fundamental to getting our messages across to parliamentarians and the public. We hope to improve the written communication skills of all staff, to help ensure our reports are easily understood and have maximum impact.

Another initiative implemented across the organisation was training in Microsoft Office 365, which allows staff to work collaboratively or independently, in and out of the office. The tools that VAGO staff need to communicate and work are more accessible than ever before. The sessions provided an overview of the new features of Office 365 with a particular focus on cloud-based access to both files and software applications. We are using feedback gathered in the sessions to develop new guidance materials, support tools and further training in 2019–20.

We also ran training to help integrate data analytics across the organisation. Both performance and financial audit staff undertook statistics training towards the end of 2018. These sessions covered descriptive analytics, sampling, regression analysis and other advanced concepts. We engaged the University of Melbourne to help provide training for performance audit staff and Audit Smarter to help provide training for our financial auditors.

We have also had some excellent opportunities for individuals that have helped build their capacity, as well as benefiting VAGO more broadly. One such opportunity was a six-month exchange with the Local Government Inspectorate. The exchange increased our collaboration and built knowledge about the way different integrity offices operate. The auditor gained more skills and knowledge and VAGO now has a permanent ongoing contact at the Inspectorate. We are more frequently exchanging information and leveraging off each other's expertise.

As well as being a valuable way of investing in our people, this secondment was also a way to share knowledge and expand the capability of Victoria's integrity agencies.

Improving our use of audit service providers

To complete our annual financial audits of over 500 agencies, VAGO engages a group of qualified audit service provider (ASP) firms to assist us. We use ASPs to get the right mix of skills and experience across our financial audit program. About 65 per cent of our audits, mostly those that are smaller or low risk, are currently outsourced to these firms to conduct audits on behalf of the Auditor‑General.

This year we began reviewing our ASP arrangements and re-evaluating our approach. We will soon re‑establish the audit service provider panel, in part to enhance and reinforce our ASP requirements to comply with our enhanced data protection and privacy needs.

We also want to make better use of the capacity and capability of these firms, and work with those that can align themselves with our data analytics approach and our strategic direction.

At the same time, we are improving our audit tendering process to make it more contemporary and fit for purpose. We have redesigned it to be more flexible and streamlined. These changes will take effect during 2019–20.

We have also considered our oversight of ASPs. During the year we developed a more risk‑based framework for overseeing ASPs, which we will use during the 2019–20 audit cycle. As required by audit standards, this means we will have a more targeted, efficient approach to overseeing the work that ASPs do on behalf of the Auditor-General.

5 Leading by example

|

Our objectives |

Our directions | What success looks like | |

|---|---|---|---|

|

Model exemplary performance in everything we do |

Simplify our business Embrace new technology Better intelligence to drive decisions |

Workforce productivity has increased Our internal practices set the benchmark for public sector entities and other audit offices |

VAGO's credibility depends on us being, and being seen to be, independent, competent and publicly accountable for our operations. To make this possible we need to lead by example.

The more we simplify our business, the more efficient we become and the more time we can dedicate to our audits. This year we have continued to streamline and automate core business processes. We implemented new technological solutions and improved our information security practices. Our improvements to human resources and payroll systems will save staff time and increase our productivity.

We continued to establish business intelligence systems that will give us simple and timely access to performance information. Our focus on fraud and corruption and improving our communications set an example for the broader public sector.

5.1 Technology updates

As in other recent years, we focused this year on updating our technology to address process issues, increase productivity and simplify operations. As mentioned in Section 2.2, we needed this capability improvement for specific projects, such as the financial audit dashboard, but there have also been several IT projects affecting the entire organisation.

To enable a more collaborative environment and allow our staff to work remotely, we have moved to using Microsoft Teams across the organisation. This change, as well as other improvements to our network, have made file sharing easier and allowed us to make the most of our investment in Microsoft Office 365.

This is one way we are harnessing new technologies and new ways of working to improve our capabilities, which is the intention of our refreshed IT strategy. The two-year strategy is shaped by industry insights and technology trends and reflects our future requirements.

We are now working with Azure, Microsoft's public cloud computing platform. It provides a range of cloud services, including those for computing, analytics, storage and networking. We use this service as Microsoft invests far more in information security than state government agencies can. Microsoft's cybersecurity budget exceeds USD 1 billion annually and our approach enables us to benefit from this investment.

This year we upgraded our human resources and payroll systems. Our old systems operated independently, which required multiple interfaces and the duplication of data. We replaced these programs with a cloud-based, integrated and easy-to-use system called SuccessFactors.

The new program has greater data capability and is a more flexible and configurable system. It will speed our payroll run, improve our data accuracy and integrity, improve our performance development process and be easier for staff to use. This was a key project for simplifying our business and is another good example of how we are using new IT solutions.

Another way that we are making the most of our new technologies is by gathering information that better informs our decision-making. We have a new project portfolio tool to prioritise investment and monitor progress, and managers are now able to access real-time information about their team's productivity.

5.2 Data protection

One of our major projects this year was reviewing our data protection practices and establishing an IT security framework.

We assessed all our information assets and classified them by considering the potential compromise to confidentiality, integrity and availability. We developed an information management framework to establish, implement and maintain information security controls. We ensure that only authorised people access information through approved processes, consistent with the Victorian Protective Data Security Standards and Australian Auditing Standards.

We have aligned our information security approach to the Australian Government Secure Cloud Strategy, 2017. This strategy recognises that appropriately certified cloud providers are significantly better placed than internal teams to implement and monitor security controls and achieve compliance.

We are increasing our compliance with the Victorian Protective Data Security Framework and also use the Australian Government's Protective Security Policy Framework and Information Security Manual.

Consistent with this guidance we focus on information security across the following domains:

|

security governance |

ICT security |

information security |

personnel security |

physical security |

With the introduction of the revised Audit Act 1994, the Auditor-General now has greater discretion to share information with a broader range of persons and bodies, including ministers, public bodies, statutory office holders, law enforcement agencies and prosecutorial bodies. We can also share information with other Australian Auditors-General when it is in the public interest, excluding Cabinet‑in-Confidence or commercially sensitive information.

Our new IT security framework will allow us to ensure that the information we gather is securely stored and responsibly shared. Part of this is ensuring that our staff engage in safe online behaviour. In March we ran a month‑long cybersecurity campaign to educate staff about phishing and other cybersecurity threats.

This year we have also enforced the application of protective markings to all VAGO documents, which is a method of classifying the sensitivity of information. This is required of all Victorian Government agencies under the Privacy and Data Protection Act 2014.

5.3 Clear communication

In an increasingly digital environment, the way people engage with information is changing. As an organisation that works in the public interest, we aim for all members of the public to be able to access our work, and easily comprehend our findings and recommendations.

To highlight our key messages, we have introduced more infographics and other vitalisations into our reports. These can be useful for clarifying complex information and turning it into something more easily understood. Conversely, these diagrams can also show where systems are particularly complicated.

This example from our Child and Youth Mental Health report illustrates the complexity of the oversight and performance monitoring system for child and youth mental health services.

We increased the graphic elements in our presentations, both those for parliamentarians and those available to the public on our website.

This year we also investigated new approaches to digital communication to plan for the future. We have researched better practice examples to make our work more accessible and engaging. While we are required to produce a printed report for tabling in parliament, we know that most people access our reports online and we aim for them to be easy to navigate and share. Our most popular report this year was viewed more than 3 500 times and our most popular video was viewed more than 1 000 times.

|

Top 10 most viewed videos in 2018–19 |

Top 10 most viewed reports on our website in 2018–19 |

|

|

Melbourne Metro Tunnel Project—Phase 1: Early Works |

1 |

Access to Mental Health Services |

|

School Councils in Government Schools |

2 |

Results of 2017–18 Audits: Local Government |

|

Access to Mental Health Services |

3 |

School Councils in Government Schools |

|

Recovering and Reprocessing Resources from Waste |

4 |

Delivering Local Government Services |

|

Delivering Local Government Services |

5 |

Child and Youth Mental Health |

|

Managing Rehabilitation Services in Youth Detention |

6 |

Auditor-General's Report on the Annual Financial Report of the State of Victoria: 2017–18 |

|

Outcomes of Investing in Regional Victoria |

7 |

Recovering and Reprocessing Resources from Waste |

|

Results of 2017–18 Audits: Local Government |

8 |

Outcomes of Investing in Regional Victoria |

|

Child and Youth Mental Health |

9 |

Reporting on Local Government Performance |

|

Contract Management Capability in DHHS: Service Agreements |

10 |

Local Government Insurance Risks |

For this Annual Report we developed more dynamic, interactive elements for our website as we start to test some of our ideas and the technologies available.

We have also considered accessibility to our information on our website, assessed our level of compliance with the Web Content Accessibility Guidelines 2.0 and explored options to improve our compliance with this standard.

5.4 Governance initiatives

VAGO is enhancing its governance and compliance systems and improving policies and procedures registers. We have also ensured we are meeting our obligations under the Financial Compliance Management Framework and the Victorian Protective Data Security Framework.

We have had several new initiatives across the organisation to develop our governance maturity and improve corporate knowledge of risk and compliance.

|

We developed a new project portfolio with enhanced internal reporting and controls as well as the ability to better track project costs. |

|

We continued to develop our business intelligence systems by automating data extraction and improving our data visualisation, making our systems more user friendly. |

|

We continued our ongoing review of policies and procedures including targeted updates required by the Audit Amendment Act 2019. |

|

We updated our gifts, benefits and hospitality policy and our independence policy. |

|

We created a new coercive powers policy and associated procedure, as well as a new information gathering policy and procedure to respond to the changes to the Audit Act 1994. |

Improving our risk management systems has been a key activity. VAGO refreshed its risk profile and implemented updated controls. VAGO also developed a risk appetite statement, consulting with risk owners for input. We added a 'risk outlook' for each VAGO enterprise risk to improve the risk management report.

As one of Victoria's integrity agencies, VAGO is committed to proper use of public money, information and property, and safeguarding our own integrity and reputation. This year we finalised our new Fraud and Corruption Control Plan. The plan addresses internal and external fraud and corruption risks and shows how we manage these risks and the associated controls, including steps to minimise and manage the risk of fraud and detection and discovery systems.

VAGO has a regular training and development program on our policies and procedures to support our governance and compliance frameworks.

5.5 Assuring our audit quality

To provide the best value to Victorians through our insights we must ensure that we maintain our high standards. We aim to set the benchmark for other audit offices, and we believe our audit quality processes demonstrate exemplary practices.

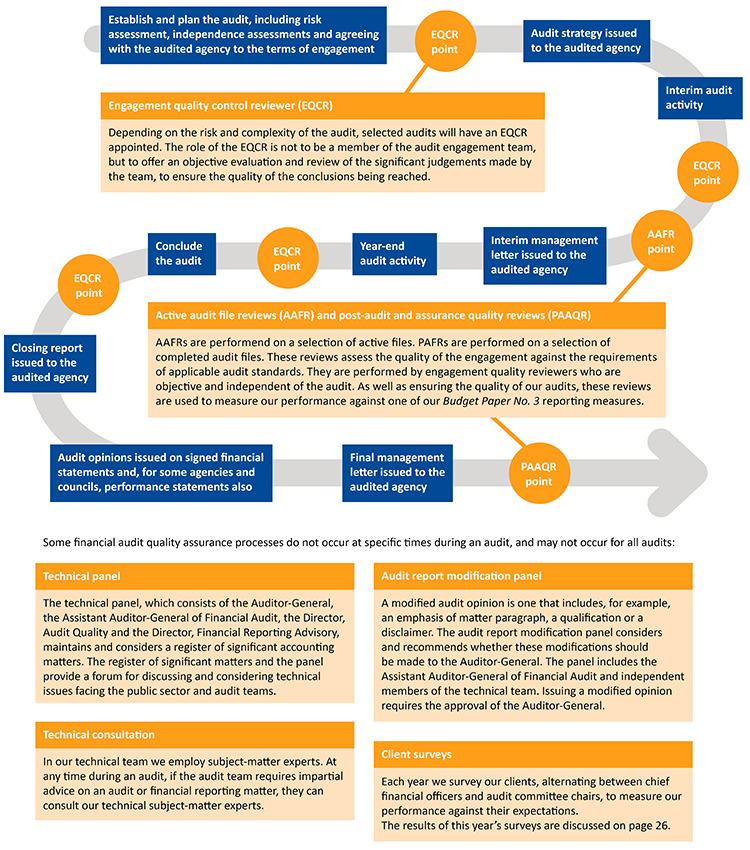

This diagram shows our financial audit quality assurance and continuous improvement processes.

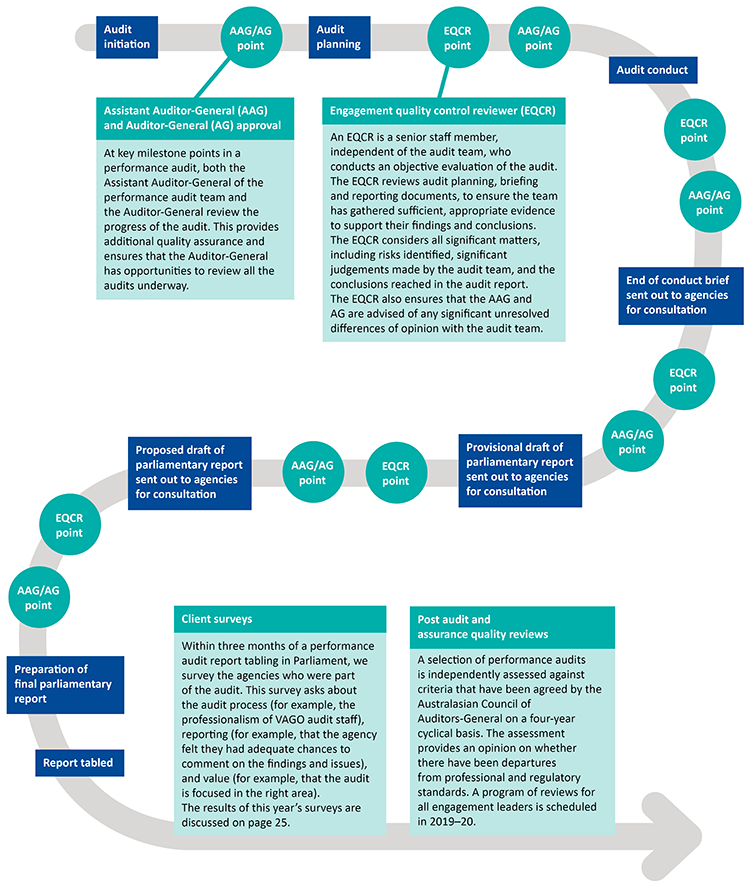

This diagram shows our rigorous framework of similar processes for our performance audits.

Note: The below is an accessible version of the above diagrams.

This diagram shows our rigorous framework of similar processes for our performance audits.

|

|

Establish and plan the audit, including risk assessment, independence assessments and agreeing with the audited agency to the terms of engagement |

|

● EQCR point Engagement quality control reviewer (EQCR) |

|

|

Audit strategy issued to the audited agency |

|

|

Interim audit activity |

|

|

● EQCR point |

|

|

● AAFR point Active audit file reviews (AAFR) and post-audit and assurance quality reviews (PAAQR) |

|

|

Interim management letter issued to the audited agency |

|

|

Year-end audit activity |

|

|

● EQCR point |

|

|

Conclude the audit |

|

|

● EQCR point |

|

|

Closing report issued to the audited agency |

|

|

Audit opinions issued on signed financial statements and, for some agencies and councils, performance statements also. |

|

|

Final management letter issued to the audited agency |

|

|

● PAAQR point |

Some financial audit quality assurance processes do not occur at specific times during an audit, and may not occur for all audits:

|

Technical panel |

Audit report modification panel |

|---|---|

|

The technical panel, which consists of the Auditor-General, the Assistant Auditor-General of Financial Audit, the Director, Audit Quality and the Director, Financial Reporting Advisory, maintains and considers a register of significant accounting matters. The register of significant matters and the panel provide a forum for discussing and considering technical issues facing the public sector and audit teams. |